"A landing on the Tomoka, Florida"

Ilargi: US small business sentiment is down. Consumer income is down. Consumer spending is down. Pending home sales are down. Worldwide, crops are threatened by drought and floods. And while some claim that a US bumper crop will ease the problems, American corn is not exactly a perfect substitute for Russian and Ukrainian wheat, which go a long way towards feeding extensive segments of Middle East and Northern African populations.

Global financial markets, though, are up. So everything must be fine after all?! Perhaps not. Perhaps what we witness is an ongoing and deepening chasm that divides the world of finance and politics on the one hand and the world of everyday people on the other, as Rasmussen Reports indicates: 67% of Political Class Say U.S. Heading in Right Direction, 84% of Mainstream Disagrees. This chasm was greatly facilitated by governments relying on policies based on the notion that too-big-to-fail -financial- institutions needed to be bailed out at any cost. Later in the year, as a direct consequence of these policies, we will see another round of insane banker and trader bonuses, just as citizens’ sentiments and incomes fall, and unemployment and poverty keep rising.

It’s very hard, when you work at a too-big-to-fail institution, not to make a profit. When you have access to discount window money at an interest rate of 0.25%, money which you can -electronically- carry across the street to purchase US Treasuries that pay, say, 2.75%, you are set for a 1000% profit margin (even "only" 500% is not that shabby either). You try losing money that way; it ain't easy.

Of course, behind the scenes plays another government policy: the same banks that are handed all this money and profit for free don't have to fess up to their losses either. The free dough is handed to a group of financials that are nothing but the proverbial walking dead. If they were obliged to clean up their balance sheets with the inclusion of all the securities and other paper that hasn't been worth more than pennies on the dollar for several years now, they'd no longer be able to raise nearly enough capital on the open market to continue their dead man's walk, let alone heal.

There are articles appearing these days that claim the Fed wishes to force financials to buy back the worthless paper the central bank took over from them, but how would they see that work out? They would, in all likelihood, have to pass them more of the 0.25% credit, so they could buy more Treasuries, which the Fed could than buy outright from them. Other than that, it's hard to see a way to execute a scheme such as that.

Then again, in our present system, it's inevitable that speculators, creators of derivatives, and high-frequency traders will at some point in time, and sooner rather than later, end up focusing their monetary power on basic human necessities. And then, it will all get a lot uglier than it already is today. We should, as will become even more obvious soon than it is today, have bannned all speculation on food, water and shelter, but it is too late in the game already.

Paul B. Farrell at MarketWatch launches a first and stern warning:

Commodity ETFs: Toxic, deadly, evilCommodity ETFs are rapidly becoming a malicious virus breeding chaos in the global markets pricing all commodities: food, farm lands, metals, oil, natural gas, livestock, water and other natural resources are the assets under commodity derivatives and their ETFs, pricing that's now controlled more by Wall Street speculators than the weather, adding wild swings in volatility and trillions in global derivative risks.

And once again the usual suspects, the Goldman Conspiracy of Wall Street Banksters, are in the lead. Today, Wall Street is making a killing on commodity ETFs. And yet at the same time they are rapidly accelerating global market conditions that'll eventually kill the goose that laid their golden egg, those high-profit-generating commodity ETFs. But unfortunately this new ideology, Chaos Capitalism, is rapidly moving past economic pricing wars into military conflicts, a trend the Pentagon predicted years ago, an ever-increasing cycle of global wars over increasingly scarce nonrenewable commodities.

[..] .... thanks to ETFs, Wall Street is already creating a dangerous new kind of global weapon of mass destruction -- a bomb primed to detonate like the 2000 dot-coms, the 2008 subprimes -- and detonation is dead ahead.

Vanguard founder Jack Bogle added: "It's insanity ... this is a case of Wall Street trying to capitalize on the worst instincts of investors." [..] ETF managers are competing against Wall Street's elite traders. And the playing field's not level: "Professional futures traders ... make easy profits at the little guy's expense. [..]

As one Wall Street trader put it: "I make a living off the dumb money... index funds get eaten alive by people like me." [..]"Just as they did with subprime mortgage-backed securities, Wall Street banks are transferring wealth from their clients to their trading desks." One commodity trader adds: "You walk into a casino, you expect to lose money ... same with these products." [..]

Suddenly Wall Street speculators ruled the commodity-pricing market. What used to be a hedge for farmers became just another way for Wall Street traders and their sophisticated algorithms to make easy profits off "dumb money." So profitable Goldman even "owns a global network of aluminum warehouses," says B/W, and my old firm, "Morgan Stanley chartered more tankers than Chevron last year."

Rolling Stone's McKenzie Funk [..] focuses on Phil Heilberg, a former AIG commodity trader who is one of the new "Capitalists of Chaos." Heilberg is a self-proclaimed pure Ayn Rand capitalist hustling Africa, making "land grab" deals to control millions of acres and commodity rights in unstable nations.

Heilberg "makes no apologies for dealing with warlords: 'This is Africa ... The whole place is like one big Mafia, and I'm like a Mafia head.'" [..] The "essential lesson in capitalism" is "that no one is actually in control." In this new Chaos Capitalism, there is no rule-of-law, democracy is dead, chaos and anarchy rule.

And the new players include nations as well corporate giants: China, Russia, Australia, Kazakhstan, etc. A global land grab is on. And while commodity ETFs are making bankers and traders rich today, most know that soon the ETF business will go the way of a small farmer hedging the season's crop in a grain silo. They also know that the "Food Bubble" they're collectively blowing will also explode, triggering wars across the planet, wars fought over ever-scarcer non-renewable commodities. [..]

Commodity-index ETFs are a global threat far more dangerous to the world than nuclear attacks from terrorist nations. [..] "Heilberg's bet on chaos is beginning to play out on the streets." The toxic trail of commodity ETFs is already proving to be deadly, starving thousands worldwide, while the new Capitalists of Chaos only see incredible profit opportunities, as they make huge bets that they'll get even richer in the next round of catastrophes, disasters, poverty, starvation and wars.

Susanne Amann and Alexander Jung have more on the topic in German magazine Der Spiegel

Speculators Rediscover Agricultural Commodities[..] The turbulence in the cocoa market is the most recent sign that speculation is back, and that the international financial markets have rediscovered agricultural commodities. They are now betting big again on commodities like wheat, coffee, rice and soybeans. As a result, prices are no longer determined by supply and demand, but by investment banks and hedge funds.

Cocoa isn't the only commodity that has become significantly more expensive in recent months. The price of wheat has gone up by 17 percent since April, and soybeans by 12 percent. At the beginning of the year, sugar prices climbed to their highest level in three decades in the space of only a few months and then plunged by almost half. But now sugar prices are back up, climbing by almost 6 percent since April. The food price index of the United Nations Food and Agriculture Organization (FAO), which aggregates price movements for key agriculture products, climbed to 163 points in June. This is only 15 percent lower than the all-time high of 191 points in 2008 [..]

Last year, Goldman Sachs earned $5 billion in profits with commodities alone. Other major players include the Bank of America, Citigroup, Deutsche Bank, Morgan Stanley and J.P. Morgan. They are no longer merely offering classic funds, but are now trading in financial instruments that function similarly to the subprime mortgage loans on the now-collapsed US real estate market. With these instruments, known as collateralized commodities obligations, or CCOs, profits are based on market prices. The higher the trading prices of wheat, rice and soybeans, the bigger the profits.

[..] ... only about 2 percent of commodities futures now end with a real exchange of goods, the FAO concluded in a June study. "As a result, these deals attract investors who are not interested in the commodity itself, but merely in speculative profit," the FAO concludes morosely. The finding is all the more remarkable given the widespread political and social outrage aimed at food speculators just two years ago.

In the Financial Times, Javier Blas and Isabel Gorst paint the following picture of world harvests:

Rise in wheat prices fastest since 1973Wheat prices have seen the biggest one-month jump in more than three decades on the back of a severe drought in Russia, prompting warnings by the food industry of rising prices for flour-related products such as bread and biscuits. Food executives are also warning about surging prices for feeding and malting barley, which could push higher the retail cost of products from poultry to beer. European wheat prices jumped 8 per cent on Monday to €211 a tonne, the highest in two years.

