"Mrs. Albert F. Walker of Westmoreland Hills, Maryland has been declared 1937 women's skeet shooting champion of the country by the National Skeet Shooting Association. The Association has released the averages on which the ratings were based, but one day last year at the Kenwood skeet club, Mrs. Walker set the women's record fall with 99x100 (skeet for 99 birds out of a possible 100). In addition to her national title, she outranks both men and women shooters in the District of Columbia and Maryland."

Ilargi: Lately, the opening quote that adorns the pages of The Automatic Earth is from John Kenneth Galbraith. It says:"In economics, the majority is always wrong". And, well, since everybody talks about the same thing these days, namely Greece, perhaps it's time we should take Galbraith to heart. Perhaps when everyone is looking in the same direction, the smart thing to do is to look where they don't. Nonetheless, the whole thing certainly takes the herded blindness of the investor crowd and puts it in a bleak light, in the same way that Hugh Hendry exposed Joe Stiglitz.

Hendry showed us all a painful truth, that economic policies are crafted by a clueless ensemble of theorists who will swear on their mothers' graves that their theories should work. And in theory they will. Just like in theory Greece could go bankrupt soon. The money managers of the planet are all anxiously waiting for a salvation signal to come from Germany and France, a signal neither is in any hurry to provide. In the past year, German and French export industries have been hammered not only by a weakening market, but even more by a rising Euro. The commotion surrounding Greece is a gift from heaven for them, and they’ll use it for all they're worth, only to say the word at the very last minute.

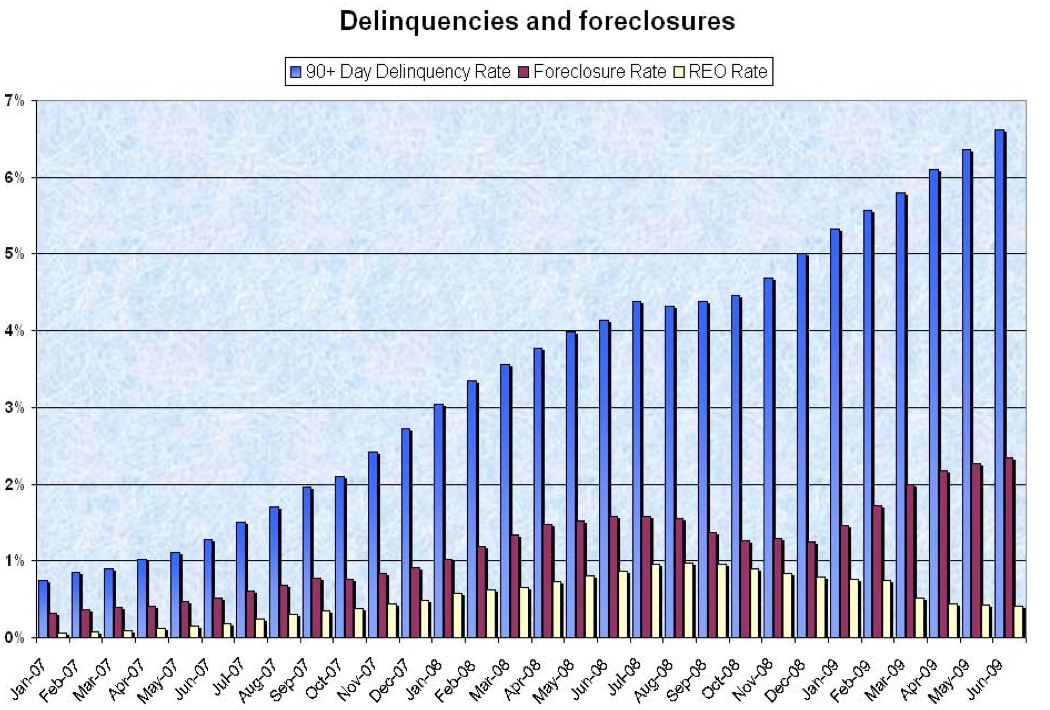

Meantime, while everyone's focused elsewhere, in the American part of the real world Elizabeth Warren warns that $1.4 trillion in commercial real estate loans that need to be rolled over by 2014 will endanger 3000 smaller US banks. Half the loans are underwater, while the government has hardly any idea how healthy these banks are. Also in an adjacent corner of the field, Fannie Mae and Freddie Mac have announced they will buy up delinquent mortgage loans they have written securities on, to the tune of at first glance $200 billion. Which is in turn of course only the first batch they'll purchase, since it's not exactly as if the rest of their portfolios are seeing better days .

You know, just in case you were wondering why they needed that Christmas Eve blank cheque from the Treasury. Remember, their loan portfolio’s are north of $5 trillion, and the latest Case/Shiller prediction calls for another 20-odd percent drop in home prices just this year, so get yourselves ready, party hat and all, to become the proud owners of a $1 trillion or so "worth" heap of failed junk, with more, much more, on the way. Don’t forget that mortgage debt valuations have come down much less than home prices, and while they may never arrive at par, the former has a long way down to go just to catch up.

Oh, and that of course still leaves open the question of the manner in, and the extent to, which Fannie and Freddie (plus Ginnie Mae, FHA and FHLB) are exposed to securities written on the failed and failing loans. An indication could possible come from the fact that the Federal Reserve has approved the backstopping of $25 trillion worth of derivatives, another grab-bag of garbage that may soon need to be expanded if and as conditions continue to deteriorate. In short, matters are rapidly getting worse back home while the gazes of the masses linger on the Acropolis. How convenient.

On another continent still, questions about China are persistent and growing in number and loudness. The same Hugh Hendry who needed to explain economics to the Stiglitz who got that Fauxbel prize for his mastery of the field, sketches Beijing's (and the world's) core issues in a few lines today:

China has become the world's biggest creditor, after amassing nearly $2.3 trillion of foreign exchange claims on us. However, the spectre of a creditor nation running persistent trade surpluses has ominous historical portents. It has happened only twice before, with the US economy in the Twenties and with the Japanese economy in the Eighties.

Economics is a cruel master and in both of the previous examples a failure to allow exchange rates to adjust to the new reality created a large speculative pool of credit that, in turn, led to overvalued domestic assets and, eventually, an economic crisis. Never forget that in economics, first can become last.[..]

A country that represents just 7% of global GDP is now responsible for 30% of global aluminum consumption, 47% of global steel consumption and 40% of global copper consumption. The overriding problem is that the Chinese model leads to a deflationary spiral that is perpetual in nature. Domestic consumption never grows fast enough to absorb the supply, prompting the planners to commit to ever-higher levels of investment.

Sometime down the line, and it could come soon, China's lending binge will need to slow; indeed, banks are already being ordered to rethink their ways. But that will slow growth as well, and it will hit global commodities markets square on the nose, as among others Marc Faber notices. The Chinese can keep doing what they do until they don't.

The overall drift of what Hendry's saying, of course, is that China is not producing wealth, it's merely producing numbers. Just like the Obama administration in its report on unemployment, which contains predictions as far out as 2020, something Washington can foresee maybe, just maybe, as accurately as Punxsutawney Phil can tell the weather 6 weeks out. Not. Have they nothing better to do? Sort of like Nero and Rome, as the country burns, the commander in chief and his staff engage in folklore.

In the skies over the Acropolis, the gods are laughing.

PS : If you have time and stamina left after all this, I would urge you read the following over at ZeroHedge:

Just How Ugly Is The Sovereign Default Truth? How Self Delusions Prevent Recognition Of Reality

And here is the crux: the black swan will be not so much a totally failed auction - we are confident the Federal Reserve will never let that be the precipitating factor for the next crisis. All that is needed is for interest rates to start going up. That's it. How much longer can money be printed out of thin air so that we can all buy each other's debt and prolong the fiat fallacy for another day or two?

Read on

Investors' infatuation with China is misguided

by Hugh Hendry

Robert Prechter, the eminent American observer of social and economic trends, wryly contends that stock markets usually deceive those people who argue for outcomes based on seemingly logical causation. Could our professional money managers' infatuation with China prove similarly unrewarding? China's economy is certainly on a tear; economic growth has averaged 9pc a year over the past 10 years, compared with a paltry 1.9pc for the British economy. Last year, despite the credit crunch, China posted a remarkable growth rate of 10.7pc against a British contraction of 3.2pc. This is impressive stuff.

