"Aluminum casting. The heads of these heat-treated pistons must be spotted prior to Brinell hardness testing. Young women are employed for this job by a large Midwest aluminum foundry now converted to war production. Aluminum Industries Inc., Cincinnati, Ohio"

Ilargi: Right. So Fannie and Freddie have now been delisted from the New York and Chicago Stock Exchanges. They’ll still be traded though, in the over-the-counter (OTC) market. If any knows of any valid reasons why government entities should be traded at all, never mind very profoundly bankrupt ones, do pray tell. Buying and selling broke government agencies can only be profitable if the taxpayer gets stuck with the difference, as far as I can make out.

Bruce Krasting has noticed that the Fed has moved $4.4 trillion of F&F’s "assets" onto their respective balance sheets. While the two GSE's have not, so far. What's that rumble I hear in the distance? Yes, the Republicans have called for all these "assets" to be put on the government's balance sheet, and they're right of course, that's where they belong. Bank of America has just confessed that they’ve pulled the same Repo 105 stunts that Lehman had, and the SEC is "going after them". Fine, good, though far too late, but what moral standing does a government have that pulls its own versions, and on a massive scale, of Repo 105s?

”Repos are short-term financing arrangements that allow banks to take bigger risks on securities trades. Classifying the transactions as sales instead of borrowings—as in the Repo 105 strategy—allows a bank to take assets off its balance sheet and thus reduce its reported leverage.”, writes Michael Rapaport in the WSJ.

You tell me how that differs from what the US government is doing with Fannie and Freddie. Sure, there's one main difference with Lehman and Bank of America: the scale of creative accounting/fraud. $4.4 trillion is real money. If Washington would do for itself what it pretends to demand from the financial industry, the US would be -technically- broke. But let’s be honest: is it really such a grand idea to keep alive a government and a banking system that can only keep their heads above water by flouting the laws of the land? Is that truly in the best interest of the citizens of the country, or does it in truth only scam those citizens ever more for the benefit of an elite that isn't even clever enough to not lose bigtime at the nation's crap tables?

Fannie Mae, Freddie Mac Debate Starts as Taxpayer Costs Pass $145 Billion[..] Setting aside their occasional animosity, industry and consumer advocates say they share certain core goals on mortgage finance. Banks and builders by and large agree with representatives of home buyers that it’s in all of their interests to have the government continue to promote residential lending by encouraging what Fannie and Freddie have done for decades: buy mortgages and bundle them into securities for sale to investors.

Ilargi: Consumer advocates want the Fannie & Freddie boondoggle to continue? The same consumer who is on the hook for every dollar that is lost through the 95% of home loans that reside with F&F, in a climate in which home prices have already plummeted 30%+, and in which pending home sales were down 30% in May? Doesn't sound to me like those advocates are on the side of the people.

To inject more caution into the system, Washington lobbyists working on housing-finance reform say that mortgage lenders who bundle loans into bonds should contribute to an insurance fund that would be available in case of calamity.

Ilargi: Well, at this point in time, that is as obviously useless as it is too late, isn't it? The losses have already been incurred, and no new insurance scheme would make one iota of difference to those losses. If prices keep on dropping for homes that carry past mortgages, Fannie and Freddie will lose trillions of dollars in taxpayer funds, until they simply implode, causing trillions more in said losses. And the best we can come up with in the face of that is years of talks about reforming the system, talks that will undoubtedly largely be dominated by the same clueless clowns that brought down the system in the first place?

If as a nation that's all you got, it might be a better idea to just close the door, hand the key to Putin, and go live somewhere else. For this is not going to be good enough. It will be for some, of course, but for the people it will be a disaster of proportions the likes of which no-one wishes to ponder.

Fannie and Freddie are the main cause why home prices in the US have risen so high that millions of Americans are being evicted from their homes as we speak simply because they can't afford to live in them anymore. Fannie and Freddie (and the FHFA and FHLB and Ginnie Mae) have been used to guarantee any mortgage at any price and at any liar's conditions, and all at the risk of the American people.

Charles Hugh Smith sums it up very well, read it a few times, I'd recommend, though he's got the timeframe wrong. It's not the con of the decade, it's the largest -financial- con ever perpetrated on the American people since 1776:

The Con of the Decade Part I1. Enable trillions of dollars in mortgages guaranteed to default by packaging unlimited quantities of them into mortgage-backed securities (MBS), creating unlimited demand for fraudulently originated loans.

2. Sell these MBS as "safe" to credulous investors, institutions, town councils in Norway, etc., i.e. "the bezzle" on a global scale.

3. Make huge "side bets" against these doomed mortgages so when they default then the short-side bets generate billions in profits.

4. Leverage each $1 of actual capital into $100 of high-risk bets.

5. Hide the utterly fraudulent bets offshore and/or off-balance sheet (not that the regulators you had muzzled would have noticed anyway).

6. When the longside bets go bad, transfer hundreds of billions of dollars in Federal guarantees, bailouts and backstops into the private hands which made the risky bets, either via direct payments or via proxies like AIG. Enable these private Power Elites to borrow hundreds of billions more from the Treasury/Fed at zero interest.

7. Deposit these funds at the Federal Reserve, where they earn 3-4%. Reap billions in guaranteed income by borrowing Federal money for free and getting paid interest by the Fed.

8. As profits pile up, start buying boatloads of short-term U.S. Treasuries. Now the taxpayers who absorbed the trillions in private losses and who transferred trillions in subsidies, backstops, guarantees, bailouts and loans to private banks and corporations, are now paying interest on the Treasuries their own money purchased for the banks/corporations.

9. Slowly acquire trillions of dollars in Treasuries--not difficult to do as the Federal government is borrowing $1.5 trillion a year.

10. Stop buying Treasuries and dump a boatload onto the market, forcing interest rates to rise as supply of new T-Bills exceeds demand (at least temporarily). Repeat as necessary to double and then triple interest rates paid on Treasuries.

11. Buy hundreds of billions in long-term Treasuries at high rates of interest. As interest rates rise, interest payments dwarf all other Federal spending, forcing extreme cuts in all other government spending.

12. Enjoy the hundreds of billions of dollars in interest payments being paid by taxpayers on Treasuries that were purchased with their money but which are safely in private hands.

Ilargi: There are very few Americans who have any idea how bad the situation is their country is in. With a government that specializes in creative accounting, outright fraud and ties to the financial industry, that shouldn't be a major surprise.

It's still tragic, though.

Fed to GSEs – Put it on the Balance Sheet!

by Bruce Krasting

The June Federal Reserve Quarterly Mortgages Outstanding report contains some interesting information. I’m not quite sure what to make of it. Consider these two slides from the June report on 1st Q mortgage outstandings.

The Federal Reserve has reclassified $4.4 trillion of IOU’s. They have taken them out of the category "Mortgage Pools and Trusts" and put them on the individual Agency’s balance sheet(s). Now consider the March 2010 reports from both Fannie and Freddie. They don’t show the shift in assets from "Guaranteed" to "On the books".

Some thoughts on this.

• This is not a small matter. $4.4 trillion of bookkeeping is involved. This is more than 40% of all individual mortgages. This is a major reclassification.

• In this case I would side with the Fed. All of these dubious assets should be on someone’s balance sheet. But I am stumped as to why the Fed did this without FHFA adjusting its book too.

• The Fed thinks this should be on the Agency’s balance sheets. We all know that Treasury owns the GSEs at this point. That being the case shouldn’t the debts of the Agencies be on the Federal balance sheet? This would put us $3T or so over the debt limit and bankrupt the government on paper. I find it odd that the Fed is pushing this at this time. It works against them.

• This is just an accounting adjustment. But these things do matter. The terms of the Conservatorship require that the GSEs keep their balance sheets below $900 billion. So this accounting adjustment would throw the legal status of the GSEs into question. They would be in material covenant default on the Senior Preferred (Treasury Basura Preff) if this adjustment takes place. Given that all of the other securities of the Agencies are "cross defaulted" this raises the question as to the legal status of all of the publicly traded debt securities of the Agencies. I know Washington did not mean that to happen. But then again, stuff does tend to happen.

