Pike's Peak, Colorado

Ilargi: OK, so the BLS Establishment Survey Data say that in March, nonfarm payroll employment rose by 162,000 (quite a bit less than the consensus among "experts"). Not a terribly reliable or important number, if you ask me, but of course people will milk it for what they can. What strikes me is a number in the Household Survey Data:

The number of long-term unemployed (those jobless for 27 weeks and over) increased by 414,000 over the month to 6.5 million.

That's almost 7% in one month, and that is downright scary. Of course, we've talked about this till the cows were home, fed, bathed, and left the barn again, but it still bears repeating that discussing US employment, for instance the initial jobless claims data, has become a futile exercise, if not an outright affront to the people, if the EUC (Emergency Unemployment Compensation) numbers are not included.

It may make for a nice feel-good story to claim that less people have jumped onto the front of the wagon, but it's simply deceitful not to mention the number that have fallen off the back. Over 44% of jobless Americans are now unemployed for more than 27 weeks. Hence, the EUC component of the stats, the by now 6.5 million who largely depend on the emergency money Congress just last week refused to extend, is now probably the most important segment of the unemployment numbers, or at least should be if the fudging would end. At present, it’s exceedingly hard to figure out where they show up in the various sets of supplied data.

And this whole focus on short term versus long term is increasingly becoming an issue in the overall economy, as well as, obviously, its data sets. We’ll have to see if the 162,000 jobs the BLS Establishment Survey Data is real, and how real it is. Note, for instance, that the ADP reported a loss of 23,000 jobs in the private sector just a few days ago. The gain may therefore stem from government jobs alone, most of which would be temp Census ones.

An increase of close to 7% in long-term unemployment is far scarier than a bunch of temp jobs is reason to cheer, that much should be clear. And there are probably millions of additional people who fall outside the scope of even these numbers. After all, don’t let's forget the difference between U3 (steady at 9.7%), U6 (rose to 16.9%) or even John Williams' SGS Alternate, which presumable has stayed near 22%. + 162,000 may be the best number in three years, but what's it mean when you know that fudging is the name of the game?

Just as long term unemployment is the real story when it comes to jobs, housing has its own version of long-term trouble. The Wall street Journal has an anonymous editorial titled The Permanent Mortgage Crisis, and that pretty much sums up the core of it all. It provides an incomplete summary of failed programs: Hope Now Alliance, Hope Now, Hope for Homeowners, foreclosure moratoriums promoted by Fannie Mae, Freddie Mac and Barney Frank, $127 billion that taxpayers have thus far poured into Fan and Fred, Federal Reserve's purchase of $1.25 trillion in mortgage-backed securities, expansion of the 2008 First-Time Home Buyer Tax Credit, Home Affordable Modification Program, that show that untold billions of your money have been spent to no avail (other than propping up the lenders that originated and/or securitized the loans), while home prices keep on dropping (as per Case-Shiller) and the foreclosures problem is now so out of hand that nobody seems to want to talk about real numbers anymore.

Meanwhile, Fannie and Freddie both report record numbers of loan delinquencies, over 5.5% now, which, given that they hold some $5.5% trillion of the stuff, indicates a potential additional loss of more than $300 billion that you will have to fork over, and believe you me, that’s just for starters. There are millions of people left out there who’ve been trying to hang on, have been spending their reserves just to stay in the house they love but paid too much for, and even IF there are a few more jobs available (big question mark), mean wages will certainly be less than what they were before, and foreclosure proceedings are set to keep coming, if not increase.

We are engaged in a futile attempt to return to a situation that no longer exists, and that was made possible by enormous amounts of cheap empty credit to begin with. Unless we will, and we want to for that matter, restart the money-for-nothing paradigm, which incidentally got us where we are now, home prices will have to come down substantially. Think 50% for starters. That would return some sort of health to the entire system. At those price levels, also, people wouldn't have to make all that much money to be able to afford their homes.

Alas, we are caught in the bind of what once was, all government policy is based on the past, even if that past was clearly a bubble to which no-one should want to return.

So why do we do it? Because the banking system took all those mortgages for homes at hugely inflated prices, and leveraged them to the hilt in order to issue securities and other derivatives. If we would acknowledge that that game is over, and get back to more sane levels of both wages and home prices, the banks would collapse. And by now, you are just about 100% responsible for all the banks' losses. So be careful what you wish for.

The mantra is that all hell would break loose if the casino on Wall Street would be allowed to fail. But it will fail regardless. SO why do we do it? Look at this:

CME working with Fannie, Freddie on swapsExchange operator CME Group Inc is working with mortgage lending giants Fannie Mae and Freddie Mac to design a clearing facility for the $414 trillion global market for interest-rate swaps.

Know what I mean? The numbers are just too huge. And what on earth are two semi-private 100% taxpayer supprted entities doing betting on interest-rate swaps? What sort of world do we live in?

There's no-one in your government who knows how to solve the riddle, even if they would be inclined to do so at the risk of their own positions (yeah, that's a good laugh). And so the next step is inevitable:

"That’s not an iceberg, captain, and even if it were, it’d be way too small to sink us".

And the band played on, a mournful tune in a minor key, about a tragic species that once ruled, but failed to comprehend its own shortcomings, and got too close to its own sun.

Ilargi: Please, with your loved ones, do have a happy Easter break, or whatever version of the ancient pagan spring ritual you prefer, and don’t forget to visit our sponsors, or donate directly to The Automatic Earth. There’s a many much worse things you could do this weekend, and few better.

The Permanent Mortgage Crisis

One more housing bailout to prolong the market agony.

Last Friday the White House announced its latest plan to prevent mortgage foreclosures, and earlier this week the famous Case-Shiller index found mostly flat home prices in January with analysts warning about a new wave of foreclosures to come. You can't blame the latest proposal for that outcome, but what about the previous 10 or 20 federal housing rescue plans?

We're supposed to believe that this latest effort to build an artificial floor under home prices will perform:

- better than the Hope Now Alliance announced by President Bush in October 2007;

- better than the revised Hope Now program announced two months later;

- better than Hope for Homeowners, which was passed by Congress and signed by Mr. Bush in 2008;

- better than the foreclosure moratoriums promoted by Fannie Mae, Freddie Mac and Representative Barney Frank into early 2009;

- better than the $127 billion that taxpayers have thus far poured into Fan and Fred, much of it for foreclosure relief;

- better than the Federal Reserve's purchase of $1.25 trillion in mortgage-backed securities;

- better than last year's expansion of the 2008 First-Time Home Buyer Tax Credit to up to $8,000;

- better than the billions in stimulus dollars that have been spent "to restore neighborhoods hardest hit by concentrated foreclosures," according to the White House;

- better than the $1.5 billion announced earlier this year to state housing finance agencies in the electorally hard-hit areas of Arizona, California, Florida, Michigan and Nevada, and $600 million more this week for other states certified as political disaster areas;

- and certainly better than Mr. Obama's year-old Home Affordable Modification Program to offer mortgage modifications to troubled borrowers or his companion program to offer generous refinancing. We could go on, but you get the joke, even if the housing market hasn't.

Here's a heretical thought: What if Washington had simply let housing prices fall on their own to find their natural bottom? The pain would have been more severe more quickly for some owners who bought more expensive homes than they could afford. But the pain might also be over by now as housing markets cleared faster, and housing might be contributing to a healthier economic expansion. Instead we are heading toward year five of the housing recession, with Washington proposing even more ideas to prolong the agony. One senior banking regulator we talk to calls it "extending and pretending."

But how long can troubled borrowers even pretend? The latest Mortgage Metrics report from the Comptroller of the Currency shows that most of the loans modified in the first quarter of 2009 had gone bad again within nine months—52% were more than 60 days delinquent. The highlights of the latest plan are increased incentives for banks to reduce mortgage principal for troubled borrowers, reduced mortgage payments for unemployed borrowers, more regulatory barriers for banks wishing to foreclose, and a new ability of underwater borrowers to refinance into taxpayer-backed loans from the Federal Housing Administration.