The spell cast by a contemporary cult is undoubtedly hard to resist and some brave souls, willing no doubt to extrapolate present trends forward, are even proclaiming that China will usurp the United States as the world's largest economy. Goldman Sachs' chief global economist, Jim O'Neill, even taunts the naysayers, saying, "You either get it or you don't." Such is his conviction. However, the composition of China's growth has undergone a potentially treacherous change: in the absence of expanding foreign demand for its exports, it has instead come to rely on a massive surge in domestic bank lending to fuel its growth rate.

Indeed, when measured relative to the size of its economy, the 27pc point jump in bank loans to GDP is unprecedented; at no point in history has a nation ever attempted such an incredible increase in state-directed bank lending. What a turnaround: from an export juggernaut to a credit addict. Who would have thought it necessary back in 2001, the year everything all started to work out for China? That was the year the Chinese gained entry into the World Trade Organisation. The ascension to the WTO also coincided with the American Federal Reserve's loose monetary policy response in the aftermath of the NASDAQ crash. Exports surged, especially to the US, and China's current account surplus increased from a modest 2pc of its economy to a monumental 11pc, all by 2007.

This appetite for cheap Chinese exports, which had at one point seemed insatiable, means that we in the West have come to owe our largest Asian trading partner quite a hefty sum of money. China has become the world's biggest creditor, after amassing nearly $2.3 trillion of foreign exchange claims on us. However, the spectre of a creditor nation running persistent trade surpluses has ominous historical portents. It has happened only twice before, with the US economy in the Twenties and with the Japanese economy in the Eighties.

Economics is a cruel master and in both of the previous examples a failure to allow exchange rates to adjust to the new reality created a large speculative pool of credit that, in turn, led to overvalued domestic assets and, eventually, an economic crisis. Never forget that in economics, first can become last. The China bulls assure us that this time it is different. Yes, the banks are lending money at breakneck speed, but look at what they are doing with it! They suggest a new era reminiscent of Protestant Capitalism. They want us to believe the atheist Chinese are prepared to work harder and defer their gratification for longer.

Undoubtedly, China's state planners have favoured investment over consumption. High-speed rail networks, first-class infrastructure projects and the urban migration of 55 million people every year are common explanations for the ability of the nimble Chinese to overcome the frailties of this global economy. But can too much of a good thing be bad for you? The goal of economic policy, after all, is to maximise households' wellbeing and consumption. Unfortunately, unlike in most countries, China's share of consumption within its economy has fallen relentlessly, reaching 35pc of GDP in 2008. Something isn't right.

The ancient ethical system of Confucius is silent on the subject of modernisation. There is no proverb counselling that "wise men not invest in over-capacity". Perhaps there should be: in China, investment spending has tripled since 2001 and the consequences are staggering. A country that represents just 7pc of global GDP is now responsible for 30pc of global aluminum consumption, 47pc of global steel consumption and 40pc of global copper consumption. The overriding problem is that the Chinese model leads to a deflationary spiral that is perpetual in nature. Domestic consumption never grows fast enough to absorb the supply, prompting the planners to commit to ever-higher levels of investment. Over-capacity inevitably plagues many sectors of the economy and Chinese profitability is already low.

Remember, it is one thing to create economic growth, but it is another thing to truly create wealth. If I commit to building a new commercial property in Shanghai I will undoubtedly contribute to GDP growth. However, if I have no tenants and the city already has a vacancy rate of 20pc, then I am probably destroying wealth. Adam Smith taught us that real wealth comes not from piles of gold or their modern-day equivalent, the foreign exchange reserves amassed from a profitless succession of current account surpluses. Rather, Smith suggests that real wealth is founded on the skills and productivity of a country's citizens. This is the central concern regarding the sustainability of the Asian economic model. Power without profit can prove ephemeral. This is an axiom the Japanese are all too familiar with. We cannot say we have not been warned.

Looming Problem of Local Debt in China-- $1.6 Trillion and Rising

by Victor Shih

Did China accomplish the impossible? Did it generate almost 9% growth and maintain low debt to GDP ratio even as its export plummeted by 20%? What about claims that the torrent of investment in China has come without too much leveraging? After spending half a year looking into the debt level of local government investment entities-- some 8000 of them-- my conclusion is no. As in the past, the Chinese government just ordered banks to lend to investment companies set up by both central and local governments. Local governments have fully taken advantage of the green light in late 2008 and borrowed an enormous sums from banks and bond investors starting in late 2008 (well, a large amount even before that). In an editorial in the Asian Wall Street Journal yesterday, I outline some problems with this massive amount of borrowing:Beijing is no longer sure how much money local investment entities have borrowed from banks and raised from bond and equity investors. The amount, however, must be large. In September, the Chinese press, citing government sources, suggested that these entities have borrowed $880 billion (6 trillion yuan). In a January interview with the Twentieth Century Business Herald, a Chinese newspaper, the vice chairman of the Finance and Economic Committee of the National People's Congress, Yi Zhongliu, revealed that local investment entities borrowed some $735 billion in 2009 alone.

These are mere guesses, however. A National Audit Agency audit conducted late last year uncovered so many problems with the data that Premier Wen Jiabao ordered another large-scale audit of local investment entities. Until a thorough audit is completed and the results announced to the public, no one really knows the total scale of local borrowing.

Given the information vacuum surrounding this issue, I spent half a year collecting data that would allow me to provide an estimate of total local debt (and also for each of China's provinces). Again, in the WSJ piece, I briefly outline my methodology and the results in the piece.To obtain an independent estimate, I collected data from thousands of sources, including regulatory filings, bond-rating reports and press releases of government-bank cooperative agreements. I estimate local investment entities' borrowing between 2004 and the end of 2009 totals some $1.6 trillion. The data are far from perfect because borrowing by low-level government entities and lending by small banks are difficult to track. Nonetheless, my evidence suggests that the scale of the problem is much larger than previous government estimates. At $1.6 trillion, the size of local debt is roughly one-third of China's 2009 GDP and 70% of its foreign-exchange reserves.

So basically, in addition to the 20% of official debt-to-GDP ratio, one has to add an additional 30%. We also have to add other debt that the central government guarantees, such as the nearly 1 trillion RMB in Ministry of Railway bonds and bonds issued by the asset management companies. All of this gives China a high debt to GDP ratio. Also, there are some disturbing implications of this high debt. For one, local governments would have to sell lots and lots of land every year for many years to come to pay interest payment on this debt. Thus, to the extent that there is a real estate bubble today, it must continue for local governments to remain solvent. Regardless of what you believe about Chinese real estate, you have to think that this growth in real estate and land prices must slow or reverse at some point.

I think that the best course of action for the Chinese government is to credibly stop leveraging by local investment companies. Instead of the half measures in place today, a public and stern order should be given to banks to stop lending to all new projects undertaken by these local entities. Other measures should follow:Since county governments are in the poorest fiscal shape and have the least ability to repay banks, the central government should take over the debt of almost all of the county-level investment vehicles. Although this will increase China's debt-to-GDP ratio significantly, the total would still be low by international standards.

A sudden contraction of lending to local investment vehicles will generate a wave of nonperforming loans, but a greater reliance on market mechanisms can easily solve this problem over the next few years. First, banks will fully recover the debt of the healthiest local entities, which may account for half of total local debt. For the remainder, the government needs to allow banks to directly sell subprime or distressed loans to both foreign and domestic investors. Beijing need not fear that China's listed banks will sell their nonperforming loans at below-market prices, as these banks report to shareholders. Banks, in conjunction with investment banks and distressed-asset investors, should also explore ways to securitize local debt for sale to both domestic and international investors. The latter in particular would have a healthy appetite for yuan-denominated security, anticipating a currency revaluation soon.

Basically, I think the Chinese government can turn this into a great opportunity for market reform in the financial system and the internationalization of the RMB. However, it has to act soon before local debt gets too large to handle.

Loans, Property Surge in China

China reported a surge in bank lending and sharply rising property prices last month, figures that reinforced growing worries that the world's fastest-growing major economy risks inflating a new bubble. Easy credit has been a key driver of China's economic recovery, and banks kept up their enthusiastic lending in January, extending 1.39 trillion yuan ($203.6 billion) of new loans in the month. That's more than in the last three months of 2009 combined, and nearly a fifth of the government's target of 7.5 trillion yuan in new loans for all of 2010. The central bank also reported Thursday that the M1 measure of money supply surged 39% in January, its fastest increase in at least a decade. Economists say that shows households moving money out of long-term deposits in preparation for spending it, a signal of future inflation.