Wheat prices have risen nearly 50 per cent since late June. Crop failures and a price rally have revived memories of the 2007-08 global food crisis, which saw the cost of agricultural commodities from corn to rice surge to record highs and food riots in countries from Haiti to Bangladesh. "This is the fastest wheat price rally we have seen since 1972-73," said Gary Sharkey, head of wheat procurement at UK-based Premier Foods [..]"The industry will be unable to ignore a 50 per cent rise in wheat prices," Mr Sharkey added [..]

Needless to say, if you’re speculating on food commodities like wheat, whether it be through Commodity ETF's or elsewhere, and you fancy yourself to be a Capitalist of Chaos, what's not to like about failed crops and rising price uncertainties? You can corner markets, the way cocoa honcho Anthony Ward has, you can sell derivative instruments to pension- and market fund managers chasing yield without sufficient savvy, and at the end of the day, you can be filthy rich. Just don’t feel too bad about the hungry, starving and dying, or about those who see their pensions and other savings vanish. Hey, if you didn't do it, someone else would, right?

The biggest irony in all of it, of course, remains that the biggest players in these ultimate dog eat dog Darwinian capitalist schemes use US and EU taxpayer money to play the games. They wouldn't be here anymore, sitting at their crap tables, if you wouldn't have handed them the money to play their ultimate to-the-death fighting games with.

If nothing else, it seems to be a fitting end to yet another economic system doomed by a lack of morals.

Commodity ETFs: Toxic, deadly, evil

by Paul B. Farrell - MarketWatch

The warning screams at you: "Do Not Buy Commodity ETFs!" Yes, this Bloomberg BusinessWeek cover reads like National Enquirer or a flashing neon sign on the Vegas Strip. And just in case you didn't get the warning, B/W repeats it twice more, on the cover: "Do Not Buy Commodity ETFs ... Do Not Buy Commodity ETFs." Then, as if afraid you still won't get it, they scream even louder: Commodity ETFs are "America's worst investment."

Worst? Add toxic, deadly, evil. Commodity ETFs are rapidly becoming a malicious virus breeding chaos in the global markets pricing all commodities: food, farm lands, metals, oil, natural gas, livestock, water and other natural resources are the assets under commodity derivatives and their ETFs, pricing that's now controlled more by Wall Street speculators than the weather, adding wild swings in volatility and trillions in global derivative risks.

And once again the usual suspects, the Goldman Conspiracy of Wall Street Banksters, are in the lead. Today, Wall Street is making a killing on commodity ETFs. And yet at the same time they are rapidly accelerating global market conditions that'll eventually kill the goose that laid their golden egg, those high-profit-generating commodity ETFs. But unfortunately this new ideology, Chaos Capitalism, is rapidly moving past economic pricing wars into military conflicts, a trend the Pentagon predicted years ago, an ever-increasing cycle of global wars over increasingly scarce nonrenewable commodities.

'Next financial time-bomb ... stuffed with derivatives'

In Bloomberg Markets' "ETFs Gone Wild," investors are warned that many ETFs are "stuffed with exotic derivatives," at risk of becoming "the next financial time bomb." In short, thanks to ETFs, Wall Street is already creating a dangerous new kind of global weapon of mass destruction -- a bomb primed to detonate like the 2000 dot-coms, the 2008 subprimes -- and detonation is dead ahead.

Vanguard founder Jack Bogle added: "It's insanity ... this is a case of Wall Street trying to capitalize on the worst instincts of investors." Actually both Wall Street and Main Street are incapable of avoiding their "worst instincts." And if you're betting the trend you know Wall Street's immune to criticism, already adjusting its strategies to keep a steady supply of naïve, clueless investors buying their toxic commodity ETFs, "dumb money" investments that "make lousy buy-and-hold investments" for Main Street investors while making Wall Street traders filthy rich.

Commodity ETFs: Wall Street's newest casino scam

Why lousy? Because ETF managers are competing against Wall Street's elite traders. And the playing field's not level: "Professional futures traders ... make easy profits at the little guy's expense. Unlike ETF managers, the professionals don't trade at set times. They can buy the next month ahead of the big programmed rolls to drive up the price or sell before the ETF, pushing down the price investors get paid for expiring futures."

As one Wall Street trader put it: "I make a living off the dumb money... index funds get eaten alive by people like me." Proof: Bloomberg data shows that "10 well-known funds based on commodity futures ... since inception ... have trailed the performance of their underlying raw materials ... The biggest oil ETF, the U.S. Oil Fund ... has dropped 50% since it started in April 2006, even as crude oil climbed 11%."

The indictment's brutal: "Just as they did with subprime mortgage-backed securities, Wall Street banks are transferring wealth from their clients to their trading desks." One commodity trader adds: "You walk into a casino, you expect to lose money ... same with these products." Another: "Turning commodity futures into securities unleashed a much larger sales force, stockbrokers selling a product many of them didn't understand."

Commodity index ETFs now a lethal WMD threat to Earth's survival

But far more chilling is BusinessWeek's warning of future consequences. Remember Bill Gross's "New Normal?" As future returns drop, investors are chasing riskier deals, like commodity ETFs: "Passive buy-and-hold investors at one point in mid-2008 held the equivalent of three years of production of soft red winter wheat. Wall Street's success in attracting those buyers boosted demand for futures contracts, which helped determine what consumers would pay for baked goods. Wheat prices jumped 52% in early 2008, setting records before plunging again, and sugar more than doubled last year even as the economy slowed." Warning: Capitalism's competitive pricing model is dead.

And if all these warnings from the likes of Bogle, Gross, Bloomberg Markets and BusinessWeek seem a bit hysterical, remember how hysteria drove past bubbles: dot-coms in 1999, subprimes in 2007. Euphoria blinds investors to dangers lurking in every bubble. And today that risk is magnified as 21st century bubbles are blowing bigger, more powerful and more dangerous, adding the new risk of nuclear "food fights."

In "The Food Bubble: how Wall Street starved millions and got away with it," Harper's Magazine's Frederick Kaufman offers another powerful indictment: "The history of food took an ominous turn in 1991 ... Goldman's analysts went about transforming food into a concept," by creating "the Goldman Sachs Commodity Index." Other bankers invented more indexes. Money flooded in.

Suddenly Wall Street speculators ruled the commodity-pricing market. What used to be a hedge for farmers became just another way for Wall Street traders and their sophisticated algorithms to make easy profits off "dumb money." So profitable Goldman even "owns a global network of aluminum warehouses," says B/W, and my old firm, "Morgan Stanley chartered more tankers than Chevron last year."

New Capitalists of Chaos love tragedies, famine, poverty, war

Rolling Stone's McKenzie Funk adds another brutal critique in "Will Global Warming, Overpopulation, Floods, Droughts and Food Riots Make This Man Rich?" Funk focuses on Phil Heilberg, a former AIG commodity trader who is one of the new "Capitalists of Chaos." Heilberg is a self-proclaimed pure Ayn Rand capitalist hustling Africa, making "land grab" deals to control millions of acres and commodity rights in unstable nations.

Heilberg "makes no apologies for dealing with warlords: 'This is Africa ... The whole place is like one big Mafia, and I'm like a Mafia head.'" Don't like his bluntness? But he does express a very dark truth driving this new ideology: The "essential lesson in capitalism" is "that no one is actually in control." In this new Chaos Capitalism, there is no rule-of-law, democracy is dead, chaos and anarchy rule.

Capitalists of Chaos like Heilberg have a warped sense of the long-term, out beyond the micro-myopic brains of Wall Street's commodity traders whose algorithms limit thinking to milliseconds. He sees a fatal flaw in Wall Street's short-term brain. The 2008 meltdown was the turning point: Wall Street's in "the death knell of the financial instrument, of the paper world" and "the rise of the commodity." Big investors demand hard assets. Proof: When Funk was in New York and London he met "leading investors who, like Heilberg, are stepping away from the paper world to make commodity plays."

