"Fire at Washington docks of Norfolk & Washington Steamboat Co."

Ilargi: I'm not even sure if it's right to claim that it's unique to our societies, but it's certainly something like a token sign. We do a lot of stupid and useless things, but this one is right up there with the cream of the crop of them.

For days now, the entire financial world seems to be holding its breath waiting for Ben Bernanke to issue a statement on what his Federal Reserve aims to do next, a statement to be delivered today, Wednesday, around 2.15 PM EDT.

What makes this so remarkable is that it should be clear to anyone with a pulse and some control of any of their senses left, that Bernanke's upcoming speech is completely inconsequential for more than a very short and fleeting moment in time. The Fed can't save our economies or banks from the upcoming recession slash depression anymore than it can send a rocketship to Andromeda.

The Federal Reserve is impotent when it comes to saving the economy, even if it tries with all its might not to show it. It flaunts its fictional capacity and ability to come up with new and creative well-calculated measures to influence everything from A to Z like once upon a time the emperor flaunted his new clothes. And no matter how badly any and all of its previous measures have failed, the vast majority among us still praises the subtly elegant materials and their dream-provoking shine. We don't want reality, we want to believe.

Oh, but you say, the Fed did succeed at times: didn't QE1 saved the economy?! No, I say, it did nothing of the kind. One might argue that it saved the day, perhaps, but all it really accomplished was to make the crisis more opaque. And granted, that may well be what it was designed for. So in that light, yes, one can argue that the Fed has been highly successful.

But that is not what we are looking for in a central bank. What we are looking for is for it to, indeed, save the economy, in order that, in the case of the Federal Reserve, ordinary Americans can look forward to decent paychecks, and homes they can keep living in, and bright futures for their kids.

Well, neither QE1, nor for that matter any other of the Fed's measures of the past few years, have done anything at all to stop housing prices from plunging, to make sure people get hired again, or to make our children's futures look less bleak. And it has failed to accomplish all of this while spending on and lending to the global financial system some $10-$20 trillion in American "wealth", public funds.

It’s simply not true that with different policy decisions, the day could be saved. The choices lie elsewhere: are we going to use the people's money to "save the financial system", or will we use it to alleviate the misery of the people themselves? To date, the choice Washington, Brussels et al have opted for is abundantly clear: not one choice has been made based on what is best for the people. Instead, the people are told that it’s in their best interest if their money is used to prop up failed and bankrupt institutions. And so far, the people buy this baloney.

Everyone wants to believe that it's possible to be saved from hardship. Even if they are thrown step by step into hardship while being "rescued". It’s time we all understand that the interests of the financial world are diagonally opposed to our own interests. This might not have been true if a rescue were possible, but it's not.

It’s not even either/or: the financial system is profoundly broke, and governments and central banks cannot fork over enough leveraged credit to make it sound again. The world of finance will have to fess up to its losses, it must default and be restructured, many of its components must disappear never to be heard from again. And the last thing that should happen is for more public funds to be thrown down the banking drain. Alas, the last thing that should happen is the only thing that does.

Basically, we are told that "our" central bank exists for the greater good of society, if not to benefit mankind as a whole, and that its decisions are based on models so complicated, and based on the most thorough science known to the human brain, that it would be futile for any of us to try and understand its actions. We should leave that to the experts, who, oh lucky us, also happen to be solely concerned with our best interests, not their own.

Right now, the only time when one of the leading political and/or regulatory bodies in the world volunteers to give you a glimpse of reality, it's to extort ever and even more of your money. The IMF came out with a dire report this week, but only so it can argue for more stimulus (which simply means more money being transferred from the public to the private sector). The IMF represents the financial sector; it does unequivocally not represent you, no matter what claims it may make to the contrary.

It's nonsense to claim that what benefits the financial sector would automatically benefit you as well. The opposite is true. To understand and process that fact, however, you will first need to figure out that the entire financial sector is indeed bankrupt. It doesn't seem to be, perhaps, at first glance, but it's not all that hard to see it for what it is.

All you need to do is imagine where Wall Street banks, and the world's other main banks, would be today if not for the money they have already received from the public trough. They wouldn’t be anywhere is where they would be; they would no longer operate as going concerns. And then, even with all that money, they have lost 70-80-90% of their market values.

It's not all that difficult. As soon as you hear Bernanke utter the phrase "economic growth" without linking it directly to the phrase "default", you’ll know he's a fraud. Our economies may in all likelihood never return to growth, ever, but they certainly won't do so until the overhanging debt has been purged, starting with the toxic part of it. You should consider anything less from Ben an affront to your intelligence. Chances are, however, that you won't. Because all these political-media-industry voices will keep on telling you how important Bernanke and the Fed are.

The Fed sets interest rates, right? Wrong. It does nothing of the kind. All Bernanke can do is set a Fed funds rate, close his eyes, fold his hands and pray it’ll stick for more than 5 minutes. That's the extent of his control over interest rates. In reality, the markets set interest rates.

A nice example came yesterday from Ian Talley at Dow Jones Newswires, with a headline that ran: IMF Urges ECB To Keep Italian Borrowing Rates Down. That's all you need to know, really, when it comes to central banks and their grip on interest rates.

Obviously, the ECB would love to keep Italy's borrowing rates down, it would save it a huge headache. Problem is, it can't: the markets currently demand a much higher rate for Italian debt than the ECB, or Rome, like. What the IMF wants the ECB to do is buy huge piles of Italian debt, while in the process de facto crippling the free market system.

But until and unless Italian debt is purged, the ECB would have to buy all of it, including all the upcoming dozens of billions in rollovers, or Italy would need to go elsewhere anyway. The ECB may save the day, but that's all: it can't even save the week that day is in.

The Fed has a bunch if options this afternoon, say the media. It can Twist, i.e. sell short term Treasuries to buy long term ones, but that buck stops at about $300 billion and carries no surprises, is priced in. It can cut the interest rate it pays on excess reserves banks hold with it (IOER). Priced in as well, and by no means a big deal to begin with: banks are not going to start lending again all of a sudden because that rate falls from 0.25% to something even less.

The third option is a change of language, to the effect that Bernanke will say they'll keep interest rates at X% until unemployment is below Y%, as long as inflation remains below Z%. Well, that is moot, since, as we saw, the Fed doesn’t set interest rates. What is interesting in this regard is what language Ben will utter when a Greek default starts the EU downfall and the grand flight to safety into the USD and Treasuries. It'll demolish US exports, which will demolish jobs, which will drive down home prices, and so on and so forth. The dollar will be strong, but the majority of Americans won't have any.

Ben will, in that case too, still be naked and impotent, but don't count on him admitting it. And that's the real problem here, isn't it? Surely there must be some neuron in that bald scalp that realizes it's attached to nothing but a chubby flubby naked body. That neuron, then, will also realize that the body has no balls either.

Wouldn't it be something if Bernanke simply states the truth later today, and tells the nation there's nothing he can do to save it, but that even though he may be impotent, he sure as hell still can grow a pair, and he's decided to come clean? Nah, dream on, that would take a real man.

PS: No, it's true, Bernanke is of course not entirely without power. He has the power to take as much of your money as he pleases, to do with as he pleases. And he does so with reckless abandon. But that's not what he's going to talk about.

Greece must default and quit the euro. The real debate is how

by Costas Lapavitsas - Guardian

A Greek default and exit must be taken in the people's interests – not entrusting the process to the EU, IMF and banks

Greece is facing an economic and social disaster, the result of its so-called rescue by the "troika" of the EU, the International Monetary Fund and the European Central Bank. Greece must change course to avoid a grim future for its people: it must default on its debt and exit the eurozone.

Consider first the scale of the crisis. After contracting in 2009 and 2010, GDP fell by a further 7.3% in the second quarter of 2011. Unemployment is approaching 900,000 and is projected to exceed 1.2 million, in a population of 11 million. These are figures reminiscent of the Great Depression of the 1930s.

The causes clearly lie with the programme of the troika. In early 2010 Greece was effectively bankrupt. In its wisdom, the troika imposed policies of severe austerity and deregulation consistent with the neoliberal ideology of the EU. Quite predictably, demand collapsed and banking credit became scarce, with the result that the core of the Greek economy was crushed.

