"Photographer at Old Orchard House, Old Orchard, Maine"

Ilargi: Some things are more equal than others. Always have been. Just maybe not always the same things. Which makes me think of Marie-Antoinette fleeing the cake-eaters in her stagecoach. It also makes me think of this:

If this well keeps leaking for three or four months, it's Katie bar the door[Stuart] Smith, [a lawyer in New Orleans, who's suing BP] on behalf of fishermen, the Louisiana Environmental Action Network and four large hotels, alleges that BP and others were "grossly negligent" in allowing the blowout to occur. [..] Because the spill has been lingering offshore, the plaintiffs who can claim damages so far are mostly out-of-work fishermen and tourist resorts that are getting cancellations. As rich as BP is, "if this well keeps leaking for three or four months, it's Katie bar the door," Smith said. "I don't think they have enough money."

BP has been shown off late to be a crummy crappy sort of organization, which -with the full faith and credit of the UK and US government- has cut all corners it could find, and then made some more to cut. And now BP has been exposed, and people like Mr. Smith are dead-set to make BP pay, while the company itself is frantically trying to mitigaste its losses through lawyers it couldn't even really afford anymore if it were to pay full damages to all parties.

Which in turn makes my warped brain wonder what the difference is between BP and, say, Goldman Sachs. Environmental disaster, financial disaster, what’s the difference? Is it just that the latter is harder to prove? I don’t know, for one thing you’d think the reward, hence the incentive, would be greater too. Yes, BP has destroyed the livelihood of fishermen and "hospitality workers". So they should be sued for that. But the Wall Street cabal has destroyed the entire economies of entire countries, as well as countless building blocks that formed the foundation of these economies. Towns, pension funds, you name it. No matter how bad Deepwater Horizon will turn out to be, the Vampire Squid disaster will be many times worse, even if it takes longer for it to trickle down to people's conscious brains.

So why is no-one, 2-3 years after the economy started collapsing, suing the Squid? Why does it instead receive ever more funds from the very people it financially strangled? Isn't that the oddest thing, if you think about it? Of course, the fact that there's trillions of public funds now stashed away in Wall Street firms, without which they'd no longer exist, complicates the matter enormously. As a lawyer, you could potentially win huge settlements for your clients, but they’d sort of end up paying for them out of their own pockets.

We've been through California, which elects to let its poor rot so it can continue to support its rich. New York State intends to lay off -another- 10,000 employees. Illinois owes billions it doesn't have. Idaho delays Medicaid payments. All these sudden bursts of creativity, what a spectacle it is. Harrisburg, PA Controller Dan Miller advises the city to declare bankruptcy. I would advise an additional 10,000 US cities to do the same. At least when you’re first in line, you may get some help. This time next year there'll be a long waiting list. That is, unless Obama et al figure out another mirror trick, and saw the lady in half yet one more time. But I wouldn't be stoo ure the lady hasn't gotten tired of that act yet.

Those 10,000 US cities, and all the counties and states they find themselves in, are -all but a precious few- at the end of their financial rope. All but a few have voted in ridiculously rosy budgets, and now they see their revenues tank. Some will install sneaky speed traps to increase revenues, others will try to raise property taxes on homes plunging in value. All will fail to restore a sound budget. Millions of government workers will be laid off nationwide, which all by itself guarantees further declines in revenue. Which will lead to more lay-offs, all of which will lead to further drops in real estate prices, which lowers tax revenues etc. You have to admit one thing: it's not a terribly hard storyline to follow. It couldn't be easier if you had seen this film before.

Obama's mortgage modification programs are slumping along, getting more tragically laughable as they go forward. All they are and ever were is a backdoor to transfer money to banks. The rate at which they've helped any real persons is too low to speak of. And of course those things could never have worked. You have one arm of government spending citizens' funds to prop up home prices, and another arm trying to firmly lock those same citizens into loans at those artificially elevated levels, and yet another shifting the bad loans from private lenders to the "public domain". It may all rinse, but it will soon no longer repeat.

The US Treasury announces a $1.6 billion loss on a loan to Chrysler, GM announces an $865 million creative accounting profit because it wants investors (who’ll be sure taxpayers' dough will support them all), and Obama announces a commission that will investigate how the Gulf of Mexico became one huge dead zone.

The President should have a commission investigate how the whole country became one. A financial dead zone.

Instead he insists it just ain’t so. Yeah, that’s right, just like BP does.

Limitless oil and limitless credit are but different manifestations of what makes systems work, and eventually, inevitably, kills them.

Katie bar the door indeed.

A Deflationary Red Flag In The U.S. Dollar

by TPC

If the chart below doesn’t grab your attention then few things will. In my opinion, the performance of the dollar is the surest evidence of the kind of environment we’re currently in. The surging dollar is a clear sign that inflation is not the concern of global investors. This is almost a sure sign that deflation is once again gripping the global economy and should be setting off red flags for equity investors around the world.The recent action in the dollar is eerily reminiscent of the peak worries in the credit crisis when deflation appeared to be taking a death grip on the global economy and demand for dollars was extremely high. The recent 16% rally in the dollar is a sign that investors are once again worried about the continuing problem of debt around the world and they’re reaching for the safety of the world’s reserve currency – the dollar. As asset prices decline and bond yields collapse this is a clear sign that inflation is not the near-term concern, but rather that the debt based deflationary trends continue to dominate global economic trends.

This is exactly the kind of market action we saw leading up to Lehman Brothers. In 2008 the dollar rallied as signs of deflation began to sprout up. This was an instant red flag for anyone who understood the deflationary forces at work (and a total surprise for the inflationistas). The dollar ultimately rallied 26% from peak to trough. Coincidentally, the dollar had rallied 16% from trough to peak just prior to the Lehman collapse when the dollar surge accelerated.

Of course, the inflationistas will argue that gold is rising in anticipation of inflation. In my opinion, this is incorrect. First of all, if inflation were a major global concern the Goldman Sachs Commodity Index wouldn’t be almost 65% off its all-time high and just 33% above its 2009 low. Second, and perhaps most importantly, bond yields around the globe wouldn’t be plummeting if there were rampant inflationary fears. For a much more detailed analysis on the reasons why inflation is not a near-term concern please see here.

As for the gold rally, I think it’s clear gold is rallying in anticipation of its potential to become a future reserve currency. The potential demise of the Euro has become a rally cry for inflationistas who don’t understand that the Euro is in fact another single currency system (like the gold standard) which is destined to fail. In the near-term, the rise in gold is likely justified as fear mongering and misguided governments increase demand for the yellow metal. Ultimately, I believe investors will realize that there is little to no inflation in the global economy and that the non-convertible floating exchange systems (such as the USD and JPY) are fundamentally different from the flawed currency system in place in Europe.

Debt deflation continues to plague the global economy. Thus far, policymakers have been unable to fend off this wretched beast and I attribute this largely to the widespread misconceptions regarding our monetary systems. This extends to the very highest levels of government and the misconceptions regarding the EMU, the Euro and the vast differences in their monetary system have only exacerbated the problems and are likely to further worsen the global deflationary threat. The ignorance on display here borders on criminal in my opinion as governments impose harsh injustices on their citizens due entirely to their own lack of understanding.

I’ve mentioned repeatedly over the course of the last 18 months that government responses to the credit crisis were misguided and unlikely to resolve the structural problems. I’ve also mentioned that this was something I have sincerely hoped I would be wrong about as the consequences have the potential to be enormously destructive. Unfortunately, the policy responses have been so tragically misguided that I now believe the global economy is on the cusp of a potential double dip. And as Richard Koo says, the second dip has the potential to be far worse than the first because investor confidence is shattered (which is clearly the case on the back of the recent market crash). Policymakers are doing little to rectify confidence and have in fact, through their ignorance of the way in which our monetary system actually functions, only increased the global risks in the economy. The dollar is the surest sign of the lack of faith in the policy response and an enormous red flag for risk markets. Allocate accordingly.

