"Old Negro. He hoes, picks cotton and is full of good humor. Aldridge Plantation, Mississippi."

Ilargi: I’ll make way in the intro today for Ambrose Evans-Pritchard, who waxes poetic about the crashing world economy:

The 9th Circle in Dante's Inferno - starring Judas and Brutus - is a frozen lake. Cold can be more frightful than heat. "Blue pinch'd and shrined in ice the spirits stood," (Canto XXXIII). Such awaits the victims of debt deflation.

U.S. Weighs Takeover of Two Mortgage Giants

Alarmed by the growing financial stress at the nation’s two largest mortgage finance companies, senior Bush administration officials are considering a plan to have the government take over one or both of the companies and place them in a conservatorship if their problems worsen, people briefed about the plan said on Thursday.

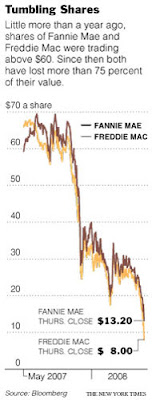

The companies, Fannie Mae and Freddie Mac, have been hit hard by the mortgage foreclosure crisis. Their shares are plummeting and their borrowing costs are rising as investors worry that the companies will suffer losses far larger than the $11 billion they have already lost in recent months. Now, as housing prices decline further and foreclosures grow, the markets are worried that Fannie and Freddie themselves may default on their debt.

Under a conservatorship, the shares of Fannie and Freddie would be worth little or nothing, and any losses on mortgages they own or guarantee — which could be staggering — would be paid by taxpayers. The government officials said that the administration had also considered calling for legislation that would offer an explicit government guarantee on the $5 trillion of debt owned or guaranteed by the companies.

But that is a far less attractive option, they said, because it would effectively double the size of the public debt. The officials also said that such a step would be ineffective because the markets already widely accept that the government stands behind the companies.

The officials involved in the discussions stressed that no action by the administration was imminent, and that Fannie and Freddie are not considered to be in a crisis situation. But in recent days, enough concern has built among senior government officials over the health of the giant mortgage finance companies for them to hold a series of meetings and conference calls to discuss contingency plans.

A conservatorship or other rescue operation would be the second time in four months that the Bush administration has stepped in to engineer a rescue to prevent the financial system from collapsing. Last March, it forced the sale of Bear Stearns to JPMorgan Chase to avert a bankruptcy of that venerable investment house. Officials have also been concerned that the difficulties of the two companies, if not fixed, could damage economies worldwide.

The securities of Fannie and Freddie are held by numerous overseas financial institutions, central banks and investors. Under a 1992 law, Fannie or Freddie could be put into conservatorship if their top regulator found that either one is “critically undercapitalized.” A conservator would have sweeping powers to overhaul them, but would not have the authority to close them.

The markets showed fresh signs on Thursday of being nervous about the future of the companies. Their stock prices continued a weeklong slide, hitting their lowest level in 17 years. The debt markets, meanwhile, pushed up the two companies’ cost of borrowing — their lifeblood for buying mortgages.

The companies are by far the biggest providers of financing for domestic home loans. If they are unable to borrow, they will not be able to buy mortgages from commercial lenders. In turn, that would make it more expensive and difficult, if not impossible, for home buyers to obtain credit, freezing the United States housing market.

Even healthy banks are reluctant to tie up scarce capital by offering mortgages to low-risk home buyers without Fannie and Freddie taking the loans off their books. Together the two companies touch more than half of the nation’s $12 trillion in mortgages by either owning them or backing them. They hold more than $1.5 trillion of the mortgages as securities. Others are sold to investors in the form of mortgage-backed bonds.

In recent weeks, the companies have spiraled downward, undermined by declining confidence in their future and shaken by sharp declines in their assets as the housing markets have continued to slide and foreclosures have risen. In the last week alone, Freddie has lost 45 percent of its value, and Fannie is off 30 percent.

Expectations of default at the companies have also risen; it costs three times as much today to buy insurance on a two-year Fannie bond as it did three years ago. Analysts expect the companies to announce a new round of write-downs and possibly be forced to raise capital by issuing additional shares, which would dilute their value for current shareholders.

Despite repeated assurances from regulators about the financial soundness of the two institutions, financial markets have concluded that by some measures they are deeply troubled. Freddie, for instance, is technically insolvent under fair value accounting rules, in which the company puts a market value on assets as if it had to sell them now.Click to enlarge

Fannie, Freddie Are Too Big to Fail, Lawmakers Say

Fannie Mae and Freddie Mac, the largest buyers of U.S. home loans, are too big for the government to let them fail, leading Republican and Democratic lawmakers said.

The government-chartered companies, which own or guarantee about half the $12 trillion of U.S. mortgages, can count on a federal lifeline, said Republican Senator John McCain, of Arizona, and Democratic Senator Charles Schumer, of New York. The remarks by the presumptive Republican presidential candidate and the head of the congressional Joint Economic Committee followed a slide in the firms' shares to the lowest level since 1991.

They indicate Congress would push the administration to use government funds to prevent the companies from failing and threatening a deeper housing recession. "They must not fail," McCain said today during a campaign stop in Belleville, Michigan. Fannie Mae and Freddie Mac "are vital to Americans' ability to own their own homes," he said at an earlier stop in the state, one of the worst affected by the surge in foreclosures.

Central banks, pension funds and other investors hold $5.2 trillion in debt sold by the companies. While bondholders can count on a backstop, equity investors can't expect the government to halt a tumble in the companies' shares, Representative Spencer Bachus, the senior Republican on the House Financial Services Committee, said today.

Fannie Mae slid 14 percent today to close at $13.20 in New York, down 67 percent this year. Freddie Mac declined 22 percent to close at $8, bringing its slump since the end of December to 77 percent. Stockholders should be prepared for more "difficulties," said Kevin Flanagan, a fixed-income strategist in Purchase, New York, for Morgan Stanley's individual investor clients. "Continued woes, continued difficulties are the expectation, and this is going to take a while to play itself out."

Freddie Mac owed $5.2 billion more than its assets were worth in the first quarter, making it insolvent under fair-value accounting rules. The fair value of Fannie Mae assets fell 66 percent to $12.2 billion, data provided by the Washington-based company show, and may be negative next quarter, former St. Louis Federal Reserve President William Poole said.

"Markets should be assured that the federal government will stand by Fannie Mae and Freddie Mac," Schumer said in a statement today. They "are too important to go under," and Congress "will act quickly" if necessary, he said. Fed Chairman Ben S. Bernanke and Treasury Secretary Henry Paulson, while noting the central role of Fannie Mae and Freddie Mac in ending the mortgage-finance crisis, today refrained from endorsing any extra federal backing for the companies.

The companies "are playing a very important and vital role right now," Paulson said in testimony to the House Financial Services Committee. They "need to continue to play an important role in the future," he said. Fannie Mae and Freddie Mac "are well capitalized now" in "a regulatory sense," Bernanke told the panel.

Still, the companies, like all financial institutions, need "to expand their capital bases so that they can be even more proactive in providing credit and support for the economy," the Fed chief said.

The federal government can't afford to take over all of Fannie Mae's and Freddie Mac's operations, because such a move would more than double federal government debt outstanding and "have disastrous consequences for the dollar," said Joshua Rosner, an analyst with Graham Fisher & Co. Inc. in New York.

Instead, the government could move the companies' combined $1.5 trillion investment portfolios into a separate limited liability corporation that would gradually liquidate the assets, Rosner said. Fannie Mae and Freddie Mac would still be able to support the U.S. housing market by packaging home loans into securities they guarantee.

While a federal rescue is "premature," Representative Paul Kanjorski said lawmakers should prepare for more trouble. "I don't think any of us could anticipate all the contingencies that can happen," said Kanjorski, a Democrat from Pennsylvania. "We recognize that we're in very dangerous waters, very stormy. We should have contingencies."

A rescue shouldn't be an option, said Representative Jeb Hensarling, chairman of the fiscally conservative Republican Study Committee. "The government should not be supporting the system as is," said Hensarling, of Texas. Fannie Mae and Freddie Mac are a "government-sanctioned duopoly" that "no longer helps the market in the way that it once did" while posing "a huge systemic risk" to the economy.