The social implications have been catastrophic. Entire communities have been devastated by unemployment, losing the means to live as well as the norms, customs and respect of regular work. Barter has appeared among the poor and the not so poor. Medical services in working-class areas are running low on basic provisions. Schools and transport are disintegrating. People are abandoning cities to return to agriculture, a sure sign of social retrogression.

As the recession deepened, the programme failed to meet even its own targets. The budget deficit for 2011 is on course for 10% of GDP, when the target was slightly above 7%. The debt-to-GDP ratio could reach 200% in 2013, up from 115% in 2009. But the troika has refused to acknowledge failure and in early September blackmailed Greece: take further austerity measures or there will be no more lending. The government has buckled, introducing the equivalent of a heavy poll tax on property. A further meeting with the troika was scheduled for today, following which there would be mass layoffs of civil servants, further wage and pension cuts, still higher indirect taxes, and so on.

These measures are also likely to fail: they will intensify the recession and be opposed politically. George Papandreou's government is isolated, and the ruling party has lost any ability to generate grassroots support. The official opposition, New Democracy, has been critical of troika policies, hoping to make electoral gains. The parties of the left have already called for open defiance and non-payment.

In practice Greece is on the brink of defaulting and abandoning the euro. This is the harsh reality, though none of the major parties is prepared to acknowledge it. The tragedy is that Greece now has a far weaker economy than in 2010. It is likely, therefore, that there will be major economic and social upheaval with unpredictable outcomes.

With the best interests of its people in mind, what should a government do? The first step would be to default, but without entrusting the process to bankers, the EU and the IMF, for we have evidence of what that would mean. Last July Greece agreed on an exchange of old for new debt that would reduce its debt to banks by 21%. Yet it also had to provide massive collateral guarantees to banks, with the result that its total debt might actually increase. Even so, many banks have not accepted this incredibly favourable deal, hoping instead for full repayment.

If default is to secure a deep cancellation of debt, it must be driven by Greece and it should be coercive as far as the banks are concerned. But it must also be democratic, based on an independent auditing of debt to ascertain how much might be illegitimate. Greece is not without advantages in this regard. Most public bonds are subject to domestic law that means terms of repayment can be altered through an act of parliament. Moreover, the "rescue" loans by the EU and the IMF may be declared illegitimate by an independent audit. The Greek people could thus regain a modicum of self-respect, savagely destroyed during the last couple of years.

The second step would be to exit the eurozone, but in a manner that would be in the long-term interests of working people, not big business or banks. Contrary to what is often asserted, Greece would not collapse if it quit the euro. After all, monetary unions have a limited shelf life, and Europe's is a particularly badly structured one. Exit is the most sensible way for Greece to restore competitiveness and start to recover. The alternative is to continue with austerity packages that do not work and will lead to long term decline.

A progressive government would take several decisive steps: switch to a new drachma quickly; nationalise the banks; and impose capital controls. There would need to be administrative measures to ensure supplies of oil, food and medicine, along with income and wealth redistribution to support the poorest. Recovery should start in a few months, spurred by devaluation that would allow industry to increase exports and recapture the domestic market. If progressive forces showed sufficient will, it would then be possible to transform the economy deeply, changing the balance of power in favour of working people.

Default and exit would cause international turmoil. Greek debt may not be large enough directly to threaten European banks, but world banking is in a fragile state. Greek action would disturb the secondary markets for sovereign bonds, potentially leading to a major crisis. But the EU authorities would have only themselves to blame, since their policies are in effect driving Greece out of the eurozone.

Europe bank debt in lurid detail

by GolemXIV

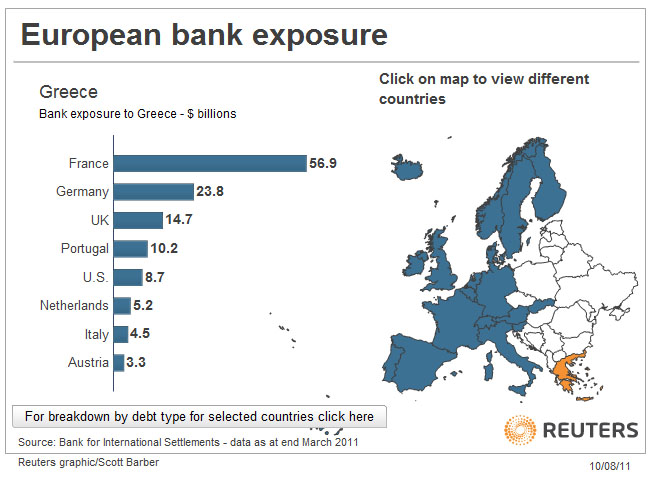

For anyone who thinks that crushing the Greeks with even more dent and even more austerity will somehow ‘save’ europe’s insolvent banks here from Reuters is why it won’t.First here’s Europe’s bank exposure to Greece:

Remember this isn’t the fabled public debt wracked up by countless lazy, feckless lay-abouts and their ugly children all determinedly doing nothing and expecting to be given flat screen televisions and hospital care they don’t deserve. This is debt created by, agreed to, marketed by and because of which huge bonuses were awarded to, private bankers throughout Europe.

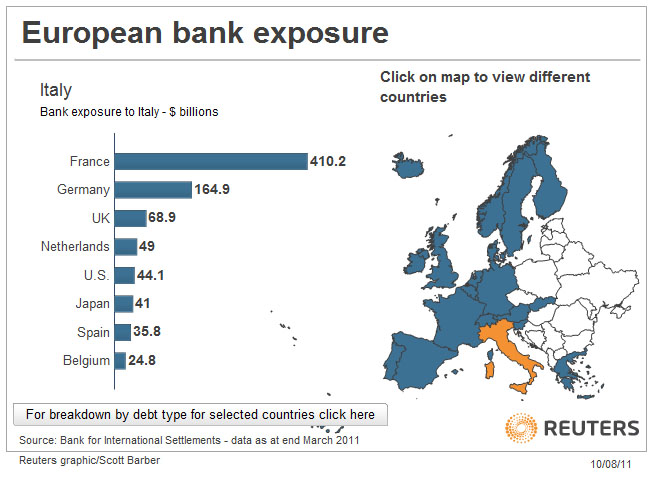

I think that shows quite clearly why French banks have been pulverized and the size of the crater on whose edge they teeter. But let’s imagine Germany ignores the rising tempest of public anger and throws its money into the hole. Now let’s look at what comes next, Italy.

Oops! France still collapses. Italy is ruled by a cretin who gives visas to men who pimp for him so he can ‘Carry on Fornicating” while Italy, never mind Rome, burns.

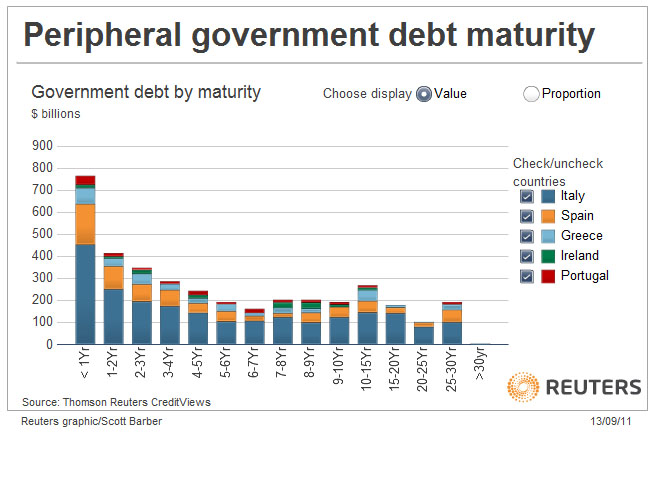

And why will Italy collapse? This is why.

Over 400 billion dollars worth of Italy’s debt has a maturity of ONE year. Another 250 billion in TWO years.

And just in case you were thinking it was all France and Italy,

“‘Germany’s 10 biggest banks need 127 billion euros ($175 billion) of additional capital’, German newspaper Frankfurt Allgemeine Sonntagszeitung reported, citing a study by economic research institute DIW.”

In case you want to see more of the images,they come from a very good Reuters graphic of the total European debt debacle which you can see in its horrid entirety here, here and here. The first two are part of the same group but I’m giving you different entry points. Then third is a larger package. And this is a ZeroHedge article in case you want to see what people are saying over there.

