Portales of the Mercado de San Marcos, Aguascalientes, Mexico

Ilargi: This is not TV. You don't have to be just an observer on a couch, you can very much be part of it.

Our Fall Fund Drive (please see the top of the left hand column) is running right now. Your donations -and visits to our advertisers- make this site possible. Without you, there can be no Automatic Earth.

We'd like to thank all our past, present and future donors for your confidence in us.

Ilargi: The title for this piece comes from an article on HousingWire, New S&P Slogan Contest. The suggested slogans were disappointing except for the one I picked, which is too good not to use, and which I think is extremely fitting, but more as a description of the overall US housing and banking situation, rather than of S&P in particular.

The following deserves far more attention than it's been getting so far. I’ve posted some of it in recent days, but I think it works better as a whole.

The first time I paid attention to Michael White was on May 14 2009, see Them's Fighting Words. I was impressed back then with the fact that White, a Chicago mortgage broker, was loudly and explicitly calling on people to NOT buy homes, and sell if they could. My words then:

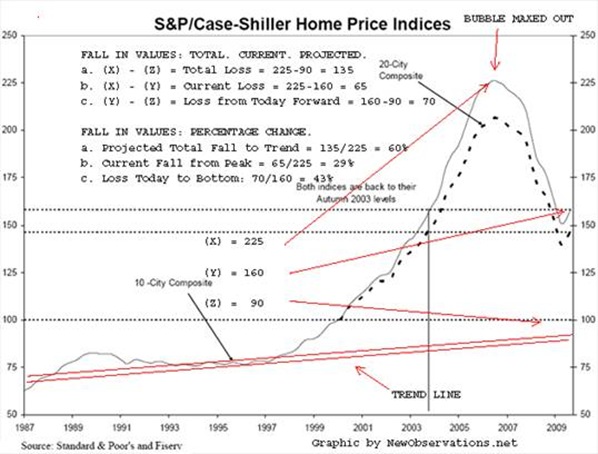

Mike White, a mortgage broker in Chicago, explains in Our American Homes. They All Fall Down - Much Further that a simple math extrapolation of the Case/Shiller index indicates that US home prices will fall 45% more from their current prices, and 62% in total peak to trough. A broker who advises people to rent, maybe there's still hope.

Lately, in a series called "Price trends/War of the Worlds", White has been expanding on what he said back then. He is collecting data series in order to get a better, more rounded, picture of what we can expect housing prices to do. Here's a summary of the graphs and conclusions he's gathered so far.

Property Values Set to Fall 43% From Current Depressed Level

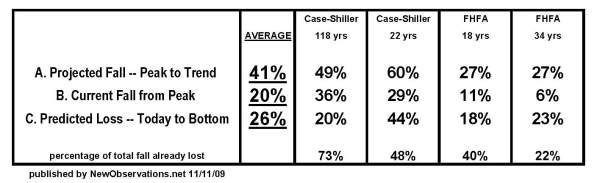

If you use a 20-year time horizon, and assume prices will return to the trend line, then our residential property bubble will bottom after values fall over 40% from current levels (see above (c) aka “(Y) – (Z)” aka “Loss Today to Bottom”). I make no predictions. I do watch numbers. The chart shows a catastrophe of falling real estate values loaded up on top of our current catastrophe in real estate values.

No one would question these numbers absent The War of the Worlds. The War of the Worlds is the United States Government versus aggregate borrower income. Uncle Sam is funding every new mortgage – high, low and in between (see chart below: the blue and red are government-backed loans). It takes very little imagination to see the world of real estate prices vaporizing without government support. If that support was lost, values would crash down faster than a big rock dropped into a shallow puddle.

While the federal government has deep pockets, at some point the persons who take out the mortgages will have to pay them. At that point the market should follow the pattern described above by the trend line. Reality bites. Prices for real estate are ultimately determined by our income, and if the trend represents a match of income and price, then the trend line is the picture of our future.

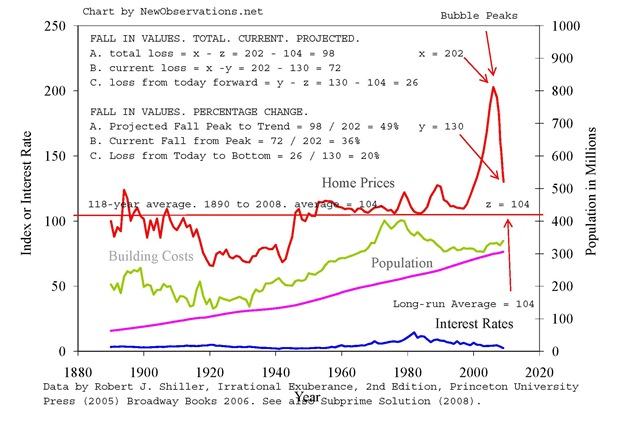

Property Values Set to Fall 49% From Bubble Peak to Long-Run Average

I will continue to work with all data sets until I have a more complete picture of property values. Please send your suggestions about the best information. We will put it all together. Maybe we will see the future. What we know today based on the best information is that values will fall a total of between 49% to 60% from the bubble top to the trend. Still ahead is a fall in property values of between 20% to 43%.

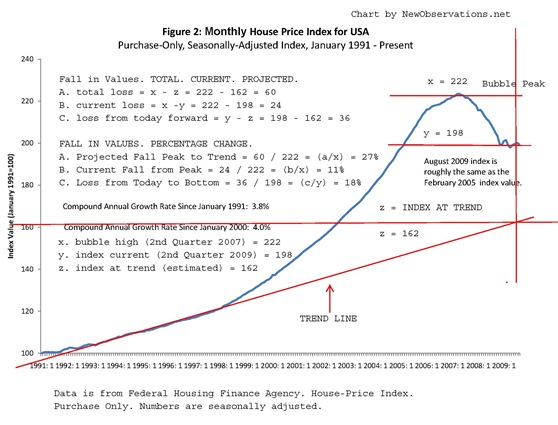

Conservative Property Index Predicts We Are Less Than Half Way Through Fall

The total projected fall from Federal Housing Finance Agency (FHFA) data shows a peak-to-trend fall of 27%. Values on this index have fallen 11% from the high. The index predicts prices will fall an additional 18% from their current levels. The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% and 60% predicted by Case-Shiller.

Based upon the three data sets reviewed, we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. After averaging the three indexes, we may estimate a total fall of 45% from the bubble high. Looking ahead from today, property values will fall a total of between 18% to 44%. The average of the three data sets says we still have 27% to fall from current levels.

