"Two brand-new Buffalo-Pitts steam tractors on a flatcar aboard the transfer steamer City of Detroit on the Detroit River in winter"

Ilargi: Last week, Prof. Robert Shiller told Reuters that he thinks another 25% drop in US home prices across the board is very possible, if not likely. Add up the 33% decline to date and a 25% fall from here and you're about at 50%. That would mean a loss in American "household wealth" of some $11 trillion. Here's saying that the US economy can't take that sort of plunge and hope to live to see another day in anywhere near its present or recent shape.

And that's just the most visible part of the iceberg: an additional 25% drop would also tremendously increase the pressure on mortgage backed securities (MBS), and with them perhaps lots of other derivatives, to such an extent that the mark-to-fantasy US FASB 157 accounting non-standards may well become untenable. At some point people need to know, and demand to know, what the real value is of assets they hold, and assets held by companies and financial institutions, if only in order to determine the value of said institutions.

So when Tyler Durden at Zero Hedge says that Ben Bernanke’s QE2 went almost exclusively to foreign banks, color me not surprised (even if I have some questions on Durden's assessments). The sellers and counterparties for the US MBS are largely American institutions, and they sold them all over the world. To China, to Japan, and to foreign banks and funds. In case of a default, a credit event, it's these American institutions that will have to pay up.

And while there are still many different interpretations floating around of what does and does not constitute a credit event, the risks are obvious. Moreover, a big chunk of the MBS issued by for instance Countrywide (bought by BofA) Fannie Mae, Freddie Mac and AIG (all bought by the state) now sits on the books of the Federal Reserve. Which may well have forked over the QE2 $600 billion to hush MBS holders, and so push a possible credit event further down the road. If so, then the Fed isn't just saving foreign banks at the expense of the US taxpayer, no matter how juicy a bit that is for the media, but saving US banks from trillions of dollars in forced pay-outs.

By now, though, we need to start wondering for real how much longer this can continue. Especially, because a credit event looms big in Europe, particularly at the negotiating tables for the next Greece bailout. Over the past few days, Der Spiegel ran a series of articles on the situation:

Greek Debt Swap: Private Creditors Could Agree to €35 Billion Rollover[..] However, both the European Central Bank and France are insisting that any rollover be conducted on a voluntary basis. They fear that any move to force private creditors to participate might lead ratings agencies to punish Greece with a "default" rating.

But the ratings agencies operate according to their own logic. A current statement by Standard & Poor's says that the agency would have no problem with a debt swap if it took place on a purely voluntary basis. If, however, default is possible - as is the case in a country like Greece - and a rating has already fallen, then "we may conclude that investors have been pressured into accepting because they fear more-adverse consequences were they to decline the exchange offer."

In other words, investors would only agree to a swap because they fear the issuer would fail to meet its original obligations. Thus, the rescue operation could actually be interpreted by the agencies as a prediction of insolvency. If that were to happen, Greece would be considered insolvent in the eyes of the financial markets and would be unable to raise money through private investors for some time to come.

Ilargi: And:

Greece Needs a New BailoutThe troika of the European Commission, European Central Bank and IMF has prepared a sobering report on Greece's efforts to combat a debt crisis. The document, which has been obtained by SPIEGEL ONLINE, concludes that Athens will not be able to return to capital markets in 2012 and a further massive bailout will be needed soon.[..]

The IMF's statutes stipulate that the organization can only lend a country money if it is certain that the state will be able to meet its payment obligations for the next 12 months.

The new report has now made it clear that Greece is not in a position to guarantee that, meaning that the IMF cannot transfer any more money while there is still a chance of Greece defaulting within the coming 12 months. "Given the remoteness of Greece returning to funding markets in 2012, the adjustment program is now underfinanced. The next disbursement cannot take place before this underfinancing is resolved" [..]

Ilargi: If Greece can't repay its obligations in 2012, the IMF can't finance it. That would mean a restructuring, soft or not, i.e. a default, would be necessary. But so far the ECB refuses to even discuss one, even though Germany now favors it. For Germany and its allies, this all hinges on the "voluntary" cooperation by those financial institutions who hold Greek debt: French, German and other European banks, plus Greek and other pension funds. Voluntary here of course means what Don Corleone meant when he said: "I made him an offer he couldn’t refuse".

In preparation for this volunteerism, banks are selling off their Greek bonds like there's no tomorrow (pun intended). They do so at sharp discounts to hedge funds and perhaps at 100 cents on the dollar to the ECB, which, like the Fed, is now loaded with zombie paper (the ECB has €10 billion in equity and is rumored to face potential losses of €30-€40 billion in the case of a "declared" Greece credit event.

In that picture, I found it very striking that Juergen Stark, Germany's man at that very ECB, said this to Reuters last week:

ECB's Stark: Avoiding credit event hard with debt dealThe ECB is not strictly against private sector involvement in a Greek deal but its demand that it does not trigger a 'credit event' looks increasing unlikely to be possible, policymaker Juergen Stark said on Friday.

"The ECB is neither demander on this instrument or against the involvement of the private sector, but the conditions have to be clear, the involvement has to be purely voluntary and neither take in a credit event nor a selective default, or in other terms room to create a rating event," Stark told reporters on the sidelines of annual ECB watchers conference.

His comments came a day after ECB President Jean-Claude Trichet stiffened the ECB's stance on a Greek restructuring. Stark said feedback from rating agencies over the last two weeks had changed the situation. "It is not very likely that a substantial involvement of the private sector will be totally voluntary," he said.

Ilargi: What this seems to tell us is that, ahead of the June 24 deadline (a heads of state meeting in Brussels), there is no compromise on the table yet. Ratings agencies S&P, Moody's and Fitch may have a prominent place at the table, since their judgments are crucial to any deal.

Still, if I were a gambling man, I'd bet that they will come up with some last-minute thing that smells worse than a skunk but will be accepted by all parties as being a thoroughbred racehorse. The EU will announce that the day's been saved, and once the European Stability Mechanism comes into place in 2013, and the ECB has additional powers, all will be fine.

But if I still were that same gambling man, I'd also bet that they won't make it into 2013 in one piece. The risks and losses are simply too great.

A substantial added drop in US home prices between now and January 1, 2013 looks set in stone. And Greece is only one of a handful of Eurozone countries that require financial assistance. Even if we leave alone for the time being the awful state of financial affairs in American states and municipalities, it is clear that the pressure on the derivatives "industry" will increase. And as it does, so will the losses. This can only be avoided if and when there's a significant uptick in US real estate and/or substantial economic growth in the EU periphery. Obviously, the chance of either of these things actually happening approaches zero.

Greek 2-year bonds are reportedly trading for 71 cents on the dollar, and investors are kindly requested to accept at least a 30-50% haircut on their assets (how about 70-80%?). An extra 25% plunge in US home prices from today would mean another $4-$5 trillion in "wealth" would disappear from the American economy.

That's bad enough. But it's not the worst. The worst is the derivatives, the so-called insurance, the swaps and securities, that have been written on all the paper. Settling the over the counter paper under the table forever is not an option. There will be parties that demand to be paid. What else do you buy insurance for?

And then of course there's the Greeks in the streets: if they find out to what extent their government has sold them out in order to keep the peace in the credit default swaps universe, chances are they'll be in the streets until that government is gone, and any potential deals with the IMF and ECB declared null and void. And as if that's not enough, people in Spain will do the same when bond markets turn on their country (as in right after a Greek deal is signed).

The IMF and ECB will then be called into Madrid to forge a deal there. And I'm thinking they can't do that, not without shaking the financial world to its core. At the very least, they’ll need a stronger union, a United States of Europe. And that will never be accepted.

We're watching a pressure cooker heating up. And the parties that pretend to have control over it, no longer do. They do, however, still have their hands in your pockets and wallets.

Ilargi: Stoneleigh and I have decided that it's time to change things around here. Observing the shenanigans of the financial and political world inevitably turns to rubber necking and accident tourism, and we feel it's time to talk more about what comes after the present, what we can supply people with that can help them when what we are witnessing today snaps out of this suspended animation and starts its way down into the gorge for real.