And the new players include nations as well corporate giants: China, Russia, Australia, Kazakhstan, etc. A global land grab is on. And while commodity ETFs are making bankers and traders rich today, most know that soon the ETF business will go the way of a small farmer hedging the season's crop in a grain silo. They also know that the "Food Bubble" they're collectively blowing will also explode, triggering wars across the planet, wars fought over ever-scarcer non-renewable commodities. That's why the new Capitalists of Chaos -- not just Heilberg and Goldman, but Monsanto, Exxon, China -- and their competitors are in the short race to buy up and hoard rights to hard assets, positioning themselves for global catastrophes dead ahead.

Commodity ETFs, new WMDs more lethal than terrorist nuclear bombs

Commodity-index ETFs are a global threat far more dangerous to the world than nuclear attacks from terrorist nations. Nuclear WMDs have the power to wipe out major urban areas killing tens of thousands instantly, like Japan in 1945, leaving massive scars across humanity for many decades. And yet, as Funk puts it: "Heilberg's bet on chaos is beginning to play out on the streets." The toxic trail of commodity ETFs is already proving to be deadly, starving thousands worldwide, while the new Capitalists of Chaos only see incredible profit opportunities, as they make huge bets that they'll get even richer in the next round of catastrophes, disasters, poverty, starvation and wars.

Bottom line: Commodity ETF/WMDs are mutating into a toxic pandemic fueled (and protected by) the insatiable greed of banks, traders and politicians whose brains are incapable of giving up their profit machine, won't until it implodes and self-destructs. The Wall Street Banksters have no sense of morals, no ethics, no soul, no goal in life other than getting very rich, very fast. They care nothing of democracy, civilization or the planet.

They are in a race to become the richest man in the world, to control more assets, more commodities, more rights, more land, more money than Warren Buffett, Bill Gates and Carlos Slim combined. It's a contest and the other 6.3 billion humans on the planet are just profit opportunities (and collateral damage) in the dangerous high-stakes games played by the new Capitalists of Chaos ruling the world.

Speculators Rediscover Agricultural Commodities

by Susanne Amann and Alexander Jung - Der Spiegel

With the financial crisis fading into the past, speculation on agricultural commodities markets has returned in force. Food prices are climbing once again as hedge funds rediscover the immense profits that can be made -- led by a British chocolate baron.

Even by the standards of London's exclusive Mayfair neighborhood, businessman Anthony Ward leads a luxurious lifestyle. He and his family live in a 500-square-meter (5,380-square-foot) townhouse with five bedrooms, each with its own bath. There are separate quarters for the staff. When Ward opens a bottle of wine on his veranda in the evening, it's likely that it comes from his own vineyard at the foot of Paardeberg Mountain near Cape Town.

Ward's fabulous wealth comes as a result of his involvement in the cocoa business. The 50-year-old Briton with the nickname "Choc Finger" heads Armajaro, a commodities business and hedge fund he co-founded in 1998. In recent weeks, the hedge fund has caused a furor in the commodities markets. Traders report that Ward has purchased a vast number of futures contracts for the delivery of 241,000 tons of cocoa worth $1 billion (€770 million).

The cocoa represents about 7 percent of annual world production, enough to supply Germany with chocolate for an entire year. It was also enough to substantially drive up prices on the cocoa market. Last week, the price of cocoa climbed to a 33-year high. What is so unusual about the British investor's coup is that he did not resell the contracts on the London International Financial Futures and Options Exchange (LIFFE) before they expired, but instead took delivery of the beans. As a result, Armajaro now controls almost all the cocoa beans currently stored in registered warehouses in Europe, from Liverpool to Rotterdam to Hamburg.

Turbulence in the Cocoa Market

Processors and traders are now accusing Ward of trying to corner the cocoa bean market. "The market is increasingly being manipulated by a few people who control the market positions," says Hamburg cocoa dealer Andreas Christiansen, adding that speculators are taking advantage of the lack of transparency on the LIFFE. This, he says, harms smaller traders, whose hedge transactions are now no longer adding up. "A lot of people have been harmed here." Ward himself has declined to comment on these accusations.

The turbulence in the cocoa market is the most recent sign that speculation is back, and that the international financial markets have rediscovered agricultural commodities. They are now betting big again on commodities like wheat, coffee, rice and soybeans. As a result, prices are no longer determined by supply and demand, but by investment banks and hedge funds.

Cocoa isn't the only commodity that has become significantly more expensive in recent months. The price of wheat has gone up by 17 percent since April, and soybeans by 12 percent. At the beginning of the year, sugar prices climbed to their highest level in three decades in the space of only a few months and then plunged by almost half. But now sugar prices are back up, climbing by almost 6 percent since April. The food price index of the United Nations Food and Agriculture Organization (FAO), which aggregates price movements for key agriculture products, climbed to 163 points in June. This is only 15 percent lower than the all-time high of 191 points in 2008, the year of the financial crisis.

Price Explosion

At the time, rice prices rose by 277 percent within only six months, and corn became so unaffordable that millions of Mexicans could no longer afford tortillas, a staple in the country. Hunger riots erupted in Haiti, Egypt and more than 30 other countries. Driving the price explosion was the growing use of agricultural commodities to produce biofuel. But 2008 was also the year in which, for the first time, the public realized that grain merchants were no longer the only ones trading on the exchanges (in their case, by buying grain futures to hedge against poor harvests), but that the major players in the financial markets had discovered the lucrative trade in agricultural commodities.

Last year, Goldman Sachs earned $5 billion in profits with commodities alone. Other major players include the Bank of America, Citigroup, Deutsche Bank, Morgan Stanley and J.P. Morgan. They are no longer merely offering classic funds, but are now trading in financial instruments that function similarly to the subprime mortgage loans on the now-collapsed US real estate market. With these instruments, known as collateralized commodities obligations, or CCOs, profits are based on market prices. The higher the trading prices of wheat, rice and soybeans, the bigger the profits. The market's behavior reminds one of the Internet bubble at the beginning of last decade and the fluctuations just prior to the financial crisis, then-Merrill Lynch President Gregory Fleming said in May 2008.

Indeed, only about 2 percent of commodities futures now end with a real exchange of goods, the FAO concluded in a June study. "As a result, these deals attract investors who are not interested in the commodity itself, but merely in speculative profit," the FAO concludes morosely. The finding is all the more remarkable given the widespread political and social outrage aimed at food speculators just two years ago. But little has changed since then. "Paradoxically, the financial crisis resulted in a brief pause for breath on the agricultural markets, but as the global economy picks up steam, the problems of scarcity are getting worse again," warns Joachim von Braun, an agricultural economist at the Bonn-based Center for Development Research and director of the renowned International Food Policy Research Institute in Washington.

Threatening Harvests

Even as trading in agricultural commodities is on the rise again, the underlying factors that have driven up food prices for years have not been eliminated. The production of ethanol and biodiesel still competes directly with food production. Energy is still so expensive that the costs of fertilizer and transportation make agricultural production unprofitable. And with 2010 shaping up to be possibly the hottest year on record, droughts in Eastern Europe and West Africa are threatening harvests.

Officials at the United Nations World Food Programme (WFP) already fear the worst. "The situation in many countries is already dramatic now," says Ralf Südhoff, director of the WFP office in Berlin. The sad record of more than a billion starving people worldwide could be surpassed this year.

The dire situation has prompted experts like Braun, as well as aid organizations and companies, to call for tighter regulation of financial markets. In March, Andreas Land, the managing partner of baked goods maker Griesson-De Beukelaer, complained that certificates were being traded for 60 million tons of cocoa, which he said was 20 times the annual volume of cocoa that was physically available. "This is neither good nor tolerable," said Land. "Speculating with food products shouldn't be allowed, unless you actually take delivery of the products."

Strictly speaking, it is re-regulation that many would like to see. In the United States, for example, the Commodity Exchange Act of 1936 limited speculation in agriculture commodities for decades. But thanks to the targeted lobbying activities of the financial industry, the law was watered down in the 1990s, leading to a sharp increase in the trading of food commodities. This shift has prompted agricultural economist Braun to call for more transparency, particularly when it comes to the question of who buys which contracts. "And second," says Braun, "we need to require higher capital investments on the part of traders, which would make speculating in basic food products less attractive."

