Star-forming region in the Carina Nebula. The enormous pillar of gas and dust is 3 light-years tall. The seam in the middle is the result of new stars forming and emitting powerful gas jets that are ripping the pillar apart.

Ilargi: It promises to be an interesting week, the one we're entering. 44 House Democrats have signed a petition for criminal investigations against Goldman Sachs. Goldman's executives (including Fabrice Tourre?!) will be heard on Tuesday by Carl Levin and his Permanent Subcommittee on Investigations. Levin released tons of internal Goldman emails over the weekend, which at the very least appear to contradict former statements by the firm that it did not profit from the housing and financial collapse.

It's not hard to predict that Blankfein c.s. will be insulted, furious and indignant. These are people for whom $10 million is NOT a lot of money. And however you think about that, it is still a sharp contrast with the millions of American citizens who've come to rely on foodstamps and emergency extended unemployment checks, to a large extent because of the financial crisis. For them, $10 million is an enormous amount of money, so large they can't even fathom it.

I think the undoing of Goldman will be that its execs, just like those at Morgan Stanley, or GE, or GM, have failed to understand that their own personal wealth can only last as long as the "lower classes" have at least a decent life. A chance to feed their kids and send them to a proper school, to get proper medical treatment for their families if and when required, and, when they age, to draw sufficient retirement funds not to suffer from hunger and cold.

The Blankfeins and Jamie Dimons of the planet have no idea who these people are, or what they think, what they're going through, many hundreds waiting in line for an entire day for a handful of low-paid jobs. See, if you make $20,000 a year, and many wish they'd make that much, you have to work for 500 years to get to that $10 million. Lloyd Blankfein made over $400 million in the past decade. John Paulson, the hedge fund man who Goldman devised the Abacus deal with that the SEC has stated is fraudulent (on Goldman's part, Paulson is not mentioned in the civil case), mae $1 billion on that deal alone. The American low-paid worker would need to work for 50,000 years to get to $1 billion.

And still, this could go on, or could have gone on, for much longer, provided the wealthy part of society had remained aware of how the poor were doing. They didn't, they look only at the next $10 million. It’s a common gambler's affliction, or an alcoholic's: forget the world around you exists.

I'd say Barry Ritholtz has it just about right (and he'll bet anyone he does). The SEC's case against Goldman has been called weak or worse from all sorts of corners, but director of SEC enforcement Robert Khuzami is not a two-bit fool. The case has been prepared over a long period of time, way more even than the 9 months since Goldman was told there was an investigation going on. Now, as I said before, it may be that Khuzami, who can only file civil cases, is just handing a handy set of tools to anyone wanting to go after Goldman in criminal court. Carl Levin and his committee may use Khuzami's research. There are at least two complaints filed vs Goldman in criminal court that are derivative cases, meaning the lawyers who filed them represent not themselves, but groups of clients.

Really, all Khuzami may have wanted is to shake the barrel, confident that this would draw out the snakes. But, as RItholtz says, he may have a whole army of additional evidence that he hasn't yet published, simply because the initial filing didn't require it.

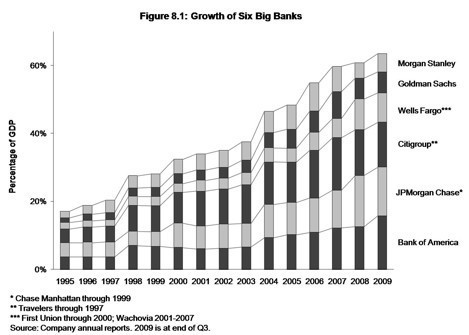

The call to break up the big six banks is getting louder all the time. The New York Times is not an anti-elite paper by any stretch, but today, its new hero Gretchen Morgenson (she had the scoop on SEC vs Goldman) phrases it like this:

It is a shame that Congress is moving forward with financial regulations that do not eliminate the heads-bankers-win, tails-taxpayers-lose mentality that has driven most of the bailouts during this sorry episode. Companies that are too mighty to fail must be broken up.

And incentives in the nation’s regulatory system that reward size with subsidies should not be enshrined into law. They should be eliminated. Only then will America be safe from toxic banking practices and the burdensome rescues they require.

Good morning! She cites that even a man like Richard Fisher, president of the Dallas Fed, calls for the big banks to be broken up. Now, you may have noticed that what Morgenson is saying is radically different from what President Obama said in his speech last week. He said nothing about breaking up banks, or about restricting their use of swaps and other derivatives, he asked them to join "us" (it wasn't very clear who "us" included). It sounded something like: "Join us in taking your money away from you (if you don’t, we won't, promise), it's good for the country and ultimately it's good for you too (who needs all that money?).

What needs to happen, and soon, if anyone is to be left with a few pennies to their name, is easy to formulate. Just for starters:

- Break up the big banks

- Take away -investment- banks' access to Fed discount windows

- Separate consumer banking and investment banking (Glass-Steagall)

- Deal with outstanding derivatives positions at the expense of shareholders and bondholders (including China)

- Eliminate corporate (not just banks) funding for A) Washington lobbyists and B) Election campaigns

As for the last point, the present bunch of representatives will never agree; their livelihood depends on it. Still, it will get increasingly harder to call for banks to be broken up on the one hand, and throw Wall Street fundraising events on the other. They may well fall in their own sword, raised to take advantage of the shift in public mood.

As McClatchy's David Lightman pointedly writes:

What do both parties have in common? Wall Street donationsIn recent days, critics and journalists have been asking lawmakers to return certain funds, notably those from Goldman Sachs. Most lawmakers find the suggestion ridiculous. "This is our system," [Sen. John Cornyn of Texas, the chairman of the National Republican Senatorial Committee] said.

"I think the system needs more transparency, so people can more easily reach their own conclusions. But if you didn't have this system, the alternative would be to have taxpayers fund elections, and I'm not in favor of that."

Well, US election campaigns are either going to be funded by the taxpayer, or they'll be funded by Goldman Sachs. Which would you prefer? Which sounds more democratic? Please realize that taxpayer funded means much more sober; just imagine the amount of nonsense that would disappear from view.

So, finally, whither the banks? Here's Sewell Chan on Laurence J. Kotlikoff's intriguing ideas (intriguing for me since I’ve long said people don’t need banks, they merely need access to their money, which they incidentally are presently losing to those same banks):

Jimmy Stewart Is Dead: Take the Money Out of BanksInstead of checking accounts, people would place money in all-cash mutual funds. Savings accounts would be replaced by short-term funds that make conservative investments. And people could also place money in more adventurous funds that made mortgage loans, or extended lines of credit or played the market in derivatives.

It is a system designed to reduce risk taking by preventing banks from gambling with other people’s money. Depositors now relinquish control when they place money in a bank. The institution decides how to use the money and it keeps the profits — or suffers any losses. Most banks also borrow large sums of money from investors to increase their lending and profits.

Under Mr. Kotlikoff’s model, called “limited purpose banking,” banks would manage families of mutual funds. No more borrowing. No more gambling. Except for office space, computers and furniture, banks could not hold any assets.

“Banks would simply function as middlemen,” Mr. Kotlikoff writes in “Jimmy Stewart Is Dead: Ending the World’s Ongoing Financial Plague With Limited Purpose Banking” (Wiley, 2010). “Hence, banks would never be in a position to fail because of ill-advised financial bets.”

From now on in, it's just a question of catching where the people's moods swing, and how desperate politicians are for their votes. Still, even though we may yet be greatly surprised by the turn of events, holding your breath for your representatives to break up their puppetmasters is not a good idea. Vocally siding with the SEC's Khuzami might be a start though. And if you holler loud and numerous enough, your president may turn on a dime and join you. Hey, it’s nothing personal; it's just politics.

The Bailout Buffet: Why Can't Reform Apply to the Biggest Banks?

by Gretchen Morgenson

Every once in a while, Congress awakens from its lobbyist-induced torpor, realizes that the masses are cranky and sets out to appease them. Such a moment occurred last week when lawmakers finally got the message that Main Street is disgusted with Wall Street and wants them to do something about it. Financial reform, which had been stumbling along, suddenly got traction. Bills and proposals began flying around Capitol Hill, and President Obama chided the bankers in an appearance in New York.

