Crowds gathered for a war-bond rally on Pennsylvania Avenue with the Capitol in the distance.

Ilargi: Yeah, yeah, initial claims are down a few thousand, so there's a party in the markets. Long-term unemployment keeps going up by at least as much as initial claims decrease, but that has no effect on investors. After all, productivity is on a roll. While hours are down, and so are wages. More work for less pay. Who could refuse such a deal? Extensions for homebuyer credits and long-term benefits. Extend and pretend, the economic version of don’t ask don't tell, rules the day.

There are many different regulatory reform plans, in several phases of the pipeline, for the financial world (or at least the financial US). Those from the Obama administration, which look hugely different from Sen. Chris Dodd's Senate proposals, while Rep. Barney Frank hangs somewhere in between with his House ideas. All three purport to address both the regulation of the banking system and the regulatory agencies themselves.

But without having read much of the details, I have zero faith in any plan that originates with Goldman's choice puppets Tim Geithner and Larry Summers, I wouldn't want a second hand car from Chris Dodd if he gave it away), and Barney Frank, smart and amusing as he can be, is as steeped in Washington establishment and campaign donations as they come. No matter what sort of plan will eventually be adopted, it will do nothing at all to address what's really going wrong.

As Dylan Ratigan says, the Obama/Geithner/Summers plan suggests we continue to hide 80% of the derivatives trade, so nobody will see that it consists of worthless paper. William Black on the plan:

If you took everything that would absolutely maximize the risk of producing a new and bigger crisis, every single policy, that would be the bill.

Ratigan this week issues a highly eloquent and passionate plea to fire Tim Geithner. Senator Maria Cantwell wonders why the Treasury Secretary still has his job. And Prof. William Black suggests Larry Summers should ride into the sunset at Geithner's side. These are calls I haven't seen before at that level, granted.

Ron Paul makes a lot of noise about a Fed audit, gets a ton of support, and then expresses (feigns?) surprise at the fact that his audit bill is watered down enough to lack any flavor. Does he really still now know where the wind blows from, after all these years? He seems smart and likeable enough, but I find that hard to swallow.

Paul's bill is probably most useful as an example of what happens to any proposal that goes through the Capitol Hill wringer. Everything comes out in 2-D, without any depth perception, assuring that nothing is done to hurt the interests of the capital that owns the 3-D machine and keeps it lubricated.

And that’s where the real problems are. You can come up with all sorts of grandiose plans on how to regulate or re-regulate regulatory agencies and the fields they are supposed to regulate, but you will never get any results, at least not positive ones, if you let these plans be drawn up by people who have or represent vested interests and resist any meaningful change every step of the way.

Firing a few people or writing up new regulation are things that miss the point. Auditing the Fed would be better, but is a fantasy under current conditions. Losing folks like Geithner, Summers or Bernanke doesn’t change anything, they are merely well-groomed facilitators for the existing system. And it's that system that would need to be changed, not the faces that represent it.

What makes the econo-political system in the US (and other countries) such a failure in the eyes of the average citizen is that money can buy political power, in the US to an almost unlimited degree. First, this means that "one man one vote" is a poorly hidden illusion. If money can buy power, it automatically and necessarily becomes "one dollar one vote". Second, the interests of wealthy individuals or corporations are often diagonally opposed to those of the average citizen. You would like to keep your money as much as possible, while the corporate world would like to take as much away from you as it can. And if you take a good look around, you will find that you're not exactly winning this one.

So even if you don't care much about your vote as long as you can have a car and a TV, you should still pay attention, because in the end you will see be left with next to nothing. And it's your own government, the very people you have voted for, who make sure that's the outcome.

The Treasury Department is the most important part of the US government when it comes to dealing with the economy, and certainly a financial crisis like the one we're in. That is obvious. What is less so is that the Treasury for many years has been filling its main positions with people straight out of the upper echelons of the nation's monied who’s who. The no.1 spot, Secretary of the Treasury, has long been reserved for those who could be relied on to serve the interests of the corporate world.

The names successive presidents have pulled out of their hats for the post tell an interesting story of a power shift from the industrial complex towards the financial world. Since Ronald Reagan brought in Merrill Lynch CEO Don Regan in 1981 (or was it the other way around?), it's finance all the way. Since Bill Clinton picked Robert Rubin picked Bill Clinton, it's all Goldman employees and friends. Many cross through the revolving doors several times. That's how you cement your grip if you’re Goldman.

When president-elect Obama announced his economic team some 11 months ago, a lot of people had doubts. Others, like me, didn't even have those. It was clear to me from the outset that Robert Rubin, Clinton's Treasury Secretary, 26-year Goldman Sachs veteran, prime Glass Steagall destroyer and guru to Larry Summers, Tim Geithner and many others, should not have been anywhere near that team. Nor should Summers or Geithner, for that matter.

Rubin and Summers had 10 years prior been directly responsible for the de-regulation that allowed Wall Street behemoths to establish their shape (and power) which had been proven to be most guilty for the financial crisis that already ran at full blast at the time of Obama's announcement. And not only that, they were the very working brains of the Wall Street behemoths, Trojan horses.

But the core is not the folks you see on TV, the Secretaries. Goldman Sachs has dozens of (former?) employees on strategic positions in the government and around it. By the way, their new main lobbyist is a former Barney Frank staffer. Ain't that just so cute? If you’re interested, there are lists of Goldman people here here and here and here, and I don't want to dwell on them too much.

I want to focus on the fact that in the US, money, not votes, can buy political power. And most of the money resides inside the banks, especially those on Wall Street. So the banks have bought the government.

And no, that is still not the entire story, and it's not even the worst of it. Because most of the money left today does not reside in the banks. They gambled it all away, and they are all bankrupt. The only real money left now resides in the government. Which has been bought by the banks. So they now control the entire nation without having a penny to their names.

Now, if you look at it from that angle, that's quite a feat, isn't it? It's like an obsessive-compulsive gambler who's managed to get hold of the family capital.

And you need to care about this because you are the family, and your home and pensions and those of your children have been put up as collateral for the next wager. Dylan Ratigan in conversation with William Black:

- Ratigan: We have legalized the casino gambling with taxpayer money, literally. It is legal for proprietary trading, which is idle speculation, although perhaps well informed and profitable, with the use of taxpayer insured assets.

- Black: We not only legalized it, we backstopped it. If you win, it all goes to you, if you lose, it all goes to the taxpayers, and the American people. That is insane. Everybody knows that’s insane.

I hope it's clear by now that none of the regulatory reform plans being floated these days will solve any of the real problems. They are not designed to do so. They are designed to invoke the image of a noble fight among different political factions to clean out the elements that have broken down the system. There will be no such fight.

Firing Tim Geithner will not solve the problem either. He may end up as the fall guy somewhere down the line, but he has a ways to go now people start to believe the recovery nonsense the media keep spouting. A ways to go , and a lot more damage to do. Still, if Geithner's forced out, his place will be filled by the next drone. People talk about Paul Volcker and Elizabeth Warren for the post, but they would be powerless sitting ducks in a bankers pond.

The only way to stop the bleeding is to separate money and politics. But the presidents, Senators and Congressmen who have the power to execute that separation have no desire to do so. They owe their very positions to the donations from the very corporations they would need to throw out of Washington. The Legislative and Executive branches of government are in the hands of private capital, without which they wouldn't be able to win a single election.

You would have to appeal to the Judicial branch, the Supreme Court, for a judgment on the legality of a federal republic being ruled by a few special interest groups. But the Supreme Court has long turned into a theater of political nominations. There is no independent court left.

Which makes it look like a pretty closed system. You are allowed to participate as onlookers in a Kabuki Theater, while your present and future wealth and happiness are being stolen away from you behind closed doors somewhere far away by shady characters who own their power to the fact that they have their hands on your money.

I think people mean well in general who propose firing the most prominent executives, or auditing hidden books filled with multi-trillion frauds and losses. But I don't think they realize how far we’ve come along this path. I’m quite sure people like Dylan Ratigan and Ron Paul would define the present conundrum as a financial crisis first and foremost, with a side-dish of political issues perhaps, but nothing that couldn't be solved with a good old fashioned hard fought democratic vote. What democracy would they suggest that vote take place in, though?

