Illustration for the Sept. 9, 1903 issue of Puck

Ilargi: As the White House and separate states are divulging budget cuts that would until recently have been unthinkable, even though they're based on completely unrealistic economic scenarios and will therefore turn out to be only a small and lukewarm beginning of the cutting heat that's coming our way, it's good to reflect on the psychology behind it all.

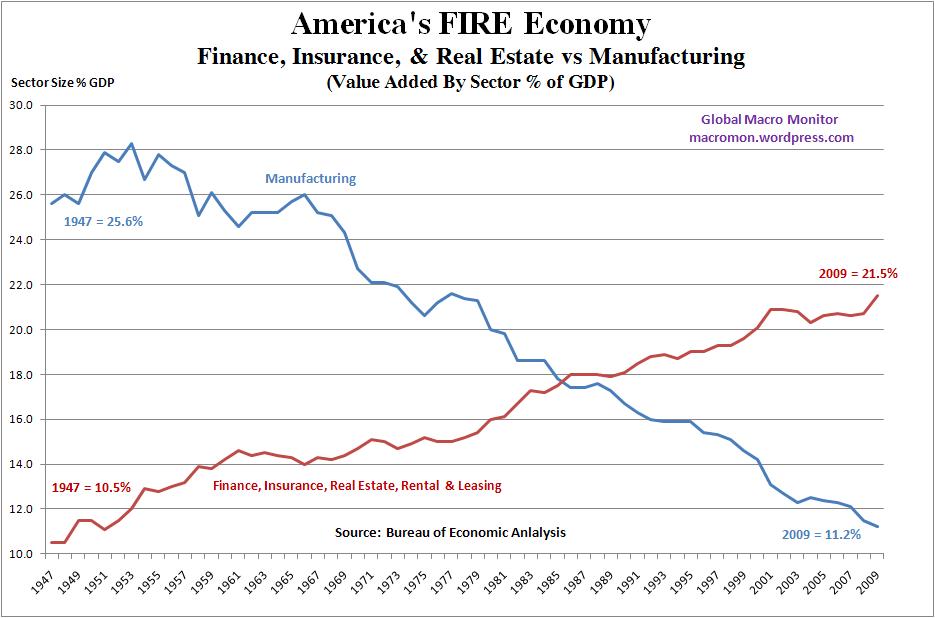

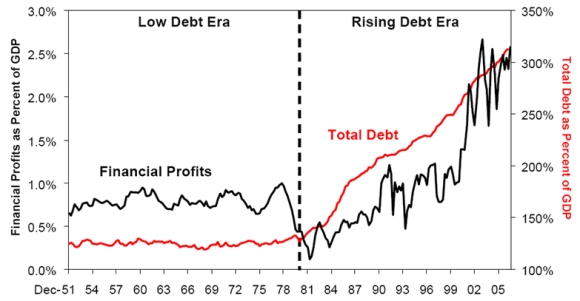

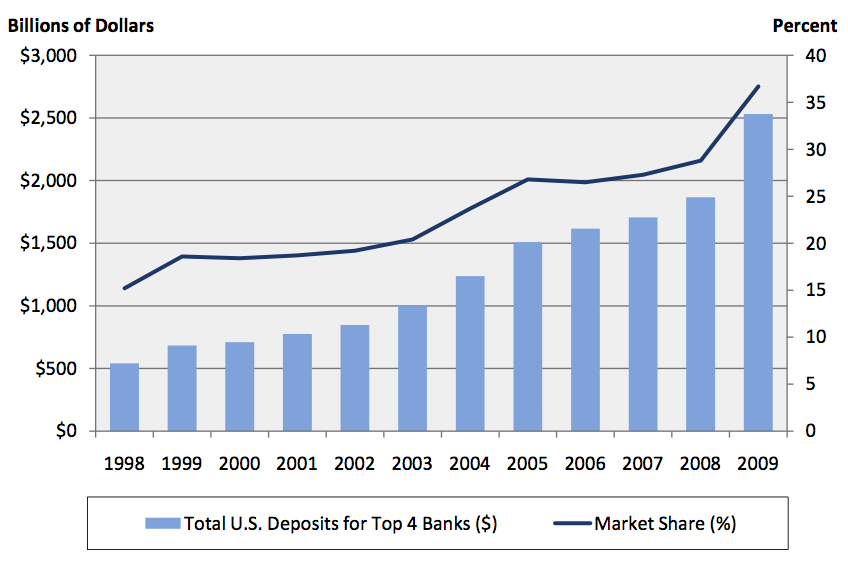

While the public at large is told there is much less money to be spend on everything from teachers to unemployment benefits to roadwork and infrastructure maintenance, the financial markets, and the big banks that control them, are having a field day, once again reaping huge profits, and this time, to add insult to injustice, with the very public money that the people are told is not there to spend on essential services anymore.

So today, here's the second installment of Ashvin Pandurangi's look at the psyche of losers (yeah, that would be you). I know the first part in the series, A Glimpse Into the Stubborn Psychology of Fish, which The Automatic Earth ran last week, was overlooked by many. I'd urge those who have missed it to go read it. We're not going to put a halt to this grand theft auto carnage if we don't even understand why it's happening, and what it is inside our brains that allows for it to do. Ashvin's focus on poker and roulette may well turn out to be key to that understanding.

Ashvin Pandurangi:

A curious thing happened to a middle-aged Frenchman in Monte Carlo last year. He had unexpectedly received a year-end bonus of 10,000 from his employer, and decided to visit Le Grand Casino for a weekend, where he could relax and gamble with his new found wealth. Since his wife and daughters were visiting his stepmother that weekend, he would be able to focus entirely on making some money. His first night was judiciously spent at the Roulette tables, where his sharp instincts and calculated patience presumably allowed him to double his allotted wealth in just five hours. It was an excellent night for the man, who was now 10,000 richer, and he spent the next afternoon lounging in a cabana at the hotel's pool.

That night, the man locked away the initial 10,000 in his room's safe and took the rest back down to the casino floor, where he quickly locked up a seat at his favorite Roulette table from the night before. His playing strategy remained the same as always - place a minimum bet on two out of three columns, switching one column each time he won a bet, and sitting out one roll each time he lost - no deviations from the strategy whatsoever. After a series of wild fluctuations in his bankroll, the man was left with only two more bets, and he decided to place them both on black. The tiny steel ball deftly rolled around the wheel for several revolutions and tensely bounced between a few numbered slots before finally choosing to settle on number 21 - red.

The man quietly finished his glass of red wine, shuffled up to his room and lay awake in bed. He couldn't help feeling extremely frustrated about the events of that evening. Frustrated with the insidious game of roulette, with his own careless betting decisions, with his "bad luck", with the other players who had won, with the man spinning the little steel ball, with the tiny ball itself. He kept replaying the spins in his mind, fantasizing about the money he would still have in his pocket if he had just made a few different decisions.

The man quietly finished his glass of red wine, shuffled up to his room and lay awake in bed. He couldn't help feeling extremely frustrated about the events of that evening. Frustrated with the insidious game of roulette, with his own careless betting decisions, with his "bad luck", with the other players who had won, with the man spinning the little steel ball, with the tiny ball itself. He kept replaying the spins in his mind, fantasizing about the money he would still have in his pocket if he had just made a few different decisions.  What especially haunted him was the would-be expression on his wife's face when he unexpectedly brought home 20,000. The 10,000 bonus would surely lift her into a state of pleasant surprise, but the man speculated that, if he had managed to double that bonus in just two short days at the casino, her pleasant surprise would be magnified ten-fold into a state of blushing pride .

What especially haunted him was the would-be expression on his wife's face when he unexpectedly brought home 20,000. The 10,000 bonus would surely lift her into a state of pleasant surprise, but the man speculated that, if he had managed to double that bonus in just two short days at the casino, her pleasant surprise would be magnified ten-fold into a state of blushing pride .On his journey back home the next day, the man began to realize just how strange his lingering feelings from the night before were. After all, he was exactly even from gambling at the end of his trip, and had actually been comped for a night's stay at the hotel and a few meals. He had even expected to lose a bit of money going into the trip, since Roulette laid players some of the worst odds in the Casino. The man reflected on the fact that his brief excitement from winning 10,000 on the first night had paled in comparison to his prolonged dismay from losing that same 10,000 on the second night. It was indeed a curious psychology that continued to puzzle the curious man, so he decided to do some Internet research when he arrived home. Hopefully, he thought, a new and more fundamental understanding of this psychology would finally put his mind at ease.

