"Butter bean vines across the porch. Negro quarter in Memphis, Tennessee."

Ilargi: I’d like to take another look at Sunday's post, The Jobs Doom Loop , which addressed two separate sets of (un-)employment numbers emerging from the US administration.

First, there is the issue of the jobs allegedly saved/created by the $787 billion stimulus plan, which turn out to be highly questionable and in all likelihood wildly exaggerated to make the current White House look good/better. Giving someone a pay raise is not the same as creating a job, guys. And saving jobs that are not threatened doesn't count either.

Second, in what goes way beyond the current White House, but is happily embraced regardless, the reporting of monthly and yearly job losses by the Bureau of Labor Statistics. For October, 192,000 lost jobs were reported, but only after 86,000 were added just about entirely arbitrarily through the moot-in-a-recession birth/death model. If we disregard the birth/death model, October saw 25,000 MORE job losses (a total of 278,000) than September. Still, the media widely reported LESS losses.

Note that the figure of 192,000 lost jobs was arrived at through the Payroll (or Establishment) Survey, while the alternative method reported by the BLS, the Household Survey, indicates that October saw 558,000 newly unemployed. While the Payroll Survey consults more firms than the Household Survey consults households, John Williams insists the latter is a far more scientific method. And it has a much wider range:

"Where the household survey includes farm workers, the self-employed and workers in private homes, the payroll survey does not.".Yes, I can see how that would keep the numbers comfortably low, completely ignoring the self-employed.

I wanted to bring two additional pieces of information to your attention, and into the equation.

One: a commenter named "Problem Is" at The Automatic Earth, see (The Jobs Doom Loop) had this to say about the infamous birth/death model:

Problem Is said... on NOVEMBER 8, 2009 6:04 PM

Great analysis as always Mr. Ilargi. Every one seems to forget what the BLS announced back on Oct. 2, 2009: The Birth/Death Ratio overestimated 824,000 jobs, mostly in the 1st Quarter 2009. They will be removed in the annual adjustment in February 2010.

From Bloomberg:U.S. Job Losses May Be Even Larger, Model Breaks DownFrom Calculated Risk:

About 824,000 more jobs may be subtracted from the payroll count for the 12 months through last March when the figures are officially revised early next year, a Labor Department report showed today. The revision would be the biggest since at least 1991.Employment Report: 190K Jobs Lost, 10.2% Unemployment RateIn other words, the 824,000 phantom jobs that don't exist won't be subtracted from the employment numbers and put back on the unemployment numbers where they belong until February 2010. So, let us fix that for the BLS now instead of February 2010:

Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

- The BLS says there are 15.7 million unemployed by U3 at 10.2% unemployment rate...

- So simple math tells us 15.7 at 10.2% means the work force being counted is 153.9 million.

- So we add back the 824,000 unemployed that the BLS shaved off with their imaginary B/D Ratio:

- We get 15.7 + .824 = 16.5 million unemployed.

- 16.5 / 153.9 = 10.7% by U3.

- Based on 153.9 million in the work force as above, by U3, I come up with 10.7% unemployment.

Now that was not so hard, was it Mr. Change?

Now, please note that these 824,000 fake jobs were counted by the BLS in the April 2008-March 2009 time bracket, even though they won’t be discounted till March 2010. In the same vein, the errors in the birth/death model that have been added to this years' job loss numbers so far won’t be known for the next year and a half, till Spring 2011. An average of 68.666 jobs every single month, invented out of thin air, whose only claim to fame is to make stock markets rise and politicians look good, and who won't be part of the real picture until some of them have been serving to polish up that picture for close to two years.

And no, that is not all, and neither is it the worst of the lot. Here’s number two:

In his weekly letter, John Mauldin shines his own light on the unemployment numbers, and quotes researcher and money manager Greg Weldon, who asserts that just about all the numbers we see published greatly underestimate the mess the US jobs market has become:

The Glide Path OptionThe headlines said unemployment, as measured by the "establishment survey," was down by 190,000; and even though that was slightly worse than forecast, market bulls were cheered by the fact that the number was not as bad as last month's. It is an improvement that we are not falling as fast. Well, maybe. What I did not see in many of the stories I read was that the number of unemployed actually soared by 558,000, to 15.7 million, as measured by the household survey. The establishment survey polls larger businesses; the household survey actually calls individual households.

Let's look at the real number in the establishment survey. If you don't seasonally adjust the number, the actual change in unemployment for October was 641,000, or about 450,000 more than the seasonally adjusted number. And the Bureau of Labor Statistics added 86,000 jobs that they simply guess were created through the so-called birth-death ratio. Interestingly, the birth-death ratio number is not seasonally adjusted, so it is just added to the unemployment number.

The total (U-6) [un]employment rate is at a record high of 17.5% (this includes those who are part-time for economic reasons). There are now over 10.5 million people who have lost their jobs since the beginning of the downturn.

My favorite slicer and dicer of data, Greg Weldon, offers up an even more horrific number. As I have noted before, if you have not looked for work in the last four weeks, the BLS does not count you as unemployed. Quoting Greg:"Moreover, when we combine the monthly change in the number of Unemployed, with the number Not in the Labor Force, we might consider the result to be a proxy for the actual 'change' in the underlying labor market situation ... in which case, October's figure of 817,000 represents the fourth LARGEST yet, behind last month's (September's) second largest figure of 1,021,000

... for a two-month combined figure of 1.838 million , in newly Unemployed, or no longer 'in' the Labor Force ...

... the second LARGEST two-month total EVER posted, barely trailing the December-08/January-09 total 1.955 million.

"Bottom line ... basis this measure AND the 'Total Unemployment Rate,' we could conclude that not only is there NO 'improvement' in the labor market, but moreover, that it continues to DETERIORATE, intently."

So if you have not looked for work in four weeks, the BLS does not count you as unemployed. If you've been listed discouraged for over a year, you're among millions of Americans who don't count either. John Williams at shadowstats.com put it this way: "The Clinton administration dismissed to the non-reporting netherworld about five million discouraged workers who had been so categorized for more than a year." Williams, when including these long-term discouraged, arrives at his SGS Alternate US unemployment percentage of 22.1%. Please note that, already, 35.6% (appr. 5.8 million) of today's unemployed (the ones that ARE counted) fall in the long-term category.

To summarize, the mostly widely quoted official US government employment numbers, the (non-farm) Payroll Survey, routinely ignores to include between 70-80% of unemployed Americans. The less quoted Household Survey fails to count "only" about 50% of the jobless. The rest reside in the netherworld. The reality is that close to 1 million Americans still become unemployed every month a trend that shows no sign of slowing down.

If we take the 153.9 million number for the total workforce, and John Williams' 22.1% for the unemployment rate, we find that 34 million Americans are currently unemployed.

There must be more constructive ways to deal with these very serious issues than just lie about them every chance you get. And America must be able to find more accurate ways of keeping tab. I doubt even the recent elections in Zimbabwe or Afghanistan came up this far off the mark.

Ilargi: The Automatic Earth Fall Fund Drive is on. Please see the top of the left hand column. Your donations (and visits to our advertisers) make this site possible. This is not TV. You are not just a dispassionate observer. Without you, there can be no Automatic Earth.

U.S. Joblessness May Reach 13 Percent, Rosenberg Says

The U.S. unemployment rate may rise to a post-World War II high of 13 percent in the aftermath of the recession, said David Rosenberg, chief economist at Gluskin Sheff & Associates Inc. in Toronto. "This is going to be the mother of all jobless recoveries," Rosenberg, one of the first to forecast the recession in his former position as chief North American economist at Merrill Lynch & Co. in New York, said today in an interview on Bloomberg Radio. "At the beginning of the year, who was calling for unemployment to go up to 10 percent?"

Rosenberg said the recession, the deepest since the Great Depression, "is truly secular in nature" and said the economy is "in a post-bubble credit collapse." A 13 percent unemployment rate would be the highest since monthly records began in January 1948, according to Labor Department data. The previous postwar high was 10.8 percent in December 1982. Yearly records, which began in 1929, show joblessness climbed to almost 25 percent in 1933 during the Great Depression. The rate exceeded 10 percent last month for the first time in more than a quarter century. The Labor Department reported Nov. 6 that unemployment increased to 10.2 percent in October, the highest since 1983, and payrolls dropped by 190,000 workers.

