Ilargi: This one is so insane.

Not only are the fines in the auction rate securities settlements ridiculously low, it gets worse: the whole kaboodle is tax deductible. Welcome to the land of the brave and the free, where crime pays. It makes me think of two people, for respective different reasons: Al Capone and Bob Dylan.

Let’s for a moment forget about the finer details of the auction rate securities trade, and stick to the big picture.

The bold fact is that there is proof in the form of emails, showing that banks were aggressively pushing and selling ARS to clients when they already knew the market was dead, and even while they were actively selling off their own ARS.

Another fact is that Andrew Cuomo, posing as a sort of hero now, has labeled these actions "multibillion-dollar consumer and securities fraud."

Fraud is a crime, right? You and I can land hefty prison terms and heftier fines if convicted of fraud.

Now look at what Cuomo is agreeing with the banks that committed this "multibillion-dollar consumer and securities fraud."

They buy back billions of dollars of it, that’s true. But then look a bit further.

There are no criminal charges! None of the banks have admitted to being guilty of any crime, or even any wrongdoing. It’s all wrapped in the "voluntary" moniker. And that’s by no means where the craziness stops.

The individuals who committed the fraud while on the payroll of the banks get to keep the multi-million dollar bonuses they were paid for perpetrating the crime.

As for the banks themselves, for them the buy-backs are tax-deductible; in legalese: "... courts have upheld the tax deductibility of payments that serve to compensate an aggrieved party".

Tax-deductible criminal proceeds. Is that hard to believe or what? Who pays for the crime? That's right, the taxpayer.

And to top it off, Cuomo "imposes" fines so low that the word "ridiculous" doesn’t do them justice. For instance, Wachovia pays a $50 milllion fine for $8.8 billion in ARS. That’s 0.57%. That fine is so out of this world, it’s a crime all by itself.

This thing stinks on all sides; Cuomo and the banks are putting on a show.

Here’s Dylan and Goffin’s take this made me think of:

Tragedy of the Trade

A young girl dies in the gutter face down

Taxi driver pulls up to the curb, dies without a sound

Copin' a squad car ridin' round is nowhere to be found

Each one has seen his last But we must let it pass

Too much money to be made The tragedy of the trade

And if you don't give ice to the mob

Life around here gets awful hard

You're likely to lose more than just a job

And if that ain’t bad enough Times are getting so tough

Most people beggin to be underpaid The tragedy of the trade

Young man working for the fast food store

Sees a recuiting poster and goes off to war

I don't think he ever knew what he was fighting for

They play Taps and lower the flag

When they bring him home in a body bag

But don't you be dismayed It's just the tragedy of the trade

A baby cries in the ghetto morn'

Before he's five he'll wish he'd never been born

'Cause all society shows him is their hatred and their scorn

He knows he doesn't stand a chance

So he grows up with a gangster's stance

Just one more reason to be afraid The tragedy of the trade

Remember the hum of the factory town

Business was booming for a thousand miles around

But they farmed out the work and let so many people down

I hear it happened just recently Another change in our history

The billionaire's promenade The tragedy of the trade

The trade takes place around the world on a derelict street

Where the masters and the slaves often congregate to meet

They make deals - turn the big wheels

With starving children dying at their feet

The world's been run with Back Room Blood

Long before the time of the flood

And it's you who are betrayed The tragedy of the trade

If you still have innocence, better lock it in a vault

Once it was a virtue, but now it's a fault

Too many people waiting around just to rip you off

And as I understand No one really gives a damn

It's not a game, but that's the way it's played

The scales of justice have really never been weighed

The tragedy of the trade.

(Goffin, Goldberg, Dylan; Album: Back Room Blood)

Cuomo's ARS Probe Goes Full Blast

Now that things are settled with Wachovia, New York Attorney General Andrew Cuomo is shifting his focus to Merrill Lynch.

On Friday, Cuomo announced that Wachovia has agreed to buy back $8.8 billion in auction-rate securities, including $5.7 billion in securities held by more than 40,000 individual owners. Wachovia will pay $50.0 million in fines as part of the settlement, which includes an agreement to buy back all illiquid auction rate securities from all Wachovia retail customers, charities and small businesses, no later than Nov. 28

Regulators say Wachovia and other banks misled investors into believing that auction-rate debt, which has rates that reset in periodic auctions, was the equivalent of cash. "They marketed things to investors making specific representations about liquidity but failing to disclose to them that there were potential risks in the marketplace that might affect their ability to actually provide the liquidity they claimed was available," said Merri Jo Gillette, director for the SEC regional office in Chicago.

On Monday, Wachovia reported that it is being investigated by the Securities & Exchange Commission and may face charges over its municipal derivatives bidding practices, though it did not specify the nature of the allegations.

According to TradeTheNews, Cuomo will also move forward with legal action against Merrill Lynch in its ARS probe. The New York attorney general said that litigation against the brokerage firm is imminent, and that it has to agree to the same terms as Citigroup and UBS.

Merrill's absence was conspicuous. While JPMorgan Chase and Morgan Stanley joined other banks Thursday, agreeing to pay a total of $60 million in fines to settle their part of the auction-rate debacle, Merrill Lynch remained a holdout, unwilling, it seemed, to enter into an agreement with the New York attorney general and other state securities regulators.

UBS and Citigroup settled earlier this month for a total of $250.0 million in fines. UBS, Citi and Merrill were the biggest sellers of the product and thus the biggest target of investigators. The UBS and Citi settlements are being used as a template for other negotiations.

Cuomo also said that Goldman Sachs is under investigation, along with about two dozen other firms that have been subpoenaed.

Senator Seeks Higher Fines For Banks In ARS Cases

A senior Republican senator wants the Securities and Exchange Commission to ensure that banks including Citigroup Inc. and UBS AG don't benefit from a tax deduction on penalties they may face for their involvement in selling auction-rate securities.

Sen. Charles Grassley, R-Iowa, the highest-ranking Republican on the Senate Finance Committee, raised the tax issue in a Friday letter to SEC Chairman Christopher Cox. He asked Cox to increase any penalty the SEC imposes in the auction-rate security scandal to anticipate potential tax deductions.

The SEC has not proposed any fine against the banks, which have entered into settlements with state regulators and the SEC. But to illustrate his point, Grassley used a hypothetical example of a $600 million fine against Citigroup.

"For example, if the SEC decides that Citigroup should pay $600 million in connection with Citigroup's representations regarding auction-rate securities, Citigroup may be allowed to deduct this $600 million payment from its taxable income," Grassley wrote.

"To prevent Citigroup from receiving this potential tax windfall at the expense of American taxpayers, the SEC should consider 'grossing-up' the payment by Citigroup to an amount of $923 million," he wrote.

The grossed-up amount would take into account that Citigroup would save $323 million in taxes if it deducted the full payment, based on a 35% tax rate. Citigroup is one of several banks that have agreed under pressure from state regulators and the SEC to repurchase auction-rate securities from investors. The banks marketed the securities as liquid investments, but stopped providing liquidity when the auction-rate market seized up in February.

Citigroup agreed Aug. 7 to buy back securities worth $7.3 billion, and pay $ 100 million in fines to state regulators. A spokesman for Citigroup declined to comment on the Grassley letter. When its settlement with state regulators was announced earlier this month, the firm said it was "committed to continuing our work on initiatives that will secure the best and fastest route to providing liquidity to our clients."

Wachovia Corp. on Friday became the latest bank to settle with regulators in the case, joining Citigroup, UBS, JPMorgan Chase & Co. and Morgan Stanley. New York State Attorney General Andrew Cuomo is investigating other banks including Merrill Lynch & Co. and Goldman Sachs Group Inc.

Grassley isn't challenging the deductibility of payments made under those settlements, but is addressing any additional fines the SEC might impose. One securities lawyer said that, while the SEC hasn't foreclosed the possibility of levying additional fines, the existence of the settlements makes it unlikely.

Tax deductions for penalties imposed by the government in most cases already aren't permitted. "Pure fines are not deductible," said Bryan Skarlatos of New York-based law firm Kostelanetz & Fink. But courts have upheld the tax deductibility of payments that serve to compensate an aggrieved party, Skarlatos said.

