"Broad Street exchange and curb brokers, New York City"

Ilargi: In the past few weeks, dysfunctional societies have become a very popular theme. So what makes them dysfunctional? Is it just about physical and mental suppression, or are economic factors just as important? How about Mubabrak's rumored $40 billion stash outside of Egypt? Or the $170 billion the US estimates Kadaffi and his family control in funds invested in foreign nations? In a Wikileaks cable on Saudi Arabia, a prince is quoted as saying "the revenues from 'one million barrels of oil per day' go entirely to 'five or six princes". At $95+ per barrel, you do that math.

And if we can agree that things like that are factors in destabilizing societies, how can we not also look at the fast increasing inequalites in western economies? Incomes, job security, health- and other benefits, pensions, average pay, and of course jobs themselves, everything is rapidly deteriorating. While at the same time bankers and politicians are siphoning off what they can get away with from the public funds that by right belong to the same people who lose their jobs, health care access, pensions and homes. And desperately need those funds.

Are we really to believe that the reaction in the western world to these financial atrocities will forever be different from what they are elsewhere today? How, exactly, then are Jamie Dimon and Lloyd Blankfein different from Mubarak and Ben Ali? Is it because what they do is legal? That would be too easy; they make the laws. What Mubarak did was perfectly legal in Egypt; he too made the laws. Is it because Lloyd and Jamie wear no crowns? Are we that easily fooled?

Here's Ashvin with the first part of this take on this.

Ashvin Pandurangi:

It's Not Rocket Science.

It's just basic arithmetic. 2+2 = 4 ...

Privately-owned central banks + discretionary monetary policy = systemic corruption/oppression.

If the Food & Drug Administration had 100% of its shares owned by private pharmaceutical companies, and, a few months after implementing some radical new regulatory directives, these companies began making record profits and their executives receiving record bonuses, then it wouldn't be too difficult to understand why.

Well, that's not necessarily a hypothetical as much as a sad representation of reality, but the connection is even more blatant in the case of the "Federal" Reserve. It's 100% owned by private financial institutions, which receive 6% annual dividends on their shares, and have enormous control over the selection of its Board of Governors, who in turn have enormous control over its Open Market Operations.

After the Fed launched its "QE1" and "QE2" programs in 2008 and 2010, the two most aggressive monetary directives ever undertaken in America (they will combine to total ~$2.5T in debt-asset purchases [1]), the banks have posted "their two best years in investment banking and trading".

For the five biggest institutions (Goldman Sachs, JP Morgan, Citigroup, Morgan Stanley, Bank of America), revenues generated in 2010 were only exceeded by those of one other year in history, 2009. [2]. These two years just happened to follow the onset of the worst economic depression the world has ever experienced, which is still right on track to surpass the global financial and social turmoil caused by the Great Depression. If you think that is an irresponsible exaggeration, then just stop and reflect on the fact that Germany and Japan did not have any access to nuclear or biological weapons of mass destruction back in the 1930s.

Moreover, the worst financial effects of the Great Depression were primarily limited to the Americas and Europe, while the latest credit bubble had stretched its tentacles to every single corner of the globe. North Africa and the Middle East have already descended into the belly of the financial beast, and it is highly likely that certain parts of Europe (i.e. Greece, Spain, Portugal, Italy) and Asia (i.e. Vietnam, Pakistan, Sri Lanka, etc.) will shortly (within the next year) follow their footsteps down the beaten path.

We must remember that the financial elites running the Fed and IMF are not only concerned with making vast sums of money, but also retaining and expanding their grip on the global levers of power. So is it a coincidence that many of these politically unstable countries had been targets of American imperialistic (financial) domination for years now, and that their sociopolitical deterioration presents glaring opportunities for outright regional intervention by the U.S. military-industrial complex?

We must remember that the financial elites running the Fed and IMF are not only concerned with making vast sums of money, but also retaining and expanding their grip on the global levers of power. So is it a coincidence that many of these politically unstable countries had been targets of American imperialistic (financial) domination for years now, and that their sociopolitical deterioration presents glaring opportunities for outright regional intervention by the U.S. military-industrial complex?Perhaps not, since the U.S. has often used economic catastrophe to direct economic and political policy in other countries and concentrate ever-more financial wealth in the hands of a few global corporations. Naomi Klein briefly outlines the dynamics of this process in the Introduction of her acclaimed book, The Shock Doctrine, under the direction of its most notorious proponent, Milton Friedman:

"Friedman first learned how to exploit a shock or crisis in the mid-70s, when he advised the dictator General Augusto Pinochet. Not only were Chileans in a state of shock after Pinochet's violent coup, but the country was also traumatised by hyperinflation. Friedman advised Pinochet to impose a rapid-fire transformation of the economy - tax cuts, free trade, privatised services, cuts to social spending and deregulation.

It was the most extreme capitalist makeover ever attempted anywhere, and it became known as a "Chicago School" revolution, as so many of Pinochet's economists had studied under Friedman there. Friedman coined a phrase for this painful tactic: economic "shock treatment". In the decades since, whenever governments have imposed sweeping free-market programs, the all-at-once shock treatment, or "shock therapy", has been the method of choice."

The invasion of Iraq was a more recent and brutal deployment of "shock therapy", which was premised on the existential threat of Saddam Hussein in possession of imaginary WMD, and this time the U.S. military was directly involved (and still is). So there is no lack of credible evidence and common sense to suggest that such "shock" tactics are now being focused on both developed and developing economies in an attempt to create a new global, neo-liberal financial order. However, the scope, scale and specific consequences of the latest financial crisis are not things which can be easily controlled by a few powerful institutions such as the Fed, IMF, World Bank or even the Pentagon, if they can be controlled at all.

Many of the existing power structures in the oil-rich Middle East are clearly targets of destabilization by the financial empire, but it is unclear whether Egypt's revolution was a part of the plan, since Mubarak has always been a tried-and-true ally of the financial elite, and surely the same is true of the House of Saud.

Mubarak's departure may very well be a non-factor for the economic/political realities faced by the Egyptian people, but it can definitely be viewed as a deeply symbolic event. As I alluded to before, the once-propagandized threats of "WMD" and "terrorists" in the region appear to have manifested themselves as actual forces of disruption to be reckoned with. Libya's Qadaffi has always been a stubborn thorn in the empire's side, so he would not be missed, but if he were to actually blow up the country's oil pipelines on his way out [3], the elites would probably not be very happy about it.

Then again, such a catastrophe could provide just the economic shock needed to justify more forceful intervention in the region, if any such justification is even needed at this point. The problem is that, while the original arithmetic is simple enough to understand, complex systems of nature always have a way of introducing unexpected variables into the equation. Are we just following the simple logic which dictates that every economic policy is crafted for the benefit of financial elites, or are we manufacturing an elaborate narrative in which every single event is a stepping stone towards a final pre-conceived destination? One thing we can be certain of is the fact that no complex network can be maintained without some level of integrity in its central hubs, where most of the activity takes place.

The major financial executives may be raking in record stacks of stolen dough, but average American and European citizens are intensely watching their wealth evaporate into thin air as they become increasingly desperate with every passing day. The same could be said of China and India, where there are enormous credit bubbles just itching to pop, and combined comprise more than 11% of the world's GDP and almost 40% of the entire world's population. [4], [5].

It will be increasingly difficult for any group of human beings, no matter how powerful, to maintain a global financial order as the masses wake up from their fleeting dreams of unbridled prosperity. Seated comfortably at my computer, writing about global financial trends marked by increasing wealth inequality, I can confidently say that two plus two always equals four. Sitting atop the ivory towers of Washington and Wall Street, the math is perhaps a bit more difficult and a bit less certain.

*Part II in this series will discuss the deterioration of ecosytems underlying the industrial/financial global economy, and how this dynamic introduces even more uncertainty for the financial elites.

