"Frank Mischa, sculptor, Washington, D.C."

Ilargi: From Fraser Nelson's A debt-filled New Year:

"In the original Superman film, the hero rescues Lois Lane as she falls from a skyscraper. ‘Don’t worry, ma’am, I got you,’ he says, midair.

‘You got me? Who’s got you?’ she replies.

This is the question that no one is asking now. If China is lending to us, who is lending to China? If the governments are saving the banks, then who will save the governments? If the European Union is offering a safety net, who would be there to bail out the EU?

There are other questions not being asked: which country, in recent economic history, has successfully borrowed its way out of a debt crisis?"

Ilargi: "Hey, did you hear what Fannie and Freddie did?"

"Who? What?"

"You know, Fannie Mae and Freddie Mac, the guys who buy all US mortgages."

"Oh, yeah, right, I have heard of them. We own them, right?"

"Well, not so fast, there, boyo, we did hand them hundreds of billions of dollars, but they are still noted on the stock exchange."

"Then they must be worth more than we handed them, no?"

"I doubt it. A lot. Come to think of it, I think their net value is probably way negative."

"Really? So why did we give them all the cash then?"

"Well, first so nobody would notice that they're way worse then broke, and more importantly, second, so nobody would notice that US homes are just about entirely worthless across the board, which, third, dooms the banks. After all, without Fannie and Freddie, these homes would have already lost 80-90% of their so-called value. You don’t think a bank would be foolish enough to give anyone a $300,000 loan who actually needs it to buy a home, do you? "

"I guess not. I sure wouldn't if I were a bank. But if all those homes are really worthless without our money propping them up, doesn't that mean the banks are worthless as well? They hold all that paper, don’t they, the loans, the MBS, you name it, don’t they?"

"They sure do. And by the way, the money propping them up is not our money anymore, the government gave it away."

"Yeah, but didn't they say all of it would be paid back, and then some? We're going to make a profit on it, right?"

"A profit on Fannie and Freddie? Isn't it a bit early in the day for you to be drinking? Look, Fannie and Freddie were broke when "we" took them over, or sort of took them over, that's why we did it in the first place, and since that time home prices are down like 20 or 30%. No profit there. There's some at banks and lenders and servicers, you know, re-calibrating loans and stuff, but that's just window-dressing really. With good bonuses on the ground, mind you."

"Oh boy! So we won’t get those hundreds of billions back anytime soon, then, will we?"

"You'll never ever see them back. That is unless Fannie and Freddie start guaranteeing mortgages for everyone, including the 99'ers and all the rest of the 20% of Americans who are unemployed or underemployed. Which obviously would cost a whole lot more than a few hundred billion. Washington might as well simply buy everybody a home. The only way to get that money back is to spend even more and get deeper into debt."

"So why don't we just get our money back and let Fannie and Freddie go the way of the dodo, you know, release them from their suffering?"

"Because that would kill off both home prices and Wall Street banks. Like in an instant. Main street banks too, by the way, but nobody seems to care about them anymore these days."

"So, seen from a different angle, basically, for a few hundred billion we managed to save the entire financial system? Sounds like a good deal to me! Paulson and Geithner and Bernanke must be very smart men."

"Yeah, that would be great, wouldn't it? But alas, it's not that simple. You see , there are some 30 million Americans who are either jobless or work part-time against their will. Then there's many millions more who flip burgers or greet you at Wal-Mart full time at minimum wage. On top of that you have countless millions with lousy credit scores, with huge debts, that sort of thing. And then of course there are lots of folks who don’t want to buy a home, either because they rent, or because they’re happy where they are and have paid off their mortgage in full, or are close to doing that. Well over a third of US homeowners own their houses outright."

"Where are you going with this? What’s the crux of the story?"

"That the pool of potential home-buyers is shrinking, and fast. And that there are far more homes for sale already than there are potential buyers, even as the banks, as well as Fannie and Freddie, have millions of additional homes in their books that they're not even trying to put on the market. And if you go through a period like this long enough, where potential sellers far outnumber potential buyers, there's only one way to go for prices, even if Fannie and Freddie buy up any and every loan around and put lipstick on them. The official inventory is something like 4 million homes, but the shadow inventory, the homes that have not yet been put on the market, may be as high as 12 million or more. And hardly any buyers left."

"Lovely! So what were you going to ask me before? Something about: did you hear what Fannie and Freddie did?!"

"Oh right, excuse me. Fannie and Freddie settled a dispute with Bank of America over fraudulent loans. Just that they don't call them fraudulent, they use the term "soured". Which, you know, seems fine, BofA buys back loans that they knew anyway were crap. So far, so good. However, when it comes down to it, BofA paid $0.01 on the dollar, at least according to for instance Barry Ritholtz: They paid "$1.28 billion to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008.""

"This is a joke, right?"

"Afraid not. It's a done deal. The separate states are preparing deals with Wall Street too, and pennies on the dollar will be the word."

"But wait, hold on a minute. Doesn't that mean that these loans are in effect VALUED at pennies on the dollar?"

"That would seem to be the only explanation, wouldn't it, in the end? But since none of the parties involved will ever say so, you'll be ridiculed if you make that claim."

"And what's the size of Fannie and Freddie's total mortgage portfolio, you said?"

"I didn't. But it's something like $5.5 trillion."

"And how much of that is "soured"?"

"Not sure. Fannie Mae is on record saying that its total amount in repurchase claims, as in loans they know for sure are garbage and want lenders to buy back, is $7.7 billion."

"$7.7 billion of a $5.5 trillion portfolio? That would mean that about 98.5% of all mortgages Fannie bought are good and fine and solid, no fraud, no liar's loans, no nothing wrong, no need to worry?"

"According to them yes, but who's going to believe that? I think you're on to something when you say this deal effectively means it's more likely the other way around, that only 1,5% are really solid. But I would never say that in public."

"One other thing: so Fannie gets to negotiate these things with BofA head to head, one company vs the other, if I get the drift. Isn't that a bit peculiar? I know you said it isn't our money anymore, but wouldn't it make sense to do these negotiations in the open, so Americans can learn about what happens with their money?"

"HA! Yeah, sure, and let them know what their homes are really worth these days? Believe you me, that's the last thing anybody upstairs would want to happen."

"But isn't it our money, don't we have a right to know how it's spent?"

"No, that's not how it works. Your role is to vote for a figurehead once every four years, who, when elected, gets to do with your money, and that of your children and their children, whatever pleases her/him and especially her/his handlers and sponsors, who often happen to be the every bankers who issued the fraudulent loans. Pure coincidence, mind you. And no, you have no right to check what happens to your money. State security issues, you know? I mean, if other banks would find out how BofA pays off its losses at 1%, and then ships the rest of it to the taxpayer, they might try to cut an even better deal. Can’t have that, now, can we? Instead, they're making you think those 98,5% of loans are good, so you can watch TV in peace, and don‘t worry your simple brain too much about these highly complicated matters that some of our brightest minds take years at Harvard, Yale and Princeton to study."

"So, down the line, when this is all said and done, how much will I, and my kids, wind up in the red?"

"Well, it all depends on how many kids you're planning on having, doesn't it?"

"Huh?"

"Look, think of it as nostalgia; it's going to be like it always was around here, and like it still is in many places in the world: the only old-age insurance you're going to have is your children. The more kids you have the more secure you will be. Or feel, at least. Your pension fund is long gone already, they've been buying all the wrong stuff for ages. They get to extend and pretend for a while longer along with the banks, but there's no money left there."

"Oh, hold on, I know where you're going with this, and I can only agree, after what you told me: The USA is not a democracy, it is a banana republic!"

"Well, sort of, but it's just that it looks like you may even have have to do without the bananas. There's a fungus spreading around the globe that kills them all."

"Oh jeez, have mercy, we can't even be a banana republic?! What about my cereal? So what can we be? Peanut democracy? Strawberry state?"

"Yeah, something like that. By the way, I’m not done yet. Did you hear about how Goldman Sachs wants to open Facebook to investors? And did you know that Obama wants to get a JPMorgan exec as his Chief of Staff?"

