Hot dogs for fans waiting for gates to open for Game Two of World Series between Cleveland Indians and Brooklyn Robins (later Dodgers) at Ebbets Field, New York City

Ilargi: In the days leading up to President Obama's inauguration, Christina Romer, since then appointed as chairwoman of the White House Council of Economic Advisers, told the media that the new administration was in uncharted waters, since a situation such as the one they inherited had never before taken place. In a 1994 paper for which she studied 50 past recessions, Romer stated that stimulus plans historically don't seem to be effective.

Today, she has changed her views, and not a little bit. She's fully behind all of Obama's stimulus plans, of which she told FOXNews this morning: "We absolutely think that they are going to do the job for the American economy”, adding she feels "incredibly confident" that they will. On another show, CNN’s State of the Union, Mrs. Romer went one step further, claiming she has "every expectation, as do private forecasters, that we will bottom out this year and actually be growing again by the end of the year."

It was Romer's second consecutive Sunday on the talk show circuit (last week's gem was "It is an economic war. We haven’t won yet. We have staged a wonderful battle."), and it's hard not to get the impression that she's being pushed into the public eye because she's one of the few faces in Obama's economic team who's not yet perceived as 'damaged goods'. Still, if and when someone on that team changes her ideas so fast and so drastic, that may not last long.

I have no idea why Romer, perhaps coached by the spin crew, deems it appropriate to now claim economic growth in the US by the end of 2009. It looks to me like a bet you can only lose, and, what's more, one you have no need to make. It would be perfectly understandable for everyone if she had said it won't be before 2010, no-one would reproach her for that. Perhaps it just smells of the increasing despair in the administration, but then again, that maybe should be reason to be careful with what is said by those whose reputations haven't yet been tainted, like those of for example Summers and Geithner have.

Presumably the growth factor religion is so strong among decision makers in Washington that they can't help themselves from uttering the word "growth" from time to time, almost like Tourette patients. Perhaps that's why they seem willing to ignore the notion that mentioning the word gets riskier all the time. If you keep talking about it, people will want to see the real thing one day. And there lies the main problem to date of the Obama administration: a lot of words, and preciously few tangible results.

The waters haven't gotten one inch more familiar or less uncharted since Christina Romer talked about them 10 weeks ago; on the contrary, things have demonstrably gotten much worse, and still she all of a sudden tries to look convinced that the course the ship has taken is the right one. Pure and abstract faith takes the day once more. Either that or the chairwoman is lying to our faces.

In the light of the coming week, in which Timothy Geithner will present his already heavily disputed $1 trillion+ toxic assets plan, and in which the president is set to present his $3.6 trillion+ budget on Capitol Hill, the reasoning behind Mrs. Romer's words is hard to fathom. She may fool ordinary people, but nary a soul in the Capital will take her seriously, perhaps ever again. It feels a little like a scorched earth strategy.

The administration, in the surprisingly small window of 8 weeks and five days, has only one surefire asset left -that is, at least for now-, and that is of course Obama's popularity and the belief and confidence Americans have in him personally. It looks more and more obvious that there is one thing only that can preserve that faith, and that is transparency, honesty, telling people how things truly stand in the country. Christina Romer's words are one more sign in a long line that we shouldn't be holding our breath waiting for it.

The Escalator of Life Is Going Down

We're riding on the escalator of life

We're shopping in the human mall

We're dancing on the escalator of life

Won't be happy 'til we have it all

We want it allEscalator of life - up and down

Escalator of life - round and round

There's 111 choices

Don't listen to those little voices

I don't let the guilty feeling shake me

You can have your cake and eat it baby--Robert Hazard – Escalator of LifeAmericans have been on the escalator of life for the last 30 years. The escalator has been going up for the vast majority of that time. Since Ronald Reagan was President, the escalator has been moving upwards with only a few momentary breakdowns. We wanted it all. We believed it was our right to have it all. Americans did whatever it took to have it all. That meant an explosion of household debt promoted by bankers, the Federal Reserve, politicians, the media, and Presidents. We were dancing on the escalator of life for decades but our shoelace got caught in the escalator last year and severed our foot. We are bleeding to death as the escalator heads relentlessly downward. There are millions of Americans who have a guilty feeling about how they have lived their lives. They had their cake and tried to eat it too. Americans are now repenting by dramatically reducing their spending. The U.S, government is desperately attempting to convince Americans to get back on the escalator.

The financial system has stopped functioning because no one trusts anyone else. The rules are changed by the Treasury and Federal Reserve on a daily basis. It seems like every company in America has converted into a bank so it can acquire a slice of the taxpayer funded pie called TARP. The government has been using all the tools at their disposal to dig the country out of this hole. If they dig too far, the stimulus could blow up in a torrent of inflation.

Which Assets Are Toxic?

In the last nine years U.S. financial institutions became extremely creative with their financial “products”. They were encouraged by Federal Reserve Chairman Alan Greenspan who was sure that any regulation other than self-regulation would be counterproductive. In the bully pulpit was our first Harvard MBA President George Bush, proclaiming the benefits of free market capitalism while not being able to pronounce or spell derivative, let alone understand them.

Watching over the creative bankers was the eagle eyed SEC, which had just received accolades for the Enron and WorldCom scandals. This trusting bunch of morons, hoping to one day get cushy jobs on Wall Street, decided that the investment bankers should be allowed to leverage their assets 30 to 1, rather than the overly restrictive 12 to 1 that had been in place for decades. Their models, created by overly confident MBAs, assured them that nothing could go wrong.

The final piece of the puzzle was obtaining a AAA rating for these new “products” from the staid old rating agencies Moody’s and S&P. These two companies had a very predictable boring revenue stream. Their CEOs wanted a little excitement in their lives, and maybe, just maybe, big bonuses and stock options. They decided to jump head first into rating the new indecipherable products. They also had their cock sure MBAs creating models which assured them that all was well. Surprisingly, after being paid billions in fees, the rating agencies provided AAA ratings across the board to all of the new investment products.

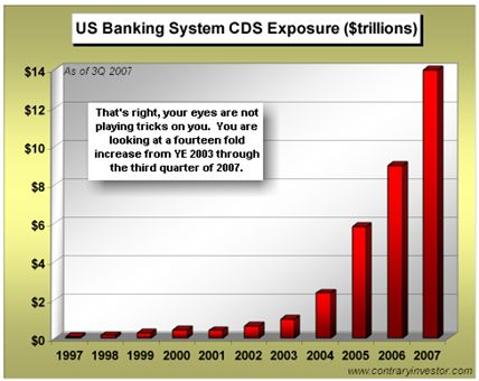

The Wall Street geniuses peddled MBSs, CDSs, and CDOs, to pension plans, cities, states, foreign banks, foreign villages, and anyone else who wanted to get in on the easy money. With AAA ratings, no one bothered to conduct due diligence and understand what could go wrong. The amount of derivatives outstanding rocketed from $40 trillion in 2000 to $684 trillion in 2008. It has been reported that 80% of all Credit Default Swaps outstanding in 2008 were speculative. There was no hedging going on. Wall Street had become a Las Vegas casino. Credit default swaps totaling $440 billion were written by AIG. These were pure speculative bets and the American taxpayer is still paying off. The bill is up to $160 billion so far. The executives at AIG must have exceeded their loss goals, because the American taxpayer is paying $165 million in retention bonuses to executives of the unit that nearly collapsed the worldwide financial system. Why would anyone want to retain these executives? If these people were asked, “How do you sleep at night?” they would respond, “On a big pile of cash”.

The economy, juiced by low interest rates, mortgage brokers handing out loans like candy, investment banks packaging thousands of worthless subprime loans into AAA products, auto companies putting deadbeats in Cadillac Escalades with no money down, and consumers sucking $3 trillion of equity from their ever increasing home values, appeared unstoppable. Home values doubled in five years. The Dow Jones reached 14,000 in October 2007, Treasury Secretary Hank Paulson was touting the fundamentally sound American economy, and Federal Reserve Chairman Ben Bernanke said there might be a minor blip from slight weakness in the housing market. As the economy was sailing along at seventy miles per hour, it hit something in the middle of the road. A Bear Stearns hedge fund blew up. The Wall Street gurus and government bureaucrats assured the public that all was well.