To even begin to solve the problem and stop the bleeding, you would have to fire the entire government in all its branches. And then start all over with people you can guarantee have never received a penny from the ruling classes. That looks like a steep cliff to climb.

Ilargi: Just a reminder: The Automatic Earth Fall Fund Drive is still on. See the top of the left hand column. You have been very generous over the past 4 weeks, thank you so very much, but we are still not even close to where we would like to be on that particular topic. And don't let's forget that our advertisers also eagerly await your attention.

Dylan Ratigan: In Geithner we trust?

It's Time To Fire Tim Geithner

by Dylan Ratigan

A year ago it was revealed to the American people that our banking system was a legalized Ponzi scheme in which bank and insurance CEOs paid themselves billions of dollars in personal compensation to lend and insure assets with money they didn't have to customers who couldn't pay back the loans.

In those dark days between the fall of Lehman Brothers and before the presidential election, we were often carried through that time by the small glimmer of hope in that at least we would soon have a new leader who would hopefully fix this mess and punish those responsible. Yet in the past 9 months, not only has the administration not fixed anything, they have made things much worse for anyone who isn't a Wall Street banker. Therefore, we are past the point where anyone in power still gets the benefit of the doubt and the process of taking back our country for all citizens must begin now.

This is why I think we must ask if U.S. Treasury Secretary Timothy Geithner is still the right person for the job. It has become clear recently that back in his previous role as New York Federal Reserve Governor, he unnecessarily gave billions of dollars of US tax money to banks and insurance companies with few strings attached. And it is now becoming clear that his lack of meaningful action is helping many of these same banks steal more by legalizing their most economically dangerous, socially destructive and self-enriching practices.

Yesterday on NBC's Meet the Press, Secretary Geithner again endorsed House bank reform legislation that would allow, by my calculations, as much as 80%, or $475 trillion, of the bank's $600 trillion in crooked insurance schemes to still be held in secret. It was and is the secret risks held in this very market that led to our collapse in the first place and continue to pose massive future risk to the global economy.

He also continued to employ the bankers' favorite, and most ludicrous, lie : that the taxpayer must somehow continue to pay executives at companies like AIG ungodly sums of money under the threat that if we don't, somehow the taxpayer will never make their money back. Well let me tell you something, the taxpayer and our nation, will never get back the lost wealth taken under these false circumstances and this colossal breach of fiduciary duty. The idea that we must somehow perpetuate this system with our tax money and the future wealth of our children goes against the very American ideal of failure, adaptation and innovation, not to mention of our democracy.

Also last week, the Treasury Secretary endorsed a piece of legislation that instead of stopping a select few companies from profiting from the implicit taxpayer-guarantee of Too Big Too Fail seeks to officially condone it. If the most prized skill in our society economically is a competition to see who can lend and insure the most money without consequences, you have doomed our nation's people to lose everything in the world's largest ever betting parlor; and that is precisely the system this Treasury Secretary -- Tim Geithner -- is seeking to legalize in America today.

However, the smoking gun for Secretary Geithner comes from a recent Bloomberg FOIA disclosure regarding events from last November. It was then that New York Federal Reserve Governor Tim Geithner decided to deliver 100 cents on the dollar, in secret no less, to pay off the counter parties to the world's largest (and still un-investigated) insurance fraud -- AIG.

This full payoff with taxpayer dollars was carried out by Geithner after AIG's bank customers, such as Goldman Sachs, Deutsche Bank and Societe Generale, had already previously agreed to taking as little as 40 cents on the dollar. Even after the GM autoworkers, bondholders and vendors all received a government-enforced haircut on their contracts, he still had the audacity to claim the "sanctity of contracts" in the dealings with these companies like AIG.

None of us were in the rooms when these decisions were made, so I don't pretend to know if Mr. Geithner was the one lone, sane voice of reason fighting against mysterious forces or the primary proponent. However, I fail to see the reasoning for why we continue to rely on those who were in the room when these horrendous decisions took place to be the same people that we choose to deal with their aftermath. There are just certain situations that are not suited for continuity. The best analogy I can think of is that it would be like asking Al Cowlings to spearhead the Nicole Brown Simpson murder investigation under the premise that he knows the layout and the "players" best.

The fact is that there are people who understand all of the intricacies of finance and policy as well as Secretary Geithner, but whose allegiances to the taxpayer are much clearer. People like Elizabeth Warren, Neil Barofsky, Rob Johnson, and Senator Maria Cantwell just to name a few. To stop the theft from continuing, it requires that the most basic rules of capitalism be applied to our banks and that our future national wealth be safeguarded by the US Government. The current custodian of America's wealth, Treasury Secretary Tim Geithner, is not doing a good job of either. The time for corrective action is now.

Obama and 'Special Interests'

For the past nine months, the Obama team has waged a campaign of political convenience against lobbyists. Its policies against so-called special interests include: a refusal to accept lobbyists' campaign contributions, a ban on employing lobbyists within the administration, discouraging lobbyists' contact with government workers, new rules that will result in the public disclosure of every lobbyist who visits the White House, and a directive to exclude lobbyists from serving on department and federal agency boards and commissions.

All of this is meant to give the impression of purity. But this is illusory. At the same time that the White House has demonized lobbyists, it has allowed itself to be infiltrated by a different army—one made up of campaign contributors. These individuals can breeze past defenses designed to repel lobbyists.

Campaign contributors, especially those who bundled large contributions from others, have been embraced by this administration. Because they aren't formally registered or regulated in the way lobbyists are, they enjoy the benefits and privileges of serving in the heart of the administration. These contributors serve in critical foreign and domestic policy positions, as well as department and agency boards and commissions. Dozens of Obama for America National Finance Committee members have joined the administration. Most of them raised hundreds of thousands of dollars for the campaign, according to the watchdog group the Center for Responsive Politics.

This inconsistent treatment does a disservice to federal policy making. Talented women and men who registered themselves as lobbyists under the Lobbying Disclosure Act are being excluded from contributing their expertise at a critical time in our nation's history. The irony of this ploy is that it discriminates against those individuals with the greatest obligations of transparency: lobbyists who register and file quarterly reports on their activities, as well as biannual reports on their political contributions. These are all publicly available. Instead, the White House favors individuals such as political contributors who have no obligation whatsoever to inform the public of the interests they represent in their interactions with the administration.

What's more, this administration's treatment of lobbyists has only decreased openness in the policy-making system. Lobbyists are now limiting their activities and deregistering themselves in order to avoid being stigmatized. If the administration truly wants to address its stated concerns about the influence of special interests, it should focus on what the public actually cares about: the influence of money on the policy-making process. Excluding and disadvantaging professional advocates who have not given any money to the president's campaign while giving campaign contributors a free pass is bad policy.

The White House has repeatedly claimed that it wants "to change the way business is done in Washington." If the Obama administration is serious about this goal, it should apply the same rules to those who raised over $10,000 for the president's campaign that already apply to lobbyists who did not contribute a cent.

William Black on Too big to fail: They’re building a bigger bomb

Geithner "Burned Billions," Shafted Taxpayers on CIT Loan, Prof. Bill Black Says

Another one of the nation's largest lenders has filed for bankruptcy. On the brink for months, CIT filed for Chapter 11 protection on Sunday. The prepackaged plan allows CIT to restructure its debt while trying to keep badly needed loans flowing to thousands of mid-sized and small businesses. The plan keeps CIT's operations alive and makes it possible for the company to exit bankruptcy by year's end.

But here's the bad news: While senior debt holders will only lose 30% of their investment, we, the U.S. taxpayer, will lose the entire $2.3 billion we lent the company this summer. William Black, professor at the University of Missouri-Kansas City School of Law is dumbfounded. "We put ourselves on the hook in a completely inept way where we lose first. We lose entirely as the taxpayers." Black, a former top federal banking regulator, blames Treasury Secretary Timothy Geithner for negotiating such a bad deal on behalf of the American public.