Treasuries Fall on Speculation U.S. to Support Fannie, Freddie

U.S. Treasuries fell the most in three weeks on speculation the government will rescue Fannie Mae and Freddie Mac, the largest buyers of home loans.

Two-year notes led the declines as stocks rallied after a person familiar with the matter said a takeover of one or both of the companies is among the options being considered by White House officials. The declines pared a weekly gain fueled by concern the mortgage lenders will need an infusion of capital to weather the worst housing slump since the Great Depression.

"The market has been driven over the past week by concerns relating to the possible collapse of Fannie Mae and Freddie Mac, and today we're seeing a reversal of those safe-haven flows," said Marius Daheim, a senior bond strategist in Munich at Bayerische Landesbank, Germany's second-biggest state-owned bank.

The yield on the benchmark two-year note rose 9 basis points to 2.49 percent by 9:52 a.m. in London, according to bond broker BGCantor Market Data. The price of the 2.875 percent security due May 2010 declined 6/32, or $1.88 per $1,000 face amount, to 100 23/32. A basis point is 0.01 percentage point. The yield on the 10-year note advanced 6 basis points to 3.86 percent.

Treasuries also slipped as stocks gained, curbing demand for the safest assets. The Dow Jones Stoxx 600 Index climbed 0.2 percent and the MSCI Asia Pacific Index of regional shares gained 0.3 percent. Fannie Mae slid 14 percent yesterday, down 67 percent this year, and Freddie Mac declined 22 percent. The mortgage lenders would have to post pretax losses and writedowns of about $77 billion before the U.S. would be compelled to start a rescue, according to estimates by Fox-Pitt Kelton and Friedman, Billings, Ramsey & Co.

Freddie Mac owed $5.2 billion more than its assets were worth in the first quarter, making it insolvent under fair-value accounting rules. The fair value of Fannie Mae assets fell 66 percent to $12.2 billion, data provided by the Washington-based company show, and may be negative next quarter, former St. Louis Federal Reserve President William Poole said yesterday.

Fannie and Freddie, created to boost homeownership and promote market stability, own or guarantee about half the $12 trillion in U.S. home loans outstanding. Two-year notes headed for a fourth weekly gain before an industry report that economists say will show U.S. consumer confidence this month fell to the lowest level since 1980 and investors cut bets the central bank will raise interest rates.

The Reuters/University of Michigan preliminary index of consumer sentiment declined to a 28-year low of 55.5 in July from 56.4 the previous month, according to the median forecast of economists surveyed by Bloomberg News before the report today. Futures contracts on the Chicago Board of Trade show 86 percent odds Federal Reserve policy makers will keep the target for overnight loans between banks unchanged at 2 percent on Aug. 5, compared with 34 percent a month ago.

"I'm betting on the weak economy," said Kei Katayama, who helps oversee $1.6 billion of non-yen debt as a fund manager in Tokyo at Daiwa SB Investments Ltd., part of Japan's second- biggest investment bank. "There's going to be weaker consumption and much weaker growth."

A Trickle That Turned Into a Torrent

The word began spreading across Wall Street trading desks on Monday morning: Fannie Mae and Freddie Mac, the giant companies at the heart of the nation’s housing market, might be in trouble.

The tumult, which continued on Thursday, started with a cautionary analyst’s report, one that might have caused few ripples in normal times. But these are not normal times. Within minutes, the price of the companies’ shares was plunging, sending shock waves through the financial markets, the economy and Washington.

Fannie Mae and Freddie Mac are so big — they own or guarantee roughly half of the nation’s $12 trillion mortgage market — that the thought that they might falter once seemed unimaginable. But now a trickle of worries about the companies, which has been slowly building for years, has suddenly become a torrent.

Virtually every home mortgage lender, from giants like Citigroup to the smallest local banks, relies on Fannie Mae and Freddie Mac to grease the wheels of the mortgage market. Virtually every Wall Street bank does business with them. And investors around the world own $5.2 trillion of the debt securities backed by the companies.

Even as senior Washington officials struggled on Thursday to reassure worried investors and discussed a government intervention that could cost taxpayers billions of dollars, the companies’ stock prices plummeted again in a rush of selling, this time to their lowest level in 17 years. Freddie Mac closed down 22 percent, at $8, and Fannie Mae fell 13.8 percent, to $13.20.

“There is a real panic about these companies on Wall Street right now, and sometimes a blaze like that grows almost without reason,” said Tom Lawler, an economist who worked at Fannie Mae for over two decades before leaving in 2006 to become a consultant. “There wasn’t really any new news to set off this crisis. The stocks just started falling, and didn’t stop.”

What set off this storm, and what happens next? The cause of this week’s huge declines remains somewhat unclear. Though each rumor and concern about the company was batted down as it arose, their overall volume was amplified by Fannie’s and Freddie’s enormous obligations.

On Monday, when the analyst report from Lehman Brothers hit the market, Fannie Mae plunged 16 percent. More than 68 million shares changed hands that day — three times as much as average. Volume jumped again on Tuesday, as the stock stabilized, and then exploded on Thursday, to 134 million, as the shares plunged once again.

Perhaps the biggest single risk facing Fannie Mae and Freddie Mac, and with them financial companies and taxpayers, is that investors might simply lose confidence in the companies, leaving them unable to pursue their core businesses — buying home loans from banks and repackaging them for sale to investors.

That buying and repackaging is the lifeblood of the American housing economy, because it provides the capital that banks and other financial institutions use to write new loans. As long as investors are confident that Fannie Mae and Freddie Mac are relatively financially healthy, then companies, banks and other institutions will continue lending them billions of dollars each week.

But, as the companies’ stock prices decline, wary investors have begun charging higher premiums for those loans. Since January, that premium, measured by the difference between what the companies pay for debt and what the United States government pays, has more than doubled, to nearly nine-tenths of a percentage point for Fannie Mae. Spread over billions of dollars in borrowing, that increase will cost the companies dearly.

Lehman Shares Sink as Fannie, Freddie Plunge Further

Lehman Brothers Holdings Inc., once the largest U.S. underwriter of mortgage-backed bonds, fell to an eight-year low in New York trading as home-loan financing companies Fannie Mae and Freddie Mac extended yesterday's drop. Lehman declined $2.44, or 12 percent, to $17.30 in New York Stock Exchange composite trading, the lowest level since Feb. 28, 2000, according to data compiled by Bloomberg.

Financial stocks sank this week on speculation government- backed Fannie Mae and Freddie Mac will need to raise more capital to withstand the credit contraction that has saddled banks and brokerages with $408 billion of writedowns. Lehman was also hit by speculation that some of its biggest customers had ceased doing business with the firm, which the clients denied.

"Constant pounding of the company's stock with one rumor after another may eventually get to the business," said Richard Bove, an analyst at Ladenburg Thalmann & Co. "After a while, people might start worrying about doing business with Lehman. It seems there's a concentrated effort to break Lehman."

Pacific Investment Management Co., manager of the world's biggest bond fund, and hedge fund SAC Capital Advisors LLC both said speculation they had backed away from Lehman was unfounded. Pimco "continues to trade with Lehman," the company said today in an e-mailed statement. Pimco fund manager Bill Gross said in an interview with CNBC that there's "no question" about the firm's solvency.

"SAC is continuing to do business with Lehman Brothers as usual," Jonathan Gasthalter, a spokesman for the hedge fund company, said in an e-mail. Similar speculation led to the demise of smaller investment bank Bear Stearns Cos. in March when clients and creditors stopped doing business with the firm.

To prevent a similar collapse, the Federal Reserve has since allowed brokers to borrow from the central bank directly. Lehman has also boosted its cash holdings and reduced dependence on short-term funding.

Freddie Mac shares dropped 22 percent today to $8, after falling 24 percent yesterday. Fannie Mae sank 14 percent to $13.20, on the heels of yesterday's 13 percent decline. "The financial turmoil is ongoing. Our efforts today are concentrated on helping the financial system return to more normal functioning," Federal Reserve Chairman Ben S. Bernanke said today on Capital Hill.

