View from Brooklyn, from left to right: Brooklyn Bridge, Manhattan Bridge (under construction) and Williamsburg Bridge

Ilargi: US Senator Ted Kaufman, a long-term confidante of Vice-President Joe Biden (whose seat he took), held a speech on the floor today that former IMF economist Simon Johnson calls: "The Speech For Which We Have Been Waiting". Uh, well, speak for yourself, Simon. I'm waiting for a completely different sort of speech, without holding out much hope, incidentally, that I’ll ever actually get to hear it.

Kaufman's speech concerns the financial crisis and the response he thinks the government needs to come up with, in particular when it comes to (de)regulation. Kaufman says: "Given that deregulation caused the crisis, why don’t we go back to the statutory and regulatory frameworks of the past that were proven successes in ensuring financial stability?"

But is that true? Did deregulation really cause the crisis? I don't believe it did, I think deregulation is just a consequence of what lies beneath and beyond. It’s no secret for anyone with a working brain that banks need to be cut down at the ankles; what remains hidden is the part Capitol Hill itself has played in the act of financial and societal decomposition.

To figure out what caused the crisis, you have to look at what caused the deregulation. And that quest leads you straight to the same people, or class of people, who are now supposed to re-regulate the financial system. The foxes rule the henhouse. It should be plain and obvious that as long as people like Geithner, Rubin and Summers are the White House's mightiest men on finance, the only things that will ever change will be those that benefit the major financial institutions, not the ones that might curtail them.

And it’s not just these three Stooges, it's also 90% of the people elected to the Hill. The politicians involved may point at the banks, but that’s the pot blaming the kettle. And if anything is to change, both sides will have to be cleansed, not just one of them. Moreover, neither will be cleansed if one gets to call the shots on the other. Today's House members will never truly clean up the mess. They know all too well who their daddies are. The banks may be financially bankrupt, Washington is morally bankrupt.

When it comes to naming causes of the crisis, Kaufman gives a leading role to the repeal of Glass-Steagall through 1999's Gramm-Leach-Bliley Act. But America's financial crisis was not caused by financial events. It was caused by political actions, not by the repeal of Glass-Steagall or the steady erosion of the act in the decade prior to the repeal.

The crisis is the result of the increasing power wielded inside the American government by American and foreign industries, by corporations with pockets deep enough to buy people like, to name an example, Senator Ted Kaufman. This takeover of the state by the banking industry facilitated the Glass-Steagall repeal, but the repeal was not the starting point.

The Gramm-Leach-Bliley Act was merely a natural and inevitable consequence of the increase in the power of money, of the move away from democracy and towards corporatism, a process that bears an uncanny resemblance to the ideas once propagated by Benito Mussolini. It’s hard to gauge when exactly the process started; it’s like a long downward sliding scale more than anything else. You could start in 1913, with the Federal Reserve Act, or even before that. The one constant, whichever point in time you would take, is that the power of money over society has been increasing all along.

And that's not going to stop when a senator holds a speech proposing regulation of the very institutions that pony up the money that keeps the vast majority of his peers, if not himself, in the plush seats they are nestled in. Simon Johnson would have you believe a speech could do just that, or at least start a process that might lead to a healthy set of regulatory laws and tools. That a true reform of the present financial system could be formulated and legislated by the present political system. Johnson might as well be talking about a good deal on a bridge in Brooklyn.

The Speech For Which We Have Been Waiting

by Simon Johnson

For nearly two years now we have waited for a speech. We need a simple speech and a direct speech - most of all a political speech - about what exactly happened to our financial system, and therefore to our economy, and what we must do to make sure it can never happen again. President George W. Bush apparently did not consider giving such a speech, and Secretary Paulson could never talk in this way. President Obama seemed, at some moments, close to making things clear - when he talked on Wall Street in September and, most notably, when he launched the Volcker Rules in January. But President Obama has always come up short on the prescriptive part - i.e., what we need to do - and his implementation people still move as if there were lead weights in their shoes.

Without a definitive speech, there is no political reference point, there is no convergence in the debate, and there is not even any clarity regarding what we should be arguing about. Without the right kind of speech, there are just many lobbyists working the corridors and a lot of backroom deals that most people do not understand - by design. Thursday, hopefully, we should finally get the speech. Not - sadly - from the White House, not from anyone in the executive branch, and not even from within the Senate Banking Committee (although Senators Merkley and Levin took a big step today), but rather on the floor of the Senate.

On Thursday, Senator Ted Kaufman (D., DE) is due to deliver a strong blow to the overly powerful and unproductively mighty within our financial sector. He will say, according to what is now on his website,

- Excessive deregulation allowed big finance to get out of control from the 1980s - but particularly during and after the 1990s. This led directly to the economic catastrophe in 2007-08.

- We need to modernize and apply the same general principles that were behind the Glass-Steagall, i.e., separating "boring" but essential commercial banking (running payments, offering deposits-with-insurance, etc) from "risky" other forms of financial activity

- We need size caps on the biggest banks in our financial system, preferably as a percent of GDP.

- We should tighten capital requirements substantially.

- And we must regulate derivatives more tightly - on this issue, he likes at least some of the steps being pushed by Gary Gensler at the CFTC.

To be sure, a speech is not legislation. And, as yet, this is just one senator's point of view. But because the administration so completely lost the narrative regarding what happened and why, there is now a free, open, and fair competition to explain what we need to do. The lobbyists will still prevail on this round. But a big debate around the nature of our financial system is exactly what we need. People who want to defend finance as-is now need come out of the woodwork. Senator Kaufman has set a very high standard. If you wish to oppose this agenda, speak clearly and in public about why we should not pursue exactly what the senator proposes.

If opponents of reform do not come out and argue the merits of their case, people will reasonably and increasingly infer that Senator Kaufman and his allies are right on all the substance. Reform is blocked by a perverse combination of bankrupt ideology and deep-pocketed corporate interests. The only way to break through is to bring a lot of sunshine into the true affairs of finance - including by speeches like the one we will hear Thursday.

Dodd to Offer Financial Regulation Bill Without G.O.P.

The chairman of the Senate Banking Committee, hoping to break a months-long logjam on the biggest overhaul of financial regulations since the Depression, will unveil his own proposal on Monday, without yet having a single Republican endorsement. The chairman, Christopher J. Dodd, Democrat of Connecticut, said on Thursday that the committee would take up the bill on March 22. The breakdown in bipartisan talks dimmed hopes for a sweeping rewrite of Wall Street’s rules, nearly two years after the collapse of the investment bank Bear Stearns started a financial crisis that has cost taxpayers hundreds of billions of dollars.

Mr. Dodd suggested that he was acting out of a sense of urgency. The House adopted a regulatory overhaul — a priority of the Obama administration — in December on a largely party-line vote. But bipartisan negotiations in the Senate have repeatedly faltered over several critical points, notably the creation of a consumer financial protection agency to regulate mortgages, credit cards and other products. In an unusual turn, Senator Richard C. Shelby of Alabama, the ranking Republican on the Banking Committee, has found himself largely shut out of the negotiations, while another Republican, Senator Bob Corker of Tennessee, has been directly negotiating with Mr. Dodd.

At a news conference later Thursday morning, Mr. Corker called Mr. Dodd’s plan to proceed with a bill without further negotiations “very disappointing.” “I understand the pressure that he is under,” Mr. Corker said. “I have enjoyed immensely working with Chairman Dodd and his team. I think his staff has negotiated with us in absolute good faith.” Mr. Corker added: “We may have disagreed on policy, but this will be the first disagreeable thing I’ve said to Chairman Dodd: this is a very important bill, and I cannot imagine a committee member, Republican or Democrat, passing a bill with this type of substance in it out of a committee in a week. I think that would be a travesty.”

Mr. Dodd’s decision to proceed, Mr. Corker said, is in part because regulatory legislation has been overshadowed by the health care overhaul. “The fact of the matter is, I think he is a victim, he is a victim of health care policy,” he said. But Mr. Dodd said later that time, and not health care was the issue. “Clearly we need to move along,” Mr. Dodd said, speaking after Mr. Corker’s news conference. “What I’m facing mostly is what I call the 101st senator, and that is called the clock, and particularly, in an election year, that clock becomes a rather demanding member.” “As time moves on, you just limit the possibility of getting something done, particularly a bill of this magnitude and this complexity,” Mr. Dodd added.