• The Fed owns $1.2 Trillion of the former "Trust Securities". Maybe the Fed feels better knowing that these are direct obligations of the GSE’s. I am not sure that makes them more collectible. But in a bankruptcy a senior claim will have a better chance than a subordinated guaranty. In that sense the reclassification puts the Fed in a better creditor position. But really this is all the same pocket, so why would that matter?

• I don’t think that the Fed makes $4 trillion changes in accounting without substantial internal discussion as to the implications. Therefore this is quite deliberate and we should not ignore the significance of it. I’m still wondering what the significance is. I’ll ask the Fed and the FHFA. If they respond, I'll let you know.

Fannie Mae, Freddie Mac Debate Starts as Taxpayer Costs Pass $145 Billion

by Lorraine Woellert and Rich Miller - Bloomberg

As the White House pushed for a Wall Street overhaul this year, Republicans hammered Democrats for ignoring two of the biggest problems in American finance: Fannie Mae and Freddie Mac. The government-backed mortgage giants have cost taxpayers $145 billion and counting. Now, with work on the 2,300-page financial-regulation bill all but complete, the Obama administration will soon turn to revamping the pair of institutions that own more than half of the nation’s $11 trillion in residential mortgages, Bloomberg Businessweek reports in its July 12 issue. The political struggle could be long and bitter.

Some Republicans in Congress contend that killing Fannie and Freddie is the only wise course. President Barack Obama is expected to advocate something closer to the rough consensus for moderate reform that is emerging among Washington lobbyists representing banking, real estate and consumer groups. Fannie and Freddie operated as shareholder-owned corporations that financed home loans with the tacit support of the federal government. When the housing market collapsed, so did Fannie and Freddie. They were formally seized by the Treasury Department in September 2008.

Setting aside their occasional animosity, industry and consumer advocates say they share certain core goals on mortgage finance. Banks and builders by and large agree with representatives of home buyers that it’s in all of their interests to have the government continue to promote residential lending by encouraging what Fannie and Freddie have done for decades: buy mortgages and bundle them into securities for sale to investors.

'Like It Or Not'

When it functions properly, the mortgage-backed securities market generates fresh cash that can be channeled back into additional affordable loans. The challenge is figuring out how to do this without the lax practices and open-ended federal commitment that left taxpayers on the hook for catastrophic losses in 2008. "There will be a government role in the market whether we like it or not," predicts Phillip Swagel, an assistant secretary for economic policy at the Treasury under President George W. Bush.

At the heart of the emerging consensus across industry and consumer lines is the preservation of the 30-year, fixed-rate mortgage. "People regard it as a right as Americans to get a 30-year, fixed-rate loan," says Susan Woodward, former chief economist at the Housing and Urban Development Department and a founder of Sand Hill Econometrics, a research firm in Palo Alto, California.

Insurance Fund

To inject more caution into the system, Washington lobbyists working on housing-finance reform say that mortgage lenders who bundle loans into bonds should contribute to an insurance fund that would be available in case of calamity. The fund could be modeled on the Federal Deposit Insurance Corp., which protects consumers from bank failures with a fund financed by lending institutions.

Another step that would limit taxpayer exposure could be mandating that only the safest loans -- such as those that include a down payment by the borrower and carry private mortgage insurance -- would be bundled into government- guaranteed bonds marketed to investors. It will be important to strike a balance that doesn’t stifle innovation, argues Edward J. DeMarco, acting director of the Federal Housing Finance Agency, which oversees Fannie and Freddie. "We’ve got over 50 million homeowners with mortgages, and they represent all kinds of different financial conditions," DeMarco adds. "We need to be a little bit careful about shoe- horning the entire country into one particular mortgage type."

Clearer Role

The government’s role in the new system ought to be a lot clearer than it was in the past, according to industry and consumer advocates. Federal officials traditionally insisted that they had no legal obligation to stand behind Fannie and Freddie, even though investors assumed they would. When the market imploded, the Treasury stepped in, despite past disclaimers. Executives with the Mortgage Bankers Association and the National Association of Realtors say that mortgage-backed securities that meet government standards should receive an explicit guarantee. Without it, they say, investors will balk at buying mortgage bonds, especially in times of economic distress.

Government Backing

"To have long-term investment in a 30-year fixed mortgage, you have to have some confidence that there is government backing," says Paul Leonard, a lobbyist for the Financial Services Roundtable, whose members include JPMorgan Chase & Co., Wells Fargo & Co., Bank of America Corp., and BlackRock Inc. These industry-inspired proposals are less radical than some ideas emanating from Congress. During debate over the financial-services overhaul, Republicans offered dozens of amendments to abolish Fannie and Freddie, only to be rebuffed by Democrats.

Led by Senator John McCain of Arizona and Representative Jeb Hensarling of Texas, Republicans say that Fannie’s and Freddie’s competing missions -- to serve shareholders and promote home-ownership among low-income households -- drove the financial institutions to ruin. The Republicans want the government to abandon any role in housing finance. The Obama Administration and Democrats, including House Financial Services Chairman Barney Frank of Massachusetts, insist that the government continue to promote homeownership. "We should not compromise any of our core policy goals in the decisions we make in structuring our housing finance system," Housing and Urban Development Secretary Shaun Donovan told Frank’s committee in April.

One thing is for sure: The White House will not lack for advice on the future of Fannie, Freddie, and the housing market. "Everybody’s telling them, ‘Don’t do anything stupid,’" says Barry Zigas, director of housing policy for the Consumer Federation of America. "It’s easy to forget that this system worked awfully well for 75 years." That is, until it didn’t.

Fannie, Freddie Dropped from New York Stock Exchange

by Diana Golobay - Housingwire

Fannie Mae and Freddie Mac common stock was removed today from the New York Stock Exchange (NYSE). The Federal Housing Finance Agency (FHFA) directed the government-sponsored enterprises (GSEs) in June to de-list from the NYSE and any other national securities exchange. The direction came after the price of their common stock hovered near the minimum average closing price of $1 for more than 30 days for most months since the conservatorship took effect in September 2008.

Both GSEs begin trading in the over-the-counter (OTC) market today. Their ticker symbols on HousingWire's industry tracker were replaced with private mortgage insurers, PMI Mortgage Insurance Co. and Mortgage Guaranty Insurance Corp. . Fannie said its common stock will begin trading on the OTC Bulletin Board — which tracks quote, price and volume information in OTC securities — under the symbol "FNMA".

The NYSE and the Chicago Stock Exchange suspended trading of Fannie's common and preferred stock prior to market open today. Fannie had been listed on the NYSE under the symbol "FNM".

As of today, Fannie will begin trading under new symbols. Freddie said shares of its common stock and the 20 classes of its preferred stock that previously traded on the NYSE also begin trading today on the OTC market. Previously trading under the symbol "FRE", Freddie's common stock will now trade under "FMCC".

The company's preferred stock will also trade under new symbols on the OTC market: "The transition to the OTC market will not affect the company's obligation to file periodic and certain other reports with the SEC under applicable federal securities laws," Freddie said in a statement.

Pending Homes Sales Crash in a Record Fall to a Record Low as Tax Break Expires

by Michael David White

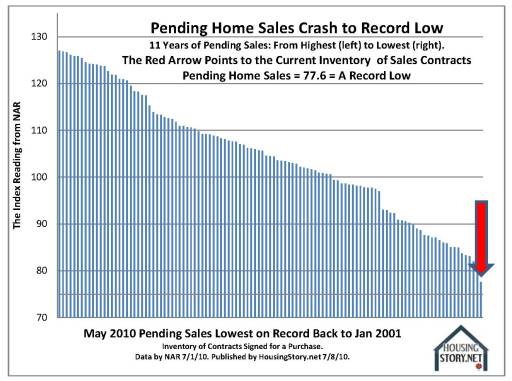

The Index of pending home sales fell a record 30% in May to a record-low reading of 77.6 — two huge pessimistic indicators of future prices nationwide. Yet the combination of two record negatives went barely reported when the stats were announced last week.

