Girls of the paper mills, taking a water break. Appleton, Wisconsin

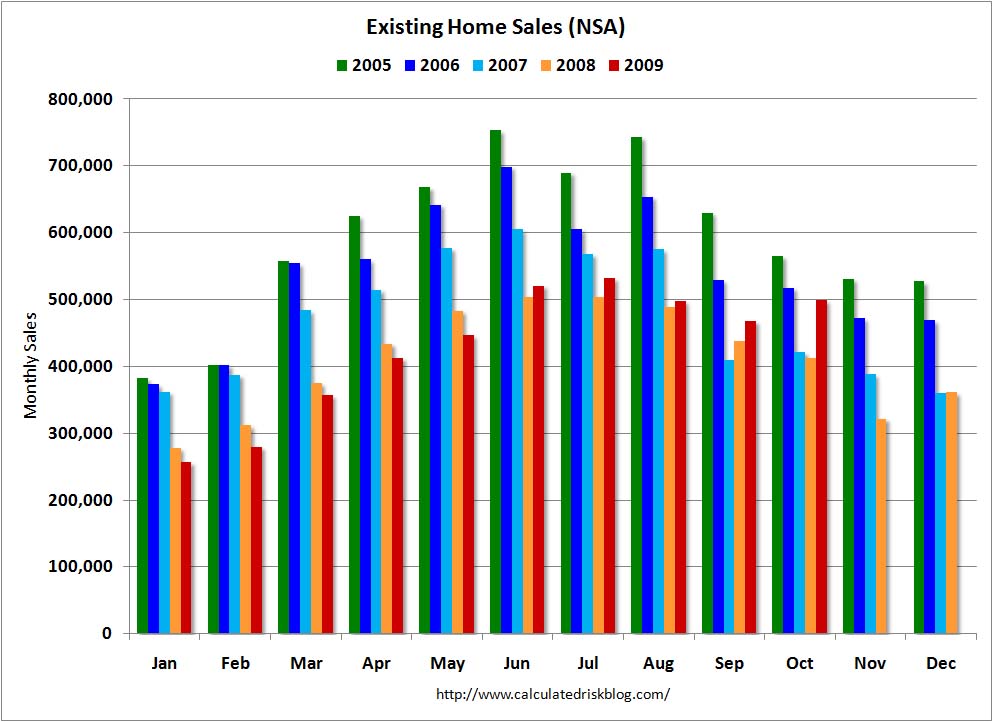

Ilargi: Yes, existing home sales were up. But between the effect of last-ditch efforts (before it was extended) to get the $8000 tax credit, falling prices and most of all the ongoing subprime-condition FHA loans and the Fed's securities purchases, is the rise such a surprise? It may lift Wall Street for a bit, but, as Calculated Risk pointed out a few days ago, existing home sales are irrelevant for the economy. Inventory remains sky-high, and that's just the homes that are actually counted. All in all, not very interesting territory, if you ask me.

What I find far more intriguing to see, via Business Insider, is a paper by Jeff Saut at Raymond James. Saut argues that even if there is a bubble in stocks,

"under-invested institutional portfolio managers have to buy stocks into year-end driven by their under-performance, their subsequent "bonus risk", and ultimately their "job risk."

He links this to game theory, and quotes Jeremy Grantham, who says:

"In markets where investors hand over their money to professionals, the major inefficiency becomes career risk. Everyone’s ultimate job description becomes ‘keep your job!’ (Manifestly) Career risk-reduction takes precedence over maximizing the client’s return.

Efficient career-risk management means never being wrong on your own, so herding, perhaps for different reasons, also characterizes professional investing. Herding produces momentum in prices, pushing them further away from fair value as people buy because they are buying."

Now, I find the connection between game theory and economics a very shaky one, even if, or should I say because, 8 Nobel Fakeconomics winners were game theorists. The problem with the connection is that things like perfect rationality, perfect information availability and perfect choices among players are presumed and even taken for granted. Which, you are right, sounds an awful lot like classical economics. Of course we've long known that such presumptions are ridiculous, and that makes game theory on the whole a lousy fit with a field such as economics. What is at the heart of this are game theory solution concepts such as the Nash equilibrium:

A set of strategies is a Nash equilibrium if each represents a best response to the other strategies. So, if all the players are playing the strategies in a Nash equilibrium, they have no unilateral incentive to deviate, since their strategy is the best they can do given what others are doing. (Wiki)I hope the idea is clear.

Still, the underlying notion Saut introduces is, as I said, intriguing. Just about everyone who follows the economy even a little is wondering why stock markets are rising while the economies they are supposed to reflect are scraping their respective gutters ever deeper? Grantham again:

"Refusing, on value principal, to buy in a bubble will, in contrast, look dangerously eccentric. And when your timing is wrong, which is inevitable sooner or later, you will in Keynes’ words – ‘Not receive much mercy’" [..] "Today the challenge is not getting the big bets right. It’s arriving back at trend with the same clients you left with . . ."

In other words, there are scores of large investors out there who are willing to put their clients’ money in what they realize, to an extent, are potentially losing or even bad bets. Going against the ruling trends, say Saut and Grantham, would be -perceived as- riskier than following one's instincts, and even than one's desire to maximize profits for clients. And that is quite a statement. Better to lose with everyone else than to lose alone. Not exactly an attitude that will make you rich, but yes, it might keep you in a job for a while.

Where it gets really good is when we ponder how many of these investors think the risk of losing is over 50%, and then still keep doing what they do. Psychological theories about herding behavior may well prove to be much more useful in understanding this phenomenon than game theory. After all, game theory doesn't seem to cover behavior that doesn't seek optimum returns.

I would add that perhaps there is an additional factor at play. Many of these institutional investors have lost fortunes for their funds last year, and until March 2009. The urgent desire to make up as much of these losses as possible may also tempt them to arrive at irrational risks and decisions. And yes, that may also be because they fear losing their jobs.

There is of course a flipside to all this. One which we all instinctively recognize. We know this can't go on forever. Somewhere down this upward line something will happen that will break the herd. Ever seen a herd panic? I know many of you think the current trend has a lot of life left in it, but herds are inherently unpredictable.

To see how this might work out, it seems reasonable to ask: what are these "game theory driven" investors buying into? We've sufficiently covered the made up and embellished number games from governments and media that accompany the market rally. Which may have outlived itself.

Today brings a veritable avalanche on sovereign debt. And hey, maybe that will do it.

As for US debt, the New York Times reports:

Treasury officials estimate that about 36 percent of the government’s marketable debt — about $1.6 trillion — is coming due in the months ahead.

And that's not the whole story. Tyler Durden noted on November 1st:

As the assets on the US balance sheet become increasingly long-dated, courtesy of QE, and locking in record low rates, US liabilities in turn have shortened their duration to a record level. Almost $3 trillion in US debt will have to be rolled by the end of 2010.

But wait, that's just the existing debt that has to be rolled over. Then there's the new debt that has to be added to keep things rolling along:

Bill Bonner writes that his friend Porter Stansberry estimates the US government alone will need to finance $4.5 trillion worth of bonds next year.

Which, by the way, given that the US added close to $2 trillion in debt in 2009, seems almost certain to be a low ball estimate. It's more likely that the total amount of new and existing US 2010 debt will come in "comfortably" over $5 trillion.

Moreover, the official federal deficit recently broke through the $12 trillion mark. And all this is happening in a situation with very low interest rates. A quote from the NYT article: "The government is on teaser rates". Which seems a good comparison. And which cannot last forever. And no, it can also not last as long as Ben Bernanke wills it to. The $5 trillion US debt in 2010 will have to compete for buyers in a global market that can look forward to a minimum of $12 trillion in sovereign debt being available for purchase.

Perhaps the best shot the US government has in that market is for the stock markets to crash, since that will lift the US dollar, and free up a lot of financial space for the administration. Of course, it would also crash the banks and the housing industry, but then, they are goners anyway. Politically, job creation would be good. Let's see Washington add another $1 trillion to that debt load.

