"Peoples Drug Store, 14th & U., Washington, D.C."

Ilargi: As Greece sinks ever deeper into its cesspool of lies and debt, dragging down the European periphery with it, even as Germany and France showed positive GDP numbers today (for what those are worth), and as Japan continues to spiral down its own cesspool of lies and radiation (and, yes, debt too) with reactor no. 1 now in full meltdown, Ashvin Pandurangi delves into what at times equally threatens to turn into a cesspool: the discussion about the future -value- of physical gold.

Ashvin Pandurangi:

Part I - Dialectic Foundations

The element Au consists of 118 neutrons, 79 protons and 79 electrons. Many particle physicists would now tell you that electrons do not always act as tiny little points of matter in space-time, but rather can consist of superimposed wave-functions that have a very large, if not infinite, number of possible values. If this premise is true, then how could we get from these rather ephemeral electrons to a solid atom or an element that exists at much larger scales, such as a flake of gold?

The answer is most likely the process of "quantum decoherence", in which superimposed quantum states separate into discrete units of electric charge, mass and spin (angular momentum). This process is overwhelmingly supported by experimental evidence and explains why a "single" electron can pass through two separated slits at the same time, but will only pass through one when it interacts with a photon from a measuring device. [1]. Physicists may disagree on the fundamental significance of these results, but they cannot deny the results themselves.

I believe that a convenient (and generalized) theoretical framework for thinking about the process is complexity theory, to the extent that quantum decoherence leads to increased systemic complexity in the resulting particle and the particle displays emergent properties. When the superimposed particle-states interact with an external environment, its wave-functions "collapse" and it takes on properties of mass, charge and momentum that simply did not exist before.

The stable atom containing these electrons can also be thought of as a complex system with internal structure, a relatively high degree of order and inter-dependent parts. It too has emergent properties, because it exhibits fundamental traits that do not exist at the level of its individual constituents. To better understand the process, imagine that you are floating above an Ocean near the coastline and looking down:

From this perspective, the Ocean appears to be a coherent body of water without any series of waves that exhibits discrete properties (amplitude, wavelength, frequency). Alternatively, you can imagine that you have come down to Earth, so to speak, and are now standing on the beach looking out into the water:

Now, we clearly see multiple waves with discrete properties moving towards us and breaking as they approach the shoreline. The first overhead perspective would represent a particle existing in coherent quantum states, while the second represents a particle that has interacted with its environment and has lost that coherence. Both of these perspectives are fundamental representations of reality, and neither is more "correct" than the other. They do, however, reflect a reality that has fundamentally changed from one perspective (level of complexity) to another.

The point of the above theoretical musings is to help the reader begin thinking about what it means for something to have a "fundamental nature", and how that nature can change as systemic complexity increases. Specifically, with regards to gold as a "monetary" asset, we can ask ourselves what its fundamental role has become in our highly inter-dependent systems of societal organization, and what it will ultimately be.

One of the most insightful and popular physical gold advocates is a blogger called Friend of a Friend of Another ("FOFOA"), and he frequently writes about what he believes to be gold's unique role in the modern global economy. He argues that physical gold, unlike fiat currency assets, has traditionally been and will continue to be the most stable "store of wealth" used by nations, central banks, many large corporate institutions and wealthy individuals around the world.

The nominal dollar value of debt-backed assets held by these "giants" currently outstrips that of their gold-related assets by a large margin, but he argues that the dollar is merely a liquid means of exchange and temporary store of value for the major players. They are hoarding gold and patiently waiting for the dollar to "find" its true "store value" in relation to physical gold, at the bottom of a very deep monetary well.

In essence, they will outrun the "haircuts" on debt-assets by converting them into gold and other hard assets before any of the smaller players even know what hit them [Another, FOA on Hyperinflation] [emphasis mine]:

"Human nature has followed this path for thousands of years. You know the old joke about outrunning the bear? Well, these lenders will influence our financial policy as such. They will try to get their debt securities liquefied first, spend the fiat and in this process outrun you and I. Leaving anyone they can beat to the mercy of the hyperinflation bear eating their remaining fiat assets…

Allowing the US to destroy our own system and offering an avenue of escape for investors worldwide is a master political play. Why dump your dollar reserves when such an action would make you the bad guy? Buy some gold quietly, yes. But, better to let your dollars dissolve and have your assets transformed by a dollar / physical gold devaluation."

The dollar hyper-inflationary process (in terms of price) could take off tomorrow or a few years from now, but, regardless of the timing, the only assured way to preserve one's excess investment wealth is by exchanging dollar-based assets for physical gold from here on out. A fundamental problem begins for this argument, in my opinion, when it attempts to predict the long-term destiny of physical gold through the lens of isolated monetary and political systems.

Isolated to the extent that they are perceived as being both able and willing to unleash a dollar devaluation "bear" on the current financial system, allowing a new global paradigm to inevitably rise in its wake. In our global society, however, we (and FOFOA) should be talking about how the role of gold will be influenced not only by monetary, currency and political systems in isolation, but also by these systems as naturally dependent components of our complex economic and financial systems; as discrete waves in the high seas of industry and credit.

Readers of this article who adhere to the concept of "Freegold" may notice that the theoretical distinctions between it and what I lay out are very subtle. That is certainly true, but subtle differences in such a broad context can spawn vastly different implications for global society's future path. Are we really watching the monetary, social and political systems around the world siege the global financial system and take back a large portion of the value lost through years of imaginary capital creation and wealth concentration? Or are we simply watching them respond in kind as mechanical parts of an unholy and inseparable union?

Can the atom let its electrons go free and reclaim their place in the coherent fabric of the Universe, or will they first be forced to float down to lower energy orbitals, a bit closer to the bright white sands of the shore? Abstract theories and philosophies help us place specific developments into a much broader context, as long as they are initially built on a block of solid foundation. FOFOA writes the following critique of Karl Marx, in his article The Debtors and the Savers [emphasis mine]:

Today we have many fine, intelligent and exacting analysts all looking at the same economic data and coming up with vastly different analyses of the present global financial crisis. What sets them all apart from each other is not intelligence, or math skills, or even popularity. What sets them apart is the foundational premises on which they operate.

And a false premise can skew a brilliant analysis 180 degrees in the wrong direction. Few analysts fully disclose their premises. But Karl Marx did, and in this we can find the one, key flaw that sent his analysis off in a disastrous direction.

Marx writes, "The history of all hitherto existing society is the history of class struggle." He got this part right! What he got wrong was his delineation of the classes.

I couldn't agree more with the statements in bold above, but, naturally, I disagree with what immediately follows. FOFOA goes on to describe Marx's premise - the capitalist system of production contains a constant dialectical struggle between the working class (labor) and the capitalist class (owners of productive capital) - but argues that, instead, the struggle is actually between the debtors (net consumers) and the savers (net producers). It is claimed that the debtors are essentially oppressing the savers by spending beyond their means, devaluing their debt (currency) via printing and diluting the value of the savings in the system.

However, as I plan to demonstrate in further detail, it is FOFOA who argues from the false premise that debtors occupy a distinct class in society apart from savers, and that the former are merely consuming more than they contribute to productive society. That premise naturally leads him to conclude that the next phase of economic evolution will involve a global monetary system that essentially rids the savers of debtor oppression, by containing a branch that functions and derives value independent of the paper financial system. Through this logic, he spins himself around to have his back conveniently turned on Marx.

The latter was, in fact, technically correct with his theory of dialectical materialism and his class delineations, but he did not envision the extent to which large financiers would absorb the functions of the capitalist producer class. He also failed to see how debtors would come to comprise such a large share of the working class, right alongside the savers. We have ended up with a global class struggle between financial owners of capital, on the one hand, and debtors (including governments/taxpayers) and savers on the other (both of them being "workers").

