Steamboat Metamora of Palatka on the Oklawaha, Florida

Ilargi: The major difference between Tim Geithner and me, apart from my obviously superior looks, is that he is willing to gamble double or nothing with your money and your lives, and I would not be. Or, as one might also put it, he thinks the risk of misery for millions of American people is less important than his own personal career. I do not.

Other than that, when it comes to the way he defines his policy decisions, there are no differences that matter, not his experience in guiding the New York Fed, or his palliness with the likes of Bob Rubin and other self-ordained rulers of the realm, nor all the inside knowledge that comes with that. The reason none of it matters is that Geithner doesn’t know what he's doing.

The US economy has never been in a situation like the one it's in now, and Tim has nothing to draw on. At least, he has no prior knowledge to draw on. What he does have is the freedom to spend trillions of dollars, and to do so largely unchecked, other than by people who think just like him. But it's still gambling.

Even before the Obama team took over, Christina Romer said, and with her many others, that governments were in uncharted waters. Ben Bernanke proclaimed that Quantitative Easing was a no-miss (even though it had never been tried), and Geithner declared in the house that he needed no Plan B in case the stimulus wouldn’t work. Their belief systems are easy to spot as just that, belief systems.

After spending all those trillions, the boys gaze around looking for praise for having saved the planet. Even though they know as well as we do that it’s at the very least far too early to tell. Their (make that your) trillions haven't solved any problems yet. They have merely hidden some of them. Most of this has been achieved by transferring debt from the private sector (banks) to the public sector. Fiddling with accounting standards has done the rest.

So yes, Bernanke and Geithner have helped the major banks. So much so that these feel entitled to pay out more bonuses than ever in history. All because the government took over their gambling debts and gave them fresh cash to go play in the casino. That, exactly that and nothing else, made Bernanke Time's Person of the Year.

And how is the government going to pay off those debts? More taxes (which they won’t say), more economic growth (which they can’t stop saying) and most of all more borrowing. The plans are grandiose. Over $2 trillion in new debt (Treasuries) in 2010, on top of the $2.5 trillion in existing debt that has to be rolled over in 2010-11. And those are just the plans.

Is it possible that Obama and Geithner weren’t paying attention when their own chief economic adviser, Larry Summers, said in New York, October 8, that:

“We will not, as a country, as the economy recovers, be in a position to issue federal debt on anything like the scale that was appropriate to issue federal debt during a profound economic downturn.”?

Sure looks like they missed that one. Then again, they may be able to issue the debt, as long as they are willing to use your money to pay interest rates on the debt that will satisfy the bond markets. Lend out money to market makers at 0.25%, and borrow what you need for yourself at 5-6%. That looks like one lousy deal to me. Unless you’re a banker.

But not to worry, Tim says he's got it all under wraps:

Geithner: There will be no 'second wave' crisis

Treasury Secretary Timothy Geithner said [on December 22 that] the Obama administration is confident it will prevent a repeat of last year's financial crisis, the worst to hit the country in seven decades. "We are not going to have a second wave of financial crisis," Geithner said in an interview with National Public Radio. "We cannot afford to let the country live again with a risk that we are going to have another series of events like we had last year. That is not something that is acceptable."

Geithner, interviewed on NPR's "All Things Considered" program, rejected the idea that a serious new crisis could be triggered by lingering problems with commercial real estate loans or with a sudden weakening in the value of the dollar. "We will do what is necessary to prevent that and that is completely within our capacity to prevent," he said.

Am I reading his words correctly? Is he saying that the Bush administration could have prevented the first wave of the crisis ("completely within our capacity"), but didn't for some reason? Just for the record, that first wave involved Hank Paulson, right? Oh, and Ben Bernanke, I almost forgot.... Sure wonder where they are now.

I think it's quite obvious where Geithner gets these ideas about his "capacity to prevent" the next crisis. He thinks that A) everyone in the world will do what the US demands and B) if he throws enough money at a problem, it will go away all by itself.

The one issue with that is that the problem is debt. And to get the money that Geithner thinks will make the debt problem go away, he has to drag the country deeper into debt. Which in his mind will soon be miraculously disappeared by a growing economy.

But what if it takes too long for that economy to start growing again? What if it simply won’t grow, other than in government statistics? What if the economy keeps contracting after the first batch of trillions has vanished?

I’d say 2010 should be the year to formulate a Plan B. It couldn't hurt to discuss something more grounded than pure belief systems. Economic growth might just be not the best consiglieri in this particular case. And I don't understand the reluctance to talk about a Plan B to begin with. We're talking about enormous risks to the welfare of millions of people, and about policies that have never even been tried before.

70 years ago it took a world war to get out of the crisis. And the president's finance meisters today don’t even want to talk about what happens when they got it wrong? What’s up with that?

Earlier this month David Rosenberg wrote in Why 2010 Looks So Dicey:

The defining characteristic of this asset and credit collapse has been the implosion of the largest balance sheet in the world: the U.S. household sector. Even with the equities rally and the tenuous recovery in housing in 2009, the reality remains that household net worth has contracted nearly 20% over the past year and a half. That's an epic $12 trillion of lost net worth, a degree of trauma never seen before.

As households assess the damage, the impact of this shocking loss of wealth on spending patterns is likely to be enormous. Frugality is more than just the new fashion; attitudes towards discretionary spending, home ownership, and credit have undergone a secular shift toward prudence and conservatism.

Economic growth could be a long long time coming. Are you sure you want to wager all you have on that one color?

And would you do things the same way at home that your government does them for you in Washington?

Ilargi: Make sure you keep your nose pressed to the glass. Donate to the Automatic Earth New Year's Fund.

U.S. may prop up housing further via Fannie, Freddie

The government's decision to provide unlimited support to Fannie Mae and Freddie Mac probably presages more aggressive action to prop up the U.S. housing market. The government may put a mortgage-modification effort, called the Home Affordable Modification Program, or HAMP, into overdrive in coming years, pushing for reductions in the principal outstanding on home loans overseen by Fannie and Freddie, Bose George, an analyst at Keefe, Bruyette & Woods, wrote in a note to investors Monday.

The U.S. Treasury Department said on Christmas Eve that it lifted $200 billion caps on the amount of taxpayer money that can be pumped into the ailing mortgage giants over the next three years. Neither institution is near its $200 billion limit -- Treasury has put $60 billion into Fannie and $51 billion into Freddie since it seized the failing companies in September 2008. However, Treasury said the promise of unlimited government money "should leave no uncertainty about the Treasury's commitment to support these firms as they continue to play a vital role in the housing market during this current crisis." Fannie shares jumped 21% to close at $1.27 on Monday, while Freddie shares soared 27% to $1.60.

KBW's George initially found the extra support "perplexing," he said, because Fannie and Freddie are unlikely to need more than $200 billion of government money each. During the depths of the recession in March 2009, the Government Accountability Office estimated that the bailouts of the two companies would cost taxpayers $389 billion, the analyst noted. Since then, house prices have stabilized and have begun to creep up in some areas. Instead, unlimited taxpayer support will give the government "more flexibility in potentially taking more aggressive action to support the housing market," George wrote.

HAMP has so far had little effect on foreclosures. So the government may push for an enhanced version of the program that includes reductions in the principal outstanding on mortgages, the analyst said. Principal reductions are controversial because they leave banks and other major mortgage lenders with bigger losses and lessened capital. The industry prefers modifications that lower interest payments in other ways, such as extending the maturity of home loans.

Aggressive reductions in principal on mortgages overseen by Fannie and Freddie could leave the companies with significant losses and cut further into their waning capital bases. But Treasury can pump more money into the institutions to make up for that, George said. Mortgage-backed securities held by private companies are trading at big discounts, so write-downs from principal reductions may not have a big impact in this part of the market, George added. However, Fannie and Freddie hold mortgage securities in their portfolios at original cost. So write-downs from principal reductions could "meaningfully impact earnings and capital," the analyst said.

The government's original bailout of Fannie and Freddie required the companies to start cutting their portfolios of retained mortgages by 10% a year starting in 2010. That's because rampant growth earlier this decade was partly responsible for the companies' collapse last year. However, Treasury said on Christmas Eve that the 10% reduction in 2010 will be based on the maximum allowed size of their portfolios, which is $900 billion, not the actual size, which was roughly $770 billion at the end of October, George noted.