So here’s the news for you now, a week late, but new to the marketplace of ideas. Pending-home sales now stand below the worst numbers we have seen since the housing crash started in 2006. The rubber bands and duct tape are breaking apart. Presume the fix of a fall is in.

Take a look at the three charts below and judge for yourself how important the facts are which the National Association of Realtors (NAR) announced last Thursday (July 1st).

The oversight by major news outlets — snubbing record negatives — is egregious by virtue of its ignorance of the expiration of the free-down-payment program. The pending-home-sales stat gave us our first view of buyer demand for housing without the hugely popular prop from the federal government.

***

Speculation has run rampant as commentators have wondered about the direction of prices as government support starts to fall away.

The future direction of real estate prices is a major obsession of almost all economy watchers as the monthly bill for shelter overshadows others, as the value of homes is a predominant factor of family wealth, and because the banking sector has huge investments based upon residential property.

"If you’re looking for a silver lining in housing, you aren’t going to find it here," Mike Larson of Weiss Research said. "Demand has fallen off a cliff in the wake of the tax credit expiration, with pending sales falling by the biggest margin ever to the lowest level ever."

It is likely that Mr. Larson’s comment drew attention to the two new record lows. Had he remained silent, these highly relevant facts likely would have gone unreported completely. Of the 15 major outlets we reviewed, four actually did learn about the two record negatives, but they didn’t understand the meaning of it.

The statement by NAR announcing pending-home sales makes no reference to either the record fall or the record new low. If their intention was to hide bad news, they got away with murder. Let’s show you the fools who fell for it.

Among the outlets who failed to uncover either of the two record negative stats are Barrons, Dow Jones, The Financial Times, Fox Business, The Los Angeles Times, and Marketwatch.

I reviewed stories on pending-home sales by 15 leading news outlets – in addition to the flunking students mentioned immediately above, I also read Atlaticwire.com, BBC News, Bloomberg, Boston.com, CNBC, Investors’ Business Daily, New York Times, Reuters, US News — and the only difference between the outlets was the extent to which they screwed up this critical epicenter-type data set (Please see the graphic nearby depicting the various degrees of incompetence.).The future direction of housing prices are arguably the most critical factor in the most critical nation in the most critical financial crisis since the Great Depression. The signs are not hunky-dory in this market. The May pending-sale figures may in retrospect serve as a Rosetta Stone: A perfect guide to the true fortunes of residential real estate. Just in case you have forgotten, we are in one hell of a market, and Mom did not tell us this is what would happen when we grow up.

***

HousingStory.net estimates current inventory for sale of 3.9 million is 1.2 million units higher than it should be, and not too far away from the record high 4.5 million. Inventory stands at 8.3 months of sales, but it should be at 5.8 months.

Fourteen percent of mortgages are behind on payments — about 7.7 million borrowers or, more starkly, one in seven. A record 4.63 percent of borrowers are in foreclosure. Approximately 13 million homeowners have no equity or negative equity. They would make nothing from the sale of their house if they could sell it. Or they would lose a little or a lot. Thus do we have the phenomena of strategic default — now as common as no-money-down mortgages during the boom.

***

We are in a pause of a tectonic shift of plates. Prices have been flat since August 2009, but are down 30% from their peak. The fall of 30% was almost completely discounted as impossible prior to its occurrence.

My speculation is that the fate of bubble-mortgage debt remains as our key obstacle blocking recovery (Unbelievers should rent the Godzilla movie "Eating the Lost Decades of Japan" for further enlightenment.). Total mortgage balances remain almost unchanged from the peak of the bubble –$11.68 trillion today versus $11.95 trillion at the peak (see chart below).

The data released last week on pending home sales and the dismal record of reporting on that data proves that breaking news business journalism fails even in surface scratching. The cows just want to feed on the grass in front of them and go on to the next field.

The smart investor is going to look at these charts on pending-home sales and have a real advantage over the common media consumer. Readers of my work know I have found pessimistic facts easy to find. The pending-sales figures are a dramatic concurrence — a record fall and a record low.

So I will give you my opinion: All hell has broken loose all over again in real estate. Don’t buy a home. Sell one.

***

Borrowers Hit New Home-Loan Hurdles

by James R. Hagerty and Nick Timiraos - Wall Street Journal

Dennis Davis has a nearly perfect credit score, equity in his home, considerable savings and a solid pension plan. But Mr. Davis recently found that his lender didn't want to refinance his mortgage. The problem? Mr. Davis's income-tax return showed he had taken a loss on an investment he made in a small, family-owned business. That was enough to raise doubts about his otherwise strong financial condition.

Three years after the onset of the mortgage crisis, lenders continue to tighten credit standards. The initial moves were a natural reaction for a business badly burned by rising delinquencies and defaults. But conditions are now so tight that lenders are frustrating borrowers who have enviable financial situations but still can't easily satisfy lenders' rigid checklists. "The pendulum may have swung too far the other way," Scott Anderson, a senior economist at Wells Fargo Securities, said in a report last month.

Some analysts thought that by this point in the business cycle, lenders would have started to relax credit conditions slightly after clamping down on the risky bubble-era practices. Instead, the screws are still tightening. That is partly because lenders are taking every precaution to avoid being forced to buy back loans from mortgage investors Fannie Mae and Freddie Mac in the event of default. When a borrower defaults, Fannie and Freddie typically buy the loan out of the mortgage-security pool and pursue a workout or foreclosure. But they can force lenders to repurchase loans when they find flaws in the way they were underwritten. Repurchases were a minor nuisance when defaults were low but have escalated over the past year.Fannie and Freddie have already tightened their standards: Borrowers with credit scores above 720 accounted for 85% of all loans purchased by Fannie and Freddie last year. But banks are being even more stringent to prevent repurchases and want several years of pay stubs, tax returns and other paperwork from potential borrowers.

During the first quarter of this year, Freddie kicked $1.3 billion in loans back to lenders, up from $800 million during the year-earlier period. At Fannie, repurchase requests jumped to $1.8 billion from $1.1 billion one year earlier. To be sure, the government has taken steps to keep mortgage spigots open. The Federal Housing Administration allows down payments as low as 3.5%. Borrowers who have received standard paychecks and have uncomplicated finances generally aren't getting tripped up. But others face hurdles. Self-employed borrowers, for example, document their incomes with tax returns that include business-related write-offs, which might understate their cash flow.

Such caution is helping to hold down lending despite the lowest interest rates in more than five decades. To revive the economy, "we need the banks back in lending," said Anthony Sanders, a finance professor at George Mason University. "We're just kind of stuck in a rut." Mr. Davis thought he was exactly the kind of customer lenders love. "I've never had a bounced check or a late payment in my life," Mr. Davis said. He hoped to lower his interest rate to less than 5% from the current 6% through a refinancing. But his mortgage broker, Steve Walsh of Scout Mortgage in Scottsdale, Ariz., said SunTrust Banks Inc. turned down the application, citing the investment-related loss, which Mr. Davis saw as a minor setback rather than a threat to his financial health. SunTrust said it doesn't comment on individual borrowers' situations.

Rather than continuing to shop around for a refinancing, Mr. Davis has decided to cash in some of his investments and pay off the mortgage. People with complicated financial situations can still find some willing lenders, but "it takes more persistence than most people want to put forth," said Brian Berg, a loan officer at Priority Financial Network, a Calabasas, Calif., mortgage firm.

Recently, Mr. Berg arranged a refinancing for a borrower with a very high credit score and lots of home equity and debt payments totaling just 19% of pretax income. But Mr. Berg said the lender was worried about a credit report showing a $14 missed payment to a credit-card company in 2001. The lender insisted on proof the money had been paid, which Mr. Berg said was impossible to get. "Who cares?" he said. "It's nine years ago, and it's $14." He appeased the lender by having the borrower write a $14 check, though no one knew where to send it.

Pete Ogilvie, a mortgage broker in Santa Cruz, Calif., hasn't found a bank that will refinance a $250,000 loan on a $1 million property for a borrower with more than $200,000 a year in income and a high credit score. Banks balked because the borrower, a technology executive, was out of work for nearly a year starting in 2008. "We're going to see that for an awful lot of people whose business disappeared unless the banks learn some flexibility," said Mr. Ogilvie.