It's the Inequality, Stupid

by Dave Gilson and Carolyn Perot - Mother Jones

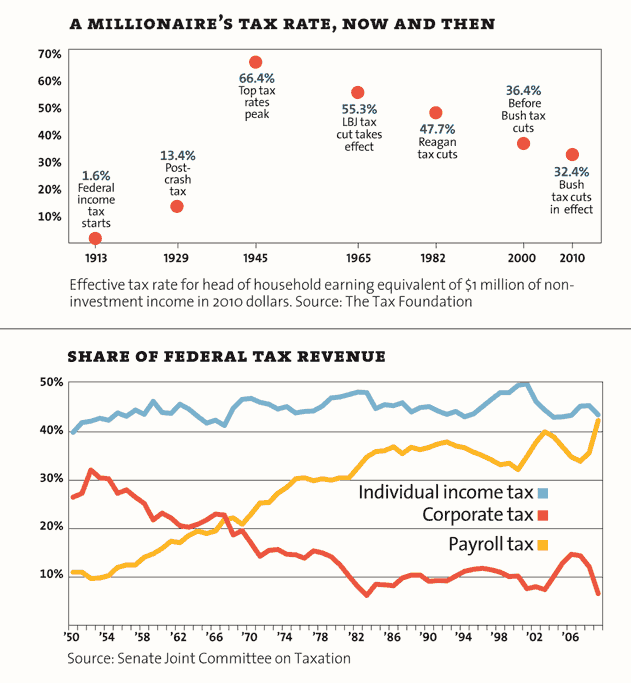

Eleven charts that explain everything that's wrong with America.How Rich Are the Superrich?

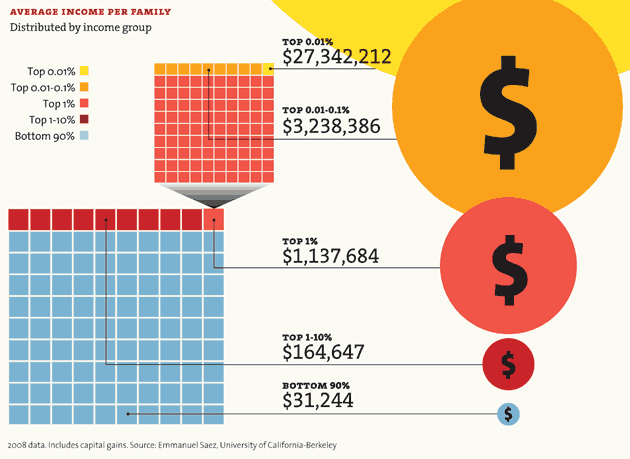

A huge share of the nation's economic growth over the past 30 years has gone to the top one-hundredth of one percent, who now make an average of $27 million per household. The average income for the bottom 90 percent of us? $31,244.

Note: The 2007 data (the most current) doesn't reflect the impact of the housing market crash. In 2007, the bottom 60% of Americans had 65% of their net worth tied up in their homes. The top 1%, in contrast, had just 10%. The housing crisis has no doubt further swelled the share of total net worth held by the superrich.

Winners Take All

The superrich have grabbed the bulk of the past three decades' gains.

Out of Balance

A Harvard business prof and a behavioral economist recently asked more than 5,000 Americans how they thought wealth is distributed in the United States. Most thought that it’s more balanced than it actually is. Asked to choose their ideal distribution of wealth, 92% picked one that was even more equitable.

Capitol Gain

Why Washington is closer to Wall Street than Main Street.Congressional data from 2009. Family net worth data from 2007. Sources: Center for Responsive Politics; US Census; Edward Wolff, Bard College.

Who's Winning?

For a healthy few, it's getting better all the time.

Your Loss,Their Gain

How much income have you given up for the top 1 percent?

Illustrations by Jason Schneider

Pension Funds Strained, States Look at 401(k) Plans

by Steven Greenhouse - New York Times

Lawmakers and governors in many states, faced with huge shortfalls in employee pension funds, are turning to a strategy that a lot of private companies adopted years ago: moving workers away from guaranteed pension plans and toward 401(k)-type retirement savings plans. The efforts come as the governors of Wisconsin and Ohio, citing dire budget problems, are engaged in bitter showdowns with public-employee unions over wages, pensions and collective bargaining rights.

The new plans allow states to set a firm, upfront limit on the amount they will contribute and leave it up to the employee and the financial markets to make the money grow. In a traditional pension system, the employer promises a certain benefit, then must find a way to pay for it. Like private employers, which in droves have terminated traditional pension plans, many government officials like the idea of shifting much of a pension plan’s risk to the worker. And some workers prefer a 401(k)-type system because it gives them more control over their retirement assets, including the ability to take the money with them when they change jobs.

Utah lawmakers voted last year to make a partial changeover to a 401(k)-type plan, following in the footsteps of Alaska, Colorado, Georgia, Michigan, Ohio and several other states, which offer at least some version of it. In February, Kentucky’s Senate approved a full switch to a 401(k)-type plan, although the bill faces uncertain prospects in the House. In Oklahoma and Kansas, legislative committees will be studying the issue intensively over the next few weeks. Gov. Sam Brownback of Kansas has made it clear he hopes the state Senate will embrace some form of a 401(k)-type plan. Texas is also considering a switch.

Utah decided to adopt a 401(k)-type plan after the stock market plunge in 2008 caused the shortfall in the state’s pension plan to balloon to $6.5 billion. "We said, ‘O.K., how do we prevent this from happening again?’ " said Dan Liljenquist, a state senator who pushed for the changes. "How do we eliminate the bankruptcy risk for our pension fund?" Under the new plan, Mr. Liljenquist said, the state’s retirement contributions for new workers will be roughly half that for current employees, potentially saving $5 million a year for every 1,000 new workers hired.

Still, these plans — similar to 401(k)’s, but named after other sections of the tax code — are not being embraced in states with the biggest pension problems like Illinois, California and New Jersey, which have shortfalls so immense that a switch would not solve their problem. Unlike private companies, most states are constitutionally or contractually barred from changing the pension plans of current employees without their consent. So the new rules are generally voluntary or apply only to new employees.

In fact, switching workers to 401(k)-type plans can make the underfunding problem even worse. As contributions move to individual investment accounts, less money goes into the traditional plan to help finance pensions promised to other workers. "There’s no free lunch here," said Alicia H. Munnell, director of the Center for Retirement Research at Boston College. "People say, ‘We can reduce our costs here if we have a defined-contribution system.’ Well, if you do this, you still haven’t done anything about your unfunded liabilities."

California’s problems are so acute that just last week a government-appointed commission of experts urged the state to consider at least a partial switch to 401(k) plans; six years ago, an effort by Arnold Schwarzenegger, then governor, to move new employees into such plans was blocked by local governments and public-employee unions. The long-term benefits of restructuring pension systems are alluring to many public officials. The new governors of Florida and Kansas, Rick Scott and Mr. Brownback, and lawmakers in North Dakota, Oklahoma, Virginia and several other states are seriously discussing adopting 401(k)-type plans for state employees.

"Every state has to solve this problem or else there’s going to be a very dire consequence," said Mike Mazzei, a Republican state senator in Oklahoma who heads the Senate select committee on pensions and is backing an overhaul of a system that faces $16 billion in unfunded obligations. The push to switch to 401(k)-type plans comes overwhelmingly from Republicans, who see them as more individualistic and free market. Democrats generally oppose the change, partly because their union allies are eager to keep traditional plans.

Utah chose to take a hybrid approach to limit taxpayers’ liability and keep money flowing into the old plan. Starting July 1, new state workers will be able to choose either a traditional pension plan or a 401(k)-type plan, with the state contributing 10 percent of an employee’s salary (12 percent for uniformed workers) to whichever plan a worker chooses. But there is an important twist: Utah will never pay more than 10 percent of a new employee’s salary to the pension plan. If the plan becomes too underfunded, employees who have joined the plan will have to pay a percentage of their paycheck to help eliminate the shortfall.

The Utah plan is meant to give workers a choice, said Mr. Liljenquist, who became such an expert on pension overhauls during Utah’s debate that lawmakers in other states have sought him out for advice. "Some state workers who will just work for the state a few years — take, say, bank examiners — I imagine 75 percent of them will choose defined-contribution plans," he said, referring to 401(k)-type plans. "And I think 90 percent of cops and firefighters and 75 percent of teachers will want a defined-benefit plan because they look at their government jobs as a single career."