Unfortunately, the leading proposals would do little to cure the epidemic unleashed on American taxpayers by the lords of finance and their bailout partners. The central problem is that neither the Senate nor House bills would chop down big banks to a more manageable and less threatening size. The bills also don’t eliminate the prospect of future bailouts of interconnected and powerful companies.

Too big to fail is alive and well, alas. Indeed, several aspects of the legislative proposals sanction and codify the special status conferred on institutions that are seen as systemically important. Instead of reducing the number of behemoth firms assigned this special status, the bills would encourage smaller companies to grow large and dangerous so that they, too, could have a seat at the bailout buffet.

Here’s an example of this special treatment: Both bills would establish a specific process to resolve big-bank failures. Smaller institutions, by contrast, would be allowed to go bankrupt without a new resolution scheme. This special resolution system is not only unfair; it also sends a pernicious signal to the market about large and intertwined institutions. The message is this: Subject as they will be to a newly codified "resolution authority," these institutions and their investors and lenders can expect to be rescued if they get into trouble.

This perception delivers lucrative advantages to these institutions. The main perquisite is lower borrowing costs, a result of lenders’ assumptions that the giants are less risky because they will be in line for government assistance if they become imperiled. Think Fannie Mae and Freddie Mac. And remember all those folks on Capitol Hill and elsewhere who assured taxpayers that we would never lose a dime on those companies? It is disappointing that none of the current proposals call for breaking up institutions that are now too big or on their way there. Such is the view of Richard W. Fisher, president of the Federal Reserve Bank of Dallas.

"The social costs associated with these big financial institutions are much greater than any benefits they may provide," Mr. Fisher said in an interview last week. "We need to find some international convention to limit their size." Limiting their leverage is another way to begin defanging these monsters, Mr. Fisher said. But he concedes that there is little will to do either. "It takes an enormous amount of political courage to say we are going to limit size and limit leverage," he said. "But to me it makes the ultimate sense. The misuse of leverage is always the root cause of every financial crisis."

The idea for a special resolution authority appears to rest on the belief that large, troubled institutions cannot be allowed to go bankrupt because their collapse will cause other entities to fail. Again, this seems exactly backward. If imperiled banks are too large and interconnected to go through our nation’s time-honored bankruptcy process, then they are too big to exist.

A two-tiered system, where large entities are more equal than others, is also deeply unfair. Smaller banks cannot hope to compete with institutions that have significant cost advantages. "Why should you have a small group of institutions get an advantage simply because they have grown too large?" Mr. Fisher asked. "It’s un-American; it’s not what makes this country great." Indeed, removing the subsidies awarded to big banks would give Main Street lenders — most of which did not bring the financial system to its knees — a chance to win market share.

Mr. Fisher also disputes the view often taken by defenders of the status quo that financial institutions hoping to compete for business in huge global markets must be gigantic. "There are those who say that America has to have the largest financial institutions to be an international player," he said. "But I don’t think that’s a strong argument. Good companies will always find bankers and investors."

Edward Kane, a finance professor at Boston College and an authority on financial institutions and regulators, said that it was not surprising that substantive changes for both groups are not on the table. After all, powerful banks want to maintain their ability to privatize gains and socialize losses. "To understand why defects in insolvency detection and resolution persist, analysts must acknowledge that large financial institutions invest in building and exercising political clout," Mr. Kane writes in an article, titled "Defining and Controlling Systemic Risk," that he is scheduled to present next month at a Federal Reserve conference.

But regulators, eager to avoid being blamed for missteps in oversight, also have an interest in the status quo, Mr. Kane argues. "As in a long-running poker game in which one player (here, the taxpayer) is a perennial and relatively clueless loser," he writes, "other players see little reason to disturb the equilibrium."

It is a shame that Congress is moving forward with financial regulations that do not eliminate the heads-bankers-win, tails-taxpayers-lose mentality that has driven most of the bailouts during this sorry episode. Companies that are too mighty to fail must be broken up. And incentives in the nation’s regulatory system that reward size with subsidies should not be enshrined into law.

They should be eliminated. Only then will America be safe from toxic banking practices and the burdensome rescues they require.

The Sickening Abuse Of Power At The Heart of Wall Street

by Simon Johnson

Here’s where we stand with regard to democratic discourse on the future our financial system: leading bankers will not come out to debate the issues in the open (despite being approached by reputable intermediaries after our polite challenge was issued) – sending instead their “astro turf” proxies to spread KGB-type disinformation.Even Larry Summers, who has shifted publicly onto the side the angels (surprising and rather late, but welcome anyway), cannot – for whatever reason – bring himself to recognize the dangers inherent in our unstable and too-big-to-manage banks. Or perhaps he is just generating excuses that will justify not bringing the Brown-Kaufman amendment to the floor of Senate?

So let’s take it up a notch.

I strongly recommend that the responsible congressional committees request and require all assistant secretaries at the US Treasury (and other relevant political appointees over whom they have jurisdiction) to appear before them early next week.

The question will be simple: Please share your calendar of meetings this weekend, and provide us with a complete accounting of people with whom you met and conversed formally and informally.

The finance ministers and central bank governors of the world are in Washington this weekend for the spring meetings of the International Monetary Fund. As is usual, the world’s megabanks are also in town in force, organizing big meetings and small dinners.

Through these meetings dutifully troop US treasury officials, providing in-depth and off-the-record briefings to investors.

Banks such as JP Morgan Chase and the other top tier financial players thus peddle influence, leverage their access, and generally show off. They accumulate information from a host of official contacts and discern which way policymakers – their “good friends” – are leaning.

And what is the megabank whisper mill working on? Ignore the "economic research" papers these banks put out; that is pure pantomime for clients-to-be-duped-later. I’m talking about what they are telling the market – communicated in specific, personal conversations this weekend.

They are telling people that, based on their inside knowledge, Greece and potentially other eurozone countries will default on their debt. Perhaps they are telling the truth and perhaps they are lying. Most likely they are – as always – talking their book.

But the question is not the substance of their whisper campaign this weekend, it is the flow of information. Have they received material non-public information from US government officials? Show me the calendar of the top 10 treasury people involved, and then we can talk about whom to summon from the private sector to testify – under oath – about what they were told or not told.

There is no question that the megabanks derive great power and enormous profit from their web of official contacts. We should reflect carefully on whether such private flows of information between governments and "too big to fail" banks are entirely suitable in today’s unstable financial world.

Large global banks make money, in part, through nontransparent manipulation of information – this is the heart of the SEC charges against Goldman Sachs. But the problem is much broader: the Wall Street-Washington corridor is alive and well on its way to another crisis that will empower, enrich, and embolden insiders (public and private) while impoverishing the rest of us.

The big players on Wall Street are powerful like never before – and they use this power to press for information and favors from sympathetic (or scared) government officials. The big banks also appear hell-bent on abusing that power. One consequence will be further destabilizing global financial markets – watch carefully what happens to Greece, Portugal, Ireland, and Spain at the beginning of next week.

It is time for Congress to step in with a full investigation of the exact flow of information and advice between our major megabanks and key treasury officials. Start by asking tough questions about exactly who exchanged what kind of specific, material, market-moving information with whom this weekend in Washington.

$1000 says Goldman Sachs can’t win against the SEC

by Barry Ritholtz

I have been watching with a mixture of awe and dismay some of the really bad analysis, sloppy reporting, and just unsupported commentary about the GS case.I put together this list based on what I know as a lawyer, a market observer, a quant and someone with contacts within the SEC. (Note: This represents my opinions, and no one elses).

Ten Things You Don’t Know (or were misinformed by the Media) About the GS Case

1. This is a Weak Case: Actually, no — its a very strong case. Based upon what is in the SEC complaint, parts of the case are a slam dunk. The claim Paulson & Co. were long $200 million dollars when they were actually short is a material misrepresentation — that’s Rule 10b-5, and its a no brainer. The rest is gravy.