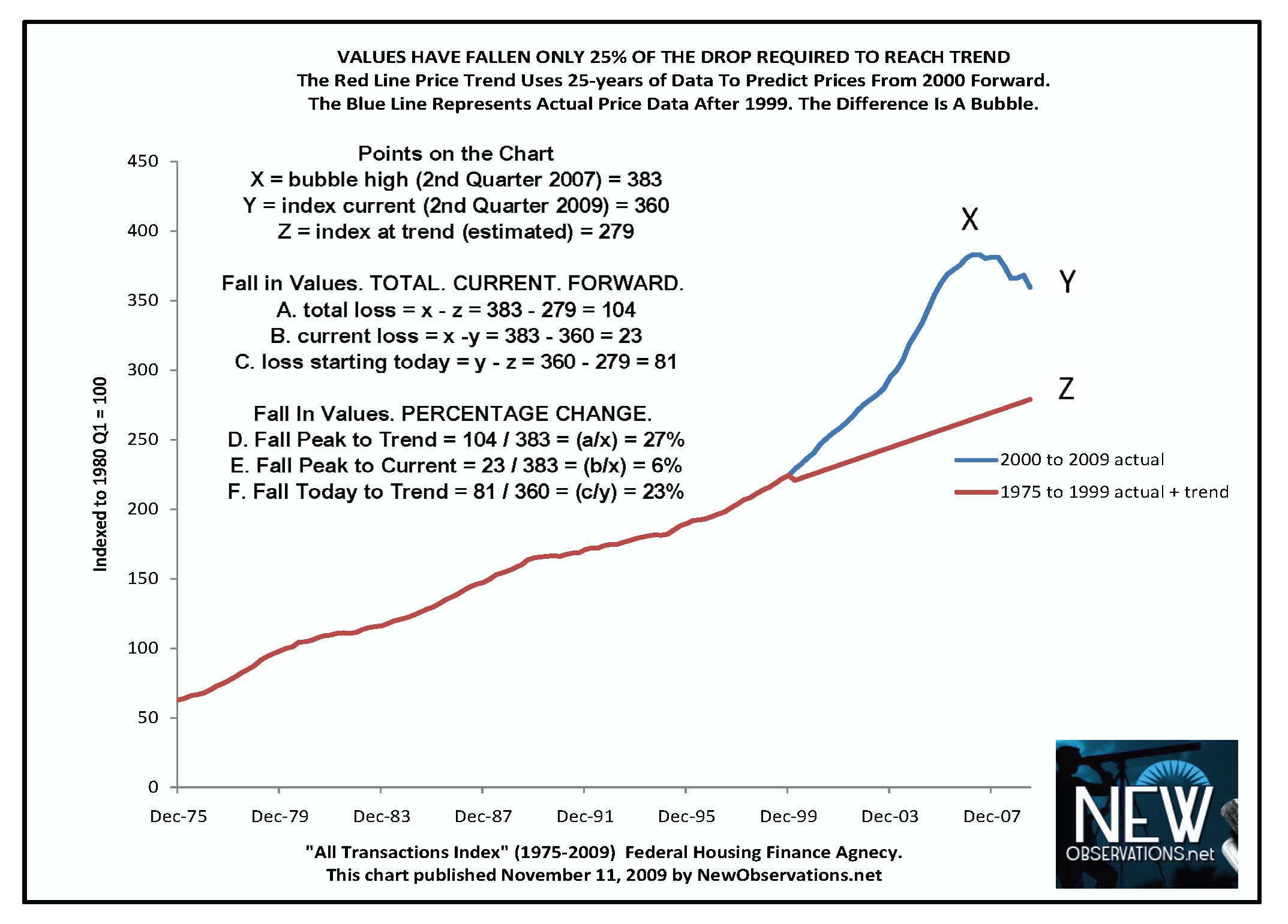

Values Have Dropped Less Than 25% of the Fall Required To Reach Trend

Property owners nationwide have lost only one dollar for every four dollars they can ultimately expect to lose on their home. The good news according to the leading data series issued by the United States government is that prices have only fallen 6 percent. If you are a homeowner, you are wealthier than you knew. The bad news is you still have three dollars to lose for every one dollar which has already been lost.

The total projected fall from the Federal Housing Finance Agency (FHFA) “All Transactions Index”, which begins in 1975, shows a peak-to-trend fall of 27%. Since prices are 6% lower by this measure, prices must still fall an additional 23% from today for prices to revert to trend. The assumption built into these estimates is that prices in the years 1975 to 1999 advanced at a typical rate. A trend line was generated to the present based upon that 25-year period. The chart depicts the divergence of the trend established from 1975 to 1999 and the actual prices recorded from 2000 to 2009.

The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% to 60% predicted by Case-Shiller. Based upon the four data sets reviewed in the last few weeks (see summary below), we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. The average of the four indexes projects a total fall of 41% from the bubble high to the trend bottom. Looking ahead from today, the average of the four indexes predicts that property values will fall 26% from our current price levels.

Yes, it's fascinating to see the differences between the data. And it's even more fascinating to see the averages that are the result of combining them:

I don’t want to add much more to Michael White’s conclusions and graphs, except perhaps to point out a detail that deserves repeating. While projected peak to trend price decreases range from the FHFA (34 years), 27%, to Case-Shiller (22 years), 60%, the fall from the peak to today is already 48% of the total in the latter, but only 22% of the total in the former.

And then of course there's always still this to deal with, in the words I used in May 14’s Them's Fighting Words.

What Mike ignores in his simple model is that even Robert Shiller himself, as I often have, has predicted that because of the huge and rapid movement in prices, they are bound to violently swing way below the bottom the index seems to point to. That is what I’ve always maintained, and it confirms my prediction of an 80%+ loss.

In the past few years, there have been quite a few graphs like the one of the Case/Shiller index, with data based on historical price ranges, and it always seemed very simple to me that prices would have to come back to the trendline. And then break it downward, as least as much as it had broken it on the upside.

We're nowhere near an end, a house price bottom. In fact we're so far away from any such thing that we should stop paying attention to it, because it keeps us from addressing today's real issues. One of which is typified by Michael White's running slogan: Sell NOW!

Housing Agency’s Cash Reserves Down Sharply

The Federal Housing Administration said Thursday morning that its cash reserves had dwindled significantly in the last year after a record drop in home prices. Still, agency executives stopped short of saying that a direct bailout would be needed. The F.H.A., which insures loans made by private lenders, guaranteed more than $360 billion in mortgages in the last year, four times the amount in 2007.

“Even if we were to go below zero, if the reserves were to become negative, there is no extraordinary action that Congress or anyone else needs to take,” the secretary of Housing and Urban Development, Shaun Donovan, said at a Washington news conference. The results of the F.H.A.’s annual audit showed the agency’s capital reserves to be 0.53 percent, far under the 2 percent minimum mandated by Congress. A year ago, the capital reserves were 3 percent. “They’re running on empty,” a consultant, Ann Schnare, said. “It all depends how long it takes housing to recover.”

Other critics were less sure that the agency’s coffers would not need replenishing. “They keep saying they’re going to outrun their problems, but some way, somehow, the tax payer is going to end up on the hook,” said Edward Pinto, a former executive with the government mortgage giant Fannie Mae. The Mortgage Bankers Association, whose members make the loans that F.H.A. insures, also expressed concern. “Today’s announcement is a major wake-up call for F.H.A. and the lending community,” the association’s president, John A. Courson, said in a statement.

The disappearing reserves are a direct consequence of the many bad loans insured by the agency in 2006 and 2007, as the housing market began to cool and private lenders withdrew. Nearly one in five loans made in 2007 are seriously delinquent, the agency said.

S&P Cut Record 26,387 Home-Loan Bonds Last Quarter

Standard & Poor’s cut credit ratings on a record 26,387 U.S. residential-mortgage securities in the third quarter, reflecting its reassessments of the debt as consumers struggle to make housing payments. The figure was more than double the 10,459 in second- quarter downgrades and the previous high of 12,077 in the fourth quarter of 2008, the New York-based ratings company said today in a statement. No bonds were upgraded last quarter.

Ratings reductions often boost the capital needs of bondholders such as banks and insurers, forcing some investors to sell debt. After S&P and Moody’s Investors Service assigned top rankings to bonds that later suffered from homeowner defaults, lawmakers and the Securities & Exchange Commission have sought changes to ratings-firm rules while insurance regulators have begun to ignore grades on home-loan debt. “It has been very clear that the market gives the rating agencies very little credit for knowing what a bond should be rated,” Jesse Litvak, a mortgage-securities trader at Jefferies & Co. in New York, said. “But the rating does start to matter from a capital-charge perspective” if downgrades lower securities from investment grades to junk levels.

The third-quarter cuts covered notes from 3,219 deals, and “continued to reflect our view of the weakening credit quality of the underlying collateral,” the company said. S&P said in a related report it had downgraded $1.76 trillion of U.S. home-loan bonds issued from 2005 through 2007 at least once as of Sept. 30, or 63 percent of the original issuance amount, including 71 percent of classes originally rated AAA. “We’ve observed that monthly delinquencies and foreclosures continue to rise for recent-vintage transactions,” S&P credit analyst Terry Osterweil said in the statement.

About 25.3 percent of mortgages underlying U.S. home-loan securities without government backing were at least 60 days late, in foreclosure or already turned into seized property as of September bond reports, up from 20 percent in January, according to data compiled by Bloomberg. About 3.75 percent were 30 days late, up from a low this year of 3.57 percent in May and down from 4.18 percent in January.

Home Values Have Dropped Less Than 25% of the Fall Required To Reach Trend

by Michael White

PRICE TRENDS / WAR OF THE WORLDS (Part 4): Property owners nationwide have lost only one dollar for every four dollars they can ultimately expect to lose on their home.

The good news according to the leading data series issued by the United States government is that prices have only fallen 6 percent. If you are a homeowner, you are wealthier than you knew. The bad news is you still have three dollars to lose for every one dollar which has already been lost.

The total projected fall from the Federal Housing Finance Agency (FHFA) “All Transactions Index”, which begins in 1975, shows a peak-to-trend fall of 27%. Since prices are 6% lower by this measure, prices must still fall an additional 23% from today for prices to revert to trend.

The assumption built into these estimates is that prices in the years 1975 to 1999 advanced at a typical rate. A trend line was generated to the present based upon that 25-year period. The chart depicts the divergence of the trend established from 1975 to 1999 and the actual prices recorded from 2000 to 2009.