Additionally, the so-called under-employment rate, which includes part-time workers who’d prefer a full-time position, and people who want work and have given up looking, reached 17.5 percent last month, the highest level since records began in 1994. Companies aren’t "cash constrained to hire workers," and instead are being "cautious about economic bellwethers," Rosenberg said. "It just comes down to the economic outlook," he said.

The economy has lost 7.3 million jobs since the recession began in December 2007. Commenting on the third quarter’s surge in worker productivity, Rosenberg said "we are producing more with fewer average hours worked -- how sustained is that is anyone’s guess." Productivity, a measure of worker output per hour, increased at a 9.5 percent annual rate from July to September as labor costs registered a record decline, the Labor Department reported Nov. 5.

The economy in the U.S. could rival Japan’s so-called "lost decade" of the 1990s, Rosenberg said. "This has some prints of Japan in many respects," where growth stagnated for years and prices fell in the aftermath of speculation in real estate and equities, he said. In the U.S., "20 percent of private credit is coming out of the system -- and on a semi-permanent basis," as reflected in the record eight consecutive monthly declines in consumer credit through September, Rosenberg said.

Credit card, auto and other installment debt declined $14.8 billion, or 7.2 percent at an annual rate, to $2.46 trillion, according to Federal Reserve data released Nov. 6. The consecutive declines were the most since records began in 1943. Government stimulus plans, such as the "cash-for- clunkers" auto rebates and tax credits for home buying, are "short-term policies that promote excess spending," Rosenberg said. Growth in the third quarter would have been "barely above zero" without the government stimulus, he said. Spending on education and job training would be a wiser investment, Rosenberg said.

Moreover, the Treasury is "on an unsustainable fiscal path irrespective of where the economy is going," Rosenberg said. The government reported a record budget deficit of $1.42 trillion in the fiscal year that ended Sept. 30. In the third quarter, gross domestic product expanded at a 3.5 percent annual rate after a yearlong contraction, Commerce Department figures showed Oct. 29. Household purchases increased 3.4 percent, the most in two years.

The Glide Path Option

by John Mauldin

The Ugly Unemployment Numbers

The headlines said unemployment, as measured by the "establishment survey," was down by 190,000; and even though that was slightly worse than forecast, market bulls were cheered by the fact that the number was not as bad as last month's. It is an improvement that we are not falling as fast.

Well, maybe. What I did not see in many of the stories I read was that the number of unemployed actually soared by 558,000, to 15.7 million, as measured by the household survey. The establishment survey polls larger businesses; the household survey actually calls individual households.

Let's look at the real number in the establishment survey. If you don't seasonally adjust the number, the actual change in unemployment for October was 641,000, or about 450,000 more than the seasonally adjusted number. And the Bureau of Labor Statistics added 86,000 jobs that they simply guess were created through the so-called birth-death ratio. Interestingly, the birth-death ratio number is not seasonally adjusted, so it is just added to the unemployment number. http://www.bls.gov/web/cesbd.htm

The total (U-6) employment rate is at a record high of 17.5% (this includes those who are part-time for economic reasons). There are now over 10.5 million people who have lost their jobs since the beginning of the downturn.

My favorite slicer and dicer of data, Greg Weldon (www.weldononline.com), offers up an even more horrific number. As I have noted before, if you have not looked for work in the last four weeks, the BLS does not count you as unemployed. Quoting Greg:

"Moreover, when we combine the monthly change in the number of Unemployed, with the number Not in the Labor Force, we might consider the result to be a proxy for the actual 'change' in the underlying labor market situation ... in which case, October's figure of 817,000 represents the fourth LARGEST yet, behind last month's (September's) second largest figure of 1,021,000 ... for a two-month combined figure of 1.838 million, in newly Unemployed, or no longer 'in' the Labor Force ...

"... the second LARGEST two-month total EVER posted, barely trailing the December-08/January-09 total 1.955 million.

"Bottom line ... basis this measure AND the 'Total Unemployment Rate,' we could conclude that not only is there NO 'improvement' in the labor market, but moreover, that it continues to DETERIORATE, intently."

There are plenty more implications in the data, but let's turn to the topic of the day.

The Present Contains All Possible Futures

Like teenagers, we as a US polity have made a number of bad choices over the past decade. We allowed banks to overleverage and, in the case of AIG (and others), sell what were essentially naked call options of credit default swaps, based on their firm balance sheets, far in excess of their net worth; and that put our entire financial system at risk. We gave mortgages to people who could not pay them, and did so in such large amounts that we again brought down the entire world financial system to the point that only with staggering amounts of taxpayer money was it brought back from the brink of Armageddon. We assumed that home prices were not in a bubble but were a permanent fixture of ever-rising value, and we borrowed against our homes to finance what seemed like the perfect lifestyle. We did not regulate the mortgage markets. We ran large and growing government deficits. We did not save enough. We allowed rating agencies to degrade their ratings to a point where they no longer meant anything. The list is much longer, but you get the idea.

Now, we are faced with a continuing crisis and the aftermath of multiple bubbles bursting. We are left with a massive government deficit and growing public debt, record unemployment, and consumers who are desperately trying to repair their balance sheets.

If present trends are left unchecked, we will need to find $15 trillion in the next ten years, just to pay for US government debt, let alone state, county, and city debt. And perhaps some loans for business will be needed? Where can all this money come from? The answer is that it can't be found. Long before we get to 2019 there will be an upheaval in the market, forcing what could be unpleasant changes.

We are left with no good choices, only bad ones. We have created a situation that is going to cause a lot of pain. It is not a question of pain or no pain, it is just when and how we decide (or are forced) to take it. There are no easy paths, but some bad choices are less bad than others. So, let's review some of the choices we can make. (Again, I am being very general here. You can go to the archives for more specifics. This is a summary letter.)

Argentinian Disease

One way to deal with the deficit is to do what Argentina and other countries have done: simply print the money needed to cover the deficits. Of course, that eventually means hyperinflation and the collapse of the currency and all debt. There are writers who think this is an inevitable outcome. How else, they ask, can we deal with the debt? Where is the political willpower?

One large hedge-fund manager in Brazil humorously remarked that Argentina is a binomial country. When faced with two choices (hence binomial) they always made the bad choice. Could it happen here?

Hyperinflation is not an economic event; it is a political choice. I think last Tuesday's election is a sign that the voter population is beginning to pay attention to the need for something more than talk of change. There is growing discomfort with the size of the deficits. Further, the Fed would have to cooperate in order for there to be hyperinflation, and I think there is only a very slight (as in almost zero) chance of that happening. Could Congress change the rules and take over the Fed? Anything's possible, but I seriously doubt there is any appetite in saner Democratic circles for such a thing to happen.

I think the chances of hyperinflation in the US are quite low. It would be the worst of all possible bad choices.

The Austrian Solution

Here I refer to the Austrian school of economic theory, based on the work of Ludwig von Mises and Friedrich Hayek, et al. There are those in the Austrian camp who argue the need to do away with the Fed, return to the gold standard, allow the banks that are now deemed too big to fail to go ahead and fail, along with any businesses that are also mismanaged (such as GM and Chrysler), and leave the high ground to new and more properly run.

In their model, government spending is slashed to the bone, as are (in most cases) taxes. The advantage is that, in theory, you get all your pain at once and then can begin to recover from what would be a very bad and deep recession. The bad news is that you risk getting 30% unemployment and another depression that could take a very long time to climb out of.

Now, let me say that I have GREATLY simplified their argument. If you want to learn more you can go to www.mises.org. It is an excellent web site for all things Austrian. While I am not Austrian, I have spent a lot of time reading the literature and have certain sympathies for this view.

That being said, this also has almost no chance of being implemented. In Congress, only my friend Ron Paul is its advocate. Most Austrian followers are Libertarian by nature, and that is just not a political reality for the coming decade.