Mind you, CDS bets against Italy are through the ceiling, Greece may fall through the floor any day now, Spain moved into the basement months ago, Japan is celebrating a decade of rigor mortis and China is a bubble with 1.5 billion souls wearing brave faces who have no-one left to sell their earthly goods to.

Everybody has to keep on buying. Until they won't.

And when they no longer do, and they're busy stampeding through the exit, you can apply all the game theory you want.

Even If Stocks Are A Bubble, Everyone Has To Keep Buying

In his latest later, Raymond James strategist Jeff Saut argues that even if there is something like a bubble in stocks, everyone has to keep buying into it, or else they lose their jobs.Thus, the trend remains your friend.

Nevertheless, we think the upside should continue to be driven by “game theory,” which suggests that the under-invested institutional portfolio managers have to buy stocks into year-end driven by their under-performance, their subsequent “bonus risk,” and ultimately their “job risk.” Verily, many of the portfolio managers we know remain under extreme pressure to commit their outsized cash positions in an attempt to “catch up” to their benchmarks between now and year-end (see the nearby Credit Suisse institutional cash versus retail cash on the sidelines chart).

Reinforcing that game theory point Jeremy Grantham notes:

“In markets where investors hand over their money to professionals, the major inefficiency becomes career risk. Everyone’s ultimate job description becomes ‘keep your job!’ (Manifestly) Career risk-reduction takes precedence over maximizing the client’s return.

Efficient career-risk management means never being wrong on your own, so herding, perhaps for different reasons, also characterizes professional investing. Herding produces momentum in prices, pushing them further away from fair value as people buy because they are buying.”Jeremy goes on to note a couple of insightful points: “Refusing, on value principal, to buy in a bubble will, in contrast, look dangerously eccentric. And when your timing is wrong, which is inevitable sooner or later, you will in Keynes’ words – ‘Not receive much mercy’” – he sums up what that means to the folks who try not to go with the herd and do the right thing, “Today the challenge is not getting the big bets right. It’s arriving back at trend with the same clients you left with . . .”

Plainly, we agree with Mr. Grantham, which is why we continue to think the improving fundamentals, and earnings, will serve as the “carrot in front of the horse” to keep investors chasing stocks even if we do get a near-term pullback.

Bets rise on rich country bond defaults

The mounting level of debt in the industrialised world is prompting a growing number of investors to use the derivatives market to bet on the chance of rich governments defaulting on bonds. The volume of activity in sovereign credit default swaps – which measure the cost to insure against bond defaults – linked to the US, UK and Japan have doubled in the past year because of concerns about their public finances.

CDS volumes for Italy, which has one of the highest debt burdens of the developed economies, are now the highest for an individual country, according to the Depository Trust & Clearing Corporation. In contrast, the outstanding volume of CDS linked to emerging nations such as Russia, Brazil, Ukraine and Indonesia have been flat or fallen in the past 12 months as investors have become less interested in trading the risks of those countries.

In the past, the CDS market for developed countries was sluggish, because few investors saw the need to buy or sell protection against a risk of default that seemed exceedingly remote. However, rising debt levels and growing political and economic uncertainty has created a more active market, with more investors now seeking insurance. Meanwhile, many banks are prepared to offer protection in exchange for a fee. This fee has recently jumped, since the cost to insure the debt of developed countries has increased since the summer of last year, while the cost of insuring emerging market debt has fallen.

Gary Jenkins, head of fixed income research at Evolution, said: "The biggest single risk hanging over the bond markets is the rapid rise in public debt in the industrialised world. "If we get to a point where the market thinks the levels of debt are unsustainable, then we will see an almighty sell-off in the government bond markets, with yields soaring. Governments need to take action to cut deficits and debt." Fitch Solutions, the data arm of the Fitch Group, said that there is almost as much uncertainty in the CDS market about the outlook for the developed economies and their bond markets as there is for emerging economies.

Comparisons between Italy and Brazil are often used by strategists as an example of the contrasting fortunes of the developed and emerging world. Italy’s debt to gross domestic product ratio is forecast to rise to 127.3 per cent in 2010. On the other hand, Brazil’s debt to GDP ratio is forecast to stabilise at 65.4 per cent in 2010. Nigel Rendell, senior emerging markets strategist at RBC Capital Markets, said: "It is not surprising that investors are increasingly worried about debt in the industrialised world. Debt to GDP of more than 100 per cent is difficult to sustain."

Wave of Debt Payments Facing U.S. Government

The United States government is financing its more than trillion-dollar-a-year borrowing with i.o.u.’s on terms that seem too good to be true. But that happy situation, aided by ultralow interest rates, may not last much longer. Treasury officials now face a trifecta of headaches: a mountain of new debt, a balloon of short-term borrowings that come due in the months ahead, and interest rates that are sure to climb back to normal as soon as the Federal Reserve decides that the emergency has passed.

Even as Treasury officials are racing to lock in today’s low rates by exchanging short-term borrowings for long-term bonds, the government faces a payment shock similar to those that sent legions of overstretched homeowners into default on their mortgages. With the national debt now topping $12 trillion, the White House estimates that the government’s tab for servicing the debt will exceed $700 billion a year in 2019, up from $202 billion this year, even if annual budget deficits shrink drastically. Other forecasters say the figure could be much higher.

In concrete terms, an additional $500 billion a year in interest expense would total more than the combined federal budgets this year for education, energy, homeland security and the wars in Iraq and Afghanistan. The potential for rapidly escalating interest payouts is just one of the wrenching challenges facing the United States after decades of living beyond its means. The surge in borrowing over the last year or two is widely judged to have been a necessary response to the financial crisis and the deep recession, and there is still a raging debate over how aggressively to bring down deficits over the next few years. But there is little doubt that the United States’ long-term budget crisis is becoming too big to postpone.

Americans now have to climb out of two deep holes: as debt-loaded consumers, whose personal wealth sank along with housing and stock prices; and as taxpayers, whose government debt has almost doubled in the last two years alone, just as costs tied to benefits for retiring baby boomers are set to explode. The competing demands could deepen political battles over the size and role of the government, the trade-offs between taxes and spending, the choices between helping older generations versus younger ones, and the bottom-line questions about who should ultimately shoulder the burden.

"The government is on teaser rates," said Robert Bixby, executive director of the Concord Coalition, a nonpartisan group that advocates lower deficits. "We’re taking out a huge mortgage right now, but we won’t feel the pain until later." So far, the demand for Treasury securities from investors and other governments around the world has remained strong enough to hold down the interest rates that the United States must offer to sell them. Indeed, the government paid less interest on its debt this year than in 2008, even though it added almost $2 trillion in debt.

The government’s average interest rate on new borrowing last year fell below 1 percent. For short-term i.o.u.’s like one-month Treasury bills, its average rate was only sixteen-hundredths of a percent. "All of the auction results have been solid," said Matthew Rutherford, the Treasury’s deputy assistant secretary in charge of finance operations. "Investor demand has been very broad, and it’s been increasing in the last couple of years."

The problem, many analysts say, is that record government deficits have arrived just as the long-feared explosion begins in spending on benefits under Medicare and Social Security. The nation’s oldest baby boomers are approaching 65, setting off what experts have warned for years will be a fiscal nightmare for the government. "What a good country or a good squirrel should be doing is stashing away nuts for the winter," said William H. Gross, managing director of the Pimco Group, the giant bond-management firm. "The United States is not only not saving nuts, it’s eating the ones left over from the last winter."

The current low rates on the country’s debt were caused by temporary factors that are already beginning to fade. One factor was the economic crisis itself, which caused panicked investors around the world to plow their money into the comparative safety of Treasury bills and notes. Even though the United States was the epicenter of the global crisis, investors viewed Treasury securities as the least dangerous place to park their money.

On top of that, the Fed used almost every tool in its arsenal to push interest rates down even further. It cut the overnight federal funds rate, the rate at which banks lend reserves to one another, to almost zero. And to reduce longer-term rates, it bought more than $1.5 trillion worth of Treasury bonds and government-guaranteed securities linked to mortgages. Those conditions are already beginning to change. Global investors are shifting money into riskier investments like stocks and corporate bonds, and they have been pouring money into fast-growing countries like Brazil and China.