This means Fannie and Freddie won't have to cut their portfolios in 2010 and will only modestly reduce them in 2011, the analyst said. Fannie and Freddie were also due to pay a commitment fee to the Treasury, starting in the first quarter of 2010. Treasury postponed that for a year, which should give the companies' earnings and capital a boost, according to George.

Why Unlimited Help for Fannie and Freddie?

by Elizabeth MacDonald

Submarined in an "update" on the "status" of Fannie Mae and Freddie Mac, the White House quietly announced on Christmas Eve that, instead of just pumping in hundreds of billions of dollars, its support for the GSEs' damaged Hindenburg-sized balance sheets would be unlimited for the next three years. Yes, unlimited.

But what is behind this drastic move to uncap the Treasury’s credit pipeline for Fannie and Freddie, since the two have been in full implosion mode for a year and a half? Is the government quietly planning to force these two invalids, permanently stuck in the government’s emergency room, to take on rotting mortgage loans? That would present a sea-change in policy, even though it’s in the bylaws of Fannie and Freddie to take on sour loans in extreme circumstances. Fannie and Freddie were placed into conservatorship in the early fall of 2008 and are now hostage to the government's every crisis move.

The dramatic shift would come as the Obama administration is putting off any effort at reforming Fannie and Freddie, and at a time when pay czar Ken Feinberg has no jurisdiction over the two companies, both of which just agreed to pay their top executives up to $6 million in compensation for 2009. If this drastic move is made, the U.S. government would push the poisonous swamp of moral hazard beyond the tipping point. It would show it’s willing and able to not just explicitly back the biggest bailouts in the history of the country, but also continue to give support to the worst, most irresponsible crop of borrowers taxpayers have ever endured.

The government-dependent enterprises have already cost taxpayers $110 billion in losses, they’ve already drawn down $111 billion from the Treasury, and both admit in SEC filings that they will continue to bleed money for some time to come in order to prop up the Administration's effort to revivify the U.S. economy by supporting home buying.

But, Why Now?

It’s more than just rising home delinquencies. Fannie Mae just reported that the rate of serious delinquencies - those at least three months behind - on conventional loans in its single-family guarantee business rose to 4.98% in October, up from 4.72% in September - and about triple the 1.89% rate in October 2008. It’s about bombed-out bank balance sheets. The banks are desperately struggling to raise capital, as their cushions remain wafer thin.

Meanwhile, the U.S. must roll over $2.5 trillion in debt in the next two years, banks worldwide have $7 trillion in corporate bonds due in the same time span and $750 billion in commercial real estate loans are coming due, too, says Stephanie Pomboy of MacroMavens, as quoted in Alan Abelson’s column in Barron’s. Of course, the loan securitization market is dead in the water, with securitizations off by 90%, depending on the day. That means banks can no longer offload new loans via securitization and are stuck with the soggy stuff on their balance sheets.

The Federal Reserve is now the mortgage securitization market, as it now has $910.3 billion in mortgage-backed securities on its balance sheet, out of a planned $1.25 trillion in such purchases. But it can only tread water for so long. And that Fed program is set to expire next March, which means Fannie and Freddie will need an assist once that happens.

At the same time, U.S. accounting rule makers are forcing the banks to take back onto their balance sheet securitizations and all sorts of other assets now warehoused in off-balance- sheet conduits. Barclays reckons the rule will force roughly $500 billion in off-balance- sheet assets back onto bank balance sheets in 2010, requiring even more capital raises. Fannie and Freddie would have to pull back onto their balance sheets off-balance sheet assets, so buying back loans may help them more quickly strip down securitizations.

Credit Suisse and JPMorgan Chase Warn: It's Coming

The government’s expanded capital backstops and portfolio limits for Fannie and Freddie increase “the prospect of large-scale” purchases by the companies of delinquent mortgages out of the securities they guarantee, Mahesh Swaminathan and Qumber Hassan, Credit Suisse debt analysts in New York, wrote in a report. The two added: “This announcement increases the prospect of large-scale voluntary buyouts by removing the portfolio cap hurdle and helping funding by potentially increasing debt-investor confidence.” JPMorgan Chase is also betting on Fannie and Freddie buying out loans that back their securities in 2010. Bloomberg broke this story within the past week.

One of the best business blogs out there, Calculated Risk, quotes former columnist Doris “Tanta” Dungey as raising this possibility a few years ago. Dungey was the most influential, gifted writer on the mortgage derivatives meltdown, and has since passed away — a terrible loss for the financial markets, as her voice has never been more needed than now:"Fannie Mae has always had the option to repurchase seriously delinquent loans out of its MBS at par (100% of the unpaid principal balance) plus accrued interest to the payoff date. This returns principal to the investors, so they are made whole. If Fannie Mae can work with the servicer to cure these loans, they become performing loans in Fannie Mae’s portfolio. If they cannot be cured, they are foreclosed, and Fannie Mae shows the charge-off and foreclosure expense on its portfolio’s books (these are no longer on the MBS’s books, since the loan was bought out of the MBS pool).

"Now, Fannie also sometimes has the obligation to buy loans out of an MBS pool. But we are ... talking about optional repurchases. Why would Fannie Mae buy nonperforming loans it doesn’t have to buy? Because it has agreed to workout efforts on these loans, including but not necessarily limited to pursuing a modification. Under Fannie Mae MBS rules, worked-out loans have to be removed from the pools (and the MBS has to receive par for them, even if their market value is much less than that)."

Questions Surround Fannie, Freddie

The government's move to ease the limits on the securities holdings of Fannie Mae and Freddie Mac has ignited a debate among analysts about what the companies will do with their longer leash. When the Treasury Department took over Fannie and Freddie last year, one of the requirements they set for the companies required them to begin shrinking their portfolios of mortgages and related investments, which total a combined $1.5 trillion. The idea was to rein in the companies' size and growth.

But last Thursday, the Treasury eased that requirement, meaning the companies won't be forced to sell mortgages next year into an already weak market and could even buy mortgages on the market, which could help hold down interest rates. The Treasury also suspended for the next three years the $400 billion cap on the bailout subsidy that the government will offer. That could give them more flexibility to modify mortgages without worrying about taking losses.

Mahesh Swaminathan, senior mortgage analyst at Credit Suisse, said the firms could use their increased capacity to purchase delinquent loans from pools of mortgage-backed securities that they guarantee. Fannie and Freddie already purchase defaulted loans as they modify them under the administration's loan-modification program, but the additional breathing room means it is now a "slam-dunk for them to speed up" purchases of delinquent loans, Mr. Swaminathan said. New accounting rules that take effect next year also could make it more cost-effective for the companies to buy out bad loans and keep them in their investment portfolios.

The relaxed portfolio limits calmed investor worries that Fannie and Freddie would be forced to sell some of their mortgage holdings just as the Federal Reserve was preparing to wind down its purchases of mortgage-backed securities next spring. The Fed's commitment to buy up to $1.25 trillion has helped to keep mortgage rates near record lows; without that support some economists have said that could rise to 6% by the end of 2010. "The alternative would have been them selling into that market, which would have been even more difficult for the market to bear," Mr. Swaminathan said.

Others said the new flexibility means that Fannie and Freddie could replace the Fed as a big buyer of mortgage-backed securities, especially if weak demand for mortgage-backed securities from private investors drives rates higher. "It's created a government-purchasing facility other than the Fed," said Karen Shaw Petrou, managing partner of Federal Financial Analytics, a research firm in Washington. A Freddie spokesman said the company has used and will continue to use its investment portfolio as "an important tool" to "keep order in the housing and housing-finance markets." A Fannie spokesman declined to comment.

A Treasury official said the more generous portfolio limits were offered to avoid forcing the companies to actively sell their holdings, and they didn't intend for Fannie and Freddie to be active buyers of mortgages. But some analysts said the government wouldn't object to Fannie and Freddie's presence in the market. "You're going to hope that because of their lower cost of capital they will be a bid in the marketplace," said Joshua Rosner, managing director of Graham Fisher & Co.