The Eastern European Solution

As it turned out, Niall Ferguson (last week I wrote about his brilliant book, The Ascent of Money) was in Dallas last night, and I was graciously invited to hear him. He gave a great speech and signed books, and then we went to a local bar and proceeded to solve the world's problems over Scotch (Niall) and tequila (me), and went farther into the night than we originally intended. He's a very fun and knowledgeable guy.

As we were talking about possible paths, he brought one to mind that I hadn't thought of. He reminded me of the period after the fall of the Berlin Wall, as the nations of Eastern Europe broke from the former Soviet Union. They started with very weak economies and simply overhauled their entire governments and economies in a rather short period of time, though not in lockstep with one another. Privatization, lowered taxes, etc. were the order of the day.

We here in the US are always talking about the need for reform. We need to reform health care or education or energy. In Eastern Europe they did not reform in the sense that we use the word. In many cases they simply started from scratch and built new systems. They had the advantage that there was general agreement that things did not work the way they had been, so there was more room for change.

Today in the US there are large constituencies that resist change. We only get to tinker around the edges, when real structural change is needed. Sadly, we agreed that here there is not much chance of major change. We can't even get the obvious changes needed in the financial regulatory world.

Sidebar: I am outraged at the paltry proposed financial "reforms." Rahm Emanuel said that no crisis should be allowed to go to waste. The Obama administration is wasting this one. How can we allow banks to be too big to fail? Where is the reinstatement of Glass-Steagall? If we are going to allow large banks to exist, then their leverage must be reduced to the point where their failure would not risk the system and require taxpayer dollars. I don't care if that makes them less profitable. They are making those large profits because they have taxpayers implicitly behind them, and I get no dividend payments from them, the last time I checked. Where is Fannie and Freddie reform (and their breakup)? No mention of an exchange for credit default swaps? (And yes, I know that such an exchange would reduce the number of swaps and the profitability of them. That is the point. They are dangerous if allowed to become too big a market.) This bill reads as if bank lobbyists wrote it. Where is the populist outrage? We have let the fox set up the rules for running the hen house. Shame on us all if we allow this to happen.

Japanese Disease

I have written a lot over the past year about the problems facing Japan. Their population is shrinking, as is their work force. They are running massive fiscal deficits and have done so for almost 20 years. Government debt-to-GDP is now up to 178% and projected to rise to over 200% within a few years. They started their "lost decades" with a savings rate of almost 16%, and are now down to 2% as their aging population spends its savings in retirement. They have had no new job creation for 20 years, and nominal GDP is where it was 17 years ago.

As bad as our problems are here in the US, their bubble was far more massive. Values of commercial property fell 87%! Their stock market is still down 70%. They had twice as much bank leverage to GDP as the US. (Think about how bad off we would be if bank lending was twice as large and had even worse defaults and capital shortfalls!)

And yet, they Muddle Through. Productivity has kept their standard of living reasonable. Up until recently their exports were strong. The trading floors of the world are littered with the bodies of traders who have shorted Japanese government debt in the belief that it simply must implode. While I believe that it eventually will, if they stay on the path they are on, Japan is a very clear demonstration that things that don't make sense can go on longer than we think.

Richard Koo (chief economist of Nomura Securities, in Tokyo) argues passionately that Japan had a balance-sheet recession, and that the only way for Japan to fight it was to run massive deficits. Banks were not lending and businesses were not borrowing, as both groups were trying to repair their balance sheets, which were savaged by the bursting of the bubble. It is said that at one time the value of the land on which the Emperor's Palace sits in Tokyo was worth more than all of California. Clearly this was a bubble that puts our housing bubble to shame.

So, I understand the point that there are differences between Japan and the US . But there are also similarities. We too have had a balance sheet recession, although here it was mostly individuals and financial institutions that have had to retrench and repair their balance sheets.

Japan elected to run large deficits and raise taxes. As I wrote in the October 16th letter (http://www.2000wave.com/article.asp?id=mwo101609), "Savings equal Investments:

GDP (Gross Domestic Product) is defined as Consumption (C) plus Investment (I) plus Government Spending (G) plus [Exports (E) minus Imports (I)] or:

GDP = C + I + G + (E-I)

I don't want to go on at length again, but basically, the literature I quoted suggests that government stimulus and deficits have no long-run positive effect on GDP. In fact, the work done by Christina Romer, Obama's chairman of the Council of Economic Advisors, shows that tax cuts have a three-times-greater positive effect on GDP, and tax increases have the same level of negative effect.

In the equation above, if you increase government spending it will have a positive effect in the short run on GDP, but not in the long run. In essence, the increase in "G" must be made up by savings from consumers and businesses and foreigners.

But "G" does not enhance overall productivity. Government spending may be necessary but it is not especially productive. You increase productivity when private businesses invest and create jobs and products. But if government soaks up the investment capital, there is less for private business.

And that is Japanese disease. You run large deficits, sucking the air out of the room, and you raise taxes, taking the money from productive businesses and reducing the ability of consumers to save. Then you go for 20 years with little or no economic or job growth.

This is the path we currently seem to be on. The Japanese experience says that it could last a lot longer than people think before we hit the wall; because if savings rise in the US, and if banks, instead of lending, put that money on deposit with the Fed, as they are now doing (in order to repair their balance sheets), the US could run large deficits for longer than most observers currently believe.

We will need 15-18 million new jobs in the next five years, just to get back to where we were only a few years ago. Without the creation of whole new industries, that is not going to happen. Nearly 20% of Americans are not paying anywhere close to the amount of taxes they paid a few years ago, and at least ten million are now collecting some kind of unemployment benefits or welfare.

Choosing large deficits does not reduce the amount of pain we will experience, it just seemingly reduces it in the short term and creates the potential for a serious economic upheaval when the bond market finally decides to opt for higher rates. This path is a bad choice, but sadly, in reality it is one we could take.

The Glide Path Option

A glide path is the final path followed by an aircraft as it is landing. We need to establish a glide path to sustainable deficits (could we dream of surpluses?). That is because at some point there will be recognition, either proactively or forced upon us by the bond market, that large deficits are unsustainable in the long term.

If Congress and the president decided to lay out a real (and credible) plan to reduce the deficit over time, say 5-6 years, to where it was less than nominal GDP, the bond market would (I think) behave. Reducing deficits by $150 billion a year through a combination of cuts in growth and spending would get us there in five years.

The problem is that there is real pain associated with this option. Remember that equation above. Absent a growing private sector, if you reduce "G" (government spending) you also reduce GDP in the short run. You have to take some pain today in order to do that. But you avoid worse pain down the road: a bubble of massive federal debt that has to be serviced will be very painful when it blows up, as all bubbles do.

The Glide Path Option means that structural unemployment is going to be higher than we like (which is actually the case with all the options). And the large tax increases that come with this option will by their very nature be a drag on growth (and cause a double-dip recession in 2011). We can debate tax increases all we want, but I sadly think we will soon have a VAT tax. There are no good options. I just hope that we cut corporate taxes enough when we do create a VAT, that it will make our corporations more competitive, which will be a boost for jobs.

That's pretty much it. This is not a problem we can grow ourselves out of in the next few years. We have simply dug ourselves into a huge hole. This is not a normal recession. There is not a "V" ending to this recession. We are going to have deal with the pain. It will be the pain of reduced returns on traditional stock market investments, a lower dollar, low returns on bonds, European-like unemployment, lower corporate profits over the long term, and a very slow-growth environment. But if we choose this path, we will get through it in the fullness of time.

And of course, then we will eventually have to deal with the $70 trillion in our off-balance-sheet liabilities in Medicare and Social Security and pensions. Sigh. But that's for another time.