His argument goes as follows: The government was in no way obligated to lend the struggling CIT money and, in fact, initially refused to provide it bailout funds. More importantly, being the lender of last resort, the government should have guaranteed we'd be the first to get paid if CIT eventually filed Chapter 11. By failing to do so, "it's like he [Geithner] burned billions of dollars again in government money, our money, gratuitously," says Black.

Black believes the problem stems from regulators' fears that if the banks recognize a loss on the bad assets it will create a domino effect that will wipe out the entire financial system. "If that's true we've got to get rid of capitalism," he warns, "because if we can't recognize losses in a capitalist system we have no future."

Who Needs Workers Anyhow?

U.S. companies increased their output in the third quarter even as they slashed working hours, driving productivity up at a 9.5% annual rate in the quarter, the Labor Department estimated Thursday.Unit labor costs - a key measure of inflation - dropped at a 5.2% annual rate in the quarter. Productivity is output divided by hours worked. Output rose 4% annualized, while hours worked plunged 5%. Real hourly compensation increased at a 0.2% annual rate.

With productivity high and real compensation low, companies captured the lion's share of the benefits of higher productivity in the form of profits. Inflationary pressures remained very low.

The huge increase in productivity explains why the U.S. economy could grow at a 3.5% annual rate in the third quarter even as jobs were being lost at a rapid pace.

Obviously at some point we'll need to get everyone back in the labor force to support end user demand . That is unless we create a welfare state in which the working class supports the non-working class... or is that what we already have?

Treasury expects to hit $12.1 trillion debt limit in December, working with Congress to boost it

The Treasury Department now expects to hit the government’s debt limit in December, two months later than its initial estimate, after scaling back an emergency loan program as the financial crisis abated. Treasury Department officials said Wednesday they’re working closely with Congress to pass the legislation needed to boost the debt ceiling, currently at $12.1 trillion, and avoid an unprecedented default on the nation’s debt obligations.

Treasury also announced it is ending sales of 20-year inflation-protected securities and will offer similar 30-year securities starting next year. The government believes the longer maturity option will be more popular with investors. The legislation to increase the debt limit is expected to trigger a congressional debate over the government’s soaring deficits, which are projected to add another $9 trillion to the debt burden over the next decade.

The government initially estimated the debt ceiling would be hit last month, but in September it reduced one of the many emergency borrowing programs to $15 billion, from $200 billion. That cleared more room for the government’s other borrowing needs. Congress still faces the need to boost the debt limit by around $1 trillion. Some senators have said they will not support that action unless it is linked to the creation of a commission that would force Congress and the administration to take credible action to restrain soaring deficits.

The administration has said the current record deficits are needed to get the country out of a deep recession and stabilize the financial system, but that the President Barack Obama will put forward new proposals to trim future deficits when he sends his next budget to Congress in February.

For the budget year that ended on Sept. 30, the federal deficit hit an all-time high in dollar terms of $1.42 trillion. As a percent of the total economy, it stood at its highest level since the end of World War II. The jump reflected the massive spending from the $700 billion financial bailout fund and the $787 billion economic stimulus package designed to get the country out of the longest recession since the 1930s. "Deficits of this size are serious and ultimately unsustainable," White House budget director Peter Orszag said in a speech Tuesday.

The deficits are making it harder for the administration to extend politically popular stimulus programs, such as support for the unemployed and the tax credit for first-time homebuyers, without greatly increasing the size of future deficits. In its announcement Wednesday, Treasury said it decided to move to 30-year inflation protected securities, known as TIPS, because it believe the longer maturity would be more popular with investors. Treasury also offers TIPS in five- and 10-year maturities.

The value earned by an investor on a TIPS bond fluctuates with changes in the consumer price index, giving investors protection that the value of their bonds will not drop if inflation accelerates. Treasury also announced that it will raise $81 billion in its quarterly refunding operations next week including $40 billion in three-year notes to be auctioned on Monday, $25 billion in 10-year notes to be auctioned on Tuesday and $16 billion in 30-year bonds to be auctioned on Thursday.

Ron Paul: They won't be able to reinflate the bubble this time

Dylan Ratigan: What if you decided you just didn't care about the children? It’s easier if we just print the money and go out to dinner, don’t you think?

Dodd's financial reform bill at odds with Obama administration

Senate Banking Committee Chairman Christopher Dodd (D-Conn.) plans to circulate a draft bill of sweeping financial reforms as early as next week that breaks with the Obama administration and the House on two key issues, officials said.The legislation, which is still being finalized, would consolidate federal responsibility for banking oversight, now assigned to four different agencies, into a single regulator. And, compared to the plan rolled out by the White House, Dodd's measure would grant less power to the Federal Reserve to curb activities that pose a risk to the entire financial system, the officials said. Under pressure from the administration to move quickly, Dodd now plans to move forward without bipartisan support, sources familiar with the matter said.

Dodd has said that he and Sen. Richard Shelby (R-Ala.), the committee's ranking Republican, have been holding regular meetings to talk about the pending legislation. But staff members on both sides of the aisle say the two men have yet to see eye to eye on a number of issues, from a proposal to create a new consumer agency to heightened government authority for dealing with large, troubled financial firms. "I don't think they ever got close to agreeing on it," said one Democratic staffer.

Whether the two sides ultimately will find middle ground remains unclear. "Sen. Shelby has not agreed to anything," his spokesman, Jonathan Graffeo, said Tuesday. "But we've yet to see the draft bill." Dodd hopes his committee will start the formal process of approving his bill as early as the week after next, spokeswoman Kirstin Brost said. Dodd's measure would reshape Washington's oversight of Wall Street on a more dramatic scale than a parallel effort in the House. The House bill would eliminate only the Office of Thrift Supervision, which regulates thrifts, while Dodd is looking to consolidate all four bank regulators into one.

An administration official, who has reviewed summaries of the bill, called Dodd's bill a good start and has expressed openness to the idea of a consolidated regulator. Meanwhile, the House Financial Services committee has moved forward its own version of the bill. That committee has passed legislation to regulate the largely unmonitored world of financial derivatives and to create a new federal agency that would monitor mortgages, credit cards and other loans to consumers. The House committee is set on Wednesday to debate the details of legislation giving the government broad power to keep watch for systemic risks to the economy and to wind down large, troubled financial companies.

Rep. Barney Frank (D-Mass.), who chairs the House committee, said he plans to move his version of the regulatory reform proposal through the entire House before the end of the year. "I don't have any question that it will be finished by the first week of December," Frank told reporters on Tuesday. The press conference by Frank and leaks about Dodd's plan were not coincidental, sources familiar with the matter said. The administration and Democratic lawmakers, who are all trying to keep the reform effort from losing steam, coordinated their publicity to illustrate that progress was being made.

Frank told reporters he was open to legislative changes that would allow the government to seize and dismantle large financial firms. For instance, he said he could agree to new language calling for these firms to be assessed upfront fees to cover the cost of a large firm's collapse. Earlier language called for charging the firms after a failure. Federal Deposit Insurance Corp. chairman Sheila Bair has questioned the wisdom of that latter approach, but the administration prefers assessing the fee afterwards.

Frank added that he wants to see the Consumer Financial Protection Agency led by Harvard Law Professor Elizabeth Warren, who was a key architect of the new agency. "I want Elizabeth Warren to be the first head of this agency," Frank said. But some Republicans oppose the agency altogether, saying it would unnecessarily reduce the availability of loans and other financial products.

Clash Looms on Banks

A key Senate lawmaker is readying legislation that would dramatically redraw how the financial system is regulated, setting the chamber on a collision course with both the House of Representatives and the Obama administration, which have championed markedly different approaches.