PS - There is a video going around called “Melt-up” and it is receiving a HUGE amount of attention on the internet. It is regarding the recent melt-up in stocks and how the U.S. is about to enter an inflationary spiral and a currency collapse. I would recommend to the good readers here at TPC to ignore this video. It is 100% factually incorrect (well, more like 75%) and full of the same fear mongering misconceptions that fuel the asset destroying portfolio strategies of well known inflationistas (we all know the names). Videos like these are based on the same misconceptions regarding the monetary system that have actually led to the current debacle. Positioning yourself for hyperinflation and a U.S. dollar collapse has been a recipe for disaster and will continue to be a recipe for disaster as debt deflation remains the single greatest risk to the global economy.

Now This Is A Deflationary Collapse

by Joe Weisenthal and Kamelia Angelova - Business Insider

Dr. Copper's prognoses for the world economy is very grim. Even as the market managed to produce some gains, the bellwether metal got crushed today, and over the last month its taken a monster loss. How come? Well, growth fears, a surging dollar, and perhaps a real slowdown in China to name a few things. A return to recession in Europe isn't helping much.

Deflation Is The Primary Trend

by David Rosenberg - Gluskin Shef

- Credit is contracting.

- Wage rates are stagnating.

- Money supply growth is vanishing

- The U.S.dollar is strong.

- Commodities have peaked.

- U.S. home prices are rolling over...again.

- Lumber prices tumbling (down nearly 17% from April 2010 highs)

- Wal-Mart is cutting prices on 10,000 items.

- Home Depot just cut prices on flowers, fertilizers, lawn equipment and outdoor furniture.

- TacoBell is offering two dollar combo meals.

- The April U.S. retail sales report hinted at deflation in groceries, electronics, apparel and sporting goods.

Given all these, the U.S . bond market looks poised to outperform. Nuff said.

The Small Business Credit Crunch

by Meredith Whitney - Wall Street Journal

The next several weeks will be critically important for politicians, regulators and the larger U.S. economy. First, over the next week Capitol Hill will decide on potentially game-changing regulatory reform that could result in the unintended consequences of restricting credit and further damaging small businesses. Second, states will approach their June fiscal year-ends and, as a result of staggering budget gaps, soon announce austerity measures that by my estimates will cost between one million to two million jobs for state and local government workers over the next 12 months.

Typically, government hiring provides a nice tailwind at this point in an economic recovery. Governments have employed this tool through most downturns since 1955, so much so that state and local government jobs have ballooned to 15% of total U.S. employment.

However, over the next 12 months, disappearing state and local government jobs will prove to be a meaningful headwind to an already fragile economic recovery. This is simply how the math shakes out. Collectively, over 40 states face hundreds of billions of dollars in budget gaps over the next two years, and 49 states are constitutionally required to balance their accounts annually. States will raise taxes, but higher taxes alone will not be enough to make up for the vast shortfall in state budgets. Accordingly, 42 states and the District of Columbia have already articulated plans to cut government jobs.

So the burden on the private sector to create jobs becomes that much more crucial. Just to maintain a steady level of unemployment, the private sector will have to create one million to two million jobs to offset government job losses.

Herein lies the challenge: Small businesses, half of the private sector (and the most important part as far as jobs are concerned), have been heavily impacted by this credit crisis. Small businesses created 64% of new jobs over the past 15 years, but they have cut five million jobs since the onset of this credit crisis. Large businesses, by comparison, have shed three million jobs in the past two years.

Small businesses continue to struggle to gain access to credit and cannot hire in this environment. Thus, the full weight of job creation falls upon large businesses. It would take large businesses rehiring 100% of the three million workers laid off over the past two years to make a substantial change in jobless numbers. Given the productivity gains enjoyed recently, it is improbable that anything near this will occur.

Unless real focus is afforded to re-engaging small businesses in this country, we will have a tragic and dangerous unemployment level for an extended period of time. Small businesses fund themselves exactly the way consumers do, with credit cards and home equity lines. Over the past two years, more than $1.5 trillion in credit-card lines have been cut, and those cuts are increasing by the day. Due to dramatic declines in home values, home-equity lines as a funding option are effectively off the table. Proposed regulatory reform—specifically interest-rate caps and interchange fees—will merely exacerbate the cycle of credit contraction plaguing small businesses.

If banks are not allowed to effectively price for risk, they will not take the risk. Right now we need banks, and particularly community banks, more than ever to step in and provide liquidity to small businesses. Interest-rate caps and interchange fees will more likely drive consumer credit out of the market and many community banks out of business.

Clearly, the issue of recharging the securitization market as an alternative source of liquidity is one that needs to be addressed over time, but politicians should not force rash regulatory reforms when significant portions of our economy remain fragile. The very actions designed to "protect" the consumer, such as rate caps and interchange fees, will undoubtedly take more credit away from the consumer.

It is important now to support any and all lending activities that would enable small businesses to begin hiring again. If the regulatory reform passes with rate-cap and interchange regulation amendments incorporated, small businesses will be hurt rather than helped. Politicians and regulators need to appreciate the core structural challenges facing unemployment in the U.S. Elected officials know better than most that an employed voter is better than an unemployed voter. They should improve their odds of re-election and do the right thing on regulatory reform.

Gerald Celente: The greatest bank robbery in world history

The turmoil that has stricken Greece has spread to Romania and Ireland. This crisis may be spreading worldwide as the debt crisis continues, there have been reports that it may spread to Japan, one of the biggest economies in the world. Gerald Celente says that this is the greatest bank robbery in history and it is the banks that are doing the stealing.

China stocks slide 5% as retail investors flee

by Lu Jianxin and Edmund Klamann - Reuters

China's key stock index tumbled more than 5 percent on Monday to its lowest close in a year, led by property stocks, as retail investors fled the market after a month-long rout sparked by the government's severe clampdown on surging property prices. The Shanghai Composite Index .SSEC closed at 2,559.9 points, its lowest close since May 4, 2009, and posted its biggest one-day percentage drop in more than eight months as panic selling emerged in the afternoon. The index has dropped nearly 20 percent in about a month.

"If you look at the thin volume of the market, you know that much of the fall in the index is not based on reality," said Wu Xiong, senior trader at Rosefinch Investment, a private equity fund. "It's a psychological problem that has long plagued China's stock market: Retail investors stay in the market only for quick profits."

While the day's volume of 88 billion yuan ($12.89 billion) was up from Friday's 82 billion yuan, it was the third-lowest turnover figure in two months, suggesting an exodus by retail investors, who traditionally account for more than two-thirds of market turnover. Losing Shanghai A shares overwhelmed gainers by 887 to 18. Wu and several other traders said the index should have the potential to rebound at any time as market fundamentals, including China's economy and corporate earnings, had not changed much over the past several weeks despite the market slump.

Shanghai has been one of the world's worst-performing major stock markets this year, with a 22 percent slide in the same league as the nearly 25 percent loss in the key Athens index .ATG and Madrid's .IBEX 22 percent decline. Analysts were unwilling to predict where the index may find support, however, given the panic that had set in among investors and a lack of positive news for the market.

Property stocks bore the brunt of the market's downtrend again on Monday, with Gemdale Corp, one of the day's top-10 shares by traded volume, falling 8.4 percent while sector heavyweight China Vanke dropped 5.3 percent. Chinese Premier Wen Jiabao said recently that China should keep housing prices from rising excessively, the Xinhua news agency reported over the weekend, signalling that Beijing's campaign against property speculation is not over.

Haitong Securities analyst Zhang Qi said the market had become starved of funds in recent weeks as retail investors saw poor prospects for making quick profits from stock trading. Zheng Weigang, head of investment at Shanghai Securities, added: "There was panic selling from retail investors, whose confidence has been battered by the recent market slump."

The Extreme Frustration Of Unemployed Americans

by Michael Snyder

When Barack Obama visited Buffalo recently, he was greeted by a billboard advertisement with a very pointed message about unemployment. In just a few words it summarized the frustrations of an entire region. The billboard along I-190 had this very simple message for Obama: "Dear Mr. President, I need a freakin job. Period. Sincerely, inafj.org." As word about this billboard got out, it quickly made headlines all over the United States.