We will continue to comment on the economy, but we will also add sections to our new site on for instance preparation, in all its diverse forms, from growing and preserving food to building homes and energy facilities to keeping your remaining wealth where it counts. In short, all that will serve to make people less dependent on the crumbling infrastructures they presently rely upon. We invite anyone who thinks they can contribute to contact us.

We’ll fill you in on the details as we go along. It may take a while longer to get all the pieces to fit into place, but they will be there. In order to make that happen, we do something today that we haven't done for a long time: launch a fund drive. People have been very generous with their donations in the past, and it's thanks to them that we have been able to do what we have done, and to contemplate doing just that, but more and better. In order to achieve this, we need a stable funding base; it is the only way we can make future -financial- commitments involved in everything a larger and more elaborate site requires.

We have been thinking about setting up a members sections at TAE for this purpose, and we may have to go that road at some point. However, if enough people sign up for recurring donations, which for members -if we would be forced to go that route- would be maybe $10 per month, we may not need to do this, which would be a relief: it's not really what we're about. We've set the goal for this Summer Fund Drive at $50,000. We know that may seem like a lot of money to some, but believe me, it's really not; not for what we have in mind.

There are several ways to support the Automatic Earth: One-time donations and recurring donations via Paypal, donations through other means, visits to our advertisers (that’s why they're there!), and clicking on the Amazon box with Stoneleigh’s book favorites in the left hand bar: if, for any Amazon purchase you make, not just those books, you go through their box at TAE, we get a percentage of what you purchase without any extra cost to you. And of course you can still purchase the DVD-ROM and/or streaming file of Stoneleigh's A Century of Challenges.

There Will Be Blood in Europe (Courtesy of the ECB)

by Justice Litle - Taipan Publishing Group

The ECB (European Central Bank)'s plan to "kick the can down the road" as long as possible requires kicking in the teeth of the eurozone periphery countries. It could lead to uprising.

Europe is supposed to be the land of compassion and enlightened social policy. America is supposed to be the domain of "jungle capitalism" and brutal discrepancies between rich and poor. Your editor heard this over and over as a student abroad in the late '90s. At the Oxford Union, a student debating society, there were spirited discussions on the treatment of the underclass. At Pulacky University in the Czech Republic, in the afterglow of the Velvet Revolution, we were reminded that America, too, had its brutal edges like the communists. Even the laid-back Aussies (during your editor's study time down under) thought the Yanks a bit harsh on social policy.

And yet now it is Europe, not the U.S., determined to grind the masses under the heel of a crony capitalism boot. The ECB (European Central Bank)'s determination to force "austerity" on the periphery countries -- and to avoid debt restructuring at all costs -- is driving multiple generations to the brink. There are families that can barely eat as neither mother nor father can find a job. There are millions of young and unemployed with no real hope of an economic future. Tens of thousands surround Greek parliament almost daily.

And meanwhile ECB bureaucrats, that enlightened bunch, can only think of the bankers and their ilk. Europe's determination to "kick the can down the road" at all costs actually involves kicking in the teeth of the peripheral eurozone economies, forcing them to endure deep recession or even outright depression conditions for years to come.

Bankruptcy is frowned on in polite company, but there is a humane reason it exists. Beyond a certain point -- when the debt load becomes intolerable -- the prospect of financial freedom vanishes completely. Without bankruptcy, the noose of debt (interest on top of interest) can tighten around a man's neck for life. Allowing for bankruptcy is not just humane, it helps keep the free market healthy. Debtors who find themselves in impossible situations are given a fresh chance to become productive again. And creditors who lose lending capital become more diligent (and thus more productive) in whom they choose to lend to.

Bankruptcy can happen to countries too. When a country is told "you are not allowed to default at any cost," this is where the moral questions get sticky. Should the debt sins of one profligate generation be passed on to the next? What about the next generation still, and the one after that? And what if the great weight of debt was born of foolish loans -- stupid credit from stupid banks? Should the leverage-happy lenders be protected at all costs? Should the perpetrators and purveyors of such suicidal leverage be enabled to walk away scot-free?

What Europe is practicing has nothing to do with human compassion, or even free market capitalism. Instead it is the worst form of Darwinism. "Survival of the fittest" has simply come to mean "Survival of the most connected." The europe banks are being looked after because they have the best connections, which they paid for with hard cash and soft influence. Those with deep hooks in the system have ensured their interests will prevail. Those without are left to go hang.

It has been predicted by many that America's experiment with leverage and debt is going to end in disaster. Your editor is fairly convinced, though, that the USA is not where such disaster is likely to strike first. At some point -- perhaps quite soon -- the brute-force social inequalities in Europe are simply going to explode, like oil drums full of kerosene sitting in 100-degree heat. Citizens of Greece, Ireland and Portugal are going to realize they are not just getting a bad deal from the ECB, they are being financially mauled.

When this realization gathers full force, we could see a sort of "Fiscal Arab Spring" in the eurozone, embracing multiple generations of pissed-off and disenfranchised citizens. Europe's current crop of leaders, determined to sacrifice the economic future of multiple countries on the altar of the banks, will be told where they can go. At some point, the citizens of Europe's periphery countries will remember what democracy is for. And if their rising voices are not heard, there will be blood and fire on a scale not yet seen. And the fallout will rock markets globally.

It will be a fairly awesome sight to behold. (As will the euro's spiraling decline -- and the dollar's jaw-dropping rally -- when this plays out.) Stepping back a bit: What is so frightening right now, not just in Europe but China and America and Japan too, is the presence of fraud-fueled "Lehman 2.0" catalysts threatening to explode. One could say that the 2008 financial crisis was the mother of all wake-up calls. But instead of actually waking up, the powers that be slammed the alarm clock, choked down a fistful of Ambien, and rolled back to sleep. As a result, the world is going to get an even bigger wake-up call in the not-so-distant future.

Eurozone v ECB: bust-up looms

by LEX - Financial Times

The gloves are off in the eurozone’s fight for survival. Ireland is jousting with France over corporate tax rates; the European Union and the International Monetary Fund have skirmished over Portugal; the Greeks are fighting with everybody, including themselves. The bust-up investors really need to watch, though, is the one looming between Frankfurt and Berlin. It will shape the resolution of the eurozone crisis.

The institutions squaring off are the European Central Bank and the German government and parliament. The ECB has been consistent in its opposition to bailing in private investors to a restructuring of Greek debt. That remains the position of Jean-Claude Trichet, the bank’s president: a "credit event" by Greece must be avoided. That used to be the position of the German government. Not any more. Wolfgang Schäuble, Germany’s finance minister, wants a private sector contribution as a condition of German participation in any more bail-out funds for Athens.

That represents a U-turn by Berlin but who, apart from the ECB, has not been doing that during this crisis? The form that such a bail-in might take is unclear. A Vienna initiative-style rollover of Greek debt on maturity – with investors agreeing to accept longer-dated paper when their existing debt matures – is one option. The question is whether that qualifies for the ECB’s definition of a "credit event". If the involvement of private investors is entirely voluntary, perhaps Mr Trichet can be persuaded that it does not.

The two parties most vital to the resolution of the eurozone crisis and the survival of the euro are in conflict. In theory, that should concern markets. Yet it could hasten rather than delay a resolution by making the critical problems explicit. As the crisis enters a decisive phase, investors should ensure a ringside seat for what follow

The Fed's $600 Billion Stealth Bailout Of Foreign Banks Continues At The Expense Of The Domestic Economy, Or Explaining Where All The QE2 Money Went

by Tyler Durden - Zero Hedge

Courtesy of the recently declassified Fed discount window documents, we now know that the biggest beneficiaries of the Fed's generosity during the peak of the credit crisis were foreign banks, among which Belgium's Dexia was the most troubled, and thus most lent to, bank. Having been thus exposed, many speculated that going forward the US central bank would primarily focus its "rescue" efforts on US banks, not US-based (or local branches) of foreign (read European) banks: after all that's what the ECB is for, while the Fed's role is to stimulate US employment and to keep US inflation modest.

