Texas cowboys

Ilargi: 2010 will be an eventful year in Europe, with a large variation in stories to tell. There's no way none of the sickly economies inside the EU and/or on its fringes is going to come too close to failure for comfort. One would almost think there’s a competition on. From Latvia, Lithuania (dare we include Ukraine?) south through Greece, Italy, Spain, Portugal and north again to Ireland and don’t let's forget Britain, which no longer has a position on any too big to fail list but its own.

It’s going to be quite a spectacle, and in good old continental tradition we could see absoluty debilitating strikes, governments falling like rotten fruit, and violent protests in numerous cities. Powerhouses France and Germany are not at immediate risk, but that doesn’t make them safe havens a few years hence. Since dissolving the European Union is not an option in any way shape or form, the rich will have to side with the poor, and the poor will be thrown back in history by decades at a time. A 20% unemployment rate is not the sort of reality that will let a society bumble along in peace and quiet for too long. Just ask the US.

Still, the year starts off with a surprising twist in the economics tale, a veritable Trojan horse, brought to you courtesy of the Greeks. Who else?

Greece has existed in its present form only since 1975. Before that it was a military dictatorship for ten years (the colonels regime, supported by the US in fine shock doctrine fashion), and before that, well, let’s just say it was a country that gave birth to a dictatorship. Once democracy was restored in its very cradle, Greece was ushered into European organizations very quickly, to a large extent because of geographic and strategic considerations. Across the Aegean lies Turkey, and beyond Turkey the Arab world. Easy as -shepherd's- pie.

Greece became a full patch EU member in 1981, only 6 years after the colonels had left. But of course the entire structure beneath the top remained intact, with a small long standing elite that has its fingers in every ouzo glass in the nation, and corruption on all levels of society that could be rivaled -maybe- only by a few African nations.

Some have suggested that today’s financial troubles in Athens tell them that Greece must have cooked its books in 1981 to get into the EU as well. And sure, the Greeks good cooks: In early 2009, Greece claimed a deficit of 3.7% of GDP, and when winter came around, it turned out to be 12.7%. Only, in 1981, the EU helped them in the financial kitchen, because everyone, EU, US, was so eager not to let Russia get its hands on the country, and voters were swinging heavily from left to right.

Which means that today's laments across Europe about Greece's problems must be seen like one of those marriages where trouble arises when one partner finds out after a number of years that the idea of changing their spouse into a person they dreamed of, is not working out. For Athens, it's obvious: you knew who we were all along. We haven't changed, but your idea about us have.

The biggest problems for Greek politics today are soaring unemployment and the riots that are closely connected to it. In that sense, in a first Trojan twist, it's a godsend for the government, whichever one it may be on any given day, to have the EU and some of its member states holler heavy rhetoric in the media about Hellas. Because now that government can point at Brussels, Paris and Berlin, and claim that's where the guilty parties are. Demands by the union of 10% across the board budget cuts, they may look nice on paper, but it'll be a whole different picture if and when shop windows are broken and barricades built.

However, people like European Central Bank President Jean-Claude Trichet and German Chancellor Angela Merkel have a greater goal in mind, a second Trojan thoroughbred. Although they publicly claim anger, denounce "irresponsible behavior" and demand budget cuts, they also know you should never let a good crisis go to waste, and have started to use the Greek situation in an attempt to achieve what they see as their number one emergency: bring down the value of the Euro.

The single EU currency's -too- high rate vs the US dollar hurts Europe like a fully equipped torture chamber, and they know it has to stop. Leaving open the option to the outside world that Greece may fail and/or leave the EU, will be, they hope, enough to terrify markets away from the Euro and into greenbacks.

And they may be right. China has stated that it feels the US dollar has gone low enough. Europe and China together may well succeed in raising the USD exchange rate considerably, and that would be bad news for America. It would also introduce some serious questions for all those who claim that central banks and Treasury department have the ability to set interest rates where they want them, and when they want.

In the end, like the US, Europe's success -and indeed survival- depend on economic recovery becoming a reality. So much so that on both sides of the Atlantic, the media have been mobilized to spread the message that the recovery is already here or very soon will be. The fact that many among the media depend for survival on that recovery as well makes that an easy sell.

Unfortunately, it's just propaganda. In scores of countries, there are amounts of debt left unpaid which in some cases will prove terminal, on all levels ranging from private to corporate to sovereign. In that order, this will lead to among others foreclosures, bankruptcies and tax increases -coupled with unrest-, while all three will increase unemployment rates and breed even more debt. There's no more surefire way to get deeper into debt than having more debt than you can service.

Home prices will and must fall further, if only to move away from their present-day insane overvaluations and get back in sync with trendlines. With consumption falling of everything, both domestically and internationally, companies will go out of business by the bucketfuls. Governments, unable to pay their bills, will need to renege on contracts for employees and retirees, with all the inevitable ensuing mess that we can all imagine.

But most of all, many trillions of dollars in toxic assets still sit on dark and dusty shelves, moldy and fermenting and waiting for resolution, on both sides of the Atlantic and the Pacific. And when all is said and done, they will be the enemy discovered too late, hiding in the one and only real Trojan horse that we invited into our cities because we couldn't resist its splendor.

Jim Rogers: Brace Yourself For Food Shortages, Thanks To The Banks Hoarding Cash

Jim Rogers is sounding the alarm -- buy agricultural commodities ahead of the riots. The financial crisis has cut off investment in agriculture, with many farmers unable to get loans for fertilizer according to Mr. Rogers. Of course, this means agricultural commodities will make a killing:CNBC: "Sometimes in the next few years we're going to have very serious shortages of food everywhere in the world and prices are going to go through the roof." Cotton and coffee are good buys because they are very distressed, while sugar, despite the fact that it has gone up a lot, is still down 70 percent from its all-time high, according to Rogers. "I don't think that the problems of the world are behind us yet," he said.

Merkel Says Greece Means Euro Faces 'Difficult' Time

German Chancellor Angela Merkel said Greece’s mounting budget deficit risks hurting the euro, saying the currency faces a “very difficult phase.” Merkel, speaking at a private forum hosted by Die Welt newspaper yesterday, questioned the fiscal discipline of other countries using the euro, according to a transcript posted on the German government’s Web site today.

“The Greek example can put us under great, great pressures,” she said, according to the transcript. “Who will tell the Greek parliament to please go ahead and pass a pension reform? I don’t know that they’ll be enthusiastic about Germany giving them instructions.” German lawmakers wouldn’t be happy if Greece told them what to do, she said. “So the euro is in a very difficult phase over the coming years.”

Greek 10-year bonds extended declines. They yielded 5.99 percent, up 11 basis points, or 0.11 percentage points at 12:08 p.m. in Berlin. That includes an increase of 3 basis points after Merkel’s remarks were reported. In Athens, Greek Prime Minister George Papandreou announced plans to cut spending and raise revenue by about 10 billion euros ($14.5 billion) this year as part of a three-year plan adopted today to bring the European Union’s biggest budget deficit within the EU limit in 2012.

“We will do whatever it takes,” Papandreou said in a televised speech to his Cabinet. “Our country can and is obliged to exit as soon as possible this vicious circle of misery. We will not retreat; we will proceed quickly.” The plan, to be presented to the European Commission tomorrow, aims to cut the shortfall from 12.7 percent of output, more than four times the EU limit, to 8.7 percent this year. That reduction will be achieved even though the economy will contract 0.3 percent, the plan says. The budget deficit will shrink to 5.6 percent next year and 2.8 percent in 2012.

Trichet Says Greece Won’t Win 'Special Treatment', Pressures Papandreou as Greek Bonds Fall

European Central Bank President Jean-Claude Trichet intensified pressure on Greece to cut the continent’s biggest budget deficit with a warning that the country won’t get any favors from policy makers. As Prime Minister George Papandreou struggles to convince investors and European Union governments he can regain control of the country’s budget, Trichet yesterday said no nation can expect any “special treatment.” “The central bank has clearly chosen to maintain its pressure on the Greek government, rather than easing the heightened tensions in bond markets,” said Laurent Bilke, a former ECB economist now at Nomura International Plc in London.

Greek bonds extended declines after Trichet’s comments, which came after the ECB left its benchmark interest rate at a record low of 1 percent. While Greece was his main target, Trichet told other euro members to take the “difficult decisions” needed to tackle “sharply rising” budget gaps or face higher borrowing costs that hurt economic growth. The Greek remarks eclipsed those made on monetary policy as officials turn their attention from the financial crisis to the nations most hurt by the recession. German Chancellor Angela Merkel said in comments published yesterday that Greece’s fiscal woes could hurt the euro and Luxembourg Prime Minister Jean- Claude Juncker said International Monetary Fund aid wouldn’t be “appropriate.”