The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% to 60% predicted by Case-Shiller. Based upon the four data sets reviewed in the last few weeks (see summary below), we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. The average of the four indexes projects a total fall of 41% from the bubble high to the trend bottom.

Looking ahead from today, the average of the four indexes predicts that property values will fall 26% from our current price levels.

Please click here to see charts for each of four data sets at “Property Price Index”.

There are still way too many houses in America

The lights are on in the housing market. But at more and more places, nobody's home. House prices have risen in recent months after a long plunge, according to the National Association of Realtors and the S&P Case-Shiller national index. Fewer Americans owe more than their property is worth, according to a report this week from Zillow.com. But a full-fledged housing recovery will remain elusive until the market can absorb all the houses and apartments that were built during the housing boom. And on that front, progress has been slow.About one in seven housing units was vacant in the third quarter, according to the Census Department. This year has registered the highest reading since the government began collecting such data in 1965. Part of the glut comes from a rash of foreclosures as strapped borrowers fall behind on their mortgages. But rental apartments are emptying out at a record clip as well, as a spike in the jobless rate and a decade of subpar wage growth have sent many Americans back home to live with Mom and Dad. And some owners, such as Treasury Secretary Tim Geithner, have decided to rent their houses out after they couldn't sell them.

"There's just too many houses out there for the population we have," said Brian Peterson, an economist at Indiana University who focuses on housing. "The market's going to take a couple years to clear." The homeowner vacancy rate dropped to 2.6% in the third quarter from 2.8% a year ago, when homeowner vacancies hit their all-time high. But a jump in the rental vacancy rate, to 11.1% from 9.9% a year earlier, more than offset that decline. Because twice as many people own their homes as rent, the total vacancy rate -- 14.5% in the third quarter -- exceeds the sum of the homeowner and rental vacancy rates.

The rise in vacancies comes after a decade in which homebuilders, motivated by easy financing and rising prices, built many more homes than the U.S. needed. About 1.2 million households are formed each year, on average, according to government estimates. But housing starts averaged 1.7 million a year between 1996 and 2006, when the boom topped out. "There was some overbuilding during that period," said Walter Molony, a public affairs specialist at the National Association of Realtors.

Since then, housing starts have dropped sharply, allowing the market to soak up some of the excess. And prices have dropped precipitously in the most overbuilt markets in the South and West, luring some buyers off the sidelines. Peterson also notes that the vacancy numbers have expanded over the years to include more types of vacant homes, such as seasonally occupied beach houses.

Meanwhile, tax credits, mortgage modifications and government mortgage market support have helped slow the decline of house prices. Federal mortgage purchases have brought down 30-year mortgage rates by a third of a point, according to Wall Street estimates. More than 350,000 Americans have used the $8,000 homebuyer tax credit to buy their first house, according to industry data. But because most of those buyers were presumably renters beforehand, their purchases filled one vacancy while creating another.

The biggest factor working for a recovery now, Peterson said, is that buyers who were once priced out of many housing markets are being lured in by lower prices. But those people may not take the plunge until their job prospects firm up, he added. That may take a while at a time when unemployment is at a 26-year high and the economy has shed jobs for 22 straight months. "We need those people to start buying houses and starting families," he said.

Initial Jobless Claims Fall 12,000 to 502,000, Total Claims Rise to 9.54 million

The number of people filing initial claims for state unemployment benefits fell by 12,000 to a seasonally adjusted 502,000 in the week ended Nov. 7, the Labor Department reported Thursday. That's the fewest initial claims since early January. Initial jobless claims have hovered above 500,000 for 52 straight weeks, as the unemployment rate has climbed to a 26-year high of 10.2%.

Economists surveyed by MarketWatch expected initial claims to drop to about 510,000. The level of initial claims in the week ended Oct. 31 was revised up by 2,000 to 514,000. The four-week average of initial claims dropped 4,500 to 519,750, the lowest since November 2008. The four-week average smoothes out quirks due to one-time events such as bad weather, holidays or strikes. Continuing state claims declined 139,000 to a seasonally adjusted 5.63 million, the lowest since March.

"The numbers are still terrible in absolute terms, but at least they are clearly heading in the right direction," said Ian Shepherdson, chief U.S. economist of High Frequency Economics Ltd. in a note. Compared with a year ago, initial claims are up 6%, while continuing claims are up 51%. The federal government has extended benefits beyond the typical 26 weeks because of the recession's severity.

The number of people collecting extended federal benefits rose by 35,000 to 4.11 million, not seasonally adjusted. "Although fewer workers are being let go, employers are simply not comfortable adding payroll right now, leading to increase numbers of jobseekers qualifying for these additional benefits," Jefferies & Co. chief economist Ward McCarthy wrote in a report. Including those federal programs, the number of people claiming benefits of any kind in the week ended Oct. 24 was 9.54 million, not seasonally adjusted. That was up 18,000 from 9.53 million in the previous week.

President Obama signed legislation this week to extend benefits for up to 20 additional weeks in the states hurt most by job losses, for a maximum of 99 weeks. Read more about the extension of unemployment benefits. The decline in continuing state claims in the past few months could show that companies are more willing to hire, or it could mean that more people were exhausting their benefits and moving into the extended federal benefits program, which is reported separately. People are typically eligible for 26 weeks of regular state unemployment benefits.

The unemployment rate rose to a 26-year high in October. Job losses have been unusually steep in the latest recession, and little evidence suggests that employees will start hiring on a mass scale anytime soon.

With unemployment stubbornly high, Obama on Thursday said he will host a forum in December to explore how the U.S. can create more jobs. He said he would invite business executives, economists and labor leaders, among others.

"The economic growth that we've seen has not yet led to the job growth that we desperately need," Obama said Thursday after the jobless data was released. Read story about Obama's forum. Yet some business leaders complain that policies under consideration in Washington, such as higher taxes and new medical and energy regulations, are partly deterring them from hiring workers.

Stimulus job boost in state exaggerated, review finds

While Massachusetts recipients of federal stimulus money collectively report 12,374 jobs saved or created, a Globe review shows that number is wildly exaggerated. Organizations that received stimulus money miscounted jobs, filed erroneous figures, or claimed jobs for work that has not yet started.

The Globe’s finding is based on the federal government’s just-released accounts of stimulus spending at the end of October. It lists the nearly $4 billion in stimulus awards made to an array of Massachusetts government agencies, universities, hospitals, private businesses, and nonprofit organizations, and notes how many jobs each created or saved. But in interviews with recipients, the Globe found that several openly acknowledged creating far fewer jobs than they have been credited for.

One of the largest reported jobs figures comes from Bridgewater State College, which is listed as using $77,181 in stimulus money for 160 full-time work-study jobs for students. But Bridgewater State spokesman Bryan Baldwin said the college made a mistake and the actual number of new jobs was “almost nothing.’’ Bridgewater has submitted a correction, but it is not yet reflected in the report.

In other cases, federal money that recipients already receive annually - subsidies for affordable housing, for example - was reclassified this year as stimulus spending, and the existing jobs already supported by those programs were credited to stimulus spending. Some of these recipients said they did not even know the money they were getting was classified as stimulus funds until September, when federal officials told them they had to file reports.

“There were no jobs created. It was just shuffling around of the funds,’’ said Susan Kelly, director of property management for Boston Land Co., which reported retaining 26 jobs with $2.7 million in rental subsidies for its affordable housing developments in Waltham. “It’s hard to figure out if you did the paperwork right. We never asked for this.’’

The federal stimulus report for Massachusetts has so many errors, missing data, or estimates instead of actual job counts that it may be impossible to accurately tally how many people have been employed by the massive infusion of federal money. Massachusetts is expected to receive an estimated $1 billion more in stimulus contracts, grants, and loans.

The stimulus bill - a $787 billion package of tax breaks, expanded government benefits, and infrastructure improvements - was signed into law in February by President Obama, who said it would create and save jobs by preserving local government services and spurring short- and long-term economic development.

To be sure, the legislation has accomplished an important goal: funding public services facing the ax after the recession created gaping shortfalls in state and local government budgets. So Worcester and Lynn, for example, were able to keep police officers targeted for layoffs, schools across the state lost far fewer teachers, and community agencies preserved staff in the face of mounting demands for social services.

The president also said the legislation demanded an unprecedented level of accounting from recipients, who report on the uses of the money and the jobs via a massive online system, www.Recovery.gov.