Watching its previous failures, Team Obama will now emphasize reducing principal instead of merely lowering monthly mortgage payments for some years. The White House no doubt noticed that many of the loans modified outside of the various government programs—with aggressive principal reductions—had better re-default rates. But this doesn't mean that such reductions are always a good idea. Many of these private reductions were the result of legal settlements, not business decisions. Obviously if taxpayers chip in to provide equity to millions of underwater borrowers, the borrowers will have less incentive to default. But how many more borrowers will be motivated to seek assistance when the subsidies become more generous?

A lower mortgage bill is surely a relief to an unemployed worker, but what he really needs is a job, and we see nothing in this plan (or any other Washington scheme) to encourage job creation. To the extent that these payments are merely unemployment benefits laundered through the mortgage system and thus reduce incentives to find work, the jobless rate will stay higher for longer and the entire economy will be worse off. Potentially the most expensive part of this plan for taxpayers is the new Federal Housing Administration refinancing option. (Yes, that is the same FHA that is already struggling under mortgage losses and announced last year that its capital had fallen below the level required by law.)

Taxpayers will be required to stand behind a "homeowner" who owes mortgage debt equal to 115% of the value of the home and whose monthly mortgage bill is up to 31% of total income. Message to owners who borrowed responsibly: Next time, don't be such a sap. You'll also be pleased to know the Administration says the price tag on this latest housing plan won't exceed the $50 billion already earmarked for mortgage relief in the Troubled Asset Relief Program. Just don't expect it to end the mortgage crisis.

Will A Perfect Prediction of the Financial Crisis Perfectly Predict a New Crisis?

by Michael David White

We are all going to die, but I hope not in the “extended period” of our current low-interest-rate environment. On the subject of a financial crisis ahead, I pull out this old prediction of crisis to boast about its obvious stunning acumen and to mark its 2-year April Fools’ Day anniversary (see image below). I also call attention to a secondary use of this ancient document: Does it predict a new crisis on top of the old crisis? Is new-crisis prediction as simple as predicting a bimbo eruption of Tiger textings?The short answer is the probability of a new gargantuan crisis is far more obvious now than it was April 1, 2008. We now can see with confident clarity the explosive panic creators which promise a new crisis, if it should erupt, that it will be of far greater severity than our recent explosion of financial destruction. What are those obvious signs?

Take a Close Look at the April Fools Day 2008 Forecast

The housing market is exhibit A. Less than 1% of 1% of 1% of 1% of the people in the world slightly understands that the housing market in the United States is dead, but that government intervention is pumping formaldehyde into the body and painting blue lips with liquid white out. Everything is fine if you live in a wax museum and enjoy sex with blow up dolls.

The data prove that the bubble must exhale more. Is this scary? Does it scare you that housing prices would fall by 50% to 75% tomorrow should we close Uncle Sam’s Mortgage Shop (Read that last sentence five times, then go on.)?

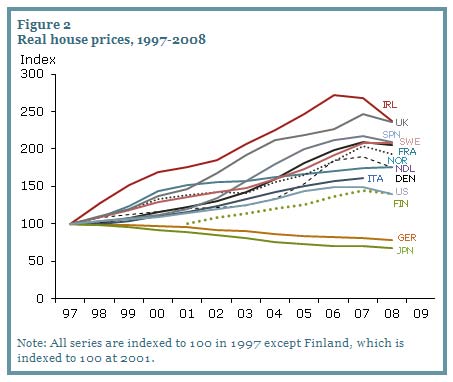

Our USA-today real estate market bubble is two or three times any previous bubble of the last 120 years, but many of the rest of the world’s housing markets are psychedelic free-verse manic mombos following a guitar-line-in-their-head of Jerry Garcia on his day of 10,000 hits. God rest his soul.

These Europeans and others make us into little quiet wall flowers. Since our 30% property fall is a bank buster their psychedelia ain’t nothing. A bigger housing bubble leads to a bigger bank crisis. What if the United States has the conservative mortgage market? The thought that this could be true makes me seriously consider a future in Scientology.

What else? Add to toil and trouble reckless government spending at home and abroad, new awful exploding fecal colonies of sovereign debt, high unemployment, and it is ridiculous to deny the possibility of a gargantuan fall. Last by not least? Our governors do not comprehend that killing a credit crisis requires fantastic debt destruction. They are running in the wrong direction.

If Ben and Tim don’t know about destroying debt in a credit crisis, then the recent crisis hasn’t been managed. And if you don’t manage a crisis, is that a negative indicator?

At least we have a president who left graduate school a callow vain fellow yet when thrown into the blood sweat and tears of business and politics, he erased a lifelong petty jealousy of majoritarians with a deep respect for capital and free markets. He embraced the American project. In the history of the world we have contributed a thousand parts good for every one part bad in the ancient war on poverty and ignorance.

With his medical reform, President Obama has reversed what was an inevitable national bankruptcy via exploding medical costs. He has now forced creative and destructive competition among insurers. We will see their numbers fall from one thousand to perhaps 20 or 10.

My prediction is cut-throat competition will cut medical care costs by half. Everybody can be covered easily. Radical competition drives prices down radically. Huge new wealth will be available for education and investment. Even the 100-year-flood in our housing bubble and its massive wealth destruction cannot stop us.

April Fools’ Day Fool you fool! Your president hates markets and free enterprise because he can’t stand to be less important than any person, place, or thing. President Obama’s medical reform merely speeds our journey into national bankruptcy. April Fools’ Day you pedantic sycophantic weasel. You and the president are one and the same personality. Civilization falls to adolescent psychopathic vanity.

Fannie Delinquencies Reach All-Time High at 5.52%

- Fannie Single-Family Mortgage Delinquencies Grow to 5.38%

- Fannie’s MBS Issuance Slides 31% in October

- Fannie’s Serious Delinquencies Nears 5% in November

- Fannie Mae Serious Mortgage Delinquencies Rise Above 5%

- Fannie, Freddie’s Portfolios Diverge in February; Delinquencies Keep on Increasing

While serious delinquencies in the Fannie Mae portfolio continue to reach new heights in January, mortgage-backed securitization (MBS) issuance dropped for the second month in a row in February, according to its monthly report. The serious delinquency rate at Fannie climbed to 5.52% in January – the most recent month of data – up 14 bps from December and doubling the 2.77% rate in January 2009. The single-family delinquency rate remains below the 4.03% rate in the portfolio of its brother Freddie Mac . Multi-family loans in the Fannie portfolio slipped into serious delinquency at a 0.69% rate in January, up from 0.63% in December.

Fannie issued $43.9bn in mortgage-backed securities (MBS) in February, a 7% drop from the $47.6bn mark in January and a 2.8% decrease from the $45.2bn issued in February 2009. MBS issuances reached its peak in the last year in June 2009, when Fannie issued more than $130bn in MBS. Fannie’s book of business declined at an annualized rate of 1% in February. The gross mortgage portfolio also fell at an annualized rate of 14.2%. The new numbers came in a week after Timothy Geithner, secretary of the US Treasury Department, stressed the need of a process that would reform the GSE’s and remove “the umbrella of public protection” before Congress.

Following Fannie's Record Delinquencies, Freddie Just Reported New Record For Loans Seriously Delinquent

by Tyler Durden

Yesterday we noted that Fannie just announced a record number of delinquencies at 5.52%. Today, not to be outdone, Freddie follows up and discloses that total delinquent loans also hit another fresh high of 4.08%, an increase from January's 4.03% and double the 2.13% from last February. Also yesterday we noted that CMBS delinquencies are likely in the 6-7% range, as both the residential and commercial real estate market continue experiencing unprecedented weakness.Also, as reader Tin Cup points out, "The credit enhanced book of business (loans insured by the private mortgage insurers) also hit a record high or 8.59%, up from 8.52% in January (and also double last year’s 4.54%). Again, despite trillions being throw at the housing market, delinquencies continue to rocket upwards."

Sure enough, the market continues to ignore all negative news and just focuses on the direct consequences of a waning fiscal and monetary stimulus program.

