Eastport, Maine, Group of young cutters, Seacoast Canning Co., Factory #2, waiting for more fish. They all work, but they waste a great deal of time, as the adults do also, waiting for fish to arrive

Ilargi: I'm going to have to invoke some sort of raincheck today. The parts to fix my computer got to Montreal today, so I had to get over (t)here. too much traffic, took 3 hours, yada yada, and now I have to do a day’s work in 2 hours, since the café I’m working in in town is filling up as we speak with people coming to see game 7 of the NHL playoffs. In other words: I’ll be back home tomorrow, and much more will follow then. Apologies in the meantime, but there's not much more I can do than I have..

Meanwhile, there are some very interesting items today. Tyler Durden says that there are strong suggestions that the entire spring rally has been founded on government interference. I doubt that will ever be proven in a substantial way, but it would explain a lot about the gap between the markets and the real world.

Willem Buiter has a good one as well: the biggest part of the US federal debt, Social Security and Medicaid/Care, is indexed and can therefore not be inflationed away. Big point! The more value the US dollar loses, the more expensive the programs will become. Well, you know, sort of.

Look, these programs are dead. All pension plans and "medicary" plans are. You ain't getting any. These plans are all heavily invested in risky assets, and they‘re all going to be hammered by the wrong side of the risk. Everybody and their pet parrots are buying into these stocks that will fall down into a dungeon soon, and your pension plan managers are the first to do so, and it's too late to stop them. If Tyler Durden's suspicions pan out, and my money is 100% on them doing just that, then Stoneleigh and me have been right all along (once again), and stock markets will be scraping red blistered hurting baby bottoms very soon.

I know, it's hard to believe. Certainly if and when you look outside and everything seems to work pretty much as it did yesterday. But really, guys, it's over.

Oh, and yes, prove me wrong in anything I’ve said, we got that one on once more. Prove me wrong. Not suggest, not insinuate, I want proof. Example: over a year ago, I said people MIGHT not recognize their world by Christmas. They did still, forgot about the word MIGHT, and said I was wrong. Nope. That’s not proof. Doing this out of context is bugger. Bring it. But bring it smart.

The fiscal black hole in the US

US budgetary prospects are dire, disastrous even. Without a major permanent fiscal tightening, starting as soon as cyclical considerations permit, and preferably sooner, the country is headed straight for a build up of public debt that will either have to be inflated away or that will be ‘resolved’ through sovereign default. The dynamics of US general government (Federal, State and Local) public debt since 1970 is shown in Figures 1 and 2 below.

They show the fiscal irresponsibility of the George W. administrations; fiscal policy was relentlessly procyclical, with the sizeable primary surpluses of the Clinton years blown away in a series of regressive tax cuts. Figure 3 shows that, even before the economic downturn started raising the numerator and lowering the denominator of public spending as a share of GDP (from the second quarter of 2008), general government expenditure had been growing faster than GDP during most of the George W. years (all three figures are based on OECD data).

US general government debt relative to GDP is now just above the level of the Euro Area - 73.0% for the US at the end of 2008 as opposed to 69.3% for the Euro Area. Public spending as a share of GDP in the US (38.7% for 2008) was still eight percentage points lower than in the Euro Area (46.7%). As the US entered the downturn 2 or 3 quarters before the Euro Area, the cyclically corrected difference is public spending programme size is likely to be even larger. Even if we ignore the relentless build-up of public outlays through the social security programmes and especially through the Medicaid and Medicare programmes, the extraordinary levels predicted for the US Federal deficit for the next couple of years (13 to 14 percent of GDP for the next year and not much less for the year after that), plus the cost of recapitalising the banks, shoring up other wonky bits of the financial system and intervening to bail out rust-belt behemoths like GM and Chrysler are likely to put the general government gross debt to GDP ratio at well over 100 percent.

Even that, however, is only the beginning. It does not yet include price tag for the laudable ambition of the Obama administration to ensure that no American is without health insurance. Nor does it include planned government outlays for updating America’s clapped-out infrastructure or the pursuit of the environmental agenda. Bringing American secondary education (numeracy, literacy, foreign language skills etc.) up to the levels of the most successful emerging markets will also be very expensive, although more government money is only a necessary condition for significant progress in this area; a major change in the governance arrangements for schools in the incentives faced by teachers, heads, pupils and parents are also necessary. And I cannot really envisage Obama confronting the American Federation of Teachers. Without reform in governance and incentives, even vastly increased public spending on health and education will achieve in the US what it achieved the UK under Labour in the past six years: very little indeed.

So new spending commitments on health, infrastructure, the environment and education will take US general government spending as a share of GDP comfortably over the 40 percent level, even on a cyclically adjusted basis. Even if the US were to recoil from further imperial overstretch and halved military spending as a share of GDP, that only would know 2.5% of the total public spending share. Then come the famous ‘unfunded liabilities’ of social security, Medicare and Medicaid. There is a bit of abuse of language in the term ‘liabilities ‘here. We are not talking about contractual commitments or legal obligations. We are talking about promises made by politicians and expectations of US citizens shaped by these promises. Unfunded social security liabilities are the “infinite horizon discounted value” of what has already been promised to recipients but has no funding mechanism currently in place.

For social security this is $13.6 trillion, slightly less than a year’s worth of US GDP (around $14 trillion). While big, social security promises are dwarfed by Medicare promises. There are three components to Medicare. Medicare Part A covers hospital stays; its unfunded component has an infinite horizon present discounted value of $34.4 trillion; Medicare B covers doctor visits; its unfunded component is worth $34.0 trillion. Medicare D covers the drugs benefit; its unfunded component amounts to $17.2 trillion. The total unfunded liability for Medicare is $85.2 trillion, just over 600% of US annual GDP. Medicare and social security together have unfunded liabilities worth 700 percent of US annual GDP. Sure, these numbers are point estimates with wide margins of error. But the potential errors can go either way. In addition, these are, once again, not legal or contractual liabilities, like public debt or pension commitments of the state to its employees. They are promises by the government; hopes and expectations for the public.

It is obvious that these unfunded liabilities of social security and Medicare will be defaulted on. They will not be met in full. The modalities by which the state will renege on these promises and commitments can be partly foreseen based on relevant experience in the UK and elsewhere: failure to index-link social security benefits to earnings or even to the cost of living; rationing of hospital stays and doctors visits; denial of expensive treatments and medication to state-insured patients (beginning with the elderly) etc. etc. But no doubt our political masters will be able to surprise us with the ingenuity of the dodges they will design to ‘default’ on these unfunded liabilities. To fund all these unfunded commitments, a permanent tax increase or spending cut as a share of GDP would be required equal in magnitude to the unfunded liability as a share of GDP (700 percent) times the excess of the long-term interest rate on the public debt over the long-term growth rate of GDP.

Even if that excess were only 1 percentage point, the permanent primary surplus would have to rise by seven percent of GDP. If the excess is 2 percent, the permanent primary surplus would have to rise by 14 percent of GDP. The optimistic case would, if the entire adjustment were to take place through higher taxes, take the US tax burden to the current average level of the Euro Area. If the long-term interest rate is 2 percentage points above the long-term growth rate and the entire adjustment were to occur through taxes, the US would be well on its way to becoming Sweden, at least as regards the tax burden. Adding Obama’s own new commitments to these unfunded liabilities would raise the necessary permanent increase in the general government primary surplus to at least 10 percentage points of GDP, and possibly 20 percent of GDP.

These figures should not come as a surprise. Obama’s plans for public expenditure are conventional, middle-of-the road social democratic spending plans. You cannot have social democratic spending ambitions if you are not able to impose social democratic tax burdens. My fears about the sustainability of the US public finances is based on my belief that the US public believes there is a Santa Claus: that you can have the higher benefit levels and higher-quality provision of public goods and services without paying the price in the form of higher taxes or user charges. The US polity is so polarised, that it is not likely that a compromise will be achieved in the years and decades to come, on how to raise the additional revenues or how to cut public spending by enough to restore public debt sustainability.