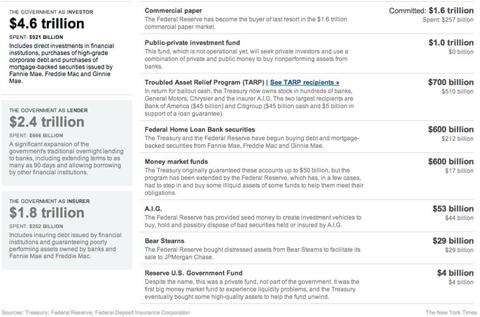

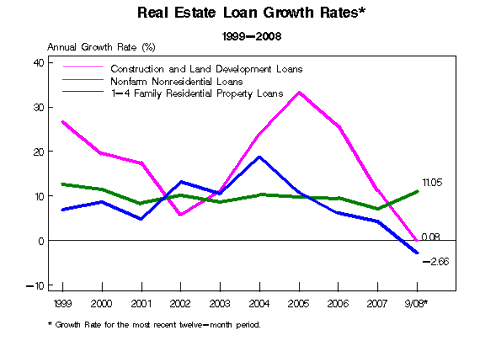

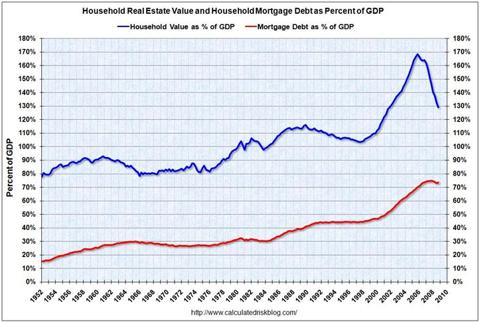

Congress, the Treasury, the Federal Reserve, and two Presidents have tried to convince Americans that the financial system is no longer infected with toxic germs. They have committed $11.6 trillion of your tax dollars to try and make the system kissable again. It hasn’t worked. They can pour another $11 trillion into the system, and probably will, but the trust in gone. The American public will no longer trust anything they are told by Wall Street, the Treasury, the Federal Reserve or Congress. We’ve been lied to, fleeced of our retirement savings, and now told to foot the bill for the criminals on Wall Street – for the good of the country. Enough is enough. The ruling elite from government and big business urgently want Americans to regain confidence and return to borrowing and spending. They again missed the train. Saving, frugality and living within your means are back. This will destroy entire industries built upon a foundation of overspending and debt. Too bad. Good old fashioned American individuality and love of liberty will revive the country, not TARP, TALF and whatever other programs the government tries to peddle.Source: Barry RitholtzWe know what has happened in the last eighteen months. We still don’t know what toxic assets still remain in the system we don’t know about. The banks’ balance sheets are a black box, they have billions in off-balance sheet “assets”, and the commercial real estate market is just starting to collapse. The ever optimistic cheerleaders on CNBC would rather extrapolate four up days in a row into a new bull market, than examine the facts staring them in the face. No wonder Jon Stewart had such an easy time obliterating Jim Cramer and the whole network. Banks were handing out construction and land development loans between 2004 and 2007 at twice the rate of residential mortgage loans. With Americans losing jobs at a record pace, corporate bankruptcies soaring, and retailers bearing the brunt of consumer deleveraging, commercial real estate loans will begin to go bad late in 2009 and through 2010.

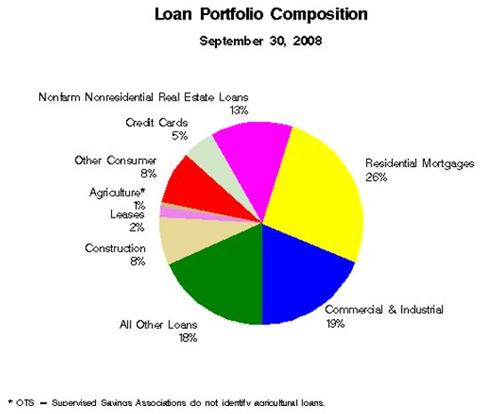

Bad mortgage loans have been the primary driver of the financial crisis so far. The nice little pie chart that follows shows that residential mortgages make up only 26 percent of bank loan portfolios. Commercial, non-residential real estate and construction loans total 40 percent of bank loan portfolios. These loans will provide the next leg down in this death spiral. Anyone who can’t see this coming is just not looking.

The credit card losses are confined to a few major players. Citicorp, Bank of America , American Express and Capital One will face the music when the credit card debt bubble bursts all over their faces. U.S. credit card defaults rose in February to their highest level in at least 20 years. AmEx, the largest U.S. charge card operator by sales volume, said its net charge-off rate, debts companies believe they will never be able to collect -- rose to 8.70 percent in February from 8.30 percent in January. Citigroup’s default rate soared to 9.33 percent in February, from 6.95 percent a month earlier. Analysts estimate credit card charge-offs could climb to between 9 and 10 percent this year from 6 to 7 percent at the end of 2008. In that scenario, such losses could total $70 billion to $75 billion in 2009. Meredith Whitney estimates that Americans' credit card lines will be cut by $2.7 trillion, or 50 percent, by the end of 2010. The pain has only just begun. Prepare to bailout more banks with your tax dollars.

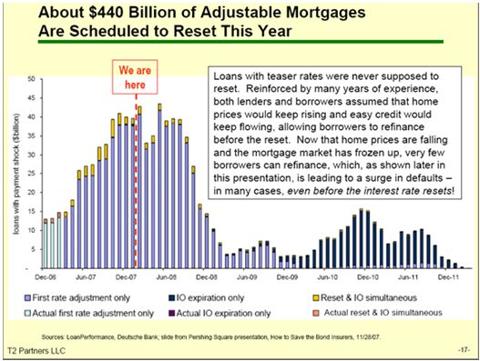

Even though we know that adjustable rate mortgages were a major cause of the financial crisis, the storm has not passed. Just because the problem is obvious, doesn’t mean it is not a problem. The chart from T2 Partners produced about one year ago shows that we are now in a lull for adjustable rate mortgage resets. There will be another crescendo of resets in 2010 and 2011. When banks ask for more taxpayer money to sure up their balance sheets in 2010, Timmy Geithner will be wearing his best “shoulda guessed” face when he gets the call from Citicorp.

After a year of frantic juvenile attempts to revitalize our financial system with your tax dollars, the government has accomplished nothing but driving our National Debt to obscene levels exceeding $11 trillion, on its way to $15 trillion by the end of Obama’s 1st term. All of the stimulus, TALFs, TARPs, TAFs, nationalizations, guarantees and printing of dollars will eventually explode in the faces of our leaders in one toxic geyser. The events of the last week show how warped the world gets when government owns private businesses. The U.S. owns AIG. The CEO, placed there by the U.S., pays out $165 million in bonuses to executives who nearly brought down the worldwide financial system. Government officials are outraged and appalled going on every TV show they can find to register their disgust. They are so used to sitting on the sidelines and criticizing the coach, they don’t even realize they are the coach.

Last week, another government owned company, Freddie Mac, reported a quarterly loss of $24 billion and demanded another $30 billion of taxpayer money. I didn’t hear Barney Frank on CNBC outraged at those results. As the government socializes the losses of corporations and Ben Bernanke attempts to create inflation, the deterioration and ultimate collapse of our economic system is pretty much a lock. Only the timing is uncertain.

Americans, from the country’s founding, have always cherished liberty over dependency. Personal responsibility and self reliance had forever been the hallmarks of the American population. Since 1913 when the Federal Reserve was created and the Federal income tax was implemented, Americans have been slowly and insidiously made dependent upon the government and criminal bankers running this country. Government has taxed and borrowed to implement policies and programs that make people more dependent on them and increased government’s control over our lives. Bankers have marketed debt as the way for Americans to live the good life. Americans have become serfs, ever indebted to the lords of the manor in Washington DC and on Wall Street. Until Americans decide to choose liberty and freedom over relying on government to solve all our problems, the country will continue on its path to socialism and bankruptcy.

