U.S. Highway 90 at Raceland, Louisiana

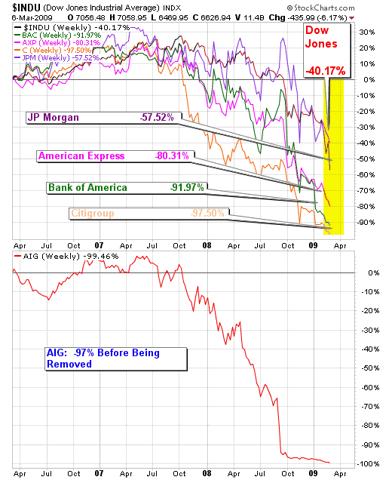

Ilargi: The US government and the Federal Reserve indicate that they will not let a big bank fail. They also hint that the uptick rule will likely be reinstated, which is great for banks that someone might want to short (many someones want to). Moreover, the drive to change fair value rules (were they ever executed?) gets so strong that blogger Karl Denninger, who's spent months clamoring for fair value and mark-to-market, today does a 180 and argues for a suspension of the all-too-rational principle. Thinking of a career in politics? Any idea of the damage a suspension would do? I think you do, Karl.

To top off today's party cake, Ben Bernanke once more reiterates (I know that’s double) that the recession "might end this year". Now, I watched Jon Stewart dig into Jim Cramer last night. Reading Bernanke's words this morning, my first thought was that I hope The Daily Show will do a similar "timeframe truth test" of Bernanke. Shrinking Ben has made so many ridiculous claims about the economy's health and its upcoming recovery since he took over, it should be a feast for the eyes and ears.

Nevertheless, all these nutty ideas and claims, pared with a "leaked" (HA!) internal memo from Citi CEO Vikram Pandit led the markets 5%+ higher today, with financials rising over 15% on average. Problem over, right, we can all get back to business?!

Not so fast, perhaps. Two things: 1) The major US banks are still insolvent, Citibank, Bank of America, HSBC Bank USA , Wells Fargo Bank and J.P. Morgan Chase, and hiding the value of their toxic assets doesn't change that one bit. 2) Changing any banking rule, whether it's fair value (in any guise), the uptick rule, or even a Glass Steagall repeal will make no difference anymore. The losses from blind greed wagers are enormous, and we can't avoid paying them, we can only make sure we execute the payment process the best we can. Problem is, we don't, we're doing the opposite: we refuse to even start the process. How do we get away with that until now? By using the present and future ability of the taxpayer to provide the capital to make good on all the losses of the billionaires and millionaires involved in institutions deemed liable to cause systemic risk, the infamous "too large to fail" idea.

Good luck with today's earnings. You will need them, because nothing has changed in the underlying factors. The US government can't even save Citi, because the by far largest part of its assets and liabilities are outside of America. For Citi to be saved, you'd need a kind of United Nations effort. And that won't happen, because countries across the planet have far too much trouble saving their own domestic banks. If you choose to believe Mr. Pandit when he claims Citigroup is healthy and profitable, and when you choose to believe Mr. Bernanke’s statement that no big banks will be allowed to fail, godspeed to you. Do check the latest US government contingency efforts for Citi though.

I think it's all just hot air, and that Citi's fate has long since been sealed. The delay to date merely serves to allow major shareholders and bondholders to transfer more of their losses to the public. That would be you. And for you, any suspension of fair value only makes things worse. But then, by now, you must be getting used to the idea of matters getting worse every single day. A one day Wall Street rally won't change that. Banks larger than governments will always be a bad idea, and we're about to find out how bad. Relevant, from a climate change piece:

"In science the truth is out there. It's there to be discovered. In politics often the truth is whatever is expedient to this or that project,"

I would add that what is true in politics is just as much in economics.

There is so much material today, and the quality is so high, I'll leave it at this and we'll talk tomorrow.

Too big to fail? 5 biggest banks are 'dead men walking'

America's five largest banks, which already have received $145 billion in taxpayer bailout dollars, still face potentially catastrophic losses from exotic investments if economic conditions substantially worsen, their latest financial reports show. Citibank, Bank of America , HSBC Bank USA , Wells Fargo Bank and J.P. Morgan Chase reported that their "current" net loss risks from derivatives — insurance-like bets tied to a loan or other underlying asset — surged to $587 billion as of Dec. 31 . Buried in end-of-the-year regulatory reports that McClatchy has reviewed, the figures reflect a jump of 49 percent in just 90 days. The disclosures underscore the challenges that the banks face as they struggle to navigate through a deepening recession in which all types of loan defaults are soaring.

The banks' potentially huge losses, which could be contained if the economy quickly recovers, also shed new light on the hurdles that President Barack Obama's economic team must overcome to save institutions it deems too big to fail. While the potential loss totals include risks reported by Wachovia Bank , which Wells Fargo agreed to acquire in October, they don't reflect another Pandora's Box: the impact of Bank of America's Jan. 1 acquisition of tottering investment bank Merrill Lynch , a major derivatives dealer. Federal regulators portray the potential loss figures as worst-case. However, the risks of these off-balance sheet investments, once thought minimal, have risen sharply as the U.S. has fallen into the steepest economic downturn since World War II, and the big banks' share prices have plummeted to unimaginable lows.

With 12.5 million Americans unemployed and consumer spending in a freefall, fears are rising that a spate of corporate bankruptcies could deliver a new, crippling blow to major banks. Because of the trading in derivatives, corporate bankruptcies could cause a chain reaction that deprives the banks of hundreds of billions of dollars in insurance they bought on risky debt or forces them to shell out huge sums to cover debt they guaranteed. The biggest concerns are the banks' holdings of contracts known as credit-default swaps, which can provide insurance against defaults on loans such as subprime mortgages or guarantee actual payments for borrowers who walk away from their debts. The banks' credit-default swap holdings, with face values in the trillions of dollars, are "a ticking time bomb, and how bad it gets is going to depend on how bad the economy gets," said Christopher Whalen , a managing director of Institutional Risk Analytics, a company that grades banks on their degree of loss risk from complex investments.

J.P. Morgan is credited with launching the credit-default market and is one of the most sophisticated players. It remains highly profitable, even after acquiring the remains of failed investment banker dealer Bear Stearns , and says it has limited its exposure. The New York -based bank, however, also has received $25 billion in federal bailout money. Gary Kopff , president of Everest Management and an expert witness in shareholder suits against banks, has scrutinized the big banks' financial reports. He noted that Citibank now lists 60 percent of its $301 billion in potential losses from its wheeling and dealing in derivatives in the highest-risk category, up from 40 percent in early 2007. Citibank is a unit of New York -based Citigroup . In Monday trading on the New York Stock Exchange , Citigroup shares closed at $1.05 .

Berkshire Hathaway Chairman Warren Buffett , a revered financial guru and America's second wealthiest person after Microsoft Chairman Bill Gates , ominously warned that derivatives "are dangerous" in a February letter to his company's shareholders. In it, he confessed that he cost his company hundreds of millions of dollars when he bought a re-insurance company burdened with bad derivatives bets. These instruments, he wrote, "have made it almost impossible for investors to understand and analyze our largest commercial banks and investment banks . . . When I read the pages of 'disclosure' in (annual reports) of companies that are entangled with these instruments, all I end up knowing is that I don't know what is going on in their portfolios. And then I reach for some aspirin."

Most of the banks declined to comment, but Bank of America spokeswoman Eloise Hale said: "We do not believe our derivative exposure is a threat to the bank's solvency." While Bank of America advised shareholders that its risks from these instruments are no more $13.5 billion , Wachovia last year similarly said it could overcome major risks. In reporting a $707 million first-quarter loss, Wachovia acknowledged that it faced heavy subprime mortgage risks, but said it was "well positioned" with "strong capital and liquidity." Within months, losses mushroomed and Wachovia submitted to a takeover by Wells Fargo , which soon got $25 billion in federal bailout money.