While the two parties have agreed to create some form of a consumer financial protection agency, they have not agreed on where to house it, or, more importantly, how much authority it should have to write and enforce rules curbing abusive, unfair and deceptive practices. “There has not been an issue yet, not one, not one impediment, that we have not been able to overcome. Not a single one. The fact is, on the issue that all of you have focused on the most, the consumer, we were there,” Mr. Corker said.

The banking industry has lobbied fiercely against the proposal, arguing that new consumer regulators would inevitably interfere with existing regulators whose duty is to ensure the “safety and soundness” of banks. Mr. Corker said that what he thought was happening was that “members on the left were getting very nervous about what they were reading.” “And I think that what Chairman Dodd is going to do probably is introduce a bill on Monday that is a little to the left of where we were, to try to ensure that he get as much as he can in the way of getting Democratic support on the committee,” Mr. Corker said. “And then hopefully what he will do is move to the right”

Another major area of contention in negotiations has been how to alter or consolidate the Depression-era regulatory patchwork. Currently, the Federal Reserve oversees bank holding companies and state-chartered banks that are part of the Fed system; the Office of the Comptroller of the Currency oversees national banks; the Federal Deposit Insurance Corporation oversees state banks that are not members of the Fed system; and the Office of Thrift Supervision oversees savings and loans. Mr. Dodd has expressed support for a proposal that would leave the Fed with oversight over only the largest bank holding companies, those with $100 billion or more in assets, currently totaling 23.

Under that proposal, the comptroller’s office and the thrift-supervision office would be merged into a new entity that would oversee the other bank holding companies, while the F.D.I.C. would oversee all state-chartered banks.

“The Fed no doubt is going to have its wings clipped,” Mr. Corker said. While the consumer agency and the regulatory architecture remain in dispute, other regulatory changes have attracted bipartisan support. Among them are these:

- Creation of an interagency council, led by the Treasury, to detect and monitor systemic risk.

- Establishment of a new Office of Research and Analysis to give the council daily updates on the stability of individuals firms and their trading partners.

- A new “resolution authority” to seize and dismantle any systemically important financial institution on the verge of failure.

- Greater transparency in the trading of over-the-counter derivatives, though some of the riskiest transactions would still be shielded from the public.

- A strengthening of the Securities and Exchange Commission’s ability to protect investors.

Is this the lull before the storm for US mortgages?

by Gillian Tett

What exactly is happening in the bowels of the American mortgage market? That is a question that investors around the world have often asked in the past three years, with a mixture of bafflement and alarm. Now they need to pose it again. For this spring, something of a paradox is hanging over the mortgage-backed securities world. At the end of this month, the US Federal Reserve is due to freeze its programme to purchase Fannie and Freddie agency MBS that it implemented in the wake of the financial crisis. Logic might suggest that could potentially deliver a jolt to the market.

After all, the reason why the Fed introduced the programme in the first place was because the US securitisation markets froze during the financial crisis, removing a vital source of funding for the American mortgage world. And thus far, at least, there is still precious little evidence that the securitisation market is ready to flourish again. As a result, the degree of assistance that the Fed has provided has been eye-poppingly large: right now it is holding some $1,200bn of MBS, representing about half of its (currently enormously bloated) balance sheet (or about a quarter of the total stock of high quality outstanding MBS).

Yet, notwithstanding those vast numbers, the news that the Fed plans to halt these purchases has not hitherto triggered any sign of panic. On the contrary, as my colleague Nicole Bullock reported this week, the spread between the 30-year Fannie Mae current coupon bond (the sector benchmark) fell to just 57 basis points over Treasuries this week. According to Credit Suisse, this is the lowest spread on record for this benchmark. Spreads on other MBS have been low, and falling too – also irrespective of the Fed move.

So what exactly is going on? In part, the explanation seems to reflect a type of displacement effect. In particular, in the past couple of years, the Fed (and others) have poured so much money into the system, that this has made it painfully hard for mainstream fixed income investors to get returns, without taking very wild risks. Last year, some investors tried to deal with this problem by buying the wave of government-guaranteed bank bonds that many institutions issued to repair their balance sheets. Other investors rushed to gobble up investment grade securities or (if all else failed) sovereign bonds.

However this year, the programmes of government guarantees for bank debt are coming to an end, and the investment grade market seems very oversold. Meanwhile sovereign credit seems to pose new risks of its own. Just, look, for example, at Greece. Thus, against that unappealing list of alternatives, dollar-denominated MBS instruments are beginning to look rather more attractive; particularly if you think that much of the bad news about the American housing market is already priced in – and, more importantly, if you are an American bank that is able to get ultra cheap funding, and thus can enjoy an immediate “carry” from holding MBS.

So far, so encouraging – or so it might seem. After all, if the financial system is going to heal itself, investors do need to rediscover an appetite for risk; and if they are becoming more willing to buy MBS, that makes the Fed’s exit strategy easier. However, before anyone is tempted to crack open the champagne, they should think – once again – about that “displacement” effect. During the past two years, the full impact of the collapse of the securitisation market has been largely concealed from most investors – let alone American politicians – because of the sheer scale of government assistance on offer. In a sense, investors have been lulled into something of a false sense of security, because so much of the support has been highly complex – and thus hard to understand.

Now it is possible that, as the Fed slowly withdraws its assistance, investors will gradually adjust too. But it is equally possible that there could be nasty shocks ahead, particularly if money market or Treasury rates rise. After all, will investors really keep buying MBS instruments if say, Treasury rates shoot up? Have American banks even hedged themselves against the chance of a sudden 1994-style swing in interest rates? What might happen if the US Fed actually starts selling its current holdings of MBS (as opposed to simply refusing to buy any more)? And what is the future of Fannie and Freddie?

For the moment, at least, the only honest answer is that nobody truly knows. The global financial machine has been so distorted by government aid that it is frustratingly hard for anyone to be entirely sure how the cogs are working. So, right now, there is reason for American officials to feel some relief about what is happening in the mortgage world; the calm is profoundly good news. But although I very much hope it lasts, I would not be willing to bet too much money on that. I fear this may yet be a lull before a bigger storm.

U.S. government runs up largest monthly deficit ever

by David Rosenberg

On the same day that the U.S. government ran up its largest monthly deficit ever, at $221 billion (up 14% from the largesse of a year ago) in February, the Senate approved a $138 billion measure that would extend unemployment benefits and provide additional aid to States in lawmakers’ second major effort this year to boost the economy (but don’t call it stimulus package #3).

In one month, the U.S. government turned in a deficit that in other times in the not-too-distant past, was what was incurred in a full year (1990, 1991, 1992, 1993, 2002, 2003, 2004, 2005 all come to mind). The fiscal year is a mere five months’ old and already we have seen Washington rack up $652 billion of red ink. The chamber voted 62-36 for the legislation, which would also extend dozens of expiring tax cuts, ease corporate-pension requirements and heads off cuts in Medicare reimbursements to doctors. It begs the question, if things are so great, why the need for this additional stimulus?

Oh yes, and in a green shoot of epic proportions, the media today is treating the news that there were “only” 30 States with rising unemployment in January as a really good thing because it was down from 43 the month before (never mind that five states, including some biggies like Florida and California, reported new highs for their jobless rates); and that home foreclosures (as per RealtyTrac) were “just” 6% above year-ago levels, which was the slowest pace in four years. (You know, you can reach a level of obesity where the percent increase in your weight from a year ago can go down rather dramatically while at the same time your health continues to deteriorate.)

This slower rate of foreclosures (nobody discusses the fact that the actual level of foreclosure filings, at 308,424 in February, is absolutely alarming) is NOT a sign that fewer homeowners are in distress but that the long arm of the law from prevention programs, to modification plans, to outright bans have managed to not only cap the number at these horrendous levels but also limit the new supply hitting the market. If the government goes the “short sale” route of paying off the servicer, the holder of the second lien and the distressed homeowner (to vacate the premises) in order to allow the market to clear, then the amount of supply that will hit the market will very likely trigger another huge round of house price deflation. (Wouldn’t it be nice to at least go to a point where we will finally see price discovery in residential real estate again?)