Why? Well, the truth is that millions of hard working Americans are extremely frustrated about their lack of work right now. When you don't have a job and you can't provide for your family, very little else seems to matter. In fact, according to a recent Gallup poll, unemployment is now the second most important issue to American voters. The number one issue is the economy.

The reality is that the American people don't want excuses. They want jobs. And some are getting so desperate that they are even putting up billboards to express their frustrations.

So who sponsored the billboard in Buffalo? Well, it was actually sponsored by a group organized by Buffalo businessman Jeff Baker. It turns out that Baker lost his own small business 15 months ago. His business had employed 25 people, and when he was forced to close it he described it as "the most heartbreaking situation" of his entire life.Baker's group, INAFJ ("I Need A Freakin Job"), says that they are not about playing politics. What they want is only one thing.

Jobs.

They want someone to put the American people back to work. Baker recently explained it this way....

"Nothing else matters unless the American people are working."

In some areas of the United States, the situation is beyond desperate. Detroit is a great example of this. Not only does the city resemble a war zone at this point, but Detroit's mayor says that the unemployment rate in his city is somewhere around 50 percent.

So how in the world is a major city supposed to function when 40 to 50 percent of the people living there can't get the work that they need?

The sad thing is that Detroit used to be one of the most prosperous areas in the United States. Once upon a time, the auto industry was booming and there were lots of great jobs available for blue collar workers.

But that all seems so far away now.

For decades, the politicians in Washington D.C. have allowed (or even encouraged) the offshoring of our manufacturing jobs, and now we are a nation with a dwindling manufacturing base that is rapidly bleeding cash.

In fact, the U.S. trade deficit widened for the second consecutive month in March to its highest level since December 2008. Every single month we buy much more from the rest of the world than they buy from us. That means that wealth is constantly flowing out of this nation, and no end to the bleeding is in sight.

The truth is that America's twin deficits (the trade deficit and the massive U.S. government budget deficit) are absolutely destroying the financial condition of this nation. For years and years economists have warned that these deficits would bring about a day of reckoning at some point, and now that day is here.

We are told by the media that we have entered an economic recovery, but with tens of millions of Americans not able to get the work that they need, most people are not convinced. In fact, a new poll shows that 76 percent of Americans believe that the U.S. economy is still in a recession.

But this is nothing compared to what is coming. The truth is that the United States is rapidly becoming a service economy. Service jobs pay less than manufacturing jobs do, and the rapid advance of technology in recent decades has made human labor increasingly unnecessary. That means that the "system" does not need our labor as much as it once did.

This is leading to a situation where there is a widening gap between the "haves" and the "have nots". In fact, the bottom 40 percent of those living in the United States now collectively own less than 1 percent of the nation’s wealth. But not everyone has been hurting during this financial crisis. Did you know that the number of millionaires in the United States rose 16 percent to 7.8 million in 2009?

Not only that, but an analysis of income-tax data by the Congressional Budget Office a few years ago found that the top 1% of households in the United States own nearly twice as much of the corporate wealth as they did just 15 years ago.The elite are getting richer, while at the same time tens of millions of other Americans are finding it increasingly more difficult to survive.That is why groups like INAFJ are becoming so popular. They are tapping into the frustration of the growing number of Americans who are desperately trying to make it from month to month. The following is a short video that INAFJ posted on YouTube about their organization....

So do have a story of economic frustration that you would like to share with the world?

Have you found yourself working harder and harder for less and less?

Does it seem like you come up short at the end of every month no matter how hard you try?

The Revenue Limits of Tax and Spend

by David Ranson - Wall Street Journal

Whether rates are high or low, evidence shows our tax system won't collect more than 20% of GDP

The Greeks have always been trendsetters for the West. Washington has repudiated two centuries of U.S. fiscal prudence as prescribed by the Founding Fathers in favor of the modern Greek model of debt, dependency, devaluation and default. Prospects for restraining runaway U.S. debt are even poorer than they appear.

U.S. fiscal policy has been going in the wrong direction for a very long time. But this year the U.S. government declined to lay out any plan to balance its budget ever again. Based on President Obama's fiscal 2011 budget, the Congressional Budget Office (CBO) estimates a deficit that starts at 10.3% of GDP in 2010. It is projected to narrow as the economy recovers but will still be 5.6% in 2020. As a result the net national debt (debt held by the public) will more than double to 90% by 2020 from 40% in 2008. The current Greek deficit is now thought to be 13.6% of a far smaller GDP. Unlike ours, the Greek insolvency is not too large for an international rescue.

As sobering as the U.S. debt estimates are, they are incomplete and optimistic. They do not include deficit spending resulting from the new health-insurance legislation. The revenue numbers rely on increased tax rates beginning next year resulting from the scheduled expiration of the Bush tax cuts. And, as usual, they ignore the unfunded liabilities of social insurance programs, even though these benefits are officially recognized as "mandatory spending" when the time comes to pay them out.

The feds assume a relationship between the economy and tax revenue that is divorced from reality. Six decades of history have established one far-reaching fact that needs to be built into fiscal calculations: Increases in federal tax rates, particularly if targeted at the higher brackets, produce no additional revenue. For politicians this is truly an inconvenient truth.

The nearby chart shows how tax revenue has grown over the past eight decades along with the size of the economy. It illustrates the empirical relationship first introduced on this page 20 years ago by the Hoover Institution's W. Kurt Hauser—a close proportionality between revenue and GDP since World War II, despite big changes in marginal tax rates in both directions. "Hauser's Law," as I call this formula, reveals a kind of capacity ceiling for federal tax receipts at about 19% of GDP.

What's the origin of this limit beyond which it is impossible to extract any more revenue from tax payers? The tax base is not something that the government can kick around at will. It represents a living economic system that makes its own collective choices. In a tax code of 70,000 pages there are innumerable ways for high-income earners to seek out and use ambiguities and loopholes.

The more they are incentivized to make an effort to game the system, the less the federal government will get to collect. That would explain why, as Mr. Hauser has shown, conventional methods of forecasting tax receipts from increases in future tax rates are prone to over-predict revenue. For budget planning it's wiser and safer to assume that tax receipts will remain at a historically realistic ratio to GDP no matter how tax rates are manipulated. That leads me to conclude that current projections of federal revenue are, once again, unrealistically high.

Like other empirical "laws," Hauser's Law predicts within a range of approximation. Changes in marginal tax rates do not make a perceptible difference to the ratio of revenue to GDP, but recessions do. When GDP falls relative to its potential, tax revenue falls even more. History shows that, in an economy with no "output gap" between GDP and potential GDP, a ratio of federal revenue to GDP of no more than 18.3% would be realistic.

In this form, Hauser's Law provides a simple basis for testing the validity of any government's revenue projections. Today, since the economy already suffers from a large output gap that is expected to take many years to close, 18.3% must be a realistic upper limit on the ratio of budget revenues to GDP for years to come. Any major tax increase will reduce GDP and therefore revenues too.

But CBO projections based on the current budget show this ratio reaching 18.3% as early as 2013 and rising to 19.6% in 2020. Such numbers implicitly assume that the U.S. labor market will get back to sustainable "full employment" by 2013 and that GDP will exceed its potential thereafter. Not likely. When the projections are tempered by the constraints of Hauser's Law, it's clear that deficit spending will grow faster than the official estimates show.

Freddie and Fannie won't pay down your mortgage

by Tami Luhby - CNN

Pressure is mounting on loan servicers and investors to reduce troubled homeowners' loan balances...but the two largest owners of mortgages aren't getting the message. Fannie Mae and Freddie Mac, which are controlled by the federal government, do not lower the principal on the loans they back, instead opting for interest rate reductions and term extensions when modifying loans.

But their stance is out of synch with the Obama administration, which is seeking to expand the use of principal writedowns. In late March, it announced servicers will be required to consider lowering balances in loan modifications. And just who would tell Fannie and Freddie to start allowing principal reductions? The Obama administration. Asked whether they will implement balance reductions, the companies and their regulator declined to comment. The Treasury Department also declined to comment.