Since the start of this financial crisis, government bureaucrats, Congressmen, Federal Reserve chairmen and have tried to hide the debris of our economic system in the woods. Nothing has worked. Bad mortgage loans, bad car loans, bad commercial loans, and bad credit card debt cannot be hidden. They must be written off. Letting banks pretend it isn’t bad debt has just led to more uncertainty in the markets. The smoke and mirrors that Treasury and the Federal Reserve have used to fool the public into trusting the banking system have not worked. Now they want to change the rules of the road.All attempts to change the rules have backfired. The SEC outlawed short selling to stop the stock market from going down. The market accelerated downward, with no possibility for short covering to stop the fall. Hank Paulson forced banks to take billions of taxpayer dollars whether they wanted it or not. This was supposed to bring confidence in the system back. It didn’t. The government took over AIG, Fannie Mae, and Freddie Mac, deciding they could run them better than the existing horrible managements. These moves have already cost the American taxpayer a quarter trillion dollars. With many more billions to be poured down these rat holes.

The financial system is gridlocked. Four lanes have suddenly converged into two lanes and the drivers are angry. The AIGs of the world went from selling plain vanilla insurance to making bets with every major bank in the world along with guaranteeing risky bets by these same banks. Fannie Mae and Freddie Mac went from providing liquidity to the mortgage markets so that average Americans could buy a house to a Democratic Party tool used to provide mortgage loans to poor Democratic constituents so they could win more votes in the next election. Investment banks went from investing in productive business ventures to creating fake credit instruments designed solely to generate monstrous fees and bonuses for executives.The rating agencies Moody’s and S&P went from the boring business of rating corporate bonds and generating 10 percent annual growth to giving AAA ratings to indecipherable derivative products that were then sold to pension plans and schools. Mortgage brokers went from helping match worthy borrowers with the best mortgage to criminals pushing no doc stated income adjustable rate mortgages on people who could never possibly afford a home. Consumers went from utilizing credit for just home purchases with 20% down to utilizing credit for multiple home purchases with nothing down, utilizing credit for car purchases with nothing down, and utilizing credit to buy every electronic gadget, kitchen appliance, and other toys flaunted by neighbors. The rules of the road were changed during rush hour causing chaos and confusion. Until honesty, integrity, and morality are again restored to our financial and governmental systems, gridlock and distrust will reign.

Where’s My Net Worth, Dude?

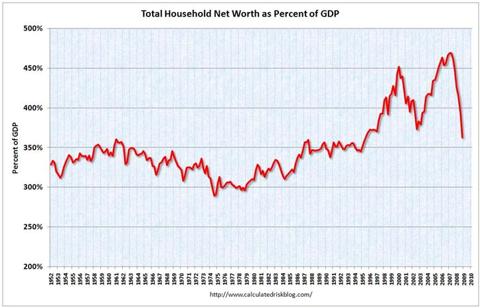

Americans are wondering where their net worth went. They can’t find it anywhere. It dissipated into thin air. It never really existed. Does that make you feel better? American households lost $11.2 trillion of net worth in 2008, and net worth is now below 2004 levels. The 17.9% drop in net worth during 2008 is mind boggling and will have a drastic impact on the future trajectory of household consumption and saving. Nearly 25% of the loss in net worth was from real estate, and equities and mutual fund shares made up 50% of the loss.

The dramatic rise in net worth coincided with the biggest debt bubble in history. Home ownership reached an all-time high of 68% in 2005. Stock ownership is still in the 50% range, so the downturn in housing values is affecting many more people than the 2000-2001 dot.com collapse. As you can see, home values fall but the debt remains the same. With at least another year of falling home prices, the number of people underwater on their home mortgages will reach 25 million, or one-third of all the houses in the United States. You won’t hear Mustard Seed Kudlow or Mad Money Cramer telling you this.President Obama and Democrats in Congress passed a $787 billion pork filled calamity that will contribute to an explosion of our financial system. Very little of this socialist’s dream will help the U.S. economy in 2009. Vast sums will be allocated to unnecessary make work projects throughout the country. Picture thousands of Ralphs taking their time on construction projects while six guys stand around watching one guy using a jackhammer. Every construction project in the country will be a union job. This means 40% more expensive and a 40% longer timeline. When the majority of this stimulus hits in 2010 and 2011, along with Bernanke’s humongous printing of dollars we will hear a rumble before inflation erupts across the globe.

Oh The Humanity!

The American economy hit debris in the road years ago. Instead of pulling over and taking care of the problems before they became a crisis, our leaders ignored the problems. Government overspending, ignoring $56 trillion of unfunded liabilities, funding over-expenditures with money borrowed from foreigners, not addressing crumbling infrastructure, not creating a cohesive energy policy, and over-reaching in empire building were the fuel that led to our economy bursting into flames before our very eyes. President Obama and his minions in Congress scream, “Oh the humanity”, and take your hard earned money and redistribute it to the fools who created the tragedy.

It’s My LifeTomorrow's getting harder make no mistake

Luck ain't even lucky

Got to make your own breaks

It's my life

And it's now or never

I ain't gonna live forever

I just want to live while I'm alive

(It's my life)

My heart is like an open highway

Like Frankie said

I did it my way

I just want to live while I'm alive

'Cause it's my life

Better stand tall when they're calling you out

Don't bend, don't break, baby, don't back down

--It’s My Life – Bon Jovi

The American people are at a crossroads. It’s our lives, not the governments. The country is headed on a path toward government running everything in our lives. Now is the time to stand tall. Barack Obama, Ben Bernanke, and Nancy Pelosi can not make us spend money we don’t have. We can force the painful restructuring of our economy on our politician leaders. They can stimulate, print, and urge you to spend, but we don’t have to listen. We can throw them out of office in 2012. If the new set of clueless morons doesn’t do what is right, we can throw them out too. We must heed the warning of Founding Father Thomas Jefferson.

A government big enough to give you everything you want, is strong enough to take everything you have.

Christina Romer: US economy will be growing again by the end of the year

President Obama’s lead economist predicted Sunday that the nation’s struggling, recessionary economy will be growing by the end of the year. "I have every expectation, as do private forecasters, that we will bottom out this year," Christina Romer, chair of the White House Council of Economic Advisers, said on CNN’s State of the Union. "And, [we’ll] actually be growing again by the end of the year." Romer’s comments came in a wide-ranging interview with Chief National Correspondent John King where she defended the new administration’s economic policies in the face of growing criticism by Republicans – particularly over how Treasury Secretary Timothy Geithner handled payment of $165 million in bonuses to AIG employees and how Geithner has been slow to roll out the specifics of his plan to stabilize some of the nation’s largest banks.

"I think it is important to realize this is just one piece of what we're doing," Romer said of the detailed Geithner bank rescue plan expected any day now. Romer pointed out that in the roughly nine weeks since Obama’s inauguration, the White House has rolled out a housing plan, a small-business plan, and a consumer and business lending initiative. "This is just one more of those pieces, and I don't think Wall Street is expecting the silver bullet . . . there’ll be more to come." Romer also left open the possibility that the White House could take more drastic action to stabilize the nation’s mortgage market through its control over mortgage giants Fannie Mae and Freddie Mac. She suggested the two massive financial entities could be broken up in order to make them more manageable and possibly avert another financial and mortgage crisis.

"I think that’s certainly going to be an issue going forward," Romer told King when asked whether the two companies needed to be broken up. "I think it should be part of the overall financial regulatory reform." "If you are going to be too big to fail, we’ve got to have an eye on you and make sure that you’re taking prudent practices," Roemer also said of large entities like Fannie, Freddie, and AIG which have posed systemic risks to the nation’s financial system in the past six months. Romer also said she wasn’t sure "it was useful" to get to the bottom of exactly how the recent stimulus bill came to include language protecting $165 million in bonus payments recently paid to the same AIG employees who brought the financial behemoth to the verge of collapse. "The President, again, is very aware of just how outrageous these things are," she said when asked about the AIG bonuses.

Romer: Firms Will Buy Toxic Assets Because 'We Need Them to Do This'

AIG outrage is genuine, but be careful about the fallout, said the head of the president's Council of Economic Advisers, noting that private investors are "kind of doing us a favor" in buying toxic assets and should be recognized for their contribution. Adviser Cristina Romer told "FOX News Sunday" that private firms not getting federal bailout money should not be intimidated by Congress' decision to tax executive bonuses by 90 percent because they understand that this is a new culture of doing business. "We've got banks with a lot of toxic assets, what 'toxic' means is they are highly uncertain ... so that is certainly the big picture, and that is going to be the main reason for doing this ... We simply -- we simply need them. We need them -- you know, we've got a limited amount of money that the government has to go in here, so we need to partner, not just with private firms, but with the FDIC, with the Fed, to leverage the money that we have," she said.

