Ilargi: Please don’t forget to order Stoneleigh's video presentation of "A Century of Challenges", the lecture that's made her famous across Europe and North America, like this weekend at the ASPO-USA conference in the nation's capital. There is a reason some people have driven hundreds of miles to see her live. It’s up to you to find out why.

to order (or click the button on the right hand side just below the banner), and why not buy a copy for someone you think needs to know what Stoneleigh has to say. Or just donate some extra cash in the top left hand column just below the banner. Stoneleigh deserves all the financial support she can get.

Ilargi: See, this always happens: I was carefully leading up to this big “you're all zombies" theme over the past week, a theme that I felt needs some space and introduction (see An 800-Pound Gorilla On A Serious Diet and Wile E.'s Suspended Reality) and then I read someone over the weekend who has thought of the same thing, in this case Brett Arends at the Wall Street Journal:

Why Are Distressed Homeowners Still Paying Their Mortgage?Japan struggled for 20 years with "zombie banks"—so called because their debts, if properly recognized, made them insolvent. Here in America, we have millions of zombie homeowners. Why is this any better?

Ilargi: Hey, but it's alright by me, this notion will soon go viral anyway, and the fact that it will dawn on people is far more important than that I thought of it. And besides, I like saying "All your neighbors are zombies" better than "You're all zombies" to begin with.

Still, to Mr. Arends, I would say: It's not like Japan has one and the US has the other: America has both zombie banks AND zombie homeowners. Plus a lot of zombie unemployed, Wal-Mart greeters and burgerflippers, and I’m not all that sure it doesn't have a zombie government too.

What drives the US economy today is zombie money. One part is the keystrokes that make up TARP, stimulus and quantitative easing, the other is the funny accounting that allows the gamblers to pretend they didn't lose their wagers.

When the banks go belly-up so does the real economy. Then again, the only way to prevent a banking collapse is to actively make the real economy collapse. And even that prevention can only be just temporary. What underlies it all is the underlying value of swaps, (mortgage-backed) securities and other derivatives on and off balance sheets which Wall Street successfully lobbied the government into "legally ignoring" that very underlying value for.

But the resulting "funny" mark-to-fantasy accounting was never meant to last forever, and for good reason: it can't and it won't. As Janet Tavakoli puts it, talking about the ongoing Foreclosure Gate quagmire:

'This is the biggest fraud in the history of the capital markets'When we had the financial crisis, the first thing the banks did was run to Congress and ask for accounting relief. They asked to be able to avoid pricing this stuff at the price where people would buy them. So no one can tell you the size of the hole in these balance sheets. We’ve thrown a lot of money at it. TARP was just the tip of the iceberg. We’ve given them guarantees on debts, low-cost funding from the Fed.

But a lot of these mortgages just cannot be saved. Had we acknowledged this problem in 2005, we could’ve cleaned it up for a few hundred billion dollars. But we didn’t. Banks were lying and committing fraud, and our regulators were covering them and so a bad problem has become a hellacious one.

Ilargi: I remember this banker recently, forget the name and context, who said that assets shouldn't be marked to market that were not meant to be sold anyway. Well, they should, really: someone who purchases a share in a bank or other financial institution has a pretty iron-clad right to know the true value of its assets, not just the one that looks more attractive.

The most positive spin we can put on it is that nothing has changed, nothing has been solved, in the past 2-3 years. And that's not all: as Ms. Tavakoli points out, problems like these don't go to sleep, they get worse if you don't solve them. And that’s why we find ourselves where we are today. It's also why I leave open the possibility that the US has a zombie government. Janet Tavakoli again:

This is the biggest fraud in the history of the capital markets. And it’s not something that happened last week. It happened when these loans were originated, in some cases years ago. Loans have representations and warranties that have to be met. In the past, you had a certain period of time, 60 to 90 days, where you sort through these loans and, if they’re bad, you kick them back. If the documentation wasn’t correct, you’d kick it back. If you found the incomes of the buyers had been overstated, or the houses had been appraised at twice their worth, you’d kick it back.

But that didn’t happen here. And it turned out there were loan files that were missing required documentation. Part of putting the deal together is that the securitization professional, and in this case that’s banks like Goldman Sachs and JP Morgan, has to watch for this stuff. It’s called perfecting the security interest, and it’s not optional.

Ilargi: It was all fraud all the time and all the way. From stated income $500,000 loans for McDonald's employee on the week to banks writing MBS securities on those loans, to the ratings agencies stamping them sight unseen with their AAA label, to the robo-clowns who until last week were signing foreclosures on these same loans at a rate of 8000 a month. So how many people involved in this have been arrested? Thought you'd never ask.

Perhaps it's all best explained by this brilliant video that Tyler Durden dug up, which you really need to see:

Is ForeclosureGate About To Become The Banking Industry's Stalingrad?

by Tyler Durden - Zero HedgeWill the High Frequency Signing scandal be the proverbial straw on the camel's back? Perhaps. In the meantime, here is a soon to be viral, and all too real, parody of foreclosure gate. At this point the guilty parties are irrelevant. All that matters is that America's terminal collapse into a banana republic status is now obvious for all to see.

And as for Cramer saying foreclosure gate will only force home prices to go higher, pray tell dear Jim, just which buyers will put their own money into a home when they have no idea at what time the real title holder shows up with a restraining and eviction order, and demands immediate access.

Of course, there is a loophole: the Fed will simply henceforth pay for all home purchases. And should the government drop mortgage rates to zero, and subsidize tax and insurance payments into infinity, that may well happen. Of course, it will also bankrupt the country, but since when was America's insolvency news to anyone...

Ilargi: However, all those who think (and I talked about this before) that now the banks will have their comeuppance, and be exposed to all for who they truly are, you haven't been paying attention.

The present US administration has been shoveling trillions of dollars of your money into both the banking system and the housing market. And the White House is not about to give up on that investment.

What they want you to see is the marked to make believe claim that TARP cost you almost nothing. What has been going on behind the scenes is a whole different ballgame. The interplay between zero interest rates, 3-4% Treasury rates and the Fed paying interest on reserves constitutes a de facto limitless continuation of bank stimulus. Think Obama will risk the same very banks he's worked so hard to save over a trivial matter like illegal foreclosures? Get with the program.

And I haven't even as much as mentioned Fannie Mae and Freddie Mac, the proud owners (in your trust) of trillions of dollars worth of these debased, greatly diminished-in-value and lawless loans. Washington can't do anything that would risk the position of Fannie and Freddie. Which exist only by the grace of another accounting trick: keeping them off the federal balance sheet, even if they're 80% state-owned. Washington will squash this thing with all it has (unless one of the two parties sees political gain in promoting it).

But don’t take my word for it, here's the government's Fannie and Freddie overseer:

US Government Steps Lightly Into Foreclosure Controversy[..] several people familiar with the matter have said banks are facing growing pressure from Fannie Mae and Freddie Mac to address deficiencies in their mortgage servicing operations. Fannie Mae and Freddie Mac [..] were taken over by the government in 2008 and have been run under a conservatorship by the Federal Housing Finance Agency since that time.

FHFA acting director Edward DeMarco [..] said his agency was working with Fannie Mae and Freddie Mac to determine the scope of the documentation issue and come up with targeted ways to address the matter. Banks and regulators are facing growing political pressure to act quickly, with multiple politicians and state attorneys general insisting in recent days on a broad freeze of foreclosures until the matter is resolved.

"I understand there's a lot of concern," Mr. DeMarco said. "Concern is understandable. We're not diminishing the concern. We are trying to be quick but measured in the approach and the response taken. We're concerned about the whole housing market and we're concerned about what this means for taxpayers and other market participants." He said he didn't want to "rush into things that create further unintended consequences."

Mr. DeMarco said he hasn't seen any evidence that people had lost their homes to foreclosure during this process who had otherwise made their monthly payments or had made "full attempts to satisfy and meet the terms of some foreclosure-alternative program." "I don't think that's what we're looking at here, from what we know to date," he said.