Casey Parry, 32, a research consultant in the Utah human resources department, would prefer the 401(k) option. "It’s hard when you’re starting a job to make a decision whether to stay with an employer for 30 years," he said. "I prefer the security of having a defined-contribution plan that I know I can take with me. It’s under my control. I can plan for it." But Debra McBride, a Medicaid policy analyst who has worked for the state for 35 years, said she was happy with a traditional pension plan. "I imagine that anyone who went through the recession with a 401(k) and saw the stock market nosedive wished they had a pension plan instead of a 401(k)," she said.

Lawmakers considering changes are trying to balance competing needs. Georgia officials — fearing that many employees would retire with paltry amounts in their plans — stopped short of embracing a full-fledged 401(k) plan, setting up a hybrid plan different from Utah’s. New employees join both a traditional pension plan, with a far less generous formula than the old formula, and a 401(k). The state contributes an automatic 1 percent of salary into the 401(k)-type plan and matches half of the next 4 percent that employees contribute.

"Georgia realized that having people solely in a 401(k), they have sole control and they might lose a lot of money in it," said Pamela L. Pharris, executive director of the Employees’ Retirement System of Georgia, adding that such people eventually "might become dependent on the state."

The National Association of State Retirement Administrators has voiced support for traditional pension plans. "Defined-contribution plans are a very unreliable vehicle for promoting retirement security," said Keith Brainard, the association’s research director. "Many workers don’t know how to invest, many don’t contribute enough to their 401(k)s, and many cash out much of what’s in their 401(k) long before they retire, leaving them too little to live on when they retire."

Mr. Brainard said it would be wiser for states to ask employees to contribute more toward underfunded plans than to switch to 401(k)-type plans. And in fact, some states have shored up their pension plans by requiring employees to pitch in more of their salary.

Despite the cautions, Bette Grande, a Republican state representative in North Dakota, vowed to continue pushing for 401(k)-type plans. Ms. Grande sponsored a bill to switch new employees entirely to such plans, but it was blocked by the House on Feb. 18. "I think it’s condescending to say that workers aren’t wise enough to manage their own investments," said Ms. Grande, who said she would push to revive the bill. "I refuse to think I’m going to have a bunch of teachers on welfare."

US conflict with unions is about more than just money

by Clive Crook - Financial Times

It began to be obvious months ago, as the fiscal stress on US states and cities increased, that friction with public sector unions was inevitable. Still, the force of the assault on the unions and the energy of their resistance have come as a shock. A startled country is unsure whose side to take. It does not help the stakes have been misrepresented. Hostilities began in Wisconsin. Tens of thousands have protested on the streets of Madison against Republican governor Scott Walker’s bill to roll back collective-bargaining rights. Neither side looks ready to capitulate.

Now the conflict has spread. Republican governors and legislatures in Ohio and Indiana have also moved against their unions. Even states with Democratic governors or legislatures are seeking big concessions on pay and benefits. A moment of truth has arrived for organised labour in the US. Make that, organised labour in the US public sector. Unionism in the private sector is practically extinct. Just 7 per cent of private-sector workers are union members, down from 30 per cent in the 1960s. But in state and local government the average is 39 per cent, and in some states far higher: 73 per cent in New York, for example, 66 per cent in New Jersey, 58 per cent in California.

The persistence of public sector unionism is partly due to market forces. Private businesses, indeed whole industries, come and go quickly in the US, which makes organising unions a struggle. Public-sector jobs tend to last. Once you have a worker in your union, you have him until he retires. But state policies have helped too. Some give legal blessing to "union shops" (workers must join the union) or "agency shops" (they can choose not to join, but still have to pay dues).

Republicans attacking these rights say unions must be tamed to balance the states’ books. The unions say their pay is not out of line, and they have made concessions. This is partly true. Wisconsin’s unions have accepted cuts in pay and benefits. The fight in Madison is not about saving money in the current budget round. Whether union power distorts pay over the longer term is a different question, and harder to resolve. Studies point both ways.

Workers in state and local government get higher wages, but once you allow for their extra years of education, they look underpaid. Their perks are vastly better – generous defined-benefit pensions are the norm; in the private sector these have mostly gone – and hours of work are fewer. Some think this puts public employees ahead in total education-adjusted pay, others say it only narrows the gap. The picture is complicated. Unskilled workers do well in the public sector; workers with degrees do badly. The answer varies from job to job.

This argument cannot be settled yet, because it will turn on the value of those pensions. Many schemes are underfunded, to the tune of several trillion dollars, according to some estimates. State pensions are protected in bankruptcy: whatever happens, taxpayers are supposed to pay up. If that commitment holds, taxpayers will be hammered. If states renege on those promises, or if the underfunding proves to be less than feared, they will not.

The main thing, though, is that this is the wrong discussion. Total pay is not the anomaly. There is a labour market, after all. Pay and benefits cannot move too far out of line without shortages of workers or surpluses of applicants getting embarrassingly out of hand. The anomaly is not the fiscal cost of the settlement unions have won, but its form, seen in the broadest terms.

Pensions are only part of it, but they point to the real problem, which is one of management and accountability. Unions have traded lower wages for better benefits – including, in some cases, retirement on full pension in early middle age and tacit acceptance of abuses such as pension spiking (pay increases in the last year of employment, to pump up final salary benefits) and liberal recourse to pre-retirement "disability". Employers have gone along, disguising the true cost of state services and shifting some of it through underfunding to future taxpayers.

This is not the only bargain unions and politicians have struck. Unions also traded wages for control. In many US school systems, bargaining rights have expanded to the point where unions are in charge. They have their say not just on basic pay and benefits, but on seniority rules, hirings and firings, school hours, you name it. In many states, schools are run like the British printing industry before Rupert Murdoch, with similarly unimpressive results.

The quality of public services – and especially of taxpayer-financed education – is a bigger issue for the US than the pay gap, if any, between public and private sectors. Some of those who want to curb the unions’ power understand this. They chose to go to war on a different, partly false, prospectus, and if the public sides with the unions, that will prove to have been a big mistake.

New Jersey Pension Fund To Decline Even With Reforms -Moody's

by Romy Varghese - Dow Jones Newswires

New Jersey Gov. Chris Christie's proposed public pension reforms are a good start, but even if they are enacted, the pension system--already the 7th-lowest funded in the U.S.--will continue to deteriorate, Moody's Investors Service said in a note. The pension system, which has a $30.7 billion unfunded liability, won't return to its current funding levels for at least a decade, Moody's said. That's because the state won't make a full contribution to its pension system until 2018.

Not contributing to the pensions has helped create the state's sizable pension funding problems. "The funded ratio, at 62% in 2009, has declined sharply over recent years because annual pension contributions were cut to fractions of the annual required contribution or eliminated completely," Moody's said. Indeed, Christie skipped a $3 billion pension payment last year.

New Jersey's unfunded pension liability is a significant factor in the decision not to buy state debt for Eaton Vance's tax-advantaged bond strategies group, said portfolio manager Evan Rourke. "Christie's taking steps in the right direction, but our feeling is this is an issue that needs further action before it can be fixed," Rourke said.

Christie's proposals, if enacted, are likely to face union lawsuits, Moody's added. Christie plans to roll back a 9% benefit increase granted in 2001, eliminate automatic cost of living adjustments for current and future retirees, raise the retirement age, and increase employee contributions. To address the growing unfunded liability for retiree health benefits--now at $56.8 billion-- Christie wants to hike employee contributions to 30% of the cost of benefits from 8% and increase co-pays and deductibles.

Municipal bonds: A balancing act

by Nicole Bullock and Aline van Duyn - Financial Times

It was October 1975 and New York City was about to run out of money. The city had to meet its payroll obligations for police, firefighters and other employees. Payments on the city’s bonds were due on the same day. There was not enough cash for both.Harrison "Jay" Goldin, who as the city’s comptroller was in charge of its finances, was summoned to a meeting with mayor Abraham Beame and a group of leading New York bankers and chief executives of companies including insurers and retailers.