The Fed, meanwhile, is already halting its efforts at tamping down long-term interest rates. Fed officials ended their $300 billion program to buy up Treasury bonds last month, and they have announced plans to stop buying mortgage-backed securities by the end of next March. Eventually, though probably not until at least mid-2010, the Fed will also start raising its benchmark interest rate back to more historically normal levels.

The United States will not be the only government competing to refinance huge debt. Japan, Germany, Britain and other industrialized countries have even higher government debt loads, measured as a share of their gross domestic product, and they too borrowed heavily to combat the financial crisis and economic downturn. As the global economy recovers and businesses raise capital to finance their growth, all that new government debt is likely to put more upward pressure on interest rates.

Even a small increase in interest rates has a big impact. An increase of one percentage point in the Treasury’s average cost of borrowing would cost American taxpayers an extra $80 billion this year — about equal to the combined budgets of the Department of Energy and the Department of Education. But that could seem like a relatively modest pinch. Alan Levenson, chief economist at T. Rowe Price, estimated that the Treasury’s tab for debt service this year would have been $221 billion higher if it had faced the same interest rates as it did last year.

The White House estimates that the government will have to borrow about $3.5 trillion more over the next three years. On top of that, the Treasury has to refinance, or roll over, a huge amount of short-term debt that was issued during the financial crisis. Treasury officials estimate that about 36 percent of the government’s marketable debt — about $1.6 trillion — is coming due in the months ahead.

To lock in low interest rates in the years ahead, Treasury officials are trying to replace one-month and three-month bills with 10-year and 30-year Treasury securities. That strategy will save taxpayers money in the long run. But it pushes up costs drastically in the short run, because interest rates are higher for long-term debt. Adding to the pressure, the Fed is set to begin reversing some of the policies it has been using to prop up the economy. Wall Street firms advising the Treasury recently estimated that the Fed’s purchases of Treasury bonds and mortgage-backed securities pushed down long-term interest rates by about one-half of a percentage point.

Removing that support could in itself add $40 billion to the government’s annual tab for debt service. This month, the Treasury Department’s private-sector advisory committee on debt management warned of the risks ahead. "Inflation, higher interest rate and rollover risk should be the primary concerns," declared the Treasury Borrowing Advisory Committee, a group of market experts that provide guidance to the government, on Nov. 4. "Clever debt management strategy," the group said, "can’t completely substitute for prudent fiscal policy."

Could sovereign debt be the new subprime?

by Gillian Tett

A few weeks ago, Claudio Borio, head of research at the Bank for International Settlements, warned in a solemn note to Group of 20 leaders that modern financial policymakers are "driving while just looking in the rear-view mirror": western finance officials have focused so much on past risks that they fail to spot new dangers. Worse still, as policymakers rush to implement reforms in response to one financial calamity, they are apt to create distortions that pave the way for the next disaster. Just such an unintended consequence could now be festering in the banking sector, as its balance sheets are increasingly stuffed with government bonds.

These days, there is a near-unanimous belief among western regulators that one way to prevent a repeat of the 2007-08 crisis is to stop banks taking crazy risks with subprime mortgage bonds or complex instruments such as collateralised debt obligations (CDOs). Instead, banks are being urged to hold a higher proportion of their assets in the form of "safe" instruments, most notably sovereign or quasi-sovereign debt. G20 regulators are holding regular meetings in Basel to draw up rules on how banks should do this, as part of a wider reform of financial regulation.

In theory, that move sounds very sensible. One reason why large banks crumbled last year was that many were carrying vast quantities of highly rated CDOs and other toxic paper. These not only lost their value during the crisis, but also became impossible to trade, creating a liquidity shock for the banks. Government bonds, by contrast, remained liquid during the recent crisis (and have been so in the past few decades). So it appears appealing to hold more of them, particularly given that sovereign debt is also widely presumed to be ultra safe; so safe that the yield on government bonds is known as the "risk-free rate".

But could this flight to the "safety" of government bonds in itself be creating subtle new dangers? Government debt, after all, has soared to levels not seen in peacetime for centuries, if ever, in many countries, not least the US and UK. Fiscal deficits are swelling across the western world. And the level of political commitment to curbing those deficits remains uncertain – not least because with yields currently so low there is less pressure on politicians to push through reform.

That does not necessarily mean an outright default looms any time soon; indeed, default seems highly unlikely. However, it is easy to imagine that some countries will end up eroding the value of their bonds by debasing their currencies in the coming years, printing money and stoking inflation. It is even easier to anticipate a sharp rise in bond yields – and a corresponding sharp fall in bond prices – particularly when central banks stop their quantitative easing programmes. Some smart hedge funds are betting on just that.

Yet there has been precious little debate about whether banks should keep loading up on sovereign debt. In Sydney, some Australian banks are grumbling about the Basel liquidity reforms. Ironically, that is because Australia is in the rare, happy position of having low(ish) debt levels, and its local banks fear they will struggle to find the bonds they need to meet the new G20 liquidity rules. In countries where there is likely to be a surplus of government bonds for sale, there is little public discussion at all. Perhaps that is because the banks do not wish to rock the boat; or maybe central banks themselves do not wish to draw attention to the swelling volumes of government bonds they now hold themselves.

Finance ministries are hardly likely to complain about the banks’ investments. Major industrialised countries will need to sell more than $12,000bn worth of government bonds this year and next to fund their fiscal hole. This is a rise of at least a third, or $3,000bn, in just two years. As Mr Borio notes, focusing only on that rear-view mirror is dangerous; whatever causes the next banking shock, it will not be mortgage CDOs. So I, for one, fervently hope that those banks holding government bonds are being cautious enough to hedge themselves against any future crash in their price; so too, for those holding quasi-government instruments, such as agency bonds.

I also hope that when the Basel regulators finally produce their new liquidity rules, the banks will have to build in a significant margin of error to reflect a potential fall in government bonds. This would underline the point to both banks and investors that government bonds are not automatically "risk-free". Most important of all, though, I hope that the current calm in sovereign debt markets does not lull politicians into thinking that they can indefinitely avoid the need to take difficult fiscal choices. For if they do, those "safe" government bonds might start to look considerably less secure – not just to bankers, but to everybody.

Greece tests the limit of sovereign debt as it grinds towards slump

Greece is disturbingly close to a debt compound spiral. It is the first developed country on either side of the Atlantic to push unfunded welfare largesse to the limits of market tolerance. Euro membership blocks every plausible way out of the crisis, other than EU beggary. This is what happens when a facile political elite signs up to a currency union for reasons of prestige or to snatch windfall gains without understanding the terms of its Faustian contract.

When the European Central Bank's Jean-Claude Trichet said last week that certain sinners on the edges of the eurozone were "very close to losing their credibility", everybody knew he meant Greece. The interest spread between 10-year Greek bonds and German bunds has jumped to 178 basis points. Greek debt has decoupled from Italian debt. Athens can no longer hide behind others in EMU's soft South. "As far as the bond vigilantes are concerned, the Bat-Signal is up for Greece," said Francesco Garzarelli in a Goldman Sachs client note, Tremors at the EMU Periphery.

The newly-elected Hellenic Socialists (PASOK) of George Papandreou confess that the budget deficit will be more than 12pc of GDP this year, four times the original claim of the last lot. After campaigning on extra spending, it will have to do the exact opposite. "We need to save the country from bankruptcy," he said. Good luck. Communist-led shipyard workers have already clashed violently with police. Some 200 anarchists were arrested in Athens last week after they torched streets of cars in a tear gas battle.

Mr Papandreou has mooted a pay freeze for state workers earning more than €2,000 a month. This has already set off an internal party revolt. "There is enormous denial," said Lars Christensen, emerging markets chief at Danske Bank. "They don't seem to understand that very serious austerity measures are needed. It is a striking contrast with Ireland," he said. Brussels says Greece's public debt will rise from 99pc of GDP in 2008 to 135pc by 2011, without drastic cuts. Athens has been shortening debt maturities to trim costs, storing up a roll-over crisis next year. Some €18bn comes due in the second quarter of 2010 (IMF). Modern economies have reached such debt levels before, and survived, but never in the circumstances facing Greece. "They can't devalue: they can't print money," said Mr Christensen.

