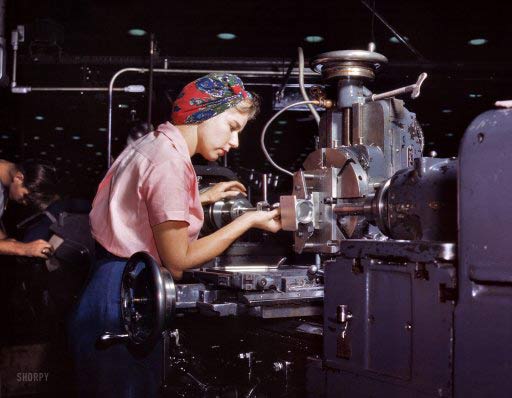

"Women become skilled shop technicians after careful training in the school at the Douglas Aircraft Company plant in Long Beach, California. Planes made here include the B-17F Flying Fortress heavy bomber, A-20 assault bomber and C-47 transport"

Ilargi: It’s time to make one thing clear once and for all: the financial institutions at the heart of our economic system are finished, broke, bankrupt. Since 2008, they have been kept alive only by gigantic infusions of our, the public's, money. We have been, and still are, told this is only temporary, and that the money will help restore them to health and then be repaid, but temporary has been 3 years and change now and there’s no restored health anywhere in sight.

The opposite is true: Obama launches another -even more desperate- half-trillion dollar jobs plan, and Europe is devising another multi-trillion dollar plan aimed solely at keeping banks from going belly-up, because these banks have lost anywhere between 50% and 90% of their market capitalization in the past few years, despite the multi-trillion capital infusions(!), and are still loaded to the hilt with investments, in sovereign bonds, in each other, in derivatives, that are so toxic they could blow them up at any moment.

If this were not true, if there were any possibility left that the banks at the heart of the system could indeed be saved and restored back to health with public funds, their assets would all long have been marked to market, and market confidence would thus be fully restored. The fact that mark-to-market is still religiously shunned 3 years after Lehman should tell you all you need to know about what's real and what's not.

There is no hope, no indication, and no possibility, that pouring even more taxpayer and future taxpayer capital into the leaks would stop the floodwater from entering. The leaks are both too big, and too numerous. If a possibility existed to seal the leaks with public funds, it would have been implemented by now, everyone -from banks to governments- would have taken their share of losses and we would now be talking about preventing the next crisis, not about how to deal with the present one, which has only gotten deeper as we've gone along.

The meme that comes from our "leaders" is that by saving the banks -and that way only-, we will be able to save ourselves. The reality is, however, that the banks are being saved at our expense, and we get poorer fast because of it.

And it's worse that that: the banks are beyond salvation, which means there can and will be no end to the constant flood of money from us, from the public coffers, towards the financial system, as long as present leadership, and their meme of saving banks to save ourselves, remain in control.

It's only when we drop that meme that we can start moving towards a world that, though admittedly much poorer and simpler than the one we inhabit today, will be less depressing, and less prone to saddle us with our present widespread mental burden of paralyzing powerlessness.

What we see in the media today is that markets are rising because the German Bundestag voted Yes to expanding the EFSF with another €200 billion or so. The news is received with relief. But it should be received, by ordinary people, with a reaction that's 180 degrees different. Because it means another €200 billion of their money is wasted on a bottomless pit, money that could have been used to alleviate the trials and tribulations of the weak among us.

It means we are moving one more step closer to ourselves being the weak among us.

The interests of the banking industry are not our interests; the two are, in the present instance, incompatible. There are situations possible where this is not the case, but our present situation is not one of them. Indeed, our interests are today diametrically opposed to those of the banking system because that system is drawing its last breath, choking on an overkill of debt, and trying hard, aided and abetted by our political leadership, to drag us down with it.

If we are to have a feasible shot at building a future that's humane, we must leave those banks to die that have no chance of survival, and we must rid ourselves of those "leaders" amongst us who refuse to build that future with and for us and who persist in taking our money only to hand it to a deeply bankrupt industry, which can subsequently use it to finance their election campaigns.

It's one thing to ask people to make sacrifices in order to save their health care and education systems. It's quite another to force, instead of ask, them to make sacrifices in order to save their banking system. And people will only take this lying down to an extent.

Greece’s austerity measures, both budget cuts and tax increases, will add up to some 20% of GDP. In comparison, US GDP is some $15 trillion. If the US were to adopt austerity measures equal to Greece, it would have to do so to the tune of $3 trillion per year. If memory serves, it presently has enough trouble trying to push through anywhere from $1.2 trillion to $4 trillion over 10 years.

The Greek bailout is built upon severe austerity measures. It is perhaps more than anything else a clear indicator of how the transfer of wealth takes place, from never-will-haves to never-will-have-enoughs. And the demands for further cuts just keeps on coming, in a vicious circle. The more cuts, the more the economy shrinks, the more demand for cuts there will be from the EU/ECB/IMF troika.

The day will come when the Greeks decide that if they have to go through hardship like this, they might as well at least be masters of their own fate. It’s one thing to decide amongst yourselves that you need to do with less so your children can do better. It's another to have others decide it for you, and with no guarantees for the children either.

Austerity will be with all of us in the western world. That's not something we can choose not to partake in. We can though, like the Greeks will soon, opt to take matters into our own hands. Let the banks go where banks go to die but protect people’s deposits as much as we can. This might make things worse for a while than continuing on the present path, but that is by no means even certain.

One thing must be clear though from now on in: the road we're traveling on today leads nowhere. Well, nowhere good. The banks at the core of the system can not be saved, and even if they could we should wonder out very loud if we would do wise to save them, given the price we would need to pay, and the reward we would get for doing so.

Whatever our choice would be in that regard, we need to become masters of our own fates again. Then we can mark all assets to market, both our own and the banks', add up the losses, restructure what must be restructured, cut what must be cut, but still while trying to preserve the institutions that keep us together as societies: our health care system, our schools, all the things that bind us together. Banks are simply not in that category.

We must get back to the core, preferably before it's all we have left. We need to ringfence our basic needs. Banks are not included in that. Don't let them fool you -any longer- into thinking that they are.

Obama's Euro-Crisis Lecture Is 'Pitiful and Sad'

by Kristen Allen and David Gordon Smith - Spiegel

US President Obama has given the Europeans a harsh lecture on the dangers of their ongoing debt crisis. Offended by the unsolicited advice, Europeans have suggested the US get its own house in order first. Obama's remarks were "arrogant" and "absurd," German commentators say on Wednesday.

Europeans are well aware of the seriousness of their ongoing debt crisis. But they don't, it seems, like to receive lectures from other countries -- especially the United States, which is struggling to deal with its own mountain of debt.

On Tuesday, German Finance Minister Wolfgang Schäuble curtly rejected recent American criticism of Europe's approach to solving its debt crisis. "I don't think Europe's problems are America's only problems," said Schäuble, who has become increasingly sharp-tongued as the euro crisis deepens. "It's always easier to give other people advice."

Schäuble was referring to strongly worded comments made by US President Barack Obama and US Treasury Secretary Timothy Geithner in recent days. At an event in California on Monday, Obama warned Europeans that their inaction was "scaring the world." The Europeans, he said, "have not fully healed from the crisis back in 2007 and never fully dealt with all the challenges that their banking system faced.

It's now being compounded by what's happening in Greece." He continued: "They're going through a financial crisis that is scaring the world, and they're trying to take responsible actions, but those actions haven't been quite as quick as they need to be."

Distracting From Problems at Home

Those comments came hot on the heels of Geithner's remarks over the weekend. Speaking in Washington Saturday at the annual meeting of the International Monetary Fund and the World Bank, Geithner warned that the European debt crisis represents "the most serious risk now confronting the world economy."

He said Europeans needed to do more to create a "firewall" against further contagion and talked of the threat of "cascading default" and runs on banks. "Decisions as to how to conclusively address the region's problems cannot wait until the crisis gets more severe," he said.