Rating downgrades sparked a rout in Greece’s bonds in December as investors tuned into a budget deficit of 12.7 percent of gross domestic product, more than four times the European Union limit. The yield on the 2-year Greek note today rose 6 basis points to 3.559 percent, extending yesterday’s gain of 44 points. Arguing that it has received enough of a benefit from euro membership, Trichet said the ECB won’t help Greece by delaying the reintroduction of its pre-crisis collateral rules at the end of 2010. Downgrades by Fitch Ratings, Moody’s Investors Service and Standard & Poor’s have fanned concerns its bonds will be excluded from the ECB’s market operations. “We will not change our collateral policy for the sake of any particular country,” Trichet said.

The subsequent selloff suggests the market “still harbors hopes that the ECB would abort its collateral decision,” said Elga Bartsch, chief European economist at Morgan Stanley in London. Juergen Michels, chief euro-area economist at Citigroup Inc., said the ECB will ultimately agree to rules “that do not put too much additional pressure on member countries.” Trichet also downplayed the importance of Greece for the euro region as a whole. While Greece makes up about 3 percent of the bloc’s GDP, 13 percent of the U.S. economy is accounted for by California, which is also suffering financial difficulties.

Those remarks drew short shift from Andrew Bosomworth, a former ECB economist and now head of portfolio management at Pacific Investment Management Co. in Munich. He warned Greece could still cause “contagion” to other economies with poor finances such as Portugal or Spain. “While each of those countries in their own right may not be very big, or a threat to the euro area, if one of them were to go you have potential domino effect that could snowball into a big problem for the euro area,” Bosomworth said in a television interview yesterday.

Marco Annunziata, chief economist at UniCredit Group in London, said policy makers are playing a “nerve-wracking game of chicken” in the hope that their tough rhetoric will pressure Greece into action. Budget Shortfall “If a rescue turns out to be necessary, a rescue operation will be mounted,” Annunziata said. In Athens, Papandreou yesterday pledged to “do whatever it takes” to rein in the budget shortfall and restore confidence in the country’s finances when he published the three-year budget plan.

The government’s latest proposals, to be presented to the European Commission today, call for about 10 billion euros ($14 billion) of spending cuts and revenue increases this year to bring the shortfall from 12.7 percent of output to 8.7 percent by year-end. “Our country can and is obliged to exit as soon as possible this vicious circle of misery,” Papandreou said. “We will not retreat; we will proceed quickly.

Has Greece delivered another Trojan horse?

Greece’s economic statistics are dubious in more than one sense. The country probably bent its figures to get into the euro zone. Now, the EU is angry that Greece has not been straightforward about the size of its fiscal deficit. But the greater doubts concern how an uncompetitive, highly indebted, weakly governed country can live with a strong currency such as the euro. The Trojans were shocked after Greek guile got them in. The feeling may be similar at Eurostat, the European Union’s statistics office. There is particular anger at Greece’s increase of its estimate of the fiscal deficit last year from a tolerable 3.7 percent of GDP to a quite intolerable 12.5 percent.

A revision that huge in the course of the year is ridiculous – and shows something worse than incompetence. Greece’s finance ministry blames interference in the statistics office by the previous government. But the EU, which says it has been applying intense scrutiny to Greek figures since 2004, also seems to have lacked sufficient insight. The Greeks were still keeping a lot of danger in the dark. With the numbers out in the open what Greece and the zone face is ugly. The country has a fiscal deficit of about 13 percent of GDP, government debt of about ten times that, and prices and wages that have risen far faster than those of France and Germany for a decade. Greece is uncompetitive and, as a member of the euro zone, cannot devalue.

That suggests its growth and unemployment will get worse, along with its deficit and debt. Crisis is coming. The only way to avoid it — with or without an ugly exit from the zone – is profound reform. Greece needs to balance the government’s budget, or come close to that, while the private sector cuts wages in order to become internationally competitive again. The process will be a brutal marathon. But before it has even begun Greek workers are protesting – louder than Irish ones, who have already started the slog. It’s not clear that Greece can make it to the zone survivors’ finish line.

Ilargi: Kyle Bass makes a series of excellent points, but I don't agree with his assessment of Japan vs the US. He argues -sort of- that Japan has taken 20 years to get where they are, and that should mean the US still has at least a decade left to correct its mistakes. But that would depend entirely on how bad the mistakes have been, and how costly they have been relative to for instance production rates and remaining values, wouldn't it?

Yes, there are many more factors that play into the picture, but my general impression is that the US have been far more aggressively mistaken, and moreover have done so in global economic circumstances that are much worse than the ones Japan found itself in in 1990.

Kyle Bass: I Don't See How Japan Has A Way Out

Kyle Bass is one of a growing number of investors betting on a collapse of the hedge fund market. David Faber caught up with Bass before the Hayman Capital founder testified at yesterday's crisis hearings. In the first part, Bass talks about some of his reform proposals (which we covered yesterday) though in the final two minutes he gets to Japan.

As he sees it, the country is a canary in the coalmine for what will happen here, and that at this point, there's no way out. *The fact that both the Euro breakup and the Japan collapse are getting so much attention these days, supports our contention that there are no paper currencies that anyone can possibly like right now. It's a very strange time.

Kyle Bass: Bring Back Glass-Steagall, Eliminate Off-Balance Sheet Assets, And Cap Leverage At 10X

Kyle Bass, one of the hedge fund managers that made a killing in the subprime fiasco (basically by taking the same bet as John Paulson) offers his clear-sounding ideas to regulating the financial system going forward.Here's the nut of it:

I believe there are three important changes that are necessary to protect the taxpayer from future crisis and restore the US banking system to its historically strong position.

First, it is imperative to separate depository institutions from proprietary capital groups and derivatives traders. We cannot have systemically important depository institutions taking enormous risks in the derivatives marketplace.

Second, I thought we learned that off-balance sheet = BAD during the Enron and Worldcom fiascos. Bring all risks and leverage back on the balance sheet in order for regulators and investors to be able to compare apples to apples. Third, we must determine if 25X leverage is the correct minimum level of capitalization.

Mandating a 10% capital balance does not seem too far away from where we need to be. 10X leverage is plenty, and it still might not be stringent enough in an environment where we have a multi-standard deviation event and 10% losses become the norm.And here's his full testimony at [the] financial crisis hearings:

Spain, Ireland Lead European Nations Using Banks for Bond Sales

Spain and Ireland led European governments raising $34 billion from bonds sold through banks this week as countries start 2010 selling debt at the fastest pace on record to finance growing budget deficits. Poland, Belgium and Austria also issued debt through syndicated offerings, boosting sales of bonds in dollars and euros 54 percent from $22 billion at the start of 2009, according to data compiled by Bloomberg.

Governments are paying banks fees to sell bonds directly to investors to fund stimulus packages aimed at lifting economies from the deepest recession since World War II. Spain posted its largest budget deficit in almost a decade last year, while Ireland has a shortfall that’s nearly four times the European Union’s limit. Euro-region countries may sell a record 1 trillion euros of bonds this year, HSBC Holdings Plc estimates.

“Deficits are higher and more issuance needs to get done, therefore countries have continued to increasingly use syndicated deals as a means of getting a wider number of investors,” said Padhraic Garvey, head of investment-grade debt strategy at ING Groep NV in Amsterdam. “You can get deals done in size and widely distributed directly to investors.” Government bond yields relative to benchmark swap rates have increased amid the surge in issuance. The yield spread on European sovereign debt widened 4 basis points this week to 28, a three-week high, according to Bank of America Merrill Lynch bond indexes. The gap averaged 25 basis points last year, and 14 in 2008. A basis point is 0.01 percentage point.

Spain, with the highest unemployment rate in the euro region, priced 5 billion euros ($7.3 billion) of 10-year bonds to yield 56 basis points more than the swap rate, Bloomberg data show. That’s less than the 67 basis-point spread on 10-year notes it issued in May. The European Commission forecasts Spain’s debt will rise to 66 percent of gross domestic product next year, up from 36 percent before the financial crisis.

Ireland sold 5 billion euros of bonds to help plug its budget deficit. The nation priced the notes due October 2020 at a spread of 150 basis points over swaps, Bloomberg data show. “It’s a very crowded and volatile market and yet Ireland managed to sell their bonds quite successfully, which shows they are confident,” said Robin Marshall, director of fixed income at Smith & Williamson Investment Management. “I find what Ireland offered quite attractive given their political willingness to consolidate their fiscal position.”