The bill, which is being readied by Senate Banking Committee Chairman Christopher Dodd (D., Conn.), would strip almost all bank-supervision powers from the Federal Reserve and Federal Deposit Insurance Corp., according to people familiar with the matter. In their place, the bill would create a new agency in charge of supervising all banks and bank-holding companies, even the country's largest and most complex institutions. Mr. Dodd's proposal also would create a powerful council of regulators, overseen by an independent White House appointee, charged with monitoring risks to the financial system.Senate aides say the legislative plan could still be adjusted in coming days. In its current form, it has the potential to disrupt progress of the financial-regulation overhaul, one of the legislative priorities of the administration. Administration officials have billed the revamp as central to their effort to prevent a recurrence of last year's financial meltdown. Mr. Dodd's proposal stakes out an extreme position, and is likely to face major resistance, especially from the banking industry. His effort comes as he prepares for a tough re-election battle in 2010. Mr. Dodd has been criticized for being too cozy with the banking industry in the past. This year he has advanced various proposals attacking banking practices, such as a new law limiting certain credit-card fees.

Even if his regulatory-overhaul plan runs aground, it could help Mr. Dodd position himself as a populist lawmaker willing to wage war on powerful financial institutions. Legislation being ushered through the House by Rep. Barney Frank (D., Mass.) differs in many ways from Mr. Dodd's proposal. Mr. Frank's series of bills, which could come to a full vote in the House in December, would eliminate the bank-supervisory powers of just one federal agency, not three. The Fed's role in bank regulation would be expanded, not diminished, with the Fed getting new responsibility for the nation's largest financial institutions. And in Mr. Frank's version, the council of regulators appears much less powerful than in Mr. Dodd's.

A final agreement is still months away. The House and Senate must pass their own bills, and differences between them will have to be reconciled. Mr. Dodd's plan to create a single national bank regulator is likely to draw fire. There are currently four different institutions with that responsibility. The banking industry has resisted such consolidation, worried that a single regulator would tend to favor large, national institutions at the expense of smaller ones. FDIC Chairman Sheila Bair has pushed back against efforts to strip her agency of the power to supervise banks, describing a system of multiple regulators as the best guard against mistakes by any one of them. In October, appearing before Mr. Dodd's panel, Ms. Bair opposed consolidating supervision in one agency.

Under Mr. Dodd's plan, the FDIC would remain an insurer of deposits and the main agency overseeing bank failures. It also would be given the new job of dissolving large financial institutions on the brink of collapse. Fed officials have also strongly resisted proposals to strip their authority, such as their current oversight of 800 banks and 5,000 bank-parent companies. Mr. Dodd's proposal is expected to retain the Fed's ability to serve as a "lender of last resort" to the financial system. The Fed would be allowed to attend bank examinations conducted by the new megaregulator, to keep a "finger on the pulse" of the banking system, one congressional aide said.

Under the proposal, the Fed likely would emerge as a completely different agency, having lost most bank-supervisory powers and the ability to write and enforce consumer-protection rules. Mr. Dodd's bill will likely throw into question the future of the 12 Federal Reserve Banks, which is where most of the Fed's bank examiners are based. Instead, the Fed would focus mostly on monetary policy. Last month, Fed Chairman Ben Bernanke said the central bank's ability to conduct an "effective monetary policy" depended heavily on its role as a bank supervisor.

The Obama administration considered merging bank regulators as it was formulating its own proposals earlier this year, but officials say they nixed the idea as unlikely to get through Congress. An administration official said the White House has been briefed on Mr. Dodd's proposal. "I think we are going to start out with the presumption of as much consolidated regulation as we can," said Sen. Jack Reed (D., R.I.) a senior member of the Senate Banking Committee.

Proponents of consolidating agencies argue such a move would stop banks from shopping around for the regulator with the lightest touch. Mr. Dodd's plan is likely to face opposition within the Senate. Republicans are mostly lined up to oppose the creation of a new regulatory agency that would focus on consumer-oriented financial products.

Property Values Set to Fall 43% From Current Depressed Level

by Michael White

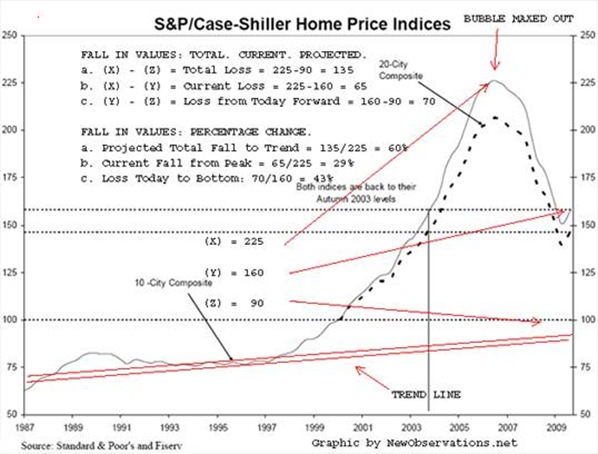

Price Trends / WAR OF THE WORLDS: If you use a 20-year time horizon, and assume prices will return to the trend line, then our residential property bubble will bottom after values fall over 40% from current levels (see above (c) aka "(Y) – (Z)" aka "Loss Today to Bottom"). I make no predictions. I do watch numbers. The chart shows a catastrophe of falling real estate values loaded up on top of our current catastrophe in real estate values.

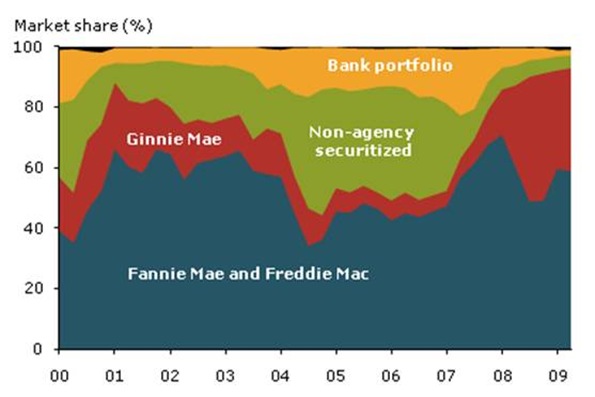

No one would question these numbers absent The War of the Worlds. The War of the Worlds is the United States Government versus aggregate borrower income. Uncle Sam is funding every new mortgage – high, low and in between (see chart below: the blue and red are government-backed loans). It takes very little imagination to see the world of real estate prices vaporizing without government support. If that support was lost, values would crash down faster than a big rock dropped into a shallow puddle.

While the federal government has deep pockets, at some point the persons who take out the mortgages will have to pay them. At that point the market should follow the pattern described above by the trend line. Reality bites. Prices for real estate are ultimately determined by our income, and if the trend represents a match of income and price, then the trend line is the picture of our future.

Almost $300 billion in housing aid (and only $60 billion of it for renters)

The CBO has a new "economic and budget issue brief" out on one of our favorite subjects, federal support for housing. The gist: there's a lot of it. I've written about this stuff before, but this time around one factoid especially caught my attention: The CBO estimated that about $230 billion went to supporting homeownership in 2009, and $60 billion to helping renters.

A little further on, there was this somewhat depressing observation:Federal housing policy has long aimed to increase the rate of homeownership and, to a lesser extent, make rental housing affordable for low-income families. The nation has made more progress on the former goal than on the latter. Homeownership rates increased steadily throughout the 1990s and early 2000s, peaking in 2004 at just under 68 percent of all households ...

However, the proportion of households paying more than 30 percent of their income for housing—an amount that is often categorized as unaffordable in light of households' other needs—increased steadily from 1997 to 2007. The burden of housing's costs is more pronounced among renters than among owners: In 2007, 45 percent of renters (compared with 30 percent of owners) paid more than 30 percent of their income for housing.

So by turning homeownership subsidies into another middle class entitlement, we've actually made housing less affordable for lots of Americans. Brilliant!

First-Time Homebuyers Rising To Dominate Housing Market

First time home buyers have risen from a tiny percentage of the market for homes to making up a significant portion of the market. Even the panic at the end of 2008 barely slowed down the first timers. In the most troubled markets, such as Las Vegas, Nevada, the first time buyers are actually dominating the market. FHA loans are extremely popular with first time home buyers, which is one reason that the market for homes has become so dependent on the FHA.