"No, no, stop it already! I don't care, mate. I've had my fill for the day, enough is enough. I’m going to have a stiff adult beverage or two. And then another or two. And then I think I’m going to find myself a tall bridge, a large jar of quaaludes, a long piece of rope, and a warm gun. I don’t think I want to live in a fruit republic, no matter what flavor it has. And this being the USA, chances are it would be an artificial flavor anyway."

BofA Freddie Mac Putbacks Resolved for $0,01 on the dollar

by Barry Ritholtz - Big Picture

Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 — that is the deal B of A appears to have gotten from Freddie Mac.

B of A also paid $1.52 billion to Fannie Mae to resolve disputes on $3.1 billion in loans (~49 cents on the dollar). They remain liable for $2.1 billion in repurchase requests, as well as any future demands from Fannie Mae. My biggest complaint about the GSEs post government takeover is that they have been used as a back door bailout of the banks. This latest deal reconfirms that view. It's a wonder BofA didn’t rally further than the 6.7% it surged yesterday . . .

BofA pact represents 44% of total Fannie repurchase claims

by Jason Philyaw - Housing Wire

Fannie Mae said the agreement reached with Bank of America regarding repurchase requests on mortgages sold to the GSE by Countrywide Financial Corp. addresses about 44% of the $7.7 billion in repurchase claims the company had outstanding with all of its seller servicers as of Sept. 30. Fannie President and Chief Executive Michael Williams said the BofA agreement is "fair and a responsible resolution of these outstanding claims."

Repurchase requests on some 12,045 loans sold by Countrywide, which Bank of America acquired in early 2008, to Fannie Mae were resolved by the agreement. The pact also addresses another 5,760 loans by allowing the GSE "to bring claims for any additional breaches of our representations and warranties that are identified with respect to those loans." As per the agreement, Bank of America paid $1.34 billion cash to Fannie Mae last week and $1.28 billion to Freddie Mac. "We appreciate Bank of America's work to reach this agreement and look forward to our continued mutual efforts to support the U.S. housing market," Williams said.

The agreement, coupled with Ally Financial's settlement with Fannie Mae, prompted Keefe, Bruyette & Woods to revisit its representations and warranties estimates for the mortgage industry on loans originated specifically to be sold to the GSEs. "Our analysis continues to make us comfortable that our base case loss assumption for rep and warranty losses on loans sold to the GSEs remains reasonable," the investment bank said.

Prior to the settlements, KBW estimated base case losses of $28 billion on loans sold to the GSEs. With the Ally deal, the estimate slid to losses of $26 billion, while the BofA settlement points to losses of $48 billion. "We believe that the Ally Financial numbers are a better template for the industry as a whole because the delinquency rates are closer to industry averages," KBW said. "We believe the Bank of America settlement is a stress case number given the company well-above average delinquency rates."

KBW analysts expect more settlements, but added "settlement clearly comes at a price that might be too high for some originators who believe their underwriting standards were strong." "Originators who do not expect a meaningful increase in losses might choose not to pay for this protection," KBW said. "This suggests that the settlement option will most likely be chosen by weaker originators trying to protect downside risk."

BofA Deal on Loan-Repurchase Demands Sets 'Template' for Banks

by Dawn Kopecki and Hugh Son - Bloomberg

Bank of America Corp.’s agreement to settle Fannie Mae and Freddie Mac’s demands it buy back billions of dollars in faulty loans may pave the way for U.S. lenders to resolve similar disputes with the government-sponsored entities, easing investors’ concerns that costs may surge.

Bank of America’s announcement yesterday that it settled claims on at least $4.1 billion in loans from its Countrywide Financial Corp. unit sent the KBW Bank Index of 24 stocks up 2.3 percent to its highest level since May. A willingness by the GSEs to negotiate may let other lenders cap costs from mounting demands they buy back loans that allegedly had bad or incomplete information about borrowers’ incomes, home values or other data. "It’s unlikely GSE claims could spiral out of control from here," said Chris Kotowski, a managing director of research for Oppenheimer & Co. in New York. "I think that’s a positive broadly for the group," because it eliminates the risk that the liability would be much higher, he said.

Bank of America, the biggest U.S. lender by assets, agreed to pay Fannie Mae and Freddie Mac a total of $2.8 billion to settle claims stemming from the 2008 purchase of Countrywide, which was then the largest mortgage company in the U.S. The government-backed entities have been pressuring lenders to make good on so-called representations and warranties, in which they vouched for the accuracy of loan documents.

‘The Worst Mess’

"You have a template that you can go use to try to clear up these liabilities," said Paul Miller, an analyst with Arlington, Virginia-based FBR Capital Markets and a former examiner for the Federal Reserve Bank of Philadelphia. "Countrywide had the worst mess, so you can probably settle for something less than the BofA settlement." Bank of America’s shares surged 6.7 percent yesterday, the most since May, to $14.19 in composite trading on the New York Stock Exchange. Citigroup Inc. jumped 3.6 percent to $4.90, JPMorgan Chase & Co. climbed 2.7 percent to $43.58 and Wells Fargo & Co. rose 1.9 percent.

Bank of America paid a premium, $1.28 billion, to Freddie Mac to resolve $1 billion in claims currently outstanding because the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008, the Charlotte, North Carolina-based lender said in a presentation on its website. The bank paid $1.52 billion to Fannie Mae to resolve disputes on $3.1 billion in loans that were currently outstanding, or about 49 cents on the dollar. Bank of America’s total loss on the loans after recovering collateral and other assets is about 27 percent, said Jerry Dubrowski, a spokesman.

JPMorgan Deal

Bank of America is still liable for $2.1 billion in repurchase requests from Fannie Mae as well as any future demands. The agreement also didn’t cover $600 million in buyback demands from Freddie Mac as well as loans covered by the deal that turn out to be fraudulent or violated fair lending laws, said Michael Cosgrove, a spokesman for Freddie Mac. The GSEs are pursuing similar agreements with other lenders, and have already reached deals with JPMorgan on loans sold by Washington Mutual, which JPMorgan acquired in 2008, and with Ally Financial Inc. for loans serviced by GMAC Inc.

JPMorgan didn’t disclose what it paid to resolve the claims or the current outstanding principal on the loans. Ally, formerly known as GMAC, paid $462 million to settle repurchase demands on $84 billion of loans, representing the current unpaid principal balance. Like the deal with Bank of America, the agreements with JPMorgan and Ally didn’t release them from liability for loans they sold to the companies through their parent companies or other affiliates. Freddie Mac and Fannie Mae said they had a combined $13.3 billion in repurchase requests outstanding among all lenders at the end of the third quarter before yesterday’s deal was reached.

Freddie Mac

Although the deal caps Bank of America’s exposure at Freddie Mac, it doesn’t do the same at Fannie Mae, leaving it vulnerable if the U.S. housing market continues to fall, Miller said. The agreement also doesn’t cover challenges from private insurers, investors or government mortgage bond insurer Ginnie Mae. JPMorgan received requests for files to review about $8.1 billion in loans that may be candidates for buybacks and $2.9 billion in repurchase requests on both "private-label" and GSE loans through the third quarter, it said in a Nov. 4 investor presentation.

"Private label mortgage repurchase losses are a more significant concern for the industry at the current time and this settlement does not change our viewpoint in any way on the likelihood or magnitude of those losses," analysts led by Chris Gamaitoni at Compass Point said in a research note.

Total Cost

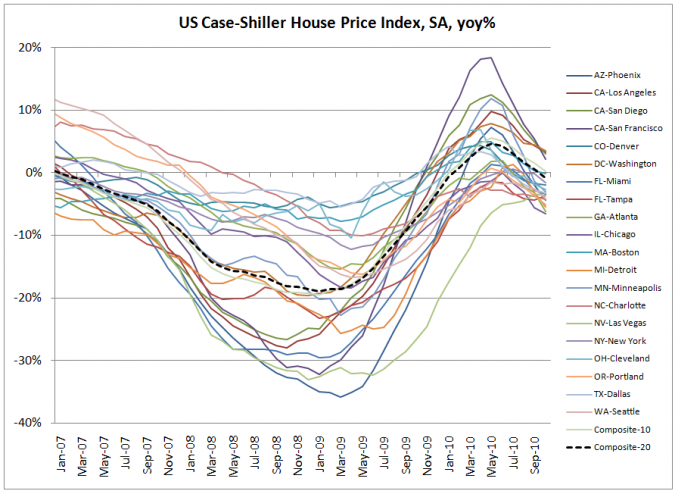

In total, repurchase demands may cost the industry between $54 billion and $106 billion, according to Miller, who said yesterday’s deal didn’t change his previous estimates. The industry is also still grappling with record-high foreclosures and an unemployment rate close to 10 percent that are depressing homebuyer demand. The S&P/Case-Shiller index of property values fell 0.8 percent in October from a year earlier, the biggest annual decline since December 2009.