German observers have reacted angrily to the comments, saying that the US is in no position to criticize other countries, given its own $14-trillion pile of national debt and ongoing wrangling over the country's debt ceiling. Others claim that Obama is just trying to distract attention from the US's problems and point out that the US president was in California to raise funds and voter support ahead of his reelection campaign next year.

But perhaps the Europeans simply don't like a taste of their own medicine. When a US default was looming back in July when Congress was unable to agree on raising the debt ceiling, European commentators were quick to weigh in and give Obama and the US unsolicited advice. "The global economy needs an American agreement," said a French government minister at the time.

On Wednesday, German media commentators slam Obama's criticism of Europe.

The mass-circulation Bild writes:

"Obama's lecture on the euro crisis … is overbearing, arrogant and absurd. … In a nutshell, he is claiming that Europe is to blame for the current financial crisis, which is 'scaring the world.' Excuse me?"

"The American president seems to have forgotten a few details. The most important trigger of the financial and economic crisis was US banks and their insane real-estate dealings. The US is still piling up debt … The American congress is crippled by a battle between the right and the left. The banks are gambling just as recklessly as they did before the crisis. The president's scolding is a pathetic attempt to distract attention from his own failures. How embarrassing."

The center-left Süddeutsche Zeitung writes:

"One needs to remember the context within which Obama's scolding of the Europeans took place. It was an event where the president was raising money for the Democrats and where he wanted to explain to voters why the US economy is much worse off than he and his economic experts had believed until recently. Hence his criticism of the EU was simple electioneering."

"The problem, however, is that the US president is absolutely right. For far too long, the Europeans -- including the Germans -- treated the financial crisis as a purely American problem. They have still found no solution for their own debt crisis. Now Europe's problems are having a negative impact on growth and jobs around the world, including in the US. It would not be an exaggeration to say that Europe is threatening Obama's already precarious chances of reelection in 2012.

That is something that surely does not leave Obama cold. In that respect, it doesn't help much to point out that, once the Europeans have got their house in order, the financial markets will return their attention to America's debt crisis and its ailing political system. Financially, Europe is currently the most dangerous place in the world."

The center-right Frankfurter Allgemeine Zeitung writes:

"Dark clouds have gathered over the American president. The gloomy state of the economy is putting a dampener on Obama's future prospects. The optimism of the past is gone, replaced by a cheap search for a scapegoat."

"Obama thinks he has found one. He blames the Europeans for reacting too late to the debt crisis. We Europeans are apparently taking on too little new debt to get out of the crisis. But we are already feeling the wonderful effects of borrowing too much money."

The financial daily Handelsblatt writes:

"That's not how friends talk to each other. That applies particularly to friends who have themselves failed to get a handle on their own, self-made crisis. Barack Obama governs a country where, despite billions in state aid, the economy is stagnating, companies refuse to invest despite calls for patriotism, and which gets embroiled in one political trench war after another … Now this country is dispensing advice, suggestions and finger-pointing."

"These are suggestions that have already failed to work in the US: Money is supposed to save Europe -- quickly and in the largest quantities possible. US Secretary of Treasury Timothy Geithner has been trying for more than two-and-a-half years to suffocate his crisis with money. But aside from the lack of success, the collateral damage is immense. It manifests itself in a loss of government credibility, a loss of trust in the currency and the paralysis of any sort of dynamism -- because the crushing debt mountain is robbing the famously optimistic Americans of their confidence."

"The fact that Barack Obama, who is a brilliant thinker, knows full well that things are much more complicated in reality does not help. Indeed, it does the opposite. In the desperate battle for his re-election he'd rather construct myths, such as claiming that the Europeans alone are responsible for the American mess. Not only is this fundamentally wrong, but -- coming as it does from a friend -- it's downright pitiful and sad."

Germany slams 'stupid' US plans to boost EU rescue fund

by Ambrose Evans-Pritchard - Telegraph

Germany and America were on a collision course on Tuesday night over the handling of Europe's debt crisis after Berlin savaged plans to boost the EU rescue fund as a "stupid idea" and told the White House to sort out its own mess before giving gratuitous advice to others.

German finance minister Wolfgang Schauble said it would be a folly to boost the EU's bail-out machinery (EFSF) beyond its €440bn lending limit by deploying leverage to up to €2 trillion, perhaps by raising funds from the European Central Bank. "I don't understand how anyone in the European Commission can have such a stupid idea. The result would be to endanger the AAA sovereign debt ratings of other member states. It makes no sense," he said.

Mr Schauble told Washington to mind its own businesss after President Barack Obama rebuked EU leaders for failing to recapitalise banks and allowing the debt crisis to escalate to the point where it is "scaring the world". "It's always much easier to give advice to others than to decide for yourself. I am well prepared to give advice to the US government," he said.

The comments risk irritating the White House. US Treasury Secretary Tim Geithner has been a key driver of plans to give the EFSF enough firepower to shore up Italy and Spain, fearing a drift into "cascading default, bank runs and catastrophic risk" without dramatic action.

The danger for Germany is that America will lose patience, with unpredictable consequences. The US Federal Reserve is currently propping up the European banking system in a variety of ways, including dollar swaps. Markets across the world ignored the mixed signals about the true scope of EU rescue measures, convinced that EU leaders have a "grand plan" up their sleeves and will unveil the details after the Bundestag has voted on Thursday on the earlier July deal to revamp the fund.

France's CAC-40 surged by 5.7pc, led by a 17pc rise for Societe Generale. Germany's Dax was up 5.3pc. The FTSE 100 jumped 4pc in London, the biggest one-day rise this year. Oil jumped almost $4 in New York to $88 a barrel.

In Berlin, Chancellor Angela Merkel was fighting for her political life as the rump of lawmakers from her coalition vowed to reject the EFSF package, though the latest tally suggests she may squeeze by with her own majority. Angry dissidents suspect that secret plans are being withheld until after the vote.

Greek premier George Papandreou told German business leaders that his country would honour its austerity pledges, but also issued a veiled warning. "The persistent criticisms levelled against Greece are deeply frustrating, not only at the political level, where a superhuman effort is being made to meet stringent targets in a deepening recession, but frustrating also for the Greeks, who are making these painful sacrifices."

"Drastic measures have had a dramatic impact on the living standards of our citizens. Many Greeks feel they have little left to give. If people feel only punishment and scorn, this crisis will become a lost cause," he said.

Mr Papandreou's Pasok party passed a crucial vote on Tuesday to raise property taxes, but at a high political price. The party's approval rating has fallen to 15pc in the latest Mega poll. However, Greece was confronted with a new threat as it emerged that several eurozone members are demanding the private sector absorb bigger losses than originally agreed as part of a second bail-out.

A deal struck in July would see creditors taking 21pc losses on their Greek debt holdings, adding around €45bn to the €109bn proposed second rescue. However, more than a third of the 17-member single currency bloc are now said to be demanding bigger haircuts for the private sector. Talk of revisions to the second bail-out may renew default fears as the IMF has yet to re-engage with Greece over the latest €8bn tranche of its initial €110bn rescue. Greece is at risk of running out of money by October 8, though analysts say the payment is almost certain to be made whether or not Greece has complied fully with the terms.

Greece has a trump card in rescue talks with the IMF-EU "Troika". If it opts for a "hard default", it could set off a chain reaction. Lorenzo Bini-Smaghi, an ECB board member, said those arguing that Europe's banks could withstand a Greek default are misguided. "Similar views were held before Lehman. Those who say this have no idea how contagion works," he said.

Analysts say the Troika will have to approve the next €8bn tranche of aid for Athens in October whether or not Greece has complied fully with the terms. It cannot risk a showdown before Europe's banks have beefed up their capital base, or before the EFSF is fully equipped to defend the rest of the system. Like a forced marriage, Europe and Greece must kiss and pretend.

German Parliament Passes Euro Fund Expansion

by Spiegel

Chancellor Angela Merkel got the majority she needed on Thursday as German parliament passed the expansion of the euro backstop fund, the EFSF. With fewer conservative renegades than feared, Merkel can breathe a sigh of relief. But with more difficult decisions approaching, the respite may not last.