Trading in credit-default contracts has sparked investor fears because they are bought and sold in a murky, private market that is largely out of the reach of federal regulators. No one, except those holding the instruments, knows who owes what to whom. Not even banks and insurers can accurately calculate their risks. "I don't trust any numbers on them," said David Wyss , the chief economist for the New York credit-rating agency Standard & Poor's . The risks of these below-the-radar insurance policies became abundantly clear last September with the collapse of investment banker Lehman Brothers and global insurer American International Group , both major swap dealers. Their insolvencies threatened to zero out the value of billions of dollars in contracts held by banks and others. Until then, "we assumed everyone makes good on the contracts," said Vincent Reinhart , a former top economist for the Federal Reserve Board .

Lehman's and AIG's failures put in doubt their guarantees on hundred of billions of dollars in contracts and unleashed a global pullback from risk, leading to the current credit crunch.The government has since committed $182 billion to rescue AIG and, indirectly, investors on the other end of the firm's swap contracts. AIG posted a fourth quarter 2008 loss last week of more than $61 billion , the worst quarterly performance in U.S. corporate history. The five major banks, which account for more than 95 percent of U.S. banks' trading in this array of complex derivatives, declined to say how much of the AIG bailout money flowed to them to make good on these contracts. Banking industry officials stress that most of the exotic trades are less risky — such as interest-rate swaps, in which a bank might have tried to limit potential losses by trading the variable rate interest of one loan for the fixed-rate interest of another.

In their annual reports to shareholders, the banks say that parties insuring credit-default swaps or other derivatives are required to post substantial cash collateral. However, even after subtracting collateralized risks, the banks' collective exposure is "a big, big number" and a matter for concern, said a senior official in a banking regulatory agency, speaking on condition of anonymity because agency policy restricts public comments. In their reports, the banks said that their net current risks and potential future losses from derivatives surpass $1.2 trillion . The potential near-term losses of $587 billion easily exceed the banks' combined $497 billion in so-called "risk-based capital," the assets they hold in reserve for disaster scenarios. Four of the banks' reserves already have been augmented by taxpayer bailout money, topped by Citibank — $50 billion — and Bank of America — $45 billion , plus a $100 billion loan guarantee.

The banks' quarterly financial reports show that as of Dec. 31 :

— J.P. Morgan had potential current derivatives losses of $241.2 billion , outstripping its $144 billion in reserves, and future exposure of $299 billion .

— Citibank had potential current losses of $140.3 billion , exceeding its $108 billion in reserves, and future losses of $161.2 billion .

— Bank of America reported $80.4 billion in current exposure, below its $122.4 billion reserve, but $218 billion in total exposure.

— HSBC Bank USA had current potential losses of $62 billion , more than triple its reserves, and potential total exposure of $95 billion .

— San Francisco -based Wells Fargo , which agreed to take over Charlotte-based Wachovia in October, reported current potential losses totaling nearly $64 billion , below the banks' combined reserves of $104 billion , but total future risks of about $109 billion .

Kopff, the bank shareholders' expert, said that several of the big banks' risks are so large that they are "dead men walking." The banks' credit-default portfolios have gotten little scrutiny because they're off-the-books entries that are largely unregulated. However, government officials said in late February that federal examiners would review the top 19 banks' swap exposures in the coming weeks as part of "stress tests" to evaluate the institutions' ability to withstand further deterioration in the economy. Representatives for Citibank, J.P. Morgan and Wells Fargo declined to comment. Hale, the Bank of America spokeswoman, said that the bank uses swaps as insurance against its loan portfolio — they "gain value when the loans they are hedging lose value."

She said that Bank of America requires thousands of parties that are guarantors on these insurance-like contracts to post "the most secure collateral — cash and U.S. Treasuries, minimizing risk roughly 35 percent." The collateral is adjusted daily. Bank of America's report of an $80.4 billion exposure doesn't count the collateral and "also assumes the default of each of the thousands of counterparty customers, which isn't likely," Hale said. Counterparties are the investors on the other side of the deal, often other banks or investment banks. In response to questions from McClatchy , HSBC spokesman Neil Brazil said that the bank closely manages its derivatives contracts "to ensure that credit risks are assessed accurately, approved properly (and) monitored regularly."

How much of Citigroup could the FDIC actually take over?

FDIC chairman Sheila Bair doesn't think a full government takeover of Citigroup and other multinational financial institutions is practical or even possible. Here are her reasons, as summarized by Pete Davis: 1. The legal authority to take over large banks does not currently extend to multinational financial conglomerates; 2. The FDIC lacks the funding to conduct such a massive bailout; 3. Other countries have regulatory oversight of these financial conglomerates too, and they may object to a U.S. takeover.

This made me curious as to how much of Citigroup was a domestic commercial bank that the FDIC could take over, and how much was multinational financial stuff outside the FDIC's jurisdiction. So I took a look at the balance sheet from Citi's new 10K (with numbers as of Dec. 31, 2008). First, there's the division between Citigroup and Citibank. Citigroup has assets of $1.938 trillion, and liabilities of $1.797 trillion. Citibank has assets of $1.227 trillion and liabilities of $1.145 trillion. So right there, about 36% of the company's assets and liabilities are outside the bank.

Then there's the bank itself. Its balance sheet separates deposits in U.S. offices, which are insured by the FDIC, from deposits in offices outside the U.S., which aren't. Of $755 billion in deposits, $241 billion are in the U.S. and $515 billion outside (the numbers don't add up because I'm rounding). The first striking thing there that Citi's U.S. banking operation just isn't all that big: J.P. Morgan Chase has $722 billion in U.S. deposits (and $287 billion outside the country). Washington Mutual, which was not deemed by regulators to be too big too fail, had $182 billion in deposits, in the same territory as Citi's U.S. bank.

The second is that if Citibank's overall business breaks down along domestic/foreign lines pretty much as deposits do (which probably isn't quite the case, but close enough), that gets you to $392 billion in assets and $365 billion in liabilities. That's the part of Citigroup that the FDIC has the authority to take over. I bet the FDIC could handle it, at least if it gets the new $500 billion credit line it wants from Congress. But this would leave an entity (or entities) with about $1.5 trillion in assets and $1.4 trillion in liabilities to be taken over by foreign governments or fail in pretty much the same unruly manner that Lehman Brothers did.

To repeat: Citigroup has liabilities of $1.797 trillion. The deposits that the FDIC has some responsibility for (up to $250,000 per depositor) add up to $241 billion. So we have this reasonably sensible system for winding down troubled banks, but when it comes to the most troubled big banking company in the country, said system only covers a fraction of the overall operation. Which leads to a couple of conclusions: 1. I get why the administration is so reluctant to take over Citi completely. 2. I don't get why we all (I'm including myself in this) thought it was okay to allow the creation and growth of gigantic financial companies for which we had absolutely no plan for winding down in case of trouble.

Ready for the Worst at Citigroup

Hot on the heals of the February restructuring that gave the U.S. government 36% of Citigroup, more plans are being hatched to stabilize the bank, according to the Wall Street Journal. It's all off-the-record stuff with no sources named, and it's supposedly worst-case scenario planning -- just in case something unexpectedly bad happens. No one is saying they expect something bad to happen. The unnamed U.S. officials just want to be ready.

Meanwhile, Citi CEO Vikram Pandit tried to reassure his staff Monday that everything is fine, except the bank's share price of $1 and change. Citi's worth much more than that, according to Pandit, and the bank has been profitable in the first two months of 2009. So don't read too much into all this chatter about another rescue initiative. It's all good. If there was something to tell, you can rest assured that you'll find out eventually. You know, after it's been done and the government completely controls Citi and whatever shares you own are worth even less.