"Deficit Attention Disorder"

by London Banker

I must admit to being delighted that the EU finance ministers have found unity on one point: dismissal of Tim Geithner as officious, ignorant and unaccountable. He is an example, right up there with George W. Bush, of the privileged American elite who "fail upwards" throughout a career.

Europe's nations may have an escalating debt crisis, but they have been addressing it sensibly and cautiously by trying to rein in further debt through reductions in government spending.

The perfect example from the meeting logistics: EU finance ministers shared a bus to the meeting, while Tim Geithner insisted on a private car.

Geithner seems to abhor austerity and sacrifice, preferring any strategy which keeps debt growing to fund the investment banking, security, prisons and war industries on which the American economy now depends for so much of its GDP. (2 percent of Americans are in prison, while 1 percent work for the Department of Defense.)

He encouraged a ten-fold increase in leverage of the EFSF to create a massive new debt overhang. Madness. The cure for a refinancing crisis is not more leverage to be later refinanced.

Europe has its problems, but one thing I know is that the default setting for Europe is cooperation where the default setting for America is conflict. If Tim Geithner's objective in coming to Poland was to stimulate consensus among European finance ministers, then he can go home happy. He succeeded. They are unified in finding him and his policies discredited. They will work together from that consensus to find a more workable solution for Europe than could ever be conceived in Washington, precisely because they will work together in recognition of mutuality of interest.

UPDATE: As this is being linked elsewhere, I'll add a suggestion about what I would advise the eurozone finance ministers. I would advise them to have every EU state with off balance sheet, hidden liabilities on derivatives - whether undertaken for window dressing to gain admission to the eurozone or any other purpose - to default on any further margin or resettlement payments. The Hammersmith and Fulham defaults of the late 1980s proved a wonderful discipline on the investment banks, schooling them in the limits of preying on local governments. It might be time for another lesson at the national level.

Each of the defaulted derivatives contracts could be referred to an EU committee to determine whether the contract had any legitimate rationale beyond disguising the financial condition or otherwise deceiving the public or other EU governments. If there was no legitimate rationale which served the public interest, then the contract would be declared unenforceable.

This wouldn't address decades of deficit spending, but it would provide a popular demonstration of resolve to shaft Wall Street rather than the taxpayer, at least in the first instance. The politicians should then have enough breathing room to reach a more resilient agreement on fiscal policy and funding going forward.

I appreciate that questioning the validity and enforceability of derivatives contracts might be "extra-legal" in the sense that it would be contrary to accepted legal norms. But since virtually every intervention and liquidity programme innovated by a central bank since 2007 has been without legal or statutory basis, despite the huge redistributions of national wealth, I hardly consider that a sticking point.

Obama announces debt plan built on taxes on rich

by Jim Kuhnhenn - AP

In a blunt rejoinder to congressional Republicans, President Barack Obama called for $1.5 trillion in new taxes Monday, part of a total 10-year deficit reduction package totaling more than $3 trillion. He vowed to veto any deficit reduction package that cuts benefits to Medicare recipients but does not raise new revenues. "We can't just cut our way out of this hole," the president said.

The president's proposal would predominantly hit upper income taxpayers but would also reduce spending in mandatory benefit programs, including Medicare and Medicaid, by $580 billion. It also counts savings of $1 trillion over 10 years from the withdrawal of troops from Iraq and Afghanistan.

The deficit reduction plan represents an economic bookend to the $447 billion in tax cuts and new public works spending that Obama has proposed as a short-term measure to stimulate the economy and create jobs. And it gives the president a voice in a process that will be dominated by a joint congressional committee charged with recommending deficit reductions of up to $1.5 trillion.

His plan served as a sharp counterpoint to Republican lawmakers, who have insisted that tax increases should play no part in taming the nation's escalating national debt. Obama's plan would end Bush-era tax cuts for top earners and would limit their deductions. "It's only right we ask everyone to pay their fair share," Obama said from the Rose Garden at the White House.

In issuing his threat to veto any Medicare benefits that aren't paired with tax increases on upper-income people, Obama said: "I will not support any plan that puts all the burden for closing our deficit on ordinary Americans." Responding to a complaint from Republicans about his proposed tax on the wealthy, Obama added: "This is not class warfare. It's math."

The Republican reaction was swift and derisive. "Veto threats, a massive tax hike, phantom savings, and punting on entitlement reform is not a recipe for economic or job growth--or even meaningful deficit reduction," Senate Republican leader Mitch McConnell said in a statement issued minutes after the president's announcement. "The good news is that the Joint Committee is taking this issue far more seriously than the White House."

Obama's proposal comes amid Democratic demands that Obama take a tougher stance against Republicans. And while the plan stands little chance of passing Congress, its populist pitch is one that the White House believes the public can support.

The core of the president's plan totals just over $2 trillion in deficit reduction over 10 years. It would let Bush-era tax cuts for upper income earners expire, limit deductions for wealthier filers and close loopholes and end some corporate tax breaks. It also would cut $580 billion from mandatory programs, including $248 billion from Medicare. It also targets subsidies to farmers and benefits programs for federal employees.

Officials cast Obama's plan as his vision for deficit reduction, and distinguished it from the negotiations he had with House Speaker John Boehner in July as Obama sought to avoid a government default.

As a result, Obama's proposal includes no changes in Social Security and no increase in the Medicare eligibility age, which the president had been willing to accept this summer. Administration officials also said that Obama's $1.5 trillion in new taxes is a goal that Congress could achieve through a broad overhaul of the tax code. They said the president's specific proposals represent one way to get to that goal under the existing tax code.

Coupled with about $1 trillion in cuts already approved by Congress and signed by the president, overall deficit reduction would total more than $4 trillion, a number many economists cite as a minimum threshold to bring the nation's debt under control.

Key features of Obama's plan:

- $1.5 trillion in new revenue, which would include about $800 billion realized over 10 years from repealing the Bush-era tax rates for couples making more than $250,000. It also would place limits on deductions for wealthy filers and end certain corporate loopholes and subsidies for oil and gas companies.

- $580 billion in cuts in mandatory benefit programs, including $248 billion in Medicare and $72 billion in Medicaid and other health programs. Other mandatory benefit programs include farm subsidies and federal employee benefits. Administration officials said 90 percent of the $248 billion in 10-year Medicare cuts would be squeezed from service providers. The plan does shift some additional costs to beneficiaries, but those changes would not start until 2017.

- $430 billion in savings from lower interest payment on the national debt.

- $1 trillion in savings from drawing down military forces from Iraq and Afghanistan.

Republicans have ridiculed the war savings as gimmicky, but House Republicans included them in their budget proposal this year and Boehner had agreed to count them as savings during debt ceiling negotiations with the president this summer.

Illustrating Obama's populist pitch on tax revenue, he suggested that Congress establish a minimum tax on taxpayers making $1 million or more in income. The measure -- the White House calls it the "Buffett Rule" for billionaire investor Warren Buffett -- is designed to prevent millionaires from taking advantage of lower tax rates on investment earnings than what middle-income taxpayers pay on their wages.

That minimum rate, however, is not included in the White House revenue projections. Officials said it was a suggestion for Congress if it were to undertake an overhaul of the tax code. At issue is the difference between a taxpayer's tax bracket and the effective tax rate that taxpayer pays. Millionaires face a 35 percent tax bracket, while middle income filers fall in the 15 or 25 percent bracket.

But investment income is taxed at 15 percent and Buffett has complained that he and other wealthy people have been "coddled long enough" and shouldn't be paying a smaller share of their income in federal taxes than middle-class taxpayers.

Household Net Worth: The "Real" Story

by Doug Short - Advisor Perspectives

After the release last week of the Federal Reserve's quarterly Flow of Funds report, I saw a number of references to the data series for household and nonprofit organization net worth. A quick glance at the complete quarterly data series in linear chart suggests a bubble in net worth that peaked in Q2 2007 with a trough in Q1 2009, the same quarter that the markets bottomed. The latest Fed balance sheet shows a total net worth that is 18.1% above the 2009 trough but still 11.3% below the 2007 peak. The disappointing news in the Q2 balance sheet is that total net worth has slipped 0.3% from Q1 of this year.But there are problems with this analysis. Over the six decades of this data series, total net worth has grown by 5000%. A linear vertical scale on the chart above is misleading in its failure to provide an accurate visual illustration of growth over time. It also gives an exaggerated dimension to the bubble that began in 2002.

