"Shorpy Higginbotham, a 'greaser' on the tipple at Bessie Mine, of the Sloss-Sheffield Steel and Iron Co. in Alabama.

Said he was 14 years old, but it is doubtful. Carries two heavy pails of grease, and is often in danger of being run over by the coal cars."

Ilargi: It seems almost blasphemous to keep talking about money when a colossal storm is approaching. It also feels like a hugely appropriate metaphor.

I'll be gone for the rest of the day. Wouldn't it be fun if Fannie and/or Freddie are nationalized today?

For the first time in human history, the North Pole can be circumnavigated

Open water now stretches all the way round the Arctic, making it possible for the first time in human history to circumnavigate the North Pole, The Independent on Sunday can reveal.

New satellite images, taken only two days ago, show that melting ice last week opened up both the fabled North-west and North-east passages, in the most important geographical landmark to date to signal the unexpectedly rapid progress of global warming.

Last night Professor Mark Serreze, a sea ice specialist at the official US National Snow and Ice Data Center (NSIDC), hailed the publication of the images – on an obscure website by scientists at the University of Bremen, Germany – as "a historic event", and said that it provided further evidence that the Arctic icecap may now have entered a "death spiral". Some scientists predict that it could vanish altogether in summer within five years, a process that would, in itself, greatly accelerate.

But Sarah Palin, John McCain's new running mate, holds that the scientific consensus that global warming is melting Arctic ice is unreliable. The opening of the passages – eagerly awaited by shipping companies who hope to cut thousands of miles off their routes by sailing round the north of Canada and Russia – is only the greatest of a host of ominous signs this month of a gathering crisis in the Arctic.

Early last week the NSDIC warned that, over the next few weeks, the total extent of sea ice in the Arctic may shrink to below the record low reached last year – itself a massive 200,000 square miles less than the previous worst year, 2005. Four weeks ago, tourists had to be evacuated from Baffin Island's Auyuittuq National Park because of flooding from thawing glaciers.

Auyuittuq means "land that never melts".

Two weeks later, in an unprecedented sighting, nine stranded polar bears were seen off Alaska trying to swim 400 miles north to the retreating icecap edge. Ten days ago massive cracking was reported in the Petermann glacier in the far north of Greenland, an area apparently previously unaffected by global warming.

But it is the simultaneous opening – for the first time in at least 125,000 years – of the North-west passage around Canada and the North-east passage around Russia that promises to deliver much the greatest shock. Until recently both had been blocked by ice since the beginning of the last Ice Age.

In 2005, the North-east passage opened, while the western one remained closed, and last year their positions were reversed. But the images, gathered by Nasa using microwave sensors that penetrate clouds, show that the North-west passage opened last weekend and that the last blockage on the north- eastern one – a tongue of ice stretching down to Russia across Siberia's Laptev Sea – dissolved a few days later.

"The passages are open," said Professor Serreze, though he cautioned that official bodies would be reluctant to confirm this for fear of lawsuits if ships encountered ice after being encouraged to enter them. "It's a historic event. We are going to see this more and more as the years go by."

Shipping companies are already getting ready to exploit the new routes. The Bremen-based Beluga Group says it will send the first ship through the North-east passage – cutting 4,000 nautical miles off the voyage from Germany to Japan – next year. And Canada's Prime Minister, Stephen Harper, last week announced that all foreign ships entering the North-west passage should report to his government – a move bound to be resisted by the US, which regards it as an international waterway.

But scientists say that such disputes will soon become irrelevant if the ice continues to melt at present rates, making it possible to sail right across the North Pole. They have long regarded the disappearance of the icecap as inevitable as global warming takes hold, though until recently it was not expected until around 2070.

Many scientists now predict that the Arctic ocean will be ice-free in summer by 2030 – and a landmark study this year by Professor Wieslaw Maslowski at the Naval Postgraduate School in Monterey, California, concluded that there will be no ice between mid-July and mid-September as early as 2013.

The tipping point, experts believe, was the record loss of ice last year, reaching a level not expected to occur until 2050. Sceptics then dismissed the unprecedented melting as a freak event, and it was indeed made worse by wind currents and other natural weather patterns.

Conditions were better this year – it has been cooler, particularly last winter – and for a while it looked as if the ice loss would not be so bad. But this month the melting accelerated. Last week it shrank to below the 2005 level and the European Space Agency said: "A new record low could be reached in a matter of weeks."

Four weeks ago, a seven-year study at the University of Alberta reported that – besides shrinking in area – the thickness of the ice had dropped by half in just six years. It suggested that the region had "transitioned into a different climatic state where completely ice-free summers would soon become normal". The process feeds on itself. As white ice is replaced by sea, the dark surface absorbs more heat, warming the ocean and melting more ice.

Lehman Brothers in urgent talks on capital injection

The Wall Street investment bank Lehman Brothers is this weekend locked in talks with a group of foreign government-backed investment funds in an effort to secure billions of dollars in new equity capital.

The Sunday Telegraph has learned that Lehman has intensified talks in recent days with Korea Development Bank, the South Korean ?government-backed lender, about a capital injection of as much as $6bn (£3.3bn). KDB has drafted in bankers from the heavyweight advisory boutique Perella Weinberg to provide counsel on the talks, which could be concluded this week.

The acceleration of the negotiations, which Lehman wants to have wrapped up before it reports third-quarter earnings in mid-September, underlines the urgency with which one of the US banking industry's most venerable names is seeking capital.

If the talks with the Koreans fall through, Lehman is lining up alternative investment from other sources, including Citic Securities, a Chinese brokerage which was on the verge of investing in Bear Stearns before its implosion earlier this year, which resulted in a cut-price takeover by JP Morgan, another Wall Street banking group.

Lehman is also holding talks with a number of sovereign funds from the Middle East, which have been invited to participate in a capital-raising. These are understood to include investors from Abu Dhabi and Qatar.

