"Rotary coal car unloader, Cleveland, Ohio"

Stoneleigh: The deflation/hyperinflation debate with Gonzalo Lira was an interesting experience. I wanted to give readers of The Automatic Earth a flavour of what was said, what issues were raised and how they were addressed. To start with here is some audience feedback posted by the moderator, Jay Carter, at Financial Survival Radio. I have commented on some of the responses sent by Jay. For those interested in hearing the debate and seeing the slide presentations made by Gonzalo and myself, it is now available as a streaming file.

The debate lasts two and a half hours, and was done in two halves. The format was an initial opportunity for each of us to make our case for hyperinflation or deflation, followed by debate between us and then audience questions. There was then a short intermission, followed by Gonzalo and myself presenting our views as to how we would expect our scenarios to play out. Each of us did a second presentation, which was again followed by a debate and then audience questions.

The major hurdle in the debate hinged on the definition of inflation, as such debates often do. Financial analysts who expect deflation typically do so because they recognize the critical role of credit in the effective money supply and the effects of credit implosion. With a natural focus on the money supply, they typically (but not universally) define inflation and deflation as monetary phenomena - as an increase or decrease in the effective money (and credit) supply relative to available goods and services.

Analysts who anticipate inflation or hyperinflation typically focus on nominal prices, which they expect to increase, likely concurrent with a loss of confidence in the currency. As I am in the deflationist camp and Gonzalo is a hyperinflationist we naturally defined inflation/deflation differently, which lead to some awkwardness at the beginning of the debate.

My view is that movements in nominal prices are of limited interest by themselves, as nominal prices say nothing about changes in affordability. It is not how much something costs that matters, but how much it costs in relation to how much purchasing power people have, and that will depend largely on changes in the effective money supply. In order to understand what is happening to affordability, one has to adjust nominal prices for changes in the money supply and thereby express price changes in real terms.

There are many drivers of prices, but changes in the money supply constitute a major one, often the primary one in fact. Changes are an effect, not a cause, and a lagging effect at that. In order to understand the world, it is better to look at the causes than the effects, and to look at leading indicators rather than lagging ones.

Deflation involves a massive change in the money supply due to the collapse of credit, which constitutes in excess of 95% of the effective money supply. Credit expansion is a ponzi scheme, and like all ponzi schemes will reach a maximum and then implode. Unlike currency hyperinflation, which divides the underlying real wealth pie into more and more pieces, credit hyper-expansion creates multiple and mutually exclusive claims to the same pieces of pie through leverage.

The best analogy is a game of musical chairs, where there is only one chair for every hundred people (or so) playing the game. It is not too difficult to imagine what happens when the music stops, when the difference between getting a chair and not getting a chair is the difference between making a fortune and destitution. At TAE we suggest that people cash out, in other words take a chair and sit on the sidelines before the music stops. The game is not compulsory, but it is addictive, and it is difficult to walk away, but ultimately it is a matter of choice whether we play or not. Given the low odds of winning after the fact, and the possibility of avoiding the that particular risk in the first place, it seems a sensible approach to stop playing.

Gonzalo’s view is that we are looking at a commodity-driven hyperinflation, where investors becoming increasingly wary of financial assets, particularly treasuries, and the dollar, and will opt instead for something tangible. He says that the Fed has monetized the debt. His advice therefore includes taking on debt in order to purchase commodities. I believe this view is distinctly premature, and the advice therefore completely wrong. While I have discussed the likelihood of a bond market dislocation myself, and have noted that all fiat currencies expire eventually, I do not believe this is at all imminent. On the contrary, in my opinion treasuries and the dollar are likely to do very well over the next year or two, and I believe that commodities are topping or close to topping.

I would point out that the Fed has not monetized the debt, but has merely taken on a tiny percentage of the debt through quantitative easing. It might have monetized 5% of the US debt, if one does not include the unfunded liabilities of the US government, namely Medicare, Medicaid and Social Security (which together represent at least half of the total debt to GDP ratio for the US). There is no provision for a meltdown in the derivatives market or other categories of debt which are international. The notional value of the derivatives market is estimated at anywhere between $600 trillion and $1600 trillion dollars. No one has pockets deep enough to monetize that, and if they were minded to try they would find out that it is impossible to get ahead of credit collapse. It will proceed faster than any reactionary (as opposed to proactive) party can act.

Attempts to monetize in the teeth of a powerful deflationary wave are destined to fail miserably. The apparent success of the last two years owes its reputation to the supportive psychology of a rally, which makes central authorities appear wise and in control, when in fact they are not. When that rally is over, as I believe it will be soon, that support will be lost, revealing central bankers to be the little men behind the curtain that they always have been. Contractions are very unkind to those in positions of power, or apparent power.

My reasoning for a dollar resurgence is twofold. First, we are on the verge of a large deleveraging of dollar-denominated debt, of which there is more than any other kind of debt worldwide. This will create demand for dollars. I also think we are going to see substantial capital flight from Europe as a result of their looming sovereign debt default crisis. That capital flight is very likely to find its way into the US as the least worst option, on a knee-jerk flight to safety into the reserve currency. While the finances of the US are obviously dire (at least as bad as the European countries at the centre of the incipient sovereign debt contagion), it is not reality that drives markets, but perception, which is emotionally-driven rather than rational. If we assume markets will behave rationally, we will be wrong-footed every time.

It is important to look at where the markets perceive risk to lie, and where they demonstrate fear. For this, one must look at credit default swap spreads. Like any good predator, markets will pick off the small and sick first and move from the weakest to the next weakest victim. The markets are currently very concerned about the situation in Greece, and increasingly concerned about the remainder of the European periphery. They are not at all concerned about the possibility of a US default, despite the obvious evidence of risk. Human beings are either in a state of complacency or one of panic at any given time, and they are currently extremely complacent about the possibility of US debt repayment difficulties. There is a perception that the US is far, far too big to fail and will therefore not fail no matter what the circumstances.

If we see the capital flight that I expect, the US should have no trouble at all selling its treasuries at a low risk premium for quite some time to come, while many European countries could easily find themselves paying risk premiums (interest rates) in the double digits. As real interest rates (ie adjusted for changes in the money supply) are always higher than nominal rates in a period of deflation, those double digit interest rates would represent even more of a burden than they would appear to at face value. The regional disparity of risk premiums would also create division and recrimination within the European Union, heightening the uncertainty that is anathema to markets, and therefore strengthening capital flight.

My reasoning for predicting a commodity top in the not too distant future is primarily that sentiment towards commodities is at an extreme. When the received wisdom is that something is highly desirable and can therefore only go up, the vast majority will have already made the investment decisions that drive markets in the prevailing direction. When sentiment is at an extreme, it generally pays to take the other side of the bet. The time to buy is when the received wisdom is that doing so would be folly. At that point, whatever it is will be cheap.

Commodities top on fear of scarcity, and that is exactly what we are seeing now for oil, gold, silver and agricultural commodities. An unfortunate dynamic sets in under such circumstances. Speculators see momentum develop and begin to pile into the sector chasing that momentum. This rapidly drives prices higher by creating artificial demand. As with all market moves, the resulting speculative fever is grounded in ponzi dynamics, meaning that only those who get in early and out early will make any money.

The much larger majority becomes the group of designated empty bag holders when the speculators dump the sector, having wrung every last ounce of profit from it. This is what happened in 2008 (when oil went from $147 a barrel to $35 in a matter of months), and what is shaping up to happen again. How quickly investors forget when there appears to be money to be made.

The effect of (monetary) deflation is to lower prices across the board, at least initially, while simultaneously rendering almost everything less affordable, as purchasing power falls faster than price. The collapse of credit, combined with increasing income insecurity and loss of benefits, reduces the effective money supply, and therefore purchasing power, very sharply and rapidly. It amounts to having the rug pulled from beneath a society’s feet. Under such circumstances there is simply no price support at anything like the current level.