Congress should consider rules and mechanisms in the event it becomes necessary to liquidate "a systematically important securities firm that is on the verge of bankruptcy," he said.

The money tap turns off, leaving the world in short supply

The money supply data from the US, Britain, and now Europe, has begun to flash warning signals of a potential crunch. Monetarists are increasingly worried that the entire economic system of the North Atlantic could tip into debt deflation over the next two years if the authorities misjudge the risk.

The key measures of US cash, checking accounts, and time deposits - M1 and M2 - have been contracting in real terms for several months. A dramatic slowdown in Britain's broader M4 aggregates is setting off alarm bells here. Money data - a leading indicator - is telling a very different story from the daily headlines on inflation, now 4.1pc in the US, 3.7pc in Europe, and 3.3pc in Britain.

Paul Kasriel, chief economist at Northern Trust, says lending by US commercial banks contracted at an annual rate of 9.14pc in the 13 weeks to June 18, the most violent reversal since the data series began in 1973. M2 money fell at a rate of 0.37pc."The money supply is crumbling in the US. There was a very sharp lending contraction in the second quarter lending. If the Federal Reserve is forced to raise rates now to defend the dollar, it would be checkmate for the US economy," he said. Leigh Skene from Lombard Street Research said the lending conditions in the US were now the worst since the Great Depression. "Credit liquidation has begun," he said.

The Fed's awful predicament does indeed have echoes of the early 1930s when the bank felt constrained to tighten into the Slump in order to halt bullion loss under the Gold Standard. Investors - notably foreigners - dictated a perverse policy. Over 4,000 US banks collapsed. This time a de facto "Oil Standard" is boxing in Ben Bernanke. Benign neglect of the dollar has started to backfire. It is pushing up crude, with multiple leverage.

The monetary picture is highly complex. The different measures - M1, M2, M3, M4 - have all given false signals in the past. Each tells a different tale, and monetarists fight like alley cats among themselves.

The Federal Reserve stopped paying much attention to the data a long time ago. It has abolished M3 altogether. The US economic consensus is New-Keynesian (dynamic stochastic general equilibrium model). Delving into the money entrails is derided as little better than soothsaying.

That attitude, retort monetarists, is the root cause of the credit bubble. The money supply almost always gives advance warning of big economic shifts. Those who track the data are now calling on central banks to move with extreme caution. If the rate-setters overreact to an inflation spike caused by oil and food - or confuse today's climate with the early 1970s - they may set off an ugly chain of events.

"The data is pretty worrying," said Paul Ashworth, US economist at Capital Economics. "US lending is shrinking dramatically in real terms, and we know from the Fed's survey that banks want to tighten further. People are clamouring for higher rates but we think deflation is now the biggest threat. The idea that the Fed should tighten with unemployment soaring is preposterous," he said. The jobless rate jumped from 5pc to 5.5pc in May.

In Britain, the Shadow Monetary Policy Committee - hosted by the Institute for Economic Affairs, and a refuge for UK monetarists - issued its own alert this week. The focus is on "adjusted M4", which covers loans to "private non-financial corporations" and may offer the best insight into the health of British business. The growth rate has dropped from 16.1pc a year ago to minus 0.5pc in April.

It is the suddenness of the decline that matters most. The data reeks of recession. Professor Patrick Minford from Cardiff Business School called for an immediate rate cut, arguing that the credit crunch is a more powerful and long-lasting force than the oil inflation. Professor Tim Congdon from the London School of Economics said the UK was lurching from boom to bust.

"Real money growth is virtually nil. The British economy is taking a thrashing and it is going to get worse. Corporate money balances have contracted 3pc over the last three months, which is double digits on an annualised basis. This is a serious squeeze for companies," he said. Mr Congdon warned three years ago that surging M4 would lead to a "dangerous" bubble, which is what occurred. He now fears the MPC will react too late as the process goes into reverse.

Roger Bootle from Capital Economics said Britain could be facing a "real economic crisis and a financial collapse. The MPC does not have the luxury of waiting until all is absolutely crystal clear. By that time the bird will have flown." The eurozone is at a later stage of the credit cycle.

Even so, house prices are collapsing in Spain, and falling in Germany and France. German industrial orders have dropped for the last six months in a row. A joint IFO-INSEE survey said eurozone growth had stalled to zero in the second quarter. "Consumer lending has fallen off a cliff. It is contracting in real terms," said Hans Redeker, currency chief at BNP Paribas. Core inflation has fallen from 1.9pc to 1.7pc over the last year.

Unlike the Fed, the European Central Bank keeps a close eye on money data (though not on real M1, now shrinking). It looks at the broader M3 figures. There is a raging debate in Europe over the signals now being sent by this indicator.

The M3 growth is still 10.5pc, down from 11.5pc in January. However, the data has been badly distorted by the closure of the capital markets. Firms have been forced to draw down existing credit lines from banks, which shows up as M3 growth. (It is the same story with America's M3 since the collapse of the Commercial Paper market).

"The credit lines are expiring. Companies cannot roll over loans. We are going to see the entire private credit multiplier go into a slowdown," said Mr Redeker. Jean-Claude Trichet, the ECB's president, said last week that the M3 data "overstates the underlying pace of monetary expansion". The ECB nevertheless pressed ahead with a rate rise to 4.25pc, setting off a storm of protest.

This may go down as one of the most unwise monetary decisions of modern times. The strain on eurozone banks is growing by the day. They bid a record $85bn (£43bn) at the ECB's last auction for dollars. Only $25bn was available. The spreads on Euribor interbank lending are still at extreme stress levels.

Few dispute that "global inflation" is taking off. Over 50 countries now face double-digit price rises. Ukraine (29pc), Vietnam (27pc), and the Gulf states are out of control, with Russia (15pc), and India (11pc) close behind. China (7.1pc) is on the cusp. Interest rates are still below inflation across much of the emerging world. This is the driving force behind spiralling commodity prices.

The oil spike is already squeezing real wages in the Atlantic region. The debate is whether the Fed, Bank of England, and ECB should squeeze them further, trying to off-set energy rises with a deflationary bust in the rest of the economy. If and when oil peaks in this cycle, they may find inflation crashing faster than they dare to imagine.

The 9th Circle in Dante's Inferno - starring Judas and Brutus - is a frozen lake. Cold can be more frightful than heat. "Blue pinch'd and shrined in ice the spirits stood," (Canto XXXIII). Such awaits the victims of debt deflation.

Dealers borrow nothing from Fed, but bills rally

U.S. investment banks borrowed no money from the Federal Reserve in the latest week for the first time since the Bear Stearns debacle, but fears about the financial sector's health still haunt markets, underscored by Thursday's rally in Treasury bills.

Banks have been slightly more willing to lend to each other since the end of June, but uncertainty is still higher than before the credit crisis erupted nearly a year ago. Lending markets have been under stress for almost a year now after the housing market meltdown forced waves of bank write-downs on mortgage bond-related investments.

Investors are now looking for clues that strains on the credit markets may be ebbing. "It's improved, but not normal," National City Corp's chief economist Richard DeKaser said about current credit conditions. The interbank cost of borrowing dollars overnight fell sharply on Thursday, continuing to retreat from peaks scaled a week ago at the turn of the quarter.Fed borrowings data, June 1 2008

The overnight London interbank offered rate (Libor) dollar rate dropped 15 basis points to 2.17750 percent, according to the British Bankers Association's latest daily fixing. Three-month borrowing rates for banks with offices in the United States slipped to 2.7975 percent on Thursday from 2.8046 percent on Wednesday, according to ICAP.

But later in the New York session, investors scooped up U.S. Treasury bills on growing worries about the financial soundness of government-sponsored mortgage finance enterprises Fannie Mae and Freddie Mac. The flight-to-safety scramble for ultra-short-dated, low-risk securities sent the yield on one-month T-bills, a proxy for cash, to their biggest single-day drop in almost four months.

