"Marine-Army game, Griffith Stadium, Washington D.C." Marines carried the day 7-0.

Ilargi: There were really people out there who really thought there would be an announcement for a plan in Europe on Wednesday? OK. Look, Merkel and Sarkozy said the end of the month. They always meant to use all that time, and they now need it even more than they already knew. They'll keep it up till it's trick or treatin' time. Our solid prediction: there'll be plenty of tricks for the people and plenty of treats for the banks.

A meeting of EU finance ministers was just cancelled. Tomorrow’s leader summit will go through. Anyone else wonder what the choice of costume will be?

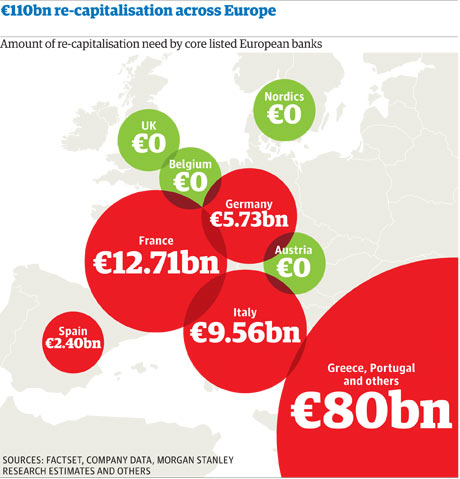

Here’s a fantastic picture of what European unity means these days:

All this is happening against the backdrop of French president Sarkozy telling UK PM Cameron he was "missing a great opportunity to shut up", of the same Sarkozy making derogatory remarks about German Chancellor Merkel's weight, and of both Sarkozy and Merkel schmirking about Italy and its PM, Berlusconi.

That last bit may be more significant than the others in the short term, since it looks like an attempt to focus market attention on Italy (and away from France). Greece is being thrown to the wolves as as we speak, and Italy looks to be set to be next in line (though likely after Ireland and Portugal).

As you may know, Stoneleigh and I are presently in Italy, and to the extent that we can understand the people here, the mood in general is really down and falling fast.

Berlusconi wants to raise the pension age to 67 years, but Umberto Bossi, leader of his coalition partner Northern League Party has said that "You cannot touch pensions to please the Germans". How about that as a way to describe the atmosphere?

The EU has given Berlusconi a deadline for later today to present a plan that proves Italy's dedication to lowering its public debt. And that's where the problem is here: private debt is not that high; only 7% of the housing market is under mortgage.

That's something Obama can only dream of. And so he announces yet another "help" plan. By now, though, we've grown very weary of those plans. And not just because none of his previous (un-)employment and housing plans have solved anything; we are also scrutinizing what exactly the plans aim at.

It's very hard to escape the notion that the further we move down the line of ever more bail-outs and other expensive "support the economy" plans, the more the little man gets squeezed. the only parties in this who actually end up being helped are bankers, ruling politicians and shareholders of banks. It's starting to seriously look, at least from the perspective of Main Street, like Occupy Wall Street and its offspring have simply come too late, and/or are doing far too little now that they're here.

Here's a cynical take on the latest US housing plan: Obama restarts the HARP plan not to help out homeowners, but to make sure that more than the measly few percent of them who signed up for HARP1 get sucked in, so a much larger number will see their mortgages change from non-recourse to recourse, which could mean an enormous potential windfall to lenders if and when home prices keep on falling and homeowners, who will be forced out of their homes even with the lower interest HARP2 provides, can no longer just walk away, but can and will be chased until the day they die for any and all other assets they may hold.

This is not a moral judgment on the existence of (non-)recourse loans; but since non-recourse loans are simply an American fact, the government should not be trying to force and/or cheat people out of them and into potentially -much- deeper debt.

There's another issue with the plan, as pointed out by Zach Carter at HuffPo:

New Obama Foreclosure Plan Helps Banks At Taxpayers' ExpenseThe newly expanded program would expunge legal liabilities associated with mortgages refinanced through the program for the original lenders of the mortgages. Each time a bank sent a loan to Fannie and Freddie, it certified that the loan met Fannie and Freddie's safe lending criteria. But many loans sent to the mortgage giants did not, in fact, meet those criteria. Currently, when borrowers default on those ineligible loans, the mortgage giants can "put back" the resulting losses onto the banks that pushed the loans.

Under the modified plan, "put back" liability at banks will be erased for any underwater mortgage that is refinanced through HARP, eliminating Fannie and Freddie's ability to sack lenders with losses in the event that the mortgage does not pan out.

If borrowers go through HARP, but decide after several months that the modest monthly savings do not outweigh owing tens of thousands of dollars more than their home is worth, taxpayer-owned Fannie and Freddie will have to take the full loss. Even if the original loan was sent to Fannie and Freddie with false or fraudulent guarantees from the bank -- promises that may directly be tied to the borrower's current financial problems -- banks will be immune from liability. Fannie and Freddie plan to charge banks "a modest fee" to extinguish this liability, but the administration has yet to determine what that fee will be.

Europe is set to recapitalize its zombie banks, while the US is freeing its version of them from legal liabilities. And all this happens under the insane notion that there is no end to the public coffers. That it's quite alright, and morally justifiable, to cuts people's jobs and pensions and their wealth in all its forms, just so the banking system and the political system it forms a conjoined twin with, can live another day.

Yes, it's obvious that Italy is a country that suffers from deepseated corruption. But looking at what the White House, the FHFA and HUD are coming up with this week, it's impossible not to wonder how much of an exception Italy really is.

The people's money, if you ask us, should be used to help the people, not to prop up systems that are ruptured, as in bankrupt and corrupt. But not only is that precisely what is happening, it gets worse fast.

The best we now can hope for is the German parliament's refusal to drag this on any further. Because the rest of us out there can't seem to be able to help ourselves.

Regulator throws lifeline to underwater homeowners

by Margaret Chadbourn - Reuters

Homeowners who owe more than their properties are worth got new help on Monday with the government's expansion of a refinancing program in a step that could help up to 1 million borrowers.

The regulator of mortgage finance giants Fannie Mae and Freddie Mac eased the terms of a program that helps so-called underwater borrowers who have made payments on time but have been unable to refinance. "These are important steps that will help more homeowners refinance at lower rates, save consumers money and help get folks spending again," President Barack Obama told a crowd in Las Vegas, a city hard hit by the foreclosure crisis.

The overhaul, which would only help a fraction of the country's 11 million underwater borrowers, is the latest government effort to breathe life into the crippled U.S. housing market. Officials have been frustrated that numerous attempts to bolster the sector and help borrowers have had little success.

The Federal Housing Finance Agency said it was scrapping a cap that prohibited borrowers whose mortgages exceeded 125 percent of their property's value from refinancing loans backed by Fannie Mae and Freddie Mac under the government's Home Affordable Refinance Program (HARP). It also took steps to coax homeowners into shorter-term loans and encourage more banks to participate in the program. The Obama administration sees lowering mortgage payments as a way to free up cash for other spending that could help support the economy's tepid recovery.

The FHFA said it wanted to focus on loans made between 2004-08, when borrowers typically locked into rates above 5 percent. Currently, 30-year fixed mortgage rates are hovering just over 4 percent. "Such modifications are no panacea, but they would move us in the right direction for housing-related stimulus for the economy," said Janaki Rao, vice president for mortgage research at Morgan Stanley in New York.

The White House expects homeowners refinancing under the program to save as much as $2,500 per household each year. Investors in mortgage-backed securities, who had anticipated a revamping of the program, were surprised at the scope of the changes, and prices for housing debt issued by Fannie Mae and Freddie Mac dropped sharply.

Administration Push

With political gridlock blocking legislation addressing the housing crisis, the administration had urged the FHFA to widen HARP to more borrowers. The regulator had moved cautiously, wary of piling too much risk on Fannie Mae and Freddie Mac. "This is an appropriate balancing of risk that's being borne by Fannie and Freddie, and hence the American taxpayer," FHFA's acting director, Edward DeMarco, said in a conference call with reporters. "This will make HARP more available."