Ms. Petrou said that the recent moves "make sense in a short-term way because you avoid market volatility," but the prospect of limitless aid will make it harder to extricate Fannie and Freddie from the government. "In a long-term way, it promotes nationalization of U.S. mortgage finance. We have increasingly gigantic, increasingly federal agencies eating up every mortgage out there," she said. Although Fannie's and Freddie's core business is their role guaranteeing payments to mortgage investors, for years they earned additional profits and generated controversy by maintaining a large investment portfolio filled with mortgages and related securities.

The most controversial part of the Christmas Eve announcement was the decision to erase any caps on the amount of Treasury money that the firms can take. That gives the mortgage-finance companies and their government masters a much freer hand to respond to the housing crisis in the year ahead, possibly by moving more aggressively to modify troubled loans. Some analysts said the companies now have greater flexibility to pursue more expensive loan modifications, including by writing down loan balances, which would have generated losses, requiring more government cash. But without a bailout ceiling, the administration "needs no longer worry that anything they do would drive Fannie or Freddie over the edge into negative net worth," said Ms. Petrou.

A Treasury representative said the bailout caps were suspended "specifically to ensure continued confidence in Fannie Mae and Freddie Mac, but were not based on any considerations" related to an expansion of the administration's loan-modification program. The Treasury already has handed over about $112 billion to help shore up the companies, which were among the first big financial institutions to fall under government control in the wake of the nation's mortgage crisis. Fannie and Freddie are playing a crucial role in providing mortgage liquidity. They own or guarantee half of the nation's $11 trillion in home mortgages and together with the Federal Housing Administration are responsible for backing nearly nine in 10 mortgages.

Fannie and Freddie's Home Inequity

That was a nice holiday gift to taxpayers.As expected, the Treasury on Christmas Eve increased the amount of money it can plow into Fannie Mae and Freddie Mac to keep them solvent. Before, the U.S. had pledged up to $200 billion to each. Now, over the next three years, the Treasury can spend as much as is needed to prevent their net worth going negative. Such a change would have required congressional consent after Dec. 31. Given that each U.S. household had effectively committed $3,800 to both firms, the Treasury should have waited till the New Year so the people's representatives could have had their say.While Congress would likely have signed off, seeking its approval would have been an opportunity to open up a serious debate about Fannie and Freddie specifically and housing subsidies in general. There are strong arguments for abolishing housing support for everyone except the poor. No other advanced economy with high homeownership levels has Fannie- and Freddie-type entities. But not only are they unnecessary, they also caused harm. In good times, they probably kept house prices above true market levels, shutting potential buyers out.

And they played a central role in the housing crash with their huge purchases of dangerous Alt-A mortgages. What is more, their politically favored status likely made it easier for executives to practice misleading accounting earlier this decade. Granted, the Treasury might not have wanted to cause jitters in the mortgage market by letting Congress get involved. But at some point the U.S. needs to be able to make economic policy without worrying about every turn in the housing market.

Bad news for US housing: Prices flattening

Home price gains earlier this year flattened out in October, according to a report issued Tuesday. The S&P/Case Shiller Home Price index, covering 20 of the largest metropolitan areas in the nation, was unchanged in October, after four consecutive months of gains. The index is down 7.3% from 12 months earlier.

"The turnaround in home prices seen in the spring and summer has faded," said David Blitzer, chairman of the Index Committee at Standard & Poor's, in a statement. "Coming after a series of solid gains, these data are likely to spark worries that home prices are about to take a second dip," he said. Just seven of the 20 cities recorded gains from a month earlier. The modest gains earlier this year were in part propped up by government initiatives. "We've seen recent stability because of low interest rates and the impact of the first-time homebuyers tax credit," said Pat Newport, a real estate analyst with IHS Global Insight. Prices are down from their all-time highs set in 2006 by 29% for the 20-city index.

Among the 20 cities, the worst tumble was taken by Tampa during the month. Prices fell 1.6% from September. Chicago and Atlanta recorded 1% losses. The biggest gainers were Phoenix, up 1.3%, and San Francisco, up 1.2%. Las Vegas sellers continued to bleed. Prices there fell just 0.1% but that marked the 38th straight monthly decline. The market in Sin City is off 55.4% from its peak. You can buy a home in Las Vegas for the same price it sold for in October of 2000. "In most of the hardest-hit markets, price declines are moderating," said Mike Larson, an analyst with Weiss Research.

Los Angeles recorded a rise of 0.3% and San Diego prices gained 0.4%. Miami, however, declined by 0.4%. According to Larson, falling supplies of homes on the market are helping to stabilize conditions. "Inventories are plunging on the new-home side and going down for existing homes," he said. Not that he's ready to break out the champagne, even with the New Year close at hand. "The market is recovering but it will be an anemic recovery," he said.

Fed Proposes Tool to Drain Extra Cash

The Federal Reserve on Monday proposed selling interest-bearing term deposits to banks, a move the U.S. central bank would make when it decides to drain some of the liquidity it pumped into the economy during the financial crisis. The new facility is intended to help ensure that the Fed can implement an exit strategy before a banking system awash with Fed money triggers inflation. Fed Chairman Ben Bernanke has described term deposits as "roughly analogous to the certificates of deposit that banks offer to their customers."

Under the plan, the Fed would issue the term deposits to banks, potentially at several maturities up to one year. That would encourage banks to park reserves at the Fed rather than lending them out, taking money out of the lending stream. The central bank said the proposal "has no implications for monetary policy decisions in the near term." "The Federal Reserve has addressed the financial market turmoil of the past two years in part by greatly expanding its balance sheet and by supplying an unprecedented volume of reserves to the banking system," it said. "Term deposits could be part of the Federal Reserve's tool kit to drain reserves, if necessary, and thus support the implementation of monetary policy."

Michael Feroli, an economist at J.P. Morgan Chase, said "it's another step forward in the exit-strategy infrastructure, but it's been well flagged in advance, so it's not a surprise." When Fed officials decide to tighten credit, they would likely use the term-deposits program ahead of -- or in conjunction with -- adjusting their traditional policy lever, the target for the federal funds interest rate at which banks lend to each other overnight. The Fed is already testing another tool, reverse repurchase agreements, in which the central bank sells securities from its portfolio with an agreement to buy them back later. Under the arrangement, the buyers move cash from banks to the Fed, removing reserves from the system.

Fed officials also have discussed selling some of the Fed's long-term securities, a move that would take reserves from the banking system. The Fed also said Monday that its balance sheet rose slightly to $2.2 trillion in the week ending Dec. 23. The Fed's total portfolio of loans and securities has more than doubled since the beginning of the financial crisis. As part of its efforts to fight the downturn, the central bank is buying $1.25 trillion in mortgage-backed securities, a program it says will end in March. The Fed now holds $910.43 billion in mortgage-backed securities, it said Monday.

Geithner: There will be no 'second wave' crisis

Treasury Secretary Timothy Geithner said [on December 22 that] the Obama administration is confident it will prevent a repeat of last year's financial crisis, the worst to hit the country in seven decades. "We are not going to have a second wave of financial crisis," Geithner said in an interview with National Public Radio. "We cannot afford to let the country live again with a risk that we are going to have another series of events like we had last year. That is not something that is acceptable."

Geithner, interviewed on NPR's "All Things Considered" program, rejected the idea that a serious new crisis could be triggered by lingering problems with commercial real estate loans or with a sudden weakening in the value of the dollar. "We will do what is necessary to prevent that and that is completely within our capacity to prevent," he said. Geithner spoke on a day when President Barack Obama met with executives from a number of community banks, reiterating his plea for banks to do more to lend to small businesses. Obama took a more conciliatory tone with the leaders of the smaller community banks than he had in a meeting last week with leaders of the country's largest banks.

Geithner, referring to the actions of the large banks in last year's crisis, said he did not believe they yet understood that they had lost the "confidence and trust of the American people." He said bankers had a "long way to go" to restore that confidence. Geithner defended his numerous contacts with executives from the largest banks, contacts that were revealed in telephone calendars obtained in October by The Associated Press under the Freedom of Information Act. Geithner said that he also spent a considerable amount of time talking to owners of small businesses and to small banks as well.

He called it a "misperception" that he was devoting too much time conferring with the largest banks. He said the conversations he had right after taking office should be viewed in the context of the serious crisis facing the financial system last winter and spring. "I'm the secretary of the Treasury. I have to spend time figuring out what it's going to take to fix the things that are broken in the financial system," he said.