German parliamentarians on Thursday approved the planned expansion of the European Financial Stability Facility (EFSF) with 523 voting in favor, 85 against and three abstentions.

The bill's passage is a vital hurdle in euro-zone efforts to increase the fund's lending capacity from its current €250 billion ($338 billion) to €440 billion. Germany's share of guarantees for the fund will rise from €120 billion to €211 billion, though several other euro-zone parliaments must still vote on the expansion.

The result also means that Merkel can breathe a sigh of relief. There had been concern that renegades within her center-right coalition could mean that Merkel would be forced to rely on opposition votes to pass the legislation. Had that come to pass, her power would have been severely curtailed .

In the end, however, 315 parliamentarians from Merkel's conservatives and from her junior coalition partners, the Free Democrats, voted in favor of the EFSF expansion. Fewer than 311 would have severely curtailed Merkel's power as it would have made her reliant on opposition votes and indicated that she could no longer rely on the support of her own coalition.

To sweeten the deal, the law passed on Thursday includes a provision which gives the German parliament a say in future EFSF decisions. In a recent verdict, Germany's highest court had demanded greater parliamentary involvement in decisions relating to euro-zone bailouts. And now, a special committee will be established in the Bundestag to ensure parliamentary involvement even in hurried EFSF resolutions.

Additional Powers for the EFSF

European Union leaders agreed to expand the EFSF in July once it had become clear that the fund as originally designed was insufficient should the debt crisis which has befallen Greece continue to spread. The fund was also granted new powers, enabling it to buy up bonds from debt-stricken euro-zone countries in order to keep their borrowing costs down. So far, the European Central Bank has been tasked with such purchases . In addition, the EFSF will be able to indirectly bail out banks that run into trouble as a result of overexposure to bonds from indebted states such as Greece.

The expansion of the EFSF still faces some significant hurdles, with several countries left to vote. Most significantly, Slovakia has threatened to reject the expansion -- a move which, given the need for unanimous approval, could torpedo the enlargement of the fund. France passed the expansion several weeks ago and both Finland and Austria passed it earlier this week.

The reform of the EFSF is just one step in the ongoing effort to prevent the common currency from collapsing as a result of the sovereign debt crisis which has struck several euro-zone member states. On Wednesday, the European Parliament passed far-reaching measures to strengthen the Stability Pact in an effort to prevent lax fiscal policy in euro-zone capitals.

Later this autumn, a second bailout package for Greece, worth €109 billion, is to be voted on. And at the beginning of next year, the German parliament will have to vote on the European Stability Mechanism (ESM), the permanent euro backstop which is set to replace the EFSF in 2013.

Several analysts, however, have said that even if the EFSF is expanded to €440 billion it still won't be large enough to convince investors that Europe is serious about stopping the ongoing debt crisis. Indeed, this week many European leaders have indicated that further changes to the EFSF may be in the offing.

Expanding the Expansion?

One idea involves leveraging the fund by allowing it to borrow heavily against its assets, thus increasing its impact to as much as €2 trillion. Others have intimated that the fund could be further expanded.

Both moves, however, are not without risk. And German politicians have been quick to deny that the second option, that of further expansion, is on the table. Both Merkel and Finance Minister Wolfgang Schäuble have clearly denied that such an expansion is possible. In the floor debate on Thursday, Schäuble reiterated his opposition, saying that an increase to Germany's €211 billion guarantee "is not up for debate."

Horst Seehofer, head of the conservative Christian Social Union, also said on Thursday in an interview with the Süddeutsche Zeitung, that his party would not agree to further expansion. Berlin is concerned that, should it pledge additional guarantees to help indebted euro-zone countries, its own credit rating could be at risk. Standard & Poor's indicated as much this week. But S&P also suggested that extensive leveraging of the EFSF could likewise have a deleterious effect on Germany's credit rating.

Still, stock markets across the world have risen this week on comments over the weekend and earlier this week indicating that the EU was planning to "maximize the impact" of the EFSF. On Thursday, the euro rose rapidly against the dollar in early trading on the expectation that German parliament would pass the EFSF expansion bill.

Shiller: House Prices Probably Won’t Hit Bottom For Years

by Henry Blodget - Daily Ticker

The July numbers for the most widely followed measure of house prices, the S&P/Case-Shiller Index, were released this morning. The numbers weren't terrible--on a seasonally adjusted basis, July was basically the same as June--but one of the creators of the index, Professor Robert Shiller of Yale University, isn't taking much solace in them.

The economy has deteriorated significantly since July, Professor Shiller observes, and he suspects that the housing market has followed suit. And, from a broader perspective, house prices are still down more than 4% year over year.

In February, Professor Shiller startled those looking for an imminent "bottom" in house prices by suggesting that house prices could still fall 10% to 25%. He's standing by that assessment.

House prices won't necessarily plunge from here in nominal terms, but in real terms--after adjusting for inflation--they could still drop significantly, Professor Shiller says. And the bottom might not arrive for years.

Split opens over Greek bail-out terms

by Peter Spiegel and Quentin Peel - FT

A split has opened in the eurozone over the terms of Greece’s second €109bn bail-out with as many as seven of the bloc’s 17 members arguing for private creditors to swallow a bigger writedown on their Greek bond holdings, according to senior European officials.

The divisions have emerged amid mounting concerns that Athens’ funding needs are much bigger than estimated just two months ago. They threaten to unpick a painfully negotiated deal reached with private sector bond holders in July.

While hardliners in Germany and the Netherlands are leading the calls for more losses to be imposed on the private sector, France and the European Central Bank are fiercely resisting any such move. They fear re-opening the bond deal could spark renewed selling of shares in European banks, which have significant holdings of Greek and other peripheral eurozone debt.

Shares in French banks have rallied in recent days following signs that eurozone officials are preparing to increase the financial firepower of the bloc’s €440bn bail-out fund, which could within months be able to inject capital into eurozone banks and purchase sovereign bonds.

On a visit to Berlin, George Papandreou, the Greek prime minister, urged Germans to recognise the "superhuman effort" his country was making to impose drastic austerity measures in a deepening recession. "I can guarantee that Greece will live up to all its commitments," he said.

Senior European said there was significant division over the move to re-open the bondholders’ deal, which could trigger a bigger and earlier restructuring of Greek debt. Even within Germany, officials are split over whether to press for a bigger "haircut" for private sector creditors. "In Germany, there are the hardliners and there are the moderates," said one senior European official. "This is the hardliners’ stance."

Because of the recent economic downturn and Greece’s slow implementation of austerity measures, officials estimate Athens’ funding needs over the next three years have grown beyond the €172bn forecast this summer. The scale of the shortfall will be determined by international lenders over the next few weeks.

Berlin has long wanted bondholders to make a bigger contribution to a new bail-out, a point reiterated publicly in recent days by Wolfgang Schäuble, Germany’s finance minister.

German insistence has recently intensified, according to people briefed on the talks. Eurozone finance ministers had originally hoped to sign off on the next aid tranche to Greece on Monday, but a decision is now expected to delay the next €8bn payment until an emergency meeting in two weeks.

Berlin is expected to back the disbursement eventually. But a senior official said some German policymakers then want the banks to take a larger haircut on their bond holdings or renegotiate bond swaps, reflecting the sharp fall in Greek bond values since July.

Under the terms of the July bail-out, bondholders agreed to trade about €135bn in bonds that come due through 2020 for new, European Union-backed bonds that would not be repaid for decades. This deal implied a haircut of 21 per cent for bondholders, but many German officials say they were forced to agree a deal that was too beneficial for the banks.

On Tuesday, eurozone banks and German and French stock markets had their biggest gains since the first Greek bail-out was unveiled in May 2010.

France’s Société Générale surged 17 per cent, BNP Paribas was up 14 per cent and Crédit Agricole gained 13 per cent while the broader eurozone bank sector increased 9 per cent. BNP and SocGen shares have now risen by a third in the past three days.