In September 2008, the U.S. government seized Fannie Mae and Freddie Mac, the two largest sources of U.S. mortgage financing, as losses on loans they backed spiraled. The two firms have so far received $141 billion in taxpayer bailouts. After meeting with DeMarco earlier this month, one lawmaker said the expanded program could help as many as 600,000 to 1 million borrowers.

DeMarco and Obama administration officials said there was no way to forecast exactly how many borrowers could benefit, although the FHFA said it could double the number helped by the end of 2013. Previously, the program was due to expire in June.

There were some signs the announcement was having an impact. Las Vegas-based mortgage originator Ben Petkewich said he had five clients who might qualify for the relaxed terms -- four paying 6 percent a year and another paying more than 8 percent. "I got two phone calls this morning and have pulled three files," said Petkewich who runs The Mortgage Outlet. "I'm a one-person shop. That's a significant amount of business for me to look into." The state of Nevada has the highest foreclosure rate in the United States.

The White House has been criticized for over-selling earlier efforts to help housing. When HARP was unveiled in March 2009, it predicted it would help 5 million borrowers, but so far fewer than 895,000 have refinanced through the program. Housing Secretary Shaun Donovan said the overhaul was "only one piece of a broader strategy to help the housing market." He said the next step would be to find a way to rent, sell or dispose of foreclosed homes that are weighing on already depressed prices.

With housing impeding a broader economic recovery, some Federal Reserve officials have said the central bank should consider buying mortgage debt to drive down borrowing costs.

Changing Incentives

To encourage banks to participate in the revamped program, FHFA moved to protect lenders from having to buy back loans if underwriting problems are later found. "Of all the barriers, this may be the most significant," said Gene Sperling, director of the White House National Economic Council. In addition, banks will only have to verify that borrowers have made their last six mortgage payments and, in most cases, they will not need to conduct an appraisal.

FHFA said Fannie Mae and Freddie Mac will also eliminate certain fees for borrowers who refinance into shorter-duration loans, in a bid to spur homeowners to pay down the amount they owe more quickly. Morgan Stanley's Rao said while the changes were helpful, they were unlikely to lead to a "wave" of refinancing.

Many economists have argued bolder steps are needed given the weight housing is placing on the recovery. Former U.S. Treasury Secretary Lawrence Summers, in a Reuters column, said what is needed are writedowns on loan principal and mass sales of foreclosed homes to investors for rentals.

"With constructive approaches by independent regulators, far better policies could be in place six months from now," he wrote. "There is nothing else on the feasible political horizon that can make as a large a difference in driving American economic recovery."

New Obama Foreclosure Plan Helps Banks At Taxpayers' Expense

by Zach Carter - Huffington Post

The Obama administration is introducing a new program on Monday designed to lower monthly mortgage payments for more troubled homeowners.

But a key new condition in the plan would shift the financial liability for refinanced loans from Wall Street banks to the American taxpayer. And by focusing on lower payments, the program does not confront what housing experts view as the core problem in the foreclosure crisis -- borrower debt that exceeds the value of one's home.

Faced with the weak response to the Home Affordable Refinance Program, the Obama administration is planning to open up the program to all borrowers who owe more on their mortgage than their homes' worth, commonly dubbed being underwater, and have not missed a mortgage payment. HARP had been limited to borrowers who owed up to 25 percent more than their home is worth. More than 22 percent of all home mortgages -- or 10.9 million homes -- are currently underwater, according to CoreLogic data. Fewer than 900,000 borrowers have elected to go through HARP to date.

The revised program also eliminates several fees associated with refinancing that can make the decision to refinance uneconomical for borrowers. But the potential benefit of the eliminated fees could be relatively small: If a few thousand dollars worth of fees made refinancing a bad deal for underwater borrowers, the ultimate benefits that refinancing can pose would remain limited.

On a conference call with reporters, White House National Economic Council Director Gene Sperling referred to the HARP expansion as "a win-win policy" that will result in "less defaults" and "fewer foreclosures." But one of the program's new terms will benefit private-sector Wall Street banks, potentially at the expense of taxpayers.

The newly expanded program would expunge legal liabilities associated with mortgages refinanced through the program for the original lenders of the mortgages. Each time a bank sent a loan to Fannie and Freddie, it certified that the loan met Fannie and Freddie's safe lending criteria. But many loans sent to the mortgage giants did not, in fact, meet those criteria. Currently, when borrowers default on those ineligible loans, the mortgage giants can "put back" the resulting losses onto the banks that pushed the loans.

Under the modified plan, "put back" liability at banks will be erased for any underwater mortgage that is refinanced through HARP, eliminating Fannie and Freddie's ability to sack lenders with losses in the event that the mortgage does not pan out.

If borrowers go through HARP, but decide after several months that the modest monthly savings do not outweigh owing tens of thousands of dollars more than their home is worth, taxpayer-owned Fannie and Freddie will have to take the full loss. Even if the original loan was sent to Fannie and Freddie with false or fraudulent guarantees from the bank -- promises that may directly be tied to the borrower's current financial problems -- banks will be immune from liability. Fannie and Freddie plan to charge banks "a modest fee" to extinguish this liability, but the administration has yet to determine what that fee will be.

While the revised program seeks to lower mortgage payments for underwater homeowners, the program does nothing to address the core problem -- owing more than the home is worth. Though borrowers may save hundreds of dollars a month in lower payments by refinancing, they routinely owe tens of thousands of dollars more than their homes are worth, even after receiving aid. "In most cases people would probably be better off walking," said economist Dean Baker, co-director of the Center for Economic Policy and Research.

During a conference call with reporters, Department of Housing and Urban Development Secretary Shaun Donovan acknowledged that negative equity is a problem, and said the administration hopes to address the issue on other fronts. Donovan cited settlement negotiations with big banks over widespread allegations of foreclosure fraud and initiatives under the Home Affordable Modification Program, a separate Obama foreclosure-relief plan administered by banks, as key initiatives.

New York Attorney General Eric Schneiderman and Delaware Attorney General Beau Biden have both objected to the foreclosure fraud settlement talks on the grounds that they give away too much to banks without investigating the scope of fraud problems in the system. The Home Affordable Modification Program has been a hotbed for the kind of borrower abuses that the administration is pressuring lenders to settle over.

Got A Hundred Bucks? Buy A Home (Or Virtually Anything Else) Using 2,000x Non Recourse Leverage

by Tyler Durden - ZeroHedge

Today's adjustment to the government's HARP program to get anything with a pulse as close to the discount window as possible was not the only proposal to revive the moribund US housing market.

According to a new proposal by HUD, beginning this month and continuing for a year, anyone with a just $100 will be allowed to buy a HUD-owned REO home. In essence: the new buyer is merely taking over the mortgage payments in a repeat of what happened in 1970s New York along the Central Park West corridor. Granted for now it is stricly limited to only... 28 states!

But it gets better: "HUD’s $100 down payment incentive program can also be applied to an FHA 203k loan, which can be used to fund repairs and renovations on the home. The 203k program allows buyers to finance both the mortgage and additional money for rehabilitation needs with a single government-insured loan."

Said otherwise, a $100 downpayment gives one unlimited degrees of freedom how to spend non-recourse, massively levered capital, and courtesy of money's fungibility, to even fund, shhh, the occasional iPhone.

"Matt Martin, CEO of Matt Martin Real Estate Management (MMREM), says this is one of the most exciting features of the new incentive program and should drive a lot of exposure to FHA’s 203k offering."

Why of course it is: it will only take enterprising Americans a few weeks to realize that the latest HUD program is basically an EFSF in sheep's clothing, which provides US consumers with a Benjamin in their pocket, the ability to lever up by a factor of about two thousand (or more) and use the proceeds for pretty much anything (but make sure to call it "home repairs").

And when the HUD is stuck with hundreds of billions of non-performing, delinquent loans, what then? Why the same that will happen to the EFSF: another wholesale taxpayer funded bailout... of those who were tricky enough to figure out this latest subsidy of the global retailer base.