"I don’t think this argument is over with, but you start getting some clarity on some numbers," Miller said. "It doesn’t address the foreclosure issues, the robo signing or private-label, so there are still some outliers out there that can cause some havoc. But it does clean up one of the messes out there." Bank of America was the largest U.S. servicer of home mortgages as of June 30, according to industry newsletter Inside Mortgage Finance. Wells Fargo, JPMorgan, Citigroup and Ally Financial round out the top five.

Is Fannie bailing out the banks?

by Colin Barr - Fortune

Financial stocks just caught fire. Someone must be getting bailed out, right? Why yes, say critics of the giant banks. They charge that Monday's rally-stoking mortgage-putback deal between Bank of America (BAC) and Fannie Mae and Freddie Mac is nothing more than a backdoor bailout of the nation's largest lender. It comes courtesy, they say, of an administration struggling to find a fix for the housing market while quaking at the prospect of another housing-fueled banking meltdown.

Monday's arrangement, according to this view, will keep the banks standing -- but leave taxpayers on the hook for an even bigger tab should a weak economic recovery falter. Sound familiar? "The administration is trying to weave a path between two bad alternatives," said Edward Pinto, a resident scholar at the American Enterprise Institute. "They want to bail out the big banks without doing apparent damage" to the sagging U.S. budget position.

Pinto says truly holding BofA responsible for all the mortgage mayhem tied to its 2008 purchase of subprime lender Countrywide would likely drive it into the arms of the Federal Deposit Insurance Corp., which has enough problems to deal with. Though BofA would surely dispute that analysis, it's easy enough to see where the feds don't want that outcome.

But BofA's many problems aren't the only reason for taking Monday's deal with a grain or two of salt. Critics also question the timing of the settlement, which comes on the heels of a court setback for the banks and a new legal challenge from a big investor. They wonder, given the huge sums being spent to prop up Fannie and Freddie, why the companies didn't get better terms.

And you don't need to be a conspiracy theorist to see that austerity talk in Congress means no more upfront support for financial firms. At a time of double-dipping house prices and nearly 10% unemployment, you can see where some people might find themselves devising new ways to prop up BofA and its housing-exposed rivals JPMorgan Chase, Wells Fargo and Citi. "This looks to me like a gift from Tim Geithner," said Chris Whalen of Institutional Risk Analytics. "There's politics all over this."

Fannie, Freddie and BofA sadly shake their heads at that one. BofA finance chief Chuck Noski spent a Monday conference call describing negotiations over the putbacks as "vigorous." Fannie and Freddie say resolving the mortgage putback issues has been a priority for months, and present BofA's $2.8 billion payment as one that is fair to taxpayers.

Freddie chief Charles Haldeman even says his company, recipient of $64 billion in federal aid over the past two-plus years, "has focused sharply on being a responsible steward of taxpayer funds."

But how sharp is Freddie if all it can do is squeeze a $1.28 billion payment out of a giant customer in exchange for relinquishing fraud claims on $117 billion worth of outstanding loans? The very best its million-dollar executives can do is claw back a penny on each bubbly subprime dollar?

That seems pretty weak even given that this is Congress' favorite subsidy dispenser we're talking about. "How Freddie can justify this decision to settle 'all outstanding and potential' claims before any of the private-label putback lawsuits have been resolved is beyond comprehension," says Rebel Cole, a real estate and finance professor at DePaul University in Chicago. "This smells to high heaven and they should be called out." Freddie declined to comment beyond its public statements and filings, and its regulator, the Federal Housing Finance Agency, didn't comment beyond its celebratory statement.

As for the scope of BofA's problems, the bank stressed in its comments Monday that the settlement with Fannie and Freddie should be viewed separately from the two other mortgage-putback categories: suits filed by the monoline insurance companies that backed many of the questionable loans, and disputes with investors in so-called private label securities, those packaged by Wall Street and sold to investors such as insurers and pension funds.

The $6 billion or so BofA has now paid to settle claims with Fannie and Freddie dwarfs its reserves in the other two channels. But that could change, thanks to recent developments in monoline and private label litigation. In mid-December, a judge ruled that the insurer MBIA can use statistical samples drawn from 6,000 case files to show BofA breached contractual representations and warranties on loans, rather than plowing through each of the 386,000 case files involved in the suit.

The finding, wrote an analyst at Gerson Lehrman Group, "dealt a blow to banks trying to defend themselves against mortgage putback liability," by shortening the path to a trial and reducing plaintiffs' court costs. Then, building on that ruling, insurer Allstate last week sued BofA, alleging that offering paperwork filed during the bubble years by Countrywide misrepresented the condition of loans that backed the bonds Allstate bought.

The insurer claimed offering documents indicated, for instance, that none of the underlying mortgages were secured by houses that were worth less than the loan. But Allstate's analysis found in various cases that between 3% and 15% of underlying houses were worth less than their outstanding mortgages. "That suit is just a slam dunk against BofA," said Cole. "Some of the stuff Countrywide was doing, you gotta be kidding me."

Of course, BofA may yet well win both those cases, or tie them up in court for years, or settle at advantageous terms. Such is the majesty of the taxpayer-backed megabank plying the byways of our legal system. But even as most of Wall Street calls BofA a buy, some contend the market is vastly underestimating the intensity of the mortgage putback pain ahead. Analysts at Iridian Asset Management, for instance, estimated in October that BofA could face between $50 billion and $100 billion of putback-related losses over coming years.

Even without a huge putback tab, the banks could be in for tough times. Falling house prices could lead to rising defaults as more homeowners find themselves owing more than their house is worth. Rising defaults would hit bank capital at a time when many bank business lines, ranging from trading to credit cards, are looking distinctly less profitable. And of course, no one is going to sign up for another round of the Troubled Asset Relief Program, no matter how strenuously the government claims it is turning a profit. Thus the appeal of a policy that would eliminate any need to go before Congress. "They're sending a signal to the banks that now is the time to do a deal and put this stuff behind you," said Pinto.

Goolsbee Says Failure to Raise U.S. Debt Ceiling Would Be 'Catastrophic'

by William McQuillen - Bloomberg

Austan Goolsbee, chairman of the U.S. Council of Economic Advisers, said if Congress fails to raise the debt ceiling, the "impact on the economy would be catastrophic." "I don’t see why anybody’s playing chicken with the debt ceiling," Goolsbee said today on ABC’s "This Week" program. "If we get to the point where we damage the full faith and credit of the United States, that would be the first default in history caused purely by insanity."

The government is slated to hit the legal limit on borrowing, $14.3 trillion, early this year. Congress must agree to raise that ceiling or the U.S. could be forced to default on its obligations. After candidates supported by anti-deficit Tea Party activists were elected on pledges to rein in government spending, some lawmakers have said they would demand budget cuts in exchange for voting to raise the debt ceiling.

The U.S. has a $1.3 trillion federal budget deficit. President Barack Obama’s debt-reduction panel failed last month to agree on its chairmen’s recommendations for ways to reduce the annual deficit to about $400 billion in 2015. The plan would have increased taxes by $1 trillion by 2020 by scaling back or eliminating hundreds of deductions, exclusions or credits such as those allowing homeowners to write off interest on their mortgage payments. It would also have cut individual and corporate income tax rates.

Seeking Common Ground

Goolsbee said he anticipates Obama will find common ground with Republicans on legislation to benefit the economy, citing investment incentives and tax cuts for workers and small businesses, and warned against cutting back on spending needed for economic growth. "The reason the deficit is big this year is because we’re coming out of the worst recession since 1929," Goolsbee said. "That’s the reason. The longer-run fiscal challenge facing the country is important."