The tourist trade is withering, down 20pc last season by revenue. Turkey was up. It is hard to pin down how much is a currency effect, but clearly Greece has priced itself out of the Club Med market. Wages rose a staggering 12pc in the 2008-2009 pay-round alone (IMF data), suicidal in a Teutonic currency union. Greece has slipped to 71st in the competitiveness index of the World Economic Forum, behind Egypt and Botswana. Greece has long been skating on thin ice. The current account deficit hit 14.5pc of GDP in 2008. External debt has reached 144p (IMF). Eurozone creditors – German banks? – hold €200bn of Greek debt.

A warning from Bank of Greece that lenders must wean themselves off the ECB's emergency funding has brought matters to a head. Default insurance on Greek debt jumped 40 basis points last week. Greek banks have borrowed €40bn from the ECB at 1pc, playing the "yield curve" by purchasing state bonds. This EU subsidy has made up for losses on property, shipping, and Balkan woes. The banks insist that they are in rude good health. EFG Eurobank has halved reliance on ECB funding. "Greek banks are very liquid: we maintain billions in extra liquidity," it said. Yet markets are wary. Recession has come late to Greece, but will bite deep in 2010. It takes three years for defaults to peak once the cycle turns.

David Marsh, author of The Euro: The Politics of The New Global Currency, said the danger for EMU laggards is that the ECB will begin to tighten before they are out of trouble. It is German recovery that threatens to stretch the North-South divide towards breaking point. Athens squandered its euro windfall. For a decade, EMU let Greece borrow at almost the same cost as Germany. It was a heaven-sent chance to whittle down debt. Instead, the country dug itself deeper into a hole by running budget deficits near 5pc of GDP at the top of the boom. Like Labour under Brown, idiot leaders mistook a bubble for their own skill. But the consequences in EMU are more dreadful. Austerity may prove self-defeating, without the cure of devaluation. Greece risks grinding deeper into slump.

The EU can paper over this by transfering large sums of money to Greece. But will Berlin, Paris – and London, also on the hook – feel obliged to bail out a country that has so flagrantly violated the rules of the club, not least by holding Eastern Europe's EU entry to ransom over Cyprus? That is neither forgotten, nor forgiven. During the panic last February, German finance minister Peer Steinbruck promised to rescue any eurozone state in dire trouble. He is no longer in office. The pledge was, in any case, a bounced political cheque even when he wrote it. Greece can assume nothing.

Dealing with America's fiscal hole

For years America’s fiscal problems had a surreal quality. No one disputed that an ageing population and health-care inflation could bust the budget, but that prospect was decades away and procrastination seemed painless. No longer. A giant hole has opened in the budget because of stimulus, bail-outs and a recession that has savaged economic growth and tax revenue. On current policies the publicly held federal debt, 41% of GDP last year, will double in the next decade. Total government debt will move well above the G20 average. In a few years the AAA rating of Treasury bonds, the world’s most important security, could be in jeopardy.

A sudden crisis is unlikely. Other rich countries with far bigger debts relative to the size of their economies, from Italy to Japan, have soldiered on without hitting a wall. Stable politics, transparent laws and economic dominance give America unequalled credibility with lenders. For all the anxiety the declining dollar drew from China this week, it has no serious rival as the world’s reserve currency. America has sensibly used this fiscal freedom to enact an aggressive stimulus programme. This should be maintained for as long as it is needed.

Yet ignoring the future is also costly. The problem is not the deficits in the next couple of years, but in the years that follow. Uncertainty over how taxes may be raised to shrink deficits may already be weighing on business confidence. Worries about inflation or default could start to push up interest rates. Eventually, private investment will be crowded out. Barack Obama and Congress can pre-empt such corrosive uncertainty with a plan to reduce the deficit now. Far from requiring immediate spending cuts or tax increases, a credible plan would reassure markets and allow an orderly exit from fiscal stimulus. The Federal Reserve provides a model: it does not plan to tighten monetary policy in the near future, but has signalled its willingness to do so when inflation threatens.

Where the cutting should begin

America’s deficit problem is in essence a spending problem, so spending must bear the brunt of adjustment. An ageing population and health-care inflation are inexorably driving up the cost of the country’s three big entitlements: Social Security (pensions), Medicare and Medicaid (health care for the elderly and the poor, respectively). Mr Obama has long promised that health reform would cover the uninsured without adding to the deficit, while reining in long-term costs.

Unfortunately, the prospects for controlling costs are tenuous. Achieving large savings will require action on many fronts. Raising the retirement age for Social Security and Medicare would save money while encouraging Americans to work longer, thereby expanding economic potential. Medicaid could be converted to block grants, compelling states to assume more of the burden of cost control. Other spending should also be vigorously squeezed, to stop federal funds being wasted on highways of dubious value or trade-distorting farm subsidies.

Still, cold arithmetic suggests that spending cuts alone cannot deliver enough. Changes to entitlements take effect only gradually. And the scope for slashing non-defence discretionary spending is limited, since it makes up merely one-sixth of total outlays. So Americans are stuck with a budgetary conundrum: they seem to be opting for more government, at least in health care, yet they do not seem prepared to pay for it. Their leaders have indulged this fantasy. Mr Obama has foolishly sworn off higher taxes on 95% of households, and Republicans will not countenance them for anybody. This newspaper strongly prefers small government and low taxes, but if Americans are to have bigger government and a sustainable budget, tax revenues will have to rise.

Taxing politics

Raising tax revenue will hurt less if the tax system becomes more supportive of economic growth in the process. Compared with other countries, America taxes consumption too little and income too much. Redressing this imbalance could, with time, help economic growth. First, broaden the income-tax base by eliminating exemptions, and if possible cutting rates. Second, introduce a carbon tax, the least distorting way to slow the growth in emissions. If that is not possible, sell rather than give away carbon-emission permits, or raise the federal fuel tax. A last resort is a broad consumption tax, such as a value-added tax. This is economically efficient, but could too easily become a politically convenient way to vacuum up more money and expand government.

The economics of fiscal reform are straightforward; it’s the politics that are tough. Mr Obama should start the process with a budget early next year that aims to stabilise, and preferably reduce, the debt-to-GDP ratio in the coming decade. The problem is getting Congress to pass the necessary laws. The polarisation of American politics has left Democrats more set on defending entitlements and Republicans determined to hold down taxes. With mid-term elections a year away, the incentive to compromise is shrivelling.

One way to finesse these toxic politics would be to establish a bipartisan commission to fix entitlements and taxes, as proposed by Kent Conrad and Judd Gregg, respectively the most senior Democrat and Republican on the Senate Budget Committee. Its membership would be drawn from both parties, both chambers of Congress and the White House. Democrats and Republicans alike would have to make sacrifices. To preserve this grand bargain, Congress would be allowed only to approve or reject the commission’s proposal, not amend it.

This is no magic bullet. Although similar processes have been used to negotiate trade deals, the stakes in this case would be far higher, as would the chances of failure. Republicans in particular may balk at co-operating. The commission could deadlock, or see its proposal voted down, precipitating the sort of market disruption the scheme was meant to avoid. But that actually may be an advantage: politicians may conclude that failure is not an option. The best defence against a crisis is to act as though you are facing one.

IMF warns second bailout would 'threaten democracy'

The public will not bail out the financial services sector for a second time if another global crisis blows up in four or five years time, the managing-director of the International Monetary Fund warned this morning. Dominique Strauss-Kahn told the CBI annual conference of business leaders that another huge call on public finances by the financial services sector would not be tolerated by the "man in the street" and could even threaten democracy.

"Most advanced economies will not accept any more [bailouts]...The political reaction will be very strong, putting some democracies at risk," he told delegates. "I do believe that the financial sector needs to contribute both to the costs of the financial crisis and to reduce recourse to public funds in the future," he said.

Mr Strauss-Kahn said that imposing high capital ratio requirements on banks was one price the financial services sector must pay to prevent the threat of further multi-billion dollar bailouts. He pointed to the debate in the US over the Troubled Asset Relief Programme and said that in many countries, including France and Germany, he doubted that politicians would secure the mandate needed to secure any further bail-outs if banks got in to trouble again, in several years' time.