U.S. Trade Gap Narrows As Both Exports and Imports Fall

The U.S. trade deficit unexpectedly narrowed in January as imports and exports both declined and oil import volumes hit their lowest in more than a decade, the Commerce Department said Thursday. The U.S. deficit in international trade of goods and services decreased 6.6% to $37.29 billion from a revised $39.90 billion the month before. The December trade gap was originally reported as $40.18 billion.The January deficit was lower than Wall Street expectations for a $41.0 billion shortfall. Separately, the number of idled U.S. workers applying for jobless benefits fell by 6,000 last week, a positive sign for the labor market and the economy.U.S. exports decreased by 0.3% to $142.66 billion from a revised $143.15 billion the previous month. Imports slipped by 1.7% to $179.95 billion from $183.05 billion in November. The U.S. trade deficit with China rose in January to $18.30 billion from $18.14 billion the month before. Exports fell by 17.6% to $6.89 billion. The deficit with Canada rose to $3.90 billion from $3.00 billion. However, U.S. trade deficits with other major trading partners declined. The deficit with Japan narrowed $3.35 billion from $4.61 billion. The trade gap with the euro area fell to $2.94 billion from $5.45 billion, while the gap with Mexico also fell to $4.62 billion from $5.23 billion.

Trade, which provided some support to the economy during the recent recession, helped contribute to the stronger-than-expected expansion in the fourth quarter. Net exports added 0.3 of a percentage point to gross domestic product in the fourth quarter, when the economy grew a revised 5.9%. The real, or inflation-adjusted deficit, which economists use to measure the impact of trade on GDP, fell to $41.04 billion from $43.78 billion in January, Commerce said Thursday.

The U.S. bill for crude oil imports in January fell to $18.12 billion from $20.28 billion the month before, despite a 69 cent rise in the average price per barrel to $73.89. Crude import volumes dove to 245.27 million barrels, the lowest level since February 1999, from 277.07 million the month before. The U.S. paid $24.68 billion for all types of energy-related imports, down from $25.55 billion in December. Auto and related parts imports dropped $1.48 billion and purchases of foreign-made capital goods fell $1.05 billion. Imports of foreign-made consumer goods fell $876 million from the month before. Imports of industrial supplies slipped $38 million in January, driven mostly by crude oil.

Meanwhile, food and feed imports rose $123 million. Among exports, U.S. sales abroad of capital goods fell by $1.04 billion. Auto exports fell by $544 million, and exports of food, feed, and beverages went down by $102 million. Exports of industrial supplies, such as fuel oil, increased $525 million, while sales of consumer goods were up $170 million.

Initial claims stood at 462,000 in the week ended March 6, from a downwardly revised 468,000 in the prior week, the Labor Department said in its weekly report Thursday. Originally, Labor said 469,000 new claims were filed the week ending Feb. 27. The weekly decline was the second in a row but smaller than expected. Economists surveyed by Dow Jones Newswires forecast initial claims to decrease by 9,000. Last week, Labor reported the U.S. economy shed fewer jobs than expected in February despite stormy weather. Jobs would likely have been created if not for two snowstorms that clobbered the East Coast, economists said. But Thursday's claims report had its blemishes. Total claims lasting more than one week rose, and the four-week moving average of new claims also climbed.

High joblessness is slowing the economy's recovery. To help some of the nearly 1 in 10 Americans in the labor force out of work, Congress has been considering legislation that would extend 2010 federal jobless benefits and subsidies to help some unemployed people afford health insurance. In the Labor Department's Thursday report, the four-week average of new claims, which aims to smooth volatility in the data, climbed last week by 5,000 to 475,500 from the previous week's revised 470,500.

The number of continuing claims -- those drawn by workers for more than one week in the week ended Feb. 27 -- increased by 37,000 to 4,558,000 from the preceding week's revised level of 4,521,000. The unemployment rate for workers with unemployment insurance for the week ended Feb. 27 was 3.5%, unchanged from the prior week. The largest increase in initial claims for the week ended Feb. 27 occurred in California. The biggest decrease was in Pennsylvania, because of fewer layoffs in construction, service, transportation, and machinery industries.

Obama to Create Export Task Force to Double Exports Over Next 5 Years

As the latest trade report showed that exports declined in January, the Obama administration on Thursday signaled its intent to appoint a panel to help promote American goods overseas. President Obama on Thursday is expected to sign an executive order creating an Export Promotion Cabinet, which will include representatives from the State, Treasury, Commerce and Agriculture Departments, as well other federal agencies involved in trade. The announcement will be one of the first concrete steps the president will take as he seeks to double exports over the next five years — a pledge made in his State of the Union address.

Details of the president’s plan came as the Commerce Department reported that the trade deficit in the United States unexpectedly narrowed in January, largely because of a drop in spending on foreign oil and cars and a decrease in exports like airplanes and cars. The deficit, which measures the gap between the value of imports and exports, declined 6.6 percent to $37.3 billion in January. Analysts had expected it to widen to $41 billion. Imports fell 1.7 percent as Americans imported the lowest amount of oil in more than a decade.

Exports declined 0.3 percent — the first drop since April — as demand for products like airplanes and cars dwindled. Economists said January’s report was probably a one-month aberration from a broader trend of growth for exports and imports. Paul Dales, an economist for Capital Economics in Toronto, said the report "does not mean that the rebound in world trade is over." "The rebound in exports and imports has much further to run yet," Mr. Dales wrote in a research note. "Further ahead, though, a fading of the economic recovery is likely to hold back imports growth."

The gap has widened in recent months as strong demand for imports has offset some of the gains for exports. A weak dollar, which makes the price of everything from computers to soybeans cheaper for foreign consumers, has helped bolster exports, but not at a pace sufficient to overcome imports. The country’s biggest trade imbalance continues to be with China, which has kept the value of its currency artificially low in hopes of jump-starting exports like toys and mobile phones. In January, the deficit rose to $18.3 billion from $18.1 billion in December, the Commerce Department said. On Wednesday, the Chinese government said its exports had grown 46 percent in February.

Mr. Obama, who is scheduled to speak on Thursday morning at a conference organized by the Export-Import Bank of the United States, also intends to name an advisory committee on international trade, called the President’s Export Council, that will be led by W. James McNerney Jr., the chief executive of Boeing, and Ursula M. Burns, the chief executive of Xerox, an administration official said on Thursday.

The official said the effort is intended to improve financing for businesses that want to increase exports, enforce existing trade agreements and help create jobs while making American goods more competitive abroad. The plan faces obstacles, chief among them the considerable disagreement in Congress, which controls trade policy, over American participation in the long-stalled Doha round of global trade negotiations. The director general of the World Trade Organization, Pascal Lamy, was in Washington on Thursday as part of an effort to assess American misgivings about the Doha round.

In addition, free-trade agreements with South Korea, Colombia and Panama that were negotiated by the administration of President George W. Bush have stalled in the Senate, even though Mr. Bush and Democratic leaders in Congress agreed in 2007 to insert labor and environmental protections into the accords. While part of Mr. Obama’s plan will involve better promotion of American products and services, the plan also requires a renewed attention to trade policy.

When asked how the export initiative differed from trade policy, Ron Kirk, the United States trade ambassador, told reporters at the National Press Club on Wednesday that the distinctions were subtle. "It’s certainly more digestible for a lot of Americans right now to talk about exports," Mr. Kirk said, "but the reality, if we’re going to meet the president’s objective to double exports over the next five years, it’s going to happen as part of a comprehensive trade strategy, and that’s why the president also talked about this National Export Initiative."

He added: "So as a practical matter, what he has done is convene all of us who touch our trade policy in any manner whatsoever, and he’s tasked us to come up with the most focus, targeted approach to expanding our exports using all of our available tools, and some of that is what we laid out. Some of that can be through enforcement. It can be through new agreements. It can be through stronger partnerships with our general system of preference partners," like the African Growth and Opportunity Act and the Central America Free Trade Act. Mr. Kirk continued: "We’re going to look at everything we can to open up those markets with the hope that by exporting more, we help create and support these jobs."