And furthermore, should the ECB need to bail out its banks, it could simply do what the Fed does, and monetize debt, thus boosting its assets, while concurrently expanding its excess reserves thus generating fungible capital which would go to European banks. Wrong. Below we present that not only has the Fed's bailout of foreign banks not terminated with the drop in discount window borrowings or the unwind of the Primary Dealer Credit Facility, but that the only beneficiary of the reserves generated were US-based branches of foreign banks (which in turn turned around and funnelled the cash back to their domestic branches), a shocking finding which explains not only why US banks have been unwilling and, far more importantly, unable to lend out these reserves, but that anyone retaining hopes that with the end of QE2 the reserves that hypothetically had been accumulated at US banks would be flipped to purchase Treasurys, has been dead wrong, therefore making the case for QE3 a done deal.

In summary, instead of doing everything in its power to stimulate reserve, and thus cash, accumulation at domestic (US) banks which would in turn encourage lending to US borrowers, the Fed has been conducting yet another stealthy foreign bank rescue operation, which rerouted $600 billion in capital from potential borrowers to insolvent foreign financial institutions in the past 7 months. QE2 was nothing more (or less) than another European bank rescue operation!For those who can't wait for the punchline, here it is. Below we chart the total cash holdings of Foreign-related banks in the US using weekly H.8 data.

Note the $630 billion increase in foreign bank cash balances since November 3, which just so happens is the date when the Fed commenced QE2 operations in the form of adding excess reserves to the liability side of its balance sheet. Here is the change in Fed reserves during QE2 (from the Fed's H.4.1 statement, ending with the week of June 1).

Above, note that Fed reserves increased by $610 billion for the duration of QE2 through the week ending June 1 (and by another $70 billion in the week ending June 8, although since we only have bank cash data through June 1, we use the former number, although we are certain that the bulk of this incremental cash once again went to foreign financial institutions).

So how did cash held by US banks fare during QE2? Well, not good. The chart below demonstrates cash balances at small and large US domestic banks, as well as the cash at foreign banks, all of which is compared to total Fed reserves plotted on the same axis. It pretty much explains it all.

The chart above has tremendous implications for everything from US and European monetary policy, to exhange rate and trade policy, to the current account on both sides of the Atlantic, to US fiscal policy, to borrowing and lending activity in the US, and, lastly, to QE 3.

What is the first notable thing about the above chart is that while cash levels in US and US-based foreign-banks correlate almost perfectly with the Fed's reserve balances, as they should, there is a notable divergence beginning around May of 2010, or the first Greek bailout, when Europe was in a state of turmoil, and when cash assets of foreign banks jumped by $200 billion, independent of the Fed and of cash holdings by US banks.

About 6 months later, this jump in foreign bank cash balances had plunged to the lowest in years, due to repatriated fungible cash being used to plug undercapitalized local operations, with total cash just $265 billion as of November 17, just as QE2 was commencing. Incidentally, the last time foreign banks had this little cash was April 2009... Just as QE1 was beginning. As to what happens next, the first chart above says it all: cash held by foreign banks jumps from $308 billion on November 3, or the official start of QE2, to $940 billion as of June 1: an almost dollar for dollar increase with the increase in Fed reserve balances.

In other words, while the Fed did nothing to rescue foreign banks in the aftermath of the first Greek crisis, aside from opening up FX swap lines, one can argue that the whole point of QE2 was not so much to spike equity markets, or the proverbial "third mandate" of Ben Bernanke, but solely to rescue European banks!What this observation also means, is that the bulk of risk asset purchasing by dealer desks (if any), has not been performed by US-based primary dealers, as has been widely speculated, but by foreign dealers, which have the designatin of "Primary" with the Federal Reserve. Below is the list of 20 Primary Dealers currently recognized by the New York Fed. The foreign ones, with US-based operations, are bolded:

- BNP Paribas Securities Corp.

- Barclays Capital Inc.

- Cantor Fitzgerald & Co.

- Citigroup Global Markets Inc.

- Credit Suisse Securities (USA) LLC

- Daiwa Capital Markets America Inc.

- Deutsche Bank Securities Inc.

- Goldman, Sachs & Co.

- HSBC Securities (USA) Inc.

- Jefferies & Company, Inc.

- J.P. Morgan Securities LLC

- MF Global Inc.

- Merrill Lynch, Pierce, Fenner & Smith Incorporated

- Mizuho Securities USA Inc.

- Morgan Stanley & Co. LLC

- Nomura Securities International, Inc.

- RBC Capital Markets, LLC

- RBS Securities Inc.

- SG Americas Securities, LLC

- UBS Securities LLC.

That's right, out of 20 Primary Dealers, 12 are.... foreign. And incidentally, the reason why we added the (if any) above, is that since this cash is fungible between on and off-shore operations, what happened is that the $600 billion in cash was promptly repatriated and used by domestic branches of foreign banks to fill undercapitalization voids left by exposure to insolvent European PIIGS and for all other bankruptcy-related capital needs. And one wonders why suddenly German banks are so willing to take haircuts on Greek bonds: it is simply because courtesy of their US based branches which have been getting the bulk of the Fed's dollars in 1 and 0 format, they suddenly find themselves willing and ready to face the mark to market on Greek debt from par to 50 cents on the dollar.

And not only Greek, but all other PIIGS, which will inevitably happen once Greece goes bankrupt, either volutnarily or otherwise. In fact, the $600 billion in cash that was repatriated to Europe will mean that European banks likely are fully covered to face the capitalization shortfall that will occur once Portugal, Ireland, Greece, Spain and possibly Italy are forced to face the inevitable Event of Default that will see their bonds marked down anywhere between 20% and 60%. Of course, this will also expose the ECB as an insolvent central bank, but that largely explains why Germany has been so willing to allow Mario Draghi to take the helm at an institution that will soon be left insolvent, and also explains the recent shocking animosity between Angela Merkel and Jean Claude Trichet: the German are preparing for the end of the ECB, and thanks to Ben Bernanke they are certainly capitalized well enough to handle the end of Europe's lender of first and last resort.

But don't take our word for this: here is Stone McCarthy's explanation of what massive reserve sequestering by foreign banks means: "Foreign banks operating in the US often lend reserves to home offices or other banks operating outside the US. These loans do not change the volume of excess reserves in the system, but do support the funding of dollar denominated assets outside the US....Foreign banks operating in the US do not present a large source of C&I, Consumer, or Real Estate Loans. These banks represent about 16% of commercial bank assets, but only about 9% of bank credit. Thus, the concern that excess reserves will quickly fuel lending activities and money growth is probably diminished by the skewing of excess reserve balances towards foreign banks."Which brings us to point #2: prepare for the Bernanke hearings and possible impeachment. For if it becomes popular knowledge that the Chairman of the Fed, despite explicit instructions to enforce the trickle down of "printed" dollars to US banks, was only concerned about rescuing foreign banks with the $600 billion in excess cash created out of QE2, then all political hell is about to break loose, and not even Democrats will be able to defend Bernanke's actions to a public furious with the complete inability to procure a loan. Any loan.

Furthermore the data above proves beyond a reasonable doubt why there has been no excess lending by US banks to US borrowers: none of the cash ever even made it to US banks! This also resolves the mystery of the broken money multiplier and why the velocity of money has imploded.Implication #3 explains why the US dollar has been as week as it has since the start of QE 2. Instead of repricing the EUR to a fair value, somewhere around parity with the USD, this stealthy fund flow from the US to Europe to the tune of $600 billion has likely resulted in an artificial boost in the european currency to the tune of 2000-3000 pips, keeping it far from its fair value of about 1.1 EURUSD. If this data does not send European (read German) exporters into a blind rage, after the realization that the Fed (most certainly with the complicity of the G7) was willing to sacrifice European economic output in order to plug European bank undercapitalization, then nothing will.

But implication #4 is by far the most important. Recall that Bill Gross has long been asking where the cash to purchase bonds come the end of QE 2 would come from.