The yield on one-month bills sagged to 1.47 percent, down 37 basis points from late Wednesday. The persistent cloud over the financial sector has mushroomed on speculation of more write-downs and losses at Wall Street investment banks, traders and analysts said.Fed non-borrowed reserves data, June 1 2008

"There was more flight to quality on fear of what was going on with Freddie and Fannie, and more rumors with what is going on in the Street," says Ted Ake, executive director and head of bond trading with Mizuho Securities USA in New York.

Yet U.S. investment banks borrowed no money from the Federal Reserve in the latest week -- the first time that primary dealers have not sought cash directly from the Fed since the emergency facility was introduced in March following the near collapse of Bear Stearns, then the fifth-biggest U.S. investment bank.

The previous week, dealers had borrowed a daily average of $1.74 billion from the Primary Dealer Credit Facility (PDCF). But dealers' decision not to go to the PDCF in this latest week, rather than showing they don't need cheap cash from the central bank, may reflect their concern to remain invisible at a time when markets are awash with rumors about the travails of major financial institutions and their need to raise more capital.

Peak borrowing via the PDCF came in the immediate aftermath of Bear Stearns' near collapse, hitting a peak daily average of $38.118 billion in the week ended April 3, and it has been falling rapidly over the past month or so. The Federal Reserve's portfolio of Bear Stearns assets, held by holding company Maiden Lane LLC, was valued at $28.94 billion as of July 9, up from $28.89 billion on July 2.

"Some of this primary dealer credit lending that existed prior to last week was the direct funding of Bear Stearns. Presumably when this acquisition and these assets were put on the Maiden Lane balance sheet, some of this funding (via the PDCF) became less necessary," said Ray Stone, economist with Stone & McCarthy Research Associates, in Princeton, New Jersey.

Now that the Bear Stearns borrowings do not show up in the PDCF data, other investment banks "may be disinclined to borrow from this facility and may want to fly under the radar" so that their borrowings do not stand out, even though individual dealers have anonymity in the data, Stone said.

The news of PDCF borrowings shrinking to zero comes after Fed Chairman Ben Bernanke said this week the Fed may keep the facility in place through year end. Initially it had been set to expire in September. The PDCF is one of several facilities the Fed has introduced to provide cheap financing to financial institutions crimped by the credit crisis.

Another option dealers have is to exchange riskier collateral at the Federal Reserve's Term Securities Lending Facility auctions for Treasuries they can convert temporarily to cash. Primary dealers submitted $21.3 billion of bids for the $25 billion of Treasuries offered on Thursday in exchange for Schedule 1 collateral, in the Federal Reserve's 28-day Term Securities Lending Facility auction. The bid-to-cover ratio, an indication of demand, was 0.85 at the auction, up from the 0.62 bid-to-cover ratio at a similar auction in late June.

A classic cornerstone of short-term borrowing, the U.S. commercial paper market, shrank by the most in 10 weeks in the latest week, Federal Reserve data showed on Thursday, although the longer-term trend toward contraction may be abating. For the week ended July 9, the size of the U.S. commercial paper market, a vital source of short-term funding for daily operations at many companies, fell by $20.6 billion to $1.759 trillion, down from $1.780 trillion the previous week.

"This is a very consistent story. What is going on here is a rather pronounced drop in overall credit demand, and that is very bearish macroeconomically," said Howard Simons, a strategist with Bianco Research in Chicago.

Lehman Says It Shrank Level 3 Assets by 2.7% in Second Quarter

Lehman Brothers Holdings Inc., the securities firm that's lost 75 percent of its market value this year, whittled down its hardest-to-value assets by 2.7 percent in the second quarter.

Lehman's so-called Level 3 assets, including mortgage- backed bonds and private-equity investments, declined to $41.3 billion at the end of May from $42.5 billion in February, according to a filing with the U.S. Securities and Exchange Commission today. The ratio of Level 3 to total assets rose to 6.5 percent from 5.4 percent at the New York-based company. Lehman's total assets dropped 19 percent from the first quarter.

Earnings have been hurt at banks and brokerages with difficult-to-sell securities on their books following more than $408 billion of writedowns and credit losses from the collapse of the subprime mortgage market. Prices for investments tied to home loans, commercial real estate, and loans for leveraged buyouts became scarce this year as investors shunned a wider array of credit, freezing the trading of securities.

Lehman, led by Chief Executive Officer Richard Fuld, fell $2.44, or 12 percent, to $17.30 in New York Stock Exchange composite trading today, sinking to the lowest level since February 2000. Financial stocks have declined this week on speculation government-backed mortgage financing companies Fannie Mae and Freddie Mac will need to raise more capital to withstand the credit contraction.

Lehman was also hit by speculation that some of its biggest customers were defecting, which the clients denied today. Pacific Investment Management Co., manager of the world's biggest bond fund, and hedge fund SAC Capital Advisors LLC both said speculation they had backed away from Lehman was unfounded.

Pimco "continues to trade with Lehman," the company said today in an e-mailed statement. Pimco fund manager Bill Gross said in an interview with CNBC that there's "no question" about the firm's solvency. "SAC is continuing to do business with Lehman Brothers as usual," Jonathan Gasthalter, a spokesman for the hedge fund company, said in an e-mail.

Lehman sold about $3.5 billion of Level 3 assets during the quarter, including mortgage-related holdings, Chief Financial Officer Ian Lowitt said last month. After some $2 billion of writedowns and $3.5 billion of assets that were re-categorized, Level 3 assets totaled about $38 billion at the end of the quarter.

Goldman Sachs Group Inc., the biggest U.S. securities firm, earlier this week reported its Level 3 assets shrank 19 percent to $78.1 billion last quarter. The harder-to-value stakes made up 7 percent of Goldman's total assets at the second quarter, down from 8.1 percent in the first quarter.

Morgan Stanley, the No. 2 firm, said yesterday that its hard-to-value assets shrank 11 percent to $69.2 billion at the end of May from $78.2 billion in February. The ratio of Level 3 to total assets remained about 7 percent. The following table compares the Level 3 assets on the balance sheets of the three top U.S. securities firms, according to their quarterly reports.

Lehman Brothers Faces ERISA Lawsuit

Lehman Brothers has become yet another name in a long list of companies facing ERISA lawsuits related to its handling of 401(k) plans. Companies like Lehman Brothers are finding themselves facing such lawsuits with increasing frequency, as plan participants realize that companies are withholding important information regarding plan stability. The participants are also learning that their assets are being not being invested with their best interests in mind.

Employees allege that Lehman Brothers Holdings breached their fiduciary duties to participants and beneficiaries of the Lehman Brothers Savings Plan. They allege that fiduciaries invested Savings Plan assets in Company stock even though the stock was not a prudent investment for retirement savings. Furthermore, they say that Lehman Brothers and other fiduciaries made such investments even though the company did not maintain adequate capital and liquidity.

One lawsuit, filed in April 2008, alleges that Lehman Brothers and some of its officers failed to disclose important information regarding the company's financial situation. This includes not disclosing the extent of its exposure to losses related to subprime mortgage-backed derivatives, the extent of its exposure to losses related to CDOs, the company's failure to writedown those losses in a timely manner, the failure to properly prepare financial statements and the failure to maintain proper internal controls.

ERISA laws require that plan fiduciaries put the needs of plan participants ahead of all other needs, including the company's. The laws also require that fiduciaries choose investments that are suitable and appropriate and give participants material information regarding the plan and its status. It is a breach of fiduciary duty to encourage participants to maintain investments in a plan if the plan is not a suitable investment.

If you own Lehman Brothers stock through the company's Savings Plan, you may be eligible to join a lawsuit against the company. Contact a lawyer to discuss your legal options.

Rising tide of bad debts will flood over banks

So far we have escaped a US-style sub-prime meltdown. We may never see anything so bad, but it's going to be a close call. House prices are falling at a faster rate than the late 1980s-early 1990s slump. House prices generally relate to highly-geared assets (mortgages on homes). As prices fall at rates not seen since the 1930s, equity is vanishing with a rising tide of negative equity the result.