Forgive me for being pessimistic, but this bank doesn't exactly inspire confidence these days. Traders on our sister site, Stockpickr.com, say Citi's stock is no better than a lottery ticket. In fact, one investor said it's more like a discarded scratch-off lottery stub that shows it's already a loser. So it's not just me, folks. If the government thinks it's wise to be ready for the worst, investors should be too.

U.S. Weighs Further Steps for Citi

Regulators Plan for Contingency if Problems Grow at Wall Street Bank

Barely a week after the third rescue of Citigroup Inc., U.S. officials are examining what fresh steps they might need to take to stabilize the bank if its problems mount, according to people familiar with the matter. Federal officials describe the discussions, which are wide-ranging and preliminary, as "contingency planning." Regulators are trying to ensure that they are prepared if Citigroup takes a sudden turn for the worse, which they aren't expecting, these people say. Citi executives said they haven't detected signs of corporate clients or trading partners withdrawing their business, even though the New York company's shares are hovering near $1 apiece -- closing Monday at $1.05 on the New York Stock Exchange. Citigroup says it has a strong liquidity position and that its capital levels are among the highest in the banking industry.

The Citigroup discussions come as U.S. officials are conducting "stress tests" on the largest banks to determine their long-term viability under tough economic scenarios. Banking regulators and Treasury officials called Citigroup executives over the weekend amid rumors about the discussions, according to people familiar with the matter. They said the talks were geared toward future planning and that no new rescue was imminent. Citigroup CEO Vikram Pandit issued a memo to employees Monday as the company's shares hovered above $1, arguing the current price does not reflect the company's capital position and earnings power. Read the memo. The discussions include the Treasury Department, Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corp. The FDIC backs many of Citigroup's deposits in the U.S., as well as a large amount of new debt issued by the firm.Regulators say the planning should be seen as a normal function of government during a financial crisis. One possible future step could involve creating a "bad bank" to take distressed assets off the balance sheet of Citigroup or other troubled financial institutions. Differing approaches are still being considered. Treasury officials already are developing a public-private partnership to tackle that problem more broadly, and the two concepts could either run parallel or be merged. Following the latest round of government assistance, announced Feb. 27, taxpayers will own as much as 36% of Citigroup's common shares. Government officials are hopeful that the steps already taken will give Citigroup time to steady itself, but they realize that global financial markets are jittery about the company's prospects.

Last week, shares of banks fell to their lowest levels in decades, as broad stock and bond markets tumbled. In the credit-default-swap market, the cost of insuring against defaults by financial institutions is soaring. That reflects sagging confidence despite repeated bailouts of financial companies from banks to insurer American International Group Inc. Also complicating matters, U.S. officials don't have a template for winding down a company of Citigroup's size and complexity, which Federal Reserve Chairman Ben Bernanke made clear at a Senate hearing last week. "I'd like to challenge the Congress to give us a framework, where we can resolve a multinational complicated financial conglomerate like Citigroup, like AIG, or others, if that became necessary," Mr. Bernanke told the Senate budget committee.

Patience on Capitol Hill for repeated bailouts is growing thin. Sen. Richard Shelby of Alabama, the ranking Republican on the Senate banking committee, described Citigroup as a "problem child" in a television appearance Sunday, adding that some troubled banks need to be shut down. The Obama administration is trying to counter criticism that its efforts to stabilize financial markets have been unsuccessful. In a private meeting Monday night with House Democrats, Treasury Secretary Timothy Geithner said the administration's efforts were working, and said policy makers had "done more in weeks" to address problems than other countries had done in years, according to a senior House aide who attended the meeting.

Moody's Identifies 283 US Firms at Risk of Default

Moody's Investment Services, in a bid to jump ahead of the curve on corporate bankruptcies, has published a list of speculative-grade companies with the greatest risk of defaulting. The Bottom Rung is Moody's answer to those that have criticized the ratings agencies for being too slow in missing the credit problems that have plagued U.S. companies and have been responsible for the global economic downturn. The list provides ample evidence of a severe default cycle with 283 speculative-grade issuers included, compared with 157 a year ago. Of the 283 companies listed, nearly half belong to the media, automotive, retail, manufacturing and gaming industries. Moody's said that more than 23% of all U.S. speculative-grade companies are on the Bottom Rung list, compared with 9% two years ago.

Among the media companies listed as probable defaults are Sirius XM, Charter Communications, Spanish Broadcasting System, Radio One and Univision. It comes as no surprise that General Motors, Ford and Chrysler are featured on the list as well, in addition to several other auto-related companies including American Axle & Manufacturing, Cooper Tire & Rubber, Lear and Visteon. Retailers have been especially hit hard with the drop in consumer spending, with several names already closing shops amid bankruptcy, including Circuit City, Mervyn's and KB Toys. Moody's cites Bon-Ton Stores, Blockbuster, Rite Aid, Michael's Stores, Duane Reade and Harry & David, among others, as those with a speculative grade rating in danger of defaulting.

Champion Enterprises was among those manufacturing stocks on Moody's the Bottom Rung, while MGM Mirage and Harrah's Entertainment were among the gaming industry companies on the list. Several other well-recognized names were included on Moody's list, including Palm, Eastman Kodak, Advanced Micro Devices, Hovnanian and Six Flags. Also included are airliners AMR Corp., UAL Corp. and JetBlue Airways. Some of the inclusions on Moody's list have done their best to argue that bankruptcy is not a looming possibility. After completing a $530 million loan infusion from Liberty Media on Friday, Sirius XM CEO Mel Karmazin said that the transactions "resolve all of the uncertainty surrounding the company's and its subsidiaries' debt maturing in 2009."

Blockbuster spokeswoman Karen Raskopf told TheStreet.com last week that the world's largest movie-rental chain does "not intend to file for bankruptcy." Additionally, Eastman Kodak told the Wall Street Journal that any speculation about whether the company is less than financially sound is "irresponsible. Kodak is financially solid, and we are taking the right actions to ensure that we remain a strong and enduring competitor," spokesman David Lanzillo said to the Journal.

Ilargi: CNBC are a TV station that seems to forget there are tapes of their shows. I see columnists questioning why Stewart went after CNBC again, but that's an easy one: Cramer denied having said to buy Bear Stearns, and Stewart knew he had. Why have Cramer call you a liar, when you can fill a very rewarding 5 minutes showing you're not, and he is instead?

Jon Stewart "corrects" Jim Cramer

Click here for Canada

Obama's gamble--Towering financial inferno?

Much of the media are following the convention of assessing President Obama's first 100 days in office. The term was first applied to new American presidents during Franklin Roosevelt's spring of 1933. But Mr. Obama may wish to note the term 100 days derives from Napoleon's escape from Elbe in March 1815, his brilliant reforming of an army, his march through France, and his final defeat by the British and the Prussians at Waterloo. It's up in the air which precedent will apply to Mr. Obama. After 50 days on the job, the average of his job approval polls according to RealClearPoltics.com is 60.3 percent - almost precisely average for such data for presidents since Richard Nixon. So the polls don't tell us much.

Ronald Reagan's and Bill Clinton's numbers generally went up from this point in their presidencies; Mr. Nixon's and Mr. Carter's went down. So the polls don't tell us much. But these polls do not yet reflect the effect on public opinion of his budget announcements. There are two likely effects: one obvious and predictable, the other more delayed and more subtle. The first is that those who are to be more highly taxed begin to know who they are. By proposing limiting charitable donations and mortgage interest deductions - along with higher marginal and capital gains rates - for the upper middle class (and in effect most of small business), he not only threatens already hard-pressed charities and churches but pulls another support out from under real estate valuations.