From DSNews:HUD has approved a program aimed at putting foreclosed homes back into the hands of owner-occupant buyers.

In select states, from now into October of next year, buyers need a down payment of only $100 to purchase a HUD-owned REO home.

The buyer must be an owner-occupant, utilizing financing insured by the Federal Housing Administration (FHA). Standard FHA underwriting guidelines apply, and the sale must be for the full amount of the current list price.

The $100 down payment incentive program has been approved for two of HUD’s four national regions – the regions managed by the Denver Homeownership Center and the Atlanta Homeownership Center. HUD homes in the states listed, as well as the Caribbean are currently eligible for the program.

Europe: Grimmer by the minute

by Ben Rooney - CNNMoney

European leaders insist they are making progress on a comprehensive plan to tackle the eurozone's debt and banking crisis. But the details are foggy and last-minute delays suggest that significant disagreements remain unresolved.

On Wednesday, government heads from all 27 members of the European Union will gather for a second time, following a summit over the weekend that failed to produce a definitive accord. EU politicians have promised to deliver an ambitious and durable solution to a crisis that poses the biggest threat to the euro since the common currency was launched over a decade ago.

"The sovereign debt crisis threatens the very existence of the eurozone," said Howard Archer, chief European economist at IHS Global. "It is therefore absolutely imperative that European policymakers finally deliver a major package of measures at the conclusion of their summit on Wednesday."

The latest talks have focused on a trio of interconnected challenges: restructuring the Greek government's crushing debt load, strengthening European banks and boosting the effectiveness of a limited rescue fund. While the stakes are exceedingly high, expectations for bold and swift action are dim. It took three months for comparatively modest crisis measures announced in July to be approved by all 17 euro area governments.

Some experts have already dismissed Wednesday's meeting as a prelude to the Group of 20 summit in early November, when the world's most powerful leaders will gather in Cannes, France, to discuss economic affairs, among other things. "We have no confidence at all that the various proposed strategies will provide any effective fix for Europe's ills," said Ian Gordon, an analyst at investment bank Evolution Securities in London.

Greece

The main issue for Greece is the role the private sector could play in restructuring Greece's debt. Calls have been growing for private sector banks and investors to voluntarily accept larger writedowns, or haircuts, on the value of Greek government bonds.

Under a July agreement, bondholders had agreed to a 21% reduction on the face-value of Greek debt. But the latest estimates suggest that writedowns of 50% or more will be necessary. It won't be easy. Analysts say talks with the Institute of International Finance, which represents the interests of banks that hold Greek debt, have been challenging.

IIF president Charles Dallara said in a statement that the institute and EU officials continue to "explore options" for Greece. But he added that "there are limits" to what the private sector will tolerate as voluntarily, warning that any "unilateral actions would be tantamount to default." Analysts said the writedowns must be voluntary because an involuntary haircut could trigger credit default swaps, which act as insurance policies on bonds.

The fear is that reducing the amount of money Greece owes will prompt other debt-burdened nations to seek a similar deal. But economists say there is no way for Greece to get out of debt without some concessions from creditors.

Banks

European banks need to raise capital reserves in order to withstand a default by Greece or another euro area government. The tab could total as much as €200 billion.

The big question: where will the money come from?

EU politicians, including German Chancellor Angela Merkel and French President Nicolas Sarkozy, have said banks should first try to raise capital from private investors before seeking government aid.

But market participants are skittish about investing in European banks because of worries over sovereign debt exposure. In addition, some banks have been shut out of the wholesale funding market and have been relying on temporary liquidity measures from the ECB. Banks that cannot raise money in capital markets should be recapitalized by member state governments, politicians say.

Bailout fund

The European Financial Stability Facility, a €440 billion fund that was recently empowered to intervene in sovereign debt markets and lend money to governments that need to boost bank capital, is widely seen as inadequate. However, increasing the amount of money the EFSF controls has been ruled out by EU nations.

There has been talk of combining the EFSF, which will be phased out in 2013, with a planned replacement called the European Financial Stability Mechanism. Leaders are also considering a Special Purpose Vehicle to attract private capital from sources, such as emerging market sovereign wealth funds. The IMF may also contribute more money via an SPV, analysts say.

But the talks have so far mainly revolved around ways to enhance or "leverage" the existing EFSF to get more miles out of its relatively limited resources. The fund has already committed loans to Ireland and Portugal. It is also expected to back a second bailout for Greece, originally expected to total €109 billion.

In addition to providing loans, the fund has been authorized to lend money to governments that need to inject capital into banks. It also has the power to buy bonds directly from investors in the secondary market. The EFSF is seen as a potential replacement for the ECB as the buyer of last resort for the debt of nations such as Italy and Spain, which are struggling to secure affordable funding.

There have been several theories about how to boost the fund's firepower but analysts say a bond insurance scheme is the most likely outcome. The plan is to use what money the fund has left after all of its other commitments to provide a partial guarantee on newly issued government bonds. The goal is to jumpstart the market for sovereign debt by giving investors some confidence that they won't lose all of their money.

The need for a large and credible rescue fund is urgent as worries about Italy grow. Italy, the eurozone's third largest economy, has one of the largest bond markets in the world, worth an estimated €2 trillion.

While Italy is in much better fiscal shape than Greece, the Italian economy has been ailing for years and the nation has debts equal to about 150% of its economic output. That's a recipe for disaster unless the government can force through more austerity and manage to boost economic growth at the same time.

Forced Greece deal "tantamount to default": IIF

by Steve Slater and Jean-Baptiste Vey - Reuters

Any deal forcing banks to take bigger losses on Greek debt "would be tantamount to default" and impose a high cost on European taxpayers, the lead negotiator for the banks warned on Monday.

Banks and other private sector holders of Greek government bonds have been holding talks with EU officials to revise a plan agreed in July and take bigger losses on the debt, but Charles Dallara, managing director of the Institute of International Finance (IIF), warned against pushing too hard.

"There are limits ... to what could be considered as voluntary to the investor base and to broader market participants," said Dallara. "Any approach that is not based on cooperative discussions and involves unilateral actions would be tantamount to default, would isolate the Greek economy from international capital markets for many years, and would impose a harsh burden on the Greek people as well as European taxpayers who have already done a lot to support Greece," he said in a statement.

EU leaders on Sunday outlined plans to recapitalize and improve funding for European banks, but failed to resolve how big a loss the private sector takes on Greek bonds and how to make best use of the EFSF euro zone rescue fund.

Banks have offered to stretch the voluntary loss on Greek debt to 40 percent, from July's agreement to take a 21 percent loss, but politicians are demanding the private sector agree to writedowns of at least 50 percent, a senior German banker said. Banks fear that too big a "haircut" will set a dangerous precedent, particularly for Italian bonds.

Private sector investors hold 206 billion euros of Greek government bonds, and losses of 50-60 percent are needed to make Greece's debt sustainable in the long term, a study said. Dallara said the IIF continued to explore options that can help renewed growth and investment in Greece, while preserving the voluntary approach.

Investors are keen for details to emerge from a second summit of European leaders on Wednesday. Officials on Sunday endorsed a broad framework for recapitalizing banks by between 100 billion and 110 billion euros ($139-152 billion) to cope with likely losses on Greek and other euro zone sovereign bonds.

The recapitalization plan aided bank shares but would be worthless without a wider debt crisis solution, analysts said. "Even if we'd got 200 billion euros in or 300 billion euros, the recapitalization is just part of a bigger picture. Unless the market becomes convinced that there's a mechanism to support Italy, even a multiple of this capital wouldn't be enough to bring reassurance," said Jon Peace, bank analyst at Nomura.

The STOXX 600 European bank index rose 1.7 percent on Monday, outperforming a 1.1 percent rise by the broader pan-European index. A breakdown of how much individual banks need is due to be released on Wednesday. The bulk of the capital is likely to be needed by banks in Greece, Spain and Portugal.