Not Behaving as Planned

US President Barack Obama has already taken a step in this direction by making derivatives trading more transparent. The Europeans, on the other hand, are balking at taking even this first step to contain speculation. EU Commissioner for Internal Market and Services Michel Barnier, who has described speculation with food products as "scandalous," plans to introduce legislation this year to impose stricter regulations. But the British have already announced their intention to create their own, less stringent rules for the London exchange. This comes as no surprise; London is the world's largest market for agricultural commodities outside the United States.

Cocoa king Ward, in other words, need not fear that his business will be restricted any time soon. Nevertheless, it is far from certain that his current massive bet will turn out in his favor. Worldwide demand for cocoa is growing, especially in Asia. But bad weather in the Ivory Coast, which produces 40 percent of the world's cocoa, does not bode well for a good harvest this fall. Ward is betting that chocolate makers like Lindt & Sprüngli or Kraft will soon have no choice but to order from him at higher prices, especially now that the Christmas business is around the corner.

The markets, for their part, have not behaved as planned. Immediately after Ward's coup, the price of cocoa beans dropped by more than 7 percent in three days. But even should it turn out that Choc Finger made a bad bet, traders and processors are no longer willing to put up with such escapades. A group of 20 companies and associations has written a letter to the LIFFE demanding that it make trading more transparent, using the New York markets as a model. The New York exchanges regularly publish information on who is trading in the market, whether they are speculators or agricultural commodities traders, how many contracts they hold and what their positions are.

This week, critics of speculation were to hold talks with the managers of the LIFFE. "Everyone should be given the same opportunities," says cocoa dealer Christiansen. Still, it is hardly likely that new rules will be in place by the next maturity date for cocoa contracts in mid-September. In other words, cocoa speculator Ward still has some time left to win his bet.

Rise in wheat prices fastest since 1973

by Javier Blas and Isabel Gorst - Financial Times

Wheat prices have seen the biggest one-month jump in more than three decades on the back of a severe drought in Russia, prompting warnings by the food industry of rising prices for flour-related products such as bread and biscuits. Food executives are also warning about surging prices for feeding and malting barley, which could push higher the retail cost of products from poultry to beer. European wheat prices jumped 8 per cent on Monday to €211 a tonne, the highest in two years.

Wheat prices have risen nearly 50 per cent since late June. Crop failures and a price rally have revived memories of the 2007-08 global food crisis, which saw the cost of agricultural commodities from corn to rice surge to record highs and food riots in countries from Haiti to Bangladesh. “This is the fastest wheat price rally we have seen since 1972-73,” said Gary Sharkey, head of wheat procurement at UK-based Premier Foods, which makes the popular Hovis brand of bread.

“The industry will be unable to ignore a 50 per cent rise in wheat prices,” Mr Sharkey added, echoing a view widely shared by other food industry executives. The rally comes as the worst heatwave and drought in more than a century continues to devastate grain crops in Russia, Ukraine and Kazakhstan. The trio are among the world’s top-10 wheat exporters and key suppliers to countries in North Africa and the Middle East – the largest importing region in the world. Executives and traders fear the three countries could restrict their grain exports or even impose an export ban in an effort to keep their local market well supplied and prices low.

Dmitry Rylko, the director of the Institute for Agricultural Market Studies, said the market could not ignore the possibility that Moscow would introduce grain export controls as it did during the 2007-08 crisis. “The scale of the drought is so severe we must be prepared for any option,” he said. Wheat traders and analysts said Russia’s wheat production could drop in 2010-11 to 45-50m tonnes, down as much as 27 per cent from last season’s 61.7m tonnes. Ukraine and Kazakhstan would also produce less. Heavy rains during the planting season are also expected to affect Canada’s wheat output. The Canadian Wheat Board, the marketing agency for the country’s farmers, is forecasting a drop of 35 per cent in the wheat harvest.

The Biggest Lie About U.S. Companies

by Brett Arends - Marketwatch

Healthy balance sheets? They owe $7.2 trillion, the most ever

You may have heard recently that U.S. companies have emerged from the financial crisis in robust health, that they've paid down their debts, rebuilt their balance sheets and are sitting on growing piles of cash they are ready to invest in the economy.

You could hear this great news pretty much anywhere — maybe from Bloomberg, which this spring hailed the "surprising strength" of corporate balance sheets. Or perhaps in the Washington Post, where Fareed Zakaria reported that top companies "have accumulated an astonishing $1.8 trillion of cash," leaving them in the best shape, by some measures, "in almost half a century." Or you heard it from Dallas Federal Reserve President Richard Fisher, who recently said companies were "hoarding cash" but were afraid to start investing. Or on CNBC, where experts have been debating what these corporations are going to do with all their surplus loot. Will they raise dividends? Buy back shares? Launch a new wave of mergers and acquisitions?

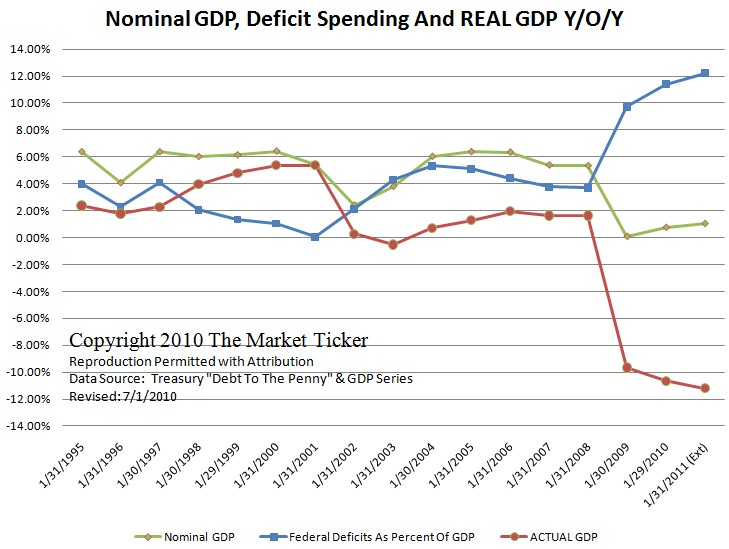

It all sounds wonderful for investors and the U.S. economy. There's just one problem: It's a crock. American companies are not in robust financial shape. Federal Reserve data show that their debts have been rising, not falling. By some measures, they are now more leveraged than at any time since the Great Depression. You'd think someone might have noticed something amiss. After all, we were simultaneously being told that companies (a) had more money than they know what to do with; (b) had even more money coming in due to a surge in profits; yet (c) they have been out in the bond market borrowing as fast as they can. Does that sound a little odd to you?

A look at the facts shows that companies only have "record amounts of cash" in the way that Subprime Suzy was flush with cash after that big refi back in 2005. So long as you don't look at the liabilities, the picture looks great. Hey, why not buy a Jacuzzi? According to the Federal Reserve, nonfinancial firms borrowed another $289 billion in the first quarter, taking their total domestic debts to $7.2 trillion, the highest level ever. That's up by $1.1 trillion since the first quarter of 2007; it's twice the level seen in the late 1990s. The debt repayments made during the financial crisis were brief and minimal: tiny amounts, totaling about $100 billion, in the second and fourth quarters of 2009.Remember that these are the debts for the nonfinancials — the part of the economy that's supposed to be in better shape. The banks? Everybody knows half of them are the walking dead. Central bank and Commerce Department data reveal that gross domestic debts of nonfinancial corporations now amount to 50% of GDP. That's a postwar record. In 1945, it was just 20%. Even at the credit-bubble peaks in the late 1980s and 2005-06, it was only around 45%.

The Fed data "underline the poor state of the U.S. private sector's balance sheets," reports financial analyst Andrew Smithers, who's also the author of "Wall Street Revalued: Imperfect Markets and Inept Central Bankers," and chairman of Smithers & Co. in London. "While this is generally recognized for households," he said, "it is often denied with regard to corporations. These denials are without merit and depend on looking at cash assets and ignoring liabilities. Cash assets have risen recently, in response to the fall in inventories, but nonfinancials' corporate debt, whether measured gross or after netting off bank deposits and other interest-bearing assets, is at peak levels." By Smithers' analysis, net leverage is nearly 50% of corporate net worth, a modern record.