Well, the punditry, in its parroting groupthink stupidity (validated by precisely zero actual research), immediately set forth the thesis that there is no problem: after all banks would simply reverse the process of reserve expansion and use the $750 billion in Cash that will be accumulated by the end of QE 2 on June 30 to purchase US Treasurys.Wrong.

The above data destroys this thesis completely: since the bulk of the reserve induced bank cash has long since departed US shores and is now being used to ratably fill European bank balance sheet voids, and since US banks have benefited precisely not at all from any of the reserves generated by QE 2, there is exactly zero dry powder for the US Primary Dealers to purchase Treasurys starting July 1.

This observation may well be the missing link that justifies the Gross argument, as it puts to rest any speculation that there is any buyer remaining for Treasurys. Alas: the digital cash generated by the Fed's computers has long since been spent... a few thousand miles east of the US.

Which leads us to implication #5. QE 3 is a certainty. The one thing people focus on during every episode of monetary easing is the change in Fed assets, which courtesy of LSAP means a jump in Treasurys, MBS, Agency paper, or (for the tin foil brigade) ES: the truth is all these are a distraction. The one thing people always forget is the change in Fed liabilities, all of them: currency in circulation, which has barely budged in the past 3 years, and far more importantly- excess reserves, which as this article demonstrates, is the electronic "cash" that goes to needy banks the world over in order to fund this need or that. In fact, it is the need to expand the Fed's liabilities that is and has always been a driver of monetary stimulus, not the need to boost Fed assets.

The latter is, counterintuitively, merely a mathematical aftereffect of matching an asset-for-liability expansion. This means that as banks are about to face yet another risk flaring episode in the next several months, the Fed will need to release another $500-$1000 billion in excess reserves. As to what asset will be used to match this balance sheet expansion, why take your picK; the Fed could buy MBS, Muni bonds, Treasurys, or go Japanese, and purchase ETFs, REITs, or just go ahead and outright buy up every underwater mortgage in the US. This side of the ledger is largely irrelevant, and will serve only two functions: to send the S&P surging, and to send the precious metal complex surging2 as it becomes clear that the dollar is now entirely worthless.That said, of all of the above, the one we are most looking forward to is the impeachment of Ben Bernanke: because if there is one definitive proof of the Fed abdicating any and all of its mandates, and merely playing the role of globofunder explicitly at the expense of US consumers and borrowers, not to mention lackey for the banking syndicate, this is it.

The Sickness Beneath the Slump

by Robert J. Shiller - New York Times

The origins of the current economic crisis can be traced to a particular kind of social epidemic: a speculative bubble that generated pervasive optimism and complacency. That epidemic has run its course. But we are now living with the malaise it caused.

News accounts of the economic crisis rarely put it in these terms. They tend to focus on distinct short-term developments or on the roles of prominent people like Federal Reserve governors, members of Congress or Wall Street financiers. These stories grab attention and may be supported by some of the economic statistics that the government and private institutions collect.

But the economic situation is primarily driven by hard-to-quantify sociological factors that play out over many years. The uptick in the unemployment rate, to 9.1 percent from 8.8 percent two months earlier and the drop in stock prices over the last month have attracted notice, yet in a sense they are symptoms of a deeper economic sickness.

Real estate prices have been a significant indicator of this ailment. An unprecedented bubble in American home prices started in 1997 and ended five years ago. Home prices rose 131 percent in that time, or 85 percent in real inflation-corrected terms, according to the S.& P./Case-Shiller National Home Price index. (I helped to develop that index, along with Karl Case of Wellesley College.) Around the same time, there were bubbles in the nation’s commercial real estate and farmland. And there were real estate bubbles in many other countries, too.

Consider this: Home prices rose nearly 10 percent a year on average in the United States from 1997 to 2006, long enough for many people to become accustomed to the pace and to view it as normal. The conventional 30-year fixed mortgage rate averaged 6.8 percent over those years, far below the appreciation rate on housing, so even if you had a substantial mortgage, you were becoming wealthier by the day, at least on paper. People who owned a home over that period had reason to feel pretty well off and proud of their investment acumen. That fed a contagion of optimism and helped to drive the speculative bubble, propelling the economy and the stock market in a feedback loop that repeated year after year.

Professor Case and I have conducted annual spring surveys of home-buyer attitudes for many years. We ask about long-term expectations: "On average over the next 10 years how much do you expect the value of your property to change each year?"

The survey we conducted in spring 2005, near the end of the bubble, included 407 home buyers. In it, the median expectation for home price appreciation over the next decade — until 2015 — was 7 percent a year. That is substantially less than the 10 percent a year that Americans had recently experienced.

But expected increases of 7 percent a year still implied another doubling of home prices by 2015. And about a quarter of our respondents in 2005 anticipated increases of at least 15 percent a year for the next decade. Something was very wrong with this picture, but few noticed it.

As it turned out, of course, those expected increases didn’t happen. Instead, home prices tumbled 34 percent nationally from the peak in the first quarter of 2006 to the first quarter of 2011 — or 40 percent in real terms — and they still appear to be falling. The brief "recovery" in home prices of 2009 and 2010 was most likely spurred by federal housing stimulus measures like the home buyer tax credit. After that stimulus ended, prices resumed their downward trend.

During the bubble, the sense of rising wealth and high expectations gave people a good reason to spend and a greater willingness to plunge into investment, too. Government policy makers breathed in the same optimism, which no doubt encouraged them to be lax on regulatory restraint.

The mood is far different now. Our latest survey, covering April and May of this year, included 296 home buyers, and their median expectation for annual home price appreciation over the next decade was down sharply, to just 3 percent. And, in comparison with the 2005 results, few people had extravagant expectations.

The 3 percent figure is well below prevailing rates for 30-year mortgages, now hovering between 4.5 and 5 percent. Amid such low expectations, buying a home with a mortgage certainly isn’t being viewed as a way to get rich.

Even for people who have other reasons to buy a house, there may be little urgency to do so. Our 2011 survey found that the median expectation for home price appreciation next year is just 1 percent. So it won’t be surprising if new home sales remain abysmally low and few jobs are created in the hard-hit construction industry. And it shouldn’t be a shock if the personal savings rate stays at around 5 percent, as it has recently, up from around 1 percent in 2005. This would mean that consumer spending will not drive a strong recovery.

A half-century ago, there was a lively discussion among economists about the dynamics of price expectations. For example, Alain C. Enthoven, then of the Massachusetts Institute of Technology, and Kenneth J. Arrow of Stanford wrote in 1956 that expectations that extrapolate past price increases can produce economic instability. But that thinking was largely cast aside in the 1960s, when my profession embraced the theory that efficient markets formed by people holding rational expectations could explain virtually all economic activity.

As a result, economists in recent decades have not developed expectations theory much further. That needs to be corrected in coming years. In the meantime, this failing helps explain why the current crisis was generally unpredicted, and why its future course is so poorly understood.

It's The Debt, Dummy

by Jim Quinn - Burning Platform

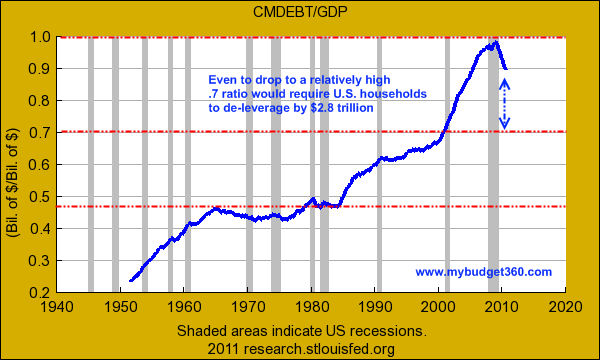

I think charts tell a story that allows you to disregard the lies being spewed by those in power. Below are four charts that tell the truth about our current predicament. The first is from http://www.mybudget360.com/. The austerity and debt reduction storyline being sold by the MSM is a crock. The total amount of mortgage debt outstanding peaked at $14.6 trillion in 2008. The total amount of consumer debt (credit cards, auto loans, student, boats) outstanding peaked at $2.6 trillion in 2008.