The defaulting debtors are not necessarily "net consumers" over time, but many times receive less and less compensation for their productive efforts. The subtle distinction leading to this class delineation instead of the debtors/savers opposition is the specific dialectic involved. FOFOA's dialectic stems from the Hegelian tradition of two opposing ideological forces (i.e. “easy money” debtors vs. “hard money” savers) synthesizing to create a new paradigm. Essentially, the cart is being put well before the horse, which is a fact that Marx (and Engels) recognized when they developed the theory of dialectical materialism and turned Hegel on his head [2].

"My dialectic method is not only different from the Hegelian, but is its direct opposite. To Hegel, the life-process of the human brain, i.e. the process of thinking, which, under the name of ‘the Idea’, he even transforms into an independent subject, is the demiurgos of the real world, and the real world is only the external, phenomenal form of ‘the Idea’. With me, on the contrary, the ideal is nothing else than the material world reflected by the human mind, and translated into forms of thought." [Marx]

The material environment of human existence is what underlies the development of socioeconomic structures in society and their inherent class delineations, and these opposing forces (“oppressor” vs. “oppressed”) are what drive the political economy. For example, the industrial (energy) revolution is what really allowed the capitalist system of production to root itself around the world, and this economic system necessarily created two general classes in society – the owners of the means of production (capitalist) and those who are forced to sell their labor to the capitalist (worker).

When discussing the scopes of these very abstract and fluid systems, it helps to have some kind of visual representation, simple and crude as it may be. The following is a snapshot of the critical systems influencing Marx's material dialectic at this point in time:

Connected Red Diamonds = Sociopolitical Systems Derived From the Financial Capitalist System

The currency system is the smallest and most specialized part of the cone, as it only encompasses mediums of exchange and stores of wealth that have been officially sanctioned by national or transnational political institutions. Our monetary system is larger because it includes the currency cone plus any tangible or intangible asset that can act as a medium of exchange and a store of wealth, regardless of whether it is officially recognized by a political body (as long as it is generally recognized by prevailing social norms in a given region).

Money is actually a less abstract (complex) concept than currency, as it can reflect the relative value of tradable goods more directly (in fact, it may be the goods themselves). All forms of currency (i.e. U.S. dollar) are money, but not all forms of money are currencies. Physical gold can be thought of as money, since it is a widely accepted means for members of a society to store their savings (net income minus non-investment consumption). It can also be used as an informal medium of exchange in many parts of the world, but it may not necessarily be accepted by large merchants in the developed world and certainly not governments collecting taxes.

FOFOA claims that, since physical gold now only acts as a global money reserve rather than a currency reserve (or a backing of currency), it is an ideal store of value for savers. That is arguably true because its "value" does not have to be diluted by expanding the currency supply for the purpose of providing "liquidity", easing debt burdens and stimulating growth. In that sense, physical gold could be a repository for saving excess wealth without stifling economic activity, and currencies used in the global monetary system as mediums of exchange can independently float against its price on the market, as the global reserve asset.

The "reference point" of gold would provide a natural carrot and stick mechanism, in which political or financial institutions that use their currency "printing presses" with relative control are rewarded with an influx of gold capital, while those that use them with reckless abandon are punished by gold capital flight to another currency region. Is such a mechanism really capable of being implemented, though, or are we projecting an ideal monetary system (a coherency) onto our global society that is very unlikely to occur, and fundamentally impossible to predict with certainty?

The following passages from Reference Point Revolution help illuminate the flaws in the logic of the Freegold paradigm [emphasis mine]:

"But right now, for perhaps the first time in history, individuals can join central bankers and the true Giants of the world by participating in the ultimate hedge fund. One that, like modern hedge funds, focuses on the hedge itself as the key investment with the most leverage, with the expectation of life-changing returns. And the main differences between this and traditional hedge funds are 1) much less risk, and 2) it is open to ALL individuals, including you!" [FOFOA]

"If you are following closely, now, we can begin to see how easy it is for the concepts of modern money to convolute our value and understanding of gold. It is here that the thought of a free market in physical was formed. Using the relationship of a free physical market in gold, we will be able to relate gold values to millions to goods and services that are currency traded the world over. Instead of having governments control gold's value to gauge currency creation; world opinion will be free to associate the values of barter gold against barter currency. In this will be born a free money concept in the minds of men and governments." [FOA]

The Freegold perspective tends to view the global monetary system as a coherent body of water, in which monetary waves can take on a nearly infinite number of forms or functions as the oppositional ideologies of humans naturally progress. That perspective does not adequately reflect the complex, inter-dependent society that has evolved over the last few hundred years, beginning with the industrialization of national economies and ending with the global financialization of nearly all economic activity. During that time, the monetary waves became increasingly discrete, diverse and dependent as they traveled towards the shores of their destiny.

The properties (roles/values) of these waves have necessarily been constrained by the vast financial body of water in which they were formed, and their potential wavelengths must be measured as a function of financial dynamics. The global financial system is characterized by digital instruments that attach legal claims onto the productive assets of others. These assets may be farmland, human labor, machinery, the actual production process, supply lines, currency, money or any number of things, but such assets do not solely imbue the instruments with value.

Another important aspect of a financial instrument's value is its ability to be issued and traded on a "liquid" market and act as a medium of exchange, promoting the ease of economic transactions. For example, "negotiable instruments" in the U.S. are required to be "payable in currency", rather than just money, because a promise to pay someone in physical gold would not be easily negotiated through markets. Finally, and perhaps most importantly, the financial instruments obtain value through the social and political leverage they affix to the debtors themselves, which include individuals, corporations and governments.

These systems, like the monetary and currency systems, have also been fundamentally transformed into tools of the financial economy. For that reason, the political will of major countries will not drive the global monetary system to its final destination, but instead both politics and money will be driven by the dynamics of industrial and financial capitalism. Eventually, all monetary waves will break on the shore and their components will recede into the water, but those components will never exist independently of the industrial and financial bodies of water, as long as the latter have not yet dried up.

As a consequence, those who are invested in various forms of money, including the U.S. dollar, physical silver and/or physical gold, will not be able to store their wealth outside the broader system of industrial production and finance until they have fully broken down, and that process could last for some significant period of time. This fact implies that no monetary store of wealth can be insulated from the manipulative forces of capitalist production, systemic finance (leveraged speculation) or the sociopolitical leverage at their disposal during such a period.

Through political control, money can be transferred between segments of society at will by means of redistributive policies, capital controls or even outright confiscation, and it could also be made much more available ("liquid") to those with "adequate" economic influence over those with little or no leverage whatsoever. If the Freegold system were to take root in certain parts of the world soon, then it would most likely consume itself rather quickly, since none of the underlying structural instabilities of the system would be absolved by its presence. These instabilities stem from the mechanisms of value creation, realization (profit taking) and speculation in the financial capitalist system.

Such instabilities escape the imagination of Freegold advocates because, along with the flawed dialectic foundation, they base its prospect on a fundamental misunderstanding of economic value in a capitalist system. The broader inevitability of financial capitalism is ignored to make room for the perceived inevitability of a global and gold-based monetary paradigm. In Part II, we will visit the foundation of economic value in modern society and it will become clear that value, just like politics and money, has been fundamentally transformed from what it once was in the simpler barter societies of our past. Until then, let this dialectic foundation settle.

There is only one holistic system of systems, one vast and immane, interwoven, interacting, multivariate, multinational dominion of dollars.

Petro-dollars, electro-dollars, multi-dollars, reichsmarks, rins, rubles, pounds and shekels. It is the international system of currency which determines the totality of life on this planet.

