"Men and a woman reading headlines posted in window of Brockton Enterprise newspaper office on Christmas Eve in Brockton, Massachusetts"

2011 !

You can make a donation - one-time or recurring (see top left hand column), you can buy the DVD-Rom of Stoneleigh's famous lecture "A Century of Challenges" ($30), or the streaming file of the same lecture ($12,50) (see top right hand column for both), and you can of course do any two of these or even all three! And please don’t forget visit our advertisers -free of charge- on a regular basis. That's what they're here for.

Ilargi: Time for reflection. Whether you're stuck at JFK or Charles de Gaulle, smugly snowed in with friends and loved ones, freezing in the dark because your bills ain't getting paid, surfing in the Pacific or scraping for food in the tropical heat , whether you're Julian Assange or Michail Khodorkovsky, we can all use some time to think about how we got here, wherever here is. Why do we do what we do, why do we let others do to us what they do?

As our world is increasingly being gutted from within, morally, economically and politically, as we have handed control over our essential needs to a few handfuls of semi-psychopaths who have never had to think about what is essential and what is not, we might do well to ponder why, throughout history, we have always gladly and willingly surrendered control over our fates and lives, as soon as someone, anyone, held up a picture that was so rosy it was clearly too good to be true.

We always have and always will find a way to believe in that picture no matter how incredible it looks. Today’s themes are familiar ones: recovery and economic growth, laced with a spiced-up sauce of fear of different people, different religions, different lands, and topped off with a promise of better days ahead. We're genetically programmed to buy it all hook, line and sinker. We can't help ourselves. In the meantime, all the wealth we have left continues to be stolen from underneath our very eyes. By the very people who promise us recovery and better days. And we can't see it, we refuse to reflect. Our need to believe functions as a giant blind spot.

We are the ultimate tragic species. We can watch ourselves destroy all we have, and all we dream of, but we can't stop ourselves from doing it. Here's Ashvin for you:

Ashvin Pandurangi:

But this time it's not necessarily Communism, or any other label used by humans to conveniently understand their complex forms of socioeconomic organization. It's the spectre of an unrelenting reality, emerging from the depths of history, with no plans to follow but its own. What exactly, then, is reality and why does it have its own plans? These are not easy questions to answer, but many brilliant minds have had much to write and say on the topic. It may be safe to say with near certainty that, if nothing else, reality is constantly evolving and always lingering in the furthest boundaries of our comprehension.

The famous German philosopher, Georg Wilhelm Friedrich Hegel, is most readily identified with using the dialectic process to describe reality. It is the process in which opposing forces of nature push and pull with each other in a very non-linear fashion, until one rapidly gives way to the other or there is a synthesis of both. This framework, of course, is itself a simplifying abstraction used to understand the complex evolution of historical processes, but it also reflects a deep truth that many people fail to recognize throughout their lives.

Although Hegel rediscovered and thoroughly popularized the dialectic method within the social sciences, he somewhat naively believed that human ideas, as a reflection of God's thoughts, were the driving force of reality's evolution. Karl Marx and Friedrich Engels adopted Hegel's method in their socioeconomic analysis, but they completely "turned it on its head". As Marx explained:

My dialectic method is not only different from the Hegelian, but is its direct opposite. To Hegel, the life-process of the human brain, i.e. the process of thinking, which, under the name of 'the Idea,' he even transforms into an independent subject, is the demiurgos of the real world, and the real world is only the external, phenomenal form of 'the Idea.' With me, on the contrary, the ideal is nothing else than the material world reflected by the human mind, and translated into forms of thought." (Capital, Volume 1, Moscow, 1970, p. 29).

One of the the hot topics in the "material world" right now is the European Union and its increasingly imminent disintegration. Toxic debts from sovereign nations across this region can no longer be serviced at their true cost, so everyone is clamoring to find the "best" way to subsidize such debt and avoid a wholesale restructuring, in which all the imaginary wealth on the balance sheets of major banks would simply evaporate. Many commentators are enraged at the idea that U.S., French or German taxpayers would have to subsidize the profligate ways of Greece, Ireland and those soon to follow in their footsteps. At the very least, these bailouts should be preceded by or conditioned with strict austerity measures designed to bring an end to the failed welfare/entitlement state and re-establish values of "personal responsibility".

Some of the more astute commentators are enraged at the idea that Greek, Irish and other EU citizens will soon be forced to live with much fewer public benefits and much higher taxes to keep malicious banks and their crony governments in power. They correctly point out that such a path of austerity is "economic suicide" and will only lead to more suffering in the long-run. Instead, they advocate that these countries should refuse to honor their unproductive debts to banks, break away from the monetary union and reissue their own national currency. While this "option" will certainly lead to uncertainty, disorder and a significant destruction of both real and imaginary wealth in the short-term, it represents the only true path to a just and sustainable future.

However misguided the bailout/austerity advocates may be, or correct the "sovereign defaulters" may be, they both seem to place themselves outside of a larger dialectic process. For the latter especially, it is absurd that anyone could possibly think bailouts conditioned on harsh austerity measures could be a good path forward for the countries involved. Why can't these people see that too much debt is the problem, and subsidizing existing debt or adding more debt will not solve it? Isn't it clear by now that TBTF banks are parasites, constantly sucking productive capital out of the global economy, and no amount of austerity will positively impact sovereign debt problems as long as they remain in operation? Perhaps the answers to those questions lie outside the realm of conscious human decision, and in the realm of complex historical evolution.

There is an ever-present debate which occurs over big government vs. small government, public entitlements vs. privatized markets, public spending vs. austerity, etc. These concepts are typically perceived as independent ideas that exist so humans can choose one over the other, but they are actually two sides of the same coin, one side being necessary for the other side to exist. Looking at only the most recent period of history, it was the credit bubble and subsequent housing crash which created the "need" for European states to respond forcefully with deficit spending.

This universal spending across the developed world, in turn, contributed to the runs on sovereign bond markets in the Eurozone, creating the "need" for regional/global institutions to respond forcefully with plans of bailouts and/or austerity. Despite these measures, the housing markets across these countries remain extremely fragile and bond markets across Europe continue to show symptoms of an incurable disease. The dialectic evidence is right in front of our eyes, where it will remain, as one force rapidly gives way to another.

The opposing forces of modern times are different from those of Marx and Engels only in form, but never in function. It is the ongoing clash between the increasingly rich and increasingly poor, the extractors of economic rents and the sellers of debt, the oppressors and the oppressed. Whatever the specific characterization of the simple dialectic involved, it must be viewed as a direct product of historical processes that have evolved over time. There should be absolutely no surprise at the fact that people hold diametrically opposed ideas on how nations around the world should proceed to deal with their debt issues. They are just ideas, after all, and they reflect an underlying tension in the material relations of human existence.

The general outcome of our current dialectic struggle will not be governed by these ambitious ideas, but by the natural forces of antagonistic evolution. Large swaths of unproductive private and public debt will not be repaid, and sovereign countries will default on their obligations. International monetary, political or strategic unions that rely on economic stability, mutual trust and confidence will not be preserved in any meaningful form. Citizens of the developed world will not stand in a single-file line and receive their bitter dose of austerity in an orderly fashion. These things are almost 100% certain, and no amount of conscious planning or top-down decision-making will make them less likely to occur.

I realize that the points made above, taken to their logical extreme, could imply that human beings have no "control" over their collective future, and therefore effectively no "free will". This implication, among many other things, could render the relentless criticisms of commentators around the world, including me, acts of zero importance or influence. If the future is set to evolve from complex, oppositional forces of nature, then there is nothing left to do but wait and watch it all unfold. Indeed, the enigma of free will, and the nature of reality itself, have been painstakingly analyzed by both scientists and philosophers alike, with no firm conclusions ever reached.