As long as people stay employed and can carry on servicing their debt, they can sit tight and wait for prices to recover to restore their equity. But with more people losing their jobs and the cost of servicing the huge debt pile already taken out, such as credit cards and other unsecured credit, mortgage arrears and repossessions will rise.

Optimists point out that although repossessions have started to rise, they're still way below the levels endured at the height of the last recession. But that's because we're still only at the beginning of this recession. Over the next 18 months banks are going to face a rising tide of bad debts, arrears and repossessions.

The worst hit will be those lenders who have focused on high loan-to-value lending, the buy-to-let market and the self-certification mortgage market where borrowers became their own credit controllers. Another source of worse-than-usual bad debts will come from the large loan books that some high street lenders bought from specialist rivals in a bid to bulk up in the boom.

All of this brings me back to Bradford & Bingley. Assuming it succeeds in raising its £400m capital injection from shareholders it will be, in the happy words of its executive chairman Rod Kent, one of the best capitalised banks in Britain.

Phew, because it's going to need to be. Given the profile of its lending (buy-to-let, specialist loan books and so on) it could be one of the worst hit for arrears and further losses and write downs on bad debts. It's going to need the capital it's raising now, not to give it a chance of weathering the onslaught to come, but to give it breathing space until a takeover can be agreed or a run off of its business arranged.

The only engineers you need in the house building trade these days are financial ones. Barratt Developments has sold 43pc less houses in the past six months than the corresponding period in 2007 but is still geared up with debt and a workforce designed for the boom.

Mark Clare, Barratt's chief executive who was finance director of Centrica, has been busy with his financial tool box trying to reinforce the company's financial foundations in the hope that it will be left standing come any recovery. The subsidence showing up on Barratt's balance sheet has been spreading alarmingly and, without yesterday's urgent action, the company's future would have been questionable.

It's managed to survive without raising fresh capital but shareholders should put the champagne on hold. On the debt, it has agreed a refinancing package which gives it breathing space. But this comes at the cost of its interest burden soaring by a third. Paying down this debt now becomes a priority so it must convert shareholders' assets for cash and then pass the cash to the banks.

For the foreseeable future, Barratt is working for its banks, not shareholders. The company's Wilson Bowden Developments will be sold and more cash will be freed up by sacking 1,200 staff. It's also going to stop buying land (which for a house builder isn't great) to conserve cash. But more radical action will be needed.

Its portfolio of starter homes could probably be sold off in bulk to a large buy-to-let specialist because first time buyers can't get mortgages any more so this part of Barratt's market is dead anyway. But this is not a seller's market and shareholders are witnessing a fire sale of their assets to keep the banks happy. However, all this comes at the start of a possibly prolonged downturn. The shares' 15pc rally yesterday seems a rather premature form of house party.

It didn't take the banking sector long to return to the Bank of England asking for an even more special Liquidity Scheme. With the ink barely dry on the initial scheme designed to inject £50bn into the credit market, banks now want the rules loosened so it's easier to borrow from the Bank's scheme.

Some banks that have been downgraded by the rating agencies, or who are at risk of a downgrade, may be finding it particularly hard to parcel up loans into the sort of triple-A rated bonds that the Bank wants in exchange for providing cash. Some want to be able to use new mortgages written this year as security, rather than just last year's vintage or before.

The Bank's scheme cannot yet be counted a success because inter-bank rates remain high, although this is for a number of reasons. But neither can it be counted a failure. The mortgage market is under pressure but that should not be an excuse to help banks back towards the profligacy that's got the economy in such trouble. Those who have over-lent must learn their lessons, just as those who have over-borrowed.

AIG, other mortgage insurers fall on loss fears

Shares of American International Group Inc , the world's largest insurer, fell 8.2 percent on Thursday on concerns that a rating cut at its mortgage insurance unit could signal more losses in the pipeline.

"Everything is bleeding together," said Rob Haines, an analyst with research firm CreditSights, pointing to a broad decline in mortgage insurance stocks after Moody's Investors Service downgraded mortgage insurance units at AIG, PMI Group Inc and Mortgage Guaranty Insurance Co.

AIG closed down $2.15 to a 12-year low of $23.99, making it the biggest drag on the Dow Jones industrial average .DJI and Standard & Poor's 500 index .SPX. Meanwhile, PMI fell 4.4 percent and MGIC closed down 22 percent. Mortgage insurers sell coverage that pays out in the event of defaults on private mortgages.

"Everyone is concerned about where the next shoe will drop," said Haines. He added that AIG investors are also skittish about new and unproven management. Late Wednesday, Moody's cut the insurance financial strength ratings on AIG's mortgage insurance arms one notch to "Aa3," the fourth-highest investment grade. The outlook is also negative.

United Guaranty Corp, AIG's mortgage insurance unit, reported an operating loss of $352 million in the first quarter. In May, AIG said it saw trouble in the U.S. mortgage market affecting this business into 2009. AIG's shares have fallen more than 65 percent in the last year as it has posted more than $20 billion in write-downs on assets linked to subprime mortgages, leading some shareholders to call for a management shuffle.

Spain pulls bond sale amid economic crisis

Spain has suspended an auction of sovereign bonds as investors take fright over the country's property crash and accelerating slide into economic crisis.

The treasury pulled an expected sale of 15-year bonds after probing the market informally, saying it would wait until credit conditions began to calm down. "We are not facing financing problems. We placed a successful three-year note on Wednesday," said a spokesman.

Government officials have been shocked by the intensity of the downturn now engulfing the country. Car sales fell 31pc in June, industrial production has fallen 5.5pc over the past year and the collapsing property sector is shedding almost 100,000 jobs a month. Miguel Sebastian, the industry minister, said the economy had ground to a halt in the second quarter and was now in "virtual recession".

Standard & Poor's has issued an alert on the banking sector, warning that "the sharp deterioration in economic conditions" would lead to a surge in bad debts. The fears are shared by Miguel Blesa, head of the lender Caja Madrid, who says the wave of defaults are "not just coming, they're galloping". Last week's interest rate rise by the European Central Bank to 4.25pc has tightened the screw further.

Spreads between Spanish bonds and German bunds have risen from four basis points last year to 27 yesterday. While state debt is low, there are concerns that bank losses from housing and commercial real estate could have knock-on effects for the government and possibly complicate euro membership.

It is unclear how Spanish authorities could conduct a rescue operation along the lines of Bear Stearns, given that there is no clear lender of last resort in the eurozone system. Fears the Bank of Spain could find itself hamstrung in a crisis have begun to unsettle investors.

Elsewhere in Europe, growth is now slowing across the board as the strong euro takes it toll. French industrial output fell 2.6pc in May, and in Germany it was down 2.4pc. Elga Bartsch, from Morgan Stanley, said Germany's resilience "seems to be melting away" as exports stall.

Europe's Aerospace and Defence Industries Association yesterday held a meeting with ECB president Jean-Claude Trichet to express "deep concern" over the euro exchange rate, now widely believed to be 25pc overvalued against the dollar bloc. They believe the ECB could steer down the euro if it gave a clear signal that the tightening cycle is over.

Slide in UK house prices is the worst since the Great Depression

Britain is now in the midst of the worst housing slide since the Great Depression, economists declared after house price inflation dropped to the lowest level since comparable records began.

Figures from Halifax, the UK's biggest mortgage lender, showed house prices have fallen by 8.7pc in the year to June, confirming that the property crunch is more severe than the last housing crash in the early 1990s. Hours before, the Bank of England voted to leave rates unchanged at 5pc.The Halifax figures - which showed prices dropped 2pc last month, following a 2.5pc slide in May - indicate that the scale of the crash now rivals the falls in UK home values in the 1930s. In the three months to June, house prices were 6.1pc lower than the comparable period last year - described by Halifax as the "annual change".

House prices have never fallen by more than 10pc over a year in recorded history, except in 1931, when Britain left the gold standard. David Owen of Dresdner Kleinwort said: "Back then, sterling had been ejected from the gold standard and the currency collapsed, and, although this helped exports, house prices collapsed. What we are seeing now has some parallels with then.