Poland raised 3 billion euros from the sale of 15-year bonds this week. Belgium issued 5 billion euros of 10-year notes and Austria sold 4 billion euros of seven-year debt. Cyprus, Slovenia and Hungary have also hired banks to raise money through syndicated bond sales.

The Coming Sovereign Debt Crisis

by Nouriel Roubini and Arpitha Bykere

In 2009, downgrades and debt auction failures in countries like the UK, Greece, Ireland and Spain were a stark reminder that unless advanced economies begin to put their fiscal houses in order, investors and rating agencies will likely turn from friends to foes. The severe recession, combined with a financial crisis during 2008-09, worsened the fiscal positions of developed countries due to stimulus spending, lower tax revenues and support to the financial sector.

The impact was greater in countries that had a history of structural fiscal problems, maintained loose fiscal policies and ignored fiscal reforms during the boom years. Going forward, a weak economic recovery and an aging population is likely to increase the debt burden of many advanced economies, including the U.S., Britain, Japan and several eurozone countries.

In 2008 and 2009, the decisions by these governments to do "whatever it takes" to backstop their financial systems and keep their economies afloat soothed investor concerns. But if countries remain biased toward continuing with loose fiscal and monetary policies to support growth, rather than focusing on fiscal consolidation, investors will become increasingly concerned about fiscal sustainability and gradually move out of debt markets they have long considered "safe havens."

Most central banks will withdraw liquidity starting in 2010, but government financing needs will remain high thereafter. Monetization and increased debt issuances by governments in the developed world will raise inflation expectations. These governments will have to offer higher real yields or investors will move to more attractive emerging markets. Some countries will continue to witness increased credit default swaps.

Higher yields and interest cost on debt will also hurt economic growth—by crowding out private consumption and investment, and reducing government's productive spending. Several factors will likely influence investors' perception about sovereign risk—a country's debt financing ability, its status as a "safe haven" relative to other developed economies, politicians' commitment to undertake fiscal reforms, exchange rate movements, and the debt maturity structure.

The UK, Spain, Greece and Ireland will face sovereign risk pressures, especially if their fiscal imbalances are not addressed immediately. Some eurozone members are quickly approaching their debt sustainability limits as deleveraging through devaluation is not an option for these countries. Countries like Germany—whose fiscal imbalances have deteriorated largely due to the economic and financial downturn—might have a greater capacity to stabilize their debt ratio.

The U.S. and Japan might be among the last to face investor aversion—the dollar is the global reserve currency and the U.S. has the deepest and most liquid debt markets, while Japan is a net creditor and largely finances its debt domestically. But investors will turn increasingly cautious even about these countries if the necessary fiscal reforms are delayed. The U.S. is a net debtor with an aging population, weaker economic growth and risks of continued monetization of the fiscal deficit. Japan's aging population and economic stagnation will reduce domestic savings.

Developed economies will therefore need to begin fiscal consolidation as soon as 2011-12 by generating primary surpluses, which can be accomplished through a combination of gradual tax hikes and spending cuts. However, an aging population, a sluggish economic recovery and higher unemployment will keep governments' entitlement spending high and revenues subdued. These factors might also make tax hikes politically challenging. Fiscal consolidation efforts might not be strong until the bond vigilantes signal shifting to safer assets. To achieve credibility, governments will need to pass binding legislation enforcing tighter fiscal belts when their economies begin to recover on a sustained basis.

Sovereign defaults top 2010 risk hitlist for WEF

The risk that deteriorating government finances could push economies into full-fledged debt crises tops a list of threats facing the world in 2010, according to a report by the World Economic Forum. Major world economies have responded to the financial crisis with stimulus packages and by underwriting private debt obligations, causing deficits to balloon. This may have helped keep a worse recession at bay, but high debt has become a growing concern for financial markets.

The risk is particularly high for developed nations, as many emerging economies, not least in Latin America, have already been forced by previous shocks to put their fiscal houses in order, the WEF think tank said in its annual Global Risks report ahead of its meeting in Davos, Switzerland. "Governments, in trying to stimulate their economies, in fighting the recession, are (building) unprecedented levels of debt and therefore there is a rising risk of sovereign defaults," said John Drzik, Chief Executive of management consultancy Oliver Wyman, which was one of the contributors to the WEF report. He said higher unemployment levels could follow, with associated social and political risks.

The report placed unsustainable debt levels and the looming shadow of the financial crisis among the top three risks, alongside underinvestment in infrastructure -- one of the fastest rising risks -- and chronic diseases such as Alzheimer's and diabetes driving up health costs and reducing growth. Other looming threats including the risk of asset price collapse, risks connected to Afghanistan and a potential slowdown in Chinese growth which could hit employment, fuel social unrest and hurt exports through the region and beyond.

The report, highlighting the risk developed nations could overextend "unsustainable levels of debt," said full-blown debt crises would have inevitable social and political consequences, not least higher unemployment. "Government debt levels of 100 percent of GDP -- which is where the United States and the UK are heading -- and higher are clearly not sustainable," said Daniel Hofmann, group chief economist at Zurich Financial Services, a contributor to the report.

"There is an inherent risk that investors may take fright, they may question the sustainability of these debt levels -- the result (would be) sovereign debt crises and defaults. "Clearly Dubai and Greece were early warnings that should be heeded," he told a press conference. Worries over Dubai, Ukraine and Greece have spilled over into global markets , and all three look set to remain under pressure, with the threat also high for the Anglo-Saxon economies -- the United States and the United Kingdom.

The WEF report said both faced with "tough choices" in the months ahead as they seek to time a "gradual and credible withdrawal of fiscal stimulus so that the recovery is sustained but not so late that fiscal deficits cause fear of sovereign debt deterioration." The report highlighted what it called a "governance gap" -- the gap between short-term pressures on governments and business and the need for long term decisions, not least on issues including health and pension reform and climate change. Too little was being done to address underinvestment in infrastructure, it said, which could hurt food and energy security. The World Bank puts global infrastructure investment needs at $35 trillion for the next 20 years.

Greater life expectancy and unhealthy lifestyles would lead to a soaring financial cost from chronic disease, they said, which must be addressed by both developing and developed nations such as through prevention campaigns promoting healthier living. "The biggest risks facing the world today maybe from slow failures or creeping risks," said the report. "because these failures at risks emerge over a long period of time, there potentially enormous impact and long-term implications can be vastly underestimated."

US retail sales drop 0.3% on widespread declines

For 2009, sales sank a record 6.2% to $4.14 trillion

U.S. retail sales fell a seasonally adjusted 0.3% in December on widespread weakness across different kinds of stores, the Commerce Department estimated Thursday. The decline was unexpected, as economists surveyed by MarketWatch were forecasting a 0.5% gain. Auto sales disappointed, dropping 0.8% in dollar terms even as the automakers reported higher unit sales. See our complete economic calendar and consensus forecast. Excluding the 0.8% decline in auto sales, retail sales fell 0.2%. The figures are adjusted for seasonal factors but not for price changes.

Bad weather during the month likely depressed sales. Perhaps in reaction to the storms, non-store sales, such as online and catalog sales, rose 1.4%. Gasoline sales jumped 1%, a surprisingly strong gain considering that prices barely budged over the month. Sales in October and November were revised up, softening the shortfall in December. November's sales were revised to a 1.8% gain from the 1.3% previously reported. October's sales were revised up a tenth point to 1.2%

Compared with December 2008, sales were up 5.4%. Excluding autos, December sales were up 5.2% from a year earlier. Sales for all of 2009 fell 6.2% compared with 2008 to $4.14 trillion. That's the largest decline on record, dating back to 1992. And it was only the second decline on record; the other was the 0.5% drop in 2008. For the year, sales fell at all kinds of retail outlets except groceries, drugstores and restaurants. Auto sales were down 12%, gasoline sales fell 25%, and department-store sales fell 6%.

Despite December's decline, economists still estimate that consumer spending added to growth in the fourth quarter, but at a slower pace than the 2.8% annualized increase in the third quarter. Ahead of the report, the median forecast for fourth-quarter gross domestic product was a 4.8% annualized gain. Much of the expected growth stems from slower inventory reductions, not final sales. In a separate report, the Labor Department said first-time claims for state unemployment benefits rose by 11,000 to 444,000 last week. Also, prices of imports into the United States were unchanged in December, the Labor Department reported.