Today, mortgage debt outstanding stands at $13.8 trillion, while consumer debt stands at $2.4 trillion. Therefore, total consumer debt has declined by $1 trillion in the last three years. The MSM and talking heads use this data to declare that consumers have been paying down debt. This is a complete and utter falsehood. The banks have written off more than $1 trillion, which the American taxpayer has unwittingly reimbursed them for. Consumers have not deleveraged. They have taken on more debt since 2008. GMAC (Ally Bank) is handing out 0% down 0% interest loans like candy again.

Never has a chart shown why the country is such a mess, with no easy way out. It was the early 1980′s and the Boomers were between 23 years old and 40 years old. Seventy six million Boomers were in the work force. Was it the chicken or the egg? The financial industry peddled debt as the solution to all problems. But, it was up to the Boomers to take on the debt or live within their means. Boomers chose to live for today and worry about tomorrow at some later date. There is no doubt what they did. The chart tells the story. Boomers can moan and blame and point the finger at others, but they took on the debt in order to live at a higher standard than their income would allow. This is why 60% of retirees have less than $50,000 in savings today. This is why 67% of all workers in the US have less than $50,000 in savings. A full 46% of all workers have less than $10,000 in savings.

In order for this economy to become balanced again would require consumer debt to be reduced by $3 to $4 trillion and the savings rate to double from 5% to 10%. This will never happen voluntarily. Americans are still delusional. They are actually increasing their debt as credit card debt sits at $790 billion, student loan debt at $1 trillion, auto loans at $600 billion, and mortgage debt at $13.8 trillion. The debt will not decline until an economic Depression wipes out banks and consumers alike. America will go down with a bang, not a whimper.

Household net worth peaked at $65.8 trillion in Q2 2007. Net worth fell to $49.4 trillion in Q1 2009 (a loss of over $16 trillion), and net worth was at $58.1 trillion in Q1 2011 (up $8.7 trillion from the trough). So, household net worth is still down by $7.7 trillion from its 2007 peak. The really bad news is that the real estate portion of household net worth dropped from $22.7 trillion in 2007 to $16.1 trillion today, a $6.6 trillion loss. Real estate continues to fall.

You can clearly see who benefitted from the monetary and fiscal stimulus implemented by Bernanke, Geithner, and Obama. If household net worth is up $8.7 trillion from the trough in early 2009, but real estate has continued to fall. This means that the entire increase in net worth came from stock market gains. As you may or may not know, the top 10% wealthiest people in the US own 81% of all the stocks in the country. The other 90% own virtually no stocks, so they have been left with depreciating houses and inflating bills for energy and food. The top 10% are about to take another multi-trillion dollar hit in the next six months as QE2 ends and the stock market implodes. This will knock the country back into deep recession.

The most amazing chart of all time is the one below showing home equity since 1952. In a normal non-delusional world, people pay down the principal on their mortgage month after month, resulting in their equity in the house methodically rising. National home prices doubled between 2000 and 2005. One might ask, how in the hell could home equity drop from 60% to 58% between 2000 and 2005 when home prices went up 100%? Equity should have risen to 75%. Well the delusional Boomers struck again. The banks made it as easy as hitting the ATM to get equity out of your house and the Boomers jumped in with both feet, as usual. Americans withdrew $2.8 trillion of fake equity from their homes between 2003 and 2007. They lived the lifestyles of the rich and famous. BMWs, Mercedes, cement ponds (pools), new kitchens, Jacuzzis, home theaters, exotic vacations, hookers, facelifts, size DDs, and putting a little more in the church basket abounded.

This astounding level of stupidity and hubris left millions of Americans vulnerable when the bubble popped all over their faces. Millions have lost their homes. Almost 11 million more are underwater on their mortgage. There is years of pain to go. Household equity is now at an all-time low of 38.1%. What makes this number even more amazing is that 33% of all homes are owned outright with no mortgage. This means that the 50 million houses with a mortgage have far less than 38.1% equity. The people who sucked hundreds of thousands out of their houses to live the good life deserve to get it good and hard.

The last and most humorous graph shows how home price gains are fleeting, while the debt stays wrapped like an anchor around your neck. The greatest bubble in history was clear to Robert Shiller, John Mauldin and many other people with their eyes open. Ben Bernanke was not one of those people. He thought we had a solid housing market in 2005. Real estate values fell from 170% of GDP to 110% of GDP today, headed down to 90% or lower by 2015. The mortgage debt behind this real estate has declined by $634 billion, from 75% of GDP to 65% of GDP. Most of this was due to default, not payment.

It should be clear to anyone that we have a bit of a debt problem. The government solutions jammed down our throats since 2008 have added $7 trillion of debt to the national balance sheet. The only thing keeping this house of cards from collapsing immediately has been the extremely low interest rates put in place by the Federal Reserve. The end of QE2 potentially could result in interest rates rising. If interest rates were to rise 2%, this country’s economic system would implode. Time is not on our side. The debt cannot be repaid. The debt cannot be serviced. The debt has destroyed this country. Years from now when historians ponder what caused the great American Empire to collapse, the answer on the exam will be: IT WAS THE DEBT, DUMMY.

Is the U.S. headed for another Great Depression?

by Konrad Yakabuski - Globe and Mail

If a depression by any other name would feel as bleak, what do you call the current state of the U.S. economy? A number of influential American economists are no longer mincing words: They argue that deficit-obsessed politicians in Washington are setting the United States up for a repeat of the 1930s.

"What we're experiencing may not be a full replay of the Great Depression, but that's little consolation for the millions of American families suffering from a slump that goes on and on," insists Nobel laureate Paul Krugman. "At some point, the pain of high unemployment may lead to some new thinking in Washington – but until that time, welcome to the second Great Depression," adds Dean Baker of the Center for Economic and Policy Research.

At first blush, the analogy seems ludicrous. The U.S. unemployment rate hit 25 per cent during the Dirty Thirties. It's now at 9.1 per cent, after peaking at 10.1 per cent in late 2009. So-called automatic stabilizers – from unemployment benefits to food stamps – mean economic downturns now resemble a big pothole more than a bottomless pit. There are no bread lines.

Still, the Depression mystique has an irresistible lure. It informs (and invariably illustrates) our understanding of economic suffering in ways statistics cannot. A CNN poll this week found that 48 per cent of Americans expect another Great Depression within a year. Who are experts to tell them otherwise?

"The use of the word ‘depression' is an abuse of the language," says Sebastian Mallaby, director of the Maurice Greenberg Center for Geoeconomic Studies at the Council on Foreign Relations. "But that doesn't mean I'm happy about where we are. There is a painful problem of long-term unemployment."

And on that level, the U.S. job market may actually be in worse shape than during the Depression. More than six million Americans, or about 45 per cent of the unemployed, have been out a job for more than six months. That's a higher proportion than at any point during the 1930s. In all, about 25 million Americans are unemployed or underemployed. And Washington may be about to make the situation worse.

Neglecting the lessons of 1937

A slew of stimulus measures have expired and more will soon. Unless Congress acts otherwise, the last of them – extended unemployment benefits and payroll tax cuts – will end on Dec. 31. Even before then, their impact may nullified if Republicans get their way and force the adoption of massive, immediate spending cuts in exchange for a deal to raise the $14.3-trillion (U.S.) federal debt ceiling by Aug. 2.

For economists of the Krugman-Baker school, 2011 is shaping up to look worryingly like 1937. Then, as now, politicians and policy makers mistook the absence of negative growth for a nascent recovery. They turned to slashing deficits and snuffing out the perceived threat of inflation. That Mistake of 1937 drove the economy back into the red.

Politicians on Capitol Hill seem strangely impervious to warnings of 1937 redux. Neither the news that the U.S. economy grew at an anemic 1.8 per cent in the first quarter, nor the fact that job creation in May was four times below the rate needed to keep up with population growth, tempered calls for spending cuts.