"I was told the group had decided that I should meet the payroll the next day and not make the payments on the debt," Mr Goldin recalls, sitting in the offices of his financial advisory firm in Manhattan’s Empire State Building.

But the next day, he made the debt service payments. "The priority under the New York state constitution was to make payment on the debt first and the obligation to do so was my duty as comptroller," he says.

A commitment to repay debt, even in the face of severe financial problems, is the bedrock of the modern US municipal bond market, a $3,000bn part of the credit markets where states, cities and other public bodies borrow for roads, bridges, schools, hospitals and utilities that their regular tax revenues cannot fund.

The depth of the latest US recession and the ripple effects of the financial crisis have shaken that foundation. Since 2008, states have managed to close budget gaps of more than $400bn, according to the National Conference of State Legislatures, a bipartisan research group, by steep cuts in spending or rises in taxes and fees.

As lawmakers struggle to plug the latest deficits – most states are constitutionally required to balance budgets annually – investors have started to worry. Some states are still spending more than their revenues, which come mostly from taxes: receipts remain below pre-crisis levels. Their expenses could also rise in the coming years as they pay out pension and other benefits promised to public sector employees in better times. A public backlash has already begun to emerge as lawmakers push for deep cuts and concessions, particularly from trade unions.

Will states and cities slash spending and increase taxes, and continue to prioritise payments on debt? Or will some US states and cities try to restructure their debts, forcing bondholders to swallow losses alongside concessions from citizens and unions? Will the federal US government step in with a bail-out? Unlike local governments, the federal US government is allowed to operate at a deficit.

"With many states and local governments struggling to close large deficits, it is time to acknowledge that defaults could happen, even in large and systemically important municipal issuers," says Christian Stracke, head of credit research at Pimco, which runs the world’s biggest bond fund.

Concern has arisen about the implications. First of all, a continued squeeze on local spending could restrain the national recovery. The $800bn US economic stimulus introduced to stem a slide into another Depression included multifaceted aid for states and local governments both directly and through programmes such as subsidies for cheap debt. This federal support largely runs out this year. Economists at Goldman Sachs, for example, predict that local government spending cuts required as part of their belt tightening will snip half a percentage point off US gross domestic product this year. More drastic spending cuts could result in an even more significant drag.

Second, many Americans have some of their wealth tied up in muni debt. About two-thirds of the muni bond market is in the hands of individual investors. In many cases, local residents buy the bonds sold by states and cities because those provide tax-free interest income. This means that losses on such bonds would also hurt local residents, further hitting local economies, local banks and US economic growth.

Third, any bail-out could further strain the finances of the federal government, which is already raising eyebrows at home and around the world for its ballooning debt. Lawmakers, particularly Republicans, vehemently oppose local bail-outs, just as many on Capitol Hill are fighting against a rise in Washington’s debt ceiling.

Muni borrowing costs have risen from historic lows, as more investors recognise that the risks in the market have grown. For 10-year bonds, top-rated municipal borrowers pay about 3.1 per cent, up from 2.5 per cent just four months ago and a three-decade low of 2.17 per cent last summer, according to the benchmark index from Thomson Reuters MMD. For the more hamstrung borrowers, the rise is more pronounced.

. . .

Few municipal market experts agree with the predictions of Meredith Whitney, the analyst who foresaw trouble at large US banks ahead of the financial crisis. Ms Whitney caused a stir last year when she warned of 50-100 local muni defaults totalling "hundreds of billions of dollars". But many now doubt whether the rock-bottom default rates of recent memory can persist.

"The kernel of truth here is that in the case of six or seven states, their long-term financial condition is quite bad if they do not do anything," says Ken Buckfire, chief executive of Miller Buckfire, an investment bank. "But companies, and by extension states, only default on debt when they run out of cash, not because they have too much long-term debt."

Mr Buckfire cites Illinois, California, New Jersey, New York, Connecticut, Massachusetts, Ohio and Rhode Island as among the most troubled states. Cities and towns are seen as more vulnerable because they rely on aid from states, which states are cutting, and property taxes. With more than 50,000 diverse issuers in the muni bond market, it is hard to pinpoint the trouble spots.

States are generally expected to muddle through. Compared with cash-strapped eurozone countries such as Greece or Ireland, US states’ debt tends to be much lower relative to the size of their economies. There are also many liabilities that the US government absorbs, such as the cost of bank failures and a chunk of unemployment and healthcare benefits. Using Census Bureau data, Pimco reckons that the median state has debt of just 7.3 per cent of gross state product, the equivalent of GDP.

Unfunded pension liabilities, which are estimated to total between $700bn and $3,000bn, are a looming problem but states still largely have time to address it, though the battle will be tough. Future pensioners can expect to make bigger contributions to their retirements and perhaps enjoy less generous benefits. Existing pensions are difficult to touch, although some politicians may try.

Among the states, Illinois has stood out recently for its deeply underfunded pension pot and because it borrowed to pay its annual contribution. Illinois wants to borrow more to address a backlog of bills for goods and services depending on the state.

As more attention focuses on governments’ efforts to make ends meet, there is the potential for a crisis of confidence in the market that would dry up sources of funding. The millions of individuals who own munis bought the bonds on the assumption that they were safe and that they would always be repaid. Yet in recent months, the market’s turmoil has resulted in paper losses showing up on their account statements.

With so many different types of debt and of individual issuers, some problems may be hidden from view. Munis are not held to the same stringent disclosure requirements as, say, corporate bonds. As investors by and large hold munis for the long term, trading can be thin and prices therefore uncertain. "It is the ultimate shadow market. There are thousands of issuers, it is remarkably illiquid and there is a lack of disclosure," says Mr Buckfire.

Investors used to rely on bond insurance to protect themselves – but that industry collapsed after many insurers also guaranteed risky mortgage debt.

In response to the growing uncertainties, people have sold their bonds. Since November, retail investors have withdrawn more than $26bn from mutual funds that invest in munis, or about 7 per cent of assets, in the biggest selling rout ever. Roman Orenchuk, a 59-year-old from Sacramento, California, became one such seller in November. Like most investors, Mr Orenchuk, who owns a manufacturing business with his son, lost money when financial markets plummeted in 2008. "When the market starts to go sideways, rather than waiting like I used to, I pull the plug."

It is this type of behaviour that could turn jitters following one problem area into a more widespread retreat from the muni market. "Because market participants have generally viewed [municipal debt] as a risk-free area, [the question is] whether an individual credit problem can create a broader confidence problem," says Raymond McDaniel, chief executive of Moody’s, the credit rating agency. "That’s where the systemic implications come in and what we and others are trying to be alert to."

The potential for systemic risks beyond the municipal markets cannot be excluded, he adds. "We consider it very unlikely. We do not rule that out. There are many different types of credits in the municipal sector, with many different forms of support."

But municipal experts take comfort in that many bond payments rank high in the priority of bills that state and local governments pay, much like the payments did 35 years ago in New York City. In California, the largest state, these debt payments rank only after education. During its budget crisis two years ago, "California paid its vendors with vouchers instead of cash in part, so it could safeguard cash to pay its bonds", says Matt Fabian, managing director at Municipal Market Advisors, a research group.

Lawmakers also have believed that they need to protect access to the capital markets. "They aren’t paying us because they love us," says Joseph Pangallozzi, a credit research analyst at BlackRock, the money manager. "There is not another stream of capital" on which states and municipalities could draw instead.

. . .

Many believe that large US banks would step in, however, should the markets ever close for big states. JPMorgan Chase and others provided bridging loans to California during past budget crises. States and local governments also have the power to increase their revenues by raising taxes. Illinois recently boosted its taxes by an average of 67 per cent.

Analysts point out, however, that such moves may ultimately backfire, driving citizens and businesses to healthier parts of the US that impose lower levies. The political mood in many statehouses around the country is also vehemently anti-tax, they note.

At some point, it may become difficult for lawmakers to ask for deep sacrifices from labour unions and citizens without some backlash against bondholders. "The jury is out on whether there will be a spate of defaults and with that a collision of borrowed money and labour," says Bruce Bennett, a partner at Dewey & LeBoeuf and the lawyer who represented Orange County, California, in its 1994 bankruptcy (in which bondholders were paid in full).