By going straight at the nation's investors with tax increases, he risks undermining already flagging investor confidence. All this Mr. Obama presumably already knew was the political and economic price for getting his hands on more taxpayer dollars to spend. But vastly more dangerous to the Obama presidency (and the nation) was his decision to go full steam ahead to immediately start to transform health care, fight carbon dioxide energy sources with new taxations that will increase the cost of all energy, goods and services, and increase new expensive education entitlements as part of federalizing American education. It is this decision to not postpone those multiyear, multitrillion-dollar programs until the economy and the financial system is revived that exposes Mr. Obama's presidency to a possible catastrophic meltdown in its first term.

Not only is Mr. Obama failing to focus more or less exclusively on protecting the financial system and the economy that depends on it. He is letting his ideological ardor drive him to expend both his own and his administration's attention, along with the vast new tax dollars, on those programs, rather than on the financial and economic crises. Thus, and here is his political danger: If the financial system fails (and much of the economy along with it), it will be a fair, true and politically lethal charge against Mr. Obama that he didn't do all he could as soon as he could to protect us from the catastrophe. It was this decision that shocked even some of his moderate supporters such as David Gergen, David Brooks and others who are muttering in private.

And this misjudgment is only compounded by the slow and inept start of Treasury Secretary Timothy Geithner, the man with the line responsibility to fix it, and who only this last weekend got around to nominating some his vital sub-Cabinet officials. The failure of both Mr. Obama and Mr. Geithner, in the five months since the election, to come up with a plan to deal with the toxic assets and insolvency of major financial institutions may well look even more irresponsible if the derivatives crises in fact hit the world. The great whispered-about possible crisis that causes shudders among financiers and governments around the world is what to do about the more than quadrillion (1 thousand trillion) dollar notional value of the world's derivatives (what Warren Buffet called the financial WMD, weapon of mass destruction) - if that notional number becomes crystallized, and thus real.

By comparison, the U.S gross domestic product (GDP) is $14 trillion; U.S. money supply is $15 trillion. The GDP of the entire world is $50 trillion, the real estate of the entire world is $75 trillion, the world stock and bond markets are worth about $100 trillion. The notional $1.14 thousand trillion (as reported by the Bank of International Settlements in Switzerland) only becomes real (and frightfully dangerous) if either counterparty to the derivative goes bankrupt - and if the defaulter is a major institution. Then it would start a cascade of cross-defaults that might well infect and bring down the world financial system.

It may well be that the U.S. government has put up $180 billion to sustain the solvency of AIG because of its derivatives holdings. Our government may well need to spend trillions more before this is over on other tainted institutions and hope that is enough to hold off the derivatives catastrophe. By trying to fix the financial system and the economy inattentively and with one hand tied behind his back (as he fritters away both attention and trillions on new health care and education entitlements and carbon use), Mr. Obama is betting so much more than his presidency. His willingness to take that risk is the chilling lesson of the first 50 days. Taking that risk itself is the political equivalent of a dangerously leveraged derivative.

Tim Geithner's Black Hole

Pity Barack Obama's economic advisers. The blogs are now demanding their scalps, and Treasury Secretary Tim Geithner and his colleagues face a nasty dilemma: There are no solutions to the banking crisis without extraordinary political and financial risks. Thus, they have adopted a three-pronged approach, delay, delay, delay, in the hope that somebody comes up with a breakthrough. Here's the problem: Today's true market value of the U.S. banks' toxic assets (that ugly stuff that needs to be removed from bank balance sheets before the economy can recover) amounts to between 5 and 30 cents on the dollar. To remain solvent, however, the banks say they need a valuation of 50 to 60 cents on the dollar. Translation: as much as another $2 trillion taxpayer bailout.

That kind of expensive solution could send the president's approval rating into a nose dive. Consider: $2 trillion is about two-thirds of the tax revenue the federal government collects each year. The logical alternative -- talk show hosts' solution du jour -- is to temporarily restructure or nationalize the banks and leave taxpayers alone. Remove the toxic assets, replace management and cut the too-big-to-fail financial dinosaurs into smaller, nimbler entities. Then reprivatize these smaller banks and let the recovery begin. Oh, if it were that simple. I suspect Obama's advisers would like nothing more than to dismantle an irresponsible firm such as Citigroup. They are afraid to do so, for one reason: All the big banks are connected to a potentially lethal web of paper insurance instruments called credit default swaps. These paper derivatives have become our financial system's new master.

The theory holds that dismantling a big bank could unravel this paper market, with catastrophic global financial consequences. Or not. Nobody knows, because the market for these unregulated financial derivatives, amounting potentially to over $40 trillion (by comparison, global gross domestic product is now not much more than $60 trillion), is the financial equivalent of uncharted waters. Geithner has reason to be terrified. He was part of the Henry Paulson-led team that underestimated the devastating global-contagion effect of the collapse of Lehman Brothers. Geithner won't make the mistake of underestimation again.

Geithner also knows that the mood in Congress has changed. Were a global financial brush fire to break out as a result of bank restructuring or nationalization, today's populist Congress might just let it burn. Congressional anger is likely to intensify when policymakers realize that credit default swaps demand a stream of premium payments like a life insurance policy, not just a payment due at termination. And recent signs indicate that firms such as Citigroup, in recycling their taxpayer bailout funding, may have helped other financial firms, including some in Europe, meet these payment obligations.

In addition, Geithner worries that because the troubled insurance giant American International Group (AIG) is a conduit for the banks' use of credit default swaps, a collapse of AIG (as an unintended consequence of dismantling the big banks) could be catastrophic. AIG's more than 300 million terrified holders of insurance-related investments and pension funds, who have investments totaling $20 trillion (U.S. GDP is $14 trillion), could suddenly rush for redemptions -- the equivalent of a run on a bank. Geithner would face a worldwide insurance collapse to accompany his global banking collapse. Or again, maybe not. Nobody knows.

Here's another likely Geithner fear -- that Congress forces the banks' bondholders to take a hit. So far, only stockholders have lost out because of the banking crisis. One reason for the fragility in the credit default swap market of late is that markets fear that bank bondholders, who today are protected even before U.S. taxpayers, could soon see their status change. The worry is that if even bondholders are put at risk, U.S. and foreign investors alike would stop financing all corporate America. The administration says that won't happen, but market participants believe (probably correctly) that this White House can't control Congress.

So our Treasury secretary has no choice but to talk of bank stress-testing and other tactics to buy time before the big bank bailout. Notice that the president's budget already contains a contingency fund of up to $750 billion for a future bank bailout -- a politically shrewd number that roughly matches the size of the Paulson bailout. The true cost is likely to be two or three times as much, unless some last-minute intellectual breakthrough -- a tax holiday for derivatives? -- arises. The Obama team needs to remember that we got into this mess because of a lack of financial transparency. It's time to tell the American people what the stock market already knows: that the path to recovery will probably be expensive and politically unpopular, perhaps explosively so.

This dire situation could take us all down, which is why Obama should name a proven, world-class problem-solver who is not from Wall Street as his bank workout czar. James Baker, the former Republican secretary of state and Treasury secretary, comes to mind. Other possibilities: former Democratic senators Bill Bradley or George Mitchell. Perhaps the White House should name a team. In the end, at least one thing is certain: Our present position is unsustainable. The longer we delay fixing the banks, the faster the economy deleverages, the more credit dries up, the further the stock market falls, the higher the ultimate bank bailout price tag for the American taxpayer, and the more we risk falling into a financial black hole from which escape could take decades.

Credit Cards Are the Next Credit Crunch

by Meredith Whitney

Few doubt the importance of consumer spending to the U.S. economy and its multiplier effect on the global economy, but what is underappreciated is the role of credit-card availability in that spending. Currently, there is roughly $5 trillion in credit-card lines outstanding in the U.S., and a little more than $800 billion is currently drawn upon. While those numbers look small relative to total mortgage debt of over $10.5 trillion, credit-card debt is revolving and accordingly being paid off and drawn down over and over, creating a critical role in commerce in America. Just six months ago, I estimated that at least $2 trillion of available credit-card lines would be expunged from the system by the end of 2010.