Asked about the economy, Geithner said there were a number of signs that economic conditions were beginning to improve in terms of consumer and business confidence rising. He said it was likely that overall economic growth in the current quarter is accelerating, but he cautioned that dealing with the economy's troubles would take time. "We were in a very deep hole and it is going to take a long time to repair the damage done to confidence," he said.

Commercial Real Estate Holders Decide to Walk Away: The Continuing Double Standard from the Banking Industry. Debt Ceiling Raised to $12.4 Trillion Making Room for more Bailouts.

There will be many new financial stories in 2010 but one that is certainly to garner much attention is the implosion of the commercial real estate market. A $3.5 trillion market that has taken it on the chin alongside the residential real estate market. The commercial real estate debacle usually follows a similar pattern. Residential real estate pulls back followed by commercial real estate. But in this massive decade long real estate bubble commercial real estate debt ballooned into uncharted territory. The bust is going to be deep and has no parallel in history just like the housing bubble bursting. Yet the U.S. Treasury and Federal Reserve have already had backroom talks about coming out with a “Plan C” to bailout this segment of the American economy.Yet the commercial real estate bust reveals again the hypocritical nature of the banking industry. Hank Paulson last year came out and stated that homeowners that walked away on their obligations were acting immorally. Well Morgan Stanley just demonstrated not only that Wall Street is amoral but corrupt to the bone:

“(WSJ) So we’ve discussed the ethics of individual borrowers walking away from their mortgages. (Some say we’ve over-discussed it.) If it’s immoral, as some would say, for a borrower to walk away their mortgage, is it any different for a bank?

Morgan Stanley is doing just that. News reports on Thursday said the bank plans to give back five San Francisco office buildings to its lender-just two years after buying them at the top of the market.

“This isn’t a default or foreclosure situation,” spokeswoman Alyson Barnes told Bloomberg News. “We are going to give them the properties to get out of the loan obligation.”

Sound familiar?

Morgan Stanley bought the buildings, along with five others, in San Francisco’s financial district as part of a $2.5 billion purchase from Blackstone Group in May 2007. The buildings were formerly owned by billionaire investor Sam Zell’s Equity Office Properties and acquired by Blackstone in its $39 billion buyout of the real estate firm earlier that year, Bloomberg reports. One analyst estimates that the buildings are now worth half of what Morgan Stanley paid.”

And keep in mind that Morgan Stanley is raking in massive profits since the corporatocracy bailouts:

So they are making a conscious choice of walking away from their bad choice. The problem with this of course is that the American taxpayer has bailed out this company that actually had a direct hand in creating massive amounts of mortgage backed securities that imploded the residential housing market. Now, here they are moving away their commercial real estate obligations and wiping their hands of any responsibility. Average Americans are getting the raw end of deal in so many of these banking bailouts. The commercial real estate bailouts have no justification for the safety of our economy but hundreds of banks will implode because of local loans they made. Yet bigger banks enjoy the safety of the U.S. government and their printing press.

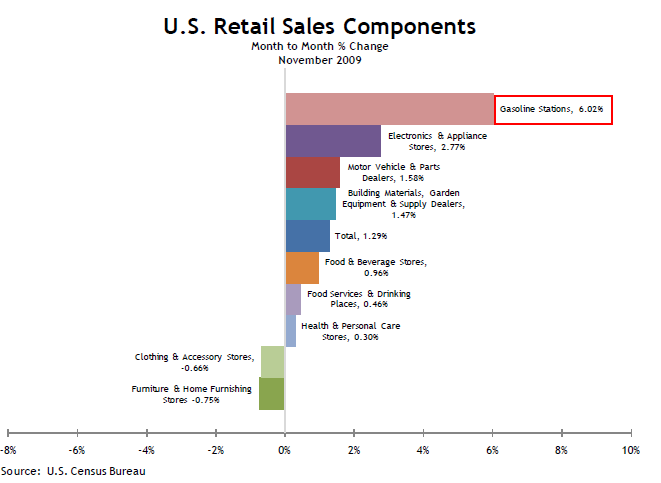

Unlike the too big to fail banks smaller regional banks will fail in the upcoming year as they have in 2009. They made loans on local businesses that simply had no way of succeeding in a new austerity that demands people cut back. The revised GDP number is down to 2.2 percent and without the government stimulus, the economy would still be contracting. And those great retail sales? Where did they come from?

The biggest jump came from gasoline stations. As you might guess there is little need for commercial real estate in this segment of the economy. So we are left with countless buildings that now sit empty while banks try to figure out their next step. At least with homes, there will be a price point where homes sell. Lower the price enough like some of the foreclosures and people will buy the property. But in some commercial real estate buildings there is little demand for properties. It is amazing that a bank like Morgan Stanley can simply walk away while having their industry chastise average Americans who even contemplate the idea of walking away.

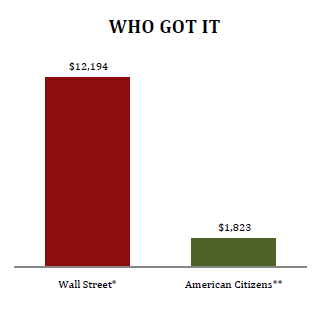

The hypocrisy of the corporatocracy has reached a crescendo. Of the $14 trillion in bailouts Wall Street received 87 percent of all the money:

The above is disturbing. What we are seeing is that the banks are basically pushing all the downside of risk to average Americans while keeping any ill gotten profits. They are rushing to payback TARP funds because they want to be unchanged so they can go back to gambling again. So what if another crisis hits in a year or two? After all, the poor U.S. taxpayer will be robbed yet again. What has changed? Nothing has changed. These corporate friendly bailouts don’t even reflect a healthy capitalist system. This is socialism for the too big to fail. The way the commercial real estate bust is handled will tell us a lot regarding our government and Wall Street. However, given the continuous hypocrisy coming from Wall Street expect more sweetheart deals for these failed bets.

And as a holiday gift, the Congress voted to raise the debt ceiling:

“(ABC) The Senate voted Thursday to raise the ceiling on the government debt to $12.4 trillion, a massive increase over the current limit and a political problem that President Barack Obama has promised to address next year.

The Senate’s rare Christmas Eve vote, 60-39, follows House passage last week and raises the debt ceiling by $290 billion. The vote split mainly down party lines, with Democrats voting to raise the limit and Republicans voting against doing so. There was one defection on each side, by senators whose seats will be on the ballot next year: GOP Sen. George Voinovich of Ohio and Democratic Sen. Evan Bayh of Indiana.”

Bankers Get $4 Trillion Gift From Barney Frank

To close out 2009, I decided to do something I bet no member of Congress has done -- actually read from cover to cover one of the pieces of sweeping legislation bouncing around Capitol Hill.

Hunkering down by the fire, I snuggled up with H.R. 4173, the financial-reform legislation passed earlier this month by the House of Representatives. The Senate has yet to pass its own reform plan. The baby of Financial Services Committee Chairman Barney Frank, the House bill is meant to address everything from too-big-to-fail banks to asleep-at-the-switch credit-ratings companies to the protection of consumers from greedy lenders.

I quickly discovered why members of Congress rarely read legislation like this. At 1,279 pages, the “Wall Street Reform and Consumer Protection Act” is a real slog. And yes, I plowed through all those pages. (Memo to Chairman Frank: “ystem” at line 14, page 258 is missing the first “s”.) The reading was especially painful since this reform sausage is stuffed with more gristle than meat. At least, that is, if you are a taxpayer hoping the bailout train is coming to a halt.

If you’re a banker, the bill is tastier. While banks opposed the legislation, they should cheer for its passage by the full Congress in the New Year: There are huge giveaways insuring the government will again rescue banks and Wall Street if the need arises.

Here are some of the nuggets I gleaned from days spent reading Frank’s handiwork:

- For all its heft, the bill doesn’t once mention the words “too-big-to-fail,” the main issue confronting the financial system. Admitting you have a problem, as any 12- stepper knows, is the crucial first step toward recovery.