Frau Merkel, it really is a euro crisis

by Ambrose Evans-Pritchard - Telegraph

Angela Merkel told German industry today that we are not facing "a euro crisis, but a debt crisis."

She is wrong. Total levels of private and sovereign debt in the eurozone are lower than in the UK, the US, and far lower than in Japan.

Greece’s debt levels are around 250pc of GDP, at the lower end of the developed world. Spain’s sovereign debt is admirably modest at around 65pc. Italy’s household debt level is the envy of the rich world. It has a primary budget surplus. Italy has many problems, but the budget deficit is not one of them.

So why is there such a destructive and long-festering crisis in the eurozone? Why have three countries required an EU-IMF bail-out? Why is the ECB having to shore the debt markets of five countries — soon to be six — with direct bond purchases, including Spain and Italy? Not because of debt, except in the most superficial sense.

The reason this crisis keeps grinding ever deeper is because the euro itself is a machine for perpetual destruction. The currency is fundamentally warped and misaligned. It spans a 30pc gap in competitiveness between North and South. Intra-EMU current account deficits have become vast, chronic, and corrosive. Monetary Union is inherently poisonous.

The countries in trouble no longer have the policy tools — interest rates, QE, liquidity, and exchange rates — to lift themselves out of debt-deflation. Just as they had few tools to prevent a catastrophic credit bubble during the boom. Their travails were caused in great part by negative real interest rates set by the ECB (irresponsibly) for German needs. Their fiscal deficits (and remember, Spain and Ireland ran big surpluses in the boom) have exploded because of the Great Recession itself — as they have in the UK, US, and Japan.

Draconian fiscal tightening might be manageable for these countries if the Teutonic bloc is willing to offset the contraction in demand by cranking up their own stimulus, allowing the intra-EMU imbalances to close from both ends. But the Teutons instead cling to their pieties, and their morality tale. The result is the downward spiral that we can all see.

Germany imposes austerity alone, seemingly convinced that there are good imbalances (German trade surpluses) and bad imbalances (Club Med trade deficits). Well sorry, Frau Merkel, this is intellectually childish. Both imbalances are equally bad. Booth sides are equally "guilty", to borrow your morality language.

As I have written many times, this austerity fetishism repeats the fatal error of the 1930s Gold Standard when surplus states (France and the US then) failed to recycle their gold hoard and instead imposed the full burden of adjustment on the deficit countries — until these countries broke free and inflicted condign revenge.

Larry Hatheway and Stephane Deo at UBS have just issued a sequel to their report warning of violence or civil war if the eurozone crisis leads to break-up. They take Berlin to task for its primitive policy prescriptions.

"We believe the Eurozone sovereign debt crisis has entered a more dangerous phase. The main reason the Eurozone has been incapable of addressing its long-running sovereign debt crisis satisfactorily is because leaders have framed an in appropriate agenda. Focused on the need for harsh and widespread fiscal austerity, policy makers have lost sight of the underlying cause of the crisis."

"That comprises the absence of institutions to manage the ‘imbalances’ problem between creditors and debtors within the monetary union, and the systemic flaws in the Eurozone’s financial and banking system, exposed by the 2008/09 financial crisis.

"Obsession with fiscal austerity to the exclusion of all else is not credible in an environment of weakening growth in Europe’s core and recession in the periphery. The immediate problem, which policy makers have been unable or unwilling to address successfully, is the negative feedback loop between diminishing sovereign credit worthiness and weak, undercapitalized banks. Improving sovereign credit though austerity is a long process, and, in any case, hard to pull off in recessionary conditions and when all one’s major economic partners are also in austerity mode. The weakest link, Greece, is now in a debt trap, which threatens to engulf other nations."

Yes, bail-out machinery is also needed:

"A robust commitment to substantial bond purchases by the ECB and bank recapitalization are the most important and urgent tools to break the vicious circle of deteriorating creditworthiness between sovereigns and banks. "Without these steps, we believe the lurch from crisis to worsening crisis won’t stop. But the crisis is also one of growth."

UBS is right about this. They are however completely wrong to keep arguing that a eurozone break-up would be catastrophic, nixing 20pc to 40pc of GDP in a year and leading to social carnage. That is a variant of the scare story now being propagated by the euro-elites.

The reality is the opposite. It is the existing status quo that risks bringing about the economic depression, social collapse, street populism, nationalistic backlash, cross-border hatred, and the violence so feared by the bank.

EMU should not be saved. It should be broken in two, or dismantled, in an orderly fashion of course. If the authorities can hold together 17 countries in EMU, they are surely capable of holding together a Teutonic Union and a Latin Union — each reduced to a more manageable fit and each more viable.

They are surely capable too of fixing the exchange rates of the two blocs, with a 25pc to 30pc devaluation for the Latin tier. This rate could be held long enough to stabilize the system and nurse the South back to health. If this was managed with an ounce of common sense and a firm hand, the apocalyptic outcomes so much in vogue could easily be avoided. The risk is that EU leaders will not entertain such blasphemous thoughts, and will not prepare the ground for any coherent solution at all.

Dr Merkel, what we have is the crisis of a foolish monetary union that ought to be shut down but is being kept alive because the priesthood has endowed it with sacred significance. Let stop this absurd quasi-religious charade. The euro is nothing but a currency. It has no intrinsic importance. None. To claim that Europe fails if the euro fails is hollow rhetoric. The great democracies of Europe will march on serenely.

Greek Debt Review May Mean More Bailout Talks, Merkel Says

by Tony Czuczka and Maria Petrakis - Bloomberg

German Chancellor Angela Merkel signaled policy makers may review Greece’s second bailout after international debt inspectors rule on whether the country is meeting the terms of its current aid package. Greece’s "numbers in September, as it now seems, were again different from what we expected under the program," Merkel told Greek broadcaster NET when asked whether the second bailout agreed by European leaders on July 21 will be revised.

"We must now await what the troika, that is the expert mission, finds out and tells us: do we need to renegotiate or don’t we need to renegotiate?" Merkel said, according to a transcript provided by her press office late yesterday. "What we would like the most, of course, is that the numbers stay as we know them. But I can’t pre-empt the outcome of the troika."

Experts from the European Commission, European Central Bank and International Monetary Fund will return to Athens tomorrow as officials race to put in place a package of measures that will ring-fence Greece. Euro-area finance ministers will hold an extra meeting on Greece in October amid international concerns that a default could plunge the global economy into recession.

Greece won’t be repay all of its debt and will have to leave the euro area, Otmar Issing, the ECB’s former chief economist, was quoted as saying by Stern magazine. The country needs to write down its debt by at least 50 percent, the German weekly quoted him as saying in an interview published today.

'Sustainable Footing'

The restart of the so-called troika review in Athens will "constitute an important step toward achieving the 2012 agreed fiscal target and putting the Greek public finances on a sustainable footing," commission spokesman Amadeu Altafaj told reporters in Brussels.

Merkel’s remarks came as a person familiar with the matter said German banks are resisting pressure to accept larger writedowns on their holdings of Greek government debt. German lawmakers have called on lenders in recent days to accept a larger writedown than the 21 percent proposed by the Institute of International Finance, an industry lobby group, said a person briefed on the talks.

Earlier, the Financial Times Deutschland reported that euro members have started talks on renegotiating the second bailout. Banks and insurance companies might have to increase their contribution to the rescue package as Greece’s economy has deteriorated, the German newspaper said, citing unidentified people familiar with the situation.

Property-Tax Vote

Greek Prime Minister George Papandreou won parliamentary backing for a property tax to meet deficit-reduction targets required to avoid default, prompting an offer of support from Merkel in Berlin, where the two had dinner yesterday.

"We want a strong Greece in the euro area and Germany is ready to offer all kinds of help that is needed," Merkel told reporters at a joint briefing with Papandreou. "I have heard so far that Greece is ready to meet the conditions" set by the IMF, the ECB and the EU commission.