No Money Down Mortgages Continue

It seems many people are takin advantae of two major prorams at the low end of the housin bubble: the FHA is aggressively promoting lending with only 3.5% down, and the $8k tax credit for buying a house less than $200k. A good realtor can apply the tax credit to last years taxes, making sure that the buyer actually gets the money right away, and the HUD is actually OK with using the $8k to make buying a home a no-money-down proposition. Remember horror stories of sellers who would pay make the slim downpayment, and leave the stupid investors with losses? Well, today that game is over, except for the government, which proves that stupidity in the private sector actually loses people money, causing them to change their ways. For the government, it's just more incentive to double down.

A person who can't afford a down payment should not be in a home. One needs capital to pay for routine maintenance, and most importantly, if something major happens, like if a heater breaks. A renter is someone who does not have the wherewithall to handle these large, unanticipated expenses. It is better for everyone if these people are renters, because otherwise a bad break leaves the property in poor shape, leading to a 'broken windows' problem.

No private bank would lend in such a manner, but FHA wants to take the risk, because unlike the greedy bank, it sees the 'bigger picture', presumably.

The government's program reminds me of the technique children independently discover to make it look like they've eaten up hated peas or carrots: spread them around the plate. Thus, the recent economic debacle is primarily centered on housing, especially lower-end housing financed by overeager lenders. The unavoidable endgame to this problem is fewer houses, and lower prices for those houses; demand was artificially high. But, we wouldn't want people to adjust, because every good Keynesian knows that all misallocations of resources in a complex economy can be solved via top down injections o fiat money, or "G"--they have the multipliers to prove it!

To the government every hangover needs a little more hair of the dog. A friend of mine says his rental real estate business is slow at the top end, because those renters are attracted to the FHA loan/$8k tax credit. Those kind of effects are basically unmeasurable, and what can't be measured is not counted. What about the complex dynamics implicated by the finite nature of the $8k tax credit? Preventing the pain with a temporary subsidy merely prolongs the amount of time spent in the doldrums (eg, 1933-39 was a period of very high unemployment).

Bad governments prioritize the seen over the unseen, the direct over the indirect. The sad fact is popular policies usually have highly concentrated benefits and highly distributed costs, and the politicians act like little children, hoping those watching do not notice stuff that's spread around.

Housing Needs To Keep Falling

More ammo for the housing bears here: Despite the dips in both the Case-Shiller and FHFA Home Price Indices, houses still aren't affordable based on historical price/income ratios. Historically, both indices have generally tracked Mean Household Income, but as this chart in a new report from St. Louis Fed (.pdf) indicates, as of the middle of this year, there's still no convergence. And based on the upswing in Case-Shiller numbers over the summer, that's still the case. Remove all of the extraordinary government support from the market, and it's easy to see prices dipping below the lines before they stabilize.

How Bloomberg Fabricates U.S. Housing Numbers

Being one of the most vigilant observers of the U.S. housing market – as well as one of the most vociferous critics of fraudulent “statistics”, there was little chance that Bloomberg's attempt to “rewrite history” would slip past me.Here is what Bloomberg wrote on February 3rd of this year:

A record 19 million U.S. homes stood empty at the end of 2008...

Here is the new version of “history” which Bloomberg spewed out Thursday:

About 18.8 million homes stood empty in the U.S. during the third quarter...The record-high was in the first quarter [of 2009] when 18.95 million homes were vacant.

Unless the U.S. propaganda-machine has also re-written the rules of arithmetic, then the 19 million empty homes which Bloomberg reported for last year (in February) is a larger number than the 18.95 million which Bloomberg claimed was a record this year.

Admittedly, as far as statistical lies go, this particular example is hardly earth-shattering. However, what is important is it clearly established the fact that U.S. propagandists are simply inventing numbers when they report “statistics”.

The really important departure from reality is how Bloomberg (and the rest of the U.S. propaganda-machine) have simply ignored the millions of already-foreclosed properties which U.S. banks are hiding from the market.

As I demonstrated in “Fantasy Housing Numbers a Prelude for NEXT U.S. Housing Crash”, U.S. banks are on track to record close to 5 million foreclosures and repossessions – just in the current year. However, they are only on pace to sell about 1.5 “distressed properties” (which also include “short sales”). This simple arithmetic means that U.S. banks are adding at least 3.5 million empty homes to the millions of foreclosed properties they were already holding off the market prior to this year.

Obviously, if there were 19 million empty homes at the end of 2008, and at least 3.5 million more empty homes this year (just counting only those being held by U.S. banks), then the real total of U.S. empty homes today would be at least 22 million. Clearly, Bloomberg's claim of 18.8 million empty homes in the U.S. in the 3rd quarter of this year has absolutely no connection to the “real world”.

Presumably a major news organization like Bloomberg is able to keep track of its own prior published articles, which strongly suggests the deliberate attempt to deceive. Interestingly, Bloomberg's previous report on U.S. empty homes provides some data which strongly supports my assertion that U.S. banks have been accumulating vast quantities of foreclosed properties.

Bloomberg noted in February that at the end of the 3rd quarter of 2008 U.S. banks were holding $11.5 billion worth of foreclosed properties (in nominal value) – more than double what they held a year earlier. This doubling of the banks' inventories of foreclosed properties occurred during a year when there were 'only' 2.2 million foreclosures.

This year, U.S. banks are on pace to nearly double the total number of foreclosures from 2008 – yet all the reports from U.S. propaganda outlets indicate declining inventories of unsold homes, month after month.

This farce also extends to the new home market – except the fabrications are even more extreme. U.S. home-builders have been building roughly 50% more homes than they are selling, for every month for the last two years. This is why the U.S. propagandists never report “new home sales” and “new home starts” in the same article. Despite this horrendous discrepancy, and a long-term trend which can only end with mass-bankruptcies among home-builders, “inventories” of new homes have been reported as declining every month.

This sham just hit a new level of absurdity this week. When “new home sales” were reported this week, there was a “surprising” decline in the latest reading – and the previous month's number was revised lower. Yet in the same piece of propaganda it was reported that the inventory of new homes still supposedly declined in the last month.

Putting aside the huge, existing gap between new home starts and sales, one would think that the compulsive liars of the U.S. propaganda-machine would not have the audacity to report increasing “starts” of new homes, decreasing sales – and still claim that inventories were falling. Clearly this is nothing less than a "slap in the face" for market sheep - who are presumed to be so brain-dead that the propagandists can write 100% contradictory "facts" in the same article, and expect no one to notice.

Returning to the millions of foreclosed properties which U.S. banks are holding off the market, obviously part of the reason for this was to try to halt the collapse in housing prices. If U.S. banks had dumped an additional 5+ million homes onto the market (equal to a full year of demand by itself) then instead of the collapse in U.S. housing prices easing, it would still be accelerating.

However, as I pointed out in “Who OWNS Foreclosed U.S. Properties, Part II: the role of MERS”, there is a second reason for U.S. banks to hide all these millions of foreclosed properties: credit default swaps. This $50+ trillion market represents the phony “insurance” on the entire Wall Street Ponzi-scheme – which was the key to (so-called) “regulators” allowing the U.S. financial crime syndicate to leverage the entire financial sector by an utterly insane average of 30:1.

Now, with the U.S. housing market collapsing, these credit default swaps are being triggered. Selling these foreclosed properties locks-in the banks' losses – causing these massive obligations to come due. As I illustrated in “Bankster Sues Bankster – AGAIN”, in one example of a credit default swap, Citigroup (C) is suing Morgan Stanley (MS) to collect on this contract.

Even after the “collateral” which “backed” this insurance was liquidated, Morgan Stanley is still facing a pay-out of more than 300:1 based on the premiums it received for this insurance. While not every CDS will require 300:1 pay-outs, there is no reason that some of these payments could not exceed 300:1 – given the gross negligence of regulators in not requiring adequate collateral for this $50+ trillion “insurance market”.

If you take the billions in losses which U.S. banks are racking-up on foreclosed U.S. properties, and then start making 300:1 pay-outs on those losses, it doesn't take long for the entire U.S. financial system to appear hopelessly insolvent – even with the new, fraudulent accounting rules enacted in the U.S. in April.