- Instead, it supports the biggest banks. It authorizes Federal Reserve banks to provide as much as $4 trillion in emergency funding the next time Wall Street crashes. So much for “no-more-bailouts” talk. That is more than twice what the Fed pumped into markets this time around. The size of the fund makes the bribes in the Senate’s health-care bill look minuscule.

- Oh, hold on, the Federal Reserve and Treasury Secretary can’t authorize these funds unless “there is at least a 99 percent likelihood that all funds and interest will be paid back.” Too bad the same models used to foresee the housing meltdown probably will be used to predict this likelihood as well.

More Bailouts

- The bill also allows the government, in a crisis, to back financial firms’ debts. Bondholders can sleep easy -- there are more bailouts to come.

- The legislation does create a council of regulators to spot risks to the financial system and big financial firms. Unfortunately this group is made up of folks who missed the problems that led to the current crisis.

- Don’t worry, this time regulators will have better tools. Six months after being created, the council will report to Congress on “whether setting up an electronic database” would be a help. Maybe they’ll even get to use that Internet thingy.

- This group, among its many powers, can restrict the ability of a financial firm to trade for its own account. Perhaps this section should be entitled, “Yes, Goldman Sachs Group Inc., we’re looking at you.”

Managing Bonuses

- The bill also allows regulators to “prohibit any incentive-based payment arrangement.” In other words, banker bonuses are still in play. Maybe Bank of America Corp. and Citigroup Inc. shouldn’t have rushed to pay back Troubled Asset Relief Program funds.

- The bill kills the Office of Thrift Supervision, a toothless watchdog. Well, kill may be too strong a word. That agency and its employees will be folded into the Office of the Comptroller of the Currency. Further proof that government never really disappears.

- Since Congress isn’t cutting jobs, why not add a few more. The bill calls for more than a dozen agencies to create a position called “Director of Minority and Women Inclusion.” People in these new posts will be presidential appointees. I thought too-big-to-fail banks were the pressing issue. Turns out it’s diversity, and patronage.

- Not that the House is entirely sure of what the issues are, at least judging by the two dozen or so studies the bill authorizes. About a quarter of them relate to credit-rating companies, an area in which the legislation falls short of meaningful change. Sadly, these studies don’t tackle tough questions like whether we should just do away with ratings altogether. Here’s a tip: Do the studies, then write the legislation.

Consumer Protection

- The bill isn’t all bad, though. It creates a new Consumer Financial Protection Agency, the brainchild of Elizabeth Warren, currently head of a panel overseeing TARP. And the first director gets the cool job of designing a seal for the new agency. My suggestion: Warren riding a fiery chariot while hurling lightning bolts at Federal Reserve Chairman Ben Bernanke.

- Best of all, the bill contains a provision that, in the event of another government request for emergency aid to prop up the financial system, debate in Congress be limited to just 10 hours. Anything that can get Congress to shut up can’t be all bad.

Even better would be if legislators actually tackle the real issues stemming from the financial crisis, end bailouts and, for the sake of my eyes, write far, far shorter bills.

MOVE YOUR MONEY

Transfer Your Money From Wall Street Banks To Community Banks

For more information, go to Move your money.

US Consumer Confidence At Crossroads As Spread Between Visions Of Present And Future Is At Record Divergence

by Tyler Durden

Yesterday's most recent data from the Conference Board's Confidence Index recapitulates very well the Economic Inquisition purgatory that living in America has become: pain and suffering now, coupled with the promise of salvation and financial bliss at some point in the future.

Of course, on a long enough timeline we are all dead, so it is only fitting that the administration, whose slogan had something to do with tangible change, is gradually encroaching on the Catholic Church's turf in an all out war for the souls of America's taxpayers as tangible becomes increasingly ephemeral and, well, intangible (save for unemployment and the wads of electronic cash deposited in Goldman Sachs' employees bank accounts - both of those are all too real).

While the CBCC number came in at about the expected reading of 52.9 (from 50.6 in November), all of the "improvement" in confidence came from rosy future expectations, which rose to a two year high of 75.6 (from 70.3 previously). As for the present: current conditions plunged to another record low of 18.8. Never before has the differential between present pain and future hope been so wide.The impact of this divergence politically is all too obvious. The voting population, which has been extremely patient, and keeps hoping that the future will finally bring something better and in line with oh so many promises, may very soon change their mood and realize that the present is here to stay, regardless of what the Fed manipulated capital markets demonstrate. When that happens watch for some interesting election fireworks on this side of the Potomac river.

Reading between the lines of the CBCC indicates that Obama and CNBC's grand plan to get consumers to spend, spend, spend again has fizzled. Autobuying intentions dropped to 3.8 from 4.5 in November, the lowest read in over a year, when the SAAR was 10.5 million. The double dip in the auto sales will soon be upon us. Furthermore, buying intentions of major household appliances held at a weak 23.7: Cash for Bidets can't come fast enough. Most troubling, however, homebuying intentions have plunged to a near-thirty year low: at 1.9, the percentage of Americans planning on buying a house is the lowest since 1982.

And just in case you thought that shellshocked US citizens will look to get the hell out of Dodge, at least temporarily, to take advantage of that strong, strong dollar and travel abroad, think again. The percentage of Americans planning a vacation in the next six months fell to 35.7, the lowest since April. The David Rosenberg-penned "frugal consumer" is here to stay, which can only mean that both the Fed and the US Government will become buyers of first, last and everything inbetween resort, as the traditional component of US GDP (sorry David Bianco, you are unabashedly wrong in your "consumer is irrelevant" propaganda). Maybe it is time to dust off all those Russian Politics 101 manuals, in our search of how to defeat Soviet Style Communist fiscal and monetary policy, which have so thoroughly penetrated the United States of America itself.

U.S. Looks Abroad in Another Week of Big Borrowing

The U.S. government will again bank on foreign investors, including its biggest creditors China and Japan, to take a record-tying $118 billion in notes to be auctioned this week. With foreign buyers holding about half of the Treasury market, their continued appetite for government securities is essential in order to continue funding mounting budget shortfalls in the U.S. at historically low interest rates. The auctions will be the last offerings of Treasury debt for 2009, adding to a record net supply of $1.48 trillion for the year. They start Monday with $44 billion in two-year notes, followed by $42 billon in five-year notes Tuesday and $32 billion in seven-year notes Wednesday, all matching the amounts offered a month earlier.

Thinner trading conditions during the winter holiday season pose a risk for such large sales. But many market participants said the selloff of short-term notes last week has made them attractive again. The two-year note's yield, which moves inversely to its price, traded at 0.96% Thursday. It has risen nearly 0.3 percentage point this month, while the yields on the five- and seven-year notes have increased by more than 0.5 point over the same period. U.S. markets were closed Friday for the Christmas holiday.

Because the five- and seven-year notes have been the favored maturities for foreign investors in recent auctions, this week's sales are likely to fare better than the offerings earlier this month of $21 billion of 10-year notes and $13 billion of 30-year bonds, which generated only tepid demand. "The auctions have been dominated by foreign bidders, and there is no particular reason to suspect that foreign reserve managers will be any less interested because of year-end," said Carl Lantz, an interest-rate strategist at Credit Suisse Securities USA LLC, one of the 18 primary dealers who trade directly with the Federal Reserve and underwrite Treasury auctions. Amitabh Arora,

head of U.S. rate strategy at primary dealer Citigroup Global Markets Inc., said he expects "strong demand for the five-year and the seven-year auctions, mainly via Asian investors." Other investors are already looking at 2010, when the U.S. will push for even larger debt sales. James Caron, head of interest-rate strategy at primary dealer Morgan Stanley, cautioned there may be "more difficulties" placing Treasury supply next year, and sees a risk that investors may demand higher yields. Mr. Caron expects net Treasury supply to hit a new record of $1.8 trillion next year.

The central bank may start raising interest rates in the latter half of the year, a move that would push yields higher. Another factor that could affect Treasury prices is the economic recovery, however slow. Many investors could turn to riskier assets, such as corporate bonds and stocks, for higher returns. Investors also remain concerned over the fiscal health of the U.S. and the delicate timing of the Fed's withdrawal of its huge monetary stimulus.