It didn't take too many Google searches before the man came across the concept of "myopic loss aversion", which explains that people are significantly more likely to experience pain or displeasure from losing a monetary amount than excitement or pleasure from winning that same amount, especially when they frequently evaluate financial outcomes. This disproportional dynamic is obviously powerful when it involves money that one can barely afford to lose, but it also forcefully applies to losses that may be small relative to an individual's bankroll. Even the multi-millionaire corporate executive who drops fifty grand gambling at a Vegas poker table will be beating himself up soon after, despite the fact that he will most likely make multiples of that by the end of the year (or at least he believes that he will).

Many of us may be familiar with the painful/shameful process of losing significant sums of money invested in the "wrong" place at the "wrong" time, but it is much more difficult to imagine the negative reactions produced when an entire economy of millions is serving up losses which, in a few short years, will threaten to wipe out all of the financial gains accumulated over decades. After the most potent "winning streak" in human history, the majority of American society has been blindsided by equally potent losses, which continue to mount and show no signs of abatement:

- It is estimated by Zillow that average home prices in the US have declined ~27% from their peak in June 2007, effectively destroying $9.8 trillion worth of homeowner's equity (in an economy worth ~$14 trillion). [1]

- About 15.7 million homeowners have negative home equity (owe more on home than it is worth), representing a whopping 27% of all mortgaged single-family homes. Joseph Stiglitz infers that these trends will lead to a total of about 9 million people losing their homes through foreclosure between 2008-2011. [2].

- According to officially under-stated statistics, the unemployment rate jumped from 5% in 2008 to ~9.6% in 2011, and the U-6 number puts it at ~16.5%. [3]. The official rate is only that "low" because millions of people have given up looking for jobs over the past few years (magically removing them from the official labor force), and millions of other people with part-time, low-paying jobs are counted as employed (26% of new private-sector hires are temporary [4]).

- Between 2006 and mid-2008, Americans had lost about 22% of total retirement assets or $2.3 trillion, and $2.5 trillion in savings and investment assets. [5]. Although a decent amount of this value has been recovered during 2009-10, it has mostly gone to a significantly smaller percentage of people who have held on to such assets and has only been achieved on the backs of taxpayers, who now owe interest on an additional $4 trillion+ in public debt (plus a few more trillion if we include the GSEs). [6]. When the markets crash again, that public debt will be money completely wasted for a large majority of Americans, if it is not considered to be already.

- Credit card defaults hit a near-record rate of 11.4% in 2010, more than double the rate in 2007, and the average late fee had risen almost 10% from $25.90 in 2008 to $28.19. [7].

- Public employees face at least a $2.5 trillion state pension shortfall mostly accumulated since 2008, and the gap can only be made up through drastic cuts to pension benefits, layoffs and cuts to public services for all other citizens. [8].

- Profits of most small businesses (unincorporated organizations such as partnerships and sole proprietorships) have fallen 5% in the last two years. [9], [10]. These businesses employ over half of all private sector employees and have created 64% of net new jobs over the last 15 years. [11].

There are many other losses that have befallen the American people over the last few years on top of those listed above, and recently they have also seen the costs of necessities increase. The real interest burden of private and public debt continues to weigh heavily on businesses, consumers, patients, students and civil servants. State welfare programs such as unemployment insurance, food stamps, Section 8 and Medicaid provide temporary crutches to dull the searing pain, but it is clear that these programs only continue to exist on recklessly borrowed time and will be selectively restricted to the American people in short order. The federal retirement program of Social Security, on which many retired Americans have come to rely on, is at the brink of insolvency (the difference between outlays and receipts for the SSA in 2010 was $76 billion [12]), and Medicare isn't looking too much better.

There are many other losses that have befallen the American people over the last few years on top of those listed above, and recently they have also seen the costs of necessities increase. The real interest burden of private and public debt continues to weigh heavily on businesses, consumers, patients, students and civil servants. State welfare programs such as unemployment insurance, food stamps, Section 8 and Medicaid provide temporary crutches to dull the searing pain, but it is clear that these programs only continue to exist on recklessly borrowed time and will be selectively restricted to the American people in short order. The federal retirement program of Social Security, on which many retired Americans have come to rely on, is at the brink of insolvency (the difference between outlays and receipts for the SSA in 2010 was $76 billion [12]), and Medicare isn't looking too much better. American politicians and officials are promising their constituents that this value lost will be recovered, but most of them remember too many broken promises to find any comfort in hollow words. When structural shortages of oil imports become a factor, Americans will have systematically lost not only their financial investments, but their entire way of life and lofty perspectives of reality. Sooner rather than later, we will be forced to fully experience the penetrating anguish and regret associated with unprecedented loss, as the tiny steel ball ceases to bounce around and settles in its pre-determined slot. It is at this time which we will realize that there is only a thinly-veiled political fiction separating us from the furiously desperate protesters in the crowded streets of the Middle East.

American politicians and officials are promising their constituents that this value lost will be recovered, but most of them remember too many broken promises to find any comfort in hollow words. When structural shortages of oil imports become a factor, Americans will have systematically lost not only their financial investments, but their entire way of life and lofty perspectives of reality. Sooner rather than later, we will be forced to fully experience the penetrating anguish and regret associated with unprecedented loss, as the tiny steel ball ceases to bounce around and settles in its pre-determined slot. It is at this time which we will realize that there is only a thinly-veiled political fiction separating us from the furiously desperate protesters in the crowded streets of the Middle East.MERS Lacks Right to Transfer Mortgages, Judge Says

by Thom Weidlich - Bloomberg

Merscorp Inc., operator of the electronic-registration system that contains about half of all U.S. home mortgages, has no right to transfer the mortgages under its membership rules, a judge said.

U.S. Bankruptcy Judge Robert E. Grossman in Central Islip, New York, in a decision he said he knew would have a "significant impact," wrote that the membership rules of the company’s Mortgage Electronic Registration Systems, or MERS, don’t make it an agent of the banks that own the mortgages.

"MERS’s theory that it can act as a ‘common agent’ for undisclosed principals is not supported by the law," Grossman wrote in a Feb. 10 opinion. "MERS did not have authority, as ‘nominee’ or agent, to assign the mortgage absent a showing that it was given specific written directions by its principal."

Merscorp was created in 1995 to improve servicing after county offices couldn’t deal with the flood of mortgage transfers, Karmela Lejarde, a spokeswoman for MERS, said in an interview last year. The company tracks servicing rights and ownership interests in mortgage loans on its electronic registry, allowing banks to buy and sell the loans without having to record the transfer with the county. It played a major role in Wall Street’s ability to quickly bundle mortgages together in securitized trusts.

"‘Don’t come around here no more,’ is basically the message to MERS," said April Charney, a senior attorney with Jacksonville Area Legal Aid in Jacksonville, Florida. "The judge basically deconstructed MERS and said there’s no possible way in any case you can come in and show you have this appropriate proper status to transfer the note."

"MERS and its partners made the decision to create and operate under a business model that was designed in large part to avoid the requirements of the traditional mortgage-recording process," Grossman wrote. "The court does not accept the argument that because MERS may be involved with 50 percent of all residential mortgages in the country, that is reason enough for this court to turn a blind eye to the fact that this process does not comply with the law."

Automatic Shield

In the case Grossman ruled on, Credit Suisse Group AG’s Select Portfolio Servicing, a mortgage servicer, sought to bypass the automatic shield against legal claims triggered by Ferrel L. Agard’s filing for personal bankruptcy in September. Select Portfolio wanted permission to foreclose on Agard’s home in Westbury, New York, on behalf of U.S. Bancorp’s U.S. Bank unit, the trustee for the mortgage-backed trust the home loan was in. The house is worth about $350,000 and the mortgage amount was $536,921, according to the decision.

Grossman ruled in favor of Select Portfolio because he couldn’t overrule a November 2008 foreclosure judgment the servicer won in state court, he said. Without that state-court ruling, Select Portfolio wouldn’t have had the right to bring its motion, Grossman said. He then addressed whether a mortgage transfer by MERS is valid, because "MERS’s role in the ownership and transfer of real-property notes and mortgages is at issue in dozens of cases before this court," including those where "there have been no prior dispositive state-court decisions," he wrote.