Under the structures being discussed by Lehman executives, including Richard Fuld, the bank's chairman and chief executive, KDB could buy up to 25 per cent of Lehman, which has a market value of just $11.2bn following a slump in its share price this year.

Alternatively, if it proceeds with a deal with Citic or the Gulf investors, Lehman is likely to sell no more than 10 per cent of itself to each of those funds, but could combine it with a broader equity-raising in the open market. Fuld, who is determined to avoid a sale of the bank's prized assets at distressed prices, is understood to have assigned several of his key executives to look at different fundraising scenarios.

Other options open to the Lehman board, whose members include Sir Christopher Gent, the former chief executive of Vodafone and current chairman of GlaxoSmithKline, include the sale of part or all of its asset management arm.Lehman's so-called "crown jewel", it includes Neuberger Berman, a highly rated fund management business. Analysts have valued the division at up to $10bn.

"The preferred option is not to sell any of it unless they cannot raise enough from external investors," said a person involved in the talks. Dozens of parties, including JC Flowers and Kohlberg Kravis Roberts, have expressed an interest in the business.

Fuld is also keeping Lehman's board appraised of plans to spin off the bank's troubled $40bn commercial real estate portfolio, which may result in the creation of a separately quoted company in which Lehman Brothers shareholders would be given equity. The demerger of the real estate assets would leave the investment bank with a cleaner risk profile and remove one of the main drags on its share price.

If the Korean, Chinese or Gulf institutions proceed with an investment in Lehman, it will be the latest in a series of international banking groups to tap the Middle East and Asia for capital since the credit crisis began just over a year ago.

In the US, Citigroup, Merrill Lynch and Morgan Stanley have been the principal recipients of such capital injections, while in Europe, Barclays, Fortis and UBS have sought new capital. Banking stocks have suffered a fresh battering on Wall Street in recent weeks following analysts' predictions that another major US financial institution will collapse.

At its earnings announcement next month, Lehman is expected to disclose further writedowns of about $4bn, to add to the $8bn in writedowns and losses already declared.

There have been suggestions in recent weeks that Lehman could become the target of a hostile takeover following the failure of an earlier round of talks with KDB and Citic. Potential buyers might include Barclays, although people close to both companies say no serious discussions have been held between them so far.

Foreign central banks sell Fannie and Freddie debt for sixth week

Foreign central banks sold $3.96 billion in agency debt this week, according to Federal Reserve data, adding yet more evidence that overseas investors are worried about the troubled mortgage giants.

The drop marked a sixth straight week of declines in offshore central bank holdings of bonds issued by government-sponsored entities (GSEs) like Fannie Mae and Freddie Mac, which have recently taken center stage in the U.S. housing crisis. It brought the total five-week decline to about $17.6 billion.

Overall, overseas institutions' total holdings of U.S. debt, including Treasury notes and bonds as well as agencies, rose $13.57 billion on the week to $2.409 trillion.

The overall rise came because foreign central banks bought government debt rather than agency debt, adding $17.53 billion to Treasury holdings on the week for a total of $1.441 trillion.

Overseas central banks, particularly those in Asia, have been huge buyers of U.S. debt in recent years, and own over a quarter of marketable Treasuries.

Foreign Central Banks and Agency Debt: 2000 to Present

Yesterday Reuters reported [1] that foreign central banks have been net sellers of agency debt, the senior debt of GSEs like Fannie Mae and Freddie Mac, for the sixth straight week. In order to get a better handle on the context for this story, Doom went to The NY Fed’s H.4.1 table [2] and extracted their weekly statistics on the holdings by foreign central banks of US treasuries and agencies. We collected [3] the data back to the start of the series on Wednesday Feb 9, 2000.When Twist performed her chart magic on the data some interesting trends emerged. From the start of 2007 to the present, agencies as compared to treasuries held by cenbanks increased smoothly from 52 to 74 percent, then fell off noticeably over the last few weeks. It is possible that the present GSE crisis is affecting the appetite for agency debt among foreign central bankers.

If we stretch the timeline for this graph back to the beginning of the data in early 2000, we see that the upward trend commenced in late 2004.

Agencies were only about 23 percent of treasuries then.

Simply graphing the absolute cenbanks holdings from 2000 tells an important tale. It’s evident that the foreign central bankers’ exposure to (mostly) Fannie’s and Freddie’s debt increased smoothly and exponentially throughout the great US housing bubble, and even through the first year and a half of the subprime crisis.

The big question is: What happens now?

Mortgage Fraud Is on the Rise, Infecting the GSEs

The Mortgage Asset Research Institute came out with its quarterly report which showed mortgage fraud is on the rise. This is curious, considering the heightened scrutiny that banks should be making during the "credit crunch". I just wanted to point out that the states which show the highest incidence of fraud are the same states which have eliminated the attorney and have substituted "settlement companies" staffed by non lawyers.

This would lead one to conclude that underwriters are still churning out loans to sell them into the secondary market to keep afloat, borrower representations and appraisal review be damned. The only difference is, the investment bankers who participated in the private market for these Mortgage Backed Securities [MBS] will no longer create or trade these ticking time bombs amongst themselves.

Instead, underwriters now need Fannie Mae and Freddie Mac to pass along these tin nickels to some poor investor. Guess who is going to foot the bill to pass along these lemons?

If you have been hearing a lot of talk about the Government Sponsored Agencies, and you don't know your CBO from your MBS, a very engaging article entitled "How Resilient are Mortgage Backed Securities to Collateralized Debt Obligations?" was presented at the Hudson Institute on February 15, 2007, by Joseph R. Mason and Joshua Rosner. This was an early warning of the credit crisis and is an extremely entertaining and enlightening read.

Why is it interesting? Because the academics are pointing out what the real estate practicioners have been seeing on the ground for years. We can talk about it on our boards and blogs but somehow, it doesn't really exist unless it gets printed in a journal. Go figure.

