"Winslow, Arizona, young Indian laborer working in the Atchison, Topeka and Santa Fe yards"

Ilargi: In case you still haven't, do order Stoneleigh's video presentation of "A Century of Challenges", the lecture that's made her famous across Europe and North America.

To order,

Or click the button on the right hand side just below the banner. Why not also buy a copy for someone you think needs to know what Stoneleigh has to say. Or just donate some extra cash in the top left hand column just below the banner. Stoneleigh deserves, and needs, all the financial support she can get.

Ilargi: On to the popular topics of the day.

The Foreclosure Crisis

What foreclosure crisis? The US government has been bailing out banks for three solid years now, and there's still anyone alive who believes they’re going to drop them over mere technicalities? I like idealism up to a point, but....

Everyone in Washington has the same line: bad things may have happened, but we couldn't hinder the industry, now could we? Da show must go on! They even say stuff like, paraphrased: 'there's no proof that anyone evicted so far could have stayed put if their lenders had not broken the law'. If you feel that sounds reasonable, and that's the main point you get out of this mess, then you too should look at a career in politics.

This whole legal issue goes back many decades, try the 1930's, and it was precisely because there once were times that people got thrown out on mere technicalities that present day requirements pertaining to foreclosures became part of US law.

In the past few years these laws have been and still are broken, no lack of proof for that, but the White House official point of view is the most important thing they take away from this is that the show must go on? Nothing has changed, and nothing ever will, not until this thing breaks up in ugly ways.

Many of the loans we're addressing here were sold based on false, that is illegal, documents (stated income, you name it), and now they're being foreclosed on using illegal documents too. So where's the convictions, where's the arrests? Ah well, never mind.

Which reminds me, I have this great link to ease us into popular topic no. 2:

Quantitative Easing

If Obama et al. would go after the banks for the foreclosure fraudulence, QE 2, coming up in a matter of days/weeks, simply couldn’t work. How are you going to get liquidity back into the financial system if you’re suing the well-deserved heebees out of the banking system at the same time? Hey, it would shatter the entire illusion. And yes, that's what it is.

All those people who claim that QE doesn't work, that QE 1 didn’t, 2 won't, yada,yada, you don't get it. QE works like charm. Just not for you, or for the purpose it's advertised for.

It won't get banks back into lending, nothing will, and it won't get anyone a job or a home or anything else. What it WILL do, though, is transfer another inordinate amount of money from the public to the private sector. QE 2 isn't meant to alleviate YOUR problems, it never was nor will be. Come on, be honest, what government program in the past 3 years has done anything for you?

QE 1 and 2 through 826 have, and always will have, only one objective in mind: to clear toxic assets from bank vaults, and at the same time transfer good non-toxic money to those same banks. It is the greatest swindle in history after Fannie and Freddie. Move over Charles Ponzi!

See, you may think you have a problem. But your government says it's the banks that have the problem. And that they're more important than you. So they are handed your money, and you are NOT handed theirs. Got it now? Why so slow? It's been three years!

What the banks do with all that new money is two things: 1) they place it with the Fed, in Treasuries and such, and 2) they go place wagers in international markets, stocks, derivatives, guns, you get the idea, whatever gets them profits and bonuses. In both cases, they make more, at less risk, than if they would lend it to you. Look, you guys were easy pickings for a bit there when you were all signing those fraudulent home loans, but now y'all got one of those, so where would the bonuses come from?

And isn't that the greatest show on earth, Wall Street announcing record payrolls for its geniuses when 1) they wouldn't have a job if not for the future tax revenues of the very Americans who are losing their homes and jobs as we speak, and 2) some 90% of their employers have just been caught with their red-hot hands in the foreclosure cookie-jar?

Record numbers of foreclosures, record unemployment numbers sizzling just below the surface, and record bonuses for the very bankers that got bailed out with the very money that belongs to those very same foreclosed and jobless US citizens.

These days, that’s the way we spell New York. And Washington. And no criminal indictments, other than for a few poor sods in Illinois who can't pay their bills.