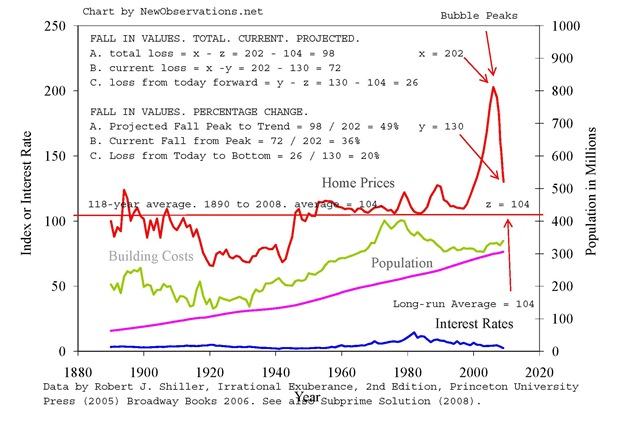

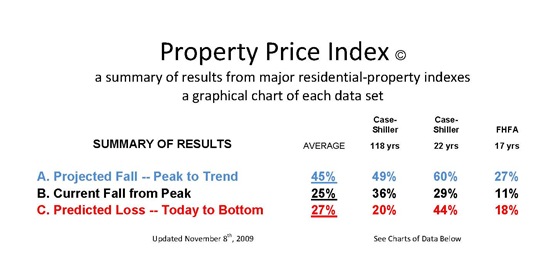

Ilargi: Mortgage broker Michael White is doing a series on property values based on longer timelines. These are the latest two.

Property Values Set to Fall 49% From Bubble Peak to Long-Run Average

Price Trends / WAR OF THE WORLDS (Round # 2): If you use 120 years of data for your time horizon, and assume prices will return to the average, then our residential property bubble will fall 49% from the bubble peak to the long-run average (see above (A) aka "(X) – (Z) / 202" aka "Projected Fall Peak to Trend").

This total projected fall is less than the 60% predicted in my recent post based upon 20 years of data and a trend line drawn with the eye (click here to see that post).

This long-horizon data also shows values falling much less from today to the bottom than was predicted in the time frame of the 20-year data. This chart shows values falling 20% from the current prices to reach the long-term average. The previous estimate showed a 43% fall from current prices to trend. Obviously it is a huge difference.

I will continue to work with all data sets until I have a more complete picture of property values. Please send your suggestions about the best information. We will put it all together. Maybe we will see the future.

What we know today based on the best information is that values will fall a total of between 49% to 60% from the bubble top to the trend. Still ahead is a fall in property values of between 20% to 43%.

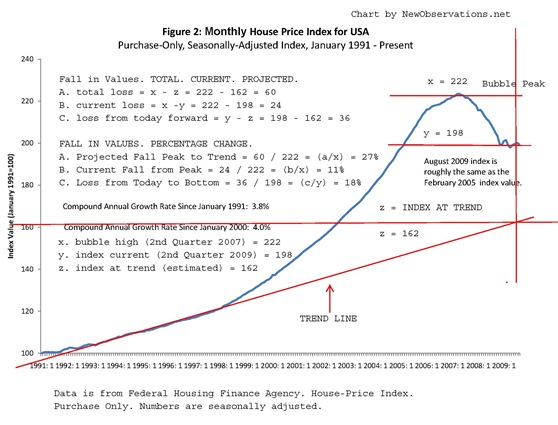

Conservative Property Index Predicts We Are Less Than Half Way Through Fall

The most conservative price data on residential properties predicts that values have fallen from the peak less than half of the way towards their long-term trend.

The total projected fall from Federal Housing Finance Agency (FHFA) data shows a peak-to-trend fall of 27%. Values on this index have fallen 11% from the high. The index predicts prices will fall an additional 18% from their current levels (please see chart above "Figure 2: Monthly House Price Index for USA").

The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% and 60% predicted by Case-Shiller. Click here and here to see recent posts with Case-Shiller data on either 22 years or 118 years of prices.

Based upon the three data sets reviewed, we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. After averaging the three indexes, we may estimate a total fall of 45% from the bubble high.

Looking ahead from today, property values will fall a total of between 18% to 44%. The average of the three data sets says we still have 27% to fall from current levels. Please see the chart below which shows the critical numbers for the three data sets and the averages. Click here to see the data in both numbers and charts at "Property Price Index".

Prechter's Predictions

Bob Prechter, President of Elliott Wave International joined Maria Bartiromo at NYSE on Novermber 4. Prechter is out with the second edition of his new book, "Conquer the Crash". He has written fourteen books since 1978. Prechter's publisher included a list of the forecasts he made in the book's first edition when it was released in May 2002. In an eerie surprise, these have all come to past!

- A rare, simultaneous fall in real estate, stocks and commodities

- Implosion of collateralized securities

- Government bailout schemes

- Fannie Mae's stock collapse

- Bond-rating services would fail to issue warnings

In a brief pre-interview, Prechter told us that he thinks the markets are now at an interesting juncture. Back in March, Prechter predicted that the Dow would make a run to the 10,000 level and the S&P would hit 1,100. His forecast was fulfilled in October. Now, Prechter is calling for the start of "another wave of the bear market," similar to what we saw in 2008. And another contrarian prediction - Prechter is expecting the dollar to rally from here!

Still, the threat of deflation is one that Prechter is most concerned about and one that he shared with us when he was on Closing Bell back in August. He is recommending investors be positioned to make sure they don't get hurt in the next wave of deflation. Prechter's deflation call for 2010 - simultaneous declines in stocks, commodities and real estate.

The Man Who Predicted the Depression

100 years ago, Ludwig von Mises explained how government-induced credit expansions led to imbalances in the economy.

Ludwig von Mises was snubbed by economists world-wide as he warned of a credit crisis in the 1920s. We ignore the great Austrian at our peril today. Mises's ideas on business cycles were spelled out in his 1912 tome "Theorie des Geldes und der Umlaufsmittel" ("The Theory of Money and Credit"). Not surprisingly few people noticed, as it was published only in German and wasn't exactly a beach read at that.

Taking his cue from David Hume and David Ricardo, Mises explained how the banking system was endowed with the singular ability to expand credit and with it the money supply, and how this was magnified by government intervention. Left alone, interest rates would adjust such that only the amount of credit would be used as is voluntarily supplied and demanded. But when credit is force-fed beyond that (call it a credit gavage), grotesque things start to happen.

Government-imposed expansion of bank credit distorts our "time preferences," or our desire for saving versus consumption. Government-imposed interest rates artificially below rates demanded by savers leads to increased borrowing and capital investment beyond what savers will provide. This causes temporarily higher employment, wages and consumption.

Ordinarily, any random spikes in credit would be quickly absorbed by the system—the pricing errors corrected, the half-baked investments liquidated, like a supple tree yielding to the wind and then returning. But when the government holds rates artificially low in order to feed ever higher capital investment in otherwise unsound, unsustainable businesses, it creates the conditions for a crash. Everyone looks smart for a while, but eventually the whole monstrosity collapses under its own weight through a credit contraction or, worse, a banking collapse.

The system is dramatically susceptible to errors, both on the policy side and on the entrepreneurial side. Government expansion of credit takes a system otherwise capable of adjustment and resilience and transforms it into one with tremendous cyclical volatility. "Theorie des Geldes" did not become the playbook for policy makers. The 1920s were marked by the brave new era of the Federal Reserve system promoting inflationary credit expansion and with it permanent prosperity. The nerve of this Doubting-Thomas, perma-bear, crazy Kraut!

Sadly, poor Ludwig was very nearly alone in warning of the collapse to come from this credit expansion. In mid-1929, he stubbornly turned down a lucrative job offer from the Viennese bank Kreditanstalt, much to the annoyance of his fiancée, proclaiming "A great crash is coming, and I don't want my name in any way connected with it." We all know what happened next. Pretty much right out of Mises's script, overleveraged banks (including Kreditanstalt) collapsed, businesses collapsed, employment collapsed. The brittle tree snapped. Following Mises's logic, was this a failure of capitalism, or a failure of hubris?

Mises's solution follows logically from his warnings. You can't fix what's broken by breaking it yet again. Stop the credit gavage. Stop inflating. Don't encourage consumption, but rather encourage saving and the repayment of debt. Let all the lame businesses fail—no bailouts. (You see where I'm going with this.) The distortions must be removed or else the precipice from which the system will inevitably fall will simply grow higher and higher.

Mises started getting some much-deserved respect once "Theorie des Geldes" was finally published in English in 1934. It is unfortunate that it required such a disaster for people to take heed of what was the one predictive, scholarly explanation of what was happening. But then, just Mises's bad luck, along came John Maynard Keynes's tome "The General Theory of Employment, Interest and Money" in 1936. Keynes was dapper, fresh and sophisticated. He even wrote in English! And the guy had chutzpah, fearlessly fighting the battle against unemployment by running the currency printing press and draining the government's coffers.