Here's How The December Retail Data Turned Out To Be Such A Disaster

According to the Commerce Department, retail sales were negative in December. This is much bleaker data than the same-store sales comps that came out a week ago. The decline was not what economists had expected. Sales were expected to rise 0.5 percent according to economists surveyed by Marketwatch.The only silver lining here is that retail trade sales were up 5.9 percent over last year. So this December did mark an improvement over last year’s disastrous holiday shopping season. However, a look at business breakout reveals that the types of retailers that shopping center owners rely on had the weakest performance. The best year-over-year seasonally adjusted performers were gasoline stations (+33.6 percent), nonstore retailers (+10.6 percent) and auto and other motor vehicle dealers (+7.6%).

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $353.0 billion, a decrease of 0.3 percent (±0.5%)* from the previous month, but 5.4 percent (±0.5%) above December 2008. Total sales for the 12 months of 2009 were down 6.2 percent (±0.2%) from 2008. Total sales for the October through December 2009 period were up 1.9 percent (±0.3%) from the same period a year ago. The October to November 2009 percent change was revised from +1.3 percent (±0.5%) to +1.8 percent (±0.2%).Retail trade sales were down 0.2 percent (±0.5%)* from November 2009, but 5.9 percent (±0.5%) above last year. Gasoline stations sales were up 33.6 percent (±1.5%) from December 2008 and nonstore retailers sales were up 10.3 percent (±1.7%) from last year.

But why were the numbers so far off? Economist Dean Baker had a post up briefly here that seems to be gone now that said economists don’t account for a bias in same-store sales metrics when thinking about retail sales. Moreover, he points out that the December numbers showed a weak result in the general merchandise sector, which isn’t a great sign for retail real estate. He explains:The big culprit in this drop was the general merchandise sector (department stores and Wal-Mart), which had a 0.8 percent drop. The likely reason that many economists missed this drop is that they continue to ignore the same store sale bias. There are many fewer stores this year than last. This means that even if overall sales were constant, sales in same stores would rise. This bias will gradually disappear as we move forward and the comparison month in the previous year looks worse, but for now it is still substantial.

Calculated Risk’s monthly take is here.

RealtyTrac Reports 2.8 Million Foreclosures In 2009, "Would Have Been Worse If Not For Delays In Processing Delinquent Loans"

RealtyTrac reported its December foreclosure number which came in at 349,519, a 14% jump from the previous month, and a 15% increase from December 2008, and an end to the favorable declining monthly trends July. And according to Rick Sharga, SVP of RealtyTrac, 2010 is expected to see between 3 and 3.5 million foreclosures, which will be another record. Some recovery.RealtyTrac, today released its Year-End 2009 Foreclosure Market Report™, which shows a total of 3,957,643 foreclosure filings — default notices, scheduled foreclosure auctions and bank repossessions — were reported on 2,824,674 U.S. properties in 2009, a 21 percent increase in total properties from 2008 and a 120 percent increase in total properties from 2007. The report also shows that 2.21 percent of all U.S. housing units (one in 45) received at least one foreclosure filing during the year, up from 1.84 percent in 2008, 1.03 percent in 2007 and 0.58 percent in 2006.

Foreclosure filings were reported on 349,519 U.S. properties in December, a 14 percent jump from the previous month and a 15 percent increase from December 2008 — when a similar monthly jump in foreclosure activity occurred. Despite the increase in December, foreclosure activity in the fourth quarter decreased 7 percent from the third quarter, although it was still up 18 percent from the fourth quarter of 2008.

“As bad as the 2009 numbers are, they probably would have been worse if not for legislative and industry-related delays in processing delinquent loans,” said James J. Saccacio, chief executive officer of RealtyTrac. “After peaking in July with over 361,000 homes receiving a foreclosure notice, we saw four straight monthly decreases driven primarily by short-term factors: trial loan modifications, state legislation extending the foreclosure process and an overwhelming volume of inventory clogging the foreclosure pipeline.

“Despite all the delays, foreclosure activity still hit a record high for our report in 2009, capped off by a substantial increase in December,” Saccacio continued. “In the long term a massive supply of delinquent loans continues to loom over the housing market, and many of those delinquencies will end up in the foreclosure process in 2010 and beyond as lenders gradually work their way through the backlog.”

Extend and pretend will continue with less of a marginal impact as more and more of the shadow inventory, which according to Jim Cramer is irrelevant, comes to market.

US jobless rate to stay above 8 percent until 2012: CBO

The U.S. unemployment rate, currently at 10 percent, is unlikely to drop below 8 percent before 2012 unless Congress takes further steps to boost the economy in the short term, the nonpartisan Congressional Budget Office said on Thursday. The estimate is likely to give increased urgency to Democratic lawmakers' efforts to create jobs before they face voters in November. The House of Representatives passed a $155 billion jobs bill in December and the Senate is expected to act in coming weeks. President Barack Obama was scheduled to address House Democrats later on Thursday as they huddle to consider other ways to boost the economy.

CBO's estimate shows the unemployment is likely to remain high for several years as the country gradually recovers from the worst downturn since the 1930s. The unemployment rate stood at 4.9 percent before the recession took hold in December 2007. The 8 percent figure remains unchanged from the office's August 2009 estimate, when a $787 billion stimulus bill had just begun to affect the economy. The effects of that stimulus bill will peak in the first half of this year, CBO said, but further efforts could help hasten the recovery.

Increased spending on safety-net programs for the jobless will likely have the most immediate impact as the beneficiaries would spend that money quickly, CBO said. Each dollar spent on that approach would yield between 70 cents and $1.90 in economic activity, CBO estimated. That element is included in the House jobs bill, along with increased infrastructure spending and aid to cash-strapped states. Those two approaches also could boost the economy but would have less of a short-term impact, CBO said.

A payroll tax credit to encourage businesses to create jobs, which was not included in the House bill, would also be among the most effective approaches, CBO said. Tax cuts, especially for the affluent, would have less of an impact as households would be likely to save the money rather than spend it, CBO said. Any stimulus efforts are unlikely to add to inflation but would worsen the budget deficit, which came in at a record $1.4 trillion in the fiscal year that ended September 30, 2009, CBO said.

Britain's recession the steepest for 88 years

Britain's economy fell last year at the sharpest rate since 1921, despite hopes that it finally emerged from recession in the last three months of the year, according to a respected economics forecaster. The National Institute of Economic and Social Research (NIESR) said today that its latest estimate showed that GDP rose by a modest 0.3 per cent in the final three months of 2009 compared with the third quarter.

That means that, for the year as a whole, the economy contracted by 4.8 per cent, a bigger fall than in any year of the Great Depression and the biggest contraction for 88 years. However, NIESR went on to say that signs of a recovery were starting to emerge after the economy bottomed out in March last year after 12 months of sharp falls. In October, NIESR predicted that British GDP would fall by 4.4 per cent in 2009. Most economists had expected the country to turn the corner in the third quarter of the year, the three months to the end of September.

But official figures shocked economists by showing that the economy was still in recession, falling 0.3 per cent. That left Britain as the world's last major economy still in recession. NIESR's prediction of 0.3 per cent growth in the fourth quarter is broadly in line with most economists forecasts. Today, official figures for Britain's industrial sector provided a mixed signal on whether Britain did indeed come out of recession in the last quarter.

A surge in oil and gas extraction meant that production grew 0.4 per cent from October to November, but manufacturing output had stagnated at low levels with no change for the second successive month. Further fears about the sustainability of any recovery were triggered today by official figures for Germany showing that, after modest growth in the third quarter, the economy ran out of steam in the fourth quarter. Growth slumped to close to zero, meaning that, for the year as a whole, the German economy fell a record 5 per cent. The Office for National Statistics will produce its official estimate for GDP third-quarter growth in two weeks' time.

China’s Forex Reserves Growing to Infinity

by Jon C. Ogg

If you are one of the ones worried that China is taking the world over, you might not need to worry about its military doing that. AT the current rate, China will just be able to start buying countries in the future. China’s central bank showed that its foreign exchange reserves rose to a record $2.399 trillion at the end of 2009. That is the world’s largest and is a sharp 23.3% gain over the reserve levels of 2008.

The reserves were listed as close to $2.27 trillion in September. While China’s exports were lower for much of 2009, that has started to rebound. The December exports rose 17.7% and direct foreign investment doubled on a year over year basis to about $12.1 billion. If China did this during a time when the world is was in recession, imagine how much it can grow when things are back at 3% to 4% growth. David Bowie sang the song “The Man Who Sold the World” (it wasn’t Nirvana)… Bowie just didn’t say that China was the buyer.

And to think, China is still considered an emerging market by most….

Shortfalls for US cities could reach $56 billion-report

U.S. cities will face a collective budget shortfall of at least $56 billion over the next two years, with the current recession not seen hitting bottom until 2011, according to a report on Wednesday. The National League of Cities said that because economic recoveries in cities lag national ones by about two years, the pain from the recession that began in 2007 could continue for years to come.