France's Societe Generale and BNP Paribas, Germany's Deutsche Bank and Commerzbank and Italy's UniCredit could each need several billion euros, according to estimates by Reuters and analysts. Spain's Santander and BBVA could also need to plump up their capital, some analysts estimate. Most of the major listed banks should be able to raise what they need privately, bankers and analysts said. But depressed valuations -- the sector is trading at 0.6 times book value -- will make it painful to raise funds privately.

Retained earnings should help banks that need cash, and lenders could accelerate the disposal of assets and the restructuring of their business models. Scrapping dividends for this year and next at the banks that need capital could save 32 billion euros, analysts at Credit Suisse estimated. Bank of France Governor Christian Noyer said French banks would need less than 10 billion euros, despite their high exposure to Greece and other peripheral euro zone nations.

Germany's banking association said a shortfall of about 5.5 billion euros is being mooted by regulators for its banks. But Greek bank shares tumbled 17 percent on fears that a deeper markdown on Greek bonds would force lenders to be part-nationalized. Greece's banks could need more than 30 billion euros in new capital. Greece wants a solution to apply to all its sovereign bonds expiring up to 2035, which should be voluntary, a government source said. Greek banks would remain in private hands and would not be nationalized, the source said.

Under the recapitalization plan, banks will need to hold core capital of 9 percent of risk-weighted assets after marking sovereign bonds to market prices. Banks are expected to be given six to nine months to raise money, first from their earnings or private investors, then by getting national bailouts or as a last resort from the EFSF.

Bank recapitalisation: who needs what

by Jill Treanor - Guardian

Wednesday's summit will decide on pumping more than €100bn into Europe's banks. An analysis by Morgan Stanley has looked at where it will be needed if bondholders, as expected, have to take severe "haircuts"

Exactly where some €108bn (£94bn) of fresh capital is going to be needed for Europe's banks is expected to become clearer after the 27 leaders of the EU, and then the 17 members of the eurogroup, have held their emergency summit on Wednesday. Leaders will also need to agree the other elements of the euro solution, particularly on how to bolster the €440bn European Financial Stability Facility.The extra capital is needed to ensure banks are able to withstand losses from Greece and other troubled eurozone countries. And, it seems likely, that any bank with a capital ratio under 9% will be banned from paying out dividends or bonuses until they have topped up their capital levels.

A recent analysis by Morgan Stanley gives some clues as to where the capital might be needed. While the July bailout for Greece assumed a 21% "haircut" for bondholders, the market is now expecting a loss of 60%. Analysts at Morgan Stanley used 59% for their calculation – as well as 10% haircuts on Ireland, 25% on Portugal, 5% on Spain, 9% on Italy and 5% on Belgium to produce their break downs.

The estimates for France – of just over €12bn – are slightly higher than the €10bn that the French central bank head Christian Noyer has said will be needed. German banks will need around €5.5bn.

The UK's banks – including the bailed-out Royal Bank of Scotland and Lloyds Banking Group – are not expected to need extra capital with the bulk of the capital shortfall resting among banks in Greece, which are most heavily laden with Greek bonds. Thomas Huertas, a former Financial Services Authority regulator who ran the European Banking Authority until September, told Newsnight on Monday that the 60% haircut would put most pressure on banks in Greece and Cyprus. Nationalisation of banks in these countries may be the only answer.

To what extent taxpayers have to plug the gap – and whether state aid rules then kick in – could depend on the timescale banks are given to raise the capital. Huertas told Newsnight that the EFSF would be there as a "last resort". He said: "The plan is for banks to access public markets first," before turning to nation states for support – and then the EFSF.

Giving banks up to nine months to fill the gap will help take the pressure off taxpayers as would allowing banks to reduce their balance sheets and dispose of risky assets. But this latter option might also come with a price – a contraction of credit just at the time when Europe's flagging economies need extra loans. Hence, as Huertas said on Monday night, governments are likely to dictate that any shrinking of banks to raise capital ratios does not affect lending to the economy.

Britain’s exposure to eurozone debt

by Ben Chu- Independent

The market focus at the moment is on the exposure of French banks to Greece. But be in no doubt how exposed British banks are to eurozone sovereigns and corporations.I’ve written about the figures before.

But this chart (courtesy of a report by the Ernst and Young ITEM club) tells the story visually.

Germany gets gold, France silver. And then it’s us. The report estimates that the overall exposure of British banks to the economies of Greece, Ireland, Portugal and Spain is around $430bn, or 19 per cent of our GDP. If the eurozone unravels and those debts fall dramatically in value (or even go into default), the fact that we’re not members of the single currency will not protect us.

Incidentally, you might wonder what British banks were doing buying up all that eurozone debt in the first place. The Vickers commission, implicitly, wondered the same thing. That’s why it recommended that only British retail and corporate lending should be inside its ring fence. If bankers want to speculate by buying eurozone securities, they should surely do it without an implicit UK government backstop.

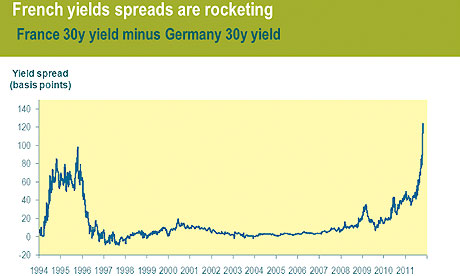

A French credit downgrade would be bad news for Europe too

by Jill Treanor - Guardian

The rise in French bond yields compared with those in Germany is worrying, according to M&G, which reckons it could force downgrade in the country's AAA rating

As much as France wants to keep its AAA debt rating – for the kudos and because it keeps the country's borrowing costs down – so Europe's new bailout fund needs one of the most important countries in the eurozone to retain its top-notch rating.The European Financial Stability Fund needs strong guarantors, such as France, to convince the markets that it has a big enough and robust enough pool of funds to bail out troubled countries.

This is at least part of the argument put forward by the bond investors at M&G Investments, the investment arm of the insurer Prudential, who produced this chilling chart to show the rise on the yields (interest rates) on French government bonds.

Source: Bondvigilantes.com

The chart shows the difference – or spread – between 30-year French and German government bonds and clearly demonstrates that, at more than 120 basis points, the gap is wider than it has been for many years.This means that it could cost France over one percentage point more than Germany to raise money on the markets.

It also matters because it could trap France in a catch-22 situation. The M&G analysts say:

French spread widening poses a major problem because the tail tends to wag the dog when it comes to credit ratings. In other words, widening spreads tend to cause credit rating downgrades, which tend to cause further spread widening.

That would not be good for France – or perhaps more crucially for the EFSF – which is why the markets are convinced that president Nicolas Sarkozy will do every thing in his power to ensure that AAA rating is maintained - and not just for national vanity.

Angela Merkel pleads for Germany to approve plans to increase European bail-out fund

by Louise Armitstead - Telegraph

Angela Merkel has appealed to German politicians to approve Europe's rescue efforts ahead of a crucial vote that could torpedo the Brussels summit.

The German Chancellor, who must secure the Bundestag's approval before European bail-out plans can proceed, briefed politicians on plans to increase the firepower of the European Finance Stability Facility (EFSF) from €440bn (£383bn) to more than €1 trillion. She assured them that Germany would not have to stump up more cash because financial engineering would be used to boost the bail-out fund.

Even so, European leaders face a tense wait before the Brussels summit resumes to meet its self-imposed deadline to "decisively address" the euro crisis. Ms Merkel's chief spokesman, Steffen Seibert, told reporters in Berlin that "this is new territory" and the outcome uncertain.

The focus of the eurozone crisis has now shifted to Italy amid growing concerns about its €1.9 trillion debt pile. Silvio Berlusconi called an emergency cabinet meeting on Monday night following demands from European leaders that Italy agrees legislation for a fresh austerity package before the summit on Tuesday.

The Italian prime minister had to skip a scheduled court appearance in Milan where he is on trial for corruption to prepare for the meeting. He insisted that "no one has anything to fear" from Italy's debt. In a thinly disguised warned to France and Germany, he added: "No one is in a position to teach lessons to their partners."