For the benefit of new readers, I will repeat my warning: it is perilous to accept any U.S. government-reported statistics at “face value”. The absurd reading on 3rd-quarter GDP is a prime example.

The U.S. economy is supposedly now growing at a robust 3.5% annual rate. Wall Street is reporting “record profits” (and paying record bonuses). Yet the state of New York is desperately trying to close a $3 BILLION budget-gap – which has materialized over the same quarter where both Wall Street and the broader U.S. economy are supposedly thriving. Apparently Wall Street's fantasy "profits" are producing only fantasy tax revenues for the state of New York.

This entire Ponzi-scheme economy continues plunging toward collapse – and formal default on its massive, unpayable debts. Total public and private debt in the U.S. is now approximately $60 trillion, and this completely excludes the roughly $70 trillion in additional “unfunded liabilities” (for the federal government, alone). However, don't expect to hear the truth about this from the U.S. propaganda-machine.

U.S. junk bond default rate rises to 11.3% - S&P

The U.S. junk bond default rate rose to 11.3 percent in October from 10.8 percent in September as corporate America's credit quality worsened despite positive economic news, Standard & Poor's said on Tuesday. Eleven bond issuers defaulted in October, bringing the year-to-date total to 175, S&P said in a statement.

A global credit crisis and the worst recession since the 1930s have already triggered six of the 10 largest bankruptcies on record, including the failures of General Motors in June and CIT Group on Sunday. Numerous government lifelines, including near-zero interest rates, are beginning to relieve default pressures as the economy revives, however. S&P last month slashed its forecast for the default rate, saying a thawing of the bond markets after last year's credit crisis is helping more companies survive.

The agency expects defaults to fall to 6.9 percent by September 2010, compared with an earlier forecast of a rise to 13.9 percent by August 2010. A 6.9 percent rate would still be above the long-term average rate of 4.3 percent between 1981 and 2008, however. S&P's previous peak junk bond default rate was 12.7 percent in July 1991, based on records dating back to 1981.

October private-sector job losses slip, but still hit 203,000

Just call it a month in which the private-sector job market treaded water: It lost 203,000 jobs in October, following a revised 227,000 reduction in September, according to data compiled in the ADP National Employment Report. September's original loss estimate was 254,000. Economists surveyed by Bloomberg News had expected private employers to cut 200,000 jobs in October. Separately, job-placement firm Challenger, Gray & Christmas said job cut announcements by U.S. employers fell to 55,679 in October, 16 percent lower than in September, CNMoney.com reported Wednesday.

ADP noted that the 203,000 private payroll cutback was the seventh straight monthly decline. Nevertheless, ADP added, "despite recent indications that overall economic activity is stabilizing, employment, which usually trails overall economic activity, is likely to decline for at least a few more months."

The job loss totals in October by business size were: 53,000 (large), 75,000 (medium), and 75,000 (small). Further, the services sector -- formerly a U.S. strength during the recent economic expansion -- lost 65,000 jobs in October. The goods-producing sector slashed 117,000 jobs and manufacturing shed 65,000 positions. The construction sector eliminated 51,000 jobs, its 33rd consecutive monthly decline, and brought total construction jobs lost since the January 2007 peak to 1.7 million.

Investors should monitor monthly job reports because job creation is positively correlated with corporate revenue and earning gains. And as corporate earnings go, so goes the U.S. stock market.

Job creation also is the key to consumption, which contributes greatly to U.S. GDP. However, given a decade of overconsumption and stagnant incomes in many job classifications, few economists expect spending patterns to return to the home equity/refinance-distorted, cash-flush years of the housing bubble. Nevertheless, many economists do expect both consumer spending and business investment to trend slightly higher in the quarters ahead.

Economic Analysis: Basically, the ADP October report on private-sector employment came in about as expected. Still, the optimist would see the continuing downtrend in job layoffs, which ADP noted. One of the ironies of the U.S. economy is that as it becomes more productive per employee, it takes fewer and fewer employees to perform the same tasks. This has the effect of reducing job gains and lengthening the recovery time to full employment. And that makes the task of policymakers and executives more difficult.

Even so, they must remain focused on job creation: The U.S. economy needs to create 150,000 to 200,000 jobs every month to lower unemployment. Also, investors should keep in mind that the more-telling job statistic, containing both private- and public-sector job data, is the U.S. Labor Department's monthly nonfarm payroll report, and the October data will be released Friday, Nov. 6 at 8:30 a.m. EST. It's expected to show a 175,000-job decline in October after a 263,000 loss in September, according to a Bloomberg News survey of economists.

Ambac Swings To Black On Derivatives; Shares Surge

Ambac Financial Group Inc. swung to a third-quarter profit thanks to large mark-to-market gains on credit derivatives, which had cost the bond insurer billions in losses a year earlier. Shares surged 27% premarket to $1.41. The stock, which has tripled from an all-time low in March, remained down 15% for the year through Tuesday. A foray into insuring mortgage-backed securities, which soured along with the housing market and home loans, combined with weak consumer sentiment and economic contraction sent the bond-insurance industry into a tailspin.

But the housing market has shown signs of stabilization and Ambac has been terminating some contracts with counterparties to reduce risk exposure. Ambac, the nation's No. 2 bond insurer behind MBIA Inc. (MBIA), posted a profit of $2.19 billion, or $7.58 a share, compared to a year-earlier loss of $2.43 billion, or $8.45 a share. The latest results included $2.13 billion of mark-to-market gains on credit derivatives and $303 million in gains from reinsurance cancellations. The prior year had $2.71 billion in derivative losses.

Revenue was $2.69 billion, compared to year-earlier negative revenue of $2.32 billion. Both results are skewed by the derivative impacts. Meanwhile, earned net premiums fell 16% and net investment income rose 6.5%. Loss and loss expenses fell 24% while claims paid surged 73% amid the continued credit-rating downgrades on residential mortgage-backed securities. The company's loss and loss-expense reserve nearly doubled to $4.52 billion.

Roubini on the dollar carry trade

October Personal Bankruptcies Filings Up 25%, Highest Since 2005 Law Changes

More Americans filed bankruptcy in October than in any month since changes to U.S. bankruptcy laws in 2005 as unemployment and falling home prices prevented consumers from paying their debts. The number of individuals filing bankruptcy rose 25 percent to about 131,200 from a year earlier, according to data compiled from court records by Oklahoma City-based Jupiter ESources LLC. The 1.2 million bankruptcies filed through October have already surpassed last year’s total of 1.1 million.

Businesses also continued to struggle to pay creditors; corporate bankruptcies climbed about 30 percent from October 2008, according to Jupiter. Chapter 11 bankruptcies, where a company attempts to reorganize rather than liquidate, rose the most in four months to 1,327 in October, according to Jupiter.

"Despite the recovery, several sectors remain in crisis," Kurt M. Carlson, a bankruptcy lawyer at Chicago-based Much Shelist Denenberg Ament & Rubenstein P.C., said in an e-mail. "The real estate markets haven’t improved. Vacancy rates continue to climb. Those in manufacturing are cutting costs." The American Bankruptcy Institute estimates personal filings will reach 1.4 million by the end of the year. That would still be less the record 2.1 million bankruptcies in 2005, when 630,000 Americans filed in the two weeks before bankruptcy law revisions made it more difficult discharge debt.

Small-Business Bankruptcy Filings Up 44% Year-over-year

Commercial bankruptcies among the nation's more than 25 million small businesses increased by 44% from the third quarter of 2008 to the third quarter of 2009, according to Equifax Inc., which analyzes its comprehensive small business database for the on-going study. Comparing the month of September 2008 to September 2009 shows an increase of 27 percent. There were 9361 bankruptcy filings in September 2009 throughout the U.S., up from 7386 a year ago, according to the data.