He was the anti-Mises. So what if Keynes had lost his shirt in the stock-market crash. His book was peppered with fancy math (even Greek letters) and that meant rigor, modernity. To add insult to injury, Mises wasn't even refuted by Keynes and his ilk. He was ignored. Fast forward 70-some years, during which we saw Keynesianism's repeated disappointments, the end of the gold standard, persistent inflation with intermittent inflationary recessions and banking crises, culminating in Alan Greenspan's "Great Moderation" and a subsequent catastrophic collapse in housing and banking. Where do we find ourselves? At a point of profound insight gained through economic logic, trial and error, and objective empiricism? Or right back where we started?

With interest rates at zero, monetary engines humming as never before, and a self-proclaimed Keynesian government, we are back again embracing the brave new era of government-sponsored prosperity and debt. And, more than ever, the system is piling uncertainties on top of uncertainties, turning an otherwise resilient economy into a brittle one. How curious it is that the guy who wrote the script depicting our never ending story of government-induced credit expansion, inflation and collapse has remained so persistently forgotten. Must we sit through yet another performance of this tragic tale?

Why Are Banks Holding So Many Excess Reserves?

Reserves (sometimes called bank reserves) are funds held by depository institutions that can be used to meet the institution’s legal reserve requirement. These funds are held either as balances on deposit at the Federal Reserve or as cash in the bank’s vault or ATMs. Reserves that are applied toward an institution’s legal requirement are called required, while any additional reserves are called excess.Fed paper by Todd Keister and James McAndrews

The quantity of reserves in the U.S. banking system has risen dramatically since September 2008. Some commentators have expressed concern that this pattern indicates that the Federal Reserve’s liquidity facilities have been ineffective in promoting the flow of credit to firms and households. Others have argued that the high level of reserves will be inflationary. We explain, through a series of examples, why banks are currently holding so many reserves. The examples show how the quantity of bank reserves is determined by the size of the Federal Reserve’s policy initiatives and in no way reflects the initiatives’ effects on bank lending. We also argue that a large increase in bank reserves need not be inflationary, because the payment of interest on reserves allows the Federal Reserve to adjust short-term interest rates independently of the level of reserves.

Four Signs that the Recession Continues

Job creation is the key to economic recovery, FHA loan exposures are becoming problematic, the Strategic Default becomes an American Craze, and Wells Fargo plays "kick the can".

Friday morning’s payroll report shows a continued problem with job creation.

Nonfarm Payrolls declined 190,000 with the unemployment rate reaching an historic 10.2%. Most important is that hours worked stayed anemic at just 33.0 hours. The underemployment rate is 17.5%. Former Fed Chief Alan Greenspan has opined that it would take several months of 100,000 plus job growth before the unemployment rate starts to decline.

Initial Jobless Claims came in at 512,000 last week, which was well above the 350,000 threshold that correlates to a Recession. Congress has extended jobless benefits by another twenty weeks, which should keep jobless claims well above 350,000 for an extended period. Productivity levels are extremely high because lower business activities are being accomplished by much fewer workers.

FHA Mortgage Exposures Balloon to problematic levels

Even though the Federal Housing Authority (FHA) has tightened credit standards, many mortgages issued in 2007 and 2008 are turning sour. Defaults on loans guaranteed in 2007 are at 24%, loans in the first half of 2008 about 20% sour. At fault is Congress, who encouraged the FHA to save as many homeowners as possible by refinancing loans that should not have been issued in the first place.

Later this month the FHA will disclose that their level of reserves has fallen below the federally mandated level for the first time in its 75-year history. The FHA doesn't make loans but insures lenders against losses if a borrower defaults on mortgages where the borrower has made a down payment of as little as 3.5%. This guarantee includes half of all home-purchase loans made in the country’s hardest-hit housing markets. This policy has added to the potential burden on taxpayers if home-price declines resume.

In addition, delinquencies on refinance loans have been rising faster than those on new loans for the past three years. It seems like the FHA is attempting to restart a housing bubble by taking on riskier loans beginning in 2007 by guaranteeing loans of borrowers with credit scores of less than 600. Sources say that these types of loans were increased by the FHA to 37% in 2007, up from 30% in 2006.

More Americans are walking away from their homes

The trend is known as Strategic Default, where the homeowner loses their job and stops making mortgage payments because they owe more than the home is worth. Such a strategy destroys one’s credit score, but many can stay in the home until the bank comes knocking at the door. Sources say that there were 588,000 Strategic Defaults in 2008, double the total of 2007. This trend should unfortunately continue as the jobless rate moves higher despite a modest bounce in home prices in recent months.

Strategic Defaults will increase foreclosures and short-circuit the fragile housing recovery, increasing bad loans at banks leading to more writedowns and bank failures. The uncertainty of one’s future makes it an easy choice to suspend mortgage payments when a job is lost. Why dip into savings when the asset you own is worth less than you paid for it. Extreme weak reading of Consumer Confidence indicates that this trend could continue for another one to three years.

If banks were able to be more proactive with mortgage holders and offer modifications including reduced loan principal and perhaps a zero percent mortgage during the time a homeowner is unemployed, the strategic default becomes a mute option. But we know banks are under performance pressures of their own as other types of consumer and real estate loans go sour. It’s a vicious cycle that signals that "The Great Credit Crunch" is nowhere near its end. The Obama Making Homes Affordable program is no help if unpaid mortgages are more than 125% of the home’s market value. Values are being adversely affected by foreclosures and short sales, which pull down appraised values.

Wells Fargo bets House Prices will rise

Wells Fargo holds $107 billion in Alt-A option-adjustable rate mortgages, a loan that allowed borrowers to make smaller monthly payments up front in return for increasing their mortgage balance three to five years from the start of the loan. To avoid defaults and foreclosures, Wells has decided to off-set increased monthly payments by offering effected homeowners interest-only loans to defer amortization of loans for six to ten years. The bank is betting that home prices will stabilize, and that the economy will improve enough for this bet to pay-off. Only a bank "too big to fail" has a balance sheet big enough to make such a bold move. Other "too big to fail" banks Bank of America and JP Morgan inherited similar mortgages with the shot-gun weddings with Countrywide and Washington Mutual, respectively.

Global Nominal Spending History

As someone who believes that stabilizing nominal spending rather than inflation is key to macroeconomic stability, I have taken the liberty in the past to reframe U.S. macroeconomic history according to this perspective. Thus, I renamed (1) the "Great Inflation" that started in the mid-1960s and ended in the early-1980s as the "Great Nominal Spending Spree" and (2) the "Great Moderation" of 25 years or so preceding the current crisis the "Great Moderation in Nominal Spending." I also labeled the late-2008, early 2009 period as the "Great Nominal Spending Crash". Below was the figure I used to summarize this reframing of U.S. macroeconomic history (Click on figure to enlarge):

Recently, I learned the OECD has a quarterly nominal GDP measure (PPP-adjusted basis) aggregated across 25 of its member countries going back to 1960:Q1. The countries are as follows: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Japan, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, United Kingdom and United States. The combined economies of these counties make up over half the world economy and thus, provide some sense of global nominal spending. So in the spirit of reframing global macroeconomic history according to a nominal spending perspective I created the following figure (click on figure to enlarge):

I suspect the similarities between these two figures speak to the size and influence of the U.S. economy. I think it also speaks to the influence of U.S. monetary policy on global liquidity conditions and, thus, it influence on global nominal spending.

Ilargi: The clip below contains Dylan Ratigan’s reaction to a 7 pages long article in the Sunday Times, entitled I'm doing 'God's work'. Meet Mr Goldman Sachs, in which Goldman CEO Lloyd Blankfein shows that in America, religion may well be an excuse for anything, if you play your cards well.

Is Goldman Sachs "doing God's work?"