Personally, I find it at least worth noting that people are always obsessing about the differences between what is and what could have been. Despite the fact that history continues to repeat itself at the most fundamental levels, humans never seem to learn from the past, change their collective behaviors and break the "vicious" cycle. It seems we always address our systemic problems with too little, too late, and are then left with intractable predicaments to face. European politicians and financial analysts may yap all day about what should be done to solve their sovereign debt problems, or what they plan to do, but I am only interested in what will happen, and that seems to be a process increasingly disconnected from even the most clever ideas or plans of human beings.

Our individual actions, however, are not unimportant or meaningless. Regardless of whether they result from freely-constructed decisions or a complex deterministic process, they are the constituents of our future. The theoretical underpinnings of reality may become largely irrelevant in terms of our practical ability to remain secure and healthy in the upcoming years. Furthermore, there are certainly many people out there with extremely flawed and/or dangerous ideas. On the off chance that our freely-chosen words and actions actually do have influence, it would be unwise not to speak out against such ideas. So I remain critical of misguided policies and opinions and do not hesitate to express such views, but I will always try to temper my personal judgments with a broader understanding of historical evolution. For that process is truly a spectre that no person can tame.

10 Reasons to be Cautious for the 2011 Market Outlook

by David Rosenberg - Gluskin Sheff

1. In Barron’s look-ahead piece, not one strategist sees the prospect for a market decline. This is called group-think. Moreover, the percentage of brokerage house analysts and economists to raise their 2011 GDP forecasts has risen substantially. Out of 49 economists surveyed, 35 say the U.S. economy will outperform the already upwardly revised GDP forecasts, only 14 say we will underperform. This is capitulation of historical proportions.

The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that.2. The weekly fund flow data from the ICI showed not only massive outflows, but in aggregate, retail investors withdrew a RECORD net $8.6 billion from bond funds during the week ended December 15 (on top of the $1.7 billion of outflows in the prior week). Maybe now all the bond bears will shut their traps over this "bond-bubble" nonsense.

3. Investors Intelligence now shows the bull share heading up to 58.8% from 55.8% a week ago, and the bear share is up to 20.6% from 20.5%. So bullish sentiment has now reached a new high for the year and is now the highest since 2007 ? just ahead of the market slide.

4. It may pay to have a look at Dow 1929-1949 analog lined up with January 2000. We are getting very close to the May 1940 sell-off when Germany invaded France. As a loyal reader and trusted friend notified us yesterday, "fighting" war may be similar to the sovereign debt war raging in Europe today. (Have a look at the jarring article on page 20 of today’s FT — Germany is not immune to the contagion gripping Europe.)

5. What about the S&P 500 dividend yield, and this comes courtesy of an old pal from Merrill Lynch who is currently an investment advisor. Over the course of 2010, numerous analysts were saying that people must own stocks because the dividend yields will be more than that of the 10-year Treasury. But alas, here we are today with the S&P 500 dividend yield at 2% and the 10-year T-note yield at 3.3%.

From a historical standpoint, the yield on the S&P 500 is very low ? too low, in fact. This smacks of a market top and underscores the point that the market is too optimistic in the sense that investors are willing to forgo yield because they assume that they will get the return via the capital gain. In essence, dividend yields are supposed to be higher than the risk free yield in a fairly valued market because the higher yield is "supposed to" compensate the investor for taking on extra risk. The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that. When the S&P yield gets to its long-term average of 4.35%, maybe even a little higher, then stocks will likely be a long-term buy.

Source: Haver Analytics, Gluskin Sheff

6. The equity market in gold terms has been plummeting for about a decade and will continue to do so. When measured in Federal Reserve Notes, the Dow has done great. But there has been no market recovery when benchmarked against the most reliable currency in the world. Back in 2000, it took over 40oz of gold to buy the Dow; now it takes a little more than 8oz. This is typical of secular bear markets and this ends when the Dow can be bought with less than 2oz of gold. Even then, an undershoot could very well take the ratio to 1:1.

7. As Bob Farrell is clearly indicating in his work, momentum and market breadth have been lacking. The number of stocks in the S&P 500 that are making 52-week highs is declining even though the index continues to make new 52-week highs.

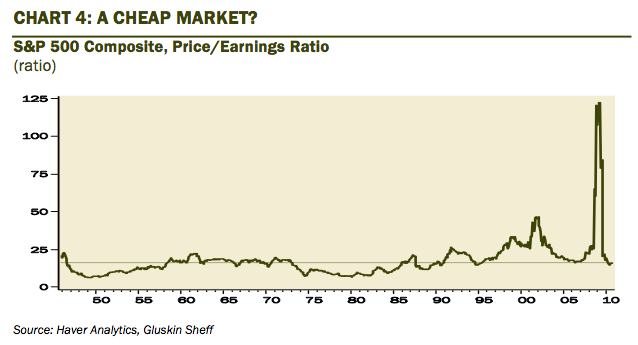

8. Stocks are overvalued at the present levels. For December, the Shiller P/E ratio says stocks are now trading at a whopping 22.7 times earnings! In normal economic periods, the Shiller P/E is between 14 and 16 times earnings. Coming out of the bursting of a credit bubble, the P/E ratio historically is 12. Coming out of a credit bubble of the magnitude we just had, the P/E should be at single digits.

Source: Haver Analytics, Gluskin Sheff

9. The potential for a significant down-leg in home prices is being underestimated. The unsold existing inventory is still 80% above the historical norm, at 3.7 million. And that does not include the ‘shadow’ foreclosed inventory. According to some superb research conducted by the Dallas Fed, completing the mean-reversion process would entail a further 23% decline in real home prices from here. In a near zero percent inflation environment, that is one massive decline in nominal terms. Prices may not hit their ultimate bottom until some point in 2015.

10. Arguably the most understated, yet significant, issue facing both U.S. economy and U.S. markets is the escalating fiscal strains at the state and local government levels, particularly those jurisdictions with uncomfortably high pension liabilities. Have a look at Alabama town shows the cost of neglecting a pension fund on the front page of the NYT as well as Chapter 9 weighed in pension woes on page C1 on WSJ.

Consumer spending was taken down 0.4 of a percentage point to 2.4%, which of course you never would have guessed from those "ripping" retail sales numbers.

In the absence of Chapter 9 declarations or dramatic federal aid, fixing the fiscal problems at lower levels of government is very likely going to require some radical restraint, perhaps even breaking up existing contracts for current retirees and tapping tax payers for additional revenues. The story has some how become lost in all the excitement over the New Tax Deal cobbled together between the White House and the lame duck Congress just a few weeks ago.

The Working Poor

by by Michael Snyder - Economic Collapse

As the middle class in America continues to be slowly wiped out, the number of working poor continues to increase. Today, nearly one out of every three families in the United States is considered to be "low income". Millions of American families are finding that they can barely make it from month to month even with both parents working as hard as they possibly can. Blue collar American workers from coast to coast are having their wages decreased at a time when it seems like the cost of virtually every monthly bill is going up. Unfortunately, there is every indication that things are only going to get worse and that average American families are going to be financially squeezed even more in the months and years to come.The Working Poor Families Project has just released their policy brief for the winter of 2010-11. What they have discovered is that the number of working poor in the United States is higher than they have ever seen it before and it continues to increase at a staggering pace. The following are some of the key findings for 2009 that were pulled right out of their report....

* There were more than 10 million low-income working families in the United States, an increase of nearly a quarter million from the previous year.

* Forty-five million people, including 22 million children, lived in low-income working families, an increase of 1.7 million people from 2008.

* Forty-three percent of working families with at least one minority parent were low income, nearly twice the proportion of white working families (22 percent).

* Income inequality continued to grow with the richest 20 percent of working families taking home 47 percent of all income and earning 10 times that of low-income working families.

* More than half of the U.S. labor force (55 percent) has "suffered a spell of unemployment, a cut in pay, a reduction in hours or have become involuntary part-time workers" since the recession began in December 2007.