That is the natural order of things today. That is the atomic and subatomic and galactic structure of things today! -

- Arthur Jensen, Network

(PS: The descriptions of FOFOA's views above are my personal interpretations and have not been confirmed as either being accurate or inaccurate by FOFOA)

Greece had 13 off-market deals with Goldman to hide debts

by Elisa Martinuzzi - Bloomberg

Greece had 13 off-market derivative contracts with Goldman Sachs Group Inc., most of which swapped Japanese yen into euros in a 2001 transaction aimed at concealing the true size of the nation’s debt, according to the European Union’s statistics office.

The amount borrowed through the swaps was due to be repaid with an interest-rate swap that would have spread payments through 2019, Eurostat said in a report on its website today. In 2005, the maturity was extended to 2037, the report said. Restructuring the swaps spread the cost over a longer period, leading to an increase in liabilities and debt, Eurostat said.

Repeated revisions of Greece’s figures, beginning in 2009, spurred a surge in borrowing costs that pushed the country to the brink of default and triggered a region-wide debt crisis. The use of off-market swaps, which Greece hadn’t previously disclosed as debt, let the country increase borrowings by 5.3 billion euros ($7.5 billion), Eurostat said in November.

Today’s report provides details of Eurostat’s analysis of data obtained by its inspectors in Greece last year. Eurostat said most issues surrounding the swaps were resolved in September, when Greece agreed to correct its debt figures.

Greece agreed in September with Eurostat to treat other swaps from 2005 as debt. Those contracts had “very short maturity, with a quick amortization of the loan component,” Eurostat said. The Goldman Sachs deal originally amounted to a loan of 2.8 billion euros, according to Eurostat. National Bank of Greece SA (ETE), the country’s biggest lender, in 2005 took over the swap from New York-based Goldman Sachs. Four years later, National Bank securitized the swap, Eurostat said.

Greece, Portugal, Ireland See Debt Topping Total GDP This Year

by Andrew Davis - Bloomberg

Greece, Ireland and Portugal, the euro region countries that needed 256 billion euros ($366 billion) in emergency aid to avoid default, may all see their debt loads exceed the size of their economies this year.

Greece’s debt, already the biggest in the euro’s history at 143 percent of gross domestic product last year, will jump to almost 158 percent this year and 166 percent in 2012, the European Commission said today in Brussels. Portuguese debt will surpass total economic output for the first time this year, growing to 101.7 percent of GDP, while Irish debt will reach 112 percent, the forecasts show.

As European Union officials consider boosting aid for Greece a year after its 110 billion-euro bailout, today’s report shows little sign of debt levels becoming more manageable. Soaring borrowing costs have left the three nations shut out of financial markets with investors increasing bets that Greece will become the first euro member to default.“Greece is facing a very serious situation,” EU Economic and Monetary Affairs Commissioner Olli Rehn said at a briefing. “Because of weaker growth last year than expected and the burden of that, there’s a need to take additional measures of fiscal consolidation.”

The cost of insuring Greece debt against default reached a record 1,371 on May 9, and its two-year bonds now yield 24.8 percent, almost 10 percentage points more than its 10-year debt, indicating investors perceive more risk in lending to Greece for two years rather than a decade.

Deficit Forecasts

The European Commission also raised its deficit forecasts for all three countries and predicted that the economies of both Greece and Portugal will shrink this year as the austerity measures choke growth needed to finance deficit reduction. Greece’s economy did expand 0.8 percent in the first quarter, snapping five straight contractions, separate data showed today.

After more than a year of austerity, which included higher taxes and cuts in wages and pensions, Greece’s budget deficit was still at 10.5 percent of GDP last year. The shortfall will narrow to 9.5 percent of GDP this year and 9.3 percent next year, still three times the EU limit of 3 percent.

The European Commission and European Central Bank have stepped up opposition to a restructuring of Greece’s debt. Rehn warned on May 11 that such a move would have “devastating implications” for the country and the euro area as a whole. Euro-region finance chiefs meet in Brussels on May 16 and will discuss additional aid for Greece that would allow it to avoid trying to return to markets and sell 27 billion euros of debt next year as envisioned under the bailout plan.

‘Sooner or Later’

“Sooner or later Greece will have to restructure,” Patrick Moonen, a senior equity strategist at ING Investment Management, said in an interview with Maryam Nemazee on Bloomberg Television’s “The Pulse.” At the same time, Europe’s donor nations insist that Greece will need to meet tougher conditions than last year to win more funds. An EU and IMF delegation is currently in Athens, conducting the fourth quarterly review of the government’s deficit-cutting program.

Ireland’s deficit, the biggest in the history of the euro region last year at more than 32 percent, is forecast to fall to 10.5 percent this year. Portugal, where the economy contracted 0.7 percent in the first three months, will have a 5.9 percent deficit, the commission said.

Greece’s Finance Ministry blames the deeper-than-forecast recession for the government’s failure to meet its 9.4 percent deficit target last year and for a 1.9 billion-euro revenue shortfall in the first four months of 2011. Record unemployment of 15 percent and an inflation rate of almost 6 percent have damped consumer and business spending. Greek GDP contracted 4.5 percent last year. The economy is forecast to shrink 3.5 percent this year, according to today’s forecast.

The government next week will submit to parliament a 76 billion-euro package of spending cuts and asset sales to help meet its fiscal targets. About 18,000 demonstrators attended union-organized marches on May 11 to protest the measures.

I.M.F. Warns Europe's Debt Crisis Could Still Spread

by Reuters

Despite bailouts for Greece, Ireland and Portugal, Europe’s debt crisis could still spread to core euro zone countries and the emerging economies of eastern Europe, the International Monetary Fund warned on Thursday.

The IMF said it stood ready to provide more aid to Greece if requested, though the country that triggered the sovereign debt crisis in 2009 still had plenty of untapped options for raising extra cash itself though privatizations. “Contagion to the core euro area, and then onwards to emerging Europe, remains a tangible downside risk,” the global lender’s latest economic report on Europe said.

Finance ministers of the 17-nation single currency area are set to approve a €78 billion, or $111 billion, rescue plan for Portugal next Monday after Finland’s prime minister-in-waiting clinched a deal to ensure parliamentary approval of the package. But markets are increasingly concerned that Greece may never be able to pay back its €327 billion debt pile and will have to restructure, forcing losses on investors with severe consequences in the euro zone and beyond.

Asked whether there could be new aid package to help Greece work through its fiscal recovery program, the I.M.F.’s European department director, Antonio Borges, said the fund was open to the possibility. “The Greeks have to take the initiative, and so far they have not approached us. The I.M.F. stands ready” to provide additional support “as a matter of policy,” he told reporters.

However, Athens also had the potential to raise funds by selling state assets, with the €50 billion mentioned as a possible estimate of revenues from a privatization program “probably less than 20 percent of all the assets the Greeks could privatize.”

The semi-annual I.M.F. report said peripheral members of the euro zone needed to make “unrelenting” efforts to overcome the debt crisis and prevent it spreading further. It also urged the European Central Bank to tread carefully on further rises in interest rates after last month’s first increase since 2007, saying euro zone monetary policy could “afford to remain relatively accommodative.”

Mr. Borges said the program of austerity measures and structural reforms agreed a year ago was “probably the best thing that can happen” to Greece, though there was always the question of whether it was too ambitious. Greece has implemented harsh cuts in public spending, public sector wages and pensions but has struggled to raise revenue due to a deep recession and chronic tax evasion. The government faces growing resistance to austerity, highlighted by a general strike on Wednesday.

Greek sovereign bond yields soared to fresh euro-era highs on a growing belief that euro-zone finance ministers will not deliver fresh aid for Athens at their monthly meeting next week. The yield on two-year Greek bonds rose to an eye-watering 27 percent. By contrast, Portuguese and Irish yields eased after the Finnish deal on Thursday removed one key political uncertainty.

The euro-skeptical True Finns party, which scored big gains in last month’s general election by vehemently opposing the Portuguese bailout, said it would not take part in talks to form the next Finnish government.