Finally, we all may be reading a lot of articles concerning the government "bailing out" Fannie Mae and Freddie Mac, but you will see the words "investors" "government" "market" and many other financial terms, but one word I rarely see is the word "homeowner".

Sometimes, financial analysts and talking heads forget that before you have a mortgage you need to have a homeowner. If we have these Government Sponsored Agencies, and the banks are getting money at 2 percent, and a 30 year mortgage is hovering at around 6.87 percent, how are the GSEs helping the homeowner? Explicame, por favor.

FHA(In)Secure

In a press release Friday, U.S. Housing and Urban Development Secretary Steve Preston bragged that his agency had helped more than 325,000 American families refinance into affordable mortgages since the housing crisis began.

"One year ago, the Bush Administration proactively provided an affordable safety net to homeowners who wanted to stay in their homes," said Preston. "Today, with the expansion firmly in place, hundreds of thousands of families are in a better place thanks to FHA [Federal Housing Administration]."

Specifically, Preston cited the success of the FHASecure program intended to help borrowers who missed mortgage payments. But according to data from the Federal Housing Administration, which oversees FHASecure, the number of delinquent borrowers Uncle Sam helped narrowly escape foreclosure is closer to 4,000.

Since late September of last year, just 1.2%, or 3,911, of the loans refinanced by the FHA, which is part of Housing and Urban Development (HUD), were made to borrowers in default, FHA data shows. This is far below what the government had forecast. The reason: Despite the hoopla about FHA helping borrowers in default, in reality, they only opened the window a crack.

So while the FHA refinanced 324,184 loans so far this year, that doesn’t necessarily mean that the program stopped a wave of would-be foreclosures. Guy Cecala, the publisher of Inside Mortgage Finance, says the surge in demand for an FHA refinanced loan had more to do with a general credit crunch and less to do with FHASecure.

“The deal is that true FHASecure delinquent loan refinance activity has been so low that HUD decided to call all of its refinance business FHASecure,” says Cecala. “In theory, the program could be expanded to accommodate more delinquent borrowers without loosening underwriting or taking on any more risk, but HUD and the Bush Administration has been reluctant to do so."

“FHASecure was a PR-driven program created to show that the Bush Administration wasn’t ignoring the mortgage crisis," says Cecala.

In his mind, it was created a year ago with the belief that only some subprime borrowers--those with exploding or resetting loans--should be helped. Since then, he says, the mortgage crisis has worsened, and foreclosures are being driven by a lot more than just subprime ARM adjustments and are impacting all types of borrowers.

An FHA official, who did not want to be named, agreed, saying the program’s restrictive terms of eligibility kept many borrowers from participating. Only those with adjustable-rate mortgages who were less than 90 days delinquent on their payments could apply, and lenders had to prove borrowers were in arrears due to ARM resets, though there are many other factors pushing them into default.

In July, the government also expanded eligibility for FHASecure to include homeowners who slid into default as a result of temporary economic setbacks, not because of impending rates resetting. When asked whether Friday’s announcement was misleading, Brian Sullivan, a HUD spokesman said, “We’re trying to make the point to families, 'We’re there for you.' With any new program the word has to get out.”

Sullivan explained that it takes 60 days to close a deal, and the agency expects the 1% number--mentioned nowhere in their press release--to grow significantly in the coming months. Sullivan admitted that FHASecure is “limited to be sure,” but said, “How far do you open the door, and how many borrowers are beyond rescue? You have to draw a line and say you’ll insure some borrowers on one side of the line and not others. It’s really a policy discussion that’s beyond me to opine on.”

That discussion goes on, as the government scrambles to help troubled homeowners. The latest effort, dubbed "Hope for Homeowners" targets borrowers already in default. It's set to go into effect in October. Unlike FHASecure, lenders must take a voluntary write-down on the value of the mortgage they issued, but in return, they get a government guarantee that if the borrower defaults, Uncle Sam will pay the bill.

Ironically, FHA--and taxpayers--may have caught a break here. Already fighting for solvency, the agency's tight eligibility rules almost completely excluded folks in default. As a result, they ended up insuring loans to borrowers with better long-term prospects for repayment.

Ponzi Finance Dynamics Still at Play

Second quarter GDP expanded at a 3.3% pace, the strongest since Q3 2007's 4.8%. Durable Goods Orders, Existing Home Sales, and the Chicago Purchasing Managers' index were all reported "stronger-than-expected".

And with commodity prices almost 20% off July highs - and crude oil notably unimpressive this week in the face of a major Gulf hurricane - the markets seem to lend support to the waning inflation viewpoint. The dollar rallied further this week.

Meanwhile, despite today's downdraft, Freddie Mac gained 60% this week and Fannie Mae advanced 37%. Monoline insures MBIA and Ambac surged 59% and 35%, respectively. MBIA saw its stock price more than double during August, to surpass $16. The Bank index jumped 3.1% this week and the Broker/Dealers rallied 4.0%. Homebuilding stocks were up 9%.

Investors are increasingly willing to accept that the worst of the Credit crisis has passed. Talk that the nation's housing markets are bottoming becomes louder each week. And every day market participants seem more receptive to the "economic resiliency" thesis.

First of all, I am certainly of the view that the economy is much weaker than the headline 3.3% growth rate. At the minimum, I am skeptical that the 1.2% annualized increase in the GDP price index accurately captures what I believe is a significant inflationary component in current "output". It is worth noting that the favored inflation gauge of Greenspan and the Fed, the PCE Deflator, was up 4.5% from a year earlier, the strongest year-over-year increase since 1991.

There is bountiful wishful thinking when it comes to our nation's mortgage and housing crises. Granted, many of the burst Bubble markets - including some spectacular busts throughout California, Florida, Nevada, and Arizona - have in some cases seemingly reached somewhat of a "clearing price".