Select Portfolio argued in part that MERS’s February 2008 assignment of the mortgage to U.S. Bank was valid because Agard agreed that MERS would hold title to it for the original lender, Bank of America Corp.’s First Franklin, and for whichever banks it was further assigned to. First Franklin transferred the promissory note the mortgage secured to Lehman Brothers Holdings Inc.’s Aurora Bank and Aurora to U.S. Bank, according to the decision.

"An adverse ruling regarding MERS’s authority to assign mortgages or act on behalf of its member/lenders could have a significant impact on MERS and upon the lenders which do business with MERS throughout the United States," Grossman wrote. "It is up to the legislative branch, if it chooses, to amend the current statutes to confer upon MERS the requisite authority to assign mortgages under its current business practices."

MERS intervened in the case and argued that Agard’s mortgage, the terms of its membership agreement and New York state law gave it the authority to assign the mortgage. MERS says it holds title to mortgages for its members as both "nominee" and "mortgagee of record."

Grossman said Select Portfolio had to show that U.S. Bank owned both the note and the mortgage, and there was no evidence that it held the note. The judge disagreed with Select Portfolio’s argument that U.S. Bank held the note because the note "follows" the mortgage, which it said U.S. Bank owned. "By MERS’s own account, the note in this case was transferred among its members, while the mortgage remained in MERS’s name," Grossman wrote.

"MERS admits that the very foundation of its business model as described herein requires that the note and mortgage travel on divergent paths." The judge said that the membership agreement wasn’t enough to assign the mortgage and that to do so the lender would have to give power of attorney or similar authority to MERS.

MERS’s membership rules don’t create "an agency or nominee relationship" and don’t clearly grant MERS authority to take any action with respect to mortgages, including transferring them, Grossman wrote. Because the interests at issue concern "real property" -- land and buildings -- under state law, any transfer has to be in writing, which isn’t done under the MERS system, he said.

"Without more, this court finds that MERS’s ‘nominee’ status and the rights bestowed upon MERS within the mortgage itself, are insufficient to empower MERS to effectuate a valid assignment of mortgage," the judge wrote. "MERS’s position that it can be both the mortgagee and an agent of the mortgagee is absurd, at best."

Grossman said parties coming to him to seek to lift the automatic ban on legal claims in cases involving MERS will have to show they own both the mortgage and the note.

Painful cuts in Obama's $3.7 trillion budget

by Jeanne Sahadi - CNNMoney

President Obama on Monday [unveiled] a $3.7 trillion budget request for 2012 that proposes painful cuts in many government programs but fails to address the largest drivers of the country's long-term debt: Medicare, Medicaid and Social Security. The budget takes a big bite out of domestic spending and would slash deficits by $1.1 trillion over the next decade, according to White House estimates.

Two-thirds of those deficit cuts would result from spending reductions, while a third would come from an increase in tax revenue, according to senior administration officials. The cuts include slashing the funding for the low income heating assistance program. "It's a tough decision and we didn't make it lightly," White House budget director Jacob Lew told CNN's "American Morning" on Monday. "The program was never designed to meet all needs."

But even as it trims deficits, the president's budget would add $7.2 trillion to the debt held by the public between 2012 and 2021. Obama's 2012 budget, which will be released in its entirety at 10:30 a.m., is sure to stoke the debate over how to get the government's fiscal house in order.

On the president's right, Republican lawmakers are calling for even deeper cuts and hankering for a fight now over 2011 spending. At the same time, many Democrats and liberal advocates are expected to lash into the administration for the depth of some of his proposed cuts. Sen. Jeff Sessions of Alabama, the ranking member on the Senate Budget Committee, told "American Morning" the budget cuts are nowhere near deep enough to reduce the deficit or the interest payments on the debt. He said the "$1 trillion reduction is insignificant and does not get us off on the right course. We are facing a fiscal crisis."

Strategic investments - and cutbacks: Broadly speaking, the president's request calls for a mix of spending proposals aimed at boosting U.S. competitiveness and belt-tightening intended as a "down payment" on serious deficit reduction. In some cases, the added investment and belt-tightening happen in the same program. For instance, Obama's budget wants to make permanent the recent increase in the level of Pell Grants to $5,500 a year to help 9 million students afford college and graduate school.

But to pay for that proposal, Obama would eliminate the grants for summer school and limit their use to the regular school year. He will also propose that interest on federal loans for graduate students start accruing during school; currently, the interest tab doesn't start running until after graduation. Overall, Obama will call for a five-year freeze on non-security discretionary spending, which the White House estimates will save more than $400 billion over 10 years.

Non-security domestic spending only makes up a little more than 10% of all federal spending, and deficit hawks lament that both the White House and Republicans have focused all of their attention in this area rather than address the country's big debt drivers, which are spending on the entitlement programs and defense. Half of all agencies will see funding reduced from 2010 levels, according to the administration. And altogether, there will be more than 200 terminations, savings and reductions of programs totaling $33 billion in the first year.

Among his proposals for strategic investments, Obama will call for three green energy initiatives:

- 1 million electric cars on the road by 2015;

- a doubling of the share of electricity that comes from clean energy sources by 2035;

- and a 20% reduction in building energy use by 2020.

To help pay for these initiatives, the president will call on Congress to eliminate 12 tax breaks for oil, gas and coal companies. The White House estimates those changes will raise $46 billion over a decade.

Overall, while president's budget doesn't reduce the debt, it does start to stabilize annual deficits around 3% of the economy by the middle of the decade. That's the point where the country's annual spending doesn't add to the debt. But high deficits will still accrue in the years after 2015 because of the interest owed on debt already accrued. For instance in 2017, the administration estimates there will be a $627 billion deficit -- all of which will be interest payments due.

And because the president's budget will not address how to curb the growth in entitlement spending, there is little chance it would stabilize deficits beyond the next 10 years. A senior administration official described the 2012 budget request as a "firm foundation to take the next step." On Social Security, a lightning-rod program that budget experts say faces serious longer-term problems, the president will use the budget to "lay out his principles" on how to strengthen the program in the future.

What could go wrong: Obama's budget request is essentially a blueprint of his fiscal priorities -- the programs he would like to fund or cut, the new investments he would make and how he would pay for it all. But the request is just that -- a request. And it's one that Congress can accept, reject or modify. Indeed, Republicans may well reject Obama's budget out of hand.

And some of his proposals are likely to be a tough sell politically. For instance, he wants to limit the value of itemized deductions for families making more than $250,000 a year. He has made the same proposal before, and it went nowhere. What's new with this budget is the context. He will call for the money raised by limiting deductions to pay for protecting the middle class from the Alternative Minimum Tax for three years. Lawmakers pass so-called AMT patches regularly but rarely pay for them.

Even if Obama's budget is adopted wholesale -- which it won't be -- the estimates for deficit reduction may or may not pan out depending on how close to reality the administration's forecasts for unemployment, interest rates and economic growth prove to be. In any case, Obama's 2012 budget is only the first step in a convoluted process that involves no less than 40 congressional committees, 24 subcommittees, countless hearings and a number of floor votes in the House and Senate.

If all goes well, a formal federal budget for government agencies will be in place by Oct. 1, the start of the 2012 fiscal year. Because Congress never passed a budget for fiscal year 2011, the government has been running on funding from a so-called continuing resolution, which expires on March 4.

White House Expects Deficit to Spike to $1.65 Trillion

by Damian Paletta and Corey Boles - Wall Street Journal

The White House projected Monday that the federal deficit would spike to $1.65 trillion in the current fiscal year, the largest dollar amount ever, adding pressure on Democrats and Republicans to tackle growing levels of debt.

The projected deficit for 2011 is fueled in part by a tax-cut extension that President Barack Obama and Republican lawmakers brokered in December, two senior administration officials said. It would equal 10.9% of gross domestic product, the largest deficit as a share of the economy since World War II. The new estimate is part of Mr. Obama's proposed budget for fiscal year 2012, which becomes public Monday morning. Mr. Obama is proposing $3.73 trillion in government spending in the next fiscal year, part of a plan that includes budget cuts and tax increases that administration officials believe will sharply bring down the federal deficit over 10 years.