The White House is increasingly worried. No postwar president has won re-election with an unemployment rate above 7.2 per cent. But the policy debate on Capitol Hill, to the extent there has been one, is over. Congress is hell bent on deficit reduction. The best Barack Obama's administration can hope for is to moderate the pace of spending cuts.

Of course, the world should be thankful that Washington finally appears to be taking deficit reduction seriously. The credit-rating agencies have been ringing their alarms louder lately: Without a viable plan to rein in spending on entitlement programs such as Social Security and Medicare, the United States will hit a debt wall sooner or later.

In its December report, the deficit-reduction commission appointed by Mr. Obama and headed by Clinton-era budget director Erskine Bowles and ex-Republican senator Alan Simpson, recommended measures that would slash growth in the federal debt by $4-trillion by 2020. But that was well before a string of dismal reports – on jobs, housing, manufacturing and consumer spending – forced economists to revise their growth forecasts downward.

"In an ideal world, you'd have the promise of deficit reduction à la Simpson-Bowles commission coupled with continued stimulus now focused on supply-side benefits, such as infrastructure spending that would make the economy stronger later," Mr. Mallaby offers.

Instead, the current fight between Democrats and Republicans for political advantage could just lead to the worst of both worlds, as Congress moves to slash spending in the short term without risking the wrath of voters by reforming their cherished entitlements. If this is a recovery, why do we still feel sick?

Vice-President Joe Biden is brokering debt talks with congressional leaders as the clock ticks toward the Aug. 2 deadline. But additional short-term stimulus measures will be a tough sell. A group of 103 Republican members this week called for immediate spending cuts of $380-billion during the 2012 fiscal year, which starts this coming Oct. 1. "At a certain point, you have to back off the stimulus. The amount of debt you have becomes either politically or economically difficult to sustain," Mr. Mallaby explains. "We're at that point in a political sense more than an economic sense."

The result is that the U.S. economy appears condemned to endure a prolonged period of subpar growth, if not a double-dip recession. (So far, strong banks and a robust housing sector have insulated Canada from the pain it typically feels when the U.S. economy stalls. But for how long?)

Recoveries following a financial crisis tend to be slow going. By this point in the average postwar recovery, the U.S. gross domestic product had risen 9.4 per cent above its low point. But this time, U.S. GDP is up barely half that amount, according to Mr. Mallaby. He does not expect any sudden improvement. "The larger truth is that the pressure to rein in government spending, coupled with continued pressure on household consumption from soft house prices, points to tough times ahead," he wrote in a June 3 report. "The latest grim jobs report may not be the last."

It probably won't turn into a depression. For millions of Americans without anything else to compare it to, it will only feel like one.

Bank Of America Faces New Probe; New York Attorney General Launches Investigation Into Mortgage Securitization

by Shahien Nasiripour - Huffington Post

New York Attorney General Eric Schneiderman has targeted Bank of America, the biggest U.S. bank by assets, in a new probe that questions the validity of potentially thousands of mortgage securities and their associated foreclosures, two people familiar with the matter said.

The investigation, which began quietly in recent weeks, is part of a larger inquiry that is scrutinizing whether mortgage companies and Wall Street firms took the necessary steps under New York state law when creating mortgage-backed securities, these people said, who requested anonymity because they weren't authorized to speak publicly about the probe.

Court testimony and independent studies have raised questions over whether banks and other financial firms passed along the required documents to trusts, the independent entities that oversee securities for investors. In some cases where trusts moved to seize borrowers' homes, judges have determined the trusts lacked legal standing due to faulty documentation.

The inquiry could prove explosive: Wall Street's great mortgage securitization machine took millions of home loans and bundled them into securities for sale to investors. If the legal steps that guide securitization -- like taking mortgage documents from one party to another, a critical step under New York law -- were not undertaken, then the investors who bought the bundled loans could force the companies to buy them back, compelling them to eat enormous losses. New York state investigators could also find that those securities aren't valid financial instruments at all and take action under state law.

The probe is part of a comprehensive investigation into Wall Street's activities before and after the credit crisis undertaken by New York's top cop. Schneiderman, a Democrat who rode to office by pointing out Wall Street's misdeeds, requested documents earlier this year from Bank of America, the largest lender and mortgage servicer, Goldman Sachs and Morgan Stanley regarding their mortgage operations.

But an investigation into whether the securities these companies created are even valid represents a new front in his ongoing probe and raises fresh questions into the potential liability sellers of these mortgage instruments face.

Last November, the Congressional Oversight Panel, a federal watchdog created to keep tabs on the bailout, said widespread paperwork problems involving mortgage securities could cause the largest U.S. banks to swallow unknown billions in losses, threatening the stability of the financial system.

"If mortgages were not properly transferred in the securitization process, then mortgage-backed securities would in fact not be backed by any mortgages whatsoever," Adam J. Levitin, a bankruptcy expert and professor at Georgetown University Law Center, said at a House panel last November. Levitin said the problem could "cloud title to nearly every property in the United States" and could lead to trillions of dollars in losses.

The six largest U.S. banks, including Bank of America, Goldman and Morgan, currently hold nearly $668 billion in so-called Tier 1 capital, cash banks are required to hold as a backstop against unforeseen losses, Federal Reserve data as of March 31 show. All six companies are defined as "well capitalized" by federal bank regulators.

Schneiderman's inquiry also raises questions about the speed the Obama administration and a coalition of state attorneys general and bank regulators are moving towards a settlement agreement to resolve claims of widespread foreclosure abuse.

The states' top cops and representatives of the Department of Justice, Federal Trade Commission, Department of Housing and Urban Development and the Treasury Department are pushing the nation's largest mortgage companies to pay about $20 billion in a deal to end the months-long probes into shoddy and possibly illegal practices employed by Bank of America, JPMorgan Chase, Wells Fargo, Citigroup and Ally Financial.

While several investigations remain ongoing at the state and federal level, no agency has systematically examined loan-level documents to ensure the creation of mortgage securities complied with state laws or to examine the scope of sloppy paperwork in foreclosure proceedings, like the so-called "robo-signing" fiasco. In its November report, the bailout watchdog said that the "robo-signing of affidavits served to cover up the fact that loan servicers cannot demonstrate the facts required to conduct a lawful foreclosure." "In essence, banks may be unable to prove that they own the mortgage loans they claim to own," the panel said.

Sheila Bair, the chairman of the Federal Deposit Insurance Corporation, said at a Senate panel last month that "flawed mortgage banking processes have potentially infected millions of foreclosures." "The extent of the loss cannot be determined until there is a comprehensive review of the loan files and documentation of the process dealing with problem loans," she added. Despite that appraisal, Bair, along with Treasury Secretary Timothy Geithner and Shaun Donovan, secretary of Housing and Urban Development, have said they want a quick settlement.

Schneiderman's investigation of defective mortgage practices comes on the heels of public reports that Bank of America systematically failed to transfer essential documents to other entities in the daisy chain that turned home loans into securities to be sold on Wall Street.

A review of 104 New York foreclosure cases between 2006 and 2010 where Countrywide Financial made the original loan found that the nation's once-biggest home lender did not follow proper procedures in securitizing the mortgages, according to Abigail C. Field, a New York-based attorney who wrote a column about her findings for Fortune. Bank of America purchased Countrywide in 2008. The review "calls into question the securitization of these loans," Field wrote. She added that the findings also raise questions over the right of investors to foreclose on the borrowers who defaulted on their loans since the mortgage securities may be invalid.

In a New Jersey bankruptcy case last November, a Bank of America executive, Linda DeMartini, testified that Countrywide routinely did not convey crucial documents for loans sold to investors. The judge cited the testimony in dismissing the bank's claim against the borrower. Bank of America later said DeMartini essentially did not know what she was talking about. The case caused an uproar in mortgage banking and securitization circles because if Countrywide held onto essential documents -- rather than pass them onto the entity representing investors who bought their securities -- then investors could question whether the security was legal and force Bank of America to buy the investments back.