Transaction volumes are up significantly in many of the locations with the greatest y-o-y price declines. I'll suggest, however, that it is unwise to extrapolate trading dynamics in these burst markets to national housing trends more generally. I believe the vast majority of markets around the country are more aptly described as Bubbles leaking air, as opposed to the collapsed markets that garner the greatest media attention.

I'll turn more constructive on home prices and housing markets generally when mortgage Credit Availability begins to loosen. It remains my view that Credit continues in a tightening dynamic. Notably, the growth in Fannie and Freddie's Combined Books of Business slowed sharply to a 3.7% rate during July, the slowest pace in two years.

And while there is nothing really in the works to compare to the abrupt Credit tightening that emanated from collapsing subprime and Alt-A securitization markets, I'll argue today's tighter Credit is a more subtle dynamic resulting from various types of lending institutions restricting, on the margin, loans to even prime Credits.

From the Wall Street firms down to the small community banks, tighter lending terms are leading to higher downpayments and less flexible payment terms for even high quality borrowers. And while the nature of this dynamic specifically does not lead to collapses for the relatively stable housing markets around the country, it nonetheless will definitely continue to pressure prices. And downward home prices will, over time, lead to only more lender nervousness and restraint.

And despite the lull, vulnerable housing markets remain acutely susceptible to any worsening in the GSE crisis. With MBS spreads having tightened somewhat during August, I'll assume Fannie and Freddie resumed aggressive mortgage purchases in the marketplace after somewhat slowing their buying during July.

Importantly, overall marketplace liquidity has deteriorated to the point where the GSEs must expand aggressively in order to forestall another major leg down in the ongoing housing crisis. As such, the marketplace of late is involved in a dangerous game of "chicken" with both the GSEs and Treasury.

These days, any time the GSEs slow their marketplace buying of mortgage paper (back away from their "backstop bid"), spreads widen sharply and fears of a liquidity crisis - and forced Treasury bailout - intensify. So, I'll assume the GSEs have resorted again to ballooning their exposure aggressively - recklessly.

There has been a lot of talk about the GSEs being "privatized." As the thinking goes, Fannie and Freddie should be temporarily "nationalized," recapitalized, split up and then released as responsible participants in the free marketplace - Credit providers no longer posing a risk to the American taxpayer. This all sounds wonderful in theory - yet is completely impractical in reality.

I fully expect the GSEs to be nationalized. But I suspect the federal government will be running - and recapitalizing - these institutions for many years to come.

The private mortgage marketplace self-destructed, and now the entire "prime" mortgage/housing market is dependent upon ongoing cheap mortgage finance available only through American taxpayer backing and subsidies.

The private sector simply cannot today - or at any time in the foreseeable future - provide the hundreds of billions of cheap ongoing new mortgage Credit necessary to forestall a systemic housing/economic/financial collapse. There will be no happy "recapitalize and privatize" ending to this saga.

The bill to the taxpayer is now growing rapidly - along with GSE exposure - and will balloon into the trillions over the coming years and decades. And for how long the holders of GSE debt and MBS will be allowed such handsome returns at taxpayer expense is a quite intriguing question.

I also read and hear too much about the continued need for "Keynesian" stimulus. Regrettably, the system has been in non-stop government (fiscal and monetary) stimulus mode for years now. It may have been indirect at the time, but it is now apparent that GSE obligations should be included today right along with debt owed directly by the Treasury.

And before all is said and done, the taxpayer will also be on the hook for enormous losses from various federal guarantees of deposits, student loans, pensions, and the like. The bottom line is that a whole range of direct and indirect federal guarantees - especially since the 2001/02 recession - have played an integral role in spurring Credit and Economic Bubbles.

"Keynesian" ammunition - fired way too early and freely in order to sustain multiple Bubbles - has definitely buoyed the U.S. Bubble Economy, although such measures will have only limited effect down the road when they're sorely needed.

Returning back to my initial paragraph, these days the economy and markets don't appear all that bad - certainly nothing as nasty as we dour prognosticators have been forecasting. I'll warn, however, that there are some very dangerous "Ponzi Finance" Dynamics Still very much At Play. The most obvious resides with the GSEs.

And there are closely related Bubbles throughout the agency and Treasury bond arena. Meanwhile, a view has gained adherents that the U.S. economy is actually in much better shape than Europe and elsewhere. The reality that Europe is not buoyed by their own government-sponsored mortgage behemoths and that their economies are more manufacturing based (and thus vulnerable to cyclical downturns) are only short-term relative disadvantages.

10 Reasons why there will be no Second Half Recovery in 2008

Ben Bernanke was spending some quality time in Jackson Hole Wyoming. In his prepared speech, Federal Chairman Ben Bernanke talked about “reducing systemic risk.” The problem however is that as the credit crisis has rippled throughout the economy the mystique of the Federal Reserve has diminished greatly. The former Federal Chairman Alan Greenspan still had the magical pixie dust to convince the markets that the Federal Reserve always had the right recipe to keep the economy going forward.

Monetary policy as many learn in their first college economics class is limited in the scope of what it can do. To a certain extent monetary policy can help when money does get tight but has little ability to help in providing solvency to a market that is largely insolvent. Once this perception is shattered, it is hard to recover.I’ve gotten a few e-mails about uber bank failure IndyMac Bank and there new method of helping out delinquent mortgage borrowers. The plan includes modifying 25,000 currently delinquent loans to a 3 percent interest rate and extending the term of the mortgage:

“(LA Times) The regulators operating failed IndyMac Bank said Wednesday that they would try to modify about 25,000 troubled mortgages by slashing interest rates to as low as 3% for five years, extending payments over 40 years and in some cases charging interest on only part of the loan balance.