Senator Lindsey Graham, a South Carolina Republican, said failing to raise the debt ceiling "would be very bad for the position of the United States in the world at large." Still, he wouldn’t vote to raise it "until a plan is in place" to deal with debt, Graham said on NBC’s "Meet the Press."

‘Continued Recovery’

Reaching an agreement with Republicans, Obama on Dec. 17 signed an $858 billion bill that extends for two years the Bush- era tax cuts for all income levels. It also continues expanded jobless insurance benefits to the long-term unemployed for 13 months and reduces payroll taxes for workers by two percentage points during 2011.

Goolsbee said the U.S. added 1.2 million private sector jobs in 2010 and cited forecasts for a "continued recovery." The unemployment rate is currently 9.8 percent. "You’re starting to see encouraging signs," Goolsbee said. "And so, you know, we’ve just got to juice this, and pump it up, and get it going faster, but that’s clearly the direction that we’re headed."

Peter Schiff: Obama Administration Admits U.S. Is Running A Ponzi Scheme

A debt-filled New Year

by Fraser Nelson - The Spectator

The Spectator is out today, with a cover story that I would commend to CoffeeHousers. Failure to learn from history usually condemns a nation to repeating its mistakes. That's why we should be nervous that no one seems to have worked out what caused the crash. Little wonder: the guys doing the analysis are the same guys who failed to spot the crisis building up, so it suits everyone to blame the banks. "How was I to know," says everyone from Gordon Brown to Joe the Pundit, "that they were doing all these complex debt swap thingies? They deceived everyone, the bounders." There is another analysis – and it's our cover story, written by Johan Norberg. He has been making his case in a short film (trailer here, if you can stand Brown’s cameo) and a book (for my money, the best written about the crisis). I thought CoffeeHousers may be interested in the bones of his argument – which I flesh out, below.

His analysis is that the hangover is not the problem: the party was. Bubbles always burst. We should ask how a debt bubble was blown in the first place. "Crazy risk-taking by banks is a symptom of the easy money era. Yes, they did outrageous things – but from the tulip bubble onwards, people always do if the supply of money is not properly controlled. What did for Britain (and America) was a fatal fixation with interest rate targeting: the idea that if CPI was about 2 percent then the economy was stable. In fact, this "stability" masked an avalanche of dangerously cheap money, to needlessly counter a benign deflationary shock from China and the Far East. Prices of assets – from fine wine to houses – were soaring. But central banks, and most mainstream commentators, didn't think it was a problem. They all bought into the idea that price stability meant economic stability. The root of the crash was an intellectual error: a rotten idea. And that idea is still with us.

Here is my ten-point breakdown of Norberg's argument. All quotes are from his piece, except point 2 which is from his book. A rather technical point, but a crucial one.

1. There are eerie parallels between 2011 and 2003. “In 2003, after the dotcom crash and the 11 September attacks had sent America into recession, everybody wanted the debt-fuelled consumer binge to continue. Not that they said so in terms. Euphemisms were deployed, then as now: there should be government ‘support’, a little touch of Keynes. The Nobel-winning economist Paul Krugman urged Alan Greenspan to ‘create a housing bubble to replace the Nasdaq [stock market] bubble’. The Fed chairman obliged, cutting interest rates to a new low. In Britain, base interest rates halved between 2000 and 2003. Money was as cheap as it needed to be to get everybody borrowing again, and returning to the market. House prices boomed. It looked like prosperity. Bubbles so often do.”

2. The error of inflation targeting. "In a dynamic economy, with constant innovation, prices often decrease. Let's assume that the real underlying costs fall by 2 per cent, due to increased efficiency. But this development could be counteracted by an increase in the money supply so that price tags in stores indicate a price increase of 1 per cent. The central bank is likely to grab the wrong end of the stick, by concluding that there is no inflation worth mentioning. This will prompt it to cut rates."

Sometimes, the world just gets more efficient – and it should mean falling prices. Norberg quotes James Grant, editor of Grant's Interest Rate Observer (which was calling the asset bubble by its name from 2003 on) in noting that "the price of a basket of good exposed to international competition had fallen by 31 per cent in the years prior to 1886, before the United States had a central bank." As Grant says: "falling prices are a natural byproduct of human ingenuity. Print money to resist the decline, and the next thing you know there's a bubble."

3. Western governments' reliance on debt now is extraordinary. The G7 countries have, on average, 50 percent more debt in 2010 than in 2007. This is an average figure: the below, using IMF data, charts how much debt they have taken on. No prizes for guessing which country raises the average:

4. David Cameron's famous baby. “For all the talk of austerity, governments everywhere plan to get through 2011 and beyond by borrowing like crazy. The world’s rich countries have increased their debt by some 50 per cent over the past three years, according to the IMF. Such statistics can too often seem meaningless, but during the British general election campaign David Cameron found a way to make them real. He unveiled a poster saying that a baby born today would owe £17,000 due to government debt. By his own estimates, that burden will rise to £21,000 within four years. Less than it would have been without the extra belt-tightening, to be sure, but a daunting figure none the less.”

5. The Russian Doll bailouts. “The crash happened because households consumed too much, sending their debts to the banks. The banks sent the debts to the governments — and, as we saw with Ireland, even governments might struggle to meet them. So they are sending their debts to the European Union. But to whom will the EU send the bills when its credit card is maxed out?”

6. The Irish bailout will not be the last of the sovereign debt crisis. “Greece and Ireland aren’t just illiquid, they are insolvent — and nothing is solved by taking new, bigger loans when they can’t pay the old ones. If Ireland or Greece default on their debt, forcing creditors to take steep losses, it might spook the markets and pull out a thread that unravels the garment.”

7. A Eurozone crisis cannot fail to impact Britain. “If the defaults start — or if it dawns on markets that the European Financial Stability Fund doesn’t have half of what it would take to save Spain, the world’s ninth largest economy — then investors might rush for the exit. And this, for David Cameron and George Osborne, would produce some deeply unpleasant surprises. What would happen to the British banks that have lent more than $110 billion to Spain?”

8. In the last debt crisis, the banks fell. This time, it might be governments. "In this regard, 2011 looks horribly like 2008. Yet again, banks are treading water, hoping that they can continue to borrow — and trying to lay their hands on as much capital as possible to cover their losses. Yet their risk is the same as last time. We have seen how jittery world markets can become, and how calamitous the consequences can be. It only took one big bank collapse — Lehman Brothers — to scare the markets so much that they avoided lending to anybody. Then, it was banks that fell like dominoes. Next time, it might be governments."

9. China may be the next bubble to pop. “Beijing has printed yuan and pushed banks and local governments to spend like drunken Keynesians. Absurdly, China’s money supply is now larger than America’s, even though its economy is a third of the size. We can see the results of this stimulus in stock market prices and in new roads, bridges and housing complexes all over the country. Not that anyone wants to travel on those roads or live in those buildings. In August, China’s largest energy company reported that an extraordinary 65.4 million residences have not consumed any electricity in the last six months — a fairly big clue that they lie empty. There are now entire ghost towns, like new Ordos in northern China, where tens of thousands of buildings erected from scratch stand empty. And yet property prices in Ordos have doubled over three years. It’s not popular demand, it’s pure speculation. In some quarters, China is being spoken of as the last, best hope for the world economy. But it might be the next bubble to pop.”

10. We may have tried to fix the old Ponzi scheme with a new one. “In the original Superman film, the hero rescues Lois Lane as she falls from a skyscraper. ‘Don’t worry, ma’am, I got you,’ he says, midair. ‘You got me? Who’s got you?’ she replies. This is the question that no one is asking now. If China is lending to us, who is lending to China? If the governments are saving the banks, then who will save the governments? If the European Union is offering a safety net, who would be there to bail out the EU? There are other questions not being asked: which country, in recent economic history, has successfully borrowed its way out of a debt crisis?”

So could 2011 be the year when the second debt bubble pops? Norberg finishes off with this point:

“’The problem with socialism,’ Lady Thatcher once said, ‘is that eventually you run out of other people’s money.’ This time, it is worse: we are running out of our children’s money, and our grandchildren’s money. We are assuming we will have a never-ending supply of borrowed money, and we have no backup plan if this supply chokes up. Things may feel safe at the moment. We can still borrow easily from international markets. So could Lehman Brothers on 12 September 2008 — the day before the bank imploded.”