The Washington-based fund’s views about Greece are being closely watched ahead of next month’s decision on whether Athens receives the next €12 billion tranche of its €110 billion E.U./I.M.F. bailout. Ireland and Greece are already dependent on €52.5 billion of I.M.F. aid while Portugal is awaiting a €26-billion, three-year lifeline from the fund. Banks in the troubled countries are being kept above water by unlimited E.C.B. liquidity, and the I.M.F. said the central bank might need to extend that system again beyond June 12.

Financial markets and economists are overwhelmingly convinced that Greece will have to restructure its debt mountain and force investors to take losses. But Mr. Borges said the I.M.F. believed Greece was not bankrupt despite its high debt. “All I.M.F. programs are based on debt sustainability, so as long as a program is in place that means that the I.M.F. believes Greek debt is sustainable,” he said.

Europe Will Need to Dig Deeper for Greece

by Charles Forelle - Wall Street Journal

A senior International Monetary Fund official said Thursday that debt restructuring would provide no miracle cure for Greece's debt crisis, as a delegation of European and IMF officials continued to pore over the Greek government's finances in Athens. The delegation is in the Greek capital to examine whether the country's tough economic program is still on track and whether its financing plan is sustainable. Their agreement is needed before they release another slice of funds next month from a €110 billion ($157.8 billion) rescue package agreed upon a year ago.

But public- and private-sector analysts agree that the €110 billion won't be enough, saying Greece will need to find a way to fill a finance shortfall of as much as €60 billion to tide it through 2013. "Obviously, there is going to be new official money," said Alessandro Leipold, a former senior IMF official who is now chief economist at the Lisbon Council, a Brussels think tank.

One way to ease Greece's troubles would be to change the terms of Greece's existing private debt—a so-called restructuring. However, Antonio Borges, director of the IMF's European department, speaking said in Frankfurt that he doesn't see a "miraculous restructuring solution" to Greece's debt travails. But that raises the question: What are Greece's options? The government has slashed spending. It has been told to increase taxes. A garage sale of government assets—a horse-racing concession, disused Olympic facilities, parcels of land—is opening soon. Mr. Borges said Greece's €50 billion privatization program potentially represents less than 20% of "an extraordinary portfolio of assets" that could be sold off to raise cash.

But raising anywhere this amount through asset sales would encounter huge domestic political opposition and there is a growing consensus among EU officials that more bailout money will be needed. German Finance Minister Wolfgang Schäuble said on Thursday that Germany could provide more aid to Greece—under strict conditions. The route for further money from EU governments—as well as an expected €78 billion bailout for Portugal—appeared to have been eased by events in Finland Thursday. The pullout by the euro-skeptic True Finns party from talks to form a new government suggested, analysts said, that Finland would be less obstructive to EU bailouts.

What to do with Greece will headline discussions at a regular meeting of European finance ministers early next week. There was widespread dissatisfaction in Europe's healthier countries—particularly Germany, the Netherlands and Finland—when the original Greece bailout was designed. Despite Thursday's developments in Finland and Mr. Schäuble's comments, asking people to shell out more bailout money is becoming more, not less, politically fraught.

The problem, at its base, is simply arithmetical: The three-year, €110 billion joint EU-IMF bailout was never enough to carry Greece through three full years. By design, the bailout covered all of Greece's needs—its long-term debt repayments, its bank-restructuring costs, its government deficits—for nearly two years, with the expectation that Greece would gradually begin to borrow again from private markets and the bailout tap would be gradually switched off.

Thus the original bailout math, from when the aid package was conceived in May 2010, showed Greece would need €151.5 billion over three years to cover deficits, repay existing long-term loans and prop up banks. The EU estimated Greece would need to borrow more than €40 billion on its own to plug the gap. In the ensuing year, the numbers have gotten worse. Greece has missed deficit targets, and now the EU expects Greece will need to borrow €44.1 billion—of which €26.7 billion is expected in 2012.

Almost no one believes Greece will be able to raise that much money; currently, markets want more than 15% to lend to Greece, and rating agencies consider the country's debt junk. What to do? There are at least four possible options, which could in some cases be combined.

First is to tweak the terms of the existing bailout in Greece's favor and hope privatization raises serious money fast. One common suggestion: Cut the interest rate Greece pays on the aid money. But in 2012, Greece will pay less than €3 billion in interest to the euro-zone lenders. Even eliminating interest payments makes only a small dent in the €26.7 billion gap. And significant cash from privatizations over the next several months is a very long shot.

Second, the EU could give Greece more money. The European Financial Stability Facility is set up for this purpose, and it could quickly write a check, backed by the taxpayers of healthier countries. This would not be popular. Moreover, some €35 billion in existing long-term debt is due to be paid back to private creditors in 2012. That means that the fresh funds would in large part go directly to repaying banks and other lenders in full, with taxpayers now bearing all the risk.

Third, Greece could be told to offer a "voluntary exchange" to its private creditors, whereby they turn in their maturing bonds for new ones that are repaid later. The risk: If not enough creditors go for the deal, it could quickly become a messier, involuntary exchange in which investors of maturing bonds are paid back with new Greek bonds, whether they want them or not. Indeed, telling creditors that there is no fresh official financing will make them less likely to accept a voluntary exchange. The benefit of delaying repayments: Since private creditors must wait to get their money, they continue to share the burden of risk.

If a solid majority of the holders of debt maturing in 2012 are persuaded or forced to wait for repayment, Greece could scrape by that year without additional money. But it is a very tight squeeze. None of these three options affects the absolute magnitude of Greece's debt, some €350 billion and heading up. Many economists believe Greece won't ever be able to repay it. That leaves the last option: "haircuts" to bondholders. If Greece can't repay, many economists say, it is better to deal with that sooner, rather than throwing good money after bad, mounting the pressure on the Greek economy and raising the exposure of the public lenders.

But, apart from cutting Greece off from private finance for a while, haircuts would be a major event that could trigger unknown consequences in the bond markets and banking systems across the euro zone. That could force Europe into bailing out other governments and their banking systems. In the end, there is a risk that forcing bondholders to take their medicine in Greece could turn out, in the short run, to be the most expensive option of all for taxpayers in rich countries.

Greek Debt Crisis “An Absolute Nightmare,” FT’s Wolf Says

by Aaron Task - Daily Ticker

Days after S&P's downgrade sent yields of Greek debt soaring, European officials are reportedly working on another bailout package for the debt-laden nation. The latest chapter in Europe's never-ending sovereign debt crisis comes about a year after Greece received a 110 billion euro ($158 billion) bailout package from the EU and IMF. That bailout was supposed to buy time for Greece to adopt austerity measures without having to tap the public debt markets.

But Greece has consistently fallen short of its budget targets in the past year and austerity measures have resulted in lower tax receipts and ever-higher deficits. As a result, financial markets are pricing in a default or major restructuring of Greek sovereign debt, putting renewed pressure on EU officials to prevent contagion into Europe's other 'PIIGS', most notably Spain. The situation in Greece is an "absolute nightmare" for European officials, says Martin Wolf, The FT's chief economics correspondent.

Because it's "completely inconceivable" Greece will be able to raise enough money to fund its debts via the private market, Wolf says the country is faced with a stark choice: restructuring its debt now — and force private debt holders to take a haircut -- or become a ward of the EU, which will absorb the debt and then be desperate to avoid haircuts that would hit taxpayers (again). From Wolf's point of view, the choice is an easy one: Restructure now and force the private sector to at least share in the pain (for a change).

"It's just not going to get better," he says of Greece's debt situation. "Essentially they have to bit the bullet. The difficultly is managing that while maintaining some financial system in Greece and avoiding massive contagion within the Eurozone." Because Greece's debt problems are widely known and the potential for a restructuring well telegraphed, a 2008-style financial crisis "probably won't happen," Wolf says. "But the longer they wait, the worse [it] gets."