Euro-area governments are withholding approval of the next loan installment under Greece’s May 2010 110 billion-euro ($150 billion) bailout until officials from the three institutions rule whether the government is meeting its targets. The next aid payment is due in October.

Merkel didn’t elaborate in the television interview on possible changes to the second bailout, which includes an accord for banks and insurers to reduce the value of their Greek debt holdings. Merkel’s chief spokesman, Steffen Seibert, didn’t reply to requests for comment by phone and text message today.

Greek Bonds

The yield on 10-year Greek government bonds fell 4 basis points to 23.27 at 12:30 p.m. in Athens today and the two-year note yield climbed 38 basis points to 70.43 percent. Greek bonds have tumbled in recent weeks and credit insurance has soared, putting the chance of default at more than 90 percent, as Papandreou struggled to rein in the deficit and a recession deepened in its third year.

"Implementation of the measures is the biggest challenge for the government as the trade unions and parts of the civil service will mount significant resistance, raising the risk of inertia and inaction," Wolfango Piccoli, an analyst in London at Eurasia Group, said before the vote.

The property tax was part of a package of cuts announced earlier this month after officials from the European Union and IMF told Greece it wasn’t meeting the terms of its rescue. European Commission President Jose Barroso called today for Europe’s permanent rescue fund to be speeded up, saying the debt crisis had reached a "serious" stage.

Due to be set up in mid-2013, the European Stability Mechanism will wield a 500 billion-euro war chest that could be used more flexibly than the current guarantee-based temporary financial backstop.

The European Union also proposed a financial-transaction tax that would take effect in 2014 and raise about 57 billion euros a year. The plan would set minimum tax rates for trading of stocks, bonds and derivatives contracts throughout the 27- nation EU, the commission, the EU’s Brussels-based executive, said today.

German turmoil over EU bail-outs as top judge calls for referendum

by Ambrose Evans-Pritchard - Telegraph

Germany's top judge has issued a blunt warning that no further fiscal powers may be surrendered to Europe without a new constitution and a popular referendum, vastly complicating plans to boost the EU's rescue machinery to €2 trillion (£1.7 trillion).

Andreas Vosskuhle, head of the constitutional court, said politicians do not have the legal authority to sign away the birthright of the German people without their explicit consent. "The sovereignty of the German state is inviolate and anchored in perpetuity by basic law. It may not be abandoned by the legislature (even with its powers to amend the constitution)," he said.

"There is little leeway left for giving up core powers to the EU. If one wants to go beyond this limit – which might be politically legitimate and desirable – then Germany must give itself a new constitution. A referendum would be necessary. This cannot be done without the people," he told newspaper Frankfurter Allgemeine.

The extraordinary interview comes just days before the Bundestag votes on a bill to revamp the EU's €440bn bail-out fund (EFSF), enabling it to purchase EMU bonds pre-emptively and recapitalise banks. Tensions are running high after it emerged over the weekend that officials are working on plans sketched by the US Treasury and the European Commission to "leverage" the firepower of the EFSF to €2 trillion, in conjunction with lending from the European Central Bank.

Carsten Schneider, finance spokesman for the Social Democrats, demanded that Chancellor Angela Merkel and finance minister Wolfgang Schäuble clarify their "true intentions " before the vote on Thursday. "A new multi-trillion programme is being cooked up in Washington and Brussels, while the wool is being pulled over the eyes of Bundestag and German public. This is unacceptable," he said.

Prince Hermann Otto zu Solms-Hohensolms-Lich, the Bundestag's deputy president and finance chief for the Free Democrats (FDP) in the ruling coalition, expressed outrage over the secret plans. "Unless the German finance minister can give an immediate assurance that there will be no leveraged formula, I will not vote for this law. We might as well dispense with months of negotiations if all this means is that the Bundestag will be circumvented and served cold left-overs," he said.

The accusation that German leaders are conspiring with EU officials to emasculate the Bundestag is highly sensitive, going to the core of the raging debate in recent months over EU encroachments on German democracy.

Dr Vosskuhle said that the improvisation of far-reaching policies had become "dangerous", and warned against schemes to circumvent the rule of law with backroom deals. "Germany has a great affinity for the rule of law. People expect the political class to obey the rules." He reminded leaders that the court had set clear boundaries to EU bail-outs in a ruling earlier this month, although it gave the go-ahead for the package of measures agreed so far.

"Our judgment makes clear that the Bundestag cannot abdicate its fiscal responsibilities to other actors. And no permanent mechanism may be created that entails taking over the liabilities of other states," he said. When asked whether eurobonds are off limits, Dr Vosskuhle said any ruling by the judges would be "pretty clear".

Ewald Nowotny, Austria's central bank governor, said it would be a grave error for Europe to try to bounce Germany into decision of huge scope and significance without the assent of the people. "It is quite dangerous when a feeling builds up in Germany that the country is being overrun, and specifically, that such an important country is being outvoted in the ECB," he told Der Standard.

There is little doubt that Chancellor Merkel can pass the EFSF bill with the help of the Social Democrats and Greens. It is less clear whether she can survive the vote without an absolute majority from her own coalition. Green leader Jurgen Trittin said her government would be "finished" if it has to rely on opposition votes. Her task has become that much harder after Standard & Poor's hinted Germany itself might loose its AAA rating if the rescue machinery is greatly expanded.

"There is no cheap, risk-free leveraging option for the EFSF any more," said David Beers, S&P's head of sovereign ratings. "We're getting to a point where the guarantee approach .. is running out of road," he said, adding the various options under discussion could have "potential credit implications".

The Social Democrats are using their political leverage over the EFSF vote to push for greater "haircuts" for banks holding Greek debt. This creates a fresh set of dangers. Deutsche Bank chief Josef Ackermann implored politicians not to open "Pandora's Box", warning of a domino effect across Europe if the existing deal for writedowns of 21pc on Greek debt is breached. "If the financial sector is further weakened, the real economy will pay a high price," he said.

Pavan Wadhwa from JP Morgan said a bigger restructuring of Greek debt could backfire badly unless proper defences are in place. "If this occurs without a simultaneous and credible plan to recapitalise the banking sector, it could prompt a full-blown crisis," he said. The bank said the eurozone is "falling into recession" as austerity policies bite deeper. It expects the ECB to cut interest rates by 50 basis points to 1pc in early October.

Euro Is Beyond Rescue in Debt Crisis, Szalay-Berzeviczy Says

by Andras Gergely - Bloomberg

The euro is "practically dead" and Europe faces a financial earthquake from a Greek default, according to Attila Szalay-Berzeviczy, global head of securities services at Italy’s biggest lender UniCredit SpA.

"The euro is beyond rescue," Szalay-Berzeviczy said in an opinion piece for index.hu., a Hungarian news portal, which he signed as former chairman of the Budapest Stock Exchange. The article described a "worst-case scenario," he said in a later telephone interview from Budapest today. "The only remaining question is how many days the hopeless rearguard action of European governments and the European Central Bank can keep up Greece’s spirits," he wrote.

A Greek default will trigger an immediate "magnitude 10" earthquake across Europe, he predicted. Holders of Greek government bonds will have to write off their entire investment, the southern European nation will stop paying salaries and pensions and automated teller machines in the country will empty "within minutes," Szalay-Berzeviczy wrote.

The impact of a Greek default will "rapidly" spread across the continent, possibly prompting a run on the "weaker" banks of "weaker" countries, Szalay-Berzeviczy said in the article. "The panic escalating this way may sweep across Europe in a self-fulfilling fashion, leading to the breakup of the euro area."

'One Scenario Among Many'

"It’s one scenario among many, one which may lead to the breakup of the euro area via a banking crisis," he said in the interview. "This can still be averted. It primarily depends on the Germans, and secondly on European citizens, especially on how much the Greek population can tolerate."

The euro strengthened versus most of its 16 major counterparts, advancing to a one-week high against the dollar, as European leaders signaled they will do what is necessary to aid debt-strapped regional nations. The European Union proposed a financial-transactions tax to take effect in 2014 and Finland’s parliament approved an expansion to the region’s rescue fund..