Clearly, the first comprehensive accounting had shortcomings. Recipients said they found the reporting system confusing, leading them to submit information erroneously, and leaving them unable to correct mistakes in their reports. Additionally, the government files are massive and unwieldy. Reports do not distinguish between newly created positions and those that were “retained.’’

“We see $15 million construction projects with no jobs, and a $900 shoe sale that created nine jobs. Both are obviously wrong,’’ said Michael Balsam, chief solutions officer for Onvia, a Seattle data company tracking the stimulus spending. “There were a lot of recipients that did not report. Those that did report have some data challenges - wrong data or missing data.’’

Cheryl Arvidson, assistant director of communications for the Recovery Accountability and Transparency Board, the federal government’s oversight panel for the stimulus money, acknowledged the problems recipients are having reporting job counts. “Some people are going to be confused. Some people are manually entering data. We figured there would be innocent mistakes,’’ Arvidson said. “We anticipate that as we go forward . . . the data quality will be increasingly improved. We knew there was going to be a shake-out.’’

Some of the errors are striking: The community action agency based in Greenfield reported 90 full-time jobs associated with the $245,000 it got for its preschool Head Start program. That averages out to just $2,700 per full-time job. The agency said it used the money to give roughly 150 staffers cost-of-living raises. The figure reported on the federal report was a mistake, a result of a staffer’s misunderstanding of the filing instructions, said executive director Jane Sanders.

Several other Head Start agencies also reported using stimulus funds for pay raises and claimed jobs for it. At Bridgewater State, Baldwin said the college mistakenly counted part-time student jobs as full time. Some agencies that received stimulus money reported jobs for work that had not started. The Greater Lawrence Family Health Center reported 30 construction jobs “have been created,’’ even though it hadn’t begun construction on a $1.5 million renovation and expansion. Grant administrator Beth Melnikas said the health center does expect to hire 30 workers.

There was often variance among recipients of the same source of funding. Some did not report any positions retained; others did. Some used different methods and got different results. For example, the City of Waltham said a $630,500 solar panel installation on the roof of City Hall created 10 jobs - even though the work had yet to begin. Revere spent $485,500 in stimulus funds to install solar panels on the roof of a city school. Revere’s job count? 64.

The city’s project consultants used a different formula than the one the federal government recommended. “If not for this stimulus money, we would not have done the solar panel roof,’’ said Revere Mayor Thomas G. Ambrosino. “A lot went into this.’’ Another source of confusion over the job counting is because Congress this year labeled as stimulus initiatives several longstanding programs, such as student work-study and low-income rental subsidies, that it otherwise regularly funds in annual appropriations bills. In some cases Congress increased the funding amount, too, so the stimulus legislation was a vehicle for expanding government support for people in need.

Regardless of its label, the recipients treated the funding as business as usual. Only in September, when government officials told them they had to report on their stimulus spending, did they confront the issue of how to account for jobs associated with the money they received. Massachusetts property owners received $75.5 million in rental subsidies from the stimulus bill, for a reported total of 437 jobs. Recipients of 27 of the 87 contracts reported zero jobs. The others, meanwhile, simply reported the number of employees working at the property. If they received two contracts, for a larger property, they reported the employee figure twice.

For example, Plumley Village East in Worcester listed 23 jobs for each of its two contracts for a total of 46 jobs, even though it has only 23 employees working throughout the complex. “There was some confusion about what they were really looking for,’’ said Karen Kelleher, general counsel for Community Builders Inc., which runs Plumley Village. Those overstated jobs are going to disappear from future counts. The Obama administration has recently determined the rental subsidies don’t have to be reported under the stimulus bill.

One of those property owners, meanwhile, is frustrated by his experience with the legislation. Robert Ercolini manages a 201-unit affordable housing development in Plymouth. After being notified his annual rental subsidies were classified as stimulus spending, Ercolini renewed a request to the US Department of Housing and Urban Development for more than $1 million to fix up the property, reasoning he would be creating jobs by hiring contractors. He was refused.

“After HUD denied me money to make needed improvements and actually create jobs,’’ Ercolini said, “it’s really funny to find out in September that I’ve been receiving stimulus funds all along and they want to know how many jobs we’ve saved or created.’’ By his count, the answer is: “No jobs.’’

White House Aims to Cut Deficit With TARP Cash

The Obama administration, under pressure to show it is serious about tackling the budget deficit, is seizing on an unusual target to showcase fiscal responsibility: the $700 billion financial rescue. The administration wants to keep some of the unspent funds available for emergencies, but is considering setting aside a chunk for debt reduction, according to people familiar with the matter. It is also expected to lower the projected long-term cost of the program -- the amount it expects to lose -- to as little as $200 billion from $341 billion estimated in August.

The idea is still a matter of debate within the administration and it is unclear how much impact it would have on the nation's mounting deficit levels. Still, the potential move illustrates how the Obama administration is trying to find any way it can to bring down the deficit, which is turning into a political as well as an economic liability. The White House is in the early stages of considering what bigger moves it might make for next year's budget. The Office of Management and Budget has asked all cabinet agencies, except defense and veterans affairs, to prepare two budget proposals for fiscal 2011, which begins Oct 1, 2010. One would freeze spending at current levels. The other would cut spending by 5%.

OMB is also reviewing a host of tax changes. The President's Economic Recovery Advisory Board will submit tax-policy options by Dec. 5, including simplifying the tax code and revamping the corporate tax code. White House Chief of Staff Rahm Emanuel is pressing for substantial spending cuts to go with any tax increases to try to avoid the "tax and spend" label that has bedeviled Democrats, according to administration and congressional officials. The administration is constrained in tackling the mounting deficit, since raising taxes or slashing spending could stunt economic growth. Administration officials say the Obama economic team is especially concerned that rapid deficit reduction could hurt the economy.

On the $700 billion Troubled Asset Relief Program, the administration is considering a change that may appear to improve the fiscal situation. Agreeing not to spend a certain amount of TARP money will enable the White House, in its budget projections, to assume less money out the door and, therefore, less debt issued. The move would also reduce the deficit by an unknown amount since a certain level of spending and borrowing is already factored into estimated future deficits.

The Treasury Department said about $210 billion in TARP funds remains unspent, including about $70 billion returned from financial institutions. A further $50 billion is expected to be repaid in the next 12 to 18 months. Budget experts said committing some TARP funds toward debt reduction could help calm concerns about the size and intent of the program. "I don't necessarily want them to pull back in a huge way, because there's a lot of uncertainty, but right now what we've got could turn into a $700 billion slush fund" for Congress, said Douglas Elliott, a fellow with the Brookings Institution, a liberal think tank.

The move could buy the Treasury Department time before it hits the so-called debt ceiling, which limits the amount of money the U.S. can borrow. Already, some members of Congress have said they won't approve an increase in the $12.1 trillion debt cap unless efforts to reduce the deficit are included. Senate Budget Committee Chairman Kent Conrad, the North Dakota Democrat who is proposing a bipartisan commission, along with Sen. Judd Gregg (R., N.H.), to examine taxes, said he won't vote for raising the debt limit unless Congress and the administration start talking about cutting spending and increasing taxes.

World Tries to Buck Up Dollar

Governments around the world stepped up efforts to stem the U.S. dollar's slide, as officials grow increasingly concerned about the impact of the weak greenback on their nascent economic recoveries. Thailand, South Korea, Russia and the Philippines have been snapping up dollars this week in order to hold down the value of their currencies, traders said Wednesday, as the U.S. currency wallowed near 15-month lows. In Latin America, Brazil's finance minister said the country's currency remained too strong, sparking speculation that the government would intensify recent efforts to curb the real's ascent. On Tuesday, Taiwan banned foreign investors from parking time deposits in the country in an effort to ease upward pressure on the local currency.

The fresh buzz over the dollar's fall prompted Treasury Secretary Timothy Geithner, visiting Tokyo on Wednesday, to repeat the Obama administration's commitment to a strong dollar. Still, Washington hasn't taken any concrete steps to arrest the slide. The weaker dollar is actually benefiting the U.S. as it struggles to come out of recession by helping keep U.S. exports competitive. China is coming under new pressure from Pacific Rim countries to let its dollar-linked currency rise in value. On Wednesday, China's central bank made a nod to concerns about the declining dollar and yuan by issuing a rare change to the official language of its exchange-rate policy. The central bank said it would take major currency trends into account in setting policy, though it wasn't clear what impact that may have on the yuan's future value.