Athens woes hit confidence in Spain

by Victor Mallet - Financial Times

A reluctant Spain has been shoved once again into the front line of the battle over the future of the euro, following indications that Greece might need another bail-out to avoid defaulting on its sovereign debt.

After the rescues of Greece and Ireland last year and the imminent bail-out package for Portugal, investors say Spain’s €1,744bn ($2,478bn) gross external debt burden and its dependence on foreign financing place it technically next in line for emergency aid from the European Union and the International Monetary Fund.

But would such a rescue for the fourth-biggest economy in the eurozone ever be needed? Spanish ministers and most of the country’s business leaders insist the answer is no, largely because Spain is successfully cutting its budget deficit and has embarked on a radical reform of its troubled savings banks.

Even foreign funds, many of which were sceptical about Spain’s chances before it introduced a harsh austerity plan last May, now tend to give the country the benefit of the doubt. “The debate has moved from ‘Will they need a bail-out?’ to ‘Will there be any growth, and is this a good place to invest my money?’,” says one London-based hedge fund analyst visiting Madrid.

Foreign investors and analysts, however, say the outcome for Spain depends as much on confidence and on market perceptions as on what actually happens to the Spanish economy. “First, the markets don’t have nearly as much information as the individual countries have and, second, they are quite fickle,” says Luis Cabral, professor of economics at Iese, the business school.

When Portugal finally accepted it needed a bail-out a month ago, markets were so relaxed that the perceived riskiness of Spanish 10-year government bonds – as measured by the interest rate spread over benchmark German bunds – actually declined to about 170 basis points.

Yet when it became clear a few days ago that Greece would need further aid on top of the €110bn already agreed, the spread rose sharply to 220bp and has declined only slightly since then. “Between the two there was about a month, and not much has happened in the real economy in Spain,” says Prof Cabral. “It has to be a combination of psychological effects and market expectations ... Greece was a big negative shock to expectations. Restructuring is no longer a problem for Greece – it’s a problem for the entire eurozone.”

Although the Spanish bond spread is well below the euro-era record of nearly 300bp that it hit last year, foreign investors are still trying to establish whether Spain is as vulnerable as pessimists assert. “Everyone saw Greece and Portugal as weak economies, and in Ireland everyone can see the obvious – the banking sector,” says Mattias Sundling, a senior strategist at Danske Markets. “Spain is a little more complicated. Everyone is struggling to get a grip on how serious the situation is.”

As Markets Worry, Spanish Regions Borrow

by David Roman - Wall Street Journal

It’s unclear whether Spanish regional governments got the memo on the pressing need to cut down debt.

Since November last year, Spain’s regions have borrowed around €8 billion via bonds, mostly short-term, high-coupon retail issues targeting “patriotic” residents, boosting the overall debt of regional governments by more than 7%, according to Moody’s. In a report released earlier this week, Moody’s says this means that regional government debt already accounts for 11% of Spain’s overall debt. The trend is for further increases, Moody’s adds, as the high cost of servicing this debt hits regional finances which are already shaky, due to the consequences of the three-year long property bust in the country.

With local and regional elections to be held May 22 in Spain, local mandarins have had a big incentive to spend. The worry now is that, as a number of regional governments are due to change hands, new incumbents may have an interest in getting skeletons out of the closets and starting afresh, by admitting to higher-than-anticipated budget shortfalls. That’s exactly what happened last year in Catalonia, Spain’s wealthiest region, when the regional government there changed hands.

The new government led by moderate Catalan Nationalists promptly accused the previous cabinet of hiding budget shortfalls. Then, in February, it unveiled a 2010 budget deficit equal to 3.9% of the regional gross domestic product—above the estimate of 3.6% of GDP that Catalonia gave a few weeks before and much higher than the 2.4% limit set for all regional governments in 2010.

Madrid’s central government doesn’t want any more of this. Last year, Madrid fought hard and long to keep spending by the regions under control, and the terms set for this year are generous—as Spain’s overall budget deficit goes down from 9.2% of the country’s GDP to 6% of GDP, the central government plans to cut its deficit from 5% of GDP to 2.3% of GDP, allowing the regions a much smaller deficit adjustment—only from 3.4% to 3.3%.

Even these relatively generous terms may be hard to achieve by Spain’s 17 regions, six of which must still make additional cost reductions to get their deficit-cutting plans approved by Madrid. This is because many of the regional governments have become employers of last resort, and have recently become about the only sources of new jobs in the country, as the number of civil servants across the country has risen to a fresh all-time high. Regional governments alone now employ 50% more people than five years ago.

It’s true that regional governments are in charge of providing key services, but often they’re not very good at it. Health care costs per insured, mostly under the regions’ administration, have grown almost 50% since 2004, according to Fitch Ratings estimates. Then there are plenty of non-essential expenses. In a recent report, the Spanish newspaper El Economista estimated that the network of 179 foreign representation offices kept by the 17 Spanish regions will have a cost of just over €400 million this year—a 10% reduction from last year’s number, but still a fairly substantial amount given that regions have no say over Spain’s international ties

Is Spain next to fall?

by Jonathan Ratner - Financial Post

Will Spain be able to avoid the debt contagion sweeping through the euro zone or is it the next domino to fall? As the world’s 12th largest economy and the fourth largest in the euro zone, many analysts point to Spain as the country that will ultimately determine whether the region’s debt crisis can be contained. Spain’s GDP also happens to be twice the size of Greece, Ireland and Portugal combined.

“While we do not go as far as to predict that the restructuring of Spain’s debt is imminent, we do believe that the current consensus view that Spain has decoupled from Greece, Ireland and Portugal underestimates the risks facing the country,” said Angelo Katsoras and Pierre Fournier, geopolitical analysts at National Bank Financial.

One factor behind the view that Spain won’t be the next bailout candidate is the much lower yield on its government debt relative to bailout recipients such as Greece, Portugal and Ireland. Yet while Spain has relatively low public debt (62% of GDP – roughly 20% lower than the euro zone) and it has implemented several key austerity measures (wage cuts for civil servants, raising the retirement age, hiking taxes), the country still faces significant economic and geopolitical challenges.

The National Bank analysts point to the recent real estate bust, a banking sector that remains fragile, Spain’s uncompetitive labour force, high private sector debt, sub-par economic growth prospects and political uncertainty both inside and outside its borders.

Spain also faces rampant unemployment, which hit a new high of 21.3% in the first quarter of 2011 and is more than double the euro zone average. The underground economy does account for 20% of Spain’s GDP, so the unemployment picture is likely better than headline numbers suggest, but the jobless rate for youth under the age of 25 is 43.5%. At the same time, 35% of this group does not have a college education, which is double the EU average.

If interest rates continue to rise following the European Central Bank’s recent quarter-point hike, the analysts expect Spain’s weak housing market would take a hit since most mortgages in the country are linked to the one-year Euribor money market rate, which is equivalent to a variable mortgage rate.

So if Spain were to need a bailout, the country’s size means its rescue package would dwarf all others seen to date. While the Greek, Irish and Portuguese bailouts totaled approximately €275-billion, many economists estimate that if Spain loses its ability to borrow from the international markets at affordable rates, it would need a loan package worth about €350-billion.

“A bailout of Spain would not only strain the capacity of the European Union bailout fund, it could also lead to a massive political backlash from angry citizens in the creditor countries,” they said, noting the large exposure of European banks to Spain. “Historically, the number of countries that have been able to overcome debt and competitiveness-related problems without resorting to currency devaluation and/or debt restructuring is exceedingly low,” Mssrs. Katsoras and Fournier wrote in a report.