The plan, aimed at about 37% of IndyMac’s seriously delinquent borrowers, is the start of a modification program that eventually could involve thousands of other borrowers at the savings and loan. Sheila Bair, chairwoman of the Federal Deposit Insurance Corp., said she hoped it would become a model for the reeling mortgage industry.”

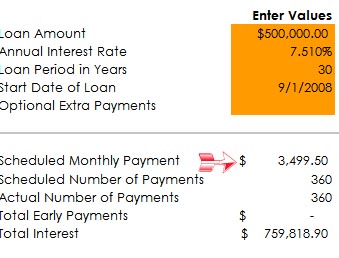

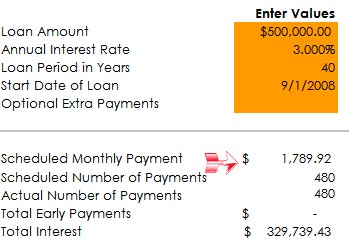

Let us do some of the math on this first. In the article we are also told that many of these loans are currently at 7.51%. They will extend some of these loans out to 40 years and allow the new 3% interest rate for the first five years. Let us take a hypothetical $500,000 mortgage here:

Initial Terms and Monthly Principal and Interest:

On a $500,000 loan, the principal and interest works out to $3,499. With the new terms and the new rate, the monthly principal and interest drops by half:

What a fantastic deal right? Not exactly. The first assumption is that many of these people will stay in their homes. This also doesn’t mitigate the fact that should this owner want to sell in the future, they may be solidly underwater. For example, say that the home was purchased at the peak for $500,000. Now the home is worth $350,000. As many of you know during the first years of your mortgage you are hardly building any equity. Most of the equity built during the first few years are not because the balance is declining but because of normal appreciation. That is not happening. In fact we are seeing massive depreciation. So this homeowner should they want to sell in 5 years and assuming prices haven’t recovered, would still need to pony up money to sell his own home. Basically it is a deal with the devil. You stay put in your home, forget about selling for many years, and you can get a major 5 year teaser rate. But after 5 years the rate will start to increase by 1 percent per year up until the standard rates of 6.5%. Once that happens, the payment will jump back to nearly $3,000 per month and the fundamental issues are still not resolved.

Ultimately, I think this is a non-issue and I know many of you were furious that this would encourage many to become delinquent on purpose. Maybe. We’ll find out soon enough how many people really want to stay (or can stay) in their homes. For what its worth, the above person would need to bring home $54,700 in gross per year to fall within the 38% debt-to-income ratio. You get a nice 5 year teaser mortgage on a 40 year term. The more and more time goes on, the Housing and Economic Recovery Act of 2008 is going to show to people how useless it will be.

With that said, I’ll give you 10 reasons why the United States economy will not recover in the second half of 2008. I personally think many of these problems will linger well into 2009 but the line in the sand is drawn and many people adamantly believe the second half of the year will bring recovery. Of course many of these vocal folks earlier in the year have gone silent in recent months.

Reason #10 - Federal Reserve: A Paper Tiger

The Federal Reserve is impotent. All their tough talk about inflation has fallen by the wayside since they are clearly like a barking Chihuahua with more bark than bite. First, they can protect us against inflation to a certain extent. Raise rates. Yet they are beholden to Wall Street and international banks and know that raising rates would cement the end of easy credit. Bernanke at Jackson Hole stated three items that the Fed is taking on to help the current crisis:

(1) “First, we eased monetary policy substantially, particularly after indications of economic weakness proliferated around the turn of the year. In easing rapidly and proactively, we sought to offset, at least in part, the tightening of credit conditions associated with the crisis and thus to mitigate the effects on the broader economy.”

(2) “The second element of our response has been to offer liquidity support to the financial markets through a variety of collateralized lending programs. I have discussed these lending facilities and their rationale in some detail on other occasions. Briefly, these programs are intended to mitigate what have been, at times, very severe strains in short-term funding markets and, by providing an additional source of financing, to allow banks and other financial institutions to deleverage in a more orderly manner.”

(3) “The third element of our strategy encompasses a range of activities and initiatives undertaken in our role as financial regulator and supervisor, some of which I will describe in more detail later in my remarks. Briefly, these activities include cooperating with other regulators to monitor the health of individual financial institutions; working with the private sector to reduce risks in some key markets; developing new regulations, including new rules to govern mortgage and credit card lending; taking an active part in domestic and international efforts to draw out the lessons of the recent experience; and applying those lessons in our supervisory practices.”

First, all three of these items are laughable. The Federal Reserve not only has been asleep at the wheel as financial regulator and supervisor but has encouraged the actual credit shenanigans that got us here in the first place! Alan Greenspan dropping rates to 1 percent and pontificating about the virtues of adjustable rate mortgages was the most irresponsible drivel I have ever seen. Now they want to regulate the market? Yeah right.

If you haven’t noticed their alphabet soup of programs have all been utter failures. Well, not completely. If you are a large Wall Street firm you may have come out ahead but for the vast majority of Americans these exercises in crony capitalism are not helping the overall economy. The Federal Reserve is virtually powerless. If they lower rates in the second half they risk fueling the flames of inflation further. If they raise rates, the housing and credit markets will face even larger pain. Call this the end game of their power. For these reasons, the Fed will actually contribute to no second half recovery and not be a player in the recovery.

Reason #9 - Energy Prices: Still at Record Highs

Everyone is running around cheering, as if $115 per barrel oil is some kind of bargain. Tell that to GM and Ford. Let us look at the cost of oil shall we?

Last August, crude stood at $69.27 per barrel. So even with the major correction from the peak prices reached a few months ago, we are still up a stunning 67 percent in one year. The bottom line is that higher fuel prices are here to stay. We can expect these higher fuel costs to keep a lid on any major economic recovery for the second half.