In the case of the auction-rate settlements, since the banks have already agreed to compensate investors, any additional fine imposed by the SEC would likely be viewed as punitive in nature, and therefore not deductible. But Skarlatos said Grassley's effort may aim primarily to send a message to the SEC and other regulators to take tax deductions into account when determining the appropriate level of fines and penalties.

"He may be trying to make sure that regulators are tax smart about what they're doing, that the firm is not paying $100 but getting $50 back from the government.

Merrill Lynch in uphill tax battle to offset American linked losses

Merrill Lynch, the investment bank, is likely to face substantial restrictions on carrying forward operating losses to reduce its UK taxation obligations, after its British arm suffered $29bn (£15.5bn) of losses linked to ailing US investments.

Tax experts said that HM Revenue & Customs would closely scrutinise the bank's British company, Merrill Lynch International, following reports that it could avoid corporation tax for decades following the loss. The investment bank, which has just announced a recruitment freeze, also has not transferred losses to the UK - and would not have been able to - purely for taxation benefits, experts say.

A government spokesman said that under British law and international tax standards, it was "not possible to transfer profits or losses made elsewhere into the UK for tax purposes". At the corporation tax rate of 28pc, Merrill Lynch could theoretically offset its forward taxation obligations by $8bn based on the operating loss, however, it faces technical difficulties.

Grant Thornton tax partner Mike Warburton said that a company could offset losses from one business subsidiary against profits from another that were recorded the same year. But carried forward to future years, losses could only be offset against profits on similar investments.

Another leading accountant said HM Revenue & Customs would be looking closely to ensure that losses carried forward by Merrill Lynch were only offset against "commensurate trade".

That would effectively handicap Merrill Lynch if it had aspirations of using the UK as a tax haven, offsetting its overwhelming 2008 losses - made in large part on derivatives such as collateralised debt obligations - against profits from other business streams.

Leading British accountants were uniform yesterday in observing that the Wall Street bank could not simply have charged losses on investments "owned" elsewhere to its London business.

"You can't just shift losses around," one said. "Transfer pricing rules require that if you do a transfer of some sort of position from the US to the UK, you need to do it at market price. In other words if the thing is loss-making, the UK buys it at that lower price, the loss having been made [in the US]."

Liberal Democrat Treasury spokesman Vince Cable said the tax shortfall that would result from Merrill Lynch International's operating losses "underlines the fact that the revenue position of the Government this year is going to be absolutely dire".

Goldman, JPMorgan May Prove 'Mortal' as Earnings Drop, UBS Says

Goldman Sachs Group Inc. and JPMorgan Chase & Co., which weathered the credit crisis better than most of their peers, may prove "mortal" in the third quarter as loan losses increase and banking revenue drops, UBS AG said.

Goldman Sachs is "not immune" to declining profits even after the biggest U.S. securities firm "escaped many of the pitfalls that have snagged rivals," said UBS analyst Glenn Schorr in a research note today. JPMorgan, the second-biggest U.S. bank by market value, faces more asset writedowns and deteriorating consumer credit, he said.

Both companies have outperformed the Standard & Poor's 500 Financials Index as their results for the past two quarters topped analysts' estimates and writedowns and credit losses totaled less than those at peers Morgan Stanley, Bank of America Corp. and Citigroup Inc. Goldman dropped 27 percent since the financial index hit a peak in October, while JPMorgan lost 21 percent. The broader measure has plunged 41 percent.

Since both "have been viewed as safer places to hide during the credit crisis, we think investors may reduce exposure to these names in the near term," Schorr wrote. He expects Goldman to earn $2.25 a share in the third quarter ending this month, down from a prior projection of $3.20. The New York-based analyst reduced his profit estimate for JPMorgan to 25 cents from 62 cents. He rates both companies "neutral."

Schorr also reduced his estimate of Citigroup and Morgan Stanley, citing weakness "across the board" in the industry. Since the start of August, Goldman and JPMorgan have fallen 13 percent and 9 percent, respectively, more than three times the 3 percent decline of the S&P financials index.

Goldman Sachs shares are down 7.6 percent this week, the most in a month. Oppenheimer & Co. analyst Meredith Whitney and Deutsche Bank AG's Mike Mayo cut third-quarter profit estimates for the company on Aug. 12. JPMorgan also reduced earnings estimates for Goldman today.

JPMorgan is headed for its biggest weekly drop since May. The second-biggest U.S. bank slumped 8.1 percent this week after reporting a $1.5 billion loss on mortgage-backed assets in less than two months, based on a regulatory filing released Aug. 11. The company also agreed to pay fines and buy back auction-rate securities that state and federal regulators said were fraudulently sold to investors.

World Economy Shows New Strain

The global economy -- which had long remained resilient despite U.S. weakness -- is now slowing significantly, with Europe offering the latest evidence of trouble.

On Thursday, the European Union's statistics agency said gross domestic product in the euro zone contracted 0.2% in the second quarter, the equivalent of a 0.8% annual rate of decline. It marked the first time since the early 1990s that GDP has fallen overall in the 15 countries that use the euro.

In a fresh sign of the pressures facing the American economy, the Labor Department said Thursday that U.S. consumer-price inflation hit a 17-year high in July, rising 5.6% from a year earlier. With the European growth report, four of the world's five biggest economies -- the U.S., the euro zone, Japan and the U.K. -- are now flirting with recession.

China, the world's fourth-largest economy, is still expanding strongly, as are India and other large developing economies. Still, weak growth elsewhere in the world is tempering the torrid rise in prices of commodities such as oil, copper and corn, giving relief to consumers from high gasoline and food costs and cutting manufacturers' raw-materials bills. U.S. benchmark crude on Thursday closed at $115.01, down roughly 20% from its July 3 peak of $145.29 a barrel.

Easing inflation pressures could also make it easier for the world's central banks to lower rates in an attempt to fan flagging growth. The global weakness marks a sharp reversal of expectations for many corporations and investors, who at the year's outset had predicted that major economies would remain largely insulated from America's woes.

For the U.S., economic sluggishness abroad is both a blessing and a curse. Lower commodity prices are giving welcome relief. In addition, the dollar has strengthened as other economies lose steam -- which benefits U.S. consumers by cutting the cost, in dollar terms, of imports ranging from flatware to flat-screen TVs.

Yet at the same time, weaker foreign economies also undercut one of the few remaining bright spots in the U.S. economy: exports. Indeed, in a sign the world is dialing back its shopping spree of the past few years, the Baltic Dry Index, a measure of demand for shipping services, has fallen 37% since hitting a record on May 20, including a stretch of 23-straight down days. Dollar strength could also hurt U.S. exports by making U.S.-made goods pricier abroad. The dollar rose against the euro Thursday to levels unseen since February.

"Every region of the world except the Middle East and North Africa -- a beneficiary of high oil prices -- will experience a slowdown this year," Global Insight, a Massachusetts forecasting firm, said in a recent report. Deutsche Bank projects global growth of 3.7% in 2008 and 3.2% in 2009, the worst two-year stretch since 2002 and 2003, when the world was coming out of recession.

Several factors are behind the worsening outlook. In addition to rising commodities prices, countries including Spain, Ireland and the U.K. are suffering from U.S.-style housing downturns and a weakened banking sector. America's economic stagnation is weighing on other nations as well, because the U.S. remains the world's largest importer and still accounts for more than a quarter of global economic output.

Many parts of the world are struggling to contain inflation. This is especially true in emerging markets, where inflation pressures are higher. From Mexico and Brazil to Romania, central banks are still raising interest rates. While that's a powerful anti-inflation tool, it also tends to damp growth just as economies show fresh signs of tipping toward recession.

"The global economy is sputtering amidst a widening in the slowdown from the United States to Western Europe and Japan," J.P. Morgan economist David Hensley said in a note to clients Wednesday. That slowdown, he said, "is feeding through to the emerging economies." On Wednesday Japan reported its economy contracted at an annual rate of 2.4% in the April-June quarter, the largest decline in seven years.

The U.K. could be heading towards its first recession in 15 years. Retail sales fell 0.9% in July from a year ago among stores open at least a year. Manufacturing output is down 1.3% on the year. Home prices are down nearly 9% from a year ago. "The next year will be a difficult one, with inflation high and output broadly flat," Bank of England Governor Mervyn King said Wednesday.

But he also predicted that inflation would begin to ease next year, which market participants interpreted as a sign that the bank may be preparing to lower interest rates in response to a weakening economy. In the U.S., an economic-stimulus package that briefly boosted consumer spending has faded. Wednesday, the Commerce Department said retail sales fell 0.1% in July, the weakest showing in five months.