There is one caveat to this, he noted: It focuses on assets and liabilities of companies within the United States. Some U.S. companies are holding net cash overseas. That may brighten the picture a little, but the overall effect is not enormous, and mostly just affects the biggest companies. That U.S. companies are in worse financial shape than we're being told is clearly bad news for those thinking of investing in U.S. stocks or bonds, as leverage makes investments riskier. Clearly it's bad news for jobs and the economy.

But why is this line being spun about healthy balance sheets? For the same reason we're told other lies, myths and half-truths: Too many people have a vested interest in spinning, and too few have an interest in the actual picture. Journalists, for example, seek safety in numbers; there's a herd mentality. Once a line starts to get repeated, others just assume it's correct and join in. Wall Street? It's a hustle. This healthy balance-sheet myth helps sell stocks and bonds. How many bonuses do you think get paid for telling customers the stark facts, and how many get paid for making the sale?

You can also blame our partisan age too. Right now, people on the right have a vested interest in claiming businesses are in healthy shape. That makes the saintly private sector look good, and demonizes President Barack Obama and Big Government for scaring away investment. Vote Republican! Meanwhile, people on the left have an interest in making businesses sound really healthy too: If greedy companies are hoarding cash instead of hiring people, they can cry "Shame on them! Vote Democratic!" As ever, the truth is someone else's problem and no one's responsibility. When it comes to the economy, let's just hope the public is too hopped up on painkillers and antidepressants to notice. If they knew what was really going on, there'd be trouble.

67% of Political Class Say U.S. Heading in Right Direction, 84% of Mainstream Disagrees

by Rasmussen Reports

Recent polling has shown huge gaps between the Political Class and Mainstream Americans on issues ranging from immigration to health care to the virtues of free markets.

The gap is just as big when it comes to the traditional right direction/wrong track polling question.

A Rasmussen Reports national telephone survey shows that 67% of Political Class voters believe the United States is generally heading in the right direction. However, things look a lot different to Mainstream Americans. Among these voters, 84% say the country has gotten off on the wrong track.

Twenty-four percent (24%) of Mainstream voters consider fiscal policy issues such as taxes and government spending to be the most important issue facing the nation today. Just two percent (2%) of Political Class voters agree.

With a gap that wide, it’s not surprising that 68% of voters believe the Political Class doesn’t care what most Americans think. Fifty-nine percent (59%) are embarrassed by the behavior of the Political Class.

Just 23% believe the federal government today has the consent of the governed.

Most voters believe that cutting government spending and reducing deficits is good for the economy. The only group that disagrees is America’s Political Class. In addition to the policy implications, this highlights an interesting dilemma when it comes to interpreting polling data based upon questions that make sense only to the Political Class. After all, if someone believes spending cuts are good for the economy, how can they answer a question giving them a choice between spending cuts and helping the economy?

Mainstream Americans tend to trust the wisdom of the crowd more than their political leaders and are skeptical of both big government and big business.

Fifty-eight percent (58%) of voters currently hold Mainstream views. In January, 65% of voters held Mainstream views. In March 2009, just 55% held such views.

Only six percent (6%) now support the Political Class. These voters tend to trust political leaders more than the public at large and are far less skeptical about government.

When leaners are included, 76% are in the Mainstream category, and 14% support the Political Class.

"The American people don’t want to be governed from the left, the right or the center. The American people want to govern themselves," says Scott Rasmussen, president of Rasmussen Reports. "The American attachment to self-governance runs deep. It is one of our nation’s cherished core values and an important part of our cultural DNA."

In his new book, In Search of Self-Governance, Rasmussen explains, ""In the clique that revolves around Washington, DC, and Wall Street, our treasured heritage has been diminished almost beyond recognition. In that world, some see self-governance as little more than allowing voters to choose which of two politicians will rule over them. Others in that elite environment are even more brazen and see self-governance as a problem to be overcome."

The book can be ordered on the Rasmussen Reports site or at Amazon.com.

The Political Class Index is based on three questions. All three clearly address populist tendencies and perspectives, all three have strong public support, and, for all three questions, the populist perspective is shared by a majority of Democrats, Republicans and those not affiliated with either of the major parties. We have asked the questions before, and the results change little whether Republicans or Democrats are in charge of the government.

In many cases, the gap between the Mainstream view and the Political Class is larger than the gap between Mainstream Republicans and Mainstream Democrats.

The questions used to calculate the Index are:

-- Generally speaking, when it comes to important national issues, whose judgment do you trust more - the American people or America’s political leaders?

-- Some people believe that the federal government has become a special interest group that looks out primarily for its own interests. Has the federal government become a special interest group?

-- Do government and big business often work together in ways that hurt consumers and investors?

To create a scale, each response earns a plus 1 for the populist answer, a minus 1 for the political class answer, and a 0 for not sure.

Those who score 2 or higher are considered a populist or part of the Mainstream. Those who score -2 or lower are considered to be aligned with the Political Class. Those who score +1 or -1 are considered leaners in one direction or the other.

In practical terms, if someone is classified with the Mainstream, they agree with the Mainstream view on at least two of the three questions and don’t agree with the Political Class on any.

Initially, Rasmussen Reports labeled the groups Populist and Political Class. However, despite the many news stories referring to populist anger over bailouts and other government actions, the labels created confusion for some. In particular, some equated populist attitudes with the views of the late-19th century Populist Party. To avoid that confusion and since a majority clearly hold skeptical views about the ruling elites, we now label the groups Mainstream and Political Class.

Pending Homes Sales Hit New Record Low Again. When Will the Deja Vu Be Over?

by Michael David White - Housingstory.net

The index of pending home sales fell to a new record low and replaced last month’s reading of a new record low. If that sounds like a broken record you have listened carefully.Pending-home sales have fallen below the worst numbers seen in the housing crash and going back to the inception of this measurement.

The chart above shows a veritable death march in the state of American residential property. It clearly proves shallow demand. The inventory of signed contracts cannot sustain current price levels. That means prices are falling unless we experience divine intervention.

The National Association of Realtors (NAR) announced the figures today, but made no mention of the record low in its press release. This is exactly the same method the NAR followed in last month’s release when they made no mention of a record fall or a new record low. They did report the raw data which is a great courtesy.

We also find again this month that major news outlets are dumb and incapable of understanding this most obvious of indicators (Headlines from the big sites follow at the end of this post. They did figure out there was a fall in the index. And that it fell 2.6%. So they read two paragraphs of the press release.). Last month was also a record low and the first report on pending sales following the April 30th expiration of the free-down-payment program.

The pending-home-sales stat gives us our best view of buyer demand without the hugely popular down-payment prop from the federal government. The news is not good and it flew right over the head of our correspondents at 15 major mainstream publications including Bloomberg, Associated Press, Reuters, and Marketwatch.

The chart of pending contracts above is literally a fall into the abyss. The May and June pending-sale figures are as bad as it gets; at least so far. HousingStory.net estimates current inventory for sale of 4 million units is 1.3 million units higher than it should be, and not too far away from the record high 4.5 million for sale.

Two months in a row of pathetic pending-home sales inventory figures will surely change months of units for sale. They are currently at 8.9 months and far above the average 5.8 months. The record high inventory is 11.3 months in April 2008.

Prices for residential real estate have been flat since August 2009, but are down 30% from their peak. Pending home sales suggest a new fall – for those with eyes to see and ears to hear.

Lawrence Yun, NAR chief economist, has a different take on it. "Since home prices have come down to fundamentally justifiable levels" Dr. Yun said today, "there isn’t likely to be any meaningful change to national home values." That’s a brave forecast. I wonder if Dr. Yun is a renter or an owner? Is his home on the market?

Hedge Fund Preparing For Deflation

by Reuters and Courtney Comstock - Business Insider

Clarium Capital's Peter Thiel told Reuters that he's preparing for deflation in an interview recently.