It’s not wealth that’s being held off balance sheet

by Max Keiser

This headline is misleading: “A Third Of All The Wealth In The World Is Held In Offshore Banks.” Wealth implies some form of tangible equity but that’s not what’s being held off the global balance sheet. We’re talking about debt, trillions and trillions of debt that has yet to be disclosed, much less written off or ‘sterilized’ with massive Quantitative Easing schemes (of more debt) attempting to keep interest rates low enough so as to not force any of the debtors to pay off any interest on this debt.Part of this ‘invisible debt’ was flashed before our eyes back in October of 2008 when Hank Paulson threatened to shut down America unless Congress wrote him and his friends at banks all over the world and Wall St. a check for 750 bn. But none of the money Congress gave Hank was used to pay down any of the debt, only pay for the resecuritization (banker and lawyer fees) to service the debt and pay for bonuses and salary (140 bn. in bonuses on Wall St. in 2010).

The debt is still growing ‘off balance sheet.’ It’s frozen in the tundra of near zero percent interest rates engineered by the globe’s CB’s. But now Mother Nature seems to be throwing a brick through the window of complacency and Fed larceny in the form of global weather catastrophes driven by man-made global warming trends – driven in part by the easy credit available to corporations like Exxon – who have been able to extract, process and burn fossil fuels for decades for virtually zero cost (if you net out the environmental damage).

The cheap money put the dollars into the pockets of the AGW terrorists and now that the globe’s weather is causing hundreds of billions of AGW related damages. The ability of CB’s to hold back the tsunami of bad debts held off balance sheet is also crumbling.

Just to repeat, as large as the bailout packages were, none of the trillions used paid down any of the debt. All the existing debt was repackaged, and to pay for that service the actual amount of debt has increased.

AGW is triggering an avalanche of bad debts hitting the world’s visible balance sheet in the form of crashing sovereign bond markets and rising precious metals.

The AGW and corporate/gov’t debt build up – both non accounted for these past several decades – have fed each other and made each other possible and deadly. Without the cheap money, corporations would never have been able to pollute like they have. Without the ability to absorb the debt – as it melts in real time before our denying eyes (unless you own PM’s) – the world credit markets will continue suffering Anthropomorphic Credit Collapse (ACC).

The biggest factor driving PM prices higher is AWG denial and its relationship to interest rate manipulation and debt camouflage.

Michael Hudson on taxes, debt, depression, unproductive income and the 90% income tax

"Take any stock in the United States. The average time in which you hold a stock is–it’s gone up from 20 seconds to 22 seconds in the last year. Most trades are computerized. Most trades are short-term. The average foreign currency investment lasts–it’s up now to 30 seconds, up from 28 seconds last month."

Overheating East to falter before the bankrupt West recovers

by Ambrose Evans-Pritchard - Telegraph

This bear is not for turning. It would be joyous indeed if a fresh cycle of global growth were safely underway, but I don’t believe it. Sorry.

Policy levers in the US, Europe, and Japan remain set on uber-stimulus with the fiscal pedal pressed to the floor and rates near zero everywhere, yet OECD industrial output has not regained the peaks of 2007-2008 by a wide margin. Leading indicators are tipping over again. We are one shock away from a liquidity trap.

The East-West trade and capital imbalances that lay behind the Great Recession are as toxic as ever. Surplus states are still exporting excess capacity with rigged currencies -- the yuan-dollar peg for China and, more subtly, the D-Mark-Latin peg within EMU for Germany.

Dangerously high budget deficits of 6pc, 8pc, or 10pc of GDP in countries with dangerously high public debts near 100pc may have prevented an acute depression, but they have not prevented the weakest rebound since World War Two, and they cannot continue, whatever the assurances of New Keynesians and pied pipers of debt.

Cyclical bulls may see the surge in 10-year US Treasuries -- and therefore mortgages rates -- as a sign that growth is about to blast off: structural bears suspect it may be the first convulsive shudder of bond vigilantes dismayed at the easy willingness of Washington to spend $1.4 trillion above revenues next year, with no credible plan to contain the monster thereafter.

Can bond yields rise on "sovereign risk" even as core prices grind lower towards deflation? Yes, they can, and this baleful possibility is not in the textbooks. Ben Bernanke made a fatal error by launching QE2 too early, with an incoherent justification, by dribs and drabs for fine-tuning purposes. The QE card cannot easily be played a third time. If he now tries to print money on a nuclear scale to crush all resistance and hold down Treasury yields, he risks exhausting Chinese patience and invites the wrath the Tea Party Congress.

Alas, my neck-sticking predictions for 2011 must be as grim as ever. This does not exclude further bear rallies over the Spring on Wall Street and Euro-bourses as institutional mammoths seek to extract themselves from bonds. Europe's insurers have as little as 5pc of assets in stocks, against 15pc or more in the 1990s. Yet it is a double-edged sword if big funds switch en masse into shares. Bond dumping has economic consequences.

Japan will slip back into technical recession. It cannot keep raiding its foreign reserve fund to pay bills. Public debt will spiral up to 235pc of GDP. Interest payments will approach 30pc of tax revenues. Fresh debt issuance will outstrip fresh private savings this year. Dagong, Fitch, and S&P will have to act. Downgrades will come thick and fast. This time they will hurt.

Yes, I thought Japanese bonds would buckle in 2010. The obsolete paradigm survived another year. The longer it takes, the worse it will be. China and India are over-heating, faced with a 1970s choice between choking credit or the onset of stagflation. If they choose the latter to buy time, the politics of food will turn on them with a vengeance.

Vietnam will have to rescue its banking system, kicking off the Asian hard-landing of 2011-2012. The Aussie dollar will come back to earth.

Dylan Grice's rule of thumb at SocGen is that regions coming off a "good crisis" -- Japan in 1987, the US during East Asia’s 1998 blow-up, Chindia this time -- typically pop about two and half years later. The reason they have a good crisis when others bleed is because momentum from credit follies and/or hubris overpowers the external shock, but that contains the seeds of its own destruction.

Speaking of rules, the Atlanta Fed’s law is that every year of debt-based boom is roughly offset by equal years of debt-purge bust, which means a Lost Decade for the old world. I doubt the West will recover soon enough to pick up the growth baton before the East hits tires. We may then have a "sub-optimal equilbrium", that modern euphemism for a trade depression.

Europe is hobbled by its Delors Error. The region makes things that world wants to buy. Its external accounts are in balance. Fiscal policy is more responsible than in Japan, America, or Britain, yet the whole is less than the parts. A dysfunctional currency union engenders chronic crisis at a lower threshold of aggregate debt. Frazzled investors will seize on China’s foray into Iberian debt markets to thin their own holdings, denying the Portugal and Spain much interest relief.

Lisbon may last until March before being forced by yields above 7pc to accept its debt servitude package. At that point the EU will order its €440bn rescue fund to buy Spanish debt pre-emptively, hoping to draw a final line in the shifting sand, with half-hearted solidarity from the European Central Bank. As usual, Frankfurt will fall between two stools, failing either to satisfy Germany by immolating EMU on an altar of Bundesbank purity, or to satisfy everybody else by blitzing QE to save the system.

Bond yields will not fall enough to stop to the vice from tightening in every EMU state south of Flanders. It will become clear that Europe’s scorched-earth rescues cannot work because they offer no means by which victims can clear debt and claw their way back to health.

Ireland's Fine Gael-Labour coalition will take its revenge on Europe for imposing such ruinous terms under Berlin's Diktat. It will restructure senior bank debt, setting an irresistible precedent for the PASOK backbenchers in Greece, the Left wing of the Partido Socialista Obrero Espanol, and America’s insolvent cities. From bank debt to parastatal debt is a hop, and from there to quasi-sovereign debt is a skip. Nobody will utter the word default. They never do. Bondholders `volunteer'.

Pudding bowl haircuts will set off the next wave of distress for Europe’s banks as they try to refinance $1 trillion by 2012, in competition with hungry sovereigns. Gold may slip at first as casino funds cut leverage to meet margin calls, before punching higher to €1300 an ounce as investors seek gold bars in a precautionary move. Talk of capital controls will grow louder.

