Youngsters at the Fourth of July picnic in Vale, Oregon

Ilargi: Have a good one.

Celebrate. And contemplate.

Hoist a flag and raise a beer. To the well-being of your family, your friends and neighbors.

If you happen to be in one of the hundreds of American towns and villages that have cancelled their fireworks exhibitions due to budget constraints, don't feel too bad about it. Watching fireworks doesn't make you independent.

Think instead of those among you who have seen much more cancelled over the past year, their jobs, their paychecks, their mortgages and their dreams. And if you can, reach out to them. You may be next.

Think about how independent you yourself really are. And remember that no-one who carries debts is truly independent. And neither is a nation that does.

Use this day to define what it is, independence. You may find yourself surprised. And quite possibly enriched.

Tilting at Windmill Jobs

The 'stimulus' promised a jobless peak of 8%; it's now 9.5%.

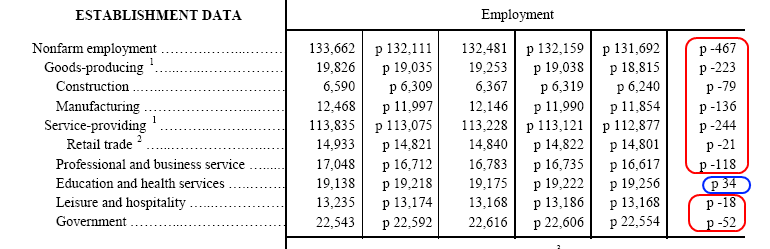

About the best we can say about yesterday's June jobs report is that employment is usually a lagging economic indicator. At least we hope it is, because the loss of 467,000 jobs for the month is one more sign that the economy still hasn't hit bottom despite months of epic fiscal and monetary reflation. The report is in many ways even uglier than the headline numbers. Average hours worked per week dropped to 33, the lowest level in at least 40 years.

This means that millions of full-time workers are being downgraded to part-time, as businesses slash labor costs to remain above water. Because people are working less, wages have fallen by 0.3% this year. Factories are operating at only 65% capacity, while the overall jobless rate hit 9.5%. Throw in discouraged workers who want full-time work, and the labor underutilization rate climbed to 16.5%.

The news is even worse for young people, with nearly one in four teenagers unemployed. Congress has scheduled an increase in the minimum wage later this month, which will price even more of these unskilled youths out of a vital start on the career ladder. One useful policy response would be for Congress to rescind the wage hike to $7.25 an hour (from $6.55) that is scheduled for July 24. But the union economic model that now dominates Washington holds that wages only matter for those who already have jobs. The jobs that are never created don't count.

The goods producing sector -- Americans who make things -- shed 223,000 more jobs last month. Asked about these job losses by the Associated Press yesterday, President Obama said Congress should pass his cap-and-tax on carbon energy because "If we're weatherizing every building and home in America, if we are creating windmills and solar panels and biofuel facilities, that is a huge promising area not only for jobs here in the United States, but also for export growth." But even under the most optimistic scenario, not every hard-hat worker in America can make windmill blades and solar panels. With manufacturing on its back, enacting a new energy tax to drive more jobs offshore is crazy even on Keynesian grounds.

Of course, the economy can't keep falling forever, and most forecasters still see a recovery starting this year. The decline in manufacturing slowed last month and housing sales have picked up -- both positive leading indicators. The plunge in inventories means industrial production and durable goods orders are bound to increase. Consumers are also spending more again, albeit with more caution than if gasoline hadn't increased by $1 a gallon in recent months and if they felt more confident about their job security.

The real question is how strong and sustained any expansion will be. If the "stimulus" were working as advertised, it ought to be very strong. Washington has thrown trillions of dollars at this recession, including that famous $787 billion in more spending that was supposed to yield $1.50 in growth for every $1 spent. This followed the $168 billion or so stimulus that George W. Bush and Nancy Pelosi promised in February 2008 would prevent a recession. The jobless rate that month was 4.8%.

Most of this government spending has gone to transfer payments -- Medicaid, jobless benefits and the like -- that do nothing for jobs or growth. The spending that might create jobs -- on roads, say -- is dribbling out with typical government efficiency. Meanwhile, the money for all of this has to come from somewhere, and Democrats are already saying it will require big (unstimulating) tax increases in 2011, and perhaps sooner.

The Administration argues that the recession would be worse without the stimulus, which is impossible to disprove.

However, it's worth recalling that Mr. Obama's economists predicted late last year that the stimulus would keep the jobless rate from exceeding 8%. That was a percentage point and a half ago. It's far more likely that the economy would have been better off without the spending, and the higher taxes and debt financing that it implies. As always, a sustained expansion and job creation must come from private investment and risk-taking.

Yet as America's entrepreneurs look at Washington they see uncertainty and higher costs from a $1 trillion health-care bill; higher energy costs from the cap-and-tax bill that just passed the House (see below); new restraints on consumer lending in the financial reform bill; new tariffs and threats of trade protection; limits on compensation and banker baiting; and the possibility of easier unionization, among numerous other Congressional brainstorms. None of this inspires "animal spirits." The best thing Mr. Obama could do to create jobs would be to declare he's dropping all of this and starting over.

Job Anti-Growth - A Decade with Zero Net Added Jobs..

- 131 Million Nonfarm Payroll Employment in June of 2000.

- 131 Million Nonfarm Payroll Employment in June of 2009.

- 6,460,000 job losses since start of Recession

The so-called second half recovery got off to a rocky start. The market was expecting 367,000 job losses for the month of June but instead got 100,000 more than expected. The market quickly turned sour as 26,000,000 Americans are now unemployed or underemployed in the job market.

Yet what is even more troubling is the magnitude and severity of job losses hitting our economy. To put this into perspective, as of June 2009 we had 131.16 million Americans employed in “nonfarm” occupations. As of June 2000 that number was 131.83 million. That is, we are going to have a decade of no net job growth.In this same timeframe, we have added 24,000,000 people to the population. But let us take a sobering look at the magnitude of job cuts we are seeing:

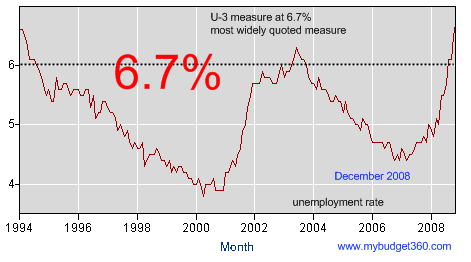

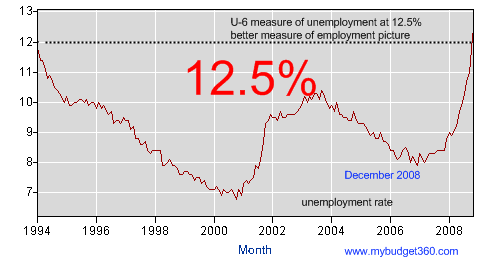

You will see that with the chart above the 2001 recession, which was modest by many standards, saw nonfarm employment peak right before the recession and did not hit a trough until January of 2004. Given that this recession is the deepest since the Great Depression even if we follow the 2001 model, we shouldn’t expect to see a trough until 2011. I am amazed that some people can look at a 467,000 job loss number and say it is okay. There is nothing good about the employment report released Thursday.If we dig deeper, we realize that the true unemployment rate measured by the U-6 data is showing a much more painful economic environment:

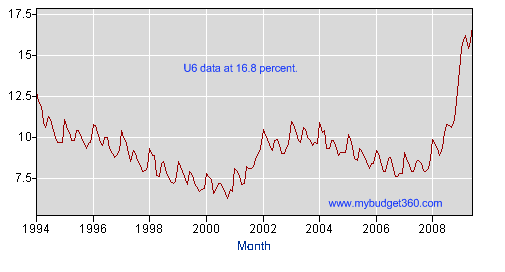

The U-6 number now shows a 16.8 percent unemployment and underemployment rate. This is now in record territory. Back in December of 2008 I posted these two charts and stated that people will start feeling this as a minor depression when the U-6 rate hit 19 percent:

Now the rate of job losses is still very high and it is very likely that we will see that 19 percent rate for the U-6 figure. There are many out there believing that a second half recovery is imminent but what sectors are going to employ the 26,000,000 unemployed and underemployed Americans? It is hard to imagine any industry having the slack to pick up this job loss amount. Take a look at how widespread job losses are hitting the economy:

The only sector that added jobs was education and health services and even here, it was a modest amount of jobs. Every other sector including government shed jobs. There really is no place to hide. Now assuming we go back to the peak employment days when 138 million people were employed in nonfarm jobs, that means that we will need to find 7 million jobs for currently unemployed or underemployed Americans (this of course assumes we lose no more jobs from here but the momentum is still moving forward).