At the same time, property prices are now rising at their fastest pace since early 2008. Loose money has enabled developers to build more housing while encouraging households to buy now. The average price of new residential property in 70 cities rose 11.3% from a year earlier in January, the National Bureau of Statistics said Thursday, accelerating from December's 9.1% gain. The recovery in China's housing market has underpinned the nation's return to double-digit economic growth, and will become increasingly crucial this year as Beijing winds down its two-year stimulus program. The growing fear of many officials and analysts is that a property bubble that leads to a bust could derail that expansion. How China handles this real-estate boom will have broad ramifications, since its strong demand for the raw materials and equipment needed to build out new housing, infrastructure and factories has been one of the few bright spots in the world economy.

"China's entire growth and investment boom is centered on sentiment in the property market," said Doris Chen, banking analyst with BNP Paribas in Shanghai. High property prices support local government budgets, she said, and so indirectly finance many of the infrastructure projects that have been rolled out as part of the stimulus. With restrictive government policies widely blamed for triggering the collapse in housing sales in 2008, officials have been cautious in changing tack this time. They have mostly targeted speculation: Purchases of second homes, for instance, are now subject to higher taxes and tighter financing. But there has also been a broader effort to contain risks in the banking system. In mid-January, regulators pressed banks to curb lending after early reports that banks had made more than a trillion yuan in new loans in just the first two weeks of the year.

The People's Bank of China, in a quarterly report also issued Thursday, said it needs to "pay attention to price movements and strengthen prevention of financial risks." The government's latest measures do seem to have had some effect on property markets in big cities, where price increases have been sharpest. The number of transactions in Shanghai's residential property market fell 46.4% in January from December, according to estimates by Soufun, a local research firm. The statistics bureau for the city of Beijing also reported that second-hand residential property transactions dropped 64.5% in January from the previous month. Nationwide sales figures for January haven't yet been published. Yet many Chinese still see higher property prices as a sure bet. A monthly consumer survey published Thursday by Hyperlink Research found 51% of respondents expect housing prices to be higher in the next six months, a proportion that was little changed from previous months.

"A property bubble is still a risk to China's economy," said Wang Tao, China economist for UBS. While inflationary pressures are strongest in property, broader price measures are also rising. The consumer price index rose 1.5% in January from a year earlier, slowing from a 1.9% rise in December. But that moderation was driven by slower gains in food prices, and nonfood prices rose 0.5% last month, picking up from 0.2% in December and a 0.7% decline in November. "China's economy still faces the risk of overheating if policy remains at current settings, and we continue to expect a move towards tighter policy in the next few months," said Brian Jackson, an economist for Royal Bank of Canada.

China Raises Bank Reserve Ratio to Cool Fastest-Growing Economy

China ordered banks to set aside more deposits as reserves for the second time in a month to cool the fastest-growing major economy after loan growth accelerated and property prices surged. The reserve requirement will increase 50 basis points effective Feb. 25, the People’s Bank of China said on its Web site today. The current level is 16 percent for big banks and 14 percent for smaller ones. China’s policy makers aim to avert asset bubbles and restrain inflation after flooding the economy with money last year to drive the nation’s recovery from the first global recession since World War II. The central bank said yesterday that it wants to gradually normalize monetary conditions from a “crisis mode” after gross domestic product expanded a more- than-forecast 10.7 percent in the fourth quarter from a year earlier, the fastest pace in two years.

“Liquidity continues to flood the financial system this year,” said Lu Zhengwei, a Shanghai-based economist at Industrial Bank Co. “The central bank needs to stay ahead of the curve by tightening before inflation starts to gain pace.” The central bank on Jan. 12 increased banks’ reserve requirements for the first time since June 2008 after a record 9.59 trillion yuan ($1.4 trillion) of new loans in 2009. New loans in January soared to more than the previous three months combined, prompting the central bank to impose even higher reserve ratios on some individual banks. January’s 1.39 trillion yuan of loans amounted to 19 percent of the 7.5 trillion yuan target set by the banking regulator for this year. M2 broad money supply rose 26 percent, compared with the central bank’s forecast of a 17 percent gain for this year as a whole.

Shanghai’s property market is in a bubble and the government is trying to “take some heat out of the economy,” investor Jim Rogers, author of “A Bull in China,” said Jan. 19. Property prices surged 9.5 percent in January from a year earlier, the fastest pace in 21 months, after Premier Wen Jiabao pledged in the previous month to clamp down on real-estate speculation and keep inflation at “reasonable” levels. Inflows of so-called hot money from abroad are complicating the central bank’s efforts to soak up liquidity and reduce the risk that the economy will overheat. Consumer prices rose for a third month in January after nine months of deflation.

Improved global trade may also aid China’s growth this year, with the customs bureau reporting a second straight increase in exports in January. Economists at the government-backed Chinese Academy of Social Sciences warned Jan. 11 that gross domestic product could expand as much as 16 percent in 2010 unless policy makers withdrew stimulus. While the central bank has reiterated it will maintain a “moderately loose” monetary policy stance this year, Governor Zhou Xiaochuan told reporters Feb. 9 that price increases will be “closely” monitored. According to a Jan. 22 note from DBS Holdings Ltd., Southeast Asia’s largest bank, “China has already been in exit-strategy mode for seven months” as policy makers gradually impose tightening measures. Besides record lending, a 4 trillion yuan, two-year stimulus package and subsidies for consumer purchases have driven China’s recovery. The nation has also kept its currency pegged at about 6.83 per dollar since July 2008 to aid exporters.

China Economy Will Slow, Hurt Commodities, Faber Says

China’s economy will slow down “meaningfully” and may even be at risk of a “crash” because of the nation’s excess capacity and as loan growth slows, investor Marc Faber said. China’s fragile economy may undermine industrial commodities in the “near term,” the publisher of the Gloom, Boom and Doom report said. Faber added that he’s pessimistic on the euro as a possible bailout of Greece by other European countries increases deficits in the region.

Gross domestic product expanded 10.7 percent in China last quarter from a year earlier, the fastest pace since 2007. Lending in January exceeded the total for the previous three months while property prices climbed the most in 21 months, even after the central bank raised banks’ reserve requirements last month, reports released today show. “The economy, for sure, will slow down meaningfully this year,” Faber said in an interview with Bloomberg Television in Hong Kong. “It has the potential to crash because of the overcapacities that have developed, and when loan growth slows down, we don’t know how the economy will react.”

Consumer prices advanced 1.5 percent in January from a year before, a third straight gain, the central bank said today. The median estimate was for a 2.1 percent increase. Lending surged to 1.39 trillion yuan ($203 billion) last month while property prices in 70 cities rose 9.5 percent from a year earlier. Central bank Governor Zhou Xiaochuan said in Sydney this week that policy makers need to “closely watch” inflation, which was still “relatively low.” Concerns that the central bank will seek to cool rising consumer and asset prices have dragged the nation’s stock market lower this year. The Shanghai Composite Index has slipped 8.9 percent, the 10th-worst performer among 94 benchmark gauges tracked by Bloomberg globally.

China may raise interest rates before the end of March as accelerating economic growth prompts the central bank to tighten monetary policy, Royal Bank of Canada’s emerging-market strategist Brian Jackson said in a Bloomberg Television in Hong Kong today. A possible crash in China’s economy will be “disastrous” for raw materials used in industrial production, Faber said. He instead favors commodities including wheat, corn and soya beans and also said he doesn’t see a “huge downside risk” for gold.

“Other commodities haven’t gone up yet, such as the grains,” Faber said. “It may take time until they start to go up substantially but if you have time, you should be long wheat, corn, soya beans or own a farm, which is one way to participate in future food price increases.” Faber advised investors to buy U.S. stocks on March 9, when the S&P 500 reached its lowest level since 1996. The measure subsequently rallied as much as 70 percent. He also predicted in May 2005 that stocks would make little headway that year, with the S&P 500 gaining 3 percent.