Exaggerating slightly, the Democrats will veto any future public spending cuts and the Republicans will veto any future tax increases. The result will be a build-up of public debt of such magnitude, that the markets will force the government to choose between inflation and default. The state will choose inflation. It always has done to in the past when the debt burden was exceptionally high. If the state wanted to signal it will not choose inflation, it would retire its dollar-denominated debt and replace is with index-linked debt or foreign-currency denominated debt. There is no sign of this. Indeed, even as regards new debt issues, index-linked debt is hardly on the menu at all. When a commitment device is easily available but is not adopted, I tend to get concerned.

The markets are slowly waking up to the threat of inflation as a solution to fiscal unsustainability in the US. The fact that, in the short run (say for the next 3 years or so) deflation is much more likely than inflation does not help, as markets are hopelessly myopic. But once we get more than 3 years into the future, and certainly more than 5 years, the risk of high inflation (between 5 and 15 percent, say) is a material one. Only if Obama manages to put together a new coalition, based on a new national consensus, about the level of public spending and the distribution of its funding burden, will there be a non-inflationary way out of the debt dilemma. Such a major political realignment is possible, but not likely.

Ten-year rates on Treasury Notes have just begun to tickle 4 percent. Sooner (if markets become less myopic) or later (if markets remain stuck between blindness and myopia) the reality of the future inflationary threat will feed into interest rates at maturities of five years and longer. The Fed will not be able to stop this. It may temporarily be able to check the rise in long rates at those exact maturities it decides to purchase, but it cannot be present continuously at all maturities. Ultimately, the 10-year rate is driven by expectations of short-term rates (like the Federal Funds rate) over the next 10 years. Sure there are term premia and there may be inflation risk premia (negative or positive) that come between the 10 - year rate and expected future short rates over a 10-year horizon. But expectations dominate.

The Fed can only commit itself to a sequence of low future short rates (on average) if it can credibly commit itself to raise future short rates, should it be required to maintain price stability, to whatever level is necessary. But if the fiscal authorities (the Treasury and ultimately the White House) are considered likely to stop the Fed from fighting inflation effectively in the future, because such inflation is deemed necessary by the fiscal authorities to restore fiscal sustainability, then we are likely to see scenario where future short rates rise, as inflationary pressures rise, but not by enough to bring inflation down rapidly. Ex-post real rates will fall, thus achieving the objectives of the fiscal authorities. The $300bn worth of Treasury securities the Fed has agreed to purchase already are not a threat to price stability - it is peanuts.

It does barely enough to offset the reduction in the balance of the Treasury’s account with the Fed since the beginning of the crisis. But as the Federal government starts issuing additional debt worth a couple of trillion US dollars or more each year, the willingness of the Fed to monetise this increased debt issuance will be the key factor determining who will win the game of monetary-fiscal chicken that is just now starting. The independence of the Fed is not securely anchored. A chairman of the Fed who refuses to monetise government debt that the Treasury wants to be monetised, or who wants to de-monetise Federal debt acquired in past quantitative easing episodes when the Treasury does not want the Fed to exit from QE, will be replaced.

Limits to inflating away debt and political commitments to future public spending

In response to my previous blog, “The fiscal black hole in the US”, ‘Peter’ makes the comment that much of the unfunded ‘liabilities’ under social security and Medicare are index-linked and cannot be inflated away. This is an important point. Inflation reduces the real value of nominal liabilities. If these nominal liabilities are interest-bearing, and have fixed market-determined interest rates that mas or menos reflect the rate of inflation expected at the date of issuance of these liabilities over the maturity of the liability, then only actual inflation higher than the inflation expected at the time of issuance actually reduces the real value servicing that liability.

If longer-maturity nominal debt instruments are floating rate securities, whose variable interest rate is linked to some short-term nominal rate benchmark, it becomes very difficult to inflate the real burden of that liability away. If the liability is index-linked, it is impossible to inflate its real value away. The same holds if the liability or the commitment is denominated in foreign currency, something that is uncommon in the US, but common elsewhere. Only a change in the real exchange rate can affect the real burden of foreign-currency-denominated liabilities. Formally, some of the unfunded liabilities, including current social security commitments to future benefits, have indexation clauses attached to them - sometimes to CPI inflation, sometimes to the inflation rate of average earnings.

Political commitments to health care provision are no doubt, in the minds of the public, commitments to a given standard of care, which amounts to index-linking to earnings growth and the growth in the cost of other health care inputs. But the legislation and rules covering these future commitments do not, as far as I know, contain any explicit indexation rules and formulae. If the political determination to renege on these commitments is there, it can therefore be achieved quite easily through actual inflation - it would not even require unexpected inflation. This is what was done in the UK with the real value of the state pension - the UK’s social security retirement benefit. As a result, the UK now has the least generous state-funded basic pension of any western country.

Of course, the true savings for the budget achieved by eroding the real value of the state pension in the UK is smaller than the reduction in the value of the state pension. The poverty in old age created by the very low state retirement pension leads to higher public expenditure in other budgetary categories. Examples of this are the Winter Fuel Payment in the UK (which amounts to throwing a discretionary payment at the elderly around Christmas, to stop them from freezing to death), or the free TV license for the over 75s, which stops the elderly from going out, rioting and blockading Parliament to demand a less stingy basic state pension.

Such examples of the Haile Selassie welfare state (named after my father’s description of watching the late Emperor of Ethiopia drive through Addis Abeba throwing bank notes from the window of his limousine) taking over when a systematic approach to welfare threatens to become unaffordable can be found all over the world. So yes, to the extent that any liabilities, whether they are formal contractual obligations or political promises or commitments are de-facto index-linked, they cannot be inflated away. This does not mean that governments will not attempt to inflate them away. The history of hyperinflations tells us what happens if neither the anticipated inflation tax nor the unanticipated inflation tax can fill the budgetary hole. Hyperinflation is not in the US future, however, as any conceivable US government would default on its formal obligations and renege on its political commitments before letting that happen.

America's Wretched Current Account Balance Points to U.S. Dollar Collapse

With a growing chorus of financial cheerleaders proclaiming that "green shoots" are sprouting, pointing to a bottoming out of the U.S. recession, the latest trade figures from the U.S. Commerce Department reveal contrary indicators. American exports are continuing their decline; imports are also plummeting, but not as sharply as exports, contributing to a widening trade gap. In essence, the report on April's imports and exports describes an American economy that is in continuing decline, in the context of a synchronized global recession that shows no signs of abating.

In April, the U.S. trade deficit widened to $29.2 billion. Some will maintain that this figure is not so bad, since in the period before the onset of the Global Economic Crisis, the United States had even larger monthly trade gaps. Those who play down the significance of April's trade numbers miss the most essential point. It is a combination of both the interest payments to foreign buyers of U.S. Treasury securities and the trade deficit that defines the nation's current account deficit. With a fiscal imbalance at an unprecedented number once thought in the realm of science fiction, adding a substantial annual trade deficit at a time when America is experiencing its worst economic and financial crisis since the Great Depression jeopardizes the prospects of any sustained recovery.

The United States is already projected to have a Federal budgetary deficit of $1.8 trillion in 2009, a figure that I believe will ultimately exceed $2 trillion, or approximately 15% of America's GDP. As is well recognized, the U.S. will have to borrow much of that deficit from overseas, resulting in ballooning payments to foreign holders of U.S. government debt instruments. Similarly, when the U.S. imports far more than it exports, the nation must pay for the resulting trade deficit with dollars. So here we have a perfect fiscal storm; quantitative easing by the Federal Reserve, massive overseas borrowing by the Federal government to pay its basic operating expenses, and massive borrowing or printing of dollars to pay for imports not covered by the net value of America's exports.