Ilargi: See? It’s like the banks were a little sloppy, perhaps, but in the end, really, the blame is put squarely with the borrower. The White House washes its hands and clears its tracks even as the entire affair has yet to come to fruition. That's not a coincidence. They want no part of this.

They want no enduring legal battles or Heaven forbid a traumatic pause in the entire housing system. Once that would start, there's no telling where it would end. If a hundred different judges look at the contracts and the way they were handled, there’ll always be a few who actually check the legality of the various practices in their law books. And that could lead to nightmarish scenarios for the administration and Congress. The biggest fear of all is a full stop to lenders' revenue flow.

David Axelrod did the first Sunday talking head nothing-to-see-here damage control:

White House: No Need For National Foreclosure Moratorium[Top White House adviser David Axelrod]: "I'm not sure about a national moratorium because there are in fact valid foreclosures that probably should go forward" "Our hope is this moves rapidly and that this gets unwound very, very quickly,"

Ilargi: Oh boy, do they ever want it over quickly. The other guys too, and they're less subtle about it:

The No. 2 House Republican, Rep. Eric Cantor of Virginia, said a national moratorium would remove the protections that lenders need. "You're going to shut down the housing industry" with a national stoppage, Cantor said. "People have to take responsibility for themselves."

Ilargi: At times you see people say things that, no matter how deranged your mind has gotten from listening to them, you could never have made up yourself. "People have to take responsibility for themselves." Eh, does that go for bankers too? And this one if poetic in its, let’s say, "blind courage": [..] a national moratorium would remove the protections that lenders need. Where does that come from, who thinks of such lines and then expresses them in public, other then some guy who holds up his hand when K-Street comes calling?

But yeah, kudos for creative bluntness. You have an industry that you already know blew up your entire economy one way, then you find out they're completely messing up on the other end as well, and your line is about "the protections the lenders need and borrowers need to be responsible?" Whoa!

After that moment of still admiration for sheer audacity, let's return to the zombies. That is to say, your neighbors. Not you, of course, you’ll be just dandy. As I said, what drives the US economy today is zombie money. The financial system lost so many bad wagers just in the new millennium, they're easily sufficient to bring down the whole country. And instead of at least trying to deal with it, Washington had decided to go for the "Watch the hand" to make people think the losses have magically vanished.

And yes, granted, it has been quite a success. Gullibility has been known to drive entire political careers from A to Z. But in times of trouble, it's not all that straightforward.

I think we can agree that the banks are zombies, that they would have been dead a while ago if not for your taxpayer money. The problem embedded in that notion is that the debts from lost bets are much higher than your taxpayer funds could ever dream of paying off. And since a very substantial part of those bets were wagered using the primary average taxpayer asset, his home, as -hidden- collateral, the country as a whole reaches upon a fork in the road.

The banking system is on life support. Can we agree on that? And the nation as a whole sees its credit life-blood contracting like a roof on fire, and therefore depends on the banking system to extinguish the flames. But the banking system is on life support! It won't and can't have a positive contribution to the economy for a long time to come. And still the nation's trillions are flowing into providing that life support, in the alleged hope that it will revive the economy.

There's something hugely false in that whole picture. It’s just not going to happen. The trillions of your money that went to the banks could instead have gone to you. Too late now! Pull the plug from the banks' drip, pull it from Fannie and Freddie, and you can call the undertaker in 10 minutes. I don't want to upset you, but many of us have seen people on life support who didn't pull through and come back: it only served to extend their lives, and often unfortunately their agony. Whether that's a good idea depends on the price that's paid.

Wall Street banks are beyond salvation. And if you let your government continue to do what it's done so far over the past 2-3 years, so is the entire US economy. What resources could be used to help the living, have instead been used to prolong the death rattle of the zombie banks. And they will not go quiet into that night. They’ll drag most of what's left of the country down with them.

Home prices are stuck at temporary artificial sugar highs. Or maybe it's crack. In order to raise home prices, you need 1) a healthy financial system, 2) a solid drop in unemployment, and 3) a way for the average American who still has a job to clear their debt and start spending again.

None of these 3 things will happen anytime soon. Everything in the economic system is still pulled down by debt, and there's no way to get rid of it, other than QE, stimulus and funny accounting. Which don’t work for banks beyond a certain expiration date, and which don’t work at all for the American citizen.

And that means that home prices will and must keep falling, that unemployment must keep rising, that governments at all levels will raise taxes on an ever more impoverished population. If you think today that your job is safe, please think again. Consider a scenario worse than you have so far. If you think you’ll be able to sell your home at a price that's favorable to you: in 95% of cases, you won't. Think about what that means for your future.

The government can keep the zombie banks alive for a bit longer, but not that much. At some point, the morphine kills the host. It can't keep you alive either, provided it would want to, not if you depend on a job that can be scratched, a pension that can be diluted, or a property that can be confiscated.

And I know, the vast majority of you may perhaps recognize some of the features, but not when it comes to their positions in life. So look at your neighbors: how safe are their jobs, the value of their homes?

You see, unemployment leads to foreclosures which lead to unemployment which leads to lower home prices which lead to fewer jobs which lead to sagging retail sales which lead to fewer jobs which lead to lower home prices which lead to bankrupt businesses which lead to fewer jobs which inevitably in the end lead to broke pension funds, collapsing stock markets, bankruptcies in the financial system, even more unemployment, even lower real estate prices and down the line to a seizure in the whole system. The last great idea is the bring down the value of the dollar, but that, as any child can see, is not that great of an idea for a nation that imports much more than it exports.

So the banks are zombies, homeowners will be zombies when prices keep on falling as they must, people losing their jobs are zombies, and their numbers will be great, and as I said, all your neighbors are zombies too because of it all. Good thing you're doing so fine, you lucky one. Now try to keep the neighbors away.

To conclude, here's what the UK is facing, just so can can get a picture of what your neighbors will be facing as a first step down the ladder:

UK middle income families £4,000 ($6400) a year worse offSignificant belt-tightening beckons as rises in tax and National Insurance and cutbacks in benefit payments begin to take effect. Middle-income families will be £4,000 a year worse off by 2013 in light of the decision to scrap child benefit for higher-rate taxpayers. Calculations for The Sunday Telegraph show that a family earning £50,000 could be £4,000 a year worse off after all of the Coalition's tax and benefit changes are implemented, while the cost of living is also predicted to rise.

Ilargi: Sure, over $75,000 seems like a lot of money. But, looking at typical spending patterns, let’s say 35% of it goes toward income tax, another 35% towards the mortgage, and 20% to other fixed costs, electricity etc, which means there's just $7500 left for discretionary spending, and $6400 of that is about to be taken away.

And that means your neighbors have zombie children too. Better start locking the back door at night.

QE1 Failed, Why Will QE2 Work?

by Cullen Roche - TPG

Most market participants are fixated with the potential for QE2 to boost asset prices and generate organic economic growth, however, without a subsequent rise in aggregate demand and productivity the program will ultimately be deemed a failure as prices readjust over time to reflect the real underlying fundamentals. Mr. Bernanke is making the same blunder that we made with the past bubbles busts – if we can create paper profits and convince consumers that they should spend those paper profits then we’ll be on our way to economic prosperity. The problems arise when asset prices readjust lower to meet their true fundamentals. It’s ponzi finance and nothing more.As I have previously explained, the goal of QE is to increase aggregate demand by creating a fictitious wealth effect and by increasing bank loans. The market appears to think that QE1 was some sort of success, but as I have argued, QE1 was only successful because it altered bank balance sheets and alleviated the credit strains. After all, this was Ben Bernanke’s goal at the time – to alleviate the credit pressures. What QE1 did not do (and what we need now) is increase lending supported by a boost in real aggregate demand. QE does not add net new financial assets to the private sector and is not inherently inflationary though Mr. Bernanke appears to be convinced otherwise. Unfortunately, QE1 failed to succeed in contributing substantially to the economic recovery as Northern Trust recently showed:

“When the Fed embarks on QE2, all else the same, Federal Reserve Bank credit will increase. What transpires with respect to commercial bank credit will determine the effectiveness of QE2 in increasing aggregate demand for U.S. goods and services. The more commercial bank credit increases in tandem with Federal Reserve Bank credit, the more effective will be QE2 in creating aggregate demand. If, however, commercial bank credit should decrease by the same or greater amount of the increase in Federal Reserve Bank credit, then QE2 will be a failure in creating additional aggregate demand. This is what happened when QE1 “set sail.” Chart 3 shows the behavior of the sum of Federal Reserve and commercial bank credit. The shaded area in Chart 3 represents the period in which QE1 was in effect. As can be seen in Chart 3, during the “voyage” of QE1, the sum of Federal Reserve and commercial bank credit trended lower. Chart 4 shows how this came about (no sailing pun intended). A small increase in Federal Reserve Bank credit in the 16 months ended March 2010 was offset by larger decrease in commercial bank credit during the same period.”