The deficit would decline in fiscal year 2012 to $1.1 trillion, or 7% of gross domestic product, under Mr. Obama's plan, as a year-long payroll tax holiday and an extension of federal jobless benefits expired, administration officials said. By 2017, the budget plan says, the deficit would be shaved to $627 billion, or 3% of gross domestic product. Senior administration officials said the new budget would address concerns about the country's long-term fiscal challenges while spending more money on education and research programs that the administration says are needed to boost economic growth.

But Mr. Obama's plan is likely to be rewritten by Republicans who control the House, as proposed spending cuts in his budget fall short of the reductions congressional Republicans are seeking. Even before turning to Mr. Obama's plan for fiscal year 2012, which begins Oct. 1, lawmakers are battling over levels of government spending for the remainder of fiscal year 2011, which House lawmakers will debate this week. "We're very eager to work with Republicans to cut spending and reduce our deficit," a senior administration official said Sunday night.

At $1.65 trillion, the administration's projection for the 2011 deficit is significantly larger than the $1.48 trillion estimated by the non-partisan Congressional Budget Office a few weeks ago. In fiscal year 2010, the deficit was $1.29 trillion. White House officials believe their budget proposal would shave $1.1 trillion off of accumulated federal deficits over 10 years, which they believe would push levels of federal spending into a healthier balance.

That would be less than the $4 trillion in reductions the White House's deficit-reduction commission proposed in December, but it's still a level administration officials believe is achievable and sustainable. The budget wouldn't do much, though, to arrest a future spike in the projected costs of Medicare, Medicaid, and Social Security. Mr. Obama has said he's open to making changes in these programs, but he wants cooperation from Republicans before he will begin.

The savings in the budget come from a combination of spending cuts and increases in revenue. A five-year freeze on non-defense discretionary spending would save more than $400 billion over 10 years, the administration says. The White House, in its plan for 2012, reduces certain programs to save an additional $33 billion. This includes more than $2 billion in cuts to travel, printing, supplies and other overhead costs. The plan also would cut more than $1 billion in grants to large airports and $950 million to revolving funds for state water treatment plants, among other things.

The proposed budget seeks to prevent many middle-class Americans from being subjected to the Alternative Minimum Tax, which would raise their tax bills, for three years starting in fiscal 2012. To cover the cost, the administration would put new limits on the ability of the wealthiest earners to utilize tax deductions to lower their tax burden, among them deductions for charitable contributions and mortgage interest.

The Alternative Minimum Tax was designed to ensure that wealthier earners do not use deductions to avoid most or all taxes. Lawmakers in both parties want to find a long-term solution that limits its growing reach into middle-class households. But Republicans are unlikely to agree to what, in effect, is a tax increase on wealthier Americans to pay the cost of doing so..

The budget will also propose averting scheduled reductions in payments to doctors who treat Medicare patients for the next two fiscal years, at a cost of $62 billion over 10 years. To cover the cost, savings would be found by making improvements in the health care delivery system that weren't detailed by administration officials. The White House will propose cutting 12 tax breaks to oil, gas and coal companies, which it projected will raise $46 billion in revenue over 10 years.

The budget calls for $148 billion in overall spending on research and development, which includes $32 billion in biomedical research at the National Institutes of Health. It would create 20 new Economic Growth Zones, providing tax incentives meant to attract investors and employers in hard-hit economic areas.

The tax deal agreed to by the president and congressional Republicans in December extended all current tax rates for two years, continued an expanded federal jobless benefits program for a year, and exempted most Americans from having to pay payroll taxes for a year. When it was signed into law, it was estimated the compromise would cost more than $850 billion over the next decade.

Budget Forecasts Bigger 2011 Deficit

by Jonathan Weisman and Naftali Bendavid - Wall Street Journal

President Barack Obama's 2012 budget proposal projects this year's deficit will reach $1.6 trillion, the largest on record, as December's tax-cut deal begins to reduce federal revenues, a senior Democrat said Sunday.

The new forecast is larger than the $1.48 trillion deficit projected last month by the Congressional Budget Office, Congress's nonpartisan scorekeeper, and up from last year's $1.3 trillion shortfall. The tax deal extended tax cuts enacted during the Bush administration while adding others, such as a temporary cut to the payroll tax. The prospect of a record deficit is likely to intensify the debate over federal spending and cost controls, which has gripped Washington in recent weeks. Conservative Republicans, many elected with tea-party support, are demanding deep budget cuts for the current fiscal year, which ends Sept. 30.

For now, Mr. Obama and the Republicans are choosing to clash over a narrow slice of federal spending—the 15% devoted to discretionary programs unrelated to security and defense—while the entitlement programs that are driving projected federal deficits remain unaddressed by either party.

Mr. Obama's budget, to be released Monday, calls for spending cuts and tax hikes that would slice about 14% of the approximately $8 trillion in cumulative federal deficits that would occur over the next 10 years without action being taken. It estimates the deficit will fall to $1.1 trillion next year as the economy picks up and the president's proposed spending freeze begins to have effect.

White House officials described the plan as a "down payment" on future deficit reduction. Both political parties are feeling a push from some lawmakers to address spending on Social Security, Medicare and other entitlement programs, which are becoming the largest drivers of the deficit. But both are fearful of proposing changes to popular programs without assurances that the other party will join in the talks.

White House officials believe the time for dealing with entitlements will come soon, when the administration and congressional Republicans come to loggerheads over spending for the current fiscal year or over raising the government's statutory borrowing limit, said Robert Greenstein, executive director of the liberal Center on Budget and Policy Priorities and a White House adviser. To avoid locking the parties into entrenched positions before closed-door negotiations, the White House didn't want to put out proposals that would take fire from both sides.

House Speaker John Boehner (R., Ohio) recently said he "made a mistake'' in backing a higher retirement age for Social Security, because a "conversation'' with Americans was needed first to explain the retirement system's problems. Social Security, Medicare and other entitlement programs will consume 60% of all federal spending, not counting interest on the debt, next year, or $2 trillion, according to the Congressional Budget Office. By 2021, they will eat up 68% and cost $3.3 trillion.

Mr. Boehner said on Sunday that Mr. Obama's budget leaves spending and debt too far out of balance. "The president's asked us to increase the debt limit, and yet he's going to present a budget tomorrow that continues to destroy jobs by spending too much, borrows too much and taxes too much," Mr. Boehner said on NBC's Meet the Press. White House aides said two-thirds of the proposed $1.1 trillion in cumulative savings over the next 10 years would come from spending cuts, while a third would come from tax increases and tax-break closures.

White House officials say the cuts they propose for next year's budget will be significant. Low-income heating assistance would be cut nearly in half, by $2.5 billion, according to an administration official. Aid to state and local governments through Community Development Block Grants would be cut by $300 million. Other programs and agencies to see significant spending cuts would include the Army Corps of Engineers; agricultural subsidies; an Environmental Protection Agency water treatment fund for state and local governments; and the Forestry Service.

Some programs that Mr. Obama says are needed to improve U.S. education and competitiveness would see increases. Overall, the budget includes a five-year freeze on domestic spending. It couldn't be learned what target the White House had set for federal spending as measured against the economy as a whole. A White House deficit-commission last year proposed cutting spending to 21.6% of GDP by 2015, down from 23.8% in 2010.

Mr. Obama's proposed cuts for 2012 reflect a trajectory for federal spending that is far higher than what House Republicans are pressing for. In a plan released Friday evening, House GOP leaders said they wanted to cut $61 billion in federal spending in the remainder of 2011, including from programs long supported by Democrats.

For instance, the White House's $300 million cut to community development grants for all of next fiscal year is more than matched by the House GOP's proposed $3 billion cut to community development in the current year. Head Start, a health and education program for low-income children, would be cut 15.3% in the GOP plan. Democrats say that would cause 218,000 children to be dropped from the program. Nutritional aid for women, infants and children would be cut by 10.3%.

The Food and Drug Administration would be cut by 8.7% under the House GOP plan, and the Environmental Protection Agency, which is emerging as a focal point of the ideological battle between the two parties, would be cut 30%. The differences between the two visions for federal spending suggest that clashes will soon come on spending for this year and next. The first showdown will come in early March, when a stop-gap spending law that has been funding the government expires. Both parties, however, are playing down the potential for a stalemate that would shut down the government.