A key factor in whether the municipal stress is contained will be the extent of the US economic recovery. Tax revenues have risen as growth has returned to parts of the US. Preliminary figures for October-December 2010 for 41 states show collections in the period were up 6.9 per cent from a year earlier, according to the Nelson A. Rockefeller Institute of Government. If confirmed in the full fourth-quarter data, the gain would represent the strongest growth in tax revenues since the second quarter of 2006, the research group says.

Political will, however, plays an enormous role in a state or local government’s success in dealing with adverse conditions and the unpopular choices that accompany them. But polarising political lines are now being drawn as states begin to take on unions in an effort to cut labour costs.

Back in 1975, New York successfully negotiated for one of its pensions to lend it money through the purchase of bonds, because the financial markets had shut to the city. So it was able to make both payments by midnight on that day in October. In the year that followed many sacrifices were made. Those included cuts in the municipal workforce, the introduction of tuition fees at city universities for the first time, sharp rises in public transport fares and more borrowing.

"You need political will and the will to sit everyone down at the same table," says Felix Rohatyn, the Lazard banker who advised New York City at the time. "Now, the lack of relationships between the people making the decisions is part of the problem."

..........................................................

Wisconsin’s budget battle

‘What will this do to my high school, and to the college I want to go to?’

Jonah Walker has never been involved in politics. But last week the 17-year-old travelled from the small town of Viroqua to Madison, Wisconsin’s capital, to join protests against the state’s proposal to end collective bargaining for its employees, writes Hal Weitzman.

A student with a greasy fringe and an earnest air, Mr Walker says he fears the plan’s effect on his father, a state employee, and on his own education. "What will this do to my high school?" he asks. "What will it mean for the college I want to go to?"

Such unease has fuelled protests for the past 13 days at the state Capitol building against Governor Scott Walker’s "budget repair bill", which has turned Wisconsin into a battleground between union activism and small-government conservatism.

Mr Walker, a Republican elected in November, says the state must restrict bargaining rights to tackle a $137m budget shortfall, projected to hit $3.6bn within two years. Public-sector unions say they will concede cuts but refuse to budge on bargaining. Indeed, critics accuse the governor of turning the debate into an attempt to weaken the unions, big donors to Democratic party campaign funds. They note that he need not scrap collective bargaining to balance the budget in the short term.

The issue has split the state. While polls suggest most Wisconsinites think unionised state employees enjoy generous pensions and low healthcare costs at taxpayers’ expense, there is little support for ending collective bargaining. Nonetheless, both sides depict the fight as one of national importance, a test of the power of unions relative to states with new Republican majorities seeking to address unsustainable finances.

The bill has been stalled since the week before last, after Democrats in the state senate fled to neighbouring Illinois to deny the Republicans a quorum. Mr Walker warned last week of "dire consequences", with up to 13,500 state job losses, if they did not return and allow his bill to pass.

The struggle is spreading. Indiana Democrats seeking to block "right-to-work" legislation, which would outlaw making union membership a condition of employment, also fled to Illinois last week, while thousands protested outside the Ohio Capitol against a proposal to limit collective bargaining for state employees.

BofA Mortgage-Bond Investors Hold $84 Billion Connected to Buyback Dispute

by Jody Shenn - Bloomberg

A bondholder group seeking reimbursements from Bank of America Corp. over soured home-loan securities said the amount of debt it holds grew to $84 billion after more investors joined the dispute. The number climbed from about $46 billion in October, according to the group’s lawyer.

The investors have had “enough progress” in negotiations with Bank of America and Bank of New York Mellon Corp., which acts as trustee of the debt, to warrant continued talks, Kathy Patrick, a partner at Houston-based Gibbs & Bruns LLP, said today in a telephone interview. Bank of America said Feb. 25 there were 225 mortgage deals in dispute, up from 115 in October. It didn’t provide a dollar value for the securities. Investors challenging the bank include Pacific Investment Management Co., BlackRock Inc. and the Federal Reserve Bank of New York, people familiar with the matter said in October.

The bank is seeking to limit losses on mortgages originated by Countrywide Financial Corp., which the Charlotte, North Carolina-based lender purchased in 2008. So-called mortgage putbacks may cost banks and lenders as much as $90 billion, JPMorgan Chase & Co. bond analysts said in an October report. The “careful approach” of Patrick’s investor group doesn’t mean it will accept less than it’s entitled to, she said, dismissing the idea that her clients will limit their settlement goals because of their other business dealings with Bank of America.

Mortgage Trust’s Role

Growing membership is a “vote of confidence” in the group’s seriousness, she said. The investors have only considered a settlement that pays through the mortgage trust, a channel that would serve even the bondholders Patrick doesn’t represent, she said. Bill Frey, head of Greenwich, Connecticut-based Greenwich Financial Services LLC, which also advises mortgage bondholders seeking buybacks, said many investors he has spoken to “are not expecting a terribly aggressive settlement,” from Patrick’s clients. “Our clients will let any results they achieve speak for themselves,” Patrick said.

In October, Bank of America said the dispute with Patrick’s clients covered bonds with a face value of about $46 billion and original balances of $105 billion. The original balance of the securities now involved totals $182 billion and the group has grown from eight to more than 20 institutions, Patrick said. New members include insurers, investment managers and banks, she said.

BofA Questions Validity

“The amount of unpaid principal balance doesn’t reflect what ultimately might be paid if, in fact, there were valid claims,” said Jerry Dubrowski, a Bank of America spokesman. “At this point we have a number of questions about the validity of the assertions, including whether the investors are qualified to bring claims.” David Grais, a New York-based lawyer, on Feb. 23 sued Bank of America on behalf of investors holding more than $700 million of mortgage securities. BNY Mellon, the debt’s trustee, refused to sue Bank of America after the lender declined to buy back loans the investors deemed faulty, according to the complaint.

“This is the strategy for investors who are serious,” Grais said Feb. 24 in a telephone interview. “This is the best strategy for investors who actually want teeth in their dogs.” The plaintiffs in his case are a group of limited liability companies with variations of the name Walnut Place. Grais declined to identify the investors behind the companies. BNY Mellon, which was named as a nominal defendant in that case, has “a limited role that is distinct from the seller and the servicer and contractually limited by the pooling and servicing agreements,” Heine said. “We have been fulfilling our obligations under these agreements,” he said.

Corporate Profits Soaring Thanks to Record Unemployment

by Mark Provost - Economic Populist

In a January 2009 ABC interview with George Stephanopoulos, then President-elect Barack Obama said fixing the economy required shared sacrifice, "Everybody’s going to have to give. Everybody’s going to have to have some skin in the game." (1)

For the past two years, American workers submitted to the President’s appeal—taking steep pay cuts despite hectic productivity growth. By contrast, corporate executives have extracted record profits by sabotaging the recovery on every front—eliminating employees, repressing wages, withholding investment, and shirking federal taxes.The global recession increased unemployment in every country, but the American experience is unparalleled. According to a July OECD report, the U.S. accounted for half of all job losses among the 31 richest countries from 2007 to mid-2010. (2) The rise of U.S. unemployment greatly exceeded the fall in economic output. Aside from Canada, U.S. GDP actually declined less than any other rich country, from mid-2008 to mid 2010. (3)

Washington’s embrace of labor market flexibility ensured companies encountered little resistance when they launched their brutal recovery plans. Leading into the recession, the US had the weakest worker protections against individual and collective dismissals in the world, according to a 2008 OECD study. (4) Blackrock’s Robert Doll explains, "When the markets faltered in 2008 and revenue growth stalled, U.S. companies moved decisively to cut costs—unlike their European and Japanese counterparts." (5) The U.S. now has the highest unemployment rate among the ten major developed countries. (6).