In June, Fannie put into effect a "loan-quality initiative" that requires more borrower information to ensure that Fannie ends up buying the same loan that it originally agreed to purchase. The effort has led lenders to pull a second credit report before a loan closes, and brokers say consumers should be very careful not to run up credit-card bills before closing on a mortgage. "If there are inquiries on your report that you're shopping for a car, that's something that has to be answered for," said Dan Green, a Cincinnati broker. "It can delay a closing and, in some cases, it'll kill a closing."

US consumer borrowing down sharply in May

by Martin Crutsinger - AP

Consumer borrowing fell again in May, more evidence that Americans remain jittery over their finances and the durability of the economic recovery. The Federal Reserve said Thursday that borrowing dropped by $9.1 billion in May. It also said borrowing declined by $14.9 billion in April, revising an initial estimate that showed a gain of $995 million for the month. Consumer borrowing has fallen in 15 of the past 16 months as households have struggled with uncertain job prospects and battered finances following a deep recession.

In May, consumers borrowed less on their credit cards and took out fewer auto loans. Credit card borrowing has fallen for 20 straight months. Many consumers, confronted by a deep recession and a weak job market, have tried to get their household finances in better shape by reducing their debt levels. In addition, banks during the recession have imposed tighter lending standards in an effort to cope with their rising levels of bad loans.

Analysts said the significant downward revision to April borrowing and May's decline show that consumers remain leery about taking on new debt. "There is simply no way to spin this data, nor the past few months, as anything other than a confirmation that the consumer has not come roaring back," said Dan Greenhaus, chief economic strategist at Miller Tabak in New York. "The consumer remains quite stressed ... with income growth relatively muted and labor improvements few and far between."

For years, economists worried about a low personal savings rate. But now they fear that sustained declines in borrowing could hamper overall economic growth because it will mean less consumer demand. Consumer spending accounts for 70 percent of total economic activity. The drop in consumer credit in May pushed total consumer borrowing down to $2.42 trillion at an annual rate. The Fed's credit report covers credit card debt, auto loans and other debt not secured by real estate. It does not cover home mortgages or home equity lines of credit.

The Con of the Decade Part I

by Charles Hugh Smith - Of two minds

The con of the decade (Part I) involves the transfer of private debt to the public (the marks), who then pays interest forever to the con artists.

I've laid out the Con of the Decade (Part I) in outline form:

1. Enable trillions of dollars in mortgages guaranteed to default by packaging unlimited quantities of them into mortgage-backed securities (MBS), creating umlimited demand for fraudulently originated loans.

2. Sell these MBS as "safe" to credulous investors, institutions, town councils in Norway, etc., i.e. "the bezzle" on a global scale.

3. Make huge "side bets" against these doomed mortgages so when they default then the short-side bets generate billions in profits.

4. Leverage each $1 of actual capital into $100 of high-risk bets.

5. Hide the utterly fraudulent bets offshore and/or off-balance sheet (not that the regulators you had muzzled would have noticed anyway).

6. When the longside bets go bad, transfer hundreds of billions of dollars in Federal guarantees, bailouts and backstops into the private hands which made the risky bets, either via direct payments or via proxies like AIG. Enable these private Power Elites to borrow hundreds of billions more from the Treasury/Fed at zero interest.

7. Deposit these funds at the Federal Reserve, where they earn 3-4%. Reap billions in guaranteed income by borrowing Federal money for free and getting paid interest by the Fed.

8. As profits pile up, start buying boatloads of short-term U.S. Treasuries. Now the taxpayers who absorbed the trillions in private losses and who transferred trillions in subsidies, backstops, guarantees, bailouts and loans to private banks and corporations, are now paying interest on the Treasuries their own money purchased for the banks/corporations.

9. Slowly acquire trillions of dollars in Treasuries--not difficult to do as the Federal government is borrowing $1.5 trillion a year.

10. Stop buying Treasuries and dump a boatload onto the market, forcing interest rates to rise as supply of new T-Bills exceeds demand (at least temporarily). Repeat as necessary to double and then triple interest rates paid on Treasuries.

11. Buy hundreds of billions in long-term Treasuries at high rates of interest. As interest rates rise, interest payments dwarf all other Federal spending, forcing extreme cuts in all other government spending.

12. Enjoy the hundreds of billions of dollars in interest payments being paid by taxpayers on Treasuries that were purchased with their money but which are safely in private hands.Since the Federal government could potentially inflate away these trillions in Treasuries, buy enough elected officials to force austerity so inflation remains tame. In essence, these private banks and corporations now own the revenue stream of the Federal government and its taxpayers. Neat con, and the marks will never understand how "saving our financial system" led to their servitude to the very interests they bailed out.

The circle is now complete: in "saving our financial system," the public borrowed trillions and transferred the money to private Power Elites, who then buy the public debt with the money swindled out of the taxpayer. Then the taxpayers transfer more wealth every year to the Power Elites/Plutocracy in the form of interest on the Treasury debt. The Power Elites will own the debt that was taken on to bail them out of bad private bets: this is the culmination of privatized gains, socialized risk.

In effect, it's a Third World/colonial scam on a gigantic scale: plunder the public treasury, then buy the debt which was borrowed and transferred to your pockets. You are buying the country with money you borrowed from its taxpayers. No despot could do better.

The Con of the Decade Part I

by Charles Hugh Smith - Of two minds

The con of the decade (Part II) involves sheltering the Power Elites' income while raising taxes on the debt-serfs to pay the interest owed the Power Elites.

The Con of the Decade (Part II) meshes neatly with the first Con of the Decade. Yesterday I described how the financial Plutocracy can transfer ownership of the Federal government's income stream via using the taxpayer's money to buy the debt that the taxpayers borrowed to bail out the Plutocracy.

In order for the con to work, however, the Power Elites and their politico toadies in Congress, the Treasury and the Fed must convince the peasantry that low tax rates on unearned income are not just "free market capitalism at its best" but that they are also "what the country needs to get moving again."

The first step of the con was successfully fobbed off on the peasantry in 2001: lower the taxes paid by the most productive peasants marginally while massively lowering the effective taxes paid by the financial Plutocracy.

One Year Later, No Sign of Improvement in America's Income Inequality Problem:Income inequality has grown massively since 2000. According to Harvard Magazine, 66% of 2001-2007's income growth went to the top 1% of Americans, while the other 99% of the population got a measly 6% increase. How is this possible? One thing to consider is that in 2001, George W. Bush cut $1.3 trillion in taxes, and 32.6% of the cut went to the top 1%. Another factor is Bush's decision to increase the national debt from $5 trillion to $11 trillion. The combination of increased government spending and lower taxes helped the top 1% considerably.

The second part of the con is to mask much of the Power Elites' income streams behind tax shelters and other gaming-of-the-system so the advertised rate appears high to the peasantry but the effective rate paid on total income is much much lower.

The tax shelters are so numerous and so effective that it takes thousands of pages of tax codes and armies of toadies to pursue them all: family trusts, oil depletion allowances, tax-free bonds and of course special one-off tax breaks arranged by "captured" elected officials.

Step three is to convince the peasantry that $600 in unearned income (capital gains) should be taxed in the same way as $600 million. The entire key to the U.S. tax code is to tax earned income heavily but tax unearned income (the majority of the Plutocracy's income is of course unearned) not at all or very lightly.

In a system which rewarded productive work and provided disincentives to rampant speculation and fraud, the opposite would hold: unearned income would be taxed at much higher rates than earned income, which would be taxed lightly, especially at household incomes below $100,000.

If the goal were to encourage "investing" while reining in the sort of speculations which "earn" hedge fund managers $600 million each (no typo, that was the average of the top 10 hedgies' personal take of their funds gains), then all unearned income (interest, dividends, capital gains, rents from property, oil wells, etc.) up to $6,000 a year would be free--no tax. Unearned income between $6,000 and $60,000 would be taxed at 20%, roughly half the top rate for earned income. This would leave 95% of U.S. households properly encouraged to invest via low tax rates.