A second showdown could come in May, when the federal government hits the statutory limit on borrowing. Before Congress raises the debt limit, Republicans say they will demand stringent cuts in spending. This summer, House and Senate subcommittees will begin drafting spending bills for fiscal 2012. The Senate, led by Democrats, will likely use the White House plan as a blueprint, but the Republican-dominated House will go its own way, setting off still more clashes in the fall, when those plans must be passed by Congress to keep the government functioning.

Mr. Obama's plan to reduce the deficit by $1.1 trillion over 10 years is short of the $4 trillion in reductions the White House's bipartisan deficit-reduction commission proposed in December. It would bring the country's deficit to around 3% of the country's GDP by 2017, an administration official said. That is higher than the 2.3% threshold the deficit-reduction commission proposed. The White House would fail to meet a promise made a year ago to balance the budget outside of interest payments on the federal debt by 2015, which would mean a deficit of 3% of GDP.

Even at the levels forecast, the administration is counting savings that it doesn't detail. For instance, the White House budget would stop a long-deferred drop in Medicare reimbursements to doctors for the next two years, and pay for it with $62 billion in cuts to Medicare, Medicaid and other health programs over the next 10 years. Of that, $18 billion would come from ending mechanisms that state governments use to boost Medicaid reimbursements from the federal government. But beyond fiscal 2013, the budget does not lay out offsetting budget cuts for what is likely to be a continuing need to address doctor reimbursement costs.

The White House will propose preventing the alternative minimum tax from expanding to hit more middle-income households, and paying for the change for three years by limiting tax deductions, two administration officials said. The mortgage-interest deduction would be limited for higher-income families. Deductions for charitable giving would be capped, an idea floated last year that went nowhere.

The budget proposal will recommend ending tax cuts for the highest earners, enacted under former President George W. Bush, when they are set to expire at the end of 2012. However, the White House isn't counting the projected $1.1 trillion in higher taxes it would collect in budget forecasts.

White House Budget director Jacob Lew said the budget would enable nine million college students to take advantage of Pell grants, but to pay for that, the budget would eliminate Pell grants during the summer, limiting them to the academic year. Similarly, the budget will help pay for 100,000 new teachers, especially in the math and sciences. But it would also begin applying interest to graduate students' loans while those students are still in school.

GOP to Block Renewal of Build America Bonds Program

by Andrew Ackerman - Wall Street Journal

Key Republicans signaled they would block renewal of the Build America Bonds program as the Obama administration prepared to reinstate the bonds in the 2012 budget plan due Monday.

Build America Bonds were originally introduced as part of the $787 stimulus program in 2009 but expired at the end of last year. They allowed states and localities to sell taxable bonds and receive a federal subsidy payment from the Internal Revenue Service equal to 35% of the interest costs on their bonds. But Sen. Orrin Hatch (R., Utah), the ranking Republican on the Senate Finance Committee, said late Friday that BABs were "simply a disguised state bailout." "These bonds rightly expired at the end of 2010 and it is my hope the Obama administration does not try to resurrect such a nonsensical provision in their upcoming budget," he said.

The Obama administration will propose reintroducing BABs, according to three people outside the administration who were briefed on the matter. They expected the administration to propose a two-year extension at a 28% subsidy rate for the bonds. Even a 28% subsidy rate wouldn't garner GOP support, according to a Republican Senate aide. The aide said the rate wasn't revenue neutral, meaning it would cost the federal government more in subsidy payments than the government loses in revenue from traditional tax-exempt municipal bonds.

Democrats see these bonds as an effective tool for job creation and funding infrastructure projects. Some were already trying to reinstate them ahead of the budget proposal last week. On Thursday Rep. Gerald Connolly (D., Va.) introduced a bill that would extend the bonds at subsidy rates of 32% in 2011 and 31% in 2012. That bill has been referred to the House Ways and Means Committee, which handles tax legislation, but it is unlikely to advance. Ways and Means Chairman Dave Camp (R., Mich.) said last year Build America Bonds were "a highly subsidized spending program."

The Obama administration proposed making the bond program permanent in its budget proposal last year at a 28% subsidy rate. Though bills to extend the program for two years twice passed the then-Democrat controlled House, they failed to get a vote in the full Senate because of Republican opposition. State and local governments sold a total of $182.5 billion of the bonds before the program expired, according to Thomson Reuters data.

Housing Crash Is Hitting Cities Once Thought to Be Stable

by David Streitfeld - New York Times

Seattle — Few believed the housing market here would ever collapse. Now they wonder if it will ever stop slumping. The rolling real estate crash that ravaged Florida and the Southwest is delivering a new wave of distress to communities once thought to be immune — economically diversified cities where the boom was relatively restrained.

In the last year, home prices in Seattle had a bigger decline than in Las Vegas. Minneapolis dropped more than Miami, and Atlanta fared worse than Phoenix. The bubble markets, where builders, buyers and banks ran wild, began falling first, economists say, so they are close to the end of the cycle and in some cases on their way back up. Nearly everyone else still has another season of pain.

"When I go out and talk to people around town, they say, ‘Wow, I thought we were going to have a 12 percent correction and call it a day,’ " said Stan Humphries, chief economist for the housing site Zillow, which is based in Seattle. "But this thing just keeps on going."

Seattle is down about 31 percent from its mid-2007 peak and, according to Zillow’s calculations, still has as much as 10 percent to fall. Mr. Humphries estimates the rest of the country will drop a further 5 and 7 percent as last year’s tax credits for home buyers continue to wear off. "We went into 2010 feeling gangbusters, thanks to Uncle Sam," Mr. Humphries said. "We ended it feeling penniless, with home values tanking."

The fact that even a fairly prosperous area like Seattle was ensnared in the downturn shows just how much of a national phenomenon the crash has been. The slump began when the low-quality loans that drove the latter stage of the boom began to go bad, but the resulting recession greatly enlarged the crisis. Many people could not get a mortgage, and others simply gave up the hunt. Now, though the overall economy seems to be mending, housing remains stubbornly weak. That presents a vexing problem for the Obama administration, which has introduced several initiatives intended to help homeowners, with mixed success.

CoreLogic, a data firm, said last week that American home prices fell 5.5 percent in 2010, back to the recession low of March 2009. New home sales are scraping along the bottom. Mortgage applications are near a 15-year low, boding ill for the rest of the winter.

It has been a long, painful slide. At the peak, a downturn in real estate in Seattle was nearly unthinkable. In September 2006, after prices started falling in many parts of the country but were still increasing here, The Seattle Times noted that the last time prices in the city dropped on a quarterly basis was during the severe recession of 1982.

Two local economists were quoted all but guaranteeing that Seattle was immune "if history is any indication." A risk index from PMI Mortgage Insurance gave the odds of Seattle prices dropping at a negligible 11 percent. These days, the mood here is chastened when not downright fatalistic. If a recovery depends on a belief in better times, that seems a long way off.

Those who must sell close their eyes and hope for the best. Those who hope to buy see lower prices but often have lighter wallets, removing any sense of urgency.

Arne Klubberud and Melissa Lee-Klubberud paid $358,000 for a new, 960-square-foot townhouse on trendy Capitol Hill a few weeks after that Seattle Times article was published. Now, with one child and with hopes for more, they need more space. They just put the townhouse on the market for $300,000. "Obviously, this is not the ideal situation," said Ms. Lee-Klubberud, a 32-year-old lawyer. They are hoping to take advantage of the sour market to buy at a good price, but first, they must sell for an amount that is acceptable. "Everyone has their limits," she said. "We have ours."

On a dark, dank Sunday, a handful of people came to look at the three-level unit. One of them was Katherine Davis, who had just sold her house in the far eastern suburbs. It took 14 months, during which she had to drop the price several times. The equity she had accumulated over the decades disappeared quickly. "At first, I thought it would be nice to come out of this with $200,000, but I adjusted my expectations," Ms. Davis said. She ended up with less than half of that. Her goal is to buy a small place in the city, but not yet. "Selfishly, I’m hoping the market continues to drop," she said.

Increasing numbers of sellers are simply surrendering. Megan and Ryan Dortch tried to sell their one-bedroom Eastlake condo for $325,000 two years ago. They rejected an offer of $295,000 as inadequate. A year later, they relisted it for $289,000, then $279,000, which was less than they paid. Without a sale at that price, they could not afford to buy a place big enough for them and their new baby.