CME working with Fannie, Freddie on swaps

Exchange operator CME Group Inc is working with mortgage lending giants Fannie Mae and Freddie Mac to design a clearing facility for the $414 trillion global market for interest-rate swaps. "We have been working with them to help structure our cleared interest-rate swap offering," CME CEO Craig Donohue said on Tuesday at the Reuters Global Exchanges and Trading Summit in New York. "I imagine that we, among others, will be competing to try to win business from them as we introduce our interest-rate swaps clearing solution." Fannie Mae and Freddie Mac, which were seized by the U.S. government in September 2008, will start moving their swaps to centralized clearing within months, their federal regulator said earlier in March.

Regulators want to shift more over-the-counter derivatives -- seen by some as a cause of the recent financial crisis -- into clearinghouses where they are seen as posing less of a systemic risk.

Fannie and Freddie's combined $3 trillion portfolio makes them the biggest swaps holders in the United States. "That's a big opportunity for us," said Donohue, adding that CME was also working with a broad range of other market participants. "Fannie and Freddie are significant customers of CME interest rate products and typically use our Treasury note and bond and interest-rate products to hedge interest rate risk."

Using CME to clear interest-rate swaps would also provide additional capital efficiencies, he said. CME has faced an uphill battle against rival IntercontinentalExchange in providing clearing for credit default swaps, the first over-the-counter derivative deemed by regulators to be ripe for clearing. ICE has cleared more than $6.4 trillion of the swaps since it began providing the service little more than a year ago. CME has done a fraction of that. "It has been a challenge for us," Donohue acknowledged, of CDS clearing. "Our biggest focus is on the rates swaps market." While ICE has not said whether it will pursue clearing of interest-rate swaps, CME will face at least two competitors for Fannie Mae and Freddie Mac's business.

LCH.Clearnet, Europe's largest independent clearinghouse, dominates clearing of interest-rate swaps between dealers and since December has offered clearing for hedge funds and other so-called buy-side firms. CME will also compete with Nasdaq OMX Group's majority-owned clearinghouse, the International Derivatives Clearing Group. Asked if CME would win the race against rivals to clear interest-rate swaps, Donohue said it was too soon to tell. He also declined to say whether CME would be ready to clear interest-rate swaps in the time frame laid out by Fannie Mae and Freddie Mac. "It's hard to declare a front runner before the race has begun," he said.

Cash-Poor Cities Take On Unions

Mayor Antonio Villaraigosa once organized for a teacher's union here, and later ran a branch of the American Federation of Government Employees. That makes him an unlikely advocate for cutting the benefits of the city's workers. But with the city facing a budget deficit that could drain its reserves by summer, Mayor Villaraigosa wants to re-open contract talks with 45,000 cops, firefighters, librarians and other city employees in hopes of persuading them to contribute more to their pensions and health-care costs. His deputy chief of staff, Matt Szabo, puts it bluntly: "Unions have priced themselves out of a job."

Nationwide, politicians looking for budget cuts are confronting politically powerful unions that represent state and local government employees—15% of U.S. workers and organized labor's biggest stronghold. In Memphis, the city's health-care committee recently recommended raising current and retired employees' health-insurance premiums by as much as 15%. And Toledo's city council last week wrung $3.1 million in concessions from its firefighters' union as part of a measure to close its budget gap. Similar things are happening at the state level. Over the past two years, 17 states have cut benefits for employees or increased the amount that individuals must contribute to their pension plans. Three of those states—Kentucky, Texas and Vermont—did both, according to the Pew Center on the States, a public-policy think tank.

At the heart of this fight is an unbalanced equation: The economy is shrinking cities' and states' tax income as their pension and health-care costs have soared. As a result, some governments are diverting money from services to cover benefits, or raising taxes and fees. That doesn't sit well with some taxpayers—many frustrated at seeing their own benefits being cut by private-sector employers. So governments are seeking cuts in union benefits long considered sacrosanct. This has risks. Public-employee unions are among the biggest political spenders, and their members vote in droves. Also, cutting benefits could make it tougher to keep the best employees.

It is tough to compare government pay to private-sector pay because many government jobs—firefighters, police officers—don't have private counterparts. But, on average, government workers make more in wages and benefits. In December, state and local governments spent an average of $39.60 in wages and benefits per hour worked on their employees, versus an average $27.42 for private employers, the Labor Department said. The fight over benefits represents a defining moment for public employees and their unions.Government is by far the most unionized sector of the work force, and among the few places left where blue-collar workers can retire with traditional lifetime pensions. In 2009, the nation's 7.9 million unionized government workers eclipsed the number of private-sector union members for the first time since the Labor Department began keeping track in 1983. "What comes out of all these negotiations will set the tone for public employees for a while," says Ken Jacobs of the Center for Labor Research and Education at University of California, Berkeley.

In New Jersey, outrage over state deficits helped Republican Chris Christie defeat incumbent Democrat Jon Corzine last November. A few weeks after Mr. Christie's victory, a Quinnipiac University poll found that three-fourths of state voters supported a wage freeze for state workers, and 61% favored layoffs. Last month, Gov. Christie signed a set of bills that would, among other things, cut pension benefits for future employees. Public-employee unions argue that it's unfair to penalize them for a financial crisis that isn't their fault. They say cities and states are opportunistically taking advantage of a short-term crisis to gut benefit plans in place for decades.

Many private-company workers have seen their retirement accounts shrivel, while public-sector benefits have been relatively unscathed. Defined-contribution plans such as 401(k)s had $3.33 trillion in assets at the end of 2009, down 4% from $3.48 trillion in 2006, according to the Federal Reserve. Such accounts have lost value even though companies and workers contributed $100 billion over that period. The rise in public-sector benefits has attracted the ire of citizens like Paul Nelson, a semi-retired investor in Upper Saddle River, N.J. Mr. Nelson, 59 years old, has a son at Northern Highlands Regional High School, where the principal says the school may have to cut teachers and increase class size. "Most public employees have retirement and health-care plans that private-sector employees can only dream of," says Mr. Nelson.

Virtually all full-time state- and local-government employees have access to retirement plans, and most are employer-funded. By contrast, only three-quarters of full-time workers in the private sector have access to retirement benefits. Disparities like these give politicians ammunition for cost-cutting. "Public-employee benefits have to be reined in," says Andrew Koenig, a Republican state representative in Missouri. Mr. Koenig is sponsoring a bill in his state that, over the next several decades, would shift away from a defined-benefit plan, where an employer puts as much money into a pension fund as needed to cover future retirement benefits. It would be replaced with a 401(k)-type of plan (similar to those now in place at many private-sector employers) where workers absorb the market's ups and downs.

Some argue that just because corporations have trimmed employee benefits doesn't mean the government should as well. "There has been an attack on American private-sector workers and benefits, with 401(k)s replacing traditional pensions," says Teresa Ghilarducci a professor at the New School for Social Research in New York City, "and they have failed" at providing retirement security. At the root of governments' problems today are promises made in past decades. As a group, state and local governments have promised an estimated $3.35 trillion in pension and health-care benefits to be paid over the next three decades, but are estimated to have 70% of the money to cover those payments, according to the Pew Center on the States. Pension and health costs can consume 20% of city and state budgets.

California offers a view of the fallout. The state's largest pension fund, the California Public Employees' Retirement System, known as Calpers, is estimated to be only 57% to 65% funded. Having suffered investment losses in recent years, the state has had to dip deeper into its revenues to make up the funding gap. Last year, a budget impasse forced the state to issue IOUs for taxpayer refunds. It wasn't long ago that California was going the other way, based on a different set of assumptions. In 1999, the state's Democratic-controlled legislature and then-governor Gray Davis passed a law expanding benefits for many state employees.A proposal prepared by Calpers—the $200 billion fund that manages money for 1.6 million of the state's employees, retirees and their beneficiaries—forecast that the boosted benefits would be paid for entirely by investment gains. "There are only two ways you can have this problem: One, the promised benefits are too big, or two, not enough money was put away," says David Crane, special adviser for Gov. Arnold Schwarzenegger. California's contribution to its public-employee pension fund is projected at $3.5 billion in the fiscal year starting July 2010, 4% of the state's general-fund budget, the highest proportion in state history. In Los Angeles, the battle is spilling into the public, including at a noisy City Council meeting in February. On the agenda was a plan to cut 1,000 workers and reopen contracts. Union members turned out to voice opposition.