Unfortunately, things are not going to be getting any better for the working poor. In the new "one world economy" that our politicians keep insisting is so good for us, millions upon millions of American workers now find that they have to compete for work with laborers on the other side of the globe that are willing to work for slave labor wages. This is causing millions of jobs to leave the United States and it is forcing wages down.

Millions of Americans now find that they are making substantially less than they used to. If that has happened to you, perhaps you can take comfort in the fact that you are not alone. Or perhaps it is not that comforting. In any event, American workers are not just competing with each other anymore. Now there is the constant threat that all the jobs could just be sent overseas.

As wages are forced down, a record number of working Americans are finding themselves forced to turn to food stamps and to other government anti-poverty programs. Millions of Americans have been forced to take part-time jobs in order to supplement their incomes. Millions of others have been forced to take part-time jobs because that is all they can find.

This is all part of a long-term trend. The numbers don't lie. About the only people doing well are those on Wall Street and the very rich. Nearly every other segment of the population is getting poorer.

The following are 10 statistics that I have shared previously, but I think that they do a really good job of highlighting the plight that the working poor in this country are now facing....

#1 In 2009, total wages, median wages, and average wages all declined in the United States.

#2 Since the year 2000, we have lost 10% of our middle class jobs. In the year 2000 there were about 72 million middle class jobs in the United States but today there are only about 65 million middle class jobs. Meanwhile, our population is getting larger.

#3 As 2007 began, only 26 million Americans were on food stamps, but now 42 million Americans are on food stamps and that number keeps rising every single month.

#4 Since 2001, over 42,000 U.S. factories have closed down for good.

#5 One out of every six Americans is now enrolled in at least one anti-poverty program run by the federal government.

#6 Half of all American workers now earn $505 or less per week.

#7 The number of Americans working part-time jobs "for economic reasons" is now the highest it has been in at least five decades.

#8 Ten years ago, the United States was ranked number one in average wealth per adult. In 2010, the United States has fallen to seventh.

#9 In 1976, the top 1 percent of earners in the United States took in 8.9 percent of all income. By 2007, that number had risen to 23.5 percent.

#10 According to one recent study, approximately 21 percent of all children in the United States are living below the poverty line in 2010.

The United States is becoming poorer as a nation even as the boys up on Wall Street are busy grabbing a bigger share for themselves.

We are rapidly becoming a nation that will have a very small privileged class of ultra-wealthy and a very large class of "workers" that is just barely trying to survive.

So is the answer even more government handouts and even more government social programs?

Of course not.

What middle class Americans need are middle class jobs.

But as I have written about previously, the United States is rapidly bleeding middle class jobs with no end in sight.

Globalism has permanently changed the game. The middle class way of life that so many millions of Americans have been enjoying for so many decades is disappearing.

Just because things were a certain way yesterday does not mean that things are going to be the same way tomorrow. The long-term economic trends that this column keeps talking about day after day after day are taking us all to a very dark economic place.

But instead of facing reality, our federal government, our state governments and our local governments just keep borrowing massive amounts of dollars to try to paper over all of our problems.

It is not going to work. Unless something is done to fix our structural economic problems, the economic decay is just going to get worse and all of this debt is eventually going to collapse our entire financial system.

If you are a member of the working poor I wish I had better news for you. Things are not going to be getting better, and unfortunately millions more Americans will probably be joining you soon.

98 Bailed-Out US Banks Slip Toward Failure

by Michael Rapoport - Wall Street Journal

Nearly 100 U.S. banks that got bailout funds from the federal government show signs they are in jeopardy of failing. The total, based on an analysis of third-quarter financial results by The Wall Street Journal, is up from 86 in the second quarter, reflecting eroding capital levels, a pileup of bad loans and warnings from regulators. The 98 banks in shaky condition got more than $4.2 billion in infusions from the Treasury Department under the Troubled Asset Relief Program.

When TARP was created in the heat of the financial crisis, government officials said it would help only healthy banks. The depth of today's problems for some of the institutions, however, suggests that a number of them were in parlous shape from the beginning. Seven TARP recipients have already failed, resulting in more than $2.7 billion in lost TARP funds. Most of the troubled TARP recipients are small, plagued by wayward lending programs from which they might not recover. The median size of the 98 banks was $439 million in assets as of Sept. 30. The median TARP infusion for each was $10 million, federal filings show.

"We certainly understand and recognize that some of the smaller institutions are experiencing stress," said David Miller, chief investment officer at the Treasury Department's Office of Financial Stability, which runs TARP. He noted that Congress mandated that banks of all sizes be eligible for TARP, adding that the government's TARP investment as a whole is performing well.

Chris Cole, senior regulatory counsel at the Independent Community Bankers of America, a trade group, said small banks are "turning around slowly." Smaller TARP recipients are in worse shape than larger banks because the larger ones got help in addition to TARP, Mr. Cole said. Bank of America Corp. and Citigroup Inc. tapped the Federal Reserve's emergency-liquidity programs frequently during the crisis. The troubled banks identified by the Journal all have either a Tier 1 capital ratio under the "well-capitalized" 6% level; both a total risk-based capital ratio of under the "well-capitalized" 10% threshold and nonperforming loans of over 10% of their portfolio; or a regulatory order requiring the bank to monitor or boost its capital.

A Federal Deposit Insurance Corp. spokesman declined to comment on the Journal's analysis, which also calculated that 814 of the nation's 7,760 banks and savings institutions are troubled according to these standards, up from 729 at the end of the second quarter. The FDIC's official list of problem banks, which uses different criteria from the Journal's analysis, includes 860 financial institutions. The banks aren't publicly identified.

In October, the Government Accountability Office said 78 banks on the FDIC's troubled-bank list as of June 30 were TARP recipients, up from 47 at the end of 2009. Dozens of TARP banks were "marginal institutions" that were financially weaker than other recipients and should have gotten more scrutiny before receiving taxpayer-funded infusions, the GAO said. In a response to the GAO report, the Treasury Department said it would consider the GAO's recommendations to improve its funding process if it ever has a program similar to TARP again. In comparison, the first eight banks and securities firms receiving TARP got a total of $125 billion. All have repaid the funds.

Arthur Wilmarth, a George Washington University law professor and expert on banking regulation, said a lot of smaller TARP recipients are burdened with risky commercial-real-estate loans tied up in troubled strip malls and the like, and that makes it hard for them to raise new capital. "A lot of them are in kind of a frozen position," he said.

One example of a TARP recipient in deep trouble: closely held Legacy Bank of Milwaukee. The bank had $205 million in assets as of Sept. 30 and got $5.5 million in TARP funds in January 2009. But more than half of Legacy's loans were in commercial real estate, and its nonperforming loans have escalated to 23% of its portfolio. It has posted eight straight quarterly losses, for a total loss of $11.6 million. Last month, the Federal Reserve declared Legacy "significantly undercapitalized," giving the bank until mid-January to either sell itself or raise more capital.

José Mantilla, Legacy's president and chief executive, said the bank lends to an underserved, lower-income customer base. During the recession, those customers "have suffered, and they have fallen behind," Mr. Mantilla said. Legacy is working to raise capital, and "we still feel optimistic" about the bank's chances, he said.

CommunityOne Bank of Asheboro, N.C., got $51.5 million in TARP funds in February 2009 through parent FNB United Corp. The company has suffered nine straight quarterly losses, sapping its capital. In July, the Office of the Comptroller of the Currency said the bank had engaged in "unsafe or unsound banking practices." R. Larry Campbell, the bank's interim president and chief executive, said CommunityOne is "fully engaged" in efforts to boost its capital.