They have given up on real estate. They are renting out their old apartment at a small loss every month, and living in a rented house. "I don’t expect the market to get better," said Ms. Dortch, 31, a customer service consultant. Neither does Gene Burrus, another frustrated seller who became a landlord. "Rent is so cheap it doesn’t make sense to buy now," he said. He might reconsider if 10 or 15 percent more comes out of the market.

Redfin, a real estate brokerage firm based in Seattle, says foot traffic began picking up in the last several weeks. Mortgage rates are rising, which could nudge those who need to buy to make a deal now for fear rates will rise even more.

But whenever the market finally does pick up, all those accidental landlords will want to unload, putting another burden on the market. "So many sellers are waiting in the shadows," said Redfin’s chief executive, Glenn Kelman. "The inventory is going to expand and expand and expand. I don’t see any basis for significant price increases."

While almost every economist is expecting another round of price declines for the next few months, many see a leveling off in the second half of the year. Fiserv, the company that produces the monthly Case-Shiller Home Price Indexes, analyzed prices in 375 communities. About three-quarters of them will be stable by December, Fiserv calculates.

"We’re at a period near the bottom but with more volatility than we normally see at this point," said David Stiff, Fiserv’s chief economist. "This sort of double dip is unprecedented for housing." Maybe that is why belief in a bottom is as elusive now as fears of a top were in 2006. "We would love to have a house," said Dan Cunningham, a 41-year-old renter. "I have more than enough for a down payment. I’m preapproved for a loan. But I have to have confidence it’s not going to lose another 20 percent." He plans to wait until he sees prices rising before making any offers.

Property taxes = Perpetual Liabilities - An endless note on your house you can never pay off

by Mish - Global Economic Analysis

Imagine the perpetual loan, a loan that no matter what you do, you can never pay off. To help conceptualize the idea, think of it as a perpetual interest-only loan in which you are forbidden to completely pay off principal.

As preposterous as that deal may sound, it is highly likely you are in one.

If you own a house, you are in exactly that deal, except it conveniently not called interest. Instead it's called a property tax.

This is a post I have been meaning to write for years. However, I was finally inspired by a reader "Russell" who writes ...Hello Mish

Here's a heads up from Portland Oregon. The city is proposing a property tax hike of 15 percent for the May ballot. Currently, most of the current city property taxes go towards police and firefighter pensions.

This proposed hike is "for the kids", threatening teacher layoffs. I assume this is the first of many hike attempts that we will be seeing in the near future.

Do we really own our property? I say we don't. We basically have a note that we can never pay off from the government. I will now have to pay around 550 a month for the right to own my house.

Isn't that like a 100,000 dollar note that can never be payed off? Why own property in these cities? Why live here? That is what my wife and I are starting to face. We like our neighborhood and the city in general, but if may be time to leave.

Thanks again for all that you do (that you can put this kind of content out daily blows me away),

Russell

Portland Seeks Two Tax Hikes

Oregon Live reports Portland school board unanimous: A second school tax hike on the May ballotThe Portland school board voted 6-0 tonight to put a second tax hike before voters in May, saying a higher operating tax is needed to save 200 teaching jobs in Portland Public Schools.

If voters say yes, the local-option property tax set aside to bolster Portland schools would rise to $1.99 per $1,000 of assessed property value, a 60 percent increase from the current $1.25 per $1,000 voters approved in 2006.

It is the second tax increase the school board has referred to the May ballot. The first was a record-setting $548 million school construction bond that, if approved, will cost property owners $2 for every $1,000 of assessed property values for the next six years.

School board members said that financial hard times for families make this a tough time to ask property owners to pay more.

But they said cutting more than 400 teachers, rather than about 150 as would be necessary if the levy passes, would be too harmful to students and to the local economy.

"We are talking about protecting family-wage jobs in Portland," board member Bobbie Regan said.

Tell Bobbie Regan to Stuff It

What Portland needs is a competing measure on the ballot to lower taxes.

If you live in Portland, it is your patriotic duty to get Bobbie Regan's phone number, call her up and tell her where to go. The arrogance and gall of these people is amazing.

Not a single teacher need lose their job, not a one. All the union has to do is accept lower wages or benefits. Instead they want to tax you to death, not one but twice so the teachers' union can get wages and benefits that no one else does.

Compute Your "Endless Note" Interest

To compute your perpetual interest, take your property tax and divide by the estimated fair market value on your house.

Property taxes in Illinois are insane. I pay about $14,000 a year ($1167 a month!) on a house worth about $650,000. Thus my property taxes are roughly 2.2% a year. Is this really "owning" a house?

Why Own a House?

As noted above, you can never really own one. Property taxes are a perpetual liability.

However, I made an agreement with my wife, decades ago, that we would get a house as soon as she finished school. She wanted one, I didn't. However, now that I have one, I am happy with it. There are tradeoffs.

My advice to people has not changed. If you want a house and can afford a house, then as long as you really know what you are getting into, and as long as you are quite sure your job is stable then buy a house. (That's quite a lot of IFs)

In 2004-2006 I was more vehemently opposed to buying a house than now.

Twenty years ago you could get nice appreciation, but that is no longer true. Moreover, I suspect that once home prices bottom, prices will stagnate for a decade.

Thus, there is no compelling financial treason to own a house. Indeed, from a financial perspective, there are good reasons to not own a house.

However, there are more important things than money. If having a house makes you or a loved one happy, then as long as you can afford a house, and as long as it does not make you a debt slave, it is reasonable to buy one.

The biggest key right now is making sure your job is stable. If it's not, then buying a house might bankrupt you if you lose your job. Unfortunately, many people vastly overestimate the stability of their job.

U.S. investors fear muni defaults, job losses

by Pedro Nicolaci da Costa - Reuters

Some of the United States' weakest local governments face a real risk of default in 2011 as well as waves of layoffs that could put upward pressure on the country's jobless rate, according to a Reuters poll. The findings from the poll published on Sunday found a majority of Wall Street professionals including municipal bond traders and investors believe -- 14 out of 25 -- up to four multibillion-dollar municipal bond defaults will take place this year.

The tremors come at a time when financial markets are still fragile as the economy recovers from its deepest slump since the Great Depression, and the turbulent finances of states and municipalities have been cited by top Federal Reserve officials as a key downside risk to the expansion. Among the investors polled, 19 of 23 thought job cuts aimed at bringing budgets into line would put noticeable upward pressure on the national unemployment rate, which over the past two months has fallen sharply to 9.0 percent from 9.8 percent.

Ten of those surveyed saw the jobless rate increasing more than 0.5 percentage point and three believed the impact would be over a full percentage point -- a rise that could potentially be associated with hundreds of thousands of job losses. "If the states fire the employees necessary to cut their budgets, unemployment will get worse," said Marilyn Cohen, president of Envision Capital Management in Los Angeles.

While few municipal market analysts think any state will default on its debt -- in part because states cannot legally file for bankruptcy -- there are intense concerns about the shaky finances at some big U.S. cities. Last March, for example, Detroit laid out bankruptcy risks in a debt offering statement. The city, which is rated in the junk category by Standard & Poor's and Moody's Investors Service -- and has not sold general obligation debt since -- said in the bond document it did not envision a bankruptcy filing.

"A credit like Detroit with limited liquidity and sizable debt could file bankruptcy in 2011, but only if politics goes against it and the state allows the filing to take place," said Richard Ciccarone, head of municipal bond research at McDonnell Investment Management in Oakbrook, Illinois.

In The Clear?

But the state governments are not completely out of the woods. Among the debt-ridden states topping the list of concerns, Illinois and California were seen by far as the weakest links, followed by Nevada, at the epicenter of the subprime mortgage crisis. Thirteen out of 27 respondents to the Reuters poll ranked Illinois as the most troubled U.S. state.

"While the recent Illinois state income tax hike proves Illinois' legislature has the will to take fiscally-conservative action, the state is facing debatable long-term economic prospects, a high debt load and an even higher unfunded pension problem," said Guy LeBas, chief fixed-income strategist at Philadelphia-based Janney Montgomery Scott, an investment fund with $52 billion under management.

Illinois' unfunded pension liability is the biggest among the states at $75.5 billion as of the end of fiscal 2010, while its funded ratio was just 45.4 percent. The cash-strapped state is turning to a debt sale for the second year in a row to raise money just to make its pension payment.