Europe is in dispute over the spiralling cost of the global economic bailout, with Germany and France calling for a reduction in state support as their economies have shown signs of an upturn. In September, George Osborne, the Shadow Chancellor, sided with Germany and France, accusing Gordon Brown of being in "complete denial" over the mounting bill of the financial rescue packages and agreed with Britain's neighbours that it was time to look for an exit strategy. Countries are recovering from recession at different rates, with Britain lagging behind.

Mr Strauss-Kahn said that while the global economy had made "remarkable" progress in exiting recession, and was on the cusp of recovery, it remained "highly vulnerable" to shocks. He said state support for the world's battered economies must remain in place if a smooth recovery is to be achieved. "We recommend erring on the side of caution as exiting too early is costlier than exiting too late." Mr Strauss-Kahn is one of a series of high-profile speakers at the CBI conference, in Central London. Gordon Brown, David Cameron and Nick Clegg will all speak at the event as they seek to sway influential business leaders before a general election next year.

In his speech, Mr Strauss-Kahn also warned that the huge amounts of capital being pumped into China could fuel a pan-Asian bubble. His comments come after warnings from economists that the economic conditions in China and the rest of Asia are such that asset prices could rip free of their fundamental values unless the bubble threat is addressed. The Chinese banking sector is currently the scene of an unprecedented frenzy of new lending, which could reach up to 11,000 billion yuan (£97.7 billion) by the end of this year.

Mr Strauss-Khan said that the old paradigm of growth generation based on households in the US was dead. The future sources of growth and the recovery will "depend on a new balance between the US and deficit countries on one hand and emerging markets and surplus countries on the other". Emerging markets will provide some of the growth that the US can no longer offer, however he warned that while China and other emerging Asian economies were shifting from exports to domestic demand, they still had some way to go.

China banking regulator gets tough on capital rules

China's banking regulator issued a stern warning to banks to strictly comply with capital requirements or face sanctions, the latest signal that Beijing is worried about possible risks building in the country's financial system after a year of blow-out lending. Banks that fail to comply by the end of the year with capital adequacy requirements—the amount of capital they must hold against their loans—could be punished with limits on market access, overseas investments and new branches, the China Banking Regulatory Commission said in a statement on its Web site. Such sanctions already exist, but have rarely been enforced.

New loans in the first half of this year totaled 7.37 trillion yuan ($1.079 trillion), equivalent to half of the country's gross domestic product over the period, as the government turned to bank lending to power its economic stimulus plans. There are fears that the lending binge could saddle banks with large amounts of non-performing loans, reversing some of the gains achieved over the past decade of financial reforms that were aimed at turning China's state banks into commercial lenders better able to manage risk. The tough statement indicates that Beijing is ready to more actively tighten the credit growth that has been the linchpin of China's economic recovery.

Higher capital requirements act as a constraint on lending, as banks would need to raise additional money before they could make more loans. The capital adequacy requirement was raised to 10% from 8% at the end of last year. At the same time, banks were ordered to set aside credit provisions equivalent to at least 150% of their bad loans. More recently, the CBRC reduced the amount of subordinated bonds—debt that has a lower priority than other claims on an asset, and has higher returns— that banks could count toward their capital requirements. This was after it became apparent that banks were using the debt to lend money to each other, raising the risk that a default could ripple through the entire system.

A spokesman for China Construction Bank Corp, one of the Big Four state lenders, said the banking regulator "is considering imposing stricter capital requirements for lenders" next year, and the bank is closely monitoring the situation. Hu Changmiao said his bank "isn't yet sure" whether the CBRC will decide to raise its capital requirement and if so, by how much, because the regulator "hasn't issued any written notices." A CBRC spokesman said there "won't be any sudden changes" in banks' capital requirements. He denied a media report saying the regulator will require major state-owned banks to have a capital adequacy ratio of 13% from next year.

The spokesman said capital ratios are decided in a "counter-cyclical" way to address "systemic risks," language that indicates Beijing sees these regulatory requirements as one way to cool down a lending boom if it threatens economic stability. In the past, Chinese authorities have curbed overheated lending by imposing sweeping credit quotas. This time, they appear to be adopting a more market-oriented approach, while being prepared to use ad hoc administrative measures as necessary.

Last week, the regulator issued verbal instructions to a mid-sized Chinese state lender that it must limit outstanding loans for the last two months of the year to its level at the end of October, according to an internal bank memo shown to Dow Jones Newswires by a bank executive on the condition that his employer not be identified. The regulator denied issuing such a notice. No other banks seem to have been similar instructed. But medium-sized banks in particular have had trouble maintaining their required capital levels and loan-to-deposit limits, having been especially aggressive in using the stimulus boost to grant more loans and expand their market share. Beijing may be tempted to again directly cap some of their lending limits rather than hope they will adjust their loan portfolio to meet the requirements.

In its statement on Monday, the CBRC said it doesn't plan to impose any controls on the size of bank loans. It also said it aims to promote a stable and continued growth in bank lending, and prevent "big swings" in lending. Lending curbs were last imposed at the end of 2007 to cool an overheating economy, and were lifted in October 2008 with the onset of the global financial crisis. There is little likelihood that loan limits might be rolled out to the entire banking system. Although China is growing faster than any major economy, a sudden pullback in bank lending could shake the country's recovery.

A greater concern for Beijing is likely to be the fallout in two or three years if banks discover that many of their loans won't be repaid. China's last efforts to rid the financial system of non-performing loans five years ago cost the country hundreds of billions of dollars, and the experience is still fresh in regulators' minds. Bank lending has slowed somewhat over the last month, with banks extending 253 billion yuan of new yuan loans in October, the lowest level so far this year and less than half of September's amount. Fitch Ratings analyst Wen Chunling says the banking regulator faces a dilemma. "On the one hand it wants to alert banks over risks. But on the other hand it wants to avoid scaring people with too strong alerts," she said.

Existing Home Sales Surge on Cheap Condos

by Barry Ritholtz

Existing-home sales gained in October on a monthly basis as prices fell and cheaper homes predominated sales. Elevated inventory levels also declined.Existing-home sales gained 10.1%, reflecting in large part an outsized seasonal adjustment. Sales were 23.5% above the 4.94 million-unit level in October 2008, when the collapse of Fannie, Lehman, AIG, Bank of America and Citigroup had paralyzed the nation.

Median existing-home price was $173,100 in October, down 7.1% from October 2008.

The biggest gains were found in the cheapest homes – especially condominiums and co-ops. Their sales surged 13.2% (seasonally adjusted) and were up an astonishing 40.8% above a year ago. Median prices for condos fell 10.4% below October 2008.

As expected, the prior month’s initial report was revised downward to annual pace of 5.54 million in September (originally reported as 5.57mm annualized). These revisions effectively eliminated the upside surprise of 220k sales last month.

It is noteworthy that the NAR claims the seasonally adjusted sales activity is at the highest level since February 2007 (6.55 million). CNN bought this nonsense hook line and sinker (Existing home sales at highest level since 2007) but it is not actually true without some accounting sleight of hand.As the chart at right shows, the NSA data is quite unimpressive relative to the past few years.

Ultra low interest rates are helping sales somewhat. A 30-year, conventional, fixed-rate mortgage fell to 4.95% Last week, the 30-year rate dropped to 4.83%.

In addition to the low rates and the now extended first time homebuyers’ tax credit, a big spike in foreclosures is attracting bargain hunters. In parts of the country, some foreclosed units are selling for less than 50% of the peak 2005-06 price – especially on the low-end of the price scale. Foreclosure units have been selling briskly in California, Florida, Arizona, and Las Vegas.

Total housing inventory for sale fell 3.7% to 3.57 million existing homes, a 7.0-month supply at the current sales pace. This does not include a variety of so-called shadow inventory: REOs, rental units, vacation properties, and bank-owned strategic non-foreclosures.