However, today, that estimate now looks optimistic, as available lines were reduced by nearly $500 billion in the fourth quarter of 2008 alone. My revised estimates are that over $2 trillion of credit-card lines will be cut inside of 2009, and $2.7 trillion by the end of 2010. Inevitably, credit lines will continue to be reduced across the system, but the velocity at which it is already occurring and will continue to occur will result in unintended consequences for consumer confidence, spending and the overall economy. Lenders, regulators and politicians need to show thoughtful leadership now on this issue in order to derail what I believe will be at least a 57% contraction in credit-card lines.

There are several factors that are playing into this swift contraction in credit well beyond the scope of the current credit market disruption. First, the very foundation of credit-card lending over the past 15 years has been misguided. In order to facilitate national expansion and vast pools of consumer loans, lenders became overly reliant on FICO scores that have borne out to be simply unreliable. Further, the bulk of credit lines were extended during a time when unemployment averaged well below 6%. Overly optimistic underwriting standards made more borrowers appear creditworthy. As we return to more realistic underwriting standards, certain borrowers will no longer appear worth the risk, and therefore lines will continue to be pulled from those borrowers.

Second, home price depreciation has been a more reliable determinant of consumer behavior than FICO scores. Hence, lenders have reduced credit lines based upon "zip codes," or where home price depreciation has been most acute. Such a strategy carries the obvious hazard of putting good customers in more vulnerable liquidity positions simply because they live in a higher risk zip code. With this, frequency of default is increased. In other words, as lines are pulled and borrowing capacity is reduced, paying borrowers are pushed into vulnerable financial positions along with nonpaying borrowers, and therefore a greater number of defaults in fact occur.

Third, credit-card lenders are currently playing a game of "hot potato," in which no one wants to be the last one holding an open credit-card line to an individual or business. While a mortgage loan is largely a "monogamous" relationship between borrower and lender, an individual has multiple relationships with credit-card providers. Thus, as lines are cut, risk exposure increases to the remaining lender with the biggest line outstanding. Here, such a negative spiral strategy necessitates immediate action. Currently five lenders dominate two thirds of the market. These lenders need to work together to protect one another and preserve credit lines to able paying borrowers by setting consortium guidelines on credit. We, as Americans, are all in the same soup here, and desperate times are requiring of radical and cooperative measures.

And fourth, along with many important and necessary mandates regarding fairness to consumers, impending changes to Unfair and Deceptive Acts or Practices (UDAP) regulations risk the very real unintended consequence of cutting off vast amounts of credit to consumers. Specifically, the new UDAP provisions would restrict repricing of risk, which could in turn restrict the availability of credit. If a lender cannot reprice for changing risk on an unsecured loan, the lender simply will not make the loan. This proposal is set to be effective by mid-2010, but talk now is of accelerating its adoption date. Politicians and regulators need to seriously consider what unintended consequences could occur from the implementation of this proposal in current form. Short of the U.S. government becoming a direct credit-card lender, invariably credit will come out of the system.

Over the past 20 years, Americans have also grown to use their credit card as a cash-flow management tool. For example, 90% of credit-card users revolve a balance (i.e., don't pay it off in full) at least once a year, and over 45% of credit-card users revolve every month. Undeniably, consumers look at their unused credit balances as a "what if" reserve. "What if" my kid needs braces? "What if" my dog gets sick? "What if" I lose one of my jobs? This unused credit portion has grown to be relied on as a source of liquidity and a liquidity management tool for many U.S. consumers. In fact, a relatively small portion of U.S. consumers have actually maxed out their credit cards, and most currently have ample room to spare on their unused credit lines. For example, the industry credit line utilization rate (or percentage of total credit lines outstanding drawn upon) was just 17% at the end of 2008. However, this is in the process of changing dramatically.

Without doubt, credit was extended too freely over the past 15 years, and a rationalization of lending is unavoidable. What is avoidable, however, is taking credit away from people who have the ability to pay their bills. If credit is taken away from what otherwise is an able borrower, that borrower's financial position weakens considerably. With two-thirds of the U.S. economy dependent upon consumer spending, we should tread carefully and act collectively.

Nobody Says Mark to Market Doesn’t Matter After GE Plunges 54% in 2009

For more than a decade General Electric Co. could easily avoid disclosing the value of its real estate and business loans. Not any more. Since Jan. 2, GE lost 54 percent on the New York Stock Exchange, mostly because shareholders are no longer willing to accept whatever the Fairfield, Connecticut-based company tells them about its finance subsidiary unless it’s based on so-called mark-to-market accounting rules. The world’s biggest maker of jet engines and power turbines told shareholders last week that 2 percent of GE Capital Corp.’s assets are being valued based on market prices. The remaining $624 billion is being carried at levels that GE, the last original member of the Dow Jones Industrial Average, established in many cases years ago, according to CreditSights Inc.

"The notion of having 98 percent opaque and 2 percent valued with clarity is something that by its very nature would make investors nervous," said Robert Arnott, founder of Research Affiliates LLC, which oversees $30 billion in Newport Beach, California and owned 481,201 GE shares as of Dec. 31. "Having some clarity on what the other 98 percent is worth is valuable." Once the world’s largest company, with a market value of almost $600 billion, GE has plummeted to $78.3 billion in New York Stock Exchange trading. The shares posted two of the three worst weekly declines since 1980 during the past month as investors speculate the deepest financial crisis since the Great Depression will cause more writedowns and losses at its finance division than the $10 billion the company anticipates.

Last week, the stock fell below $6, the price of some GE light bulbs, for the first time since 1991. Yesterday, GE rose 5 percent to $7.41. "We recognize there is a need and an opportunity to do more" to improve disclosure and transparency, GE spokesman Russell Wilkerson said in an e-mailed response to questions. GE, which will hold a five-hour meeting with investors and analysts on March 19 to discuss the finance unit’s business, follows generally accepted accounting principles, which don’t require it to mark all assets to market, according to Wilkerson. In fact, the rules in many cases forbid it, he said. GE predicts the finance unit will earn $5 billion this year, more than forecasts by analysts surveyed by Bloomberg. Goldman Sachs Group Inc. analyst Terry Darling in New York expects the finance unit to break even this year as losses from loan losses swell in commercial real estate and in Eastern Europe.

GE’s forecast reserves relative to loans of 2.5 percent this year are still "thin" relative to banks, which means raising more capital is "inevitable," according to Darling. The gap between GE and the analysts reflects differing valuations for assets in the finance division. The unit is similar in size to the sixth-biggest U.S. bank, according to an estimate by CreditSights, an independent bond research firm based in New York. Most of its loans are senior secured debt tied to assets such as aircraft. GE Capital generated 48 percent of the parent company’s $18.1 billion in profit last year. That compares with about 20 percent in the late 1980s, according to Nicholas P. Heymann an analyst at Sterne Agee, a Birmingham, Alabama-based brokerage.

He estimated in a note on March 3 that GE may need more money to cover losses of between $21 billion to $54 billion in the next several years. That would be almost as much as Merrill Lynch & Co. wrote down, according to data compiled by Bloomberg. New York-based Merrill was acquired by Bank of America Corp. of Charlotte, North Carolina. Heymann’s "analysis is flawed and produces misleading estimates," according to GE’s Wilkerson. "The transparency is what you want," said Barry James, chief executive officer of James Investment Research Inc. in Xenia, Ohio, which oversees $1.3 billion. "I don’t think anybody knows what they’re worth."

The debate over the fair-value rule, which requires companies to assess assets every quarter to reflect a market price, divides finance industry executives. Banks say the rule, also known as mark to market, requires them to report losses from falling values even if they don’t expect to incur penalties because the assets aren’t for sale. The lower valuations can force companies to raise capital to comply with federal regulations. Blackstone Group LP Chairman Stephen Schwarzman, the American Bankers Association and 65 lawmakers in the House of Representatives urged that fair-value accounting, mandated by the Financial Accounting Standards Board, be suspended last September.