It appears that the trade deficit for 2009 will likely exceed $300 billion. When added to a multi-trillion dollar U.S. government deficit, a figure not even inclusive of state, county and municipal deficits, the result is a fiscal imbalance that is unsustainable. In short, the current account deficit is exploding, when one aggregates the quantum leap in interest payments the U.S. taxpayers will be compelled to make to overseas creditors in addition to financing the widening trade imbalance.

Typically, a nation that is experiencing a major gap in exports versus imports that is beyond fiscal prudence will have no recourse but to facilitate the devaluation of its currency. The rationale is quite simple; a cheaper currency means your consumers will buy fewer imported goods, while the nation's exports become cheaper. In normal fiscal times, that might be a prudent course to follow. However, as strong market forces are already weakening the U.S. dollar, any policy response designed to further depreciate the value of America's currency will destroy much of the value of U.S. Treasuries held by sovereign creditors, in particular China.

Yet, the U.S. trade imbalance combined with other economic and financial forces will inevitably devalue the dollar, which in turn will lead to heightened tensions between the United States and its primary foreign creditors. It just may be that April's trade figures are a leading indicator of a pending catastrophic collapse in the value of the U.S. dollar, a fiscal calamity that will add immeasurably to the financial and economic woes of the United States and the global economy. Green shoots? More like black clouds, at least to this observer.

True or False: U.S. Economic Stats Lie

How’s the economy treating you? Chances are, your answer is colored largely by three things: whether you’re working (if you want to), how much you’re making and how quickly your expenses are rising. Economists rely heavily on the same factors to judge the nation’s health. At last count, 9.4% of the workforce is jobless. Compared with a year ago, the goods and services we produce are worth 5.7% less while the ones we buy are 0.7% cheaper.

Two bright people might see sharply different things in those numbers. To one, the shrinking economy is a healthy unwinding of past excess, for example, while to another it’s a dangerous downturn that calls for bold government action. But what if the numbers themselves are something we should be debating? In the alarming view of a vocal few, America’s economic measures are misstated -- rigged, really.

The accusation goes like this: Surveyors collect the nation’s data and statisticians compile and report it. Politicians naturally want the numbers to show improvement. Not being able to change the facts, they focus on the handling of facts, pressuring statisticians to change their measurements. It’s not quite one grand conspiracy but decades of minor ones compiled. Today’s reports are so perverted, the theory holds, that the numbers have detached from common experience.

If the theory has a chief architect, it is John Williams, a semi-retired grandfather of five living in Oakland, Calif. The son of a chainsaw importer, Williams sold the family business in the 1970s and began consulting for corporations, recalculating government economic data to arrive at what he says were more reliable measures, and with them, truer forecasts. Today Williams runs Shadow Government Statistics (ShadowStats.com) from his home. For $175 a year subscribers get economic data and analysis adjusted to back out the accumulated effects of what Williams has dubbed the Pollyanna Creep -- Pollyanna being the orphan protagonist of the 1913 children’s book who learns to play the “glad game” to find cheery perspectives on life’s sorrows. In other words, he provides figures he feels are properly miserable, to offset government ones he says are too prettied-up.

If Williams is right, unemployment is over 20%, gross domestic product is shrinking by 8% and consumer prices are jumping by nearly 7%. His forecasts border on apocalyptic. The government is creating so much new money, he says, that the all but inevitable result is hyperinflation, where “your highest denomination, the $100 bill, becomes worth more as toilet paper than money.” Buy physical gold, he advises.

Whether we believe the forecasts or not, the possibility of a Pollyanna Creep has serious implications. Social Security payments are just one benefit adjusted each year for increases in the cost of living. If the figures hadn’t been corrupted, says Williams, checks might be close to double what they are.

Williams has managed to attract plenty of press. A year ago, Harper’s magazine featured a cover drawing of a grinning Uncle Sam fondling numeral-shaped party balloons, with the headline, “Numbers Racket: Why the Economy is Worse Than We Know.” The story centered on Williams’ data. The San Francisco Chronicle followed with “Government Economic Data Misleading, He Says.” Last fall in the London Times: “Forget Short-Sellers and Manipulators, Pollyanna Creep Could Be the Culprit.”

Government statisticians are frustrated. “Economic Data Seems Accurate” doesn’t make for a catchy headline, so the press, they say, are too quick to give credence to conspiracy theories. “We go out of our way to be transparent,” says Thomas Nardone, who during 32 years at the Bureau of Labor Statistics helped implement many of the changes in calculating the unemployment rate. “We’d be remiss if we didn’t make changes,” he says. “I’ve never seen measurement changes that were politically motivated.”

Katherine Abraham served as commissioner of BLS during the Clinton administration. Commissioners, unlike the statisticians who work for them, are political appointees. Now a professor at University of Maryland, Abraham says she did see political pressure, but rarely, and never with results. Once, she says, a prominent lawmaker told her the BLS might get more funding if it would agree to propose changes that reduce the appearance of inflation. Abraham says she rebuffed the offer.

Decide for yourself. Here’s a roundup of measurement changes at the heart of Williams’ claims, along with responses from people who work closely with the measurements. I’ll focus on unemployment and inflation, but not GDP, since the chief flaw with it, according to Williams, is how problems with the inflation measure overstate real, or after-inflation, growth. (There’s a different case to be made -- that GDP measures some fairly undesirable things, like the cost of war and divorce lawyers, and so isn’t a great proxy for economic well-being -- but I’ll save that subject for another day.)

About 13 million people were unemployed during the Great Depression, or around 25% of the work force, but those are fairly recent estimates. At the time, the government simply didn’t track data like it does today, which made it difficult to judge whether things were getting better or worse. Two main developments in the 1930s made tracking unemployment feasible. The first was an improvement in the way statistics are used to turn a relatively small sample into a faithful representation of the larger population. That allowed for the use of surveys. The second was the notion of basing one’s status as part of the unemployed work force on actions. Whether someone wants to work, after all, is a subjective thing. Whether they’re looking for work is not.

Today the BLS reports six measures of unemployment, called U-1 through U-6, for which the definition of unemployment gradually broadens. For example, 4.5% of the work force has been unemployed for 15 weeks or longer and is actively looking for work (U-1), while 15.8% is unemployed if we count those who say they want work but aren’t looking, and those who work part-time for lack of full-time options (U-6).

Williams takes issue with a 1994 change that coincided with a shift to computerized data collection from pencil and paper. Until then, a discouraged worker was someone who wanted to work but had given up looking because there were no jobs. The BLS tightened the restrictions with additional questions, which reduced the ranks of discouraged workers by half. As Williams puts it, “The Clinton administration dismissed to the non-reporting netherworld about five million discouraged workers.” Add those in, he says, and unemployment approaches Great Depression levels.

Nardone, the longtime BLS economist who today serves as assistant commissioner for current employment analysis, says the 25% unemployment rate often cited for the Great Depression is based on research that corresponds with today’s U-3, the unemployment rate most commonly reported by the media. It stands at 9.4%, recall -- not close to Depression-era levels. The 1994 changes did reduce the ranks of discouraged workers, but also introduced a new category: the marginally attached, who want jobs but aren’t looking for reasons like transportation problems and child-care requirements.

The most commonly watched measure (now U-3, before the change U-5) is mostly unaffected, since it doesn’t include discouraged workers. The benefit of the changes, explains Steven Haugen, a BLS economist, is a less subjective measure of discouragement, and some additional ways to judge whether the nation is not only working, but working up to its ability. Williams says the change reduced the broadest measure of unemployment in a way that “doesn’t match with public perception, and for good reason.”