With most of the world's big economies struggling, booming emerging markets are feeling a pinch. Last week Taiwan said July exports fell short of economists' expectations. A survey of Chinese purchasing managers indicated that manufacturing activity declined in July, the first time that's happened in the report's three-year history. On Thursday, Brazil said June retail sales advanced at their slowest pace in over a year.

Exports also have taken a blow. Gary Goh, the export manager for Singapore-listed Lorenzo International Ltd., a sofa and home-furnishing maker, says sales are softening. Exports within Asia have begun to slow, although not nearly as much as to the U.S. and Europe. "It's a global problem," says Mr. Goh.

In Malaysia, an electronics-manufacturing base, economists project slowing export growth in this year's second half. High prices for commodities such as palm oil (a cooking product that's a big Malaysian export) have propped up the country's export growth over the past year. But prices recently have come down sharply. As a result, analysts have trimmed 2008 GDP-growth estimates to around 5.5% from as high as 6.3% earlier this year.

U.S. firms are also seeing more trouble spots abroad. Starwood Hotels & Resorts Worldwide Inc. late last month lowered its earnings guidance for the rest of the year. "We are starting to see a few non-U.S. markets also being impacted...like London, Paris and Tokyo," said Vasant Prabhu, the company's chief financial officer, in a call with analysts.

A prime example of the global slowdown is Britain, which is getting hit by a housing downturn, tighter credit and lofty commodity prices. In England and Wales, some 3,560 companies were either forced into liquidation or did so voluntarily during this year's second quarter, a 15% increase form the year-earlier period, according to government figures.

Cains Beer Co., Liverpool, England, has seen revenues at the 100 pubs it owns suffer as consumers cut spending. The cost of making beer at the 150-year-old brewer increased as the price of hops shot up. It also faced a 40% increase in the cost of aluminum for beer cans over the past year or so.

With banks across the U.K. becoming more cautious about making loans, Cains's bank, the Bank of Scotland, said it wouldn't be offering any more credit on Aug. 7. Unable to borrow to pay off a large tax bill it owed, Cains put itself into "administration," the process of selling off a company or its assets to pay debts. "A year ago, two years ago, one bank said 'no,'" recalls Cains Chief Executive Sudarghara Dusanj, "another said 'yes.'"

British consumers are hunkering down. "The cost of living has rocketed," says Gareth Lucas, 34 years old. He works part time at a hospital in Swansea, south Wales. With fuel costs so high, Mr. Lucas tries to fit more tasks into each car trip and no longer treats himself to cappuccino at a nearby café.

At night, to make extra cash, Mr. Lucas does gigs as a stand-up comedian -- but increasingly he performs to smaller audiences. "People just aren't going out anymore," he says.

In Continental Europe, the European Central Bank has been more hawkish on inflation than the U.S. Federal Reserve. The ECB raised its key lending rate a quarter point to 4.25% in July. Before that, it had kept rates steady throughout the credit crisis that began to unfold last summer -- even as the Fed cut its target rate deeply. Those higher interest rates, too, are weighing on Europe's economy.

For European exporters, the persistently high euro has been an increasing burden since 2006, when it began to strengthen from around $1.20 to nearly $1.60 earlier this year. It has also gained against the pound, the currency of the U.K., one of its major trading partners. The euro has fallen against the dollar, but still remains painfully high for European exporters.

Exports from France, Italy and Spain were the first to suffer, since many make consumer products such as household appliances, shoes and clothing that compete directly with goods made in Asia, where most currencies haven't risen as strongly against the dollar.

German exporters coped better until the past few months, thanks to their greater specialization in goods such as machine tools and luxury cars, which are less price-sensitive than mass-market consumer goods. But car makers such as BMW AG and Daimler AG say they're hurting in the U.S. market, partly because a generally weak dollar in recent years has made European cars costlier to American buyers paying in dollars.

The past few months, German exports have started to slow markedly. The slowdown in global demand is more important than the high euro, many companies say. "It can't be denied: Growth is clearly flattening," says Karl Haeusgen, chief executive of Munich-based HAWE Hydraulik, a midsize company typical of Germany's large engineering industry.

Sales of equipment to construction-related industries world-wide are falling as a construction downturn grips countries on both sides of the Atlantic. In Japan, manufacturers have been unable to pass their higher raw-material costs through to the prices they charge, shrinking their profit margins. And because Japanese manufacturers import most of their raw materials, and export much of what they make, manufacturers' inability to pass on higher costs is weighing on the economy at large.

Japanese companies are seeing the global slowdown cut into overseas sales. Manufacturing remains a much larger part of Japan's economy than in the U.S. Last week, Toyota Motor Corp. said profits were 28% below their year-ago level in the quarter ended June 30. North American sales have been weak since last year, but now the sluggishness is spreading: The car maker said it sold 9% fewer cars in Europe than it did a year earlier.

Funds See Inflation Falling, Dollar Rising

Fear of a worldwide recession is actually helping the dollar gain ground after months of decline. Investors around the world think that a global slowdown will be bad for foreign economies, so they are buying up U.S. assets. The dollar is already down 10.4 percent from its high against the euro of 1.60 set on July 15.

Since they need dollars to do that, the flight to quality is also strengthening the greenback. According to a new Merrill Lynch survey, fund managers' fear of inflation has hit its lowest level since 2001. Now, 18 percent of fund managers think global core inflation (that is, inflation minus food and energy) will actually fall in the coming 12 months. Falling oil prices, which feed into other products by driving up production and raw materials costs, is behind the change of views.

Plus, 24 percent of the fund panel now think that the global economy has already entered a recession, up from 20 percent in July and 16 percent of them in June. Meanwhile, just 9 percent think that companies are under leveraged, down from as high as 40 percent believing so at the end of 2007.

"The message from investors to corporates is that if we are headed for a recession, they should clean up their balance sheets and prepare a financial buffer," says Karen Olney, chief European equities strategist at Merrill Lynch. "As banks de-lever, non-financial corporates will have to wake up a to far less flexible world of credit."

All this adds up to money flowing from emerging economies, where investors have been betting on higher, and safer, returns, and back to dollar-based assets. It's a bet that can pay off in two ways: There is the safety and potential upside of a U.S. recovery, but many managers also have come to believe that the dollar is undervalued. Thus, investments in dollars can gain from both equity and currency appreciation.

Seventy-one percent of fund managers now call the euro "overvalued," according to the survey. Investors also believe that the United States has a better corporate profit outlook and higher quality earnings than the eurozone.

In Europe itself, investors have begun to sell shares in oil producers and instead are buying discretionary consumer stocks, like retail stores, and electronics manufacturers. Technology and media companies, which depend on consumers to prosper, are back in favor, Merrill Lynch reported.

Meanwhile, European investors as a group are even less concerned about inflation than the global panel. Nearly half think inflation will fall over the next 12 months. "The market appears to have overreacted to a fall in the oil price, and investors have turned a blind eye to second round effects of inflation, such as rising wages," said Olney.

"It will take several months of slowing global growth to be sure that the inflationary dragon has been slain."

Lehman Brothers in talks over sale of $40 billion real estate assets

Lehman Brothers, the Wall Street investment bank, is understood to be in talks to sell its entire $40 billion (£21.5 billion) real estate portfolio in a move to stem losses incurred during one of the worst property slumps since the Great Depression.

The bank – whose stock has fallen 69 per cent since the credit crisis erupted just over a year ago – is believed to be prepared to take a $5 billion hit on the sale of the assets and securities. Lehman is believed to have begun sale negotiations with firms such as Blackstone, the private equity group, and BlackRock, the fund manager.

However, it is thought that Lehman is optimistic about the price it might secure for the portfolio even though both residential and commercial real estate assets have collapsed in value. Some mortgage-backed securities – which are collateralised by residential real estate – are so untradeable, they are effectively worthless.

It is thought that the bank, which is headed by Richard Fuld, is considering whether to hive off its real estate portfolio and float it in the event that it fails to sell the assets to buyers such as private equity or fund managers. It is also believed that Mr Fuld is prepared to sell the assets off as a whole or piecemeal to the highest bidder.