William Isaac, chairman of the Federal Deposit Insurance Corp. from 1981 to 1985, has called fair value "extremely and needlessly destructive" and "a major cause" of the credit crisis. Robert Rubin, the former Citigroup Inc. senior counselor and Treasury secretary, said Jan. 27 the rule has done "a great deal of damage." Goldman Sachs Chief Executive Officer Lloyd Blankfein, Lazard Ltd. Chairman Bruce Wasserstein and Treasury Secretary Timothy Geithner support fair-value accounting. Federal Reserve Chairman Ben S. Bernanke told Congress Feb. 25 that fair value is a "good principle in general" even if accounting rulemakers have to "figure out how to deal with some of these assets" that aren’t actively traded. Securities and Exchange Commission Chairman Mary Schapiro has said mark to market wasn’t a significant factor in the current crisis.

Blaming the rule "is a lot like going to a doctor for a diagnosis and then blaming him for telling you that you are sick," Dane Mott, an analyst at JPMorgan Chase & Co., wrote in a September report. GE, which may lose its AAA ratings from Moody’s Investors Service and Standard & Poor’s, will meet with analysts this month to make good on Chief Financial Officer Keith Sherin’s promise of a "deep dive" explanation of the finance unit. The company cut its dividend for the first time since 1938 last month to preserve $9 billion in cash. "Investors need the assets broken down so they can see what’s really there," said Craig Hester, president of Hester Capital Management, which oversees about $1.1 billion in Austin, Texas. "The market cares about whether GE is being honest. In the case of GE, there is fear."

Detox for Troubled Assets: Sheila Bair

The government's plan to strip banks of troubled assets could force some firms to record large losses, but the painful purge would help restore confidence in the banking system, according to Sheila C. Bair, chairman of the Federal Deposit Insurance Corp. Bair said yesterday that the effort might require more money than the $700 billion Congress has approved to aid the financial industry, but she added that taxpayers would probably reap an eventual profit on the asset purchases. She said the greatest challenge was persuading banks and taxpayers to accept the necessity of the costly program.

"This takes courage to do, but if we don't do it, history shows that this kind of mechanism -- recognize the losses, get at the root of it and move on -- this is how you jump-start the economy. The other option, just to park those assets on the balance sheet, I don't think that gets us very far," Bair said in a discussion with Washington Post reporters and editors. The government plans to partner with private investors to buy troubled assets, in part by providing financing at low cost. Bair and other federal officials said discussions were ongoing about the appropriate extent of the federal subsidy. A larger government contribution would allow investors to pay higher prices, limiting the losses that banks would record but also exposing taxpayers to greater risk.

The administration hopes to find the right balance and announce the details within the next two weeks, possibly as soon as next week, according to people familiar with the matter. Since the early days of the crisis, plans have circulated to buy troubled assets, such as distressed mortgage loans, from banks. The Bush administration requested $700 billion from Congress to fund such a program, then instead decided to inject most of the money directly into companies. Bair said yesterday that the original plan to buy assets faltered in part because of concerns about the cost. "What the pricing looked like, what the losses would be, I think that's what stymied this effort before," she said.

Bair, who remained in office after the election as the head of the independent FDIC, said the Obama administration appeared to understand the need for the program. She said buying troubled assets would create a clear strategy for ending the government's intervention in the banking system, something investors are eager to see. The government's approach would involve investment partnerships with money from both private investors and the government. The government would establish multiple funds to compete with one another, creating a market that would determine prices. Bair calls the initiative an "aggregator bank," though Treasury officials contend that the partnerships should be called "public-private investment funds."

The funds would use that capital to borrow more money, in much the way that a home buyer makes a down payment to take out a mortgage from a bank. In this case, the loan would be likely to come from the Federal Reserve. In a theoretical example, to raise $10 million, the government and the private investors might each contribute $1 million, and then borrow $8 million from the Federal Reserve. The government and private investors also could contribute different shares. Officials said the proportions remain under discussion. The funds would use the money to buy toxic assets from banks. The private investors would manage the funds and determine how much to pay for the assets. That would allow the government to benefit from their expertise and desire to maximize profits.

The plan emerged from discussions about creating a "bad bank," in which a company's troubled assets are split off and placed in a new company, leaving behind a "good bank." Bair said the term "bad bank" was misleading because the structure of the deal should benefit both sellers and buyers. "You end up with two healthy institutions," she said. "It's not a good bank and a bad bank; it's an aggregator bank with good upside potential because it bought at good discounts and you've got a clean balance sheet over here with an opportunity to raise private capital." Bair emphasized that banks forced to take large losses might not need more government money because, newly cleansed, they would be in position to raise money from private investors. She said the size of the write-downs actually could be a positive, by establishing that banks are free of their problems.

"The thing that really makes people gulp about this is the size of the hole, but we view that as a strength and not a weakness," she said. Other banks could be forced to raise money from the government. And she said it was possible that some banks would take losses too large to survive. A key issue that has derailed past plans to buy troubled assets is the large gap between the prices banks consider fair and what investors are willing to pay. Bair said part of that gap reflected the cost of borrowing money, because fear continues to hang over the financial markets. She said the government can eliminate that portion of the difference by providing low-cost financing. "One of the reasons that prices are distressed right now is because of the lack of financing to make purchases," Bair said. "The government, by providing low-cost funding, it will help to tease out that liquidity premium from the pricing and hopefully get the pricing a little higher."

Even so, the losses faced by banks could be steep, raising the question of how many banks will be willing to participate. The government already has made it easier for banks to borrow money and has provided banks with fresh capital. Some banking executives have questioned why they should sell assets at a loss rather than simply hold them and wait for prices to improve. General Electric's finance arm, which had been seeking to sell some commercial loans, is no longer looking for buyers. Morgan Stanley also decided not to sell commercial and subprime mortgages it had once considered selling.

Here Is What's Really Wrong With Sheila Bair's Bad Bank

The key to making the bad bank work is the gap between private interest rates and government interest rates, Sheila Bair argues in a revealing interview with the The Washington Post today. Bair says the "bad bank" would buy troubled assets at levels above what the market could pay because the costs of financing by the government are much lower than those by private investors. This is undoubtedly true. The question is whether or not this will be as effective as Bair hopes.

First, let's clear away all the confusing nomenclature. Bair likes to call it an "aggregator bank." Others prefer the term "public-private partnership" because they think they will be able to get private investors to invest alongside the government in the troubled assets purchased from financial institutions. Whatever you want to call it, and however it is actually managed, the idea is the same: have a government entity buy up assets from banks at prices above what they could get on the market. The banks would take some losses because they still have the assets marked at unrealistically high levels, but not as much as they would if forced to sell them privately.

Bair thinks the cost of financing purchases is at the heart of the difference between what banks think their assets are worth and what investors are willing to pay. She said the government can eliminate that portion of the difference by providing low-cost financing. "One of the reasons that prices are distressed right now is because of the lack of financing to make purchases," Bair tells the Washington Post. "The government, by providing low-cost funding, it will help to tease out that liquidity premium from the pricing and hopefully get the pricing a little higher." The biggest potential stumbling block is whether or not the difference in borrowing costs is enough to bridge the gap.

There are plenty of warning signs it won't be. If a bank holds on its books a mortgage backed security at 89 cents on the dollar that the market prices at 60 cents on the dollar, the gap is far too broad to be bridged by this kind of borrowing cost arbitrage. Even if the government paid the full borrowing cost difference to a bank, and let's say that was as high as 1500 basis points, the bank would have to huge losses on the sale. Many banks may be in such poor financial health that taking such losses could render them insolvent or below regulatory capital requirements.