Year III of the Long Slump is when we confront the Primat der Politik in tooth and claw, the phase when states become erratic, victims fight back, and dissident intellectuals start to inflict damage on failed orthodoxies. The dog that hasn't barked yet is the jobless army in Spain, the 43pc of youths without work. Bark it will when the €420 dole extension expires in February.

The cruelty of Europe’s `internal devaluations’ will become clearer. Wage cuts are tectonic events. They set off the protests that forced Britain and then France off the Gold Standard in the 1930s, and smashed Argentina’s dollar peg a decade ago. What we need is an iTraxx European Wage Index to navigate EMU's treacherous waters from now on. Spain’s Jose Luis Zapatero has barely begun to cut, yet he has already had to impose the first state of emergency since Franco to keep airports open.

Certainly, this is the year when Europe's unions will remember their own warnings twenty years ago that EMU was a "bankers’ ramp", a scheme for the convenience of elites. They will ask louder why crucifixion on a Deutschmark cross is in their interests. Those few and reviled Iberian economists who dare to suggest that monetary union itself is the reason why Spain and Portugal cannot take action to fight the slump, will find a voice in the press at last. Once debate is engaged, it will be impossible to contain.

It would be a mercy if the German constitutional court brought this unhappiness to a swift close by ruling in February that Europe’s rescue machinery is a breach of EU treaty law, and therefore of the Grundgesetz. But it cannot happen, can it? A court order forcing Berlin to suspend payments would drive a stake through the heart of German foreign policy, and for that reason the eight judges must recoil, and the law be damned. One presumes.

Alas, there may be no neat solution, no division into two currency blocs with the South keeping the euro and the North launching the euro-plus, no brave decision by Germany to get out, revalue, and let others recover. Instead, there will be month after month of catfights, and flashes of hatred.

The EU will do just enough to prop up the edifice, but too little to restore lasting confidence. The German bloc will not confront the elemental point that either they agree to pay subsidies – not loans – on a scale equal to Versailles reparations, for year after year, or the South with stay trapped in slump until electorates blow a fuse.

Norway will sail on serenely.

Happy New Year.

Facebook Deal Offers Freedom From Scrutiny

by Miguel Helft - New York Times

In Silicon Valley, going public used to be the ultimate rite of passage for a start-up — a sign it had arrived. No more. With its $500 million infusion from Goldman Sachs and other investors, Facebook is now flush with cash, and a market value of about $50 billion, giving it the financial muscle it needs to compete with better-heeled rivals like Google.

And Facebook hopes for an even bigger advantage from the deal, the ability to delay an initial public offering. That would allow it to remain free of government regulation and from the volatility of Wall Street. It would also allow Mark Zuckerberg, the company’s chief executive, to retain near absolute control over the company he co-founded in a Harvard dorm room in 2004.

This strategy was unthinkable in Silicon Valley just a few years ago, when hundreds of start-ups with scant revenue and no profits, like Pets.com and Webvan, raced to go public, and investors eagerly lined up to buy their shares. Lots of people would stand in line to buy shares in Facebook, but for now, only an exclusive few — wealthy clients of Goldman Sachs — will be able to. On Monday, Goldman e-mailed certain clients, offering them the chance to invest in the company.

That offer is the latest sign of the emergence of active markets in the shares of closely held companies. Those markets are helping successful start-ups like Facebook develop the financial wherewithal to compete in the big leagues of business. They have also become an avenue for venture capitalists and start-up employees to cash in their stock, turning many overworked engineers into instant millionaires.

And so a young mogul like Mr. Zuckerberg, the world’s youngest billionaire at age 26, can enjoy many of the benefits of going public without having to tie the knot with Wall Street. Other hot technology companies like Twitter, Zynga and Groupon are also tapping secondary markets to keep stock market investors at bay. They are in no rush to go public and no longer need the bragging rights that a stock offering used to bestow.

"This is a topsy-turvy world," said Scott Dettmer, a founding partner of Gunderson Dettmer, a law firm that has advised venture capitalists, start-ups and entrepreneurs since the 1980s. He added that even a few years ago, "there were all sorts of business reasons to go public, but for entrepreneurs it was also a badge of honor." Perhaps more than any company founder, Mr. Zuckerberg, who declined to comment for this article, has frequently expressed his disinterest in Wall Street, though Facebook is clearly not above taking its cash. He passed on opportunities to make a killing, for example, when, at age 22, he rejected billion-dollar offers for Facebook.

"Mark would absolutely prefer not have an I.P.O. until he absolutely has to," said David Kirkpatrick, the author of "The Facebook Effect." "He absolutely doesn’t want to sacrifice control because he believes that his vision is necessary to keep powering the company forward." Mr. Zuckerberg’s quest to keep Facebook private, though, will not last forever. Federal regulations require companies with 500 or more investors to disclose their financial results, eliminating one of the principal advantages of staying private.

The Goldman Sachs investment, for a stake of less than 1 percent in the company, is formulated in part to skirt those rules. But it may help for only a limited amount of time. The Securities and Exchange Commission is investigating private company trades in secondary markets, and regulators may decide that what is good for Facebook is not necessarily good for the investing public.

Still, the huge cash infusion is a coup both for Mr. Zuckerberg, who is said to own about a quarter of the company, and Facebook. The deal gives the company cash to hire employees or build data centers. It also puts Facebook, which makes most of its money through advertising, on a path to surpass Google, by some measures, as the most successful Internet company to come out of Silicon Valley. Facebook is on track to bring in as much as $2 billion in revenue this year.

The deal with Goldman values Facebook at nearly twice the $27 billion that Google was worth after its first day as a public company in August 2004. Google did not cross the $50 billion mark until about six months later. The two companies have become enemies, but their founders share a deep suspicion of Wall Street, born in part from witnessing the devastation that followed the dot-com bubble. Like Mr. Zuckerberg, the founders of Google, Larry Page and Sergey Brin, set up two classes of shares, which kept them in control after the public offering. They also vowed not to be beholden to short-term investors.

Mr. Zuckerberg is exhibiting many of the same misgivings about the stock market. Mr. Zuckerberg has frequently demurred when asked about an eventual public offering. One of Facebook’s earliest investors said recently that the company would not go public before 2012. But Mr. Zuckerberg is benefiting from the fast-growing market for trading in the shares of privately held tech companies, which the Google founders did not have. Through private exchanges like Secondmarket and Sharespost, and through direct transactions between investors, closely held companies, their investors and their employees have been able to sell their shares to others. For start-ups today, that has opened new options to going public.

"Companies have financing alternatives that they didn’t have," said Marc Bodnick, a managing partner at Elevation Partners, which invested in Facebook in the last year. Those alternatives have become more attractive for companies, in part because of the increased regulations imposed on public companies but also because of the rise in short-term trading, which leaves some executives feeling they have lost control of their companies.

Ben Horowitz, a partner with Andreessen Horowitz, a venture capital firm, said the cost of being a public company had risen to about $5 million a year, from about $1 million a year. Mr. Horowitz, an early employee of Netscape, said that such costs would have eaten into the meager profits of the pioneering Internet company when it went public in 1995.

Additionally, accounting and legal requirements have become distractions for many start-ups, said Mr. Horowitz, whose firm is an investor in Facebook. Those distractions are bothersome for strong-willed entrepreneurs like Mr. Zuckerberg. "If you’re 30 years old and you think you’re building a business that’s going to be a 100-year-old business, what year you’re public doesn’t really matter," Mr. Bodnick said. "But if you think the steps you’re taking are laying the groundwork to long-term strategic growth, it’s good to be quiet, it’s good to be out of the light."

Still, some experts say that the option to remain private is a luxury that only few start-ups will be able to enjoy. "Things have changed dramatically for the 2 percent of companies that stand out from the pack like Facebook," said Lise Buyer, the principal of the Class V Group, which advises private companies about going public. Ms. Buyer, a former Google executive who was involved in its public offering, added: "If you are a semiconductor, or a biotech company, or an enterprise software company, you are not going to have investors throwing money at you without any disclosure."