Demand, which is what one can pay for rather than what one happens to want, will fall very sharply, and so will prices, but those lower prices will be less affordable than the previous higher prices in the easy credit era we have lived through. The essentials will, however, receive relative price support as a much larger percentage of a much smaller money supply begins to chase them. As we move further into depression, and essentials likely become increasingly scarce, their prices could even rise in nominal terms. Against a backdrop of money supply collapse, that would mean real prices were going through the roof, and it could happen in a few short years.

Gonzalo was of the opinion that no sane investor would ever sell something as tangible and valuable as commodities in favour of the sovereign debt of a country ovbiously heading for bankruptcy. This comes back to the fallacy of rational markets. Investors will sell that which is falling, as markets' moves are swings of positive feedback. If speculators dump the commodity sector, anyone else involved in the market will sell en masse. If treasuries yields fall and prices therefore rise, denoting that treasuries are perceived as a safe haven (at least temporarily), then investors will buy. Market participants act in the short term and follow the herd, typically off a cliff.

If my position is correct, then Gonzalo’s advice to take on debt in order to purchase commodities would be disastrous in two ways. Firstly, it would be a bad bet if commodities in fact fall. Secondly, the debt assumed would come to respresent a tremendous burden in a deflation when real interest rates would be punishingly high, even if nominal rates are low (ie the nominal rate minus negative inflation is always a larger number).

My advice is quite the contrary. I would suggest cashing out of stocks, most bonds (except short term teasuries), commodities, real estate and collectibles etc, and sitting safely on the sidelines out of the game (while not, of course, trusting one’s newfound liquidity to an insolvent banking system). While there is no no-risk scenario, cash and cash equivalents (ie short term treasuries) represent the lowest risk in an increasingly risky world. Cash is king in a deflation. It is not a long term solution, but it is the least risky means to ride out a great deleveraging as the giant overhang of debt we have built over at least the last thirty years comes crashing down around our ears like a tidal wave finally reaching the shore. Our current phase of extend-and-pretend represents the period where the tide mysteriously withdraws and the curious public ventures out on to the newly exposed sand in search of pretty shells. The wave is coming though, and its force will sweep all before it.

How the middle class became the underclass

by Annalyn Censky - CNNMoney

Are you better off than your parents? Probably not if you're in the middle class.

Incomes for 90% of Americans have been stuck in neutral, and it's not just because of the Great Recession. Middle-class incomes have been stagnant for at least a generation, while the wealthiest tier has surged ahead at lighting speed. In 1988, the income of an average American taxpayer was $33,400, adjusted for inflation. Fast forward 20 years, and not much had changed: The average income was still just $33,000 in 2008, according to IRS data.

Meanwhile, the richest 1% of Americans -- those making $380,000 or more -- have seen their incomes grow 33% over the last 20 years, leaving average Americans in the dust. Experts point to some of the usual suspects -- like technology and globalization -- to explain the widening gap between the haves and have-nots.

But there's more to the story.

A real drag on the middle class

One major pull on the working man was the decline of unions and other labor protections, said Bill Rodgers, a former chief economist for the Labor Department, now a professor at Rutgers University. Because of deals struck through collective bargaining, union workers have traditionally earned 15% to 20% more than their non-union counterparts, Rodgers said.

But union membership has declined rapidly over the past 30 years. In 1983, union workers made up about 20% of the workforce. In 2010, they represented less than 12%. "The erosion of collective bargaining is a key factor to explain why low-wage workers and middle income workers have seen their wages not stay up with inflation," Rodgers said.

Without collective bargaining pushing up wages, especially for blue-collar work -- average incomes have stagnated.

International competition is another factor. While globalization has lifted millions out of poverty in developing nations, it hasn't exactly been a win for middle class workers in the U.S. Factory workers have seen many of their jobs shipped to other countries where labor is cheaper, putting more downward pressure on American wages. "As we became more connected to China, that poses the question of whether our wages are being set in Beijing," Rodgers said.

Finding it harder to compete with cheaper manufacturing costs abroad, the U.S. has emerged as primarily a services-producing economy. That trend has created a cultural shift in the job skills American employers are looking for. Whereas 50 years earlier, there were plenty of blue collar opportunities for workers who had only high school diploma, now employers seek "soft skills" that are typically honed in college, Rodgers said.

A boon for the rich

While average folks were losing ground in the economy, the wealthiest were capitalizing on some of those same factors, and driving an even bigger wedge between themselves and the rest of America. For example, though globalization has been a drag on labor, it's been a major win for corporations who've used new global channels to reduce costs and boost profits. In addition, new markets around the world have created even greater demand for their products.

"With a global economy, people who have extraordinary skills... whether they be in financial services, technology, entertainment or media, have a bigger place to play and be rewarded from," said Alan Johnson, a Wall Street compensation consultant. As a result, the disparity between the wages for college educated workers versus high school grads has widened significantly since the 1980s. In 1980, workers with a high school diploma earned about 71% of what college-educated workers made. In 2010, that number fell to 55%.

Another driver of the rich: The stock market. The S&P 500 has gained more than 1,300% since 1970. While that's helped the American economy grow, the benefits have been disproportionately reaped by the wealthy. And public policy of the past few decades has only encouraged the trend.

The 1980s was a period of anti-regulation, presided over by President Reagan, who loosened rules governing banks and thrifts. A major game changer came during the Clinton era, when barriers between commercial and investment banks, enacted during the post-Depression era, were removed. In 2000, the Commodity Futures Modernization Act also weakened the government's oversight of complex securities, allowing financial innovations to take off, creating unprecedented amounts of wealth both for the overall economy, and for those directly involved in the financial sector.

Tax cuts enacted during the Bush administration and extended under Obama were also a major windfall for the nation's richest. And as then-Federal Reserve chairman Alan Greenspan brought interest rates down to new lows during the decade, the housing market experienced explosive growth. "We were all drinking the Kool-aid, Greenspan was tending bar, Bernanke and the academic establishment were supplying the liquor," Deutsche Bank managing director Ajay Kapur wrote in a research report in 2009.

But the story didn't end well. Eventually, it all came crashing down, resulting in the worst economic slump since the Great Depression. With the unemployment rate still excessively high and the real estate market showing few signs of rebounding, the American middle class is still reeling from the effects of the Great Recession. Meanwhile, as corporate profits come roaring back and the stock market charges ahead, the wealthiest people continue to eclipse their middle-class counterparts. "I think it's a terrible dilemma, because what we're obviously heading toward is some kind of class warfare," Johnson said.

How Big is the U.S. Debt?

by Antony Davies

Deficit is biggest as share of economy since 1945

by Jeannine Aversa and Christopher S. Rugaber - AP

Not since World War II has the federal budget deficit made up such a big chunk of the U.S. economy. And within two or three years, economists fear the result could be sharply higher interest rates that would slow economic growth.

The budget plan President Barack Obama sent Congress on Monday foresees a record deficit of $1.65 trillion this year. That would be just under 11 percent of the $14 trillion economy - the largest proportion since 1945, when wartime spending swelled the deficit to 21.5 percent of U.S. gross domestic product. The danger is that a persistently large gap in the budget could threaten the economy.

Investors would see lending their money to the U.S. as riskier. So they'd demand higher returns to do it. Or they'd simply put their cash elsewhere. Interest rates on mortgages and other debt would rise as a result. And if borrowing turned more expensive, people and businesses might scale back their spending. That would weaken an economy still struggling to lower unemployment, revive real estate prices and restore corporate and consumer confidence.

So far, it hasn't happened. It's still cheap for the government to borrow money and finance deficits. But economists fear the domino effect if all that changes. "The moment when markets react negatively to our budget deficit cannot be known in advance, but we are absolutely in the danger zone," says Marvin Goodfriend, an economics professor at Carnegie Mellon University's Tepper School of Business.

Higher interest rates would also raise interest payments on the federal debt. It would be costlier for the government to finance its operations. The interest payments themselves could then make the deficit increase, creating a vicious cycle. Under the projections in Obama's budget, the deficit as a share of the overall economy would narrow from 10.9 percent this year to 7 percent next year and eventually to 2.9 percent by the 2018 fiscal year.