QE1 failed to boost bank lending and aggregate demand. Therefore, why would anyone assume that this time will be different? I think the market is pricing in an economic outcome that will fail to materialize.

US Government Steps Lightly Into Foreclosure Controversy

by Damian Paletta - Wall Street Journal

The top regulator for Fannie Mae and Freddie Mac said Friday that government officials aimed to develop a tailored response to the recent foreclosure-documentation controversy that wouldn't have an adverse impact on the fragile housing market. The comments came the same day Bank of America Corp. said it was temporarily going to freeze foreclosure sales across the country as it reviewed the process used by mortgage servicers to handle foreclosures. Several other lenders had agreed to halt foreclosure sales in certain states, but Bank of America's announcement was the most sweeping.

It is unclear if other large mortgage servicers will follow suit, but several people familiar with the matter have said banks are facing growing pressure from Fannie Mae and Freddie Mac to address deficiencies in their mortgage servicing operations. Fannie Mae and Freddie Mac were created by Congress to provide liquidity and stability to the housing market. The companies were taken over by the government in 2008 and have been run under a conservatorship by the Federal Housing Finance Agency since that time.

FHFA acting director Edward DeMarco wouldn't comment specifically on the Bank of America decision. But he said his agency was working with Fannie Mae and Freddie Mac to determine the scope of the documentation issue and come up with targeted ways to address the matter. Banks and regulators are facing growing political pressure to act quickly, with multiple politicians and state attorneys general insisting in recent days on a broad freeze of foreclosures until the matter is resolved.

"I understand there's a lot of concern," Mr. DeMarco said. "Concern is understandable. We're not diminishing the concern. We are trying to be quick but measured in the approach and the response taken. We're concerned about the whole housing market and we're concerned about what this means for taxpayers and other market participants." He said he didn't want to "rush into things that create further unintended consequences."

Mr. DeMarco said he hasn't seen any evidence that people had lost their homes to foreclosure during this process who had otherwise made their monthly payments or had made "full attempts to satisfy and meet the terms of some foreclosure-alternative program." "I don't think that's what we're looking at here, from what we know to date," he said.

Fannie Mae and Freddie Mac carry enormous influence over the housing market. They buy mortgages from banks and other originators, so banks are often dependent on these companies for liquidity to originate loans. Fannie Mae and Freddie Mac enter into servicing agreements with scores of companies to collect payments and work with homeowners, and its these contracts that are central to the companies' involvement in the current issue.

"From where I sit, I'm concerned the country's housing finance system remains fragile, and it's my intention to work through this subject in a manner that is fair to households with delinquent mortgages but is also fair to servicers, to mortgage investors, and most of all is in the best interest of the taxpayers and the housing market," he said.

The White House is working on a plan to overhaul the housing finance system, and Congress is expected to tackle the issue early next year. Democrats and Republicans have said Fannie Mae and Freddie Mac shouldn't be allowed to continue operating in their current form, but there are competing proposals for how to restructure the system. The government has spent billions of dollars in the last two year to keep Fannie Mae and Freddie Mac operational.

Government had been warned for months about troubles in mortgage servicer industry

by Zachary A. Goldfarb - Washington Post

Consumer advocates and lawyers warned federal officials in recent years that the U.S. foreclosure system was designed to seize people's homes as fast as possible, often without regard to the rights of homeowners.

In recent days, amid reports that major lenders have used improper procedures and fraudulent paperwork to seize properties, some Obama administration officials have acknowledged they had been aware of flaws in how the mortgage industry pursues foreclosures. But the officials said they could take only limited action to address the danger. In part, this was because they wanted lenders' help carrying out federal programs to modify mortgages that had fallen into default or were poised to do so.

New concerns about improper practices - such as those involving faked documents or "robo-signers" who signed tens of thousands of documents without reviewing them - have prompted the mortgage servicing arms of the country's largest banks to freeze millions of foreclosures. As momentum builds for a national moratorium, the administration has begun assessing the potential impact, examining the threat it could pose for the ailing housing market and the wider financial system.

There is no evidence so far that the specific abuses made public in the past few weeks were known to government officials. Nor is it clear whether they were aware that the process of the selling and reselling of mortgages among financial firms - which became extremely common and highly profitable during the housing boom - was raising legal questions about who actually owned the loans and had the right to foreclose if they want bad.

But government officials were told repeatedly that the mortgage servicing industry was deeply troubled, according to administration officials, consumer advocates, housing lawyers and congressional aides. "Have we talked to them about servicer incompetence? Repeatedly. Have we talked to them how the servicer system is broken? Yes," said Ira Rheingold, executive director of the National Association of Consumer Advocates. "Have we talked to them about the costly stream of errors made by servicers? Yes."

In meetings and letters to the government, consumer advocates and lawyers accused the servicer industry of violating its agreements with the government to help slow foreclosures, saying it instead was structured to accelerate the foreclosure process. "The message was that servicing needs to be regulated, and that the existing regulators of the servicers need to be on the job and needed to look at what has happened in the servicing industry," said Julia Gordon, a lawyer with the Center for Responsible Lending. "If it had been mandatory for servicers to engage in some kind of evaluation of the loan prior to foreclosure, you'd have seen a much different outcome for many borrowers."

Loan modification plans

Many of the warnings came in the context of the administration's signature housing policy program, the Home Affordable Modification Program. The initiative seeks to rework the loans of struggling borrowers to make them more affordable.

As discussions about the program began in late 2008 and early 2009, consumer advocates and housing lawyers say they told senior officials that they had to escalate pressure on mortgage servicers to revamp their procedures if they hoped to stem the foreclosure crisis. In particular, the advocates and lawyers cautioned that servicers had incentives to foreclose and would only pay lip service to modifying mortgages.

In July of last year, a coalition of housing advocates and consumer lawyers wrote to the administration. "The Federal Government should use sticks that it has available to put pressure on servicers to fully comply" with the legal commitments they had made to federal officials about helping borrowers avoid foreclosure, the coalition said.

Several reports by government watchdogs, meanwhile, raised concerns that mortgage servicers were not up to the challenge presented by the staggering number of troubled borrowers, including many looking to modify their loans. The reports, from the Government Accountability Office and the Congressional Oversight Panel for the government bailout of the financial industry, warned that servicers employed staffers who gave borrowers inaccurate information, didn't hire enough staffers, failed to track complaints and lost important paperwork.

"Servicers are generally understaffed for handling a large volume of consumer loan workouts. Staffing is not simply a matter of manpower, but also of sufficiently trained personnel and adequate technological support," said a March 2009 oversight panel report.

Housing advocates and government reports gave several reasons why servicers try to foreclose so quickly. In general, servicers make more money when they foreclose on a loan than when they find a better arrangement for the borrower. That's because the payments to the servicer decline when a loan is modified. But if instead the borrower is in default, the servicer adds fees on the account and can collect when the house is sold, even at foreclosure. In addition, servicers are under pressure to continue to transfer the money paid by the borrower to the investor in the loan. When a borrower isn't paying the loan, the servicer has to cover the difference.