Here's what he's thinking:

- The proper view right now is deflationary, we're not headed towards a runaway inflationary situation.

- The consensus seems to be on the inflationary side. People are nervous about the government printing money. But that's not right.

- The economy is going to have a slow recovery for a number of years.

- There might be a double dip recession.

Investment tips:

- Don't go long equities

- Government bonds are probaly fine

- The dollar is probably fine

- Avoid gold

He says to look 40 miles outside of major cities (SF, NYC), and remember that you're still in the housing bust. "There are lots of problems."

Then he waxed nostalgic for the good ol' days. If the whole US was like Silicon Valley, we'd be in good shape. But now, the entire US is not driven by technology, is not driven by innovation. The model of the US economy is that we are the country that does new things. But over the past few decades, that's changed. Now we have people that do crazy things, like weigh 600 pounds. We have to get back to being the country where people do things that are new. We're headed towards government austerity in a lot of countries, we're not going to eep on piling on debt, but growth is going to be slow.

It’s the derivatives, stupid

by Jeremy Grant - Financial Times

If you only have time to focus on one figure in today’s second quarter earnings from NYSE Euronext, you should pick this one: its derivatives business represented 49 per cent of operating income. In other words, the company that runs the good old New York Stock Exchange – complete with opening and closing bell ceremonies that you see on business TV every day – is really a derivatives shop.

Okay, I exaggerate somewhat. Technology is also becoming increasingly important. Operating income from technology rose to 7 per cent, from 5 per cent in the second quarter of 2009. Duncan Niederauer, chief executive, wants technology to be generating annual revenues of $1bn by 2015. But the real showstopper is derivatives, where net revenue was 34 per cent higher than the previous year’s quarter.

That was mainly due to European derivatives like euribor futures and options on NYSE Liffe in London – proof, if any were still needed, of why it made sense for John Thain, Niederauer’s predecessor, to buy Euronext in 2007. Thain’s then-counterpart at Euronext, Jean-Francois Théodore, laid the groundwork by snatching what was then the London International Financial Futures Exchange from under the nose of former London Stock Exchange chief executive Clara Furse.

What looked like the acquisition by NYSE of the Euronext collection of cash equities bourses – Paris, Amsterdam, Brussels and Lisbon – was actually a clever move to get hold of a fast-growing derivatives franchise. Thain knew that cash equities would become increasingly commoditised as competition from the likes of BATS and Direct Edge turned it into a lower margin business. The same analysis has forced consolidation of cash and derivatives exchanges around the world in recent years.

BM&FBovespa is the product of a merger of the Brazilian stock and commodity derivatives exchanges. So is TMX Group in Canada, as well as Australia’s ASX, where 24 per cent of total revenue comes from derivatives (including trading and clearing). None of this will make comfortable reading in Paternoster Square, current headquarters of the LSE, where Dame Clara’s successor, Xavier Rolet, is busy trying to figure out how he will make good on his declaration – at an industry conference in June – that the LSE plans to get serious about derivatives and take on Liffe and Eurex, owned by Deutsche Börse.

The LSE has a small derivatives business in the EDX Nordic and Idem Italian platforms. But together they account for only 3 per cent of LSE group revenue (the exchange doesn’t break out derivatives clearing revenue). Rolet – who, like Niederauer and Thain is ex-Goldman Sachs - knows this will be a tough hill to climb.

That is not the only challenge, however. With a nice derivatives trading business comes the opportunity to earn clearing fees too – that is, if you own your own derivatives clearing house. NYSE Euronext has this in the form of NYSE Liffe Clearing. The LSE doesn’t yet have a clearing solution in place for its planned derivatives drive. But with NYSE Euronext showing numbers like this already, they’d better get a move on.

ISM survey confirms sharp slowdown in US economy

by Gavyn Davies - Financial Times

The ISM Survey of the US manufacturing sector (published on Monday) offers the first reliable glimpse of activity in the US economy in the third quarter of the year. It is not encouraging.

Although the headline reading was rather better than widely anticipated (an out-turn of 55.5 compared to 56.2 in June), the details of the survey showed that new orders are now slowing markedly, and inventories have started to rise more rapidly than companies may be intending. Taken together with the GDP data for Q2, the ISM survey points to a significant danger that the US economy will continue to slow sharply in the months ahead.

The ISM surveys in the US are among the few items of monthly information which are capable of moulding market sentiment in a profound way. This is because they have an excellent track record of picking up changes in trend in US activity, because they are never revised, and because they are published earlier than most other data series on the economy.

The manufacturing survey tends to get the most attention, because it comes out first, and because it has a much longer series of historical data, than the non manufacturing series. In fact, it would be only a slight exaggeration to say that once the ISM series are published, very little else is likely to change market psychology on the course of the economy during the coming month. (OK, I accept that the employment data which are due on Friday will often do so, but very little else will.)

The headline figure for the manufacturing sector in July had been expected to fall to about 54.5, but in fact it fell only to 55.5, down by 0.7 on the previous month. Although superficially encouraging, the details lying behind the headlines were much worse than expected. Economists tend to track two series in particular, because they can be combined to provide a useful leading indicator for the manufacturing sector in the months ahead.

The first of the key series is new orders, which this month fell by a horrible 5 points to 53.5. This speaks for itself. The second is inventories, which rose by 4.4 points in July, suggesting that companies may have been forced to build their stock holdings because they have not been able to maintain their sales at expected levels. The difference between new orders and inventories, which is the leading indicator mentioned above, therefore plummeted by 9.4 points this month (see graph). Although this can be a somewhat volatile series on a monthly basis, the underlying trend in the series (also shown in the graph) is now definitely headed downwards.

It is surprising to me that the stock market has so far been so resilient in the face of the mounting weight of evidence that growth rate in the US economy has dipped below trend, with no knowing where this will end.

Wells Fargo/Gallup Small Business Index Hits New Low in July

by Dennis Jacobe - Gallup

Small-business owners' expectations turn negative for first time since index's inception

The Wells Fargo/Gallup Small Business Index -- which measures small-business owners' perceptions of six measures of their current operating environment and future expectations -- fell 17 points to -28 in July. This is its lowest level since the index's inception in August 2003.

Record Pessimism in Future Expectations

Most of the decline in the overall index came in the Future Expectations Dimension of the index, which measures small-business owners' expectations for their companies' revenues, cash flows, capital spending, number of new jobs, and ease of obtaining credit. The dimension fell 13 points in July to -2 -- the first time in the index's history that future expectations of small-business owners have turned negative, suggesting owners have become slightly pessimistic as a group about their operating environment in the next 12 months.

Small-business owners' future expectations for their operating environment show significant declines in their revenue, cash-flow, capital-spending, and hiring expectations for the next 12 months. Forty-two percent expect it to be "somewhat" or "very difficult" to obtain credit -- no improvement from April and January. One in five (22%) small-business owners expect their companies' financial situations a year from now to be "somewhat" or "very bad."

More Negativity About Present Situation

The Present Situation Dimension of the index declined by a more moderate four points to -26 in July -- the second-lowest rating for this dimension that hit its low of -29 in January 2010.

When evaluating the past 12 months, small-business owners suggest there has been a modest further decline in their current operating environment, driven largely by a significant decline in the percentage of companies having good cash flows.

Implications

The sharp deterioration in small-business owners' economic perceptions and expectations in July is fully consistent with Gallup's tracking of a steady decline in consumer confidence over the past three months. So is the weaker-than-expected growth of the U.S. economy during the second quarter, as well as the general expectation of a further slowing of the economy during the second half of 2010.The Wells Fargo/Gallup Small Business Index seems to be something of a precursor of future economy activity. It peaked at the end of 2006; matched that peak once more in June 2007; consistently declined thereafter as the recession deepened, before bottoming out in mid-2009; and finally, improved modestly until its July 2010 decline.

Small-business owners are the embodiment of America's entrepreneurial and optimistic spirit. As a result, their increasing concerns about their companies' future operating environment do not bode well for the economy in the months ahead. Nor do small-business owners' intentions to reduce capital spending and hiring: 17% of owners plan to increase capital spending in the next 12 months -- down significantly from 23% in April -- and 13% expect jobs at their companies to increase, while 15% expect them to decrease over the year ahead.