The U.S. wants to see a stronger yuan, though Washington has avoided explicit public pressure on China to abandon its policy of managing its currency. But in the jargon of finance ministers, Mr. Geithner has made clear that's what he thinks should happen. In an op-ed piece in Thursday's Wall Street Journal Asia, he emphasized the advantages of "market oriented exchange rates in line with economic fundamentals." On Wednesday, the dollar briefly sagged to a 15-month low against a basket of major currencies before recovering slightly. It fell slightly against the euro, which was quoted at $1.4982 at 4 p.m. in New York. So far this year, the dollar is down 7% against the European currency.

Asian finance ministers, now gathered in Singapore for a meeting of the 21-member Asia-Pacific Economic Cooperation forum, are expected to raise their concerns about both the dollar's decline and the inflexibility of the Chinese yuan. The fear is two-fold. If currencies surge against the dollar, it damages the ability of countries in the region to compete in world markets, by making their exports more expensive. What's more, one of their major competitors -- China -- ties its currency to the dollar. As the yuan sinks in tandem with the dollar, China is able to keep its export prices low and price out competition.

A concluding statement from the assembled APEC officials is expected to underline the importance of flexible exchange rates to sustainable global growth -- generally viewed as code for a rise in the Chinese yuan. Such efforts are unlikely to bear fruit in the near term, which means these countries must act on their own to slow their currencies' rise. Experts estimate that some of the largest emerging economies may have spent as much as $150 billion on currency intervention over the past two months, judging from the growth of their international reserves, according to data from Brown Brothers Harriman. While that's not a huge amount in the currency markets, which have turnover of more than $3 trillion a day, traders pay keen attention to what the authorities are doing and where they are likely to intervene.

Thailand alone has bought $15 billion trying to push the dollar higher against the baht, Korn Chatikavanij, Thailand's finance minister, said in an interview with Dow Jones Newswires. "Quite clearly, all Asian central banks have found it necessary to intervene, and it's costing us," Mr. Korn said. The Chinese authorities aren't going to tip off financial markets in advance of a move in their currency, said Jim O'Neill, head of global economic research at Goldman Sachs Group Inc. But the fact that they adjusted the phrasing of their exchange-rate policy in a quarterly report Wednesday could be a response to the growing attention to the yuan, particularly from fellow developing nations. "It's one thing for the Chinese to ignore the U.S. and Europe," he said. "But when they start ignoring the developing G-20 it's a bit trickier."

For the last three years, the International Monetary Fund has been pressing China to revalue its currency. At the recent meeting of finance ministers from the Group of 20 nations in Scotland, the IMF once again said the yuan "remains significantly undervalued from a medium-term perspective." Emerging nations are recovering from the global slump far faster than their developed counterparts and investors are flocking to buy their stocks and bonds. That in turn puts upward pressure on their currencies.

Efforts to stem the flow of foreign capital or to intervene in currency markets pose serious challenges for governments and aren't always successful. Unless a government takes radical steps, it can't affect a U-turn in its currency. However, it "can lean against the wind," says Win Thin, a currency strategist at Brown Brothers Harriman, in this case by slowing the pace of currency strengthening. Developing nations aren't the only ones uncomfortable with the dollar's slide. European governments, especially Germany, will be increasingly uneasy if the euro continues to gain on the dollar. Governments that try to check the rise of their currency often end up accumulating dollars which they may not need. "I'm convinced that in the long term the dollar is more likely than not to decline in value, so we're building up assets that are declining in value over time," says Mr. Korn of Thailand. "That's not healthy."

10 states face looming budget disasters

In Arizona, the budget has grown so gloomy that lawmakers are considering mortgaging Capitol buildings. In Michigan, state officials dealing with the nation's highest unemployment rate are slashing spending on schools and health care. Drastic financial remedies are no longer limited to California, where a historic budget crisis earlier this year grew so bad that state agencies issued IOUs to pay bills.

A study released Wednesday warned that at least nine other big states are also barreling toward economic disaster, raising the likelihood of higher taxes, more government layoffs and deep cuts in services. The report by the Pew Center on the States found that Arizona, Florida, Illinois, Michigan, Nevada, New Jersey, Oregon, Rhode Island and Wisconsin are also at grave risk, although Wisconsin officials disputed the findings. Double-digit budget gaps, rising unemployment, high foreclosure rates and built-in budget constraints are the key reasons.

"While California often takes the spotlight, other states are facing hardships just as daunting," said Susan Urahn, managing director of the Washington, D.C.-based center. "Decisions these states make as they try to navigate the recession will play a role in how quickly the entire nation recovers." The analysis, "Beyond California: States in Fiscal Peril," urged lawmakers and governors in those states to take quick action to head off a wider catastrophe. The 10 states account for more than one-third of the nation's population and economic output, according to the report.

Historically, states have their worst tax revenue year soon after a national recession ends. At the same time, higher joblessness and underemployment mean more people need government-sponsored health care and social safety-net programs, further taxing state services. California leads the most vulnerable states identified by the report, which describes it as having poor money-management practices. Since February, California has made nearly $60 billion in budget adjustments in the form of cuts to education and social service programs, temporary tax hikes, one-time gimmicks and stimulus spending, according to the Legislative Analyst's Office.

Many of those fixes are not expected to last. The state's temporary tax increases will begin to expire at the end of 2010, while federal stimulus spending will begin to run out a year after that. Gov. Arnold Schwarzenegger estimates California will run a deficit of $12.4 billion to $14.4 billion when he releases his next spending plan in January. The governor warned that the toughest cuts are ahead. "I think that we are not out of the woods yet," Schwarzenegger said this week.

At the same time, the Legislature is hamstrung by requirements that budget bills and tax increases be passed with a two-thirds majority, a mandate that the report labeled "a recipe for gridlock." The Pew report was based on data available as of July 31 and scored all 50 states based on revenue changes, unemployment, foreclosures and budget requirements. It also gave them grades. California and Rhode Island scored worst with D-pluses, then New Jersey and Illinois with C-minuses.

In reviewing why some states are suffering more than others, Pew found that the 10 states tend to rely heavily on one type of industry, have a history of persistent budget shortfalls or face legal constraints making it extra difficult to implement major changes, such as tax increases. Many require a supermajority vote for passing tax increases or budget bills.

Wisconsin officials issued a statement late Wednesday saying the Pew report was inaccurate. Wisconsin Department of Administration Secretary Michael Morgan said the state has balanced its budget by cutting spending and raising revenue. It projects a $270 million budget surplus for the period ending July 1, 2011, Morgan said in his statement. Several state legislatures have been unable to enact long-term fixes. Instead, they asked voters or governors to make the call, or used accounting gimmicks to put off the hard choices until later. For example:

- Arizona lawmakers relied on one-time fixes to balance recent budgets as the state's home foreclosure rate surpassed California's and the nationwide average. Among the many ideas being explored by the state are a plan to mortgage state buildings, then rent the property until the state regains ownership at the end of the contract.

- Michigan, where two of the Detroit Three automakers filed for bankruptcy protection this year, continues to offer tax incentives even as they take a toll on the state's pocketbook, leading to declining tax revenue. According to the Pew study, Michigan offered $6.3 billion more in total tax exemptions, credits and deductions than it actually collected in taxes in 2008.

- Illinois, which has run deficits every year since 2001, is facing an $11.7 billion budget gap for its next fiscal year, beginning in July, according to the Center on Budget and Policy Priorities. Pew's Government Performance Project ranked Illinois behind only California and Rhode Island for its lack of fiscal management on paying medical bills and pension liabilities.

- With Florida facing a shrinking population for the first time since World War II, Republican Gov. Charlie Crist and the GOP-controlled Legislature balanced a $5.9 billion shortfall with cuts, federal stimulus money and tax hikes, including a $1-a-pack tax increase on cigarettes. But the future remains uncertain. "Florida continues to face the same challenges as last year, including a very austere budgetary environment," said Rep. David Rivera, a Miami Republican who chairs both of the Florida House's two appropriations councils.

California: Most Commercial Property Deals From 2005 Onward Are Underwater

Buried in the California Controller's November analysis is a guest article: Overview of the Commercial Property and Capital Markets with Implications for the State of California by Dr. Randall Zisler.