What's holding them back is the companies' mandate to conserve their assets and limit their need for taxpayer-funded cash infusions, experts said. If Fannie and Freddie lower homeowners' loan balances, they are locking in losses because they have to write down the value of those mortgages. Essentially, that means using tax dollars to pay people's mortgages. The housing crisis has already wreaked havoc on the pair's balance sheets. Between them, they have received $127 billion -- and recently requested another $19 billion -- from the Treasury Department since they were placed into conservatorship in September 2008, at the height of the financial crisis.

Housing experts, however, say it's time for Fannie and Freddie to start reducing principal. Treasury and the companies have already set aside $75 billion for foreclosure prevention, which can be spent on interest-rate reductions or principal write downs. "Treasury has to bite the bullet and get Fannie and Freddie to participate," said Alan White, a law professor at Valparaiso University. "It's all Treasury money one way or the other."

Though servicers are loathe to lower loan balances, a growing chorus of experts and advocates say it's the best way to stem the foreclosure crisis. Homeowners are more likely to walk away if they owe far more than the home is worth, regardless of whether the monthly payment is affordable. Nearly one in four borrowers in the U.S. are currently underwater. "Principal reduction in the long run will lower the risk of redefault," said Vishwanath Tirupattur, a Morgan Stanley managing director and co-author of the firm's monthly report on the U.S. housing market. "It's the right thing to do."

Meanwhile, a growing number of loans backed by Fannie and Freddie are falling into default. Their delinquency rates are rising even faster than those of subprime mortgages as the weak economy takes its toll on more credit-worthy homeowners. Fannie's default rate jumped to 5.47% at the end of March, up from 3.15% a year earlier, while Freddie's rose to 4.13%, up from 2.41%. On top of that, the redefault rates on their modified loans are far worse than on those held by banks, according to federal regulators.

Some 59.5% of Fannie's loans and 57.3% of Freddie's loans were in default a year after modification, compared to 40% of bank-portfolio mortgages, according to a joint report from the Office of Thrift Supervision and Office of the Comptroller of the Currency. This is part because banks are reducing the principal on their own loans, experts said. So, advocates argue, lowering loan balances now can actually save the companies -- and taxpayers -- money later. "It can be a financial benefit to Fannie Mae and Freddie Mac and the taxpayer," said Edward Pinto, who was chief credit officer for Fannie in the late 1980s.

What might force the companies' hand is another Obama administration foreclosure prevention plan called the Hardest Hit Fund, which has charged 10 states to come up with innovative ways to help the unemployed and underwater. Four states have proposed using their share of the $2.1 billion fund to pay off up to $50,000 of underwater homeowners' balances, but only if loan servicers and investors -- including Fannie and Freddie -- agree to match the writedowns. State officials are currently in negotiations with the pair. "We remain optimistic that we can get a commitment from Fannie, Freddie and the banks to contribute to this strategy," said David Westcott, director of homeownership programs for the Florida Housing Finance Corp., which is spearheading the state's proposal.

Euro Zone Likes a Weaker Currency, Up to a Point

by Jack Ewing - New York Times

In Europe, businesses are generally giddy to see the euro fall and exports rise. But the currency’s plunge in recent days is starting to make the Continent nervous. After falling to an 18-month low relative to the dollar last week, the euro declined again early Monday, falling at one point to a new four-year low. For exporters like the German carmaker Daimler, the decline has been a boon. Sales of its Mercedes-Benz models surged 22 percent in the United States during the first four months of the year, and those sales in dollars are worth 15 percent more when converted to euros than they would have been at the beginning of the year.

But the volatility of the euro — sliding more than 8 percent in the last month — is unnerving managers at factories across the Continent, even at Daimler in Stuttgart. More than anything at this point, Europe longs for stability. And business people worry that the euro sell-off reflects a broader loss of faith in the common currency. "The volatility can really create a lot of problems," said Olaf Wortmann, a business-cycle specialist at the German Engineering Federation, a manufacturers’ association. Sharp currency swings complicate contracts with foreign suppliers and upset investment plans, he said.

"A cheaper euro helps us in certain markets," agreed Christoph Liedtke, a spokesman for SAP, a maker of business software based in Walldorf, Germany. But, he said, "We have a strong interest in a stable currency. The stronger the currency fluctuations, the more difficult it is for all companies." The euro’s decline accelerated last week after European Union leaders agreed on a nearly $1 trillion aid package intended to guarantee that Greece, Spain and other countries could pay their debts. The European Central Bank also began buying government and corporate debt to prevent a market freeze. The moves were unprecedented.

Businesses generally applauded the huge commitment to stabilize the euro area, and stocks ended the week higher. But after a brief rally last Monday morning, the euro began moving in the opposite direction. Investors are concerned that the central bank’s relentless focus on price stability is now in question, analysts said. Investors were also shaken by the abrupt reversal in policy. On Thursday, the president of the European Central Bank, Jean-Claude Trichet, had insisted that its governing council not even discuss bond purchases.

"They have lost credibility because they are now acting against their own talk from before," said Jürgen von Hagen, a professor of economics at the University of Bonn. Faced with the need to supply cash to European banks, the central bank will have to keep its benchmark interest rate at 1 percent for the foreseeable future, said Jörg Krämer, chief economist at Commerzbank in Frankfurt.

The Federal Reserve is likely to begin raising interest rates sooner than the European Central Bank, Mr. Krämer said, making it more attractive for investors to hold assets in dollars. He predicts that inflation will rise to an annual rate of 3 or 4 percent in coming years, rather than the official target of about 2 percent. Mr. Trichet insists that the central bank will never deviate from its mandate to preserve price stability. "Those who believe — or even worse, are suggesting — that we will tolerate inflation in the future are making a grave error," he told the German magazine Der Spiegel.

The euro, which was trading around $1.25 on Friday, is still above "purchasing power parity," the point at which the currencies are aligned with how much they buy in the real world. The fair value of the euro is about $1.20, analysts say. If the euro settles at something close to parity, businesses will be happy. But experience shows that rarely happens. "The exchange rates always over- or undershoot," said Mr. Wortmann of the Engineering Federation. "We wouldn’t be happy about an undervalued euro."

To be sure, a big euro devaluation would be good for some of the countries that have the most serious problems. Besides alarming debt levels, countries like Greece, Spain and Portugal have allowed wages to rise faster than productivity, and now have trouble competing on world markets. A depressed euro would make their products cheaper in foreign markets, and help restore competitiveness. A stronger dollar would also help tourism, which is an important industry in Mediterranean countries. Bookings from the United States at Silversea Cruises are up about 10 percent, said Manfredi Lefebvre d’Ovidio, deputy chairman of the cruise ship operator. But he attributes most of the gain to the improved American economy.

For most exporters, though, a cheaper euro brings problems as well as advantages. Oil and raw materials, which are often priced in dollars, become more expensive. Currency hedging, like any other kind of insurance, becomes more expensive when the risk rises, as it does during big exchange rate moves. Many international companies have moved some of their manufacturing abroad, in part to cushion themselves against currency fluctuations.

SMA Solar Technology, a maker of inverters for solar plants that is based in Niestetal, Germany, is setting up a factory in Denver that is expected to employ 700 people, partly to serve the American market but also to guard against a gyrating euro. "SMA will be able to reduce transportation and interim storage costs as well as currency exchange risks," Günther Cramer, the company’s chief, said in a statement.

For such companies, a swing in the dollar-euro rate may simply be a wash. While Daimler cars made in Germany become more profitable, Daimler S.U.V.’s made in Tuscaloosa, Ala., and exported outside the United States — as more than half are — become less profitable in euro terms. Mr. Wortmann said that the machinery makers in the Engineering Federation were more concerned about the state of world trade and the health of the European economy than they were about the dollar-euro exchange rate. "Demand is what is decisive," Mr. Wortmann said. "We are getting one or the other new contract, but it’s not a flood."