Why doesn't Bair see this as a problem for her bad bank plan? On the one hand, she doesn't understand the severity of the problem at banks (which is frightening for someone in her position). On the other, it seems that Bair, like so many top officials in the Washington, is operating under the conviction that toxic assets are really worth much more than anyone is actually willing to pay for them. But since many bankers believe the very same thing, they'll be unwilling to part with the assets except at highly elevated prices. So we have a kind of dangerous contest where the bad assets will wind up in the hands of whoever is most confident the market is mispricing the assets.

Bernanke: We need improvements to fair value rules

"Audit regulators need more mark-to-market accounting guidance"

Federal Reserve Chairman Ben Bernanke on Tuesday argued that regulators should identify the weak parts of controversial mark-to-market accounting rules, which require daily revaluing of assets, and try to make some improvements. "We all acknowledge that in periods like this when some markets don't exist or are highly illiquid that the numbers that come out can be misleading or not informative," Bernanke said at a Council on Foreign Relations event in New York. "We need to provide more guidance to financial institutions about what are reasonable ways to address the valuation of assets that are traded at all in highly problematic markets."

Also known as "fair value" rules, mark-to-market is an accounting methodology that requires banks and other corporations to assign a value to a financial product, such as a mortgage security, based on the current market price for the product or similar product. However, the market for troubled mortgages securities and other illiquid assets owned by banks have frozen up, making valuation of these securities more difficult. Proponents of eliminating or adjusting mark-to-market rules argue that changes could help restore confidence in the overall economy by propping up the value of banks, which would expand lending again as a result. However, supporters contend that keeping the methodology intact is necessary because shareholders deserve to understand the troubled state of financial institutions.

Bernanke did not provide details about what kind of changes he would like to see to mark-to-market rules. Lawmakers on Capitol Hill will be considering alternatives at a House securities Subcommittee committee hearing Thursday to examine the regulations. One possible alternative would allow banks to develop a model and analysis of what they believe the illiquid assets are worth and what they forecast the securities will be worth in the following quarter. The financial institution would also be required to explain what a bid for that asset would be worth if sold today. As part of this measure, banks could say a particular asset is worth $80 based on their analysis, forecast it will be worth $90 next quarter, and it could be sold immediately for $50.

Big banks will not be allowed to fail, Bernanke says

Federal Reserve Board Chairman Ben Bernanke stressed Tuesday that major financial institutions would not be allowed to fail given the fragile state of financial markets and the global economy. In a speech in Washington, Bernanke repeated that a sustainable economic recovery will "remain out of reach" until the banking sector is stabilized. "In particular, the continued viability of systemically important financial institutions is vital to this effort," Bernanke said in a speech to the Council of Foreign Relations. "We have reiterated the U.S. government's determination to ensure that systemically important financial institutions continue to be able to meet their commitments," Bernanke said.

Some senior Republican members of Congress and even one president of a regional Fed bank are calling for the government to pull back from assisting a large financial institution. They are worried that the government is throwing good money after bad in propping up these troubled institutions, including Citigroup and American International Group. "Close them down, get them out of business. We've got to bury some big ones and send a strong message to the market," Sen. Richard Shelby, the ranking Republican on the Senate Banking Committee, said on ABC News over the weekend. Bernanke's comments could be viewed as a forceful response against that idea.

Bernanke met with President Obama and his top economic advisors on Monday behind closed doors to discuss the economic outlook and the financial market crisis. The Obama team has yet to spell out important details of how a public-private partnership will remove toxic assets, primarily mortgage securities, off the balance sheets of banks. Administration officials said the details could come within a few weeks. White House spokesman Robert Gibbs said Obama is pleased with the coordination between Treasury and the Fed in response to the crisis.

The bulk of Bernanke's address included a summary of his thinking about how to improve the regulation of financial markets. He spent some time describing the idea of one systemic regulator to oversee the entire financial market looking for signs of stress. Many members of Congress want the Fed to take that new role but Bernanke played it coy and said the issue would have to be solved down the road and depended on what Congress had in mind. Bernanke said the U.S. regulators failed in their duty to maintain a stable financial system leading up to the crisis, but added that the "details of the story are complex."

Bringing back uptick rule could soothe U.S. markets

Reinstating a rule designed to slow the pace of short selling could help calm volatile markets, preventing already battered stocks from snowballing further. Short selling, where an investor bets on a declining share price, has come under increased scrutiny, with opponents arguing it has exacerbated the sharp losses seen since the onset of the global credit and economic crisis. Bringing back the uptick rule, which would only allow short sales when the last sale price is higher than the previous one, would stem a stock's decline by preventing short sellers from piling on one after another, market-watchers said.

U.S. Rep. Barney Frank, chairman of the House Financial Services Committee, said on Tuesday that he expects the Securities and Exchange Commission will restore the rule in about a month. His comments added strength to a rally in U.S. stock markets, pushing the broad S&P 500 .SPX up more than 5 percent. Critics say banks have been especially hurt by short sellers betting their stocks have further to fall, serving to drive the shares down more than warranted. "If there's no uptick rule, the short selling can become overwhelming," said Bill Rhodes, founder and chief investment strategist at Rhodes Analytics in Boston. "When you get a tidal wave of pessimism, everybody wants to short, and what the uptick rule does is it creates a queue so you have to get in a line to do it."

The SEC repealed the uptick rule in 2007 because the agency found that changes in trading strategies made it ineffective. Since then, the world economy has unraveled as massive bank losses and write-downs have pummeled confidence and changed the landscape of the financial system; shares of major banks such as Bank of America have fallen to single digits and Citigroup has traded below $1. Federal Reserve Chairman Ben Bernanke has said in Congressional testimony that the SEC was looking at restoring the rule and that the measure might have had some benefit if it had been in effect in the current crisis. "I believe that what happened is a lot of things have been done the last few years which are fine for stable markets, but the real test comes when markets are unstable," said Subodh Kumar, chief investment strategist at Subodh Kumar & Associates in Toronto.

"Taking out the uptick rule during a time of stress exacerbates things." Following the collapse of Lehman Brothers and the government bailout of American International Group, some pundits and corporate executives blamed the market turmoil on short selling, a process which involves selling a borrowed stock in the hopes of buying it back at a cheaper price. Regulators responded by imposing a temporary ban on shorting financial stocks in late September, but markets continued to dive. That proves that imposing such rules have no effect on prices, said Scott Jacobson, chief investment strategist at Capstone Sales Advisors, in New York, who said the uptick rule would not calm markets as it would create an "artificial friction."

"Let's just say that the short seller is correct and the price should be lower. If you prevent that price from going lower through some artificial means, it will have to go there at some point in the future," said Jacobson. Whether bringing back the rule would help, analysts said the discussion by prominent policy makers signals it is not something to be taken lightly. "Bernanke is a person who's very careful with his words. On top of that, central bankers are known for being relatively obtuse for good reason," said Kumar, who favors reinstating the rule. "So when we put those two things together, and he specifically says that it is something to look at, in my opinion, that's more than just off-hand comments."

IMF Sees ‘Great Recession’ as Global Economy Shrinks

The International Monetary Fund expects the global economy to contract this year and the slump will be the worst "in most of our lifetimes," Managing Director Dominique Strauss-Kahn said. The global financial crisis that has slashed international trade can now be termed the "Great Recession," Strauss-Kahn said in a speech to African central bank governors and finance ministers in Dar es Salaam, Tanzania today. "The IMF expects global growth to slow below zero this year, the worst performance in most of our lifetimes," Strauss- Kahn said. "Continuing deleveraging by world financial institutions, combined with the collapse in consumer and business confidence is depressing domestic demand across the world."