Here is the same chart, courtesy of the FRED (Federal Reserve Economic Data) repository), this time with a log vertical scale. The difference is rather astonishing.

But there is another problem, one that has to do with the data itself rather than the method of display. Over the same time frame that net worth grew 5000%, the value of the 1951 dollar shrank to about 11 cents. The Federal Reserve gives us the nominal value of total net worth, which is significantly skewed by money illusion. Here is my own log scale chart adjusted for inflation using the Consumer Price Index.

Let's now zoom in for a closer look at the period since 1980. I've added some callouts to highlight where we are currently with regard to the all-time peak and 2009 trough.

So now let's compare the nominal and real statistics for the peak-to-trough and recovery-to-date.

- Peak: The nominal peak occurred in Q2 2007; the real peak occurred in Q1 2007.

- Trough: The nominal and real troughs occurred in Q1 2009. The nominal peak-to-trough decline was 24.9%. The real decline was 27.0%.

- Recovery to date: The latest Flow of Funds report shows a nominal recovery of 18.1% off the trough. The real recovery is 11.0%.

- Latest Quarter: Quarter-over-quarter, nominal total net worth in Q2 declined 0.25% from Q1. The real decline was 1.96%.

We'll take another look at the nominal and real numbers after the release of the Q3 Flow of Funds data on December 8th.

Note: I've referred to this data series as "household" net worth. But, as I show in the chart titles, it also includes the net worth of nonprofit organizations. The ratio of two isn't clearly defined in the Fed data, and it obviously varies by asset and liability component. I've seen estimates that the nonprofit component is around six percent of the total net worth.

One easy (and rather illuminating) point of comparison in the Flow of Funds data is the relative share of real estate at market value (B.100 lines 3,4, and 5). In the latest report, nonprofit organizations hold 10.9% of combined household and nonprofit real estate. That percentage in the quarterly data has ranged from a high of 16.9% in 1974 to a low of 7.3% in Q2 2005, a couple of quarters before the peak in the residential real estate bubble.

Albert Edwards Sends Warning: This Chart Signals An Imminent Stock Market Breakdown

by Joe Weisenthal - Business Insider

This chart was just sent out from Albert Edwards:The chart below shows the monthly S&P together with the MACD.

For those normal people who don’t know what the MACD is or even what it stands for, it is the Moving Average Convergence-Divergence. It is a momentum oscillator closely followed by many market participants. When the faster moving mav breaks the slower moving mav (up or down) we get a key buy or sell signal.

We may be about to break downwards on the monthly S&P chart which would give us a HUGE sell signal as was the case in Nov 2007 and the end of 1999 (also see attached note on The Killer Wave signal). If the S&P cracks we will be at 1.5% 10y US yields within a few days and probably heading to 1%. Watch this space.

Global stock markets braced for further turmoil after S&P downgrades Italy

by Philip Aldrick - Telegraph

Global financial markets are bracing themselves for another day of turmoil on Tuesday after credit ratings agency Standard & Poor's downgraded Italy late on Monday night.

The news came after panic gripped global markets as a fresh showdown over Greece renewed fears that the eurozone will be plunged into crisis. The rating for Italy, which has Europe’s second-largest debt load, was lowered from A+ to A, S&P said in a statement. The agency said the country's net general government debt is the highest among A-rated sovereigns, and now expects it to peak later and at a higher level than it previously anticipated.

"In our view, Italy’s economic growth prospects are weakening and we expect that Italy’s fragile governing coalition and policy differences within parliament will continue to limit the government’s ability to respond decisively to domestic and external macroeconomic challenges," S&P said in a statement. "The measures included in and the implementation timeline of Italy's National Reform Plan will likely do little to boost Italy's economic performance, particularly against the backdrop of tightening financial conditions and the government's fiscal austerity program."

S&P also said it lowered its outlook for Italy’s annual average growth to 0.7pc for 2011 to 2014, from a prior projection of 1.3pc. Earlier, as Greece and the bail-out "troika" of the International Monetary Fund (IMF), the European Union (EU) and the European Central Bank (ECB) thrashed out their differences, investors hit the sell button – hammering confidence and threatening the recovery.

Greece warned that it is just weeks away from default unless the troika releases an €8bn (£7bn) instalment of its original €110bn rescue. Creditors, though, stressed that they need evidence the country is delivering on its promised spending cuts.

In a robust exchange, Bob Traa, the IMF's representative in Greece, urged the government to outline plans to shrink a bloated public sector to avoid further emergency taxes – arguing that Athens should give up the "taboo" of firing civil servants. "I have compared Greece to a Mercedes that can go 120 kilometers per hour but is only going 40 because it has so much sludge in the engine," Mr Traa said.

In response, the Greek finance minister Evangelos Venizelos claimed European and international institutions were using Greece as a "scapegoat" to "hide their own lack of competence to manage the crisis". The country, he said, had been "blackmailed and humiliated".

He later admitted to holding "productive and substantive" talks with the bail-out "troika". These are set to continue, with sources indicating that a deal could be sealed as early as Tuesday. The stand-off spooked markets across the world. European and US indices slumped, and £28bn was wiped off the FTSE 100 as its four-day rally came to a juddering halt.

Signs of stress were once again evident in the bond markets on fears the crisis would rapidly spread, with yields on Italian and Spanish government debt climbing closer to the dreaded 6pc level widely seen as the point of no return. The euro weakened to a near seven-month low against the dollar, falling 1.2pc to $1.3631. Sterling fell to a nine-month low against the dollar. The Italy downgrade wiped around 70 points off the 24-hour Dow. The euro/dollar slumped to 1.36. The FTSE 100 is now expected to open flat on Tuesday.

Greece must demonstrate that it can hit its deficit reduction targets but the deeper-than-expected recession, sluggish privatisation programme and the authorities' failure to collect taxes is jeopardising its efforts. Proposing roughly 100,000 job cuts by 2015, Mr Traa said: "This will inevitably require the closure of inefficient state entities as well as reductions in the excessively large public sector workforce and generous public sector wages, which in some cases are above those of the equivalent private sector workers."

Rejecting a new property tax, he added: "This will neither be economically or politically sustainable." Better would be a "much stronger resolve to tackle the problem of tax evasion".

Mr Venizelos accepted that Greece had "delayed" major structural reforms and that the tax collection system was ineffective. Preparing the country for more austerity, he said: "We cannot go forward without the true implementation of major structural reforms."

World Bank chief Robert Zoellick warned that the euro crisis now threatened a wider downturn. "The drop in markets and confidence could prompt slippage in developing countries' investment and a pull-back by their consumers, too," he said. Investors are now looking to the US Federal Reserve to help by restarting quantitative easing. The Fed meets on Tuesday and Wednesday to discuss the state of the economy and may decide to undertake more stimulus.

Italy follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries having their credit rating cut this year. Prime Minister Silvio Berlusconi passed a €54bn austerity package this month that convinced the European Central Bank to buy its bonds after borrowing costs surged to euro-era records in August.

IMF Urges ECB To Keep Italian Borrowing Rates Down

by Ian Talley - Dow Jones Newswires

The European Central Bank must continue to keep Italian debt rates low to ensure Europe's fourth-largest economy doesn't fail, the International Monetary Fund's chief economist said Tuesday. If Rome implements declared budget measures, Italy should remain solvent, IMF's Olivier Blanchard said at a briefing on the world economic outlook.

Late Monday, Standard & Poor's downgraded Italy, leaving open the possibility of further downgrades. "If for some reason, the markets start to believe Italy's debt is not sustainable and start asking for eight, nine or 10% interest rates, then it's clear that Italy's debt is unsustainable," Blanchard said. "It's absolutely essential that somebody be there to make sure that interest rates are low and Italy's debt is sustainable," he said.

So far, that role has been played by the ECB as it buys Italian bonds to help prop up Rome's debt. "It's a very important role" for the ECB to play, Blanchard added. But European officials suggest the EUR500 billion ($685 billion) bailout fund could also be used to buy sovereign bonds once member countries ratify a July 21 agreement.

The IMF warned in its economic outlook that if European policy makers don't act fast to contain the sovereign-debt crisis, it could plunge the U.S. and European Union economies into a deep recession.