Investors in mortgage securities, which include pension funds and insurance companies, are currently embroiled in numerous lawsuits and private actions to compel banks to repurchase faulty mortgages. Some of the lawsuits raise questions over such paperwork problems.

Germany sticks to demand for Greek bond swap

by Noah Barkin and Harry Papachristou - Reuters

European paymaster Germany stuck to its guns on Friday in demanding that private investors contribute to a second bailout for Greece despite a European Central Bank warning against triggering market turmoil. Finance Minister Wolfgang Schaeuble urged parliament to back additional aid for the heavily indebted euro zone country but said private creditor participation in a new package was "unavoidable" and reiterated he favored a bond swap that would push out Greek debt maturities by seven years.

The Bundestag lower house approved a non-binding resolution supporting extra emergency loans to Greece, but only on the condition that bondholders be made to share the burden.

Germany received backing for its stance from the Dutch, whose Prime Minister Mark Rutte said he viewed Berlin's debt proposals favorably. "If there are doubts about the ability of Greece to pay back its debt and we must win time with a new package, then the participation of the private sector in the solution is unavoidable," Schaeuble said in a speech to parliamentarians.

At a Brussels summit on June 23-24, European Union leaders are due to finalize a new rescue package for Greece that officials say will total 120 billion euros and ensure the country is funded through 2014. Half of that sum would come from the EU and IMF, with the remainder equally divided between privatization receipts and a contribution from the private sector, but deep divisions remain about how to get the banks that hold Greek debt on board.

A deal would not help reduce Greece's massive 340 billion euro debt load, but it would give the country more time to implement economic reforms and return to growth. Still, many economists believe Athens will struggle to avoid a harsher restructuring in the years ahead that imposes forced losses of 50 percent or more on holders of its debt.

The risk premiums on peripheral euro zone sovereign bonds rose on Friday as investors fretted over the lack of consensus just two weeks before the summit. But European Council President Herman Van Rompuy, who will chair the EU summit, said he was confident there would be an agreement on a new package for Greece by the end of the month, "creating no default or credit event."

Schaeuble dismissed criticism of his bond swap plan, telling lawmakers it was a fair solution that would protect taxpayers. "This would give Greece the necessary time to carry out reforms and win back confidence," he said. "It would limit the risks of a negative market reaction, establish fair burden-sharing between taxpayers and the private sector and send a clear signal to all that losses cannot be pushed on to taxpayers alone."

ECB Opposed

ECB President Jean-Claude Trichet made clear on Thursday the central bank opposed any scheme for private sector involvement that would cause a "credit event" or be considered by credit ratings agencies as a "selective default." Reflecting the sensitive nature of the debate within the ECB, Trichet's deputy Vitor Constancio was forced on Friday to retract comments made earlier in the day in which he said his boss was not ruling out an extension of Greek maturities.

In a clarification statement issued by the ECB, Constancio parroted the stance Trichet laid out at his Thursday news conference, saying that he excluded all concepts that were not purely voluntary. The ECB is concerned that tinkering with Greek debt may set off a chain reaction in financial markets that would stretch far beyond Greece and undermine the creditworthiness of other stressed euro zone sovereigns.

The international body that adjudicates on events that could trigger the payout of default insurance has said it would not typically regard a voluntary bond swap or a rollover of maturing debt as a "credit event."

However, all three major ratings agencies have said they would be likely to classify even an ostensibly voluntary debt swap as a "selective default," since it was hard to imagine a rational investor maintaining Greek exposure without coercion. Trichet's German colleague at the ECB, Juergen Stark, said he was personally in favor of private sector involvement but noted that feedback from the ratings agencies over the past weeks had changed the situation.

ECB To Compromise?

The ECB has warned it will reject Greek bonds as collateral in its liquidity operations, a step that would leave Greek banks stranded, if debt moves sparked a credit event. But many analysts doubt the central bank would take that risk.

Clemens Fuest, an academic adviser to the German finance ministry, said the ECB had backed down in past stand-offs in the debt crisis and was likely to compromise now. "The language is stark at the moment, but if we look back, the ECB has bought government bonds during this crisis to fight the crisis, so it is already a party in the crisis and it has deviated from the very strict and clear rules for normal situations," Fuest told Reuters Insider TV in an interview. "I think in the end the ECB will be ready to compromise."

France favors a less sweeping form of private sector involvement in which bondholders are asked to commit voluntarily to roll over their Greek bonds when they mature, sources familiar with government thinking say. French President Nicolas Sarkozy will hold talks with Merkel on the euro zone crisis next Friday in Berlin in what could be a decisive meeting between Europe's central powers a week before the EU summit.

Schaeuble acknowledged the ECB was opposed to his ideas for private sector involvement in a Greek solution, but said euro zone ministers had agreed to set up a working group to work on a solution that avoided negative market consequences.

In Athens, Greek Prime Minister George Papandreou defended a new austerity package from attacks in parliament, saying it was the only way the EU and IMF would rescue Greece from bankruptcy. "No prime minister of any country wants to go out with a beggar's tray and collect money from other countries ... I certainly don't, but I do it for Greece," Papandreou said.

Helping euro states vital for Germany, says Merkel

by Brian Rohan - Reuters

Helping indebted European countries get back on their feet is vital to Germany's economic health, Chancellor Angela Merkel said on Saturday in a message aimed at the general public. The comments come a day after Germany's parliament approved a non-binding resolution supporting extra emergency loans to fellow euro zone member Greece, but only on the condition that bondholders be made to share the bailout burden.

Asked in a weekly podcast if the euro zone debt crisis could threaten Germany's economic recovery, Merkel said: "If we don't take action in a positive way, that could happen, but it is exactly what we want to prevent." "Therefore we should not simply allow the uncontrolled bankruptcy of a state -- instead we must see how we can increase the competitiveness of countries in difficulty and give them the chance to work off the debt," she added.

European Union leaders are due to finalise a new rescue package for Greece at a Brussels summit on June 23-24, which officials say will total 120 billion euros and ensure the country is funded through 2014. German Finance Minister Wolfgang Schaeuble urged parliament on Friday to back additional aid for Greece but said private creditor participation in a new package was "unavoidable" and that he favoured a bond swap that would push out Greek debt maturities by seven years.

In her podcast, Merkel said troubled members of the currency union must enact reforms, but warned that allowing one to go insolvent could trigger disastrous consequences for Germany. "We should not do anything that would endanger the global recovery and put Germany back in danger," Merkel said, adding that the bankruptcy of investment bank Lehman Brothers had triggered a major recession in 2009. "Such an event had not happened for decades and absolutely must be prevented," she said. The recession in Germany was its worst since World War II. (Reporting by

Greece pays a heavy price as eurozone strives to protect its reckless banks

by Heather Stewart - Observer

Further austerity by the Athens government will only serve to hide the catastrophic consequences of irresponsible lending

While Germany was locked in an embarrassing public spat with the European Central Bank last week over who should pay the price for a new Greek bailout, fresh evidence was emerging of the impact of the savage cuts Athens has already imposed on its increasingly restive citizens.

The number of people unemployed has shot up by 40% over the past 12 months; the jobless rate now stands above 16%. Among young people it's a devastating 42%, representing extraordinary human and social cost. Yet the government's latest plans envisage another four years of slash and burn, taking the deficit from 7.5% of GDP this year to 1% by 2015. It's extreme fiscal masochism, and it isn't going to work.

Growth is suffering: the economy expanded by a miserable 0.2% in the first quarter of 2011, official figures revealed. Over the past year, it has contracted by a total of 5.5%, and forecasters – including Greece's creditors, the IMF and the ECB – are expecting a further catastrophic decline of more than 3% over the coming 12 months.

Yet while Greece is swallowing its medicine, it's become increasingly clear – as many economists and investors have argued for months – that it's not just caught in a short-term cash crunch, but a solvency crisis. With its economy shrinking, Greece simply cannot afford to pay its debts. The past year of pain has had very little to do with putting Greece's finances on a sustainable footing, and everything to do with papering over the catastrophic losses of the eurozone banks that indulged in an irresponsible lending spree in the run-up to the credit crunch.