Such a deal would echo the transaction made by Merrill Lynch, which sold the bulk of its portfolio of collateralised debt obligations this month. The last 12 months have been tough for Lehman Brothers. After the collapse of Bear Stearns – then Wall Street’s smallest investment bank – capital markets speculated whether Lehman, which is heavily exposed to the US housing market, would be next.

Shares in the bank sank rapidly this year on rumours that it was suffering a problem with liquidity. Those alleged problems were swiftly denied. Last month there was also speculation on Wall Street that Lehman was considering a range of options to put a floor under its plummeting share price, including a possible strategic alliance.

Lehman Brothers announced plans in June to raise $6 billion by issuing new shares as it unveiled a larger-than-expected $2.8 billion loss for its second quarter. The results were dragged down by about $4 billion of writedowns on Lehman’s mortgage and private equity-related investments, and were well below the loss of $300 million to $1 billion that most analysts had predicted. They represented the first loss since Lehman went public in 1994 and compared with a $1.26 billion profit the year before.

Worryingly, Lehman said that many of the British mortgage-related assets on its books had become virtually impossible to value. This is in marked contrast with its first quarter, when the assets had been fairly easy to value, according to Erin Callan, Lehman’s then chief financial officer.

Barclays battered on write-down fears

Barclays, HBOS, and other British banks may have to raise new capital to cover escalating losses on toxic debt and meet fresh needs if the economy slides into recession, according to analysts at Merrill Lynch.

The US investment bank said the European banking sector as a whole had not yet revealed the full damage from US mortgage debt, warning that lenders across the region may face another $120bn in write-downs.

"We do not believe in a V-shaped recovery for bank shares. We fear they could weaken again in coming months as more bade news comes through," he said Stuart Graham, Merrill's chief European bank strategist.

"We see a danger that European banks will have to raise new capital, though how bad it will be depends on what happens to US house prices. Barclays and HBOS may be among them. "We are concerned about their starting level of capital and the low level of mark-downs on structured credit," he said.

Barclays' share price tumbled almost 9pc in early trading today to 346.00p and were down 1.7pc in early afternoon trading. The shares closed down 7.1pc on Wednesday. It follows a powerful rally since mid-July. HBOS is also down heavily this week.

Merrill Lynch said it had conducted a "stress test" on European lenders that assumes a total 34pc fall in US property prices. This is the current expectation built into derivatives contracts, although critics say this overstates the likely damage.

The test also assumes a recession in both Britain and Europe, as well as a continued squeeze in wholesale bank funding at roughly at today's level - but far below the extremes reached in March during the Bear Stearns crisis.

The test did not include possible losses from a fresh wave of defaults linked to property slumps in Spain, Ireland, Scandinavia, and potentially in Eastern Europe. There are already signs that European banks are facing write-downs from EU-area asset-backed securities. This is a new risk.

The Irish brokers Goodbody issued a report this week warning that Irish house prices could fall 40pc from peak to trough. Falls of this order would present a serious challenge to some Irish lenders. Barclays wrote down £2.8bn last week. It has raised £4.5bn in fresh capital so far, mostly from Mid-East and Asian funds.

However, Barclays plans to use half of the cash raised to expand the business and also, unlike some rivals, has not cut its dividend and will pay it in cash. The bank's interim report on August 7 shows that mix of US property debt is relatively benign, since much of it relates to earlier vintages where default rates are lower.

Most of Barclays' £3,738m exposure to residential mortgage backed securites (RMBS), which stems from subprime and Alt A debt, comes from the 2005 vintage or earlier. This is marked down to 76pc. The 2006 vintage is fare worse: marked down to 30pc.

Barclays also has almost £11bn of commercial mortgages, £2.6bn of monoline insurer exposure, £5bn of net leveraged finance, and a mix of other instruments.

HBOS has raised £4bn of fresh money, but not without difficulty. Just 8pc of the original offering in July was taken up by investors before the deadline expired, although underwriters have since managed to find buyers. Any further requests for capital may receive an icy welcome.

"Having successfully obtained £4bn of fresh capital, this makes HBOS the best capitalized of any major UK bank and one of the best capitalized in Europe," said a spokesman. Mr Graham said European banks were now suffering harsher conditions than US banks, explaining why their share prices are now under so much pressure.

The dramatic fall in US interest rates to 2pc has created a steep "yield curve", allowing US lenders to repair their balance sheets by taking advantage of the wide spread between short-term rates and yields on long-term bonds. This is the time-honoured method of restoring the health of banks.

By raising eurozone rates to 4.25pc, the European Central Bank has created an "inverted yield curve". This leaves banks at the full mercy of the credit crisis. It accounts for the continuing stress in the interbank lending markets. One-month Euribor is still at 5.31pc, up well over 100 basis points since the crunch began a year ago.

Richard Bernstein, Merrill's chief strategist in New York, rattled Wall Street this week with warnings that the credit crisis is "far from over". He predicted another wave of heavy losses after a downward lurch in US credit conditions in July. The bank downgraded rivals Goldman Sachs, Lehman Brothers, and Morgan Stanley.

The expiry of a temporary freeze on short-selling of key financial stocks has knocked away as key prop for US bank shares. The stocks soared in late July as hedge funds were forced to buy back stocks in a severe "short squeeze". It is the latest example of one-sided intervention by the US authorities. They never stepped in to cap excessive moves upwards during the bubble.

Merrill Lynch itself has set the bar for losses at a punitive level by selling a $30.6bn CDOs to Lone Star for $6.7bn, or 22pc on the dollar. Some tranches were written off with a 100pc loss. The move has put intense pressure on other banks to follow suit.

European Stocks Fall on Bank Concerns

European stocks had the biggest weekly drop in a month after JPMorgan Chase & Co. reported a $1.5 billion loss on mortgage-backed assets, deepening concern that banks will post more writedowns.

Hypo Real Estate Holding AG fell as the German lender said profit tumbled 95 percent. Standard Chartered Plc sank after analysts downgraded the shares on speculation the bank may have to raise capital. Swiss Life Holdings led insurers lower after it agreed to buy stakes in MLP AG and AWD Holding AG. Eurasian Natural Resources Corp. paced a retreat among mining companies.

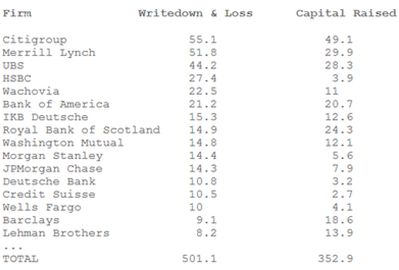

Europe's Dow Jones Stoxx 600 Index slipped 0.7 percent to 287.25, the steepest decline since the week ended July 11. The benchmark is down 21 percent this year as asset writedowns and credit losses at financial firms topped $500 billion worldwide, threatening to prolong the slowdown in global economic growth.

JPMorgan's figures "spooked investors and triggered profit-taking in financials," said Piers Hillier, the London- based head of European equities at WestLB Mellon Asset Management who oversees the equivalent of $8.8 billion. "Concern Standard Chartered will need to raise more capital didn't help. We've also seen a sharp fall-off in commodities."

Crude oil, gold, silver and copper all retreated this week as a strengthening dollar reduced the appeal of commodities as alternative investments. National benchmark indexes declined in 11 of the 18 western European markets. France's CAC 40 dropped 0.9 percent. The U.K.'s FTSE 100 fell 0.6 percent, while Germany's DAX sank 1.8 percent.

Economic reports also weighed on equities as higher-than- forecast U.S. consumer prices and jobless claims added to concern inflation is accelerating while growth slows. Europe's economy contracted in the second quarter for the first time since the launch of the euro almost a decade ago, data also showed.

JPMorgan, the second-biggest U.S. bank by market value, said it lost $1.5 billion on mortgage-backed assets in less than two months and that subprime writedowns are expected to continue to rise "significantly" during the second half of this year, with "deterioration" expected to continue into 2009.

Hypo Real Estate declined 6.5 percent after Germany's second-largest commercial-property lender said second-quarter pretax profit plunged 95 percent because of writedowns on debt- related investments. Deutsche Bank AG, Germany's biggest bank, fell 3.1 percent. Barclays, the U.K.'s third-largest lender, retreated 4.6 percent. Europe's Stoxx 600 Banks Index has lost 30 percent this year, the steepest slump among 18 groups in the broader index.