EU Split Over Push for Bigger Bank Haircut in Greek Rescue

by Rebecca Christie - Bloomberg

The European Commission is resisting a push to impose bigger writedowns on banks’ holdings of Greek government debt than those agreed on at a July 21 summit, a European official said.

The commission, the European Union’s executive body, opposes ideas being floated by some government officials to get banks to accept bigger so-called haircuts and doesn’t want to have talks about any such attempt, the official said on condition of anonymity because the deliberations are private. Germany and the Netherlands are leading a drive by as many as seven euro-area countries for more private-sector involvement in the second Greek package, the Financial Times reported today.

The German Finance Ministry said it wasn’t "putting pressure on anybody" over haircuts after Chancellor Angela Merkel signaled in an interview with Greek television broadcast today that policy makers may review Greece’s second bailout depending on the results of an international progress report.

Experts from the commission, the European Central Bank and the International Monetary Fund will return to Athens tomorrow as officials race to put in place a package of measures that will ring-fence Greece. The experts will resume their review of whether Greece has met the conditions for the next slice of the initial, 110 billion-euro ($150 billion) bailout package engineered last year.

Troika Findings

Euro-area finance ministers will hold an extra meeting on Greece in October amid international concern that a default could plunge the global economy into a recession. That meeting is likely to focus on the 8 billion-euro aid installment from the first package, without tackling questions about the second bailout and broader framework that was agreed in July.

"We must now await what the troika, that is the expert mission, finds out and tells us: do we need to renegotiate or don’t we need to renegotiate?" Merkel said in the interview with Greek NET television, according to a transcript.

The Financial Times Deutschland reported earlier today that euro members have started talks on renegotiating the second bailout. Banks and insurance companies may have to increase their contribution to the rescue package as Greece’s economy has deteriorated, the German newspaper said, citing unidentified people familiar with the situation.

Premature

"It’s way too early to talk about this," Bertrand Benoit, a German Finance Ministry spokesman, said by phone, denying that Germany is behind the efforts. "We want to take everything one step at a time and the priority now is the sixth tranche" of Greece’s current aid package.

Bondholders will take a broader role in the second Greek package, a 159 billion-euro bailout that includes more public funding, a debt swap, bond buybacks and broad changes to the terms of the EU’s main rescue fund.

The package must be ratified by the euro area’s member states and is making its way through the region’s legislatures. Finland today became the ninth country to ratify the package designed by EU leaders to prevent the region’s debt crisis from spreading. The measures must be approved by all 17 countries that share the euro.

Bondholders are in the midst of consultation with authorities on the debt swap, which aims to include 90 percent of eligible bonds and contribute at least 50 billion euros to the rescue effort. "Participation is firmly building," Charles Dallara, managing director of the Institute of International Finance, said in an interview on CNBC today. The IIF is a Washington- based trade group that has been coordinating the debt swap and helping design its technical details.

"I’m sure there are a few authorities in Europe who would like to see a bigger contribution for the private sector, but the overwhelming majority in Europe are focused on moving this thing through the parliaments," Dallara said.

The dangerous subversion of Germany democracy

by Ambrose Evans-Pritchard - Telegraph

Optimism over Europe’s "grand plan" to shore up EMU was widely said to be the cause of yesterday’s torrid rally on global markets, lifting the CAC, DAX, Dow, crude and copper altogether.

This is interesting, since Germany’s finance minister Wolfgang Schäuble has given an iron-clad assurance to the Bundestag that no such plan exists and that Germany will not support any attempt to "leverage" the EU’s €440bn bail-out plan to €2 trillion, or any other sum. "I don’t understand how anyone in the European Commission can have such a stupid idea. The result would be to endanger the AAA sovereign debt ratings of other member states. It makes no sense."

All of this was out in the open and widely reported. Markets appear to be acting on the firm belief that he is lying to lawmakers, that there is indeed a secret plan, that it will be implemented once the inconvenience of the Bundestag’s vote on the EFSF tomorrow is safely out of the way, and that German democracy is being cynically subverted. The markets may or may not right about this. Mr Schäuble has a habit of promising one thing in Brussels and stating another in Berlin.

But it is surely an unhealthy state of affairs. One of the happiest achievements of the post-War era is the emergence of a free, flourishing, and democratic Germany under the rule of law. Carsten Schneider, finance spokesman for the Social Democrats, spoke for many last week, denouncing the shabby back-room dealings as a scandal. "A new multi-trillion programme is being cooked up in Washington and Brussels, while the wool is being pulled over the eyes of Bundestag and German public. This is unacceptable."

Indeed it is.

Mr Schäuble has now been forced to give a categorical assurance that the EFSF will not be expanded. He cannot break his word without very serious consequences, or before the financial crisis turns deadly.

We have reached the point where the unseemly scramble to find ever more inventive and extreme ways to save monetary union – yet without coming clean, and invariably by trying to deceive German citizens about the real implications of each deal – is clashing directly with the integrity of German democracy.

Andreas Vosskuhle, head of the constitutional court or Verfassungsgericht, specifically warned this week that Germany is entering treacherous waters. He said that the improvisation of far-reaching policies to shore up EMU had become "dangerous", and warned against schemes to circumvent the rule of law with backroom deals. "Germany has a great affinity for the rule of law. People expect the political class to obey the rules."

"There is little leeway left for giving up core powers to the EU. If one wants to go beyond this limit – which might be politically legitimate and desirable – then Germany must give itself a new constitution. A referendum would be necessary. This cannot be done without the people," he told the Frankfurter Allgemeine.

Dr Vosskuhle reminded politicians that they do not have the legal authority to sign away German constitutional prerogatives. "The sovereignty of the German state is inviolate and anchored in perpetuity by basic law. It may not be abandoned by the legislature (even with its powers to amend the constitution)," he said.

He repeated that the Court had set clear boundaries to EU bail-outs in a ruling earlier this month. "Our judgment makes clear that the Bundestag cannot abdicate its fiscal responsibilities to other actors. And no permanent mechanism may be created that entails taking over the liabilities of other states," he said.

Otmar Issing, the ECB’s founding guru, has gone even further in recent weeks, warning that the current course must ultimately provoke the "resistance of the people" and perhaps civil wars. Dr Issing is not a German nationalist. He is open to the idea of an authentic union with a "European government controlled by a European Parliament" on democratic principles.

What he opposes is the deformed halfway house that is now Europe, where supra-national bodies – accountable to no elected body and taking decisions behind closed doors – are usurping legislative primacy over tax and spending. As he reminds us, it was monarchical assault on the power of the purse that led to England’s Civil War, and America’s Revolution.

Large matters.

As for the assurances of Mr Schauble, either he really is lying, in which case there will be all Hell to pay in the Bundestag, and most likely a massive political backlash that will change German politics profoundly. Or he is not lying, in which case there is no plan to save the eurozone, and we therefore face the mounting risk of a spiral into a banking crash, serial sovereign defaults, and a disorderly break-up of EMU.

Not pretty.

Financial markets face 'severe strains', warns Bank of England

by Jill Treanor and Heather Stewart - Guardian

Financial Policy Committee says banks might need to eat into capital cushions to keep credit flowing

The Bank of England yesterday warned of "severe strains" in financial markets and told banks they should cut staff and axe any dividend payouts to shareholders to boost their capital cushions. But at the same time the Bank's new Financial Policy Committee appeared to concede that banks might need to eat into their capital cushions to keep credit flowing into the stagnating economy.

The second report by the FPC – set up by the coalition inside the Bank to be responsible for financial stability – shows it has considered the need for "short-term measures" to try to prevent a re-run of the 2007 credit crunch.

In a two-page update of its latest meeting, on 20 September, the FPC said: "The committee had advised UK banks in June that, if their earnings were strong, they should seek to build capital levels further, given the risks to the economic and financial environment. But events had lowered the likelihood that banks would be able to strengthen their balance sheets in this way over the short term."