Here's a few numbers I picked up along the way today:

$13,624,678,196,435.07

Public debt as of 10/06 (U.S. Dept. of Treasury)

310,435,842

Latest population (U.S. Census Bureau)

$43,888.87

Amount owed by every man, woman and child (See above)

$550,000,000,000 (est)

Amount financed at 10 years or longer (U.S. Dept. of Treasury)

$13,074,678,196,435.07

Amount to be refinanced within 10 years (See above)

53% ($6,929,579,444,110.58)

Amount of debt maturing in 1 to 3 years. (U.S. Dept. of Treasury)

-35%

Corporate tax receipts on a rolling 12 month period. (U.S. Dept. of Treasury)

Yup. $7 trillion in US debt needs to be rolled over in the next 3 years. Another $6 trillion in the 7 years after that. And that's before any new debt commitments are taken on, which they presently are at some $1-1,5 trillion per year. With corporate tax receipts down 35% y-o-y.

But no, that doesn’t spell the demise of the US dollar, really, it doesn't. It spells the demise of the American people.

I told you, QE works.

Ilargi: We can talk finance till we're blue in our faces, hands and toes, in the end what matters is how real people are doing. There's nothing more valuable than that. Here’s our longtime friend Dan Weintraub with his take:

Dan Weintraub: The Nominal Man

I am a nominal man living in a real world. Yesterday, I spent $16 on a bag of whole-grain rice, a bag of beans and a hunk of cheese.

One goal of the Federal Reserve’s quantitative easing policies is debasement of the dollar. It is often argued that a weak dollar – relative to other currencies – promotes our supposed export-based economy. Lest we forget, however, our $14-trillion-plus economy is 70-percent consumer-dependent. The most productive capital in the U.S. was shipped overseas long ago. Economic growth over the past three decades has been predicated not on the creation of productive capital, but on access to cheap credit, and thus on consumer spending. The United States, despite beliefs to the contrary, is no longer an export-driven economy. And I remain a nominal man living in a real world.

While the world operates on numbers, I subsist on the relative value of those numbers. For several months now, commodity prices have been rising – and not just those of precious metals. The price of wheat, of cotton, of coffee, of cocoa: all rising sharply. But why would the price of commodities rise when a contracting global economy should equate to a decrease in overall demand (and thus to falling prices)? Commodity prices are rising because investors increasingly believe that the relative value of their financial assets is no longer assured. In a global financial system rife with fraud, in a system teetering precariously close to the brink of an all-out currency conflagration, investors and speculators are abandoning financial assets in lieu of commodities because these same investors believe that the world’s central banks are bent upon destroying the purchasing power of their money. And still I remain a nominal man living in a real world.

I am a middle-class citizen. I make a modest wage teaching history at a local independent school. Like many in the middle class, my nominal monthly income purchases less of the real goods and services that I need in order to get by. I understand that the federal government ultimately must increase its tax revenues in order to subsidize its growing debt-service obligations and to pay for an ever-expanding pool of necessary social services (unemployment insurance, food stamps, etc.), but the real impact of these tax burdens hits those of us in the middle class the hardest. For members of the shrinking American middle class, a seemingly modest nominal tax increase of perhaps $100 a month is, in real terms, far more expensive than the numbers convey.

I understand why economists like Paul Krugman are calling for trillions more in government spending. Fiscal austerity disproportionately hurts the middle class and working poor, and political extremists and opportunists are famous for promoting their nativistic and self-aggrandizing agendas while skyrocketing unemployment hurls millions of citizens toward the abyss. But in our credit- and debt-subsidized economy, virtually all stimulus monies are created, either directly or indirectly, by the Federal Reserve through its open-market operations – in this case, through the monthly purchase of billions of dollars in government securities.

And while such actions may increase systemic liquidity in the near term, these policies of debt monetization also further destabilize the world’s already shaky currency markets. As more people lose trust in the long-term viability of the world’s currencies, more people “buy” commodities. In other words, you may not be able to trust the value of the dollar from one day to the next, but you can always rely upon the hard value of such assets as food and energy. And so, one by one, investors abandon financial assets and move toward commodities, and as they do the price of commodities goes vertical. In nominal terms, this is disastrous for the majority of Americans who subsist on fixed incomes. In real terms, it is far worse. This is but one of the unspoken impacts of our government’s stimulus policies.