Treasury Sec. Tim Geithner has long stated the U.S. needs a public-private partnership to deal with toxic assets. The new plan is expected to be announced Monday -- in advance of President Obama's prime time press conference. The Wall Street Journal reported over the weekend that the administration plans to create an entity backed by the Federal Deposit Insurance Corp. to buy and hold loans, and it will expand the Federal Reserve's ability to hold older, "legacy" assets. The newspaper added that the public-private partnership would be managed by private investors but financed with a combination of private money and capital from the government, which would share in any profit or loss. The price for the mortgages and other securities has not been determined yet.

Meanwhile, the Obama administration is in the midst of developing a plan that would increase oversight on executive pay at all banks and financial firms, and possibly other companies, The New York Times reported Sunday. The paper reported that the plan would cover publicly traded companies, including ones not getting federal bailout money. Already many of those firms have to report some of their pay practices to the Securities and Exchange Commission, but this would evidently go further. The administration has not indicated yet what "oversight" means, and whether it is merely reporting pay levels, or possibly limiting them. "We have to level the playing field," Rep. Charles Rangel, D-N.Y., chairman of the House Ways and Means Committee, told "FOX News Sunday," about the decision to tax executive bonuses at 90 percent at firms getting federal bailout funds.

An administration official told FOX News on Sunday that it's "inaccurate" to say the administration's plan includes "sweeping" measures to address excessive bonuses. The aide said the administration "recognized these incentives to take risky bets to get a quick return contributed to risky behavior in the financial system that led to this crisis. ... Our regulatory reform efforts are focused on the big picture, rules of road because we cannot ever allow this to happen again." Deputy White House Press Secretary Jen Psaki added that the administration will work with congress in the coming weeks to "unveil financial regulatory reform to make our system stronger and smart, and to ensure we never find ourselves in a situation like this again." She said the administration is focused this week on addressing "the systemic risk built into our regulatory structure, including updating regulations and establishing new resolution authority to deal with companies that pose risks to our broader financial system."

Romer said that many of the investors helping out in the toxic asset purchases understand that President Obama realizes they are in a different category from American Insurance Group and other bailed-out companies. "We ought to be careful for a minute ... we have to acknowledge that outrage is genuine and something we all feel," she said. "I think we're going to have sensible strategy going forward. The president understands the distinction between" placing restrictions on companies that contributed to the financial mess and those that are trying to help. They are firms that are being the good guys here, are coming into a market that hasn't existed to try to help us get these toxic assets off banks' balance sheets," Romer said.

Shelby Says Geithner May Not ‘Last Long’ at Treasury

Senator Richard Shelby, the leading Republican on the Senate Banking Committee, said that confidence is ebbing in U.S. Treasury Secretary Timothy Geithner after his handling of bonuses at American International Group Inc. Speaking today on "Fox News Sunday," Shelby said Geithner is on "shaky ground" with Congress and many other Americans. "My confidence is waning every day," Shelby said when asked about the Treasury chief whose nomination he voted to confirm in January. "If he keeps going down this road, I think that he won’t last long." The Alabama senator’s comments came as the Treasury secretary prepares to lay out detailed plans to remove so-called toxic assets from banks’ balance sheets in an effort to spur lending during the recession.

Shelby criticized the Treasury last week for not stopping $165 million in bonuses being paid out to employees of AIG, the global insurer rescued by the government. President Barack Obama said he would refuse a resignation offer from Geithner, joking in a March 20 interview with the CBS News program "60 Minutes" that he would tell the Cabinet member: "Sorry, buddy, you’ve still got the job." House Majority Leader Steny Hoyer said Geithner should have taken a tougher line with AIG. "I think he is of the opinion that he should have acted more forcefully with the institutions, AIG in particular," Hoyer said in an interview with C-Span aired today. "I think Congress shares that view." Hoyer, a Maryland Democrat, added that Geithner should keep his job. "As long as he has the president’s confidence, he ought to stay," Hoyer said.

Christina Romer, the chairwoman of the President’s Council of Economic Advisers, said on the Fox program that Geithner was doing a good job and had been dealt an "unbelievably difficult hand." New York Mayor Michael Bloomberg, speaking on NBC’s "Meet the Press" program today, also defended Geithner. "I think Tim Geithner is exactly the guy that I would want there," he said. Bloomberg, an independent, is founder and majority owner of Bloomberg News parent Bloomberg LP. House Financial Services Committee Chairman Barney Frank and Senator Charles Grassley of Iowa, the top Republican on the Finance Committee, rejected suggestions Geithner should quit.

"I don’t think anybody after two months has been tested enough that I would say he should resign," Grassley said on CBS’s "Face the Nation" program. Still, Grassley said Geithner "screwed up twice" with New York-based AIG: as president of the Federal Reserve Bank of New York and as Treasury secretary. "I think it raises questions about whether he’s got his eye on the ball or not," Grassley said. The troubles at AIG are "a Bush administration creation" and Geithner inherited "a difficult situation," said Frank, a Massachusetts Democrat. He said the government, which is now the majority shareholder of AIG, should sue to recover the disputed bonuses paid to employees of the global insurer.

The issue of compensation at financial firms may weigh on an emerging government effort to attract private money to ease lending by banks. Romer said investors who buy up troubled bank assets in partnership with the government are "doing us a favor" and would be treated differently than bailed-out companies whose bonuses are targets of taxes proposed by angry lawmakers. Shelby said that it was possible that congressional plans to tax bonuses could scare away those investors. Romer dismissed a forecast by the nonpartisan Congressional Budget Office that the budget deficit will total $9.27 trillion between 2010 and 2019. Romer said the projection was based on expectations for economic growth that were "too pessimistic."

G.O.P. Wary of White House Optimism on Economy

A top economic advisor to President Obama said on Sunday that she was confident that the economy would begin to rebound this year, a message starkly contradicted by Republican leaders who expressed doubts about the growing deficit. "I think we are absolutely taking the right policies," said Christina D. Romer, chairwoman of the White House Council of Economic Advisers, during an appearance on CNN’s "State of the Union," one of two stops she made on the talk-show circuit. "I have every expectation, as do private forecasters, that we will bottom out this year and actually be growing again by next year." Asked on "Fox News Sunday" how confident she is that a year from now Obama administration policies would be succeeding, she replied: "Incredibly confident." "We absolutely think that they are going to do the job for the American economy," Ms. Romer added.

That optimism was not met by Senator Judd Gregg of New Hampshire, the senior Republican on the Senate Budget Committee, and Senator Richard Shelby of Alabama, top Republican on the Senate Banking Committee. They cited new estimates released Friday by the Congressional Budget Office that calculated that the White House’s tax and spending plans would create deficits totaling $2.3 trillion more than the president’s budget projected for the next decade. "The practical implications of this is bankruptcy for the United States," said Mr. Gregg, who also appeared on CNN. "There’s no other way around it. If we maintain the proposals which are in this budget over the 10-year period the budget covers, this country will go bankrupt. People will not buy our debt; our dollar will become devalued. "It is a very severe situation. And I find it almost unconscionable that this administration is essentially saying, well, we’re just going to blithely go along on this course of action after they’re getting these numbers."

Mr. Shelby, speaking on "Fox News Sunday," said Mr. Obama was going to have to scale back his budget in light of the new estimates: "He’s going to have to. We’re on a — on the fast road to financial destruction, and I see a 20 billion — a $20 trillion deficit in the few years to come," he said. Maine Senator Susan Collins, one of the few Republicans to support President Obama’s stimulus package, said she could not back his budget plan, which she said would bring debt to an unprecedented level. "It poses a threat to the basic health of our economy," she said on ABC’s "This Week." Ms. Romer challenged the estimates, calling the figures unrealistically pessimistic. "There is a question whether the C.B.O. is right," Ms. Romer said. "So we know that forecasts, both of what the economy is going to do and of what the budget deficit are going to do, are highly uncertain. And especially when you get further out in the C.B.O. numbers, we think they really are too pessimistic in thinking about how fast the U.S. economy can grow."