The private sector has not only been the chief source of massive dislocation in the labor market, but it is also a beneficiary. Over the past two years, productivity has soared while unit labor costs have plummeted. By imposing layoffs and wage concessions, U.S. companies are supplying their own demand for a tractable labor market. Private sector union membership is the lowest on record. (7) Deutsche Bank Chief Economist Joseph LaVorgna notes that profits-per-employee are the highest on record, adding, "I think what investors are missing - and even the Federal Reserve - is the phenomenal health of the corporate sector." (8)

Due to falling tax revenues, state and local government layoffs are accelerating. By contrast, U.S. companies increased their headcount in November at the fastest pace in three years, marking the tenth consecutive month of private sector job creation. The headline numbers conceal a dismal reality; after a lost decade of employment growth, the private sector cannot keep pace with new entrants into the workforce.

The few new jobs are unlikely to satisfy Americans who lost careers. In November, temporary labor represented an astonishing 80% of private sector job growth. Companies are transforming temporary labor into a permanent feature of the American workforce. UPI reports, "This year, 26.2 percent of new private sector jobs are temporary, compared to 10.9 percent in the recovery after the 1990s recession and 7.1 percent in previous recoveries." (9) The remainder of 2010 private sector job growth has consisted mainly of low-wage, scant-benefit service sector jobs, especially bars and restaurants, which added 143,000 jobs, growing at four times the rate of the rest of the economy. (10)

Aside from job fairs, large corporations have been conspicuously absent from the tepid jobs recovery. But they are leading the profit recovery. Part of the reason is the expansion of overseas sales, but the profit recovery is primarily coming off the backs of American workers. After decades of globalization, U.S. multinationals still employ two-thirds of their global workforce from the U.S. (21.1 million out of 31.2 million). (11) Corporate executives are hammering American workers precisely because they are so dependent on them.

An annual study by USA Today found that private sector paychecks as a share of Americans’ total income fell to 41.9 percent earlier this year, a record low. (12) Conservative analysts seized on the report as proof of President Obama’s agenda to redistribute wealth from, in their words, those ‘pulling the cart’ to those ‘simply riding in it’. Their accusation withstands the evidence—only it’s corporate executives and wealthy investors enjoying the free ride. Corporate executives have found a simple formula: the less they contribute to the economy, the more they keep for themselves and shareholders. The Fed’s Flow of Funds reveals corporate profits represented a near record 11.2% of national income in the second quarter. (13)

Non-financial companies have amassed nearly two-trillion in cash, representing 11% of total assets, a sixty year high. Companies have not deployed the cash on hiring as weak demand and excess capacity plague most industries. Companies have found better use for the cash, as Robert Doll explains, "high cash levels are already generating dividend increases, share buybacks, capital investments and M&A activity—all extremely shareholder friendly." (5)Companies invested roughly $262 billion in equipment and software investment in the third quarter. (14) That compares with nearly $80 billion in share buybacks. (15) The paradox of substantial liquid assets accompanying a shortfall in investment validates Keynes’ idea that slumps are caused by excess savings. Three decades of lopsided expansions has hampered demand by clotting the circulation of national income in corporate balance sheets. An article in the July issue of The Economist observes: "business investment is as low as it has ever been as a share of GDP." (16)

The decades-long shift in the tax burden from corporations to working Americans has accelerated under President Obama. For the past two years, executives have reported record profits to their shareholders partially because they are paying a pittance in federal taxes. Corporate taxes as a percentage of GDP in 2009 and 2010 are the lowest on record, just above 1%. (17)

Corporate executives complain that the U.S. has the highest corporate tax rate in the world, but there’s a considerable difference between the statutory 35% rate and what companies actually pay (the effective rate). Here again, large corporations lead the charge in tax arbitrage. U.S. tax law allows multinationals to indefinitely defer their tax obligations on foreign earned profits until they ‘repatriate’ (send back) the profits to the U.S. U.S. corporations have increased their overseas stash by 70% in four years, now over $1 trillion—largely by dodging U.S taxes through a practice known as "transfer pricing". (18)Transfer pricing allows companies to allocate costs in countries with high tax rates and book profits in low-tax jurisdictions and tax havens—regardless of the origin of sale. U.S. companies are using transfer pricing to avoid U.S. tax obligations to the tune of $60 billion dollars annually, according to a study by Kimberly A. Clausing, an economics professor at Reed College in Portland, Oregon. (18)

The corporate cash glut has become a point of recurrent contention between the Obama administration and corporate executives. In mid December, a group of 20 corporate executives met with the Obama administration and pleaded for a tax holiday on the $1 trillion stashed overseas, claiming the money will spur jobs and investment. In 2004, corporate executives convinced President Bush and Congress to include a similar amnesty provision in the American Jobs Creation Act; 842 companies participated in the program, repatriating $312 billion back to the U.S. at 5.25% rather than 35%. (19) In 2009, the Congressional Research Service concluded that most of the money went to stock buybacks and dividends—in direct violation of the Act. (20)

The Obama administration and corporate executives saved American capitalism. The U.S. economy may never recover.

A U.S. Recovery Built on Low-Paying Jobs

by Joshua Zumbrun and Shobhana Chandra - BusinessWeeek

Before she lost her job last November as a full-time health department caseworker in Aurora, Ill., Amy Valle was making $23 an hour. Now she's paid $10 an hour as a part-time assistant coordinator in an after-school program. "From here on out, it will be a struggle," says Valle, 32, whose husband lost his $50,000 government job and still is out of work after a year. "I don't feel like there's any place we can go to get what we were getting paid."

While the unemployment rate dropped to 9 percent in January, from a two-decade peak of 10.1 percent in October 2009, many of the jobs people are now taking don't match the pay, the hours, or the benefits of the 8.75 million positions that vanished in the recession, according to Paul Ashworth, chief U.S. economist at Capital Economics in Toronto.

This may restrain wage and salary growth, limiting gains in consumer spending, which accounts for 70 percent of the U.S. economy. The good jobs that would trigger a solid boost in spending just don't seem to be there. "In the last recovery we were adding management jobs at this point, and this time it's disappointing," says Ashworth, who published a report on Jan. 27 about pre- and post-slump employment based on U.S. Labor Dept. data. "The very best jobs, we're still losing those."

Projections from the Bureau of Labor Statistics reinforce his pessimism. While the number of openings for food preparation and serving workers will grow by 394,000 in the decade ending in 2018, the average wage is only $16,430 including tips, based on 2008 data. Meanwhile, the number of posts for financial examiners, who work at financial-services firms to ensure regulatory compliance, will expand by just 11,100. The average pay for examiners is $70,930.

Lowe's, the second-largest U.S. home improvement retailer, typifies the reshuffling of the U.S. workforce. The chain, based in Mooresville, N.C., said on Jan. 25 it is eliminating 1,700 managers responsible for store operations, sales, and administration as profit growth trails that of the larger Home Depot chain. Meanwhile, Lowe's said it will add 8,000 to 10,000 weekend sales positions and is creating a new assistant store manager position.

The trend is troubling for the country's long-term prospects, says Edmund Phelps, who won the Nobel Prize for economics in 2006 and directs the Center on Capitalism and Society at Columbia University in New York. Businesses aren't innovating as much, so companies "just don't seem to require all those relatively high-paid workers they once did," he says.

The health-care industry is one example, the BLS said in a December report on the occupational outlook. As costs continue to rise, "tasks that were previously performed by doctors, nurses, dentists, or other health-care professionals increasingly are being performed by physician assistants, medical assistants, dental hygienists, and physical therapist aides."

Michael Greenstone, a former staff member for the White House Council of Economic Advisers, says it's "premature to make too much of where the particular job creation is occurring," because the "immediate issue is that there are too many people" out of work. "I'm not in favor of ditch-digging, but the first thing is to get more people employed," says Greenstone, an economics professor at the Massachusetts Institute of Technology. "Unemployment is a scourge of society right now, and it has to be the front-and-center issue."

Job hunters are adapting, with 60 percent prepared to settle for a full-time position they don't really want or one they're not qualified for, says Dennis Jacobe, chief economist for Washington-based Gallup, based on a survey he conducted last month.

Ken Niswonger, 51, a machine builder by training, spent five months looking for work after losing his job in October 2009. Unable to find anything in his field, he enrolled in a college computer security program to learn new skills. "I'm hoping I can find something entry-level," he says, adding that he'll have to begin his search for an information technology job before he finishes his program. "I'm well aware I might not get what I used to make," he says. "Who knows? Might get a job at $12 to $14 an hour. That's not even $30,000 a year."