"However, it is a very unreal situation because this is happening without there being a major recession, and we haven't seen distressed selling, nor a significant increase, yet, in unemployment." The Bank of England reported recently that the number of mortgages being approved for housing purchases dropped to 42,000 in May - the lowest level since comparable records began in 1993 and down 64pc on the previous year.

Alex Vitillo, of Fathom Consulting, said that the downturn was already more severe than the early 1990s, where, according to figures from Nationwide, prices dropped by around 20pc over a number of years. He said: "As the UK housing market downturn gathers pace, it is common for analysts to argue that this downturn will not be as bad as the early 1990s vintage. It looks like it will be worse, perhaps far worse.

"The decline is far greater and swifter than anything we saw in the early 1990s. Our modelling work suggests that nominal house prices could fall by another 15pc to 20pc from here," he said, adding that there was a risk of even greater falls. Economists predicted that, with the economy slowing sharply, it may have to cut interest rates by the autumn.

Former MPC member Charles Goodhart warned yesterday that with the economy looking "dire", Britain is now facing a recession. Prof Goodhart, now at the London School of Economics, said: "Output is going to fall, unemployment is going to rise, possibly quite sharply. It's a horrible situation. "The British economy is getting into quite a recession.

I remember when the Queen had an 'annus horribilis,' and this is the annus horribilis for the MPC. "The third quarter will show no growth, maybe even a marginal reduction in output," he said in an interview with Bloomberg Television. "I think it will last rather longer than is going to be comfortable. The situation looks dire."

Michael Saunders of Citigroup said: "The housing market is probably not even close to the bottom, and sizeable further declines in house prices are likely, not necessarily every month, in the rest of this year and in 2009. In turn, plenty more weakness lies ahead for the overall economy as well."

UK house prices falling at fastest rate since 1990s

House prices are falling at the fastest rate since the 1990s crash and have shed almost £20,000 from their peak values last summer, according to the latest house price survey. UK house prices fell by 2 per cent in June, and are now 6.1 per cent lower than a year ago, with the average home costing £180,344, Halifax said.

Britain’s biggest lender reported that average house prices were now at the same level as in August 2006. As the Bank of England prepares to announce its interest rate decision at noon, Halifax chief economist Martin Ellis warned that a squeeze on consumers’ finances and the lack of availability of mortgages were hurting the housing market.

“These factors have curbed housing demand. There has been a slight fall in ‘real’ earnings over the past year,” he added. The figures from Halifax confirm a similar fall experience by rival Nationwide, which said the average home costs 6.3 per cent less than a year ago. Economists warned that house prices were likely to carry on falling for many months to come.

“Grim numbers and little to suggest things will get better any time soon. In fact we expect to be in negative double digit territory from next month,” said Alan Clarke, UK economist at BNP Paribas. The Halifax figures came as Barratt became the latest housebuilder to slash its workforce. The company said it was cutting 1,200 jobs owing to the housing slump and the squeeze on mortgage lending.

The Bank of England’s Monetary Policy Committee (MPC) is widely expected to keep rates on hold, disappointing home owners who have suffered from banks and building societies putting up their rates on an almost daily basis. According to data from the Bank, the average two-year fixed-rate mortgage is now at a ten-year high, with home buyers or people remortgaging having to pay a rate of 6.63 per cent.

GM Gives 'No Thoughts' to Bankruptcy

General Motors Corp., the biggest U.S. automaker, has "no thoughts whatsoever" of bankruptcy, Chief Executive Officer Rick Wagoner said.

GM's cash will remain "robust" this year, and the company would be able to tap additional funds as needed, Wagoner said today in a speech to the Dallas Chamber of Commerce. A Merrill Lynch & Co. analyst said July 2 that GM may need to raise $15 billion and that bankruptcy is "not impossible" should U.S. economic conditions worsen, pushing GM shares to a 54-year low.

"When things like this happen, some of the critics call this the end of the U.S. auto industry as we know it," said Wagoner, 55. "We're taking the tough but necessary actions to keep GM competitive over the long, long term." His comments may ease investors' concern that the Detroit- based automaker lacks enough cash after three years of losses and a 16 percent decline in 2008 U.S. auto sales. Wagoner said GM "has a lot of money" for a company of its size.

"With GM's liquidity, near-term bankruptcy talk is overdone, so Wagoner is right to dismiss it," said Pete Hastings, a fixed-income analyst at Morgan Keegan & Co. in Memphis, Tennessee. "GM will need capital late in 2009 or early 2010, and a lot can happen between now and then."

GM had $24 billion in cash and marketable securities and access to about $7 billion in undrawn U.S. loans on March 31, at least $6 billion more than it expected would be needed during a U.S. sales slide, Chief Financial Officer Ray Young said May 13.

The company's 8.375 percent note due in July 2033 rose 0.3 cent to 55.5 cents on the dollar, cutting the yield to 15.4 percent, according to Trace, the bond-price reporting service of the Financial Industry Regulatory Authority. The bond fell to 55 cents on the dollar, its lowest price ever, on July 8. GM fell 64 cents, or 6.2 percent, to $9.69 at 4 p.m. in New York Stock Exchange composite trading. The shares have tumbled 61 percent this year, the most among 30 companies in the Dow Jones Industrial Average.

Wagoner reiterated other executives' comments this week that Hummer is the only one of GM's eight U.S. brands being studied for a possible sale or shutdown. GM said June 3 it would review the future of that sport-utility vehicle line as $4-a- gallon gasoline spurs consumers to embrace cars and shun trucks.

Option traders see big swings in mortgage REITs

Option traders on Thursday were bracing for more turbulence in two U.S. mortgage real estate investment trusts after worries about the capital needs of mortgage finance giants Fannie Mae and Freddie Mac hurt the sector.

The options anxiety surrounding Freddie and Fannie regarding the ability to raise capital needed to offset losses and purchase home loans extended into Annaly Capital Management Inc and MFA Mortgage Investments Inc.

"Option traders are betting on further share price turbulence in Annaly and MFA. The catalyst could be the same issues that are befalling Fannie Mae and Freddie Mac," said Jud Pyle, chief investment strategist at Options News Network.

"The common denominator is that all of these companies are involved in the business of investing in pools of mortgages. As the value of those pools deteriorate, the shares of Annaly and MFA could get stung," Pyle said. On the New York Stock Exchange, Annaly shares suffered a loss of just over 10 percent, a drop $1.51, to $13.55 while MFA shares fell 2.2 percent to $5.81.

The rush to buy options in these mortgage REITs sent their respective option implied volatility readings to heightened levels, according to Interactive Brokers Group data. Late in the session, Annaly's implied volatility stood at around 109.9 percent, up 47 percent from Wednesday -- higher than the spikes posted in both Freddie and Freddie and more than twice the historic reading on the stock.

The options market's barometer of perceived risk in MFA was about 105 percent, up sharply from 71.9 percent at Wednesday's close, and twice the level of its historic volatility. Implied volatility measures the expected magnitude of share price movement conveyed by option prices.

A sudden rise in implied volatility often indicates the options market is pricing in expectations about a fundamental event, such as corporate news that could jolt the stock price. "Suddenly the risk perception of any company that is involved in the mortgage industry is exploding," said Joe Kinahan, chief derivatives strategist at online brokerage thinkorswim Inc.

29 comments:

You're early on this Black Friday, ilargi!

Something tells me there'll be more to post today.

Well, we all know where we are headed... and NOW we know the path we'll take...

Ha! Seems lots of us are up and watching this ' black Friday"...

I did break my self imposed rule and " warn" 3 more people this week.One blamed me as a rumour monger causing loss of confidence!

Ilargi and Stoneleigh, I'd like to know how you forsaw these events so long in advance of everybody else. What specific info formed your conclusion.Was it leverage ratios? Money supply? US deficit? Or...?

We've been talking about Lehman, Wachovia, WaMu, and others as Front Burner problems with Fannie\Freddie simmering in the back.

Is this a real frothing-over for these GSEs or just some bubbling? Are the others mentioned more fragile at this point?