I am a nominal man living in a real world. In the real world, trillions more in government stimulus has no substantively positive impact upon my life. In the real world, a 2-percent cost-of-living (wage) increase for someone earning $40,000 per year, in terms of cost inflation, more closely resembles a 2-percent reduction in pay than it does a “raise.” In the real world, the majority of government stimulus monies are used by the largest and most powerful financial institutions to drive up the cost of those very commodities that the majority of us find increasingly difficult to afford. In the real world, as access to credit contracts (real deflation) and as the prices of food and energy increase, austerity arrives regardless of the Federal Reserve’s policy decisions.

I am a nominal man living in a real world, and in my world the numbers just don’t add up.

Debt market strips U.S. of triple-A rating

by Colin Barr - Fortune

The United States has lost its gold-plated triple-A rating -- in the eyes of credit traders, at least. U.S. sovereign debt was the third-worst performer in a closely watched derivatives market during the third quarter, CMA said Tuesday in its quarterly review of global sovereign credit risk.

The cost of insuring against a default on U.S. government bonds via so-called credit default swaps rose 28% in the quarter ended Sept. 30, the firm said. That puts the United States' third-quarter performance behind only two other nations, both of which are struggling with the early stages of sovereign debt crises: Ireland, whose CDS prices rocketed 72% to a record amid growing questions about the costs of a massive bank bailout, and Portugal, whose costs jumped 30%.

What's more, the decline leaves U.S. debt trading at an implied rating of double-A-plus for the first time in memory. Despite building worries about its financial outlook, the U.S. had traded in recent quarters in line with its triple-A rating from S&P and Moody's. But some skeptics have been arguing the U.S. is overrated, and that argument now seems to be gaining steam."You can see an indication of concern about the easing course the Fed is likely to continue on," said Sean Egan, who runs the Egan-Jones credit rating agency in Haverford, Pa. "There's a number of items that are going to be difficult to reverse as we get down that road, starting with the dramatic underfunding of state pension funds." The shift comes at a head-spinning time for the U.S. economy. The government has run two straight trillion-dollar-plus budget deficits, with more to come. Yet Treasury bonds are trading at record-low yields, reflecting questions about the economic outlook.

Meanwhile, the Federal Reserve is considering another round of major asset purchases in a policy observers have dubbed QE2, for the central bank's second attempt at quantitative easing – a bid to boost economic activity by expanding the size of the Fed's balance sheet. Comments by Fed chief Ben Bernanke and other policymakers have sent the dollar tumbling to its lowest level since January and helped light a fuse under commodity prices. Those remarks have had the effect of making even weak economic numbers look bullish, by suggesting the Fed will ride in if jobs data, for instance, get too ugly.

The rising price of insuring against a default on U.S. government debt is of a piece with these moves and suggests the full tab for the profligacy of the past decade has yet to be presented. To be sure, a default on U.S. debt remains a remote possibility. Even after the third quarter's runup, it costs just $48,000 annually to insure for five years against a default on $10 million worth of Treasury securities. That's a tenth the going rate on Irish debt and about one-eighth the price prevailing in Portugal.

And at that, CDS spreads are far from a pure read on default risk. A report by rating agency Fitch on Tuesday noted that credit default swaps performed "unevenly" during the credit crisis in predicting defaults by companies and other private-sector debt issuers. "While there are notable instances in which CDS spread widening preceded eventual defaults, there have also been numerous false positives where spreads ramped up dramatically even though few if any defaults ensued," Fitch wrote.

Even so, the third-quarter rise in its CDS spreads knocks the U.S. out of the triple-A league it has long shared with the likes of Germany, Switzerland and the Nordic countries, all of which regularly run trade surpluses and have relatively manageable debt positions. It's early to say there's no going back, but our political leaders certainly have their work cut out for them – without any particular sign they're up to the task.

Moody’s warns on refinancing risks

by Aline van Duyn - Financial Times

The credit quality of US companies may soon start to deteriorate as they take on debt to carry out share buy-backs and finance mergers and acquisitions, says a report by Moody’s Investors Service. The credit rating agency is also concerned that companies with relatively low ratings, those at the bottom end of the “junk” or speculative grade category, may have trouble refinancing the large amounts of debt due to mature in coming years. This could lead to an increase in default rates. “Signals could be showing that much of the improvement in corporate credit quality since the depths of the downturn may have been realised,” said Mark Gray, managing director at Moody’s.