“Growing political tensions between the creditor and debtor countries of the euro zone and voter backlash against incumbent governments are undermining efforts to achieve the necessary compromises and effective domestic policy measures.”

Forex focus: watch out for Greece

by Liz Phillips - Telegraph

Beware Greeks bearing bonds is the message from across the Channel at the moment.

It’s looking increasingly likely that Greece – and therefore the European Central Bank (ECB) – will have to face crippling costs to restructure its debt, with ratings agency Standard & Poor (S&P) downgrading Greece from BB- to B. The worrying factor is that Greek banks hold predominantly Greek government bonds.

As Simon Smith, chief economist of FxPro says: “Greece is stuck between a rock and a hard place. Greek banks will take the biggest hit from any restructuring. In turn, the ECB – Greek banks having borrowed €94 billion from it – will take a hit on a major restructuring. “S&P reckon you need to lop 30 to 50 per cent off the Greek debt pile just to pull Greece out of the current nose-dive. In hair-dressing terms, that’s a pretty severe hair-cut. “There is a sense that Europe’s response to the debt crisis is now verging on the shambolic.”

Greece was the first nation to need a hand-out last time. History could be repeated with Ireland and Portugal not far behind. As Caxton FX’s Richard Driver says: “Greek debt levels are unsustainable. They will certainly need more support of some sort. It’s a matter of when and in what form, not if, Greece receives help.”

In recent weeks the euro has shown remarkable resilience in shrugging off any bad news. The reasons were that it is being propped up by rich Asian friends buying the currency as an alternative to the US dollar, its relatively high interest rates and the strength of Germany’s economy under-pinning the single currency. But finally everyone seems to be taking notice of the extent of the debt crisis.

“The worm has started to turn,” comments Jeremy Cook, chief economist at World First. “And, like a patient lying in a hospital bed with the painkillers wearing off, the markets are starting to take more and more notice of the great big European debt problem. “The rebound in the euro’s fortunes over the past week has been short and sharp. It’s been the kind of movement which suggests that the market is scared, and they are dumping it with very little care for the consequences.”

With the spotlight once again on how vulnerable the Eurozone really is, the future for the area looks bleak. As Chris Towner, director of FX Advisory Services at HiFX notes: “The euro looks vulnerable from a number of angles. The most obvious one is the suffering peripheral economies for whom the rating agencies continue to circle in the air like birds of prey diving in with downgrades.”

He also points out the shaky political will from stronger nations to continue to fund the weaker ones – the Finnish electorate is revolting against hand-outs and Germany’s Angela Merkel is struggling to maintain support politically because of her helpful attitude to the weaker peripheral countries. Her problems will only get worse if Germany’s export trade is knocked by higher wage and energy costs and a strong euro.

Mr Towner adds: “It is also important to add that the sovereign debt crisis does not need to spread any further into Spain or Italy. If it were to spread into these economies then the sovereign debt crisis would become even more alarming; however the point here is that the alert is already bright red due to Greece, Ireland and more recently Portugal.”

ECB President Jean Claude-Trichet didn’t help either by suddenly announcing at the end of last week that a further rate rise was not ear-marked for the next month or so, causing a sell-off of the single currency. The euro is now on the back foot.

And that wasn’t the only bad news. “On Friday rumours swept the currency markets that an emergency meeting could see Greece pull out of the euro. This heaped more pressure on the euro and it has dropped by nearly six cents in just over three trading days,” says Mark O'Sullivan, group head of dealing and products at Currencies Direct.

“The great thing about the ECB and the euro politicians is that they continue to peddle the same story: that the countries that had sought a bail-out - Greece, Portugal and Ireland - didn’t really have that much effect when it came to total Eurozone GDP. “This is true, but what they failed to acknowledge is the 'iceberg effect' these countries have. The tip of the iceberg is their total input to Eurozone GDP, but under the water the debt they owe is huge, to the point that a default from all three of these nations would cause a global implosion.

“To add even more uncertainty, the newly elected Finnish government have come out and publically stated that Eurozone bail-outs are nothing more than a 'Ponzi scheme', with taxpayer’s money being used to fund countries that have no real means to pay off their debts and need a constant source of bail-outs just to meet their on-going debt requirements.

“The elephant in the room is Spain and Italy. Both have different problems and day by day the yields the market demand to lend to these nations continue to rise. So the PIGS, who have been ridiculed by their northern neighbours for poor fiscal policy, have suddenly pulled a gun from under the table and held it to their heads, threatening to pull the trigger unless they get some kind of debt forgiveness.”

And where does all this leave sterling – within the EU but not in the euro club? Could the pound be seen as an alternative? HiFX’s Chris Towner thinks so. “Sterling looks far more attractive as an alternative. The UK has of course its own issues, but at least these issues are being addressed, and at least we have a currency that weakens in reaction to a crisis rather than strengthens.”

Inflation Fears: Real or Hysteria?

by Ellen Brown - Truthout

Debate continues to rage between the inflationists who say the money supply is increasing, dangerously devaluing the currency, and the deflationists who say we need more money in the economy to stimulate productivity. The debate is not just an academic one, since the Fed's monetary policy turns on it, and so does Congressional budget policy.

Inflation fears have been fueled ever since 2009, when the Fed began its policy of "quantitative easing" (effectively "money printing"). The inflationists point to commodity prices that have shot up. The deflationists, in turn, point to the housing market, which has collapsed and taken prices down with it. Prices of consumer products other than food and fuel are also down. Wages have remained stagnant, so higher food and gas prices mean people have less money to spend on consumer goods. The bubble in commodities, say the deflationists, has been triggered by the fear of inflation. Commodities are considered a safe haven, attracting a flood of "hot money" - investment money racing from one hot investment to another.

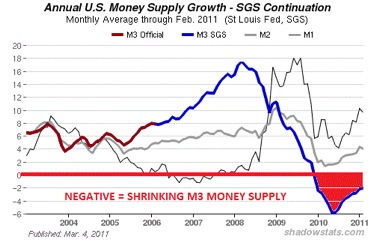

To resolve this debate, we need the actual money supply figures. Unfortunately, the Fed quit reporting M3, the largest measure of the money supply, in 2006.

Fortunately, figures are still available for the individual components of M3. Here is a graph that is worth a thousand words. It comes from ShadowStats.com (home of Shadow Government Statistics, or SGS) and is reconstructed from the available data on those components. The red line is the M3 money supply reported by the Fed until 2006. The blue line is M3 after 2006.

The chart shows that the overall US money supply is shrinking, despite the Fed's determination to inflate it with quantitative easing. Like Japan, which has been doing quantitative easing (QE) for a decade, the US is still fighting deflation. Here is another telling chart - the M1 Money Multiplier from the Federal Reserve Bank of St. Louis:

Barry Ritholtz comments, "All that heavy breathing about the flood of liquidity that was going to pour into the system. Hyper-inflation! Except not so much, apparently." Ritholtz quotes David Rosenberg: "Fully 100% of both QEs by the Fed merely was new money printing that ended up sitting idly on commercial bank balance sheets. Money velocity and money multiplier are stagnant at best." If QE1 and QE2 are sitting in bank reserve accounts, they're not driving up the price of gold, silver, oil, and food, and they're not being multiplied into loans, which are still contracting.

The part of M3 that collapsed in 2008 was the "shadow banking system," including money market funds and repos. This is the non-bank system in which large institutional investors that have substantially more to deposit than $250,000 - the Federal Deposit Insurance Corporation (FDIC) insurance limit - park their money overnight. Economist Gary Gorton explains:

[T]he financial crisis ... [was] due to a banking panic in which institutional investors and firms refused to renew sale and repurchase agreements (repo) - short-term, collateralized, agreements that the Fed rightly used to count as money. Collateral for repo was, to a large extent, securitized bonds. Firms were forced to sell assets as a result of the banking panic, reducing bond prices and creating losses. There is nothing mysterious or irrational about the panic. There were genuine fears about the locations of subprime risk concentrations among counterparties.