Art Sweatman, a tree surgeon for the Department of Public Works, showed up wearing baseball cap that read "Deadwood." It was a reference to comments by Mayor Villaraigosa last year in which he said a new early-retirement program could rid the city of "deadwood" employees. "We have to let them know we're here," says Mr. Sweatman, a member of the Service Employees International Union local 721. Mr. Sweatman's union says it is trying to meet the city half way. Local 721 has agreed to early-retirement programs and furlough days, says executive director John Tanner, but it has resisted health or pension rollbacks. "Our goal was to get through this without layoffs or cost-shifting on health care," he says.

Government benefits are almost as old as government itself. Military pensions stretch back to the Roman Empire, predating private-sector benefits by centuries. The U.S. offered retirement pay to soldiers who fought in the revolutionary war, and by 1930 the federal government gave pensions to all its employees. Pensions at private-sector employers came into widespread use only after World War II. Lee Craig, an economics professor at North Carolina State University, says pressure has been building for years to cut government benefits, with the financial crisis accelerating that. "Their promises have finally outstripped the growth of their tax bases," he says.

California's Santa Barbara County, a coastal area known for wineries and Spanish architecture as well as Michael Jackson's former Neverland Ranch, has seen tax revenues fall over the past three years. The county has reduced its work force by 7.5% and management salaries have been frozen since 2008. At a workshop conducted by the county's executive office, representatives from two dozen departments—the sheriff's office, mental services, and public works, among others—were required to suggest cuts. The proposals included eliminating two Spanish-speaking interpreters in the public defender's office, closing a camp for delinquent teenage boys that opened in 1944, and reducing staff in a child-abuse prevention program. Another proposed move could add four to six more weeks to the wait for food stamps.

In Redding, Calif., the mayor and city council are asking city workers to contribute 7% to 9% of their salaries to their pension funds; currently the city picks up that tab. Patrick Jones, who runs his family's gun shop in addition to serving as part-time mayor, says if the council doesn't win concessions it might use a November ballot initiative to ask voters to demand that the city negotiate benefit cuts. That move, he said, would give the city leverage in any union negotiations. "We're just trying to get as many tools as possible to quicken the time it takes" to get concessions, Mr. Jones says.

One group fighting back in Redding is the International Brotherhood of Electrical Workers, which represents 53 electrical workers on the city payroll. One recent morning, about two dozen members gathered in the "bull room," where linemen and electricians meet to get their work assignments. The workers listened to union representative Ray Thomas update them on the contract fight. Mr. Thomas said he hasn't any intention of agreeing to benefit cuts, but told his workers not to expect much. "If it doesn't screw the future, it's something we'll have to discuss," Mr. Thomas said. A member of the audience raised his hand and asked if it was true that deputy sheriffs in surrounding Shasta County had been considering a plan to pay more of their retirement costs. "Did they vote to accept that?" another asked. Mr. Thomas nodded his head yes.

Fed Ends Its Purchasing of Mortgage Securities

The Federal Reserve’s single largest intervention to prop up the American economy, its $1.25 trillion program to buy mortgage-backed securities, came to a long-anticipated end on Wednesday. The program has been credited with holding mortgage interest rates at near-record lows and slowing the nationwide decline in home prices that threatened to send the economy into an extended slump. When the central bank announced the program two days before Thanksgiving 2008, the spread, or difference, between the rates for a 30-year fixed-rate mortgage and a 10-year Treasury note exceeded 2.5 percentage points, or 250 basis points, nearly twice the typical spread.

Demand for mortgage bonds had been frozen since the federal takeover of Fannie Mae and Freddie Mac, the giant mortgage-finance companies, in September 2008. “We were in a deflationary spiral, causing mortgages to go underwater, more foreclosures and a further decline in housing prices,” said Susan M. Wachter, professor of real estate and finance at the Wharton School of the University of Pennsylvania. “The potential maelstrom of destruction was out there, bringing down not only the housing market but the overall economy. That’s what was stopped.” She called the Fed’s mortgage purchases “the single most important move to stabilize the economy and to prevent a debacle.”

The program was initially for $500 billion. The purchases began in January 2009, and in March, the Fed raised the goal to $1.25 trillion. The purchases were to end by Dec. 31, but in September, the Fed said the purchases would taper off more slowly, ending on March 31. The purchases caused rates for 30-year mortgages, which exceeded 6 percent in late 2008, to fall to below 5 percent by March 2009. They are hovering slightly above 5 percent today. Economists had feared that mortgage interest rates would climb sharply after the 15-month program, but those fears have abated in recent weeks. Fed policy makers have suggested that they would consider resuming the purchases if conditions warranted it, but only as a last resort.

“Financial markets have improved considerably over the last year, and I am hopeful that mortgages will remain highly affordable even after our purchases cease,” Janet L. Yellen, the president of the Federal Reserve Bank of San Francisco, said in a speech on March 23. “Any significant run-up in mortgage rates would create risks for a housing recovery.” Ms. Yellen is President Obama’s choice to be the next vice chairwoman of the Fed, after Donald L. Kohn retires in June, but she has not been formally nominated.

Lawrence Yun, chief economist at the National Association of Realtors, said the private market for mortgage-backed securities had sufficiently recovered for the Fed program to end without a hiccup. “Just as the Fed is stepping out, private investors appear to be stepping in,” Mr. Yun said. “As long as there are buyers on Wall Street for mortgages, it should have no impact on consumers. Having said that, it’s possible that the mortgage rate could be higher later in the year, but that would be due to macroeconomic forces unrelated to the Fed purchase program.”

A major factor in that recovery was the government’s announcement last December that it would guarantee debts owed by and securities issued by Fannie and Freddie, according to David Crowe, chief economist at the National Association of Home Builders. While the future of the two mortgage-finance entities remains uncertain, the government backing has been particularly reassuring for foreign investors, including the Chinese and Japanese central banks, that hold securities based on mortgages originated in the United States, Mr. Crowe said.

Another reason mortgage interest rates are not expected to rise sharply is that the supply of the securities has not increased substantially, said Michael Fratantoni, vice president for single-family research at the Mortgage Bankers Association. “Home sales really are running at quite a slow pace, and we haven’t seen much of a spring buying season yet, so there haven’t been a lot of mortgages originated or securities issued,” Mr. Fratantoni said. He projected that as the job market recovered, mortgage rates for 30-year mortgages would rise to 5.8 percent or so by the end of the year.

For consumers, the biggest impact of the Fed purchases was to encourage mortgage refinancing, Mr. Fratantoni said. “Although they did induce some additional sales, more importantly, the Fed enabled a lot of homeowners to have lower monthly payments,” he said. Brent W. Ambrose, professor of real estate in the Smeal College of Business at Pennsylvania State University, said the Fed had “done a credible job of telegraphing what its intentions were,” giving the markets ample time to prepare for the end of the program.

The Employment Situation - March 2010

from the U.S. Bureau of Labor Statistics

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today. Temporary help services and health care continued to add jobs over the month. Employment in federal government also rose, reflecting the hiring of temporary workers for Census 2010. Employment continued to decline in financial activi- ties and in information.

Household Survey Data

In March, the number of unemployed persons was little changed at 15.0 million, and the unemployment rate remained at 9.7 percent.

Among the major worker groups, the unemployment rates for adult men (10.0 per- cent), adult women (8.0 percent), teenagers (26.1 percent), whites (8.8 per- cent), blacks (16.5 percent), and Hispanics (12.6 percent) showed little or no change in March. The jobless rate for Asians was 7.5 percent, not seasonally adjusted.

The number of long-term unemployed (those jobless for 27 weeks and over) increased by 414,000 over the month to 6.5 million. In March, 44.1 percent of unemployed persons were jobless for 27 weeks or more.