Britain's trade deficit widens

Britain's trade deficit with the rest of the world widened unexpectedly in January after lower sales of chemicals and other commodities led a drop in exports. The trade gap in physical goods widened to 7.99 billion pounds ($12 billion), well above the 7 billion pounds forecast by analysts, according to figures from the Office for National Statistics. The figures were a disappointment given that economists had expected recent weakness in the British pound to boost exports. The British currency dropped further after the trade report. It was 0.7 percent lower at $1.4957 midmorning in London.

The statistics office said there was no obvious reason for the wider deficit, although some have suggested that the particularly bad weather in January may have disrupted trade flows. Imports fell 1.6 percent and exports dropped 6.9 percent, the sharpest decline in more than three years. Officials and economists cautioned against reading too much into one month's data. "You cannot read too much into any monthly trade figures. The overall long-term export figures are good, with exports rising by 2.6 billion pounds to 60.3 billion pounds in the last quarter," said Mervyn Davies, the minister for Trade, Investment and Small Business.

"The different value in sterling will take some time to feed through to improved export performance and the full benefits will not be seen until demand in our main markets picks up more strongly," he added. "With sterling persistently weak and not expected to appreciate markedly in the coming months, U.K. exporters should be able to take advantage of the boost to competitiveness and the pick up in the U.S. and Asian economies," said Hetal Mehta, Senior Economic Advisor to the Ernst & Young ITEM Club economic consultancy.

German exports plunge 6.3% in January

German exports plunged 6.3 percent in January, figures released Wednesday showed, ending four consecutive monthly increases and raising fresh worries about the outlook for Europe's biggest economy. The January slump followed a 3.4 percent surge in exports in December, which in turn followed a 1.6 percent gain in November. Analysts had forecast a rise of about 0.5 percent in January. Amid signs of weak domestic demand, German exports have emerged as the key driving force behind the nation's recovery from what has been its steepest economic downturn in more than six decades.

"This surprisingly bad figure probably does not mark the end of the recovery in exports," said Commerzbank economist Simon Junker. "Despite exports backtracking, we are retaining our prediction that the German economy will continue to recover and that foreign trade will play a major role in driving this recovery," he said. In particular, Germany's exporters are looking to the world's leading emerging economies, such as China, to boost the nation's foreign order books.

Figures also released in Beijing Wednesday showed China's exports surging by 46 percent in February versus the same month in 2009, cementing the Asian powerhouse's lead over Germany as the world's top exporter. The Federal Statistics Office also monthly imports dropped by 6 percent in January. As a consequence, the trade surplus narrowed to 8.7 billion euros ($11.8 billion) from 16.6 billion euros in December. Year on year, January exports edged up 0.2 percent, while imports slumped 1.4 percent compared with the same month in 2009.

The release of the latest trade figures follow a slew of new data and economic indicators which have painted a mixed picture of the German economy as the new year got underway. After the economy stagnated during the fourth quarter of last year, signs have also now emerged that Europe's extreme winter weather might have left a dent in Germany's economic growth rate during the first three months of 2010. While German factory order books swelled by 4.3 percent in January, output edged up by just 0.6 percent as cold winter weather hit industrial production, dragged down by business sectors relying on outside work such as construction.

German business confidence posted its first monthly decline in 10 months in February, partly as a result of the long period of sub-zero temperatures and regular snow falls. However, most economists are still expecting Germany to report modest economic growth in 2010 after the country emerged from recession during the second quarter of last year. Germany's central bank, the Bundesbank, forecasts growth for the nation this year of 1.6 percent after the economy shrunk by a dramatic 5 percent in 2009.

China exports leap 46% in February

China's exports rose 46% in February from a year earlier, beating expectations and setting the stage for more calls to increase the value of the Chinese currency, analysts said. The increase, announced Wednesday, was driven by heightened demand from the United States, the European Union and Japan. Trade tensions have mounted over China's artificially low currency, the yuan, also known as the renminbi.

Competing exporters say it gives China an unfair advantage at a time when the rest of the globe is still seeking to recover from the financial crisis. Chinese policymakers say they cannot consider appreciation until economic conditions are more stable. Chinese Premier Wen Jiabao said last week the country would keep the value of the yuan at an "appropriate and balanced level" this year. February's increase marks the third consecutive month exports have grown from the same month a year earlier.

"The strong export recovery should provide support for those who advocate for a resumption" of the appreciation of the yuan, said Tao Wang, head of China Economic Research for UBS Securities, in a report released Wednesday.

However, Chinese officials are striking a cautious tone. Minister of Commerce Chen Deming told reporters Saturday that China's exports were still far from returning to levels seen before the global recession. "Although China's exports have regained momentum since the beginning of this year, it would take two or three years for exports to return to the level of 2008, as global recovery is still haunted by uncertainties," Chen said.

Ben Simpfendorfer, chief China economist for the Royal Bank of Scotland, warned that next month's export numbers could dive because the Chinese New Year national holiday took place in late February (the festival's date changes each year because it's based on the lunar calendar). The timing encouraged exporters to ship their merchandise earlier instead of waiting for March. Simpfendorfer also noted that last month's glowing export totals were aided by the fact that February of last year was the second-worst month for exporters in 2009.

Record Export Rise Tips Japan Into Current-Account Surplus

A record rise in exports helped Japan's current-account balance swing back to surplus in January, government data showed Monday, adding to hopes that overseas demand will continue to support the nation's economic recovery. Underlining the importance of exports for Japanese economic growth, separate data released Monday showed bank lending fell for the third month in a row in February as businesses continued to shy away from making new investments.

January's current-account surplus, or Japan's net earnings from international trade and investment, stood at ¥899.8 billion ($9.95 billion) compared with a ¥132.7 billion deficit a year earlier, data from the Finance Ministry showed Monday. The result represents the 12th-straight month of surplus, while the rebound from the previous year—¥1.033 trillion—is the largest since a ¥1.222 trillion recovery in March 1992, a ministry official said.

A major boost came from exports of goods, which jumped 40.6% to ¥4.616 trillion partly due to strong Asian demand for Japanese electronics parts and automobile exports to the U.S., analysts said. The increase was the biggest since January 1986 when the ministry adopted the present current-account data format. "The results basically mirror recent strength in Japanese exports, and I'm expecting the growth trend to continue" on the back of Asian demand for Japanese products, said Yoshimasa Maruyama, an economist at Itochu Corp.

The recovery in Japan's trade performance may provide some relief to Prime Minister Yukio Hatoyama's government. His popularity continues to decline as public discontent grows over political fund scandals ahead of a key Upper House election planned for the summer. His cabinet's approval rate fell to 36.3%, according to the latest Kyodo News survey released over the weekend, down 5.1 points from the previous month and the worst showing since the government's inauguration in September.

The finance ministry data showed that Japan's goods trade balance returned to a ¥197.2 billion surplus in January, from a ¥844.8 billion deficit in the year-earlier month. The country also posted a ¥37.3 billion surplus in trade of goods and services, reversing its a ¥1.057 trillion deficit a year earlier. Japan's income surplus slipped 8.1% on year to ¥911.0 billion, partly because falling interest rates overseas cut returns on Japanese investment in foreign bonds, the ministry official said.

Meanwhile, the nation's bank lending in February—excluding that by Shinkin, or credit-union banks—dropped 1.6% from a year earlier, according to BOJ data released Monday. The figure improved on a 1.7% fall in January, but still marks the third-straight month of decline. Weak lending highlights that while Japan's economic recovery continues, it still lacks the necessary strength to prompt companies to borrow more to expand their operations, a central bank official said.

Firms have also reduced their reliance on bank lending as improving financial market conditions make it easier for them to raise money through selling bonds or issuing stocks if needed. The BOJ also said Japan's money stock increased 2.7% on year in February, compared with a revised 3.0% rise in January. M2 includes cash currency in circulation and deposits held by the BOJ and other financial firms in Japan, excluding Japan Post Bank.

US jobless claims show long-term problem

The number of Americans filing continuing claims for unemployment insurance spiked last week, the Labor Department said Thursday, as sluggish hiring continues to drag on the labor market's recovery. The number of people filing continuing claims jumped to 4,558,000 in the week ended Feb. 27, the most recent data available. That was up 37,000 from the preceding week's upwardly revised 4,521,000 claims. Economists were expecting continuing claims to remain unchanged at 4,500,000.