Here are some excerpts:Whereas excessive and imprudent leverage fed the bubble, deleveraging not only popped the bubble, but, in the process, destroyed record amounts of equity and debt. Most deals financed with high leverage from 2005 to the present are under water. The equity is gone and the debt, if it trades at all, trades at a deep discount to face value. Most leveraged equity invested in real estate has evaporated since property prices, if marked to market, have fallen 30% to 50%.The chart [right] shows overall U.S. property total returns, quarterly (at annual rates) and lagging four quarters. This appraisal-based, lagging index shows sharp negative returns exceeding the deterioration of the RTC (Resolution Trust Corp.)The author points out that many local and regional banks will fail because of CRE loans.

period of the early 1990s. (See Chart 1.) Second quarter 2009 returns indicate the possibility that total returns, while still negative, may have hit a point of inflection. We expect that property values in many sectors, especially office, retail, and industrial, will likely deteriorate further in 2010 with improvement beginning sometime in 2011.

...

A crisis of unprecedented proportions is approaching. Of the $3 trillion of outstanding mortgage debt, $1.4 trillion is scheduled to mature in four years. We estimate another $500 billion to $750 billion of unscheduled maturities (i.e., defaults). Unfortunately, traditional lenders of consequence are practically out of the market and massive amounts of maturing debt will not easily find refinancing. Marking-to-market outstanding debt will render many banks, especially regional and community banks, insolvent, especially as much of the debt is likely worth about 50% of par, or less.

The inability of many banks and other capital sources to lend not just to real estate firms but to other businesses in the State as well presents a real challenge to the private sector and state and local governments.

FDIC Chairwoman Sheila Bair said today: "We do obviously have a lot more banks that will close this year and next," Bair said, adding the failures "will peak next year and then subside."

These bad loans are also limiting lending to small businesses. Atlanta Fed President Dennis Lockhart made the same argument this morning:I am concerned about the potential impact of CRE on the broader economy ... there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

...

Many small businesses rely on these smaller banks for credit. Small banks account for almost half of all small business loans (loans under $1 million). Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

Schwarzenegger: Budget Deficit Could Swell to $14 Billion by January

Saying that more spending cuts would be necessary with "very tough decisions still to be made", Governor Arnold Schwarzenegger said Monday (November 9th) that the state's dire financial situation is growing worse, with a state budget deficit that could swell to over $14 billion when he submits his proposed state budget for 2010-2011 in early January. The news, while not unexpected, comes at a time when disability, mental health, senior and low income family advocates, local governments and several state agencies are reeling from the impact of implementing a wide range of sweeping cuts to health, human services, education and other programs passed as part of the current revised state budget – and from previous budgets before that.

The Governor, speaking to the Fresno Bee editorial board in Fresno, said that the state’s current budget will have an additional shortfall of between $5 to $7 billion by the time the budget year ends on June 30, 2010, which policymakers had hoped would not happen. That shortfall is on top of an over $7 billion deficit that lawmakers and the Governor projected for the next state budget year that begins July 1, 2010 through June 30, 2011.

The deficit – the difference between what the state brings in as revenues (including taxes) and what it actually spends and is projected to spend – is growing because of a combination of several factors, including a sharp drop in revenues that the current budget did not anticipate; lawsuits that have stopped several major cuts from going forward; and spending on some programs that have increased due to growing caseloads.

An official monthly financial report covering October from State Controller John Chiang is due any day that will likely confirm the Governor’s dire budget news. That report from the state controller, who is the statewide elected official who pays the state’s bills, will likely show a further drop in the state’s revenues from what was projected in the state budget. His report covering September showed a steeper drop in revenues of over $1 billion then what the budget projected, since the budget year began on July 1.

Growing Deficit Will Have Huge Impact on People With Disabilities, Seniors

The news of a growing deficit with more proposals of massive and permanent spending cuts likely to be proposed to close it, will have almost certain impact again on services and programs for children and adults with disabilities, mental health needs, the blind, low income seniors and families, community organizations, facilities, workers and counties to provide services and supports.

The state budget for 2009-2010 passed in February four months early and revised in late July, tried to close a gap of over $60 billion with massive permanent cuts to major programs including those impacting regional centers that provide funding to community-based services to persons with developmental disabilities, SSI/SSP grants to the lowest income and needy who are persons with disabilities, the blind and seniors, Medi-Cal including permanent elimination of 9 benefits called "optional" because the federal government does not require the states to provide them, In-Home Supportive Services (IHSS), CalWORKS, senior programs, mental health and other critical services for children (including adoption assistance and foster care) that impact a wide range of people with special needs or seniors.

Governor Offers No Specifics Yet – But Says "Very Tough Decisions" Will Need to Be Made on Spending Cuts

The Governor told the Fresno Bee editorial board that more spending cuts would be needed because "…we are not out of the woods yet. ... the key thing is, we have to go and still make cuts and still rein in the spending. It will be tougher because I think the low-hanging fruits and the medium-hanging fruits are all gone. I think that now we are going to the high-hanging fruits, and very tough decisions still have to be made."

The Governor did not offer any specifics – either regarding the growing budget shortfall or where he would propose new spending cuts – which would need approval from the Legislature. The Governor did not say whether or not he would call the Legislature back into special session to deal with the growing shortfall earlier than January as he did last year. The Governor did not mention any possibility of proposing new tax or other revenue increases, which was part of the budget deal passed in February. Since then the Governor and legislative Republican leaders have strongly opposed any additional new revenue increases.

Most revenue increases – including tax increases – require approval of 2/3rds of both houses of the state Legislature. That means getting 54 votes of the 80 member Assembly and 27 votes of the 40 member State Senate. With Democrats hold 50 seats (Republicans hold 29 with 1 seat held by an independent) in the Assembly, at least 3 Republican votes would be needed (along with the independent or a 4th Republican – assuming all 50 Assembly Democrats support a tax or other revenue increase proposal).

In the State Senate Democrats control 25 seats to the Republicans 15 – which means at least 2 Senate Republicans would be needed to support any revenue or tax increase proposal – a prospect that seems at this point, highly unlikely in an election year.

California debt binge shakes up muni bond market

The municipal bond market’s message to California: Enough with the borrowing already! Over the last seven weeks the state has sold more than $21 billion of short- and long-term debt for budget-related reasons and to finance voter-approved infrastructure projects. That flood -- in a period when muni bond yields nationwide already were rebounding after diving in summer -- has helped to boost yields more than they might otherwise have risen, some analysts assert. "Yields are higher because California has so much paper in the market," said Matt Fabian, who tracks muni bond trends at Municipal Market Advisors in Westport, Conn.

The state has been its own worst enemy: Its borrowing costs have risen with each bond deal, which means taxpayers will bear a bigger hit to service the debt over time. Rising market yields also have the effect of devaluing older fixed-rate muni bonds. If you own a California muni-bond mutual fund, chances are its share price has been sliding since the end of September as the market has suffered indigestion from the supply of new bonds.

In California’s latest offering -- a sale Tuesday of nearly $1.9 billion of bonds maturing in June 2013 -- the state had to pony up for a 4% annualized tax-free yield to lure investors to the deal. Less than two weeks ago the state paid a yield of 2.48% on a bond with a similar maturity. Investors’ ability to squeeze 4% out of the state in this week’s deal "is an expression of saturation of the market" by California, said George Strickland, a muni bond fund manager at Thornburg Investment Management in Santa Fe, N.M.

Demand for the bonds sold Tuesday also may have suffered because the deal stemmed from one of the gimmicks concocted by the Legislature and Gov. Arnold Schwarzenegger in July to close the state’s huge budget deficit: The proceeds will repay local governments for the $2 billion in property tax revenue that the state is borrowing from them to plug the budget gap. The bonds become part of the state’s overall debt burden, but they’re a step below so-called general obligation issues, which have an iron-clad repayment guarantee in the state Constitution.

Treasurer Bill Lockyer obviously knows that he has dumped a lot of debt on the market this autumn. He didn’t have much choice, given the budget fixes ordered by the Legislature, and given the backlog of infrastructure bonds California has to sell. The state’s borrowing plans had been put on hold for much of this year because of the deepening budget crisis. "We had a lot of work to do to get our financing program back on track" this fall, said Tom Dresslar, Lockyer’s spokesman.

Of course, for investors with money to put to work, rising muni yields are welcome. Ken Naehu, who manages bond investments at Bel Air Investment Advisors in L.A., believes the state’s budget woes are far from over, which Schwarzenegger acknowledged Tuesday. Still, a 4% tax-free yield on a bond maturing in less than four years was too good an opportunity to pass up, he said. "We gave them a large order," Naehu said.

Which Big Country Will Default First?