Most French expect Paris to default

by Ralph Atkins - Financial Times

Europeans and Americans see a plausible chance of their governments defaulting in the next decade, with the French emerging from among the largest nations as most nervous about their country’s public finances. Some 53 per cent of those polled in France thought it was likely that their government would be unable to meet its financial commitments within 10 years, according to a Financial Times/Harris opinion poll published on Monday.Just 27 per cent said it was unlikely. Americans were only slightly less worried, with 46 per cent saying default was likely, against 33 per cent who saw it as unlikely.The results highlighted how worries about public sector finances, initially focused on Greece, have generated worldwide concern. A €750bn emergency European Union rescue plan, backed by central banks, helped calm financial markets last week. But the package failed to assuage worries about the long-term sustainability of many countries’ finances and the euro fell sharply. Jean-Claude Trichet, European Central Bank president, told Germany’s Spiegel magazine at the weekend that doubts being cast over governments’ creditworthiness "is a problem for almost all industrialised countries".

French nervousness reflected the size of the country’s public sector deficit, which was expected to be about 8 per cent of gross domestic product this year. In the US, the deficit was expected to be bigger, possibly 11 per cent of GDP. In contrast, the British appeared relatively unperturbed about the prospect of a default, even though the UK deficit was forecast to reach about 12 per cent of GDP this year. Only a third of the British people polled thought a government default was likely in the next 10 years.The Spanish were also less worried than the French and Americans, in spite of a deficit ratio expected to approach double digits this year. About 35 per cent of Spaniards said a default was likely. Germans, at 28 per cent, were the least worried. But the survey also showed confidence that governments would still be able to fund welfare and other spending programmes. The Spanish were the most optimistic – in spite of their country being forced to announce fresh austerity measures last week to cut the deficit: 86 per cent of Spanish respondents were confident that their government would still be able to pay for a "reasonable state pension" in the future and 93 per cent thought healthcare spending was secure.

More than 50 per cent in the UK, France, Italy and the US thought reasonable public pension provision would remain. But the Germans were gloomier – with only 42 per cent expressing confidence. German pessimism about the future of the welfare state was reflected in a speech on Friday by Angela Merkel, chancellor, which warned that "we cannot live beyond our means for ever". A special international tax on banks was supported by more than 60 per cent of those polled in Europe and 44 per cent in the US.

There was strong opposition to more general tax increases to fund government spending without increasing debt levels further. Opposition was strongest in Italy and France, where 72 per cent and 69 per cent were opposed. But opposition was noticeably weaker in the US and UK, at 52 per cent and 49 per cent. The FT/Harris poll was conducted online between April 27 and May 4 among 6,318 adults in France, Germany, the UK, Italy, Spain and the US.

Fears Intensify That Euro Crisis Could Snowball

by Nelson D. Schwartz and Eric Dash

After a brief respite following the announcement last week of a nearly $1 trillion bailout plan for Europe, fear in the financial markets is building again, this time over worries that the Continent’s biggest banks face strains that will hobble European economies. In a sign of the depth of the anxiety, the euro fell Friday to its lowest level since the depth of the financial crisis, as investors abandoned the currency as well as stocks in favor of gold and other assets seen as offering more safety, Nelson D. Schwartz and Eric Dash report in The New York Times. In trading early Monday morning, the euro declined again, managing at one time to reach a four-year low relative to the dollar.

The president of the European Central Bank, Jean-Claude Trichet, in an interview published Saturday, warned that Europe was facing "severe tensions" and that the markets were fragile. For Europe’s banks, the problems are twofold. Short-term borrowing costs are rising, which could lead institutions to cut back on new loans and call in old ones, crimping economic growth. At the same time, seemingly safe institutions in more solid economies like France and Germany hold vast amounts of bonds from their more shaky neighbors, like Spain, Portugal and Greece.

Investors fear that with many governments groaning under the weight of huge deficits, the debt of weaker nations that use the euro currency will have to be restructured, deeply lowering the value of their bonds. That would hit European financial institutions hard, and may ricochet through the global banking system. Bourses and bank shares in Europe plunged on Friday because of these fears, with Wall Street following suit. Shares were also down in Tokyo and Australia in early trading on Monday.

"This bailout wasn’t done to help the Greeks; it was done to help the French and German banks," said Niall Ferguson, an economic historian at Harvard. "They’ve poured some water on the fire, but the fire has not gone out." The European rescue plan, totaling 750 billion euros, is intended to head off the risk of default but would vastly increase borrowing. That could hamstring Europe’s nascent recovery. Indeed, it was too much debt that caused the problem in the first place: a new report by the International Monetary Fund warns that "high levels of public indebtedness could weigh on economic growth for years."

The world’s budget deficit as a percentage of gross domestic product now stands at 6 percent, up from just 0.3 percent before the financial crisis. If public debt is not lowered back to precrisis levels, the I.M.F. report said, growth in advanced economies could decline by half a percentage point annually.

To be sure, not all of the trends are negative. A lower euro will actually make European exports — be it German automobiles or Italian leather — more affordable and more competitive around the world. And Greece, Spain and Portugal took the first steps last week toward enacting austerity measures that would reduce their budget deficits. Those steps were not enough to prevent a flare-up in money market funds, a crucial but little-noticed corner of the financial system in which American investors provide more than $500 billion in short-term loans to help European banks finance their daily operations.

The cash comes from conservative funds that hold the savings of big American corporations and individual American consumers. So far, the proposed rescue package has failed to ease worries at these funds, which have cut back on loans to European banks and are demanding higher rates and quicker repayment. "More people are making the yes or no decision to pull out of the market and keep their money closer to home," said Lou Crandall, the chief economist of Wrightson ICAP, a money market research firm.

Initially, it was Greek and Portuguese banks that got the cold shoulder from American lenders. But over the last two weeks big banks in Spain, Ireland and Italy have struggled to secure short-term funds from the United States as the anxiety has spread. By Friday, even banks in solid European economies like France, Germany and the Netherlands were caught in the undertow, according to market analysts and traders. "Investors are waiting to see whether the stability package can be put into place," said Alex Roever, a short-term fixed-income analyst for J.P. Morgan Securities. "Until investors get a better feel, we are hung in limbo."

Because of the pullback by American lenders, the rate banks charge one another for overnight loans, known as Libor for the London Interbank Offered Rate, has been steadily climbing. And the significance of Libor stretches far beyond Europe’s shores: that is the benchmark that helps determine the interest rate on many mortgages and credit cards held by American consumers.

Bank borrowing rates are still well below where they were at the height of the crisis. Fears that the problems in Europe could rebound in the United States, however, led the Federal Reserve to restart lines of credit to the European Central Bank and other central banks in conjunction with the European rescue package announced a week ago. The move ensured that European institutions would be able to borrow dollars to lend to their clients, but that is more expensive than relying on private investors.

"We didn’t do so out of any special love for Europe," Narayana R. Kocherlakota, the president of the Federal Reserve Bank of Minneapolis, told a group of small-business owners in Wisconsin on Thursday. "We’re American policy makers, and we make decisions to keep the American economy strong." However, he said, "The liquidity problems in European markets were showing signs of creating dangerous illiquidity problems in our own country’s financial markets."

That is not the only domino that could fall.

While the direct exposure of American banks to Greece is minimal, American financial institutions are closely intertwined with many big European banks, which in turn have large investments in the weaker European nations. For example, Portuguese banks owe $86 billion to their counterparts in Spain, which in turn owe German institutions $238 billion and French banks $220 billion. American banks are also big owners of Spanish bank debt, holding nearly $200 billion, according to the Bank for International Settlements, a global organization serving central bankers.

Furthermore, financial policy makers find themselves running out of weapons in their arsenal. After borrowing trillions to stimulate their economies and ease credit concerns during the last wave of fear in late 2008 and early 2009, governments cannot borrow trillions more without risking higher inflation and shoving aside other borrowers like individuals and companies. Short-term interest rates, already near zero in the United States, cannot be lowered any further. And vital steps like raising taxes or cutting spending increases could snuff out the beginnings of a recovery in northern Europe and worsen the pain in recession-battered economies like Spain, where unemployment recently passed 20 percent.

With the exception of wartime, "the public finances in the majority of advanced industrial countries are in a worse state today than at any time since the industrial revolution," Willem Buiter, Citigroup’s top economist, wrote in a recent report. "Restoring fiscal balance will be a drag on growth for years to come."