The civilian labor force participation rate (64.9 percent) and the employment- population ratio (58.6 percent) continued to edge up in March. (See table A-1.)

The number of persons working part time for economic reasons (sometimes re- ferred to as involuntary part-time workers) increased to 9.1 million in March. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Jobless Claims Drop Slightly

The number of workers filing new claims for jobless benefits continued to fall last week, bolstering expectations that claims appear to be back on a clear downward trend as the labor market slowly heals. Meanwhile, U.S. construction spending dropped a fourth consecutive month in February. Separately, the Institute of Supply Management's manufacturing index posted a strong gain for March, rising to 59.6 from 56.5 a month earlier. The March number was the strongest since July 2004. Readings above 50 indicate expansion. Prices and inventories showed the strongest expansion, while the employment subindex ticked down. New orders and production were both up modestly.

The Labor Department said in its weekly report Thursday that initial claims for jobless benefits declined by 6,000 to 439,000 in the week ended March 27. The previous week's level was revised upward to 445,000 from 442,000. Economists surveyed by Dow Jones Newswires expected initial claims to decrease by 2,000. The four-week moving average, which aims to smooth volatility in the data to help paint a better picture of the underlying trend, fell to the lowest level since Sept. 13, 2008 for the week ending March 27. The Labor Department said the four-week moving average went down by 6,750 to 447,250 from the previous week's revised average of 454,000. Total claims lasting more than one week, meanwhile, declined to levels last seen in December 2008.

The latest decline in jobless claims falls in line with economists' expectations that claims are finally back on a downward path after being stuck in a lull since the beginning of the year. Even if unemployment figures start to show some improvement, however, economists and other experts also don't expect to see major gains in labor market conditions for 2010. Forecasters are expecting the national 9.7% unemployment rate in Friday's monthly jobs report to hold steady, suggesting the pace of new hiring is still slow. And any gains that may be shown in the March job figures may not suggest a full turnaround since some of it may be driven by temporary things like government hiring for the Census.

In addition, a report this week by Automatic Data Processing Inc. and consultancy firm Macroeconomic Advisers actually reported an unexpected 23,000 decline in private-sector jobs when forecasters surveyed by Dow Jones had expected to see a 50,000 gain. As a response to the unemployment situation, the Obama administration recently unveiled a series of expansions to foreclosure prevention programs that target in part unemployed Americans. One program, known as the Home Affordable Modification Program or HAMP, would let unemployed homeowners that meet certain criteria temporarily reduce their mortgage payments to an affordable level while they look for work.

Congress has also sought to respond to the jobs crisis with several legislative packages. One bill, which was passed recently by the U.S. Senate, would provide tax credits to workers who hire the unemployed. Another proposal still in the works is a bill to provide tax credits to small businesses. That proposal was approved by the U.S. House, but still must be voted on by the Senate. In the Labor Department's Thursday report, the number of continuing claims -- those drawn by workers for more than one week in the week ended March 20 -- decreased by 6,000 to 4,662,000 from the preceding week's revised level of 4,668,000.

The unemployment rate for workers with unemployment insurance for the week ended March 20 was 3.6% -- unchanged from the prior week's rate. The largest increase in initial claims for the week ended March 20 occurred in Illinois due to layoffs in the construction, trade, and manufacturing sectors. The largest decrease in claims occurred in California.

Construction Spending Falls Again

U.S. construction spending dropped a fourth consecutive month in February, dragged lower by a sagging commercial real estate market and a weak housing sector that are restraining the economy's recovery. Spending decreased by 1.3% in February, to a seasonally adjusted annual rate of $846.23 billion compared to the prior month, the Commerce Department said Thursday. January spending was revised down, falling 1.4% instead of 0.6% as previously estimated. Spending fell 3.4% in December and 2.5% in November. The 1.3% decrease in February matched the forecast of economists surveyed by Dow Jones Newswires. Spending on residential construction in February slid 2.1% to $258.49 billion, after rising 0.7% in January. Groundbreaking on houses is down because of slack demand for new homes.

Buyers brave enough to ignore high unemployment in the U.S. are taking advantage of low interest rates and signing contracts for cheaper used homes, which are a better deal because of the wave of foreclosures in the market. Spending on non-residential projects decreased 1.0%. Outlays dropped for hotels, hospitals, schools, churches, and roads. Office construction spending fell 2.6% and commercial spending dropped 3.2%. Vacancy rates are rising and loans for building are difficult to secure. By sector, private construction spending during February decreased by 1.2% to $553.49 billion. Spending was down 1.7% in January. Public-sector spending decreased in February 1.7% to $292.74 billion.

French workers threaten to blow up closing factory

Workers at a factory north of Paris are threatening to set fire to a huge gas tank to protest the planned closure of the factory. About 50 workers at Sodimatex, which makes car rugs, have been occupying the site in Crepy-en-Valois since Thursday. They are pressuring the company for better compensation. A union representative said Friday that "determined" workers have not backed down from their threat to set fire to a 1,300-gallon gas tank just outside the factory. Gas canisters were also seen on the roof. Plant closings have led French workers to increasingly militant behavior, with numerous cases of boss-nappings over the past year and one other case of a threat to blow up a factory.

Treasury Unemployment Benefit Outlays Surge To All Time High

by Tyler Durden

Even as the BLS and DOL would like us to believe that the unemployment picture is getting better, we present a chart comparing the initial and continued claims as presented by the Dept. of Labor and compare these to actual government outlays. Even as the two combined series have been declining (offset by increasing much discussed EUCs), the most recent Unemployment Insurance Benefit outlay reported by the Treasury (as of March 30 - there is still one more day of data for March), just hit an all time record high of $15.4 billion.What this means is that in March the average paycheck from Uncle Sam for sitting dong nothing, surged to an all time high of $1,447/month.Fair enough, the spike may be due to a surge in EUCs one may say. Well, here is a chart of the reported EUCs added to the disclosed Initial and Continued claims:

Indeed, even the worst case reported picture of America's jobless seems to have plataued in the upper 10 million range, after hitting a record of 11.1 million in late January.

So what happens when one divides the total population collecting benefits (I.C.+C.C.+EUC) by the actual UST outlays? We get a very curious chart:

It appears that in March either the government decided to payout an additional roughly 20% per unemployment paycheck, or once again, there is a shadow population of beneficiaries, which are not caught in any of the standard cohorts. Keep in mind that the average monthly paycheck has traditionally been indicated as being about $1,000.

What are we missing here?

Previous Employment Levels Founded On High Credit Limits

by MatrixAnalytix

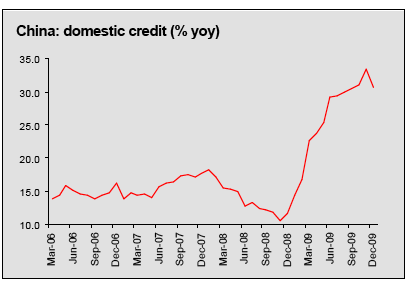

The uptick in unemployment is directly correlated to the extreme tightening in credit standards we've seen over the past year or so. The environment of lax credit "easy money" we experienced over the past several decades artificially inflated the perceived purchasing power of households by most likely several magnitudes. If someone had $2,000 in bank but had a $10,000 credit card, there was no reason this person couldn't ratchet up credit card debt to the hilt and pay it off slowly. This was no doubt due to confidence in "job security." If I feel confident that I will have a job one year from now, I then believe that I will be able to finance any debt I may incur for the foreseeable future and can continue spending well beyond my earned income.

However, the underlying "bid" in the job market over the past several decades was ironically and without doubt directly correlated to this lax credit environment. In this environment, if someone with $2,000 in the bank had purchasing power of $10,000 and was more than willing to spend up to that amount + a percentage of earned income, then the demand for goods and services throughout the economy was in fact significantly driven by that credit portion of someones purchasing power and hence employers were bidding for labor based on a demand for goods and services founded on credit lines. In other words, high credit lines were producing "job security" which was producing demand based on easy access to credit lines...which was producing "job security", etc

Now what we've experienced over the past year or so is a significant retraction of those credit lines down to levels equivalent to real earned income. In other words, someone with $2,000 in the bank now most likely only has access to $5,000 in credit and that credit is most likely already spent. In other words, $5,000 of purchasing power has been eliminated from the economy and hence the demand for goods and services must be adjusted downward by the same amount unless the decrease is offset by an increase in spending by cash (which we know is not the case).