California remains the most negatively affected state with eight MSA's (metropolitan statistical areas) among the 15 areas with the most commercial bankruptcy filings during September 2009. Los Angeles, Riverside/San Bernardino and Sacramento metropolitan areas continued to lead the nation in small-business bankruptcy filings as they did at the end of the second quarter. The other MSA's with the most bankruptcy filings during the month include:

--Denver-Aurora, CO --Santa Ana-Anaheim-Irvine, CA --San Diego-Carlsbad CA --Dallas-Plano-Irving, TX --Portland-Vancouver-Beaverton, OR-WA --California (excluding MSA's within the state) --Oakland-Fremont-Hayward, CA --Oregon (excluding MSA's within the state) --Chicago-Naperville-Joliet, IL --Houston-Sugar Land-Baytown, TX --San Jose-Sunnyvale-Santa Clara CA --Atlanta-Sandy Springs-Marietta, GA"Economic pain is continuing for small businesses across the country. We're still seeing hefty increases in the number of bankruptcies in a lot of major metro areas." said Dr. Reza Barazesh head of North American research for Equifax's Commercial Information Solutions division.

"However, the 69 percent drop and 49 percent decline in bankruptcies in Charlotte and New York-White Plains respectively, and a 44 percent drop in Atlanta between the second and third quarters indicates that the East Coast may be experiencing an earlier recovery from the recession than the West Coast." Charlotte - number four in June - dropped out of the top 15 entirely to 39th; Atlanta dropped from fifth to 15th; and New York - White Plains dropped from eighth to 24th.

Equally consistent with this east/west difference over the same period, the 11th, 12th and 13th MSAs with the greatest number of bankruptcies at the end of the second quarter of 2009 -- Santa Ana-Anaheim, Denver and San Diego -- increased in rank to 5th, 4th, and 6th by the end of the third quarter. Santa Ana-Anaheim increased three percent, Denver was up 13 percent and San Diego increased four percent.

For its research, Equifax reviewed and analyzed small business data for the month of September, the most recent month for which complete data is available, and compared it with results from September 2008. Equifax defines a small business as a commercial entity of less than 100 employees.

A fruitless clash of economic opposites

by Edmund Phelps

In the theory wars, which are as much wars over policy choices, two very bad kinds of theories are driving out good theories. Keynesian economics, which had been nearly forgotten inside the macro field, has found new voices from outside. They take the position that fiscal "stimulus" of all kinds is effective against slumps of all causes. Their strategy is to defeat their only popular rivals, the neoclassicals, by deriding their view that the employment downturn involves a contraction of the labour supply.

Neoclassical equilibrium theory, which some macroeconomists had grown sceptical of, has also found new practitioners. They take the position that, aside from bad policy moves, recessions, even "great" ones, are caused by random market events and corrected by market adjustments. Demand stimulus is of no use, since there is no systematic shortage of demand. These spokesmen show little knowledge of the several theoretical perspectives in macroeconomics over the past 100 years. The "Keynesians" seem not to have studied Keynes and the neoclassicals misread or do not read Hayek. No wonder fallacies abound.

The fallacy of the "Keynesians" is their premise that all slumps, all of the time, are entirely the result of "co-ordination problems" – mis-expectations causing a deficiency of demand. Having modelled the effects of expectations decades ago, I know they have consequences. I agree that companies appeared to underestimate the cutbacks and price cuts of competitors on the way down. That excessive optimism signalled deficient demand for goods and labour. So any stimulus then may have had a Keynesian effect. By now, though, such optimism has surely been wrung out of the system. To pump up consumer or government demand would force interest rates up and asset prices down, possibly by enough to destroy more jobs than are created.

The fallacy of the neoclassicals is their tenet that total employment, though hit by shocks, can be said always to be heading back to some normal level. In this view, employment is impervious to shifts in any particular demand. If told that consumers are broke, they say that markets will respond by lowering interest rates until investment has filled the gap. If told that business investment looks weak and will not be getting the help of another housing boom, they say that a real exchange rate depreciation will fill the gap with an increase of net exports. They do not understand that interest rates cannot fall much in an open economy and that a weaker currency has contractionary effects on output supply that could spoil the expansion coming from the effects on export and import demands.

These fallacies lull analysts into the false sense that, one way or another, a full recovery lies ahead – thanks to government spending or to self-correcting market forces. As I see it, the poor state of balance sheets in households, banks and many companies augurs a "structural slump" of long duration. Employment will recover, quickly or slowly, only as far as investment demand will carry it. It is highly uncertain whether government spending on infrastructure would help, after taking into account the employment effects of the higher tax rates to pay for it.

The most profound fallacy is the newfangled idea that misalignment of incentives in banks caused the housing bubble – a bubble that, when it burst, shook the economy to its foundations. All can agree that increased lending and building ran into the awkward fact that costs increase when production is stepped up. On that account, prices sought a higher level. But that analysis does not capture the steep four-year climb in housing prices, which rose by more than 60 per cent.

To account for so large an increase, we have to recognise that expectations played a role. Speculators appear to have expected that housing prices would go sky-high, so prices took off and then went on climbing in anticipation that those high prices were getting closer. The banks, seeing the houses offered as collateral were worth more and more, responded by supplying an increasing flow of mortgage loans.

From this viewpoint, speculation drove the crisis. Misaligned incentives were not sufficient to do it – and not necessary either. Bubbles long predate bonuses. The crisis could have happened with a 1950s financial sector. The lesson the crisis teaches, though it is not yet grasped, is that there is no magic in the market: the expectations underlying asset prices cannot be "rational" relative to some known and agreed model since there is no such model.

The gravest error of the phony debate between two non-starters is that their superficial and mechanical character – the clockwork of the neoclassical system and the hydraulics of the Keynesian one – operate to distract policymakers from asking basic questions about the dynamism of the US and UK economies. Economics has paid a terrible price for its dalliances with the Keynesian and neoclassical theories. Now policymakers are being misled by the siren call of these same, hopelessly inadequate views.

The writer, winner of the 2006 Nobel prize in economics, is director of the Center on Capitalism and Society at Columbia University

No Slave To Fashion

It's the lack of monetary enforcement that will likely save Europe from overspending. European Central Bank President Jean-Claude Trichet has proven throughout this financial crisis that he is his own man when it comes to navigating the euro-land banking system through the deflation and debt deleveraging storm. He has proven to be an excellent communicator, consensus builder, and a maverick among the world’s central bankers. To his credit, and much to the benefit of the 16-nation euro region, his policy positions of eschewing massive fiscal stimulus and rejecting excessive quantitative easing (QE) have proven that Trichet is no slave to fashion.

Many have pointed out that among the world’s prominent central bankers, he saw the looming financial meltdown and voiced his concerns while many others touted the new and wonderful world of financial engineering. Trichet was most concerned by the complexity and opaqueness of debt products that were beginning to dominate finance. On October 12, 2005, the Federal Reserve Chairman Alan Greenspan gave a speech to the National Italian American Foundation, and the following quotes reveal the en vogue thinking of the day: "The new instruments of risk dispersal have enabled the largest and most sophisticated banks, in their credit-granting role, to divest themselves of much credit risk by passing it to institutions with far less leverage…These increasingly complex financial instruments have contributed to the development of a far more flexible, efficient, and hence resilient financial system than the one that existed just a quarter-century ago."

The following month, in Basel, Switzerland, Trichet was quoted, "Perhaps there is an underestimation of risks by financial markets at the present juncture." Clearly, Trichet was unwilling to follow the siren call of the newly-engineered ‘Money for Nothing’ that clogged the balance sheets of banks, hedge funds and insurance companies on both sides of the Atlantic. As the financial meltdown began in 2007 and the Fed fell over itself in a rush to slash interest rates, Trichet and the ECB bucked the easy monetary policy trend and held rates firm through July 2008. In the U.S soon came TARP, TALF, an alphabet soup of bailouts, special lending facilities and asset purchases, and then a massive fiscal stimulus package. By the summer of 2009 the Fed had committed more than 12% of U.S. GDP to asset purchases under the guise of QE - all a desperate attempt to keep banks liquid and asset values artificially high. The UK soon followed, also committing more than 12% of annual GDP to its own QE program. Jean-Claude Trichet, on the other hand, was unwilling to provide funds for even 1% of aggregate GDP for the covered bond purchase program.