Reason #8 - Education Getting More Expensive

As a nation, we have always championed education as a means of pulling yourself up from your bootstraps. The fact that California now has a 7.3% unemployment rate, the third highest in the nation, is largely in part because so many people relied on the housing market for their employment. That bubble has now burst and is not coming back. Many of these people will need to go back to school to retrain if they want any chance of making similar incomes in the new economy. As it turns out, education just got more expensive:

“(LA Times) Despite angry protests from students that led to 16 arrests at UCLA, California’s two public universities took actions Wednesday to charge higher fees for education in the fall.

The trustees of the Cal State University system voted to raise annual undergraduate student fees 10%, or $276. A key committee of the University of California regents approved a 7.4%, or $490, raise per year for undergraduates that is expected to be endorsed by the full Board of Regents today.”

Education has gone up across the board for our country. The fact that the two largest university systems in California the UC and the CSU are raising rates is simply indicative of the consumer inflation we are seeing.

There is a limited supply of money. If you go back to school, that is money you aren’t spending on consumption. If you are in school full-time, you aren’t working therefore pushing the tax revenue base lower. I’m all for going back and retraining and getting yourself ready for the new economy. The fact that only 1 in 4 Americans has a 4-year degree does cause one to pause for a second. Yet seeing the cost of education, there may be some economic reasons for this.

Reason #7 - Elections and Political Calculus

The California budget is now into record territory and not in a good way. We’ve been talking about this economic budget for months yet nothing has gotten done. In fact, you would think that we would have better solutions than “no taxes period” or “raise taxes on everyone” from both parties but there you have it. This is the inability to compromise and reach a middle ground. This is unfortunately an issue our country has always faced. People do not want nuisance in their answers but simple easy to read responses.

Given that the elections are heating up, you can expect no major changes to happen. This is another contributing factor to seeing no second half recovery. What needs to happen is bold reform and legislation and there is no way that is going to happen in the next few months. Heck, we can’t even agree on a freaking budget here in California!

Reason #6 - Lenders are Stuck

Lenders are sticking their fingers in their ears and trying to ignore the bombastic sound of the piper coming down the street. They don’t want to listen to the utter reality that we have $500 billion in shameless toxic pay option mortgages that are set to reset starting NOW. These loans will prove to be more troublesome than the subprime loans for a variety of reasons. First, the housing market has no buffer room anymore. That is, the entire housing market is in shambles and people will now be selling at the worst time possible. In addition, there was something about looking at subprime loans as the “other” in the economy. That is, “subprime” had a connotation of poor and of course anyone with an Alt-A or prime loan is nowhere near that. Only subprime people don’t make their payment. Well here’s a newsflash, we are all subprime.

These loans are just as toxic if not more so because they carry larger loan balances and people will not hesitate to stop making payments on a home that is severely underwater. California is seeing this happen in real-time.

Reason #5 - Employment Still Faltering

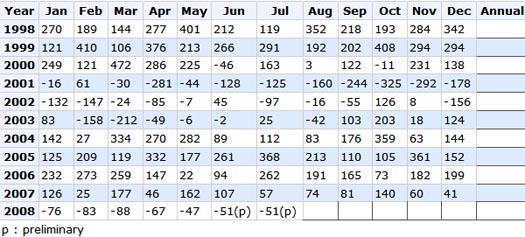

Employment is still not picking up. Take a look at the chart below:

Since the start of 2008, over 463,000 jobs have been lost. Keep in mind that for us to remain a healthy and growing economy we need to have 100,000 to 150,000 jobs being added each month. This is clearly not happening. The fact that we are a “consumerist” economy and for the past decade much of employment growth has been in the FIRE economy (finance, insurance, and real estate) there is little reason to believe that job growth will happen anytime soon. In fact, there is still too heavy of a reliance on these industries and these industries are largely dependent on a healthy housing market. Do you really think housing is going to get better in the next few months?Employment is vital for keeping an economy healthy. The massaged numbers used by the BLS vastly under report unemployment and I would say that true nationwide unemployment is over 10 percent.

Reason#4 - People Don’t Believe the 10% Solution

Take a trip to a Barnes and Noble store and stroll down to the finance section. You’ll see tons of books highlighting the ease of becoming a millionaire overnight or starting your own real estate empire. No time in our nation’s history has this dream been sold to more people. Yet here is an observation. How is it that with so many books and seminars about becoming rich that our nationwide income distribution has actually gotten worse over this time? In fact, there has never been a time when people where in such horrible debt like we are in today’s economy.

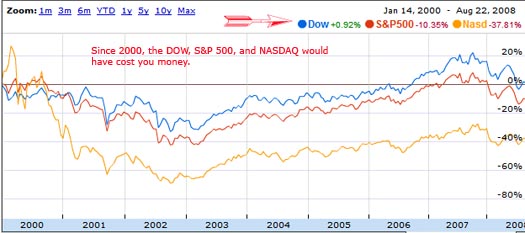

This dream is starting to find cracks. In fact, many of these people were simply selling the books with sizzle but no steak. That is, you buying many of these books were making the author/publisher rich while you remained stuck in your lot in life. Some of the advice was flat out wrong. One solution recycled over and over is putting away 10% of your money in the DOW, NASDAQ, and the S&P 500. How has this performed for this decade:

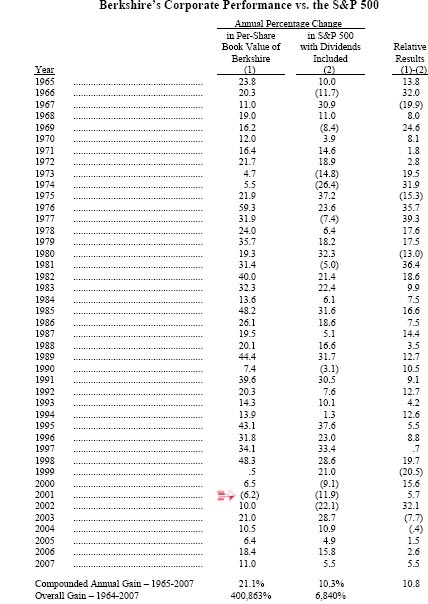

If you put $10,000 in the S&P 500, NASDAQ, and DOW in January of 2000 you would have actually lost money. Even after almost 9 years, the DOW is up only about 1 percent, the NASDAQ is down 37%, and the S&P 500 is down 10.35%. So much for that 10 percent solution. After a decade given the U.S. Dollar destruction plus stagnant wages you actually lost much more in real terms if you left your money in these markets. Most books nearly follow this investing philosophy like a Wall Street religion but many are now figuring out that something is rotten in Denmark. Even the sage Warren Buffet who has had 42 years of stellar returns is seeing some problems. Since 1965 Warren Buffet’s Berkshire Hathaway had only one down year in 2001 and that was a 6.2 percent drop. Take a look at the data from their annual shareholder letter:

*Source: Berkshire Shareholder Yearly Letter

How is Berkshire doing this year?

Berkshire Hathaway is down 17.62% for the year. The worst year to date performance ever. If the sage of Omaha is having problems with this economy are you really going to think some over the counter guru is going to have the magic bullet for every American to become the next Donald Trump?Reason #3 - Consumer Psychology

People are now realizing that you cannot become wealthy with too much debt. In fact, they are realizing that stealing money from Peter to pay Paul is not a recipe for success. Consumer psychology is changing because the market is forcing people to live within their means. This is a global recession. The idea that we were going to decouple is now being proven false. The size of the largest economies are so intertwined that pain in one will ripple to another. The United States, Japan, China, the Euro-zone are all facing hard economic times.

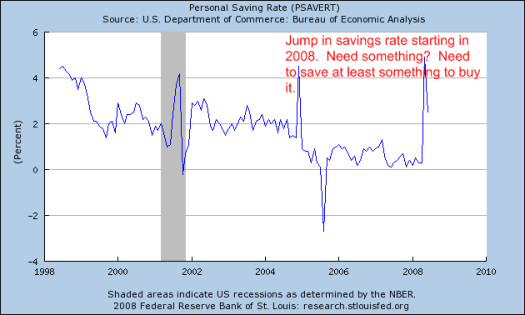

I recently showed a chart that had a boost in the savings rate:

Initially my assumption was that people were saving money and being more prudent. After reading a few articles and seeing the overall contraction in M3 my perspective has now shifted a bit. This increase in savings looks more like people moving money from 401(k)s, investment accounts, bonds, or any other form of longer term investments into checking accounts to pay day to day needs. This is definitely not good. What I initially thought to be a silver lining is simply people raiding the storage cabinet to live for today.

Another sign that the economy is not recovering anytime soon.

Reason #2 - Too Much Debt

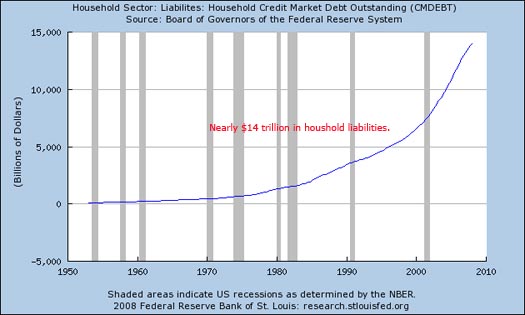

No time in our history has their been so much debt outstanding. Take a look at this chart:

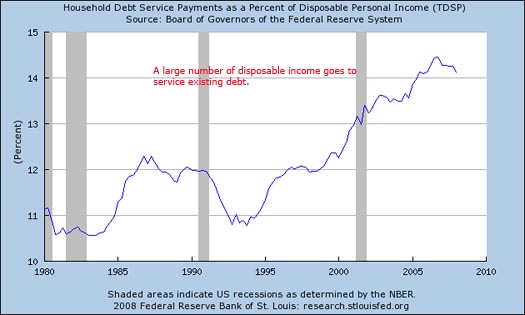

Even with the contraction in the economy, debt is in a perpetual upward movement. With nearly $14 trillion in household liabilities out there, we have now reached a precarious situation. The United States economy, the largest in the world has a GDP of $13.84 trillion in 2007. What this means is the households of Americans are carrying more in debt obligations than what we actually produce! Some may say so what and this doesn’t matter but it does when more of your money is being used to service this existing debt:

As you can see from the chart above, more and more disposable income is going to pay for debt service. This is a very unproductive use of money. First, this is money that isn’t going into the consumer economy. It also puts a burden on the ability of households to invest money for long-term planning. Basically we have reached a point of maximum debt saturation. The good news however if you want to see it this way is there is a major onslaught of debt destruction going on. Each mortgage that isn’t paid in full decreases the overall debt obligations out there. If a $500,000 mortgage defaults and the lender can only get $300,000, $200,000 of debt has just been destroyed. This however is going to make lenders more restrictive with their money and ultimately force consumers to rely more on actual income than debt.

Reason #1 - Housing is Nowhere Near a Bottom

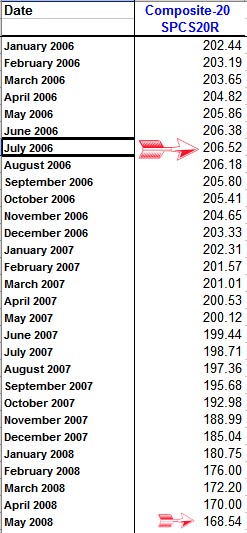

Finally, who can forget the housing market. With $12 trillion in mortgage debt outstanding this is by far the largest obligation of Americans. Yet prices are falling at a faster rate than at anytime in history including the Great Depression. Given this immense debacle, people are feeling the negative pangs of wealth destruction. At the height, $24 trillion in residential real estate wealth was out there. Now, we are seeing estimates at $19 or $20 trillion giving us a destruction of $4 or $5 trillion. To be exact, we can multiply the Case-Shiller decline to the overall peak price:

$24 trillion x 18.39% = $4.4 trillion in equity gone

At the peak in July of 2006 the Case-Shiller Index stood at 206.52. Currently it stands at 168.54, a decline of 18.39% from its peak nationwide. So with that, we can multiply the decline to the peak estimate residential wealth and you can see that $4.4 trillion in housing equity is gone. The trend is also heading lower so each subsequent decline is further equity destruction. Keep in mind that the debt remains the same. That is the problem with falling prices. The underlying debt reflects bubble prices and doesn’t adjust but the market value of the asset is falling and falling.