The problem of course if we look at the data above again, we are losing higher paying jobs in “goods-producing” and also in manufacturing. These sectors are getting hit the hardest. Sectors like “leisure and hospitality” and “retail trade” are losing jobs but at a slower pace thus inflating the situation. The real story is good paying jobs are disappearing at a faster rate.

It is amazing how quickly things are changing. Since the start of the recession in December of 2007 we have seen 6,460,000 job losses. And keep in mind this is the official number. During this time, we have seen those working part-time for “economic reasons” go from 4.4 million to 9.3 million. And how many people are working less hours, seeing no raises, and are having to cut back? These numbers aren’t reflected here. Already with the job losses and the part-time for economic reasons, we see that over 11 million Americans have either lost their job or are working part-time for economic reasons since December of 2007.

The employment situation is tough because many of the jobs added this past decade were based on the bubble economy. Real estate and finance dominated many sectors. In a sense, it is no surprise that we are now seeing no net added jobs for the entire decade. The question not being explored by the media or those calling for a second half recovery is what industry is going to make up for all these job losses? To try to re-inflate the bubble by giving banks and the housing industry more money is simply a bad approach yet that is for the most part what we are doing and calling it stimulus. Is it any wonder that it hasn’t worked for the average American?

Hey, Look, The Stress Tests Really Weren't Stressful Enough

Calculated Risk illustrates what we already knew: the bank stress tests weren't nearly stressful enough. The chart below looks at unemployment by quarter. The green bars are the "base case" in the stress tests (the most likely scenario, in the government's opinion). The blue bars are the "adverse case" scenario--unlikely but possible. And the red bars are what's actually happening (Q2 is a forecast).

The larger story here, unfortunately, is that the Obama administration continues to blow its credibility on the economy. By being too optimistic from the get-go, the administration is opening the door for critics and opponents who are already arguing that the Obama plan has failed.

Out of Work, Out of Hope

U.S. unemployment is inching toward 10 percent. What will that mean to you? Nothing good.

At this point in her life, Kelley Krostoski has a few relatively simple expectations: a successful career as a high tech and management consultant that would easily afford her the ability to pay her two daughters' college tuition, plus enough for a comfortable retirement in her town of Beaverton just outside of Portland, Ore. Instead, the 47-year-old has been unemployed since February. Her sole job prospect, so far, would have required her to take a 40 percent pay cut—something she gladly would have accepted had the company not suspended new hiring. "A lot of my former colleagues have been out of work for over a year," she says from her home, during what should have been the middle of her workday. "It's nerve-wracking that it could go on."

Today's unemployment figures don't offer much solace for job seekers like Krostoski. Nationally, unemployment reached 9.5 percent, up from 9.4 percent in May, according to the U.S. Bureau of Labor Statistics. "Clearly, having a large number like this at this point is disconcerting," says Sharyn O'Halloran, a professor of political economy at Columbia University. "We are not seeing the stabilization we had hoped." Indeed, this is the worst peak of unemployment in the last 26 years. The last time we were this close to the 10 percent mark was during the 1982 to 1983 recession, when the nation was dealing with the savings and loan crisis, the residual effects of the 1979 oil crisis and prime interest rates as high as 21.5 percent.

Could things get that bad again? It's unclear. While a few optimistic economists are eager to point to "green shoots", the on the ground scene in many states more closely resembles scorched earth. That's particularly true in a Western group of states including California, Oregon and Nevada where unemployment rates have surpassed 11 percent. The overall economic picture there is grim. California's looming budget deficit means the state may have to hand out IOUs in lieu of paying its bills. Within the last year, more than 300,000 homes have gone into foreclosure in Nevada.

Officials at the Oregon Employment Department say anecdotally they're trying to absorb an increasing number of jobless transplants from places like California. Then there are states like Michigan which rely heavily on a single industry. There, the unemployment is now 14.1 percent and officials are running a budget deficit of roughly $1.7 billion. In all these states, funding for education, public safety and parks is in danger of being cut even more.

Still, the current "Great Recession" isn't quite as bad as the "Great Depression" when unemployment averaged 25 percent and when the economy suffered for a full 43 months. This recession may not be as long, but it still feels acute, and unemployment figures vary widely across social, ethnic and racial groups. Despite our modern safety nets and President Obama's emphasis on boosting social service programs, it's still incredibly easy to fall through the cracks.

"The people who would be the top earners are now making less. This means people will be working longer and the capacity to open jobs for the next generation is very limited," O'Halloran says. While government assistance can help blunt the impact of joblessness, if the national unemployment rate crosses the threshold of 10 percent, it may batter people's psyches, O'Halloran says. How will they act out? In much the same way they have over the past year: consumers stop spending. If that worsens, retailers' inventory will continue to pile up and manufacturers will suspend production even more and companies of all kinds will have to layoff additional employees.

And, high unemployment means workers are more likely to accept lower salaries, which, in turn, lowers the regional and national tax base. To stem the tide, the Obama Administration has launched several stimulus packages to help the unemployed -- from subsidizing the cost of COBRA health insurance to extending the number of weeks during which people can collect benefits. The stimulus money is also supposed to create jobs, but there has been lag time as the "federal money trickles into states."

For job seekers like Krostoski, the double digit unemployment rate means more uncertainty. Her husband's business as a self-employed real estate appraiser has fallen off, and the couple has stopped spending any unnecessary money so they can make their savings last as long as possible. "I don't know if I'll be able to get the same compensation again," Krostoski says. "Maybe those days are gone."

The Scariest Jobs Chart Ever

The chart below, from Calculated Risk, shows the percentage decline in jobs from peak employment in all the recessions since World War 2. We still haven't quite eclipsed the 1948 drop, but we likely will in another month or two. And that will leave only the Great Depression to make us feel better about ourselves. The good news in the chart, such as it is, is that employment can recover quickly once it finally turns. Anyone care to place a bet as to when that will be?

That ’30s Show

by Paul Krugman

O.K., Thursday’s jobs report settles it. We’re going to need a bigger stimulus. But does the president know that? Let’s do the math.

Since the recession began, the U.S. economy has lost 6 ? million jobs — and as that grim employment report confirmed, it’s continuing to lose jobs at a rapid pace. Once you take into account the 100,000-plus new jobs that we need each month just to keep up with a growing population, we’re about 8 ? million jobs in the hole. And the deeper the hole gets, the harder it will be to dig ourselves out. The job figures weren’t the only bad news in Thursday’s report, which also showed wages stalling and possibly on the verge of outright decline. That’s a recipe for a descent into Japanese-style deflation, which is very difficult to reverse. Lost decade, anyone?

Wait — there’s more bad news: the fiscal crisis of the states. Unlike the federal government, states are required to run balanced budgets. And faced with a sharp drop in revenue, most states are preparing savage budget cuts, many of them at the expense of the most vulnerable. Aside from directly creating a great deal of misery, these cuts will depress the economy even further. So what do we have to counter this scary prospect? We have the Obama stimulus plan, which aims to create 3 ? million jobs by late next year.

That’s much better than nothing, but it’s not remotely enough. And there doesn’t seem to be much else going on. Do you remember the administration’s plan to sharply reduce the rate of foreclosures, or its plan to get the banks lending again by taking toxic assets off their balance sheets? Neither do I. All of this is depressingly familiar to anyone who has studied economic policy in the 1930s. Once again a Democratic president has pushed through job-creation policies that will mitigate the slump but aren’t aggressive enough to produce a full recovery. Once again much of the stimulus at the federal level is being undone by budget retrenchment at the state and local level.