The same agency that reports unemployment, the BLS, also reports the consumer price index. It tracks changes in the prices of more than 8,000 goods and services, from apples in New York to gasoline in San Francisco. There are several variants of the CPI index. For example, CPI-W weights things like fuel more heavily to better reflect the commutes of workers, and is the basis for Social Security adjustments. CPI-U, the measure most often reported in the media, includes items a typical urban consumer might buy, and determines adjustments to inflation-indexed Treasury bonds. Note that “core” inflation, which excludes food and fuel, isn’t used as the basis for any federal spending program (and isn’t called “core” by the BLS, which reports but doesn’t seem to especially prize the measure).

Most CPI criticism is based on three changes that affect all indexes. In 1983 the BLS replaced house prices with something called owners’ equivalent rent to measure the cost of shelter. Williams and other critics say it understates the cost, since house prices, until recently, had outpaced rents. John Greenlees, a BLS economist, says the new method is the most widely used among developed nations and is meant to fix a flaw in the old one. The CPI is supposed to measure things people buy to use, not things they invest in. For many people, houses are a little of both. The new measure attempts to isolate the portion of housing expenditures that best reflects the cost of living. Williams says the purchase price of housing is an important factor in determining a constant standard of living, and he doubts the ability of “the government to accurately calculate how much a person would pay to rent his own house.”

Another change: In 1999 the BLS adopted a geometric mean formula to replace its arithmetic mean one. The new method weights goods less as their prices rise, and is supposed to reflect patterns of consumer substitution. Critics say that treats consumers as if they’re no worse off when they switch to hamburger from steak. Greenlees says the analogy is flawed; the methodology allows substitution only between similar goods in the same region -- from steak in Chicago to a different type of steak in Chicago, and not to hamburger. The old measure was really an overstatement of price increases, one that assumed consumers don’t react at all to higher prices, he says.

Also, the impact is relatively small. The BLS has continued to calculate prices under both methodologies and says over five years ended 2004 the new measure reduced CPI growth by 0.28 percentage points a year. Williams says geometric weighting has moved the CPI away from measuring a constant standard of living. He says that when the effects are combined with those of other changes, like increased price surveying among discount stores (which he contends offer poorer service and thus a lower standard of living than the shops they replaced) the overall impact is larger than the BLS states.

Finally, in 1999 the BLS began using what it calls hedonic adjustments. Williams explains the approach with a dash of sarcasm: “That new washing machine you bought did not cost you 20% more than it would have cost you last year, because you got an offsetting 20% increase in the pleasure you derive from pushing its new electronic control buttons instead of turning that old noisy dial.” He calls the impact on CPI “substantial.”

Greenlees says the name “hedonic” was an unfortunate choice, since the technique has little to do with making judgments about pleasure. It’s designed to measure the quality difference between goods when one is discontinued and must be replaced in the index with another that’s not quite the same. Adjustments can push the index in either direction, but Greenlees says the overall impact since the change has been a tiny increase in the CPI -- about 0.005% a year. Williams says some hedonic adjustments are indeed necessary, like when the size of a box of crackers changes from 12 ounces to 10 ounces. But more theoretical adjustments, he says, “overstate the quality of what the public is buying."

Is State Street Trading For Federal Accounts?

Zero Hedge has always been fascinated by the behemoths of securities lending (or not so much lately) State Street and Bank Of New York: these firms, which allegedly had just marginal toxic exposure, were in the front lines for the TARP bailout and have traditionally been handled with velvet gloves by the administration. In fact, many would say the custodian firms are in a league of importance much higher than even Goldman or JP Morgan as with their repo activity, security lending and cash collateral reinvestment, they are the de facto center of the shadow banking system.

A Cliff notes version of the stock lenders' Modus Operandi, sent in compliments of a reader:

- In the securities lending arb, stocks and bonds are lent out by custodians and investment managers. The loan is collateralized by the borrower with cash, the lender promises the borrower a return on that cash and then invests the cash in repo and short-term debt at a spread to that promised rate of return. The sec lending market is in the trillions. This market is basically rolling overnight repo right now as it tries to dig itself out of the MTM/liquidity hole.

- Many of the Fed/Treasury balance sheet efforts have been basically attempts to supplant securities lenders. Sec lending funds were the biggest buyers of 1-3yr FRNs (hence, TLGP). Lenders were also the biggest buyers of AAA cards and autos (read TALF 1.0). They were the second-biggest buyers of ABCP after 2a7 funds (ergo AMLF). Indirectly they were the largest funder of LT2 bank debt (via SIVs MTNs). They're large repo counerparties, and did everything from short-dated CDS to liquidity put options on Canadian levered super-senior CDOs.

- Many stock lending funds, which have similar accrual accounting regimes to '40 Act money-market funds, have broken the buck but are still trading at $1. for example see the section beginning "We may be exposed to customer claims" on p.11. What does this mean? Not only are certain securities lending providers opening themselves up to significant litigation risk but, importantly, clients in stocks can't reallocate to bonds (or vice-versa), since the sec lending funds aren't letting them out (except in-kind). Finally, of course, as long as sec lenders remain hurt but unsupplanted, they stay short duration, which extracts hundreds of billions of $$ in term financing capacity out of the market. Fed won't act as a lender of last resort since they're still smarting from the AIG sec lending bail-out they didn't see coming.

It is no surprise that in order to incite a return to pre-Lehman economic levels (the administration's #1 goal bar none), not only the stock market would have to much higher from its March lows (a task largely accomplished through market increases on disappearing breadth, liquidity extraction by the likes of Goldman Sachs, and assorted last minute inexplicalbe ramp ups in the various futures and ETF markets), but also the shadow system would have to be back with a vengeance. And while new mechanisms to achieve this such as securitization replacement alphabet soups have yet to prove their efficacy, the real heart of the shadow banking system Frankenstein is and has always been the repo market.

Which is why we were greatly troubled when we learned recently on good authority that Federal representatives may have opened multiple undisclosed-type accounts with none other than State Street Global Advisors over the past few months. All of these accounts are allegedly handled by one single trader, who is cocooned and isolated from interaction with other partners.

Zero Hedge can, as of yet, not vouch for this being 100% factual and is asking readers who may have additional knowledge of the situtation to please come forward and share their views (tips@zerohedge.com). If, indeed, the Federal Reserve or other derivatives of the administration, are now directly involved in trading, managing repo terms, stock lending, collateral distribution and other liquidity-crucial aspects of what was once an efficient market, then indeed this rally could be written off not merely as the biggest short covering rally of all time, but one that has been explicitly orchestrated by those who should be most impartial to an efficiently working market.

Ilargi: Two days ago, I posted this comment at Business Insider, on the WJS story Bonddad addresses below. Henry Blodget said he agreed with Laffer. Nor smart. At all.

Bonddad's angle is different from mine, but the outcome is similar: there will be no hyperinflation in the US for years to come. It's a nonsense story.

Ilargi (URL) said: Jun. 10, 1:24 PM

That graph is about as misleading as they come. M1 is not money supply, nor is it monetary base. John Williams' Shadowstats.com, for example, tells a whole different story. M3, of which M1 is a part (!), hardly rises at all.

Hint: M1 rises because if it wouldn't, deflation would have long hit us over the head like the motherfc*ker of all sledgehammers. And it still can't keep up, we're deflating fast, as evidenced by falling home prices, foreclosures, job losses etc. They all represent money vanishing into outer space. If you would make a graph of that with the same sort of parameters, it would look even more sensationalist than Laffer's one.

It has not much of a level at all, this sort of "reporting", it's hot air that's gas only, no substance. Inflation? Oh really? From where? Do we have any idea how much money has disappeared from US pockets over the past year? A lot more than has been injected back in, that's for sure. On top of that, velocity plummets with a vengeance. All of which makes this a non-discussion.

By the by, looking at the graph, I wonder, if that's the basis of his worldview, can Laffer explain why we're not in Weimar yet?