California -- the biggest issuer of bonds in the $2.8 trillion U.S. municipal debt market -- is also facing tough times. Its economy was hit hard by the combined effects of the recession, housing market downturn and financial market turmoil, leaving it with an unemployment rate above 12 percent and slashing at the state government's revenue. The most populous U.S. state's government faces a budget gap of more than $25 billion through mid-2012, which newly elected Governor Jerry Brown has proposed tackling with deep spending cuts and revenue from extensions of temporary tax increases that will create a drag on growth.

Despite the likely absence of any financial failures at the state level, many investors foresee small blow-ups that, taken together, could hamper an already fragile U.S. recovery marked by very slow growth in employment. "No states should default, and most if not all of the local government defaults will occur amongst smaller, less liquid entities," said Peter Cardillo of Avalon Partners.

Investors in the Reuters poll were also asked to rank the various risks facing the usually tame muni bond market. They cited the rising costs of healthcare and borrowing costs as well as "headline risk" as the biggest looming threats. Medicaid costs can take up to a third of a state's budget, a proportion that swells during economic downturns.

Headline risk likely refers to Wall Street banking analyst Meredith Whitney's recent forecast of an impending wave of credit defaults by struggling local governments. Her prediction has stirred up anxiety among retail investors, playing a role in the nearly $25 billion pulled from municipal bond funds in the past three months.

Wisconsin Governor Says National Guard Could Respond to Unrest, as State Employees Learn of his Budget Proposal

by Ann-Elise Henzl - WUWM

Gov. Scott Walker says he is confident state workers will continue to show up for work and do their jobs, despite their potential disappointment in his emergency budget proposal. However, if there is worker unrest, Walker says the Wisconsin National Guard is prepared to respond.

The governor revealed Friday that he wants the state Legislature to go into Special Session next week to take up his plan to close a budget deficit. His plan calls for workers to lose nearly all their collective bargaining rights. State employees also would be required to pay more for pension and health care benefits.

Walker first shared his plan with fellow Republican lawmakers in a closed-door meeting Thursday. He’s talking more about his proposal Friday. The governor says he’s briefed the National Guard and other state agencies, to prepare them for any problems with workers, as they learn of Walker’s emergency budget plan.

Illinois Governor Quinn wants to borrow $8.75 billion to pay down bills

by Monique Garcia - Chicago Tribune

State's income tax increase hasn't solved money woes. Gov. Pat Quinn says money isn't coming in fast enough to repay billions owed to schools, other providers.

Taxpayers might have expected that state government was back on solid financial footing after lawmakers approved a major income tax increase that's already being docked from their paychecks. But Gov. Pat Quinn says Illinois' books were so neglected for so long that the money isn't coming in fast enough to repay billions owed to schools, doctors, mental health centers and other providers. So during his budget speech Wednesday, Quinn is expected to push a plan to borrow $8.75 billion to help alleviate the pressure.

The idea is to use the cash infusion to whittle down the bill backlog from a mountain to a molehill and rush payments to the 36,000 vendors owed an estimated $7 billion. The loan would be paid back over 14 years using money generated by a portion of the income tax hike. "We have to do this," Quinn said. "The state should pay what it owes small businesses and schools and many other employers across Illinois. It will keep men and women working and add to the employment ranks."

Some providers have been waiting as long as six months to be repaid by the state, continuing a cycle that has led some to lay off workers, cut services and stretch their credit to stay open. Quinn has tried to channel their frustrations into a lobbying campaign, asking those owed money to contact lawmakers to support the borrowing plan. Quinn's budget office has acknowledged that the borrowing still isn't enough to cover everything the state owes. "We actually wanted it to be a bigger number because our needs and our pressures are greater," Malcolm Weems, chief of staff in Quinn's budget office, told a Senate committee last week.

It's a cash-flow problem. Weems said the state doesn't just owe money to those who have contracts to provide services, but must also pay for state employee health insurance costs, send tax returns to corporations and give municipalities across the state a cut of tax revenues. A Quinn budget spokeswoman said those costs could top $4 billion. Quinn first pushed for the borrowing plan along with an income tax increase after the election, but the idea failed to gain traction with legislators weary of signing off on such a large loan after voting for a tax hike.

Prospects aren't much better now that a new crop of lawmakers have been sworn in. State law requires that three-fifths of lawmakers vote in favor of borrowing proposals, which means that some Republican support is a must. Republican leaders, however, say the state must first implement more spending reforms before saddling itself with high interest payments.

"The proposals that have been brought forth have to make fiscal sense for the taxpayers, and the proposal we have learned of so far doesn't meet that test," said Patty Schuh, spokeswoman for Senate Republican leader Christine Radogno of Lemont. Schuh said the borrowing deal will cost roughly $5 billion in interest over 14 years.

Other lawmakers say the state shouldn't borrow to pay off bills, but use revenue coming from the tax increase to pay down debt over time. Quinn argues that borrowing now will save Illinois money in the long run because interest rates will be lower than what the state must legally pay providers for falling so far behind.

Last year, Illinois paid $62 million in late payment penalties, according to a spokesman for Illinois Comptroller Judy Baar Topinka. House budget expert Rep. Frank Mautino, D-Spring Valley, said borrowing would allow the state to effectively wipe out its bill backlog within months. Without borrowing, Mautino said, the backlog would take nearly a decade to pay off, and schools and service providers would continue to suffer.

"There's not one senator or representative who doesn't have a school in his or her district that isn't owed hundreds of thousands of dollars, and the money we didn't pay them has a direct correlation to the teachers that they've laid off," Mautino said. "Because of our failure to do anything, many bad things have happened."

Detroit Schools Manager Sees Crisis Deepen

by Matthew Dolan - Wall Street Journal

Two years after his appointment as emergency financial manager for the Detroit Public Schools, Robert Bobb has outsourced many services, unearthed corruption and closed a number of schools. Yet the district's mammoth deficit has continued to grow during amid the state's downturn and growing pension and debt obligations, and the city's schools are still grappling with longstanding problems, including political battles involving the state, school board and teachers' unions and a long-term exodus by students.

With weeks left in his term, Mr. Bobb has put forth some radical ideas to overhaul the system. One would split the district into two entities to help retire its debt, along the lines of the government-engineered bankruptcy of General Motors. Another would use money from a national tobacco settlement to inject $400 million into the Detroit schools and some 40 other deficit-ridden Michigan districts. A third is modeled on post-Katrina New Orleans, where a shrunken district was remade with mostly charter schools.

All would need approval by the state legislature and governor, and none appears to have much traction now. Only one has even been circulated in writing. The tobacco-settlement idea has been debated in public, but state lawmakers didn't take it up last fall, and no bill has emerged in the new legislative session. But Mr. Bobb warns that without action, the current deficit could force Detroit Public Schools to close 100 more schools —the district now has 134—and cram an average of 62 students into each high-school classroom. In an interview, he said some in the state may hold a bias against their financially troubled biggest city."I've heard on more than one occasion, that when something this important is Detroit-specific, it's very difficult to get people for good, sufficient reason focused on Detroit," he said. Mr. Bobb arrived in Detroit just two years ago, appointed by former Gov. Jennifer Granholm to take over an urban district that the U.S. secretary of Education had called one of the nation's worst, after his predecessor was fired and the state declared a financial emergency in the system. He had previously served as president of the board of education in Washington, D.C.

Detroit had seen its test scores plummet, along with its population, trends that continue. The district today enrolls 84,875 students, down more than half from a decade ago. A national reading test last May showed that Detroit was the worst-performing larger, inner-city district in the country. Mr. Bobb claimed a mandate to overhaul both finances and academics. He launched campaigns to stabilize enrollment—which determines state funding—in hopes of slowing the exodus to suburbs and charter schools. He also conducted hundreds of audits, laid off teachers, privatized services such as busing and custodial work and closed 59 schools.

In his interview with the Journal, he said that without his budget cuts, the district's annual deficit—now at $327 million, up from $218 million in 2009—would have grown to more than $500 million. The schools have a $1.025 billion annual budget. He also said the district has made new strides, including a new teacher contract that allows 40% of a teacher's evaluation based on student performance, an extended school day and a new requirement for 120 minutes in daily reading and math instruction which double for high schools students. Mr. Bobb also has expanded advanced placement class offerings and expanded college entrance test prep courses, while pitching a message of focusing on students and classrooms.