So have we failed to learn from history, and are we, therefore, doomed to repeat it? Not necessarily — but it’s up to the president and his economic team to ensure that things are different this time. President Obama and his officials need to ramp up their efforts, starting with a plan to make the stimulus bigger. Just to be clear, I’m well aware of how difficult it will be to get such a plan enacted.

There won’t be any cooperation from Republican leaders, who have settled on a strategy of total opposition, unconstrained by facts or logic. Indeed, these leaders responded to the latest job numbers by proclaiming the failure of the Obama economic plan. That’s ludicrous, of course. The administration warned from the beginning that it would be several quarters before the plan had any major positive effects. But that didn’t stop the chairman of the Republican Study Committee from issuing a statement demanding: “Where are the jobs?”

It’s also not clear whether the administration will get much help from Senate “centrists,” who partially eviscerated the original stimulus plan by demanding cuts in aid to state and local governments — aid that, as we’re now seeing, was desperately needed. I’d like to think that some of these centrists are feeling remorse, but if they are, I haven’t seen any evidence to that effect. And as an economist, I’d add that many members of my profession are playing a distinctly unhelpful role.

It has been a rude shock to see so many economists with good reputations recycling old fallacies — like the claim that any rise in government spending automatically displaces an equal amount of private spending, even when there is mass unemployment — and lending their names to grossly exaggerated claims about the evils of short-run budget deficits. (Right now the risks associated with additional debt are much less than the risks associated with failing to give the economy adequate support.)

Also, as in the 1930s, the opponents of action are peddling scare stories about inflation even as deflation looms. So getting another round of stimulus will be difficult. But it’s essential. Obama administration economists understand the stakes. Indeed, just a few weeks ago, Christina Romer, the chairwoman of the Council of Economic Advisers, published an article on the “lessons of 1937” — the year that F.D.R. gave in to the deficit and inflation hawks, with disastrous consequences both for the economy and for his political agenda.

What I don’t know is whether the administration has faced up to the inadequacy of what it has done so far. So here’s my message to the president: You need to get both your economic team and your political people working on additional stimulus, now. Because if you don’t, you’ll soon be facing your own personal 1937.

Smells like deflation

by Paul Krugman

The grim jobs number wasn’t the only scary thing in today’s BLS report. Here’s the rate of wage change over the past three months, expressed as an annual rate:

Bear in mind that inflation usually runs below the rate of wage change, thanks to productivity growth. So we’re really heading into Japanese-style deflation territory.

Ilargi: Good to see that Rufus Wainwright's dad Loudon, immortalized of course through such unforgettable evergreens as "I wish I was a lesbian", "Rufus Is A Tit Man" and "Glad to see you've got religion", still has the talent and the licks and the humor.

The Krugman Blues ~ Loudon Wainwright III

Ilargi: And since it's summer, one more Loudon.

The swimming song ~ Loudon Wainwright III

Ilargi: And a Rufus. And then it’s back to business. Pwomise.

Rufus, Moby, & Sean Lennon - Across The Universe

If Paul Krugman Were a Japanese Woman

"Please do not believe all the talk about the green shoots of the Japanese economy, which I suspect you might have heard. We are in pretty bad shape." Narika Hama, a professor of economics at Doshisha University in Kyoto, is a sort of Japanese version of Paul Krugman—if Paul Krugman were a woman with a purple rinse, pink jacket, funky blue jeans, black patent leather pumps, and a vague British accent. Hama, who lived in the United Kingdom as a child in the 1960s, is something of an intellectual celebrity in Japan. (One of my Japanese hosts was excited to get her autograph after our meeting.)

She's a respected academic economist and a well-known commentator. She writes a monthly column for the Japan Timesand is a regular contributor to Open Democracy. Like Krugman, she's a scholar and polemicist who doesn't shrink from speaking directly about politics. She's also got the columnist's gift for phrasing and buzzwords. The 1990s, for Hama, were a "period of hospitalization for the Japanese economy," during which "all major Japanese companies were in intensive care."

Coming into the crisis of 2008, things weren't much better. In this past decade, she said, Japan's economy had "become a very nonparticipatory economy." As Japanese companies became fully engaged in global competition, they abandoned their paternalistic ways and were "very willing to fire and very unwilling to hire." The Japanese economy and Japanese society used to operate like a convoy—"a fleet of ships that proceeds at the pace of its slowest member. Nothing terribly exciting happens but nobody gets left behind." Now, she argues, the convoy has become a "fleet of ships that is sinking at the pace of its fastest sinker."

Hama is eager to disabuse her audience—Japanese students and visiting American journalists—of hoary domestic myths. Japan, a society that prides itself on equality, is now riven with disparities, between, for example, rich and poor. The struggles of workers over the past decade tamped down Japanese consumption to the point that "as we came into the crisis, it was exports and exports only that were propping up the economy." But Tokyo, with its buzzing department stores and booster-ish business types, seemed to be doing quite well, no?

"You'll know next to nothing about what's happening in the economy if you keep talking to people at the U.S. Chamber of Commerce in Tokyo." Out in the rural areas and distant regions, she notes, there's a phenomenon called "shutter street"—all the shutters of the stores and companies closed. "It has become a very serious dual economy, in which Tokyo goes from strength to strength but everybody else sinks further down the tubes."

Like Krugman, Hama is sympathetic to President Obama but also quite critical. The "Buy American" provisions in the stimulus package are counterproductive. The U.S. government, she argues, "is becoming the largest nonconforming loan for the Japanese bankers." And she doesn't like the directions in which things are going. "Ever since his inauguration, I have persistently feared that Obama might become the Reluctant President," Hama said. "And by that I mean someone who keeps on saying, 'Reluctantly, reluctantly, against my better judgment I have to go down this road.' " She cites, for example, the takeover of General Motors.

Hama has a low opinion of the economic capabilities of elected politicians generally, especially her own. She notes that "the Bank of Japan has been very pragmatic, very broad-sighted, and very calm and collected in terms of dealing with this current situation." While it can be a little opaque, "on the whole, we can be confident that the Bank of Japan is not going to lose its mind anytime soon," she said. "The same cannot be said about the government, the prime minister, and the Cabinet." The Liberal Democratic Party, paralyzed by internal rivalries and declining popularity, seems likely to lose power for the first time in a half-century in upcoming elections.

"This is the worst possible moment in terms of economic management to have this type of situation on our hands politically. The lot in power are really at the end of their sell-by date." As with many economists, Hama is excellent on the diagnosis but not as sure-footed when it comes to a cure. What is to be done? She turns to the white board and draws two acronyms with an arrow between them: SLICS and SLYCS. The global economy needs to move from a SLICS (So Long as I Can Survive) mentality to a SLYCS (So Long as You Can Survive) mentality.

Central banks and governments should worry less about stimulating domestic demand for domestic goods and more about stimulating demand for traded goods. Toyota workers should buy Nissan cars, and vice versa. "The U.S. has no business saying 'buy American'; it should be saying buy non-American," she said. "It's this kind of a huge mental leap that is actually required if we are going to move out of this situation we're in." Slow food and locavores have their place, Hama says. But she'd prefer that China and Japan export shiitake mushrooms to each other. Japan can send its most delicious, most expensive ones to China, where the free-spending nouveau riche will pay big money for them, while China can mass-produce cheaper ones that can be consumed by Japan's yen-pinching masses. "We'll have a mushroom barbecue."

Banks own the US government

by Dean Baker

Last month, when the US Congress failed to pass a bankruptcy reform measure that would have allowed home mortgages to be modified in bankruptcy, senator Dick Durbin succinctly commented: "The banks own the place." That seems pretty clear. After all, it was the banks' greed that fed the housing bubble with loony loans that were guaranteed to go bad. Of course the finance guys also made a fortune guaranteeing the loans that were guaranteed to go bad (ie AIG), and when everything went bust, the taxpayers got handed the bill. The cost of the bailout will certainly be in the hundreds of billions, if not more than $1tn when it is all over.