Thanks -

Forrest

I am fairly new to your blog, and struggling to wade through economics lingo that I know almost nil about. But I "get" that the situation is dire. I have a really stoopid newby question though. When I read about how highly leveraged Fannie/Freddie are, and how they and other financial institutions are struggling to raise capital - at a time when their shares are dropping like stones and the value of the mortgages they hold is too.... what does "raising capital" look like? Where does that capital come from?

Linda,I'm a newbie too as of the beginning of the year! good question.

I've been thinking the 'Hot" money is looking for action and the returns would be high due to the risk.Some scope for money laundering here, I'd think. Let's see what more experienced readers have to say...

Although Martin Weiss (Money and Markets) talks inflation, he recently did a bit on

How to Prepare for the NEXT Panic.

As he shows there is another way to play this. Comprehensive List of Inverse ETFs (.pdf)

If the Dow breaks 10,697 I will seriously think about doing it. Any comments on shorting?

Hello,

In response to Scandia's question as to how S&I knew and know, I would again advise this:

http://www.theoildrum.com/node/2871

The information is there. If you understand it (and it is designed for non-experts), everything happening now is foreseeable.

That being said, I had to read it three times at three-month intervals to really nail some of the concepts down.

In response to Linda, one thought crossing my mind is that capital could come from existing shareholders who think the companies may have a chance to pull through with more capital. Without the new capital, the companies will fail and current shareholders will lose everything.

Other shareholders are not so confident and are pulling out, thus accepting significant losses, but still recouping something.

Tough choice.

Ciao,

François

Linda,

Lots of money out there, and most of it is dumb as a rock.

The "Shearing of the Bulls" is a fabulous sport.

http://realestateandhousing2.blogspot.com/2008/07/financials-zero-zip-zilch-znobeli.html

fb, I too have read this " paper" by Stoneleigh- twice in fact. Reading it again from the perspective of my question was again enlightening. I change my question. I can see how S@I drew their conclusion and chose to warn a few folks like us. The question now is that many economists/financiers must have had access to the same information and perspective. So why didn't they share it with the public? Central bankers must have known the inevitable outcome yet continued the play. All those Harvard grads and all! Why? so incredibly self defeating. Or is the defeat( read destruction) intended?

Honing the question...A " bull" must have evidence in support of a bull position. What would that be? Any bulls out there reading TAE?

Am I naive to assume that anyone sitting on the Finance Committee in Ottawa knows what we know here. So why are they not speaking up and out?

Hello,

In response to Scandia, I observe that many people do not think outside the box and even among those that do, many feel bound not to stray too far from the current consensus. Was it not Lincoln who said that leaders must be ahead of the public, but not too much ?

Many times, if one wishes to be taken seriously, one must walk very softly. With family and friends, I started about ten months ago with very cautious statements, making great efforts not to overstate my case. Simply feed information, point to trends, etc. I am not an expert and am obviously not regarded by others as one either, so any unsolicited advice, particularly if it runs counter to the consensus, rapidly leads to being branded as a hothead or a fanatic. In any event, the end goal of raising awareness is not achieved.

As for real experts, it is tough, even for them, to buck the general opinion. It takes courage.

Ciao,

François

fb,Wise words,good advice. Merci.

Hey luv ya musashi, if the bull shearers don't get us, you will send us to the guy that skins bears:)

If you are interested, listen-only is $150 and Q&A access is $450

So 150 smackaroonies to go back in time to the days of eavesdropping on a party line? I guess the 450 clam Q&A is so you can complain about the previous?

Nice to see you are back, I was starting to speak in tongues and likely annoying ilargi.

An amazing portrait, ilargi, that one surely can't be staged, too much written there, eh!

I was early because I had to leave at 7.15 am.

Scandia, nice compliments, but not deserved, there were surely plenty who saw it all before I did.

The specific info you ask about is I think simple annoyance at reading nonsense and lies, plus some basic things on who really owns this society, and probably most of all trendlines in various sectors of the economy and the world it exists in. When home prices triple within 10 years, that is a sign of a problem, and those prices will always come down again, and with a nasty downward swing. Systems 101.

What woke me up more than anything was spending an entire month going through everything Jay Hanson had posted at dieoff.com. Reading what the real brains like Garrett Hardin, Albert Bartlett, Herman Daly and all the others there had been writing about for years, in such a comprehensive fashion, that hit me upside the head. Don't forget that Hubbert had the energy situation figured out in the 1950's, before I was even born. He did great work on the economy as well later on.

For me, energy and the environment are passé as topics: I understand them, and know that nothing will change to sweep us off the downward slope.

Finance still has a few issues left I need to "feel" better (I despise academics, it's what got us in this mess, I want to intuitively "understand") , so it's what I cover now. But, like Jay, I inevitably move into biology, psychology, genetics and more, since seeing and understanding all that goes on and wrong starts begging questions on the "why".

Unlike Jay, I think right now that much of the answer, or the evidence if you will, lies in money matters, and how people deal with them. Jay sees printing presses, I understand there ain't any. In the grand scheme, these are details, but a more thorough insight into the economic system does provide inroads into the human mind.

Economics as we know it in our part of the world is the perfect metaphor for how the brain functions, simply because they're so perfectly fitted for it. Perpetual growth is the essence of all life, and the only thing that stops it and creates a -false- sense of "balance" does not originate within a lifeform itself -NEVER!-, but with the rest of the system, with Gaia if you will.

Still, we all fool ourselves into thinking that we will be able to stop ourselves from doing what every other species will always do, if left unchecked: we think we can slow down, we'll be compassionate and sociable and so on. But if you take a look around, at what happens on the planet today and through history, there is zero proof for that. We use more energy, we pollute more, and there's more poverty. We can't do it, we can't make that change, our genes can't be reprogrammed.

We are about to get a hell of a truckload nastier to each other, not kinder or more compassionate. We had that chance while we bathed in surpluses, and we failed that one hugely. All we managed to do is act too busy to see how our wealth came through the blood of other people.

There is individual kindness in people, but there is none in the species. And we will all kill if that is what it takes to feed our children.

Hey, maybe that's the best response to your question: that it is much easier to understand things when understanding them is not your end goal. Like a karateka can break a brick with a single stroke of a fist, because the point of focus lies beyond the stone.

Ilargi, Much food for thought and feeling in your words...especially resonating is, "the point of focus lies beyond the stone." I feel like I've been wacked by the Zen stick!

My interest in the economy isn't about money or wealth.I have little materially to lose, not much " skin in the game". I am engaged somewhat like you in the human being drama( history ) which leads to self perception as species which leads to the universal laws....

A spirit of compassionate kindness animates this site. I feel safe here to risk exposing ignorance and I thank-you both for this opportunity.

And I thank all the commentors who expand my " understanding" with such goodwill.

Ilargi,

Thanks for the info. While we are probably quite different people, I've always sensed something in your work that reminded me of myself. Scandia is right: there is a lot of kindness on this site and I appreciate it as well.

FWIW, I spent 20 years outside academia independently researching and writing (10 years full time, 10 part-time). When I finally finished, I began showing my work to academics who I thought might have a common interest and discovered they had no clue--not the least--what I was doing. Eventually, I began to see that society itself was dead and what passed for reasoned discussion was sophistry.

Anyway, I can't tell you how much I value the clear-sighted, heart-felt analysis here that isn't trying to sell something.

I second Scandia's comment there. I am (sort of) new to thinking deeply about financial matters, and really trying to understand the system. I'm OK with being an ignoramus about how it works, and this has allowed me to learn a good deal in a fairly short period.

I have ideas similar to those Ilargi just wrote about, energy, environment - these are realms I understand fairly well both intuitively and empirically.