>

Seasonal Adjustments Continue to Skew Data:

Mark Hanson notes the ongoing skew of Seasonal Adjustments, and the continuing spin of the NAR:

- The month of October was thought to be the end of the stimulus, so it reflects a last minute dash to get in before the tax credit sunset

- Rates fell sharply to below 5% in Sept/Oct 2009

- Despite this, Oct YTD sales are DOWN a whopping 716k from 2007

- NSA sales were up 31k sales MoM to 499k in Oct — the exact same as Aug

- NSA sales were up 86k sales from Oct 2008 – but in Oct 2008 rates were high (pre Fed QE) and there was not stimuli of any kind

- Median and Avg prices fell again – about 1.5% MoM and 6% YoY – price drop accelerated into shoulder season as price dumping and short sales picked up

- Year to date Oct 2008 vs Oct 2009 – 2009 sales finally passed 2008 sales by only 61k houses.

So in a nutshell, prices keep falling month after month and 2009 has produced 61k more real sales over 2008.>

chart courtesy Barron’s Econoday

Housing Leads the Economy, Existing Home Sales are Irrelevant (November 18)

by Calculated Risk

After reading some of the commentary regarding the housing starts report this morning, it might be useful to reiterate these three points:

Residential investment is the best leading indicator for the economy.

Residential investment will not recover rapidly because of the large overhang of existing vacant housing units.

Existing home sales are largely irrelevant for the economy.

Residential investment is reported quarterly by the Bureau of Economic Analysis (BEA) as part of the GDP report. We can also use monthly housing starts and new home sales as indicators of residential investment. I've written extensively about how residential investment is an excellent leading indicator for the economy (also see Dr. Leamer's paper: Housing and the Business Cycle)

This morning several commentators suggested that housing starts were depressed in October because of the expiration of the tax credit (new home buyers had to close by Nov 30th to get the tax credit), and also because of the weather. Probably. But the key point is that housing starts will not increase rapidly because of the large overhang of existing vacant housing units (see 2nd graph here). And that suggests that the economy will not recover quickly either.

Another key point is that existing home sales are largely irrelevant for the economy. This is an important point to remember next week when the NAR announces that existing home sales surged to 5.8 million units or so in October (seasonally adjusted annual rate). Some reporters and analysts will jump on the existing home sales report as evidence of a housing recovery. Others will point to it as showing that the first-time home buyer tax credit is helping the economy.

Both points are wrong. The only contribution from existing home sales to the economy are some commissions and fees. That is good news for real estate agents and mortgage brokers, but not for the overall economy.

The good news is the level of inventory for new and existing homes is declining. The bad news is the inventory of rental units is at record levels - as is the combined inventory of vacant single family homes and rental units. Residential investment will not increase significantly until this overhang is reduced.

The key to reducing the overall inventory is new household formation (encouraging renters to become owners accomplishes nothing in reducing the overall housing inventory). And the key to new household formation is jobs. And usually the best leading indicator for jobs is residential investment. Somewhat of a circular trap. And that suggests the recovery will be sluggish and unemployment will stay high for some time.

Geithner’s Crisis Sleepwalk Is Reason He Must Go

If Timothy Geithner were a Broadway show, the producers would shut it down. Treasury secretaries get attacked all the time and have to take it with aplomb. It’s in the job description. The criticism serves a purpose: A secretary who can withstand the withering attacks of congressmen has what it takes to manage a real crisis. Against this backdrop, Geithner’s performance last week was the most pitiful by a major economic policy maker in ages. Geithner broke the cardinal rule for Treasury secretaries. He lost his cool.

On the ropes at a hearing at the Joint Economic Committee on Nov. 19, Geithner defended himself with the only weapon in the Obama administration’s playbook: whining. But this wasn’t the hip, self-assured whining so artfully employed by President Barack Obama. It was shrill. It was unseemly. It was offensive. When Representative Kevin Brady, a Texas Republican, asked Geithner to resign, Geithner chose not to defend his actions. Instead, he pointed his finger back at Brady: "You gave this president an economy falling off the cliff."

After another Texas Republican, Michael Burgess, suggested that the government should offer tax relief to business and then get out of the way, Geithner took the question as an opportunity to bash the entire free enterprise system: "That broad philosophy helped produce the worst financial crisis and the worst recession we’d seen in generations." The problem, in Geithner’s view, seems to be that Brady, Burgess and other Republicans so messed up the world that even his brilliant policies have yet to fix the problem.

It is an iron law of Washington that policy makers lose their cool when they are on shaky ground in terms of substance. Geithner must know in his heart that he, far more than Brady or Burgess, is responsible for the financial crisis. That’s why minor political theater sets him off. Look at the facts. Geithner was president of the Federal Reserve Bank of New York for the five years leading up to the financial crisis. The crisis occurred, in part, because Wall Street firms spun out of control. The New York Fed is the cop charged with patrolling Wall Street, the eyes and ears of the financial regulatory system. It fundamentally failed on his watch.

Why did the Fed fail? Might it have been because it was run by a man who misunderstood the circumstances? Here is what Geithner had to say about financial markets in a speech in Atlanta in May 2007, just about a year before the crisis really ignited: "Changes in financial markets, including those that are the subject of your conference, have improved the efficiency of financial intermediation and improved our confidence in the ability of markets to absorb stress."

Later he added, "The larger global financial institutions are generally stronger in terms of capital relative to risk. Technology and innovation in financial instruments have made it easier for institutions to manage risk." That rosy description by a Fed president kind of makes you want to run out and buy stock in Lehman Brothers Holdings Inc., doesn’t it? No wonder the Fed failed to press the industry harder. It thought that financial innovations had worked a miracle. Geithner used to be asleep at the wheel in New York. Now he is asleep at the wheel in Washington.

The Treasury secretary is supposed to stand up for correct policy. This Treasury Department sat back and let Congress dictate a costly and ineffective stimulus plan. It looked the other way while politicos in the White House hatched a plan to produce false and laughable claims of jobs created from that stimulus, a procedure that is so flawed that it has attributed job creation to congressional districts that don’t exist.

He has allowed Democrats to play budget tricks to understate the costs of their health-care proposals by trillions, even as deficits soar to levels not seen since World War II. He failed to remind, or at least to convince, the president that a deep recession is a bad time for the government to increase fiscal imbalances by staging a takeover of health care. During the presidential campaign, Obama correctly pointed out that a cap-and-trade system to reduce greenhouse gas emissions should use an auction to distribute the pollution permits. Geithner snoozed while Congress decided to hand out the permits as political favors.

And don’t get me started on the dollar. The operatives in the White House clearly picked Geithner because they could count on him to look the other way while they play their economically destructive political games, just as he looked the other way while Wall Street undermined the economy. Geithner is a reliable political sidekick. As for substance, that is another story. New York Times columnist David Brooks wrote that when he asked him what government could do to promote innovation, Geithner "said that government’s limited job was to get the underlying incentives right so the market could figure out what innovations work best." Wait. Isn’t that the "broad philosophy" that produced the financial crisis? It is time for Geithner to go.

Jamie Dimon seen as good fit for Treasury

As support for Treasury Secretary Timothy Geithner wanes on Capitol Hill amid frustration with the Obama administration's handling of the economy, JPMorgan Chase CEO Jamie Dimon is emerging as a potential replacement.

Sources tell The Post that a number of policy makers have begun mentioning Dimon as a successor to Geithner, whose standing in Washington has suffered because of the country's high unemployment rate, the weakness of the dollar, the slow pace of the recovery and the government's mounting deficit. Last week, Geithner faced a withering attack from some Republican members of the Joint Economic Committee, getting into a testy exchange with one congressman who at one point asked Geithner if he would step down.

Dimon, meanwhile, has achieved rock star status during the financial crisis, having navigated JPMorgan through the recession and being a go-to guy when Uncle Sam last year needed Wall Street's help during the collapses of Bear Stearns and Washington Mutual. Furthermore, while many bank chiefs are facing heat over outsize bonuses, Dimon has repeatedly made clear he won't write fat checks to attract or keep talent.

People familiar with Dimon's thinking said he "would love to serve his country," and in recent weeks Dimon has had a noticeably higher profile in Washington, making frequent visits to government officials and earlier this month publishing an op-ed in the Washington Post that makes the case for letting large institutions that take big risks collapse rather than receive government aid.