Even so, the committee said it was recommending banks take "any opportunity" to strengthen their capital and stock of liquid assets to "absorb flexibly any future shocks without constraining lending to the wider economy". This could be done by raising long-term funds on the markets and reducing dividends and bonuses in line with any fall in profits.

The Bank's quarterly credit conditions survey, issued alongside the committee's report, said lenders were warning that the shaky state of financial markets could constrain credit in the coming months. The credit conditions survey showed that the supply of loans to households increased modestly in the third quarter of the year, while the availability of lending to businesses was flat; but, "lenders pointed to adverse wholesale funding conditions as a key factor which might constrain future lending".

The FPC, which is chaired by Bank governor Sir Mervyn King, also advised the Financial Services Authority to encourage banks "to manage their balance sheets in such a way that would not exacerbate market or economic fragility". "For example, at the present time, some actions taken to raise capital or liquidity ratios could potentially worsen the feedback loop between the financial sector and the wider economy and so should be avoided," the committee said.

After its first meeting in June, King described the eurozone as posing the "most serious and immediate" single threat to financial stability and the committee acknowledged that since then there had been "severe strains" in financial markets. The FPC does not yet have powers to intervene in markets but yesterday spelled out some of the powers that it would like to be able to deal with the crisis, including the ability to intervene on bank balance sheets and putting limits on loan-to-value ratios on mortgages.

It also urged the Treasury to resist attempts by the EU set a maximum threshold for capital ratios which might prevent it from requiring banks to hoard even more capital than the regulatory minimum,

Is the New Euro Backstop Fund Just the Beginning?

by Charles Hawley - Spiegel

Markets are convinced that Europe is preparing to massively increase the reach of the euro backstop fund known as the EFSF. But politicians have been just as quick to deny it. What is going on? Even before the EFSF is approved, it would appear that additional steps are under consideration.

Who is one to believe these days? On the one hand, there are the global stock markets which have been surprisingly buoyant this week. Analysts are insisting that the positive mood is the result of renewed efforts in Europe to solve its ongoing debt crisis, with some reports indicating that European leaders are considering expanding the euro backstop fund and others saying that the fund could be leveraged to the tune of €2 trillion ($2.72 trillion).

On Tuesday alone, share prices for French banks BNP Paribas and Societe Generale, both of which are highly exposed to Greek and Italian debt, rose by 16.8 percent and 14.2 percent respectively. Risk premiums on Italian bonds, which have been steadily rising this year, have fallen back.

On the other hand, though, Europe's politicians are denying that any grand plan -- beyond the ongoing ratification of the €440 European Financial Stability Facility -- is afoot. German Finance Minister Wolfgang Schäuble said on Tuesday that an expansion of the EFSF beyond €440 billion isn't planned, adding that "a lot of nonsense" comes from Brussels. In separate comments, he called the idea "stupid" due to the pressure it could put on Germany's AAA debt rating.

What is clear, as became apparent over the weekend, is that Europe has come to realize that -- with the futures of several banks likely hanging in the balance should Greece topple, and the threat of contagion spreading elsewhere as a result -- the EFSF as currently constituted is insufficient. And the idea of leveraging the fund, by using its assets as collateral to borrow tens of billions more, would seem to be gaining support.

'Increase the Firepower'

Olli Rehn, European commissioner for economic and monetary affairs, admitted as much on Saturday during a semi-annual meeting IMF meeting in Washinton. He said that the EU was considering ways to "increase the firepower" of the EFSF.

It is not an uncontroversial idea, which explains why there is so much confusion at the moment as to what Europe's next move might be. With euro-zone parliaments currently in the process of passing the initial EFSF expansion, to €440 billion, few seem willing to speak openly about what the immediate future might hold. Austria approved the plan on Tuesday and Finland is set to vote on the plan on Wednesday.

On Thursday, it is Germany's turn and the vote has developed into a crucial one for Chancellor Angela Merkel. A test vote on Tuesday revealed that several members of her Christian Democrats plan to oppose the EFSF expansion along with a handful of legislators from her junior coalition partners, the Free Democrats.

While passage of the bill is a foregone conclusion due to widespread opposition support, Merkel's power would be drastically curtailed were she forced to rely on help from the center-left Social Democrats to pass the bill. Indeed, her shaky coalition majority partially explains the vehemence with which Merkel and Schäuble have denied rumors of further EFSF expansion.

Furthermore, the FDP has made it a condition of their support that no further EFSF expansion be undertaken. The ceiling for German obligations must remain €211 billion, as currently planned, said FDP head Philipp Rösler on Tuesday. "That is the common position of the governing coalition," he said.

Given the continued rise of global markets on Wednesday, it would seem that investors are not taking such statements at face value. And French Finance Minister Francois Baroin implied earlier this week that they were right to have their doubts. "It is out of the question to put forward, three days before the Bundestag vote, the issue of whether we should increase the fund. Let's not open Pandora's box on something that is a red flag for Germany."

'All Kinds of Help'

Markets, of course, aren't just responding to expectations that Europe will maximize the impact of the EFSF. The Greek parliament this week passed a controversial new real estate tax and the country now appears to be on track to receive the next tranche of the €110 billion bailout fund passed in the spring of 2010, forestalling insolvency for now.

Furthermore, during a visit of Greek Prime Minister George Papandreou to Berlin on Tuesday, Merkel reiterated German support for Athens. "We want a strong Greece in the euro area and Germany is ready to offer all kinds of help that is needed," she said.

Still, Standard & Poor's made it clear earlier this week that there may be limits to what Germany can do when it comes to propping up the euro. In comments to Reuters, David Beers, the head of S&P's sovereign rating group, said that either leveraging the EFSF or boosting it further could have "potential credit implications in different ways."

Whereas analysts have indicated that some €2 trillion might be needed were Italy and Spain to run into significant trouble, Beers said that "we're getting to a point where the guarantee approach of the sort that the EFSF highlights is running out of road."

In addition to looking at ways to increase the effect of the euro bailout fund, there have also been indications this week that euro-zone countries were looking into an extensive haircut on Greek debt. The Financial Times on Wednesday reported that several members of the common currency union would like to see private investors take a bigger hit, with some saying that bond investors should be forced to accept losses of 50 percent or more.

'Baptism of Fire'

The calls imply revisiting a deal struck just two months ago as part of a second €100 billion bailout package for Greece, to be finalized later this fall. But with worries increasing that Athens' cash needs have actually risen since the agreement was struck, some have advocated a new look at losses investors should be forced to absorb. Even Otmar Issing, a former chief economist of the European Central Bank, said that writedowns of 50 percent or more are necessary. "Greece will not get back on its feet without a serious reduction in debt," he told the German news magazine Stern on Tuesday.

Clarity on the euro zone's plans is not likely to come soon, despite a Wednesday warning from European Central Bank head Jean-Claude Trichet that "now is the time for effective action, implementation, verbal discipline and a stronger team spirit." Several more member states must still approve the EFSF and the process isn't expected to be completed until the second half of October.

And once it is, there are, it would seem, several more questions to be addressed. European Commission President Jose Manuel Barroso hinted as much during his state of the union speech on Wednesday morning.

"If we do not move forward with more unification, we will suffer more fragmentation," he said in Brussels. "I think this is going to be a baptism of fire for a whole generation."

Debt crunch threatens China and emerging markets

by Ambrose Evans-Pritchard - Telegraph

Europe's banking woes have begun to set off a funding crunch in the emerging markets of Asia, Latin America, and Eastern Europe, leaving them nakedly exposed as the rich world slides into a double-dip downturn.

Corporate bond issuance has collapsed by three-quarters over the past three months in these regions, touching the lowest level since depths of the Great Recession in early 2009, according to Bloomberg data.

Contagion has spread to Chinese "Dim Sum" bonds issued in yuan on the offshore market in Hong Kong, where companies linked to China's property market and building sectors have taken a beating. Yields on Dim Sum bonds jumped by 105 basis points to 5.85pc in August, the worst month since the instruments were created.