Moreover, servicers can expect to charge more if they receive higher ratings from credit rating agencies. And the faster a servicer forecloses when loans are in default, the higher the rating they stand to receive. So new businesses have emerged to accelerate the foreclosure process. Companies have launched electronic platforms that allow servicers to rapidly foreclose, quickly hiring lawyers to file necessary court documents in a process that is often divorced from the circumstances facing an individual borrower.

Problems outlined

In an interview this week, a senior administration official confirmed that the White House and Treasury Department had received warnings that the mortgage industry employed inexperienced staffers to oversee foreclosures, had problems handling documents and communicating with borrowers, and often failed to comply with regulations. But the government had struggled to address shortcomings in the industry, the official said, because the administration was also seeking the servicers' help with modifying the home loans of millions of borrowers to help them avoid foreclosure.

In addition, a Treasury official said the federal government's power to tackle problems in the servicer industry is limited because foreclosure law is largely the domain of states. Both officials, who were not authorized to speak on the record but were providing the administration's views on the matter, said problems in the foreclosure process were largely the result of mortgage servicers being overwhelmed.

The only immediate response to warnings was a letter to servicers urging them to behave better. But in June, the administration enacted a policy requiring that servicers try to modify a loan before beginning the foreclosure process. "Though we cannot and should not prevent every foreclosure, the administration continues to work hard to stop preventable foreclosures and promote policies to stabilize the housing market and keep more Americans in their homes where possible," said Amy Brundage, a White House spokeswoman.

Brundage added, "We will continue to focus on implementing our existing housing programs and on working closely with appropriate agencies to ensure programs are working as effectively as possible and that all participants are complying fully with any and all applicable rules and laws."

Is ForeclosureGate About To Become The Banking Industry's Stalingrad?

by Tyler Durden - Zero Hedge

Will the High Frequency Signing scandal be the proverbial straw on the camel's back. Perhaps. In the meantime, here is a soon to be viral, and all too real, parody of foreclosure gate. At this point the guilty parties are irrelevant. All that matters is that America's terminal collapse into a banana republic status is now obvious for all to see.

And as for Cramer saying foreclosure gate will only force home prices to go higher, pray tell dear Jim, just which buyers will put their own money into a home when they have no idea at what time the real title holder shows up with a restraining and eviction order, and demands immediate access.

Of course, there is a loophole: the Fed will simply henceforth pay for all home purchases. And should the government drop mortgage rates to zero, and subsidize tax and insurance payments into infinity, that may well happen. Of course, it will also bankrupt the country, but since when was America's insolvency news to anyone...

White House: No Need For National Foreclosure Moratorium

by Alan Fram - Huffington Post

A top White House adviser questioned the need Sunday for a blanket stoppage of all home foreclosures, even as pressure grows on the Obama administration to do something about mounting evidence that banks have used inaccurate documents to evict homeowners.

"It is a serious problem," said David Axelrod, who contended that the flawed paperwork is hurting the nation's housing market as well as lending institutions. But he added, "I'm not sure about a national moratorium because there are in fact valid foreclosures that probably should go forward" because their documents are accurate. Axelrod said the administration is pressing lenders to accelerate their reviews of foreclosures to determine which ones have flawed documentation. "Our hope is this moves rapidly and that this gets unwound very, very quickly," he said.

With the reeling economy already the top issue on voters' minds, the doubts raised over foreclosures and evictions are becoming a political issue with the approach of Nov. 2 elections. Underscoring those pressures, two leading lawmakers took opposing stances on the wisdom of a moratorium. Rep. Debbie Wasserman Schultz of Florida, a top House Democrat, said she backed a foreclosure moratorium and government talks with the banking industry to concoct ways to let lenders reshape troubled mortgages. She said the foreclosure problem has been "extremely vexing" in her state.

The No. 2 House Republican, Rep. Eric Cantor of Virginia, said a national moratorium would remove the protections that lenders need. "You're going to shut down the housing industry" with a national stoppage, Cantor said. "People have to take responsibility for themselves."

In recent days, Senate Majority Leader Harry Reid, D-Nev., in a tough re-election race, urged five large mortgage lenders to suspend foreclosures in his state until they establish ways to make sure homeowners don't lose their homes improperly. Attorney General Eric Holder said that the government is looking into the matter, and Democratic lawmakers urged bank regulators and the Justice Department to probe whether mortgage companies violated laws in handling foreclosures.

The attorneys general of up to 40 states plan to announce a joint investigation soon into banks' use of flawed foreclosure paperwork, a person familiar with the investigation told The Associated Press late Saturday. On Friday, Bank of America became the first bank to halt foreclosures in all 50 states. Three other institutions – JPMorgan Chase & Co., Ally Financial's GMAC Mortgage unit and PNC Financial – have stopped foreclosures in the 23 states where foreclosures must be approved by a judge.

President Barack Obama vetoed a bill last week that would have made it easier for banks to approve foreclosure documents, which the White House said could hurt consumers. Axelrod spoke on CBS' "Face the Nation" while Wasserman Schultz and Cantor appeared on "Fox News Sunday."

'This is the biggest fraud in the history of the capital markets'

by Ezra Klein - Washington Post

Ezra Klein: What’s happening here? Why are we suddenly faced with a crisis that wasn’t apparent two weeks ago?

Janet Tavakoli: This is the biggest fraud in the history of the capital markets. And it’s not something that happened last week. It happened when these loans were originated, in some cases years ago. Loans have representations and warranties that have to be met. In the past, you had a certain period of time, 60 to 90 days, where you sort through these loans and, if they’re bad, you kick them back. If the documentation wasn’t correct, you’d kick it back. If you found the incomes of the buyers had been overstated, or the houses had been appraised at twice their worth, you’d kick it back.

But that didn’t happen here. And it turned out there were loan files that were missing required documentation. Part of putting the deal together is that the securitization professional, and in this case that’s banks like Goldman Sachs and JP Morgan, has to watch for this stuff. It’s called perfecting the security interest, and it’s not optional.

EK: And how much danger are the banks themselves in?

JT: When we had the financial crisis, the first thing the banks did was run to Congress and ask for accounting relief. They asked to be able to avoid pricing this stuff at the price where people would buy them. So no one can tell you the size of the hole in these balance sheets. We’ve thrown a lot of money at it. TARP was just the tip of the iceberg. We’ve given them guarantees on debts, low-cost funding from the Fed. But a lot of these mortgages just cannot be saved. Had we acknowledged this problem in 2005, we could’ve cleaned it up for a few hundred billion dollars. But we didn’t. Banks were lying and committing fraud, and our regulators were covering them and so a bad problem has become a hellacious one.

EK: My understanding is that this now pits the banks against the investors they sold these products too. The investors are going to court to argue that the products were flawed and the banks need to take them back.

JT: Many investors now are waking up to the fact that they were defrauded. Even sophisticated investors. If you did your due diligence but material information was withheld, you can recover. It’ll be a case-by-by-case basis.

EK: Given that our financial system is still fragile, isn’t that a disaster for the economy? Will credit freeze again?

JT: I disagree. In order to make the financial system healthy, we need to recognize the extent of our losses and begin facing the fraud. Then the market will be trustworthy again and people will start to participate.

EK: It sounds almost like you’re saying we still need to go through the end of our financial crisis.

JT: Yes, but I wouldn’t say crisis. This can be done with a resolution trust corporation, the way we cleaned up the S&Ls. The system got back on its feet faster because we grappled with the problems. The shareholders would be wiped out and the debt holders would have to take a discount on their debt and they’d get a debt-for-equity swap. Instead we poured TARP money into a pit and meanwhile the banks are paying huge bonuses to some people who should be made accountable for fraud. The financial crisis was a product of our irrational reaction, which protected crony capitalism rather than capitalism. In capitalism, the shareholders who took the risk would be wiped out and the debt holders would take a discount but banking would go on.