Continuing claims reflect people filing each week after their initial benefit week until the end of their standard benefits, which usually last 26 weeks. The figures do not include those who have moved into state or federal extensions, or people whose benefits have expired. "Continuing claims represent the pool of workers who have been unable to get back into the labor market quickly," said Robert Dye, senior economist at PNC Financial Services Group. "Long-term unemployment remains a significant problem and will remain a drag on the economy, as it has for some time now."

Dye said the reluctance of small businesses to commit to hiring adds substantial pressure to a jobs recovery. "The climate for hiring is highly uncertain at small businesses, with health care legislation still pending and tax policies in flux," he said. "I think it will take months before we see hiring there." Wells Fargo senior economist Mark Vitner added that the sharp increase in continuing claims in the latest data could also be because severe winter weather hindered employers from hiring.

Last week, lawmakers pushed the deadline to apply for unemployment claims to April 5, but the Senate approved a measure Wednesday to extend the deadline until year-end. The bill has moved to the House for approval. There were 462,000 initial claims filed in the week ended March 6, down 6,000 from the previous week's downwardly revised 468,000, A consensus estimate of economists surveyed by Briefing.com expected claims to drop to 460,000.

The 4-week moving average of initial claims, which levels out volatility, was 475,500, up 5,000 from the previous week's downwardly revised average of 470,500. "Initial claims are improving, but they are stalling at the current level and are still too high to create sustained job growth," Vitner said. "In a healthy economy that is functioning normally, jobless claims need to come to closer to 350,000."

Vitner said hiring at the Census Bureau to conduct the 2010 Census will improve jobless claims data in the coming months, but warned that those jobs are only temporary.

"Excluding any Census hiring, we'll be hard pressed to see job growth in March. There's a high probability that the unemployment rate will rise again because hiring is not picking up fast enough, and layoffs are not slowing down enough," Vitner said.

Unemployment Rises In 30 States In January

Unemployment rose in 30 states in January, the Labor Department said Wednesday, evidence that jobs remain scarce in most regions of the country. The data is somewhat better than December, when 43 states reported higher unemployment rates, but worse than November, when rates fell in most states. Still, five states reported record-high joblessness in January: California, at 12.5 percent; South Carolina, 12.6 percent; Florida, 11.9 percent; North Carolina, 11.1 percent; and Georgia, 10.4 percent.

Michigan's unemployment rate is still the nation's highest, at 14.3 percent, followed by Nevada, with 13 percent and Rhode Island at 12.7 percent. South Carolina and California round out the top five. There were some signs of job creation. Thirty-one states added jobs in January, up from only 11 in the previous month. But the job gains weren't enough, in many cases, to lower the unemployment rate. For example, California reported the largest job gains, of 32,500, though its unemployment rate also rose. Illinois, New York, Washington state and Minnesota reported the next highest totals of new jobs.

The lowest unemployment rates are still found in upper Plains states, with North Dakota's jobless rate of 4.2 percent the lowest in the nation. Nebraska and South Dakota had the next lowest rates, at 4.6 percent and 4.8 percent, respectively. In January, the national unemployment rate fell to 9.7 percent from 10 percent the previous month. Last week, the Labor Department said the national rate was unchanged in February at 9.7 percent, a better reading than most analysts expected.State unemployment data for February won't be released until later this month.

Is It All About GDP?

by David Rosenberg

The GDP numbers that the markets have been trained to focus on may be misleading. Look at the charts below. While GDP has to do with spending, there are other accounts in the National Accounts that also focus on income. In the final analysis, income is what drives everything in the economy — it is just a different measure of economic activity.

What is interesting is that as of Q3, Gross Domestic Income was still contracting, albeit fractionally. And the ‘statistical discrepancy’ between it and the spending accounts, at $253 billion (annualized), is without precedence. Could it be that we were actually not joking around when we mentioned previously that this was, in fact, the Houdini recovery? Could it be that the GDP data that portfolio managers are focusing their attention on are actually as mis-stated as the nonfarm payrolls were as per the latest massive downside benchmark revision?

If it is about GDP, then all we can say is that even with the latest statistical bounce that has largely reflected State capitalism and inventory adjustment, this measure of economic activity is still, amazingly, 1.7% lower today than it was at the pre-recession peak — despite the mountain of government stimulus. What is “normal” is that by now — eight quarters after a recession begins and the stimulus follows — real GDP has actually not just surpassed the pre-recession peak but has not so by nearly 5%.

Employment at this stage of the cycle is typically growing at least 150,000 per month and here we are still waiting for the turn (payrolls by now are also normally at a new all-time high, having taken out the recession losses and then some — by over 300,000). Instead, the level of employment is 8.4 million lower now than it was before the recession began. Not only that, but the output gap is so big that the U.S. economy is now nearly 12 million jobs shy of being at full employment — it will take at least five years to get there and in the meantime, expect deflation to remain the primary trend. Income will be king.

Meanwhile, the excitement continues for now. The Russell 2000 has rallied 15% since the February low and is up now for eight straight sessions as the speculative fervor builds. Japan also enjoyed its share of intermittent sharp technical bounces along the way — including a post-collapse 40% rebound back in 1991 and there were others in the past two decades as the Nikkei posted no fewer than 260,000 rally points in a market that is still down 70% from the highs. Even the Dow managed to accumulate 30,000 rally points during the 1930s but even then the Great Depression did not end until the early 1940s and the next secular bull market did not ensue until 1954. (And, despite sharp swings in GDP — many double digit advances, by the way — by 1939 it was still 10% below the 1929 peak.)

To reiterate, there are other measures of economic health.

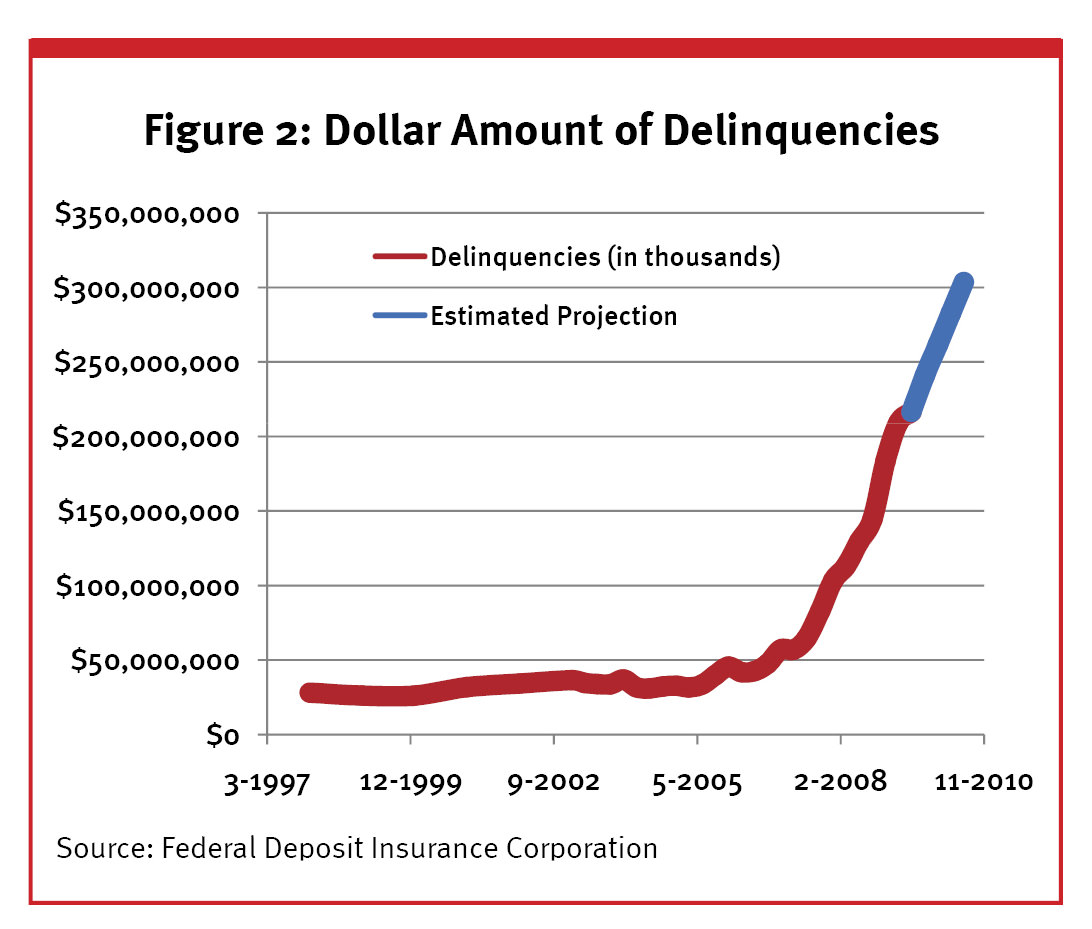

- More than five million homes are behind on their mortgage.