Forget the wolf pack – the ongoing euro crisis was caused by EMU

by Ambrose Evans-Pritchard - Telegraph

Jean-Claude Trichet tells us the world faced a second Lehman crash in the days and hours before EU leaders launched their €720bn (£612bn) defence fund. If the European Central Bank’s president is correct, we are in trouble. The EU-IMF package is already unravelling. What will the West do for its next trick?

Mr Trichet was ash-white at the Brussels summit a week ago. He distributed charts of credit stress to every eurozone leader. By the time he had finished his hair-raising discourse, everybody round the table finally understood what they faced. "The markets had ceased to function," he told Der Spiegel. "There is still a risk of contagion. It can happen extremely fast, sometimes within hours."

The spreads on Greek, Iberian, and Irish bonds have, of course, dropped since the ECB stepped in with direct purchases. But the euro rally fizzled fast, to be followed by a fresh plunge to a 18-month low of $1.24 against the dollar. European bank stocks have buckled again. Spain’s IBEX index fell 6.6pc in capitulation fever on Friday. Geneva professor Charles Wyplosz said EU leaders made the error of overselling up their "shock and awe" package before establishing any political mechanism to mobilise such sums. "The fund is an empty shell," he wrote at Vox EU. "Worse still, crucial principles have been sacrificed for the sake of unconvincing announcements."

Brussels was unwise to talk of smashing the "wolf pack" speculators and defeat the "worldwide organised attack" on the eurozone. As Napoleon said, if you set out to take Vienna, take Vienna. Besides, the language of the EU priesthood – ex-ECB board member Tomasso Padoa-Schioppa talks of the advancing battalions of the "anti-euro army" – frightens Chinese and Mid-East investors needed to soak up EU debt. These metaphors are a mental flight from the issue at hand, which is that vast imbalances – masked by EMU, indeed made possible only by EMU – have been decorked by the Greek crisis and now pose a danger to the entire world.

One can only guess what Mr Trichet meant when he said we are living through "the most difficult situation since the Second World War, and perhaps the First". Is this worse than Credit Anstalt in the summer of 1931, the event that brought down central Europe’s banking system and tipped Europe into depression? Or was Mr Trichet alluding to something else after witnessing the Brussels tantrum by President Nicolas Sarkozy? According to El Pais, Mr Sarkozy threatened to pull France out of the euro and break the Franco-German axis at the heart of the EU project unless Germany capitulated. To utter such threats is to bring them about. You cannot treat Germany in that fashion.

Chancellor Angela Merkel has put the best face on a deal that has so damaged her leadership. "If the euro fails, then Europe fails and the idea of European unity fails," she said. Too late, I think. The German nation is moving on. I was struck by a piece in the Frankfurter Allgemeine proposing a new "hard currency" made up of Germany, Austria, Benelux, Finland, the Czech Republic, and Poland, but without France. The piece entitled The Alternative says deflation policies may push Greece to the brink of "civil war" and concludes that Europe would better off if it abandoned the attempt to hold together two incompatible halves. "It can be done," the piece says.

What makes this crisis so dangerous is not just that Europe’s banks are still reeling, with wafer-thin capital ratios. The new twist is that markets are no longer sure whether sovereign states are strong enough to shoulder rescue costs. The IMF warned in last week’s Fiscal Monitor that the tail risk of a "widespread loss of confidence in fiscal solvency" could no longer be ignored. By 2015 public debt will be 250pc in Japan, 125pc in Italy, 110pc in the US, 95pc in France, and 91pc in the UK.

There is a way out of this crisis, but it is not the policy of wage deflation imposed on Ireland, Greece, Portugal, and Spain, with Italy now also mulling an austerity package. This can only lead to a debt-deflation spiral. The IMF admits that Greece’s public debt will rise to 150pc of GDP even after its squeeze, and that Spain’s budget deficit will still be 7.7pc of GDP in 2015.

The only viable policies – short of breaking up EMU or imposing capital controls – is to offset fiscal cuts with monetary stimulus for as long it takes. Will it happen, given the conflicting ideologies of Germany and Club Med? Probably not. The ECB denies that it is engaged in Fed-style quantitative easing, vowing to sterilise its bond purchases "euro for euro". If they mean it, they must doom southern Europe to depression. No democracy will immolate itself on the altar of monetary union for long.

Berlin calls for eurozone budget laws

by Daniel Schäfer and Ben Hall - Financial Times

The German government is to press other eurozone countries to adopt their own versions of Berlin’s balanced budget law as part of a set of sweeping reforms to stabilise the euro. Germany last year enshrined in its constitution a law that prohibits the federal government from running a deficit of more than 0.35 per cent of gross domestic product by 2016. German states will not be allowed to run any deficit after 2020. Applied across the eurozone, that would imply much tighter fiscal discipline than the bloc’s existing rules requiring deficits of less than 3 per cent of GDP.

Wolfgang Schäuble, the German finance minister, is working on a set of sweeping reforms for the stricken eurozone, which he will present on Friday at the first meeting of a working group set up to consider closer economic policy co-operation. Finance ministers meet on Monday to discuss the €750bn eurozone and International Monetary Fund rescue plan for Greece, which failed to prevent the euro hitting fresh lows against the dollar last week. They will also look at the latest austerity measures announced by Spain and Portugal.

A German government official told the Financial Times that one of Mr Schäuble’s proposals would be for other eurozone countries to adopt similar fiscal constraints to Germany’s Schuldenbremse – as the law is known. "Something like that would be a good idea for other countries to have – although it might take on different shapes and forms for each member of the eurozone," the official said. The severity of the euro crisis could give impetus to Berlin’s proposed reforms, which would have been unthinkable even six months ago.

The idea has won the the backing of the Austrian government. "Considering the high indebtedness in Europe, I am in favour of a Schuldenbremse," Josef Pröll, Austria’s finance minister, told German newspaper Die Welt. "This would lead to a clear cap on new debt, strict budgetary discipline and balanced budgets in Europe," he said. Many governments are likely to balk at the idea of a fiscal rule such as Germany’s, which does not distinguish between underlying deficits and those attributable to weak growth, although there is flexibility for severe recessions and natural disasters.

But national rules targeting a cyclically adjusted balance – taking into account the state of the economy – could win wide support. Nicolas Sarkozy, the French president, is in favour of some form of balanced budget rule with constitutional force. He might even back the idea on Thursday when the Elysée Palace is holding a summit of ministers, local authorities, employers and unions to discuss ways of slashing France’s public deficit, which is due to reach 8 per cent of gross domestic product this year. Michel Camdessus, former managing director of the International Monetary Fund, is due to publish a review in the next few days on how such a budget rule might be applied in France.

Berlin is anxious to tighten fiscal discipline in the eurozone after reluctantly agreeing last week to the €750bn rescue package. The debate came as Angela Merkel, German chancellor, urged Europe quickly to tackle the gap between weaker and stronger member states. "We’ve done no more than buy time for ourselves to clear up the differences in competitiveness and in budget deficits of individual eurozone countries," she said. "If we simply ignore this problem we won’t be able to calm down this situation," Ms Merkel added at the annual meeting of the German Federation of Trade Unions.

Greeks work more, owe less than Germans

According to many accounts of the financial crisis in Europe, one reason intervention has been slow is that it is hard to convince Germans, widely seen by themselves and others as hard-working, thrifty and virtuous, to "bail out" those lazy, spendthrift Greeks. This bit of OECD data on hours worked per worker (via Economix) runs contrary to the stereotypes: That is, according to the OECD, the average Greek worker logs 2120 hours per year - 690 more than a German worker.

Twice As Many Homeowners Kicked Out Of Obama Foreclosure Program As Given Permanent Relief, New Data Show

by Shahien Nasiripour - Huffington Post

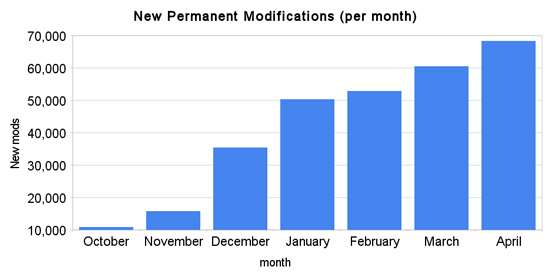

More than twice as many homeowners were kicked out of the Obama administration's signature foreclosure-prevention program last month as were granted permanent relief, new data released Monday show.