Bank of America Halts Foreclosures in All States

by David Streitfeld and Nelson D. Schwartz - New York Times

Bank of America, the nation’s largest bank, said Friday that it was extending its suspension of foreclosures to all 50 states. The plan swept states with some of the highest foreclosure levels, including California, Nevada and Arizona, into a swelling crisis over lenders’ flawed paperwork that had been mostly confined to 23 other states that require judicial review of foreclosures.

Bank of America instituted a partial freeze last week in those 23 states, and three other major mortgage lenders have done the same. The bank’s decision on Friday increased pressure on other lenders to extend their moratoriums nationwide as well. An immediate effect of the action will be a temporary stay of execution for hundreds of thousands of borrowers in default. The bank said it would be brief, a mere pause while it made sure its methods were in order.

But as the furor grows over lenders’ attempts to bypass legal rules in their haste to reclaim houses from delinquent owners, there is a growing expectation that foreclosures will dwindle for months as the foreclosure system is reworked. Stan Humphries, an economist with the housing site Zillow.com, said what was initially cast as a problem of sloppy record-keeping is rapidly evolving into one that suggests the banks’ procedures for recording loans might not have followed the law.

“The former scenario represents a hiccup for the market, maybe a 30- to 90-day slowdown in foreclosure initiations,” Mr. Humphries said. “The latter scenario is more like hitting a wall.” The uncertainty is putting the housing market in turmoil and causing vast confusion. Bank of America, for example, said it was not halting sales of foreclosed properties to new owners, but Fannie Mae, the giant mortgage holding company, is doing exactly that with properties it bought from Bank of America.

One real estate agent in Florida said Friday that he had six deals involving former Bank of America properties that had been at least temporarily scuttled. Representatives for Fannie, which was taken over by federal regulators after it failed two years ago, did not return calls. Real estate agents said the extent of any disruption depended on how long the moratorium lasted, how many lenders ultimately participated — and what people in default decided to do.

“If it’s still January, February, March, and they’re not foreclosing, you’ll see a big effect,” said Jim Klinge, an agent in San Diego. “It’ll be a banker’s holiday, free rent for everybody and a lawyers’ gold mine.”

As soon as Bank of America announced its freeze in a terse press release, Senate Majority Leader Harry Reid and Edolphus Towns, the New York Democrat who leads the House Committee on Oversight and Government Reform, both pointedly asked other lenders to follow suit. Increased pressure also came from Christopher J. Dodd, the chairman of the Senate Banking Committee, who announced a Nov. 16 hearing on foreclosures.

The other lenders, however, did not seem to be swayed. JPMorgan Chase, which has halted foreclosures in the 23 states where they need a judge’s permission, says it is putting hundreds of lawyers and executives to work addressing what it characterizes as a “technical” paperwork problem with 56,000 mortgages with improper documentation. Officials have no plans to halt foreclosures nationwide, and believe they can fix the problems within weeks, they said.

Chase officials acknowledge they had a flawed process, but they say they have not mistakenly foreclosed on any homeowners, because the underlying information is accurate. People close to the bank say that about one-third of the properties tied to mortgages under scrutiny are vacant, in line with their assessment of the overall industry. The average borrower that Chase has foreclosed on, these people added, has not made a payment on the mortgage for about one and a half years — a figure that they say is also consistent with the industry.

Inside Citigroup, which has not suspended foreclosures, officials said they were breathing a sigh of relief. Sanjiv Das, the head of CitiMortgage, began a review of loan servicing processes about 18 months ago in anticipation of a groundswell of foreclosures. At that time, Citi stepped up its employee training and tightened its documentation processes, giving officials there confidence that they have sidestepped the document issue. But given the huge number of mortgages it processed and its sprawling operations, Citi — which has faced one embarrassment after another — is not publicly declaring victory.

On Friday, Wells Fargo, another big lender that has not halted foreclosures, continued to maintain that its foreclosure processes were accurate and said it was not planning to initiate a nationwide moratorium. “As a standard business practice, we continually review and reinforce our policies and procedures,” said Vickee Adams, a Wells Fargo spokeswoman. “If we find an error or if an improvement is needed, we take action.”

Bank of America’s chief executive, Brian T. Moynihan, speaking at the National Press Club in Washington, said he did not believe the bank’s action would disrupt the housing market. “We haven’t found any problems with the foreclosure process and what we’re saying is that we’ll go back and check our work one more time,” he said.

Not only is Bank of America watched more closely as the nation’s largest bank, it also finds itself deeper in the subprime mortgage mess. It holds $102 billion in subprime loans on its balance sheet from the period when lending standards were most lax — 2005 to 2007 — more than JPMorgan Chase, Citigroup or Wells Fargo, according to a report by Christopher Kotowski, an analyst with Oppenheimer.

Bank of America’s troubled mortgage portfolio is a legacy of its July 2009 acquisition of Countrywide, a subprime specialist that was among the financial institutions with the most troubled loans, as well as its January 2009 merger with Merrill Lynch, which was a major player in the business of taking mortgages and transforming them into securities to be sold to investors.

In addition, as the beneficiary of two capital infusions by Washington under the federal bailout, Bank of America was among the banks most dependent on Washington to help survive the financial crisis, receiving $45 billion from taxpayers. Of that, $20 billion came in emergency aid after Merrill’s losses were revealed. That money has been paid back, but several analysts said the company was eager to maintain good relations with the government, and emphasized that restoring the bank’s public image was a crucial factor in the action on Friday.

“What prompted Bank of America is they see the political writing on the wall, and this has clearly become a political issue,” said Guy D. Cecala, the editor of Inside Mortgage Finance. “Almost every lawmaker is calling for a national mortgage foreclosure moratorium, and given the momentum out there, they wanted to deal with it on their own terms.”

In fact, earlier this year, with a government ban on automatic overdraft fees for debit cards looming, Bank of America actually went further than its rivals and pre-emptively eliminated the overdraft option entirely. Other banks allow customers to now opt in to the program, which can result in huge charges for small overdrafts.

Another reason for Bank of America’s broader action, suggested Richard X. Bove, an analyst with Rochdale Securities, is that the attorney general of the state where it is based, North Carolina, has called on the bank to halt foreclosures there. “It’s a pre-emptive strike,” he said. “The smartest thing to do is to get ahead of the attorneys general around the country on this.”

Attorneys General in 40 States Said to Join on Foreclosures

by Dakin Campbell and Prashant Gopal -Bloomberg

Attorneys general in about 40 states may announce by next week a joint investigation into potentially faulty foreclosures at the largest banks and mortgage firms, according to a person with direct knowledge of the matter.

State attorneys general led by Iowa’s Tom Miller are in talks that may lead to the announcement of a coordinated probe as soon as Oct. 12, said the person, who asked not to be named because an agreement wasn’t completed. The number of states may change because several are deciding whether to join, the person said. New Mexico Attorney General Gary King said yesterday in a statement that his office will join a multi-state effort.

Lawyers representing the banks expect a widening investigation, according to Patrick McManemin, a partner at Patton Boggs LLP, a Washington-based law firm that represents banks, loan servicers and financial institutions. Bank of America Corp., the biggest U.S. lender, yesterday extended a freeze on foreclosures to all 50 states.

“We are aware of or involved in a large number of investigations that lead us to believe there are in the neighborhood of 40 state attorneys general who have initiated investigations or expressed an interest,” McManemin said in a telephone interview.

Justice Department

Officials in at least seven states have already announced probes into claims that employees at home lenders and loan servicers signed court documents without ensuring the information was accurate. On Oct. 7, Miller said in a statement that he was working with state officials, banking regulators and the U.S. Justice Department to launch a coordinated review. Attorneys general in Ohio and Connecticut have said some of the practices may amount to fraud.