But after that, in the remaining years of this decade, the deficit would widen slightly as a percentage of the economy. It would average about 3.1 percent because of escalating costs for programs like Social Security and Medicare as baby boomers age and receive benefits. Economists generally say cutting the deficit to about 3 percent or less of the economy would be healthy. Deficits at that level are considered "sustainable" - meaning they could be easily financed and wouldn't make investors nervous about the government's finances.

Most economists don't think the deficit should be cut deeply now. They say the economy remains so fragile - unemployment is at 9 percent - that it needs big government spending to invigorate growth. In this camp is Federal Reserve Chairman Ben Bernanke. He's argued that now isn't the time to slash government spending or raise taxes. Instead, Bernanke has urged Congress and the White House to preserve federal stimulus - including tax cuts - in the short run but draft a plan to reduce the deficit over the long run.

A presidential commission last year made recommendations that Bernanke and other economists say could help curb the deficit over the long term. Its suggestions included raising the Social Security retirement age and reducing future increases in benefits. It also proposed increasing the gasoline tax and eliminating or scaling back tax breaks, like the mortgage interest deduction claimed by many Americans.

Obama embraced none of these proposals in his budget. But his plan is designed to cut $1.1 trillion from the deficit over the next decade, two-thirds of it from spending cuts. The rest would come from tax increases, such as limiting the deductions for high-income taxpayers. In Bernanke's view, a long-term plan to reduce future deficits would mean lower long-term interest rates and increased consumer and business confidence.

For months, though, longer-term rates have been creeping up, driven by prospects of stronger growth and concerns about higher inflation. The yield on the 10-year Treasury note is now 3.61 percent. That's up sharply from 2.48 percent in early November. That increase is making other loans, including mortgages, more expensive. The average rate for a 30-year fixed mortgage just rose above 5 percent for the first time since April.

Rates are still extremely low by historical standards. In 1983, during Ronald Reagan's first presidential term, the deficit soared to $208 billion, about 6 percent of the economy at the time. The rate on the 10-year note topped 10 percent. And getting a 30-year mortgage meant paying 13 percent.

Economists say that if investors trust that Congress and the White House will curb budget deficits over the long haul, interest rates could stabilize - even if deficits exceed $1 trillion over the next year or two. But if investors lose confidence that Washington policymakers can curb the deficits, rates could rise sharply. "It's all about perception," says Lou Crandall, chief economist at Wrightson ICAP, a research firm.

So far, China, the biggest buyer of U.S. debt, and other countries have maintained their appetites for Treasurys. Foreign demand for Treasury debt has helped keep U.S. interest rates historically low. The reason is that the United States is still considered a haven for many foreign investors. That point was underscored by Europe's debt crisis last year, when money poured into dollar-denominated Treasurys.

If the United States had to finance its debt through U.S. investors alone, the government, along with American companies and consumers, would have to pay higher rates. Last year's budget deficit totaled $1.3 trillion. That was just under 9 percent of U.S. economic activity. The first time the deficit topped $1 trillion was in 2009.

The growth of U.S. budget deficits has reflected the costs of the wars in Iraq and Afghanistan, the continuation of broad tax cuts, the worst recession since the 1930s and a surge in spending on Social Security, Medicare and the military. The recession prompted higher government spending to stimulate the economy and cushion the effects of the downturn. It also reduced tax revenue.

The Organization for Economic Cooperation and Development estimates that the United States' deficit as a share of the U.S. economy will be smaller - around 8.8 percent- than the president's budget estimates. Still, that would be a higher figure than for other major industrialized countries.

The OECD projects, for example, that Britain's deficit this year will be about 8.1 percent of its economy. Germany's deficit is expected to make up 2.9 percent of its economy, Japan's 7.5 percent. "So far, investors haven't been bothered by large U.S. budget deficits," says Jim O'Sullivan, economist at MF Global, an investment firm. "The fear is that could suddenly change. It's not clear whether investors will remain patient once the U.S. recovery is on track."

Barack Obama tests bond markets with mega-deficits

by Ambrose Evans-Pritchard - Telegraph

US President Barack Obama faces a stiff battle with Republican foes in Congress after unveiling plans for $7.2 trillion (£4.5 trillion) of deficit spending over the next decade, and making little attempt to control the spiralling costs of social security and medical entitlements.

Mr Obama proposed a budget that will push the this year's deficit to a fresh record of $1.65 trillion or 11pc of GDP, partly due to payroll tax cuts agreed with Congress last Autumn. It is unprecedented to run deficits on this scale two years into recovery. While he called it a budget of "hard choices and sacrifices" needed to return the US to a sustainable debt trajectory, the deficit is significantly above the $1.5 trillion recommended by the Congressional Budget Office (CBO).

Paul Ryan, Republican chair of the House Budget Committee, accused Mr Obama of a "total abdication" of leadership. "I expected more taxes, but I also expected more spending controls or reforms, but we're not getting any of it." Mr Obama aims to cut $1.1 trillion in fiscal fat over the next decade. This relies on rosy growth forecasts and falls far short of the $4 trillion squeeze demanded by his own deficit commission. It would push the US national debt further into the danger zone.

The IMF already expects US gross public debt to double from 62pc of GDP in 2007 to 111pc by 2015, a figure that will now have be revised upwards. The White House proposes a 5-year freeze in discretionary spending. This covers just an eighth of federal spending. Mr Obama has chosen not to court political fate by slashing entitlements, chiefly the trio of social security, medicare, and medicaid that ratchet ever upwards.

House Speaker John Boehner said the long-term cuts were not nearly enough. "We're broke. Let's be honest with ourselves," he said, calling for every area of spending to be examined. The Republicans could resort to the 'nuclear option' of shutting down the US government if Mr Obama refuses to meet them half way, but such Capitol Hill poker has to be played carefully.

The US Treasury market gave a muted reaction to the spending details yesterday, but some analysts fear this may be the calm before the next storm. Ten-year yields have already jumped 120 basis points since October, partly on concerns over fiscal laxity. It remains unclear whether bond vigilantes will tolerate such extreme deficits once the Fed's quantitative easing (QE) ends in June..

"The US is pushing its luck," said Stephen Lewis from Monument Securities. "Markets sense that Obama is reluctant to cut spending before the election in 2012. The Fed may have to stop QE because the policy of asset purchases is pushing up commodity prices, and when that happens the bond markets could react in a very negative way." Mr Obama plans a big shift in energy policy, cutting subsidies for the oil and gas industry and rotating money into solar, wind, and other green energy sources. While he hoped to overhaul the US corporate tax system by closing loopholes and cutting the 35pc rate, there was no clear timetable.

Defence spending will increase this year by $22bn to $671bn to cover Afghanistan, and cyberwarfare threats, before facing a squeeze from 2013 onwards. Nobel economist Paul Krugman said the Obama plan is "much less awful" than Republican austerity, arguing that the economy is not yet strong enough to withstand fiscal tightening. This is becoming a minority view outside Keynesian academic circles.

The CBO warned last month that debt interest is "poised to skyrocket" without drastic cuts. Fresh borrowing will reach $12 trillion over the next decade on current policies, pushing public debt to nearly 140pc under IMF measures. Even if Washington faces up to the crisis by raising taxes a third, debt interest costs will still jump from 1.5pc to 3.3pc of GDP. While countries such as Japan can draw on a reservoir of domestic savings to cover big debts, the US has no such luxury. The savings rate is just 5.3pc. The US relies on Japan, China, and other foreigners to finance 40pc of its debt.

Fed dictator Bernanke needs to be toppled

by Paul B. Farrell - MarketWatch

Forget Mubarak, it’s Fed reign of terror that must end

Fed boss Ben Bernanke is the most dangerous human on earth, far more dangerous than Hosni Mubarak, Egypt’s 30-year dictator, ever was. Bernanke rules a monetary dictatorship that will trigger the coming third meltdown of the 21st century. But this reign of economic terror will end.

Just as Mubarak was blind to the economic needs of the masses and democratic reforms, Bernanke is blind to the easy-money legacy that’s set the stage for revolution, turning the rich into super rich while the middle class stagnates and peanuts trickle down to the poor.