Wall Street Bonuses Rise as Big 3 May Pay $30 Billion

Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co.’s investment bank, survivors of the worst financial crisis since the Great Depression, are set to pay record bonuses this year. The firms -- the three biggest banks to exit the Troubled Asset Relief Program -- will hand out $29.7 billion in bonuses, according to analysts’ estimates. That’s up 60 percent from last year and more than the previous high of $26.8 billion in 2007.

The money, split among 119,000 employees, equals $250,400 each, almost five times the $50,303 median household income in the U.S. last year, data compiled by Bloomberg show. The three will award more in stock and defer more cash payments under pressure from regulators to tie pay to long-term results, compensation experts said. They may still face public wrath over the size of bonuses after the government injected capital into all the major financial institutions following Lehman Brothers Holdings Inc.’s collapse in September 2008.

"Wall Street is beginning to resemble Clark Gable as Rhett Butler in the film ‘Gone With the Wind’: ‘Quite frankly, my dear, I don’t give a damn,’" Paul Hodgson, a senior research associate on compensation at the Portland, Maine-based Corporate Library, said in an e-mail. "It doesn’t seem as if even political threat, disastrous PR, envy, rising unemployment rates and home repossessions is enough to get any of these people to refuse the bonuses they have ‘earned.’"

Bonuses for employees in fixed income will likely jump the most, 40 percent to 45 percent, while employees in asset management may see no growth in their year-end bonuses, according to a report from Options Group, a New York-based executive search and compensation consultant firm. Average bonuses for employees at financial firms worldwide will rise about 35 percent to 40 percent this year, according to the annual report, which is set to be released this week. They will still remain below 2007 levels after dropping an average of 40 percent to 45 percent last year, the report said.

Managing directors in high-yield credit sales are expected to see some of the largest average increase in bonuses, a 50 percent jump to a range of $1.3 million to $1.7 million. The bonuses of directors in commodity sales units may also climb 50 percent to a range of $650,000 to $850,000, the report said. Managing directors in commodities trading will receive the largest bonuses for that level, an average of $4 million to $6 million each.

Global heads of equities, commodities trading, interest- rate trading and investment banking each will receive total compensation that may reach at least $10 million, most of it coming from bonuses, according to the report. Morgan Stanley is among banks that are offering a larger portion of bonuses in stock and instituting so-called clawback clauses to tie incentive pay to risk, the report said. JPMorgan and UBS AG are also raising base salaries for some employees to reduce the share of bonuses in total pay.

"Wall Street is all about creating wealth, and when banks start making money again, they have to pay their people," said Michael Karp, co-founder of Options Group. "But because there’s so much public scrutiny, people will be very sensitive in terms of putting caps on some of these cash figures, and you’ll see a lot more in stock." Securities firms typically use slightly less than half of their revenue to pay salaries, benefits and bonuses, a percentage that is adjusted throughout the year. In the first nine months, Goldman Sachs, Morgan Stanley, and JPMorgan’s investment bank told their shareholders that they set aside $36.4 billion for compensation, up 27 percent from the same period a year earlier.

The three New York-based firms will likely set aside $49.5 billion for compensation for the full year, according to estimates from David Trone, an analyst at Fox-Pitt Kelton Cochran Caronia Waller in New York. That’s up from $30.9 billion last year and $44.7 billion in 2007. The rise in compensation is led by Goldman Sachs, which had record profit in the second quarter. Its compensation expense is expected to more than double from last year to $21.9 billion, or about $691,000 per employee, according to Trone’s estimates. The expense at JPMorgan’s investment bank is expected to jump 55 percent to $12 billion, about $482,400 for each employee, while Morgan Stanley’s compensation cost will rise 27 percent to $15.6 billion, or $252,000.

Year-end bonuses usually account for about 60 percent of compensation, the Options Group report said. While the total this year is expected to be greater than in 2007, it will come to less per employee than the $256,000 paid out that year by the three firms because of increased staffing. Bank of America in Charlotte, North Carolina, and New York- based Citigroup Inc. don’t break out compensation data for their investment-banking units.

More than a third of Wall Street finance professionals expect their bonuses to increase for 2009, according to a survey by eFinancialCareers.com, a job-search Web site specializing in the financial industry. Of the 1,074 people who responded to an e-mail poll conducted by the company in September, 36 percent said they’re anticipating a bigger annual payout and 11 percent said it will jump by at least half.

Wall Street is behaving like, "We made it through the storm, and now it’s back to doing things that we know how to do in our comfortable environment," said Mark Borges, compensation consultant at Compensia Inc. in Corte Madera, California. "It really runs counter to the things you’re hearing out of the administration, about how things have to change." The Fed said last month it will review the 28 largest banks to ensure that compensation doesn’t create incentives for the kinds of risky investments that brought the global financial system to the edge of collapse, prompting bailouts of firms including Bank of America and Citigroup. It also offered guidelines on making pay more tied to risk management.

Lloyd Blankfein, Jamie Dimon and John Mack, the chief executive officers of Goldman Sachs, JPMorgan and Morgan Stanley, were summoned to the Federal Reserve Bank of New York on Nov. 2 by President William Dudley. They were told they had to follow the new rules, people familiar with the matter said. Blankfein set a Wall Street pay record in 2007 when he was awarded a $67.9 million bonus on top of his $600,000 salary. He went without a bonus last year after the firm reported its first quarterly loss and accepted financial support from the government. Other bank CEOs, including Citigroup’s Vikram Pandit and Morgan Stanley’s Mack, also didn’t take bonuses in 2008.

Kenneth Feinberg, the Obama administration’s special master on pay, ordered pay cuts Oct. 22 averaging 50 percent for top executives at seven taxpayer-rescued companies and will rule on the pay structures of the 26th to 100th highest-paid employees at those firms by the end of the year. Feinberg’s decisions on the second tier could have more influence on other companies than his initial rulings, said Rose Marie Orens, a senior partner at Compensation Advisory Partners LLC in New York.

"Here he gets to see the methodology," said Orens. "If a company says it’s paying from revenue, he can come back and say it would be better if you paid out of profits. He has that kind of latitude." Feinberg’s rulings are "making their way into the hallways of non-financial companies," even if they aren’t likely to influence pay practices at private equity firms or hedge funds, she said. Wall Street firms may have to find other ways to stagger payments. Even shifting compensation to stock from cash might not blunt attacks from politicians and a U.S. public that faces a 10.2 percent unemployment rate, the highest since 1983.

Executives who received stock awards early this year in the midst of the credit crisis are gaining from the rally in bank stocks. The Standard & Poor’s 500 Financials Index has risen 24 percent so far this year and has more than doubled from an almost 17-year low on March 6. Goldman Sachs and Morgan Stanley’s shares have more than doubled this year, while JPMorgan’s have climbed 38 percent.

"The big firms are going to need to be very creative now, because of the populist sentiment," Peter Weinberg, 52, a founder of New York-based Perella Weinberg Partners LP, said last week at the "Capitalism and the Future" forum co- sponsored by Bloomberg LP and the Aspen Institute in New York. "It is very, very intense, it is bitter, and I understand it." Weinberg, who ran Goldman Sachs’s international operations from 1999 to 2005, is a grandson of Sidney Weinberg, the firm’s senior partner from 1930 to 1969.

Credit Suisse decided last year to use leveraged loans and commercial mortgage-backed debt, some of the securities blamed for generating the financial crisis, as part of variable compensation for senior employees. The bank told employees in August that the pool of toxic assets gained 17 percent since January, according to a person familiar with the matter. Weinberg said one possibility would be for large firms to take part of their bonus pool and use the funds to serve a function helpful to the economy, such as a small-business lender. Employees could be paid years later from the profits of the new entity.

"One thing they could do is to take an amount of money that would have been used for compensation and make a commercial investment that ultimately would go to those who would have been compensated," Weinberg said. "You’re not taking away compensation that arguably was due to them, but what you’re doing is you’re adding risk to it." While banks may change the way they structure pay, they probably can’t avoid disclosing the money as compensation, said Steven W. Rabitz, a former compensation lawyer at Goldman Sachs and Lehman Brothers Holdings Inc. who now works as a partner at law firm Stroock & Stroock & Lavan LP in New York.