Therefore, employers must now adjust their expectations of production to this lower level of demand which requires the need for less labor. Therefore, the bid for labor declines significantly, unemployment rises, and the level of "job security" declines. In the short-term this produces an increase in cash saving levels, and a decrease in demand for goods and services. The labor market is adjusting to a new paradigm in credit standards which are certain to remain for several years until cash levels increase to a level which allows for the re-extension of credit and confidence by creditors that those debt levels will be repaid in a timely fashion.

In other words, expect unemployment to remain relatively high for several years until cash savings levels increase dramatically and credit lines begin to be re-extended. However, expect even when those credit lines are re-extended they will be to a much lower level than their previous highs as the market has seen the consequences of extremely easy access to credit, and hence the lows and new historical averages in unemployment will begin to rise in response to new lower levels of credit.

Long-Term Unemployed Clouds the Jobs Picture

New jobs numbers will be released Friday morning, and they are expected to show, at last, some significant creation of new jobs. A cheer will go up at the White House at this sign that the long climb out of the recession's unemployment hole may have begun. But any cheering will be tempered by nagging concern over an insidious problem lurking within the numbers: the startling number of Americans who have fallen into the ranks of not just the unemployed, but the long-term unemployed. The numbers of long-term unemployed—defined as those unable to find a job for six months or longer—are swelling because of the peculiar causes and character of this deep recession. The consequences are troubling: The long-term unemployed tend to be particularly hard to get back into jobs, and they generate their own set of social problems along the way.

President Barack Obama and his team are particularly worried about the phenomenon, and have set out to find ways to combat it. But they're finding policy prescriptions limited by politics and money. Statistics from the Bureau of Labor Statistics tell the grim story. The number of long-term unemployed in February rose to more than six million, fully double the number in the same month one year earlier. Just over 40% of Americans out of work now fall into the category of the long-term unemployed.

More startling, the problem is markedly worse in this recession than even in the deep slide of 1981 and 1982. During that painful recession, the overall unemployment rates were just as bad as now, but the problem of the long-term unemployed was far less acute. At the peak of the unemployment scourge in 1981 and 1982, the share of jobless Americans classified as long-term was 26%, compared to the 40% today. (The numbers would actually be worse if they included those who have simply dropped out of the work force in frustration.)

In large measure, of course, any calamitous recession is going to produce a big chunk of long-term unemployed. But in this one, the problem is especially pronounced. One way American workers have traditionally recovered from job loss is by being mobile—that is, by being willing and able to move to where new jobs are being created. But this recession was caused, in the first instance, by a housing crisis, which also has significantly restricted workers' mobility. Even workers willing to move find that the collapsed housing market has left their house underwater—that is, worth less than the mortgage they owe on it—so they can't absorb the loss a sale entails. Or they can't find a buyer at all. Workers are stuck because of their houses.

In addition, many families now cope by having both spouses work. So even if the main bread-winner loses his or her job, the second job of the other spouse becomes a crucial lifeline the family is loath to give up by moving to a new city. Oh, and the places to which Americans usually flee to find hope—well, they're pretty hopeless themselves this time around. California, Nevada, Florida, the normal hot-spots of growth, all now have jobless problems worse than the nation at large thanks to their housing busts. More broadly, and perhaps most troubling, the long-term unemployment problem fits into a long-term pattern in which the old job skills of many Americans no longer match the job requirements in an information-age economy.

Behind these economic problems lie substantial social problems. Experience has shown that those out of work the longest also find it hardest to get back into the work force, particularly in jobs that match their previous earning power. Research also shows the long-term unemployed tend to have more health problems, and that, not surprisingly, their children get less education and, in turn, inherit their own problems when they enter the job market. So what can be done? To some extent, says Robert Reischauer, president of the Urban Institute and former head of the Congressional Budget Office, "the answer is, we're doing it."

Congress has extended unemployment benefits for longer periods to help workers cope (which, some analysts argue, may actually exacerbate the problem a bit by giving the jobless a reason to decline jobs not to their liking). Government training programs and community college opportunities are being expanded. A jobs bill Congress recently passed gives employers a tax credit for hiring workers unemployed for two months or more. But skeptics doubt such credits actually create new jobs, but rather just give a break for jobs that would have been filled anyway. What some in the administration would really like is to launch a new infrastructure program, to fund more transportation projects and programs to make buildings more energy-efficient, thereby soaking up some of the many construction workers in the long-term unemployed category.

That would require more deficit spending on a new stimulus bill, which is politically impossible this election year. So if Mr. Obama still looks a bit grim even as he talks about an improving jobs picture, it's partly because nobody has a good solution to this troublesome piece of the puzzle.

Geithner: Bailouts 'Deeply Unfair,' Financial System Was Run In A 'Crazy Way'

Treasury Secretary Timothy Geithner said Thursday it's "deeply unfair" that some financial institutions that got taxpayer-paid bailouts are emerging in better shape from the recession than millions of ordinary Americans.

He acknowledged public outrage over that and said people watched with disdain as Washington protected high-risk banks and investment houses, even as the national unemployment rate was soaring to double-digit levels for the first time in a generation.

But in a nationally broadcast interview, Geithner also argued that President Barack Obama had no choice when confronted with a financial crisis. "As the president has said, we had to do some very unpopular things," Geithner said. "People looked at what had happened." "It's not fair. It's deeply unfair," he said. "He (Obama) had to decide whether he was going to act to fix it or stand back ... and that would have been calamitous for the American economy."

The government eventually embarked on a program of assisting the threatened financial institutions, and the sweeping, multibillion-dollar Troubled Asset Relief Program (TARP) created as a bailout engine. Geithner also said that administration officials are "very worried" about recovering the more than 8 million jobs lost in the recession. But he noted that business growth has been improving and expects the economy "is going to start creating jobs again." The secretary agreed that the national jobless rate -- now at 9.7 percent -- is "still terribly high and is going to stay unacceptably high for a very long time" because of the damage caused by the recession.

"Just because this was the worst economic crisis since the Great Depression," Geithner said, "a huge amount of damage was done to businesses and families across the country ... and it's going to take us a long time to heal that damage. " More than 11 million people now are drawing unemployment insurance benefits, and the overall jobless rate of 9.7 percent understates the true level of economic misery because many people who give up looking for work are no longer in the official count of the unemployed. The Bureau of Labor Statistics on Friday will release a report on conditions in the labor markets in March.

Geithner said he hopes skeptical voters will note legislation moving through Congress to bring reforms to the financial system. "What happened in our country should never happen again," he said. "People were paid for taking enormous risks. It was a crazy way to run a financial system." Geithner said, "It's the government's job ... to do a better job of restraining that kind of risk-taking."

Fed Reveals Bear Stearns Assets It Swallowed in JPMorgan Chase Takeover

After months of litigation and political scrutiny, the Federal Reserve yesterday ended a policy of secrecy over its Bear Stearns Cos. bailout. In a 4:30 p.m. announcement in a week of congressional recess and religious holidays, the central bank released details of securities bought to aid Bear Stearns’s takeover by JPMorgan Chase & Co. Bloomberg News sued the Fed for that information.

The Fed’s vehicle known as Maiden Lane LLC has securities backed by mortgages from lenders including Washington Mutual Inc. and Countrywide Financial Corp., loans that were made with limited borrower documentation. More than $1 billion of them are backed by “jumbo” mortgages written by Thornburg Mortgage Inc., which now carry the lowest investment-grade rating. Jumbo loans were larger than government-sponsored mortgage buyers such as Fannie Mae could finance -- $417,000 at the time.