More importantly, we are looking at the most severe economic downturn since the Great Depression. The cumulative lost output over the years 2008-2012 will almost certainly exceed $5tn. That comes to more than $60,000 for an average family of four. This is the price that we are paying for the bankers' greed, coupled with incredible incompetence and/or corruption from our regulators. Under these circumstances, it would be reasonable to think that the bankers would be keeping a low profile for a while. That's not the way it works in Washington.

The banks are aggressively pushing their case in Congress and Obama administration. Not only are we not going to see bankruptcy reform, but any financial reform package that gets through Congress will probably contain enough loopholes that it will be almost useless. In this political environment, the poor might get empathy, but Wall Street gets money, and lots of it. Even when the issue is global warming Wall Street has its hand out. The fees on trading carbon permits could run into the hundreds of billions of dollars in coming decades. A simple carbon tax would have been far more efficient, but efficiency is not the most important value when it comes to making Wall Street richer.

This is why it was so encouraging to see congressman Peter DeFazio's proposal to tax trades in oil options and futures. DeFazio proposed a tax of 0.02% on trades in oil futures and options as a way to make up a shortfall in the federal government's highway trust fund. This tax could raise billions of dollars each year in revenue and make speculation in the oil market a more dangerous affair. The logic is very simple. For someone using these markets to hedge, the tax will be inconsequential. For example, a farmer that hedges a $400,000 wheat crop will pay $80 when selling a future.

Similarly, airlines that hedge by buying oil futures will barely notice the higher cost. In fact, because trading costs have fallen so much in recent decades, a tax at this level would just be raising costs back to their levels of two decades ago, a point at which there was already a very vibrant futures and options market. However, even a modest tax will make life much more difficult for speculators. Many of them expect to make quick short-term gains, often buying and selling the same day. For these traders, an increase in transactions costs of 0.02% would be a burden.

Of course, a modest tax will not drive the speculators out of the market altogether, it is just likely to reduce the volume of speculation. For this reason, even a modest tax can still raise an enormous amount of money in a market where tens of trillions of dollars of derivatives changes hands each year. This tax can best be thought of as a tax on gambling. Gambling is heavily taxed in every state that allows it. DeFazio's bill is effectively a tax on gambling in the oil markets. It will not stop it, but it would discourage it, and in the process raise a huge amount of money that could go to productive purposes.

The bill faces an enormous uphill struggle in Congress. As Durbin said, the banks own the place, and they are not going to just step aside and let Congress impose a tax on such a lucrative business. But, it is important that people know about the DeFazio bill. First, DeFazio deserves a place on the honour roll for standing up to Wall Street. Also, it is important for the public to know that there is a relatively low-cost way to make up the shortfall in the highway trust fund. When Congress raises some other tax and/or cuts a useful programme, people should know that there was a better alternative. It just didn't happen because, as we know, the banks own the place.

Why zombie banks will need more taxpayer's money

Former independent member of the Bank of England's Monetary Policy Committee Professor Willem Buiter tells Robert Miller why the central bank should take over regulation of banks again. And, why zombie banks will need more money from the taxpayer.

Much ado about central bankers

by Martin Wolf

Will no one rid me of this turbulent central banker? Gordon Brown, the UK’s prime minister, may be asking just that when he learns of yet another critical comment from the governor of the Bank of England. For Henry II, king of England in the 12th century, the troublemaker was Thomas Becket, his own choice as archbishop of Canterbury. For Mr Brown, it is Mervyn King, whom he has reappointed to an equally impregnable position. The parallel is clear: central bankers are cardinals in the cult of monetary stability. Becket was murdered. Mr King will not suffer that fate.

But a later king of England brought the church and his archbishops to heel. Could the Bank suffer a similar fate? Indeed, one of the results of this crisis is to imperil central bank independence, not just in the UK. This is so for three reasons: at close to zero official interest rates, the boundary between monetary and fiscal policy erodes; governments are running huge fiscal deficits, particularly in the UK and the US, which threaten monetary stability; and, finally, those in charge wish to divert blame for the disaster.

Indeed, Mr King is not the only central banker to be under attack. US legislators savaged Ben Bernanke, chairman of the Federal Reserve, over his role in Bank of America’s takeover of Merrill Lynch. Astonishingly, Angela Merkel, chancellor of Germany, has directly attacked unconventional policies, including those pursued by the European Central Bank. Turbulent times produce turbulent central bankers and turbulence over central banking. The question, particularly in the UK, where central bank independence is so fragile, politics so tumultuous and times so tough, is how central bankers should act. My view is: with caution, but not under a vow of silence.

Mr King has made four points, all critical of the government: first, contrary to the views of the Treasury, “if banks are thought too big to fail, then?.?.?.?they are too big”; second, the Bank of England has “a new statutory authority for financial stability ... [But] it is not entirely clear how the Bank will be able to discharge its new statutory responsibility if we can do no more than issue sermons or organise burials”; third, he has not been consulted on the forthcoming financial services white paper; and, last, as he told the Commons Treasury committee: “If the economy were to recover along the path assumed in the Budget projections of GDP then I think the time over which deficits need to be reduced is likely to have to be faster than was implied by [the Budget] projection.”

Let us start with a simple question: is the governor correct on the substance? The answers are: yes, yes, yes and yes. While size is not the sole consideration, private businesses must not operate freely if they are not subject to the fear of bankruptcy. Similarly, it is not only necessary for power to align with responsibility, but the Bank of England, the body whose focus is on the economy as a whole, is best suited to exercise “macroprudential” controls over the financial system.

Again, if true, it seems incredible that the governor of the Bank should not have been consulted on the forthcoming white paper. Above all, only Mr Brown and those closest to him deny what is obvious: the fiscal position, with a deficit of 14 per cent of gross domestic product forecast by the Organisation for Economic Co-operation and Development for 2010, is radically unsustainable. Big spending cuts and tax increases, relative to GDP, are inevitable. So the issue is whether it is the business of the governor to make his views public, particularly on such politically sensitive terrain. Should he not be “economical with the truth”, following Alan Greenspan, former chairman of the Fed, in studied ambiguity? In normal times, the answer is yes.

But in the dire circumstances of the day, it is surely better to have the big disagreements out in the open than buried. True, the politicisation of the independent central bank is potentially very dangerous. The Bank’s still-limited independence may be compromised or even overturned. Moreover, at a time when co-operation among the authorities is essential, the appearance of disarray is itself damaging to confidence. Yet, against these powerful considerations, a responsible public official has to decide whether a particular issue has become so important that bringing his views into the open has become the only patriotic thing to do.

In the case of the UK’s fiscal position at least, it surely is. We are not talking here of modest deficits, but of a yawning chasm, one that could well compromise monetary stability. Furthermore, the UK no longer has credible fiscal rules or procedures, while the prime minister is denying the implications of his own government’s fiscal projections. Given this irresponsible behaviour, the governor should be allowed to speak. The prime minister may well hate his turbulent central banker. But the country is no politician’s property. Central bankers should always be careful. But this does not mean they should never speak out. Today, they have a duty to do so.

US bank buy-outs get tougher

Private equity that want to buy troubled banks would have to maintain significant capital levels and promise not to “flip’’ investments for at least three years under proposals by US regulators seeking to attract money into the ailing industry. The proposed rules, which would require private equity companies to maintain a tier one capital ratio of at least 15 per cent – three times what is typically required of other banks – for at least three years, were introduced on Thursday in spite of disagreements among regulators over whether the requirements were too strict.

First reported by the Financial Times, the proposed rules to facilitate private equity acquisitions of failing banks come amid a growing effort by regulators to unlock tens of billions of dollars that could be deployed to recapitalise ailing lenders. Authorities have traditionally preferred selling troubled financial groups to other banks because of concerns over conflicts of interest created by buy-out funds’ ownership of banks. But buy-out executives say private equity companies are among the few remaining sources of capital for troubled lenders.