After a choppy day, stockmarkets closed higher as traders bet that leaders would reach an agreement despite the remaining complexities. The Stoxx Europe 600 index closed up 1.3pc, Germany's DAX rose 1.4pc and France's CAC put on 1.5pc. In London the FTSE 100 climbed 1.1pc. Eurozone countries are discussing two methods to boost the EFSF: a special-purpose fund to buy troubled bonds and/or another fund that would guarantee bondholder losses.

On the other key areas that leaders have to agree on Tuesday, there was continued wrangling over the writedowns private bondholders will have to take on Greek debt and the extent of the bank recapitalisation programme. Financial companies, represented by the Institute of International Finance (IIF) have proposed a "haircut" of 40pc on Greek debt but politicians have demanded 60pc.

Charles Dallara, managing director of the IIF, warned there were "limits" to the hit that can be considered "voluntary", adding: "Any approach that is not based on co-operative discussions and involves unilateral actions would be tantamount to default... and would isolate the Greek economy from international capital markets for many years." Insiders at the briefings said a 50pc cut will be more likely.

Following the weekend's summit, Europe's 90 most important banks are expected to require €108bn of fresh capital. On Monday analysts said UniCredit, Deutsche Bank and BNP Paribas are among the biggest lenders to face recapitalisation.

Separately, the European Central Bank revealed it ramped up purchases of government bonds in recent days, buying €4.49bn last week, double the previous week's €2.24bn. The bank has now spent €169.5bn on eurozone debt in the past year.

Europe is now leveraging for a catastrophe

by Wolfgang Münchau - FT

It is time to prepare for the unthinkable: there is now a significant probability the euro will not survive in its current form. This is not because I am predicting the failure by European leaders to agree a deal. In fact, I believe they will. My concern is not about failure to agree, but the consequences of an agreement.

I am writing this column before the results of Sunday’s European summit were known. It appeared that a final agreement would not be reached until Wednesday. Under consideration has been a leveraged European financial stability facility, perhaps accompanied by new instruments from the International Monetary Fund.

A leveraged EFSF is attractive to politicians for the same reason that subprime mortgages once appeared attractive to borrowers. Leverage can have different economic functions, but in these cases it simply disguises a lack of money. The idea is to turn the EFSF into a monoline insurer for sovereign bonds. It is worth recalling that the role of those monolines during the bubble was to insure toxic credit products. They ended up as a crisis amplifier.

Technically, the EFSF monoline insurer would provide a first-loss tranche insurance for government bonds up to an agreed percentage. It sounds like a neat idea, until the recipients of the insurance realise their sovereign bonds have turned into hard-to-value structured products.

One of the factors that will make them hard to value is the incalculable probability that France might lose its triple A rating. In that case, the EFSF would automatically lose its own triple A rating – which is derived from that of its guarantors. The EFSF’s yields would then rise, and the value of the insurance would be greatly reduced. The construction could ultimately collapse.

Leveraging also massively increases the probability of a loss for the triple A-rated member states, who ultimately provide the insurance. If a recipient of the guarantee were to impose a relatively small haircut – say 20 per cent – the EFSF and its guarantors would take the entire hit. Under current arrangements, they would only lose their share of the haircut.

The simple reason why there can be no technical quick fix is that the crisis is, at its heart, political. The triple A-rated countries have left no doubt that they are willing to support the system, but only up to a certain point.

And we are well beyond that point now. If Germany continued to reject an increase in its own liabilities, debt monetisation through the European Central Bank and eurobonds, the crisis would logically end in a break-up. There is no way the member states of the eurozone’s periphery can sustainably service their private and public debts, and adjust their economies at the same time.

Each of Germany’s red lines has some justification on its own. But together they are toxic for the eurozone. The politics is not getting any easier. The behaviour of the Bundestagunderlines the political nature of the crisis. Last month’s ruling of Germany’s constitutional court strengthened the role of parliament. But it also reduced the autonomy of the German chancellor, who now has to seek prior approval by the Bundestag’s budget committee before negotiating in Brussels.

This power shift will not prevent agreements, such as the one currently negotiated, but it will make it harder to co-ordinate policy in the European Council on an ongoing basis.

The way eurozone leaders have been handling the crisis ultimately vindicates the German constitutional court’s conservatism in its definition of what constitutes a functioning democracy. Policy co-ordination among heads of state is both undemocratic and ineffective.

A monetary union may require more than just a eurobond and a small fiscal union. It may require a formal, if partial, transfer of sovereignty to the centre – that includes the rights to levy certain taxes, impose regulation in product, labour and financial markets, and to set fiscal rules for member states.

Under normal circumstances, European electorates would not accept such a massive transfer of sovereignty. I would not completely exclude the possibility that they might accept it if the alternative was a breakdown of the euro. Even then, I would not bet on such an outcome. Current policy is leading us straight towards this bifurcation point, which may only be a few weeks or months away.

The biggest danger now is the large number of politicians drawing red lines in the sand, and the lack of even a single EU authority willing and capable of cutting through them. Given the multiple uncertainties, there is no way to attach any precise probabilities to any scenarios. But clearly, the chance of a catastrophic accident is bigger than merely non-trivial. The main consequences of leverage will be to increase that probability.

Italy battles to meet EU deadline on economic reforms

by Telegraph

Silvio Berlusconi, the embattled Italian prime minister, is in last-ditch talks on a comprehensive plan to boost economic growth in Italy with just hours to go on an EU-imposed deadline.

A Cabinet meeting to draft measures on Monday evening ended without agreement after Mr Berlusconi's coalition allies in the Northern League party opposed raising the pension age to 67 years - a measure demanded by the EU.

Northern League leader Umberto Bossi said the disagreement on pension reform could bring down the government and force early elections. "The government is at risk.," he said. "The situation is difficult, very dangerous. This is a dramatic moment." He also added that If the government changed the pension system, voters "will slaughter us".

EU leaders, led by German Chancellor Angela Merkel and French President Nicolas Sarkozy, have demanded that Berlusconi present firm plans for growth and reducing Italy's massive debt in time for a summit meeting in Brussels on Wednesday.

The worry is Italy's €1.9 trillion debt pile, which at 120pc of GDP leaves the country vulnerable. Mr Berlusconi yesterday insisted that "no one has anything to fear" from Italy's debt and in a thinly disguised warning to France and Germany, he said: "No one is in a position to teach lessons to their partners."

The European Commission said the pressure on Italy was about trying to strengthen a member state's economy. "This is not about challenging sovereignty, it's not about lecturing, it's not about humiliating," said Commisison spokesman Amadeu Altafaj.

"But at the same time we have 27 democratically elected sovereigns that have agreed on reinforcing surveillance and having a higher degree of coordination of their economic policies. It makes sense, it's one of the main lessons of this crisis, so one (country) doesn't affect another."

Adding to Italy's woes were figures showing Italian consumer morale fell to its lowest in more than three years in October. National statistics bureau ISTAT's headline consumer confidence index fell for the fifth month running to 92.9 in October from 94.2 in September, hitting its lowest level since July 2008, when the global economic crisis was intensifying.

Hard line adopted on Greek debt loss

by Peter Spiegel, Gerrit Wiesmann and Hugh Carnegy - FT

European negotiators have asked Greek debt holders to accept a 60 per cent cut in the face value of their bonds, a hardline stance that far exceeds losses agreed in a deal between private investors and eurozone authorities three months ago.

The stance, delivered to a consortium of international banks at the weekend by Vittorio Grilli, Italian treasury chief and lead eurozone negotiator, is a victory for German-led northern creditor countries who have been pushing for Greek bondholders to accept far more of the burden for a second bail-out.

According to officials briefed on the talks, France, the European Central Bank and the International Monetary Fund remain concerned the tough stance could trigger bondholder insurance policies known as credit default swaps, sparking investor panic because of uncertainty over which financial institutions face CDS losses.

"The CDS market is not very transparent," said Jacques Cailloux, European economist at RBS. "You don’t know where the exposures are."

But Paris, the ECB and IMF went along with the hardline negotiating position. Officials said Christine Lagarde, IMF chief, Nicolas Sarkozy, French president, and Jean-Claude Trichet, ECB president, met Mr Grilli on Saturday night to give him the mandate.