Blanchard said that downside scenario could materialize at any moment. Governments don't have the luxury of time, he said.

The IMF warned that if growth in Italy was 1 percentage point below its forecast, the debt-to-output ratio would jump 20% of GDP. That would put Italian debt-to-GDP levels up to 140%, around the same level that Greece's debt is expected to peak at.

Still, Carlo Cottarelli, head of the IMF's fiscal affairs department, estimates that Rome's budget plan can lower the country's deficit to about 1% of output in 2013. He said the government needs to do much more to boost growth, however, including increased competition throughout several of its major sectors.

Lenders press Greece to shrink state and avoid default

by George Georgiopoulos and Ingrid Melander - Reuters

International lenders told Greece on Monday it must shrink its public sector to avoid running out of money within weeks, as investors spooked by political setbacks in Europe dumped risky euro zone assets. Adding to concerns, Standard & Poor's cut its ratings on Italy in a major surprise that threatens to stoke fears of contagion in the debt-stressed euro zone.

Greece is near a deal to continue receiving bailout funds, a Greek finance ministry official said after a conference call with lenders, though "some work still needs to be done." U.S. stocks recovered some of their losses on the news. Greek Finance Minister Evangelos Venizelos held what Greece termed "productive and substantive" talks by telephone with senior officials of the European Union and International Monetary Fund after promising as much austerity as necessary to win a vital next installment of aid.

The talks will resume on Tuesday evening after experts meet through the day. Earlier, the IMF's representative in Greece spelled out steps Athens must take to secure the 8 billion-euro loan it needs to pay salaries and pensions next month. "The ball is in the Greek court. Implementation is of the essence," Bob Traa told an economic conference.

Additional savings measures were required to cut the public deficit to a sustainable level and reduce the public sector's claim on resources -- code for axing jobs and cutting pay and pensions -- while improving tax collection rather than adding further taxes, Traa said.

Venizelos said Greece would do what was needed to get more funds but would not be made a scapegoat by euro zone policymakers who had failed to tackle the region's debt woes. European stocks and the euro fell sharply on fears of a Greek default, compounded by the failure of EU finance ministers to agree new steps to resolve Europe's debt crisis at weekend talks, and another regional election defeat for German Chancellor Angela Merkel.

The euro fell about 0.5 percent in early Asian trade on Tuesday after S&P cut its rating on Italy, citing weakening economic growth prospects and a fragile ruling coalition. In a sign of mounting stress, yields on Italian and Spanish bonds rose further above 5 percent despite six weeks of European Central Bank buying to stabilize them. The cost of insuring peripheral debt against default also rose.

"There will be additional volatility in the global financial markets heading into the end of the month as the pressure to get Greece and others to enact their reforms will be white-hot intense," said Andrew Busch, global currency strategist at BMO Capital Markets in Chicago.

The euro zone debt crisis is now dominating the thoughts of policymakers worldwide with the United States, in particular, pushing for more dramatic action from Europe's leaders. President Barack Obama and Germany's Merkel spoke by telephone on Monday -- the latest of several calls between the two leaders -- and agreed that "concerted action" would be needed in the coming months to address it.

Emerging economies are also worried about being hurt by a deepening of the crisis in Europe. A Brazilian official said Brazil will propose this week that it and other large emerging economies make new funds available to the IMF to help ease the crisis in the euro zone.

"A new and larger risk looms. The drop in markets and confidence could prompt slippage in developing countries' investment and a pull back by their consumers too," World Bank chief Robert Zoellick said ahead of Group of 20 talks and an IMF/World Bank meeting in Washington later in the week.

Without its next loan tranche, Athens says it will run out of cash in mid-October. A default would threaten contagion to larger euro zone economies such as Italy and hammer European banks with heavy exposure to Greece.

Prime Minister George Papandreou canceled a planned trip to Washington and the United Nations at the last minute and returned home in response to the crisis. A senior Greek government official told Reuters the EU/IMF inspectors expect a new property tax unveiled last week to yield just half the two billion euros targeted this year.

Greek media published a list of 15 austerity measures it said the troika was demanding the Socialist government implement to receive the next tranche of aid. They included firing another 20,000 state workers, cutting or freezing state salaries and pensions, increasing heating oil tax, shutting down loss-making state organizations, cutting health spending and speeding up privatizations. The European Commission said it was not asking Athens to adopt any additional austerity steps on top of what had already been agreed in the Greek reform program.

Public Support Lacking

The IMF's Traa acknowledged that the IMF/EU bailout plan lacked public support and said there was plenty of goodwill to give Greece more time for its adjustment program in a weaker-than-expected economy. He said the economy was set to contract by 5.5 percent this year and 2.5 percent in 2012.

Asked whether Greece would get the next loan tranche, finance minister Venizelos told Reuters: "Yes, of course." Even if it does, many economists and investors believe Athens will default on its debt mountain -- more than 150 percent of gross national product -- perhaps within months.

Former IMF chief Dominique Strauss-Kahn joined the chorus on Sunday, saying Greece's debt must be cut and government and private creditors should take losses now. "(EU) governments are not solving things, they are kicking the problem down the road, and the snowball is growing...," he told French television. Uncertainty over Greece was compounded by another political shock in Germany at the weekend.

The sixth regional election defeat this year for Merkel's center-right coalition on Sunday raised questions about the stability of her government and her ability to push through more euro zone rescue measures. Her Free Democratic (FDR) junior coalition partners crashed out of Berlin's regional assembly with 1.8 percent of the vote, raising pressure from some party activists for a more Euroskeptical line.

Leaders of both the Bavarian Christian Social Union (CSU) and the FDR have raised the prospect of Greece defaulting and possibly having to leave the 17-nation single currency area, ignoring rebukes from the chancellor for alarming markets. Merkel said on Monday it would send a disastrous political message if euro zone members could be thrown out of the bloc because they faced difficulties. Instead, she advocated tougher rules to force euro states to obey budget discipline.

German lawmakers are due to vote on September 29 on reforms agreed by euro zone leaders in July to allow the European Financial Stability Facility to buy government bonds in the secondary market, give states precautionary loans and lend to recapitalize banks. Merkel insisted she would win the vote.

In another illustration of the pressures on her, German central bank chief Jens Weidmann told parliament that planned measures to beef up the euro zone's rescue fund would not encourage countries to put their budgets in order.

Last week Treasury Secretary Timothy Geithner pressed euro zone finance ministers apparently in vain to take stronger action to stop the sovereign debt crisis spreading. One of his predecessors, Lawrence Summers, said in a Reuters column that all nations should pressure Europe to go beyond "grudging incrementalism" to recapitalize banks, and revive economic growth.

Question over how far Fed will ‘twist’

by Michael Mackenzie and Robin Harding - FT

The Federal Reserve is expected to ease monetary policy at its two-day policy meeting this week – investors’ only uncertainty is how aggressively it will move. "Given the weakness of the incoming economic data, the Fed is now almost certain to do something, but exactly what is still not entirely clear," said Paul Ashworth, chief US economist at Capital Economics.

Investors expect easing in the form of the central bank selling some of its short-term Treasury holdings in order to buy longer-dated bonds, namely the 10-year sector, a policy move dubbed Operation Twist. An aggressive "twist" is seen by economists and traders involving the Fed selling between $300bn and $400bn of shorter-dated Treasuries and buying longer-dated bonds. The 10-year sector, for example, strongly influences mortgage and company borrowing costs.

The rationale behind lowering long-term bond yields is that it will enable homeowners to cut their borrowing costs, encourage greater borrowing and investment, while pushing more investors to leave government bonds and buy riskier assets.

The market’s drumbeat for Operation Twist helped propel the 10-year Treasury yield down to a 60-year low of 1.88 per cent last week, but expectations have subsequently moderated, due to some apprehension the Fed’s twist may be less aggressive, pushing the yield back above 2 per cent.

An alternative policy option could involve the Fed cutting the 0.25 per cent interest rate paid on excess reserves, or IOER, held at the central bank, in the hope banks lend more funds into the broad economy. In turn the Fed could well elect to undertake a modest "twist" in conjunction with cutting its overnight rate. "The Fed may cut the interest on overnight reserves and that could result in less Treasury purchases under a twist policy," said Michael Pond, strategist at Barclays Capital.