Kent Conrad, chairman of the Senate Budget Committee, said the different estimates could be explained. "In fairness to this administration, they locked down their forecasts three months ago," said Mr. Conrad, a Democrat of North Dakota. "There’s been a lot of bad news since." But he added: "We have got to get back to a more sustainable fiscal circumstance. We cannot have debt pile on top of debt. We cannot run budget deficits in the out-years of over $1 trillion a year. "I will present a budget that I think begins to move in that direction," Mr. Conrad said. "It acknowledges in the short term, yes, we have got to have added deficits and debt to give lift to this economy, but longer term, we have got to pivot."

The state of the economy once again dominated the talk shows on Sunday, the day before the administration plans to unveil its toxic-asset plan. The plan, which will likely offer generous subsidies to coax investors to buy as much as $1 trillion in troubled mortgages and related assets from financial institutions, is core to President Obama’s effort to rescue the nation’s banking system. Industry analysts estimate that the nation’s banks are holding at least $2 trillion in so-called "toxic assets," mostly residential and commercial mortgages that are weighing down bank balance sheets, crippling their ability to make new loans and deepening the recession.

Ms. Romer stressed that the private investors entering a partnership with the government to buy assets of trouble companies would not be subject to the same scrutiny now being leveled at American International Group. In response to the $165 million in bonuses that A.I.G. dispensed to the business unit that caused its near-collapse, the House moved to impose a 90 percent tax on bonuses given out at companies receiving more than $5 billion in bailout money.

"What we’re talking about now are private firms that are kind of doing us a favor," Ms. Romer said on Fox, "right, coming into this market to help us buy these toxic assets off banks’ balance sheets. And I think they understand that the president realizes they’re in a different category, and I think they are going to have confidence that they’re going to be able to come into this — into this program." The job security of Treasury Secretary Timothy F. Geithner was another topic of conversation on Sunday, with both Democrats and Republicans saying that they favored giving him more time. "In the area of trying to stabilize the financial sector of our economy, they’re doing the right things," Mr. Gregg said. "They haven’t done it as definitively as they should have, clearly. We would have liked a plan that was more definitive earlier, but they are moving in the right direction, and the Fed is moving in the right direction," he said.

"I don’t think anybody after two months has been tested enough that I would say he should resign," Senator Charles E. Grassley, Republican of Iowa, said on CBS’s "Face the Nation." Other leaders backing Mr. Geithner included New York Mayor Mayor Michael R. Bloomberg and California Gov. Arnold Schwarzenegger. President Obama reiterated his support for Mr. Geithner during an interview with "60 Minutes" to air Sunday evening. One exception was Mr. Shelby, who said his confidence is waning daily. "I think he’s probably on shaky grounds now, at least with the Congress and a lot of the American people," he added. Ms. Romer dismissed talk of a resignation as "really silly." "Tim Geithner is an excellent secretary of the treasury," she said.

Six months after the AIG bailout: Where is the money?

Under public and media pressure caused by the news that AIG used the bailout money to distribute generous bonuses, the group decided last week to publish stats on spending. I worked with Damiko Morris in DC to finding the best way to translate the six-page document into a comprehensive information graphic.click to enlarge

G20 warned unrest will sweep globe

A wave of social and political unrest could sweep through the world's poorest countries if G20 leaders fail to come to their aid, the World Bank warns today, as new research says the credit crunch will cost developing countries $750bn (£520bn) in lost output and drive millions more into poverty. Ngozi Okonjo-Iweala, managing director of the World Bank, is urging G20 leaders to use the London summit in less than a fortnight's time to help protect the developing world against the worst effects of the financial crisis. "We have to look at the impact of this on low income countries. Otherwise, without wanting to sound alarmist, social unrest and political crisis could be the result. It's in the self-interest of everyone to prevent that," she told the Observer

Her stark warning came as a new report from the Overseas Development Institute (ODI) said the collapse of the global economy would cost 90 million lives, lead to an increase to nearly a billion in the number of people going hungry and cost developing countries $750bn in lost growth. "Tens of millions of people will be forced back below the poverty line. There will be irreversible effects on the very poorest," said Simon Maxwell, the ODI's director. The ODI is calling for an extra $50bn in aid for Africa, and urging G20 countries to set aside a "significant proportion" of the cash they are spending on fiscal packages, to help build up the infrastructure in poor countries, and lift people above the breadline.

"When they sit down around the table at the G20, there will be plenty for the leaders to disagree about. This should not be one of those things, but it might well be," Maxwell said. The ODI also said the G20 should not set unrealistic expectations about resuscitating the stalled Doha round of international trade talks, and should instead make a firm promise to avoid tit-for-tat protectionism. Okonjo-Iweala said hundreds of thousands of workers were losing their jobs across the developing world, where social safety nets are almost non-existent, and called for more resources for the World Bank's "vulnerability fund," which helps cash-strapped governments to make direct welfare payments. "There is a credit crunch in many of these countries: foreign direct investment has dried up," she said.

Gordon Brown will fly to Brazil this week to try and win the support of President Lula for his agenda of co-ordinated fiscal stimulus, free trade, and a boost to overseas aid budgets. Downing Street wants to secure a doubling in the resources of the International Monetary Fund, so it can bail out the worst-affected countries; and a promise of new loans to help facilitate cross-border trade. With budgets tight at home, and noisy demands for help from domestic constituencies, however, Brown is concerned many countries are failing even to live up to the promises on aid they made at the Gleneagles G8 meeting in 2005. In Italy, Silvio Berlusconi has slashed aid spending in the face of a fiscal crisis.

Hopes fading for salvation at the summit

For more than a decade, London's Docklands, with its glass and steel skyscrapers, was the pulsating heart of global financial capitalism, the East End postcode with a Wild West atmosphere, where interfering politicians feared to tread. In 11 days' time, 20 of the world's most important leaders will gather here, at the ExCeL Centre, with a mandate to clear up the chaos unleashed by the crunch - and rein in the might of the financiers. Gordon Brown has trumpeted the London summit as nothing less than a New Deal for the world's crisis-hit economy; one day that will rewrite the rules of financial markets, fix the broken banking system and pull the world back from a new Great Depression.

Last week, the International Monetary Fund warned the stakes could not be higher: for the first time since 1945, the global economy as a whole will contract in 2009. "Turning around global growth will depend critically on more concerted policy actions to stabilise financial conditions, as well as sustained strong policy support to bolster demand," the IMF said. The fund sees the current crisis as the most serious since the 1930s, when the US economy contracted by 25% in four years and six million unemployed in Germany led to the rise of Hitler. The devastation of the Great Depression and the ravages of the second world war led to the most radical shake-up of the world's economic system since the industrial revolution. In 1944, the historic Bretton Woods summit created the system of fixed exchange rates that lasted until the 1970s, and the IMF and World Bank, which remain guardians of the global economy today.

In the autumn, the government was hailing the London summit as a 21st-century Bretton Woods, yet Downing Street has already begun rowing back from the early fanfare about rebuilding capitalism - and judging by the communiqué from G20 finance ministers after their summit in Horsham, West Sussex on 14 March, ambitions are now relatively modest. "They're just not tackling the problem of how much of the casino needs to be shut down," says Heiner Flassbeck of Unctad, the UN's trade and development arm, which published a scathing report last week calling for G20 ministers to overturn two decades of "market fundamentalist laissez-faire". Flassbeck said the sub-prime mortgages that triggered the crisis were only one symptom of an out-of-control financial sector; there had also been rampant speculation in markets for commodities, currencies and other assets, which must now be re-regulated.

"Because all these pyramids have collapsed in a very short time, that's why we have seen such a global impact." An early warning that next month's meeting might not meet Brown's grand expectations came when he clashed with other G8 countries, including Italy, about whether it should be called a "G20 summit" at all - hence its official title of the London summit. (This despite unfortunate associations with the ill-fated 1933 London summit of world leaders, which was torpedoed by Franklin Roosevelt, a Democrat president newly arrived in the White House with a mandate to revive a US economy deep in slump.)

Signs of potential conflict abound: Barack Obama wants the summit to focus on measures that can be taken now to revive growth and create jobs, and will be armed by the latest emergency steps taken by the Federal Reserve to pump trillions of dollars into the US economy. The Europeans worry that policymakers are doing too much in the short term to boost demand and too little in the long term to ensure there is no return to the bubble conditions that created the current crisis. But calls from Nicolas Sarkozy and Angela Merkel for curbs on hedge funds and private equity companies, together with tougher regulations on "toxic" derivative products may be greeted coolly by the Americans.