Mr Sarkozy’s backing was a significant breakthrough, officials said. France had initially resisted but Mr Sarkozy accepted the need for a big writedown on the condition it be voluntary. "The French president has moved, very much so," said a person familiar with the talks.

Officials said some countries, including Germany, were less concerned about a so-called credit event – an explicit default that would trigger CDS contracts. But others, including the IMF, feared consequences similar to the collapse of Lehman Brothers in 2008.

"You don’t need to be paranoid to be terrified," said the person familiar with the talks. "They need to find a fine line where they don’t create a credit event but where the effect is significant enough so the [Greek] debt is sustainable over the long term." A senior German official said: "We are trying to avoid a credit event."

Steven Kennedy, a spokesman for the International Swaps and Derivatives Association, said the group’s determination committees only rule on credit events after they are asked to intervene, but the determining factor is whether debt holders agreed to take losses. "There are limits, however, to what could be considered voluntary," said Charles Dallara, managing director and chief negotiator for the Institute of International Finance, representing bondholders.

The 60 per cent cut is a significant shift both in magnitude and in kind. The July deal did not force cuts in the face value of Greek debt; instead, bondholders would have been given new bonds that only delayed repayment for 30 years.

The IIF estimated the deal amounted to a 21 per cent reduction in net present value. A person close to bondholders said a 60 per cent cut in face value would be equivalent to a 75-80 per cent reduction in net present value.

According to officials, IIF negotiators have offered a 40 per cent cut in net present value rather than a face value reduction. In addition, the IIF has asked new bonds used in a proposed swap transaction be backed by €55bn in collateral, a €20bn increase on the July deal.

Private investors, mostly European banks and in particular Greek and Cypriot ones, hold about €206bn in Greek bonds. Shares of National Bank of Greece fell 21 per cent on Monday; Alpha Bank shares were off 19 per cent; and Eurobank EFG fell 20 per cent amid fears the banking sector would be nationalised.

Eurozone 'is heading for recession'

by David Gow - Guardian

Latest PMI indicates that sovereign debt crisis has pushed the eurozone into recession

The European Central Bank is almost certain to cut interest rates next week after startling evidence that the sovereign debt crisis may have pushed the eurozone into recession. With uncertainty crippling economic activity and investment, it emerged on Monday in Berlin that the eurozone's main bailout fund, the €440bn (£383bn) EFSF, is likely to have its firepower boosted to €1tn-€1.5tn at Wednesday's second summit this week.

As Italy emerged as the eurozone's latest core problem country, Silvio Berlusconi summoned an emergency cabinet meeting in Rome and sharply criticised Germany and France for belittling his country's economy. "We have firm positions, that we will bring to the next EU summit," the Italian premier said as EU officials rebutted French reports that Italy would be bailed out by the EFSF.

But while Italy has been singled out as the zero-growth, unreformed problem child of the eurozone, fresh evidence emerged that the entire area is in trouble – while fears for the UK economy also resurfaced after Martin Weale, a member of the monetary policy committee, admitted he "wouldn't be terribly surprised if we were to see output contract in the fourth quarter".

The key eurozone PMI composite output index, measuring both manufacturing and services, plunged this month at its fastest pace for two years – from 49.1 to 47.2. Economists united in arguing that the zone is now in recession, although the official data is not out until next month, putting pressure on the ECB to send a strong pro-growth signal at its first meeting without Jean-Claude Trichet as president for eight years.

Mario Draghi, his Italian successor, was expected to stay his hand on rates but the speed of deterioration in the real European economy is so rapid that analysts now expect the ECB governing council to reverse this year's rises and slash borrowing costs to 1% before the New Year. Both Germany and France have officially downgraded their growth forecasts for 2012 and the European commission's autumn forecast, due on 11 November, is likely to confirm wintry prospects for the eurozone and for the EU as a whole.

In its interim forecast last month the EC said that, while growth in 2011 would still be 1.6% in the eurozone and 1.7% in the EU, a "pronounced deceleration" was expected in the second half. Monday's figures from Markit prompted economists to say the destabilising effects on confidence of the debt crisis had reached danger point. RBC Capital Markets said: "[The figures] convey an unambiguous message that the risks of a recession in the euro area are both material and increasing."

The prevailing gloom was lifted only by signs that, while German manufacturing is suffering, service sector activity in the eurozone's biggest economy enjoyed a surprising surge. Figures for August showed new orders for eurozone industry jumping by an astonishing 2%.

But this was effectively ignored by economists. "All in all, this [PMI] is a miserable report, highlighting the fact that the eurozone is falling into recession again," said Peter Vanden Houte, chief eurozone economist at ING. He expects the ECB to delay rate cuts until the new year and only 0.5% growth in the eurozone as a whole in 2012. But Howard Archer at IHS Global Insight said the surveys "pile pressure on the ECB to cut rates at its 3 November policy meeting".

Senior researchers at Brussels-based thinktank Bruegel, pinpointing a "growth emergency", called for temporary wage-price subsidies, tax breaks and reinvigorated industrial policies among other growth-enhancing measures. "Without growth, Europe is at risk of struggling permanently with debt sustainability and it is at the mercy of stagnation and a debt overhang," they said.

Wednesday's twin summits at both EU-27 and eurozone level are meant to endorse measures to promote growth and jobs but all eyes are on whether the leaders can finally adopt a three-pronged package to recapitalise banks, write-down Greek debt in an orderly fashion and further boost the EFSF. Christian Noyer, Bank of France governor, reckoned France's banks needed only €10bn of the €108bn expected to be needed for Europe's banks. German's banks are expected to need €5bn .

German chancellor Angela Merkel added to the uncertainty surrounding the outcome by agreeing that the entire parliament, the Bundestag, and not just the budget committee should approve the latest EFSF proposal. German MPs will vote on Wednesday afternoon before she flies back to Brussels.

After talks with her, opposition leaders spoke of Germany agreeing to a €1tn-plus fund as it was confirmed that this could be achieved by setting up a special purpose investment vehicle to attract investors who would buy bonds and be insured against some losses in any default. As negotiations on the three-part package continued into yet another night, EU and Italian officials ridiculed a report that the EFSF would be used to buy up Italian debt – replacing the ECB which has been buying Italian and Spanish bonds since August.

EU may combine insurance, SPIV to boost euro fund

by Matthias Sobolewski - Reuters

The euro zone should combine two proposals for increasing the firepower of its rescue fund -- an insurance model and a special purpose investment vehicle (SPIV) -- according to an EU paper for the mid-week summit obtained by Reuters on Monday.

The paper said neither option would require politically-difficult changes to the existing European Financial Stability Facility (EFSF), which has been approved by national parliaments after some problematic debates. The euro zone wants to boost the firepower of its 440 billion euro bailout fund without putting more money into it.

With France dropping its idea of turning the fund into a bank to tap European Central Bank funds at a summit this weekend, EU leaders will decide at a second summit on Wednesday which of the two approaches left on the table should be used, with a combination looking increasingly likely. Under the credit enhancement or insurance model, the EFSF could boost market confidence in new debt issued by a struggling member state by guaranteeing an unspecified proportion of the losses that could be incurred in the event of a default.

This would work via the EFSF extending a loan to a member state, which would buy EFSF bonds in return. The bonds would be the collateral for a partial protection certificate to be held in trust for the state. Both the bond and the certificate would be freely tradable, according to the paper.

If the state defaulted, the investor could surrender the protection certificate to the trust and receive payment from the EFSF. This option does not apply to states already receiving euro zone/International Monetary Fund bailouts as they are no longer issuing bonds on the primary market.

Under the SPIV scheme, one or more vehicles would be set up either centrally or in a beneficiary member state to invest in sovereign bonds in the primary and secondary markets. Its structure -- the senior debt instrument could be credit rated and targeted at traditional fixed income investors -- is meant to attract international public and private investors, according to the paper.