The benefits of cutting IOER may have risen somewhat, but the costs are considerable. A cut would undermine money markets that are already functioning poorly and so the ratio of reward to risk may well be too low to persuade the Fed to act. While both the Fed and bond investors expect inflation to moderate, the recent rise in core inflation to a year-over-year rate of 2 per cent in August, may compel some policymakers to favour a less aggressive easing policy.

From the Fed’s point of view, higher inflation today may not be a barrier to further easing, unless it changes the expectation that a weak economy will drag inflation down over the next couple of years. "Looking ahead, I expect inflation to ease to about a 1.5 per cent annual pace next year," said John Williams of the San Francisco Fed in a recent speech. "My expectation that inflation will fall reflects the fact that the economy is performing so far below its potential."

But the high core inflation reading will strengthen the hands of policymakers such as Narayana Kocherlakota, president of the Minneapolis Fed, who argues that the rise in inflation may itself be an indicator that there is less slack in the underlying economy. Mr Kocherlakota dissented from the FOMC’s decision in August.

Also, clouding the outlook for interest rate policy are doubts that low rates will do much to boost the economy as it struggles for traction after the bursting of the mortgage and credit bubble in 2008.

"The problem with the economy is not low rates," said Eric Green, chief market economist at TD Securities. "Policy cannot force consumers to borrow, cannot force businesses to hire and invest, cannot force banks to lend, and cannot channel liquidity where it is most needed which is in small and medium-sized businesses," he added.

Stock Fund Withdrawals Top Lehman at $75 Billion

by Whitney Kisling - Bloomberg

Investors have pulled more money from U.S. equity funds since the end of April than in the five months after the collapse of Lehman Brothers Holdings Inc., adding to the $2.1 trillion rout in American stocks.

About $75 billion was withdrawn from funds that focus on shares during the past four months, according to data compiled by Bloomberg from the Investment Company Institute, a Washington-based trade group, and EPFR Global, a research firm in Cambridge, Massachusetts. Outflows totaled $72.8 billion from October 2008 through February 2009, following Lehman’s bankruptcy, the data show.

Bears say investors are abandoning stock managers because there’s no end in sight to the decline that pushed the Standard & Poor’s 500 Index within 2.1 percentage points of a bear market in August. Bulls say the retreat by individuals has been a reason to buy since the bull market began in March 2009 and withdrawals mean money is available to buy stocks in the future.

"When we’re getting close to a market bottom, the phone starts ringing off the hook and our clients want us to sell everything," Bruce McCain, who helps manage $22 billion as chief investment strategist at the private-banking unit of KeyCorp, said in a phone interview on Sept. 14. "Market bottoms are less about an improvement in the fundamental situation, whether the economy or outlook for earnings, and a lot more about getting rid of all the anxious investors."

Fund Outflows

About $177.7 billion has been removed during the past 30 months from mutual and exchange-traded funds that invest in U.S. shares as the benchmark gauge for American equity rallied as much as 102 percent, before falling 17.9 percent through Aug. 8. Investors pumped in $18.7 billion during the first four months of 2011, before removing about four times that amount since, according to the average of data from EPFR and ICI, the money managers’ trade group. The August estimate doesn’t include ETF data from ICI.

Bond funds added $42.3 billion from the end of April through July and started posting weekly outflows last month, according to ICI. Since the bull market began, fixed-income managers have received a net $666.4 billion.

The last time equity fund outflows exceeded $40 billion during a four-month period was in August 2010, the data show. The S&P 500, which completed a 16 percent decline the previous month, went on to gain 13 percent through November. Monthly outflows in the last two years exceeded $10 billion seven different times. The S&P 500 advanced the next month in five of those cases, according to Bloomberg data. The stock index dropped 1 percent to 1,204.09 at 4 p.m. New York time today.

AllianceBernstein

AllianceBernstein Holding LP’s assets under management slipped 5 percent to $433 billion in August, "with retail in particular affected by the month’s volatile capital markets," the New York-based company said in a Sept. 13 statement. Invesco Ltd.’s equity assets fell 7.8 percent to $276.4 billion from July, reflecting the "effects of negative market returns."

Withdrawals accelerated in September and October 2008 as Lehman’s bankruptcy, the biggest in U.S. history, dragged down shares and spurred the worst financial crisis since the Great Depression. The S&P 500 dropped 30 percent in two months. Investors never got over that shock, said Walter "Bucky" Hellwig, who helps manage $17 billion at BB&T Wealth Management in Birmingham, Alabama.

Banking Crisis Concern

Now, concern Greece will default and spur a banking crisis has driven the S&P 500 down 11 percent since April, leaving it trading at 13.3 times reported earnings, 20 percent less than the last trading session before Lehman fell.

"It’s the once burnt, twice shy phenomenon," Hellwig said in a telephone interview on Sept. 12. "Investors are much less risk tolerant than they have been in the past. You would think that someone would say, ‘I can take a little bit of risk, look at the P/E,’ but they just want to stay on the sidelines."

The benchmark gauge for U.S. equities advanced 5.4 percent to 1,216.01 last week, the third-biggest rally since 2009, after central bankers said they would provide dollar loans for European lenders and French President Nicolas Sarkozy and German Chancellor Angela Merkel said they’re convinced Greece will remain in the euro area. The index has lost 3.3 percent in 2011 and is now up 80 percent from its March 2009 low.

Manufacturing Contraction

Bears say the withdrawals foreshadow more declines. Stocks have fallen four straight months, losing 5.7 percent in August after economists lowered forecasts for global economic growth, manufacturing in the Philadelphia region contracted by the most in more than two years and a debate in Congress over the budget deficit prompted S&P to strip the U.S. of its AAA credit rating.

"The average investor is less financially and psychologically prepared for this increased volatility," Jason Brady, a managing director at Thornburg Investment Management Inc, who helps oversee about $76 billion from Santa Fe, New Mexico, said in a Sept. 15 telephone interview. "They’re staying out and there’s something of a secular move to a demand for income and safety."

Chances the global economy enters a recession have risen to 1-in-2, Nobel-prize winning economist Paul Krugman said Sept. 8. JPMorgan Chase & Co. sees the chance of the second recession since 2007 at 40 percent, according to a Sept. 7 note.

Bigger stock swings are leading individuals to sell shares, Brady said. The VIX, the benchmark measure of U.S. equity derivatives, surged 50 percent to 48 on Aug. 8 for the biggest increase since February 2007 after S&P lowered its rating on U.S. long-term debt to AA+. The VIX has averaged 20.43 over its 21-year history.

Frustrating Investors

"The individual investor is very frustrated and at their wits’ end with the equity market, and it’s hard to blame them," Walter Todd, who helps manage $940 million at Greenwood Capital in Greenwood, South Carolina, said in a Sept. 16 telephone interview. "It’s certainly not going to help push the market higher if you’ve got that constant drain."

While BNY Mellon Wealth Management’s Leo Grohowski says he understands the aversion to equity price swings, valuations are too low to justify more selling. Of the 500 companies in the benchmark equity index, 331 had price-earnings ratios at the end of August lower than they were when the year began, data compiled by Bloomberg show.

'Lack of Confidence'

"There is this lack of confidence in equities as an asset class just due to the volatility," Grohowski, the chief investment officer for BNY Mellon, which oversees $171 billion, said in a telephone interview on Sept. 15. "But for investors who are long term and intermediate term, the market is undervalued. Now would not be a wise time to be reducing equity exposure because there’s an awful lot of bad news or expectations already priced in to the market."

Outflows following September 2008 lasted through March 2009. During the last three months of 2008, companies were reporting their fourth quarter of shrinking earnings and the U.S. jobless rate was halfway through its climb to the highest level since 1983. Gross domestic product slid 5.1 percent from the fourth quarter of 2007 to the second quarter of 2009, the most of any recession since the 1930s, according to Commerce Department data.

Now, investors are withdrawing funds after companies beat profit estimates for 10 straight quarters. The world’s largest economy posted two years of growth and economists are calling for GDP to expand 1.6 percent in 2011 and 2.2 percent in 2012, according to the median estimates compiled by Bloomberg.