The Senate Banking Committee plans to hold a hearing Nov. 16 to investigate mortgage servicing and foreclosure practices, according to its website. “American families should not have to worry about losing their homes to sloppy bureaucratic mismanagement or fraud,” the panel’s chairman, Connecticut Democrat Christopher Dodd, said in a statement. “Regulators at the federal, state and local levels have a responsibility to uphold the law and protect consumers from unfair foreclosure.”

Frozen Foreclosures

Bank of America, JPMorgan Chase & Co. and Ally Financial Inc. already froze foreclosures in 23 states where courts supervise home seizures, amid allegations that employees used unverified or false data to speed the process. Litton Loan Servicing LP, a mortgage-servicing business owned by Goldman Sachs Group Inc., said yesterday it’s halting some foreclosures to review how they’re handled.

Senate Majority Leader Harry Reid, a Democrat from Nevada, called on other banks and mortgage firms to follow Bank of America’s lead and “review their practices to ensure that they are not unfairly targeting homeowners in Nevada and across the nation,” according to a statement yesterday. “There are reasons for these procedures and those are to make sure the banks own the homes they are foreclosing on,” Robert Lawless, a professor at the University of Illinois College of Law in Champaign, said in a telephone interview. “At the same time I don’t think it is going to be a tidal wave of relief for homeowners. My bet is that there will be a delay.”

Vickee Adams, a spokeswoman for San Francisco-based Wells Fargo & Co., and Mark Rodgers, a spokesman for New York-based Citigroup Inc., said the companies were still processing foreclosures. Thomas Kelly, a spokesman for New York-based JPMorgan, and Gina Proia, spokeswoman for Detroit-based Ally, declined to comment.

Homes Taken

Lenders took possession of a record 95,364 homes in August and issued foreclosure filings to 338,836 homeowners, or one of every 381 U.S. households, according to RealtyTrac Inc., an Irvine, California-based data vendor. “If you have a national moratorium on foreclosures, that’s a problem,” Paul Miller, an analyst for FBR Capital Markets Corp. in Arlington, Virginia, said in a phone interview. “The longer you drag out foreclosures the longer it takes to get through” the housing slump, he said.

Why Are Distressed Homeowners Still Paying Their Mortgage?

by Brett Arends - Wall Street Journal

The big question from the mortgage meltdown isn't why so many distressed homeowners are defaulting on their loans. It's why any of them are still making payments.

In the worst-hit areas millions have no equity left, and little hope of seeing any anytime soon. The market value of their homes is far below the size of the mortgage. If they just stop paying, what is going to happen to them? In many cases they may get to live in the home rent-free for months, even years, until the bank gets around to seizing it. If Frank Abagnale—the con man played by Leonardo DiCaprio in the film "Catch Me If You Can"—were operating today, he'd probably be living rent-free in a super-luxury high-rise in Miami.

Consider the latest revelations. The big banks are so backed up with foreclosures that some of them resorted to hustling through repossessions without the proper paperwork. Some of them—including Bank of America, J.P. Morgan Chase and Ally Financial's GMAC Home Mortgage—have announced a temporary freeze in some states on further foreclosures while they sort through the mess.

In one case, a bank employee said she was approving 8,000 foreclosures a month. By my math, that's roughly one for every minute and a half. No, she wasn't reading all the documents thoroughly. (As one wit observed, the banks paid about as much attention to foreclosing on the loans as they did to making them five years ago.) In many cases, thanks to the fallout from securitization, it's not even clear who owns the mortgage. The payments may be due to different financial institutions around the world, some of which have gone the way of all flesh.

No wonder a fair number of borrowers have simply gone on strike. Nobody knows exactly how many are doing so deliberately—a so-called strategic default—though some estimates suggest these may account for nearly a third of recent defaults. According to the Federal Reserve Bank of New York, one mortgage borrower in five in Florida and Nevada is more than 90 days' late on payments, and in Arizona and California it's about one in eight. It's a wonder it's not more.

A while back I received an email from a woman in Florida that illustrates the issue. Her neighbor across the road had stopped paying his mortgage about a year and a half earlier, she wrote. He was still living in his "luxury condo," and the lender hadn't come after him yet. After all, he told her, they were so backed up with the housing collapse it might take them years. My correspondent—a lawyer—was wondering whether she was being stupid for continuing to make her own payments. After all, she, too, was deeply underwater; her mortgage was far bigger than the value of the home.

So what happens to those who simply go on strike? Even where the bank is coming after them to evict them, it is taking months, maybe years. During that time they are living rent-free. When they are evicted, the bank then puts the home on the market. It may take months more to sell. Let's assume it sells, but for a lot less than the size of the mortgage. What can the bank do then?

In some states, the bank can do very little. In so-called nonrecourse states—which include California and Arizona, two of the worst-hit in the housing collapse—banks basically have to eat the loss. In other states, the banks have some ability to come after the homeowners for the shortfall. But for most distressed homeowners, this threat is more theory than reality. Why? The banks have too many cases to handle. And distressed homeowners typically have so little in surplus capital that there may not be much point.

Imagine you're the bank executive. The loss on the home came to, say, $200,000. The borrower is unemployed, driving a 10-year-old Chevy and living on food stamps. In another state. Or he has a part-time job in gas station, maybe $2,000 in savings, and two kids. How much do you want to spend on lawyers and debt collectors to hunt him down? How much do you think you're going to get back, after costs? You've got 5,000 cases like this.

Indeed, there's a lot the banks can't touch anyway. Money held in a 401(k) account, pension plan or individual retirement account is beyond the reach of creditors. So is college money for the children or grandchildren if held in a 529 plan for more than two years. And so are other assets; it varies by state. Often life insurance is sheltered: That may include mutual funds held in a variable annuity account. Once the borrower files for bankruptcy, the lender ends up with nothing.

Assuming people have taken legal advice, and taken the smart steps, the rules give many of them strong economic incentives to stop paying. In some circumstances, there might be state-tax consequences. They may find it harder to get a mortgage in the future. And their credit score will get dinged, sure, but in the grand scheme of things, is this really a fate worse than death? The ruthless and the reckless have already walked. Meanwhile, the middle class continues to pay through the nose. It's that old "middle-class morality" that George Bernard Shaw mocked a century ago.

But is this really a case of morality anyway? I'll confess this issue makes me uneasy. But my feelings are almost certainly awry. We live, alas, in a world, and an economy, which rewards ruthless self-interest and penalizes "morality." Just look at the big banks.

A mortgage isn't a blood oath, it's a business contract—a collateralized loan. It isn't simply a promise to repay the lender. It's a promise to repay the lender or to forfeit the home. Isn't someone simply fulfilling their contract by handing over the keys when asked? The banks knew full well what the fine print said when they made the loan. And so they should: They wrote the fine print. The economy will suffer if more homeowners default. But it will suffer if they don't. Those bad debts are doomed and need to be written off. Why should the homeowners eat them rather than the banks? Why is the reckless lender more at fault than the reckless borrower?

Japan struggled for 20 years with "zombie banks"—so called because their debts, if properly recognized, made them insolvent. Here in America, we have millions of zombie homeowners. Why is this any better?

Businesses make secured loans against property or collateral all the time. If the loan goes bad, the lender takes the collateral. Nobody expects executives to dip into their own pockets (a fortunate thing, as they never do). Bank executives pocketed tens of millions in the run-up to the financial crisis, directly as a result of the phony profits from reckless lending. Stockholders pocketed billions in dividends for the same reason. If the taxpayers hadn't stepped in, those banks would have collapsed and creditors would have lost a fortune. But they would have had no recourse—absent proof of fraud—against executives or those who owned equity.

Look through the financial statements of the big companies involved in the housing market, including major homebuilders and property developers, and you'll find frequent references to all the "nonrecourse financing" they've obtained. It's a boast. "Look," they're telling stockholders, "even if things go bad, the lenders can't touch us." Apparently the only people who haven't gotten the memo are the middle class. For how much longer?