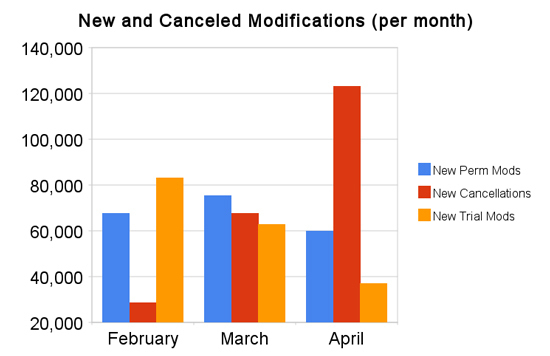

More than 123,000 homeowners were bounced from the administration's Home Affordable Modification Program in April versus about 60,000 who were offered five-year plans of lowered monthly payments. This is the first month since the administration started reporting cancellation figures that the number of canceled modifications outpaced the number of new permanent modification offers.

The number of canceled modifications skyrocketed 82 percent in April compared to March.

"I think it's important to remember that our focus has been on getting homeowners in trial modifications through the decision," said Phyllis Caldwell, chief of Treasury's Homeownership Preservation Office, during a conference call with reporters. "As those decisions get made, it's certainly expected that there would be some that would fall out of HAMP and be considered for other foreclosure alternatives."

"The number is a very, very small percentage of the total amount of permanent modifications," Caldwell added.

More than 295,000 homeowners currently are in five-year modification plans, which are considered "permanent" because the interest rate won't increase very much over the life of the loan. Interest rates are at historic lows.

There were more cancellations in April than there were new permanent and trial modifications combined. The number of cancellations was about 27 percent higher than the number of new trial and permanent plans, according to Treasury Department data.

"I think it's great to take these numbers in context... with the broad efforts to stabilize the housing market," said David Stevens, chief of the Federal Housing Administration. Stevens pointed out that home prices and the number of new foreclosures have started to stabilize. He credited the administration's efforts in keeping down interest rates with helping homeowners to refinance their existing mortgages into lower rates, resulting in lower payments.

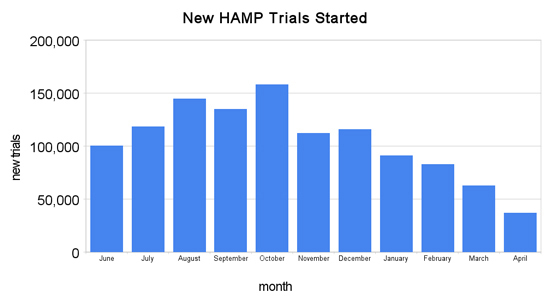

Trial modifications have been offered to more than 1.2 million homeowners during the year-long program.

"You know, while enabling eligible homeowners to modify their mortgages is vital to addressing the housing crisis with HAMP, it's also extremely important to keep this in context that this is just one part of the administration's comprehensive approach to assisting homeowners and stabilizing the housing market," said Stevens, assistant secretary for housing at the Department of Housing and Urban Development.

"We don't claim that the housing market is totally out of the woods, but it's certainly showing signs of stabilizing," added Herbert M. Allison Jr., assistant secretary for financial stability at the Treasury Department.

Allison pointed to the fact that the program, part of the administration's $75 billion effort to stem the rising tide of foreclosures, initially allowed homeowners to state their income when applying for three-month trial plans, rather than submitting documents proving their income. That's played a large role in the number of cancellations, he said.

The program lowers homeowners' monthly payments by reducing their mortgage payments to 31 percent of their monthly income. Beginning in June, the initiative will require homeowners to prove their income before qualifying for a trial modification. Mortgage servicers have already begun to apply this upcoming requirement.

Allison predicted that by June, after servicers clear through the stated-income trial mods, "we will see a higher level of permanent modifications."

The conversion rate of eligible trial plans to permanent status is currently at about 30 percent, Treasury data show. Allison said it "eventually will be about 100 percent" since servicers will be requiring documentation up front.

He cautioned that "perhaps" more homeowners also will be bounced from the program.

GM Posts $865 Million Net Income in Push for IPO

by Katie Merx and David Welch - Bloomberg

General Motors Co. reported first- quarter net income of $865 million, helped by higher production and smaller discounts, as the maker of the GMC Terrain and the Chevrolet Equinox works toward an initial public offering. Operating profit was $1.2 billion in the first three months of the year, and the company generated $1 billion in free cash flow, Detroit-based GM said today in a statement. Revenue rose 40 percent from the same period a year earlier to $31.5 billion.

Chief Executive Officer Ed Whitacre has said reporting a profit is a necessary milestone as the biggest U.S. automaker seeks freedom from government ownership. GM, which emerged from bankruptcy protection in July, is considering a return to the auto-lending business to make its offering more appealing to investors, people familiar with the plans said last week. "The unfortunate process of bankruptcy is yielding positive results," Rebecca Lindland, an analyst at IHS Global Insight in Lexington, Massachusetts, said today in an interview. "It certainly keeps them on track for an IPO."

GM North America and the company’s international operations each had profits before interest and taxes of $1.2 billion, while the automaker had a $500 million loss in Europe. GM’s 8.375 percent bonds due in July 2033 rose 1.625 cents to 36.5 cents on the dollar at 9:15 a.m. in New York, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority. The debt was issued by predecessor General Motors Corp. and will convert into equity in the new GM.

U.S. Auto Sales

GM’s sales in the U.S. rose 16.8 percent to 475,253 vehicles in the first quarter from 406,770 a year earlier, according to researcher Autodata Corp. Industry-wide, U.S. sales gained 15.5 percent in the period after falling to 10.4 million last year, the worst since 1982. The annualized rate for the first quarter was about 11 million cars and trucks. GM trimmed its U.S. customer discounts in the first quarter by an average of $230 per vehicle, or 6.7 percent, to $3,222, according to Autodata.

Profit was helped by higher output than a year earlier, when GM cut spending to try to avoid bankruptcy. The automaker built 667,085 vehicles in North America in the first quarter, an 8.5 percent increase from the fourth quarter, according to Michael Robinet, vice president of global forecasting for CSM Worldwide in Northville, Michigan. GM will produce 2.7 million vehicles on the continent this year, a 44 percent increase from 2009, CSM said.

"This is a good, useful step on the road to the IPO," GM Chief Financial Officer Chris Liddell told reporters today. GM is planning to reinstate at least 666 dealers and will have to build hundreds of cars to fill the lots and introduce new models, Robinet said. "The product renaissance is relatively strong," CSM’s Robinet said. "They have new stuff coming next year and the year after." GM posted a fourth-quarter loss of $3.4 billion and used $1.9 billion in cash. For the third quarter, a period that began with the end of bankruptcy on July 10, GM said generated $3.3 billion in cash and lost $1.15 billion on what it called a managerial basis. It reported a net profit, including the company’s recapitalization.

Higher Prices

First-quarter profit was helped by higher prices and lower fixed costs after GM transferred hourly retirees’ health costs to an independent trust, said Kirk Ludtke, senior vice president for CRT Capital Group LLC in Stamford, Connecticut. GM filed for protection from creditors on June 1, 2009, and emerged on July 10 with Whitacre, 68, as chairman. He took on the chief executive officer’s job in December and has shuffled management and cut brands to four from eight. The old General Motors Corp. had a $5.98 billion net loss in the first quarter of 2009.

The company has repaid $8.4 billion in U.S. and Canadian loans it assumed as it emerged from bankruptcy and is seeking to return to profit before offering shares publicly, allowing the U.S. to sell the 61 percent stake it acquired in the $50 billion bailout.

Bank Talks

The U.S. Treasury is talking with banks including Greenhill & Co., Lazard Ltd. and Perella Weinberg Partners about advising the department on the company’s return to public trading, a person with direct knowledge of the matter said last week. "They’re doing the right things in terms of paying down debt," said Mark Oline, head of corporate ratings at Fitch Ratings in New York. "They still don’t have all of their products refreshed." GM hasn’t issued any new debt since exiting bankruptcy and has no rating. The company and rival Ford Motor Co. will need profits and cash flow to attain investment-grade credit status, Oline said. "In both cases, it’s a very long road to get there," he said.