That would mean higher Treasury yields, resulting in higher funding costs for the U.S. government in order to lure fresh buyers. Despite these headwinds, David Rosenberg, chief economist and market strategist for Gluskin Sheff & Associates Inc. in Toronto, noted that with more than $1 trillion sitting in cash, U.S. banks have ample resources to buy bonds, while other potential buyers, such as the household sector, remain underrepresented.

"Deficits are a concern, but of all entities, the federal government is least likely to get downgraded," said Mr. Rosenberg, former North American chief economist for Merrill Lynch. "I don't expect there to be anything more than brief periods of indigestion at worst from the Treasury auctions in 2010."

World Credit Market Shrinks First Time in 15 Years, Mizuho Says

The amount of corporate debt outstanding globally shrank for the first time in at least 15 years in the first half of 2009 as U.S. banks reduced the size of their balance sheets, according to Mizuho Securities Co. The volume of corporate bonds, commercial paper and asset- backed securities fell to $52.9 trillion at June 30 from $53.2 trillion on the same day in 2008, Tetsuo Ishihara, a senior credit analyst for Mizuho in Tokyo, said in a report yesterday that analyzed data from the Bank for International Settlements.

“It’s unprecedented that the global debt market shrinks,” Ishihara said in a telephone interview. “When redemptions and buybacks are greater than new issues the outstanding size can shrink, which appears to have happened here.” Financial companies in the Americas had $1.1 trillion of losses and writedowns since the credit crunch started in 2007, about 65 percent of the global total, according to data compiled by Bloomberg. The extra yield investors demand to own investment-grade U.S. corporate bonds instead of Treasuries narrowed to 1.91 percentage points from 6.03 percentage points this year, Merrill Lynch & Co. data show, prompting companies to buy back debt to reduce interest payments.

The global credit market shrank 2.2 percent between Jan. 1 and March 31 from a year earlier and 0.5 percent in the second quarter, according to Mizuho’s report, which cited BIS data back to 1994. Companies reduced net debt even as U.S. corporate bond sales climbed to $744.7 billion in the first half from $617.8 billion in the same period a year earlier, Bloomberg data show. If the size of the market shrinks further, “spreads will be well supported,” Ishihara said.

Sprott Says S&P 500 to Tumble Below its March Low

The Standard & Poor’s 500 Index will collapse below its March lows as an expected rebound in economic growth fails to materialize, according to hedge fund manager Eric Sprott. The Toronto-based money manager, whose Sprott Hedge Fund returned 496 percent over the past nine years while the S&P 500 lost 32 percent, said the index’s 67 percent rally since March reflects investors misinterpreting economic data. He’s predicting the gauge will fall 40 percent to below 676.53, the 12-year low reached on March 9.

“We’re in a bear market that will last 15 or 20 years, and we’ve had nine of them,” Sprott, chief executive officer of Sprott Asset Management LP, which oversees C$4.3 billion ($4.09 billion), said in an interview Dec. 18. Investors in Sprott’s funds have been rewarded by his holdings in gold, which has climbed 40 percent since October 2007 as the S&P 500 lost 26 percent. The metal has retreated 9.3 percent since closing at a record $1,218.30 on Dec. 3.

Sprott said the Federal Reserve has kept bond yields and interest rates artificially low through its program to buy agency debt and mortgage-backed securities. The central bank expects the securities purchase program to finish by the end of March. Expiration of the program would reduce demand for fixed- income securities, forcing up bond yields and interest rates and hurting economic growth, Sprott said.

Should the Fed renew the programs while the U.S. government continues to run record deficits, investors will lose faith in the U.S. currency, he said. “If they announce another quantitative easing, trust me, the gold price will go up another 50 bucks that day,” he said. Gold futures rose 1 percent to $1,104.80 an ounce Dec. 24, data compiled by Bloomberg show. Sprott has been bullish in gold and gold stocks, which are used as a hedge against inflation, since at least 2001, when the precious metal was trading below $300 an ounce. Gold futures have slipped 6.4 percent this month in New York as the U.S. dollar has rebounded on data that signaled a recovery in the U.S. economy.

American payrolls fell by 11,000 in November, the fewest since the recession began, while retail sales gained 1.3 percent, twice the rate forecast in a survey of economists by Bloomberg, according to government reports released this month. Sprott says investors have been too eager to see the data as signs of recovery. While the S&P 500 added 0.6 percent on the day of the employment report, a 23rd consecutive month of payroll contraction was no reason for optimism, he said. “We don’t have employment gains,” he said. “We have less of a decline. That’s a sign of weakness. The data is weak.”

Sprott said gold is the only asset about which he remains positive in the short term. His C$1.42 billion Sprott Canadian Equity Fund -- which is up 22 percent in five months -- has 34 percent of its portfolio in mining stocks and another 39 percent in bullion as of Nov. 30. He said though he has no target price for the metal he doesn’t think it has reached a ceiling after quadrupling over the past eight years. “If you get into this thing where you’ve got to keep printing more and more and more, who knows about the price of gold?” he said. “It will be the new currency in due course.”

Within the mining industry, Sprott prefers companies with smaller market capitalization, which he said have greater potential to grow. Since last year, Sprott’s firm has become the biggest shareholder of Avion Gold Corp., which mines in Africa, and East Asia Minerals Corp., which explores in Indonesia. Avion is undervalued for its projected 2010 production, he said. According to a Dec. 16 note from analyst Eric Zaunscherb of Canaccord Financial Inc., Avion was trading at 2.9 times its estimated 2010 earnings, compared with a multiple of 10.5 for its peers. Regarding East Asia Minerals, Sprott said, “I just get the feeling that these guys could find a multi-double-digit-million- ounce property.”

East Asia completed a 2,000-meter, 14-hole drilling program at its largest Indonesian property that Canaccord analyst Wendell Zerb called “encouraging” and indicative of a large zone of gold mineralization. Over the next two quarters, East Asia is to drill 45 more holes at the site and begin drilling in four more locations in the country, Zerb said. Outside of the gold industry, Sprott owns shares of Wavefront Technology Solutions Inc., a TSX Venture Exchange- listed company whose products are meant to increase oilfield production. Its technology could be used on at least two-thirds of the world’s oil wells, he said. Sprott, 65, founded his current firm in 2001 after divesting Sprott Securities, now Cormark Securities Inc., to its employees.

Morgan Stanley Sees 5.5% Note as U.S. Faces Deficits

If Morgan Stanley is right, the best sale of U.S. Treasuries for 2010 may be the short sale. Yields on benchmark 10-year notes will climb about 40 percent to 5.5 percent, the biggest annual increase since 1999, according to David Greenlaw, chief fixed-income economist at Morgan Stanley in New York. The surge will push interest rates on 30-year fixed mortgages to 7.5 percent to 8 percent, almost the highest in a decade, Greenlaw said.

Investors are demanding higher returns on government debt, boosting rates this month by the most since January, on concern President Barack Obama’s attempt to revive economic growth with record spending will keep the deficit at $1 trillion. Rising borrowing costs risk jeopardizing a recovery from a plunge in the residential mortgage market that led to the worst global recession in six decades. “When you take these kinds of aggressive policy actions to prevent a depression, you have to clean up after yourself,” Greenlaw said in a telephone interview. “Market signals will ultimately spur some policy action but I’m not naive enough to think it will be a very pleasant environment.”

Yields on the 3.375 percent notes maturing in November 2019 climbed 4 basis points to 3.84 percent at 11 a.m. in London today, according to BGCantor Market Data. The price fell 10/32 to 96 5/32. They have risen 65 basis points this month, the most since April 2004, as government efforts to unfreeze global credit markets lessened the appeal of the securities as a haven. Speculators, including hedge-fund managers, increased bets that 10-year note futures would decline more than fivefold in the week ending Dec. 15, according to U.S. Commodity Futures Trading Commission data. Speculative short positions, or bets prices will fall, outnumbered long positions by 52,781 contracts on the Chicago Board of Trade. It was the biggest increase since October 2008.

In a short sale, investors borrow securities and sell them hoping to profit by repurchasing the securities later at a lower price and returning them to the holder. Ten-year notes will end 2010 at 3.97 percent, according to the average of 60 estimates in a Bloomberg News survey that gives greater weight to the most-recent forecasts. Edward McKelvey, senior economist in New York at Goldman Sachs Group Inc., the top-ranked U.S. economic forecasters in 2009, according to data compiled by Bloomberg, expects yields to drop to 3.25 percent. Goldman Sachs says unemployment will average 10.3 percent in 2010, hindering the recovery.