"We have to ask ourselves, what is our core mission?" Mr. Bobb said late last month, flanked by contractors slated to take over the district's custodial work and save the district an estimated $75 million over five years. "We need clean and well-kept facilities. However, our core mission is educating students." But Mr. Bobb has encountered strong opposition from some entrenched corners. He is in a testy court battle with the system's board of education—whose financial powers he was given in 2009—over who will run the district next. "The complete victory is getting rid of Mr. Bobb and getting the money from Lansing" to run the Detroit schools, the board's attorney, George Washington, said during a January public meeting.

The board earlier sued to challenge his authority over the curriculum and won. A lawyer from the state representing Mr. Bobb said in a statement Saturday he planned to appeal, saying the decision inappropriately prevents Mr. Bobb from hiring staff and selecting teachers. He has also drawn fire from teachers' unions with his push to outsource more functions and seek more teacher accountability, taking heckling for everything from his accounting to his salary. In their 2009 contract, teachers gave concessions on pay and benefits worth tens of millions of dollar. But Mr. Bobb said extended contract talks reduced the potential savings.

Additionally, Mr. Bobb reversed himself on some cuts after complaints, bringing back some staff he had sought to cut—counselors, bus attendants and pianists for music lessons. Parents sued to get the bus attendants back. And a miscalculated enrollment forecast cost the district $20 million. Mr. Bobb said he has learned from the experiences. A self-described "bean counter" with no teaching background, he said that when "you're making those hard decisions, you have to listen to the other voices that tell you about what impact those decisions are having on children."

The immediate question is whether the financial ship can be turned. The most pressing concern is a need for the state to guarantee the district won't fall into bankruptcy, Mr. Bobb told a state legislative committee panel last week. If the state can't do that, he said, the district's insurer will double the district's short-term borrowing costs to almost $40 million a year to meet payroll expenses by April 1.

So far, the state, facing a $1.8 billion deficit of its own, is standing on the sidelines. Gov. Rick Snyder, elected last fall, has asked Mr. Bobb, whose contract expires Feb. 28, to stay on until June, and while Mr. Bobb separately has said he would like to stay, a formal agreement hasn't yet been struck. The governor also hasn't said how, or whether, he would seek more state money for the Detroit district.

Long-term, Mr, Bobb said, the future of the Detroit schools depends on an academic overhaul. He urges that any infusion of new money be used to usher in changes that would eliminate seniority rights for teachers and tie compensation to classroom performance. "We should know how all of us are performing, and those things should be made public," Mr. Bobb said.

Pennsylvania Governor Corbett Promises Drastic Budget Cuts

by Scott Bomboy - MyFoxPhilly.com

Pennsylvania Gov. Tom Corbett has vowed again to cut the commonwealth's huge budget gap and not raise taxes. Here is a look at where some of the sharpest cuts will come - and how it may cost you money. Corbett told Republican State Committee activists this weekend balancing the budget without a tax increase will require "drastic" measures and breaking that promise would sweep the GOP out of office.

Corbett will announce the budget cuts and other measures on March 8 in an address to the state legislature. The state faces a budget gap that ranges between $4 billion and $5.5. billion, by some estimates. Here is a look at where the cuts may come from:

How The Budget Gap Happened

In September 2009, state Auditor General Jack Wagner said revised figures showed that there was a potential $5 billion budget gap in Pennsylvania. Wagner said the gap was created by a $2.5 billion loss in federal stimulus funds, $3 billion in unemployment payments now owed to the federal government, and an increase of at least $800 million for rising pension costs. He also pointed that state spending increased 33 percent, or about twice the inflation rate, during Gov. Ed Rendell's time in office

In his February 2010 budget statement, Rendell said he cut the cost of state government by $1.7 billion over eight years, but that 80 percent of budget costs are dictated by legally mandated spending. Rendell also said, one year ago, the potential budget deficit into two years' time was $5.6 billion, because of the impact of a 2001 pension increase legislation. He expected a $2.6 billion gap in the upcoming budget year. In June 2010, Budget Secretary Mary Soderberg told state legislative leaders the budget deficit had grown to $3 billlion, not $2.6 billion.

Privatizing Public Services

A widely publicized plan to sell Pennsylvania's liquor stores may not be part of Corbett's initial plan. Some estimates say Pennsylvania could get $2 billion for the state stores at auction. Others downplay that number. Corbett is committed to the concept, but has said he wants more information, and some of the studies are a decade old. One system Corbett said he will never privatize in the Pennsylvania prison system.

Also off the table is a tax or fee on proceeds from the Marcellus Shale natural gas extraction, which could be a big economic boom for the state. Another measure that has been debated for years is privatizing the Pennsylvania Turnpike. Former Gov. Ed Rendell failed in his efforts to lease the turnpike out. Other state-owned properties such as state parks and museums could also see some level of privatization.

Education Funding Cuts

The state will spend less on local school districts. This would have a direct effect on local taxpayers, who will need to fund the difference if school districts keep current staffing and pension levels. Since Harrisburg actually runs Philadelphia's school district, officials in Philadelphia are bracing for the worst, and getting ready to cut services to students and parents. The local education battle will get nasty, since an estimated 75 percent of budget costs for all local school districts in Pennsylvania come from staff salary and benefits.

The state spends $5.2 billion a year on local education and about $10 billion on all education programs, including colleges. The state will lose $1 billion in 2012 for local education as federal stimulus money goes away. And that is before the state starts cutting other program funding. So local schools districts will need to make up for at least a 20 percent cut in their state funding, increasing the likelihood of big, local school-tax hikes.

One measure under way in Harrisburg has already started a fight, as GOP lawmakers want to allow school districts to furlough teachers in an effort to save money. Currently, school districts can only furlough teachers if there is a substantial decline in student enrollment and they must do so by eliminating a school program.

Social Programs

The state will also likely cut back its funding of unemployment compensation and health-insurance programs. Two options available to Corbett will be to increase payroll deductions for unemployment and reduce the number of payments to collectors. Pennsylvania's current state-subsidized adultBasic health insurance plan ends in March and a new plan will probably cost more to participants. Another program that will end is a system of state grants known as WAMs (or Walking Around Money) that was used by Rendell and others. Cutting WAMs will save taxpayers around $100 million.

Battle shaping up over Florida pension proposal

by David Smiley, Kathleen McGrory, Carli Teproff and Julie Brown - Miami Herald

Gov. Rick Scott has picked a fight with more than a half million employees with his proposal to make them fund their own pensions.

Hal Krantz says it has been years since he brought home a pay raise. After 16 years of teaching, the married Coral Springs Middle School instructor with a daughter in college is struggling to stretch his salary while meeting the soaring costs of healthcare, food and other necessities. Gov. Rick Scott's plan to compel public employees like Krantz to kick in as much as 5 percent of their paychecks into their pensions is causing quite a bit of angst.

This is particularly true of teachers, who traditionally earn modest salaries offset by a broad benefits package, but also state workers, many of whom have not received pay raises in years. The proposal is included in the budget that Scott will unveil Monday at a rally of tea party supporters in the Lake County community of Eustis. Employees say the pension measure is the equivalent of a pay cut. "We give up so much because we love this profession,'' said Krantz. `Now they are cutting even deeper into our pocket.''

Around the nation, governments are reeling from the poor economy and falling tax revenues. Supporters of Scott's plan, which would affect not just state workers but school employees and many municipal workers in the state retirement system, say it's imperative to change gears to keep the state and the pension fund solvent. They note that for many in the private sector, salaries have fallen, jobs have grown scarce and traditional pensions have long since been replaced by 401(k) accounts that require workers to sock away money for their own retirement.

They point out that other states have already taken the step Scott is proposing. New York, for instance, requires employees to kick in 3 percent of their salary toward funding their pension for a period of 10 years. Scott estimates it will save the state, which is facing a multibillion-dollar shortfall heading into the legislative session, $2.8 billion over two years. "It's only fair that if you're going to have a pension plan, you're going to do just like the private sector does,'' Scott said.

Florida's pension system is currently funded by state and local governments contributing the equivalent of between 9 and 10 percent of an employee's income toward retirement. In the case of high-risk workers like police and firefighters, the percentage is higher. Scott has talked of a 5 percent buy-in by employees -- basically splitting the difference with the state.