Alistair Darling tried valiantly to paper over the cracks at last weekend's meeting in Horsham. Policymakers pledged to do "whatever it takes", for as long as it takes, to lift the world economy out of recession, while acknowledging that many governments have already taken steps; but back in London, Merkel was reminding Brown that any decisions Germany might take to launch a further fiscal stimulus would be a matter for its parliament in Berlin, not for an international summit. "Leaders talk global, think national," says Gerard Lyons, chief economist at Standard Chartered, though he adds that the lack of substantive proposals after the finance ministers' meeting could mean they are saving the goodies for their bosses.

The chemistry between the G20 leaders is hardly warm. Brown spent a decade as chancellor lecturing his continental counterparts about Britain's deregulated financial markets and flexible labour market, and they are determined not to let the prime minister claim credit for saving the world, especially when Britain is going to have one of the deepest recessions. Forecasts presented to G20 governments by the IMF last week showed UK GDP declining by 3.8% this year and a further 0.2% in 2010.

In the US, meanwhile, Obama is struggling to complete his financial team, with Treasury secretary Tim Geithner the only major post at the department confirmed. Geithner, who scraped through his confirmation on Capitol Hill after admitting failing to pay $34,000 in taxes, has since been battered by the political storm over bonuses paid to executives at AIG, and Wall Street's initial lack of confidence in his rescue package. Expectations for what the leaders should achieve are still running high. A mass rally, involving a coalition of more than 100 groups, from churches to trades unions, is planned for next Saturday. Under the banner of "Jobs, Justice and Climate", thousands will march through central London to a rally in Hyde Park, calling for Brown and his fellow leaders to reform international markets, protect vulnerable jobs and support the world's poor through the credit crunch.

On 2 April though, a security lockdown will be in place. Police are on high alert lest the first summit of world leaders to be held in London since John Major hosted the G7 in 1991 become a pitched battle between the security forces and anti-globalisation protesters. With the leaders of rich countries facing intense pressure at home to combat mass unemployment and shore up their embattled financial systems, campaigners are nervous that there will be little will for fresh efforts to help the poor. Ngozi Okonjo-Iweala, managing director of the World Bank and a former Nigerian finance minister, says more than 50 million people are likely to be plunged into poverty by the credit crunch, as developing countries are starved of resources and volatile commodity prices wreak havoc on exporting countries' public finances. "The story that needs emphasising is how the emerging countries have been impacted by the second and third rounds of the crisis," she says. "The fact is that developing countries should be part of the solution: they did not cause the problem."

Simon Maxwell, director of the Overseas Development Institute, says: "If Gordon Brown had his way, extra money would be found. He has provided extraordinary leadership in keeping development high on the agenda. Other countries are much less willing to take development seriously. Some are saying, 'Don't ask us, because we don't want to embarrass you by saying no'." However, the fact that the G20, rather than the G8, is the forum for these discussions is a recognition of the changing global economy. For decades after the second world war, the leading capitalist economies of western Europe, North America and Japan dominated the scene. They accounted for the lion's share of global output and trade and controlled the IMF and World Bank, promulgating a controversial set of free market policies known as the "Washington consensus".

When modern summitry began in the mid-1970s, it involved only six countries - the US, West Germany, Italy, Japan, France and Britain - but the G6 quickly became a G7 with the arrival of Canada. Boris Yeltsin was rewarded for his role in turning Russia into a market economy when he was given a seat in the 1990s, but in recent years the limitations of the G8 have been exposed. Attempts to discuss currencies and the global economic imbalances have been rendered futile by the absence of China and the oil exporters; the input of China and India have been deemed vital if there is to be progress on climate change; China, India, Brazil and South Africa are all key players in the long-running Doha round of trade talks.

Reluctant to cede power and influence, the G8 first came up with an uneasy compromise. It invited five leading developing countries - China, India, Brazil, South Africa and Mexico - to some sessions of the annual summer summit. This G8-plus-5 format, predictably, ruffled feathers in Beijing and New Delhi, and matters came to a head in Japan last year when the top-level Chinese delegation took great offence at being kept waiting for an hour in Hokkaido while the G8 wrapped up private business. So, when George Bush called a crisis meeting after last autumn's financial meltdown, it was clear that the format had to be wider than the G8. It included all five big developing countries together with Indonesia, the world's fourth most populous country, Saudi Arabia, the biggest oil producer, Argentina, Turkey, Korea and Australia - and the EU took the 20th seat around the table.

While broader and more representative than the G8, the G20 has its critics. Some doubt if a body so diverse can come to any agreement, pointing out that it was hard enough to reach consensus at the G8. Others argue it still excludes the very poorest countries of sub-Saharan Africa - though Downing Street has invited Ethiopia, representing Nepad, the African development coalition, Gabon's foreign minister Jean Ping from the African Union, and Donald Kaberuka, president of the African Development Bank. Leaders are expected to promise measures to tackle the immediate crisis, including more resources for the IMF to lend to struggling economies, and help for poor countries unable to finance international trade because of the credit crunch. Amar Bhattacharya of the G24 Secretariat, which represents low-income countries, says he is encouraged by the progress already made, but it will be crucial to ensure that any promises - on new fiscal stimulus, for example - are carefully monitored: "I think the best way to proceed is to have a very effective monitoring system, so that we can ensure that those locomotives with the most steam are doing the most work."

The G20 leaders will also discuss how to regulate international financial markets more effectively, to prevent a crisis on the extraordinary scale of the past two years from happening again. Hedge funds are likely to find themselves facing a stricter regime after 2 April, though details remain sketchy - the finance ministers merely called on them to be more transparent in reporting their positions. Complex assets such as derivatives, and the off-balance-sheet vehicles used by many credit-crunched banks, are also expected to come under closer scrutiny. All G20 leaders also agree something may be needed to rein in the activities of tax havens, not just to stop government revenues being lost, but to throw open the complex and secretive dealings of multinational financial institutions that have used offshore locations to conceal parts of their business from regulators.

However, with several of the most notorious tax havens, including Liechtenstein and Jersey, making grand declarations about their new commitment to openness, there are fears that the will to take tougher action may be absent. Claire Melamed, director of policy at Action Aid, says: "It would be a major missed opportunity if they don't follow through. At the moment, there are quite worrying signs they're not going to." For Brown, much more is at stake than creating international common purpose in the face of economic disaster. The London summit is one of two meticulously planned political moments for Labour to show that, despite Britain's role as home of some of the worst-regulated and hardest-hit financial institutions, the government is part of the solution, not the author of the crisis.

Little more than a fortnight after the summit, Darling hopes to use his budget as a new assault on the worsening recession and lengthening dole queues. In October, when Britain's bank recapitalisation plan looked firmer and more decisive than US treasury secretary Hank Paulson's flailing response to the woes of Wall Street, Brown saw his popularity bounce, as he bestrode the world scene. But with 2 million now unemployed at home, it may take more than even the most successful summit to restore his electoral fortunes. So determined is the government to win the favour of the leaders flying into Docklands that it has passed special legislation to suspend the smoking ban in the vicinity of the ExCeL centre for the duration. But it may take more than a grand international bargain struck in the nostalgic surroundings of a smoke-filled room to save the world economy - or resuscitate the Brown premiership.

Nearly 500 years of key political gatherings

The field of the cloth of gold

The first summit the modern age would recognise as such took place in the summer of 1520 just outside Calais, when Henry VIII crossed the Channel for talks with Francis I. Although it lacked TV cameras and spin doctors, the Cloth of Gold had all the classic features of summitry; it was orchestrated by top officials; it involved more pageantry and feasting than substance; and the show of amity did little to paper over the cracks in the fragile relationship between the two countries.

The treaty of Versailles

Two months after the end of the first world war, the Allied Powers gathered at Versailles in January 1919. A mixture of the idealistic plans for a League of Nations and the self-determination of peoples proposed by the US President Woodrow Wilson and the desire for recompense for the damage to France from the devastation on the western front, the conference saddled a dismembered Germany with a massive reparations bill. John Maynard Keynes, part of the UK delegation, warned in his Economic Consequences of the Peace that Versailles was storing up problems for the future.