Behind a Rise in Auto Sales, Easier Credit

by Eric Dash - New York Times

Detroit is crowing that the auto industry is back, but so far, at least, it is a success story built as much on a revival in lending as on the development of desirable cars. Sales of new cars rose 11 percent, to around 11.4 million, in 2010 and are off to an even stronger start this year, according to Autodata, an industry research service. Sales of used cars have been similarly robust.

After radically scaling back auto lending during the financial crisis, banks and the lending arms of the automakers have started to issue loans more aggressively. Borrowers of all types are now finding it much easier to obtain a loan compared with a few months ago. Even car buyers with tarnished credit histories are getting financing, in some cases without making a down payment. More than 859,000 new cars were sold to consumers with a so-called subprime credit rating in 2010, a nearly 60 percent increase from the year before, according to CNW Marketing Research.

The revival of auto lending is emblematic of an increased appetite for risk in the American economy. Consumers, showing renewed confidence in the recovery, are opening their wallets again after putting off car purchases during the recession. Banks, flush with deposits to lend out, have eased their standards for extending credit. And investors, who fled from the bond market during the throes of the crisis, are starting to snap up higher-risk debt as they seek higher yields.

Wall Street’s loan packaging business has once again become a crucial engine for supplying money to auto and credit card lenders — and it is happening much faster than most economists had predicted. Nobody is suggesting an imminent return to the heady, reckless days of the housing boom, and any one of a number of factors — like the recent surge in oil and commodities prices — could set the recovery off track. But the gradual expansion of credit in virtually every area except real estate is an important sign that the American economy is returning to health.

The rebound in auto lending has been especially pronounced. Michael E. Maroone, the president of AutoNation, which has a coast-to-coast network of more than 200 dealerships, called it the single biggest factor spurring the sharp increase in car sales last year. "We had people coming to our showrooms that wanted to buy, but we couldn’t get them financed," Mr. Maroone said in an interview. "We are now getting them the financing."

Kevin Lauterbach, 29, an operations manager from Coral Springs, Fla., said he was surprised that so many lenders were willing to give him a loan when he went shopping for a new car in December. Although he had worked hard to repair a mildly damaged credit score, several major lenders rejected his application for a new credit card a few months earlier. But five banks offered to help him finance a car, all with no money down.

Mr. Lauterbach eventually locked in a 4.75 percent rate on a $19,000 loan from City County Credit Union of Fort Lauderdale to cover the cost of a 2008 Jeep Liberty. The 72-month loan requires payments of $150 every two weeks. "My credit wasn’t great, and what I had been hearing is that credit is tight right now," he said. "But it wasn’t really as difficult as I was anticipating."

For the auto industry, the surge in sales represents a remarkable reversal. Only two years ago, Detroit’s Big Three automakers were in such dire condition that they took more than $87 billion in federal aid; Chrysler and General Motors required Chapter 11 bankruptcy protection to turn themselves around, with the government’s help. The Obama administration provided other forms of assistance as well. It engineered the rescues of the CIT Group, a major lender to auto dealerships and parts suppliers, and also bailed out the troubled auto finance companies Chrysler Financial and GMAC, now known as Ally Financial.

Just as crucial, economists say, was the administration’s effort to lure private investors back into what was once a $100 billion-a-year bond market for auto finance companies, according to Deutsche Bank Securities. That market had all but dried up by the end of 2008. The federal program provided more than $11.7 billion in below-market financing to dozens of private investors — a group that included hedge funds like FrontPoint Partners, money managers like BlackRock and Pimco, and even a retirement fund operated by the City of Bristol, Conn. — to encourage them to resume buying bonds backed by auto loans.

Although the amount of government financing was relatively small, it accomplished its goal: to revive the market for packaged consumer loans and get credit flowing again, especially to weaker borrowers. That market stood at $36 billion in 2008, during the throes of the crisis, but by 2010 it had bounced back to almost $58 billion. Bankers and analysts project that could rise by as much as 15 percent in 2011. "To me, it feels like it’s returning to normal," said Ted Yarbrough, Citigroup’s head of global securitized products.

Several factors contributed to the quick recovery of auto lending. Both banks and auto lenders can reap large profits on new loans, since interest rates near zero have kept the cost of their funds extremely low. Auto lending was also largely unaffected by the Dodd-Frank Act and other regulations, which reduced the fees that banks could charge for services like credit cards and overdraft protection.

In addition, auto lenders, unlike home lenders, have long issued loans expecting that the vehicle will start to lose value as soon as it is driven off the lot. That helped them avoid the costly mistakes of mortgage lenders, who underwrote loans during the boom on the belief that prices would keep going up. In fact, auto loans fared better than almost any other loan category during the crisis. There were other reasons, too. Car dealers, unlike mortgage brokers, tend to have closer relationships with their lenders, so that a dealership that passes along a lot of bad loans might quickly find it hard to secure loans for other customers.

Meanwhile, used cars began drawing higher prices, a result of sagging new vehicle sales over the last few years. That encouraged banks to take bigger risks since they would assume ownership of a more valuable car if a borrower defaulted. As the economic recovery gathered steam, domestic auto lenders like GMAC and Chrysler Financial flooded back into the business in the fall. That lured traditional banks like Bank of America, Banco Santander, Capital One, JPMorgan Chase, TD Bank and Wells Fargo back in a bigger way, and helped prop up lending for used vehicles.

Dealers say the frenzied competition has made it possible for weaker borrowers — those denied credit even six months earlier — to finally obtain loans. AutoNation, for example, said that approvals for subprime customers reached 38 percent in the fourth quarter of 2010, compared with 18 percent a year earlier, amid only a modest increase in applications. Over all, lending to subprime borrowers has risen to about 38 percent of the auto finance market, although it is still well below its precrisis highs when it made up nearly half of all loans, according to credit bureau data from Experian.

"The biggest improvement started in December," said Rick Flick, who runs Ford and Chevrolet dealerships in the New Orleans area. "The banks are getting aggressive again. They are calling us and asking why aren’t we sending them more business." Still, lenders are typically demanding more stringent terms, including higher down payments compared with those required in the boom years. But, as Mr. Lauterbach’s experience suggests, even those are starting to ease.

Meanwhile, the automakers have come up with innovations to help. One program that is currently popular: down payment assistance.

U.S. cables detail Saudi royal welfare program

by Simon Robinson - Reuters

When Saudi King Abdullah arrived home last week, he came bearing gifts: handouts worth $37 billion, apparently intended to placate Saudis of modest means and insulate the world's biggest oil exporter from the wave of protest sweeping the Arab world. But some of the biggest handouts over the past two decades have gone to his own extended family, according to unpublished American diplomatic cables dating back to 1996.

The cables, obtained by WikiLeaks and reviewed by Reuters, provide remarkable insight into how much the vast royal welfare program has cost the country -- not just financially but in terms of undermining social cohesion.

Besides the huge monthly stipends that every Saudi royal receives, the cables detail various money-making schemes some royals have used to finance their lavish lifestyles over the years. Among them: siphoning off money from "off-budget" programs controlled by senior princes, sponsoring expatriate workers who then pay a small monthly fee to their royal patron and, simply, "borrowing from the banks, and not paying them back."

As long ago as 1996, U.S. officials noted that such unrestrained behavior could fuel a backlash against the Saudi elite. In the assessment of the U.S. embassy in Riyadh in a cable from that year, "of the priority issues the country faces, getting a grip on royal family excesses is at the top." A 2007 cable showed that King Abdullah has made changes since taking the throne six years ago, but recent turmoil in the Middle East underlines the deep-seated resentment about economic disparities and corruption in the region.

Monthly Cheques

The November 1996 cable -- entitled "Saudi Royal Wealth: Where do they get all that money?" -- provides an extraordinarily detailed picture of how the royal patronage system works. It's the sort of overview that would have been useful required reading for years in the U.S. State department. It begins with a line that could come from a fairytale: "Saudi princes and princesses, of whom there are thousands, are known for the stories of their fabulous wealth -- and tendency to squander it."