Sheila Bair, chairman of the Federal Deposit Insurance Corporation, acknowledged that the requirement to hold tier one capital such as shares and liquid securities equal to 15 per cent of a bank’s total assets, was “high’’. “Obviously, we want to maximise investor interest in failed bank resolutions. On the other hand, we don’t want to see these institutions coming back,’’ she said. John Dugan, the Comptroller of the Currency, expressed concern that the proposal contained standards that “go too far’’. Some regulators suggested some elements might have to be scaled back.

The private equity industry is likely to press for change to some of the proposed rules. Thursday’s guidance “would deter future private investments’’ in banks that need fresh capital, said Douglas Lowenstein, president of the Private Equity Council. In addition to the strong capital requirements, the proposals would require private equity groups to make extensive disclosures to the FDIC about their ownership structure and “all entities in the ownership chain’’. Ms Bair said she was “troubled’’ by the opacity of some of the ownership structures, which have made it difficult to determine ownership.

On Wall Street: Banks no longer so lucrative

The planned merger of two Japanese banks is the latest unhappy chapter in the 10-year saga of foreign private equity capital’s adventure in Tokyo finance. The two banks, Shinsei and Aozora fell into the hands of Ripplewood and Chris Flowers and Cerberus Capital Management respectively at what appeared to be close to the end of the country’s lost decade. The two purchases came after the Ministry of Finance was unable to find any domestic buyers for the two ailing institutions. Ten years on, the two are still not healthy.

Both got into trouble like many of their US peers by straying into investments that promised high yields with seemingly low risk, whether junk bonds that proved worthless for Shinsei or a piece of GMAC in the case of Aozora. It has been easy for both banks to stray from the banking business in Japan in recent years because they lacked a broad base of cheap funding from deposits and they never became the go-to source of loans for corporate Japan.

Now private equity is an eager if frustrated buyer of troubled banks in the US and one of the few sources of fresh equity for a sector that desperately needs capital. US authorities are as paranoid as their Japanese peers of these would be owners’ intentions and intend to impose onerous requirements, (which may or may not prove very burdensome) on private equity. At the same time, regulators also intend to impose all sorts of constraint on the banks and limit the degree of leverage all banks are allowed, which will likely lead to lower profitability. Given all the new shackles, why would anybody want to own a bank these days?

Partly because, in spite of the new constraints, banking ought to be the most simple, guaranteed profitable business under the sun. Moreover, during hard times, the Fed tries to help banks support the economy by providing cheap funds that the owners then turn round and lend at a guaranteed spread over what they paid for the funds. Owners essentially get to control the profit level by deciding how much money to tuck away for a rainy day in the form of loan loss reserves. Also, for private equity, these days owning a bank is particularly attractive because there isn’t much else to buy, for the simple reason that there isn’t much debt around.

Banks are innately leveraged, making it possible to make decent returns even if the private equity firms have to put down a lot of their own money. The desire to buy banks assumes a normal environment. But these days aren’t exactly normal economic times and there isn’t much new net lending. The authorities have been leaning on the banks to turn on the credit tap, but they are resisting. Why make a loan today when any signs of recovery are still fragile and a good loan today can turn bad tomorrow? And even if they wished to lend, there is little demand.

That is what happened in Japan. Merging Aozora and Shinsei will allow the two banks to cut some costs. Aozora’s strong capital base will help support Shinsei. But the combination will do little to address the underlying problems. That’s why rating agency Moody’s issued a sceptical report on the prospects of the latest incarnation of the two banks. “Moody’s notes that in light of each entity’s weak franchise and management, as well as their relatively weak financial fundamentals, there is a low probability of a prompt improvement in the merged bank’s competitive position and franchise,” the report stated.

In the last cycle in the US, 20 years ago, private capital made massive profits from the savings and loans crisis partly because the government took on the losses and partly because the buyers were able to ride the powerful upward momentum of a recovering economy. But this time, the recovery is likely to be far less robust. Demand can no longer be built on the sand of over-borrowing. Consumers, 70 per cent of the US economy, will have to finance purchases with their own money, not their bankers’. Private equity in the US, as in Tokyo, may end up with far less lucrative investments than they anticipate in any banks that they do succeed in acquiring.

Buyout Firms Balk at FDIC's Proposed Rules for Bank Takeovers

Private-equity firms said the Federal Deposit Insurance Corp.’s proposed rules for buyout groups that take over failed banks will dampen interest in such deals. “The FDIC’s proposed guidance would deter future private investments in banks that need fresh capital,” Douglas Lowenstein, president of the industry group the Private Equity Council, said in a statement today. The FDIC is courting private-equity companies that have about $400 billion to invest while trying to placate lawmakers such as U.S. Senator Jack Reed who have expressed fear that buyout firms may be lax stewards of the banking industry.

Private-equity firms pumped more than $1 billion into U.S. banks, 47 of which have been closed by the FDIC this year. The FDIC outlined changes today under which investor groups would act as a source of strength for “subsidiary depository institutions.” Private-equity firms have expressed concern that expanding the so-called source of strength provision, which requires owners to support ailing banks, might impose obligations on minority investors. The rules, subject to a 30-day public comment period, also require buyers to be well-capitalized for three years and to maintain a Tier 1 capital ratio of at least 15 percent. There’s also a provision requiring investors to own the bank for a minimum of three years.

“The dialogue has begun with respect to the rules and that’s a process that I think both sides would welcome,” said Thomas Vartanian, a partner at the law firm Fried Frank Harris Shriver and Jacobsen LLP in Washington. “The bad news is that the discussion has started in a way that suggests private equity investors should be treated differently.” The plans would bar investment by so-called silo structures, in which a controlling investment would be isolated from a private-equity firm’s other holdings.

“The proposal may represent the starting point of an interesting compromise,” said Joseph Vitale, a partner at New York-based law firm Schulte Roth & Zabel LLP, who advises buyout firms on investments in financial institutions. “At first blush, the source of strength provision does not seem to be as problematic as it might have been.” U.S. Comptroller of the Currency John Dugan and Office of Thrift Supervision acting director John Bowman, both members of the FDIC’s board, said the proposals may go too far.

The rule changes could “choke off capital,” Bowman said during the board meeting. “We hope that the comment period yields changes that facilitate the flow of private capital into the banking system, consistent with the administration’s other efforts to address the financial crisis,” Lowenstein said in the statement. The FDIC has worked on policy guidance for private-equity investors since January, after the sale of Pasadena, California- based IndyMac Bancorp to a group led by Steven Mnuchin, an ex- Goldman Sachs Group Inc. investment banker, and including buyout firm J.C. Flowers & Co.

The largest U.S. bank to collapse this year, Coral Gables, Florida-based BankUnited Financial Corp., was sold in May to firms including Blackstone Group LP and Carlyle Group LP, the world’s two largest private equity firms. Those buyers were told to hold the lender for at least 18 months. The FDIC rules would require private-equity firms to disclose their ownership structure and provide details about their capital fund investments.

California IOUs Spell Uncertainty For Small Businesses

Business consultant Katrina Kennedy has taken her young son out of preschool and put a family vacation on hold. Dairyman Mike O'Kelly is wondering whether he is going to have to let employees go. The problem? They rely on contracts with state agencies for much of their business and, cash-strapped California may start sending them IOUs instead of money until the state has enough cash to cover all payments.

"I've dealt with the state for many, many years, and the failure of the state to come up with a budget has always caused problems for July and August," said O'Kelly, owner of Morning Glory Inc. in Susanville, which supplies milk and eggs to prisons. "This particular economic crisis, however, has me more worried than all of the others combined." The reason for the IOUs is California's $26.3 billion deficit. Lawmakers have not been able to agree on a balanced budget by cutting spending, raising taxes or both.

Without a balanced budget, the state controller's office says the treasury does not have enough cash to meet all its financial obligations. So IOUs were scheduled to go out beginning Thursday to private contractors, state vendors, people getting tax refunds and local governments for social services. Assistance payments to elderly, blind and disabled people will be disbursed as usual, because the federal government is paying the state's share. For California's small businesses and social agencies, which are accustomed to a Legislature that rarely meets the June 30 budget deadline, a lean summer is not new. Most say they expect to cope despite delays in getting paid.