Warning, Egypt also had a huge wealth gap before its revolution. Bernanke is the final egomaniac in America’s bubbling 30-year wealth gap, where the top 1% went from owning 9% of America’s wealth to owning 23% during this dictatorship.

Bernanke’s ruling ideology is the culmination of a 30-year economic war that has forged together Reaganomics for the super rich, former Fed chairman Alan Greenspan’s toxic allegiance to Wall Street, the extreme Ayn Rand’s capitalist dogma, culminating in the toxic bailouts of Treasury Secretaries Hank Paulson and Tim Geithner, two Wall Street Trojan Horses corrupting government from within.

Since 1981 this monetary dictatorship has caused enormous collateral damage, systematically sabotaging democracy, capitalism and the American dream while fueling the rise of our most dangerous new enemy, China.

When Obama reappointed Bernanke a couple years ago, "Black Swan’s" Nicholas Taleb was "stunned." Bernanke "doesn’t even know that he doesn’t understand how things work," that Bernanke’s economic methods are so inadequate they make "homeopath and alternative healers look empirical and scientific."

We called Bernanke, the "Captain of the Titanic," warning that he was setting up the third meltdown of the 21st century, predicted by "Irrational Exuberance’s" Robert Shiller, a coming crash worse than the 2000 dot-com crash and the subprime credit meltdown of 2008 combined.

Inside the Fed: Cassandras, Chicken Littles, governors crying wolf

Unfortunately, as with Egypt’s dictator, the 30-year dictatorship now headed by Bernanke must end soon: And this class war will not be pretty. But it is no black swan; no one can claim they didn’t see a new crash coming.

For several years before the 2008 meltdown we reported on money managers, economists and financial gurus warning of a coming meltdown. They included two Fed governors who warned Greenspan in the early Bush years. And yet, as late as summer 2008 Bernanke, Paulson and Greenspan were systematically dismissing mounting evidence of a mega crash dead ahead.

That’s why Time magazine’s cover story about Thomas Hoenig, president of the Federal Reserve Bank of Kansas City, grabbed me. David Von Drehle’s "The Man Who Said No to Easy Money" is a warning to all America.

Like Ed Gramlich and William Poole, the two Fed Governors who warned Greenspan during the Bush years, Hoenig regularly dissented from Bernanke’s easy-money policies that have been favored by Wall Street throughout this 30-year dictatorship.

We’re paraphrasing Drehle’s interview with Hoenig as 10 warnings because it brilliantly reveals the broader historical tragedy of the Fed’s 30-year monetary dictatorship driving America to the edge of another 1930s economic revolution, one that will be triggered by a repeat of the 1929 wake-up call.

1. Commodity price inflation will soon end the Fed dictatorship

Hoenig consistently "cast his lonely ballot against the indefinite reign of easy money. Eight meetings, eight no votes … an unyielding point of view, one that has become ever more relevant now that rising commodity prices have put inflation worries back on the economic radar screen."

In short, global commodity inflation may soon do what Hoenig could not, put an end to America’s self-destructive easy money reign of economic terror, and more importantly finally end the Fed’s 30-year "monetary dictatorship."

2. Central bank dictatorship destroying America’s democracy

Hoenig was America’s lone voice against the Bernanke monetary dictatorship, says Drehle: "For all the headlines over the past quarter-century about the death of American manufacturing and the twilight of community banks and the vanishing farmer, those humble building blocks of a sound economy still figure significantly in Hoenig’s perspective. The way to strengthen them … is not by pumping money into a financial system that encourages megabanks to engage in high-risk speculation. You build them up by encouraging savings, which form capital for investment, which builds stronger businesses, which hire workers and pay dividends, which leads to more savings and more investment."

3. Near-zero rates, banks richer, masses poorer, meltdown

Honenig’s opposition to Bernanke dictatorship is also clear, says Drehle: "By keeping interest rates near zero indefinitely, the Fed is asking savers to continue to subsidize borrowers. What incentive is there to save and invest?"

Earlier in his long career, Hoenig was heartsick as an "irrationally exuberant Alan Greenspan kept piling so much money onto the economic bonfire that led to the Great Recession" in 2008. Now the "time’s come to start sobering up." Except Wall Street’s addicted to easy money, won’t sober up.

4. Easy money blowing new speculation bubble … pops soon

"This is how bubbles are formed," warns Hoenig, whose long career as president of the Kansas City Federal Reserve Bank made him leery of the power buildup by the central banks monetary dictatorship. So again, "rocketing land and energy prices are telltale signs … too much money sloshing around. When you put this much liquidity into the system, it has to go somewhere."

But with the Fed keeping interest rates near zero, easy money won’t go into savings. Instead, "money starts chasing assets with higher yields — like land, the once again booming stock market and energy" and "as more money joins the chase, asset prices rise and keep rising until … pop," a new meltdown.

5. Bernanke’s narcissistic illusion of monetary power

The Fed has too much power: Hoenig "watched uncomfortably as the central bank began playing a larger and larger role in the public’s perception of the economy. Monetary policy came to be seen as the solution to more and more economic issues. It has been used to deal with one crisis after another," stock .market crashes, recessions, the tech bubble, after the 9/11 attacks, during the Iraq war, then the 2008 meltdown.

Hoenig warns against the Fed’s power: "People came to feel that all you had to do was ease interest rates and everything would be fine. But that’s what gives us these bubbles."

6. Easy money fueling worldwide inflation, and a new meltdown

Yes, Hoenig’s an inflation hawk: "The sequence of events that led to runaway inflation in 1979 got started back in the mid-1960s. That’s … long term." Drehle captures the shift in Hoenig’s position: At first backing "the Fed’s dramatic actions in 2008 and 2009 to pour trillions into the staggering financial system."

But now it is time to stop. As easy money chases higher returns across the world, in places like Brazil and China, Hoenig warns that "inflation is rising sharply. Global food prices have risen 25% in the past year, according to the U.N., and many nations are starting to hoard commodities."

7. Fed policies favor the rich, sabotaging American Dream

In favoring Wall Street bankers, Bernanke’s monetary dictatorship is clearly feeding the conditions that, as happened in Egypt, will ignite a class war in America: "The poorest 60% of American households spend 12% of their income on energy alone, compared with the 3% spent by the richest 10% … Inflation is so unfair … it is the most regressive tax you can impose on the public … eroding the buying power of the poor and people on fixed incomes. The people who have money and are savvy come out ahead. In fact, they end up stronger than before."

8. Unfortunately, the Fed learned nothing from the 2008 crisis

A lot more than the Fed’s toxic alliance with Wall Street bothers Hoenig: America "learned little from the crisis … government policy continues to smile on Wall Street but not on Main Street. Instead of breaking up the financial giants whose gambles crashed the economy, the government has let the biggest banks grow even bigger. Now they’re gorging on free money."

9. Market economy? A joke, big-money lobbyists run America

Remember folks, 20 years ago in the S&L bank crisis 3,800 bankers were jailed. This time? Wall Street robbed us, got away with it, are still robbing us. Hoenig asks: "Where’s the penalty for failure? … We don’t have a market economy." American capitalism is now "crony capitalism … who you know, how big your political donation is."

10. America must end easy money, add new Glass-Steagall

What would Hoenig do as Fed chairman? "High savings rates, low leverage and a strong currency." Finally, Drehle says Hoenig would bring back the Depression-era Glass-Steagall rule that barred commercial banks from taking excessive risks. He would reduce government debt and promote a manufacturing revival, but it won’t be easy, there is no painless approach."

Unfortunately, none of this will happen until America gets hit over the head by brutal wake-up call, like 1929 and the Great Depression 2. Until then, the 30-year monetary dictatorship now headed by Bernanke will keep pushing its self-destructive easy-money policies, ignoring the warnings of Thomas Hoenig and all of the other Cassandras, Chicken Littles and Americans Crying Wolf, over and over again.

Debt now equals total U.S. economy, jumps $2 trillion in a single year

by Stephen Dinan - The Washington Times

President Obama projects that the gross federal debt will top $15 trillion this year, officially equalling the size of the entire U.S. economy, and will jump to nearly $21 trillion in five years' time. Amid the other staggering numbers in the budget Mr. Obama sent to Congress on Monday, the debt stands out — both because Congress will need to vote to raise the debt limit later this year, and because the numbers are so large.