Above $60,000, then unearned income would be taxed the same as earned income, and above $1 million (the top 1/10 of 1% of households) then it would be taxed at 50%. Above $10 million, it would be taxed at 60%. Such a system would offer disincentives to the speculative hauls made by the top 1/10 of 1% while encouraging investing in the lower 99%.

Could such a system actually be passed into law and enforced by a captured, toady bureaucracy and Congress? Of course not. But it is still a worthy exercise to take apart the rationalizations being offered to justify rampant speculative looting, collusion, corruption and fraud.

The last step of the con is to raise taxes on the productive peasantry to provide the revenues needed to pay the Plutocracy its interest on Treasuries. If the "Bush tax cuts" are repealed, the actual effective rates paid on unearned income will remain half (20%) of the rates on earned income (wages, salaries, profits earned from small business, etc.) which are roughly 40% at higher income levels.

The financial Plutocracy will champion the need to rein in Federal debt, now that they have raised the debt via plundering the public coffers and extended ownership over that debt.

Now the con boils down to insuring the peasantry pay enough taxes to pay the interest on the Federal debt--interest which is sure to rise considerably. The 1% T-Bill rates were just part of the con to convince the peasantry that trillions of dollars could be borrowed "with no consequences."Those rates will steadily rise once the financial Power Elites own enough of the Treasury debt. Then the game plan will be to lock in handsome returns on long-term Treasuries, and command the toady politicos to support "austerity."

The austerity will not extend to the financial Elites, of course. That's the whole purpose of the con. "Some are more equal than others," indeed.

Prechter says Dow could fall to 1,000

by John Parry - Reuters

Longtime technical analyst Robert Prechter said on Tuesday he expects that as the U.S. economy sinks into a deflationary depression stocks will plunge. The Dow Jones industrial average .DJI stock index could fall to between about 1,000 and 3,000 points over the next five to seven years, he said in a telephone interview. The Dow was trading at 9,754 in early afternoon on Tuesday. "It is very clear there is substantial stock market risk," said Prechter, who urges investors to put their money in cash proxies such as safe-haven U.S. Treasury bills instead.

Prechter is known for his very bearish views on the economy and also for forecasting a big bull market in stocks in 1982 and for getting out before the 1987 market crash. Over the near term, the dollar will remain under pressure against the euro and against the safe-haven Swiss franc, he said.

In early June, Prechter said the euro was about to embark on a near-term rebound of about 10 percent over two or three months because technical indicators showed that amid the euro zone sovereign debt crisis, investors had become overly bearish on that currency. Prechter reiterated that forecast on Tuesday, saying that the euro will continue firming for about another two months, until it has gained about 10 percent. In the past month, the euro has gained about 6 percent against the dollar.

But because Prechter expects that both the euro-zone and the U.S. economies will experience deflation, he prefers investing in the classic safe-haven currency, the Swiss franc. He forecast that the dollar could weaken to parity against the Swiss franc over the next few months. On Tuesday, the dollar was buying 1.0579 Swiss francs. "If you are betting against the dollar, the Swiss franc is a better place to go (than the euro)," Prechter said.

Recent data have shown the pace of U.S. economic growth is decelerating, with housing turning especially weak. "U.S. house prices are about half way down in their bear market," said Prechter, adding that on aggregate, U.S. house prices have fallen about 40 percent from the peak.

Prechter, the president of research company Elliott Wave International in Gainesville, Georgia, is also known for his 2002 book, "Conquer the Crash," which warned about the huge credit bubble that burst a few years later. As companies struggle in an economy that Prechter expects to become increasingly gloomy, he expects junk bond yields to continue widening over Treasuries. High-yield corporate bond spreads have widened to more than 700 basis points now from about 550 basis points in late April, according to Bank of America Merrill Lynch data.

"We think we are back in a widening spread trend between reliable debt and risky debt," he said. "That's a safer bet than forecasting interest rates per se," Prechter added. The bear market in crude oil, which started after prices hit a record $147 per barrel in summer 2008, is not over, Prechter said. Oil should fall below its December 2008 lows of about $32 per barrel, he added.

Illinois Readies $900 Million Debt Sale Amid Fiscal Woes

by Kelly Nolan - Wall Street Journal

Illinois is expected to sell $900 million in taxable municipal bonds in the coming week, just days after its comptroller said the state finished its fiscal year on June 30 in the worst cash position in its nearly 200-year history. The state is scheduled to sell the debt on Wednesday, having moved the date back a few weeks to let potential investors absorb the state's approved general-fund budget for fiscal 2011. The $24.9 billion state budget, which Gov. Pat Quinn signed on July 1, includes about $1.4 billion in cuts. It relies in part on borrowing to help cover what Comptroller Daniel Hynes estimates to be as much as $6 billion in unpaid bills from the past fiscal year. Illinois will also shuffle funds among departments to whittle down outstanding bills.

"We're going to have to put a tremendous focus on paying last year's obligations over the next six months with some exceptions," Mr. Hynes said in an interview. One exception is debt service, 2011 obligations that he described as "our top [spending] priority." Mr. Hynes said Illinois's new budget doesn't solve the state's financial problems. "It really just defers the problems and tries to allow the state to survive," he said. Illinois capital-markets director John Sinsheimer said the fiscal 2011 budget reflects the condition of the state, and potential investors should view it as a step in the right direction. "What I have told investors is that it took 15 years to create these problems," he said in an interview. "It's going to take three or four years to ... correct them."

Mr. Sinsheimer said there should be room for the market to absorb next week's $900 million sale of Build America Bonds, as well as nearly $3 billion in additional debt that the state plans to sell later this year through two separate sales. Pending legislative approval, Illinois may also issue a $3.7 billion pension bond late in the year, he said. Illinois has already issued about $7.8 billion in debt in 2010, most of it taxable, according to Thomson Reuters. Build America Bonds pay more interest than traditional municipal bonds, but unlike munis the returns on BABs are taxable. The higher payout makes BABs more attractive to investors who don't pay U.S. taxes, such as foreign investors and domestic nonprofits like university endowments.

Mr. Sinsheimer said European and Asian investors reacted positively to a marketing road show last month. Foreign investors have bought some Illinois debt in the past, and the state is looking to develop and enhance that relationship, Mr. Sinsheimer said. "They understand and appreciate the efforts being made to address the challenges" Illinois faces, he said. Some potential domestic investors, however, didn't seem as enthusiastic about Illinois's coming Build America Bonds sale, on which Citigroup is the lead book runner. They say they would shy away from the deal. given the state's financial woes.

Richard Saperstein, managing director and principal of Treasury Partners, a division of HighTower Securities in New York, said Illinois needs "a permanent solution" to its budget problems. "Without a permanent increase in revenues and a meaningful reduction in expenditures," Mr. Saperstein said, "they are not going to eliminate their ongoing financial problems." It is likely that Illinois may have to pay a premium on its Build America Bond sale, said Judy Wesalo Temel, principal and director of credit research at Samson Capital Advisors in New York. In addition to budgetary woes, investors also fret over the state's significantly underfunded pension, she said.

The state's relatively lower credit ratings mightn't help either. Along with California, Illinois is one of the lowest-rated U.S. states. Moody's Investors Service and Standard & Poor's give it the fifth-highest of 10 investment-grade ratings, at A1 and A-plus, respectively, while Fitch rates it a notch lower, at single-A. Price whispers on the coming BAB sale have the longest maturity in 2035 potentially going for around 3.40 percentage points, give or take 0.10 percentage point in either direction, over the 4.625% Treasury maturing in February 2040.

40,000 Illinois State Workers To Get 14% Payraises

by Mike Flannery, FOX Chicago News

More than 40,000 unionized state workers got a pay raise last Thursday, bringing to 7 percent the amount they're gotten since last year. These same state employees are in line for another 7 percent by next July 1, all at a cost of a half-billion tax dollars a year. It's more than the virtually bankrupt state can afford, and some Republican lawmakers say the raises need to be rolled back. "I'm outraged," said State Senate Minority Leader Christine Radogno. "It's very difficult to buy this rhetoric that, 'We need to borrow, we need increased revenue,' when these kind of poor management decisions are going on."