Credit Suisse Sells Soured Loans to Appllo at Huge Discount

by Anton Troianovski and Eliot Brown - Wall Street Journal

Credit Suisse Group is selling a $2.8 billion portfolio of soured commercial-property loans to Apollo Management LP for $1.2 billion, marking one of the largest bank sales of distressed real-estate loans since the downturn, according to people familiar with the matter. The properties backed by the loans include apartment buildings in Germany and hotels in Denmark, Sweden and France, many of them of lower quality and in hard-hit locales, the people say.

Real-estate investors are watching loan sales closely. Ever since the 2008 financial crisis, expectations of a world-wide wave of defaults by landlords and fire sales by banks have tantalized private-equity firms. In the early 1990s, some of these same firms generated handsome profits after buying big loan portfolios from the government as it took over failing U.S. savings-and-loans. This time around, fire sales by banks have been few and far between. Banks have been wary of taking big losses on their boom-time loans while regulators have encouraged banks to restructure many of their commercial mortgages rather than simply foreclose.

Now some buyers say the spigot is starting to open. Renewed banking profits have made losses on bad loans easier to swallow. Signs of a stabilizing real-estate market and demand for distressed assets from private-equity funds have pushed up prices that buyers are willing to pay. The loan sales could help healthier banks clean up their balance sheets as they look to expand with the economic recovery. "We're starting to see loans in the marketplace at more realistic prices," said Paul Fuhrman, an executive at private-equity firm Colony Capital LLC, which has been buying distressed-loan portfolios. "We are definitely seeing the banks loosen up."

Major loan-sale advisers say they also have seen a large uptick in business. A CB Richard Ellis Group Inc. executive, Brian Stoffers, said at a November conference that the real-estate brokerage's loan-sale activity was up nearly 90% through the third quarter compared with the same period last year. Loan-sale-advisory firm Debt Exchange Inc. has sold commercial real-estate loans on behalf of 38 different financial institutions since early October, compared with 19 in the last three months of 2009, according to Chief Executive Kingsley Greenland. "Many banks are getting more aggressive," Mr. Greenland said. "Not only are they marking the assets appropriately but they're actually moving to dispose of the assets."

Small banks, which have heavy commercial real-estate exposure across the U.S., are also seeing the market for their bad loans open up. Sun Bancorp Inc., based in Vineland, N.J., with $3.6 billion in assets, announced last week that it sold an $87 million portfolio of commercial real-estate loans to a group of investors for $55 million. Private-equity firms such as Apollo, Colony, Lone Star Funds, and Starwood Capital Group have raised billions of dollars from pension plans, college endowments, and sovereign-wealth funds to buy souring real-estate loans on the cheap.

One strategy: acquire a large portfolio and then rework each loan individually, profiting after taking over the property or restructuring the loan. Some of these firms have been buying portfolios from the Federal Deposit Insurance Corp., which has been taking over failed banks and has sold more than $22 billion in real-estate assets this year in deals that, like the Credit Suisse deal, often involve seller financing and profit-sharing arrangements.

But far more is still tied up inside U.S. banks. They currently hold on their balance sheets about $1.6 trillion in commercial real-estate loans, down from a peak of $1.9 trillion in mid-2008 but still above mid-2006 levels, according to the FDIC.

For Credit Suisse, the Apollo deal marks a major step in reducing a massive book of commercial mortgages the firm accumulated during the boom years as it made loans around the world that it planned to securitize and then sell off to investors. In the summer of 2007, Credit Suisse had about $30.5 billion in commercial mortgages in its investment-banking division, according to the company's securities filings. With storm clouds forming over the global economy, the firm scrambled to reduce its exposure in the following months, cutting its exposure to $2.5 billion by the end of the third quarter of 2010.

The portfolio it is selling to Apollo has already been written down well below its face value, people familiar with the matter said. Sweetening the pot for Apollo, Credit Suisse is providing debt financing for the deal, magnifying Apollo's return on its equity. Credit Suisse is also taking an equity stake in the joint venture formed with Apollo Management that is buying the loans, according to people familiar with the transaction. That means the Swiss bank will share in both the risk and some of the upside as Apollo negotiates pay-downs with borrowers or takes over buildings, improves their operations, and sells them.

Strapped Cities Hit Nonprofits With Fees

by Ianthe Jeanne Dugan - Wall Street Journal

Facing budget gaps and an aversion to new debt and taxes, states and local governments are slapping residents with an array of new fees—and some are applying them to nonprofits. That marks a sharp departure from long-standing tax exemptions mandated by state law or adopted on the theory that churches, schools and charitable organizations work alongside governments to provide services to the community.

The issue is on display in Houston, where some flood-prone roads are in such disrepair that signs warn drivers, "Turn around, don't drown."

Houston's taxpayers in November narrowly voted to adopt a "drainage fee" to raise at least $125 million a year toward the cost of improving roads and storm-water systems. The city will charge fees to property owners, and it won't grant exceptions to churches, schools and charities. The city has been tightening its budget. "We're cutting up the city's credit cards," says Mayor Annise Parker. "Everyone who contributes to drainage issues has to share in the cost of correcting those issues."A number of groups—including schools, businesses, churches and senior citizens—are demanding exemptions. "We'll defeat this," says David Welch, of the Houston Area Pastor's Council, who plans to lobby state legislators in January. "This is really a tax. It is the first time that churches would not be exempt from property taxes," he says. Some opponents have filed suit claiming the ballot wording was misleading. At a group called the National Council of Nonprofits, Tim Delaney, chief executive, says, "Governments are taking their public burdens and putting them on the backs of nonprofits, at a time when the demand for our services is skyrocketing."

Some cities are charging religious groups property taxes on buildings no longer used for worship. Other localities are soliciting voluntary contributions. Albany, N.Y., recently passed an ordinance asking schools, hospitals and other nonprofits to contribute to city services. In Minneapolis, residents recently began paying a street-light fee that also applies to nonprofits, which in some places pay fees for elevator safety and fire inspection.

Drainage fees that apply to nonprofits have been adopted by cities that include Richmond, Va.; Lafayette, Ind.; and Verona, Wis. Such fees are emerging now because the federal government has been cracking down on how cities handle the rain that rolls off roofs, parking lots, and other impervious surfaces, sometimes causing floods and ripping up roads. The runoff can collect debris, oil and other pollutants and ultimately drag it all into the nation's waterways.

The federal Environmental Protection Agency recently issued strict storm-water rules for real-estate developments and stepped up enforcement of run-off rules for municipalities. In 2010, municipalities accused of violations paid $5.3 billion in repairs, a nearly four-fold increase from 2009. Those settlements ranged from Kansas City, Mo., with $2.5 billion in fixes, to Revere, Mass., which agreed to spend $50 million on repairs.

The American Society of Civil Engineers estimates that cities and towns need to spend more than $250 billion over the next five years fixing crumbling storm systems. As municipalities try to bridge budget gaps with fees that also hit nonprofits, some residents are kicking up a storm. Chicago and Dade City, Fla., scrapped proposals for drainage fees after protests from these groups. Cleveland suspended its proposal after community groups and businesses sued. In Arnold, Mo., a similar suit was filed in October. Residents of Mobile, Ala., rejected a referendum that would have imposed a drainage fee.

The federal government itself is refusing to pay drainage fees in several cities, including Washington, D.C., saying it is really a tax so the U.S. government is immune. In Houston, among drainage-fee proponents was City Councilman Stephen Costello, the owner of an engineering firm. He says he and his firm invested $100,000 for the petition drive that got "Proposition 1" on the ballot, while other engineers helped finance the campaign.

A former Harris County tax assessor, Paul Bettencourt, was outraged. "I have never seen nonprofits taxed before," he says. He helped raise $100,000 to fight the measure. On Election Day, 165,000 people voted yes—50.9%. About 160,000 said no. The outcome came as a jolt to Greg Meyers, president of the board of the Houston Independent School District, which includes 300 schools. Mr. Meyers says schools will have to lay off 50 to 70 teachers or raise taxes to pay their share—$3 million to $4 million a year. "One taxing entity taxing another is mind-numbing," Mr. Meyers says. The board intends to lobby for a new state law.