Bretton Woods

A quarter of a century later an ailing Keynes had the opportunity to do better, second time round. Two-and-a-half years in the planning, the three weeks of talks at the Mount Washington hotel in New Hampshire in July 1944 were dominated by Keynes, but the real decisions were taken by his American counterpart, Harry Dexter White. Bretton Woods created the International Monetary Fund to oversee a post-second world war system of fixed exchange rates, and the World Bank to help to rebuild the economies of western Europe, but plans for a World Trade Organisation were put on ice for half a century following opposition from the US Congress.

Rambouillet

Three decades of prosperity came to an end with the oil shock of 1973-74. The combination of rising unemployment and inflation - stagflation - prompted the French President Giscard D'Estaing to invite five other world leaders for a "fireside chat" at a château just outside Paris. Although modest by later standards, this was the first of the gatherings of world leaders which now take place on a rotating basis each year. Rambouillet had no easy answers to the first recession in the west since the 1930s, but its main themes - avoiding protectionism, energy dependency and boosting growth - will be on the agenda next week.

Gleneagles

The last big summit of world leaders to be held on British soil, the meeting at the Scottish luxury hotel in July 2005 coincided with - and to an extent was overshadowed by - the 7/7 terrorist bombings in London. Tony Blair shuttled between the summit and Downing Street and, after much arm-twisting, persuaded the G8 to sign up to a package for developing countries that involved debt relief, a £50bn increase in aid and easier access to western markets. Although Gleneagles was one of only a handful of summits to result in more than a bland communiqué, the G8 has yet to deliver on its promises.

China to Develop Derivatives, Introduce New Products, PBOC Says

China will develop its derivatives market and introduce interest-rate options even though problems in that market triggered the global financial crisis, said Liu Shiyu, deputy governor of the People’s Bank of China. "If we don’t develop our over-the-counter market for derivatives as early as possible, we may find ourselves lagging behind once the global financial crisis bottoms out," Liu told a forum in Beijing today. "We should shift from a government- led to a more market-oriented mechanism to encourage financial products innovation."

The nation will introduce interest-rate options on the interbank market, he said, without giving a time frame. The platform accounts for more than 95 percent of the bonds traded, compared with the stock-exchange based facility. The government currently allows trading in bond forwards, interest-rate swaps and forwards, yuan forwards and swaps. China’s regulators have pledged repeatedly the nation won’t reverse the course of financial innovation since the onset of subprime crisis in 2007, while stressing on improved monitoring. The government will "steadily push forward" development of fixed-income products and related financial innovations, the State Council, China’s cabinet, said in a financial sector guideline in December.

China’s over-the-counter trading of derivatives rose 35 percent last year to 4 trillion yuan ($585 billion), compared with 130 trillion yuan of all transactions in the market, Zhang Shengju, a researcher at the National Interbank Funding Center told the forum. Li Bo, the department head of laws and regulations at the central bank, proposed at the forum to establish "as early as possible" a central clearing house for over-the-counter trading, which will help reduce risks in derivatives such as credit-default swaps. Options are the right, without the obligation, to buy or sell an asset by a set date. Credit-default swaps are used to speculate on the ability of companies and sovereigns to repay their debt. They pay buyers the face value of debt protected if the borrower fails to meet payments.

Has a ‘Katrina Moment’ Arrived?

A charming visit with Jay Leno won’t fix it. A 90 percent tax on bankers’ bonuses won’t fix it. Firing Timothy Geithner won’t fix it. Unless and until Barack Obama addresses the full depth of Americans’ anger with his full arsenal of policy smarts and political gifts, his presidency and, worse, our economy will be paralyzed. It would be foolish to dismiss as hyperbole the stark warning delivered by Paulette Altmaier of Cupertino, Calif., in a letter to the editor published by The Times last week: "President Obama may not realize it yet, but his Katrina moment has arrived."

Six weeks ago I wrote in this space that the country’s surge of populist rage could devour the president’s best-laid plans, including the essential Act II of the bank rescue, if he didn’t get in front of it. The occasion then was the Tom Daschle firestorm. The White House seemed utterly blindsided by the public’s revulsion at the moneyed insiders’ culture illuminated by Daschle’s post-Senate career. Yet last week’s events suggest that the administration learned nothing from that brush with disaster. Otherwise it never would have used Lawrence Summers, the chief economic adviser, as a messenger just as the A.I.G. rage was reaching a full boil last weekend. Summers is so tone-deaf that he makes Geithner seem like Bobby Kennedy.

Bob Schieffer of CBS asked Summers the simple question that has haunted the American public since the bailouts began last fall: "Do you know, Dr. Summers, what the banks have done with all of this money that has been funneled to them through these bailouts?" What followed was a monologue of evasion that, translated into English, amounted to: Not really, but you little folk needn’t worry about it. Yet even as Summers spoke, A.I.G. was belatedly confirming what he would not. It has, in essence, been laundering its $170 billion in taxpayers’ money by paying off its reckless partners in gambling and greed, from Goldman Sachs and Citigroup on Wall Street to Société Générale and Deutsche Bank abroad.

Summers was even more highhanded in addressing the "retention bonuses" handed to the very employees who brokered all those bad bets. After reciting the requisite outrage talking point, he delivered a patronizing lecture to viewers of ABC’s "This Week" on how our "tradition of upholding law" made it impossible to abrogate the bonus agreements. It never occurred to Summers that Americans might know that contracts are renegotiated all the time — most conspicuously of late by the United Automobile Workers, which consented to givebacks as its contribution to the Detroit bailout plan. Nor did he note, for all his supposed reverence for the law, that the A.I.G. unit being rewarded with these bonuses is now under legal investigation by British and American authorities.

Within 24 hours, Summers’s stand was discarded by Obama, who tardily (and impotently) vowed to "pursue every single legal avenue" to block the bonuses. The question is not just why the White House was the last to learn about bonuses that Democratic congressmen had sought hearings about back in December, but why it was so slow to realize that the public’s anger couldn’t be sated by Summers’s legalese or by constant reiteration of the word outrage. By the time Obama acted, even the G.O.P. leader Mitch McConnell was ahead of him in full (if hypocritical) fulmination. David Axelrod tried to rationalize the lagging response when he told The Washington Post last week that "people are not sitting around their kitchen tables thinking about A.I.G.," but are instead "thinking about their own jobs." While that’s technically true, it misses the point.

Of course most Americans don’t know how A.I.G. brought the world’s financial system to near-ruin or what credit-default swaps are. They may not even know what A.I.G. stands for. But Americans do make the connection between their fears about their own jobs and their broad understanding of the A.I.G. debacle. They know that the corporate bosses who may yet lay them off have sometimes been as obscenely overcompensated for failure as Wall Street’s bonus babies. As The Wall Street Journal reported last week, chief executives at businesses as diverse as Texas Instruments and the home builder Hovnanian Enterprises have received millions in bonuses even as their companies’ shares have lost more than half their value.

Since Americans get the big picture of this inequitable system, that grotesque reality dwarfs any fine print. That’s why it doesn’t matter that the disputed bonuses at A.I.G. amount to less than one-tenth of one percent of its bailout. Or that CNBC — with 300,000 viewers on a typical day by Nielsen’s measure — is a relatively minor player in the crash. Or that Edward Liddy had nothing to do with A.I.G.’s collapse, or that John Thain, of the celebrated trash can, arrived after, not before, others wrecked Merrill Lynch. These prominent players are just the handiest camera-ready triggers for the larger rage. Passions are now so hot that even Bernie Madoff’s crimes began to pale as we turned our attention to A.I.G.’s misdeeds, just as A.I.G. will fade when the next malefactor surfaces.

What made Jon Stewart’s takedown of Jim Cramer resonate was less his specific brief against CNBC’s cheerleading for bad stocks than his larger indictment of the gaping economic inequality that defined the bubble. As Stewart said, there were "two markets" — the long-term market that Americans earnestly thought would sustain their 401(k)’s, and the fast-moving, short-term "real market" in the back room where high-rolling insiders wagered "giant piles of money" and brought down everyone with them.

No one is more commanding on this subject than our president. In his town-hall meeting in Costa Mesa, Calif., on Wednesday, he described the A.I.G. bonuses as merely a symptom of "a culture where people made enormous sums of money taking irresponsible risks that have now put the entire economy at risk." But rhetoric won’t tamp down the anger out there, and neither will calculated displays of presidential "outrage." We must have governance to match the message. To get ahead of the anger, Obama must do what he has repeatedly promised but not always done: make everything about his economic policies transparent and hold every player accountable. His administration must start actually answering the questions that officials like Geithner and Summers routinely duck.