Facebook (Effectively) Just Announced Plans To Go Public

by Nicholas Carlson - Business Insider

The wait is over! Facebook is going to have to register as a public company – and soon. At least, that's the opinion of Michigan law professor Adam Pritchard, one of the top securities law professors in the country and author of the authoritative text book, "Securities Regulation: The Essentials." Why now? The answer is the Securities Exchange Act of 1934, rule 12g5-1(b)(3), of course. For those not blessed with immediate and total recall of all acts of Congress, let us explain.

The SEC requires companies with more than $10 million in assets and 499 shareholders to register as public companies. Importantly, this does not mean that these companies have to list on the public markets, just that they have to disclose their financials – stuff like profits, revenues, and top executive hires and departures. Today, it was reported that Facebook has agreed to allow Goldman Sachs to sell $1.5 billion worth of its stock at a $50 billion valuation to high net worth Goldman clients. It's expected the private offering will sell out. You'd think this would put Facebook's shareholder count well above 500.

According to the New York Times, however, Goldman and Facebook have a plan to get around this limit. Andrew Ross Sorkin writes that "Goldman is planning to create a "special purpose vehicle" to allow its high-net-worth clients to invest in Facebook." "While the S.E.C. requires companies with more than 499 investors to disclose their financial results to the public, Goldman’s proposed special purpose vehicle may be able get around such a rule because it would be managed by Goldman and considered just one investor, even though it could conceivably be pooling investments from thousands of clients."

Clever – and Close! But no cigar. Our top securities law professor, Adam Pritchard, doesn't think Goldman's plan is going to work. Why?

Let's go through Rule 12g5-1 of the Securities Exchange Act of 1934 for the answer.

(Bear with us. We promise securities law has never been more dramatic.)

Rule 12g5-1 starts out sounding very optimistic for Goldman and Facebook's plans. Section A reads…"For the purpose of determining whether an issuer is subject to [the 500 shareholder limit that would requirement it to disclose financials] securities shall be deemed to be "held of record" by each person who is identified as the owner of such securities on records of security holders maintained by or on behalf of the issuer, subject to the following…Securities identified as held of record by one or more persons as trustees, executors, guardians, custodians or in other fiduciary capacities with respect to a single trust, estate or account shall be included as held of record by one person."

Translation: A trust or corporation – or "special purpose vehicle," in Goldman's parlance – can be considered a SINGLE shareholder, even if it has multiple beneficiaries, as Goldman's "special purpose vehicle" will. All the Goldman clients who buy Facebook shares are "beneficiaries." So far, Rule 12g makes it sound like Goldman and Facebook are in the clear. Party for Mark Zuckerberg, who never wants to have to share any of Facebook's financials!

But wait, Rule 12g5-1 goes on – with a twist! Section B, paragraph 3 reads…"Notwithstanding paragraph (a) of this section…If the issuer [Facebook] knows or has reason to know that the form of holding securities of record is used primarily to circumvent the provisions of Section 12(g) or 15(d) of the Act, the beneficial owners of such securities shall be deemed to be the record owners thereof."

Translation: BUSTED!

If the primary reason Goldman created the "special purpose vehicle" was to avoid crossing Facebook's 500 shareholder limit, then Goldman's many clients are all each considered individual shareholders in the company.

Again: BUSTED!

Says Professor Pritchard: "If Facebook is selling to [Goldman] knowing this is going to happen, then they are on their way to having to register the company as a public company with the SEC." A reminder: If Facebook is forced to register, it will not HAVE to offer stock to the public. But since it will be forced to disclose its financials anyway, we expect the company will go ahead and offer up some second class (non-voting) shares.

So what's going on? Didn't Mark Zuckerberg want to wait until 2030 (or never) to go public?

Here's what we would speculate happened: Thanks to it's popularity on secondary markets and an SEC investigation into that popularity, Facebook has finally resigned itself to an IPO. It shopped the IPO to the major investment banks. Goldman won because it promised to raise $2 billion for Facebook at an incredible $50 billion valuation. Smartly, Goldman decided not to pour its own $2 billion into Facebook, but turn around and offer its clients "pre-boarding" into the IPO through this "special purpose vehicle." It gets the IPO and a flashy product its private wealth clients will go nuts for.

Albert Edwards, SocGen bear, takes a bite out of China

by Nils Pratley - Guardian

Stock markets ended 2010 on an upbeat note. The FTSE 100 index reclaimed the 6000 mark before slipping back, but still registered a 9% gain, while the S&P 500, the most widely watched US index, has regained the level seen before the collapse of Lehman Brothers. There is an air of optimism among investors and a confidence among economists that a much feared double-dip recession has been avoided. A tough moment, then, to be bearish?

Not for Albert Edwards, the best known and longest-standing bear in the City. He has seen nothing to dent his Ice Age thesis – the term he coined as long ago as 1996 to describe the relative decline of equities versus bonds. He thinks there may still be another Japanese-style economic "lost decade" to endure. "Big structural bear markets take 19 years on average and have four recessions," he says. "We've had two."

Edwards is thus sticking to two eye-catching predictions. Stock markets will revisit their March 2009 lows (3512 for the FTSE 100). And, despite the hints in recent months of a return of inflation, gilt yields will fall below 2% (from 3.5% today) as deflationary forces reassert themselves. Oh, and for good measure, prepare for the hard landing in China and the crash in commodity prices.

Ridiculous? Well, remember that Edwards' Ice Age call in 1996 has proved to be a winner: even if you include the stock market's dotcom bubble years at the end of the 1990s, equities are still a long way behind bonds since 1996.

Remember, too, that Edwards' forecasts were generally rubbished at the time. His dismissing of the supposed Asian Miracle in the mid-1990s as "Noddynomics" was resented – until the Asian currency crisis of 1998.

To Edwards' amusement (he includes selected "fan mail" in his latest research pack), correspondents to his employer were still trying to get him sacked in 2000. "Send this old, sclerotic and dangerous man into pension or – this would be much better – take him to prison," said one. "He's obviously ill and not qualified to be chief strategist of Dresdner Kleinwort. I hope his prophecy will destroy his career for the next thousand years."

In fact, the Ice Age prophecy has been the making of Edwards' career. He started out in the Bank of England's economics department, spend three years in fund management and then had a 19-year stint at Kleinwort until 2007.

Ruinous

He and his colleagues (at the French bank Société Générale) have been the top-rated analysts in the "global strategy" category for seven consecutive years, despite being too quick out of the blocks with some of their predictions.

"Often the call is right but it is early and the clients know that," says Edwards, 49. His research is also a model of brevity (others produce 100-page tomes; SocGen's strategists regard 10 pages as a long read) and throws punches – especially at the "criminally negligent" central bankers in the US and UK who allowed house prices to escalate and ruinous levels of debt to accumulate.

At times, though, during the great banking bust, Edwards' views have come dangerously close to becoming consensus wisdom. The same cannot be said about his view on China. "The biggest risk to market valuations and to sentiment generally is a China hard landing," he says. "In reality, China is a much more potentially volatile economy than people think.The Chinese situation is the one that could come out of nowhere because people are not considering it as a serious possibility."

But hasn't China been gloriously unaffected by the turmoil in the west, producing growth of 10% or so with little difficulty? Edwards' argument is that "when you have a good crisis, success can become a curse". Japan, he points out, sailed through the 1987 stock market crash. Similarly, the US economy escaped with a shallow recession after the bursting of the dotcom bubble; house prices started to rise as the authorities declared a period of stable inflation and "great moderation" to be under way.

"Then what happens is that housing and credit bubble goes out of control," argues Edwards. "You tap your foot on the brakes and the whole thing starts crashing and you can't control it on the downside," he says. "China is exactly the same. It had a very good crisis in 2007, opened the credit floodgates, got a house price bubble going, and they're now trying to tap their foot on the brakes."

In Edwards' view, China is a "freak economy"; its investment-to-GDP ratio is off the scale in terms of size and endurance. "In development history, Korea is the only one that got close. It then collapsed. China is basing a growth model on the most unstable part of GDP. The Chinese authorities have recognised this and are trying to steer the economy over to consumption – which is fine, but it will take a long time."