Faber was less prescient in March 2007, when he said the S&P 500 was more likely to fall than rise because the threats of faster inflation and slower growth persisted. The S&P 500 climbed 10 percent between then and its record of 1,565.15 seven months later. The investor said today the euro may rebound to $1.40 against the U.S. dollar because the currency is currently “oversold” amid concerns over Greece’s deficit, the largest in the European Union. The region, along with the European Central Bank, will probably “bail out” the country, in turn creating more deficits, he also said.

The euro traded at $1.3752 as of 9:16 a.m. in Tokyo from $1.3737 in New York yesterday. It reached a nine-month low of $1.3586 on Feb. 5. “When Greece is bailed out, it’s a further indication that paper money is losing its purchasing power because it’s diluted through larger and larger bailouts and more and more deficits,” Faber said. “Now it can rebound to around $1.40 but more than that, you shouldn’t expect.”

Sovereign Default Is Plausible on a Global Scale

In a CNBC interview on Feb. 10, Marc Faber of Gloom, Boom & Doom Report went out on a limb by stating that he is not buying any sovereign debt or bonds, because ALL governments will eventually default, including the United States. Faber believes some countries like Singapore may fare better due to very little or no debt and large reserves; however, most of the developed world will be severely affected by Greece, bailout or not. In the near term, Faber is relatively optimistic about stocks, but still thinks precious metals will have better returns. Meanwhile, Jon Levy with Eurasia Group, though sharing an equally gloomy view, does not share the same dire prediction. Levy believes it will be a “long and drawn-out” adjusting process different from country to country.

Back in December of 2009, Moody's Investors Service reported that there was $49.5 trillion of sovereign debt outstanding. The rating agencies are worried that governments' massive deficit-spending to pull their economies out of last year's crisis won't produce enough growth to pay for itself. Furthermore, Moody's pointed to the U.S. and the U.K., whose public debt runs to $12.1 trillion and $1.3 trillion, respectively, as two prime candidates that could potentially lose their triple-A ratings in "worst-case scenarios." Analysts are also worried that Japan, plagued by deflation, will be unable to repay a debt that's projected to hit 220% of GDP in 2014. Last November, the International Monetary Fund projected that the average debt-to-gross domestic product ratio of the 10 advanced country members of the Group of 20 developing and developed nations would mushroom to 118% by 2014.

The recent market jitters could be a self-fulfilling prophecy. Falling bond prices and higher yields will make it even harder for governments to refinance future obligations. That, in turn, will hurt their currencies, and especially the eurozone. Sure, central banks can always print more money. More printing will inevitably lead to run-away hyper inflation, and / or the eventual monetary tightening. Higher interest rates and inflation, of course, will probably push all the sovereign strugglers over the cliff while adding a few new ones. Either way, there will be some nasty consequences to the global bailouts and deficit spending, including a scenario where the dollar could lose its reserve status. Only time will tell. In that sense, Faber's prediction, while considered extreme by some, is probably not all that far off.

Economic Growth in Europe Slows to a Crawl

The economic recovery in the euro area almost ground to a halt in the last quarter of 2009, data showed Friday, adding to worries about the ability of some countries in the region to use growth to improve their budgetary positions. Much of the weakness appeared to stem from Germany, where the economy unexpectedly stalled during the last quarter; the expansion in France strengthened. Gross domestic product increased by 0.1 percent in the 16-nation euro area during the fourth quarter of 2009, compared with the previous quarter, according to an initial estimate from Eurostat, the European Union’s statistics agency. During the third quarter, the economy had expanded by 0.4 percent.

The same tepid 0.1 percent expansion was recorded for the 27 members of the E.U. For the whole year, gross domestic product contracted by 4 percent in the euro area and by 4.1 percent in the E.U. The slowing growth comes at a difficult moment for Europe’s single currency area as governments struggle to address soaring deficits in Greece and other countries, while assuaging market fears that have pulled the euro lower and government bond yields higher. After the data were released, the euro slipped to $1.3562 in London, having earlier traded as high as $1.3695. European countries will need solid growth to help limit the surge in their debt levels caused by the recession of 2008 and 2009. Details of an official plan to bail out Greece are expected next week.

Germany’s gross domestic product was flat in the final quarter of last year compared to the third quarter, the Federal Statistics Office said, following an expansion of 0.7 percent during the third quarter and an increase of 0.4 percent in the second period of 2009. Analysts had forecast a 0.2 percent rise in the fourth quarter. From the year-earlier quarter, growth was down 2.4 percent according to seasonally adjusted figures. No detailed breakdown of the data will be available until Feb. 24. But the agency said that the “only positive contribution was made by foreign trade,” while consumption and investment declined.

Aline Schuiling, an economist at Fortis Bank in the Netherlands, said the stabilization “reflects some payback for the sharp expansion in the third quarter.” During that period, growth was helped by strong gains in fixed investment, which have probably fallen away. “We think the economy will embark on a moderate growth path from the start of this year,” she added, noting that exports remain solid. France, the euro zone’s second- largest economy after Germany, posted a 0.6 percent increase in G.D.P in the fourth quarter, driven in large part by consumer spending and inventory changes, according to the statistic office, Insee. The contribution of inventories to growth was 0.9 of a percentage point, while the contribution of domestic demand was 0.5 point. The external sector had a negative contribution. The economy expanded by 0.2 percent in the third quarter. For the whole year, growth was down 2.2 percent.

Christine Lagarde, the economy minister, welcomed the data and attributed the quarterly gain to stimulus measures introduced by the government over the course of 2009. Meanwhile, the Italian economy unexpectedly contracted 0.2 percent in the fourth quarter, after a 0.6 percent expansion in the previous three months, the Rome-based national statistics institute Istat said. G.D.P. contracted 2.8 percent in the fourth quarter from a year earlier, Istat said. On Thursday, data showed that Spain, hit especially hard by a housing slump, stayed in recession during the fourth quarter. By contrast, during the fourth quarter in the United States, G.D.P. increased at an annualized rate of 5.7 percent, equivalent to an expansion of about 1.4 percent compared with the previous quarter.

Will markets call EU bluff on Greek rescue?

by Ambrose Evans-Pritchard

The white smoke has at last emerged from the Bibliotheque Solvay in Brussels, but global markets do not like its odour. The Greek rescue plan agreed by EU leaders after a week of leaks is strangely thin, raising suspicions that Germany, Holland and the creditor states of Northern Europe still cannot agree on the terms of any bail-out. The euro tumbled 1pc to a nine-month low of $1.36 against the dollar and Club Med debt yields jumped as investors read the summit text, searching in vain for details of debt guarantees or bilateral loans, or guidance on an EU eurobond. All they found was an expression of "political will".

"Euro area member states will take determined and co-ordinated action, if needed, to safeguard financial stability in the euro area as a whole. The Greek government has not requested any financial support," it read.

The 27 leaders never even discussed how they might shore up Greece or the rest of Club Med. German Chancellor Angela Merkel said she was not willing to broach the subject at all. The only relevant topic was whether Greece was complying with Treaty obligations, and how the country would slash its budget deficit from 12.7pc to 8.7pc this year – in a slump. "They offered nothing," said Jochen Felsenheimer, a credit expert at Assenagon in Frankfurt. "It was just words without any concrete measures, hoping to buy time."

Whether the EU has time is an open question. Credit Suisse says Greece must raise €30bn (£26bn) in debt by mid-year, mostly in April and May. Greek banks have been shut out of Europe's inter-dealer markets, forcing them to raise money at killer rates. They are suffering an erosion of deposits as rich Greeks shift money abroad. This could come to a head long before April. "Economically, we are in a very risky situation. Greece is close to default. We face systemic risk like the Lehman collapse and unless there is a bail-out for Greece, there will have to be a bail-out for the whole European banking system within two or three months," he said.

Yet they are damned if they don't, and damned if they do. "A Greek bail-out increases the risk of EMU break-up, because monetary union can only work if everybody sticks to the rules," Mr Felsenheimer said. French banks have $76bn of exposure to Greece, the Swiss $64bn, and the Germans $43bn. But this understates cross-border links. There are large loans between vulnerable states. The exposure of Portuguese banks to Spain and Ireland equals 19pc of Portugal's GDP. Interlocking claims within the eurozone zone are complex. Contagion can spread fast.