Hoarding Cash

Corporations have been hoarding cash and paying down borrowings. The S&P 500’s net debt to earnings before interest, tax, depreciation and amortization ratio is down to 2.5 from 5 in the second quarter of 2008, data compiled by Bloomberg show. This year’s earnings will increase 18 percent to a record $99.57 a share and break $100 next year, according to the data.

DirecTV in El Segundo, California, is trading at 14.4 times reported earnings, a valuation 14 percent below the level at the end of 2008. Since the third quarter of 2009, profits at the largest U.S. satellite-television provider increased an average 64 percent each quarter. They’re forecast to rise 26 percent next year, according to analyst estimates compiled by Bloomberg.

Earnings at Dow Chemical Co. retreated during the financial crisis. While profits more than doubled in every quarter of 2010, the shares are down 17 percent this year. The largest U.S. chemical maker fired workers, shut plants and sold assets to bolster earnings. Since 2009, the Midland, Michigan-based company has posted better-than-estimated sales in all but one period.

When fund flows show investors bailing out of stocks at the rate they are now, it’s usually bullish, Brian Barish, the Denver-based president of Cambiar Investors LLC, which oversees about $8 billion, wrote in a Sept. 15 e-mail.

"The five months after Lehman were an epic buying opportunity, yet investors liquidated en masse," Barish said. "Retail unfortunately tends to time things poorly. I don’t expect the current situation to be all that different."

Don’t expect China to ride to the rescue

by Yao Yang - FT

The expectation that China might swoop down and rescue the euro in its hour of need is running high. Premier Wen Jiabao last week told a meeting of the World Economic Forum that "China is willing to give a helping hand, and we’ll continue to invest there." But those expecting China to offer anything more than symbolic assistance will soon be disappointed.

China knows that greater eurozone stability is in its national interest. The European Union is its second largest trading partner, and a disorderly collapse in Greece and other southern European countries would have dire consequences for Europe’s economic prospects. Neither turmoil in currency markets, nor sharp changes to trade flows, nor potential moves towards greater protectionism would be at all welcome in Beijing.

More strategically, the euro’s ongoing success is vital if China is ever to escape the "dollar trap" that currently ensnares its economy. Analysts believe that two thirds of China’s $32,000bn foreign reserves are dollar-denominated, leaving her constantly fearful of a falling dollar. China’s long-term goal is to make the RMB an international currency, but this will take time. In the meantime, her interests are clearly served by a strong euro.

For all that, however, any more than notional support for the eurozone would come with significant political risks. China isn’t stupid: it can see that the deadlock over Greece is less about money, and more about political will. To end the crisis every EU country, starting with Germany, must put aside its short-sighted self-interest. But with both Germany’s people and politicians so divided, this isn’t going to happen.

Put simply, investing in Greek, Portuguese, Irish and even Italian government bonds is now a hazardous activity. China is not going to go ahead without some form of iron guarantee from Germany and France which seems equally unlikely.

Naturally, Chancellor Angela Merkel and President Nicolas Sarkozy would be delighted if China took unilateral action, but that would put China in an awkward position – both risking a backlash in European public opinion, and doing nothing to move towards the type of more fiscally united Europe that, ultimately, is required to sustain the single currency.

Then, think of the money. Bailing out Greece is an expensive business: €110bn has already been spent by the EU and the International Monetary Fund, with around €120bn more still needed. Ought China really pay this amount to be a wealthy market economy?

True, it might buy some temporary friendships, perhaps to be used when another country files yet more anti-dumping charges against China at the World Trading Organisation. It would also be a public statement confirming China’s commitment to playing a more constructive role in the international capitalist system. But this, on its own, is hardly temptation enough.

Some thinkers, including CNN’s Fareed Zakaria, have even suggested that China should be bribed to help out. Ideas include offering a bigger role in the international financial system, or pledging that a Chinese candidate becomes the next head of the IMF. Yet even here, China may not be ready. There is a serious shortage of qualified candidates for the latter option; the former seems improbable for a country whose currency will not be fully convertible for some time.

The most likely outcome, therefore, is that China will risk almost none of its extensive foreign reserves to rescue the euro. It may buy some small symbolic quantity of southern European bonds, as an ersatz commitment to the future of the EU. But, in the end, China is an outsider. It knows that America is retreating from European affairs, but it is not yet ready to take its place. As seen from Beijing, the euro is a European affair. And the Europeans will have to make right their own mistakes.

The writer is director and professor at the China Center for Economic Research at Peking University.

Greece should default and abandon the euro

by Nouriel Roubini - FT

Greece is stuck in a vicious cycle of insolvency, low competitiveness and ever-deepening depression. Exacerbated by a draconian fiscal austerity, its public debt is heading towards 200 per cent of gross domestic product. To escape, Greece must now begin an orderly default, voluntarily exit the eurozone and return to the drachma.

The recent debt exchange deal Europe offered Greece was a rip-off, providing much less debt relief than the country needed. If you pick apart the figures, and take into account the large sweeteners the plan gave to creditors, the true debt relief is actually close to zero. The country’s best current option would be to reject this agreement and, under threat of default, renegotiate a better one.

Yet even if Greece were soon to be given real and significant relief on its public debt, it cannot return to growth unless competitiveness is rapidly restored. And without a return to growth, its debts will stay unsustainable. Problematically, however, all of the options that might restore competitiveness require real currency depreciation.

The first of these options, a sharp weakening of the euro, is unlikely while the US is economically weak and Germany über-competitive. A rapid reduction in unit labour costs, through structural reforms that increased productivity growth in excess of wages, is just as unlikely. Germany took 10 years to restore its competitiveness this way; Greece cannot wait in depression for a decade.

The third option is a rapid deflation in prices and wages, known as an "internal devaluation". But this would lead to five years of ever-deepening depression, while making public debts more unsustainable.

Logically, therefore, if those three options are not possible, the only path left is to leave the eurozone. A return to a national currency and a sharp depreciation would quickly restore competitiveness and growth, as it did in Argentina and many other emerging markets that abandoned their currency pegs.

Of course, this process will be traumatic. The most significant problem would be capital losses for core eurozone financial institutions. Overnight, the foreign euro liabilities of Greece’s government, banks and companies would surge. Yet these problems can be overcome. Argentina did so in 2001, when it "pesified" its dollar debts. America actually did something similar too, in 1933 when it depreciated the dollar by 69 per cent and repealed the gold clause. A similar unilateral "drachmatisation" of euro debts would be necessary and unavoidable.

Major eurozone banks and investors would also suffer large losses in this process, but they would be manageable too – if these institutions are properly and aggressively recapitalised. Avoiding a post-exit implosion of the Greek banking system, however, may unfortunately require the imposition of Argentine-style measures – such as bank holidays and capital controls – to prevent a disorderly fallout.

Realistically, collateral damage will occur, but this could be limited if the exit process is orderly, and if international support was provided to recapitalise Greek banks and finance the difficult fiscal and external balance transition. Some argue that Greece’s real GDP will be much lower in an exit scenario than in the hard slog of deflation. But this is logically flawed: even with deflation the real purchasing power of the Greek economy and of its wealth will fall as the real depreciation occurs.

Via nominal and real depreciation, the exit path will restore growth right away, avoiding a decade-long depressionary deflation.

Those who claim contagion will drag others into the crisis are also in denial too. Other peripheral countries have Greek-style debt sustainability and competitiveness problems too; Portugal, for example, may eventually have to restructure its debt and exit the euro too.

Illiquid but potentially solvent economies, such as Italy and Spain, will need support from Europe regardless of whether Greece exits; indeed, a self-fulfilling run on Italy and Spain’s public debt at this point is almost certain, if this liquidity support is not provided. The substantial official resources currently being wasted bailing out Greece’s private creditors could also then be used to ringfence these countries, and banks elsewhere in the periphery.

A Greek exit may have secondary benefits. Other crisis-stricken eurozone economies will then have a chance to decide for themselves whether they want to follow suit, or remain in the euro, with all the costs that come with that choice. Regardless of what Greece does, eurozone banks now need to be rapidly recapitalised. For this a new European Union-wide programme is needed, and one not reliant on fudged estimates and phoney stress tests. A Greek exit could be the catalyst for this approach.

The recent experiences of Iceland, along with many emerging markets in the past 20 years, show that the orderly restructuring and reduction of foreign debts can restore debt sustainability, competitiveness and growth. Just as in these cases, the collateral damage to Greece of a euro exit will be significant, but it can be contained.