“The Fed absorbed that risk on its balance sheet and is now seen to be holding problematic, legacy assets,” said Vincent Reinhart, a resident scholar at the American Enterprise Institute in Washington who was the central bank’s monetary- affairs director from 2001 to 2007. “There is both an impairment to its balance sheet and its reputation.” The Bear Stearns deal marked a turning point in the financial crisis for the Fed. By putting taxpayers at risk in financing the rescue, the central bank was engaging in fiscal policy, normally the domain of Congress and the U.S. Treasury, said Marvin Goodfriend, a former Richmond Fed policy adviser who is now an economist at Carnegie Mellon University in Pittsburgh.

“Lack of clarity on the boundary between responsibilities of the Fed and of the Congress as much as anything else created panic in the fall of 2008,” Goodfriend said. “That created a situation in which what had been a serious recession became something near a Great Depression.” Central bankers also created moral hazard, or a perception for investors that any financial firm bigger than Bear Stearns wouldn’t be allowed to fail, said David Kotok, chief investment officer at Cumberland Advisors Inc. in Vineland, New Jersey.

Policy makers’ resolve was tested months later by runs against the largest financial companies. Lehman Brothers Holdings Inc. collapsed into bankruptcy in September 2008. The ensuing panic caused the Fed to take even more emergency measures to push liquidity into markets and institutions. It rescued American International Group Inc. from collapse and allowed Goldman Sachs Group Inc. and Morgan Stanley to convert into bank holding companies, putting them under greater oversight by the central bank. “Letting somebody fail early would have been a better choice,” Kotok said. “You would have ratcheted moral hazard lower and Lehman wouldn’t have been so severe.”

The Bear Stearns assets include bets against the credit of bond insurers such as MBIA Inc., Financial Security Assurance Holdings Ltd. and a unit of Ambac Financial Group, putting the Fed in the position of wagering companies will stop paying their debts. The Fed disclosed that some of Maiden Lane’s assets were portions of commercial loans for hotels, including Short Hills Hilton LLC in New Jersey, Hilton Hawaiian Village LLC in Hawaii, and Hilton of Malaysia LLC, in addition to securities backed by residential mortgages.

More than a year after Washington Mutual, the largest U.S. savings and loan, was purchased by JPMorgan Chase in a distressed sale arranged by the Federal Deposit Insurance Corp., the home loans that helped bring down the Seattle-based thrift live on in the Maiden Lane portfolio. For example, 94 percent of the mortgages in one security, called WAMU 06-A13 2XPPP, required limited documentation from borrowers, meaning the lender often didn’t ask customers for proof of their incomes. Almost 10 percent of the borrowers whose mortgages make up the security have been foreclosed on, and almost a quarter are more than two months late with payments, according to data compiled by Bloomberg.

The portfolio also includes $618.9 million of securities backed by Countrywide, mortgages now rated CCC, eight levels below investment grade. All the underlying loans are adjustable- rate mortgages, with about 88 percent requiring only limited borrower documentation, according to Bloomberg data. About 33.6 percent of the borrowers are at least 60 days late. Countrywide is now part of Charlotte, North Carolina-based Bank of America Corp. Maiden Lane has $19.5 million of securities from a series of collateralized debt obligations called Tropic CDO that are backed by trust preferred securities of community banks and thrifts. CDOs are investment pools made up of a variety of assets that provide a flow of cash.

Trust preferred securities, or TruPS, have characteristics of debt and equity and their interest payments are tax- deductible. The securities created by Bear Stearns are rated C, one level above default, by Moody’s Investors Service and Fitch Ratings. CDO securities have tumbled in value as banks are failing at the fastest rate in 17 years, according to data compiled by Bloomberg. The average price of TruPS CDO debt of this rating is pennies on the dollar, according to Citigroup Inc. “The trust of the taxpayer was abused,” said Janet Tavakoli, president of Chicago-based financial consulting firm Tavakoli Structured Finance Inc. CDOs rated CCC and lower “have a high likelihood of default,” she said.

Chairman Ben S. Bernanke defended the Bear Stearns deal as a rescue of the financial system. He said in a speech at the Kansas City Fed’s annual Jackson Hole, Wyoming conference in August 2008 that a sudden Bear Stearns failure would have caused a “vicious circle of forced selling” and increased volatility. “The broader economy could hardly have remained immune from such severe financial disruptions,” Bernanke said in the speech. The Fed chief, who took office in 2006 and began his second term as chairman this year, also has repeatedly called for an overhaul of financial regulations that would allow authorities to take over a failing financial institution and oversee an orderly unwinding of its positions.

Bernanke said last year that nothing made him “more angry” than the AIG case, blaming the insurer for making “irresponsible bets” and a lack of regulatory oversight for the debacle. Officials “had no choice but to try and stabilize the system” by aiding the firm in September 2008, he said. Yesterday’s release by the Fed, through its New York regional bank, also identified securities acquired in the bailout of AIG held in vehicles known as Maiden Lane II and III.

Assets in Maiden Lane II totaled $34.8 billion, according to the Fed, which set their current market value in its weekly balance sheet at $15.3 billion. That means Maiden Lane II assets are worth 44 cents on the dollar, or 44 percent of their face value, according to the Fed. Maiden Lane III, which has $56 billion of assets at face value, is worth $22.1 billion, or 39 cents on the dollar, according to the Fed’s weekly balance sheet. A similar calculation for the Bear Stearns portfolio couldn’t be made because of outstanding derivatives trades. “The Federal Reserve recognizes the importance of transparency to its financial stability efforts and will continue to review disclosure practices with the goal of making additional information publicly available when possible,” the New York Fed said in yesterday’s statement.

The central bank said it reached agreement on “issues of confidentiality” for the assets with JPMorgan Chase, which bought Bear Stearns in 2008, and AIG. New York-based JPMorgan and AIG would incur the first losses on the portfolios. In April 2008, Bloomberg News requested records under the federal Freedom of Information Act from the Fed’s Board of Governors related to JPMorgan’s acquisition of Bear Stearns. The central bank responded that records retained by the New York Fed “were proprietary records of the Reserve Bank, and not Board records subject” to the request, court records show.

Bloomberg filed suit in November 2008 in U.S. District Court in New York, challenging the Fed’s denial, as well as the denial of a separate request made in May 2008, seeking records of four other emergency lending programs. The district court held that the Fed should release documents related to those four programs, and should search documents held by the New York regional bank to determine whether any of them should be considered records of the board of governors. The U.S. Court of Appeals on March 19 upheld the district court’s ruling on the lending programs. Representative Darrell Issa of California said in a statement that yesterday’s disclosure may “signal a new willingness to cooperate with Congress as we investigate how these bailout deals were structured and what the decision making process entailed.”

The Fed in Hot Water

by Robert Reich

The Fed has finally came clean. It now admits it bailed out Bear Stearns -- taking on tens of billions of dollars of the bank's bad loans -- in order to smooth Bear Stearns' takeover by JP Morgan Chase. The secret Fed bailout came months before Congress authorized the government to spend up to $700 billion of taxpayer dollars bailing out the banks, even months before Lehman Brothers collapsed. The Fed also took on billions of dollars worth of AIG securities, also before the official government-sanctioned bailout.

The losses from those deals still total tens of billions, and taxpayers are ultimately on the hook. But the public never knew. There was no congressional oversight. It was all done behind closed doors. And the New York Fed -- then run by Tim Geithner -- was very much in the center of the action.

This raises three issues.

- First, only Congress is supposed to risk taxpayer dollars. The Fed is not part of the legislative branch. Its secret deals, announced almost two years after they were done, violate the democratic process, if not the Constitution itself. Thomas Jefferson put a stop to Alexander Hamilton's idea of a powerful central bank out of fear it would be unaccountable to the public. The Fed has just proven Jefferson's point.

- Second, if the Fed can secretly bail out big banks, the problem of "moral hazard" - bankers taking irresponsible risks because they know they'll be rescued - is far greater than anyone assumed after Congress and the Bush and Obama administrations bailed out the banks. Big banks will always be too big to fail because they know the Fed will secretly back them up if they get into trouble, even if Congress won't do it openly.