The collective shortfall could reach $83 billion through 2012, the league said. Cities will seek to cure revenue declines and spending pressures with higher service fees, layoffs, unpaid furloughs, and drawing on reserves or canceling infrastructure projects, the report said. Many cities have already used these options as the recession has worn down their finances. States are also threatening to cut another lifeline for cities -- direct aid transfers. As they attempt to reconcile their own battered budgets, states are saying they can send less money to cities. California, for one, has already taken back aid it had granted.

States cut aid to cities by 9 percent in 2003 and 2004 in response to the 2001 recession, according to the report. "In comparison, the current recession is by nearly all measures more severe than the 2001 recession, suggesting that state cuts in transfers will, if anything, be more severe as well," the group said. If states simply cut 10 percent of aid per year from 2010 to 2012, cities will lose $21 billion in total, the league estimated.

Like the states, cities are pressing for more federal aid, through a job creation bill like the one recently passed by the House of Representatives; a transportation bill; or additional funding for programs begun through the economic stimulus bill passed last February, such as the energy efficiency grant program. "We urge federal action that would create jobs. Inaction at the federal level could worsen the already difficult situation facing cities and the country," said the group's president, Ronald Loveridge, who is mayor of Riverside, California, one of the areas hardest hit by the housing downturn.

California's debt rating cut to A-minus by S & P on budget woes

S & P, worried that the state could face a cash crunch in March, warns that the grade could be further reduced.

California's only remaining A-level credit grade from a major rating firm is in greater danger as the state's budget woes deepen yet again. Standard & Poor's on Wednesday cut its rating on California's $64 billion in general-obligation debt to A-minus from A and warned that the outlook was "negative," meaning another reduction could loom. S&P cited new concerns about the state's finances, including a possible cash shortage "if the state's revenue and spending trajectories continue."

Scrambling to close a $20-billion budget gap, Gov. Arnold Schwarzenegger has proposed a number of one-time fixes -- including having the federal government contribute nearly $7 billion in new aid. Yet the state's chief budget analyst believes the odds of getting that much help from the U.S. are "almost nonexistent." S&P worries that the state could face a cash crunch in March, before it receives the income tax payments due in April.

"There could be days in March when they go into a negative cash position," said Gabriel Petek, an S&P analyst in San Francisco. Although Petek said he didn't believe California would be in jeopardy of missing any payments due on its debt, he said the government might pay other obligations with IOUs, as it did last summer, or the state might require a short-term loan from Wall Street.

S&P's main rivals in the credit-rating business -- Moody's Investors Service and Fitch Ratings -- already rate California's debt the lowest of any state, and below "A" level. Moody's rating is Baa1; Fitch's is BBB. Falling bond ratings often can drive up the interest rates a state or municipality must pay to borrow. But in California's case, even as the budget picture has worsened over the last two months the market for the state's bonds has been fairly placid, with yields on the securities holding relatively steady in the marketplace.

After a flurry of bond offerings last fall, California Treasurer Bill Lockyer has no plans to test investors' appetite for new state debt in the near future, a spokesman said. In a statement, Lockyer's office said S&P's move Wednesday "highlights the critical need for the Legislature and governor to act swiftly to solve our budget problems, and do so in a way the market finds credible." "The agency made it pretty clear that a failure to adopt real budget solutions in a timely manner will threaten us with a further downgrade. Every time that happens, taxpayers' debt service burden grows heavier. It's time we started lightening that load, not making it worse."

Report Challenges California Budget

California lawmakers and analysts are challenging Gov. Arnold Schwarzenegger's days-old budget proposal, which relies on billions of dollars in emergency federal aid. A report released Tuesday by the state's nonpartisan legislative analyst said the Republican governor's spending plan, which would close a $20 billion budget shortfall over 18 months, is built on risky assumptions -- including agreement by Washington to rescue the state.

"While the odds seem favorable for some federal relief sought by the administration," the report said, "we believe that the likelihood of Washington agreeing to all of the governor's requests is almost nonexistent." The report also said Mr. Schwarzenegger's proposal, which envisions spending $82.9 billion in the 2010-11 fiscal year, is built on optimistic revenue and spending estimates. Such challenges to the Republican governor's Jan. 8 budget proposal illustrate the task of solving California's latest budget crisis.

State lawmakers last year closed a $60 billion deficit with spending cuts, accounting gimmicks and other maneuvers, but only after battles that forced California to delay payments and issue IOUs to creditors to keep from going into default. Legislators have said they were prepared for another stalemate that could further strain the state's finances. The challenge from the legislative analyst's office was directed at Mr. Schwarzenegger's budget proposal for the 18 months ending June 30, 2011. The proposal calls for $8.5 billion in spending cuts, $4.5 billion in accounting maneuvers -- such as shifting money to the general fund from other accounts -- as well as $6.9 billion in federal aid.

Without the federal funds, the governor said he would cut an additional $4.6 billion in spending, in part by eliminating major health and welfare programs, and raise $2.4 billion in revenue, largely by extending the suspension of tax breaks. The governor said last week that the federal government owed California the money because the state sends far more in taxes to Washington than it receives, adding that federal mandates force California to spend money it doesn't have.

House Speaker Nancy Pelosi, a San Francisco Democrat, and the state's two Democratic U.S. senators have said new federal aid was unlikely, given that California has already received billions of dollars from the stimulus package. "The federal government is not responsible for the state of California's budget, and we look forward to hearing a sustainable plan for the state to get its house in order," a spokesman for Ms. Pelosi said after the budget was released Friday. Added Sen. Barbara Boxer: "If you're talking about a straight check to the governor, I don't think we're going to do that."

Mr. Schwarzenegger said on NBC's "Meet the Press" Sunday that he thought the California congressional delegation was not "representing us very well." He reiterated his concerns in a speech Monday. Even if the nation's most populous state gets more federal aid, Mr. Schwarzenegger's budget proposal faces challenges from the state Legislature's Democratic leaders. They said Friday that they wouldn't consider the major cuts and indicated a preference for industry-specific taxes, such as on tobacco and oil extraction.

The report by the state's legislative analyst, Mac Taylor, also said the governor's plan doesn't factor in the possibility that some of his proposals could be challenged in court. Because of that and optimistic forecasts, "the legislature and governor eventually may have to address a budget problem a few billion dollars larger than the administration identifies," the report said. The report added that legislators were unlikely to find a way to avoid the deep spending cuts the governor proposed. It said legislators, instead of eliminating some social programs, could pare them to benefit only the "most vulnerable."

The report did say the governor's estimate of the size of the problem was reasonable. "We commend the [legislative analyst] for recognizing that our budget was a reasonable estimate of the problem and for encouraging the governor and the legislature to seek federal fairness," said gubernatorial spokesman Aaron McLear. The report concluded that to save money through new spending cuts in the current fiscal year, the state Legislature and governor must approve a budget by the end of March. That will be difficult in a statheouse where the majority Democrats are likely to have trouble winning over enough Republicans to pass a budget by the required two-thirds majority.

California Rating Cut Shows $20 Billion Gap Lifts Bond Costs

California bondholders got an early glimpse of what the state’s budget-negotiation season may bring as a looming $20 billion deficit led Standard & Poor’s to cut its credit rating for the second time in less than year. S&P yesterday lowered its assessment on $64 billion of the most-populous U.S. state’s general obligation bonds one level to A-, four steps above speculative grade, saying a plan by Governor Arnold Schwarzenegger to erase the spending gap relies too much on proposals that may not succeed.

It was S&P’s first downgrade of California since February, when it preceded Moody’s Investors Service and Fitch Ratings in lowering the state’s rating as lawmakers were locked in a stalemate over how to fill what was then a $46 billion gap. “This is déjà vu,” said Kenneth Naehu, who invests $2.5 billion in municipal bonds for Bel Air Investment Advisors in Los Angeles.

A taxable California bond maturing in 2039 traded yesterday for as little as 97.90 cents on the dollar, to yield 7.73 percent. That’s down from 98.67 cents a day earlier, when the yield was 7.66 percent.

The extra yield on California 10-year bonds was 1.30 percentage points yesterday compared with top-rated municipal securities. Last year at this time, the so-called yield spread on California 10-year debt soared above one percentage point, or 100 basis points, for the first time in more than a decade.

Schwarzenegger’s budget plan seeks to cut spending by $8.5 billion on top of the $30 billion slashed last year. He said he’ll lower it another $7 billion if the federal government won’t reimburse California for money he said the state is owed for health care mandates, education standards and illegal immigrants in its jails. “There is no rational way to absolve Washington of any responsibility for state budget deficits until Congress acts to remove the barriers that prevent states from reducing spending as needed to live within our means,” Schwarzenegger said in a letter yesterday to the state’s congressional delegation.