Wells Fargo, Bank of America and Chase bank say they will accept IOUs from existing customers through July 10, while other banks haven't decided. Some credit unions also said they'll take IOUs, but it was unclear if payday lending businesses would cash them. Most small businesses and social agencies are confident the state will come through eventually, and say it's a matter of when -- not if -- they'll get their money. Still, having the government of the world's eighth-largest economy resort to IOUs creates uncertainty.

"Getting an IOU through the summer months -- I'd rather have the money, but we're prepared for it," said Kennedy, who runs management training programs for a number of state agencies. "It's when it goes past September and into October, which I'm completely anticipating this year, that things begin to get really tight." State Controller John Chiang, who plans to issue about $3.3 billion in IOUs this month along with nearly $11 billion in regular payments, was scheduled to start printing the IOUs on Thursday, marking the first time since 1992 the state has found itself in this position.

Last time around, the IOUs went to state workers in place of paychecks, and the workers filed suit. A federal judge ruled it was a violation of the Fair Labor Standards Act, and the issue eventually was settled with the workers getting extra vacation time or, if they no longer worked for the state, cash payments. So far, no lawsuits have been threatened over the latest round of IOUs. The latest IOUs, called individual registered warrants, will be redeemable with interest in October by banks, individuals or anyone who still has them. The interest rate was set at 3.75 percent.

Bank of America will stop accepting IOUs after July 10 but will try to assist those customers in other ways, perhaps by waiving fees or making other arrangements on payments, bank officials said. Wells Fargo and Chase didn't elaborate on their plans for IOUs after July 10. The California crisis came as lawmakers in several other states wrestled with recession-wracked budgets. In Illinois, the legislative session ended with no plan for paying state employees or delivering services. In Pennsylvania, the governor is proposing a 16 percent tax increase.

Though the crisis has been coming for a while, some cannot believe California has gotten itself to this point. "Twenty-four billion dollars -- that's just a number I can't even wrap my mind around," said Lynn Merritt, whose small business provides office supplies to several state agencies. Getting IOUs for payment "would be terrible as a business person, and it would put me in a really bad bind," she said, "but they can't just keep going like they are."

Pay Your Taxes With an IOU!

Can California residents pay their taxes with IOUs now? I mean, it would only be fair right? The same arguments apply. Expenses exceed revenues for the individual consumer, just like the state. So why can the state pay its bills with IOUs but individuals can't pay the state with IOUs? Oh wait. Isn't fiat currency (like the DOLLAR) just one big fat IOU? Hehe.How can this end well? How? (The last paragraph is epic.)

"State rolls out $3.36 billion in IOUs today:" "California plans to begin issuing billions of dollars in IOUs today to scores of creditors, including private businesses and county governments. The move will not affect many individuals who receive government assistance. Low-income people, the elderly and the disabled will receive their regular checks on schedule. Schools, state workers, Medi-Cal providers, pension funds and In-Home Supportive Services are all protected by law from receiving an IOU in lieu of a real check.

But thousands of vendors who provide goods and services to the state will be given IOUs instead of cash. From a company that sells french fries for prisoners to a firm that pumps out latrines in state parks, many businesses are trying to save cash and hoping their banks will accept the IOUs. Meanwhile, the University of California has not yet decided whether it will front the money for educational Cal Grants, another program that will get IOUs. State Controller John Chiang expects to disburse $3.36 billion in IOUs and $10.9 billion in regular payments this month.

After officials decide this morning how much interest they'll pay on the IOUs and when they can be redeemed, the controller's printing presses will churn out the first batch of IOUs for 28,742 state tax refunds totaling $53.3 million, said Garin Casaleggio, a spokesman for the controller. The IOUs probably won't be cashed by the state for 90 days - and then only if the treasury has the money to cover them."

Consumer Bankruptcy Filings Rose 36.5% in First Half

U.S. consumers made 675,351 bankruptcy filings in the first half, a 36.5 percent increase from a year ago, according to the American Bankruptcy Institute. June filings by consumers totaled 116,365, up 40.6 percent from the same period in 2008, the ABI said in a release. The monthly rate of consumer filings slowed, however, declining by 6.8 percent from May 2009. “Consumers are turning to bankruptcy as a last financial resort,” said ABI Executive Director Samuel Gerdano. Gerdano said in the release he expects 1.4 million new bankruptcy filings by year end. ABI uses data from the National Bankruptcy Research Center.

The human factor

The other day, a senior figure in the US government showed me some pieces of old paper he has taken to keeping in his pocket. These scraps, he solemnly explained, were used for jotting down words or numbers which he needed to remember or communicate to other officials – such as sensitive data about banks or the budget. Now, you might wonder why he needs such scraps, given that we are supposed to live in a brave new digital age. After all, paper is a fragile and inefficient way to keep notes or communicate to a wide pool of people, compared with a blackberry, say.

But that – perversely – is the whole point. Late last year, during the heat of the financial crisis, American officials fired off numerous e-mails about highly sensitive topics, assuming that these would never see the light of day. Now some of these messages are becoming public and creating embarrassment. Last week, for example, e-mails related to the Bank of America merger with Merrill Lynch last autumn were released as a result of subpoenas – and Ben Bernanke, Federal Reserve Chairman, was fiercely grilled by politicians in connection with that.

So, in an effort to avoid engaging in any actions which might provoke a witch-hunt one day, some US officials are trying to avoid using e-mail or written memos for anything too sensitive. Instead, old-fashioned face-to-face meetings or phone calls are back in fashion – along with those scraps of paper which can be subsequently (legally) thrown away. “It’s crazy,” mutters one US bureacrat, who admits that what really worries him is that if another crisis occurs on a scale similar to that seen last autumn, many officials may freeze up, and avoid taking any speedy or tough decisions – due to concern that will expose them to a future political witch-hunt.

It is a telling little saga. As the crisis has unfolded in the last two years, it has exposed with brutal clarity the governance failures that have been besetting private sector banks. But, these events have not just provided a stress test for the Western financial system – but for the political and policy making apparatus as well. And in that arena, governance structures are also looking flawed. Never mind the peculiarity of those scraps of paper flying around the halls of US power. What is more significant is that the current mood of shrill recrimination, nationalist posturing and political squabbling risks torpedoing – or delaying – any attempt to implement sensible or thoughtful policy reform in Washington, or elsewhere.

On paper, for example, it seems self evident that there is a pressing need for Western governments to devise a mechanism for winding up large, bust banks, particularly when these banks have operations that straddle borders. There is also a strong case for changing the way that complex instruments are traded and rethinking capital rules. But, given all the current political jostling, there is little chance of tangible financial reform being implemented in the US for another year, or so. Working out when – if ever – any international bank resolution scheme might emerge is anyone’s guess, given the increasing nationalist bent to policy making.

And the problems are not just confined to the US. This week in Brussels, the release of a long-awaited paper on credit derivatives has been repeatedly delayed by internal bureaucratic hiccups at the Commission. In October, the Commission’s reform efforts will probably be suspended for a few months, because the term of the current Commission is due to end. Meanwhile, in the UK, political infighting – and uncertainty about how long the government can last – is also hobbling efforts to have a sensible reform debate.

Perhaps all this is the price to be paid for having some semblance of a democratic system. After all, elected politicians watching what unelected officials do is clearly a good thing. So is the fact that reform is being debated, rather than implemented in a hurry. But what makes me wince is that so many of the core issues are still not being properly explained to the electorate. Which western politician, for example, has had the courage to spell out the scale of wealth destruction unleashed by the banking disasters?

Who has clearly told voters that if they create a more highly regulated financial system this will probably make capital more expensive? And has any government asked voters to choose whether they would prefer a more “boring”, regulated financial world – even at the price of having credit more tightly rationed? Instead, much of the policy debate is being lost in a frenzy of finger-pointing. It is a sorry state of affairs and a salutary reminder that fixing the current financial mess does not just demand a rethink of how we run banks, but how the policy machine works too. Even, or especially, when that machine is strewn with old-fashioned scraps of paper.