"The SPIV ... would aim to create additional liquidity and market capacity to extend loans, for bank recapitalization via a member state and for buying bonds in the primary and secondary market with the intention of reducing member states' cost of issuance," the paper said.

The SPIV would be funded by freely traded instruments, such as senior debt and participation capital instruments. The EFSF would also invest in this, and would absorb the first proportion of losses incurred by the vehicle if a state defaulted.

The paper said the insurance option would not work for every member state because some are no longer on the primary market, and also because some have negative pledge clauses on existing debt, which prevent them from granting new security to creditors without granting existing creditors the same level of security. It concluded that "the leverage which can be achieved can only be determined after dialogue with investors and rating agencies."

In euro zone debt crisis - it's Italy, stupid

by Reuters

German lawmakers win full say on EFSF

by Stephen Brown and Sarah Marsh - Reuters

German lawmakers flexed their muscles to secure a full parliamentary vote Wednesday on euro zone crisis measures negotiated by Chancellor Angela Merkel and her euro zone peers, a move senior politicians said would give Merkel a stronger mandate.

The new vote comes just one month after Germany's Bundestag (lower of house of parliament) approved greater powers for the euro zone rescue fund, and should pass without problems, but it risks delaying Europe's response to the debt crisis at a crucial juncture.

Merkel cannot agree to changes to the 440 billion euro European Financial Stability Facility (EFSF) without approval at least from the Bundestag's budget committee, as a result of a constitutional court decision last month.

However, Merkel's Christian Democrats' (CDU) floor leader Volker Kauder demanded a full debate and vote by the German Bundestag (lower house of parliament) rather than just a vote by the 41-member budget committee, which might have been quicker and less risky while still meeting new rules on consulting MPs.

"On such important questions it's good if parliament gives the chancellor broad backing for her negotiations," said Kauder regarding the vote due early Wednesday, before Merkel returns to Brussels for a second, decisive euro summit.

Major opposition parties the Social Democrats (SPD) and the Greens welcomed the vote, and indicated they would back proposals aimed at countering the debt crisis. But they stopped short of confirming they would vote "yes," saying they needed to see documents detailing the proposals first.

With criticism ringing in Germany's ears from the head of the Eurogroup of single currency members, Jean-Claude Juncker, about it being slow to make decisions, Merkel met the heads of the main parties to seek consensus.

Juergen Trittin, parliamentary co-leader of the opposition Greens, said Merkel had told them the haircut for Greece would be "above 50 and below 60" percent and that leveraging of the European Financial Stability Facility (EFSF) could be above 1 trillion euros.

Merkel will address parliament before the vote and before returning to Brussels for what should be a more decisive summit on boosting the firepower of the EFSF, raising the contribution of private banks to Greece's rescue, and getting European banks to increase their own capital to prevent contagion.

Frank-Walter Steinmeier, head of the SPD parliamentary group criticized the fact that lawmakers were still waiting to see full proposals. "We are still not able to talk of concrete texts... Therefore I am not in a position to talk conclusively or to tell you how the SPD will vote this week in parliament," he told reporters.

Battling Merkel

The Chancellor's supporters praised her for getting France to drop demands to use the European Central Bank to leverage euro crisis funds, and there was broader support also for a leader often accused of dithering.

"Merkel's Battle for our Euro," was Monday's headline in the mass-circulation conservative paper Bild, saying she taught France's Nicolas Sarkozy "that the EFSF rescue fund cannot be used to print money" to solve the debt crisis. "The chancellor must stick to her guns -- in the interests of Germany and of Europe," said the newspaper.

Her conservative bloc's chief whip, Peter Altmaier, said Sunday's summit "made headway" on all three issues, including "using the EFSF to avoid having to print money," and it should now be possible to produce the "comprehensive" crisis response that Merkel and Sarkozy have promised by the end of this month.

"The chancellor negotiated well in Brussels. She showed strong leadership," Altmaier told reporters. "The French president says he sees things just like Angela and I see that as progress," said the conservative premier of Hesse state, Volker Bouffier. "Germany and France must take the same line as the most important two countries."

Sarkozy ceded to German insistence at Sunday's summit that the ECB should not be used to fight the crisis, which poses an especially big threat to French banks and France's triple-A sovereign debt rating.

Instead, an EU paper obtained by Reuters suggested the euro zone would take up Germany's proposal of boosting the EFSF's firepower by using it as a form of debt insurance, combined with seeking help from emerging market economies like China and Brazil via a special purpose investment vehicle (SPIV) to prop up the euro zone's secondary bond market.

Merkel's spokesman Steffen Seibert said these two options, which had no ECB involvement, were the only two left on the table for leveraging the EFSF and would be discussed by the summit Wednesday. He said they were not mutually exclusive.

Euro zone nears flawed crisis strategy

by Paul Taylor - Reuters

First the good news: European leaders are nearing a strategy to counter the euro zone's sovereign debt crisis. Now, the less good news: it has some apparent flaws and may fall apart.

Under an emerging deal likely to be struck on Wednesday, Greece's debt will be reduced, European banks will be recapitalized, the euro zone's rescue fund will scaled up to provide partial insurance in sovereign bond markets, and Italy will be pressured into getting serious about economic reform.

Each of those planks may fall short of expectations. The euro and stocks rose after Sunday's first part of a two-leg summit on hopes that Europe is finally close to adopting a comprehensive response to the two-year-old crisis, which has sent shudders through the global economy.

Yet it remains unclear whether the likely agreement will be enough to stop the rot and restore investor confidence, not least because it relies on some untested financial engineering. Unable or unwilling to use the European Central Bank to provide the firepower to fight contagion in bond markets, the 17-nation single currency area is contemplating turning to China and other emerging economies for funds.

One idea on the table is to create a special purpose investment vehicle (SPIV), backed by the euro zone rescue fund, to attract foreign investors to buy sovereign bonds in the primary and secondary markets. "It's incredible to think that we may give the Chinese a say in the euro zone because the Germans won't let us use our own central bank like a central bank," one EU official said.

Berlin and the ECB rejected a French proposal to turn the 440-billion-euro European Financial Stability Facility into a bank, giving it access to central bank funds, arguing it would breach a prohibition on monetary funding of governments. French President Nicolas Sarkozy has backed down for now, but diplomats said Paris had put down a marker and the idea would return if the alternatives proved inadequate.

Greece Unique?

The two options still on the table involve using the EFSF to guarantee buyers of new Italian and Spanish bonds against the first slice of potential losses, and the special purpose vehicle to draw in outside sovereign and private wealth. Creating the SPIV would require weeks of talks with investors and credit ratings agencies.

Analysts say the insurance scheme could create a two-tier bond market with old bonds worth less than new ones, and said the overall plan was still insufficient to tackle the crisis. It may also fail to create sufficient demand for the more than 600 billion euros which Italy alone needs to issue in the next three years to refinance its maturing debt.

"Will guarantees of 20-25 per cent be sufficient to entice investors to buy the sovereign bonds of the countries concerned, given that the Greek example already shows that a much higher 'haircut' is possible in the event of a sovereign default?" asked Janis Emanouilidis, senior policy analyst at the European Policy Center think-tank.

Governments are trying to convince banks and insurers this week to accept a "voluntary" write-down of 50-60 percent on their Greek bond holdings, while insisting that Greece is a unique case, not a precedent. "Will the leverage effect be large enough to persuade markets that the EFSF is able to offer a liquidity net to all eurozone countries in danger?" Emanouilidis said.

Officials estimate the bond insurance option could scale up the available funds to about 1 trillion euros. But the whole edifice would crumble if France, the second largest EFSF guarantor after Germany, were to lose its AAA credit rating.

Two ratings agencies, Moody's and Standard & Poor's, said last week they might downgrade France due to the prospect of weak economic growth and rising contingent liabilities for banks and euro zone crisis management. "This latest so-called solution is going to flop very, very quickly and when it does, France is going to be downgraded and then we'll really see a mess," said one EU adviser involved in drawing up possible solutions to the debt problems.