It looks like it was a banner bad bank day today. Geez. IndyMac is in receivership and FNM and FRE are both cliff diving. I listened to NPR's "Marketplace" this evening, and the host interviewed a broker from Dallas he talks to almost every week. The broker used words like "spooky" and "scary" to describe the mood in the brokerages. He even said he'd had a client call to ask about pulling all his money out of his bank accounts. The host and broker both pooh-poohed, practically laughed, at this idea, while at home I talked back to my radio. The broker concluded the segment with a quote along the lines of, "I've been at this a long time and when it gets this bad something always comes along [to perk the market up again]. Something most people wish they'd seen but didn't." I'm not too old yet so I hope he's right. I'd prefer to be wrong in my assessment of just how bad things are about to get. However, I'd rather be liquid, wrong, and "lose out on gains" than be right and fail to act, leaving all my family's resources tied up in almost worthless stocks and securities.

Oh, by the by,

IndyMac got shut down late today, as you may have read. After the bell on Friday..... Timing is everything.

All $16 billion of its deposits covered by the FDIC's $51 billion in reserves. I'm curious to see how fast that will all be paid back.

Will the FDIC take over Freddie Mac, or will the Fed open a discount window for Fan and Fred?

I thought they'd drop Freddie first (much smaller), and let Fannie wrestle on a bit, but then Fannie lost almost 25% today, so who knows? I'm starting to wonder if the PPT actively makes the two of them go down this fast.

Don't forget the Bear Stearns scam was concocted over a weekend. Maybe Monday will come without Fannie and Freddie.

And did you guys pick up on this paragraph in yesterday's Debt Rattle? Kind of important, but lost between the li(n)es.

There is at least one precedent for the government making concrete a financial obligation that was previously only assumed.

During the crisis caused by the failure of savings-and-loan institutions in the 1980s, Congress passed the Competitive Equality Banking Act of 1987, making the government legally liable for obligations of the Federal Deposit Insurance Corp.

Congress had previously adopted a joint resolution that the government would support the deposit insurance fund if necessary, but the pledge wasn't binding.

ebrown said "However, I'd rather be liquid, wrong, and "lose out on gains" than be right and fail to act, leaving all my family's resources tied up in almost worthless stocks and securities."

I'm with you 100%. I've pulled everything I can out of the market and used it to pay down debt (no point in holding cash). I liquidated an older 401k, which raised quite a few eyebrows. I haven't had time to run the numbers to see if I would have lost more than the 10% early withdrawal penalty had I kept it. I feel it does me more good as equity in my house, or more specifically a more manageable mortgage.

I'd like to join in too in expressing my thanks to S&I for the great work and effort they put into this site.

-Fab

EB,

You said: I'd rather be liquid, wrong, and "lose out on gains" than be right and fail to act, leaving all my family's resources tied up in almost worthless stocks and securities.

This is an important point - it's called minimizing the consequences of being wrong. If I'm wrong in my assessment of the future, I haven't really lost anything by thinking about where the essentials of my family's existence come from and trying to become more self-sufficient.

If however, I did nothing on the assumption that all would be well (despite all evidence to the contrary), and we then experienced a deflationary depression, then my family could easily be thrust into an abject poverty from which there is no escape. If you have no money, you have no choice, no freedom.

It has been clear to me for ten years how this would eventually end. All credit bubbles, and there have been many of different sizes, have eventually ended this way, yet each time people collectively refuse to recognize a bubble until it's too late.

Each time you hear that it's different this time, that it's a new paradigm, but all it ever is is the rediscovery of leverage - leverage that can carry you a very long way up, but then crushes you on the way down. Humans are very good at collective denial - following the consensus because there's less cognitive dissonance that way.

Those who follow the herd can always claim that they can't be blamed for doing what everyone else did, which allowed them to stay in their comfort zone. Breaking away from the consensus position is, in contrast, a very psychologically uncomfortable thing to do. It can easily cost you credibility, and often social status as a result. People will think you are crazy and treat you accordingly. If you're later proven right, then they may blame you for not trying harder to convince them earlier and envy what you have managed to save as a result.

During good times, people looking to legislate fairness seek to ensure that nobody loses, through the redistribution of wealth, but during bad times they seek instead to make sure that nobody wins. Both ends of the political spectrum have a more and a less attractive side, and you can bet that the less attractive side will emerge during the blame game that inevitably arises when there isn't enough to go around, whichever politicos are in power.

On the left, a desire for inclusive equality and fairness can turn into vindictive envy and forced collectivization. On the right, can-do self-reliance and individual responsibility can morph into unbridled greed, a callous disregard for life and dignity, and aggressive xenophobia. Both sides will seek to exploit the natural anger of the dispossessed masses for their own ends, fatally undermining the grass-roots cooperative spirit that could make difficult times bearable.

In short, it's even more difficult, although even more important, to refuse to be part of the crowd (or mob as the case may be) during hard times than it is to resist the pull of a socioeconomic mania during the best of good times.

Mish

writes today:

"The credit bubble has popped. Fannie Mae (FNM), Freddie Mac (FRE), Washington Mutual (WM), Wachovia (WB), and Lehman (LEH) are all at serious risk. Many smaller payers are at huge risk as well"

Hey CR, how are things?

Hot out here in the desert, especially in the back country.

Scandia,

A lot of the bulls aren't crazy, they are just locked into boxes that force their moves.

The only time one has 100% freedom and flexibility is when being totally unleveraged and playing with house money.

Musashi,I didn't intend to say bulls are crazy. I have been categorizing them as " cheerleaders". There must be more to their position than that. As " bear" fits my own view I realize I am not seeking a bull view. Is there a good bull site I can check out.

I am very grateful for this blog and especially to S&I for their insight and wisdom which is helping me to better understand this financial crisis and to take steps to prepare for the future. It has caused me to do a lot of serious thinking and everyday another piece of the financial mess becomes clearer.

Unfortunately, most of my family is still clueless, though for the past month I have been sending them pertinent articles, hoping for them to become aware of their financial portfolios. They can choose to read them, or not.

Some have gone to their financial planner who always say...don't worry, the stock market may go down, but it will always come back up. There has been crisis before and to remember how far the market dropped after September 11, 2001.

The professionals say to move from stock funds into safer bond funds. Yikes! I tell my family to really look at those funds, check for the toxic securities contained in them. One sibling is beginning to wake up.

Thanks to everyone here for their participation. It helps to read how others are planning for what lies ahead.

Anonymous Reader

As far as I can tell the whole 401K thing is just another pyramid scheme like Social Security and Federal entitlements programs. A huge amount of money in one place for managers to manipulate to their benefit. The first half or so of the participants (read "The Greatest Generation") do well but the bottom half pay in but never get a pay out. I wish I had never put a nickel into my 401K but had bought gold and silver instead (I was inclined to do so but listened to "experts" instead of my own gut feeling). Sigh. Better late than never I guess.

An acquaintance who is a financial

"planner" told me he had a client who wanted to move her money out of stocks because of the down turn. His response: "She just doesn't understand the stock market". Ha! They tout the stock market as a place to make money. In today's miniscule dividend environment it is no such thing. It is a place to transfer money. At this point there has been a huge amount of money transferred to big playerz, financial managers, CEOs and other employees with stock options, etc. The whole thing has been "hollowed out".

Come to think of it this is very similar to real estate with a slightly differnt cast of characters. As I and S have said, what goes boom must go bust.

The articles we post show that collective fear is increasing, as it always does during the latter stages of a declining phase (in this case since May 19th). I think fear will spike to an even greater extent into the coming short-term bottom, but then we should see a rally where fear will abate - even though nothing about the situation will have materially changed - and people may well drop back into a false sense of security temporarily.

I would expect such a rally to last at least a couple of weeks, and perhaps longer, although not nearly as long as the March to May rally, as this one will be correcting a shorter decline. My guess as to the extent of it is that it should test the underside of the recently broken trendline dating from 1974, which would suggest it would reach the low 12,000s. At the top we should see a little flourish of optimism, setting up the next phase of the decline, which should be considerably more severe than the recent one.

If you doubt that emotions drive markets and are reflected in their internal dynamics, just watch the hope at tops and the fear at bottoms, against a backdrop of a situation that is getting steadily worse, not flipping back and forth the way our collective reactions to it would suggest. Our collective mood swings, and the volatile perceptions they engender, are thoroughly grounded in human nature. Google 'mirror neurons' for more on the mechanism.