Earnings for financial firms in the Stoxx 600 will decline 25 percent this year, more than 13 times the projected drop for all companies in the measure, according to analysts' estimates compiled by Bloomberg. Forecasts at the start of the year saw profit for the group increasing 4.5 percent.

Standard Chartered retreated 11 percent. Citigroup Inc. cut its recommendation on the shares to "sell" from "hold," saying the U.K. bank that earns most of its money in Asia faces "a choice of slower growth or having to raise equity to support its capital ratios."

Swiss Life slumped 16 percent after Switzerland's largest life insurer agreed to buy stakes in MLP and AWD from AWD Chief Executive Officer Carsten Maschmeyer for a total of 427 million euros ($627 million). UBS AG downgraded Swiss Life shares to "sell" from "neutral," citing the risk of further earnings dilution if the company were to bid for MLP.

ENRC declined 14 percent. Kazakhmys Plc, Kazakhstan's biggest copper producer, paid 402 million pounds ($750 million) to raise its stake in the ferrochrome producer to 25 percent. Kazakhmys shares lost 6 percent. Xstrata Plc, which is making a hostile 5 billion-pound bid for Lonmin Plc, dropped 3.8 percent. Norsk Hydro ASA, the world's fifth-largest aluminum producer, fell 4.7 percent.

Michael Page International Plc, the U.K.'s second-biggest recruitment company, sank 11 percent after saying it rejected a 1.3 billion-pound takeover from Adecco SA and ended talks. CSM NV tumbled 19 percent, the steepest drop in the Stoxx 600. The world's largest supplier of ingredients to bakeries said first-half profit slumped 63 percent from a year earlier, when the company had a gain from selling its sugar unit. CSM also forecast price increases would hurt sales in the U.S. this year.

Arcandor AG sank 12 percent. Germany's biggest department- store operator reported a third-quarter loss, said operating profit fell and cut its forecast after sales at the company's Karstadt chain declined. William Demant Holding A/S lost 14 percent. The world's second-largest hearing-aid maker said first-half profit fell 18 percent after the economic slowdown in the U.S. curbed demand for its most expensive products. Earnings missed analysts' estimates.

European Bonds Rise for Third Week on Signs Economy is Shrinking

European government bonds advanced for a third week as mounting evidence the region's economy is contracting made it less likely the European Central Bank will raise interest rates.

The gains sent yields to the lowest level in 12 weeks. The European Union said Aug. 14 gross domestic product fell 0.2 percent in the second quarter. Separate data showed the German and French economies shrank. Bonds stayed higher after a private poll yesterday showed optimism about Germany's economic outlook fell in June to the lowest level in more than five years.

"We expect the euro-area economy to cool further and we may see the ECB preparing to cut rates," said Niels From, chief analyst in Copenhagen at Nordea Bank AB, Scandinavia's biggest lender. "Risks for the economy are still on the downside and any rise in yields will be temporary."

The yield on the 10-year German bund, Europe's benchmark government security, fell 1 basis point to 4.19 percent by 4 p.m. in London. It dropped 7 basis points this week, after sliding to 4.18 percent on Aug. 13, the lowest level since May 21. The price of the 4.25 percent bond due July 2018 gained 0.53 this week, or 5.3 euros per 1,000-euro ($1,473) face amount, to 100.42. The yield on the two-year German note was at 4:01 percent.

The 10-year yield may drop to 4 percent in 12 months, while that on the two-year note may slip to 3.7 percent, From said.

Traders have reduced bets the ECB will raise interest rates a second time this year, with the implied yield on the December Euribor futures contract dropping 2 basis points since Aug. 1, to 5.02 percent.

UBS AG, the world's second-biggest foreign-exchange trader, expects the ECB to keep interest rates on hold through the rest of 2008, changing an earlier prediction for an increase in borrowing costs in September. Economists at the Zurich-based bank said growth slowed "more rapidly than initially expected" and policy makers will lower rates in the first quarter of next year, according to a client note yesterday.

The difference in yield, or spread, between 10-year bunds and similar-maturity U.S. Treasuries was at 29 basis points yesterday, down from 41 basis points July 31, reflecting falling investor expectations that the ECB will lift rates. Analysts and politicians are talking down the economy and this may have "a negative impact on business and consumer sentiment," the International Herald Tribune cited ECB policy maker Juergen Stark as saying Aug. 14.

The share of people who see Germany in an economic decline rose to 45 percent, from 26 percent in June, according to a Forschungsgruppe Wahlen poll for ZDF television. Fourteen percent of respondents said the economy is in an upswing, down from 26 percent in June, ZDF said yesterday.

Euro-region growth will be "particularly weak" through the second and third quarters, ECB President Jean-Claude Trichet said Aug. 7, when the central bank kept its main interest rate at 4.25 percent, the highest level in seven years. The Ifo research institute will cut its forecast for German economic growth this year to about 2 percent from 2.4 percent, Wirtschaftswoche reported yesterday, citing an interview with Hans-Werner Sinn, Ifo's president.

Bonds rallied as the EU said the region's economy contracted for the first time since the introduction of the euro in 1999 during the second quarter. Another report showed German GDP fell an adjusted 0.5 percent from the first quarter, when it rose a revised 1.3 percent.

Index-linked bonds signaled investors are reducing their inflation expectations, with the difference in yield between the five-year French inflation-protected note and its regular counterpart falling 2 basis points yesterday to 2.19 percentage points. The difference, the so-called breakeven rate, was at a record 2.83 percentage points on July 3.

Gains by bonds may be limited as some investors bet yields don't reflect the risk of the ECB raising rates to curb inflation, which quickened to 4.1 percent last month, more than twice the bank's 2 percent ceiling. "It's too early to completely price out the risk of the ECB raising rates," said Andre de Silva, global deputy head of fixed-income strategy in London at HSBC Holdings Plc, Europe's biggest bank by market value.

"Inflation is stubbornly high and we might see a flatter curve." The 10-year bund yielded 18 basis points more than the two- year note, which is more sensitive to the interest-rate outlook, a 3 basis-point narrowing of the spread since Aug. 8. European government bonds returned 2.3 percent this year, while U.S. debt earned 3.3 percent, according to Merrill Lynch & Co.'s EMU Direct Government and U.S. Treasury Master indexes.

EU Politicians Trying to Stall Hedge Funds

Politicians in the European Union are using an obscure anti-trust law as jurisdiction to give them legal leverage to curtail hedge funds and other speculators, and rein in oil and food prices on the Continent. This could spell trouble, says Ambrose Evans-Pritchard.

"Any such attempt to restrict the futures and derivatives markets would have a major impact on the City of London and Dublin's financial industry. It's far from clear whether Britain could muster a blocking alliance in the current anti-market climate," Evans-Pritchard writes in The Telegraph. If enacted, the policies may also stifle American hedge funds too.

According to Evans-Pritchard, politicians have been "scouring" through law casebooks, and have found Article 81 of the European Union treaty, which prohibits anti-competitive deals between businesses in Europe. The governments of Italy, France and Germany, particularly the Social Democratic Party, are "agitating" for legal action against "asset-stripping locusts," Evans-Pritchard writes, explaining this term is being used to describe "private equity groups and hedge funds."

If the policy moves are successful in the European Commission, or European Parliament, or European Court for Justice, they could wreak havoc on the financial industry in London, Evans-Pritchard writes. The socialists are apparently enjoying something of a resurgence, thanks to the global financial crises of the last few months.

Tony Robinson, chief spokesman for the Socialist Group in the European Parliament, said the capitalist system had disgraced itself and must now face much stricter regulation," writes Evans-Pritchard. Evans-Pritchard believes that EU lawyers can gain leverage outside of the EU, using the same sort of tactics they used seven years ago to stop the Honeywell-GE merger from being approved for business in Europe. That policy has cost the new company all of its European sales.

China's Economy Slows on Weaker Production, Olympics Closures

China's growth is cooling and may spur the government to ease lending restrictions, provide more export-tax rebates and stall yuan appreciation, analysts said after economic reports this week.

Industrial production grew in July at the weakest pace in 16 months amid faltering orders for Chinese exports. Consumer prices rose the least in 10 months, giving policy makers room to boost the economy without fueling inflation.