2. Robert Khuzami is a bad ass, no-nonsense, thorough, award winning Prosecutor: This guy is the real deal — he busted terrorist rings, broke up the mob, took down security frauds. He is now the director of SEC enforcement. He is fearless, and was awarded the Attorney General’s Exceptional Service Award (1996), for “extraordinary courage and voluntary risk of life in performing an act resulting in direct benefits to the Department of Justice or the nation.”

When you prosecute mass murderers who use guns and bombs and threaten your life, and you kick their asses anyway, you ain’t afraid of a group of billionaire bankers and their spreadsheets. He is the shit. My advice to anyone on Wall Street in his crosshairs: If you are indicted in a case by Khuzami, do yourself a big favor: Settle.

3. Goldman lost $90 million dollars, hence, they are innocent: This is a civil, not a criminal case. Hence, any mens rea — guilty mind — does not matter. Did they or did they not violate the letter of the law? That is all that matters, regardless of what they were thinking — or their P&L.

4. ACA is a victim in this case: Not exactly, they were an active participant in ratings gaming. Look at the back and forth between Paulson’s selection and ACAs management. 55 items in the synthetic CDO were added and removed. Why?

What ACA was doing was gaming the ratings agencies for their investment grade, Triple AAA ratings approval. Their expertise (if you can call it that) was knowing exactly how much junk they could include in the CDO to raise yield, yet still get investment grade from Moody’s or S&P. They are hardly an innocent party in this.

5. This was only one incident: The Market sure as hell doesn’t think so — it whacked 15% off of Goldman’s Market cap. The aggressive SEC posture, the huge reaction from Goldie, and the short term market verdict all suggest there is more coming.

If it were only this one case, and there was nothing else worrisome behind it, GS would have written a check and quietly settled this. Their reaction (some say over-reaction) belies that theory. I suspect this is a tip of the iceberg, with lots more problematic synthetics behind it.

And not just at GS. I suspect the kids over at Deutsche bank, Merrill and Morgan are working furiously to review their various CDOs deals.

6. The Timing of this case is suspect. More coincidental, really. The Wells notice (notification from the SEC they intend to recommend enforcement) was over 8 months ago. The White House is not involved in the timing of the suit itself, it is a lower level staff decision.

7. This is a Complex Case: Again, no. Parts of it are a little more sophisticated than others, but this is a simple case of fraud/misrepresentation. The most difficult part of this case is likely to turn on what is a “material omission.” Paulson’s role in selecting mortgages may or may not be material — that is an issue of fact for a jury to determine. But complex? Not even close.

8. The case looks thin: What we see in the complaint is the bare minimum the prosecutor has to reveal to make their case. What you don’t see are all the emails, depositions, interrogations, phone taps, etc. that the prosecutors know about and GS does not. During the litigation discovery process, this material slowly gets turned over (some is held back if there are other pending investigations into GS).

Going back to who the prosecutor in this case is: His legal reputation is he is very thorough, very precise, meticulous litigator. If he decided to recommend bringing a case against the biggest baddest investment house on Wall Street bank, I assure you he has a major arsenal of additional evidence you don’t know about. Yet.

Typically, at a certain point the lawyers will tell their client that the evidence is overwhelming and advise settling. That is around 6-12 months after the suit has begun.

9. This case is Political: I keep hearing that phrase, due to the SEC party vote. It is incorrect. What that means is the case is not political, it means it has been politicized as a defense tactic. There is a huge difference between the two.

10. I’m not a lawyer, but . . . Then you should not be ignorantly commenting on securities litigation. Why don’t you pour yourself a tall glass of STF up and go sit quietly in the corner.

I have $1,000 against any and all comers that GS does not win — they settle or lose in court. Any takers? My money is already in escrow — waiting for yours to join it. Winnings go to the charity of the winners choice.

44 House Democrats call for criminal investigation of Goldman

by Eric Zimmermann

We reported on Wednesday that 18 House Democrats are calling for a criminal investigation of Goldman Sachs. As of today, that number has more than doubled, reaching 44 lawmakers.You can see the full list of signing members at the website of the Progressive Change Campaign Committee (PCCC), which is organizing a grassroots campaign to get more lawmaker support.

The SEC has of course filed a civil action against Goldman for allegedly selling investmant packages that were designed to fail. The SEC does not have authority to launch a criminal investigation, however, so the letter-signers are urging the Department of Justice to open their own probe.

The effort was spearheaded by Rep. Marcy Kaptur (D-Ohio).

What do both parties have in common? Wall Street donations

by David Lightman

Although painting Republicans as pawns of Wall Street is a cornerstone of the Democratic strategy to overhaul financial regulation, financial interests have given campaign money generously to both political parties for years. "No one party has any firm hold on righteousness here," said David Levinthal, a spokesman for the Center for Responsive Politics, which tracks donations.

In the past two election cycles, when Democrats controlled Congress, the Democrats benefited most. So far in the 2010 cycle, the finance/insurance/real estate sector has given $65.2 million, or 56 percent of its contributions, to Democrats. Republicans have received $51.7 million. People and political committees affiliated with securities and investment banking interests have been particularly kind to Democrats, giving them $21.7 million, or 63 percent of their donations so far. Commercial banks, though, prefer Republicans; they've given GOP hopefuls $4.7 million so far, or 54 percent of their total.

According to the Sunlight Foundation, an independent research group, lobbyists with connections to the financial sector have hosted 10 fundraisers this year for members of the Senate Banking and Agriculture committees - six for Democrats and four for Republicans. The two panels wrote different parts of the financial overhaul bill. None of that has stopped Democrats from insisting that they're the party of Main Street, not Wall Street. "To those still willing to do what is right, to those still willing to help us slam the brakes on Wall Street's joyride, we're ready to work with you," Senate Majority Leader Harry Reid, D-Nev., said at a news conference last week. "If anything, some of us would like further consumer protections that go beyond what is in the bill," added Sen. Charles Schumer, D-N.Y.

Among members of Congress, Schumer so far this cycle has received $3 million from financial interests, more than twice as much as the runner-up, Sen. Kirsten Gillibrand, D-N.Y. Both are up for re-election and are considered heavy favorites. Reid, who has a difficult re-election, is third, at $1.26 million. The three also top the list of recipients of money from the securities and investment banking industry - Schumer at $1.5 million, Gillibrand at $639,450 and Reid at $533,025. Gillibrand leads the list of commercial bank recipients, followed by Rep. Roy Blunt, R-Mo., who's running for the Senate, and Schumer.

Reid raised about $37,000 in January at a New York breakfast set up by Goldman Sachs, the investment firm recently sued by the Securities and Exchange Commission, which alleges civil fraud. Though Reid reportedly was taken to task by executives at the breakfast for harshly criticizing Wall Street, he refused to provide details about the event. Republicans gleefully point the finger back at Democrats. "Democrats have had so many conversations with people in the industry about this legislation," said Senate Republican leader Mitch McConnell of Kentucky.

McConnell and Sen. John Cornyn of Texas, the chairman of the National Republican Senatorial Committee, visited hedge fund investors in New York two weeks ago and raised money at KKR, a private equity firm. The Republican senators said they wanted Wall Street executives to understand their positions better. "Democrats have had no conversations with these people?" McConnell asked.

Levinthal and groups advocating changes to the campaign finance system contend that the flood of money into both parties amounts to "buying long-term influence. They develop relationships and make sure their views are heard." Nonsense, countered industry spokesmen. "I refute it," said Scott Talbott, the chief lobbyist for the Financial Services Roundtable, which represents the nation's largest finance companies, about charges that contributions buy access to lawmakers. "It's not that contributors want anything. You're supporting candidates who understand the industry."

"We give to candidates from both sides of the political aisle, and that's a matter of public record," said Peter Garuccio, a spokesman for the American Bankers Association. The Senate is expected to begin consideration of the financial overhaul bill on Monday. Several factors go into who gets money, including who needs it and who's on key committees. Securities and investment banking interests, for instance, gave more to Republicans in the 1996 to 2004 cycles, when the GOP controlled Congress.