Art Laffer Is Wrong on Inflation

Yesterday the right wing world was ablaze with an Art Laffer editorial in the WSJ. Hyper inflation is on the way -- at least according Art Laffer and echoed by Ed Morrissey at Hot Air, and Scott Johnson at Powerline. The problem is Laffer's argument is half the story -- and once you know the other half you realize how wrong Laffer is. <

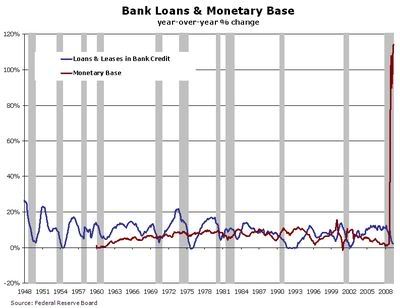

Here's the chart that Laffer bases his entire argument on:

Notice he calls this "Our exploding money supply." Only it's not our money supply, it's our monetary base. According to Laffer:About eight months ago, starting in early September 2008, the Bernanke Fed did an abrupt about-face and radically increased the monetary base -- which is comprised of currency in circulation, member bank reserves held at the Fed, and vault cash -- by a little less than $1 trillion. The Fed controls the monetary base 100% and does so by purchasing and selling assets in the open market. By such a radical move, the Fed signaled a 180-degree shift in its focus from an anti-inflation position to an anti-deflation position.

The key here is "member bank reserves held at the Fed" -- this is what banks make loans on. Here's how it works. The Federal Reserve buys securities from a member bank, giving the member bank cash. The member bank then uses this cash as reserves for more loans. In a fractional reserve system (like the banking system we have) a bank only needs to keep a percentage of cash on hand. So an increase in reserves can lead to a really big increase in money supply. But it requires increasing loan demand -- which means consumers have to take out more loans -- and banks have to be willing to lend.

But that's assuming a few things that just aren't happening right now. First, households are decreasing their overall loan holdings. According to the latest Flow of Funds report total household debt outstanding decreased in the fourth quarter of last year and the first quarter of this year. And that trend is likely to continue:U.S. household leverage, as measured by the ratio of debt to personal disposable income, increased modestly from 55% in 1960 to 65% by the mid-1980s. Then, over the next two decades, leverage proceeded to more than double, reaching an all-time high of 133% in 2007. That dramatic rise in debt was accompanied by a steady decline in the personal saving rate. The combination of higher debt and lower saving enabled personal consumption expenditures to grow faster than disposable income, providing a significant boost to U.S. economic growth over the period.

In the long-run, however, consumption cannot grow faster than income because there is an upper limit to how much debt households can service, based on their incomes. For many U.S. households, current debt levels appear too high, as evidenced by the sharp rise in delinquencies and foreclosures in recent years. To achieve a sustainable level of debt relative to income, households may need to undergo a prolonged period of deleveraging, whereby debt is reduced and saving is increased. This Economic Letter discusses how a deleveraging of the U.S. household sector might affect the growth rate of consumption going forward.

History provides examples of significant deleveraging episodes, both in the household and business sectors, which offer a basis for gauging how debt reduction may affect spending. From 1929 to 1933, in the midst of the Great Depression, nominal debt held by U.S. households declined by one-third (see James and Sylla 2006). In a contemporary account, Persons (1930, pp. 118-119) wrote, "[I]t is highly probable that a considerable volume of sales recently made were based on credit ratings only justifiable on the theory that flush times were to continue indefinitely....When the process of expanding credit ceases and we return to a normal basis of spending each year,...there must ensue a painful period of readjustment."

And in case you missed it, the entire financial system is really tightening lending standards right now. Here are some relevant points from the latest Senior Loan Survey from the Federal Reserve:On net, about 40 percent of domestic respondents, compared with around 65 percent in the January survey, reported having tightened their credit standards on commercial and industrial (C&I) loans to firms of all sizes over the previous three months. On balance, domestic banks have reported tightening their credit standards on C&I loans to large and middle-market firms for eight consecutive surveys and to small firms for ten consecutive surveys. Although 40 percent is still very elevated, the April survey marks the first time since January 2008 that the proportion of banks reporting such tightening fell below 50 percent. Similarly, the net percentages of domestic respondents that reported tightening various terms on C&I loans over the previous three months remained elevated but were slightly lower than those reported in the January survey. Specifically, about 80 percent of domestic banks, on balance, indicated that they had increased spreads of loan rates over their cost of funds for C&I loans to large and middle-market firms, compared with around 95 percent in January. About 75 percent of domestic respondents, compared with about 90 percent in January, indicated that they had increased such spreads for C&I loans to small firms. A significant majority of banks reported having charged higher premiums on riskier loans and having increased the costs of credit lines over the survey period.

And then there is the story of residential real estate lending:In the April survey, somewhat larger fractions of domestic respondents than in the January survey reported having tightened their lending standards on prime and nontraditional residential mortgages. About 50 percent of domestic respondents indicated that they had tightened their lending standards on prime mortgages over the previous three months, and about 65 percent of the 25 banks that originated nontraditional residential mortgage loans over the survey period reported having tightened their lending standards on such loans. About 35 percent of domestic respondents saw stronger demand, on net, for prime residential mortgage loans over the previous three months, a substantial change from the roughly 10 percent that reported weaker demand in the January survey. About 10 percent of respondents reported having experienced weaker demand for nontraditional mortgage loans over the previous three months-a substantially lower proportion than in the January survey. Only two banks reported making subprime mortgage loans over the same period.

But perhaps the most damning chart comes from David Altig -- senior vice president and research director, at the Atlanta Fed -- who posted the following chart on his blog:

In Altig's own words: "OK, but in my opinion it is a bit of a stretch -- so far, at least -- to correlate monetary base growth with bank loan growth ... Let's call that more than a bit of a stretch."

In short, Laffer's contention is not based in any current fact. Instead, it's based in his desire to get Republicans elected.

Calls for Brown to go nuclear in City battle with EU

As Europe's leaders prepare to strip Britain of ultimate control over finance, insurance, and securities, defenders of the City have begun to talk darkly of the nuclear option – known in EU lore as the "Luxembourg Compromise". Britain cannot veto the massive shift in regulatory power to Brussels now under way. Internal market laws are decided by qualified majority voting (QMV), and London has few friends in this fight. What Gordon Brown can do at next week's EU summit it to play the Luxembourg card by invoking "vital national interest", if he is willing to risk a showdown with fellow leaders. This has no legal status. It is the political equivalent of a stamping bull, or a viper's rattle.

It means back off, or we strike. "This is an extremely serious crisis," said David Heathcote-Amory, former Europe Minister and now a key Tory MP on the European Scrutiny Committee. "Once we lose of control over the City of London we will never get it back, and the consequences could be catastrophic. I think we are in 'Luxembourg terrritory'. If the City was in Paris you could be pretty sure that French would fight like tigers to save it," he said. "The Continental countries have no interest in the health of the City, and some want to turn the tourniquet tighter. I fear the Commission is going to get its way since we have such a weak government," he said.

Downing Street has given no hint that Mr Brown intends to put up serious resistance. City leaders doubt he will go to the wall for the sake detested bankers. It is easier to claim a cosmetic victory on fiscal sovereignty, letting the killer detail go through. One British minister admitted privately that UK strategy is to play for time in the hope that "other governments start getting cold feet about giving new powers to the EU". Some might, but our ally Ireland remained silent at a meeting of EU finance ministers this week, unwilling to waste political capital on Dublin's Canary Dwarf. It relies on EU favour to survive its own desperate crisis.