The U.S. will face increased competition from other debt issuers, spurring investors to demand higher yields as the Federal Reserve ends a $1.6 trillion asset-purchase program, according to James Caron, head of U.S. interest-rate strategy in New York at Morgan Stanley. The central bank was the largest purchaser of Treasuries in 2009 through a $300 billion buyback of the securities completed in October. The Treasury will sell a record $2.55 trillion of notes and bonds in 2010, an increase of about $700 billion, or 38 percent, from this year, Morgan Stanley estimates. Caron says total dollar-denominated debt issuance will rise by $2.2 trillion in the next 12 months as corporate and municipal debt sales climb.

Mortgage rates last reached 7.5 percent in 2000 as productivity gains slowed after the demise of some Internet companies. The average rate on a typical 30-year fixed-rate mortgage climbed to 5.05 percent in the week ended Dec. 24, according to McLean, Virginia-based Freddie Mac. Yields on mortgage securities issued by Fannie Mae rose to a four-month high of 4.54 percent last week. Fannie and Freddie securities are used to guide borrowing costs on almost all new U.S. home lending.

Higher borrowing costs as the U.S. shows signs of beginning to emerge from the longest economic contraction since the 1930s puts Treasury Secretary Timothy Geithner in a situation similar to one faced by his predecessor Robert Rubin. “This is the re-emergence of the bond market vigilantes,” said Mitchell Stapley, the Grand Rapids, Michigan-based chief fixed-income officer for Fifth Third Asset Management, who oversees $22 billion. “The vigilantes are saying, OK guys you want to do this, you’re going to pay a higher price for it.”

Inflation-adjusted 10-year note yields have more than tripled this year to 1.5 percent at the end of November, according to Bloomberg data, subtracting the gains in the consumer price index excluding food and energy from the nominal yield on the securities. A surge in so-called real yields to a seven-year high in the 1990s was viewed by the Clinton administration as a sign that they needed to address growing budget deficits, Greenlaw said. “Rubin went to Clinton and said we have to do something to support the recovery, and taxes went up,” Greenlaw said. “You don’t really start to put pressure on policy makers to respond until the market sends a signal.”

Sales of existing homes rose 7.4 percent last month, following October’s 10.1 percent gain. The difference between two- and 10-year yields to a record 2.88 percentage points on Dec. 22 as traders added to bets a recovery will fuel growth and inflation. The yield curve contracted a day later after a separate report showed sales of new homes unexpectedly fell in November. “When you couple the growing probability of a belief in a recovery combined with the supply, it could mean some indigestion problems for Treasury yields,” said James Sarni, senior managing partner in Los Angeles at Payden & Rygel, which oversees $50 billion. “As long as the demand is there, the supply won’t be a problem. I think what’s going to happen is there’s going to be a problem with the demand.”

Spending by Obama and lawmakers is increasing as the Fed winds down its stimulus programs. The Senate voted on Dec. 24 to raise the limit on federal borrowing to $12.39 trillion, enough to tide the government over for about two months. The House approved the legislation Dec. 16, along with a $154 billion aid package to pay for extended unemployment benefits, new infrastructure projects and help for state governments. Greenlaw says the U.S. will probably have to offer investors such as foreign central banks and mutual funds real returns of more than 3 percent for 10-year notes to attract funding.

“There’s no free lunch, and when you take these kinds of aggressive policy actions to prevent a depression, you have to clean up after yourself,” Greenlaw said. “Foreign central banks are just not going to be able to finance these kinds of budget deficits for very long.” Monetary officials in China, Japan and other countries helped Geithner lower U.S. borrowing costs by 15 percent in the government’s 2009 fiscal year. Indirect bidders, a group of investors that includes foreign central banks, purchased 45 percent of the $1.917 trillion in U.S. notes and bonds sold this year through Nov. 25, compared with 29 percent a year ago, according to Fed auction data compiled by Bloomberg News.

The decline in interest expense was the biggest decrease since before 1989 and came even as the nation’s debt increased by $1.38 trillion this year to $7.17 trillion in November, the data show. An increase in yields may even add to demand for Treasuries, said Ian Lyngen, a senior government bond strategist at CRT Capital Group LLC in Stamford, Connecticut. He doesn’t anticipate 10-year note yields rising above 4.25 percent in the first quarter. “The data has yet to prove definitively more bullish for the economy and more bearish for the bond market,” Lyngen said. “A significant backup in rates will simultaneously make the debt more expensive for the Treasury and potentially make it more attractive for investors to buy.”

White House officials have acknowledged the bond market’s message about the need to cut the federal deficit. Rahm Emanuel, Obama’s chief of staff, said on Nov. 17 in a speech in Washington that a plan for reducing budget deficits “is foremost” on the president’s mind. “Could one imagine the market for debt being saturated? Of course,” said Lawrence Summers, director of the National Economic Council, speaking in New York on Oct. 8. “We will not, as a country, as the economy recovers, be in a position to issue federal debt on anything like the scale that was appropriate to issue federal debt during a profound economic downturn.”

Morgan Stanley’s Caron predicts the spread between 2-and 10-year yields will rise to 3.25 percentage points next year. “There is a lot of supply coming to the markets next year,” Caron said. “In 2009 there was a lot of support for that supply. The question going forward is what happens when there is not.”

A Permanent Backstop Would Be Permanent Pain

Imagine your delight if the government was suddenly prepared to guarantee all your debts. That's more or less what U.S. politicians are offering banks in legislation designed to fix the financial sector. That lawmakers are pushing a debt backstop, despite the moral-hazard risk, reveals their concerns about the ability of banks to borrow through an economic downturn. That's understandable. In the latest crisis, many firms could have failed without the Federal Reserve's emergency credit lines and the Federal Deposit Insurance Corp.'s Temporary Liquidity Guarantee Program, or TLGP.

Even so, the permanent offer of a backstop takes the system in the wrong direction. What's needed are far-reaching changes that make bank funding far safer and protect the taxpayer, not put them on the hook. The details of the backstop beggar belief. The bill passed by the House says that if a "liquidity event" occurs that could "destabilize the financial system," regulators and the Treasury can widely offer the guarantee. The bill stipulates that the guarantee can only go to "solvent" institutions, but its definition of solvency—having more assets than obligations to creditors—could let just about anyone in.Regulators may feel they need this new backstop because they now oversee a higher number of large firms that borrow heavily in the market to fund investment-bank operations. Indeed, experience in Japan shows that a banking sector is safer if deposits are by far the predominant source of funding. In the mid-'90s, total Japanese bank loans were 25% higher than deposits, according to figures from Pali Capital. That gap had to be filled with market borrowing. Now, loans are 22% lower than deposits. Granted, this low loan-to-deposit ratio partly exists because Japanese banks are reluctant to lend. But it meant they were liquid going into the latest crisis—and thus didn't destabilize their system.

To be fair, the loan-to-deposit ratio has improved markedly in the U.S. during the crisis, falling to 97% in November at large banks, from a multiyear high of 114% in May 2008. But this measure captures only traditional loans, and doesn't reflect other assets held by securities arms for example, that are likely to be funded in wholesale markets. One way to tackle the funding problem would be to remove all government protection from bank businesses that are not mostly deposit-funded. The market would likely become more wary of funding wholesale-funded businesses, forcing universal banks to shrink such operations to less systemically risky levels or sell them

GMAC Set for Another Cash Infusion

GMAC Financial Services is close to getting approximately $3.5 billion in additional aid from the U.S. government, on top of $12.5 billion already received since December 2008, according to people familiar with the situation. The announcement, expected within days, will coincide with GMAC taking additional steps to absorb losses related to its mortgage operations, these people said. The cleanup is designed to return the Detroit-based finance company to profitability in the first quarter of 2010, according to one of these people.