In recent days, critics and journalists have been asking lawmakers to return certain funds, notably those from Goldman Sachs. Most lawmakers find the suggestion ridiculous. "This is our system," Cornyn said. "I think the system needs more transparency, so people can more easily reach their own conclusions. But if you didn't have this system, the alternative would be to have taxpayers fund elections, and I'm not in favor of that."

Rating Agencies Shared Data, and Wall Street Seized on It

by Gretchen Morgenson and Louise Story

One of the mysteries of the financial crisis is how mortgage investments that turned out to be so bad earned credit ratings that made them look so good. One answer is that Wall Street was given access to the formulas behind those magic ratings — and hired away some of the very people who had devised them. In essence, banks started with the answers and worked backward, reverse-engineering top-flight ratings for investments that were, in some cases, riskier than ratings suggested, according to former agency employees.

The major credit rating agencies, Moody’s, Standard & Poor’s and Fitch, drew renewed criticism on Friday on Capitol Hill for failing to warn of the dangers posed by complex investments like the one that has drawn Goldman Sachs into a legal whirlwind. But while the agencies have come under fire before, the extent to which they collaborated with Wall Street banks has drawn less notice.

The rating agencies made public computer models that were used to devise ratings to make the process less secretive. That way, banks and others issuing bonds — companies and states, for instance — wouldn’t be surprised by a weak rating that could make it harder to sell the bonds or that would require them to offer a higher interest rate. But by routinely sharing their models, the agencies in effect gave bankers the tools to tinker with their complicated mortgage deals until the models produced the desired ratings.

"There’s a bit of a Catch-22 here, to be fair to the ratings agencies," said Dan Rosen, a member of Fitch’s academic advisory board and the chief of R2 Financial Technologies in Toronto. "They have to explain how they do things, but that sometimes allowed people to game it." There were other ways that the models used to rate mortgage investments like the controversial Goldman deal, Abacus 2007-AC1, were flawed. Like many in the financial community, the agencies had assumed that home prices were unlikely to decline. They also assumed that complex investments linked to home loans drawn from around the nation were diversified, and thus safer. Both of those assumptions were wrong, and investors the world over lost many billions of dollars.

In that Abacus investment, for instance, 84 percent of the underlying bonds were downgraded within six months. But for Goldman and other banks, a road map to the right ratings wasn’t enough. Analysts from the agencies were hired to help construct the deals. In 2005, for instance, Goldman hired Shin Yukawa, a ratings expert at Fitch, who later worked with the bank’s mortgage unit to devise the Abacus investments. Mr. Yukawa was prominent in the field. In February 2005, as Goldman was putting together some of the first of what would be 25 Abacus investments, he was on a panel moderated by Jonathan M. Egol, a Goldman worker, at a conference in Phoenix.

The next month, Mr. Yukawa joined Goldman, where Mr. Egol was masterminding the Abacus deals. Neither was named in the Securities and Exchange Commission’s lawsuit, nor have the rating agencies been accused of wrongdoing related to Abacus. At Goldman, Mr. Yukawa helped create Abacus 2007-AC1, according to Goldman documents. The safest part of that earned an AAA rating. He worked on other Abacus deals. Mr. Yukawa, who now works at PartnerRe Asset Management, a money management firm in Greenwich, Conn., did not return requests for comment.

Goldman has said it will fight the accusations from the S.E.C., which claims Goldman built the Abacus investment to fall apart so a hedge fund manager, John A. Paulson, could bet against it. And in response to this article, Goldman said it did not improperly influence the ratings process. Chris Atkins, a spokesman for Standard & Poor’s, noted that the agency was not named in the S.E.C.’s complaint. "S.& P. has a long tradition of analytical excellence and integrity," Mr. Atkins said. "We have also learned some important lessons from the recent crisis and have made a number of significant enhancements to increase the transparency, governance and quality of our ratings."

David Weinfurter, a spokesman for Fitch, said via e-mail that rating agencies had once been criticized as opaque, and that Fitch responded by making its models public. He stressed that ratings were ultimately assigned by a committee, not the models. The role of the rating agencies in the crisis came under sharp scrutiny Friday from the Senate’s Permanent Subcommittee on Investigations. Members grilled representatives from Moody’s and Standard & Poor’s about how they rated risky securities. The changes to financial regulation being debated in Washington would put the agencies under increased supervision by the S.E.C.

Carl M. Levin, the Michigan Democrat who heads the Senate panel, said in a statement: "A conveyor belt of high-risk securities, backed by toxic mortgages, got AAA ratings that turned out not to be worth the paper they were printed on." As part of its inquiry, the panel made public 581 pages of e-mail messages and other documents suggesting that executives and analysts at rating agencies embraced new business from Wall Street, even though they recognized they couldn’t properly analyze all of the banks’ products.

The documents also showed that in late 2006, some workers at the agencies were growing worried that their assessments and the models were flawed. They were particularly concerned about models rating collateralized debt obligations like Abacus. According to former employees, the agencies received information about loans from banks and then fed that data into their models. That opened the door for Wall Street to massage some ratings. For example, a top concern of investors was that mortgage deals be underpinned by a variety of loans. Few wanted investments backed by loans from only one part of the country or handled by one mortgage servicer.

But some bankers would simply list a different servicer, even though the bonds were serviced by the same institution, and thus produce a better rating, former agency employees said. Others relabeled parts of collateralized debt obligations in two ways so they would not be recognized by the computer models as being the same, these people said. Banks were also able to get more favorable ratings by adding a small amount of commercial real estate loans to a mix of home loans, thus making the entire pool appear safer.

Sometimes agency employees caught and corrected such entries. Checking them all was difficult, however. "If you dug into it, if you had the time, you would see errors that magically favored the banker," said one former ratings executive, who like other former employees, asked not to be identified, given the controversy surrounding the industry. "If they had the time, they would fix it, but we were so overwhelmed."

Abacus might have had other benefits for Goldman

by Matthew Goldstein

Goldman Sachs Group may have used a subprime mortgage-linked security that is the focus of a U.S. civil fraud lawsuit against the bank to unload other complex bonds it created, according to a deal document obtained by Reuters. Some of the proceeds from the sale of Abacus 2007-AC1 notes were used to buy a $192 million portion of another security that Goldman also arranged and peddled in early 2007. The 196-page prospectus for Abacus reveals that the initial collateral for the deal's so-called funded notes was supposed to include a big chunk of another security underwritten that same year by Goldman Sachs called Greywolf CLO 1.

Goldman arranged and marketed the Greywolf CLO for Greywolf Capital Management, a Purchase, New York, investment management firm founded by a group of former Goldman distressed bond traders. Derivatives consultant Janet Tavakoli said the use of Abacus funds to buy Greywolf assets may have posed a conflict of interest for Goldman. The Greywolf link could prove problematic if institutional buyers were not told Goldman underwrote the Greywolf deal, or did not know that Goldman had relevant information about the quality of the Greywolf portfolio, she said. "Goldman's paw prints were all over this," said Tavakoli. "There is a conflict of interest between investors and underwriters who are putting their own deals into CDOs."

The Abacus prospectus said a copy of the Greywolf CLO prospectus was also provided to prospective investors. But the Greywolf offering document was not attached to the Abacus prospectus obtained by Reuters. The U.S. Securities and Exchange Commission claims Goldman misled institutional investors in the Abacus deal by failing to disclose that hedge fund manager John Paulson was shorting the synthetic collateralized debt obligation and also had help to pick the underlying portfolio of 90 mortgage-backed securities. Goldman has said it did nothing wrong in marketing the Abacus deal and has begun mounting a vigorous defense. The SEC has not raised any allegations about the use of the Abacus proceeds to buy Greywolf CLO assets.