Financial commission stuck

Democratic and Republican leaders have yet to nominate a single person to the high-profile commission aimed at investigating the financial crisis, even though it was signed into law by President Obama more than a month ago. House and Senate leaders, responsible for naming all 10 members of the panel, say an announcement could come as early as this week so that the panel, with broad subpoena power, can begin looking into the causes of the crisis.

“We may have a joint announcement from the leadership by the end of the week,” said Jim Manley, spokesman for Senate Majority Leader Harry Reid (D-Nev.), on Tuesday. But the panel, modeled after the famed Pecora Commission from the 1930s, is off to a slow start and may have a limited impact as the administration and Congress aim by the end of 2009 to complete the biggest overhaul of the financial system since the Great Depression.

Compared to the 9/11 Commission, the “Financial Crisis Inquiry Commission,” signed into law by Obama on May 20, is struggling to get off the ground. President Bush signed the 9/11 Commission into law in November 2002, and although he had opposed it for several months, he named Henry Kissinger as chairman the same day. All 10 members of the panel were in place within three weeks, despite criticism that led Kissinger and Democrats’ first choice, George Mitchell, not to serve on the commission.

“We’re working through the process,” said Nadeam Elshami, spokesman for House Speaker Nancy Pelosi (D-Calif.). “This is a serious commission that requires serious candidates.” But some Republican lawmakers are concerned about the seeming lack of urgency. “There couldn’t be a more important and relevant time to jumpstart this commission,” said Kurt Bardella, spokesman for Rep. Darrell Issa (R-Calif.), an early supporter of setting up a panel. “You would think that there would be quick action to name the participants so the commission can begin its work.”

Pelosi and Reid each have three appointments, while Senate Minority Leader Mitch McConnell (R-Ky.) and House Minority Leader John Boehner (R-Ohio) each have two. Congress appropriated $8 million in June to pay for the commission, which must issue a report to lawmakers by Dec. 15, 2010. The bill setting up the commission was approved by a 92-4 vote in the Senate and a 338-52 vote in the House. Issa wrote to Pelosi earlier this year asking to use one of her choices to ensure that the commission is split evenly between Democrats and Republicans. “We’ve taken steps to make sure everyone is on board,” Elshami said on Tuesday.

The panel cannot include current members of Congress or federal employees, and the chairman and vice chairman must be from different political parties. Former Republican Sen. Fred Thompson (Tenn.) and former Republican Ways and Means Committee Chairman Bill Thomas (Calif.) are among those who have been considered, according to industry and congressional sources. On the Democratic side, there has been discussion about Erskine Bowles, White House chief of staff under President Clinton, and Brooksley Born, former head of the Commodity Futures Trading Commission (CFTC).

The commission will have broad authority to look into nearly every aspect of the financial system, including accounting practices, state and federal regulators, monetary policy, executive compensation and derivatives. The commission can subpoena testimony and documents with agreement from at least one Republican-appointed member. The panel can also refer findings to federal and state law enforcement agencies for possible prosecution.

The panel’s work will come as the Obama administration pushes forward on a revamp of the financial system. On Tuesday, the administration unveiled draft legislation to create a Consumer Financial Protection Agency to oversee products such as credit cards and mortgage loans. Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee, said on Tuesday that he hopes to draft and approve a bill in his committee on the agency by the August recess. Meanwhile, Frank and House Agriculture Committee Chairman Collin Peterson (D-Minn.) scheduled a hearing for July 10 with Treasury Secretary Timothy Geithner about new regulation of the derivatives market.

China's overseas investments surge

China, sitting on the world's largest foreign exchange reserves of about $2 trillion earned from burgeoning trade surpluses, has been on a spree to invest its money overseas while attracting inward foreign direct investments. As China's overseas direct investments skyrocket, some estimates say they could soon overtake China's FDIs. "ODI is one way to relieve the growing pressure that China is under because of increasing foreign exchange reserves and to promote the internationalization of the yuan," one analyst told the China Daily.

In April, Standard Chartered Bank estimated that China's ODIs in 2009 could range from $150 billion to $180 billion as the country acquires foreign assets in every major economic sector in keeping with its explosive economic growth. The projected FDI for 2009 is $80 billion to $100 billion. Chinese media reports say last year's ODIs totaled $52.1 billion and FDIs $92.4 billion. By any measure, these amounts are staggering and explain why the world's third-largest economy in gross domestic product terms after the United States and Japan continues to grow even in these difficult times brought on by the global financial crisis.

In fact, the global slowdown, which has led to a decline in the prices of overseas resources, is only spurring more Chinese investments overseas. Unlike in the past when it discouraged Chinese companies from making overseas ventures to preserve precious foreign exchange, the government is now doing the opposite. A China Daily report Thursday focused on whether China's ODIs will soon overtake its FDIs and quoted officials and experts as saying it was unlikely at least this year partly because Chinalco, or the Aluminum Company of China, had failed in its $19.5 billion bid to boost its stake in Rio Tinto, the giant Anglo-Australian mining company.

Also, the report said that even though Chinese National Petroleum Corp. along with British Petroleum, had won a bid to develop Iraq's biggest oilfield, it wouldn't significantly increase China's overall ODI this year because deals concluded in the previous months were of "small volume." In other high profile acquisitions, Sichuan Tengzhong Heavy Industrial Machinery took over U.S. auto giant General Motors' Hummer brand. Beginning Aug. 1, the Chinese government plans to relax foreign exchange curbs to allow firms to invest abroad, with up to $30 billion expected to flow out.

Chinese experts say with many foreign firms hurt by recession eager to sell their assets, they expect a wave of Chinese ODI outflows. On the other side, China is also taking measures to arrest the decline in FDI flows into the country. The plan is to relax restrictions on foreign investment, the commerce ministry has said. China's foreign direct investments in May totaled $6.38 billion, down 17.8 percent from the same month of last year.

The May figure was the eighth consecutive monthly decline but wasn't as steep as April's 22.5 percent on a yearly basis. FDIs in the first five months totaled $34.05 billion, down 20.4 percent from the same period of last year. The government also wants to invite foreign-funded companies to be listed in the country. The plan, which is also an effort to build Shanghai into a major international financial hub, calls for high-quality foreign firms to go public in China. In fact, some domestically incorporated foreign banks have already announced plans to issue yuan-denominated bonds.

China Launches Pilot Program for Yuan Trade Settlement

The central bank has published rules governing trials for settling trade in China's currency, the yuan, officially kicking off a program proposed earlier this year. The rules, released by the People's Bank of China on July 2, are effective immediately, and call for the selection of qualified firms in specified regions to participate in the pilot program. The selected firms can choose clearing banks in Hong Kong and Macau as well as domestic lenders to act as agents for foreign banks seeking to settle trade in yuan, the central bank said.

The PBOC, in conjunction with the Hong Kong and Macau monetary authorities, designated Bank of China's Hong Kong-listed unit as the clearing bank for the two special administrative regions. Clearing banks are also allowed to offer yuan cross-border settlement and clearing services to clients from Hong Kong, Macau and the ASEAN nations included in the pilot program. Exporters receiving payment in yuan will still be eligible for tax rebates, but they no longer need to provide foreign exchange verification documents issued by the State Administration of Foreign Exchange when applying for the rebates.

The State Council approved the yuan settlement pilot program on April 8. It will link five mainland cities - Shanghai, Guangzhou, Shenzhen, Zhuhai and Dongguan - to Hong Kong and Macau. However, the scheme's implementation was delayed as transactions will be handled by the State Administration of Taxation rather than the State Administration of Foreign Exchange. The shift in supervision required the drafting of new tax rebate guidelines. BOC Hong Kong Ltd. research chief Xie Guoliang told Caijing that almost all the Hong Kong local banks had reported strong demand for yuan settlement services.