As the venerable Leigh Skene of Lombard Street Research put it last week: "Writing assets down to fair value and then recapitalising banks should be the first priority in restoring economic growth after a banking crisis. Sadly, Europe went in the opposite direction and tried to ensure that no bank, regardless of how insolvent [it was], defaulted on its liabilities."

We've been here before. In the first of Adam Curtis's brilliant series of documentaries, All Watched Over by Machines of Loving Grace, broadcast on BBC2 over the past month, he described how the IMF – with the backing of Washington – wrought havoc on the Asian economies in the late 1990s. After a credit boom, driven by a frenzy of lending from the rich world's banks, turned into a crash, the IMF oversaw a series of bailouts, often insisting on savage budget cuts and "structural reforms" as a quid pro quo, emboldened by the idea that unleashing market forces would, in the end, lead to stability.

In many cases, including Indonesia, the Philippines and Thailand, the result instead was political and social chaos, but the west's banks, which had recklessly poured cash into the "Asian Tigers", didn't lose out. Even the IMF itself has since acknowledged that its prescriptions at the time made the problems worse. "While tough measures are needed to address deep economic problems, the conditions accompanying its programmes need to be more focused on the problems at hand, and it needs to be more conscious of the social impact of those programmes," it now says.

Yet the "rescue" of Greece, Portugal and Ireland – this time administered under the guise of European solidarity – followed precisely the same logic: private sector creditors must be protected; deficits must be tackled at a breakneck pace; no gain without pain.

Last week's intervention by Wolfgang Schäuble, the Germany finance minister, suggested that, in Berlin at least, reality is starting to dawn. Under pressure from domestic politicians, Germany is pressing for Greece's private-sector creditors, including Germany's own banks, to shoulder some of the burden of a fresh bailout through a "voluntary" debt swap, which would extend the lifetime of existing bonds by seven years. At the same time, Greece would step up its privatisation programme to raise short-term cash, and the "troika" of the IMF, the European commission and the ECB would find another €60bn (£53bn) or so.

Details are hazy, but such a "reprofiling" is just a default by another name, and the ratings agencies would be likely to see it as such. That would force banks holding Greek bonds, including the German banks, to write down their face value.

The ECB is vehemently opposed to the idea, partly because it is sitting on a pile of Greek bonds itself, and partly because it fears that a default, even one as widely anticipated as this, would create panic on a scale not seen since the Lehman Brothers bankruptcy in September 2008 – and we all know how that story ended.

The number-crunchers at consultancy Fathom reckon that a debt swap along the lines proposed by the Germans would mean a writedown of anything up to 36% on the value of Greek bonds. That would probably require eurozone governments, including the French and Germans, to recapitalise their banks, at huge political and economic cost, but Fathom's Erik Britton reckons that even a default on this scale will not be enough to put Greek public finances back on a sustainable footing. "It needs to be twice that," he says. "If they're going to do it, they might as well do it properly."

He suggests a 70% default will eventually become necessary and that Greece will inevitably be followed by Portugal and Ireland. The all-out market panic that could result might well drag in Spain, too.

In other words, by shifting the pain on to the hapless taxpayers of Greece in order to cushion the eurozone's banks from the consequences of their own actions, all that Europe's leaders have succeeded in doing is exposing a political schism at the heart of the eurozone project – and sowing the seeds of an almighty market panic.

Even if Germany and the ECB can somehow patch up their differences and cobble together a short-term rescue deal for Greece, they will rapidly have to turn their attention to Portugal, Ireland, and – perhaps some time next year – back to Greece. And if the economics look grim, the politics of the euro project look even worse. Skene is exactly right to say that Greece is "the canary in the coalmine".

Juncker: Greece Needs 'Soft' Debt Restructuring

by Bernd Radowitz - Wall Street Journal

Highly indebted Greece needs a "soft, voluntary restructuring" of its debt, said Jean-Claude Juncker, the head of the group of countries using the euro as a common currency, in a radio interview Saturday. At the same time, he lashed out at the U.S., calling their debt level "disastrous."

Backing proposals by German Finance Minister Wolfgang Schäuble, Mr. Juncker told Inforadio Berlin Brandenburg that private lenders need to participate in a fresh aid program for Greece, but only on a voluntary basis. Also, any such move has to be made in a way that credit ratings agencies don't interpret as a credit default, he said. And it needs to be done without the "danger of infecting" other euro-zone members. The euro group president didn't explain what exactly such a voluntary, soft restructuring should look like, but he said there won't be a full restructuring of Greek debt.

Meanwhile, Michael Kemmer, head of Germany's BdB banking association, cautiously accepted the participation of private lenders in a rescheduling of Greek debt as proposed by Mr. Schäuble. But, in a radio interview Saturday to Deutschlandfunk broadcaster, he said such a move needs to be done in a voluntary way, so that credit rating agencies don't see it as a default and financial markets don't get unsettled. The BdB represents commercial banks such as Deutsche Bank AG and Commerzbank AG.

Mr. Juncker called for an agreement with the European Central Bank on the issue. The ECB so far has rejected any kind of restructuring, be it a "haircut" on the principal of Greek sovereign bonds, or just an involvement of private lenders in an extension of Greek debt maturities via a bond swap, as Mr. Schäuble has suggested. "We can't push through a private lender participation without and against the ECB," Mr. Juncker said.

In exchange for any fresh program, Greece needs to make sure it reaches its 2011 fiscal targets, Mr. Juncker added. "If Greek policies continue as they have in the first six months [of this year], then they won't reach the budget target," he said, adding that any additional aid would be linked to very strict conditions. The euro group head declined to give a possible amount of fresh aid, but said figures circulating in the media were right. Asked whether that could mean anything between €60 billion and €120 billion ($86 billion and $172 billion), Mr. Juncker said he doesn't believe that euro-zone countries will have to come up with such a sum.

Not withstanding the euro zone's problems, Mr. Juncker said that both the deficit and overall debt in the U.S. and Japanese economy are substantially higher than in Europe. "The debt level of the USA is disastrous," Mr. Juncker said. "The real problem is that no one can explain well why the euro zone is in the epicenter of a global financial challenge at a moment, at which the fundamental indicators of the euro zone are substantially better than those of the U.S. or Japanese economy."

French banks lead exodus of EU lenders from hardest-hit European economies

by Phillip Inman - Observer

European banks increase pressure on Greece and other struggling economies by refusing support for business deals

The crisis enveloping Greece, Ireland and Portugal appeared to deepen after figures showed EU banks were refusing to support business deals in the EU's hardest-hit economies. Figures from the Bank of International Settlements (BIS) show French, German and UK banks have embarked on a mass exodus from Greece, Portugal, Spain and Ireland, in what analysts see as an effort to bolster their balance sheets and conform to new rules designed to protect financial institutions from going bust. The move is expected to add to tensions in Brussels over how to prevent Greece defaulting on its loans because vital business contracts will cost more to insure.

French banks cut their exposure to Greece from $92bn (£57bn) to $65bn in the last three months of 2010. They also reduced their involvement in Ireland, Portugal and Spain, slicing their total exposure to the four hardest-hit economies by $112bn.

Richard Batty of Standard Life Investments said the reduction in credit derivatives issued by French banks was due to "the reduced risk appetite of the major banks, and in parallel, a shift to bolstering capital positions to reflect the requirements of the Basle III rules". He said stress tests planned by Brussels for the summer could lead to a further exodus as banks sought to insure only the safest risks.

Banks are exposed to different countries through credit derivatives that insure business transactions, in addition to direct loans to governments and businesses, which are also recorded by the BIS. Credit derivatives are typically sold to businesses wanting to insure transactions in the event that their suppliers or customers unexpectedly go bust. According to the BIS figures, a French firm wanting to sell goods and services in Greece or other peripheral EU countries is likely to be rebuffed by their own bank and be forced to look elsewhere for credit insurance.

French banks including BNP Paribas, Crédit Agricole and Société Générale are understood to have withdrawn from the Greek market to avoid the effects of Athens defaulting on its debts.