- Third, the announcement throws a monkey wrench into the financial reform bill now on Capitol Hill, which gives the Fed additional authority by, for example, creating a consumer protection bureau inside it. Only yesterday, Sen. Jim DeMint (R-S.C.) blasted the Dodd bill for expanding the Fed's authority "even as it remains shrouded in secrecy."

The Fed has a big problem. It acts in secret. That makes it an odd duck in a democracy. As long as it's merely setting interest rates, its secrecy and political independence can be justified. But once it departs from that role and begins putting billions of dollars of taxpayer money at risk -- choosing winners and losers in the capitalist system -- its legitimacy is questionable.

That it chose to reveal the truth about its activities during a week when Congress is out of town, when much of official Washington and the Washington media have gone on vacation, and only after several federal courts have held that the Fed must release documents related to its bailout of Bear Stearns, suggests it would rather remain secret than become transparent.

Much of what Ben Bernanke and Tim Geithner did (when Geithner was at the New York Fed) in 2008 was presumably necessary. But the public has no way of knowing. The public doesn't even know who else the Fed has bailed out, or what entities it will bail out in the future. All we know is the Fed secretly bailed out Bear Stearns and AIG and thereby subjected taxpayers to risks that remain even today, without informing the public. That's not a record on which to build public trust.

JPMorgan’s Dimon Regrets Using FDIC Guarantee Program

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said he regrets using the Federal Deposit Insurance Corp.’s guarantee program to issue $40 billion in unsecured debt during the height of the financial crisis. “We didn’t need it,” Dimon, 54, said in his annual letter to shareholders, which was released yesterday. “And it just added to the argument that all banks had been bailed out and fueled the anger directed toward banks.” Dimon said the New York-based company was “highly criticized” for issuing debt backed by the FDIC and for accepting $25 billion from the Troubled Asset Relief Program. The company repaid all TARP funds in June, stopped using the FDIC’s program last April and shunned participation in other federal programs “to avoid the stigma,” he said.

JPMorgan, which ranks second behind Bank of America Corp. in deposits and assets among U.S. lenders, remained profitable through the crisis with combined net income of $17.3 billion in the last two years. The company issued $20.8 billion in FDIC- guaranteed long-term debt in 2008, and $19.7 billion in 2009. “It was not a question of access or need,” Dimon said of the FDIC program, whose government backing helped keep interest rates low. “The markets always were open to us, but the program did save us money.”

Dimon apologized for what he said were the bank’s mistakes. He said the two biggest were lowering mortgage underwriting standards and making too many leveraged loans that “may have contributed to the financial crisis.” At the same time, he claimed some credit for helping to stabilize markets through JPMorgan’s purchases of Bear Stearns and Washington Mutual.He also sought to deflect some of the public anger toward financial companies and to correct the perception that all banks would have failed if the federal government hadn’t intervened. “We should acknowledge that the worst offenders among financial companies no longer are in existence,” Dimon said. “And while it is true that some of the surviving banks would not, or might not, have survived, not all banks would have failed.”

Dimon, who took over as CEO in 2005, said his “number-one priority” this year is to find his successor. “Poor CEO succession has destroyed many a company,” Dimon said, adding that the board believes there are several strong internal candidates that could “do my job today.” He said JPMorgan will continue rotating senior staff across the business to ensure they could smoothly take over the company. The company also intends to expand retail banking, which accounted for $97 million of JPMorgan’s $11.7 billion in net income last year. Dimon said the bank will add 2,700 personal bankers, 400 investment sales representatives and 120 more branches this year, even though consumer lending lost $3.8 billion in 2009. The bank plans to ramp up its branch expansion in California and Florida over the next two years, building on its acquisition of Washington Mutual, he said.

Automakers Report Rise in Sales, Helped by Incentives

Big discounts last month, led by Toyota’s efforts to overcome damage to its reputation from recent recalls, made March one of the best months in years for new-vehicle sales in the United States. Toyota said Thursday that its sales increased 41 percent from March 2009. That compares with a 12 percent decline in January and February. Sales of the models that Toyota has recalled since November rose 48 percent in March after dropping 11 percent the previous two months. Sales of two sport-utility vehicles on the recall list, the Rav4 and Highlander, more than doubled.

Toyota sold 558 more of the recalled models, which include the Camry and Corolla sedans, in March than in January and February combined. “Toyota’s strong sales performance in March reflects our customers’ continued confidence in the safety and reliability of our vehicles and their trust in the brand,” Don Esmond, senior vice president for automotive operations for Toyota Motor Sales U.S.A. said in a statement. “We are standing by our cars, and we’re grateful that our customers are standing by Toyota.” Nearly all automakers reported increases for March, and several analysts projected that total sales for the industry surged about 30 percent from a year ago.

The Ford Motor Company said its sales rose 40 percent. Ford’s sales rose 36 percent in the first quarter over all. General Motors said sales of the four brands that it would continue to operate increased 43 percent and that its total sales rose 21 percent. Buick sales jumped 76 percent. Sales of the four brands that G.M. is selling or closing fell 88 percent, as the inventory runs out. Hyundai’s sales increased 15 percent. Chrysler’s sales dropped 8 percent, however.

Toyota, after recalling more than eight million vehicles worldwide as it tried to resolve complaints about unintended acceleration, focused on pushing sales last month with deals that it described as unprecedented. Toyota buyers could get zero percent financing for five years or low lease payments on many models. G.M., Ford, Honda and Chrysler were among the other carmakers dangling no-interest loans in front of shoppers. But G.M. said its overall spending on incentives fell by 42 percent, or $2,000 a vehicle, from a year ago.

G.M.’s vice president for United States marketing, Susan Docherty, said a quarter of vehicles sold were new for the 2010 model year and came with very few discounts. G.M. does not want to begin relying on incentives again to artificially raise sales, she said. “We’ve been down that road before and we know it’s a dead end,” Ms. Docherty said on a conference call. “It’s really important that we earn our market share. We’re not interested in buying it.”

Toyota, meanwhile, increased its incentive spending by 43 percent, or nearly $700 a vehicle, according to estimates from Edmunds.com. The offers seemed to be more successful than even company executives anticipated. “February was tough, but once the new incentives came out it was good times again,” said Barry Jackson, the general manager of Sandy Springs Toyota, north of Atlanta. “Toyota has never been known for big incentives on their cars, so people are taking advantage.”

Mr. Jackson said his dealership moved 23 new vehicles on Wednesday, including two Prius hybrids to a man who had never owned a Toyota and originally came in looking for only one. “He ended up leasing two of them because the payments were so low,” he said. Analysts expected the industry’s retail selling rate, which excludes bulk sales to rental car companies and other fleet operators, to be at the highest level since 2008, aside from the months in 2009 when the government’s cash-for-clunkers program suddenly increased demand.

Greece May Be Heading to 'Square One' as Bonds Fall

Europe’s week-old rescue plan for Greece has so far failed to do what its leaders predicted: reduce borrowing costs for the region’s most indebted country. The yield on 10-year Greek government bonds has increased 25 basis points since EU leaders agreed to the aid blueprint on March 25, reaching a one-month high of 6.529 percent yesterday. The yield eased to 6.525 percent today, still more than double the rate on comparable German debt. Seven-year bonds sold by Greece on March 29 fell for a third day today. “What they were hoping for was to set up some sort of arrangement that never has to be used,” said Phyllis Reed, head of bond research in London at Kleinwort Benson, which manages about $32 billion. “The markets have sniffed that out and it seems like we’re heading back to square one.”

As borrowing costs increase, the risk is that EU leaders will have to deploy a rescue mechanism that still needs to be fleshed out. That would push them to decide the role of the Washington-based International Monetary Fund in any rescue and force the head of Europe’s biggest economy, German Chancellor Angela Merkel, to counter public opinion by funding a bailout with taxpayers’ money. So far, EU officials say they expect Greek yields to decline as the government in Athens carries out a plan to reduce its deficit to 8.7 percent of gross domestic product from 12.7 percent last year. European Central Bank President Jean-Claude Trichet said yesterday investors will “progressively recognize” the steps taken by Greece. EU spokesman Amadeu Altafaj said that Greece’s deficit-cutting plan is “on track.”