For his part, Governor Quinn said the 14 percent pay raise deal was cut by then-Governor Rod Blagojevich in 2008. Quinn did persuade the AFSCME union last year to postpone 2 percent of the pay raise until 2011, the first time AFSCME had ever consented to even a temporary deferment of a pay raise. Quinn and the union also agreed to find $70 million in savings in health care costs. Employees agreed to pay higher health insurance premiums and higher co-pays for health care. "For two years that I've been governor, preparing a budget, the General Assembly doesn't want to do anything very challenging on this area," said Quinn. "They defer everything to the governor. My job is to get the job done for the public. I think we've done that, in as positive a way as possible, under the circumstance."

AFSCME said it's outrageous that Republicans like Radogno have "done nothing to help solve the state's financial problems." The union argues that the state needs to raise taxes. AFSCME's chief negotiator in Illinois, Union International Vice President Henry L. Bayer, responded to Radogno. "I'm outraged Sen. Radogno and her fellow Republicans have done nothing to help solve the state's financial problem," Bayer said. " Where would she cut $9 billion? It can't be done with just cuts. We need more revenue." Bayer and other union leaders strongly support tax increases.

A spokesman for AFSCME said Fox Chicago News and critics of the wage increases had taken them out of context. He noted that the wage increases, which because of compounding are actually larger than 14 percent, come over the life of a four-year union contract. "Fox neglected to mention that Illinois has the nation's fewest state employees per capita. Manufactured controversies like this misinform the public and insult the men and women of state government who care for the disabled, aid the unemployed, prevent child abuse, analyze crime-scene evidence, keep our prisons safe, and perform all the other essential services Illinois residents rely on every day," the AFSCME spokesman said.

The contractual raises are now legally locked in. Any roll back could come only with the union's agreement. Bayer has said that would require a vote of the rank and file state workers AFSCME represents. A threat of massive layoffs would be the most likely source of leverage for any future state official wanting to re-open the union contract.

Texas Budget Mess Now as Bad as California's

by Dave Mann - Texas Observer

It’s come to this: The Texas budget outlook has become so bleak that we’re comparing rather favorably to the one state where balanced budgeting goes to die. People, our budget deficit is now as bad as California’s. Yes, the over-spending, over-regulated capital of hippiedom now has a state fiscal outlook on par with the Lone Star State.

That fact may not sit well with some people—especially in the governor’s office, which loves to bash California and never misses an opportunity to point out how Texas’ low-tax, business-friendly model has led to a more robust economy and sound state finances. When California faced a $60 billion deficit last year—a shortfall that was bigger than the entire budget of most states—you could almost hear the chortling from the Texas governor’s office. It seemed a handy example of what happens when you put big-spending liberals in charge.

It wasn’t that simple, though. The causes of California’s problems—and Texas’ lack thereof—were varied and complex. And now the states’ budget deficits are looking very similar.

Texas: $18 billion shortfall (estimated) or about 20 percent of state spending.

California: $19.1 billion shortfall (official estimate) or about 20 percent of state spending.

The numbers match up pretty neatly.

A couple of caveats: Texas—as you probably know—budgets in two-year cycles. If the budget gap does turn out to be $18 billion (and we won’t have an official number until early next year), that would represent about 20 percent of the $87 billion in state funds that Texas allocated for 2010-2011. California budgets one year at time. But the state spends about double what Texas does. So a $19.1 billion budget gap represents about 20 percent of the roughly $83 billion California will spend this year from its general fund.

Another caveat: I found several different figures for California’s state spending (not counting federal funds). The governor’s office budget proposal seems to show $123 billion in state spending. But the Wall Street Journal and Los Angeles Times both reported about $83 billion, so I’m going with that number.

It’s also worth noting that even though Texas’ budget deficit is very similar to California’s, the Lone Star State is still in a better fiscal position. Texas has better credit ratings and nearly $9 billion banked in the Rainy Day Fund. We also haven’t yet sliced our budget by about a quarter, as California did last year. (And California is losing $52 million a day because state leaders missed their deadline to pass a budget and still can’t agree.)

But if our budget deficits persist, we could very well end up in the same position. The days when Texas leaders could mock California—or at least its budget mess—appear to be over.

Bank of America Admits Hiding Debt

by Michael Rapoport - Wall Street Journal

Bank of America Corp. admitted to making six transactions that incorrectly hid from view billions of dollars of debt, following a bid to cut the size of a unit's balance sheet and meet internal financial targets. The disclosure, made in a letter to the Securities and Exchange Commission, comes as the agency prepares to unveil the results of an inquiry into banks' accounting for borrowing deals known as repurchase agreements, or "repos."

BofA's letter was sent in April in response to the inquiry, but this is the first time the details of the six trades in question have been disclosed. The bank had acknowledged in its last quarterly report that its accounting for the transactions, made at the ends of quarters from 2007 to 2009, was incorrect. The bank's disclosure also suggests the trades may be an example of end-of-quarter "window dressing" on Wall Street, in which banks temporarily shed debt just before reporting their finances to the public. The practice, which The Wall Street Journal has uncovered in a series of articles, suggests the banks are carrying more risk most of the time than their investors or customers can easily see, and then juggling it during quarter-end reporting of financials.

Window dressing isn't illegal in itself. But intentionally masking debt to deceive investors violates regulatory guidelines. BofA said its incorrect accounting wasn't intentional. Apart from requiring more disclosure about the bank's repo accounting, the SEC hasn't taken any action against BofA over the matter. The fact that the letter was released suggests the SEC has concluded its review. Though much smaller in scope, Bank of America's accounting of the six trades is similar to what a bankruptcy-court examiner said Lehman Brothers Holdings Inc. did to make its balance sheet look better before it filed for bankruptcy in 2008. Lehman used a strategy dubbed "Repo 105" that helped the Wall Street firm move $50 billion in assets off its balance sheet, the examiner said in March.

Following the Lehman examiner's report and the Journal disclosures, the SEC said it is considering stricter disclosure and a clearer rationale from firms about quarter-end borrowing activities. The SEC review on repo activity could be released as early as this coming week. A spokesman said Friday that the SEC will release the banks' responses after the agency completes its review.

In its letter to the SEC, which has been posted as a regulatory filing, BofA disclosed details of how it erroneously classified some short-term repos as sales when they should have been classified as borrowings over the past few years. Repos are short-term financing arrangements that allow banks to take bigger risks on securities trades. Classifying the transactions as sales instead of borrowings—as in the Repo 105 strategy—allows a bank to take assets off its balance sheet and thus reduce its reported leverage. In the letter, the bank said its incorrect accounting for the six trades wasn't intentional. "We do not deliberately structure transactions that are economically disadvantageous simply for the purpose of recording a sale or reducing recorded liabilities."

The bank also said, "We believe that our efforts to manage the size of our balance sheet are appropriate and our policies are consistent with all applicable accounting and legal requirements." The intent of the transactions, it said, "was to reduce the specific business unit's balance sheet to meet [the bank's] internal quarter-end limits for balance sheet capacity." The classifications involved as much as $10.7 billion in repos, a relatively small amount for the bank, which has $2.3 trillion in total assets.

The six transactions are known as "dollar roll" trades, executed by Bank of America's investment-banking and capital-markets unit with an unidentified trading partner at the ends of fiscal quarters from 2007 to 2009. Dollar rolls are deals in which mortgage-backed securities are transferred to a trading partner with a simultaneous agreement to repurchase similar securities from the same partner soon thereafter. The practice amounts to a bank renting out its balance sheet for short periods; the bank gets fees, and the client on the other end of the trade gets short-term cash.

BofA says it designed the trades so that the securities coming back to BofA would be similar to but not "substantially the same" as those it transferred out. That would require the trades to be treated as sales that would remove assets from the unit's balance sheet. But the securities that came back to Bank of America were in fact "substantially the same"—the same type, for instance, with the same guarantor and coupon. That means they should have been accounted for not as sales, but as borrowings that wouldn't have reduced the unit's balance sheet. BofA said the accounting error was immaterial to its financial results and had no effect on its earnings.