Currency wars are necessary if all else fails

by Ambrose Evans-Pritchard - Telegraph

The overwhelming fact of the global currency system is that America needs a much weaker dollar to bring its economy back into kilter and avoid slow ruin, yet the rest of the world cannot easily handle the consequences of such a wrenching adjustment. There is not enough demand to go around. Asian investment in plant has run ahead of Western ability to consume. The debt-strapped households of Middle America, or Britain and Spain, can no longer hold up the dysfunctional edifice. Asians must take over, or it will come down on their own heads.

The countries actively intervening in exchange markets to suppress their currencies – China, Japan, Korea, Thailand, even Switzerland, to name a few – are all too often the same ones that have the biggest trade surpluses with the US. They are taking active steps to prevent America extricating itself from the worst unemployment since the Great Depression, now 17.1pc on the latest U6 index and rising again.

Each country is doing so for understandable reasons: Japan to avoid a deflationary crisis, China to hold together a political order that is more fragile than it looks. In both these cases they are trapped because they clung too long to a mercantilist export strategy, failing to wean themselves off American demand when the going was good. Yet this is an intolerable situation for the US. It should be no surprise that Washington has begun to retaliate in earnest, and not just by passing the Reform for Fair Trade Act in the House (not yet the Senate), clearing the way for punitive tariffs against currency manipulators.

The atomic bomb, of course, is quantitative easing by the Federal Reserve. America has in effect issued an ultimatum to China and G20: either you stop this predatory behaviour and agree to some formula for global rebalancing, or we will deploy QE2 `a l’outrance’ to flood your economies with excess liquidity. We will cause you to overheat and drive up your wage costs. We will impose a de facto currency revaluation by more brutal and disruptive means, and there is little you can do to stop it. Pick your poison.

This is what QE2 means, though Fed officials prefer to talk of their “mandate” of supporting employment. It is nothing like QE1, which was emergency action to halt the economic free-fall of late 2008 and early 2009. This time the Fed is using QE as a long-term tool to manage America’s chronic ailments. Uber-dovish Fed comments over recent days have been enough to send the dollar crashing to a 15-year low of 82 against the Japanese yen, to below parity against Swiss franc, and back to the EMU pain barrier of $1.40 against the euro.

There was much tut-tutting about currency warfare at the IMF meeting over the weekend. "If one lets this slide into protectionism, we run the risk of the mistakes of the 1930," said World Bank chief Robert Zoellick. You have to say this kind of thing if you run a Bretton Woods institution, but in real life wars occur because somebody finds the status quo unacceptable, perhaps justifiably so. As Nobel economist Paul Krugman puts it: “people are looking for innocuous ways to deal with this problem, and there aren’t any”.

Devaluation was not the mistake of the 1930s: it was the cure, albeit a bad one. The Gold Standard broke down during the inter-war years because the US and France had structurally undervalued exchange rates (like China/Asia today) and ceased recycling their trade surpluses (like China/Asia today). This caused a deflationary downward spiral for everybody. Escaping from such a deformed system was a path to recovery. The parallel with modern globalization – though not exact – is obvious. So is the 1930s lesson that currency and trade clashes are asymmetric: they are calamitous for surplus countries, but not always for deficit countries. Britain enjoyed a five-year mini-boom after retreating into an Empire trade bloc in 1932.

Fed chair Ben Bernanke knows his history. In a speech as a junior Fed governor he described Roosevelt’s 40pc devaluation against gold as “an effective weapon” against deflation and slump, adding “1934 was one of the best years of the century for the stock market”. I suspect that the Bernanke Fed is working with the Treasury to steer the dollar lower, and above all to stop it rising again, since the global dollar index looks poised for a powerful rebound. There is certainly something odd about the latest Fed rhetoric. New York chief William Dudley said inflation had fallen to “unacceptable” levels. Has it really? The Dallas Fed’s `trimmed-mean’ CPE inflation index has been creeping up over the last three months.

His Chicago colleague Charles Evans has called for “much more accommodation". Why now? Bank credit has stopped contracting. The M2 money supply growth has accelerated sharply to a 7.4pc rate over the last month of published data. The St Louis Fed’s monetary multiplier has edged up at last. By the Fed’s own account, the double-dip scare of the early summer has abated.

I happen to think that the Fed will need to launch QE2 on a big scale as US fiscal tightening bites, the inventory spike fades, and the housing foreclosure crisis gathers pace. But we are not there yet. Fresh QE cannot be justified at this juncture under any normal understanding of central bank policy.

Is the Fed in reality trying to shore up consumption by juicing asset prices, and trying to ensure that the effect boosts jobs at home rather than in China, Germany, or Japan by holding down the dollar? This is a dangerous moment for the world, and may backfire against the US itself. We are already starting to see the same sort of rush into oil and resources that played such havoc in mid-2008, and may have been a key trigger for the Great Recession. There is a risk that this commodity shock will hit before QE stimulus filters through.

And while the French deny that they are in talks with China over the creation of a new currency regime, I heard French finance minister Christine Lagarde say in person at a meeting in Italy that France would use its G20 presidency to push for an alternative to the dollar. She specifically cited the “Bancor”, the idea floated by Keynes in the 1940s for a commodity currency priced off a basket of metals. The US risks gambling away the “exorbitant privilege” it has enjoyed for two thirds of a century as currency hegemon.

Yet the surplus states have most to lose if this brinkmanship tips into commercial war. They must know this, but what we are witnessing may run deeper than a calculus of advantage. Was it naïve to think that Confucian Asia and the old democracies of the Atlantic seaboard can share an open global trading system?

Everything's Going Up? Not Quite

by John Lounsbury - Seeking Alpha

Stocks, gold, commodities.... they are all going up in lock step. How many talking heads have you heard in the last month or two say that many stocks are correlated making buying indexes as good as trying to pick a basket of stocks? I have heard that more times than I can count from memory.Well, you are not really any wealthier for the investing you are doing in stocks, precious metals or commodities. At least, not if you are investing using the U.S. dollar as your currency. As Steve Hansen pointed out in his review of a Bernanke speech Monday, the dollar is behaving in a way that doesn't make sense to many observers. Bernanke was talking up fiscal responsibility, but the dollar continued dropping. It seems that just the thought that their might be further quantitative easing was enough to overcome anything else that might effect the value of the dollar.

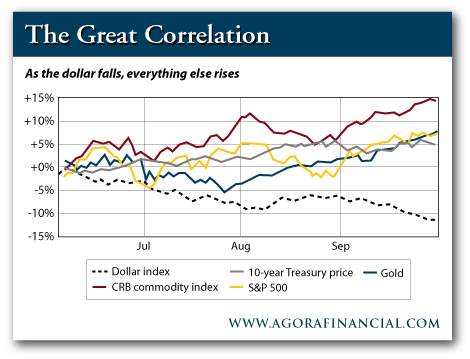

Everything is going up? Not quite as much as the dollar is going down in many cases, as seen in the following graph from the 5-Min. Forecast:

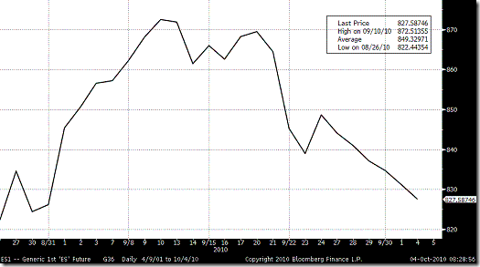

As Edward Harrison pointed out, when priced in Euros the big advance in September for the S&P 500 was actually very unremarkable with the price on October 4 only about 0.8% higher than on August 26:

All that seems to be happening, on average, is a milling around to accommodate changes in the relative value of the dollar.

In related news, the head of the IMF, Dominique Strauss-Kahn, warned that currency wars were not the way for countries to solve their internal problems. This comes after an article this weekend by Jason Rines discussed the internal issues that the U.S. and China each should be addressing instead of fighting over currency valuations.