Inquiring Americans have the right to know why it took six months for us to learn (some of) what A.I.G. did with our money. We need to understand why some of that money was used to bail out foreign banks. And why Goldman, which declared that its potential losses with A.I.G. were "immaterial," nonetheless got the largest-known A.I.G. handout of taxpayers’ cash ($12.9 billion) while also receiving a TARP bailout. We need to be told why retention bonuses went to some 50 bankers who not only were in the toxic A.I.G. unit but who left despite the "retention" jackpots. We must be told why taxpayers have so little control of the bailed-out financial institutions that we now own some or most of. And where are the M.R.I.’s from those "stress tests" the Treasury Department is giving those banks?

That’s just a short list. In general, it’s hard to imagine taxpayers shelling out billions for a second bank bailout unless there’s a full accounting of every dime of the first, and true transparency for the new plan whose rollout is becoming the most attenuated striptease since the heyday of Gypsy Rose Lee. Another compelling question connects all of the above: why has there been so little transparency and so much evasiveness so far? The answer, I fear, is that too many of the administration’s officials are too marinated in the insiders’ culture to police it, reform it or own up to their own past complicity with it.

The "dirty little secret," Obama told Leno on Thursday, is that "most of the stuff that got us into trouble was perfectly legal." An even dirtier secret is that a prime mover in keeping that stuff legal was Summers, who helped torpedo the regulation of derivatives while in the Clinton administration. His mentor Robert Rubin, no less, wrote in his 2003 memoir that Summers underestimated how the risk of derivatives might multiply "under extraordinary circumstances."

Given that Summers worked for a secretive hedge fund, D. E. Shaw, after he was pushed out of Harvard’s presidency at the bubble’s height, you have to wonder how he can now sell the administration’s plan for buying up toxic assets with the help of hedge funds. It will look like another giveaway to his own insiders’ club. As for Geithner, people might take him more seriously if he gave a credible account of why, while at the New York Fed, he and the Goldman alumnus Hank Paulson let Lehman Brothers fail but saved the Goldman-trading ally A.I.G.

As the nation’s anger rose last week, the president took responsibility for what’s happening on his watch — more than he needed to, given the disaster he inherited. But in the credit mess, action must match words. To fall short would be to deliver us into the catastrophic hands of a Republican opposition whose only known economic program is to reject job-creating stimulus spending and root for Obama and, by extension, the country to fail. With all due deference to Ponzi schemers from Madoff to A.I.G., this would be the biggest outrage of them all.

Obama's Big Week

The Obama administration is going on the offensive following a week of stinging rebukes for overspending and failing to curb executive bonuses for bailed out firms. Tuesday evening, President Obama will attempt to defuse Americans' ire in a nationally televised press conference at 8 p.m. ET. He'll also make the case for the Treasury Department's risky gambit to partner with the private sector to remove toxic assets from banks' balance sheets. It's a crucial week for this young administration, still fighting to brand itself as a guardian of the middle class without alienating business, swept up in a class drama over $165 million in bonuses doled out by American International Group.

Voters who put Obama in the White House want to know what he's doing about it. Impatience is also growing over his hydra-headed spending plans, which the Congressional Budget Office said underestimated the deficit damage by $2.3 trillion. The public wants the economy back on track and stock markets to rise. Inherited or not, the mess is Obama's now. Treasury's plan to remove bad assets from bank balance sheets could help. The New York Times reported Saturday that it will have three basic parts. The Federal Deposit Insurance Corp. will lend investors about 85% of the money needed to buy toxic securities from banks that want to remove them from their balance sheets, the paper reported.

In addition, the government is expected to pay several investment management firms to match private-sector money and expand a new Treasury-Federal Reserve program designed to boost consumer lending. The troubled assets reportedly will be priced via an auction mechanism, according to reports. Treasury officials did not respond to a request for comment. If successful, the plan will show critics that the administration is not just in favor of increased government spending to lift the country out of its malaise but that private sector involvement is important as well.

To work, it must be specific enough to restore confidence among investors that the White House knows what it is doing. Lack of detail left markets nonplussed when Treasury Secretary Timothy Geithner first mentioned the so-called Public-Private Investment Fund last month. It will also need to be the government's "final answer"--or something close to it--in devising a program to rid banks of rotten securities. Former Treasury Secretary Henry Paulson head-faked markets last fall by announcing that the government would buy the assets with bailout money but then used it to keep banks afloat. This time, investors need assurance the government will do what it says.

Democrats threaten the banking plan, as well as the nation's broader agenda, by stoking public anger at AIG and other Wall Street firms. Hot to send Obama legislation aimed at heavily taxing executive pay, they risk rigging a booby trap for the new president. If he opposes the legislation, he could look insensitive to Main Street. If he favors it, he may alienate the business community, potentially prolonging the banking crisis. It's all a troubling distraction from more crucial debates on financial services regulation, fixing U.S. health care and righting the education system. Can the president get America beyond bonuses in the week ahead? Here's hoping.

Congress loathe to more bailouts after AIG

Forget about any more bailouts anytime soon.Any Obama administration bid to seek more taxpayer money for failing banks will face stiff resistance in Congress, where Treasury Department credibility is ebbing fast and lawmakers are bowing before a constituent revolt. Treasury Secretary Timothy Geithner is expected to roll out the details of his next financial rescue plan any day. But the administration faces resistance on several fronts: Its credibility has been badly damaged, with Geithner under withering scrutiny in Congress, even as lawmakers’ constituents are boiling mad and Republicans are increasingly united in opposing more bailouts.

News that executives at American International Group got $165 million in bonuses after taxpayers bailed AIG out to the tune of $170 billion triggered a political firestorm last week that’s likely to burn for some time. It crystallized public revulsion at bailing out big banks. "AIG has become the straw that broke the camel’s back. It pushed people off the edge," said Sen. Mary Landrieu, D-La. "Blanket bailouts have been taken off the table," added Sen. Ben Nelson, D-Neb. Obama’s fiscal 2010 budget outline listed another $250 billion as a "contingent reserve for further efforts to stabilize the financial system," and his aides said that amount could be leveraged to spend as much as $750 billion more buying bad assets from imperiled banks. Congress expects to vote on that budget blueprint next week.

Sen. Christopher Dodd, D-Conn., is a daily reminder of the bailout credibility problem. As the Senate Banking Committee chairman and a 28-year Senate veteran, colleagues have long looked to him for guidance on complex financial issues. Now, though, he’s become a convenient target for bailout critics. Here’s why: First he said last week that he wasn’t involved in a last-minute change to last month’s economic stimulus bill that allowed AIG to pay the bonuses. The next day, Dodd reversed himself. He said his comments had been misinterpreted, that he’d "agreed reluctantly" to include the language permitting the bonuses, but "did so at the request of administration officials."

Republicans pounced and Democrats winced. Geithner confirmed on CNN that Treasury had asked Dodd to insert the language, but denied that he’d done it himself, placing responsibility on some unidentified Treasury staffer. That didn’t help his credibility. Many Democrats already had reservations about Geithner because of his lapses in paying income taxes; the latest news intensified their skepticism. "This matter has been misjudged by the administration," said Landrieu, a moderate Democrat who’s one of a handful of swing votes in the Senate.

Sen. Ron Wyden, D-Ore., emphatically agreed. He and Sen. Olympia Snowe, R-Maine, had won overwhelming Senate approval of a plan to sharply restrict and tax big bonuses at firms receiving government bailout money, only to see their provision dropped during last-minute negotiations with the House. A miffed Wyden said "the Obama economic team" engineered the elimination of his terms. He said he wasn’t sure if Geithner himself was behind it; still, suspicions focus most on him. Helping to stoke the surliness on Capitol Hill are the lawmakers’ constituents, who have never embraced bailouts since they started last year, as polls have made clear.

The AIG bonus mess is both a lawmaker’s dream and nightmare. It’s a dream because people understand the issue, so members of Congress can use it to show that they’re in tune with their constituents’ struggles. Hence the speed with which the House voted Thursday to tax back 90% of the bonuses. Listen to Sen. Carl Levin, D-Mich. He noted that autoworkers recently "agreed to significant reductions in their pay and benefits. They are doing what they can to help their companies survive and help get our nation out of this economic ditch. ... Contrast those autoworkers with AIG executives."