BofA says it hasn't entered into such trades since early 2009. The errors in accounting for the trades resulted from a deficiency in internal controls, according to a separate letter the bank sent the SEC. The bank says it since has strengthened its controls and re-emphasized to its staff the need to "escalate" consideration of any unusual balance-sheet changes, in particular if they result from "non-normal" transactions near the end of a quarter.

The SEC sent letters in March to 19 large financial institutions asking about their repo accounting. SEC Chief Accountant James Kroeker said in May that the inquiry hadn't found any widespread inappropriate practices. But Mr. Kroeker said the SEC had asked several companies to provide more disclosure about their repo accounting in their securities filings. At least three banks, including BofA, already have done so.

Regulators Close Four More Banks

by AP

Regulators shut down banks in Maryland, Oklahoma and New York on Friday, lifting to 90 the number of bank failures this year. The Federal Deposit Insurance Corporation said it was appointed receiver of Bay National Bank and Ideal Federal Savings Bank, both based in Baltimore. Bay National Bank had $282.2 million in assets and $276.1 million in deposits as of March 31. Ideal Federal Savings Bank had $6.3 million in assets and $5.8 million in deposits. The agency also took over Home National Bank in Blackwell, Okla., with $644.5 million in assets and $560.7 million in deposits, and USA Bank in Port Chester, N.Y., with $193.3 million in assets and $189.9 million in deposits.

Bay National Bank’s deposits will be assumed by Bay Bank, FSB, based in Lutherville, Md., the F.D.I.C. said. Its branches will reopen Monday. The F.D.I.C. approved the payout of the insured deposits of Ideal Federal Savings Bank after failing to find another institution to take over its operations. RCB Bank in Claremore, Okla., will assume Home National Bank’s deposits, the F.D.I.C. said, while Enterprise Bank and Trust agreed to buy $260.8 million of the bank’s assets. New Century Bank in Phoenixville, Pa., agreed to assume USA Bank’s deposits and most of its assets.

America: Optimism on hold

by Alan Beattie and Robin Harding - Financial Times

A month ago, it all seemed to be going so well. Growth in the US economy was picking up. The financial system was, mainly, functioning. The risk of contagion from Europe had diminished after an unprecedented €110bn ($139bn, £91bn) bail-out from the European Union and the International Monetary Fund. Things were creeping back towards normality.

Then in early June, as Alan Greenspan, former Federal Reserve chairman, put it, the economy hit "an invisible wall". The US had a run of bad news – disappointing job growth; unexpectedly low employment; indices suggesting manufacturing and services losing momentum; renewed jitters from Europe’s sovereign debt markets and its banks. While most economists think it unlikely this heralds the famous double-dip recession feared by policymakers, it does come at a time when America’s monetary and fiscal authorities are struggling for room to manoeuvre.

In truth, there was always a risk that growth would hiccup at this point. Fiscal stimulus and companies rebuilding inventories have given the recovery a strong push start. But those are one-off effects; the recovery must now switch to power from its internal engine. "We haven’t entered into that self-sustaining stage yet," says Gus Faucher of Moody’s Analytics, who estimates the chance of a dip back into recession at 25 per cent.

A self-sustaining recovery needs a steady rise in jobs, wages and profits that will allow a steady rise in consumption and investment, feeding back into jobs, wages and profits. So it is worrying that private payrolls rose by only 33,000 in May and 83,000 in June – not fast enough to support a rapid rise in consumption – and both average wages and hours worked have dipped a little.

Business investment has boosted the recovery in the past few quarters but some surveys suggest it is slowing. June’s purchasing managers index for manufacturing fell from 59.7 to 56.2 – implying still rapid but slowing expansion. Nor is the housing market a roaring source of growth. Home sales and housing starts fell in May after the expiry of a tax credit. Prices appear to have stabilised but the IMF recently noted that "the backlog of foreclosures and high levels of negative equity, combined with elevated unemployment, pose risks of a double dip in housing".

All this sounds bad. But as Neal Soss of Credit Suisse in New York points out, there is a big difference between a slowdown in growth and actual falls in economic activity. "The economy is still growing and there’s every reason to think it will keep growing," he says. Like many economists, Mr Soss has always thought the recovery would be slow as households have heavy debts and banks need to repair their balance sheets. One consequence, however, may be recurring alarm about a double dip. "You’ll have some speed-up scares and some slowdown scares," he says. "But if you’re starting from a high level of unemployment, then slowdown scares are more likely to get attached to words like ‘recession’ instead of ‘deceleration’."

The US could really do with a helping hand. Sadly, that seems elusive. If Europe thought the Greek crisis had been solved by the EU-IMF rescue package, it had succumbed to an early bout of World Cup euphoria. It may have eliminated Athens’ immediate financing needs but it did not end speculation that Portugal or Spain would follow. Nor did it quiet fears about the amount of Greek and Spanish debt held by eurozone banks. In the past month, a familiar pattern of risk aversion has re-emerged. Credit spreads of indebted countries widened as investors fretted about the solvency of governments; equities dropped; the dollar and US Treasury bond prices rose as investors sought safe havens. This is not all bad news: higher bond prices equal lower long-term interest rates.

But more than America needs cheaper money, it needs businesses and consumers to be optimistic. "The net effect of the past month on the US has been slightly negative. The purely economic factors cancel each other out but the uncertainty, on top of a poor jobs picture, has not done any good," says Professor Eswar Prasad of New York’s Cornell University. Seeking to rebalance its lopsided economy, the US is embarking on a drive to double exports and thereby create 2m jobs. But plans announced this week by President Barack Obama – a ragbag of bureaucratic shake-ups and trade missions – are regarded by many economists as inadequate. Far more importantly, the global environment for demand looks unpropitious.

With a strong dollar, even higher demand growth in emerging markets is unlikely to give US net trade much of a boost. The flexibility in the Chinese exchange rate announced in June was symbolically important. But the small rises allowed so far will not suck in many US exports. Net trade boosted US gross domestic product by 1.2 percentage points in 2009 but largely because weak consumer spending caused a huge drop in imports. The Organisation for Economic Co-operation and Development, the Paris-based think tank, predicts that imports will grow faster than exports, subtracting from economic growth by 0.3 percentage points this year and 0.4 percentage points in 2011.

Worryingly, a combination of economic and political factors constrains US authorities. Thus any hit to confidence from events such as the Greek crisis are likely to be magnified. On the monetary policy front, Federal Reserve officials are, as yet, not particularly concerned about the health of the recovery. They still think that the most likely outcome is steady growth over the next couple of years. But they do think the downside risks to growth and inflation have risen in recent months, and probably outweigh upside risks such as a surge in bottled-up consumer demand.

So one measure Fed officials will watch is inflation expectations, especially if inflation is very low later this year, which could become a self-fulfilling process. The risk of a slide into outright deflation could prompt easier monetary policy from the Fed. The central bank thinks it has tools available for the unlikely eventuality that it is forced to act. One is buying more long-term assets such as Treasury bonds and mortgage-backed securities. Another is cutting the interest rate paid to banks that deposit money with it. That would increase their incentive to lend money out instead.

But no amount of monetary easing will help if banks do not extend credit because consumers do not want to spend nor companies to invest. And the weapons governments tend to use in such circumstances – spending rises and tax cuts – pose prob?lems more political than economic. On the economic side, bond market investors do not seem worried about the effect of current deficits on US solvency or expecting Washington to inflate its way out of debt. Yields on 10-year Treasury bonds have sunk to very low levels, about 3 per cent, and expected inflation derived from the prices of index-linked bonds remains about 2 per cent.

Less happily for those in the administration who believe in continued stimulus, political support for public spending is eroding. Although recent primary elections ahead of November’s midterms have produced mixed results, some seemed to punish candidates for favouring Big Government.