Both companies and lenders in Hong Kong welcome China's moves in signing currency swap deals with other countries, said Xie, adding the yuan settlement pilot program is a "very good auxiliary measure" that complements the swap agreements, China has recently signed six such deals worth a total of 650 billion yuan with regions and nations including Hong Kong, Indonesia and Malaysia. Xie said that the volume of transactions settled in yuan will initially be small as all the lenders, firms and regulators involved take tentative steps to test the program during the initial phase.

Bank of Communications chief economist Lian Ping also said that the volume and scope for yuan settlement will be limited in the preliminary period, adding that the "the key is to see if the implementation of the program can effectively push up market demand." People familiar with the situation also told Caijing that the central bank is planning to set up a new regulatory unit to manage the pilot program, as well as efforts to boost the internationalization of yuan.

1 yuan = 14 US cents

India Joins Russia, China in Questioning U.S. Dollar Dominance

Suresh Tendulkar, an economic adviser to Indian Prime Minister Manmohan Singh, said he is urging the government to diversify its $264.6 billion foreign-exchange reserves and hold fewer dollars.

“The major part of Indian reserves are in dollars -- that is something that’s a problem for us,” Tendulkar, chairman of the Prime Minister’s Economic Advisory Council, said in an interview today in Aix-en-Provence, France, where he was attending an economic conference.

Singh is preparing to join leaders from the Group of Eight industrialized nations -- the U.S., Japan, Germany, Britain, France, Italy, Canada and Russia -- at a summit in Italy next week which is due to tackle the global economy. China and Brazil will also send representative to the G-8 summit. As the talks have neared, China and Russia have stepped up calls for a rethink of how global currency reserves are composed and managed, underlining a power shift to emerging markets from the developed nations that spawned the financial crisis.

“There should be a system to maintain the stability of the major reserve currencies,” Former Chinese Vice Premier Zeng Peiyan said in a speech in Beijing today, highlighting the nation’s concerns about a global financial system dominated by the dollar. Fiscal and current-account deficits must be supervised as “your currency is likely to become my problem,” said Zeng, who is now the head of a research center under the government’s top economic planning agency. The People’s Bank of China said June 26 that the International Monetary Fund should manage more of members’ reserves.

Russian President Dmitry Medvedev has repeatedly called for creating a mix of regional reserve currencies as part of the drive to address the global financial crisis, while questioning the dollar’s future as a global reserve currency. Russia’s proposals for the Group of 20 major developed and developing nations summit in London in April included the creation of a supranational currency. “We will resume” talks on the supranational currency proposal at the G-8 summit in L’Aquila on July 8-10, Medvedev aide Sergei Prikhodko told reporters in Moscow today.

Singh adviser Tendulkar said that big dollar holders face a “prisoner’s dilemma” in terms of managing their holdings. “That’s why I’m telling them to do this,” he said. He also said that world currencies need to adjust to help unwind trade imbalances that have contributed to the global financial crisis. “The major imbalances which led to the current situation, the current account surpluses and deficits, have to be addressed,” he said. “Currency adjustment is one thing that suggests itself.”

For all the complaints about the dollar, emerging markets such as India remain dependent on the currency of the U.S., the world’s largest economy and a $2.5 trillion export market. The IMF said June 30 that the share of dollars in global foreign- exchange reserves increased to 65 percent in the first three months of this year, the highest since 2007. Tendulkar said that the matter needs to be taken up in international talks, and that it emphasizes the need for those talks to go beyond the traditional G-8. “They can meet if they want to,” he said. “The G-20 has a wider role, has representation of the countries that are likely to lead the recovery process.”

EU Seeks Use of Clearinghouses for OTC Derivatives

The European Union called for the use of clearinghouses for some over-the-counter derivative trades to “ensure they do not harm financial stability” as part of a response to the global economic crisis. The EU will also study shifting more trades to exchanges and consider the creation of a data warehouse to boost the transparency of trades, and promote the standardization of contracts, the European Commission in Brussels said today. The proposals, which could lead to legislation later this year, are an attempt to cut risk in the $592 trillion over-the- counter derivatives market after the collapse of banks such as Lehman Brothers Holdings Inc.

U.S. President Barack Obama last month released a similar plan that would require standardized over-the-counter derivatives to be guaranteed by clearinghouses. “From 10,000 feet it all looks fine, but for us what matters is how it looks much closer to the ground,” Andre Allee, a derivatives lawyer at London-based law firm Simmons & Simmons, said in a telephone interview. “It’s really similar to what was proposed in the U.S. to the extent that it does look like there was coordination. Our clients are really happy with that.”

The EU plans come after U.S. Treasury Secretary Timothy Geithner sent a proposal to congressional leaders laying out his plan to police over-the-counter derivatives trading, the unregulated market where swaps based on interest rates, currencies, commodities and a company’s ability to pay back debt are exchanged. “Derivatives markets play an important role in the economy, but the crisis has shown that they may harm financial stability,” Charlie McCreevy, the EU financial services commissioner, said in a statement today.

Central counterparties “have proven their worth during the financial crisis” as illustrated by their role in managing the consequences of Lehman Brothers’ default, the commission said. “The broader use of CCPs in other OTC derivatives markets should be incentivised, wherever possible,” the commission said. There are “strong reasons,” the regulator said, for insisting on CCP clearing being located in Europe. Standardization could be achieved by encouraging broader use of standard contracts and electronic affirmation and confirmation services, central storage, automation of payments and collateral management processes, the commission said.

The creation of standardized contracts will be “the main problem” for McCreevy, Karel Lannoo, chief executive officer of the Centre for European Policy Studies in Brussels, said in a telephone interview. “There are thousands of products.” The commission said moving trades onto exchanges would improve price transparency and strengthen risk management. Still, the regulator said, this may “come at a cost in terms of satisfying the wide diversity of trading and risk management needs.” The commission said it will “further access” what action, if any, it will take.

Robert Pickel, chief executive of the International Swaps and Derivatives Association, said that exchanges might “remove flexibility” for banks and institutional investors. “Forcing bilateral participants to trade on an exchange or otherwise limiting the availability of customized risk management solutions, would be a step backwards,” Pickel said in a statement. Some clearinghouses operate as central counterparties for every buy and sell order executed on an exchange, reducing the risk that a trader defaults on his obligation in a deal. Capitalized by its members, a clearinghouse allows regulators to assess market positions and prices.

Lannoo said risk management would be a “big issue” for groups that agree to take on the central counterparty role. “The risk you take as a central counterparty can’t be underestimated,” he said. The commission said it will amend EU rules on regulatory capital or adopt new legislation if dealers don’t abide by agreements to use a central clearinghouse for credit default swaps in the region by July 31. Allee said the commission may try to encourage a shift toward CCPs by forcing EU banks and investment houses to set aside additional capital for OTC derivatives that aren’t safeguarded in a clearinghouse. That would be “completely unfair” for those who trade in markets such as equity and commodity derivative where contracts are often non-standardized.

Derivatives are financial instruments derived from stocks, bonds, loans, currencies and commodities, or linked to specific events such as changes in interest rates or weather. Credit- default swaps were created initially as a way for banks to hedge their risk from loans. They became a popular vehicle for hedge funds, insurance companies and other asset managers to speculate on the quality of debt or on the creditworthiness of companies because they were often easier and cheaper to trade than bonds.

Stock market investors keen to make the worst of the bad news

It's hard to see some economic data as anything but ugly. Thursday's US labour market report wasn't pretty by any standard. The 467,000 June decline in payrolls, up from 322,000 in May, broke a four-month improving trend. Stock market investors made the worst of the bad news. The S&P 500 and the Dow Jones Euro Stoxx 50 both dropped 3pc. The price of a barrel of oil, a proxy for economic sentiment, fell by the same. But hold on. A determined optimist might still see reasons to cheer.

The June US payroll reduction was lower in absolute terms than April's monthly drop, and 47pc less than January's record fall. The other big economic indicator on Thursday was US factory orders, and they were up 1.2pc. The news came a day after data showing that purchasing managers for US and European manufacturers had become less gloomy. But investors are no longer willing to twist whatever data they find into garlands of hope. That seemed appropriate in the spring, after the end of a winter marked by fears of a general collapse.