Mr. Obama's budget said 2011 will see the biggest one-year jump in debt in history, or nearly $2 trillion in a single year. And the administration says it will reach $15.476 trillion by Sept. 30, the end of the fiscal year, to reach 102.6 percent of gross domestic product (GDP) — the first time since World War II that dubious figure has been reached. In one often-cited study, two economists have argued that when gross debt passes 90 percent it hinders overall economic growth.

The president's budget said debt as a percentage of GDP will top out at 106 percent in 2013, but only if the economy booms. "I still don’t see a sense of urgency from the president about the massive federal debt," said Sen. Lamar Alexander, Tennessee Republican. "His budget calls for too much government borrowing – even though the debt is already at a level that makes it harder to create private-sector jobs."

Speaking on MSNBC on Monday, Jacob "Jack" Lew, the White House budget director, said their long-term plan to lower deficits will stabilize the debt. "When we came into office, when President Obama took office, the deficit was climbing to over 10 percent of the economy. We have a plan that would bring it down to 3 percent," he said. "That is the most rapid reduction in the deficit in history. It is what we have to do to be able to say we're paying our bills and we're not adding to the debt."

The administration said debt as a percentage of GDP will stabilize at about 105 percent in the middle of this decade, though those calculations assume economic growth levels significantly above projections of the non-partisan Congressional Budget Office. The government measures debt several ways. Debt held by the public includes the money borrowed from Social Security's trust fund. Actual debt held by the public will reach 72 percent of GDP in 2011 and will climb as the Social Security trust fund's finances continue to deteriorate.

Geithner Quietly Tells Obama Debt Expense to Increase to Record

by Daniel Kruger and Liz Capo McCormick - Bloomberg

Barack Obama may lose the advantage of low borrowing costs as the U.S. Treasury Department says what it pays to service the national debt is poised to triple amid record budget deficits.

Interest expense will rise to 3.1 percent of gross domestic product by 2016, from 1.3 percent in 2010 with the government forecast to run cumulative deficits of more than $4 trillion through the end of 2015, according to page 23 of a 24-page presentation made to a 13-member committee of bond dealers and investors that meet quarterly with Treasury officials.

While some of the lowest borrowing costs on record have helped the economy recover from its worst financial crisis since the Great Depression, bond yields are now rising as growth resumes. Net interest expense will triple to an all-time high of $554 billion in 2015 from $185 billion in 2010, according to the Obama administration’s adjusted 2011 budget.

"It’s a slow train wreck coming and we all know it’s going to happen," said Bret Barker, an interest-rate analyst at Los Angeles-based TCW Group Inc., which manages about $115 billion in assets. "It’s just a question of whether we want to deal with it. There are huge structural changes that have to go on with this economy." The amount of marketable U.S. government debt outstanding has risen to $8.96 trillion from $5.8 trillion at the end of 2008, according to the Treasury Department. Debt-service costs will climb to 82 percent of the $757 billion shortfall projected for 2016 from about 12 percent in last year’s deficit, according to the budget projections.

That compares with 69 percent for Portugal, whose bonds have plummeted on speculation it may need to be bailed out by the European Union and International Monetary Fund. Forecasts of higher interest expenses raises the pressure on Obama to plan for trimming the deficit. The President, who has called for a five-year freeze on discretionary spending other than national security, sent Congress a $3.7 trillion budget today that projects the federal deficit will exceed $1 trillion for the fourth consecutive year in 2012 before falling to more "sustainable" levels by the middle of the decade.

"If government debt and deficits were actually to grow at the pace envisioned, the economic and financial effects would be severe," Federal Reserve Chairman Ben S. Bernanke told the House Budget Committee Feb. 9. "Sustained high rates of government borrowing would both drain funds away from private investment and increase our debt to foreigners, with adverse long-run effects on U.S. output, incomes, and standards of living."

Yield Forecasts

Treasuries lost 2.67 percent last quarter, even after reinvested interest, and are down 1.54 percent this year, Bank of America Merrill Lynch index data show. Yields rose last week to an average of 2.19 percent for all maturities from 2010’s low of 1.30 percent on Nov. 4.

The yield on benchmark 10-year Treasury note will climb to 4.25 by the end of the second quarter of 2012, from 3.63 percent last week, according to the median estimate of 51 economists and strategists surveyed by Bloomberg News. The rate was 3.61 percent at 10:48 a.m. today in New York. The economy will grow 3.2 percent in 2011, the fastest pace since 2004, according to another poll.

"People are starting to come to the conclusion that you’ve got a self-sustaining recovery going on here," said Thomas Girard who helps manage $133 billion in fixed income at New York Life Investment Management in New York. "When interest rates start to go back up because of the normal business cycle, debt service costs have the potential to just skyrocket. Every day that we don’t address this in a meaningful way it gets more and more dangerous."

‘Kind of Disruption’

While yields on the benchmark 10-year note are up, they remain below the average of 4.14 percent over the past decade as Europe’s debt crisis bolsters investor demand for safer assets, Bank of America Merrill Lynch index data show.

"The market is still giving the U.S. government the benefit of the doubt," said Eric Pellicciaro, New York-based head of global rates investments at BlackRock Inc., which manages about $3.56 trillion in assets. "What we’re concerned with is whether the budget will only be corrected after the market has tested them. Will we need some kind of disruption within the bond market before they’ll actually do anything."

Still, U.S. spending on debt service accounts for 1.7 percent of its GDP compared with 2.5 percent for Germany, 2.6 percent for the United Kingdom and a median of 1.2 percent for AAA rated sovereign issuers, according to a study by Standard & Poor’s published Dec. 24. Among AA rated nations, China’s ratio is 0.4 percent, while Japan’s is 2.9 percent, and for BBB rated countries, Mexico devotes 1.7 percent of its output to debt service and Brazil 5.2 percent, the report shows.

Demand for Treasuries remains close to record levels at government debt auctions. Investors bid $3.04 for each dollar of bonds sold in the government’s $178 billion of auctions last month, the most since September, according to data compiled by Bloomberg. Indirect bidders, a group that includes foreign central banks, bought a record 71 percent, or $17 billion of the $24 billion in 10-year notes offered on Feb. 9.

Foreign holdings of Treasuries have increased 18 percent to $4.35 trillion through November. China, the largest overseas holder, has increased its stake by 0.1 percent to $895.6 billion, and Japan, the second largest, boosted its by 14.6 percent to $877.2 billion.

‘Killing Itself’

"China cannot dump Treasuries without killing itself," said Michael Cheah, who oversees $2 billion in bonds at SunAmerica Asset Management in Jersey City, New Jersey. "They’re holding Treasuries as a means to an end," said Cheah, who worked at the Singapore Monetary Authority from 1982 through 1999, and now teaches finance classes at New York University and at Chinese universities. "It’s part of what’s needed to promote exports."

At least some of the increase in interest expense is related to an effort by the Treasury to extend the average maturity of its debt when rates are relatively low by selling more long-term bonds, which have higher yields than short-term notes. The average life of the U.S. debt is 59 months, up from 49.4 months in March 2009. That was the lowest since 1984.

The U.S. produced four budget surpluses from 1998 through 2001, the first since 1969, as the expanding economy, declining rates and a boom in stock prices combined to swell tax receipts. Tax cuts in 2001 and 2003, the strain of the Sept. 11 terror attacks, the cost of funding wars in Afghanistan and Iraq, the collapse in home prices and the subsequent recession and financial crisis has led to the three largest deficits in dollar terms on record, totaling $3.17 trillion the past three years.

The U.S. needs to manage its spending decisions "in a way that demonstrates confidence to investors so we can bring down our long-term fiscal deficits, because if we don’t do that, it’s going to hurt future growth," Treasury Secretary Timothy F. Geithner said in Washington on Feb. 9. The Treasury Borrowing Advisory Committee, which includes representatives from firms ranging from Goldman Sachs Group Inc. to Soros Fund Management LLC, expressed concern in the Feb. 1 report that the U.S. is exposing itself to the risk that demand erodes unless it cultivates more domestic demand.