Administration officials insist that the damage is mainly to candidates who supported the troubled asset relief programme, the federal financial bail-out, rather than government spending in general. But even continuing current stimulus is a struggle. Proposals to extend unemployment benefits and prolong aid to states are snarled in Congress. One senior administration official reports an interlocutor saying: "There are only three Keynesians left in America, and they all work in the administration."

Alec Phillips of Goldman Sachs says: "The potential expiration of stimulus measures appears to be an increasingly important risk to growth." As Treasury secretary Tim Geithner is fond of pointing out, for all the accusations that the US is a fiscal profligate, its deficit is due to fall more sharply in the near future than that of almost any other leading economy, from 10.6 per cent of GDP in 2010 to 5.1 per cent in 2013, compared with a fall from 5.5 per cent to just under 3 per cent in supposedly self-flagellating Germany.

Mr Phillips calculates that if the stimulus bill enacted last year is allowed to expire, including unemployment benefits, aid to states and a special personal tax credit, the effect could be to subtract 2 percentage points of GDP growth – more than half the US trend growth rate – at about the middle of next year. Even a more plausible scenario, in which the unemployment payments and tax credits are extended, would take at least a percentage point off growth throughout next year.

The US economy is not yet in severe trouble. Rises in equity prices over the past few days have comforted optimists that confidence is returning. But the economy’s sputter over the past month indicates just how fragile the recovery is and how dependent America is on generating its own demand. And if it starts to turn down rather than simply to decelerate, policymakers turning to their arsenal will find it dangerously depleted.

IMF issues broad call for U.S. financial prudence

by Howard Schneider - Washington Post

Cut Social Security. Ditch the deduction for interest on home mortgages. Tax gasoline.

The United States recently opened itself to the most intense scrutiny yet by the International Monetary Fund, and on Thursday was offered a bitter pill when the agency criticized some well-defended aspects of American culture -- cheap fuel, subsidized housing, and a government retirement check. In a broad call for U.S. financial prudence, the agency also said the Obama administration was overestimating U.S. economic growth and needed to trim government deficits by hundreds of billions of additional dollars if its announced budget targets are to be met.

The recovery is going reasonably well in the United States, the IMF said, but some of the tougher decisions remain to keep it on track. "The risks are tilted to the downside," David Robinson, deputy director of the IMF's Western Hemisphere department, said as he presented both the IMF's annual assessment of the U.S. economy and its first-ever review of the country's financial sector.

Combined, the reports will feed into a larger effort by the Group of 20 major nations to use peer pressure as a tool in repairing the damage from the recent financial crisis, with the IMF dishing out advice and the other members of the organization poised in judgment of one another's follow-through. The United States and China only recently agreed to let the IMF go beyond the broad economic survey performed annually on all members of the fund and undertake a more detailed review under the fund's Financial Sector Assessment Program. The two countries had been among the most notable of the fund's 187 members to refuse to participate in the financial sector study.

The analysis of China's financial sector is ongoing, and a date for the results has not been announced. The U.S. reports outline a number of problems facing the American economy as it emerges from its worst economic downturn since the Great Depression -- lingering unemployment, a likely permanent loss of output, an expected wave of defaults on commercial real estate deals that could damage local and regional banks -- and include a long list of recommendations for U.S. officials and regulators.

The document did not go over well with the Obama administration, which has made a strong commitment to coordinate global economic policy within the G-20 and agreed with the other members at the recent meeting in Toronto to allow country-by-country "name and shame" reports to be submitted by the IMF when the group gathers for periodic summits. Though the Federal Reserve and other U.S. analysts have started worrying themselves about the strength of the country's economic recovery, Obama said in a Midwest tour on Thursday: "What is absolutely clear is we're moving in the right direction; we're headed in the right direction." An administration official said the IMF's conclusions were too harsh.

"Their economic projections over the next decade are overly pessimistic" and below what many independent analysts forecast, said a U.S. official who was not authorized to speak for the record. The Obama administration's budget for next year, for example, assumes economic growth of close to 4 percent, with growth above 4 percent in the years that follow. The IMF forecast U.S. growth of 2.9 percent in 2011 and slightly slower growth in subsequent years. The agency also assumes that the United States will have to pay slightly higher interest to borrow money in the future.

That's enough to make the difference between a public debt load that gradually stabilizes at about 70 percent of gross domestic product by 2015, and one that under the IMF's scenario would continue piling up and approach 100 percent of GDP by the end of the decade, a level many economists consider unsustainable. To combat that possibility, the agency argues that the United States needs to move more aggressively to both cut spending and raise revenue, to the tune of $350 billion or more above what the administration now plans.

Its recommendations are similar to those made for other highly indebted nations in Europe -- countries such as France, Greece and Britain are all moving to reduce entitlement costs by increasing their national retirement age, for example -- but in a U.S. context may prove politically untenable. Allowing homeowners to deduct their mortgage interest payments from their income taxes, for example, is a staple of U.S. housing policy, considered a way to make homeownership more affordable.

The IMF came out harshly against the deduction, saying that it was part of a homeownership system that was "costly, inefficient and complex," did not demonstrably increase ownership rates compared with similar countries without the same tax incentives, and mostly benefited "the better-off." "Each country is going to have to find the policies that work for that particular country and its values in finding the right fiscal path," said the administration official. "That is something the president's economics advisers are working on daily."

IMF tells Europe to inject more stimulus

by Ambrose Evans-Pritchard - Telegraph

The International Monetary Fund has called on the European Central Bank to prepare fresh emergency action to stabilise debt markets, throwing its weight behind calls for renewed monetary stimulus to offset budget cuts. "Markets are not yet convinced of the central bank's commitment to scaling up purchases if necessary to prevent a further deterioration in market functioning," said the IMF's Global Financial Stability Report.

The IMF called on Europe's authorities to make their €500bn (£420bn) rescue fund is "fully operational" and to explain how they intend to shore up banks that fail stress tests. "Test results will need to be complemented by a plan that specifies how capital-deficient institutions would be handled. Bank reporting and disclosure standards, in general, need to be improved," it said. Credit Suisse said Deutsche Postbank, Italy's Monte Dei Paschi, Greece's Piraeus, ATE, and Helenic Postbank, as well as a clutch of Spanish cajas and German Landesbanken, are likely to fail a rigorous test and will need fresh capital.

The Swiss bank said the real value of the probe is to test whether authorities themselves are ready to rescue any bank in trouble. The backstop funds include Germany's SoFFin with €50bn left, the FROB fund in Spain which has nearly exhausted its €12bn pre-funding, Italy's "Tremonti" fund with €8bn left, as well as the EU's huge Stability Facility "in extremis". While the IMF stopped short of calling for the ECB to launch full quantitative easing (QE), it is clearly worried that the bank's passive policies have allowed credit to wilt and led to fresh strains in interbank lending markets and sovereign debt.

"Downside risks to the recovery have risen sharply. Bank funding pressures may accelerate the ongoing deleveraging process. It is too early to tell if actual bank lending growth will worsen in the euro area, after recently stabilising at barely positive year-on-year rates," it said "In spite of a recent rebound in June, issuance from European firms was especially anaemic, and smaller than in the period surrounding the Lehman bankruptcy. If these tighter conditions continue, they could begin to have a significant impact on the availability of credit to corporates."

The ECB has so far purchased €59bn of Greek, Portuguese, Spanish, and Irish bonds, but has sought to drain any stimulus through "sterilisation" operations. Jean-Claude Trichet, the ECB's president said yesterday that the need for fresh purchases was "progressively diminishing" but pledged that the bank would continue to provide lenders with unlimited liquidity for the time being. With German industry was booming, he said there is no risk of double-dip recession. "I see perhaps a tendency from the outside to be excessively pessimistic. The numbers we have are not confirming this pessimism," he said.

The IMF's implicit criticism comes amid press reports that the US Federal Reserve is drawing up plans for fresh monetary stimulus in case recovery stalls, including more bond purchases. The news story has been widely seen as "kite-flying" by doves on the Fed Board to test the response to a fresh burst of QE.

ECB set for rethink on bond purchases

by Ralph Atkins - Financial Times