This banking system (the "shadow" or "parallel" banking system) - repo based on securitization - is a genuine banking system, as large as the traditional, regulated banking system. It is of critical importance to the economy because it is the funding basis for the traditional banking system. Without it, traditional banks will not lend, and credit, which is essential for job creation, will not be created.[Emphasis added.]

Before the banking crisis, the shadow banking system composed about half the money supply, and it still hasn't been restored. Without the shadow banking system to fund bank loans, banks will not lend, and without credit, there is insufficient money to fund businesses, buy products, or pay salaries or taxes. Neither raising taxes nor slashing services will fix the problem. It needs to be addressed at its source, which means getting more credit (or debt) flowing in the local economy. When private debt falls off, public debt must increase to fill the void. Public debt is not the same as household debt, which debtors must pay off or face bankruptcy. The US federal debt has not been paid off since 1835. Indeed, it has grown continuously since then, and the economy has grown and flourished along with it.

As explained in an earlier article, the public debt is the people's money. The government pays for goods and services by writing a check on the national bank account. Whether this payment is called a "bond" or a "dollar," it is simply a debit against the credit of the nation. As Thomas Edison said in the 1920's:If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good, also. The difference between the bond and the bill is the bond lets money brokers collect twice the amount of the bond and an additional 20%, whereas the currency pays nobody but those who contribute directly in some useful way.... It is absurd to say our country can issue $30 million in bonds and not $30 million in currency. Both are promises to pay, but one promise fattens the usurers and the other helps the people.

That is true, but Congress no longer seems to have the option of issuing dollars, a privilege it has delegated to the Federal Reserve. Congress can, however, issue debt, which, as Edison says, amounts to the same thing. A bond can be cashed in quickly at face value. A bond is money, just as a dollar is.

An accumulating public debt owed to the International Monetary Fund (IMF) or to foreign banks is to be avoided, but compounding interest charges can be eliminated by financing state and federal deficits through state- and federally owned banks. Since the government would own the bank, the debt would effectively be interest-free. More important, it would be free of the demands of private creditors, including austerity measures and privatization of public assets.

Far from inflation being the problem, the money supply has shrunk and we are in a deflationary bind. The money supply needs to be pumped back up to generate jobs and productivity and, in the system we have today, that is done by issuing bonds, or debt.

Foreclosure Filings Drop to 40-Month Low as U.S. Lenders Delay Processing

by Dan Levy - Bloomberg

Foreclosure filings in the U.S. fell 34 percent last month from a year earlier as lenders already swamped with seized homes delayed action on thousands of additional delinquent mortgages, RealtyTrac Inc. said.

A total of 219,258 properties received default, auction or repossession notices in April, the fewest in 40 months, the Irvine, California-based data seller said today in a statement. It was the seventh straight month that filings dropped from a year earlier. They were down 9 percent from March. One in 593 U.S. households got a notice. “Banks already sitting on thousands of properties they can’t sell as quickly and profitably as they’d like aren’t going to be anxious to accelerate foreclosures on tens of thousands more,” Rick Sharga, RealtyTrac’s senior vice president, said in an e-mail.

The U.S. housing market faces “enormous challenges,” Brian Moynihan, chief executive officer of Bank of America Corp. (BAC), the largest U.S. bank, told shareholders yesterday in Charlotte, North Carolina. Three-fourths of U.S. cities had declines in home prices in the first quarter, according to the National Association of Realtors. Distressed properties, which include foreclosures and short sales, accounted for 40 percent of transactions in March, the group said.

As many as 11 million home loans are underwater, in foreclosure or close to default, Lewis Ranieri, a pioneer of mortgage securitization, said last week while urging lenders to reduce the debt of U.S. mortgage holders with solid credit histories.

Investigation by Attorneys

Foreclosure filings have been falling since U.S. attorneys general in October began a probe of lender practices including improper documentation. Bank of America and JPMorgan Chase & Co. (JPM) are among five U.S. mortgage servicers in talks with state and federal officials to settle the investigation.

RealtyTrac is planning to revise its forecast for 2011 foreclosures at midyear, Sharga said. A 20 percent increase in total filings, which the company predicted in January, is unlikely amid scrutiny of lenders and “market saturation” from distressed homes already for sale, he said. Default notices were filed on 63,422 U.S. properties last month, close to a four-year low and down 39 percent from a year earlier, according to RealtyTrac.

Auctions were scheduled for 86,304 properties, the lowest number in 31 months and a decrease of 37 percent from April 2010, while lenders seized 69,532 homes, down 25 percent from a year earlier. States where courts oversee foreclosures showed a 47 percent decrease in filings from a year earlier, while non- judicial states had a 26 percent decline, RealtyTrac said.

Nevada had the highest rate of foreclosure filings per household at one in 97, with a record 4,606 homes seized. Arizona had the second-highest rate at one in 205 and California was third at one in 240. Utah, Idaho, Michigan, Florida, Georgia, Colorado and Oregon also ranked in top 10. Ten states accounted for 70 percent of the U.S. filing total, led by California’s 55,869. Florida was second at 19,649 and Arizona third at 13,419. Michigan, Nevada, Illinois, Texas, Georgia, Ohio and Colorado rounded out the top 10.

RealtyTrac sells default data from more than 2,200 counties representing 90 percent of the U.S. population.

Proposed US Mortgage Bill Favors Private Firms

by Nick Timiraos - Wall Street Journal

Two lawmakers, a California Republican and a Michigan Democrat, are set to unveil legislation Thursday to replace mortgage giants Fannie Mae and Freddie Mac with at least five private companies that would issue mortgage-backed securities with explicit federal guarantees. The measure is a compromise between conservative Republicans who have advanced bills to build a mostly private mortgage-finance system and Democrats, who say the government shouldn't abandon the mortgage market.

Fannie and Freddie were taken over by the government in 2008 as rising mortgage losses wiped out thin capital cushions. Taxpayers are on the hook for $138 billion to keep the companies afloat and stabilize mortgage markets. Amid an uneven housing recovery, lawmakers have largely shied away from fashioning a successor to the failed mortgage giants.

Analysts say that the compromise proposed by Rep. John Campbell (R., Calif.) and Rep. Gary Peters (D., Mich.) may be the only plan likely to attract sufficient support from both parties on a politically explosive subject, particularly at a time when gridlock looms over issues such as how to curb federal spending.

Other policy makers, including Treasury Secretary Timothy Geithner, have publicly discussed the merits of a limited but explicit government guarantee of securities backed by certain types of mortgages.

Rep. Campbell said, "Rather than putting out a political marker, we can move a piece of legislation that is significant...and can actually become law. The only other approach that's out there in a bill is one that replaces Fannie and Freddie with nothing."Like Fannie and Freddie, the new entities would be restricted to buying loans that meet certain standards, including size caps. But the firms would have to hold much more capital than Fannie and Freddie. And only the mortgage-backed securities that they issue—not the companies themselves—would enjoy federal guarantees. The companies would operate more as public utilities and likely wouldn't have exchange-listed shares.

The approach signals policy makers' desire to usher more private capital into the mortgage market, where the government currently backs more than nine in 10 new loans. But the measure also reflects an unwillingness to cut the federal cords entirely. The bill comes as the housing and financial-services industries dial up efforts to block more aggressive overhauls of the mortgage market. Thursday's measure mirrors proposals advanced by industry groups such as the Financial Services Roundtable's Housing Policy Council.

Critics say the hybrid model risks recreating the same dynamics that led Fannie and Freddie to use their government ties to take risks that cost taxpayers. "In reality, this is almost surely going to be terrible," said Dwight Jaffee, finance professor at the University of California, Berkeley. Government insurance programs, he says, inevitably lead to "a catastrophe."