Marc Touati, of Global Equities in Paris, said the "haemorrhage of Greece" must be stopped to prevent a domino effect. "We have to move fast, above all to keep Greece in the eurozone. If not, Spain, Portugal, and Italy will be next. It could reach France," he said. French President Nicolas Sarkozy drew an explicit parallel with Lehman Brothers in his press conference with Chancellor Merkel, saying EU leaders had given a cast-iron pledge that no eurozone member would be allowed to fail, just as they promised during the financial crisis that no big bank would be allowed to fail.

Details can be thrashed out later, in this case by finance ministers next week. The talk is of a "coalition of the willing", a group of states acting outside the EU Treaty structure. Britain would not be obliged to help. The IMF would bring "expertise" but not set policy. Each country will choose its own way of helping, perhaps using state banks or sovereign wealth funds to buy Greek debt. In Germany's case this might be KFW: for France in might be Caisse des Depots. The arm's-length solution is elegant but it does not hide the fact that such action amounts to a debt guarantee for a serial violator of EMU rules. It implicitly opens the door to bail-outs for a string of countries in crisis.

BNP Paribas said any rescue confined to Greece is doomed to fail. "The market would only concentrate on its next 'victim', which would be Portugal," it said. Put another way, investors will demand a similar guarantee for Iberian debt. It is this worry over open-ended liability that made Germany hesitate. Such help would need approval by the German Bundestag – and some other national parliaments. If Germany finances an unpopular rescue that merely puts off the day of reckoning, or if Athens squanders the aid, the deal will come back to haunt Mrs Merkel. There was an element of bluff in Thursday's accord, as if the EU leaders hope to muddle through with "constructive ambiguity", fingers crossed that their vague political pledge will never be tested. Bluff is a valid tool of statemanship, but in this case their bluff could be called very soon.

Germany and France Take on the Euro Speculators

EU member states have agreed to come to Greece's aid -- but only if in the case of a complete emergency. First of all the country has to make significant spending cuts. The euro zone states have little choice. Neither Germany nor France can afford to see Athens go bankrupt -- that would end up costing them billions. Not hurting anyone, not risking anything, yet still coming to a decision -- it was a very European solution that Herman Van Rompuy announced after the special summit of EU leaders on Thursday. The countries belonging to Europe's common currency zone declared their willingness to come to Greece's aid in the case of an emergency, in order to prevent the country from going bankrupt, the European Council President said. But there would not be any financial aid, he stressed, because the Greek government had not asked for it.

That was all the more astounding as there had been wild speculation about what the meeting would produce: direct EU aid, a European bond issue, bilateral loans, help from the International Monetary Fund -- almost every conceivable instrument was brought up as a way to help get the highly indebted country back on its feet. Even an expulsion from the euro zone was discussed. And in the end, none of these solutions were agreed upon -- at least not yet. Instead, Greece has been asked to set take "rigorous and determined" austerity measures, reduce the budget deficit by 4 percentage points and to agree to further spending cuts with the finance ministers of the other EU states, Van Rompuy said. The European Commission and the European Central Bank (ECB) are to monitor Greece's efforts and the first assessment will be made in March. According to information obtained by SPIEGEL, the German government is considering asking the IMF, known as a tough taskmaster, to step in and oversee the spending cuts.

The outcome of the summit reveals the EU's dilemma: "It is in the interests of all of the states, particularly Germany and France, to hep Greece," says Ansgar Belke, from the German Institute for Economic Research (DIW). However, the governments' hands are tied by the terms of the Maastricht Agreement, which governs European monetary union. In reality, the other states are not allowed to help Greece -- at least not officially. In order to safeguard the euro, and to encourage each country to follow strict budget discipline and a solid economy, the states who joined the single currency agreed to a so-called "no bailout" clause. It stipulates that neither other member states nor the ECB may come to the aid of a state in the form of loans.

Still, it is clear to all that the European Union cannot afford to see one of its member states go bankrupt. On the one hand, Athens owes its neighbors billions. According to estimates from the Bank of International Settlements, Greece owes French banks $75.5 billion (€55.3 billion), Swiss banks $64 billion and German banks $43.2 billion. In total, Greece owes foreign financial institutions $302.6 billion. "That could certainly be one reason for the German-French initiative to stabilize Greece," says banking expert Hans-Peter Burghof, from the University of Hohenheim. Should Greece go bankrupt, then at least a part of that money would be lost. Large corporate banks would not necessarily be the hardest hit. In a departure from normal banking-industry discretion, Deutsche Bank head Josef Ackermann said recently that his bank's share of Greek debt was "extremely small." It appears that mortgage banks, which invested heavily in Greek bonds, would suffer the most, say observers. Even should Greece avoid insolvency, these banks are still at great risk.

But as high as Greece's foreign debt may be, experts see the greatest danger elsewhere. "A Greek bankruptcy could result in a collapse of the entire euro system," says financial market expert Rudolf Hickel with Bremen University's Institute of Labor and Economy. Currency market speculators are currently earning well by betting against Greece. "After Greece, Spain and Italy would then become the focus of the speculators," says Hickel "and that is what France and Germany have to stop." It makes little difference that Greece's share of the European Union's gross domestic product is a mere 2.6 percent. "Of course that is merely comparable to the economic output of Lower Saxony and Bremen, but it's the principle," Hickel argues. The size of the country plays a role only insofar as "the smaller the state, the greater the effects from the speculators."

One wonders, in fact, why the European Union has been so slow to take action. The effects on the euro have already become very apparent. In the last three months, the price of one euro has dropped from $1.50 to $1.37. Many currency experts consider a weakening of the euro to be a welcome development -- but not in the way it has come to pass. Currency speculators aren't interested in a euro-dollar exchange rate that adequately reflects economic output. Rather, their profits result from erratic changes on the currency markets. In addition, "nobody knows what would happen if Greece actually did go bankrupt, what it would mean for the financial markets and whether it would have dramatic consequences similar to the bankruptcy of Lehman Brothers," says banking expert Burghof. For that reason as well as to avoid a political destabilization, Burghof feels firmly that other EU countries will intervene if worse comes to worst.

But that could happen sooner than some might think. In hushed tones, some are saying it will take only two months before Greece runs out of money. Whether or not the country will be able to secure money on the international financial markets at better conditions than it has recently had at its disposal is unclear. So far, the market has reacted coolly to the EU's vague pledges of aid. "The announcement by the EU translates as: 'Problem, please go away," gibes DIW expert Belke. People are now hoping the markets will take note and that the message will be understood; "In an emergency, the EU will step in with bilateral aid." For now, though, the EU is continuing to delay this step. As long as it continues to do so, the markets will continue to shy away from Greece.

Obama Advisers Predict Unemployment of 8.2% by 2012

The Obama administration projected Thursday that the unemployment rate would fall this year by only a little, if at all, and would remain well over 6 percent until 2015. The forecast was the most closely watched element of the annual Economic Report of the President, a 458-page document outlining the White House’s outlook and policies on areas as diverse as savings and investment, health care and climate change. The report projected that an average of 95,000 jobs would be added to the payrolls each month this year — barely enough to keep up with the normal number of jobs the economy would have to create to meet the growth in the labor force and keep the unemployment rate steady.Although the Labor Department has estimated that unemployment fell to 9.7 percent last month, the new report projected that the average rate for the year would be 10 percent. That would fall to 9.2 percent next year, the report said, and to 8.2 percent in 2012, when President Obama would be up for re-election. The report also estimated that the nation’s gross domestic product, the broadest measure of economic output, would grow 3 percent this year, in line with the projections for global growth of 3.1 percent by the International Monetary Fund, and 3.4 percent by the 30-nation Organization for Economic Cooperation and Development.

The president’s Council of Economic Advisers, which prepares the report, was criticized last year for failing to foresee that unemployment would reach 10 percent, as it did in the fall. But Christina D. Romer, chairwoman of the council, said last year’s report had been “remarkably accurate” in its G.D.P. forecast. “The usual relationship between G.D.P. growth and the unemployment rate has broken down somewhat,” Ms. Romer, who is on leave from the University of California, Berkeley, told reporters at the White House. “The unemployment rate has risen much more than one would have predicted.” Asked whether the advisers felt pressure to offer gloomy predictions because the president has been pushing Congress to pass a jobs bill, she said: “The truth is, we don’t have a crystal ball. Every year, we try to do an honest, reasonable, conservative forecast.”