France's Charles de Gaulle was the last EU leader to opt for a showdown in the "empty chair crisis" in 1965, withdrawing his officials from Brussels after the commission pushed its luck too far. It led to the Luxembourg Compromise. No country since has ever pulled the trigger on vital interests. Disputes have always been resolved in time. Lord Turner, the head of the Financial Services Authority, said in April that the banking crisis would either lead to "more Europe, or less Europe" since the current half-way house is unworkable. Brussels has seized on events to offer more Europe. "It's now or never: if we cannot reform the financial sector when we have a real crisis, when will we?", said Commission president Jose Manuel Barroso.

While earlier talk of an EU super-regulator has been dropped, the same goal is being achieved by other means. The plan is to create three "authorities" with a permanent staff and powers to impose "binding" decisions on states. Appeals go to the European Court. There is to be a European Banking Authority in London, an Insurance Authority in Frankfurt, and a Securities Authority in Paris. Lord Turner fired a warning shot on Thursday, questioning plans to bring London's securities houses under EU oversight. "Frankly, this is an area that when it gets Europeanized you sometimes get things that are not actually to do with good regulation.

If one was absolutely confident that European supervision was going to be completely politics-free, in a neutral, technocratic fashion, we would be more relaxed," he said. There is little doubt that Brussels is exploiting the backlash against finance to bring the City under its thumb. Its own Larosiere Report concluded that hedge funds were marginal players in the credit crisis. Yet that has not stopped it drafting draconian rules for hedge funds as well, with chunks copied from French law. What is the purpose, if not to hobble a successful British industry? Christen Thomson from the Alternative Investment Management Association said 80pc of Europe's hedge funds are in Britain, supporting 40,000 jobs, and are already regulated by the FSA.

"A whole galaxy of hedge fund strategies would be impossible under this law and it is not necessary. The FSA tracks the top 40 funds and knows the level of systemic risk, and it keeps the cowboys out," he said. Britain has long fudged matters in dealings with the EU, hoping that common sense will prevail, as it often does. But the assault on the City may be a line too far. London has been the centre of global finance for three hundred years. Either the British government controls the City, or the EU apparatus controls it. This cannot be fudged.

What's Next For The US Economy, or What's Left of It?

It's ugly, folks. About as ugly as one could imagine. For starters, the entire global meltdown looks like it was engineered by the large mercantilist influences on Wall Street. That's correct. The whole thing, engineered, as in deliberate. Remember that predatory interests don't really care whether economies or currencies get wrecked or not - they benefit mainly by massive volatility, in either direction, caused by their actions. They know the timing as they engineer the swings, thus are perfectly positioned to profit from everyone elses's loss.

An example of how the current calamity played out:

1) The Fed loosens and Greenspan encourages everyone to get into adjustable rate mortgages. The government encourages riskier lending, under the guise of enabling minority or low income home ownership. This feeds a speculative frenzy and drives asset values up, as do all easy money policies.

2) The Fed tightens, crunching all the borrowers as the rates start adjusting up, as well as driving unemployment higher as easy money shuts off and jobs are cut as credit tightens. The jobs lost are usually the most expendable, i.e. the subprime type of job.

3) Wall Street innovates the ABX index in 2007. That index is used to value mortgage paper. A little known but extremely important aspect of it is that the entire index is based upon the value of 24 bonds. If you know (because you are GS or another big Wall Street player), or can guess those 24 bonds, you can then go out and buy massive CDS bets against those 24 bonds, driving the market into the cellar for the entire index. Easy as pie.

Anyone plugged in will get wind of the big CDS purchases of those bonds and dump the bonds ASAP, understanding that they have been targeted or are unexplainably going to crash, further accelerating the downward spiral. That's how the entire mortgage paper market tunneled when only a fraction of it was composed of sub-prime paper that was actually defaulting. As with naked short selling, you could create the appearance of an asset in sharp decline just by playing the CDS game with the right bonds, generating massive drops in asset values. That's what happened.

4) FASB 157 requires quarterly mark to market of assets, including mortgage backed securities. FASB 157 was introduced in 2007. The benchmark to establish value of the assets was, you guessed it, the ABX index, as well as ratings by agencies whose ownership ultimately leads back to, well, Wall Street.

5) Goldman and the like made massive money shorting the MBS they were selling globally. So they were betting on a big decline in the value of those assets, even as they sold tens of billions of them. GS is also key in creating the ABX index, putting them in a unique position to ensure their bets pay off handsomely from a crash in that index driven by, well, CDS purchases against the 24 bonds that literally price the index.

6) Global oil goes to $147 in a wildly manipulated dark market whose main movers are, you guessed it, Wall Street's biggest names. That additional load on the global economy, the skyrocketing cost of the price of oil coupled with asset values dropping through the floor, causes banks to stop writing things like letters of credit, which are used to enable shipping internationally. Ports sit clogged with empty container ships as nobody can get paper with which to ship things. This makes a bad crisis a disaster of magnified proportions.

7) Paulson leaves GS, and abandons his almost billion dollar worth, to run Treasury, ensuring a strong GS hand at the tiller to decide who will benefit from government handouts, as well as which policies will be enacted to amplify and sustain the disaster, as opposed to stopping it. Remember that GS under Paulson was huge in the CDS game with AIG as the contra-party, and was busy under Paulson shorting their own paper they were selling to clients all over the world.

He also was critical in keeping CDS unregulated, as well as subsequently deciding which entities survived the crisis, and which ones didn't. He played a major role, some would say godlike, in nationalizing banks like Fannie and Freddie even as analysts came out saying things at the banks weren't as bad as thought. As treasury secretary, he could just pronounce them DOA and the markets would make them so, making any massive short positions wildly profitable for those on the inside of the loop. Same for deciding Lehman would fail, but AIG wouldn't. And the list goes on.

8) The SEC removes virtually all safeguards against illegal delivery failure, i.e. naked short selling. They roll out the red carpet to market makers to just print as much stock as they like, ensuring those market makers would be used by those wishing to manipulate stocks down. We witness time and time again, massive dislocations in companies like Bear, Wachovia, Indymac, Lehman, etc. Much hand wringing and fist shaking goes on at the Congressional level about investigations, but like the investigations into oil price manipulation, nothing ever actually happens. Oh, but the SEC also removes the uptick rule, and then pretends to be mystified as bear raids accelerate and the market loses half its value.

Some spurious media questions whether too little, too late anti-NSS measures were effective, yet somehow manages to miss that during the shorting ban shorting tripled year over year - so the ban wasn't enforced, and amounted to more placating media soundbites from a compromised regulator running interference for Wall Street. Additionally, naked shorting of Treasuries increases to record levels, creating a double-whammy where Wall Street fails to deliver Treasuries, thereby artificially creating supply and ensuring that the country gets lower prices for its bonds. Again, regulators refuse to do anything of note. Anyone see a pattern?

9) Instead of declaring CDS a scam form of insurance fraud, where those without any interest in the asset can bet on the decline of its value even as they force its decline, Congress and Treasury studiously pretend that CDS are sacrosanct. Not surprisingly, it later turns out that much of the money going from taxpayers to AIG made its way into large Wall Street firms like GS as payoffs on these CDS bets. Congress could render CDS illegal tomorrow, ending this looting of the treasury, but won't. So it continues.

10) Once Paulson gets TARP passed against the majority of the populace's wishes, Treasury and the Fed then circumvent Congress and the taxpayers by simply doing multi-trillion dollar loans out the back door. The Fed then refuses to discuss those loans, any collateral associated with them, or the recipients. The total tab now is being estimated in the $14 trillion dollar range. In a little over a year. You are reading that correctly. Nobody actually knows the number, because nobody is talking.

11) The Fed is Wall Street friendly, and inevitably does things that favor Wall Street. The current Treasury Sec used to run the NY Fed, which is why all Treasury's "fixes" amount to little more than keeping CDS legal while funneling the wealth of the nation to Wall Street.