"It is critical to the standing of the United States in the global financial economy to have a Treasury secretary who has the full support of the president and Congress; a person who has earned respect on their own as a result of hard-won battles in finance to represent this nation," said Dick Bove, a banking industry analyst at Rochdale Securities who this week will publish a report on Dimon. "That is not Timothy Geithner. It is Jamie Dimon."

The timing might be right for Dimon to pursue the Treasury post. He recently put into place a succession plan, and JPMorgan is currently considered one of the strongest banks in the country, even though it, too, faces a threat of sizable consumer-loan losses. However, sources said Dimon also has tried to tamp down enthusiasm for his replacing Geithner, whom the JPMorgan boss continues to support and thinks is doing "a good job," according to sources.

He doesn't want to be perceived as gunning for Geithner's job and is said to be keenly aware of the anti-Wall Street sentiment gripping the country. He has told people he plans to stay at JPMorgan for another "six or seven years," according to one source.

Dimon has long been a big Democratic supporter, and his ties with Obama go back to when he ran Chicago-based Bank One. In addition, White House visitor logs show Dimon has been a repeated guest there. He also was a point man during the previous administration, rescuing Bear and WaMu. This isn't the first time Dimon's name has been floated for Treasury secretary. He was considered a candidate last year and is still viewed as an executive who could be instrumental as Washington looks to overhaul the financial regulatory infrastructure.

Why is Obama Championing Bush’s Financial Wrecking Crew?

by William K. Black

Tom Frank’s book, The Wrecking Crew explains how the Bush administration destroyed effective government and damaged our social fabric and our economy. The Obama administration has chosen to reward two of the worst leaders of Bush’s crew — Geithner and Bernanke - with promotion and reappointment. Embracing the Wrecking Crew’s most destructive members has further damaged the economy and caused increasing political and moral injury to the administration.Last week was a bad one for Geithner and Bernanke. Senator Dodd said that Bernanke’s confirmation was no longer a done deal. The House Financial Services Committee revolted against the administration, the Fed, and Chairman Barney Frank. It voted for a strong bill to audit the Fed. Senate Banking Chairman Schumer went to a conference at Columbia University — where a generation of students salivated at the prospects of Wall Street wealth — and was overwhelmed by an audience denouncing the continuing stranglehold of the finance industry over successive administrations and the Congress. Neither Barney’s blarney nor Schumer’s schmooze was any avail before an outraged public.

The administration promptly secured a column in the Washington Post claiming that the effort to fire Geithner “buoy[ed]” him because, as the subtitle to the article explained: “Even ex-Bush aides sympathetic, sources say.” The article didn’t note that Geithner is an “ex-Bush” senior official who, with his fellow “ex-Bush aides” (particularly Bernanke and Paulson) produced a chain of disasters: the bubble, an “epidemic of mortgage fraud” by lenders, the Great Recession, and the scandalous TARP and AIG bailouts. Of course they’re “sympathetic” to a fellow member of the Wrecking Crew that destroyed effective regulation and turned the nation over to Wall Street. The craziest part of the story is that the anonymous Obama administration flack that spread this anecdote believes that we should support Geithner because his fellow members of the Bush Wrecking Crew empathize with him because they, too, have been criticized for wrecking the economy.

The Washington Post article then offers a metaphor that serves as an apology for the Bush Wrecking Crew. The metaphor is driving over a cliff: “‘Secretary Geithner has helped steer the American economy back from the brink, and is now leading the effort on financial reform,’ White House spokeswoman Jen Psaki said.” Geithner pushed back against Republicans who questioned his performance, telling them, “you gave this president an economy falling off the cliff.”

You? How about we? Bush’s financial Wrecking Crew “gave this president an economy falling off the cliff.” Geithner was President of the Federal Reserve Bank of New York from October 23, 2003 until President Obama chose him as his Treasury Secretary. He was supposed to be the lead regulator of many of the largest bank holding companies. His failures as a regulator were a major cause of the “economy falling off the cliff.” Bernanke held prominent positions in the Bush administration from 2002 to the end of the administration and failed as a regulator an economist. Geithner and Bernanke failed to regulate even after the FBI publicly warned in September 2004 that (1) there was an “epidemic” of mortgage fraud and (2) it would lead to a financial crisis if it were not contained. Their refusal to take responsibility for the harm they inflicted on our nation as leaders of Bush’s financial Wrecking Crew adds to their unsuitability. Rewarding their perennial failures with a promotion and reappointment represents a dereliction of duty by the Obama administration.

The administration apologists praise Geithner and Bernanke for “steer[ing] the American economy back from the brink.” Greenspan, Paulson, Bernanke, and Geithner were the leaders of Bush’s financial Wrecking Crew. They were the guys blinded by their pro-Wall Street ideology that drove the car 120 mph down an icy mountain road and lost control of it. They took us to the “brink” of running “off the cliff” and creating the Second Great Depression. The bizarre claim is that we should praise them because they, and Wall Street, only wrecked the economy — they haven’t (yet) utterly destroyed it. Under their metaphor, we’re supposed to cheer Geithner and Bernanke because once they finally figured out that they were careening toward the cliff, they decided to sideswipe a row of trees in order to avoid going over the edge. They wrecked the car but they walked away from the crash without a scratch. If your teenager gets drunk, speeds, crashes into a school bus (injuring dozens of kids), and flips the Ford Focus — but walks away from the crash — you don’t praise him, give him the keys to the family minivan, and have him drive the soccer team to practices. You take all the keys away from him and ground him.

The Obama administration promoted Bush’s architects of the financial disaster and demands that we hail them as heroes. President Bush was ridiculed for saying: “Brownie, you’re doing a heck of a job.” FEMA administrator Michael Brown stood by while Hurricane Katrina reduced a single large city to ruin. Geithner and Bernanke stood by while scores of large cities were devastated.

I suggest that we will build on the momentum we’ve achieved on the Fed audit by making the following issues our near term financial priorities:

- 1. Can the Wrecking Crew. Fire the senior leaders of Bush’s and Clinton’s financial Wrecking Crews and stopping treating them as financial experts. President Obama should not reappoint Bernanke as Fed Chairman. He should dismiss Geithner and Summers and cease to take any advise from Rubin. Replace them with the Reconstruction Crew — people with a track record of getting things right and being effective economists, regulators, and prosecutors. Members of Bush’s financial Wrecking Crew run far too many regulatory agencies, often as “Actings.” They can, and should, be replaced promptly.

- 2. End “too big to fail.” These banks are “systemically dangerous institutions” (SDIs). They should not be allowed to grow. They should be shrunk to the point that they no longer pose systemic risk, and they should be subject to vigorous regulation while shrinking. They are too big to manage and too big to regulate. They are ticking time bombs that will cause recurrent global crises as long as they are SDIs.

- 3. More white-collar watchdogs. Adopt Representative Kaptur’s proposal to provide the FBI with at least 1000 additional white-collar specialists. Senator Durbin and (then) Senator Obama made a similar proposal several years ago.

- 4. No more executive compensation looting. End the perverse executive compensation systems that reward failure and fraud. The private sector has made compensation worse since the crisis. Modern executive compensation creates a virtually perfect crime — “accounting control fraud” (looting a company for personal profit). Until we fix the perverse incentives of executive compensation we will have recurrent epidemics of fraud and global financial crises.

- 5. Kill TARP and PPIP. Use the funds to help honest homeowners that would otherwise lose their homes because of predatory loan terms.

- 6. Make the Federal Reserve System public. It is a largely private structure that creates intense conflicts of interest and ensures that it is controlled by the systemically dangerous institutions. We have already decided that such a structure is inherently improper. The Federal Home Loan Bank System was set up along the same institutional lines and suffered from the same conflicts of interest. Congress ordered an end to these conflicts in the 1989 FIRREA legislation. It should end private control of the Fed.