And you thought everything was going up.

After QE, A Dramatic Dollar Upturn

Raoul Pal, of Global Macro Investor, and Marc Sumerlin, of The Lindsey Group, discuss gold, the dollar and more with CNBC's David Faber at the Barefoot Economic Summit in Larue, Texas.

Europe's Woes & Your Nest Egg

by

The biggest victim of the sovereign debt crisis could be your pension, according to Bruce Zimmerman, CEO and CIO of U. of Texas Investment Management Co. abd Raoul Pal, of Global Macro Investor.

America's Third World Economy

by Paul Craig Roberts - Counterpunch

For a number of years I reported on the monthly nonfarm payroll jobs data. The data did not support the praises economists were singing to the “New Economy.” The “New Economy” consisted, allegedly, of financial services, innovation, and high-tech services. This economy was taking the place of the old “dirty fingernail” economy of industry and manufacturing. Education would retrain the workforce, and we would move on to a higher level of prosperity.

Time after time I reported that there was no sign of the “New Economy” jobs, but that the old economy jobs were disappearing. The only net new jobs were in lowly paid domestic services such as waitresses and bartenders, retail clerks, health care and social assistance (mainly ambulatory health care services), and, before the bubble burst, construction.

The facts, issued monthly by the US Bureau of Labor Statistics, had no impact on the ”New Economy” propaganda. Economists continued to wax eloquently about how globalism was a boon for our future.

The millions of unemployed today are blamed on the popped real estate bubble and the subprime derivative financial crisis. However, the US economy has been losing jobs for a decade. As manufacturing, information technology, software engineering, research, development, and tradable professional services have been moved offshore, the American middle class has shriveled. The ladders of upward mobility that made American an “opportunity society” have been dismantled.

The wage and salary cost savings obtained by giving Americans’ jobs to Chinese and Indians have enriched corporate CEOs, shareholders, and Wall Street at the expense of the middle class and America’s consumer economy. The loss of middle class jobs and incomes was covered up for years by the expansion of consumer debt to substitute for the lack of income growth. Americans refinanced their homes and spent the equity, and they maxed out their credit cards.

Consumer debt expansion has run its course, and there is no possibility of continuing to drive the economy with additions to consumer debt. Economists and policymakers continue to ignore the fact that all employment in tradable goods and services can be moved offshore (or filled by foreigners brought in on H-1b and L-1 visas).

The only replacement jobs are in nontradable domestic services, that is, those jobs that require “hands-on” activity, such as ambulatory health services, barbers, cleaning services, waitresses and bartenders--jobs that describe the labor force of a third world country. Even many of these jobs are now filed with foreigners brought in on R-1 type visas from Russia, Ukraine, Thailand, Romania, and elsewhere.

The loss of American jobs and the compression of consumer income by low wages has removed consumer demand as the driving force of the economy. This is the reason expansionary monetary and fiscal policies are having no effect. The latest jobs report issued today shows that America’s transformation into a third world economy continues. The economy lost 95,000 jobs in September, mainly due to cuts in local education and federal employment. Part of the loss of 159,000 government jobs was offset by 64,000 new private sector jobs.

Where are the new jobs? They are in nontradable lowly paid domestic services: 32,000 were in health care and social services, and 33,900 were in food services and drinking places. There you have it. That is America’s “New Economy.”

An ugly, temporary answer to California's intractable budget problems

by Evan Halper - Los Angeles Times

With few services left to cut, little left to tax and almost no political will or legislative experience to move past partisan bickering, the state budget was bound to be a disappointment.

It was another prolonged Sacramento production, full of bickering, posturing and inaction that led to the latest state budget in modern history and provided a convenient target for the gubernatorial candidates, who say things would be different if they were in charge. One of them will be put to the test come January, when California starts the exercise all over again. Gov. Arnold Schwarzenegger and the current crop of lawmakers are leaving much of the $19-billion deficit for either GOP nominee Meg Whitman or her Democratic rival, Jerry Brown.

The most optimistic projections show that the spending plan Schwarzenegger signed Friday will produce a shortfall of at least $10 billion — more than 11% of state spending — in the next fiscal year. Many experts predict it will be billions more. The leaders mostly papered over this year's gap, punting many tough decisions forward. The failure of lawmakers, again, to set the state on firm financial footing highlights Sacramento's dysfunction. But it is also a reflection of a state in which the economy has been sour so long, and revenue has dwindled so much, that there are few places left to cut spending.

Broad tax increases have already been put in place, and more are not politically viable. Complicating the problem are the public's expectations of what government can accomplish with the state's shriveled tax base. "We're going in the wrong direction fast, " said Bob Hertzberg, a former Assembly speaker who co-chairs the nonpartisan think tank California Forward. "There is a big pile of work waiting on the desk of whoever is governor next. But I don't think the outcome will be any different" from this year no matter who is elected, he said, "because the demands are so difficult."

All the problems that have haunted the budget process for years were in full force this time around, many of them more pronounced than ever. The state's volatile tax system — which economists have consistently warned is too reliant on the fortunes of the wealthy — caused revenues to continue dropping. The lack of a substantial rainy-day fund left the state without emergency reserves to blunt the blow.

Term limits ensured that relative novices had significant control over the complicated and politically charged task of negotiating a budget. The Assembly speaker and minority leader, whose most important job is to help hammer out a spending plan, had never been involved in budget talks before. And none of the legislative leaders has the kind of clout over their caucuses that their counterparts had in days past, making compromise and the necessary two-thirds vote of the Legislature much tougher to come by.

The governor's lame-duck status hurt his already limited ability to move things forward. So did his chilly relationship with his own political party, which undermined any power he might have had to pressure Republicans to work more purposefully toward a bipartisan agreement. The public was largely cut out of the process, along with the legislative rank and file. The influence of special interests loomed large, with the biggest ones able to persuade — or bully — some lawmakers into rallying their colleagues behind untenable demands, prolonging the stalemate.

Schwarzenegger administration officials say there is a silver lining. They point to concessions made by unions that roll back some of the generous pension benefits state employees have received over the last decade. New hires will get more modest retirement benefits, limiting the contributions taxpayers must make to keep the pension fund solvent. The budget package also places on the 2012 ballot a measure that would create spending controls to force lawmakers to build a bigger rainy-day fund.

But other budgeting measures, pushed by good-government groups seeking to bring some fiscal stability to California, stalled in the Legislature, beaten back by corporate interests and unions anxious that they could lose influence if the system were too radically changed. As for the deficit, some say this just wasn't the year to wipe it out. Government services have already been sliced by several rounds of brutal reductions. With revenue continuing to plunge, they say, there's a point at which delaying a deficit solution does less harm to the economy than confronting it.

"In some ways, this is a reasonable ending point," said Jean Ross, executive director of the California Budget Project, a think tank that focuses on how the budget affects low-income residents. As the sour economy has limited lawmakers' will to take bold action, the public is increasingly confused about what their taxes are paying for and what sacrifices would help bring the state into the black.

In a survey of 1,000 Californians conducted in June by the Pew Center on the States and the Public Policy Institute of California, half of respondents believed state spending could be cut 20% or more with no impact on services. The report points out that the state would have to eliminate the equivalent of its entire prison system, all welfare programs and all transportation spending to save that much.

The authors went to Mike Genest, Schwarzenegger's former budget director, for some perspective. "Reality hasn't caught up with the voting public," Genest told them. "Politicians have made it sound like there are other alternatives, like we can simply get rid of fraud, waste and abuse and [have] a spending freeze and … have the same kind of government we've always had. … That's just not true."

Susan Urahn, a managing director at the Pew Center, says California's incoming governor, whoever it is, should be under no illusions. "There will likely be a fairly short honeymoon," she said. "The problems are so significant."

The costs of rising economic inequality

by Steven Pearlstein - Washington Post