Advocates say taxpayers will be less exposed to losses because borrowers would be required to make significant down payments and the new firms would be required to hold more capital. The firms will also pay a fee for government backing to finance a catastrophic insurance fund, much as the Federal Deposit Insurance Corp. levies fees and handles bank failures. "There is a lot of private capital ahead of the federal government and the taxpayers on this," said Rep. Peters.

The proposal leaves many details to an independent regulator, which Rep. Campbell says should be insulated from Congress to prevent lawmakers from leaning on it "to do politically correct things, which may not be financially correct things." That role would fall to the Federal Housing Finance Agency, which currently regulates Fannie and Freddie. It would issue charters to the mortgage "guaranty associations," and would be charged with setting guarantee fees and ensuring appropriate capital levels.

While the bill doesn't specify whether the new entities would be allowed to hold mortgage portfolios, the more-stringent capital requirements would make such investment vehicles economically unattractive.

Since the Great Depression, the government has had a hand in the U.S. housing-finance system, which has featured an odd blend of public and private roles. The loans Fannie and Freddie buy from lenders are primarily long-term fixed-rate ones that banks are less willing to hold on their balance sheet. They repackage them for sale to investors as securities, offering guarantees to make investors whole if borrowers default.

Investors were willing to buy those securities in part because the shareholder-owned firms had an "implied" government guarantee. The government was forced to make good on that guarantee by taking the firms over in 2008. The bill pledges that the U.S. would stand behind the existing obligations of Fannie and Freddie, formalizing in writing a position thatthe Bush and Obama administrations never quite made explicit.

The bill would require Fannie and Freddie to accelerate a planned run-off of their combined $1.5 trillion mortgage portfolios. But it wouldn't liquidate the firms until after two or more new associations had been chartered.

Federal Retreat on Big Mortgage Loans Rattles Housing

by David Streitfeld - New York Times

By summer’s end, buyers and sellers in some of the country’s most upscale housing markets are slated to lose one their biggest benefactors: the deep pockets of the federal government. In Monterey, Calififornia, a seaside community of pricey homes, the dread of yet another housing shock is already spreading. “We’re looking at more price drops, more foreclosures,” said Rick Del Pozzo, a loan broker. “This snowball that’s been rolling downhill is going to pick up some speed.”

For the last three years, federal agencies have backed new mortgages as large as $729,750 in desirable neighborhoods in high-cost states like California, New York, New Jersey, Connecticut and Massachusetts. Without the government covering the risk of default, many lenders would have refused to make the loans. With the economy in free fall, Congress broadened its traditionally generous support of housing to a substantial degree.

But now Democrats and Republicans agree that the taxpayer should no longer be responsible for homes valued well above the national average, and are about to turn a top slice of the housing market into a testing ground for whether the private mortgage market can once again go it alone. The result, analysts say, will be higher-cost loans and fewer potential buyers for more expensive homes.

Michael S. Barr, a former assistant Treasury secretary, said the federal government’s retrenchment would be painful for many communities. “There’s always going to be a line, and for the person just over it it’s always going to be an arbitrary line,” said Mr. Barr, who teaches at the University of Michigan Law School. “But there is no entitlement to living in a home that costs $750,000.”

As the housing market braces for more trouble, homeowners everywhere have been reduced to hoping things will someday stop getting worse. In some areas, foreclosures are the only thing selling. New home construction is nearly nonexistent. And CoreLogic, a data company, said Tuesday that house prices fell 7.5 percent over the last year.

The federal government last year backed nine out of 10 new mortgages nationwide, and losses from soured loans are still mounting. Fannie Mae, which buys mortgages from lenders and packages them for investors, said last week it needed an additional $6.2 billion in aid, bringing the cost of its rescue to nearly $100 billion.

Getting the government out of the mortgage business, however, is proving much more difficult than doling out new benefits. As regulators prepare to drop the level at which they will guarantee loans — here in Monterey County, the level will drop by a third to $483,000 — buyers and sellers are wondering why they should be punished simply for living in an expensive region.

Sellers worry that the pool of potential buyers will shrink. “I’m glad to see they’re trying to rein in Fannie Mae, but I think I’m being disproportionately penalized,” said Rayn Random, who is trying to sell her house in the hills for $849,000 so she can move to Florida.

Buyers might face less competition in the fall but are likely to see more demands from lenders, including higher credit scores and larger down payments. Steve McNally, a hotel manager from Vancouver, said he had only about 20 percent to put down on a new home in Monterey County. If a bigger deposit were required, Mr. McNally said, “I’d wait and rent.”

Even those who bought ahead of the changes, scheduled to take effect Sept. 30, worry about the effect on values. Greg Peterson recently purchased a house in Monterey for $700,000. “That doesn’t get you a palace,” said Mr. Peterson, a flight attendant. He qualified for government insurance, which meant he needed only a small down payment. If that option is not available in the future, he said, “home prices all around me will plummet.”

The National Association of Realtors, 8,000 of whom have gathered in Washington this week for their midyear legislative meeting, is making an extension of the loan guarantees a top lobbying priority. “Reducing the limits will put more downward pressure on prices,” said the N.A.R. president, Ron Phipps. “I just don’t think it makes a lot of sense.” But he said that in contrast to last year, when a one-year extension of the higher limits sailed through Congress, “there’s more resistance.”

Federal regulators acknowledge that mortgages will get more expensive in upscale neighborhoods but say the effect of the smaller guarantees on the overall housing market will be muted. A Federal Housing Administration spokeswoman declined to comment but pointed to the Obama administration’s position paper on reforming the housing market. “Larger loans for more expensive homes will once again be funded only through the private market,” it declares.

Brokers and agents here in Monterey said terms were much tougher for nonguaranteed loans since lenders were so wary. Borrowers are required to come up with down payments of 30 percent or more while showing greater assets, higher credit ratings and lower debt-to-income ratios. In the Federal Reserve’s quarterly survey of lenders, released last week, only two of the 53 banks said their credit standards for prime residential mortgages had eased. Another two said they had tightened. The other 49 said their standards were the same — tough.

The Mortgage Bankers Association has opposed letting the limits drop, although a spokesman said its members were studying the issue. “I don’t want to sugarcoat this,” said Mr. Barr, the former Treasury official. “The housing finance system of the future will be one in which borrowers pay more.”

The loan limits were $417,000 everywhere in the country before the economy swooned in 2008. The new limits will be determined by various formulas, including the median price in the county, but will not fall back to their precrisis levels. In many affected counties, the loan limit will fall about 15 percent, to $625,500.

Monterey County, however, will see a much greater drop. The county is really two housing markets: the farming city of Salinas and the more affluent Monterey and Carmel.

Real estate records show that 462 loans were made in Monterey County between the current limit and the new ceiling since the beginning of 2009, according to the research firm DataQuick. That was only about 1 percent of the loans made in the county. But it was a much higher percentage for Monterey and Carmel — about a quarter of their sales.

Heidi Daunt, with Treehouse Mortgage, said loans too large for a government guarantee currently carried interest rates of at least 6 percent, more than a point higher than government-backed loans. “That can definitely blow a lot of people out of the water,” Ms. Daunt said.

The housing crash will be short-lived for America's politicians

by Richard Blackden - Telegraph

President Bill Clinton once described homes as something Americans "will always know that their country wanted them to have because they were entitled to it as part of the American dream".

It's how the 42nd president ended an address in The White House extolling the virtues of homeownership. He gave the speech in 1995, a year like most before it and several since, when US politicians were more than happy to talk about the housing market.

Fast forward 16 years and the relative silence is striking. More than three years since the collapse of Bear Stearns – a bank that choked on mortgage debt – the only financial debate in the capital is how to cut the country's $14 trillion (8.6 trillion) debt.