Mayor Parker is holding her ground. "If we take away one broad category, somebody else will have to pay significantly more," she says. "It's a zero-sum game." Churches also are seeking an exemption. The Roman Catholic Archdiocese of Galveston-Houston anticipates paying $750,000 to $1 million a year in fees. "We as a society have said we are not going to tax places of worship," says C.O. Bradford, a Houston councilman. "This is different from paying for other utilities," he said. "If they stop paying their bills, we can turn off their water or electricity. But we can't stop the rain from falling out of the sky."

The US of Debt

by Dan Weintraub

Christmas Stories

by Michael Snyder - Economic Collapse

If you and your family are blessed and prosperous this holiday season, you should consider yourself to be very fortunate, because there are tens of millions of other Americans that are desperately hanging on by their fingernails. The Christmas stories that you are going to read below aren't going to give you any warm fuzzies. They aren't about "Santa Claus" sliding down the chimney to leave huge piles of presents around the tree. Rather, they are representative of what so many American families are feeling this holiday season - horrible, suffocating, soul-crushing despair.

As you and your family gather around the holiday tree on December 25th, millions of other Americans will be facing a Christmas with absolutely no gifts. As you and your family dig into a delicious holiday meal, millions of other Americans will be breaking out the meager supplies they picked up at the food bank or that their food stamps have enabled them to purchase. As you and your family tell stories around the fire, millions of other Americans will literally sit shivering in their own homes because they have no money to heat them. The stories of those who are suffering so deeply very rarely get put on television, but that doesn't mean that they aren't very real.The truth is that there are millions upon millions of American families that have been pushed to the edge of despair by the lack of jobs. In August 2009, only 10 percent of the unemployed had been out of work for 2 years or longer. Today that number is up to 35 percent.

One very disturbing sign of the times is that many churches are now holding "blue Christmas" services to comfort those who are going through hard times. Back during the "good times" such a thing would have been unimaginable, but now they are being held from coast to coast.

All over the nation, food banks, aid agencies and homeless shelters find themselves absolutely overwhelmed this winter. Connie Lassandro, Nassau County's director of Housing and Homeless Services, recently was quoted in the Huffington Post as saying that she has never seen a greater demand for her agency's services....

"The new faces we're seeing are families who have never before faced the risk of actually being homeless. Children don't understand. 'Where's my bedroom? Where's my toys? Where are my friends?'"

Sadly, the truth is that the U.S. economy no longer produces even close to enough jobs for everyone, so somebody is going to suffer. Today, there are over 6 million Americans that have been unemployed for half a year or longer. It can be really easy to quote economic statistics such as this, but sometimes what gets lost in all the numbers are the very real stories of the people that are actually living through all of this. This year there are literally millions of American families that have sad Christmas stories to share.On The American Dream blog, a reader of my column identified as "momma loses hope" recently left a comment in which she really opened up and shared her story with us. Sadly, her story is so similar to what so many millions of other young American families are going through this holiday season....

While my husband has experience, and an education, he is yet to find and keep a job that is worth anything, that would be possible to pay back these $400/mnth loans on deferment, let alone keep us going barely.Despite his greatest effort and attempts, to locate work that would pay anything over $10 an hour in the field he trained for, or some cross over skills in another profession, still nothing has been happening beyond numerous and then dwindling interviews in the last 2 years.

He is currently working at a $10/hr people mill that has outrageous expectations that are near impossible to meet, just to keep your job. Much of what you are supposed to control, is not within your control! That was after having lost unemployment due to its exhaustion, where we had nothing coming in for 30 days. He found this job and went through training. We were thankful to have anything coming in, but it is not going well. Half of his training class is gone either bc they quit or were fired. We are finding out this is the normal for this business.

Prior to the unemployment of 99 weeks, he had a great new job. $60 k a year was good from having some on the job experience at another job prior to that which was an internship, he got. So this was a good option for a chance out of school. They were content with his level of experience of 3- 4 years in IT w/ the hands on education and internship. We moved to relocate for this job 2500 miles away and then he was let go 6 months later, after he was able to clean up a bunch of unresolved problems for them. They wanted someone with 10 years of experience, all the sudden, despite they knew his skill level! Anyhow, the network was held together with tape and bubble gum. So long "best practice" theory.

I guess they had been left in the lurch bc someone left without notice, they advertised for help for months even out of state, and then they hired my husband to fill the desperate gap. Then they didn’t want to keep shelling out the money to keep him. Used him and turned us away, like no big deal; They fired him after 6 months, after we spent all our savings to move to another state… That is when we went on unemployment, and hubby returned for more education, while still looking for a job too.

We moved back home confused as could be. We were helpful that something would come along back home. Things only got worse for the prospect of careers being offered.

I was hoping they were going to improve, but no they have not. We are dying here. But that is not the end of our troubles.

Last year my husband got a $10 a hour job, got H1N1 and Dble Pneumonia and went to the hospital for 14 days or whatever. He was fired by Stream for not being in training and they refused to place him in another training class when he got out the ICU. Then we were left with over $10,000 ( the other $90 grand was forgiven) and we have collectors after us. We survive day by day, we don’t have anything extra to pay anyone or anything….

So, we don’t have any savings,( we used it to relocate to gain employment as I already mentioned) & we have needed things bc we have a baby coming. We haven’t made it long enough to get anything else saved up to rely on, bc unemployment doesn’t pay you what you were making at your job. The unemployment is gone and there is none left, if he loses this job. We don’t qualify for anymore student loans at this stage. This job is shaky at best and these people fire and lose people like there is no tomorrow, and have constant training going on. What a nightmare! We are not able to get a career in the IT Industry that he trained for and paid for with these loans. What do we do? We have a 6 year old and a baby that is on the way in 3 months.

We are so lost and without hope. We trust in Jesus, but what do we do beyond trying to get a better job? It takes effort to gain a job, but there are not enough possiblities hiring as this article states, and I testify to. All my husband does beyond going to this crap job, and playing with our son, is scouring the internet for jobs, and this has been going on for so long!….

I can’t believe this is happening again…..What is a mother and wife to do? We can’t get on track! We don’t drink or drug or sabotage ourselves and our family, and yet we cannot get on track "with the go to school and get a great job" crap I have heard my whole life. Something is broken and cannot be fixed. Sometimes we wonder why God hadn’t just taken my husband’s life when it was in peril and the rest of our family, as it would be better than dealing with this pain and unresolved heartache.

I am so scared and lonely, I could just die. My tears go unnoticed. I sit here without answers. I am one of millions going through the same thing.

Can you imagine being in such a situation? What is perhaps saddest of all is what this economy is doing to so many children. According to one recent study, approximately 21 percent of all children in the United States are living below the poverty line in 2010 - the highest rate in 20 years.Poverty is absolutely exploding all over the United States. The number of Americans living in poverty has increased for three consecutive years, and the 43.6 million poor Americans in 2009 was the highest number that the U.S. Census Bureau has ever recorded in 51 years of record-keeping.

So, no, this Christmas is not "a season of joy" for many Americans. For example, a commenter on the Unemployed-Friends website identified only as "jobless_in_MA" says that her holidays are going to be quite depressing since she has been out of work for 2 Christmases in a row now....

Well, this is now my 2nd Holiday season in a row being jobless, and this year seems far bleaker than last years. Ive always been the type to love this time of they year. I would look forward to it. I was always the one in the family who would be the great gift giver, especially to the younger members of my family. Last year I was REALLY upset because I couldn't do 1/4 of what I normally would do, but still managed to enjoy the season. Im not so sure about it this year.

A lot has happened to my situation in the past year, Ive lost my place, filed bankruptcy, lost some of my dignity, and my marriage is on the rocks.