This is a deliberate, systematic, studied crash of the system and subsequent looting of it by Wall Street's most powerful interests, nothing more. Like the Great Depression, where millions lived in misery as the rich got much, much richer, the globe is experiencing a massive value drain so that a few interests on Wall Street can build dynastic wealth in a few short years.

I could go on, and cite many other contributing deliberate manipulations. I won't bother. You probably know most of them. A friend of mine has written a stunning book outlining the history of all this, as well as defining in detail the manipulation - it is a masterwork, and hopefully will soon find a publisher.

But the truth is that we are witnessing a nation whose policy is being run so special interests can profit at unprecedented levels while the standard of living of the populace inevitably declines to accommodate the transfer of wealth. It is completely deliberate, and not a bit of it is accidental. The smartest guys in the financial world didn't all just get stupid and blow it - that's a facile cover story being propagated by the captured press. They knew exactly what they were doing, they crashed the system to profit at levels it would normally take 50 years of stability to see, and they could give a rat's ass whether you work at Burger King during your retirement as a result. They win. You lose.

But don't expect to see it in the WSJ or NY Times - those rags are devoted to broadcasting Wall Street's spin on things. That's why you keep hearing about how the heads of the big banks are morons, and how outraged everyone is that they kept their jobs, etc. They aren't morons. They, and their buds in hedge funds and trading desks, made trillions from being "morons." And the reason they are declared idiots over and over, is because there's no prosecuting a guy for being a retard.

The smartest guys in the room always pretend to be fools when the prosecutor is around, however they don't have to worry - they long ago bought off the establishment, including the regulators and prosecutors. Nobody but a few token outsider fall guys will see any prosecution - like Countrywide's CEO. But not the head of BofA or Goldman or JP Morgan. They got away with it. And they now are so rich they will never be touched. Welcome to the Banana Republic of America, brought to you by 300 rich white guys on Wall Street. Game over.

Let us roll out the euro to the whole Union

When our great-grandchildren look back at the past 100 years of European history they are likely to remember Jean Monnet and Robert Schuman, fathers of the European Union, or Lech Walesa and Mikhail Gorbachev, destroyers of communism. However, when they turn to the first decade of the 21st century there will be little to impress them. They will see the EU brought to its knees by recession , with no transformational leaders to rekindle its spirit.

They will see that strategic thinking was in short supply, protectionism flourished and there was no common immigration policy, single market or common monetary policy. Crisis times call for great leaders and projects that create hope. We call on the EU leaders to show leadership and launch a “big bang” euro area expansion to introduce the euro in all 27 member states by 2012. Such a bold decision would give a credibility boost to the enlarged eurozone, accelerate replacement of the dollar by the euro as the global reserve currency and breathe new life into a united Europe.

Eurozone candidate countries in central and eastern Europe would be ready to join the euro within a year or two, starting with non-cash transactions. They are in many cases better prepared than the founding eurozone members: their trade, financial sector and labour markets are more integrated with the eurozone, their labour and product markets are more flexible, their business cycles are fully synchronised with the eurozone, as the crisis has unfortunately shown. Fiscal policy of candidate countries is also more responsible than that of current eurozone members: according to the European Commission, the budget deficits of eurozone candidate countries in 2009 will be lower than in the eurozone, while public debt in proportion to gross domestic product will be only about half that of the eurozone.

Inflation will be higher in candidate countries than in the eurozone, as it should be for faster-growing economies, but next year’s regional inflation is expected to be only 1 percentage point higher than in the eurozone. If all CEE countries were allowed into the eurozone, it would increase eurozone average inflation by less than 0.1 percentage points. Foreign exchange rates have been stable in the Baltic states and Bulgaria, countries that have fixed their currencies to the euro, but volatile in candidate countries with floating exchange rates. This volatility, however, is not due to faulty economic policies: foreign exchange rates reflect the global flight to safety. The euro has been highly volatile relative to the US dollar. It would not pass its own eurozone entry stability test.

Eurozone candidate countries would not just sit and wait to be invited into the eurozone; they know they need to increase their economic flexibility further and improve their fiscal positions. But they know how to reform. They have done nothing else in the past 20 years and have achieved spectacular success. They will continue to reform, but need a clear signal that they are truly welcome in the euro club. Today they have doubts. The big bang eurozone expansion would not complicate monetary management in the eurozone, since the combined GDP of all eurozone candidate countries in central and eastern Europe amounts to less than 10 per cent of the eurozone’s GDP.

Equality of treatment would also be adhered to; after all, many of the original eurozone members have not fully met the entry criteria, in letter or in spirit. Expansion would strengthen the eurozone, as new members would provide impetus for reforms such as strengthening fiscal co-ordination, integrating financial markets and creating the world’s largest, most liquid bond market. Candidate countries do not just want to enter the eurozone; they want to become part of the most successful global currency area. Eurozone expansion would prevent the rise of the “euro curtain” dividing EU members into central and peripheral categories, and provide a new reforming spirit to the European project. It would help save countries such as Latvia, struggling to defend its currency peg with the euro. New leaders are needed to make it happen.

Economic Downturn Accelerates Collapse of Ponzi Schemes

The great recession has decimated many industries; home builders, automakers and bankers are obvious casualties. Now, add Ponzi schemers to the list. Ravaged by the same fiscal turbulence pounding the nation's legitimate businesses, Ponzi operations have been collapsing at a record clip, exposing prolific, rampant and colossal frauds that have bilked investors of billions of dollars. The FBI, which is handling about 20 such cases in the Washington region, has almost 500 open Ponzi investigations nationwide -- up from about 300 in 2006, bureau officials said. Law enforcement officials with other agencies have noticed similar trends, and authorities said they expect to turn up many more cases in coming months.

"We have more open Ponzi scheme cases than at any time in FBI history," said Special Agent David G. Nanz, chief of the FBI's economic crimes unit. "We anticipated a spike, but the numbers we are seeing are even greater than expected. . . . There is an old saying, though: 'When the tide goes out, you can see who isn't wearing a bathing suit.' And that definitely applies to Ponzi" operators. Pyramid schemes like those named after Charles Ponzi, a notorious rip-off artist who stole millions in 1920, involve investors who are told that they are buying real estate, securities and other assets. But no investments are ever made, and the flow of new money is used to pay "returns" to earlier investors. Eventually, the flow of new money dries up and everything collapses.

Authorities said the schemes blossomed during good times. But their very nature -- the constant solicitation of new investors to pay off old ones -- makes them vulnerable to the harsh economic climate. Federal officials said they also have become more aggressive in trying to uncover schemes before they implode and the assets evaporate. The cases range from the $65 billion fraud orchestrated by Bernard L. Madoff, a former chairman of the Nasdaq stock exchange, to what is now considered a relatively minor rip-off -- a $23 million fraudulent hedge fund run by a Jacksonville, Fla., man guaranteeing a 50 percent rate of return.

In the Washington region, federal prosecutors recently charged five people in a $70 million mortgage fraud Ponzi scheme that targeted many in Prince George's County. Last week, they announced that they had charged a Vienna man with stealing $17 million in a sophisticated Internet Ponzi operation that led investors to believe that he had offices in the District, New York and London. In reality, the man rented a box from Mailboxes Etc., prosecutors said, and spent investors' money on expensive cars such as a Bentley and Ferrari.

"It has been a flood," said veteran postal inspector James H. Tendick, who supervises the Justice Department fraud team. "We don't have to go out scouring for these things. They are all just coming in the door." As recently as a few decades ago, most Ponzi schemes were relatively small, relying on word of mouth, direct mail and advertisements in magazines. They generally burned out after two or three years. But through the Internet and modern communications, Ponzi schemes have grown in size, scope and sophistication.