"One way or another there’s going to be some kind of disclosure," Rabitz said. "The devil is in the details. People are talking about the details, and people are talking about the structures." Goldman Sachs is considering a new charitable program and has been working with Bridgespan Group, a Boston-based philanthropy consulting and recruiting firm, people familiar with the matter said last month. A charitable gift may be announced by the end of the year, when the firm awards bonuses.

Lucas van Praag, a spokesman for Goldman Sachs in New York, declined to comment on the firm’s compensation plans for this year. He said the company ties its pay closely to revenue. "Over the last eight years compensation at Goldman Sachs has been perfectly correlated with net revenue," van Praag said. "The average annual earnings generated per employee over the same period are $221,731, which is 67 percent more than our next most profitable competitor."

A jump in Wall Street bonuses this year may bring relief to Albany and New York City as the state and its biggest metropolis struggle with a combined $14 billion in budget deficits this fiscal year and next. The benefit may be muted since many of the bonuses will be awarded in stock that isn’t taxed immediately. Before the financial meltdown slammed bank earnings last year, Wall Street’s compensation and corporate profits provided 20 percent of New York state tax revenue and 9 percent of the city’s taxes. Bonuses in 2008 fell 44 percent from the prior year, to $18.4 billion, according to New York State Comptroller Thomas DiNapoli.

The reduction cost the state $1 billion in income tax revenue and New York City $275 million, he said. State personal income tax collections in first six months of the current fiscal year declined $4.4 billion, or 21.6 percent, from the same period a year earlier, DiNapoli’s September cash report said. The size of this year’s bonus payments to investment bankers and the public profile of the firms have obscured the struggles occurring in other parts of the finance industry, said Orens, of Compensation Advisory Partners.

More than 337,000 financial jobs have been eliminated worldwide since the middle of 2007, according to data compiled by Bloomberg. Finance industry jobs in New York City have fallen by 41,400 in the two years through August, according to the New York State Department of Labor. "It’s a narrow area, though clearly large in terms of dollars," Orens said. "Asset management is still hurting, the hedge funds are still down, many haven’t met their performance hurdles, and the normal lending functions and real estate are not pretty. It’s not as rosy everywhere else."

Secret £165bn loan keeping Lloyds alive

Lloyds Banking Group is being kept afloat with £165 billion of loans and guarantees from the Bank of England and other central banks around the world, The Sunday Times can reveal. The bank’s reliance on state funding, detailed in a document released last week in connection with a separate £21 billion fundraising, gives the first insight into the huge scale of aid extended to banks during the financial crisis. The document says the bank is still "heavily reliant" on government funding. Lloyds also says it would face a "materially higher refinancing risk" if it was not available.

The scale of Lloyds’ dependency has surprised analysts, but they say it shows just how big a financial timebomb it has become. The support is nearly equal to the £175 billion of UK government borrowing to be raised this year, and almost as big as the Bank of England’s £200 billion quantitative easing programme. The government has extended the money through two funding plans — the Special Liquidity Scheme, which gives loans, and the Credit Guarantee Scheme, under which guarantees are given to allow banks to get commercial loans.

Royal Bank of Scotland is less exposed — it has about £40 billion in state funds. It has cut its dependency on state funding by 69% since the peak of the crisis. Lloyds inherited most of the government loans from HBOS after it agreed to acquire the bank in September 2008. Banking sources have revealed that the Bank of England’s Special Liquidity Scheme was created in April 2008 with the express purpose of helping HBOS. The group was heavily exposed to mortgage lending, which dwarfed its retail deposits. When markets deteriorated and HBOS could not recycle its capital, the Bank stepped in.

The document shows Lloyds drew down further loans early this year. The bank said the loans should be seen in the context of its £1 trillion balance sheet and said all western banks received state help during the crisis. However, analysts say few continue to be helped on this scale. The Bank of England will make record profits this year from fees and interest rates paid by the banks for emergency funding. The Lloyds document also reveals the bank faces a £3.7 billion pension deficit. It is transferring £5 billion of assets to fill the hole.

This weekend the bank faces another potential threat to its fundraising plans. TCI, an activist hedge fund, has begun to orchestrate a potential investor rebellion over a £7.5 billion debt swap deal, part of the bank’s plans. Some investors continue to put pressure on Lloyds’ chief executive Eric Daniels to announce a succession plan as a condition for backing the rights issue. RBS, meanwhile, faces another potential row over staff bonuses.

The bank is offering cash advances to its bankers to by-pass new rules. Cut-price loans are being offered to staff allowing them to instantly release the value of bonuses being paid in shares. The loans would enable them to borrow against up to 25% of the total value of the bonus, at interest rates of 3.75%. The bank claimed the rate represented "commercial terms", even though it is lower than the mortgage rates offered by RBS to customers.

The bank is also continuing its process of disposals, with first-round bids having been tendered for RBS Asset Management, which controls £30 billion of assets. Aberdeen Asset Management, Black Rock, Henderson, Schroders and Neuberger Berman have all tabled offers. Morgan Stanley is advising RBS on the sale, which is estimated to be worth between £250 and £300m.

Credit Default Swaps Sink Jefferson County

The stench that started rising from the sewers of Jefferson County, Ala., earlier this decade has grown all the more foul. Last month former Birmingham Mayor and former County Commission President Larry Langford was convicted for taking kickbacks related to the refinancing of county bonds that were issued to fund reconstruction of the county's antiquated sewer system.

And on Nov. 4, J.P. Morgan Securities agreed to a settlement with the Securities & Exchange Commission regarding the bank's alleged involvement in a "pay-for-play" scheme that helped Morgan secure the rights to some of Jefferson County's sewer bond offerings. While Morgan admitted no wrongdoing, it has agreed to pay the financially strapped county $50 million and drop a $647 million claim for termination fees. Bettye Fine Collins, the current president of the County Commission, which has been weighing whether to declare bankruptcy in the face of the mounting sewer bond debt, declared the J.P. Morgan settlement "significant" in a press release but issued no further comment.

But bankruptcy experts aren't convinced. "It has a nice splash in the media," says Jeffrey Cohen, a partner at Washington law firm Patton Boggs who has served as an adviser to some of Jefferson County's creditors. "But it really has very little effect." The roughly $700 million windfall puts only a minor dent in the more than $3 billion in bond debt the county owes. Jefferson got mired in debt because it relied on complex credit default swaps to protect sewer bond issues against a jump in interest rates. When the economy turned sour last year, the default swaps backfired, and chaos ensued. The state so far has refused to throw the county a lifeline. That leaves just two options: declaring bankruptcy or renegotiating the debt with creditors.

If Jefferson's finances can't be put right, county residents may see things they public services they take for granted—such as road maintenance and water—deteriorate rapidly. In order to avoid cuts in the budget that would affect living standards, Cohen recommends declaring bankruptcy immediately. "The county would be much better off filing bankruptcy, proposing a plan for all of its debts, and providing the investment community with some certainty," says Cohen. "[Further delay] could eat into the [county's ability] to provide services to its citizens, which is why governments exist."

Others aren't so sure bankruptcy is the most prudent decision for the much-maligned county. If it were to file for Chapter 9, Jefferson County might find temporary relief, but its future would be dismal, says municipal bankruptcy attorney Jim Spiotto, since it would face enormous difficulty securing funding to finance new initiatives. "No municipality of any size wants to file Chapter 9 because of the stigma," he says. "You want to work through these so you have continued access to the municipal market. The biggest problem people face after a Chapter 9 is what is life like thereafter."

Bankruptcy or not, municipal bond analysts say Jefferson County will have trouble for several years raising any funds through bond issues. Although experts are quick to note that the bond market is forgiving, and investors tend to have short memories, the magnitude of the debacle in Jefferson won't soon slip the minds of the muni-bond investment community. In order to overcome potential bondholders' leeriness, the county will have to be willing to pay higher interest rates or find other means to fund county initiatives.

"At some point they will be able to get market access back," says Matt Fabian, a managing director at Municipal Market Advisors in Concord, Mass. "But it's just going to be much more expensive for them. Jefferson County is the scariest situation in the market today." Fabian worries that Jefferson County's method of solving its problem could set a precedent for other bond issuers. While investors are prepared to risk default on riskier bonds, such as land speculation district bonds in Florida that default frequently, Jefferson County's sewer bonds are considered to be "safe sector credits" that yield a steady and supposedly worry-free return.