The danger, he suggests, is that China has produced such strong growth for such a long time that investors assume the process will last indefinitely. "There is too much confidence in the lack of volatility. If you get a zero or a small minus for Chinese GDP, in the great scheme of long-term development it's not a great problem. But it's a bit like investing in Nasdaq stocks in 2000 – there would be a big adjustment in price. There is an investment edifice built on the idea that China is the new growth engine of the world."

For statistical support, he points to the OECD's leading indicator of economic activity, which measures factors such as electricity production, freight activity and money supply. In China, it is slowing rapidly, even though commodity prices are as elevated as they were in early 2008 (prices then plunged). Something has to give – and probably sooner than most people assume. The degree of "push-back" from clients to his view on China reminds him of the resistance to his bearish calls on the dotcom and east Asian bubbles.

Closer to home, the Ice Age thesis suggests disappointments for the economy are inevitable. Edwards points to Japan, which enjoyed occasional strong rallies in share prices without conquering its long decline. "During the deleveraging process in early 1990s, the economy was incredibly vulnerable to renewed recession." The lesson, he argues, is that "to avoid recession you need to stimulate all the way through the deleveraging phase". That makes Austerity UK more vulnerable to recession than the US.

Retrenchment

But even the US, where monetary and fiscal stimuli have been greater, is "spewing money out but just kicking the can down the road for a bit". He expects the public appetite for retrenchment to fade when recessions return. The middle classes have been "totally shafted" by a house price bubble that created the illusion of prosperity.

"In the US, one in eight are on food stamps. Japan was a cohesive society that shared its pain collectively. That is not how it stacks up in the US, UK, Spain, Greece etc. You have much more fractious environment to have a lost decade in. The ructions for society will be far worse."

So Edwards' answer to the question that obsesses investors at the moment – are we past the worst? – is a resounding "no". Or, as his final research piece of 2010 put it: "I've been doing this job long enough to recognise when the markets are entering a new phase of madness that leaves me scratching my head with bemusement.

The notion that we are back in a sustainable economic recovery is as ludicrous as it was in 2005-07. But investors are backon the dance floor, waltzing their way towards the next, inevitable implosion[, which] yet another they will no doubt claim in retrospect was totally unpredictable!"

China's war on inflation a threat to global recovery

by Graham Ruddick - Telegraph

China's Premier Wen Jiabao has vowed to step up the country's fight against inflation, increasing the likehood of further interest rate rises that could threaten the strength of a global economic recovery.

Mr Wen's pledge to curb inflation came as new government figures revealed that measures already taken are leading to a slowdown in manufacturing growth.

Speaking on a trip to supermarkets in Inner Mongolia over the weekend, Mr Wen said: "The central government has taken a slew of steps to stabilise prices. We will put it higher up on our agenda."

Chinese inflation is at the highest rate for more than two years – 5.1pc – sparking fears in the government of social unrest as the price of food soars. China raised interest rates for the second time in three months on Christmas Day, lifing them 0.25 to 5.81pc.

Policymakers have also raised the amount of money banks must keep in reserve in an effort to restrain bank lending that has powered the economy but also driven up prices.

However, a clampdown by China on inflation threatens to slow the growth of the domestic and global economy, which has been heavily reliant on the strength of the world's second largest economy. Stock markets around the world slid after the country raised interest rates over Christmas.

A survey by the state-affiliated China Federation of Logistics and Purchasing (CFLP) shows manufacturing expansion eased in December, with the Purchasing Managers Index falling from 55.2 to 53.9. The decline – based on a survey of 820 companies – was the first in five months and economists have attributed the slowdown to the government's inflation policies.

Although any measurement above 50 represents growth, the PMI survey also showed slowing expansion in new orders, which fell to 55.4 from 58.3, and output, from 58.5 to 57.5. "This suggests a very strong tightening force at work which could be the tightening in financial conditions which has been more than we previously expected," Goldman Sachs said.

On December 31, the central bank governor Zhou Xiaochuan pledged to keep prices "basically stable" this year with a shift to a "prudent" monetary policy from the "moderately loose" stance taken as the country tried to drive growth. His tone was markedly different from 12 months ago, when he earmarked "defeating the international financial crisis" as the crucial task.

The bank chief's comments were supported by Mr Wen, who in a rare radio appearance faced callers angry about rising prices. "I can tell everybody, the government has complete confidence in tiding over this difficult stage," he said. The price of basic foods has doubled in some parts of China and there are fears that a freezing winter could drive prices up further. High inflation has been driven by aggressive lending by banks following the financial crisis and Beijing's ¥4 trillion (£389bn) spending programme.

However, a subindex by the CFLP of input prices for raw materials, energy and supplies fell sharply to 66.7 in December from 73.5 in November, indicating that policies to stabilise prices have met with initial success. Ken Peng, an economist at Citigroup said: "I do not see much risk of a sharp economic slowdown."

It's only a matter of time before China's housing bubble bursts

by Wu Guangqiang - Shanghai Daily

Despite a multitude of measures, many of them considered decisive and effective, taken by the central government to curb wild property prices, the overheating Chinese home market shows few signs of cooling-off.

Property developers everywhere are competing to break records for the highest land-bidding prices, hence, we see a series of "kings of the land," referring to lots acquired at the highest bid.

What's more, the fever for land acquisition is spreading from the major cities, mostly coastal ones, to medium and small cities. The masses are puzzled.

On the one hand, the authorities spare no efforts to rein in soaring prices. The population, trusting the government, had high hopes that it would bring down the prices in a swoop. Premier Wen Jiabao has several times expressed determination to achieve this objective. On the other hand, developers have never shown a shred of willingness to cave in, and by pushing the prices so high they are protesting their commanding edge.

As a result, the longer people wait, the higher the prices. Frustrated people are even beginning to doubt that authorities have silver bullets, and scrambling to buy before prices rise further. This is a vicious cycle, making it more difficult to control prices.

The People's Daily has been bashing tudi caizheng, or "land revenue," meaning taxes and fees local governments levy on developers and other land users. Almost everyone knows that tudi caizheng is at least partly responsible for the ever-inflating bubble.

National data shows, during 2001-2003, the total land-sales revenue was over 0.91 trillion yuan (US$137 billion), accounting for 35 per cent of total fiscal revenue. The figure for 2009 rose to 1.5 trillion yuan, equivalent to 46 per cent of the total. This year's figure is expected to surpass 2 trillion yuan, an astronomical one.

In the breakdown, the combined land revenues for Beijing, Tianjin and Shanghai - whose housing prices are among the nation's highest - are expected to hit 400 billion yuan, 20 percent of the expected national total of 2 trillion yuan. In contrast, the combined GDP of these three cities accounts for only 11 percent of the national total. Many other cash-strapped cities and counties are virtually running on land sales.

Since the 1990s, China's urbanization and industrialization has been dominated by local governments and features vast urbanization. The adoption of the "revenue-sharing-scheme" in 1994 gave governments great incentive to sell as much land as possible at top prices. While the ingenious model did spur economic development, it sowed seeds of risks.

With farm land disappearing around cities, vegetables and other food are more expensive; conflicts - many bloody and even deadly - are escalating between demolition teams and home owners. Tudi caizheng is now dismissed as unsustainable. There are calls for reform.

The tricky question now is how we can expect insatiable officials and developers, who are usually in cahoots to boost land prices, to part with their long-savored meat. If this craziness carries on, there will be a day when all land is sold, ending most cities's land-generated growth.

Despite wide concern over rising risks, few seriously think the bubble is likely to burst here, as it did in Japan, Ireland and now in Spain. The latest buzzword is "rigid demand" for homes, meaning demand is endless considering the huge population and booming economy.

There seems to be a "China Myth." Is that true? A study of the Japanese property bubble may be helpful. In the heyday of Japanese prosperity, the land value of Tokyo alone exceeded that of the entire US. Japanese tycoons were considering buying up America. What happened later is history.

Wandering around newly completed residential areas near my home in Shenzhen - stacked with gleaming apartments, I find 80 per cent of the units are still unoccupied one year after completion. The same is true in Beijing. Prices have made ownership impossible for most buyers. So, it's a matter of time before the bubble bursts, I think.

When a rope is strained beyond its limits, it snaps, which is common sense.

World on red alert over China's inflation

by Malcolm Moore - Telegraph