TIMBERWOLF

The Greywolf CLO deal closed on January 18, 2007, roughly four months before Goldman began looking for institutional investors to sink money into Abacus, which tracked the performance of a bundle of mortgage bonds-backed, mostly subprime loans. Greywolf CLO, meanwhile, was a $502 million collateralized loan obligation, a complex bond backed by debts often used to finance corporate buyouts. The deal was one of the first complex securities put together and managed by Greywolf, which later went on to do a $1 billion CDO backed by mostly subprime assets called Timberwolf 1.

The Timberwolf deal also was underwritten by Goldman Sachs. In March 2007, Goldman sold a $300 million slug of the Timberwolf deal to the now-infamous Bear Stearns hedge funds, which was the single biggest investor in the transaction, said people familiar with the now-defunct hedge funds. A week after closing the deal with Bear, Goldman began marking down the value of Timberwolf securities, said people familiar with the situation but who declined to be identified because they still work on Wall Street. Greywolf, which manages about $700 million in assets, is led by Jonathan Savitz, who helped run Goldman's distressed trading desk before leaving to start the firm in 2003. In August, Greywolf lost one of its key employees when partner Greg Mount died. At Goldman, the 44-year-old Mount had helped build the investment firm's CDO business.

The Abacus prospectus does not disclose from whom the $192 million "tranche" of the Greywolf deal was being purchased. The Abacus prospectus said the decision to purchase the Greywolf assets was made by Goldman Sachs Capital Markets, a division of the investment firm. But it is not unusual for an underwriter of a security to retain some of the deal on its balance sheet until it is able to sell it. In fact, Goldman claims it lost more than $90 million on the Abacus deal because it had retained a portion of the notes, some of which were purchased by Germany's IKB Deutsche Industriebank AG.

The Greywolf deal was given a Triple A rating by Moody's Investors Service in February 2007. The Abacus deal also got a Triple A rating from Moody's. But Greywolf fared better. In March 2009, Moody's downgraded the security. But a few months later, the Greywolf deal saw new life when Morgan Stanley repackaged some of its pieces into a new $130 million CLO. By contrast, the Abacus deal was dead by summer 2008. The SEC said institutional investors lost $1 billion on the deal, while Paulson's hedge fund, Paulson & Co, made $1 billion from shorting the transaction. Securities regulators have said there is no indication that anyone from Paulson did anything wrong in the Abacus transaction.

Goldman Sachs Emails: Firm Had 'The Big Short' As Economy Fell

by Shahien Nasiripour

As homeowners were falling behind on their subprime mortgages, wreaking havoc for investors that owned slices of their mortgages in securities peddled by Wall Street, Goldman Sachs was "well positioned," according to internal company emails from top executives.

The firm had "the big short," declared chief financial officer David Viniar -- Goldman Sachs was making money off the souring of the very securities it had peddled to the market.

The internal emails released Saturday by the Senate Permanent Subcommittee on Investigations paint a picture long known by most of the country, yet never before so vividly and explicitly articulated by Goldman officials. (Scroll down to see the full text of the emails.) As early as May 2007, as homeowners were being crushed under the weight of subprime mortgages, the most profitable firm on Wall Street had long taken out a form of insurance on those delinquencies.

The firm made money on the upside -- originating, securitizing and selling subprime mortgage-based securities to investors -- and on the downside, thanks to the insurance. "Bad news," a May 17, 2007, email began from one Goldman employee to another. A security the firm had underwritten and sold had just lost value, costing Goldman about $2.5 million. Further down in the email, the employee, Deeb Salem, wrote "Good news...we own 10mm protection...we make $5mm." The firm made $5 million betting against the very securities it had underwritten and sold.

In a July 25 email that year, Gary Cohn, the firm's chief operating officer, wrote Viniar to update him on the firm's mortgage market activities. The firm lost about $322 million on residential mortgages -- but it made $373 million on its bets against the market, bets that increased in value as the market tanked. About 25 minutes later, Viniar wrote back, "Tells you what might be happening to people who don't have the big short." The firm made $51 million that day.

"There it is, in their own words: Goldman Sachs taking 'the big short' against the mortgage market," subcommittee chairman Sen. Carl Levin (D-Mich.) said in a statement accompanying the release of the internal emails.

"Investment banks such as Goldman Sachs were not simply market-makers, they were self-interested promoters of risky and complicated financial schemes that helped trigger the crisis," Levin said. "They bundled toxic mortgages into complex financial instruments, got the credit rating agencies to label them as AAA securities, and sold them to investors, magnifying and spreading risk throughout the financial system, and all too often betting against the instruments they sold and profiting at the expense of their clients."

Levin's panel points out that in the firm's 2009 annual report, Goldman Sachs stated that the firm "did not generate enormous net revenues by betting against residential related products." "These e-mails show that, in fact, Goldman made a lot of money by betting against the mortgage market," Levin said.

Top Goldman Sachs executives will testify before Levin's panel on Tuesday to answer for their subprime activities. The panel is using the firm as a case study to focus on the role played by investment banks in contributing to the worst financial crisis and economic downturn since the Great Depression.

The nearly 18-month-long investigation has already netted impressive results. The panel exposed the subprime shenanigans at failed lender Washington Mutual, and how lax federal supervision allowed it to become the biggest bank failure in U.S. history, and this week it showed how the major credit rating agencies essentially worked with Wall Street in allowing the firms to peddle AAA-rated securities that had no business ever earning top ratings. That lulled investors into buying what they were told was gold but was really just lead.

Goldman Sachs is under a particularly harsh glare, as its profits have engendered the kind of enmity normally reserved for swindlers. The Securities and Exchange Commission filed charges against the firm April 16 for defrauding investors. Goldman vigorously denies that it did anything wrong.

In a Nov. 17, 2007, email, Goldman's chief executive officer, Lloyd Blankfein, wrote to his top lieutenants in response to an upcoming New York Times story about how the firm had profited off the souring subprime market: "Of course we didn't dodge the mortgage mess. We lost money, then made more than we lost because of shorts."

Blankfein is one of the top executives to be questioned Tuesday by Levin.

In an Oct. 11 email that year, one Goldman employee, reacting to news that Moody's Investors Service had downgraded $32 billion in mortgage-related securities, wrote to a colleague: "Sounds like we will make some serious money." "Yes, we are well positioned," the colleague responded.

Most investors lost money off that downgrade. But Goldman had been shorting the market.

As of November 2007, Goldman had about $2.1 billion worth of long positions in subprime mortgage products, meaning it was betting that those securities would increase in value, according to the firm's 2008 annual filing with the SEC. But in a cautionary note to investors and regulators, the firm also noted that "At any point in time, we may use cash instruments as well as derivatives to manage our long or short risk position in the subprime mortgage market."

See the full emails:

Goldman Sachs Emails

Goldman Insiders Sold Shares As SEC Probed Firm

by Randall Smith

Five senior executives of Goldman Sachs Group Inc., including the firm's co-general counsel, sold $65.4 million worth of stock after the firm received notice of possible fraud charges, which later drove its stock down 13%. Sales by three of the five Goldman insiders occurred at prices higher than the stock's current level. The stock sales by co-general counsel Esta Stecher, vice chairmen Michael Evans and Michael Sherwood, principal accounting officer Sarah Smith and board member John Bryan occurred between October 2009 and February 2010. It was the most active spate of insider selling in three years, according to InsiderScore.com in Princeton, N.J., which tracks and analyzes purchases and sales of stocks by top executives and directors.

Goldman received notice of the possible charges last July, but didn't publicly disclose that fact, later explaining that it didn't consider such a notice material information investors would have needed to value the stock. A week ago, on April 16, the Securities and Exchange Commission filed civil-fraud charges against Goldman for failing to disclose that a short seller, Paulson & Co., participated in selection of assets in a pool tied to subprime mortgages. The charges drove Goldman stock down from a closing price of $184.27 on April 15 to $160.70 on April 16. The stock hasn't recovered any of the first-day loss. It closed out the week at $157.40 in 4 p.m. trading on the New York Stock Exchange.