Of the world's six largest economies, three currently have budget and public debt positions that if allowed to fester will push those nations into bankruptcy (the seventh largest, Italy, also has a budget and debt position that is highly vulnerable, but its problems appear chronic rather than acute). Given the proclivities of modern politicians for delaying pain and avoiding problems, it is likely that festering is just what those positions will do. So which major country, the United States, Japan or Britain, will default first on its foreign debt?

The other three of the six top economies, Germany, China and France, appear to have fewer problems but are not out of the woods entirely. Germany has substantial public debt because of the costs involved in integrating the former East Germany, but those costs are now mostly past and the current government is highly disciplined – thus Germany is now the most stable major economy. France is less disciplined; its debt level is similar to that of Germany but its current budget deficit is much higher, at around 8% of Gross Domestic Product (GDP) in 2009, according to the Economist forecasting panel. However, its problems pale in comparison to those of the deficit-ridden trio. China has huge amounts of hidden debt in its banking system, which could well collapse, but its direct public debt is small, as is its budget deficit, so it is unlikely to enter formal default.

The worst budget balance of the three deficit countries is in Britain, where the forecast budget deficit for calendar 2009 is a staggering 14.5% of GDP. Furthermore, the Bank of England has been slightly more irresponsible in its financing mechanisms than even the Federal Reserve, leaving interest rates above zero but funding fully one third of public spending through direct money creation. Governor Mervyn King has a reputation in the world's chancelleries as a conservative man of economic understanding.

He doesn't really deserve it, having been one of the 364 lunatic economists who signed a round-robin to Margaret Thatcher in 1981 denouncing her economic policies just as they were on the point of magnificently working, pulling Britain back from what seemed inevitable catastrophic decline. King's quiet manner may be more reassuring to skeptics than the arrogance of "Helicopter Ben" Bernanke, but the reality of his policies is little sounder and the economic situation facing him is distinctly worse.

Britain has two additional problems not shared by the United States and Japan. First, its economy is in distinctly worse shape. Growth was negative in the third quarter of 2009, unlike the modest positive growth in the U.S. and the sharp uptick in Japan. Moreover, whereas U.S. house prices are now at a reasonable level, in terms of incomes (albeit still perhaps 10% above their eventual bottom), Britain's house prices are still grossly inflated, possibly in London even double their appropriate level in terms of income.

The financial services business in Britain is a larger part of the overall economy than in the U.S. and the absurd exemption from tax for foreigners has brought a huge disparity between the few foreigners at the top of the City of London and the unfortunate locals toiling for mere mortal rewards. A recent story that the housing market for London homes priced above $5 million British pounds was being reflated by Goldman Sachs bonuses indicates the problem, and suggests that the further deflation needed in U.K. housing will have a major and unpleasant economic effect.

A second British problem not shared by the U.S. is its excessive reliance on financial services. As detailed in previous columns, this sector has roughly doubled in the last 30 years as a share of both British and U.S. GDP. In addition, the sector's vulnerability to a restoration of a properly tight monetary policy has been enormously increased through its addiction to trading revenue. The U.S. has many other ways of making a living if its financial services sector shrinks and New York is only a modest part of the overall economy. Britain is horribly over-dependent on financial services, and the painful if salutary effects of London costs being pushed down to national levels by a lengthy recession are less likely to be counterbalanced by exuberant growth elsewhere.

The other question to be answered for all three countries is that of political will. If as is certainly the case in Britain, deficits at the current levels will lead to default (albeit not for some years since the country's public debt is still quite low), then to avoid default tough decisions must be taken. Britain is in poor shape in this respect. Its current prime minister, Gordon Brown, is largely responsible for the underlying budget problem, having overspent during the boom years, largely on added bureaucracy rather than on anything productive or value-creating. However, the opposition Conservatives, likely to take power next spring, are led by a center-leftist with a background in public relations and no discernable backbone or principles.

Britain has a history of such leaders, which it has managed to survive – the ineffable Harold Macmillan, in particular, who wanted to abolish the Stock Exchange and contemplated nationalizing the banks when they raised interest rates, was a man of outlook and temperament very similar to David Cameron's. Macmillan was notoriously prone to soft options that postponed economic problems, firing his entire Treasury team in pursuit of soft options in 1958 and leaving behind an appalling legacy of inflationary bubble on his retirement in 1963. If Cameron is truly like Macmillan, his government's response to economic and financial disaster will be one of wriggle rather than confrontation. With neither party providing solutions to an economic crisis, the British public is likely to discover that, unlike in the crisis of 1976, no solutions will be found. Default (doubtless disguised as with Argentina as "renegotiation") would in that case inevitably follow.

The United States is in somewhat better shape than Britain. Its deficit is somewhat lower, at 11.9% of GDP in calendar 2009, although its debt level is higher if you include the direct debt of Fannie Mae and Freddie Mac, as you should. It also has lower overall levels of public spending, although spending is rising rapidly. Furthermore, it has a much more diverse economy and a healthier real estate market, so that further likely downturns in California and Manhattan real estate and the financial services sector can be easily overcome.

U.S. pundits like to whine about the impending deficits in social security and health-care, but the former is easily overcome by adjusting the retirement age while the latter could be greatly mitigated by simple cost-containment measures, such as limiting trial lawyer depredations, making the state pay for the "emergency room" mandate to treat the indigent and allowing interstate competition for health insurance. All those changes would be politically difficult, but they are clearly visible and involve no damaging cuts in vital services, unlike the changes that would probably be necessary in Britain.

The other U.S. advantage is political: it has an alternative to overspending. Last Tuesday's election results were a useful shot across the bows of the overspending consensus that had developed in both the Bush and Obama administrations (as well as among the ineffable barons of Congress) since 2007. Whereas voter concern about spiraling deficits and public spending has no satisfactory outlet in Britain, it can now express itself clearly in the U.S., producing either a sharp change of policy by the current administration and Congress or a change of administration in 2012. Since the likelihood of a reversal of policy towards sound budgetary management is greater in the U.S. than in Britain, the probability of eventual default is less.

Japan has already had its change of government, throwing out the faction of the Liberal Democrat Party (LDP) that regarded politics as the art of creating pointless infrastructure. Unfortunately, the Japanese electorate, faced in August with a no-good-choices problem similar to that of U.S. voters last year and British voters next spring, replaced a long-serving overspending government with another committed to a different set of spending priorities rather than to ending the spending itself. The Democratic Party of Japan (DPJ) has cut back sharply on the infrastructure "stimulus" but is showing signs of replacing it with social spending. It is also committed to economically dozy policies such as reversing postal privatization, organized with such great political effort by Junichiro Koizumi in 2005.

Japan does however have a couple of advantages that may enable it to avoid default. First, its public debt carries very low interest rates, mostly below 2% per annum, and is owned almost entirely by its own citizens. What's more, state-owned entities such as the now un-privatized Postal Bank lend vast amounts of money to the government, acting as conduits to the less efficient bits of the public sector in the same way as do China's state-owned banks. This is appallingly bad for the efficiency of the economy and for living standards, but it postpones default and makes it less likely.

Second, it's not inevitable that the LDP's wasteful infrastructure spending will simply be replaced by wasteful social spending. Finance minister Hirohisa Fujii is reputed to be a budgetary hard-liner. Further, at least part of the DPJ's spending will take the form of handouts to families with children. Those may increase domestic consumption compared to exports and thereby balance the Japanese economy better, increasing its growth potential marginally. Nevertheless, since Japan's public debt is currently around 200% of GDP, Japan is much closer to the default precipice than either the U.S. or Britain. Thus, while the better structure of Japan's economy and its debt make Japan's probability of default lower than Britain's, it's likely that if both countries defaulted, Japan would do so first.

We have not experienced a debt default by a major economy since the 1930s. That three such defaults are currently conceivable indicates both the severity of the current downturn and the wrong-headedness of the policies taken to address it. If it happens, a major sovereign debt default of this kind will cause the seizure of global capital markets, prolonging downturn for a decade or more. We'd all better hope the urge for fiscal responsibility hits London, Washington and Tokyo pretty damn soon.

Roubini Is Wrong

by The Mad Hedge Fund Trader

Nouriel Roubini is wrong. He has embarked on a global campaign to warn the world, Cassandra-like, of the “mother of all highly leveraged asset bubbles” now in progress. Shorts in the US dollar are being built up to unprecedented levels, and are being used to finance the purchase of every asset class, especially in energy, commodities, and precious metals. This bubble will be pricked by a huge snap back rally in the greenback, the exhaustion of Fed support measures, a growth surprise in the US leading to an early Fed tightening, or a real double dip recession.