Should Jefferson County declare bankruptcy or make an arrangement where bondholders get cents on the dollar, analysts fret that other municipalities facing similar problems—though likely on a lesser scale—would follow suit and either declare bankruptcy or make arrangements with creditors that would yield skimpy payments. "How Jefferson County got into its situation is unique," says Fabian. "But how it gets out could set an example for other issuers to follow, and that's the fear for investors."

Greenlight Capital founder Einhorn calls for CDS ban

When one of the world’s most renowned hedge fund investors turns 180 degrees on a key financial instrument that has been centre stage throughout the financial crisis, it is worth paying heed. David Einhorn, founder of Greenlight Capital, was one of the earliest and most prescient users of credit default swaps. Now he is calling for these instruments, in effect a form of insurance on individual firms (or governments) that pays out when the institution defaults or restructures, to be banned.

"I think that trying to make safer credit default swaps is like trying to make safer asbestos," he writes in a recent letter to investors, adding that CDSs create "large, correlated and asymmetrical risks" having "scared the authorities into spending hundreds of billions of taxpayer money to prevent speculators who made bad bets from having to pay". CDSs are "anti-social", he goes on, because those who buy credit insurance often have an incentive to see companies fail. Rather than merely hedging their risks, they are actively hoping to profit from the demise of a target company.

This strategy became prevalent in recent years and remains so, as holders of these so-called "basis packages" buy both the debt itself and protection on that debt through CDSs, meaning they receive compensation if the company defaults or restructures. These investors "have an incentive to use their position as bondholders to force bankruptcy, triggering payments on their CDS rather than negotiate out of court restructurings or covenant amendments with their creditors", Mr Einhorn says.

His remarks are particularly interesting as he belonged to the club of hedge fund managers who attracted the wrath of such senior executives as Dick Fuld of Lehman Brothers and John Mack of Morgan Stanley, whose companies were targets of CDS trades. Mr Einhorn is not alone in expressing concerns over CDSs. Similar reservations are being shared by a growing number of responsible players, including prominent bankruptcy lawyers, as credit insurance plays a role in more Chapter 11 filings, such as AbitibiBowater, General Growth Properties and Six Flags.

That said, most measures contemplated today are trying to make CDSs safer, not seeking to eliminate them altogether. For example, among the biggest risks in the CDS market is that a counterparty won’t be able to pay out on a CDS agreement which normally comes into force when the target company files for Chapter 11. That risk can be doubly dangerous with the possibility that the target of the insurance and the counterparty backing the CDS both get downgraded or default.

Such a possibility is more than theoretical, especially after the cautionary tale of AIG, which sold more than $440bn in CDSs with no offsetting positions at all. The Federal Reserve had to step in when the toxic assets that AIG sold protection on were downgraded and AIG, the insurance giant itself, was downgraded and unable to post the collateral it owed to counterparties. Today, a central clearing house is increasingly being embraced "as the best solution to counterparty and liquidity risks", Matthew Leeming, analyst at Barclays Capital, writes in a recent and thoughtful report, adding: "Centralisation of counterparty risk at least places the market in a situation where it can start to measure the risk and adequately capitalise against it."

But growing numbers of market participants, along with the more vocal Mr Einhorn, believe that many of the proposed solutions to the risks posed by the market, such as a centralised clearing house, themselves pose further risks. In his letter, Mr Einhorn disputes the notion that a central clearing house will act as a panacea for the other big problems the market poses including counterparty risk and the risk of contagion or a daisy chain of counterparty failures. "The reform proposal to create a CDS clearing house does nothing more than maintain private profits and socialised risk by moving the counterparty risk from the private sector to a newly created too big to fail entity," he notes.

That’s because it is almost impossible to adequately capitalise against such developments. "There is no way a clearing house could demand enough collateral," he says. "The market can be so big and discontinuous that it is very hard to figure out the correct amount of collateral." His comments will almost certainly spark further debate on how best to capitalise clearing houses to make them virtually failsafe. More drastic measures, such as banning the CDS market outright, however, remain an outside bet.

Here There Be Big Nymbers (Sic)

by Tyler Durden

The earlier discussion of CDS, Einhorn, and the US UST-CDS basis trade, sparked a flurry of queries on the topic of "really big numbers." Therefore, even as ZH staff awaits the most recent data out of the BIS, we present for your numeric (in)comprehension pleasure lots and lots of zeroes. The chart below summarizes the biggest relevant numbers currently out there, appearing as pixels occasionally on every single computer in the financial world.

And what does it say? That the total notional value of all OTC derivative contracts as of the most recent count (sucks to be on the recount committee), was $592,000,000,000,000.00 at the end of 2008. Fear not: this number is actually a reduction from the most recent previous read of $683,700,000,000,000.00 in June of 2008.

Well wait, that thing we said about fear not, ignore that: because the net notional, or the market value of all OTC contracts, i.e. what someone (cough taxpayer cough) would be on the hook for when the Fed's plans go astray, increased by 66.5% over the same period, to $33,900,000,000,000.00. Like we said, big numbers - and this is just OTC. The real number includes regulated exchanges, and to estimate that, double the numbers above.

In totality, the "sidebets" on everything from interest rates, to F/X to corporate default risk, amount to about $1.3-$1.4 quadrillion (that's 15 zeroes before the decimal comma) in terms of uncollateralized liquidity (think inflation buffer): take all those zeroes away and the value of the dollar would go down by 1E10-15: you listening yet American middle class? And the actual exposure, or "money at risk" is roughly $60 trillion: a number which is about the same as the world GDP if one were to remove all the various stimulus programs. Take away Goldman, JP Morgan, and all the other wannabe BSD's, and this is what you end up with: the heart and soul of the Too Big To Fail monster itself. And there is no way on earth to stop that mangled, mutated heartbeat without destroying the very fabric of both our capital markets and societal system. Please give the Federal Reserve a golf clap for this truly amazing accomplishment.

So with everyone and the kitchen sink focused on CDS and the neutron bomb that they undoubtedly must be if even such anointed shamans of CDSology as David Einhorn (one wonders, will David donate the billions of dollars he has made while trading CDS to charity?) say they are evil incarnate, here is the truth about CDS courtesy of the Fed's Fed- the Bank of International Settlements.The volume of outstanding CDS contracts fell 27.0% to $41.9 trillion against a background of severely strained credit markets and increased multilateral netting of offsetting positions by market participants. This was a continuation of the developments seen in the first half of 2008. Single-name contracts declined by 22.8% to $25.7 trillion while multi-name contracts, a category that includes CDS indices and CDS index tranches, saw a more pronounced decrease of 32.7%, to $16.1 trillion.

Despite the lower outstanding volumes, the gross market value for CDS contracts increased by 78.2% to $5.7 trillion as a result of the credit market turmoil. Gross market values grew 95.6% to $3.7 trillion for single-name contracts and 52.5% to $2.0 trillion for multi-name contracts. [As noted previously, the $5.7 trillion number has since collapsed to under $3 trillion as per most recent DTCC data].

Greater use of multilateral netting during the second half of 2008 also resulted in a change in composition across contract types (Graph 3, left-hand panel). Amounts outstanding of multinamecontracts fell 32.7% to $16.1 trillion, while the 22.8% decline in single-name contracts to $25.7 trillion was somewhat smaller.

The composition across counterparties also changed during the second half of 2008 (Graph 3, centre panel). Although the amount of CDS contracts between reporting dealers declined 24.4%, this was smaller than the 29.8% decrease in outstanding contracts between dealers and other financial institutions and the 47.7% drop in contract volumes between dealers and non-financial institutions.

Developments in gross market values across counterparties reflected the uneven declines in the outstanding volumes for the different market segments (Graph 3, right-hand panel). The market value of contracts between reporting dealers grew by 89.3% to $3.2 trillion, representing 56.2% of the total market value of outstanding CDS contracts. The market value of contracts between reporting dealers and other financial institutions increased by 66.3%, while the market value of contracts between dealers and non-financial institutions was 51.0% higher.