It isn't clear whether any of the sales could be questioned under insider-trading rules, which bar stock purchases or sales in violation of a duty by investors who have non-public, market moving information. "You've got to have material, nonpublic information that you misappropriate from someone to whom you owe a duty," said John Coffee, a professor at Columbia law school in New York. The Goldman officials could have believed that such a probe was routine or wasn't likely to affect the stock price, he said. And some of them may not have known of the possible charges. The trades are "something that investors look very closely at—are high level insiders selling stock when they have information that the public doesn't have?" said Darren Check, a lawyer in Radnor, Pa., who represents investors in class-action cases against several financial-services giants.

Messrs. Bryan and Sherwood and Ms. Stecher sold some or all of their shares after exercising options to buy at lower prices that would have expired between November 2010 and November 2012. Ms. Smith sold 16,129 shares on Oct. 16 for $3 million at $186.57 a share, according to InsiderScore.com. Mr. Sherwood sold shares between Nov. 13 and 24 for $31.9 million, or $174.65 a share, InsiderScore.com said. Mr. Evans sold shares between Nov. 23 and 27 for $23.7 million, or $169.56 a share. Ms. Stecher sold shares on Feb. 8 and 26 for $5.8 million, or $153.38 a share. And Mr. Bryant sold shares on Feb. 18 for $932,223, or $155.37 a share.

Mr. Sherwood, co-chief executive of Goldman sachs International in London and Mr. Evans, chairman of Goldman Sachs Asia in Hong Kong, are on the Goldman management committee with Ms. Stecher. Ben Silverman, director of research at InsiderScore.com, said the insider selling since October "was the most aggressive" at Goldman in three years, since late 2006 through early 2007. Securities rules require directors, 10% holders and executives with a significant function to report their sales and purchase promptly. Some investors track such transactions as a sign of a company's future prospects.

How Goldman Sachs Screwed Ghana

Goldman Sachs, the global financial institution, with fraud allegations levied against it has a long history of setting up its clients for a fall...and making handsome profits. This is a story of how this global investment banking and securities firm screwed Ghana In 1998, Ashanti Gold was the 3rd largest Gold Mining company in the world. The first "black" company on the London Stock Exchange, Ashanti had just purchased the Geita mine in Tanzania, positioning Ashanti to become even larger. But in May 1999, the Treasury of the United Kingdom decided to sell off 415 tons of its gold reserves. With all that gold flooding the world market, the price of gold began to decline. By August 1999, the price of gold had fallen to $252/ounce, the lowest it had been in 20 years.

Ashanti turned to its Financial Advisors - Goldman Sachs - for advice. Goldman Sachs recommeded that Ashanti purchase enormous hedge contracts - "bets" on the price of gold. Simplifying this somewhat, it was similar to when a homeowner 'locks in' a price for heating oil months in advance. Goldman recommended that Ashanti enter agreements to sell gold at a 'locked-in' price, and suggested that the price of gold would continue to fall. But Goldman was more than just Ashanti's advisors. They were also sellers of these Hedge contracts, and stood to make money simply by selling them. And they were also world-wide sellers of Gold itself.

In September 1999 (one month later), 15 European Banks with whom Goldman had professional relationships made a unanimous surprise announcement that all 15 would stop selling gold on world markets for 5 years. The announcement immediately drove up gold prices to $307/ounce, and by October 6, it had risen to $362/ounce. Ashanti was in trouble. At Goldman's advice, they had bet that gold prices would continue to drop, and had entered into contracts to sell gold at lower prices. These contracts were held by a group of 17 other world banks. Ashanti found themselves being forced to buy gold at high world prices and sell it at the low contract prices to make good on the contracts. The result? In a few weeks time, Ashanti found itself with 570 million dollars worth of losses. It had to beg the 17 banks not to force the execution of the contracts.

Who served as the negotiator for the 17 banks and Ashanti? Goldman Sachs. The same company that designed the contracts for Ashanti (making a profit in their sale). The basic bankruptcy of Ashanti drove its stock price from an all time high of $25 per share to a paltry $4.62 per share. Thousands of investors - your blogger among them - lost their investments almost overnight as Ashanti was declared insolvent. In the end (2003), Ashanti was purchased by their largest African competitor, AngloGold, a British company headquartered in South Africa, who bought them for a song. The Financial Advisors to AngloGold? You guessed it: Goldman Sachs.

The destruction of Ashanti Gold by Goldman Sachs was saturated with fraud and conflicts of interest: Goldman Sachs served as Ashanti's Financial Advisors; profitted form the contracts they designed and marketed for Ashanti; was involved in the manipulation of the gold prices on which the contracts depended; represented Ashanti's creditors when the contracts went bad; and profitted as the Financial Advisors to the company that picked up the Ashanti corpse for pennies on the dollar.

Galleon Probe Turns to Goldman Buffett Deal

by Susan Pulliam

A Goldman Sachs Group Inc. director tipped off a hedge-fund billionaire about a $5 billion investment in Goldman by Warren Buffett's Berkshire Hathaway Inc. before a public announcement of the deal at the height of the 2008 financial crisis, a person close to the situation says.

The revelation marks a significant turn in the government's case against Raj Rajaratnam, the hedge-fund titan at the center of the largest insider-trading case in a generation. Mr. Buffett's investment in Goldman in September 2008 was a watershed moment in the financial crisis. One of the world's savviest investors, Mr. Buffett helped allay fears about the instability of the financial system by backing America's leading investment bank.The new disclosure stems from a government examination into whether the Goldman director, Rajat Gupta, gave inside information to Mr. Rajaratnam. In a court filing March 22, the government alleged that Mr. Rajaratnam or "co-conspirators" traded on non-public information about Goldman. In a filing last week, the government provided more details about the information it alleges Mr. Rajaratnam received, including advance notice about the Buffett transaction with Goldman.

That information came from Mr. Gupta, a person familiar with the matter says. Federal prosecutors notified Mr. Gupta in a letter that they had intercepted phone conversations between him and Mr. Rajaratnam. Mr. Gupta told Goldman last month he wouldn't seek re-election as a director.

Mr. Gupta hasn't been charged in the case, and denies any wrongdoing in the matter. The government's examination of him was first reported last week in The Wall Street Journal. Mr. Rajaratnam, founder of the Galleon Group hedge fund, is fighting criminal insider-trading charges in the case. He declined to comment on any discussions with Mr. Gupta. Goldman also declined to comment.

"Rajat has neither violated any law nor done anything else improper. He has always conducted himself with integrity in his business, philanthropic and personal life," says Mr. Gupta's lawyer, Gary Naftalis. A spokeswoman for the U.S. Attorney's office declined to comment.

The Buffett investment buoyed Goldman's shares. In the days leading up to the deal, the firm's stock had slid more than 40%—to $86 intraday on Sept. 18. By the time the deal was announced, on Sept. 23, its shares surged 45% to $125. On Thursday, Goldman's shares were up 12 cents to $159.05.

The investment, preferred shares in Goldman paying a 10% dividend, has been lucrative for Mr. Buffett: Berkshire has reaped profits totaling $750 million.

In papers filed in a New York federal court late last week, the government disclosed for the first time details about inside information Mr. Rajaratnam allegedly obtained regarding Goldman. Prosecutors said this included non-public information about the Berkshire investment in Goldman in September 2008, as well as Goldman earnings before their release to the public between June and September 2008, a time of market tumult.

Mr. Gupta wasn't mentioned in the filing. A person familiar with the matter says that Mr. Gupta spoke with Mr. Rajaratnam about the non-public data regarding Berkshire. Goldman has made no public disclosures about the U.S. notification received by Mr. Gupta in the insider-trading probe. he firm says Mr. Gupta will remain on as a director until next month, when his term ends. Since 2006, he has received a total of $1.7 million in compensation as a Goldman director. Goldman's in-house lawyers interviewed Mr. Gupta about the matter, and he denied wrongdoing, a person familiar with the matter says.