While China dances to its own tune, fears are growing that a global relapse could strike as the country's debt excesses come back to haunt it. The Shanghai bourse tumbled on Wednesday to a 14-month low and is now 60pc below its 2008 peak.

Property groups China Vanke and Poly Real Estate have led the falls. Some developers have already cut home prices by 20pc to clear the glut. Standard & Poor's expects credit conditions for Chinese builders to "become increasingly severe". The Industrial and Commercial Bank of China said on Wednesday that it plans to raise up to $11bn in fresh capital to shore up its defences. Morgan Stanley said emerging economies have $1.5 trillion of external debt that has to be rolled over on a 12-month basis. Most of it is owed by companies and issued in dollars.

Most developing countries lack a proper bond market so firms rely on global finance to raise capital. Almost 80pc of the money come from European banks, which have lent $3.4 trillion to emerging markets. Part of the funding comes from US money markets – which have effectively pulled the plug on Europe. This adds a nasty twist to what is already a very twisted nexus.

Data from the Bank for International Settlements show that Europe's banks have lent $1.3 trillion to Eastern Europe, $900bn to emerging Asia and almost $500bn to Latin America. The danger is a "sudden stop" in lending. This threat is acute in Russia, where companies have to refinance $30bn by December, a tricky task as investors flee after the messy dismissal of finance minister Alexei Kudrin – viewed by Westerners as the rock of credibility in Moscow.

The International Monetary Fund (IMF) warns that emerging markets face the risk of "sharp reversals" in capital flows if Europe fails to contain its debt crisis. The process has already begun. The currencies of Brazil, India, Indonesia, Korea, South Africa, Turkey, Poland and Hungary have all plunged over the past month, some by 10pc or more, dashing the hopes of a "decoupling" from the travails of the Old World.

The so-called "currency wars" of recent months have taken on a different character as the central banks of Brazil and Korea intervene to stop their exchange rates falling too fast and aggravating inflation. Just weeks ago Brazil was complaining bitterly that the real was too strong.

The IMF said the biggest danger is an abrupt halt to this year's corporate debt boom, especially in Latin America and Eastern Europe. "The volatile nature of portfolio flows means that they could reverse rapidly if investors take fright or valuations are perceived as too stretched," it said. "Over the past year, flows into emerging market corporate external debt have surpassed flows into US high-yield debt. Gross issuance accounted for nearly half of all new private credit in some regions," it said.

Manoj Pradhan from Morgan Stanley said emerging markets should outperfom the West "handsomely" over time but will not been immune in this crisis as botched policy responses push Europe and the US "dangerously close to recession".

Developing nations should act pre-emptively and loosen fiscal policy to cushion the blow, he said. That will not be easy for all. High-spending India has already hit the fiscal buffers, while Hungary cannot safely let the forint fall because most home mortgages are in Swiss francs or euros.

China is a special case. It has foreign reserves of $3.2 trillion. It is deliberately choking credit to stop property speculation and slow inflation, mostly through loan curbs. Beijing clearly has leeway to reverse course and launch a fresh blast of stimulus, but not on the scale of 2008 as off-balance sheet lending.

The IMF warns that loans have doubled from less than 100pc of GDP to nearly 200pc over the past five years, when off-books lending is included. The surge in credit is greater than during the US housing boom or Japan's Nikkei bubble in the late 1980s. China's local governments have racked up $1.7 trillion of debt through arms-length vehicles, while the Chinese railways have run up a further $300bn.

Credit default swaps (CDS) measuring risk on China's sovereign debt jumped 16 basis points on Wednesday to 170, the highest since the blackest month of the crisis in March 2009.

Is that a canary in the coal mine?

Rousseff Crisis Spurred by Lula Debts as Brazil Boom Diminishes

by Alexander Ragir - Bloomberg

On a cool July evening, Brazilian President Dilma Rousseff hosts a cocktail party for 50 leaders of her governing coalition, Bloomberg Markets magazine reports in its November issue. Speaking from the foot of a red-carpeted staircase in the living room of Alvorada Palace, where she lives with her mother and aunt, Rousseff tells the gathered politicians that these are the best times for Brazil, according to four people who attended.

"The world is going through economic and financial turbulence," says Rousseff, who’s dressed in a black pantsuit. "But we’re living through a great moment." In a toast, Dilma, as she’s known to almost all Brazilians, juxtaposes the task of managing the country’s new economic prosperity with U.S. President Barack Obama’s struggle with the Republicans to get the U.S. government budget under control.

"And up there, they only have two parties," she jokes. Brazil has 27.

Rousseff, 63, inherited just about everything a president could want from her mentor and predecessor, Luiz Inacio Lula da Silva: an economy growing at a 7.5 percent annual pace and unemployment, at 5.3 percent, that was the lowest since at least 2001. Brazil’s Bovespa stock market index rose six-fold during Lula’s eight-year tenure, as iron ore, soybean and sugar exports boomed, driven in large part by demand from China.

Lula pulled 24.5 million people out of poverty in his years in office, according to data compiled by the Getulio Vargas Foundation, and Rousseff says that in the next four years, she will eliminate extreme poverty in Brazil.

A Miracle Subdued

Yet Rousseff took office in what has turned out to be a rocky period for Brazil’s economic miracle. Her government and Brazil’s economy have been hit with a series of setbacks. Brazil’s subdued mood may be best captured by the swoon in its stock prices: The Bovespa index was down 22 percent in 2011 as of yesterday.

The bad news spills over into politics. From June to September, five of Rousseff’s cabinet ministers resigned, four of them after the police or the press made allegations they had misused public money.

On Aug. 17, Agriculture Minister Wagner Rossi stepped down after Veja magazine alleged he had illegally used his influence for personal gain. Rossi denies wrongdoing. His PMDB party, with 80 deputies in the 513-member lower house, is a crucial part of the 15-party governing coalition led by Rousseff’s Workers’ Party, which itself has just 86 Assembly seats.

Inflation Affliction

On the economic side, Brazil is once again suffering from an old affliction: inflation. Consumer prices, as measured by Brazil’s IPCA index, rose 7.2 percent during the 12 months ended in August. Though mild compared with the country’s legendary hyperinflation -- which peaked at an annual rate of 6,821 percent in April 1990 -- the price increases are eroding some of the progress Lula and Rousseff, who used to be his chief of staff, have made at reducing poverty and building a middle class.

The dilemma for Rousseff’s government is that officials don’t want the fight against inflation to choke off economic growth. From January to July, central bank President Alexandre Tombini responded to the inflation threat by raising Brazil’s benchmark interest rate five times.

Then, on Aug. 31, to the surprise of analysts, the central bank lowered the rate, to 12 percent from 12.5 percent. Even after the cut, Brazil’s rate was the highest among the Group of 20 nations, representing the world’s largest economies.

Global Downturn

The central bank’s rationale for the rate cut was that a "substantial deterioration" in global economic growth will also slow Brazil’s expansion and push down inflation. "Even assuming that they’re correct on their overly bearish view on Brazil’s economy, they’re clearly putting growth above their inflation target," says Tony Volpon, Latin America strategist at Nomura Securities International Inc. in New York. "The outcome in the long run will be higher overall inflation."

Despite the global economic gloom, Will Landers, who manages $8.5 billion in Latin American stocks at New York-based BlackRock Inc., sees only blue sky for Brazil’s economy.

"The natural resources aren’t going away, global food demand isn’t going anywhere and the middle class will continue to develop," Landers says. "The domestic consumption story is unparalleled. It’s still a great place to invest."

There are two immediate culprits behind what is the worst inflation in six years: skyrocketing credit and heavy spending by the government. Bank lending to businesses and consumers stood at 47 percent of GDP as of July, up from 24 percent when Lula took office in 2003, according to the central bank.

Lula’s Mixed Legacy

And in the run-up to the Oct. 31, 2010, election that put Rousseff into the presidency, Lula spent lavishly. Government spending in 2010 jumped 22.3 percent to 700 billion reais ($378 billion).