Big-firm earnings and global growth may drive profits on Wall Street, but small business is the major source of U.S. job creation. And most small-business owners are unlikely to hire as long as they are becoming increasingly uncertain about the revenues and cash flows of their companies in the months ahead.

America's Incredible Shrinking Safety Net

by Arthur Delaney - Huffington Post

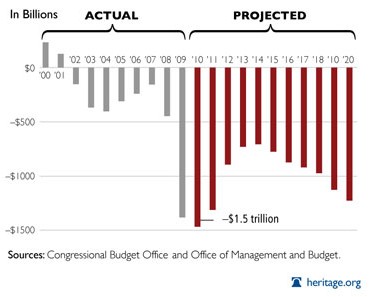

President Obama's 2009 stimulus bill expanded federal aid for people affected by the worst recession since the Great Depression, but congressional heartburn over deficit spending has prompted a campaign to reduce the deficit impact of further spending almost entirely through slashing the safety net. On Wednesday, Senate Democrats hope to pass a bill that, to offset the cost of $16 billion in Medicaid assistance for states and $10 billion to prevent teacher layoffs, will cut $6.7 billion in future food stamp funding. The cut is the latest in a series of drop-in-the-bucket efforts to avoid adding to a federal budget deficit expected to top $1.4 trillion this year.

The first cuts came in May, when Democratic leaders hoping to move a broad domestic aid package in the House of Representatives, bowed to deficit demands and dropped $24 billion in state Medicaid assistance and $7.7 billion in subsidies for laid-off workers to maintain their health insurance via the COBRA program. "It's obscene," said Rep. David Obey (D-Wisc.). House Democrats also shortened the extension of unemployment benefits for the long-term jobless by one month, saving roughly $6 billion.

When the scaled-down bill landed in the Senate, Democratic leaders discovered they'd need to make further cuts to win the support of conservative Democrats and moderate Republicans. A handful of senators fought to replace the COBRA subsidy and the state Medicaid assistance (known as FMAP), but the amendment that prevailed instead cut $25 per week from unemployment benefits, saving $5.8 billion.

Another program that fell by the wayside was the TANF Emergency Fund, a welfare-to-work program that has subsidized more than 240,000 jobs. Extending the program through next year would have cost $2.4 billion. Each of the programs cut was put in place by the stimulus bill, formally known as the American Recovery and Reinvestment Act, enacted in February 2009 when the unemployment rate stood at 8.2 percent. The rate is now 9.5 percent and few economists expect it to drop much further down anytime soon, but compassion for the unemployed has been replaced in Washington with the suspicion that extended jobless aid discourages people from looking for work.

After a 50 day delay, Senate Democrats finally passed a reauthorization of unemployment benefits with a $33 billion deficit impact at the end of July. Democrats have attempted to pay for their domestic aid packages by closing tax loopholes exploited by investment fund managers and companies that ship jobs overseas, but those measures have failed. The bill coming up for a vote in the Senate on Wednesday would revive one of them and raise $9 billion by eliminating foreign tax credit loopholes, but Democrats have apparently lost their appetite for trying to drum up support for hiking taxes on hedge fund managers.

Before it went away, that provision was weakened every time a different piece of jobless aid disappeared, deficit reduction needs notwithstanding. At first, closing the loophole would have raised $18.685 billion. In the next draft of the domestic aid bill, it raised $14.157 billion. Then $13.905 billion, and then $13.594 billion. (In Obama's budget, raising taxes on "carried interest" would have raised $23.89 billion.) The Obama administration has encouraged Congress to reauthorize the programs, but the pressure hasn't been overwhelming.

Meanwhile, Republicans have done everything they can to stand in the way of reauthorizing jobless and state aid, a strategy that will continue this week. "The $1 trillion stimulus bill was supposed to be timely, targeted and temporary," said Senate Republican leader Mitch McConnell on Tuesday. "Yet here we are, a year and a half later, and they're already coming back for more."

The Death of Market Fundamentals

by CIGA Pedro/Jim Sinclair

If the past three years has taught us anything about markets, it is that they will do what they are set up to do. OTC Derivatives, financial Ponzi schemes (Madoff etc) and gyrating Fed policy are but a few of the machinations determined by the new market Fundamentals… the Fundamentals of government policy.The political and legislative environment creates new Fundamentals that economic realities were supposed to. As government becomes more self-indebted, and politically captured by special interests, the markets reflect these political realities instead of the economic fundamentals they should.

None of this is news. It has been going on for years. But it is not as benign as it used to be. At the outset its just favouritism: a (usually no-bid) government contract is awarded and a company share price roars on the back of it. Legislative tweaking portends winners and losers. But then things get out of hand.

An early signal was found not only in the insanity of the mortgage backed securities markets and their attendant derivatives, but was also evident in the energy industry. Nobody in their right mind believes that fundamentals had the slightest thing to do with crude oil’s move from 2006 to 2008 – but the shrill cry of "Peak Oil" (Hat Tip Media) sure did help. (Where is it now?) Far more likely is that a couple of market participants decided to clear some competition from the market by running it to ridiculous levels, and make a large amount of money along the way… and enlisted the Media’s help. A natural bull market presented a great opportunity to push the market to unnatural levels and then drop it like a stone. Fundamentals had no role. Not even the first Gulf War when the borders of Kuwait and Saudi Arabia fell, produced a similar event in terms of scale, though the market was overrun with fear. Even before the Algos started ripping markets up and down for fun and profit the game was on.

The West Coast electricity market did a similar thing – by creating unscheduled maintenance that somebody had (personally) "scheduled". $40 million+ people got their eyes gouged out for months on end, but it sure was fun for someone. A similar situation occurred (several times) in the German power market around the turn of the millenium. An American utility or marketer would simply buy every KwH in sight, along the curve, bar none, in a one or two hour space of time, until people who needed the physical power position to meet actual customer demand were forced to follow them, whereupon the relentless buyer would line up every bid in the market and try and unload everything in one shot. Many times it worked. But the US utility industry blew itself up in fraud, and the main German companies refused to trade with them after a while. Deregulation had happened – but the fall back for the near-monopoly German utilities was to say, "I don’t like you as a credit risk. So I can only trade in very, very small size with you." The gamers were forced out. They killed their own game in the rush for personal glory.

The charade of options expiry in the Gold market is similar. Get the market up, knowing that call buyers are the public and liked to go naked, and the put buyers are usually market makers trying to butterfly their position and get short the at-the-money strike in expiry. Just before expiry the market is whipsawed down. The public goes out worthless on the call side and the market makers (volume traders) get expired near or at their long strike (i.e. max. loss) and are forced out. Next time around – spreads are wider. It’s an attractive strategy if you can control the underlying for a few hours at the right time of the month. If you can’t – tough luck. Only a fool would trade in such a game. People should roll out weeks before expiry – but the public never does. They hang right on in there every time because the market gets so close to going in the money. (Like the Bbanks aren’t aware of this psychology!). The professionals have a name for these people: They’re called Screen Jockeys… and in case you didn’t know – it’s a term of derision.

A similar situation now exists in that bastion of public interest – the stock market. Trading is simply impossible. Stop-losses can’t be held as orders because they will be used against anyone with a position. As related in M. Lewis’ latest book, the Chinese Walls that supposedly exist in the multiple platforms that trade a single stock should be properly considered as "Bullshit". Charts are painted to flush people out. What passes for a market is now just a serious of raids up and down the flagpole to shake the hell out of its minor participants. If you aren’t equipped to play "chase the algos" (entry ticket c. $40 million for the technology and servers), your money will simply be taken. The market has for hundreds of years taken money from weak hands, but now anyone without a first class algo can be considered and proven as weak.