"A more diversified debt holder base would prepare the Treasury for a potential decline in foreign participation," the report said. Foreign investors held 49.7 percent of the $8.75 trillion of public Treasury debt outstanding as of November, down from as high as 55.7 percent in April 2008 after the collapse of Bear Stearns Cos., according to Treasury data.

Potential Demand

The committee projects there may be $2.4 trillion in latent demand for Treasuries from banks, insurance companies and pension funds as well as individual investors. New securities with maturities as long as 100 years, as well as callable Treasuries or bonds whose principal is linked to the growth of the economy might entice potential lenders, the report said.

"They are opening up a can of worms with the idea of all these other instruments," said Tom di Galoma, head of U.S. rates trading at Guggenheim Partners LLC, a New York-based brokerage for institutional investors. "They should try to keep the Treasury issuance as simple as possible. The more issuance you have in particular issue, the more people will trade them -- whether it be domestic or foreign investors."

Deficit Forecasts

The deficit for the current fiscal year is forecast to hit a record $1.6 trillion -- 10.9 percent of gross domestic product -- up from the $1.4 trillion the administration estimated previously. It would be $1.1 trillion in 2012, 7 percent of GDP. By 2015 it would decline to $607 billion, or 3.2 percent of GDP.

Obama’s budget plan would reduce federal shortfalls by $1.1 trillion over a decade through spending cuts in areas ranging from heating subsidies for the poor to grants for airports and water-treatment plants and revenue increases, including letting taxes rise for married couples with more than $250,000 in annual income.

Still, about $4.5 trillion, or 63 percent of the $7.2 trillion in public Treasury coupon debt, needs to be refinanced by 2016. That gives the government a narrowing window as growing interest expense will curtail its ability to spend. "There is roll-over risk," said James Caron, head of U.S. interest-rate strategy at Morgan Stanley in New York, one of 20 primary dealers that trade with the Fed. "It’s a vicious cycle."

Even with bank-constricted pipeline, some foreclosures auctions surge

by Kerri Panchuk - Housing Wire

Foreclosures in some markets are on the rise, according to one survey of courthouse auctions. However, the numbers do not indicate a peak in foreclosure sales has been reached. "Despite months of slow sales, we've simply returned to prior levels, which to me indicates banks remain reluctant to aggressively foreclose despite the time it takes to foreclose being at or near record levels," said Sean O'Toole, founder and CEO of ForeclosureRadar. "And large inventories of properties [are] still scheduled for foreclosure sale."

Foreclosure auction sales grew as much as 50% in some states during January as foreclosure moratoriums came to an end, sending hundreds of distressed properties back to the auction block, foreclosure data firm said Tuesday. "While the increase is significant, we've seen larger surges after moratoriums or delays have played out in the past," said O'Toole in an email. "For example in California after the delays caused by Senate Bill 1137 we saw a surge in Notice of Default filings that far eclipsed any prior period. That is not the case here."

In Arizona, notice of trustee filings jumped 10.9% between December and January, the first increase recorded in six months. Foreclosure sales in Arizona also spiked with ForeclosureRadar recording a 56.2% rise in the number of homes sold back to the bank. The southwestern state also experienced a 52.7% increase in foreclosure sales to third-parties on a month-over-month basis in January.

California — one of the state's hit the hardest by unemployment and falling real estate prices during the recession — saw its back-to-bank foreclosure sales jump 51.1% between December and January. Sales of foreclosed homes to third parties in California also rose 52.8%. The Golden state reported a 6.9% rise in notice of default filings on a month-of-month basis, reversing a four-month decline in new defaults. At the same time, notice of trustee sale filings in California dropped 13.8%, turning one negative trend positive.

Oregon and Washington also recorded back-to-bank foreclosure sale increases of 33.4% and 54%, respectively. In terms of sales to third parties, Oregon noted a 70% jump in activity, compared to a 23% jump in Washington.

Derivatives: The Real Reason Bernanke Funnels Trillions Into Wall Street Banks

by Graham Summers - Phoenix Capital Research

We’ve been over the numerous BS excuses that US Dollar destroyer extraordinaire Ben Bernanke has made for QE enough times that today I’d rather simply focus on the REAL reason he continues to funnel TRILLIONS of Dollars into the Wall Street Banks.I’ve written this analysis before. But given the enormity of what it entails, it’s worth repeating. The following paragraphs are the REAL reason Bernanke does what he does no matter what any other media outlet, book, investment expert, or guru tell you.

Bernanke is printing money and funneling it into the Wall Street banks for one reason and one reason only. That reason is: DERIVATIVES.

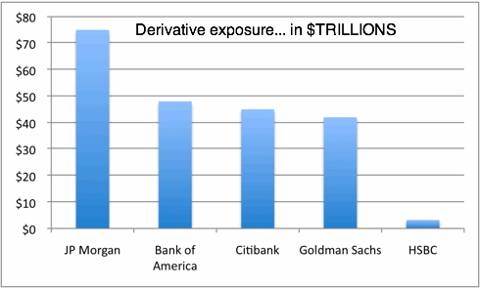

According to the Office of the Comptroller of the Currency’s Quarterly Report on Bank Trading and Derivatives Activities for the Second Quarter 2010 (most recent), the notional value of derivatives held by U.S. commercial banks is around $223.4 TRILLION.

Five banks account for 95% of this. Can you guess which five?

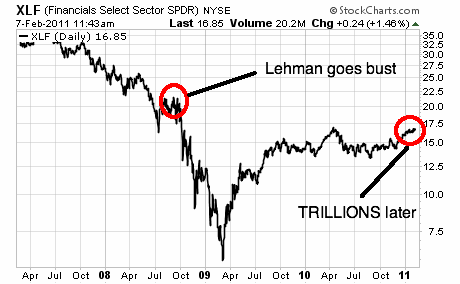

Looks a lot like a list of the banks that Ben Bernanke has focused on bailing out/ backstopping/ funneling cash since the Financial Crisis began, doesn’t it? When you consider the insane level of risk exposure here, you can see why the TRILLIONS he’s funneled into these institutions has failed to bring them even to pre-Lehman bankruptcy levels.

Ben Bernanke is a stooge and a fraud, but he is at least partially honest in his explanations of why he wants to keep printing money. The reason is to try to keep interest rates low. Granted, he’s failing miserably at this, but at least he understands the goal.

Of course, Bernanke tells the public and Congress that the reason we need low interest rates is to support housing prices. He doesn’t mention that $188 TRILLION of the $223 TRILLION in notional value of derivatives sitting on the Big Banks’ balance sheets is related to interest rates.

Yes, $188 TRILLION. That’s thirteen times the US’ entire GDP, and nearly four times WORLD GDP.

Now, of course, not ALL of this money is “at risk,” since the same derivatives can be traded/spread out dozens of ways by different banks as a means of dispersing risk.

However, given the amount of money at stake, if even 4% of this money is “at risk” and 10% of that 4% goes wrong, you’ve wiped out ALL of the equity at the top five banks.

Put another way, Bank of America, JP Morgan, Goldman and Citibank would CEASE to exist.

If you think that I’m making this up or that Bernanke doesn’t know about this, consider that his predecessor, Alan Greenspan, knew as early as 1999 that the derivative market, if forced into the open and through a public clearing house, would “implode” the market. This is DOCUMENTED. And you better believe Greenspan told Bernanke this.

In this light, all of Bernanke’s monetary policies and efforts are focused on doing one thing and one thing only: trying to shore up the overleveraged, derivative-riddled balance sheets of the Too Big to Fails, or Too Bloated to Exist, as I like to call them.

The fact that the bank executives taking this money and using it to pay themselves and their employees record bonuses only confirms that these folks have NO interest in taking care of shareholders or their businesses. They’re just going to take the money and run for as long as this scheme works.

I don’t know when this will come unraveled. But it WILL. At some point the $600+ TRILLION behemoth that is the derivatives market will implode again. When it does, no amount of money printing will save the Too Bloated To Exist banks’ balance sheets.

At that point, it’s game over for Wall Street and the Fed.