- There are over six million Americans who have been unemployed for at least six months, a record 40% of the ranks of the joblessness.

- The private capital stock is growing at is slowest rate in nearly two decades.

- Roughly 30% of manufacturing capacity is sitting idle.

- Nearly 19 million residential housing units or about 15% of the stock is vacant.

- One in six Americans are either unemployed or underemployed.

- Commercial real estate values are down 30% over the past year.

- The average American worker has seen his/her level of wealth plunge $100,000 over the last two years even with the recovery in equity markets this past year.

- Bank credit is contracting at an unprecedented 15% annual rate so far this year as lenders sit on a record $1.3 trillion of cash.

- Unit labour costs are down an unprecedented 4.7% over the past year and what has replenished household coffers has been the federal government as transfer payments from Uncle Sam now make up a record 18% of personal income (and the Senate just passed yet another jobless benefit extension bill!).

It’s all very bullish, indeed.

If there is a lesson learned from the Japanese experience, it is that recessions or “double dips” come faster than you think. After going nearly 20 years without a recession at all, Japan then went on to endure one in every four years after its credit bubble burst two decades ago. Has it dawned on anyone what it means to have come out of this credit bubble collapse with the employment-to-population ratio for adult males declining to a record low of 67% (it was 73% when the recession began) and the same for the labour force participation rate (89% from 91%)? Surely one cannot be serious about being worried about inflation after a glance of these labor market trends.

But everyone does seem to focus on GDP; that much is for sure. So for what it is worth, the U.S. wholesale trade report was a bit surprising in terms of the weakness it showed for January inventories, and there were revisions, which suggests that Q4 real GDP growth will be lowered to a 5.5% annual rate from 5.9%. Moreover, it now looks like Q1 GDP will do very little better than a 2% annual rate, with very little to show from final sales.

How to handle the sovereign debt explosion

by Mohamed El-Erian, CEO of PIMCO

Every once in a while, the world is faced with a major economic development that is ill-understood at first and dismissed as of limited relevance, and which then catches governments, companies and households unawares. We have seen a few examples of this over the past 10 years. They include the emergence of China as a main influence on growth, prices, employment and wealth dynamics around the world. I would also include the dramatic over-extension, and subsequent spectacular collapse, of housing and shadow banks in the finance-driven economies of the US and UK.

Today, we should all be paying attention to a new theme: the simultaneous and significant deterioration in the public finances of many advanced economies. At present this is being viewed primarily – and excessively – through the narrow prism of Greece. Down the road, it will be recognised for what it is: a significant regime shift in advanced economies with consequential and long-lasting effects. To stay ahead of the process, we should keep the following six points in mind.

First, at the most basic level, what we are experiencing is best characterised as the latest in a series of disruptions to balance sheets. In 2008-09, governments had to step in to counter the simultaneous implosion in housing, finance and consumption. The world now has to deal with the consequences of how this was done. US sovereign indebtedness has surged by a previously unthinkable 20 percentage points of gross domestic product in less than two years. Even under a favourable growth scenario, the debt-to-GDP ratio is projected to continue to increase over the next 10 years from its much higher base.

Many metrics speak to the generalised nature of the disruption to public finances. My favourite comes from Willem Buiter, Citi’s chief economist. More than 40 per cent of global GDP now resides in jurisdictions (overwhelmingly in the advanced economies) running fiscal deficits of 10 per cent of GDP or more. For much of the past 30 years, this fluctuated in the 0-5 per cent range and was dominated by emerging economies.

Second, the shock to public finances is undermining the analytical relevance of conventional classifications. Consider the old notion of a big divide between advanced and emerging economies. A growing number of the former now have significantly poorer economic and financial prospects, and greater vulnerabilities, than a growing number of the latter.

Third, the issue is not whether governments in advanced economies will adjust; they will. The operational questions relate to the nature of the adjustment (orderly versus disorderly), timing and collateral impact. Governments naturally aspire to overcome bad debt dynamics through the orderly (and relatively painless) combination of growth and a willingness on the part of the private sector to maintain and extend holdings of government debt. Such an outcome, however, faces considerable headwinds in a world of unusually high unemployment, muted growth dynamics, persistently large deficits and regulatory uncertainty. Countries will thus be forced to make difficult decisions relating to higher taxation and lower spending. If these do not materialise on a timely basis, the universe of likely outcomes will expand to include inflating out of excessive debt and, in the extreme, default and confiscation.

Fourth, governments can impose solutions on other sectors in the domestic economy. They do so by pre-empting and diverting resources. This is particularly relevant when there is limited scope for the cross-border migration of activities, which is the case today given the generalised nature of the public finance shock.

Fifth, the international dimension will complicate the internal fiscal adjustment facing advanced economies. The effectiveness of any fiscal consolidation is not only a function of a government’s willingness and ability to implement measures over the medium term. It is also influenced by what other countries decide to do.

These five points all support the view that the shock to balance sheets is highly relevant to a wide range of sectors and markets. Yet for now, the inclination is to dismiss the shock as isolated, temporary and reversible. This leads to the sixth and final point. We should expect (rather than be surprised by) damaging recognition lags in both the public and private sectors. Playbooks are not readily available when it comes to new systemic themes. This leads many to revert to backward-looking analytical models, the thrust of which is essentially to assume away the relevance of the new systemic phenomena.

There is a further complication. Timely recognition is necessary but not sufficient. It must be followed by the correct response. Here, history suggests that it is not easy for companies and governments to overcome the tyranny of backward-looking internal commitments. Where does all this leave us? Our sense is that the importance of the shock to public finances in advanced economies is not yet sufficiently appreciated and understood. Yet, with time, it will prove to be highly consequential. The sooner this is recognised, the greater the probability of being able to stay ahead of the disruptions rather than be hurt by them.

Why the U.S. can't inflate its way out of debt

It's dawning on people that getting a handle on burgeoning U.S. debt will be a long and hard process. So if lawmakers can't agree on a credible plan, some have suggested that the country could just "inflate its way" out of its fiscal ditch. The idea: Pursue policies that boost prices and wages and erode the value of the currency. The United States would owe the same amount of actual dollars to its creditors -- but the debt becomes easier to pay off because the dollar becomes cheaper. That's hardly a good plan, say a bevy of debt experts and economists. "Many countries have tried this and they've all failed," said Mark Zandi, chief economist at Moody's Economy.com.

It's true that inflation could reduce a small portion of U.S. debt. The International Monetary Fund (IMF) estimates that in advanced economies less than a quarter of the anticipated growth in the debt-to-GDP ratio would be reduced by inflation. But the mother lode of the country's looming debt burden would remain and the negative effects of inflation could create a whole new set of problems. For starters, a lot of government spending is tied to inflation. So when inflation rises, so do government obligations, said Donald Marron, a former acting director of the Congressional Budget Office (CBO), in testimony before the Senate Budget Committee.

"[W]e have an enormous number of spending programs, Social Security being the most obvious, that are indexed. If inflation goes up, there's a one-for-one increase in our spending. And that's also true in many of the payment rates in Medicare and other programs," he said. Inflation would also make future U.S. debt more expensive, because inflation tends to push up interest rates. And the Treasury will have to refinance $5 trillion worth of short-term debt between now and 2015.

"[The debt's] value could go down for a couple of years because of surprise inflation. But then ... the market's going to charge you a premium interest rate and say 'you fooled us once but this time we're going to charge you a much higher rate on your three-year bonds,'" Marron said. The Treasury is increasing the average term of its debt issuance so it can lock in rates for a longer time and reduce the risk of a sudden spike in borrowing costs. But moving that average higher won't happen overnight. And, in any case, short-term debt will always be part of the mix.