The 62-year-old Republican governor isn’t likely to get much of the federal aid he’s seeking, California state Legislative Analyst Mac Taylor said Jan. 12. At the same time, criticism of his proposal from top Democratic state lawmakers, who control both chambers of the Legislature, has stoked investors’ concern that prolonged political fighting over the $82.9 billion budget will drain the state of its cash, as it did last year.

George Strickland, who invests $4.5 billion of municipal debt for Thornburg Investment Management in Santa Fe, New Mexico, said he’s avoiding adding California bonds, anticipating that the fiscal negotiations will depress prices should the budget fight extend into mid-year again. “It’s going to make last year’s cycle look not so bad,” he said. “It will spook a number of investors.” Controller John Chiang in July resorted to using IOUs to pay bills to make sure the state had enough money for payments given the highest priority under the law, including debt service. Budget officials have already said they may delay paying some of the state’s bills in March because the cash balance will dip below the $2.5 billion cushion they like to maintain.

S&P’s cut brings its rating on California closer to that of Moody’s and Fitch, which have the state at Baa1 and BBB, respectively. California is the largest borrower in the municipal bond market. Moody’s lowered its assessment of California’s debt in March and again in July, leaving it three steps above non- investment grade, according to the California Treasurer’s office. Fitch reduced its grading three times last year and now rates it two steps above so-called junk, according to the Treasurer.

California Treasurer Bill Lockyer has rejected any assertion that the state will default on its obligations to bondholders. Lockyer said last week that the state may be forced to shutter or delay thousands of public works projects should it lose access to the bond market and in December he told lawmakers he may need to look to international investors to sell debt after issuing $36 billion of securities last year. Peter Hayes, who oversees $115 billion of municipal bond investments for New York-based BlackRock Inc., said this week before the S&P cut that California politicians would move to preserve the state’s investment-grade rating, as losing it would shut off access to some investors and increase interest costs. “I don’t think the state of California wants to go through that process,” he said.

Jobless Claims in U.S. Increased 11,000 Last Week to 444,000

The average number of Americans filing first-time claims for unemployment benefits over the past four weeks dropped to the lowest level since August 2008, indicating companies are making fewer job cuts as the economy improves. Jobless claims increased in the latest week. The four-week moving average of initial claims fell to 440,750 last week from 449,750, Labor Department figures showed today in Washington. Weekly jobless claims, which are more volatile, rose by 11,000 in the week ended Jan. 9, more than anticipated, to 444,000.

Factories are ratcheting up production and companies are slowing the pace of firings as the economy rebounds from the worst recession in seven decades. An unexpected decline in employment last month indicates companies are hesitant to add to payrolls until demand accelerates. “The labor market is moving in the right direction,” Ryan Sweet, a senior economist at Moody’s Economy.com in West Chester, Pennsylvania, said before the report. “The outlook for the labor market still hinges on broader business confidence. Businesses appear to be very, very cautious.”

The number of people receiving unemployment insurance declined to the lowest level since Jan. 10, 2009, and those receiving extended benefits decreased. Economists forecast claims would increase to 437,000 from a previously reported 434,000 for the prior week, according to the median of 43 projections in a Bloomberg News survey. Estimates ranged from 400,000 to 450,000. Claims have fallen 34 percent since reaching a 26-year high of 674,000 in the week ended March 28.

Continuing claims dropped by 211,000 to 4.6 million in the week ended Jan. 2. The continuing claims figure does not include the number of Americans receiving extended benefits under federal programs. Today’s report showed the number of people who’ve used up their traditional benefits and are now collecting extended payments decreased by about 135,587 to 5.3 million in the week ended Dec. 26. Thirty of the states and territories where workers are eligible to receive the government’s latest six-week extension have begun to report that data, a Labor Department spokesman said.

The unemployment rate among people eligible for benefits, which tends to track the jobless rate, fell to 3.5 percent in the week ended Jan. 2 from 3.6 percent, today’s report showed. Thirty-seven states and territories reported an increase in claims, while 16 had a decrease. These data are reported with a one-week lag.

White House changes stimulus job accounting

New method will make it impossible to track ones saved or created

The White House has abandoned its controversial method of counting jobs under President Barack Obama's economic stimulus, making it impossible to track the number of jobs saved or created with the $787 billion in recovery money. Despite mounting a vigorous defense of its earlier count of more than 640,000 jobs credited to the stimulus, even after numerous errors were identified, the Obama administration now is making it easier to give the stimulus credit for hiring.

It's no longer about counting a job as saved or created; now it's a matter of counting jobs funded by the stimulus. That means that any stimulus money used to cover payroll will be included in the jobs credited to the program, including pay raises for existing employees and pay for people who never were in jeopardy of losing their positions.

The new rules, quietly published last month in a memorandum to federal agencies, mark the White House's latest response to criticism about the way it counts jobs credited to the stimulus. When The Associated Press first reported flaws in the job counts in October, the White House said errors were being corrected and future counts would provide a full and correct accounting of just how many stimulus jobs were saved or created.

Numbers published last month identified more than 640,000 jobs linked to stimulus projects around the country. The White House said the public could have confidence in those new numbers, which officials argued proved the administration was on track to keep Obama's promise that the stimulus would save or create 3.5 million jobs by the end of this year. But more errors were found, with tens of thousands of problems documented in corrected counts, from the substantive to the clerical. Republicans have used those flaws to attack what so far is the signature domestic policy approved during Obama's presidency.

The new rules are intended to streamline the process, said Tom Gavin, spokesman for the White House's Office of Management and Budget. They came in response to grant recipients who complained the reporting was too complicated, from lawmakers who complained the job counts were inconsistent and from watchdog groups who complained the information was unreliable, Gavin said. "We're trying to make this as consistent and as uniform as we possibly can," he said.

The new stimulus job reports will continue to offer details about jobs and projects. But they were never expected to be the public accounting of Obama's goal to save or create 3.5 million jobs, Gavin said. The quarterly job reports posted on the Web site for the Recovery Accountability and Transparency Board reflect only a fraction of the jobs created under the program and can't account for job creation stemming from other stimulus programs such as tax rebates and other federal aid, the spokesman said.

But the result of the new rules will be that future claims of job creation from the stimulus will be even more misleading, said Rep. Darrell Issa, the ranking Republican on the House Oversight and Government Reform Committee. "It is troubling that the administration is changing the rules and further inflating the Recovery Act's impact and masking the failure of the stimulus to produce sustainable economic growth or real job creation," Issa said in a letter sent last week to the government board monitoring stimulus spending.

Recipients of recovery money no longer have to show that a job would have been lost without the stimulus help, and they no longer are required to keep an ongoing tally of jobs saved or created. The new rules allow stimulus recipients to limit the job tally to quarterly reports, making it impossible to avoid double-counting a job that was created in one quarter and continued into the next. Issa wants the Recovery Board, the government's independent oversight panel, to change how it identifies the count of stimulus jobs and to add a note on its Recovery.gov Web site explaining that there is now a different definition for what constitutes a job under the stimulus.

One In Eight Dollars In Receivables During November Collection Period Has Been Written Off As Uncollectable

by Tyler Durden

Taking a playbook straight from Wall Street, consumers maxed out their store-branded retail cards and decided simply to not pay them in November-December. And even that could not prevent December retail sales from coming it at below expectations: one wonders just what it is that will drive the retail dynamo that ever more clueless pundits on CNBC claim will boost 2010.

Here are the facts: "Fitch notes that in December more than one in every eight dollars of receivables was written off as uncollectable during the November collection period on an annualized basis." Well, at least the government (if not private retailers) got something out of this and managed to revise November sales slightly higher. Good luck repeating this. One knows when a "rating agency" tells you things are bad and getting worse, it behooves one to listen:"We do not foresee any meaningful improvement in the retail card credit quality in the coming months," said Managing Director Michael Dean. "U.S. consumers remain under stress on a number of fronts, most notably on the employment front, and retail card chargeoffs will continue to reflect those pressures."

Despite the elevated chargeoff and delinquency measures, Fitch expects retail card ABS ratings to remain stable throughout 2010. Excess spread remains robust, which coupled with loss coverage multiples and other structural protections will shield investors from potential downgrades or early amortization scenarios.

In December, Fitch's Retail Credit Card Chargeoff Index snapped a two-month decline, rising 122 basis points (bps) to 12.56% from the previous month. Throughout 2009, chargeoffs surpassed the previous record (12.25% in January 2005) five times, establishing a new all-time high of 12.81% in August. Throughout the year, retail chargeoffs averaged 11.88% (more than 42% above the historical average of 8.34%).