The inevitable collapse will make the last financial crisis look like a cake walk, and take all markets, especially equities, down to new lows. The flaw in the Turkish New York University economic professor’s logic is lurking in his own arguments. The basis for his “U” shaped recession (described by others as “bathtub” or “toilet bowl” shaped), is the absence of credit, especially at the regional and small business level. But I can tell you from my own experience that credit is also absent, or severely diminished, in the hedge fund community too. Terms have been tightened across the board. Collateral requirements are much stricter. Margin requirements on the futures markets are vastly heavier than they were two years ago, especially for the most volatile contracts, like crude.

You can forget about financing for any kind of instrument that is illiquid or trading over-the-counter. Prime brokers really play hard ball. The days when big hedge funds borrowed stock and shorted them with no money down are a distant memory. The last time I checked, Lehman, Bear Stearns, and AIG weren’t doing any new lending. Many credit markets, such as those for certain CDO’s, are still completely closed, and are never coming back. So where is all this leverage?

The net net is that speculative positions are but a fraction of those seen at the 2007 peak. To get a real crash with new lows, someone has to sell, and there just isn’t that much around to be sold these days. I think Nouriel is one of those Mount Olympus guys who can only give a very broad, general overviews of what we mere mortals are doing. Never having worked on a trading desk, he doesn't realize that what he is proposing can't actually be executed. When the current trends reverse, there will be much volatility, pain, hand wringing, and gnashing of teeth, for sure. But it is much more likely that we are going to die from ice, not fire, and of boredom, not from cardiac arrest.

In China's Growth Story, Credit as Villain?

The bull case for global financial markets hinges partly on belief in a bulletproof Chinese economy. But China is vulnerable to the same Kryptonite that has hurt countless other economies: credit. Fresh evidence of China's strength is expected this week, when the government is due to release data on trade, retail sales, industrial production, consumer and producer-price inflation, money supply and fixed-asset investment. Economists expect the inflation and trade measures to fall from a year ago; they expect other measures to rise by fat double digits.China has supplied most of the world's economic growth in the past three years, according to the International Monetary Fund. While the U.S. and other developed nations are expected to expand sluggishly for years to come, China's economy is widely expected to keep rising at this year's 8% growth rate or better. Most of China's growth this year has been unsustainable, driven by stimulus. China's money supply has risen 29% in the past year. At the government's behest, banks have increased their lending by nearly $1.4 trillion, or 32%, during that time.

That flood of borrowed cash has been channeled into new infrastructure and production capacity. These investments will account for up to half of China's gross domestic product this year, according to some estimates. A key question is whether China needs all of this investment. Analysts at the London hedge fund Pivot Capital Management say that China already has enough idle steel-production capacity, for example, to match the steel output of Japan and South Korea combined.

Meanwhile, the ratio of investment to GDP is rising, suggesting China's investment is less and less efficient, says Edward Chancellor at Boston asset-management firm GMO. The combination of soaring investment and dwindling returns was seen in Japan in its asset bubbles in the 1980s and in the "Asian Tigers" just before their crises in the late 1990s, he says. These data are hard to measure and subject to much debate. China's economy may turn out to be strong enough to merit all of this investment. But any hiccup in growth raises the risk that these investments become bad debts.

Chinese credit card debt mounts

The world economy is placing a bet on its future with China, but some Chinese are placing bets on their future with plastic. In rebalancing the world economy, analysts have said U.S. citizens should take cues from the Chinese, where 40 cents of every dollar of disposable income is saved, compared to 3 cents of every dollar in the U.S.

But there are worrying signs in China that some young consumers are starting to emulate the worst habits of U.S. consumers -- like 27-year-old Yuan Shuai in Beijing, whose credit card bets on his future have turned into overwhelming debts. In the last two years, he got seven cards from seven banks and wracked up $29,000 in debts. "I spent money on eating and having fun," he said. "That's all."

Unemployed and studying to be a taxi driver, Yuan now has debt collectors from banks turning to his father, Yuan Yizhong, for bill payment. "The banks told me they could lend to him because he's an adult," his father says. "Now they hold me responsible and threatened me." With no laws for bankruptcy protection in China, those threats can be real. "If you cannot pay it back you either have to go to parents or friends to pay back for you, or you got to jail," said Yeongwen Chiang, a consumer expert.

Credit card issuance is up 32 percent in China in the past year, according to China Market Research and the National Bureau of Statistics. Credit card debt is up more than 130 percent to $838 million. That still pales compared to U.S. credit card debt, but the quick rise have some observers alarmed. With the decrease in exports during financial crisis, China has been working to build domestic consumption, offering subsidies on cars, home appliances and other big ticket items. That has helped China to continue to grow through the recession. During the October holiday week celebrating the 60th anniversary of the People's Republic of China, Chinese poured $83 billion into the economy - a 20 percent increase in spending from the same holiday period last year.

By comparison, retail spending in the United States fell 6 percent in September compared to the same time last year. But some of the increased spending in China is with money the consumers didn't have. In the first six months of this year, the number of Chinese consumer with credit card debts more than two months overdue rose 133 percent. For the Yuan family, credit card debt will take years to pay back. "I have only one son, and he failed to live up to my expectations," Yuan's father said.

Europe's industry slams China over currency

Europe's industry federation has called for urgent measures to cap the surging euro after it blasted through $1.50 against the US dollar and 10.25 against China's yuan on unexpectedly strong data from Germany. "I am deeply concerned about recent exchange rate developments," said Jurgen Thumann, president of Business Europe, the pan-EU lobby. "An overvalued euro is not good news for growth and is inconsistent with the commitments of the G20 countries for an orderly resolution of global imbalances. We must insist that our partners honour their commitments." He was addressing his words directly to top officials from the European Central Bank and the Eurogroup in Brussels.

China has held the yuan fixed to the dollar despite its huge trade surplus through vast purchases of foreign bonds. This has allowed it to flood Europe with cheap exports, gaining market share on the coat-tails of dollar devaluation. Mr Thumann called on EU leaders to "push the message" in Beijing that China must let the yuan rise. There is growing irritation over the apparent insouciance of EU officials in the face of the euro's 24pc rise against the dollar/yuan since March. China's central bank governor, Zhou Xiaochuan, let slip at the G20 summit that global pressure for yuan appreciation "is not that big". Germany has so far seemed able to shrug off the currency effects. Exports jumped 3.8pc in September from a month earlier.

However, a study by Ansgar Belke from Duisburg University found that even Germany has clear limits. Berlin's pleasure in the muscular performance of the euro is likely to prove "nasty, brutish, and short", he said. "Firms with standard products exposed to the biting winds of international competition have a huge problem with a strong euro," he said. Germany's small and medium-sized family firms produce locally and cannot switch plant abroad. Currency hedging is complex and costly. Mr Belke said the "pain threshold" varies by sector but overall demand for German goods will "fall dramatically" if the euro goes above $1.55 for long. Furthermore, it will do lasting damage as firms lose their global foothold. Many will struggle to re-enter these markets even if the euro falls again. Currency effects are slow but powerful.

Professor Willem Buiter from the London School of Economics said the ECB has made an error by pushing the euro too high through tight-money policies. "The German export industry has learned to cope by wage restraint and productivity gains. This is not something that other countries can emulate easily," he said. "There is going to be some egregious suffering." IMF data shows that Spain and Italy are over-valued by more than 30pc. Germany's car scrappage scheme and a rebound in inventories have lifted the country out of recession but from a very low base. Exports are still down 19pc from a year ago. The Bundesbank says the economy may not regain its former output until 2014.

Recovery is not secure in any case. Private credit in the eurozone contracted for the first time in September. Germany's Bank Federation has given warning of a "generalized credit crunch" next year due to the delayed effect of rising defaults and G20 pressure for higher capital ratios. Business Europe called on regulators to move carefully as they clamp down on banks. "We have absolutely no idea of the overall impact on our economy," it said. European firms raise two thirds of their debt from banks, compared with one third in the US. "Company investment in machinery and equipment is already down more than 20pc since last year. We need to reverse this trend rapidly, otherwise we will never get back on our former growth track," it said.

China Signals That It May Allow Currency to Rise Against Dollar

China sent its clearest signal yet that it was ready to allow yuan appreciation after an 18-month hiatus, saying on Wednesday it would consider major currencies, not just the dollar, in guiding the exchange rate. In its third-quarter monetary policy report, the People's Bank of China departed from well-worn language on keeping the yuan "basically stable at a reasonable and balanced level." It hinted instead at a shift from an effective dollar peg that has been in place since the middle of last year.