The slowdown in China, which powered almost 30 percent of the global expansion last year, may be exacerbated by factory closures aimed at cutting pollution during the Beijing Olympics, according to Goldman Sachs Group Inc. The central bank yesterday said it would "fine-tune" monetary policy as weaker overseas demand for the nation's goods poses risks to the economy.

"Concerns over China's export health will translate into a complete reversal of the current tightening policy," said Donald Straszheim, vice chairman of Newport Beach, California- based Roth Capital Partners. "Maintaining economic growth is now number one."

China's economy grew 10.1 percent in the second quarter, the fourth consecutive slowdown, prompting Communist Party leaders to put a bigger emphasis on maintaining growth and protecting jobs. Government statements in the past month have dropped references to a "tight" monetary policy.

"China needs much faster growth than an average Western country as it has to generate 10 million jobs a year," said Tao Dong, chief Asia economist at Credit Suisse Group AG in Hong Kong. "Eight percent growth in China is equivalent to a recession. Below nine percent would make the authorities quite nervous."

Economic statistics for July released in the past week showed a mixed picture. Exports rose, retail sales climbed the most since 1999 and spending on factories and property increased. At the same time, weaker production growth foreshadowed softening demand for Chinese goods as the U.S., Japanese and European economies falter. A government-backed survey earlier this month showed export orders falling to a record, suggesting shipments may ease in coming months.

The People's Bank of China yesterday said demand from abroad "will continue to weaken." The central bank has halted the yuan's appreciation, making exports more affordable to overseas buyers. The yuan fell 0.2 percent to 6.8700 against the dollar today for a fourth weekly loss, the longest stretch since a peg to the U.S. currency was scrapped in 2005. The Chinese currency gained 6.6 percent in the first half, double the pace of a year earlier.

Factory closures and restrictions on construction, mining and motor vehicles to reduce pollution for the Olympics will also be a drag on growth in August and September, Goldman Sachs said in an August 8 report. Factories closed in Beijing and the surrounding areas account for 26 percent of China's economy, according to Goldman.

Inflation slowed to 6.3 percent in July, giving the government more leeway to promote growth. The government has already raised loan quotas for banks to help small and medium- sized businesses and increased tax rebates for exports of textiles and garments.

"Beijing wants her export sector to thrive," said Roth Capital's Straszheim. "Since 2004 double-digit economic growth has been taken for granted." Policies to sustain growth in Asia's second-largest economy could put a floor under raw material prices, helping commodity- dependent countries from Australia to Brazil.

China has the funds to pay for pro-growth policies, according to Credit Suisse. The country has a budget surplus of 1.5 percent of gross domestic product and currency reserves equal to 45 percent of GDP. "Without this firepower we would be very negative on both China and commodities," said Andrew Garthwaite, an economist at Credit Suisse in London.

China plans to spend 3.8 trillion yuan ($550 billion) on transportation and infrastructure in its five-year plan running through 2010 and this year is tripling annual spending on railways to 300 billion yuan.

"New policy measures to support growth could include further tax rebates for low-end exporters, an easing of lending quotas, slower yuan appreciation or even depreciation," said Glenn Maguire, chief Asia-Pacific economist at Societe Generale SA in Hong Kong. "China is returning to the investment-heavy growth model we saw in 2003 and 2004."

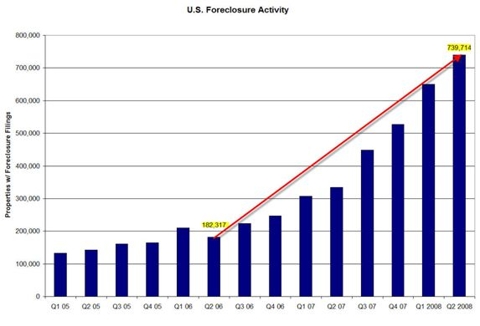

Ilargi: A bit of reference: while the UK complains of clogged-up courts with less than 10.000 reposessions per month, in the US there are over 200.000 foreclosures per month these days, more than 20 times as much.

Surge in repossession orders clogging up UK courts

Courts are having to delay adoption hearings and personal injury claims to deal with a surge in mortgage repossessions.

County courts in England and Wales issued 28,658 repossession orders between April and June as banks and building societies clamped down on borrowers who fell behind with mortgage payments. The volume of repossessions, up 24 per cent on the same period last year to the highest level since 1992, at the end of the last recession, has alarmed judges.

On a single day this week, Judge Stephen Gerlis, a district judge at Barnet County Court, in North London, heard 45 repossession cases. His court has appealed for additional part-time judges to help with the caseload. “The only way that extra cases can be accommodated is by squeezing out less urgent ones,” Judge Gerlis told The Times. “They have been steadily increasing for at least the past two years and are now accelerating at an alarming rate.”

He said that the increase in repossession applications was causing havoc with court schedules, because these applications must legally be dealt with within eight weeks of being filed. The court previously set aside one day a week for hearing repossession orders, and two days each for family cases and small claims.

Most days are now dominated with applications from people whose homes were about to be seized. People waiting for the court to hear other civil matters, including adoption applications, contract disputes and personal injury claims, have been forced to wait hours or even days while judges deal with the repossession cases.

Judge Stephen Gold, who sits at Kingston-upon-Thames County Court, in South London, had also experienced an increase in repossession cases but so far the court had been able to cope. He said that the courts had managed to deal with other sudden “blitzes” of cases, such as the recent claims over bank charges.

Lenders issued 39,078 claims for repossession in the past three months, according to figures published by the Ministry of Justice, 17 per cent more than a year ago. Not all are granted and in some cases borrowers come to a late arrangement to pay.

According to separate figures issued by the Financial Services Authority, the number of people who missed three or more mortgage payments doubled in the first three months of this year to 300,000, which suggests that many more homeowners could be at risk of repossession. So far 18,900 homes have been repossessed this year, 6,100 more than in the first six months of last year.

Housing charities have accused banks and building societies of becoming more aggressive in pursuing homeowners who fail to keep up with their payments. Andy Sampson, chief executive of Shelter, the housing charity, said that mortgage lenders were using repossession as a first, rather than last, resort.

Not all repossession orders result in borrowers losing their homes, as homeowners can still negotiate with lenders after the order is issued. Earlier this year, the Civil Justice Council, the body responsible for advising the Lord Chancellor on civil law, issued a set of draft guidelines that would require lenders to seek a compromise with defaulting borrowers and avoid legal action unless necessary.

The guidelines, which are based on existing rules that govern disputes between landlords and tenants, will be handed to the Ministry of Justice’s rules committee for endorsement in October, with a view to being implemented in March next year.

The number of bankruptcy petitions also rose to nearly 20,000 in the three months to June. More than 15,300 people petitioned for bankruptcy while creditors sought to force a further 5,625 people into becoming insolvent. The total number of petitions was 5 per cent higher than in the same period last year.

Gordon Brown's problem is the dollar

Gordon Brown has frequently reminded people that he has guided the economy through the longest unbroken period of growth since the dawn of the industrial revolution.

Whether or not this run comes to an end in the coming quarters as the UK economy slows sharply, history shows that the Prime Minister's fate will depend less on his economic growth tally than on the strength of the pound - and the direct effect on inflation.

It is a lesson he would do well to learn, and for an example he need look no further than the story of Edward Heath in the early 1970s. When Heath lost to Harold Wilson in 1974, he did so despite presiding over economic growth of some 7.3pc the previous year.

It transpired, of course, that the economic vitality of the UK in the early '70s was very much an illusion, but at the time the main clue was not GDP growth but the drop in the value of sterling. And in an eerie parallel with today's situation, the pound was being driven lower not by domestic decisions but by the United States' monetary policy.

Three years earlier, under orders from Richard Nixon, US monetary authorities severed the dollar's link to gold, and it swiftly went into freefall. The UK foolishly mimicked the US monetary mistake, and the result was massive inflation that naturally coincided with rising commodity prices, including oil.

Though the pound only fell 3.1pc against the dollar from August of 1971 to 1975, but against other currencies and commodities it simply plummeted. Measured in pounds, gold rose 338pc. On the face of it it was Watergate which did for Nixon, but the weakness of the dollar and the sharp rise in inflation meant he suffered the same fate as Heath despite overseeing annualised economic growth of 8.8pc in the first quarter of 1973.

Roll on to today, and the pound's weakness helps explain why Brown's hold on power is so tenuous. The pound may have risen 41pc against the greenback since June of 2001, but, in short, the pound is only strong right now insofar as the dollar is very weak.