The most common mechanism for distributing Saudi Arabia's wealth to the royal family is the formal, budgeted system of monthly stipends that members of the Al Saud family receive, according to the cable. Managed by the Ministry of Finance's "Office of Decisions and Rules," which acts like a kind of welfare office for Saudi royalty, the royal stipends in the mid-1990s ran from about $800 a month for "the lowliest member of the most remote branch of the family" to $200,000-$270,000 a month for one of the surviving sons of Abdul-Aziz Ibn Saud, the founder of modern Saudi Arabia.

Grandchildren received around $27,000 a month, "according to one contact familiar with the stipends" system, the cable says. Great-grandchildren received about $13,000 and great-great- grandchildren $8,000 a month. "Bonus payments are available for marriage and palace building," according to the cable, which estimates that the system cost the country, which had an annual budget of $40 billion at the time, some $2 billion a year. "The stipends also provide a substantial incentive for royals to procreate since the stipends begin at birth."

After a visit to the Office of Decisions and Rules, which was in an old building in Riyadh's banking district, the U.S. embassy's economics officer described a place "bustling with servants picking up cash for their masters." The office distributed the monthly stipends -- not just to royals but to "other families and individuals granted monthly stipends in perpetuity." It also fulfilled "financial promises made by senior princes."

The head of the office at the time, Abdul-Aziz al-Shubayli, told the economics officer that an important part of his job "at least in today's more fiscally disciplined environment, is to play the role of bad cop." He "rudely grilled a nearly blind old man about why an eye operation promised by a prince and confirmed by royal Diwan note had to be conducted overseas and not for free in one of the first-class eye hospitals in the kingdom." After finally signing off on a trip, Shubayli noted that he himself had been in the United States twice for medical treatment, once for a chronic ulcer and once for carpal tunnel syndrome. "He chuckled, suggesting that both were probably job-induced."

Following The Money

But the stipend system was clearly not enough for many royals, who used a range of other ways to make money, "not counting business activities."

"By far the largest is likely royal skimming from the approximately $10 billion in annual off-budget spending controlled by a few key princes," the 1996 cable states. Two of those projects -- the Two Holy Mosques Project and the Ministry of Defense's Strategic Storage Project -- are "highly secretive, subject to no Ministry of Finance oversight or controls, transacted through the National Commercial Bank, and widely believed to be a source of substantial revenues" for the then-King and a few of his full brothers, according to the authors of the cable.

In a meeting with the U.S. ambassador at the time, one Saudi prince, alluding to the off-budget programs, "lamented the travesty that revenues from 'one million barrels of oil per day' go entirely to 'five or six princes,'" according to the cable, which quoted the prince. Then there was the apparently common practice for royals to borrow money from commercial banks and simply not repay their loans. As a result, the 12 commercial banks in the country were "generally leary of lending to royals."

The managing director of another bank in the kingdom told the ambassador that he divided royals into four tiers, according to the cable. The top tier was the most senior princes who, perhaps because they were so wealthy, never asked for loans. The second tier included senior princes who regularly asked for loans. "The bank insists that such loans be 100 percent collateralized by deposits in other accounts at the bank," the cable reports. The third tier included thousands of princes the bank refused to lend to. The fourth tier, "not really royals, are what this banker calls the 'hangers on'."

Another popular money-making scheme saw some "greedy princes" expropriate land from commoners. "Generally, the intent is to resell quickly at huge markup to the government for an upcoming project." By the mid-1990s, a government program to grant land to commoners had dwindled. "Against this backdrop, royal land scams increasingly have become a point of public contention."

The cable cites a banker who claimed to have a copy of "written instructions" from one powerful royal that ordered local authorities in the Mecca area to transfer to his name a "Waqf" -- religious endowment -- of a small parcel of land that had been in the hands of one family for centuries. "The banker noted that it was the brazenness of the letter ... that was particularly egregious." Another senior royal was famous for "throwing fences up around vast stretches of government land."

The confiscation of land extends to businesses as well, the cable notes. A prominent and wealthy Saudi businessman told the embassy that one reason rich Saudis keep so much money outside the country was to lessen the risk of 'royal expropriation.'" Finally, royals kept the money flowing by sponsoring the residence permits of foreign workers and then requiring them to pay a monthly "fee" of between $30 and $150. "It is common for a prince to sponsor a hundred or more foreigners," the 1996 cable says.

Big Spenders

The U.S. diplomats behind the cable note wryly that despite all the money that has been given to Saudi royals over the years there is not "a significant number of super-rich princes ... In the end," the cable states, Saudi's "royals still seem more adept at squandering than accumulating wealth."

But the authors of the cable also warned that all that money and excess was undermining the legitimacy of the ruling family. By 1996, there was "broad sentiment that royal greed has gone beyond the bounds of reason". Still, as long as the "royal family views this country as 'Al Saud Inc.' ever increasing numbers of princes and princesses will see it as their birthright to receive lavish dividend payments, and dip into the till from time to time, by sheer virtue of company ownership."

In the years that followed that remarkable assessment of Saudi royalty, there were some official efforts toward reform -- driven in the late 1990s and early 2000s in particular by an oil price between $10-20 a barrel. But the real push for reform began in 2005, when King Abdullah succeeded to the throne, and even then change came slowly.

By February 2007, according to a second cable entitled "Crown Prince Sultan backs the King in family disputes", the reforms were beginning to bite. "By far the most widespread source of discontent in the ruling family is the King's curtailment of their privileges," the cable says. "King Abdullah has reportedly told his brothers that he is over 80 years old and does not wish to approach his judgment day with the 'burden of corruption on my shoulder.'"

The King, the cable states, had disconnected the cellphone service for "thousands of princes and princesses." Year-round government-paid hotel suites in Jeddah had been canceled, as was the right of royals to request unlimited free tickets from the state airline. "We have a first-hand account that a wife of Interior minister Prince Naif attempted to board a Saudia flight with 12 companions, all expecting to travel for free," the authors of the cables write, only to be told "to her outrage" that the new rules meant she could only take two free guests.

Others were also angered by the rules. Prince Mishal bin Majid bin Abdulaziz had taken to driving between Jeddah and Riyadh "to show his annoyance" at the reforms, according to the cable. Abdullah had also reigned in the practice of issuing "block visas" to foreign workers "and thus cut the income of many junior princes" as well as dramatically reducing "the practice of transferring public lands to favored individuals."

The U.S. cable reports that all those reforms had fueled tensions within the ruling family to the point where Interior Minister Prince Naif and Riyadh Governor Prince Salman had "sought to openly confront the King over reducing royal entitlements."

But according to "well established sources with first hand access to this information," Crown Prince Sultan stood by Abdullah and told his brothers "that challenging the King was a 'red line' that he would not cross." Sultan, the cable says, has also followed the King's lead and turned down requests for land transfers. The cable comments that Sultan, longtime defense minister and now also Crown Prince, seemed to value family unity and stability above all.

Executives Behind Financial Crisis at Little Risk of Jail Time

by Joe Nocera - New York Times

So much for Angelo Mozilo taking the fall for the financial crisis.

Late last week, word leaked out that Mr. Mozilo, who had co-founded Countrywide Financial in 1969 — and, for nearly 40 years, presided over its astonishing rise and its equally astonishing fall — would not be prosecuted by the Justice Department. Not for insider trading. Not for failing to disclose to investors his private worries about subprime loans. Not for helping to create a culture at Countrywide in which mortgage originators were rewarded for pushing fraudulent loans on borrowers.

In its article about the Justice Department’s decision, The Los Angeles Times said prosecutors had concluded that Mr. Mozilo’s actions "did not amount to criminal wrongdoing." Just months earlier, the Justice Department concluded that Joe Cassano shouldn’t take the fall for the financial crisis either. Mr. Cassano, you’ll recall, is the former head of the financial products unit of the American International Group, a man whose enthusiasm for credit-default swaps led, pretty directly, to the need for a huge government bailout of A.I.G. There was a time when it appeared that there was no way the government would let Mr. Cassano walk. But it did.