The IMF had forecast in January that the global economy would expand 0.5 percent this year. The World Bank said in a March 8 report that the international economy was likely to shrink for the first time since World War II, and trade will decline by the most in 80 years. European governments from Dublin to Athens have committed more than 1.2 trillion euros ($1.5 trillion) to protect their banking systems and leaders pledged to spend a combined 200 billion euros to try and lift their economies out of the worsening slump. The U.S. is spending $787 billion on an economic stimulus package to revive its economy. The IMF is aiming to double its resources to $500 billion to better address the crisis, with Japan already pledging an extra $100 billion.

Strauss-Kahn said he is "confident" the Group of 20 countries will agree to this goal at a summit in April. He urged better coordination between leading nations to help boost the global economy and called on rich countries to "reject protectionism, both in trade and finance." "If one crisis amongst all crises in the world that requires some coordination, it is this crisis," Strauss-Kahn said. "It’s a global crisis, so the solution can’t be implemented by one country alone." Finance ministers from the 20 largest industrialized and emerging-market economies will meet in London this weekend, as the U.S. tries to push European governments to increase spending to stimulate their economies.

Poor countries may be worst hit by a slump in economic growth and trade because poverty will increase, the IMF managing director said. That increases the threat of political conflict and even war in some regions, he added. Economic growth of about 3 percent forecast for Sub-Saharan Africa may be "too optimistic" and the global crisis threatens to wipe out economic progress in the world’s poorest continent in the past decade, Strauss-Kahn said. "We have to be concerned that the remarkable gains achieved by Africa over the last decade are now under threat," Strauss- Kahn said. "As growth around the world has almost come a halt, demand for Africa’s products is plunging."

EU backs IMF funds, shuns US spending call pre-G20

The European Union on Tuesday backed calls for a doubling of the International Monetary Fund's crisis-fighting funds to $500 billion ahead of a key meeting of the G20 group of old and new economic powers later this week. At talks among finance ministers, the 27 EU countries also said exceptional government spending to combat world recession was as much as it would envisage for now, exposing a rift with Washington, which wants more done on that front. The EU position on both IMF funding and fiscal stimulus were contained in a document that mapped out a joint EU policy stand for G20 talks taking place in Britain on Friday and Saturday to prepare for a G20 summit on the global economic crisis on April 2.

The EU document said the IMF funding increase should be split fairly among IMF members, particularly those with large currency reserves -- in line with previous calls for countries like China and Saudi Arabia to pay a sizeable share. "EU member states support a doubling of IMF resources and are ready to contribute to a temporary increase, if needed," it said. "It is essential that the IMF has appropriate financial means to assist countries particularly affected by the current crisis," it said. The document also detailed the EU's position for the G20 on economic policy, regulation and the role of key international financial institutions.

It also made clear that Europe has no intention for now of increasing the fiscal stimulus governments have announced as their contribution to the battle against global recession. Larry Summers, one of U.S. President Barack Obama's chief economic policy advisers, called on Monday for more but got a blunt "no way" from Europe. Jean-Claude Juncker, chairman of a meeting of finance ministers from euro zone countries, led the response overnight at a news conference where he said: "The 16 finance ministers (of the euro zone) agreed that recent American appeals insisting Europeans make an added budgetary effort were not to our liking, given that we are not prepared to go further in the recovery packages we have put forward."

"The EU is doing its part to support demand," the document approved by finance ministers of the euro zone and the rest of the EU on Tuesday said. "The focus should now be on swift implementation of planned fiscal stimulus packages to avoid that the recession becomes entrenched," it said. The EU fiscal stimulus is worth between 3 and 4 percent of EU gross domestic product (GDP) in all and about one third of that is discretionary spending, it said. U.S. President Obama's $787 billion stimulus plan, for 2009-10 but a bit longer in the case of tax cuts, amounts to about 5.5 percent of the GDP of the United States, where the now global crisis began two years or so ago.

Even though there is general agreement on the need to double the IMF's resources, the debate is far from straightforward. The G20's emerging market countries, notably China, want their contribution linked to bringing forward a renegotiation of voting power within the IMF, to 2011 from 2013, one G20 official told Reuters on condition of anonymity. The exception is Saudi Arabia, which has a history of being more generous to the IMF than China. Saudi Arabia is not keen to open the voting debate as it risks losing out, the source said. African countries are also concerned about reopening the debate, as they might lose gains that were made in the 2008 round of discussions, the source said.

Several countries, including the United States, have not yet even ratified the existing 2008 agreement on IMF voting rights and Russia, which was unhappy with this deal, has proposed scrapping it altogether. The 2008 agreement took two and a half years to conclude and the developed countries, all in the G20 too, are not keen to get sidetracked onto this in the middle of the crisis. Europe and the United States could foot the bill without China but they are not keen to do this because they want everybody to chip in.

EU Finance Ministers Increasingly Gloomy About 2010

Hopes for an economic upturn in Europe in 2010 are fading. EU finance ministers now believe it is "highly uncertain" that the economy will start to recover next year, according to a newspaper report. But the EU has rejected US calls for fresh stimulus measures. Europe's finance ministers have become more pessimistic about the outlook for the European economy and now believe it's "highly uncertain" the much-predicted recovery in 2010 will materialize, according to an internal paper prepared by ministers for the European Union summit on March 19, German business daily Financial Times Deutschland reported on Tuesday. In mid-January, EU Monetary Affairs Commissioner Joaquin Almunia had forecast that the economy would start to improve in the second half of 2009. But many economists now believe that the economic crisis will be far worse and last longer than expected. Europe's economies are being hit by negative growth, historically low business and consumer confidence and faltering credit cycles, the document says.

"Negative spirals between the real economy and the financial markets are worsening the situation," it adds, according to Financial Times Deutschland. "All forecasts available are extremely gloomy. This is a deep recession, deeper than at the beginning of the 1990s," Jean-Claude Juncker, who is Luxembourg's prime minister and finance minister, told reporters on Monday. Juncker is chairman of the 16 finance ministers from euro zone, which consists of the states that have adopted the euro single currency. The European Commission predicted on Jan.19 that the euro zone economy would shrink 1.9 percent this year. The European Central Bank, however, forecast last Thursday the contraction could be between 2.2 percent and 3.2 percent. Nevertheless, the EU has rejected an appeal from the US government to launch additional economic stimulus packages. "We're not prepared to increase the economic programs," Juncker said. Stimulus measures undertaken so far should first be allowed to take effect, he added.

The senior economic advisor to US President Barack Obama, Lawrence Summers, had urged Europe in a newspaper interview on Monday to pump more money into the economy to keep on boosting domestic demand and help lift the world out of recession. The EU states have spent around 3.3 to 4 percent of their combined economic output to kick-start economic growth. In January Germany introduced a €50 billion ($63 billion) program, its second since the crisis escalated in late 2008. German Finance Minister Peer Steinbrück also rejected further measures. "We should concentrate on the measures that have already been decided," he said on Monday evening. Despite the worsening outlook, the finance ministers plan to set a timetable for reducing their national budget deficits, with most planning to start consolidating in 2010, according to Financial Times Deutschland. That will help prevent financial markets from punishing highly indebted governments by imposing higher risk premiums on their government bonds.

However, the document adds that countries with especially high budget deficits should be allowed longer grace periods to reduce the deficits. This is aimed at countries such as Ireland, which is expected to post a deficit of almost 10 percent of gross domestic product (GDP) in 2009, almost three times higher than the 3-percent limit set by EU rules. The EU finance ministers are meeting in Brussels on Tuesday to discuss cuts in sales tax for certain sectors and to agree on long-term economic and budget plans for a number of EU countries, including Germany. The German government expects a budget deficit of 4 percent of GDP for 2010, but plans to reduce it back below the 3-percent limit in 2012. But not everyone's happy with the EU's crisis management. The managing director of the International Monetary Fund, Dominique Strauss-Kahn, accused the EU of poor coordination in tackling the downturn.