During the economic boom years, many schemes lured investors -- including huge hedge funds and financial firms -- into putting up billions of dollars. Smaller investors, drawing on home equity loans, also flooded Ponzis with cash. The largest operations were the one run by Madoff, who is scheduled to be sentenced this month on fraud charges, and what authorities say was an $8 billion scheme managed by R. Allen Stanford, a prominent Texas businessman.

Then the housing bubble burst, and the stock market began to sag and the financial markets went into cardiac arrest. Soon, Ponzi operators couldn't find new investors to keep their wheels spinning. Investors began screaming for their money back. When their calls were not returned or they were blown off, they started calling authorities. Cautious potential investors, bombarded with news reports about Madoff, quickly alerted regulators and federal agents to deals that seemed too good to be true.

"A lot of investors have become more aware of the risks and are asking harder questions," said Scott Friestad, deputy director of enforcement at the Securities and Exchange Commission, adding that he was "surprised that there are so many instances where people have raised hundreds of millions of dollars from thousands of investors and been ripping them off as pervasively as they have." With the walls crashing down, insiders even started reporting each other, and some Ponzi operators surrendered to federal agents, hoping to cut deals. That is what happened to Joseph S. Forte, 54, of Broomall, Pa., federal prosecutors said.

Authorities said that over 12 years, Forte collected $80 million from at least 80 investors who believed that he was putting their cash into Standard & Poor's index futures contracts. By 2008, Forte's revenue dried up because he could no longer find anyone willing to invest with him, authorities said. Then he couldn't pay off redemption requests, and he turned himself in to authorities, postal inspectors wrote in court papers. Forte has pleaded guilty to fraud charges. Federal agents uncovered what they allege is a $3 billion pyramid operation allegedly operated by one of Minnesota's most prominent businessmen, Thomas Petters, after an employee tipped them off to the operation.

The employee reported the fraud, her attorney has said, because she had lost confidence in Petters's ability to pay back investors. Petters has pleaded not guilty. And in April, a California man was indicted on charges of operating a $40 million scam that promised investors, many of whom he met at church, huge returns in a hedge fund. Suspicious about the firm's financial performance, a potential investor approached federal authorities, court records show.

"This kind of climate is death on Ponzis," said William K. Black, a law and economics professor at the University of Missouri-Kansas City School of Law and a former executive director of the Institute for Fraud Prevention. But Black said the same trends that pumped up the Ponzi industry and then tore it apart will eventually lead to new opportunities for scam artists who manage to escape the law and financial carnage. The crooks know that potential investors, some desperate for a quick return, will not always be so wary.

Stimulus fraid could hit $50 billion

Swindlers, con men, and thieves could siphon off as much as $50 billion of the government's planned stimulus package as the money begins flooding the economy in coming months, according to David Williams, who runs Deloitte Financial Services Advisory and counsels clients on fraud prevention. Williams predicted that about $500 billion of the total $787 billion stimulus would be channeled into the traditional procurement network for government contracts, while the rest will be spent directly by the government or outside the corporate network.

"The rule of thumb typically is that of the about $500 billion worth of money that's going to run through the procurement process, somewhere between 5% and 10% of that usually finds it way into potential problems," Williams said. "That's sort of the benchmark that I use." Companies will face increased pressure to try to stem the tide, and need to be prepared to safeguard data as well as the cash, according to Williams.

Williams said this week that the money flowing from the current stimulus package is particularly vulnerable to fraud because almost all movement of money is now done electronically. "We're telling our clients to be very careful and to make sure their firms are resilient in terms of dealing with the potential opportunities for fraud and waste," Williams said. That means keeping an eye out for the traditional scams such as billing for services not performed. But it also means firms must become even more diligent about electronic records and network security. "It becomes ever more important that firms remain diligent about their data," Williams said.

Earlier this month, FBI Director Robert Mueller warned the nation to brace for a potential crime wave involving fraud and corruption related to the economic stimulus package. "These funds are inherently vulnerable to bribery, fraud, conflicts of interest, and collusion. There is an old adage, that where there is money to be made, fraud is not far behind, like bees to honey," Mueller said.

Earlier this month, Vice President Joe Biden said some stimulus-related scams had already happened and that some mistakes were inevitable. President Barack Obama said Monday that the White House is trying to make sure the stimulus money isn't being ill-spent. He said many of the safeguards and transparency measures "so far seem to have worked" but added his administration will have to stay vigilant. "At a time when everybody is tightening their belts, the last thing the American people want to see is that any of this money is being wasted," Obama said.

Williams suggested that the fraud and theft losses from the roughly $787 billion stimulus package approved earlier this year could reach about $50 billion. Williams said firms would be well advised to beef up monitoring of their transaction systems, and that his firm is helping clients develop software and computer systems to predict and catch fraud before it gets started. Williams acknowledged that the FBI has geared up its efforts to focus on financial scams. He said other agencies, including the Department of Justice and industry watchdogs, are also beefing up oversight.

"They are going to spend their time making sure that this money gets to being used in the way it's supposed to be used," Williams added. After 9-11, counterterrorism became the FBI's top priority, even as the agency grappled with corporate crime such as the Enron and WorldCom scandals, said Mueller, who took the helm of the FBI on Sept. 4, 2001, just one week ahead of the terrorist attacks.

The 9-11 attacks prompted the FBI and other government agencies to divert resources from financial fraud and other corporate crimes to fighting terrorism, including the transfer of 2,000 agents tracking white-collar crime to counterterrorism, Mueller said. But now the focus is returning to white-collar crime and fraud in a big way. "These rules will come right back to haunt companies if they are not careful," Williams said. "So firms need to make sure that their organizations are ready to receive funds and protect those funds diligently as the potential for fraud surfaces."

He said that for the largest companies used to doing contract work with the government a high level of oversight will be business as usual. "But there will be others where this is unprecedented and they will have to do more to comply," Williams added. Meanwhile, Obama said the White House will keep trying to make sure citizens know where the stimulus money is going. "We're going to do it continuing to operate in a transparent fashion so that taxpayers know this money is not being wasted on a bunch of boondoggles," Obama said at the White House on Monday

Big-Shot Investors Eyeing Toxic Debt

With the Treasury's efforts to sell banks' toxic loans in shambles, well-heeled investors like Pacific Investment Management Co. and bank billionaire Gerald J. Ford are mulling the creation of publicly traded entities to snap up the problem loans. According to people familiar with the matter, Ford, Pimco and Legg Mason's Western Asset Management Co. are among a growing group of big-name investors looking at establishing vehicles similar to real-estate investment trusts that would sell shares to the public and use the proceeds to buy troubled residential mortgages and commercial real estate.

Sources told The Post that Ford is said to be prowling around for battered assets and is contemplating forming a REIT-like company or private-equity-like entity to buy undervalued assets. In the late 1980s, Ford made a killing during the savings-and-loan crisis and vaulted to billionaire status in 2002 when he sold Golden State Bancorp to Citigroup for $6 billion. Sources warn that his plans might not pan out. Talk of these plans comes as Wall Street has pretty much written off the government's Public-Private Investment Program, which was designed to ease the purchase of banks' troubled assets by providing cheap financing for private firms, like hedge funds and private-equity firms, to buy the loans.

However, the program, announced in March, has had trouble getting off the ground in part because banks holding the toxic assets have been unwilling to dump them at giveaway prices and have to take the resulting writedowns on their books. Also, some would-be participants have shied away because they worry that getting into bed with the Treasury through the PPIP might lead to the government wanting a say on matters such as compensation or how these firms run their business.

Already, a bevy of high-profile investors have launched public entities as an entrée into buying troubled assets from banks. Last week, hot-shot real-estate investor Barry Sternlicht said he would seek to raise as much as $500 million in an initial public offering in Starwood Property Trust to purchase distressed loans. And Nelson Peltz is looking at raising $300 million to buy high-yield securities

Ringmaster of British finance rediscovers its muscles

by Gillian Tett