The European Union contains 27 member states, only 16 of which belong to the euro area, and the ECB cannot force any member state to undertake fiscal policy. They also have disparate needs: Spain, Greece, Iceland and much of the eastern bloc need capital infusions, while Germany, France and the UK think that such burdens are unfairly weighted. Hence, we see the International Monetary Fund playing the role of the ECB where direct cash infusion is required. In the end, it is the lack of monetary enforcement that will likely save Europe from overspending and committing hundreds of billions of euros in a vain attempt to prop up deflating asset values.

In the U.S., it would take a generation of above-average growth (combined with confiscatory taxation) to eliminate the projected deficits, given the recent actions of our central bankers and legislators. Japan tried stimulus in the nineties (to no avail), and the U.S. and the UK are playing the same game now. Jean-Claude Trichet, ever cautious, was recently quoted, "What is very important for a central bank is not to succumb to fashion… What we try to do is to take decisions, including when needed, bold decision that are designed…to preserve…monetary stability. We think we have reasonably struck the balance between those two considerations." (Bloomberg) Given Europe's lack of debt overload, I would agree. Trichet is no slave to fashion.

Technical Analyst: The World Is About To End

Since expressing ridicule skepticism about technical analysis a few months ago, we have been politely badgered by reader John Brims, who has been sending us charts and murmuring about wedges.We will confess that we have not been listening too carefully, because, well, because we think technical analysis is a bunch of bullsh**.

But John has been persistent, so we'll give him his chance to shine.

John says the chart below indicates that the world is about end. So hang on to your hat!

Henry, I am going to give up on you. As a non believer you are missing out. These 5 wedges have clearly shown the end of each rally and on each occasion have signaled further heavy falls. The fifth wedge which I have sent you several times has just broken to the downside and indicates extremely heavy falls are now in the pipeline.

(Let us at least go on record as saying that we're generally bearish, too, for reasons having nothing to do with wedges.)

Fears of a New Bubble as Cash Pours In

Concerns are mounting that efforts by governments and central banks to stoke a recovery will create a nasty side effect: asset bubbles in real-estate, stock and currency markets, especially in Asia. The World Bank warned Tuesday that the sudden reappearance of billions of dollars in investment capital in East Asia is "raising concerns about asset price bubbles" in equity markets across Asia and in real estate in China, Hong Kong, Singapore and Vietnam. Also Tuesday, the International Monetary Fund cited "a risk" that surging Hong Kong asset prices are being driven by a flood of capital "divorced from fundamental forces of supply and demand."

Behind the trend are measures such as cutting interest rates and pumping money into the financial system, which have left parts of the world awash in cash and at risk of bubbles, or run-ups in asset prices beyond what economic fundamentals suggest are reasonable. Prices are surging across a host of markets. Gold, up about 44% this year, soared to a record high Tuesday. Copper is up about 50% in the past year. In the U.S., risky assets are rising rapidly in price: The risk spreads, or interest-rate premiums, on low-rated junk bonds have narrowed to about where they were in February 2008, before Bear Stearns and Lehman Brothers fell, according to Barclays Capital.

Policy makers from Beijing to London, seared by the fallout from burst housing and credit bubbles, are searching for ways to head off new ones. How to handle a bubble "is one of the big two or three unanswered questions at the end of this crisis," says Adair Turner, chairman of the U.K.'s Financial Services Authority. Bank of Korea Governor Lee Seong-tae hinted last month he would raise interest rates, if necessary, to prevent Seoul's housing market from lurching out of control.

"This is the beginning of another big and excessive run-up in asset prices," said Simon Johnson, a former IMF chief economist. The symptoms of a frenzy are most evident in Asia and the Pacific, where economies are recovering most quickly. In Hong Kong, high-end real-estate prices are soaring. A luxury flat in the tony Midlevels district is expected to sell for US$55.6 million, or $9,200 a square foot, said developer Henderson Land Development Co. Elsewhere, a bidder at a city-run auction to operate food stands at February's Lunar New Year celebration recently paid a record US$63,225 for the right to occupy a 400-square-foot stall to sell fish balls and other snacks. Prices in the auction of 180 stalls were up 33% from 2008.

Over the summer, a Singapore condominium developer raised prices 5% the day before units went on sale. After dozens of would-be buyers lined up on a steamy night, the developer -- a joint venture of Hong Leong Group and Japan's Mitsui Fudosan -- held a lottery for a chance to bid on the units. Singapore home prices rose 15.8% in the third quarter, the fastest rate in 28 years. Australian real-estate markets also have heated up. After a Melbourne property-research firm recently predicted that average home prices will double over the next 12 years, a news report in Australia's Herald Sun said: "The staggering prediction shows the importance of buying a home as soon as you can afford it because the longer buyers delay, the more chance there is that their dream will slip out of their reach."

The Australian dollar has jumped about 35% over the past 12 months as investors borrow in U.S. dollars to purchase Australian currency. The practice is propelling stock and bond markets faster than in the U.S. and Europe. Currency traders are betting that the Australian central bank, which raised interest rates by 0.25% on Tuesday, the second rise in two months, will continue tightening. Asian stock prices are shooting up, in part due to low interest rates in the U.S. Investors looking for higher yields are borrowing in U.S. dollars and then pouring that money "into countries that are growing more rapidly," said Stephen Cecchetti, chief economist at the Bank for International Settlements, the central banks' central bank, which warned early of the last asset bubble and is beginning to do so again. "That runs the risk of creating property and equity booms in those countries."

About $53 billion has gone into emerging-market stock funds this year, according to data collector EPFR Global. Through Monday's trading, the broad MSCI Barra Emerging Markets Index this year was up 60.7%. Brazil was up 100%, and Indonesia had gains of 102.7%. Over the same period, the Dow Jones Industrial Average was up 11.5%. Discerning a bubble is as difficult as preventing one. Rapidly rising prices aren't definitive proof. Stocks in Asian emerging markets currently trade at about two times book value, about average for the past 20 years, according to UBS. From 2004 to 2008, the price-to-book-value average was about three times. "This doesn't feel like a bubble," said Hugh Simon, chief executive of Hamon Investment Group, which manages Asia-investment funds. "There's too much skepticism" among investors.

To battle bubbles, policy makers are turning first to regulation. Singapore's authorities tightened mortgage requirements, ended real-estate stimulus policies and pledged to make more land available for development. South Korea regulators tightened real-estate lending requirements in seven districts around Seoul where prices have jumped. "Even those who say we should respond directly [and deflate bubbles] have no idea how to do it," said Laurence Meyer, a former Fed governor. "It is easy to take a philosophical position, but hard to become operational and practical about it."

Forget Inflation, Deflation Is a Bigger Danger

by Mortimer Zuckerman

Is this the time to worry about inflation? We are, after all, awash in money with stagnant output.

In the past year, the Federal Reserve has increased our monetary base by about 120 percent, more than double the previous highest annual increase over the past 50 years. The Fed has made huge loans to private lenders and bought over $1 trillion of mortgage securities and hundreds of billions of dollars of long-term treasury bonds. It has succeeded in lowering the federal funds rate below 1 percent—even, for most of the time, to less than half that. The goal, of course, is to force-feed money into the economy in the hope of sparking a recovery.

The mountain of reserves on bank balance sheets, which so scares the inflationary hawks, would normally encourage banks to lend and increase their profits. But while the Fed has been pumping money through the banks, little of it has entered the economic mainstream. Instead of boosting lending, the banks have just increased their reserves at the Fed by hundreds of billions of dollars.

The government may be borrowing more, but consumers and businesses are borrowing less. If anything, they are paying down their debts. Households will reduce their total debts by $200 billion this year, Forbes magazine projects, and banks and businesses by $2.3 trillion. Small-business lending will contract by at least $113 billion. Since the credit crisis began more than two years ago, credit available to consumers and the small-business sector—which employs half of the country's workforce—has contracted by trillions of dollars, mostly because of curtailment of credit card lines. The hope that new bank reserves would be available to prop up the faltering economy has not been fulfilled.