New report details scope of Chicago's public pension shortfalls

by Jason Grotto - Chicago Tribune

Continuing to sound the alarm on local pension funds, Chicago's Civic Federation will release a report Thursday that shows the unfunded liabilities for 10 city and county pension funds grew sixfold from 2000 to 2009, with shortfalls now totaling nearly $23 billion.

Coupled with Chicago residents' share of state pension debt, covering the unfunded liabilities of public pensions would now cost every man, woman and child in Chicago more than $11,934, up from $2,442 just a decade ago, the report found.

The Civic Federation's findings mirror many of those detailed in Tribune stories about Chicago's pensions published in November. The newspaper received an advance copy of the public policy think tank's report, which includes a detailed analysis of every county and city pension fund.

Eight of the 10 pension funds included in the report had funding levels above 80 percent in 2000. Since then, all but two have dropped below 60 percent, which pension fund experts say is a perilous position. The funding problems have continued despite pension reforms touted by Gov. Pat Quinn and the state Legislature, which lowered benefits for new hires.

"The takeaway here is that despite pension reforms that have been passed, public pension funds remain stressed," said Laurence Msall, president of the Civic Federation. "There is a great deal more work to be done to stabilize and maintain these pension funds. And it will require sacrifices by everyone."

Only the city's laborers pension fund and the Chicago Transit Authority pension had funding levels above 60 percent in 2009. The CTA retirement plan is that high only because it received a $1 billion pension obligation bond bailout from the state in 2008 to stop it from sliding into insolvency. Many now fear that other pension funds could face a similar crisis if something isn't done to shore up their finances.

In December, the Legislature passed reforms that will require Chicago to contribute more to police and firefighter pensions, which had been historically underfunded. City officials lambasted the law because they said it will lead to the largest property tax increase in city history.

While many have pointed to the economic downturn as the primary culprit of the pension crisis, the Civic Federation blames much of it on flaws in Illinois' pension code, which allows state and local governments to avoid paying the actuarially required contributions for employees' retirements. Those fundamental flaws have been exacerbated by benefit increases and early retirement incentives, as well as the recession.

Although the funds have seen significant improvement in investment returns during the last year, the pension hole is now so big that there is no way the funds can invest their way out of it, according to a report in April 2010 by Mayor Richard Daley's Commission to Strengthen Chicago's Pension Funds.

One significant issue highlighted in the Civic Federation report is a 75 percent decrease in the ratio of active-to-retired city and county workers since 2000, meaning there are now fewer workers paying into a system that requires ever more resources.

"People nationwide are starting to ask why Illinois and Chicago have allowed this fiscal recklessness to happen," Msall said. "That's not an easy question for politicians to answer. But if we don't take action soon, we may be beyond the point of fixing these problems."

Congressional Forecast Worsening: Gridlock With Increased Chance of Shutdown

by Matthew Jaffe - ABC News

There is a three-pronged budget war between President Obama and Republicans in Washington and it has politicians uttering a word they haven't used since 1994: shutdown. On one front: the fight over what programs to cut next year. On another: whether to extend the ever-rising debt ceiling again. And then there is the confrontation that could have the most immediate impact: whether the federal government will be shut down next month.

Government funding is due to run out on March 4 when the latest continuing resolution expires. If Congress fails to act, then the government would shut down. In recent days Democrats have repeatedly called for Republicans to take the prospect of a shutdown off the table, a call that Jack Lew, the Office of Management and Budget director reiterated today.

"We all want to avoid a situation like that. It's not the right way to run the government and I think we have a broad agreement that we need to keep essential services going," Lew said. But the chairman of the House Budget Committee, Rep. Paul Ryan, R-Wis. had a different view. "It is not our desire to see the government shutdown, but equally we don't want to rubber-stamp these elevated spending levels."

Even if the shutdown is avoided, at some point later this spring the national debt is set to hit its current $14.3 trillion limit. If Congress fails to act on the administration's request to raise the debt limit, then the government would have trouble refinancing its debt, taking in money to continue operations, and even default would be a possibility.

Then there is the longer term skirmish over funding for the next fiscal year. That fight kicked off this week with the unveiling of President Obama's 2012 budget proposal. The battle lines have already been drawn: Republicans want big cuts, Democrats less so. The GOP has been bolstered by its victories in last November's elections. Now Republicans feel the need to demand ever more sweeping cuts to appease their political base. "We're broke," House Speaker John Boehner said last week. "Let's be honest with ourselves."

"We have two opportunities just ahead of us to do something important on spending and debt," the Senate's top Republican Mitch McConnell said. "We have the continuing resolution for the balance of the year. We have the president asking us to increase the debt ceiling. Both of those are opportunities to do something important on spending and debt, which we believe is directly related to the sluggish growth we've had in the private sector."

In addition to the GOP's desire to make far larger cuts than the President has proposed, Republicans are also attempting to eliminate $100 billion from this year's budget. s emphasize the need to slash federal spending, Democrats -- who still control the Senate -- are urging caution, warning that drastic cutbacks could prove damaging. They fear that it could harm the nation's economic recovery, and they see the chance to portray their GOP counterparts as extreme and reckless in their budget proposals.

"We need to think about what we're cutting, and make sure those cuts aren't counterproductive. We need to pay attention to the quality of these cuts, not just the quantity," Senate Majority Leader Harry Reid said last week. "After all, you can lose a lot of weight by cutting off your arms and legs. But no doctor would recommend it." Sen. Chuck Schumer, D-N.Y., accused Republicans of "blindly swinging the meat axe to the budget when they should be using a sharp, smart scalpel."

The ramifications for the spending debate in Congress go far beyond the partisan jockeying to get the upper hand heading into next year's elections. A government shutdown could become a distinct possibility. If no deal is reached before March 4, then what are merely whispers about a shutdown right now could quickly grow into full-blown threats.

Rep. Paul Gosar, a newly-elected Republican from Arizona, was asked Monday on ABC's "Top Line" if he would support a federal shutdown if Democrats do not agree to sufficient budget cuts for fiscal year 2011 in the debate leading up to the March 4 deadline. "We wait and see," Gosar said. "I think, you know, what we've done is, we've had that adult discussion on our side -- we'll have that discussion coming about on the [House] floor. And I hope the Senate takes heed of that. And I think there's plenty of people that are listening over there with eyes wide open."

Other Republicans have gone even further. Former Minnesota Gov. Tim Pawlenty last week bragged to the Conservative Political Action Conference gathering in Washington that he oversaw the first government shutdown in Minnesota state history. Those Democrats on the Senate side with "eyes wide open" want the GOP to take the prospect of a federal shutdown off the table. "They need to say so, one way or the other. It is time for the House Republicans to stop with the games and finally rule out a government shutdown once and for all," Schumer said.

Vanishing Act: ‘Advisers’ Distance Themselves From a Report

by Andrew Ross Sorkin - Dealbook

A new study backed by pro-business groups takes a harsh stance on rules intended to bring transparency to the $600 trillion derivatives market. The report, published on Monday, claims that proposed regulation could cost 130,000 jobs and could cut corporate spending by $6.7 billion.

The findings are clearly meant to scare politicians and drum up public support — just as financial regulators are set to testify on the issue before a Congressional committee on Tuesday. And at first blush, the study would seem to be good ammunition for the Chamber of Commerce and its other supporters.

The study was conducted by Keybridge Research, a seemingly independent economics and public policy consulting firm. The firm’s bona fides include an all-star roster of academics, including Joseph E. Stiglitz, a Nobel laureate in economic science; David Laibson, a professor of economics at Harvard, and Stephen P. Zeldes, a professor of economics and finance at Columbia’s Graduate School of Business.

But a closer look at the report raises some serious questions. For one, the findings seem oddly out of step with the views of some of the group’s luminaries, including Mr. Stiglitz, who is advertised on Keybridge’s site as an adviser.

How could that be? Well, it appears that Mr. Stiglitz and many of the firm’s advisers are not advisers at all. "This is the first I have heard about it," said Mr. Stiglitz, who just returned home on Sunday after a five-week trip abroad. He said he was surprised to be listed on the group’s Web site. After reading the study, he said, "It’s not a very good report."