Chinese Goodwill, Italian Compliance

Even if France keeps its top rating, the strategy seems heavily reliant on Chinese goodwill and Italian compliance. It is not clear whether the SPIV scheme will entice China to increase its estimated 600 billion euro exposure to euro zone debt, courtesy of the 25 percent or so of its $3.2 trillion foreign exchange reserves that analysts believe is invested in euro-denominated assets.

Some EU officials say it is aimed primarily at attracting foreign banks rather than sovereign funds, but U.S. investors have cut back their exposure to the euro zone and seem unlikely to reverse that move in a hurry.

Chinese officials have argued that stabilizing the euro zone is in Beijing's interest since Europe is China's biggest export market, but Internet bloggers and academics are urging caution in pouring more money into a Western crisis zone.

The head of China's sovereign wealth fund, Jin Liqun, who manages assets of over $230 billion, said last month that Beijing could not help heavily indebted euro zone countries without seeing a solution to the debt problem. "China cannot be expected to buy high risk euro zone (instruments) without a clear picture of debt workout programs," he told a conference in London on September 29.

Jin also said Europe should recognize China's market economy status, which would give Beijing better protection from EU anti-dumping duties. Brussels says China must meet a series of criteria before it can receive the designation.

As for Italy, EU officials acknowledge they have scant faith in Prime Minister Silvio Berlusconi's will and ability to push through unpopular pension and labor market reforms and business deregulation to boost Rome's anemic economic growth.

Sarkozy and German Chancellor Angela Merkel applied public pressure on Berlusconi on Sunday to speed up the reforms, but diplomats recall that after promising deficit-cutting measures earlier this year, the premier laughed them off within days. It took another bond market frenzy to force the government to enact tougher austerity.

With Berlusconi fighting for political survival while facing three court cases for alleged fraud, tax evasion and frequenting an under-age prostitute, his capacity for imposing radical reforms on a fractious coalition and a divided parliament looks slim.

17 comments:

Comments open for a few.

My timing seems better these days...

I cannot help but wonder the If/when of armed conflict in the near future The "weaker" middle east dictators/strong men are being knocked down,one by one,after that...Could a full court press on Iran be far behind.Classicly this is about the time in a economic cycle when the knives come out and world war...occurs

Who will the players be this time?and what will be their excuse?

This is one of the strong,dark fears,that ensure my continuing efforts in "preps"...

Bee good,or

Bee careful

snuffy

Glennda said...

Here is what happened in Occupy Oakland this morning. Seems like a huge over-reaction to 85 people that were finally arrested. Tear gas, rubber bullets? This kind of over reaction could really lead to the very "riots" they seem to fear so much. I'll be going down there at some point this afternoon. This could become the civil unrest they've been worried about. The SF Occupy has been broken up several times in the wee hours earlier this week. I can give some friends accounts of what it's been like there, if there is any interest here.

"Police Brutalize, Dismantle Occupy Oakland Camp

October 25, 2011

"This morning at 5am over 500 police in riot gear from cities all over central California brutally attacked the Occupy Oakland encampment at 14th & Broadway. The police attacked the peaceful protest with flash grenades, tear gas, and rubber bullets after moving in with armored vehicles. Apparently the media was not allowed in to document this repression, and the police established barricades as far apart as 11th and 17th. Over 70 people were arrested and the camp gear was destroyed and/or stolen by the riot police.

Contact the mayor and tell her what you think of her actions.

Reconvene today at 4pm at the Oakland Library on 14th & Madison. Occupy Oakland is not finished, it has only begun."

Oh, and I emailed the mayor as a small business owner in Oakland. Others who phoned got hung up on. I told the mayor that not letting any witness watch was really bad practice.

I'm beginning to fear that the troops in Iraq could be brought back to Oakland, to "help" here.

Polka Dot Gallows material is all too easy to come by now. This one I do find to be a prizewinner, though.

From NHK, in toto:

"Japanese experts develop dressing assistant robot

Japanese researchers have developed a new type of robot that assists the physically handicapped with putting on clothes.

"Nara Institute of Science and Technology Associate Professor Tomohiro Shibata and his team developed the robot, which is equipped with 2 arms and a monitoring device to recognize human posture.

"The robot simulates moves it has been taught. For example, if a human holds the robot's arms and moves them as if to dress someone, it memorizes and simulates the movements on a person sitting in front of it.

"The robot is designed to automatically adjust movements in response to whatever posture the handicapped person in front of it takes.

"According to the researchers, this is the first robot of its kind.

"Shibata said he felt frustrated that advanced technologies have yet to be fully applied in care for the elderly and handicapped.

"He said at present the robot can only help users put on a T-shirt, but that he hopes to improve its functions to the point where it can also help users put on pants.

Tuesday, October 25, 2011 12:53 +0900 (JST)

---------------------------

Progress!!! $100,000 machine designed that can put 2 elder care workers out of work- and does their work poorly! Prize awarded for socially crucial research direction!

On the serious side: we're losing the irreplaceable.

http://tinyurl.com/62vnepa

Anyone heard of Dr. Burzynski? I hadn't until now.

"Merola says the story "makes the "Watergate scandal' look like a kindergarten pottery class."

This movie won the Humanitarian Vision Award at the Newport Beach Film Festival, 2010.

Variety calls "Burzynski, The Movie" "a dramatic expose of the FDA and its incestuous relationship with Big Pharma as it seeks to first discredit, then co-opt Burzynski's discovery."

Another excellent article from Matt Taibbi.

OWS's Beef: Wall Street Isn't Winning – It's Cheating.

Interesting post at Golem XIV:

The Saved and the Damned

snip:

"What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned."

If I remember correctly, this goes right along with what Ilargi said would happen.

Archie,

I think Taibbi made his best point in the CNN interview when he said OWS growing larger is a good "end in itself" right now, and there is no need to label or structure it in a "comprehensible" way. In fact, that point may slightly undermines his other point that there is no envy or "entitlement" involved and everyone simply wants a "level playing field". Well, that may be true, but where were these people when the playing field for poorer regions of the world was heavily tilted for decades?

Even in the developed world, it has been the corruption has been going on for some time. The difference is that, now, the brutality and inequality of the system is in everyone's face, threatening all of the things an average consumer takes for granted - the home, the car, the high-tech electronic gizmos, the seasonal vacations, the non-stop energy consumption, etc. So his question works both ways - why now?

That's a complex question from the perspective of individual or group motivation, and it can't summed up be either "envy of the rich" or "hatred of the systemic cheating". When we take a step back, though, and ask the question from the perspective of global economics and finance, it becomes clear that the most fundamental reason for OWS is that the edifice the entire system is built on is crumbling, and it is only natural for people to lose all confidence in and respect for the most powerful institutions of that system.

Blogger Greenpa said...

On the serious side: we're losing the irreplaceable.

http://tinyurl.com/62vnepa

Man that was depressing! I wonder how many Rhinos perished in the carpet bombing and Agent Orange deluge.

Looks like the Italian politicians are well on their way to coming up with a "credible austerity" (oxymoron) plan for the EMU:

Telegraph update: "13:35 Tensions over the tough economic reform programme have proved a little too much for a pair of Italian deputies, who just started a brawl in parliament.

Two deputies from the Northern League, a member of the ruling centre-right coalition, fought with members from the opposition FLI party of speaker Gianfranco Fini, grabbing each other by the throat as other parliamentarians rushed to separate them.

The sitting was suspended for a while after the fight, which broke out because of sarcastic remarks on television by Fini alleging that the wife of League leader Umberto Bossi had retired at 39.

It was only last year tempers flared in the lower house of parliament in Rome with one MP calling an opponent "a piece of ----" before several ended up wih black eyes."

Meanwhile, the IMF has just said it would like for Greek bonholders to take a 75%(!) haircut, presumably as a condition to their participation in any SPIV "rescue plan". That's not going to happen, because it would be game over.

Karl D. blames the Republicans! Really? Posts some scary arithmetic...

http://tinyurl.com/karlblamesrepubs

Matt came close but still ends up saying eventually we need to give a list of demands to... to who? To the 1% who control everything?