Fundamental analysis will not help the small trader. It’s simply pointless to participate. Instead of tree-shaking… now the whole damn forest is being shaken. As explained in the book "A Pocketbook of Gold", any individual with the slightest amount of margin will be destroyed by the hyper-over-leveraged banks that don’t have to mark to market, never have a margin call, and have a government guaranteed, taxpayer funded bailout. These are the NEW fundamentals. You want to participate on the other side of this, so call "trade"? If you do, you need serious help. Do you want to play with the take-down artists, the chart painters and algo-drive market-bashers? (To Mr Sinclair’s "haters" of the past fortnight please recall his relentlessly iterated warning to abandon all Gold trading and margin at $548 per ounce, and hold the core as insurance only.)The result is that retail has had it with the so-called "market". Outflows are increasing steadily, while liquidity swamps financial institutions unwilling to do anything other than sit on the liquidity. The bail-out looks like a bail-in. Only idiots like the zero-return in a decade (and a lot less if properly numerated against Gold) pension funds are left. The suckers have woken up and are refusing to play. Computer driven markets go from awash with liquidity to zero liquidity and back again in seconds. It’s enough to make a schizophrenic look balanced. Risk is fully on, then fully off, then fully on again several times in a given day, soon to be in a given hour, minute, second, mille and then micro-second. Trade if you have a death wish only. As the public exits, the algos will now attack each other in a macabre pas de deux of death dance.

Government, of course, is playing its part too in the death of the markets by destroying the value of fundamental analysis. The capitulation of FASB to a government/Fed dictated policy of suspending the assessment of fair value has, as its corollary, the suspension of even the possibility that ‘fair value’ can still, in fact BE determined. Since the government now determines market outcomes, reading Maoist "Wall Posters" is now all one has. ("If one knows the nuances, the walls tell all" was the nod for Deng Xio Peng’s political destruction. This is what we have been reduced to.) As if analysing Greenspan’s FedSpeak wasn’t enough to live through, we now must be scanning the horizon all day for the QE II, instead of analysing a company’s worth and prospects. Resistance may be futile, but participation is now idiocy. Money supply is viciously ramped up and then completely shut-off, at a whim, and with few but opaque methods for observation. When people are buying the stock market only because they envision a Bernanke money-printing induced melt-up, it’s time to leave. That is no reason to be in the marketplace, it is a reason to avoid it.

Previous market participants are sick of trying to decide the level of deceit in Government statistics. No one can anticipate whimsical "on the hoof" policy (like occupying Iraq), so everyone is fearful of investing. Money is going to the mattress like a Spaniard living under Franco. Germans and other Europeans are rushing into the Swiss Franc in outright fear of what politicians might do next. The level of trust from the investing public has never been lower. Government won’t let Fundamentals play out, just like they refused to take a recession ten years ago. The Fed can trump all fundamentals until, of course, they can’t any longer, and they blow up everyone including themselves (i.e. sovereign default). When proper valuation is suspended for as long as possible and seemingly, hopefully, forever, one would be advised to spend their time building a nuclear resistant financial bunker, preferably lined with Gold. It could give a whole new meaning to the old adage that the "Fundamentals always win in the end". In the new intonation, the emphasis is on the word "end". An "end" that seems to be in the process of being succinctly arranged.

In the search for absent fundamental indicators, "Shadow Stats" became preferred, but that only detracts from confidence. It does nothing to enhance it. Mr. Williams does not sit at the Fed or in Government. Most likely, it will be QE to infinity, because the disastrous outcome of a Treasury market implosion could be even more devastating than perpetuating a depression. QE is a government played trump card that destroys Fundamental analysis by moving the pricing numerator. Desperation is palpable. It’s why the Government is actively destroying any attempt at fundamental analysis. The sustaining of the smoke and mirrors game demands it. If Government continues to spend, they eventually go bust from debt. If they head down the austerity path, you’ll never have enough GDP to SERVICE the debt. They’re cornered. Devaluation de facto or de jure (i.e. default) is the only possible outcome short of waiting for inevitable systemic collapse along with the hyper-inflation which will give you about as much warning as a Tsunami on your visible horizon. As Mr. Sinclair has related, "Gold is financial High Ground, when a Global Tsunami hits." Prepare accordingly.

China Said to Test Banks for 60% Home-Price Drop

by Philip Lagerkranser - Bloomberg

China’s banking regulator told lenders last month to conduct a new round of stress tests to gauge the impact of residential property prices falling as much as 60 percent in the hardest-hit markets, a person with knowledge of the matter said. Banks were instructed to include worst-case scenarios of prices dropping 50 percent to 60 percent in cities where they have risen excessively, the person said, declining to be identified because the regulator’s requirement hasn’t been publicly announced. Previous stress tests carried out in the past year assumed home-price declines of as much as 30 percent.

The tougher assumption may underscore concern that last year’s record $1.4 trillion of new loans fueled a property bubble that could lead to a surge in delinquent debts. Regulators have tightened real-estate lending and cracked down on speculation since mid-April, after residential real estate prices soared 68 percent in the first quarter from a year earlier, according to estimates from Knight Frank LLP, the London-based property adviser.

A deep slump in China’s property market may further slow the nation’s economy, which grew at a less-than-forecast 10.3 percent pace in the second quarter. China is still the fastest growing major world economy. Concern that China’s economy may cool due to a real-estate slump erased an early rally in U.S. stocks. The market rebounded on economic data showing stronger- than-estimated growth in American service industries.

Non-Performing Loans

The China Banking Regulatory Commission said in a July 20 statement that banks should “continue to deepen” stress tests on lending to property and related industries, citing a speech by Chairman Liu Mingkang during a meeting attended by regulatory officials and bank heads. The release didn’t give details. Officials at CBRC didn’t return calls seeking comment.

Results from previous stress tests show that the ratio of non-performing real estate loans among Chinese banks would rise by 2.2 percentage points if home prices drop 30 percent and interest rates rise by 108 basis points, the person said. Pretax profits would fall 20 percent under that scenario. A basis point is 0.01 percentage point. Measures to cool property-price gains included raising minimum mortgage rates and down-payment ratios for second-home purchases, and a suspension of lending for third homes. Property prices in 70 Chinese cities dropped 0.1 percent in June from the previous month, the statistics bureau said July 12. Prices rose 11.4 percent from a year earlier, the second monthly slowdown after April’s record expansion.

Bad Loans

Bank of China Ltd.’s bad-loan ratio would climb 1.2 percentage points under the worst-case scenario drawn up in the latest stress tests, Li Lihui, president of the nation’s third- biggest lender by market value, said May 27. Record lending last year in China and the ensuing surge in home prices have stoked concern that a bubble is forming that may threaten the banking industry. Property stocks are the worst performers on the Shanghai Composite Index this year with an average 21 percent drop, data compiled by Bloomberg show.

“There is a perception in the real-estate development community that banks and the market cannot tolerate much more than a 25 to 30 percent drop in prices,” said Nicholas Consonery, an Asia specialist at Eurasia Group in Washington. Still, the government probably doesn’t expect prices to drop by 60 percent, Consonery said in a phone interview. It’s seeking to “signal to the market that banks are sound even with a significant drop in prices,” he said.

Rogoff’s Warning

China’s property market is beginning a “collapse” that will hit the nation’s banking system, Kenneth Rogoff, a Harvard University professor and former chief economist of the International Monetary Fund, said July 6. Average prices may fall as much as 20 percent over the next 12 to 18 months, with declines of up to 40 percent in “big bubble” cities, Nomura Holdings Inc. said in a July 2 report. The impact on banks’ asset quality will still be “limited” as long as borrowers have adequate income to keep paying their mortgages, Nomura said. Regulators testing banks for a 60 percent correction in “only the most bubbly markets” will probably find lenders “will not pose a systemic risk to the banking system,” said Daniel Rosen, principal of the Rhodium Group, a New York-based advisory company.

The banking regulator has reminded lenders that some developers with high debt burdens and large land reserves already face the risk of a funding collapse, the person said. Banks were told to gauge developers’ real borrowing needs by monitoring the progress of projects under construction and to “strictly” control the pace of lending, the person said. “Special mention” real-estate development loans have climbed in Shanghai since April and rose by 1.4 billion yuan ($207 million) in June, Xinhua News Agency reported Aug. 1, without saying where it got the information.

Fed Propaganda Machine Credits Bernanke Bailouts For Ending The Great Recession

by Dr. Pitchfork - Daily Bail