- 7. Defeat any proposal to make the Fed the “Uberregulator.” The Fed, for inherent institutional reasons, is unsuited to be the “systemic risk regulator.” The Fed has never cared about regulation. The Fed cares about monetary policy and (theoclassical) economic theory and research. Regulation is, at best, a tertiary concern. Its economists wrote frequently about systemic risk — but missed the obvious, massive systemic risk of the financial bubble and the epidemic of accounting control fraud. Its policies intensified rather than restricting systemic risk. Theoclassical economists have no effective theories (or policies) to deal with bubbles or epidemics of accounting control fraud. Greenspan, Bernanke, and Geithner epitomize the Fed’s inability to recognize or reduce systemic risk. Their policies consistently increased systemic risk. Greenspan didn’t believe that the Fed should act against fraud. Geithner testified before Congress that he had never been a regulator (a true statement - but one that should have gotten him fired rather than promoted). Bernanke praised the subprime loans that caused the crisis and were so often fraudulent.

- 8. Ensure a robust CFPA. Sever the Consumer Financial Product Agency portion from the broader (and deeply flawed) regulatory reform bills in the House and Senate and adopt it into law. Revise the broader bill to strip out its many anti-reform provisions.

- 9. End the waste of long-term unemployment. Anyone able and willing to work should be employed by the government as an employer of last resort and should help repair our crumbling infrastructure. Paying people to do nothing or allowing them to become homeless (the status quo) is an insane system.

- 10. Adopt a $250 billion revenue sharing program. American state and local governments are in economic crisis. They are slashing spending at the worst possible time when their services are most vital and when cutting spending is pro-cyclical and will delay our recovery from the Great Recession. Revenue sharing was a Republican initiative. Republicans and “Blue Dog” Democrats killed the revenue sharing provisions of the administration’s proposed Stimulus bill. That was an enormous mistake. The federal government is not like a state government (or a household). It is a sovereign government with its own currency and a central bank. It can - and should - run large deficits during deep recessions, but the states and local governments cannot.

Revenue sharing is the ideal answer to the crisis and it is an answer with an impeccable conservative pedigree. State and local governments should come together and demand a program to offset the state and local cutbacks - roughly $250 billion. (The Obama administration’s claim that reducing the deficit should be a priority - at a time when unemployment has reached tragic levels - is economically illiterate. It repeats the error that FDR made when he listened to conservative economic advisors and slashed the budget deficit during the Great Depression - causing a surge in unemployment and the extension of the depression. The large federal deficits of World War II reversed the policies of his conservative economic advisors and ended the Great Depression.)

Fed's Bullard Wants Asset Buying Program Kept Alive After 1Q 2010

Federal Reserve Bank of St. Louis President James Bullard repeated Sunday it would be good to keep the Fed's asset buying program active beyond its current end date, to give the central bank more policy options should it need them. "I would just like to keep (the efforts) active at a very low level," Bullard said of the Fed's ongoing effort to buy mortgage related securities, done in a bid to help support economic growth. The official was speaking to reporters after an event held before students in New York.

Bullard was repeating what he'd told Dow Jones earlier Sunday. In that interview, he said he wants to see the central bank effort to buy mortgage backed securities maintained beyond the first quarter 2010's end. "I have advocated to keep the asset purchase program open but at a very low level, and wait and see what happens, and as information comes in about the economy we can adjust that program while the federal funds rate remains at zero," Bullard told Dow Jones Newswires. He added "no decision has been made" about the program's fate.

Citing the current level of the Fed's overnight interest rate target, Bullard said "as long as we are at zero (percent) we'd be able to send signals to the markets about what we are thinking about the economy, and how much accommodation the economy needs at various points, by adjusting the asset purchases." The central bank has committed to buying $1.25 trillion of agency mortgage-backed securities and around $175 billion of agency debt, as part of a bid to keep borrowing costs low and supportive of economic growth.

Bullard reiterated to reporters keeping the program alive would largely be aimed at keeping Fed options open, and any activity would not have an economic impact. He also repeated to reporters the outlook for Fed policy depends on what happens with the economy. When it comes to the economy, "I wouldn't say I'm worried," Bullard told reporters. "The economy has come in on track during the summer and the fall here" and "it looks like will do well here in the fourth quarter." But he added "I am a little concerned" about the reluctance to hire.

When it comes to some of the issues arising from commercial real estate problems, Bullard said "I am hopeful we'll be able to work with this and it will be contained." In his other comments at the event, Bullard told the audience what happened with the dollar during the financial crisis should allay fears about the currency's value. For all the fears about the dollar, "it is interesting the world came to the dollar" during the crisis, and that the currency rallied in the initial stages of the financial crisis. While the dollar has weakened of late, "at least right now the dollar is still viewed as the reserve currency" and "the place to go," and "we don't want to lose that," Bullard said.

In Bullard's formal remarks he noted growth had returned to the U.S., and he said household spending had stabilized. He described unemployment as "high" and said labor markets were lagging the recovery. The official said "the U.S. is in the early stages of recovery." In his remarks, Bullard said the problem of financial institutions that are deemed too-big-to-fail is real, and must be dealt with, because these institutions exact a cost on the financial system. Bullard defended the Fed's record during financial crises of the last generation, and he added Fed official did warn of the imbalances that led to the financial crisis of the last couple of years.

As financial reform efforts move forward, Bullard said he believes the Fed should remain a regulator of financial institutions. He also said this regulator role enhances monetary policy because it gives the central bank insight into the functioning of the financial system. Bullard also argued against moves that would compromise the Fed's independence, saying that would be bad for inflation and would complicate recovery efforts.

States Hit by Drop in Tax Collections

Tax collections tumbled 11% across 44 states in the third quarter, according to a report that suggests government revenue will remain depressed long after the economy has recovered from recession. Every major source of state tax revenue -- sales, corporate- and personal-income taxes -- fell in the third quarter compared with the same period a year ago, according to a report to be released Monday by the Nelson A. Rockefeller Institute of Government at the State University of New York.

The steepest decline was in volatile corporate-income taxes, which fell 19.4% across the 44 states surveyed by the Rockefeller institute. Personal-income taxes fell 11.4%, while sales taxes fell 8.2%. Roughly 80% of states' total tax collection comes from sales and personal-income taxes. With tax receipts heavily dependent on wages and spending, state revenues are expected to continue falling for months or years after the technical end of the recession. The economy continued to shed jobs in October, and employment growth is expected to remain muted even as the economy recovers. Many states could be forced to cut spending further.

"State tax revenues will remain fragile and gloomy at least throughout fiscal years 2010 and 2011," said Lucy Dadayan, a senior policy analyst at the Rockefeller institute. Each of the 44 states surveyed saw overall taxes decrease in the third quarter from a year earlier, and half saw total taxes fall 10% or more. The hardest-hit region was the Southwest, with third-quarter tax revenue falling 21.5%. Of the 38 states in the report that collect income taxes, all saw revenue declines, and 21 had double-digit-percentage declines.

The weakness in personal income taxes has for the most part mirrored the recession that began in December 2007. Far Western states, which have been among the hardest hit by falling home prices and the recession, recorded a nation-leading 15.3% decline in personal-income taxes. California, Oregon and Nevada all have unemployment rates greater than 11%, among the highest in the nation. The report added that despite new taxes and budget cuts in areas including legislators' salaries and higher-education funding, tax revenue is likely to continue falling short of expenses. Indeed, a report last week from California Legislative Analyst's Office showed the state is facing a $21 billion budget shortfall, and California's controller said the state could have trouble making payments as early as next spring.

"Further revenue shortfalls and more spending cuts are mostly likely on the way for many states -- particularly those that did not take significant actions to balance revenues and expenditures in their 2010 budgets," the Rockefeller institute concluded.

One in eleven US homeowners are at risk of losing their property

Almost one in eleven Americans is at imminent risk of losing their home, as the housing crash continues to claim thousands of victims, more than three years after prices began to fall. Data from the Mortgage Bankers Association show that almost 5% of all American homeowners are already in the process of having their properties repossessed, while another 4.5% are at least 90 days in arrears with their mortgage repayments. In total, that means more than 9% – almost one in eleven – are on the brink of being forced to hand back their keys, on top of the many hundreds of thousands who have had their homes repossessed since the crisis began.