Perhaps consumer have finally figured out the great scheme: if nobody will lend to you, what use are good FICO numbers? Which is why spend, spend, spend, and max out anything and everything you can. As for the consequences: well, just write a letter to Obama, explaining how your $50,000 in credit card debt makes you too big to fail. If you are lucky, you just may get bailed out. Holding a few trillion in Interest Rate swaps with Goldman as a counterparty sure would help.High unemployment and ongoing household deleveraging will continue to limit demand for consumer credit in 2010. Consumer confidence as measured by the Conference Board remains historically low despite rising in the most recent period and unemployment is expected to remain elevated averaging 10.2% in 2010. 'Households will remain cautious with their spending and further curtail their use of retail cards in 2010,' said Dean.

This does not bode well for prospects of a robust rebound in retail sales or credit usage in 2010 as the employment situation and economic environment overall continues to weigh on consumers' spending decisions. The latest Fed figures show revolving credit usage decreased at an annual rate of 18.5% in November - the largest dollar-value drop since 1968 and the 14th consecutive decline since October 2008. As long as the employment and income growth remain weak, demand for consumer credit - especially retail credit - will be limited.

Well, with credit increasingly limited, thank god consumers at least have jobs, savings and steady incomes to fall back on. Otherwise one may be forced to take all those predictions of strong retail performance in 2010 with just a grain of salt.

Mortgage Default Is A Patriotic Duty

by Michael David White

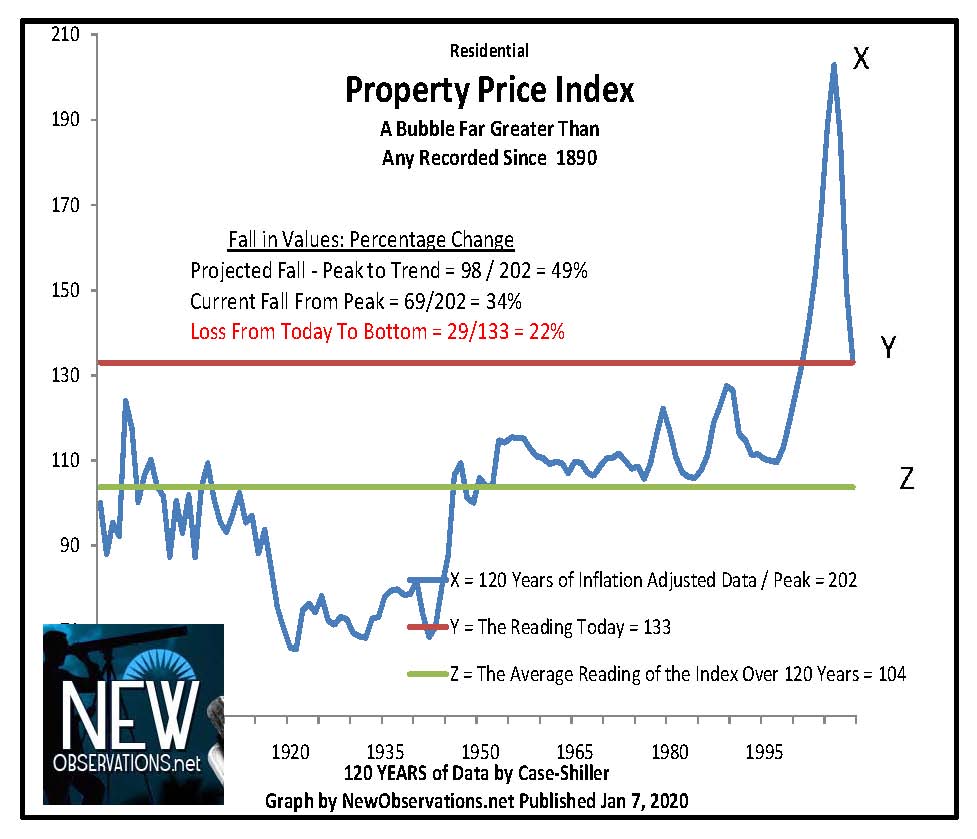

I read a mysterious statement the other day.“My data show that between 1890 and 1990 real home prices actually didn’t increase,” said Robert Shiller, in Newsweek (Dec 30, 2009), Why We’ll Always Have More Money Than Sense.

We have all been in a long state of delusion. Our psychosis is simple. We are married to real estate which increases in value. I can get rich. You can too.

The belief in increasing values of real estate is the president of our financial crisis. Now we know he didn’t deserve the office. The price will be paid. We can all confirm the high stupidity of the crowd which we are in. Of course I’m a member, but I’ve decided I’m done, and you have too.

Now we are cured. Or some are. Or a few maybe.

If real estate is a “flat” asset, with price changes created only by inflation, and not true increases in value, than you know we still have quite a big fall to go ahead of us. And if we don’t fall, that’s almost certainly worse. The graph above shows Case Shiller through the third quarter of 2009. The numbers are adjusted for inflation.

***

Take a minute and pick out the most striking feature of the graph. Study it a minute. What do you think it is? Do we agree?

The striking feature is that the current breaking bubble is a bubble which was a King Kong bubble. Any predecessor bubble in the last 120 years was a hiccup. Now we have gangrene. At least one limb must go.

The best numbers, which are Case Shiller, predict a fall of 22% from current levels. And that’s if we don’t overshoot.

Over the last three or four months I have been looking closely at the data on pricing from Case Shiller, Freddie Mac, The Federal Housing Finance Agency, and First American Core Logic. I have been surprised by how negative the forecast is based upon long-term price trends.

While there are variations, all of the different data sets point to patterns very much like what you see above from Case Shiller. If history has a pattern, and the most educated voice on the matter says it does, then a fall is written in stone. The critical question: Should we respect what the stone says? Or should we try to break the tablet?

Who can imagine the perverse effects of a policy which successfully circumvents something as towering as the pricing of all of our 129 million residential housing units?

If successful, the most obvious perversion of our current policies on housing is that we will continue to pay too much for the most expensive cost which each of us shell out for every day and every month and every lifetime. We are fighting an ocean’s tide retreating. How will we hold the water on the shore? We are forcing a more expensive lifestyle across our entire economy. Rich and poor. Young and old. All are scheduled to pay more if the bubble doesn’t pop completely.

***

We live in a world of radical price competition. The obvious competition we are losing is the competition based upon the price of labor. Expensive housing exacerbates our competitive disadvantage.

Our focus should be on providing our services for a lower cost. Does anybody think it makes sense for us to increase the cost of housing when the price of labor is too high? If housing costs are high, will that help our competitiveness?

Those new to this argument about the price of housing should consider that the government effort to artificially inflate prices includes radical intervention. Fannie Mae, Freddie Mac, and the FHA, all government banks, are the entire mortgage market today. Private investment in mortgages is gone. No sane banker is going to make a loan on an asset that has fallen 30% in value.

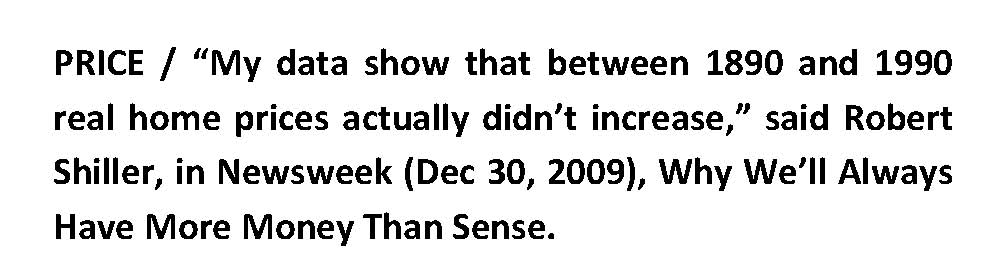

The federal government is also literally giving money to buyers through a tax credit. And the federal government is buying a huge percentage of mortgages to artificially keep interest rates low (see above). And the federal government has issued an unlimited credit line to Fannie and Freddie so they can write as many mortgages as they want.

If you don’t understand all of these names and programs, trust me when I say that nuclear bombs have been used on the housing market.