While the report sought to provide empirical support for the administration’s objectives, it also contained some implicit criticisms of the handling of the economy under Mr. Obama’s predecessor, George W. Bush. “After a half-decade of higher growth in the 1990s, the real income of the typical American family actually fell between 2000 and 2006,” it added. The report said consumption and foreign borrowing, rather than investment and net exports, fed the last decade’s economic expansion. It said, “The long-term fiscal outlook the administration inherited” was “more troubling” than recent deficits. And while the report described the rising cost of Medicare, Medicaid and Social Security as the “main reason” deficits are projected to balloon over time, it also said that “the policy choices of the previous administration contribute a substantial amount” to that growth.

The deficit, relative to the size of the economy, stands at its highest level since World War II. The report argued that while deficit growth would be unsustainable because it could undermine global investors’ willingness to buy American debt, huge short-term deficits are manageable. “It is essential that the United States follow a fiscal policy that stabilizes the debt-to-G.D.P. ratio at a feasible level,” the report concluded. On that measure, the debt of the United States is proportionally lower than that of Belgium, Italy or Japan, but somewhat higher than that of Germany, Britain or France.

The report offered three primary prescriptions for bringing the deficits under control: curbing the rising cost of health care; undoing many of the provisions of the 2001 and 2003 tax cuts adopted under Mr. Bush; and eliminating wasteful spending. The report asserted that, from a historical perspective, effective tax rates for high-income Americans reached their lowest point in at least a half-century in 2008. Mr. Obama has urged raising personal income tax rates for those making at least $250,000 a year to the levels of the late 1990s, along with other changes, starting in 2011. The tax increases would raise nearly $1 trillion over 10 years, the report said. The report represents a consensus view from Ms. Romer and the council’s two other members, Austan Goolsbee and Cecilia E. Rouse.

US Jobless Suffer With Corporate Cash Hoard Climbing to $1.19 Trillion

A majority of companies in the Standard & Poor’s 500 stock index increased cash to a combined $1.19 trillion while simultaneously reducing spending, keeping a jobs recovery on hold. Caterpillar Inc., Eaton Corp., Walgreen Co. and General Electric Co. are among 260 companies that ended last quarter with $522 billion more than a year earlier after cutting capital spending by 42 percent. Economists say the dearth of investment is keeping the jobless rate at about 10 percent as the U.S. emerges from its worst recession since the 1930s. “It’s not clear we are going to see the type of growth following this recession that we’ve seen in previous recessions,” Sandy Cutler, Eaton’s chief executive officer, said in an interview yesterday. That view “is leading people to be cautious as to their rate of reinvestment, and right in parallel with that, in terms of hiring additional employees.”

Investment and hiring may remain low as companies bring unused capacity back on line and rely on productivity gains to fill demand, said Edward Lazear, former economic adviser to President George W. Bush and a professor at Stanford University in Stanford, California. Employers have eliminated 8.4 million jobs since the U.S. slipped into recession in December 2007. “About three years into the recovery, you start getting significant wage growth,” Lazear said in an interview. “It’s unfortunate because it means workers suffer for a pretty long time after the recovery takes off.” Congressional leaders of both parties share a “common commitment” with President Barack Obama to promote employment and help small businesses, Lawrence Summers, director of the White House’s National Economic Council, said in a Feb. 9 interview with Bloomberg Television.

“There’s going to be a great deal of activity, and I’m optimistic there’s going to be a jobs bill,” Summers said. Based on the latest quarterly reports from S&P 500 companies, the 262 companies increased cash and short-term investments by a combined 78 percent from a year earlier while reducing spending by $30.1 billion to $41.5 billion. For the entire S&P 500, cash rose about 14 percent to $2.18 trillion. Steps companies took to accumulate cash also included lowering costs, selling shares, raising debt, crimping dividends and putting share repurchases on hold. In February 2009, GE decided to cut its quarterly dividend to 10 cents a share from 31 cents, saving about $9 billion annually. The reduction in the annual payout was the company’s first since 1938.

Eaton’s Cutler, who voluntarily gave up eight weeks of pay in 2009, said in the interview he doesn’t expect his Cleveland- based maker of hydraulics and valves to resume hiring until 2011. Eaton required its 70,000 workers to take furloughs equal to a month of unpaid leave last year. Its cash and short-term investments rose 46 percent from a year earlier to $773 million. Caterpillar is working to convince S&P and Moody’s Investors Service to lift their negative credit outlooks on the maker of backhoes and bulldozers. The Peoria, Illinois-based company’s cash rose 78 percent to $4.87 billion in a year as it reduced capital spending. Caterpillar has cut more than 36,000 full-time and temporary jobs since December 2008.

“Once we get past this recessionary environment, once we hear from the rating agencies that they’re stable with where we’re going on this, you could expect us to get back into our mode that we’ve been in for many years,” Douglas Oberhelman, chief executive officer elect, said on a Jan. 27 analyst call. Walgreen plans capital spending of $1.6 billion this year, lower than $1.9 billion last year and $2.2 billion in 2008, as the biggest U.S. drugstore chain slows the number of stores it opens, Chief Financial Officer Wade Miquelon said at a Feb. 8 UBS Global Healthcare Services conference. Walgreen’s cash more than tripled to $3.15 billion at the end of November from a year earlier. Miquelon said that has bolstered the Deerfield, Illinois-based company’s balance sheet in a strategy that has “suited us very, very well.”

A lack of investment opportunity has caused some companies to accumulate cash, Miquelon said on a call in December. “It’s not great having money in the bank earning almost no interest, but we also want to be very smart and very driven” by return on invested capital, Miquelon said then. “Just because we’re generating cash doesn’t mean that we’re going to feel compelled to do something that doesn’t earn a good, robust return for the company and for the shareholder.” There is a debate among economists as to when and how the recovery will start. Summers, the White House economic adviser, in December disputed the idea of a “new normal” of slower growth and higher unemployment popularized by Pacific Investment Management Co., the Newport Beach, California-based company that runs the world’s largest bond fund.

Companies may be wary of investing and hiring because of questions about government stimulus, taxes and other federal policies that impact business, Lazear said. Subsidies designed to create jobs “just don’t work” and only drive up deficits that may require higher taxes to control, he said. “What you need to do is make sure the climate for business continues to be positive, and talking about tax increases is not the right way to do that,” Lazear said. Some companies are taking initial steps. Cisco Systems Inc. added about 2,100 workers during the quarter ending Jan. 23 from acquisitions and to meet higher demand for networking equipment, CEO John Chambers said in a Feb. 4 interview.

The San Jose, California-based company has increased its cash by $10 billion to $39.6 billion over the past year and may be ready to begin investing if the U.S. government follows the basic tenet of “do no harm,” Chambers said. Cisco may add as many as 3,000 workers over the next several quarters, he said. “Going forward -- assuming government regulations that favor job creation, economic growth, exports and innovation -- we would continue to add, balanced around the world,” he said. Investment in equipment and software rose 13 percent in the fourth quarter and temporary-worker hiring is on the rise, suggesting companies are “on the cusp” of using cash to invest more, said Stephen Stanley, chief economist at RBS Securities Inc. in Stamford, Connecticut. “Firms are going to be in a position very soon where they’re going to have to hire people,” Stanley said. “We’re starting to see signs that we’re fast approaching that point.”

Stanley predicts the U.S. may post payroll gains of 200,000 to 300,000 a month by yearend. The unemployment rate may end the year at 9 percent and may take until 2013 to reach the levels before the recession. Executives will keep adding cash to balance sheets this year but at a lower rate than in 2009, said Eli Lustgarten, a senior analyst with Independence, Ohio-based Longbow Securities who covers industrial companies including Caterpillar and Eaton. Companies may begin to buy back stock, boost dividends and make acquisitions rather than accumulate as much cash, he said. “There will be a time when working capital starts to be re-employed and capital expenditures start to go up,” Lustgarten said. “We’re at the bottom of the cycle, but it won’t reverse that quickly.”

General Electric, the world’s biggest maker of power-plant turbines, medical-imaging equipment and jet engines, had $124.2 billion in cash and equivalents at the end of 2009 including the GE Capital finance arm. Use of cash for regular costs and shoring up GE Capital in the financial crisis left a year-end balance of $8.7 billion at the parent, a January investor presentation showed. GE’s cash balance should triple to about $25 billion this year, after spending on the dividend, plant and equipment investments and other items, Chief Executive Officer Jeffrey Immelt said during an investor conference call to discuss earnings last month. The figure includes an expected $10 billion in proceeds from selling a majority of NBC Universal and a security unit. GE, based in Fairfield, Connecticut, had about 23,000 fewer employees at the end of 2009 than it did at the end of 2008, based on data from regulatory filings and press releases. In the past year, GE has announced plans to keep or add more than 13,000 U.S. positions to beef up manufacturing, research and development, based on data from public announcements.