Another potential concern: Treasury inflation-protected securities (TIPS), which have maturities of 5, 10 and 20 years. They make up less than 10% of U.S. debt outstanding currently, but the Government Accountability Office has recommended Treasury offer more TIPS as part of its strategy to lengthen the average maturity on U.S. debt. The higher inflation goes, of course, the more the Treasury will owe on its TIPS.

Just last week, the CBO noted that interest paid on U.S. debt had risen 39% during the first five months of this fiscal year relative to the same period a year ago. "That increase is largely a result of adjustments for inflation to indexed securities, which were negative early last year," according to the agency's monthly budget review. What's more, the knock-on effects of inflation are not pretty. A recent report from the IMF outlined some of them: reduced economic growth, increased social and political stress and added strain on the poor -- whose incomes aren't likely to keep pace with the increase in food prices and other basics. That, in turn, could increase pressure on the government to provide aid -- aid which would need to keep pace with inflation.

So where does that leave lawmakers? Facing tough choices. Deficit hawks and market experts have been calling on lawmakers to come up with a strategy to stabilize the growth in U.S. debt, which would be implemented only after the economy recovers more fully. The idea is to signal to the markets that the country is serious about getting its longer term debt under control so that the burden of paying it back doesn't consume an ever-increasing share of the federal budget.

The recommended exit strategies are pretty basic, if unpopular: tax increases and spending cuts. Economic growth will play a key role as well -- since a strong economy produces more tax revenue. But the country cannot grow its way out of its problems. To do that, the economy would have to expand at Herculean rates annually from here on out. And even the most optimistic economist doesn't see that on the horizon.

Defaults Signal Bursting Muni Junk Bubble After Surge

Investors in search of better returns poured $7.8 billion into high-yield municipal bond funds last year, pushing assets to a two-year high. They may start experiencing losses as early as this year as default risks grow. "People are starving for yield because rates are at zero," said Paul Tramontano, co-chief executive officer of New York- based Constellation Wealth Advisors, which manages about $4 billion. "They’re taking more risk than they think."

Below-investment grade munis are typically issued by companies raising debt through a municipality for a project with a public interest such as hospitals, nursing homes, housing developments and sports stadiums, said Eric Jacobson, director of fixed-income research for Morningstar Inc. "In order to be muni-junk, you really have to be junk," said Gary Pollack, who helps oversee $12 billion as managing director of fixed income for Deutsche Bank AG’s Private Wealth Management unit in New York. "I wouldn’t touch them."

High-yield municipal bonds rated BB+ or lower by Standard & Poor’s or Ba1 by Moody’s Investors Service, one level below investment-grade debt, have returned about 31 percent in the last 12 months compared with 11 percent for investment-grade municipal securities, according to the indexes from S&P/Investortools.

U.S. state and local government tax revenue fell 6.7 percent as of September from a year earlier, marking the fourth consecutive quarter of decline, according to a December Census Bureau report. That may drive defaults higher this year and next, according to Moody’s, which didn’t provide a number. The New York-based company also said it expects "somewhat higher rates of default" among bonds not rated and those below investment-grade.

Health care and housing have suffered from the recession and weak economy, said Anne Van Praagh, a Moody’s analyst. "And their ratings are at lower levels," she said. "While high-yield, tax-exempt funds may look like a great opportunity, people better be very wary of getting in there now," said Michael Janik, senior credit analyst for the Virtus Tax-Exempt Bond Fund of Virtus Investment Partners Inc. "They could be burned." The Hartford, Connecticut-based firm doesn’t buy below investment-grade municipal bonds.

Rising taxes are also driving investors to munis, said Jim Rosenkoetter, a fixed-income portfolio manager for Chicago-based Talon Asset Management, whose average client has $3 million to $5 million. That’s because the bonds are generally exempt from federal taxes as well as state and local levies for residents in most states where they’re issued, he said.

Nine states raised personal income taxes last year including California, Connecticut, New York and New Jersey, according to the Washington-based Tax Foundation. President Barack Obama has proposed raising the top income tax rate on joint filers earning more than $250,000 to 39.6 percent next year from 35 percent. "If they go to a 40 percent tax bracket, a 7.25 percent yield from a high-yield municipal bond fund is the equivalent of 12 percent taxable yield," said John Miller, who manages a $4.5 billion high-yield municipal bond fund for Chicago-based Nuveen Asset Management. "Where are you going to get that type of potential return?"

The Nuveen High Yield Municipal Bond Fund is about 80 percent invested in bonds rated BBB and below, Miller said. High-yield municipal bonds due in 8 years to 12 years were yielding an average 6.63 percent last month, almost double the 3.42 percent on similar maturity bonds in the broader tax-exempt market, according to Barclays Capital indexes. The average dividend yield on a stock in the Standard & Poor’s 500 Index was 1.98 percent on March 9 and the average interest on a taxable money market fund was 0.02 percent as of March 2.

High-yield municipal funds had $49.3 billion in assets as of January, the most since November 2007, according to Morningstar. Those are portfolios holding at least 50 percent in municipal debt rated BBB and below, according to the Chicago- based research firm. They attracted an estimated $7.8 billion in 2009, the most since 2006, according to Morningstar. Individual investments in municipal debt, either directly through broker-dealers or mutual funds, accounted for more than half of the overall $2.8 trillion market as of the third quarter last year, according to Federal Reserve data. The Fed does not break down the number of households holding below investment- grade bonds.

Investors buying lower-rated issues risk not receiving interest payments, losing their principal or having to sell the securities at a discount, said Lynnette Kelly Hotchkiss, executive director of the Municipal Securities Rulemaking Board, the market’s self-regulator based in Alexandria, Virginia. The risk of municipal-bond defaults in the future is "higher than it’s been in quite some time," said Deutsche Bank’s Pollack, because of the unprecedented stress on state and local budgets. From 1970 to 2009, the average five-year default rate was 3.43 percent for speculative-grade debt, Moody’s said. Harrisburg, the capital of Pennsylvania, has considered filing for reorganization under Chapter 9 of the U.S. bankruptcy code as it faces $68 million in debt.

About $2.4 billion of Florida’s so-called dirt bonds, or debt to finance real-estate developments, used reserves or failed to make interest payments in November, up from $1.7 billion in May, according to Interactive Data Corp. That’s the largest amount on record and "reflects an increasing trend," said Edward Krauss, an analyst for the Bedford, Massachusetts- based research firm, in an e-mail. State and local governments can raise taxes and cut services to continue to pay the interest and principal on their debts, said Scott Cottier, who oversees the $6.4 billion Oppenheimer Rochester National Municipals fund of New York-based OppenheimerFunds Inc. It had a 44 percent total return in the past 12 months, the most among high-yield municipal funds, according to Morningstar. "The fear of defaults is over-baked in the muni market," Cottier said.

The Oppenheimer fund has fluctuated the past four years, declining 60 percent from December 2006 to December 2008 and then regaining 39 percent as of February, according to Bloomberg data. That means an investor lost 44 percent during that time period. Price volatility is as important for retail investors to understand as the potential for default, said Josh Gonze, who helps manage about $4 billion of municipal bonds including a high-yield fund for Thornburg Investment Management Inc., based in Santa Fe, New Mexico.

"Let’s say one nursing home bond goes bad and then the price on similar bonds in that category decline in value," he said. "The bonds may never default, but the market value of the account has declined." A fund manager mitigates risk by diversifying across states, industries and maturities, Gonze said. Sixty-three percent of the Thornburg Strategic Municipal Income Fund, which holds debt from 100 different issuers, are rated BBB and below, the company said. Assessing the credit quality of high-yield, high-risk municipal bonds may be harder than similar corporate junk bonds because fewer Wall Street analysts review them, said Deutsche Bank’s Pollack. The bonds also tend to be less liquid because they don’t trade as often, he said.