I am NOT in the holiday season at all, and its really bringing me down. Usually around now we would be talking about getting a tree. Sometimes we would cut our own tree down, and decorate it together.

We would always have a family holiday party at our place, and I don't see that happening this year at all.

Yes, every year there are some Americans that are "down and out", but it is undeniable that the number of Americans that are suffering extreme economic pain has absolutely skyrocketed in recent years. Today, one out of every six Americans is now enrolled in a federal anti-poverty program. As 2007 began, "only" 26 million Americans were on food stamps, but now 42 million Americans are enrolled in the food stamp program and that number keeps rising every single month.Sadly, there are millions upon millions of Americans that do have jobs and yet barely find themselves able to hang in there. Many Americans have been forced to grab whatever job they can find. In fact, the number of Americans working part-time jobs "for economic reasons" is now the highest it has been in at least five decades.

It is becoming increasingly more difficult to make a living in the United States. Today, half of all American workers earn $505 or less per week.

Could your family get by on $505 per week?

That is something to really think about.

So is anyone doing well?

Well, the only group that saw their household incomes increase in 2009 was those making $180,000 or more.

Not that being wealthy is a bad thing, but what that statistic shows is that the middle class in America is being wiped out.

We are seeing this in community after community across the nation. A reader of this column identified as "Bibi" recently left a comment that did a great job of describing the economic decline and economic despair that we are now seeing all across America....

I have recently traveled from coast to coast and then some. This is a synopsis of what is really going on. Californians seem to be in lalaland. Look good and spend money, lots of it that you don’t have. LA has become very dangerous. Police will knock on your van if you stop to rest with a coffee even if you are at a convenience store. It is illegal to sleep in your vehicle and you will be arrested. Las Vegas is full of poor and homeless wandering around aimlessly. Tent cities and blocks of people living on the streets. dirty and super dangerous. The decline is in your face. Police and security presence are at ‘ad nauseum’ levels.

AZ and NM are ****holes. My family refused to get out of the van in Albuquerque. Sedona is still nice but its surrondings make it on borrowed time. Little artsy towns will be taken over quickly when TSHTF. The only city I went to in TX was Amarillo. Didn’t see much but it looked seedy and dirty along the highway. OKlahoma- ***. If I didn’t stay on a military base, I would have broke the speed limit to get through it. The thought of getting gas in Little Rock still gives me nightmares. Enough said. AK- Lots of boarded up towns. Saw this all along Route 40.

TN- Stay away from Memphis if you want to live. Nashville is the craziest city I have ever seen. Everyone acts like they are on speed. When you get around Pigeon Forge, Maggie Valley and Gatlinburg, you see the true beauty of this state but they are tourist traps. W. VA is beautiful, but the people are very backward. I could live in Northern W. VA. East coast- VA. Beach has been in decline and was just dubbed the "most drunken city in the U.S." They must be proud. Lots of trouble here. Big police presence. Took 10 minutes for me to get questioned about my out-of- state plates. N&

S Carolina- Bigger cities are dangerous, especially Columbia, SC. Big police presence. Baltimore- be afraid, be very afraid. Keep going. NJ- Something like a horror movie. Do people really live here? Scary and smelly. NYC- Was advised by thruway attendent to "keep going and don’t stop" Overturned cars, tons of high rise ghettos, not a safe place. I was terrified my van would break down.

Albany, NY.- my destination. Ghettopolis. Stopped by police within minutes as to why I was driving in city so late. ? Informed it was not safe. Stopped again the next day regarding my plates at a police check. They threatened to tow my van because my "license didn’t come up". [he was holding it] Stopped again for seatbelt violation. I always wear it but he said he couldn’t see it. Am I imagining it or did I really see National Guard walking around with rifles? Well, I promply left NYS and will never go back. The Florida panhandle is far from perfect and has an ever expanding police force, but it is quiet. Not safe, but quiet.

Once upon a time, there were a few cities and towns around the U.S. that were obviously in a state of decline, but now it is happening everywhere.In fact, there are many areas throughout the country that scream "economic despair" the moment you drive into them. It is almost as if someone has sucked the life right out of them.

So why is this happening? Well, as I recently pointed out, America's economic pie is rapidly shrinking. As our national wealth continues to be destroyed, even more American families are going to suffer.

For decades we have enjoyed a debt-fueled binge of prosperity that was unlike anything the world has ever seen. But now the day of reckoning is fast approaching and things are going to get even worse.

So if you are doing really well this holiday season, be thankful, because next year it may be you that has the sad Christmas story.

Lawmakers seek cash during key votes

by Carol D. Leonnig and T.W. Farnam - Washington Post

Numerous times this year, members of Congress have held fundraisers and collected big checks while they are taking critical steps to write new laws, despite warnings that such actions could create ethics problems. The campaign donations often came from contributors with major stakes riding on the lawmakers' actions.

For three weeks in June, for instance, the members of a joint House and Senate committee worked to draft final rules for regulating the financial industry in the wake of its 2008 meltdown. During that time, the 35 members of the drafting committee collected $440,000 in donations from that same industry, which was then lobbying heavily for looser rules.

Earlier this month, the chairman of the Senate committee overseeing tax policy, Sen. Max Baucus (D-Mont.), gave himself a birthday-party fundraiser - on the same day that the chamber took its first vote on an $858 billion tax package that would provide breaks to wealthy citizens and business interests. Members of Congress contacted for this article declined to answer questions about ethics rules and the possible appearance of impropriety. Instead, they stressed that their votes can't be bought.

"Money has no influence on how Senator Baucus makes his decisions," Baucus spokeswoman Kate Downen said. "The only factor that determines Senator Baucus's votes is whether a policy is right for Montana and right for our country." But ethics watchdogs complain that, in a race for money to help them win reelection, lawmakers routinely ignore congressional ethics rules that urge them to avoid fundraising around the same time that they are making key lawmaking decisions. The rules say that such sensitive timing could give the appearance that donors are improperly influencing decisions.

The Washington Post found that the pattern of crunch-time fundraising has continued this year, even after a congressional investigative office warned this summer that it could violate ethics rules. The Post analysis - using data from two nonprofit organizations, the Center for Responsive Politics and the Sunlight Foundation - scrutinized lawmakers involved in pushing key legislation and donations made to them by interested parties.

"Citizens generally feel this kind of thing falls between the bookends of 'icky' and 'bribery,' " said David Levinthal, a spokesman for the Center for Responsive Politics, which charts campaign donations and special interest influence. "It makes people wonder: Is the donor making the donation because they are trying to get a particular legislative action? Or is the member soliciting the donation because they feel they have a whole bunch of special interests over a barrel at that moment and can profit from that?"

Members of Congress say that donations close to key votes are often coincidental. Some argue that because legislative action and fundraising happen all the time on Capitol Hill, it is impossible to know when the two are connected. Ethics watchdogs say that instead of protesting their innocence, members should write clearer rules, disclose all fundraisers or both, in order to address public concern that monied donors are able to buy access at critical stages in lawmaking.

"What this reveals is just how much this is general operating procedure on Capitol Hill, raising money around key legislative decisions," said Nancy Watzman, who oversees analysis of political fundraisers for the Sunlight Foundation, which advocates for government transparency. "This hits right to the core of how lawmakers get and keep their jobs. And they complain when you show the public how it works."

A test case

The issue of the timing of donations came up this summer when reports surfaced that eight members were under investigation by the independent Office of Congressional Ethics. They had solicited hundreds of thousands of dollars in donations from financial firms just before a critical House vote last December on new regulations for Wall Street. The ethics office was looking at whether they should have avoided those donations because of the potential for or appearance of impropriety.