Enter Cede & Co II; The Fed Is Now Backstopping $25 Trillion In DTCC Cleared Credit Default Swaps

by Tyler Durden

And you thought the $23 trillion in backstops for the financial system was bad; you ain't seen nothing yet. Earlier today, the Depository Trust & Clearing Corporation, best known for its Cede & Co. partnership nominee which is the holder of virtually every single physical stock certificate in the known universe, and accounts for over $2 quadrillion in stock transactions per year, announced that "the Federal Reserve Board had approved its application to establish a DTCC subsidiary that is a member of the Federal Reserve System to operate the Trade Information Warehouse (Warehouse) for over the-counter (OTC) credit derivatives."

With this approval the DTCC is now the de facto legally accepted global repository for over-the-counter credit derivative transactions. Simply said, the Federal Reserve is now the guarantor behind all CDS transactions that clear via DTCC, which would be pretty much all of them (sorry CME, you lose). The total bottom line in terms of gross notional? 2.3 million contracts with a gross notional value of $25.5 trillion. When the next AIG implodes, and the CDS market is once again facing annihilation in the face, who will be on the hook? You dear taxpayer, that's who.The new Fed-endorsed organization will settle CDS obligations in all currencies and process credit events. It will also include all OTC credit derivatives traded worldwide, and will be regulated by the Fed and the NY State Banking Department and will be overseen by other US and International regulators.

To be sure, the net notional CDS amount, which is what counterparties would be on the hook for in the case of an orderly unwind of the financial system, is materially lower than the gross total. Yet, as systemic unwinds are never orderly, gross tends to become net in those occasions when Lehman bonds go from par to 10 cents in the span of 24 hours. Should systemic risk flare up again (and this time Europe will be both shaken and stirred, thank you Mr. Hazard... Moral Hazard), and fiat-based market values quickly catch up with fair values (which in our ponzi economy can easily be calculated: they are all zero).

The actual organization that will soon be in need of a bailout, is the Warehouse Trust (there's that word again) Company, which in turn will operate the DTCC's Trade Information Warehouse, and will begin operations “once certain organizational conditions have been met, which are expected shortly." Presumably, the TIW, which has been in operation for just over one year, is somehow supposed to inspire confidence that the DTCC has an idea of everything that goes on in the quadrillion + CDS Market.

"The release of this information has been an important step forward in helping increase transparency in the marketplace. More detailed information on individual firm trading has been made available confidentially to regulators around the world with the consent of market participants." Oh great, at least someone has information to the confidential information.What all this implies is that basis spreads will likely compress very shortly, once counterparty risk becomes a thing of the past and all systemic risk in the biggest derivative market out there (ex IR swaps) is fully backstopped by the Federal Reserve. It will also guarantee the DTCC monopoly status when it comes to CDS trading as nobody will desire to transact and/or clear elsewhere.

We shudder to think if the Fed grants DTCC with exclusive status for IR and FX swaps as well, and the associated $600 trillion notional outstanding.

And from an insider, we know that the company will be funded and commence operations by March 1.

Fed in Talks With Money Market Funds to Help Drain $1 Trillion in Preparation for Interest Rate Hike

The Federal Reserve is in talks with money-market mutual funds on agreements to help drain as much as $1 trillion from the financial system as policy makers prepare for the first interest-rate increase since June 2006, according to a person familiar with the discussions. The central bank is looking to the $3.2 trillion money- market mutual-fund industry because the 18 so-called primary dealers that trade directly with the Fed have a capacity limited to about $100 billion, estimates Joseph Abate, a money-market strategist at Barclays Capital in New York.

Money-market funds may welcome the opportunity to trade with the Fed after the financial crisis reduced the supply of safe assets in which they can invest. In one example of demand for such assets, auctions on four-week Treasury bills have attracted an average of $5.47 in bids for every dollar sold this year, compared with an average of $3.77 last year, according to Bloomberg data. Yields on the four-week bill fell to five basis points from 20 basis points a year ago. “There are lots of great credit stories, but the option of going with the Fed and the government -- it takes away part of the risk,” said Deborah Cunningham, a chief investment officer at Federated Investors Inc. in Pittsburgh, which manages $318 billion in money-market investments. Conversations with the Fed “seem pretty positive,” she said, adding that the Fed and the industry should be in a position to conduct operations before the end of the year.

Chairman Ben S. Bernanke yesterday charted ways the Fed might withdraw record monetary stimulus pumped into the economy to fight the recession. Among the central bank’s tools are reverse repurchase agreements, in which the Fed sells securities with the intention of repurchasing them at a later date. The Fed is also considering reverse repurchase agreements with mortgage lenders Fannie Mae and Freddie Mac, said the person familiar with the discussions. Freddie Mac spokeswoman Sharon McHale declined to comment. Fannie Mae spokesman Brian Faith also declined to comment. “To further increase its capacity to drain reserves through reverse repos,” Bernanke said, the Fed is “in the process of expanding the set of counterparties with which it can transact” beyond primary dealers of government securities.

The primary dealers, which are required to bid at auctions of Treasury notes and trade directly with the New York Fed’s markets desk, include BNP Paribas Securities Corp., Banc of America Securities LLC and Goldman Sachs & Co. Bernanke repeated yesterday that while interest rates are likely to stay low for an “extended period,” the Fed in “due course” will need to “begin to tighten monetary conditions to prevent the development of inflationary pressures.”

The central bank has created more than $1 trillion in excess reserves in the banking system through its purchases of $300 billion of Treasury debt and $1.25 trillion of mortgage- backed securities. To put upward pressure on the federal funds rate, the Fed may need to drain as much as $800 billion, Abate estimates. One potential tightening tool is the interest rate on reserves that commercial banks keep on deposit at the Fed. By raising that rate, the central bank “will be able to put significant upward pressure on all short-term interest rates,” Bernanke said. The Fed can also use reverse repos to shrink the quantity of reserves, which in turn gives it “tighter control over short-term interest rates,” he said.

Fed officials face the risk that when they start to tighten policy by raising the rate they pay banks on reserves, other market rates may not follow. That would keep monetary conditions too loose in an expansion.

Controlling Rates “They still seem nervous that they might not be able to control short rates, and if they can’t control short rates, how do they tighten?” said Mark Spindel, chief investment officer at Potomac River Capital LLC, which manages $200 million in Washington. The Fed has sought to keep the benchmark rate in a range of zero to 0.25 percent since December 2008. The federal funds rate is now 0.13 percent, even though banks can earn 0.25 percent by keeping their money on deposit at the Fed.

One reason for the discrepancy is that Fannie and Freddie have become “significant sellers” of funds in the overnight market and aren’t eligible to place cash on deposit at the Fed, according to a December research paper by the New York Fed. Some hurdles remain in the Fed’s efforts to secure bigger repo capacity. Fed officials and mutual-fund industry representatives are working on a structure that would allow funds to invest in relatively liquid assets that can be sold in seven days, while allowing the central bank to avoid having to renew billions of dollars in transactions each week. “There needs to be liquidity,” said Cunningham of Federated. “A reverse repo contract is not considered to be liquid in the context of anything beyond seven days.”

Bond Sales Tumble 90%, Junk Returns Go Negative

Investment-grade debt sales are drying up and returns on high-yield bonds have turned negative for the year as investors wait to see whether European leaders can contain Greece’s budget crisis. Borrowers in the U.S. and Europe sold $4.71 billion of high-grade securities this week, the least this year and about 90 percent less than the average $52.9 billion, according to data compiled by Bloomberg. Speculative-grade, or junk, bonds in the U.S. have lost 0.09 percent in 2010 after gaining 1.52 percent in January, Bank of America Merrill Lynch index data show.