Mr. Gupta didn't participate in a Goldman board meeting this Monday after the Securities and Exchange Commission charged the firm in a separate civil case with fraud over a derivatives deal it arranged; Goldman denies wrongdoing in the SEC case. Mr. Rajaratnam is one of 21 people who have been charged in the Galleon insider trading case. Of those, 11 have pleaded guilty while Mr. Rajaratnam and former hedge fund consultant, Danielle Chiesi, have vowed to fight the charges.Mr. Gupta was told by prosecutors in a letter that his conversations with Mr. Rajaratnam were intercepted through wiretap recordings by the government of Mr. Rajaratnam's phones. It couldn't be determined whether wiretap recordings include discussion between Mr. Gupta and Mr. Rajaratnam of the Berkshire investment. Such wiretap recordings are at the center of the government's case against Mr. Rajaratnam.

Under the federal statute governing wiretaps by the government, prosecutors send letters to some of the individuals whose conversations are captured in the recordings. Not everyone who turns up on the government's recordings receives such a letter, however, unless the conversation in question is of interest to the government.

In order to bring charges against Mr. Gupta, prosecutors would need to believe that they could prove that Mr. Gupta knowingly provided Mr. Rajaratnam with inside information. Mr. Gupta, 61 years old, and Mr. Rajaratnam were close associates and once had a business partnership together. They met frequently, sometimes several times a month, at Galleon's midtown Manhattan offices, people familiar with the matter say. Mr. Gupta was invited to attend parties hosted by Galleon, one of those people says.

Mr. Gupta was head of consulting firm McKinsey & Co. from 1994 to 2003 and remained at the firm until 2007; he also sits on the board of AMR Corp. and Procter & Gamble Co. There is no indication that trading in shares of either of those companies is being scrutinized by the government. McKinsey, AMR and Procter & Gamble declined to comment.

The exact nature of the conversation between Mr. Gupta and Mr. Rajaratnam couldn't be determined. Goldman declined to comment on when its board was notified about the Buffett transaction.

In the weekend leading up to the 2008 Buffet deal, Goldman Chief Executive Lloyd Blankfein, co-presidents Gary Cohn and Jon Winkelried, Chief Financial Officer David Viniar and others discussed ways to raise capital. They zeroed in on Mr. Buffett. His Goldman broker, Byron Trott, who has since left Goldman, called Mr. Buffett, asking him what it would take to get him to do a deal, says a person close to the situation.

Mr. Buffett responded that he wanted preferred shares with a 10% dividend and warrants. By the time the market closed that day, Sept. 23, 2008, Mr. Buffett's deal had been nailed down.

Goldman, meanwhile, worked the phones to sell an additional $5 billion in common stock to other investors. The two deals—$5 billion from investors and the $5 billion preferred stock investment—from Mr. Buffett were announced that day, helping set the stage for a powerful recovery for both Goldman and the financial world.

Check Out The New Housing Frenzy Our Government Engineered

by Vincent Fernando and Kamelia Angelova

Thanks to the upcoming April 30 expiration of the government's new-home-buyer tax credits, in March the U.S. just experienced the sharpest spikes in new home sales back to 1963. According to the U.S. Census Bureau, new homes sales leaped at an annualized 27% rate in March. You'll see this below, on the right.

It's clearly an abnormally high jump -- welcome to the distorting force of government in markets. People were rushing to buy ahead of the April 30th deadline to qualify for the tax incentives. Thing is, this isn't healthy buying behavior. Given we just came off a housing mania, creating new mini-buying manias seems a bit dangerous. It's kind of like taking shots to cure a hangover.

Number of the Week: 103 Months to Clear Housing Inventory

by Mark Whitehouse

103: The number of months it would take to sell off all the foreclosed homes in banks’ possession, plus all the homes likely to end up there over the next couple years, at the current rate of sales.How much should we worry about a new leg down in the housing market? If the number of foreclosed homes piling up at banks is any indication, there’s ample reason for concern.

As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20% from a year earlier, according to estimates from LPS Applied Analytics. Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That "shadow inventory" was up 30% from a year earlier.

Based on the rate at which banks have been selling those foreclosed homes over the past few months, all that inventory, real and shadow, would take 103 months to unload. That’s nearly nine years. Of course, banks could pick up the pace of sales, but the added supply of distressed homes would weigh heavily on prices — and thus boost their losses.

The government is understandably worried about the situation, and its Home Affordable Modification Program has made an impact by helping people stay in their homes and avoid foreclosure. As people who enter the program catch up on their payments, the number of homeowners 60 or more days delinquent has fallen 9% over the past two months.

Now, though, the effect of modifications could be on the wane. According to Goldman Sachs, HAMP started less than 80,000 trial modifications in March, less than half the number in the peak month of October 2009. At the same time, a growing number of modifications are being canceled as borrowers prove unable to pay. By Goldman’s count, about 68,000 were canceled in March.

All this means that little can stop banks’ inventory of distressed homes from growing. Too many people owe too much more on their homes than they can afford. For the housing market, that could mean a long-lasting hangover.

Inching Toward FDR: President Obama and the Struggle for Financial Reform

by by David Woolner

Over the weekend, President Obama asserted that although there were many causes of the turmoil that ripped through our economy in the past two years, it was first and foremost “caused by failures in the financial industry.” He then suggests that the crisis could have been avoided “if Wall Street firms were more accountable, if financial dealings were more transparent, and if consumers and shareholders were given more information and authority to make decisions.” Interestingly, these goals mirror many of those articulated by FDR when he sought to establish the Securities and Exchange Commission (SEC) in 1934.President Obama also asserts that the reasons we have lost control over the financial industry is due largely to the special interests that “have waged a relentless campaign to thwart even basic, common-sense rules” that would prevent abuse and protect consumers. Thanks to these special interests-best represented by the powerful lobby that represents the financial industry-and the obstructionism of the GOP leadership, whom he accused of waging a “cynical and deceptive attack” against” financial reform, even modest safeguards against the kinds of bad practices that led to this crisis are in jeopardy of being stalled in the Senate.

In taking on his opponents directly, President Obama has inched towards the tactics used by FDR to carry his landmark reforms through Congress. But to date he has avoided using perhaps FDR’s most effective weapon-a direct and hard hitting appeal to the populist anger that had swept the country in the wake of the 1929 crash; a populist anger that is not unlike the mood of the country today.

In FDR’s speech to the 1936 democratic convention, for example, Roosevelt, reflecting on the greed that led to the economic crisis, remarked that

"..it was natural and perhaps human that the privileged princes of these new economic dynasties thirsting for power, reached out for control over government itself. They created a new despotism and wrapped it in the robes of legal sanction. In its service new mercenaries sought to regiment the people, their labor, and their property. And as a result the average man once more confronts the problem that faced the Minute Man."

In another speech given two years later, FDR noted that"Unhappy events abroad have re-taught us two simple truths about the liberty of a democratic people. The first truth is that the liberty of a democracy is not safe if the people tolerate the growth of private power to a point where it becomes stronger than their democratic State itself. That, in its essence, is fascism –ownership of government by an individual, by a group or by any other controlling private power.The second truth is that the liberty of a democracy is not safe if its business system does not provide employment and produce and distribute goods in such a way as to sustain an acceptable standard of living."

It certainly a good thing that President Obama, noting the loss of eight million jobs and the other terrible consequences of the recent financial crisis believes “we have to do everything we can to ensure that no crisis like this ever happens again.” But if we are to ensure this then perhaps we also need to look much more closely at the root causes, which are not merely economic, but also moral, having to do with the nature of democracy itself.As to the desire to be bi-partisan, FDR also once said:

"The true conservative seeks to protect the system of private property and free enterprise by correcting such injustices and inequalities as arise from it. The most serious threat to our institutions comes from those who refuse to face the need for change. Liberalism becomes the protection for the far-sighted conservative."David Woolner is a Senior Fellow and Hyde Park Resident Historian for the Roosevelt Institute.