Three cases, involving Reps. John Campbell (R-Calif.), Tom Price (R-Ga.) and Joseph Crowley (D-N.Y.), were referred to the House ethics committee, which last week asked for more time to investigate. All three have said that they complied with House ethics rules. But just as the public learned of the ethics office's probe in June, a conference committee of House members and senators met to draft a compromise bill on landmark Wall Street reform.

The measure would force firms to follow new rules for previously secret and risky transactions that were blamed for the 2008 market meltdown. Over the course of three weeks in June, the 35 conference committee members collected $440,000 in donations from the financial industry. Sen. Charles E. Schumer (D-N.Y.), a member of the Senate banking committee and a powerful conferee, collected the most that month - about $90,000 from financial interests.

Executives of accounting giant Ernst & Young contributed the lion's share of that amount for Schumer: $49,000 in all of June, including $2,000 from chief executive James Turley. Ernst & Young works for some of the biggest firms on Wall Street. This week, New York state sued the company, accusing it of using a paperwork shuffle to help Lehman Brothers hide billions of dollars in debt before that firm's 2008 collapse.

Schumer's staff declined to discuss the ethics rules' advice on forgoing some donations, but said the timing is not relevant. "During this period, Senator Schumer was actively fighting for some of the proposals most opposed by the banking industry, including a strong consumer watchdog agency and greater oversight on derivatives," spokesman Brian Fallon said. Conference members also were busy on the party circuit that month. There were 54 fundraisers held to benefit the reelection campaigns of committee members, or featuring one of those members as a VIP guest.

Rep. Barney Frank (D-Mass.) was mentioned as the VIP guest for a Florida lawmaker's fundraiser 48 hours before the committee officially began work. The party host was DLA Piper, a law firm registered to lobby on the bill for several financial clients, including Discover Financial Services, Experian and Charles Schwab. Frank's committee office did not respond to a request for comment, but Frank has previously said that he follows all ethics rules carefully.

Business generosity

In September, the Senate voted on what it considered one of the year's most important pieces of legislation, the Small Business Job Creation Act. The bill, which later became law, created a $30 billion loan fund for community banks and gave them incentives to lend the money to small businesses. Hundreds of lobbyists were registered to lobby on this legislation, in part because it meant more business for banks.

Senators collected $469,000 from the financial industry the day before, the day of and the day after that key Sept. 16 vote, a Post review of donations shows. The biggest recipient was Senate Majority Leader Harry M. Reid (D-Nev.), who shepherded the legislation and faced a tight reelection race. Reid spokesman Zac Petkanas said the timing was not of Reid's making. The vote was supposed to come months earlier but was delayed by Republican obstruction, Petkanas said.

"Senator Reid's sole consideration on any piece of legislation is always how it will benefit Nevada's families and small businesses," Petkanas said. "He will not apologize for working for months to pass the Small Business Job Creation Act, which is now helping Nevada small businesses during these difficult economic times by opening up otherwise unavailable lines of credit to help them grow, strengthen our economy and put people back to work."

Birthday surprise

Early this month, when Baucus held his birthday fundraiser, Democrats that same day sent to the floor a $858 billion tax cut package. The bill, which has since become law, extends tax cuts passed during George W. Bush's presidency, but also provides huge breaks for wealthy Americans and niche business interests. The invitation to Baucus's event solicited money from lobbyists and executives with major stakes in the package.

Baucus's office said that the bill that passed was not his and that his fundraiser - which included an event for donors of at least $5,000, held at a location that was not made public - was scheduled months before the legislation went to the floor.

Senate fails to act on nominee to head Federal Housing Finance Agency

by Peter Schroeder - The Hill

The 111th Congress concluded its work without voting on the administration's nominee to head the Federal Housing Finance Agency, Joseph A. Smith, Jr. The Obama administration notched a number of victories in the last week of the lame duck session, but in the flurry of activity, the Senate failed to act on the president's pick to head the agency overseeing Fannie Mae and Freddie Mac.

The administration would have to re-nominate Smith for the position when the new Congress is sworn in next year. Smith, currently the North Carolina Commissioner of Banks, had been cleared by the Senate Banking Committee on Dec. 14 by a 16 to six vote. However, he faced some stringent opposition from Republicans, most notably the committee's ranking minority member, Sen. Richard Shelby (R-Ala.).

Shelby pressed Smith during a nomination hearing about whether he would reject administration pressure to write down mortgages held by Fannie and Freddie if it was not in their best interest economically. Smith responded that in the position he would act first and foremost as conservator of the government-sponsored enterprises. However, his answer did not win over Shelby, who blasted Smith after the committee's approval, saying he lacked the skills and experience necessary for the position, and again questioning his ability to stand up to the administration.

"We need a watchdog, not a lapdog," he said in a statement. If he had been approved, Smith would have replaced Edward DeMarco, who has served as acting director of the FHFA since August 2009. The inaction on the nomination comes as lawmakers are expected to consider reforming Fannie and Freddie next year.

Japan tightens short selling rules

by Michiyo Nakamoto

Japan is introducing a rule to ensure that short selling does not undermine new share issues, in response to criticism that current practices, coupled with suspected insider trading, unfairly punish long-term shareholders and distort the market. Under the new rule, any investor who shorts a company’s shares during the period between the announcement of a new share issue and its pricing, will be prohibited from receiving shares in the new share issue.

The Financial Services Agency will introduce the new measure sometime between April and September next fiscal year. The move is in response to concerns that massive short selling before recent new share issues has hurt both the issuer and its long-term shareholders. Under current rules, when a company announces a new share issue, hedge funds and other investors can short the company’s stock and then buy back shares to cover their short position through the new share allocation, which is usually priced at a discount to the market price.

"It’s a trading practice that is negative for long-term shareholders and for the companies and it is due to a regulatory loophole," said Ken Kiyohara at Jones Day, the law firm. "It is both necessary and desirable that the loophole is closed."

The US prevents investors who have shorted shares during a specified period before a new share issue from covering their positions by buying back shares through the allocation. The latest FSA move comes amid complaints from some investors of rampant short selling by funds with access to inside information before a new share issue has been announced. Early last month, for example, shares in Resona, Japan’s fourth largest bank, plunged 16 per cent in one day, immediately before its announcement of a hugely dilutive Y600bn ($7.2bn) new share issue.

However, some worry that the new rule could have undesired consequences. One banker said that while the move was in the right direction, it did not solve the problem of alleged insider dealing. "I would argue that it provides an even greater incentive to get the information before the deal is announced," said the banker, adding that the prohibition against shorting should start earlier to discourage inside trading.

To tackle insider dealing, the FSA is also asking the Japan Securities Dealers’ Association to consider ways to ensure stricter compliance by companies issuing new shares and their underwriters. The regulator is also examining ways to facilitate rights issues, which are virtually unheard of in Japan, to counter the problem of short selling ahead of new issues. Rights issues would make it more difficult for hedge funds to profit from shorting stocks ahead of new issues, since they would need to own shares already to participate in the new allocation.

Bank of Japan Has Done All It Can to Overcome Deflation, Cabinet Office's Wada Says

by Tatsuo Ito and Keiko Ujikane - Bloomberg

A Japanese government official who attends Bank of Japan policy board meetings said the central bank has provided adequate stimulus and it’s the "government’s turn" to try boosting demand.

"The BOJ has pretty much done everything it can do," Takashi Wada, a parliamentary secretary at the Cabinet Office and a ruling party member, said in an interview in Tokyo on Dec. 22. "It’ll probably be hard for the Bank of Japan to find more effective policy tools. So, it will be the government’s turn to make more of an effort with policy steps."

Wada’s remarks reflect reduced political pressure on the BOJ to further ease credit as the yen retreats from 15-year highs against the dollar and stocks gain. While a group of ruling Democratic Party of Japan politicians last month urged the BOJ to supply more liquidity to eradicate price declines, Wada said instead the government needs to get banks to lend more rather than invest in bonds to overcome deflation.