Investors are avoiding credit risk as European Union leaders meet to hammer out an aid package for Greece. While relative borrowing costs in the U.S. remained steady yesterday and prices to insure against defaults fell, Huntsville, Alabama- based telephone service provider ITC Deltacom Inc. canceled a $325 million bond sale, citing “current market conditions.” “Sentiment has turned significantly amid concerns about sovereign deficits and problems surrounding Greece and other peripheral euro-zone economies,” Simon Ballard, a senior credit strategist at RBC Capital Markets in London said yesterday. “For the moment, we’re unlikely to see much in the way of primary market activity as investor sentiment remains fragile and the broad market feeling is one of nervousness.”

The extra yield investors demand to own corporate bonds instead of Treasuries narrowed 1 basis point to 170 basis points yesterday, Bank of America Merrill Lynch’s Global Broad Market Corporate Index showed. The spread has widened from this year’s low of 160 basis points, or 1.6 percentage points, on Jan. 14, after narrowing from 443 basis points a year ago. Greece, the most-indebted member of the euro region, triggered a retreat from riskier assets as its swelling budget deficit prompted European Union leaders to consider a bailout. While credit-default swaps in Europe have fallen since August as the economy improved, swaps on Greek debt surged to a record last week, signaling doubts about the nation’s recovery.

Corporate bonds have returned 1.39 percent this year, according to the Merrill index. Junk bonds lost 1.58 percent so far this month, the most in a year, the bank’s U.S. High Yield Master II Index shows. Elsewhere in credit markets, credit-default swaps were little changed. Europe’s Markit iTraxx Crossover Index of 50 companies with mostly high-yield ratings, used to hedge against losses on corporate bonds or speculate on a borrower’s ability to meet debt payments, fell 1 basis point to 471, according to JPMorgan Chase & Co. prices at 1:11 p.m. in London. The Markit CDX North America Investment Grade Index fell 0.65 basis point to 101.6 basis points yesterday, according to broker Phoenix Partners Group. A decline shows improved perceptions of credit quality.

Mortgage bonds guaranteed by Fannie Mae and Freddie Mac fell after the companies said they would increase purchases of delinquent loans from the securities. The Philippines is planning to sell as much as 100 billion yen ($1.1 billion) of Samurai bonds. Software maker Autonomy Corp. raised about 500 million pounds ($785 million) from the biggest sale of convertible bonds in the U.K. this year. Prices of high-yield loans fell for the fifth straight day. The S&P/LSTA U.S. Leveraged Loan 100 Index declined to 88.93, the lowest since Jan. 8 and down from 89.07 the day before. Leveraged loans and junk bonds are rated below Baa3 by Moody’s Investors Service and below BBB- by Standard & Poor’s.

Federal Reserve Chairman Ben S. Bernanke said yesterday the central bank may raise the discount rate “before long.” The comments helped push the yield on the benchmark 10-year Treasury note as high as 3.707 percent. The yield, which traded as low as 2.05 percent in January 2009, is used as a benchmark for corporate borrowing costs. The Bernanke comments “worried some as it implied another drop of support for the financials,” Tim Backshall, chief strategist at Credit Derivatives Research LLC in Walnut Creek, California, said in an e-mail. Investors also “are nervous that the sovereign liquidity crisis is far from over,” he said.

Sunoco Logistics Partners LP, the Philadelphia-based oil and product pipeline company, is the sole U.S. investment-grade borrower to sell debt this week, issuing $500 million of 10- and 30-year bonds, according to data compiled by Bloomberg. While sales typically decline in February as companies try to avoid selling bonds before releasing year-end earnings, U.S. investment-grade issuance is less than the average $10.3 billion for the same period over the past 10 years, Bloomberg data show. Deals declined by an average of 28 percent between January and February from 2001 to 2009, Bloomberg data show.

Following a record start to the year, junk bond offerings may slow after debt issued by Freescale Semiconductor Inc., Appleton Papers Inc. and Stallion Oilfield Holdings Inc. fell in the days after they started to trade. Freescale’s $750 million of 10.125 percent bonds due in 2018 traded yesterday at 98.4 cents on the dollar, down from face value when sold on Feb. 9, according to New York-based brokerage firm RW Pressprich & Co. Appleton’s five-year, 10.5 percent notes tumbled 5 cents on the dollar from their issue price to 93 cents. Houston-based Stallion’s five-year, 10.5 percent bonds dropped 1.6 cent on the dollar in secondary trading to 97.5 cents, RW Pressprich said. “Three months ago, every piece of spaghetti stuck to the wall,” said Jason Brady, a managing director who invests $54 billion at Thornburg Investment Management Inc. in Santa Fe, New Mexico. “Now it seems, the market is more price-sensitive.”

ITC Deltacom was the fourth high-yield borrower in almost four weeks to cancel a sale. New World Resources NV, a Czech- owned coal company, called off its 700 million euro ($964 million) bond offering, citing “negative market volatility,” in a statement distributed yesterday. In India, state-owned lender Bank of India canceled a dollar bond sale citing “current market conditions,” according to a note sent to investors Feb. 9. Bank of Baroda another state-owned lender, last week canceled a bond sale, three people familiar with the matter said at the time. “Everyone’s just trying to get a better feel for globally what’s happening at a macro perspective, that’s the biggest concern right now,” said Sabur Moini, who oversees $1.3 billion of high-yield assets at Los Angeles-based Payden & Rygel.

Credit-default swaps on Greek government debt dropped 23.5 basis points to 332.5, after soaring to a record 428 on Feb. 4, according to CMA DataVision prices. Contracts on Portugal fell 14.5 to 176 and Spain slid 6.5 to 132.5, CMA prices show. European leaders said in Brussels today they’d come to an accord on Greece, which is struggling to reduce the region’s largest budget deficit, though details weren’t announced. They will probably press Greece to present more detailed budget cuts and stop short of announcing an aid package.

“We fully support the efforts of the Greek government and their commitment to do whatever is necessary, including adopting additional measures, to ensure that the ambitious targets” on the deficit are met,’’ said EU President Herman Van Rompuy. Leaders are scheduled to brief reporters after the summit and finance ministers meet in Brussels on Feb. 15-16. “If for any reason the EU decides not to commit any cash following the summit, then there will be blood on the walls in the market on Friday,” Gary Jenkins, head of credit strategy at Evolution Securities Ltd. in London, wrote in a note to investors. “They must be aware of that and thus it is an extremely unlikely scenario.”

In the mortgage bond market, Freddie Mac, the housing- finance company seized by the U.S. government 17 months ago, said it will purchase “substantially all” loans delinquent by 120 days or more from its home-loan securities. Fannie Mae, also seized by the U.S., said it would do the same. Freddie Mac’s 30-year fixed-rate 6.5 percent securities fell to 107.41 cents on the dollar from a record 108.28 on Feb. 9, on concern by investors that they would lose out on interest payments, Bloomberg data show. Fannie Mae was unchanged in Frankfurt stock trading at $1.40, the highest level since Jan. 21. Freddie Mac was also unchanged at a three-week high of $1.24. “The decision to effect these purchases stems from the fact that the cost of guarantee payments to security holders, including advances of interest at the security coupon rate, exceeds the cost of holding the nonperforming loans in the company’s mortgage-related investments portfolio,” Freddie Mac said.

Elizabeth Warren: 3000 Small US Banks Facing Severe CRE Loan Losses

Nearly 3,000 small U.S. banks could be forced to dramatically curtail their lending because of losses on commercial real-estate loans, a congressional inquiry concluded. The findings, set to be released Thursday by the Congressional Oversight Panel as part of its scrutiny of the Troubled Asset Relief Program, point to yet another obstacle for the slow-moving economic recovery. The small banks being threatened by loans they made for shopping centers, offices, hotels and apartments represent a major cog in the U.S. credit system, especially to entrepreneurs. "The banks that are on the front lines of small-business lending are about to get hit by a tidal wave of commercial-loan failures," said Elizabeth Warren, a law professor at Harvard University who heads the TARP oversight panel.

Concern about banks' exposure to commercial real estate has been building for months. Job losses, corporate retrenchments and curtailed spending by many Americans are increasingly squeezing banks that financed commercial properties. Some troubled lenders were previously battered by residential mortgages that soured when the housing bubble burst, leaving banks with less capital to cushion them from commercial-real-estate-woes. Of the roughly 8,100 U.S. banks, some 2,988 small institutions have problematic exposure to commercial real-estate loans, according to the oversight panel's report. That means their level of commercial real-estate loans is at least 300% of total capital or their construction and land loans exceed 100% of total capital.