Financial Reform Freak Outs

by Mike Konczal

Over the weekend, Kevin Drum joined those who have had the "Seriously? This is all we are going to do in response to the largest financial crisis in 80 years!?" freak-out moment. (I’ve had several. Trust me, I’ve had several.)The realization, and I’ve reflected on this a lot, is that we are rebuilding the 2007 financial sector with some additional legal powers for regulators to exercise in the middle-of-the-next financial crisis. I encourage Kevin, when he’s in a safe place, to reflect on it from the point of view of the biggest players, if they had survived.

Over the next few years your major competitors in the regionals are going to be crushed by the wave of CRL losses, while the government is never going to touch your second-lien exposures, furthering that concentration. We’ll see what happens with derivatives, and I am rooting for the Lincoln Bill to survive. Maybe we’ll actually get involved with suing the banks for fraud. There’s still some hope out there. But it’s very likely you’ll look at it all and think things are pretty much ok.

A few additional things:

1) Break up the largest banks in addition to the current bill. Forget feasibility. Once you stand back and realize that structural change is necessary in addition to the prudential regulation stuff, the whole things feels better. It’ll probably lose – but what a good idea to lose on.

Because it is right. The concentration is from non-existent anti-trust law over the past few decades. There’s no advantage to them that anyone can quantify.

2) The new status quo will be even worse. Listen for allusions to the canadian banking sector. It’s a poor analogy, first off. But it also involve an even higher level of, as Steve Randy Waldman horrified me a little over a year ago by pointing out, the largest parts of the financial sector shaking hands with the government in a way that should scare us. What percent of the corporate profits that go to finance look like in 2014?

3) In some ways it’s a very exciting time to be thinking about financial reform. I’m thinking about Dean Baker’s financial transaction tax, Zephyr Teachout’s new financial anti-trust law, Jane D’Arista new financial regulatory infrastructure, Waldman-ian delinking of FDIC insurance, and a ton of other things. So is the Right, thinking through CDS as a resolution mechanism.

We could do all this now, especially a financial transaction tax or a really serious tax on liabilities. But most of this will have to wait until the next financial crisis to come under serious discussion again, but hopefully we’ll be ready this next time, and sadly the doom loop might amplify to the point where we have to take more serious action. I wish we could sail this reform into the sunset, but most of the major players say that a financial crisis every 6-10 years is the new normal.And our last financial crisis was already 2 years ago.

Bank failure Friday: 7 in Illinois, one tied to Obama

by Rolfe Winkler

FDIC may be using up all available hotel rooms in Chicago this weekend as it closes five banks in the city and two others elsewhere in Illinois.But the big news is that one in particular has close ties to the whippersnapper Democratic candidate for IL’s U.S. Senate seat, and peripheral ones to President Obama. The Senate Candidate, Alexi Giannoulias, was an executive at Broadway Bank, owned by his family. While he was there, the bank morphed into an aggressive commercial real estate lender, funding itself primarily with high interest-rate brokered deposits.

Using brokered deposits to expand quickly in CRE is a common recipe for failure ever since the S&L crisis.

Most interesting are the characters that Broadway lent to. The Chicago Tribune reported earlier this month that it had lent $20 million to two known felons … while Giannoulias was a senior loan officer.

It’s a must read story:

Shortly after Broadway began lending money to a Chicago firm the pair formed, Giorango and Stavropoulos used that company to launch their own lending business and make more than 40 short-term loans to borrowers who might not qualify for traditional bank financing, the Tribune found. Such so-called hard-money loans are typically riskier than long-term mortgages offered by banks.Broadway officials say they were unaware of the pair’s lending operation and believe the bank’s loans were used solely to fund real estate purchases. They acknowledged they did not inspect or audit the company’s business records, though Broadway’s loan provisions allowed the bank to do so.

They were lending millions to these guys and they didn’t even know where the money was going?!?In a two-hour interview this week with the Tribune, Giannoulias’ older brother, Demetris Giannoulias, the bank’s president and CEO, said he established Broadway’s relationship with Giorango in the mid-1990s. Giorango began investing in Chicago properties after completing two federal prison stints for running bookmaking schemes….Demetris Giannoulias said the bank learned of Giorango’s bookmaking and prostitution promotion convictions from a spring 2004 Tribune report detailing those cases.

“But we’re a relationship bank,” he said. “So somebody comes in and in all his dealings with the bank seem to be on the level, everything makes sense, nothing seems illicit or untoward. Just because somebody gets a bad article written about them there’s no reason to say, ‘Hey, listen, I’m going to kick you out the door because you don’t win a popularity contest.’ We didn’t think he was doing anything illegal.”

Alexi Giannoulias happens to be an old basketball buddy of the President and his is just the latest seedy story in Chicago politics. He was elected state Treasurer at 29 thanks to an endorsement from then Senate candidate Barack Obama. His only experience had been at Broadway.How did he get elected Treasurer? Because Obama endorsed him. Why did Obama endorse him? Because the Giannoulias family had been big financial supporters for Obama’s Senate campaign (Alexi continued his financial support for presidential candidate Obama).

Another well-known felon also got loans from Broadway: Tony Rezko.

Giannoulias continues to dodge questions about his time at the bank. As I noted in February, he won the Democratic primary despite Broadway having received a rebuke from FDIC just days before the election.

Now that the bank has officially been seized, it will be a tougher topic to avoid. Hopefully Democrats will lean on Giannoulias to quit the race. He has no business being there in the first place.

Is the US Facing a Cash Crunch?

by Gordon T. Long

The US government is caught in a cash vise and is being squeezed between too slow a rebound in tax revenues and the limitations on how quickly it can realistically take its funding requirements to the US Treasury auction. The US Treasury was saved in March by what the government reports as “proprietary receipts.” Those receipts require an explanation that isn’t well publicized since it begs the question of what happens next month without the $117 billion journal entry.

The March cash management numbers from the US Treasury’s Financial Management Service are alarming and in my estimation have become perilous. The economy is simply taking much too long to recover, which is affecting urgently required tax receipts.

If the US Treasury issues even higher debt supply to the market too fast, it threatens driving up interest rates prematurely and thereby elevating already strained government financing costs despite already increased supply. Since the US government has steadily reduced maturity duration over the last few years to obfuscate a growing debt problem, the issue is compounded by the rapidly increasing levels of rollover funding now additionally being required.

It’s a tricky balance between gauging how fast tax receipts will return and what supply the monthly Treasury auction is able to absorb. Cash flow is the primary reason small businesses fail unexpectedly. This is also why sovereign governments fail abruptly.

We witnessed in Greece what happens when investors get nervous. Yields not only spike but typically move to even higher levels than most originally thought possible.

US Treasury Cash Requirements

On April 14 the Financial Management Service, a bureau of the US Department of the Treasury, released its Monthly Treasury Statement for March 2010. I was waiting for it because of what I saw in February: The gap between receipts and outlays was widening disturbingly.

I knew the US Treasury was going to have to pull a rabbit out of a hat, or we might see a similar scare in the US Treasury auction, with a spike in treasury yields that occurred in Greece. What was reported was a mystery and for those that read Extend & Pretend: Gaming the US Tax Payer, I’ll call this Suspicious Clue #8.

Suspicious Clue #8

The report shows US Treasury receipts were down disturbingly and almost all government outlays were up. I personally have had Profit & Loss responsibility on numerous occasions during my career and I would have been apprehensive facing the auditors or board of directors with such a blatant example of mismanagement. Absolutely no cuts in expenses, with falling revenues, all made to marginally appear better than the February report by a single line item called “other.” Executives get fired for such a report but governments just carry on until the inevitable crisis event finally occurs. Then the traditional blame game begins, blame is assigned and belated and poorly formulated policy responses are enacted.So what is this “other”? When you examine the Outlay Ledger of the Department of the Treasury for March 2010 (below), you see it to be a one-time item classified as a negative outlay. For the non accountants, this is a government receipt that is placed in the outlays as a negative amount, thereby showing government outlays to be smaller than they otherwise would have been. Though this is acceptable accounting, it would lead to the wrong conclusions, unless you read the details buried in the back pages. This “other” is referred to as a “Proprietary Receipt from the Public.”