While gold, oil and corn have respectively risen 244pc, 333pc and 188pc in dollars since June '01, the three commodities have risen 144pc, 203pc and 108pc in pounds over the same period. It explains why some measures of UK inflation are at 18-year highs. Brown's mistake with the 10p tax rate pales into comparison against the greater effective tax on earnings that inflation has wrought.

Unfortunately US monetary authorities are the major miscreant. With the US political class mired in its latest bout with protectionism, the Treasury has itself spoken with a forked tongue regarding dollar strength. With the Treasury not defending the dollar amid heavy-handed commentary about new trade barriers, the market's reaction has been predictable with a sell-off of the currency.

Sadly, its fall has led to what my Wainwright colleague David Ranson terms a "classic run on paper currencies." Seeking to keep at least some measure of currency parity with what is the world's largest importer, central banks around the world have yet again mimicked our monetary mistakes.

Evidence supporting this claim includes inflation that has reached a 16-year high in Euroland, along with inflation at an 11-year high in China despite the yuan's 18 percent rise against the dollar since July of 2005. That government measures of inflation stateside are somewhat quiescent merely speaks to the faulty nature of our own calculations.

Make no mistake: the world is inflating at present, and with the US dollar the weakest of all major currencies in recent years, inflation is most pressing in the United States. Unsurprisingly, the political result has been much the same as it was in the mid-'70s.

Despite presiding over tax cuts and a war that is being fought continents away, President George W. Bush's approval rating is right now the lowest of any president's in over 70 years. Similarly, YouGov has found that the Labour Party is more unpopular than it has been in the 65-year history of polling.

Remarkably, a recent story about Mr. Brown's troubles in the Wall Street Journal referenced a gathering of "10 finance and legal professionals" in which "no one could come up with a way for Mr. Brown to boost the economy." That's surprising considering the strong historical correlation between inflation and economic malaise. The latter in mind, Mr. Brown's solution is simple, and it involves strengthening the pound.

Importantly, shoring up the pound's weakness need not involve increases in the Bank of England's bank rate. Instead, the answer is to be found in Nigel Lawson's autobiography, The View from No. 11: show the market where you want the pound to be.

As Lawson wrote, once he made apparent his desire for a 3DM/Pound exchange rate, "the market started to do much of the stabilizing for us, selling sterling when it approached DM3 and buying sterling whenever it dipped below it." Mr. Lawson was actually able to reduce England's bank rate afterwards with the City's traders doing his work for him.

Gordon Brown's problem is inflation and the massive tax increase it forces on all of England's voters. With all due haste he should get together with Alistair Darling and craft a Lawsonian plan to communicate to the markets a higher value for the pound. If he does, a large but hidden form of tax will be removed from the shoulders of British voters. If the pound is strengthened, voters' paychecks will go farther alongside a rise in Mr. Brown's popularity.

Pound Declines 11th Day, 4th Week Against Dollar, Longest Losing Streak in 37 years

The pound slid for an 11th day against the dollar yesterday, the longest run of declines in at least 37 years, on speculation a recession will force the Bank of England to cut interest rates.

The U.K. currency posted its fourth weekly drop after Bank of England Governor Mervyn King said Aug. 13 there was a "chill in the economic air" and a report showed unemployment climbed in July by the most in almost 16 years. Growth is being hurt as tourism flags and tax revenue fall. The pound tumbled about 6 percent since July 31.

"These are ferocious moves," said Simon Derrick, chief currency strategist in London at Bank of New York Mellon Corp. "The consensus has shifted. The talk three or four weeks ago was whether the central bank would hike rates. Now we've cemented the idea that a rate cut may come sooner."

The pound dropped 0.3 percent to $1.8650 in London, after falling as much as 1 percent, from $1.8698 on Aug. 14. The 11-day run was the longest since at least January 1971. The currency, poised late yesterday for a decline of about 3 percent in the week, tumbled to a more than two-year low. The pound also traded at 78.73 pence per euro, from 79.28 pence the day before.

Britain's currency may recover to $1.90, though investors should still sell it against the dollar over the longer-term, Derrick said. The U.K. economy will expand about 0.1 percent on a year-on- year basis in the first quarter of 2009, according to central bank forecasts published Aug 13. Its previous prediction was 1 percent. Growth has sputtered as house prices plunged. The property market came to a "virtual standstill" in July, the Royal Institution of Chartered Surveyors said this week.

At the same time, inflation running at 4.4 percent, the highest in at least 11 years, has limited the central bank's ability to reduce interest rates to revive the economy. Traders pared bets that the 5 percent benchmark interest rate will be left unchanged or raised. The implied yield on the March short-sterling futures contract dropped to 5.20 percent on Aug. 15 from 5.44 percent at the end of July.

The pound fell about 11 percent since reaching a 26-year-high of $2.1161 on Nov. 9 as the Federal Reserve slashed interest rates seven times to 2 percent from 5.25 percent since September. The BOE cut its main rate by 0.75 percentage point in the period.

"The market had thought the Fed had blundered while the Bank of England stood firm on inflation," said Derrick. "Now it's thinking the Fed had it absolutely right and has positioned the U.S. economy to cope far better than the U.K. will be able to do. There has been a fundamental shift in thinking."

The number of foreign tourists visiting the U.K. in the second quarter fell as financial concerns affect the economic outlook in other European countries, according to Britain's Office for National Statistics. Visits by overseas residents dropped 5 percent from the previous three months, seasonally adjusted, and in the year through June visitor numbers declined 3 percent.

Merrill Lynch & Co. booked $29 billion of losses from U.S. subprime mortgages and collateralized debt obligations through its U.K. unit, making it unlikely it will pay British taxes for years to come. Most of the losses were recorded this year, including $5 billion from the sale of $30.6 billion in collateralized debt obligations, the New York-based firm said in an Aug. 5 filing with the U.S. Securities and Exchange Commission.

"We are seeing the start of what we believe is going to be an aggressive move lower in yields and also the pound as the bearish developments in asset markets and the economy continue to overwhelm," a team led by Tom Fitzpatrick, global head of currency strategy in New York at Citigroup Global Markets Inc., wrote in an investor report Aug. 14.

Technical indicators suggested the pound may be due for a recovery. The 14-day relative strength index fell to 16.2 yesterday, similar to "Black Wednesday" in 1992, when the pound was forced out of the Exchange Rate Mechanism that tied its value to other European currencies. A reading below 30 can signal a change in price direction.

The pound's losing streak is the longest since at least 1971, when Britain was two years away from joining the European Economic Community, a precursor of the European Union, and U.S. President Richard Nixon ended the so-called gold standard. The pound averaged about $2.44 that year.

This month's decline may deepen the unpopularity of Prime Minister Gordon Brown, whose Labour Party lags behind the opposition Conservatives in opinion polls. Labour has been criticized because of slower economic growth amid rising food and fuel prices. "The Prime Minister's rating has just been in a downward direction and it is picking up pace," said Greig Baker, research director at the polling company ComRes.

Government bonds rose, with the yield on the 10-year gilt falling 6 basis points to 4.58 percent. The yield dropped 11 basis points in the week. The price of the 5 percent security due March 2018 rose 0.44, or 4.4 pounds per 1,000-pound ($1,865) face amount, to 103.23. The yield on the two-year gilt, which is more sensitive to the outlook for interest rates, dropped 3 basis points to 4.53 percent, down 14 basis points since Aug. 8. Bond yields move inversely to prices.

The pound is already weaker than the level at which it's forecast to end 2008 against the dollar. The currency will be worth $1.89 and 80 pence per euro by year-end, according to the median forecast of analysts and strategists surveyed by Bloomberg. The yield on the 10-year note will end the year at 4.87 percent, according to a separate survey.

The pound fell 6.2 percent versus the dollar this year, after being little changed against the U.S. currency as recently as July 31. It's down 6.7 percent against the euro in 2008.

Pound could fall as low as $1.55, economist warns

The pound could fall to as low as $1.55 in the next 12 to 18 months as the dollar continues to strengthen, a leading economist warned.

Michael Saunders, head of European economics at Citigroup, said it "would not be a surprise" if sterling fell to levels last seen in 2002, despite rising above two dollars as recently as mid July. The pound slid to its lowest for two years today as the dollar surged further over fears of weakening economic growth in the eurozone.