Investors should do their own research before buying a more speculative bond, said Hotchkiss of the Municipal Securities Rulemaking Board. The MSRB Web site provides trade data, financial statements and disclosures for free. "Make sure you understand the credit of the issuer, the source of repayment for the bond and the priority of repayment," Hotchkiss said. When investing through a mutual fund, find out the parameters for the credit quality of the fund’s bonds and the manager’s investment strategy, she said. "Where I get worried is when Mom and Pop get interested in chasing yield," Hotchkiss said. "It’s very intoxicating."

Geithner Warns Europe on Fund Legislation

U.S. Treasury Secretary Timothy Geithner has warned the European Commission that its proposals for more restrictive regulation of alternative fund managers could affect cross-border investment, demonstrating how the controversial European Union directive could have transatlantic ramifications. According to Paul Myners, the U.K. financial services minister, Mr. Geithner had raised the issue of the Alternative Investment Fund Managers directive in a letter to Michel Barnier, who was confirmed as European commissioner for the internal market last month. Lord Myners mentioned the letter at a breakfast briefing, which was organised by the British Private Equity and Venture Capital Association.

Mr. Myners didn't comment on what Geithner specifically said about the directive. However, according to two senior private equity sources with knowledge of the situation, Mr. Geithner was worried about the "third country" clause, which limits European Union investors from investing in non-EU alternative investment funds run outside the EU. The U.K. has been one of the leading opponents to this proposal, arguing that it is protectionist and damages the interests of institutional investors.

Additionally, Canada-based Institutional Limited Partners Association, which represents large investors in private equity, has also written a two-page letter to Barnier, while Jean-Paul Gauzès, the parliamentarian charged with pushing it through the European Parliament, has also complained about the same issue, according to high-level sources in Brussels familiar with the affair. The moves by the two North American bodies comes ahead of an important European Parliament meeting next week to discuss the directive.

According to the people at the meeting with Lord Myners, the financial services minister also managed down expectations as he said the U.K. "cannot block" the proposed directive. He said the UK would aim for a compromise as "what we have to do is secure support". But earlier, at the briefing, he added to the criticism of the directive by warning of "regulatory hypochondria." He added that the EC should "eschew regulation for its own sake".

The directive will have to be ratified by a qualified majority at the highest political levels among EU member states. Simon Walker, chief executive of the BVCA, said: "The likelihood is the third country [part of the EC's AIFM directive] will stay in. That's what we ask the UK government to stave off". The EC said it would check Lord Myners's comments concerning the letter; the U.S. Treasury was unavailable for comment.

France vows retaliation against US in air tanker dispute

by Ambrose Evans-Pritchard

France has vowed to retaliate against the United States for allegedly shutting Europe's aviation giant EADS out of a $50bn (£33.4bn) defence contract, warning of potential damage to the Atlantic alliance. "This is a serious affair," said France's Europe minister Pierre Lellouche. "I can assure you that there will be consequences." "You cannot expect Europeans to contribute to global defence if you deny their industries the right to work on both sides of the Atlantic," he said, adding that French president Nicolas Sarkozy would take action "at the appropriate time".

The escalating spat comes after EADS withdrew this week from a joint bid with Northrop Grumman to supply the Pentagon with A330 air refuelling tankers, alleging that the procurement terms had been rigged to favour Boeing. EADS had already won the contract before, offering a larger and more efficient aircraft than Boeing's 767, which is based on technology dating back to the early 1980s. The original deal was struck down after an appeal by Boeing.

Defence disputes fall outside the ambit of the World Trade Organization so Paris is looking at other ways to strike back. "It is obvious that if we roll over and do nothing after a fait accompli by the Pentagon, it is the end of Europe's credibility," said Mr Lellouche. Rainer Brüderle, Germany's economy minister, has also expressed outrage, alleging that the tender "had clearly been designed to favour Boeing under political pressure." Joachim Pfeiffer, Bundestag spokesman for the Christian Democrats, said the Pentagon's conduct was "scandalous", a sentiment echoed by a string of politicians on Wednesday.

The dispute casts a cloud over EADS ambitions to become a major player in the US and may have larger strategic implications, causing Europe to reshape its defence doctrines. Mr Sarkozy has been a staunch ally of the US, bringing France back into Nato and holding firm in Afghanistan, but concerns are mounting that the mercurial French leader may revert to Paris's prickly traditions. Germany's Bernhard Stiedl, a member of the EADS board, said Europe needs to rethink its whole approach to defence in light of the affair. There is a risk that the spat could sap goodwill towards a NATO alliance already struggling to reinvent itself after the Cold War.

EADS had agreed to assemble the A330 tanker in Alabama, and half the jobs would have been in the US, but that was not enough to overcome deeper – if unstated – concerns about the role of rival powers in US defence procurement. EADS is perceived in Washington as a tool of French foreign policy, despite efforts by current chief Louis Gallois to tone down its Gallic image.

Germany Government Ponders Guaranteeing Banks' Credit Portfolios

The German government said Thursday it is considering guaranteeing credit portfolios of private banks in order to create more leeway for banks to hand out business loans. "In order to avoid potential grave shortages in business financing the federal government ponders portfolio guarantees at risk-adequate prices to revive the granting of loans," it said in a joint declaration with the country's leading banking and business associations. The measures would be targeted especially to assure credit supply for medium-sized businesses.

Ahead of the talks, Economics Minister Rainer Bruederle told reporters that "we don't have a broad credit crunch but only partial problems." He pointed out that "especially on the level of the larger medium-sized firms are signals detectable that there can occur [credit] shortages." The president of the German Wholesale and Export Association (BGA), Anton Boerner, earlier today warned that the risk of a credit crunch still persists. Such a credit squeeze could already come about by the middle of the year when investment spending is seen rising while the leeway of banks to grant credit is expected to narrow further, he said. The chief economists of the top private banks in Germany last month also warned in a joint report that "a credit crunch cannot be ruled out by autumn 2010 when investment demand will pick up again more markedly."

Greek workers strike as anger at austerity grows

Greek public and private sector workers went on strike on Thursday, grounding flights, shutting schools and halting public transport in the second nationwide walkout in a fortnight in protest against austerity plans. Under pressure from markets and European Union partners, the government unveiled a new austerity package last week worth 4.8 billion euros ($6.51 billion). It included a rise in value added tax (VAT), cuts in civil service incomes and a pension freeze.

Many Greeks see the plan as unfair and hitting the wrong people, in a country where corruption and tax evasion are widespread. Opinion polls showed increasing opposition to the taxes and cuts but the 24-hour strike was unlikely to halt government plans to slash spending and increase taxes to rein in a yawning deficit that has shaken the euro. Asked about protests, Greek Prime Minister George Papandreou said in Washington on Wednesday: "Demonstrators have the right to demonstrate but the crisis is not this government's fault."

Hostility to the measures was growing. The private sector union GSEE and its public sector sister ADEDY, which together represent half of the country's 5 million workforce, say the EU-backed austerity plan will hurt the poor and aggravate the recession-hit country's economic problems. "Workers will raise their fist and shout with one voice: We won't pay for the crisis," GSEE said in a statement. "No one, nothing is going to terrorise workers." The level of participation in the strike and protests will be watched closely outside Greece. EU policymakers, rating agencies and financial markets welcomed the latest austerity package but want to see it implemented quickly and smoothly. For that to take place, public support was crucial.

Unions from taxi drivers to refuse collectors have stepped up protests over the past weeks. The polls showed most Greeks believed some belt-tightening was necessary and believed the government would press ahead. "Everything will be dead in Greece but the majority of people understand there is no other option," ALCO pollster Costas Panagopoulos said. "I don't believe a strike and rallies can seriously affect the government's policies." Opposition to the cuts has been relatively subdued so far, but Greeks are prone to take to the streets in protests that can turn violent.

Police said they were bracing for trouble after clashes at an anti-austerity march last week. About 1,500 riot police would patrol the centre of Athens on Thursday and more would be ready to join in if needed, they said. Communist labour union PAME was expected to kick off the day with a rally at about 11 a.m. (0900 GMT), followed by a march to parliament organised by the two public and private sector umbrella unions.

Bank employees, firemen, tax collectors and even police officers would be among those marching. Buses and trains were not operating in Athens, and ships were docked. Journalists and state TV also stopped work. The new austerity package has driven a wedge between public employees and private sector workers, with resentful private staff seeing their state-employed peers as privileged and demanding they pay more for the crisis.