A GMAC spokeswoman declined to comment on any potential government action but said, "GMAC has been conducting a strategic review of its business and evaluating options to address the challenges in its mortgage operation." The spokeswoman said GMAC wants to prepare itself to repay the U.S. government. The willingness by the U.S. Treasury to deepen taxpayer exposure to GMAC reflects the troubled company's importance to the revival of the auto industry. The company was told to raise additional capital as part of government-led stress tests of large banks conducted earlier this year. The tests were to determine whether firms would need more capital to continue lending if the economy deteriorated in 2009 and 2010.

GMAC has only filled a portion of its capital hole and, unlike other banks that participated in the stress tests, has been unable to attract much capital from private investors. The Treasury said earlier this year that it would make as much money available to GMAC as needed to fill its capital hole and projected the firm would need another government infusion of as much as $5.6 billion. GMAC's capital needs have turned out to be somewhat less than originally envisioned, in part because impact from the bankruptcies of General Motors Corp. and Chrysler Corp. was not as severe as federal regulators originally projected.

A Treasury spokesman said Tuesday: "As we stated on Nov. 9, Treasury is in discussions with GMAC to ensure its capital needs as determined last May by the stress tests are met." GMAC has argued it didn't need additional support. The Treasury has authority to provide funds to GMAC through the Troubled Asset Relief Program, the $700 billion program authorized by Congress at the height of the financial crisis. This will be the first big infusion to a single company in several months. The Treasury has been working to wind down many of the TARP programs as the financial crisis eases, and it has already seen $175 billion returned from banks.

The Treasury agreed to inject $5 billion into GMAC in December 2008, as part of a broader rescue of the auto sector, and another $7.5 billion in May after the stress tests were completed. That $7.5 billon was considered by the Treasury to be a down payment, with additional funds likely coming later. The government's existing 35.4% stake in GMAC is likely to eventually increase, a move that could give the government more control over the firm, including the right to appoint additional directors to GMAC's board. GMAC is subject to pay restrictions imposed by the government's pay czar. The additional financing comes as many other companies that received large sums of government aid have begun repaying the government, including Citigroup Inc. and Bank of America Corp.

GMAC, founded in 1919, provides wholesale financing for thousands of General Motors and Chrysler dealerships across the U.S., meaning scores of local distributors would be unable to bring cars onto their lots if GMAC were to collapse. The new capital will likely allow GMAC to avoid placing its ailing mortgage unit, Residential Capital LLC, or ResCap, into bankruptcy, these people said. GMAC had set the end of the year as a deadline for deciding ResCap's fate after losses from loans made to borrowers with shaky credit dragged down GMAC's results in 2009. The mortgage unit lost $2.7 billion through the first three quarters of 2009 following $9.96 billion of losses in 2008 and 2007.

The fate of ResCap was a flash point between the board and GMAC's former chief executive, Alvaro de Molina, who was ousted in November following clashes with the government and his directors. Board member Michael Carpenter succeeded Mr. de Molina. Some board members were upset, saying management had left out bankruptcy as an option; management's view was that it had presented all options, including a potential sale, and the board was unable to make a decision.

The mortgage-related write-downs to be announced as early as this week will affect assets held by ResCap and Ally Bank, GMAC's online bank. Ally Bank was created after the company received approval in late 2008 to convert to a bank holding company and qualify for government money under TARP. The arrangement left the Federal Reserve with regulatory authority over the parent. Ally's pursuit of deposits at high rates became a key leg of its strategy, since deposits provide a cheap form of funding, but the taxpayer-assisted approach rankled competitors and the Federal Deposit Insurance Corp. Ally and FDIC reached an agreement that requires GMAC to keep its rates at certain levels in exchange for FDIC's support, according to people familiar with the situation.

Reviving Glass-Steagall Means Escalating 'War' on Wall Street

A one-page proposal gaining traction in Congress could turn back the clock on Wall Street 10 years, forcing the breakup of banks, including Citigroup Inc. Lawmakers in both parties, seeking to prevent future financial crises while soothing public anger over bailouts and bonuses, are turning to an approach that's both simple and transformative: re-imposing sections of the 1933 Glass-Steagall Act that separated commercial and investment banking.

Those walls came down with passage of the Gramm-Leach-Bliley Act of 1999. A proposal to reconstruct them, made by U.S. Senators John McCain and Maria Cantwell on Dec. 16, would prevent deposit-taking banks from underwriting securities, engaging in proprietary trading, selling insurance or owning retail brokerages. The bill could also force the unwinding of deals consummated during the financial crisis, including Bank of America Corp.'s acquisition of Merrill Lynch & Co.

"The impact on Wall Street would be severe," Wayne Abernathy, an executive vice president at the American Bankers Association, said in a telephone interview. Resurrecting Glass-Steagall goes beyond the array of new regulatory powers that President Barack Obama has proposed to fix the financial system. It has also sparked debate among academics, regulators and legislators over whether the Depression-era law could have prevented the crisis of 2008 or might help avoid future ones.

"If you look at what happened, with or without Glass-Steagall, it would have made no difference," said H. Rodgin Cohen, chairman of New York-based law firm Sullivan & Cromwell LLP, who represented one side or the other in more than a dozen transactions stemming from the financial crisis last year, including the rescues of Bear Stearns Cos., Fannie Mae, Wachovia Corp., and American International Group Inc. Cohen and others say the law wouldn't have saved Bear Stearns or Lehman Brothers Holdings Inc., both of which were pure investment banks, from collapse.

And the government would not have been able to enlist JPMorgan Chase & Co. to take on the assets of Bear Stearns or allow Goldman Sachs Group Inc. and Morgan Stanley to become bank holding companies, giving them access to the Federal Reserve's discount window. Rather than split up banks, regulators should provide better supervision and require tougher capital requirements, said Cohen, who was also involved on behalf of banking clients in shaping the bill that dismantled parts of Glass-Steagall.

The McCain-Cantwell proposal, which has picked up four additional co-sponsors, could be considered by the Senate Banking Committee as early as January, if Senator Christopher Dodd, the Democratic chairman from Connecticut, and other members complete negotiations on a financial overhaul bill. A similar bill has been introduced in the U.S. House of Representatives by Maurice Hinchey, a Democrat from New York. The House already adopted a measure on Dec. 11 to revamp financial regulation without Hinchey's proposal. The chief sponsor of the overhaul measure, Representative Barney Frank, has said he supports giving regulators the power to apply Glass-Steagall in individual cases.

"It is fair to argue that if the bill picks up steam in the Senate, the House could have the political appetite to pass it as well," Paul Miller and four other analysts at FBR Capital Markets in Arlington, Virginia, said in a Dec. 17 note. One reason support for the idea is growing is that lawmakers see public anger building over what Obama called "fat cat bankers." As industry profits bounce back and banks repay Troubled Asset Relief Program funds—and also get set to hand out billions of dollars in bonuses—Americans are still struggling with a 10 percent unemployment rate and home foreclosures. That's leading Congress to seek ways to rein in the firms blamed for the financial crisis.

"Congress is at war with Wall Street," said former Fed Governor Lyle Gramley, now a senior economic adviser at Soleil Securities Corp. in New York. "They perceive Wall Street as being the root source of our financial crisis, and they want to do something to make sure that doesn't happen again."

Splitting banking functions needed for the smooth operation of the economy from riskier securities and trading activities was proposed earlier this year by the Group of Thirty, a nonprofit organization made up of former government officials and bankers, including Paul Volcker, a former Fed chairman and head of the president's Economic Recovery Advisory Board. The group said the crisis spread like a contagion from firm to firm, putting both commercial banks and securities companies at risk. To prevent a domino effect, systemically important financial institutions shouldn't be allowed to engage in proprietary trading that involved "particularly high risks" or "serious conflicts of interest," the group said.

While that would not bar banks from underwriting securities, as some U.S. lawmakers want, it might force them to shutter or sell trading divisions. The financial system has "failed the test of the marketplace," Volcker said in January. He added that "it's been proven that they're unmanageable, the existing conglomerates." Some Wall Street executives endorse such a split.

"What we need is a 21st century Glass-Steagall," said Gerald Rosenfeld, deputy chairman of Rothschild North America Inc. and a professor of business and law at New York University. Rosenfeld favors regulating commercial banks like public utilities, while giving securities firms and hedge funds more freedom, as long as they adhere to capital guidelines. "The important thing is we have to have a structure that prevents the contagion from spreading when there are catastrophic losses in those riskier businesses," he said.