"The central bank has created the right environment" to encourage banks to extend more loans, said Wada, 47. "It’s strange that private banks can’t lend. They are pouring money into government bonds even though they have sufficient funds to extend loans. Their money should go into companies rather than government bonds."

Anti-Deflation Group

Prices of corporate debt and real estate investment trusts have climbed since BOJ Governor Masaaki Shirakawa introduced in October a 5 trillion yen ($60 billion) fund to buy those assets as well as government and corporate debt. The BOJ also lowered its target interest rate to between zero and 0.1 percent. The yen has dropped more than 3 percent against the dollar from a 15-year high of 80.22 reached Nov. 1. The Japanese currency traded at 83.05 as of 11:11 a.m. today. The Nikkei 225 Stock Average has gained more than 9 percent this quarter.

The DPJ’s anti-deflation group last month said the BOJ should adopt an inflation target to stop price declines and increase employment, and called for the revision of law that guarantees the bank’s independence to ensure the BOJ pursues those policy goals. The group consists of about 150 lawmakers, more than a third of the party’s total members in the diet. Underscoring the deflationary pressure on Japan’s economy, nationwide consumer prices excluding fresh food fell for the 20th straight month in October.

Lending Decline

Bank lending decreased for a 12th month in November, extending the longest streak of declines since 2005, central bank figures show. Corporate demand for loans has slid for six quarters as some businesses pare investments, according to a Bank of Japan survey of loan officers. Japanese lenders held 278.8 trillion yen of Japanese government debt as of Sept. 30, compared with 270.2 trillion yen as of June 30, according to the Bank of Japan’s flow of funds data released last week.

Wada, who worked at the Finance Ministry from 1988 to 2003, said the BOJ’s 5-trillion yen fund will benefit the economy. He has attended BOJ policy board meetings along with Finance Ministry officials as a government representative.

China Increases Interest Rates to Curb Its Fastest Inflation in Two Years

by Li Yanping - Bloomberg

China raised interest rates for the second time since mid-October to counter the fastest inflation in more than two years and more moves may follow. The benchmark one-year lending rate will rise by 25 basis points to 5.81 percent and the one-year deposit rate will climb by the same amount to 2.75 percent, effective today, the People’s Bank of China said in a one-sentence statement on its website late yesterday.

Economists surveyed by Bloomberg News earlier this month forecast one percentage point of increases by the end of 2011.PremierWen Jiabao is seeking to slow gains in property values and consumer prices that are making it harder for families to buy homes and pay for food. Bank lending and a wider-than- forecast November trade surplus have pumped more cash into an economy already awash with money.

"This demonstrates how determined the government is to control inflation," said Wang Qing, a Hong Kong-based economist with Morgan Stanley. "Interest rates on medium and long-term loans are adjusted by banks at the beginning of every year so by raising rates now, this will have a much greater tightening effect than it would have in January." Wang said he expects three more interest-rate adjustments of 25 basis points each in the first half of next year. Ken Peng, an economist at Citigroup Inc. in Hong Kong said yesterday he forecasts increases totaling 100 basis points next year.

Tighter Policies

Today’s interest-rate increase is the first since Chinese leaders on Dec. 3 announced a shift to a "prudent" monetary policy from the "moderately loose" stance adopted to support the economy amid the global financial crisis. China reported 5.1 percent inflation for November, the highest in 28 months. Also in November, exports reached a record $153.3 billion and the trade surplus exceeded $20 billion for the fifth time in sixth months, indicating a recovery in international trade from the global financial crisis.

The latest rate increase is aimed at reining in inflation expectations and narrowing the gap between gains in consumer prices and savings rates, Ba Shusong, a researcher at the State Council’s Development Research Center, told state television yesterday after the announcement. The new benchmark one-year deposit rate of 2.75 percent and the five-year rate of 4.55 percent compare with inflation of 5.1 percent in November.

Concern that the government would increase interest rates to slow expansion in the world’s fastest-growing major economy spurred an 11 percent selloff in the benchmark Shanghai Composite Index of stocks in November. The index jumped 2.9 percent on Dec. 13, the biggest gain in eight weeks, after the central bank ordered lenders to set aside more money as reserves to control liquidity rather than boosting borrowing costs.

‘Prudent Move’

"A rate hike is not normally on the wish-list for Santa Claus, but in China’s case this is a prudent move," said Brian Jackson, a senior strategist at Royal Bank of Canada in Hong Kong. "It is increasingly clear that using quantitative measures such as the reserve requirement ratio to rein in liquidity and credit hasn’t been enough and adjusting the price of credit is needed to get price pressures under control."

China is tightening after a record expansion of credit to counter the effects of the world financial crisis. The broadest measure of money supply, M2, has surged by 55 percent over the past two years and outstanding yuan-denominated loans have climbed 60 percent to 47.4 trillion yuan.

The country is lagging behind counterparts across Asia that took steps earlier to raise borrowing costs from global recession lows. Malaysia boosted its benchmark rate three times, starting in March, Taiwan began in June and South Korea in July. The PBOC last lifted the benchmark one-year lending and deposit rates on Oct. 19, the first increase since 2007.

The government is taking a "very prudent approach" to boosting interest rates because of an unstable and rapidly changing global environment, central bank Governor Zhou Xiaochuan was cited as saying by the official China Daily on Dec. 17. Yesterday’s announcement may indicate that policy makers now regard curbing inflation a more pressing task as price increases extend beyond seasonal fluctuations in food.

Residence-related costs, including charges for water, electricity and rent, jumped 5.8 percent last month from a year earlier, the most in more than two years, and consumer goods prices rose 5.9 percent, the biggest gain since August 2008, according to statistics bureau data.

‘Long-term Battle’

China raised gasoline and diesel prices by as much as 4 percent on Dec. 22 to reflect higher global costs of oil. Still, the increase was less than half of the gain in crude prices over the previous month and the nation’s planning agency said it limited the rise because of the "rapid increase in overall prices." The nation must prepare for a "long-term battle" against price increases, Peng Sen, vice chairman of the National Development and Reform Commission, told state television on Dec. 21. The root causes of inflation have yet to be resolved, he said, citing domestic supply shortages, gains in global commodity prices and excessive liquidity.

Inflation is likely to reach 3.3 percent for the whole of this year, breaching the government’s target of 3 percent, Peng said. The commission raised its expectation of average gains in consumer prices next year to 4 percent, state television reported on Dec. 14.

Consumer price increases may accelerate to more than 6 percent in coming months, Ben Simpfendorfer, a Hong Kong-based economist at Royal Bank of Scotland Plc, said in a Dec 11 note. Inflation will remain "relatively high" in the first half of next year, especially the first quarter, as the impact of rising costs in October and November feeds through to the data, the NDRC said on Dec. 11.

The government has been reluctant to raise interest rates, preferring to increase the amount of deposits banks must set aside as reserves to curb liquidity that’s fueling gains in food and asset prices. The People’s Bank of China has increased the reserve ratio six times this year, including three times since November. Policy makers are concerned that raising interest rates could "encourage hot money inflows," Paul Cavey, a Hong Kong- based economist at Macquarie Securities Ltd. said. "Raising interest rates has far more implications" than ordering lenders to set aside more of their deposits as reserves, as it may affect the ability of local governments and companies to pay their debts.

Hot Money

State Council researcher Ba Shusong told state television yesterday that the government will step up regulation of capital inflows, without specifying measures that will be taken.

The nation’s foreign-exchange regulator this month published a list of companies involved in illegal currency deals including the use of fake contracts as part of its crackdown on hot money inflows, the official Xinhua news agency reported on Dec. 10.

The Ministry of Commerce is stepping up supervision of foreign investment in real estate to crack down on speculation after a 48 percent jump in overseas fund inflows to the industry in the first 11 months of the year, spokesman Yao Jian said on Dec. 15.