Like a broken marriage that requires a break-up, it is better to have rules that make separation less costly to both sides. Breaking up and divorcing is painful and costly, even when such rules exist. Make no mistake: an orderly euro exit will be hard. But watching the slow disorderly implosion of the Greek economy and society will be much worse.

Greece Nears the Precipice, Raising Fear

by Landon Thomas Jr. - New York Times

Slower economic growth throughout Europe, and probably in the United States. Huge losses by major European banks. Declining stock markets worldwide. A tightening of credit, making it harder for many borrowers to get loans.

As concerns grow that Greece may default on its government debt, economists are starting to map out possible outcomes. While no one knows for certain what will happen, it’s a given that financial crises always have unexpected consequences, and many predict there will be collateral damage.

Because of these fears, Greece is working frantically in concert with other European nations to avoid default, by embracing further austerity measures it has promised in return for more European bailout money to help pay its debts.

But some economists believe default may be inevitable — and that it may actually be better for Greece and, despite a short-term shock to the system, perhaps eventually for Europe as well. They are beginning to wonder whether the consequences of a default or a more radical debt restructuring, dire as they may be, would be no worse for Greece than the miserable path it is currently on.

A default would relieve Greece of paying off a mountain of debt that it cannot afford, no matter how much it continues to cut government spending, which already has caused its economy to shrink.

At the same time, however, there is a fear of the unknown beyond Greece’s borders. Merrill Lynch estimates that the shock to growth in Europe, while not as severe as in the aftermath of the financial crisis of 2008, would be troubling, with overall output contracting by 1.3 percent in 2012.

While other countries have defaulted on their sovereign debt in recent times without causing systemic contagion, analysts weighing the numbers on Greece note that its debt is far higher, so the ripple effects could be more serious.

Total Greek public debt is about 370 billion euros, or $500 billion. By comparison, Argentina’s debt was $82 billion when it defaulted in 2001; when Russia defaulted, in 1998, its debt was $79 billion.

Economists also warn that a Greek default could put further pressure on Italy, the euro zone’s third-largest economy, which, though solvent, is struggling to enact austerity measures and find a way to stimulate growth. Moreover, Italy’s government debt is five times the size of Greece’s, and concerns about Italy’s ability to meet its obligations could grow if Greece defaults.

In a new sign of trouble for the country, Standard & Poor’s on Monday cut Italy’s credit rating by one notch to A, citing its weakening economy and limited political response. "Orderly or not, we have no idea what the effect of a default would be on other countries, especially Italy," said Peter Bofinger, an economist who advises the German Finance Ministry. "If there is just a 5 percent chance that this affects Italy, then you don’t want to do it."

In part, what would happen in the wake of a Greek default would depend on whether European leaders could create a firewall to control the damage from spreading widely. That would require officials to come together in ways they so far have not been able to, because it is politically unpopular in some countries to spend many billions more bailing out Greece.

In particular, work on transforming Europe’s main financial rescue vehicle, the 440 billion euro European Financial Stability Facility, would have to be fast tracked so that it would be in a position to buy European bonds and, crucially, provide emergency loans to countries that need to inject money into capital starved banks. Differences over the best way to go forward so far have delayed approval of the expanded fund.

Bailing out the banks will be crucial if Greece either defaults or imposes a hard restructuring, whereby banks would be forced to take a larger loss on their holdings compared with the fairly benign 21 percent losses that they are now being asked to accept as part of the second, 109 billion euro bailout package set for Greece in June.

Merrill Lynch, in a recent report on the contagion effect of a worst-case situation in which a severe Greek debt restructuring results in other weak European countries having to take a hit on their bonds, estimated that overall European bank losses could be as high as $543 billion. French and German banks would be the hardest hit, because they are among the biggest holders of Greek debt.

"We believe losses could be substantially larger through deleveraging and second-round effects, contagion from failure of individual banks from or outside the periphery, exposures of the nonbank financial sector," the Merrill Lynch report concluded.

While a 60 to 70 percent debt write-down seems extreme, it actually represents the market expectation, with most Greek debt now trading below 40 cents on the dollar.

A Greek default also would be costly to the European Central Bank, the Continent’s equivalent of the Federal Reserve. To help prop up Greece, the central bank is believed to have bought about 40 billion euros in Greek bonds at much higher prices than where they now trade. If the central bank were forced to take a major loss on its Greek bonds, it too would need a capital infusion. And the burden would most likely fall on Germany.

Analysts also say the seriousness of the crisis will depend on whether Greece stays within the euro common-currency zone or is forced to leave it, and return to the drachma as its national currency.

Willem Buiter, the chief economist at Citigroup, presents two possible default outcomes. In the first, Greece forces private sector creditors to take a loss on their bonds of 60 to 80 percent but manages to stay inside the euro zone by keeping current on the smaller amount that it owes its official lenders, like the European Union and the I.M.F. While technically a default, the loss would not be an outright repudiation of Greece’s debt and the contagion could, in theory, be contained.

One big unknown revolves around the fact that, unlike other countries that have defaulted on their debts in the past, Greece does not have its own currency. The potentially more dangerous default outcome is if Greece decides to leave or is forced to leave the euro, according to Mr. Buiter. Then, Mr. Buiter believes, the debt write-off would approach 100 percent and the effects on international markets could be much more serious.

Offsetting this, to some extent, is the fact that exiting the euro zone and re-adopting the drachma would enable Greece to devalue its currency versus the rest of Europe, and help it become more competitive, perhaps spurring economic growth.

For the moment, Greek officials are adamant that neither a default nor a euro exit and devaluation is in the cards. One senior policy maker in Greece’s Finance Ministry, who declined to be identified because of the delicacy of the matter, even offered to send his questioner a case of 2005 Dom Perignon Champagne if Greece ever repudiated its debt.

But close followers of Greece’s budget dynamics point to the fact that, despite the country’s deficit woes, by next year Greece is likely to have achieved a primary budget surplus, meaning that after taking out the high levels of interest it pays on its debt, it will be running a surplus.

History shows that a country tends only to take such a drastic step as cutting ties with its international lenders when it has tightened its belt enough to achieve a budget surplus, and it is only payments to its bankers that is keeping it in the red. Such was the case in most of the recent country defaults, including Argentina, Ecuador, Indonesia and Jamaica, economists at the I.M.F. found in a paper published last year that addressed when a country finds its interest is served by default.

"My view is that it is very much in Greece’s interest to default now, as there is no prospect that it can repay its debt," said Desmond Lachman, a former I.M.F. economist at the American Enterprise Institute. "If it is inevitable that an insolvent Greece is going to have to restructure, it would be better for Greece to do it now."

ETFs have potential to become the next toxic scandal

by Tom Stevenson - Telegraph

Who says regulators are only good for slamming the barn door after the horse has bolted?

Back in April, the Financial Stability Board (FSB), an international super-regulator, wrote a prescient if less than catchily-titled paper "Potential financial stability issues arising from recent trends in Exchange Traded Funds (ETFs)".

Its central warning - that ETFs are not the cheap and transparent vehicles the marketers would have us believe - was spot on. When UBS's $2bn black hole hit the screens on Thursday, no one who read the FSB report was surprised to see the words ETF and rogue trader in the same sentence.

The past ten years have seen an explosion in the popularity of ETFs. In part this reflects some of their acknowledged benefits – relatively low costs and the ability for investors to trade them throughout the day. A third claim, that ETFs are simple products, may once have been true but it no longer holds water. Many of these funds are now fiendishly complicated and way beyond the comprehension of the individual investors and professionals alike who are buying them.

Here are just a few of the reasons why ETFs are not all they are cracked up to be.

First, around half of the ETFs in Europe today do not match the index they are designed to track by holding all of its constituent shares. Unlike the plain vanilla "full replication" ETFs which do, 45pc of the market is in the form of so-called "swap-based" ETFs which instead use derivative agreements, often with investment banks, to simulate the performance of the underlying assets.

Derivative trades add a second layer of uncertainty to the unavoidable ups and downs of the market, the counterparty risk that the organisation on the other side of the contract might go bust. Even worse, the provider of the ETF might sometimes be a part of the same organisation as the derivatives desk carrying out the swap.