Sterling was trading at $1.8572 just before noon, down from $1.8752 when the market closed yesterday. It was trading as low as $1.8514 earlier today. The weakness of the pound reflects the strength of the dollar, which is rising on concerns that the sharp economic slowdown in the US is now spreading to other countries.

Official figures yesterday showed that the European economy contracted for the first time since the launch of the euro in 1999, down by 0.2pc in the second quarter. The Japanese economy also shrank in the second quarter by 0.6pc.

The Bank of England's Governor, Mervyn King, warned on Wednesday that it was now almost inevitable that the UK would face "a quarter or two of negative growth", making the prospect of a recession very likely.

Gold fell below $800 an ounce in the Far East for the first time in eight months as part of a wider commodities sell-off in response to a stronger dollar. It continued to fall alongside oil, copper and precious metal when the market opened in London this morning.

Fears that the global slowdown is spreading has reduced the appeal of alternative investments. Paul Robson, currency strategist at RBS, said: "I would suggest that commodity prices are coming off because the dollar is going up but equally people have really got on board now with the fact that the world is not decoupling. "It is clear that Europe and Asia are really starting to slow now and it's not just the US."

Gold hit $788.50 an ounce at one stage during trade in the Far East, down from $811 in late trading in New York. It stayed below $800 when markets opened in London. Silver fell to its lowest level since last September. Platinum and palladium also fell.

In March gold was trading at a record highs above $1,000 but has lost its gains as the liquidity crisis feeds through to the global economy. OPEC has revised downwards its 2008 forecast for global oil demand growth to 1.17pc from 1.2pc, citing the weakness of the world economy in a report out today.

With oil coming off its recent highs above $147 a barrel - it opened down $1.86 at $111.82 in London - gold's role as a hedge against inflation has diminished. Some investors are betting that with figures out yesterday showing inflation rising in the US, the Federal Reserve will have little scope to raise rates.

"I am not surprised to see a breakthrough of $800 now, and I guess what's coming into play now is more technical selling below $800," Darren Heathcote of Investec Australia in Sydney told Reuters.

Small-business owners' outlook bleak

Is the country in a recession? While economists debate the question, small-business owners live it.

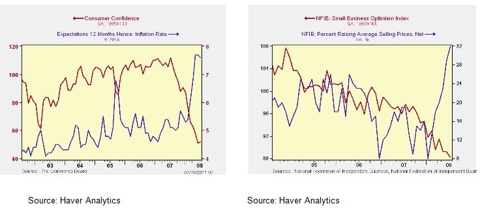

The National Federation of Independent Business' monthly Index of Small Business Optimism fell one point to 88.2 in July, continuing one of the longest strings of recession-level readings in the 22-year history of the survey. Weak capital-spending plans, lower earnings, a soft labor market and heavy inventory reductions contributed to the continuing decline.

Inflation remained the number-one concern of those polled for the second month in a row; the government announced earlier this week that inflation jumped to 5.6% in July, its highest point in 17 years. "I'd like to see the light at the end of the tunnel," said Tom Ulbrich, president and CEO of Mow More Landscape Supplies in Alden, NY.

Ulbrich, who also works at the University of Buffalo's Center for Entrepreneurial Leadership, speaks with small-business owners on a daily basis and sees a number of factors contributing to owners' frustration. "I've been hearing a lot about increasing costs of health care, fuel and materials," he said.

"In my own business, we have to get our lawnmower replacement parts from the south, then ship them back out for delivery, but the parts are heavy and the fuel costs are impacting us."

Spending activity has declined since September and has fallen to early '80s levels, according to the NFIB's poll results. Nearly half of respondents (48%) said their earnings were down in July compared to the previous three months, with weaker sales and higher materials costs weighing on companies' bottom lines. Employment also remains soft: 10% of those polled said they had hired new workers, but 15% reduced employment at their firm.

The NFIB's chief economist, Bill Dunkelberg, thinks the outlook is glum for the economy for the next six months. "That said, we should remind everyone that the U.S. is never uniformly in a boom or a recession," he said. "You really have to analyze what's happening in your market where you are and how it ties in to the fortunes of the larger economy."

Not all owners are pessimistic; some treat the recession as a creative challenge. Even in the hard-hit construction industry, 19% of owners polled by the NFIB said plan to expand their workforce, while just 12% intend to cut back - and while 13% have cut their selling prices, 48% said they hiked them.

Another glimmer of light: so far, the credit crunch remains a Wall Street problem and has not crimped small-business financing opportunities. Borrowing activity has stayed on pace with typical trends, and few owners say loans are hard to get.

"Our country was built on the entrepreneurial spirit and we will get through this," Ulbrich says. "Entrepreneurs are optimistic by nature, and although they may be being cautious right now, they're still looking for opportunities."

The good news is that the economy isn't as battered as small-business owners' optimism. The NFIB notes that its index showed similar numbers in grim days of the early '80s, but back then, inflation and unemployment were sharply higher than they are today.

But if you still want to hunker down, Dunkelberg suggests resisting buying a lot of inventory, collecting customer payments quickly, and paying slowly on receivables. He encourages discussions with your bank - a relationship that serve you well if it stays on friendly terms. Finally, he believes that advertising is critical. "Don't pull back on it," he says. "Customers are so important now."

New Zealand Quarterly Retail Sales Decline By Most in 13 Years

New Zealand's retail sales fell by the most in at least 13 years in the second quarter, when adjusted for inflation, as spiraling food and fuel prices left consumers with less to spend on dining out and clothes.

Sales slumped 1.5 percent from the first quarter, when they dropped 1.2 percent, Statistics New Zealand said in Wellington today. That was the first back-to-back quarterly decline in a decade. The median estimate of 12 economists surveyed by Bloomberg News was for a 1.8 percent decrease.

The biggest sales drop since the quarterly series began in 1995 adds to signs New Zealand's $105 billion economy sank into a recession in the first half of the year. Reserve Bank Governor Alan Bollard lowered interest rates for the first time in five years in July and said further cuts are likely as spending wanes.

"Consumers' wallets are well and truly shut," said Khoon Goh, a senior economist at ANZ National Bank Ltd. in Wellington. "We're in the midst of a retail recession and there's a strong likelihood of a negative print for second-quarter GDP."

New Zealand's dollar traded at 69.98 U.S. cents at 12:02 p.m. in Wellington from 69.76 cents before the report was released. The currency has dropped almost 10 percent against the U.S. dollar this year. Faltering consumer spending and a slump in the housing market probably pushed the economy into a recession in the first half of 2008, the Treasury Department forecast on Aug. 4.

Gross domestic product contracted 0.3 percent in the first quarter. ANZ National's Goh estimates the economy shrank 0.5 percent in the three months ended June 30. Second-quarter GDP figures are due in September. Bollard last month cut New Zealand's benchmark interest rate by a quarterpoint from a record 8.25 percent, where he had kept it since July 2007. He said spending is likely to remain weak amid a deterioration in the housing market and high gasoline prices.

"The Reserve Bank has a lot more work to do and will continue to cut the official cash rate in the coming months," said Su-Lin Ong, senior economist at RBC Capital Markets in Sydney. She forecasts another rate reduction in September.

Briscoe Group Ltd., which sells home-ware and sporting goods, said Aug. 4 that sales at its Rebel Sports stores fell 9.2 percent in the three months ended July 27. "Trading conditions continued to be challenging during the second quarter," said Managing Director Rod Duke. Profit margins were squeezed by a high level of discounting, he said.

The interest rate on a two-year fixed mortgage was 8.69 percent in June from 7.98 percent a year earlier, according to central bank figures. Gasoline prices jumped 35 percent in the same period, according to government figures. Consumer confidence slumped to a 17-year low in the second quarter, according to an index calculated by Westpac Banking Corp. House sales plunged 42 percent to a 16-year low in June, the Real Estate Institute said July 11.

In the quarter, supermarket and grocery-store sales fell 3.7 percent and vehicle sales dropped 4.8 percent. Core sales excluding vehicles dealers, fuel outlets and workshops declined 0.7 percent in the quarter. In June, sales rose 0.9 percent led by spending at vehicle dealers and on fuel. The monthly series doesn't adjust for higher prices. Economists surveyed by Bloomberg expected no change.

Ilargi: Very strong from James Quinn.