GM has said it needs better performance from its Opel unit in Europe. Opel Chief Executive Officer Nick Reilly told the Tagesspiegel newspaper this month that sales in Western Europe won’t return to 2007 levels for at least five years. GM decided to keep Opel in November after negotiating a deal to sell the Ruesselsheim, Germany-based unit to Canada’s Magna International Inc. and Russian lender OAO Sberbank.

Marketing Changes

Whitacre also has sought to retool the company’s marketing arm, changing U.S. sales and marketing leadership three times since December. On May 5, he hired Nissan Motor Co.’s Joel Ewanick as vice president of marketing to replace Susan Docherty, who held the job for two months and will be reassigned. Ewanick will be responsible for delivering more sales as the company devotes marketing resources to fewer brands. GM is focusing on Chevrolet, Buick, GMC and Cadillac in the U.S., selling Saab and shutting down Saturn, Pontiac and Hummer.

New UK Chancellor Osborne braced for cuts

by Lionel Barber, George Parker and Chris Giles - Financial Times

George Osborne will on Monday create an independent fiscal watchdog to rectify what he claims are "fixed" Treasury forecasts, as he prepares public opinion for a painful round of spending cuts and tax rises in next month’s Budget. The chancellor will name Sir Alan Budd as the interim head of the Office for Budget Responsibility, charged with looking into the Treasury books and preparing a "proper set of national accounts". Sir Alan is a former chief economic adviser to the Treasury.

In his first newspaper interview since arriving at the Treasury, Mr Osborne claimed that under Labour "forecasts were fiddled in order to help the government to present the sort of Budget it wanted to present". His decision to hand over the Treasury’s responsibility for growth and public finance forecasting to a new body has some parallels with Gordon Brown’s first act as chancellor: handing over monetary policy to an independent Bank of England.

But the OBR’s remit to produce new forecasts in time for the June "emergency" Budget is also in keeping with the time-honoured practice of incoming governments finding unexpected public accounts horrors. "We are finding all sorts of skeletons in various cupboards and all sorts of decisions taken at the last minute," Mr Osborne said. "By the end, the previous government was totally irresponsible and has left this country with absolutely terrible public finance."

Mr Osborne declined to give details, other than a "performance-related" bonus scheme for top civil servants, which he says is too widely disbursed. He will cut it by two-thirds, saving £15m. But the first big step towards filling the published £163bn deficit will be taken this week when he sets out details of how he intends to find £6bn of efficiency savings. Although Vince Cable, business secretary, has insisted some of that money is recycled into job creation projects, Mr Osborne told the Financial Times "the majority" would be used to pay down the deficit.

Mr Osborne also hinted that taxes may have to rise higher than he had expected to plug the hole, suggesting the Liberal Democrats had toned down his aim of splitting the fiscal tightening on an 80:20 ratio between spending cuts and tax rises. "I said that as a rule of thumb – I said it didn’t have to be exactly 80:20," he said. The coalition agreement speaks only of the "main burden of deficit reduction" being borne by reduced public spending. The chancellor declined to comment on whether he might raise VAT rates, only repeating his campaign assertion that he had no plans to do so.

Interviewed on the BBC on Sunday, David Cameron, prime minister, pointedly refused to rule out any increase in VAT, saying "you’ll have to wait for the first Budget". But the chancellor believes voters will "see the benefits more quickly than is expected". He hopes fruits of a sound and expanding economy will feed through well before the next election, slated for May 2015. Mr Osborne also stood by his plan to cut headline corporation tax rates, even if it meant removing some allowances popular with manufacturers.

Meanwhile, the chancellor shared Mr Cable’s concern about bank pay and bonuses, and said he would consider a new tax on bank profits and remuneration under an IMF-sponsored global agreement, as well as his proposed bank levy.

'There's No Money Left,' U.K. Minister Learns From Predecessor

by Robert Hutton - Bloomberg

Arriving for work at the U.K. Treasury last week, the incoming chief secretary, David Laws, found a note from his predecessor, Liam Byrne, offering advice on the job. According to Laws, it read: "Dear Chief Secretary, I’m afraid to tell you there’s no money left." "Which was honest," Laws, whose position is the No. 2 in the Treasury after the chancellor of the exchequer, told a press conference in London today. "But slightly less than I was expecting."

The note underscores the task facing Britain’s coalition government as it seeks to reconcile demand for improved health and education services with promises to reduce the largest budget deficit since World War II. It was also in the tradition of Reginald Maudling, Conservative chancellor of the exchequer from 1962 to 1964. Leaving his residence after election defeat, he was reported by James Callaghan, his successor, to have remarked, "Sorry, old cock, to leave it in this shape.

Whatever happened to Ireland?

by Morgan Kelly - VoxEU

The Celtic Tiger faces severe challenges. This column argues that the Irish government’s commitment to absorb the losses of its banking system may well lead to a Greek-style debt ratio by 2012. It is a test-in-waiting for the EU, but one that could be solved by a debt for equity swap to cover the losses of Irish banks.

From basket case to superstar and back again – or almost. One has to wonder: How did all this happen? How did an economy where employment doubled and real GNP quadrupled during the “Celtic Tiger” era from 1990 to 2007, come to have GNP contract by 17% by late-2009 (with further falls forecast for 2010), the deepest and swiftest contraction suffered by a western economy since the Great Depression? The adjustments faced by the nation are monumental (see Cotter 2009 and Honohan and Lane 2009).

Two boomsThe key to understanding what happened to Ireland is to realise that while GNP grew from 5% to 15% every year from 1991 to 2006, this Celtic Tiger growth stemmed from two very different booms. First, the 1990s saw rising employment associated with increased competitiveness and a quadrupling of real exports. As Ireland converged to average levels of western European income around 2000 it might have been expected that growth would fall to normal European levels. Instead growth continued at high rates until 2007 despite falling competitiveness, driven by a second boom in construction. I analyse this second boom, the Irish bubble, in a recent CEPR Discussion Paper (Kelly 2010).

Credit bubbleIreland went from getting about 5% of its national income from house building in the 1990s – the usual level for a developed economy – to 15% at the peak of the boom in 2006–2007, with another 6% coming from other construction. In effect, the Irish decided that competitiveness no longer mattered, and that the road to riches lay in selling houses to each other.

However, driving the construction boom was another boom, in bank lending. As Figure 1 shows, back in 1997 when Ireland’s economy really was among the world’s best performing, Irish banks lent sparingly by international standards. Lending to the non-financial private sector was only 60% of GNP, compared with 80% in Britain and most Eurozone economies. The international credit boom saw these economies experience a rapid rise in bank lending, with loans increasing to 100% of GDP on average by 2008.

These rises were dwarfed, however, by Ireland, where bank lending grew to 200% of national income by 2008. Irish banks were lending 40% more in real terms to property developers alone in 2008 than they had been lending to everyone in Ireland in 2000, and 75% more to house buyers.

Figure 1. Bank lending to households and non-financial firms as a percentage of GDP (GNP for Ireland), 1997 and 2008.

This tripling of credit relative to GNP distorted the Irish economy profoundly. Its most visible impact was on house prices. In 1995 the average first-time buyer took out a mortgage equal to three years’ average industrial earnings, and the average house cost 4 years’ earnings. By the bubble peak in late 2006, the average first-time buyer mortgage had risen to 8 times average earnings, and the average new house now cost 10 times average earnings, with the average Dublin second-hand house costing 17 times average earnings (see Figures 2 and 3).

As the price of new houses rose faster than the cost of building them, investment in housing rose. By 2007, Ireland was building half as many houses as Britain, which has 14 times its population.

The flow of new mortgages peaked in the third quarter of 2006, and then fell rapidly. By the middle of 2007 the Irish construction industry was in clear trouble, with unsold units beginning to accumulate. More than one-sixth of housing units are now estimated to be vacant.

Figure 2. Irish house prices relative to average industrial earnings, 1980 – 2009