These are 10 reasons why there will be no second half recovery. There are other reasons but these are sufficient to keep us from seeing any major changes for a very long time. Anyone telling you otherwise is probably just trying to sell a book or a seminar.

Arctic Ice May Reach Lowest Level on Record in September

Scientists said that the arctic ice is at its second lowest level in the past 30 years or since the satellite records began.

Experts from the National Snow and Ice Data Center (NSIDC) said the latest data shows that the arctic ice is now bellow the 2005 level and that the melting process started earlier this year. This means that it might reach its lowest recorded level in September despite the fact that this year’s temperatures have been lower compared to last year, NSIDC scientists explained.

Ice in the Arctic Ocean is at a climatic "tipping point," as the experts put it. The arctic ice now covers 2.03 million square miles (5.26 million sq km). The lowest level ever was recorded last September when the arctic ice was covering about 1.65 million square miles. Most of that is thin ice which formed during the past year and melts faster.

Just a few years ago, scientist predicted that by 2080 all the Arctic ice will melt during summer. However, the computer models revealed the fact that this could happen much earlier, around 2030 to 2050.

"We could very well be in that quick slide downward in terms of passing a tipping point," said Mark Serreze, senior scientist at the NSIDC. "It's tipping now. We're seeing it happen now."

According to NASA ice scientist Jay Zwally, if the accelerated melting process continues, within "five to less than 10 years," the Arctic Circle will be ice-free during the summer period.

"It means that climate warming is also coming larger and faster than the models are predicting and nobody's really taken into account that change yet," Zwally said.

.png)

10 comments:

The mooing herd is milling; perhaps more than usual. I would think the the news in your first article today should be being repeated, and discussed, all over the place- but the only place it turned up in my morning news perusal is here.

For what it's worth in the metals department- the Chinese historically have depended on silver for actual emergency living transactions, not gold. Gold is simply too valuable; too hard to break down into usable small chunks. They used gold too- but for larger needs, not day to day.

Right, greenpa,

And doesn't this, from that article, present a desperate and ominous image?

Two weeks later, in an unprecedented sighting, nine stranded polar bears were seen off Alaska trying to swim 400 miles north to the retreating icecap edge.

C/R:

And doesn't this, from that article, present a desperate and ominous image?

Two weeks later, in an unprecedented sighting, nine stranded polar bears were seen off Alaska trying to swim 400 miles north to the retreating icecap edge.

-----------------

Before reacting to this news I'd want to see the "base rate" of polar bear stranding, in, say, 1950 or something.

The idea that nature "cares for bears" and wouldn't let them strand and drown is probably pathetic nonsense.

thehangedman

I wouldn't say nature cares for bears, as that seems a very strange idea to me, but what I would say is that those bears are adapted to a nature that has been relatively constant. Possibly there is another reason for those bears taking a 400 mile swim than because the-times-they-are-a-changing but that seems the simplest explanation, if you know of another one I would like to hear it.

I think if you look on the net you can find lots of information about how the polar bear seems to be faring, body weight - fat storage - as well as survival of pups. Might be harder to find stats on their long distance swimming. antics though.

Our society operates on a wrongheaded belief that money can fix everything. Reading on the same day of the threatening Hurricane Gustav and the melting Artic. These events respond somewhat to the recently asked question of a timeframe for collapse. More than one system is experiencing acceleration.A whole lot more is happening with the fundamentals that interest rates!

Someone pointed out a movie to me the other day (can't find the link right now) that is the "Anti-Global Warming Crowd" version of "Expelled".

It took around 10 seconds of watching the trailer before the first comedic moment comes up. An unidentified "Expert" makes the claim that "there is no life in cold climates" and that "warming is good".

There are many reasons why this is funny, I am sure you can find some yourself, but what I found more telling is that the entire trailer showed a lot of talking heads, but not ONCE did they identify any of these.

Now I wonder, why would you create a "documentary" with "Experts" but then not advertise these "Experts"? Could it be that this is the usual half a dozen or so "experts" that constantly write against GW?

The funny thing is that there are a lot of people who take these people seriously, the moment you look into any of these "studies" what becomes apparent is that it is always three or four organizations behind it who two decades ago were at the forefront (at times with the same "Experts") in telling the public that smoking is not causing any health risks.

Has anyone got more up to date and possibly more complete libor rates than those at something called Priorbank it might be interesting to add to what is there. When I compare the one and six month rates it looks like there is a distinct increasing lack of trust, at least during that rather short period.

Oh, Phil Flynn, senior trader at Alaron Trading, you took the words out of my mouth:

"...I'm about as optimistic as I can be in this type of disastrous situation."

CR

I don't know about libor (except that it is NOT ducky) but Markit tells me all I need to know about the risk of debt these days. e.g. one of the AAA asset backed home equity tranches is currently fetching 45% of its face value. I'll go out on a limb here and predict new lows for many of these and other debt products this week. And BBB? A bargain at only 4.93%!

C/R:

"Might be harder to find stats on their long distance swimming. antics though."

Indeedy. And it's up to the news sources showing the bears to find that out and tell us. Its the difference between information and propaganda.

I just don't climb on bandwagons until I know the tune.

Post a Comment