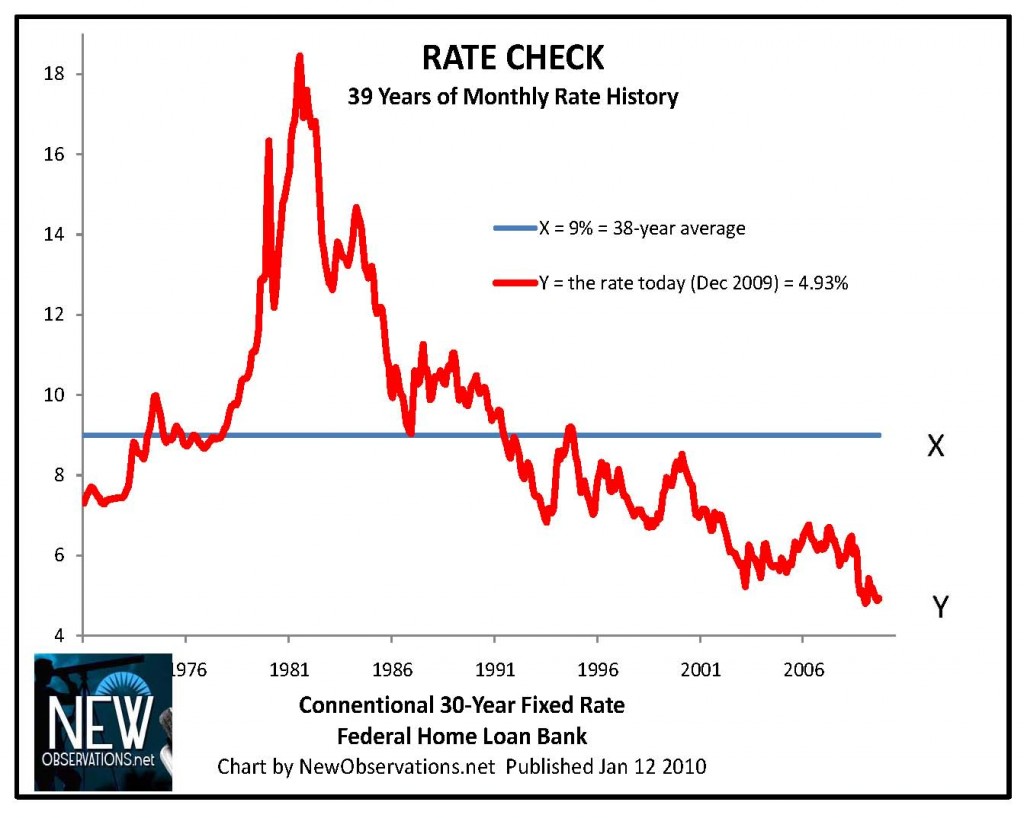

Think about that for a minute, and look at the pathetic unit sales above. The government is dropping nuclear bombs on the mortgage market and nobody is dying. They can’t move the product.

What has been taking off are foreclosures. They are soaring. The general feeling is that foreclosures are terrible and should be stopped because of the distress they bring both to a family and a neighborhood. The more important truth, widely ignored, is that foreclosures promise to bring back cheap prices. We know from the first chart in this story that lower prices are natural.

In our post-bubble world, foreclosures are the surest mechanism for creating affordable housing. Consumer advocates should now welcome this method of price correction. Those true to their mission will embrace a mass-foreclosure remedy.

In a credit bubble, the smart economist makes the highest goal a true reckoning with phony debt. The common man now has a chance to play the smart economist.

Let the house go back to the lenders. The bank will throw the mortgage in the garbage. Reality will return. Prices will fall – perhaps dramatically. Systemic mortgage debt in the United States will be reduced.

Default is now a patriotic duty. It is a courageous intelligent act. Take the right steps so we can beat the Chinese. We need the jobs. We need to get back to work. We don’t need the phony debt issued to buy a bubble.

The government has screwed up management of the financial crisis by granting debt assets special status. What the owners of debt assets deserve are losses. It’s time for the people to fix the financial crisis.

FDIC chief puts blame on Fed for crisis

The Federal Deposit Insurance Corporation laid much of the blame for the financial crisis at the door of the Federal Reserve at an inquiry that causes fresh problems for the US central bank. Sheila Bair, chairman of the FDIC, which insures depositors against bank failures, said on Thursday that the Fed waited seven years to use fully its powers to regulate subprime lending. “If HOEPA (Home Ownership and Equity Protection Act) regulations had been amended in 2001, instead of in 2008, a large number of the toxic mortgage loans could not have been originated and much of the crisis may have been prevented,” she said.

The typically forthright written testimony from Ms Bair to the second day of the hearings from the new Financial Crisis Inquiry Commission pits one of the most politically powerful regulators against one of the weakest. The Fed is under attack on multiple fronts in Congress with attempts to conduct sweeping audits of the central bank and remove much of its regulatory role.

The FCIC, which on Wednesday heard from four Wall Street executives, also heard from Mary Schapiro, the Securities and Exchange Commission and Eric Holder, the attorney-general. Ms Bair acknowledged that many regulators had failed in the crisis in a thorough 54-page analysis of the events leading up to the 2008 shocks across the credit and equity markets. “Regulators were wholly unprepared and ill-equipped for a systemic event that initially destroyed liquidity in the shadow banking system and subsequently spread to the largest firms throughout the financial system,” she said.

Ms Bair has opposed giving the Fed a principal role in regulating systemic risk. She also reiterated her belief, which goes against the wishes of Tim Geithner, Treasury secretary, that a new “resolution” fund, used to wind up a failing systemically important fund, should be built up before a crisis with a new assessment on the industry.

Banks are already reeling from the news that they will have to pay about $90bn over 10 years in a levy to recoup the government’s costs of bailing out the system. Finally, Ms Bair concluded with a call for the financial sector to be constrained from outsized growth. “Longer term, we must develop a more strategic approach that utilises all available policy tools — fiscal, monetary, and regulatory — to lead us toward a longer-term, more stable, and more widely shared prosperity,” she said.

Geithner faces demand for AIG phone records

The House oversight committee has submitted a legal demand for any phone records and e-mails from Tim Geithner that discuss payments from the New York Federal Reserve to AIG's counterparties. Republicans on the committee are attempting to link the Treasury secretary to the bail-out of AIG's counterparties - a list headed by Société Générale and Goldman Sachs - which were made while Mr Geithner was president of the New York Fed.

The Treasury has said Mr Geithner recused himself from the case ahead of a move to the top economic job in Barack Obama's new administration. The New York Fed has emphasised that Mr Geithner played no part in a decision not to disclose details about the AIG -payments.

In 2008, with AIG under threat of collapse because of demands from counterparties that the insurance group pay increasing amounts of cash collateral on credit default swaps, the New York Fed stepped into avert what it believed could be an event that threatened the financial system. But its decision to pay $27.1bn to 16 institutions has been subject to scrutiny ever since, with both Democrats and Republicans asking why the New York Fed did not demand a discount from the banks and whether it improperly asked AIG to withhold details on the deal from the Securities and Exchange Commission.

Darrell Issa, the senior Republican on the oversight committee, has led the campaign to implicate Mr Geithner in the decision. Edolphus Towns, the Democratic chairman of the committee, has asked the Treasury secretary to attend a hearing in spite of the administration's protestations that he was not involved. The Treasury has not yet confirmed that Mr Geithner will attend.

Why the Financial Industry Can't Pre-Fund Its Next Bailout

Nicole Gelinas

Would President Obama’s financial-industry tax be okay if Obama presented it as a sort of FDIC fund for high finance — that is, an industry-funded insurance pool into which “too big to fail” financial firms would pay to pre-fund their next bailout? No. Confusion here is understandable. But applying the FDIC model to the broader financial system is unworkable.

A permanent bailout fund for the “too big to fail” financial industry would have to measure in the multiple trillions of dollars. For a “too big to fail” bailout fund to replace implicit and explicit government guarantees, it would have to be big enough to do credibly what the federal government has done over the past two (!) years.

TARP doesn’t even begin to cover the resources that taxpayers have devoted to banks and other financial firms since March 2008, when Washington took on the risk of some of Bear Stearns' murkiest assets. The federal government essentially backstopped the financial industry after Lehman Brothers collapsed that September. Washington has backed everything from AIG’s derivatives obligations, to hundreds of billions of dollars' worth of investments on Citigroup’s balance sheet, to money-market funds and the multi-billion-dollar bonds that banks floated in late 2008 and early 2009 to replace the money their private lenders had once provided.

The “too big to fail” bailout fund, then, would itself represent a systemic risk to the economy. Washington and Wall Street would have to invest the fund's trillions of dollars in something. What? Treasury bonds? It then would be a new pool of cash from which the feds could borrow with no market surveillance. The global stock markets? At the hint of the next crisis, markets would panic at the understanding that the fund could have to sell those assets at fire-sale prices to cover its unknowable obligations, depressing similar asset prices worldwide. Mortgage bonds? Let’s not even go there.