Some of the firm’s other so-called advisers must have agreed with him. As I made calls about the relationship between Keybridge and the academics, names mysteriously disappeared from the group’s site on Monday. By the end of the day, Keybridge’s list of affiliated advisers had shrunk to four, from seven.

When I called Keybridge’s president, Robert F. Wescott, who during the Clinton administration was a special assistant to the president for economic policy at the National Economic Council, he seemed slightly startled. "It is true that David and Steve asked to be removed from the Web site," he said. "These professors did not work on this project and were not aware of it, but they helped us with other projects."

He asserted that none of their names were attached to the study, just to the firm. He also contends that Mr. Laibson and Mr. Zeldes were distancing themselves as a result of "what happened with the movie ‘The Inside Job,’ " not the study. "That’s how it was presented to me," Mr. Wescott said.

The movie, which focuses on the financial crisis, raises questions about economists and their consulting arrangements with big business. Shortly after the film’s release, the American Economic Association voted to establish a special committee to create a professional code of conduct.= Mr. Laibson and Mr. Zeldes both said in e-mails that they just learned about the report on Monday and were not advisers to the firm. The Chamber of Commerce did not return a call for comment. Mr. Stiglitz said he had done "some work" for Keybridge, but not for a while. "The last thing I did for them was in May 2009."

Clearly the substance of the study — and the regulations it takes aim at — matter in shaping the future of the derivatives market. The study was strategically released for high impact. Gary Gensler, the chairman of the United States Commodity Futures Trading Commission, and other financial regulators are scheduled to testify on Tuesday about proposed derivatives rules before of the House Financial Services Committee.

At issue is how the rules apply to so-called end users like airlines or food companies that often buy derivatives to hedge their commodity costs. The fear is that companies will be required to post extra capital against those complex securities, amounting to 3 percent of their value. The potential results: a hit to their bottom lines and, more broadly, the economy.

The study, whose proponents also include the Business Roundtable, was clearly in the camp that such legislation would be bad for the economy since companies would have to set cash aside for derivatives instead of spending the money on jobs or new factories. But many economists derided the report within hours of its publication.

"This is not any kind of research. This is people who want to overleverage and risk the system — because, once again, they will get the upside and taxpayers/all citizens get the downside," Simon Johnson, a professor at the Sloan School of Management of the Massachusetts Institute of Technology and a senior fellow at the Peterson Institute for International Economics, wrote on his blog.

Mr. Stiglitz was even more adamant, saying the study’s conclusions encouraged the equivalent of "free fire insurance," in that companies could protect themselves from commodity price swings without paying up. "The argument they make is particularly foolish," he said. Mr. Stiglitz also said the argument seemed ludicrous in light of corporate America’s already stingy ways: "Companies are sitting on $2 trillion of cash. It’s just an embarrassment that they’d use that argument in the current context."

When I told Mr. Wescott of Keybridge about Mr. Stiglitz’s comments, he replied that "the client had asked us" to put the report together. "It was a hypothetical study."

All You Need to Know About Why Things Fell Apart

by Michael Lewis - Bloomberg

A surprising number of my fellow citizens appear to be unaware of my service these past 18 months as a member of the Financial Crisis Inquiry Commission. Thus it may come as news that I have declined to sign the report issued by the majority, or the dissent by the three- member minority, or even the dissent from their dissent, written by the now-immortal Peter J. Wallison. I hereby dissent from the dissent from the dissent. My dissent is different from all those other dissents, which is why I am dissenting.

I do this, of course, not to call attention to myself. Still less do I seek to enhance the status of my application for employment with JPMorgan Chase. I seek merely to inform the general public of the true causes of our so-called financial crisis. The task is not a simple one. In limiting me to a mere two pages at the end of their 633-page book, the majority and the other dissenters have suppressed not only several apt metaphors, but deep truths.

Here, in a far-too-brief executive summary, they are:

Financial Crisis Cause No. 1: Wall Street’s shifting demographics.

In the commission’s report Federal Reserve Chairman Ben Bernanke describes recent events as “the worst financial crisis in global history, including the Great Depression.” The event, in other words, was unprecedented. To understand an event that has never before occurred, we must logically begin with those factors that have never before been present. On Wall Street, the most obvious such factor is women.

Of course, the women who flooded into Wall Street firms before the crisis weren’t typically permitted to take big financial risks. As a rule they remained in the background, as “helpmates.” But their presence clearly distorted the judgment of male bond traders --- though the mechanics of their influence remains unexplored by the commission (on which several women sat).

They may have compelled the male risk takers to “show off for the ladies,” for instance, or perhaps they merely asked annoying questions and undermined the risk takers’ confidence. At any rate, one sure sign of the importance of women in the financial crisis is the market’s subsequent response: to purge women from senior Wall Street roles. Wall Street’s gender problem is, for the moment, of merely academic interest. Less academic is...

Financial Crisis Cause No. 2: The moral collapse of the American working class.

AIG head Robert Benmosche has recently pointed out that the reason his firm has enjoyed such great success is precisely because it has avoided selling insurance to the large number of Americans who believe, as Benmosche put it, “that the government is responsible for what happens to me.” (As we know, the government is responsible only for what happens to AIG).

The CEO of JPMorgan, Jamie Dimon, has often called our attention to the outrageous amount of banker bashing by Americans outside the financial sector, who seek to blame their troubles on others.

Wall Street leaders now understand that they made a mistake, one born of their innocent and trusting nature. They trusted ordinary Americans to behave more responsibly than they themselves ever would, and these ordinary Americans betrayed their trust. Amazingly, these ordinary Americans don’t even appear to feel guilty for their actions. Like wild animals that have lost their fear of humans, they continue to wander down from the hills to rummage through our garbage cans for sustenance.

Frankly, the commission’s report does nothing to improve public morals. In discussing the role of the 1977 Community Reinvestment Act, for instance, the report notes that the loans made by big banks to meet the act’s requirements -- that is, loans to poor people in crap neighborhoods -- outperformed, dramatically, the general run of subprime loans.

Such nitpicking merely obscures the critical point. For at least two centuries the U.S. government has encouraged people who didn’t work on Wall Street to think of themselves as “equal.” Government policies have emboldened ordinary Americans to borrow money they never intended to repay, just like rich people do, and cowed the financial elite into lending it to them. You can’t forget to bear-proof the garbage cans, and expect the bears won’t notice.

Along these same lines I cannot help but point out...

Financial Crisis Cause No. 3: The Chinese.

The willingness of this remote and curious people to sell us goods at ridiculously low prices is disruptive. It encourages our poor to believe they can afford many items which they should not be able to, for instance. And the vast number of dollars these same Chinese people willingly lend to us at absurdly low rates of interest places an unfair burden on our financiers, who must find someplace to put them.

This is a far more difficult job than is commonly understood; it often leaves Wall Street people feeling overworked and underappreciated. If we want our financiers to perform even better than they do, we must cease to expect more from them than they can give. Which brings me to...

Financial Crisis Cause No. 4: Upon our trusting, hard- working and underappreciated financiers we thrust the impossible task of overcoming impersonal historical forces.

The most distressing aspect of the commission’s report is its attempt to blame actual human beings for the financial crisis: fraudulent CDO managers, greedy ratings companies, Wall Street bond traders and, especially, Wall Street CEOs. Think about this: If everyone on Wall Street is guilty, how can anyone be? If no one on Wall Street saw it coming, how can anyone be expected to have seen it?

Details for Dummies

Anyway, as several Wall Street CEOs tried patiently to explain to the commission, the details were never their responsibility. Martin Sullivan, the CEO of AIG in the three years leading up to its near collapse, even went so far as to prove that he had no idea how much he’d been paid ($107 million).

The commission proved incapable of grasping the point: the rare man capable of running a big Wall Street firm remains focused on the big picture. And in the big picture, from the point of view of their firms and their earnings potential, the so-called financial crisis was a blip. They’ve already forgotten about it. And they assume that, eventually, you will, too.

MERS Lacks Right to Transfer Mortgages, Judge Says