One warning sign has been an increase in the number of credit ratings being reviewed for possible downgrades. In August, this jumped to 42, the highest level since July 2009, Moody’s said, driven mostly by reviews related to M&A activity. “With the economy in a slow-growth phase, companies are beginning to shift emphasis from conserving cash and cutting costs to increasing pay-outs to shareholders and engaging in strategic M&A activity,” Moody’s said.

Another source of concern is a persistently high number of companies with the lowest junk ratings, which are the most at risk of default. “Some companies at the lower end of the scale are having more difficulty with cash flow or refinancing,” Moody’s said. “Many of the lowest-rated companies can and will avoid default in the near term with the aid of receptive bond and loan markets. Yet many are wounded, with unsustainable capital structures that leave them at longer-term risk of default, even in a moderately growing economy.”

Investor demand for bonds has been very strong as interest rates have continued to fall amid concerns that stocks are too risky. This has resulted in record amounts of junk bond sales this year. However, such high levels of investor demand may not persist. Historically, demand for the riskiest types of corporate debt can fluctuate sharply.

Gregg Lemos-Stein at Standard & Poor’s, which together with Moody’s dominates the credit rating industry, says that the ease with which companies can borrow in the bond markets may be masking the potential for corporate funding problems ahead, especially as the costs for banks rise amid tighter regulation. “Costs will increase for banks, and banks, like any other business, look to pass on those costs to their customers,” he said.

Jobless America threatens to bring us all down with it

by Jeremy Warner - Telegraph

A depression may have been averted, but nothing has been fixed. This is the depressingly downbeat message that came across loud and clear from last weekend's annual meeting of the International Monetary Fund. The destructive trade and capital imbalances of the pre-crisis era are back, banking reform appears stuck in paralysing discord, public debt in many advanced economies remains firmly set on the road to ruin, and the spirit of international co-operation that saw nations come together to fight the crisis has largely disappeared.

This was not where we were meant to be in tackling the underlying causes of the crisis and returning the world to sustainable growth. Yet beneath this sense of frustration at lack of progress – and at international organisations such as the IMF and the G20 to bring it about - there is an underlying truth that's often left unspoken; many of the problems in the world economy right now are not international at all, but US specific and can only really be solved by America itself.

I don't want to belittle the difficulties faced by some of the peripheral eurozone nations, but in the scale of things they are a sideshow alongside the malaise which has settled on the world's largest economy. Ignoring the troubled fringe, Europe as a whole is to almost universal surprise starting to look in reasonable shape again, and for reasons that I will come to, Europeans are in any case not nearly as fixated by high unemployment as their American peers.

What applies to the eurozone is also true of the UK. As in Europe, the dominant issue in UK policy is not joblessness, but unsustainable public debt. There's a real, and growing, trans-Atlantic divide in perceptions and rhetoric. And with good reason. Europe had a much deeper economic contraction than the US – oddly, perhaps, given that the crisis originated in the US – but joblessness didn't climb nearly as steeply, and in the main eurozone economies is now falling again. In Germany, unemployment is already below pre-crisis levels.

Even in the UK, this has so far been a relatively jobs rich recovery, backed by a reasonably robust pick up in manufacturing and investment. For us, things are not as bad as the doomsayers of America suggest. Heathrow experienced record levels of cargo and passenger traffic last month, according to new figures from BAA, and in a key marker of returning business confidence, premium traffic is also well up again. This chimes with what UK bankers were saying on the fringes of the IMF meeting in Washington last week. A year ago at the same event, they were still trying to convince each other that they were still solvent. This year, new mandates are being thrown around like confetti, and many of the inter-bank disputes of the crisis period are now being resolved.

Why America has failed to respond as positively is still not entirely clear, though continued deep recession in house building and other forms of private construction is obviously some part of it. These sectors have historically been a larger proportion of employment than in Britain and Europe, and won't begin to recover until prices stabilise and unsold stock is cleared. The house price collapse means people can't sell and move to economically stronger parts of the country, as they've tended to in past downturns. High US unemployment – already at 9.7pc and getting on for double that on some wider measures - is becoming entrenched.

If there is one thing the crisis has reminded politicians of it is that they really must be running surpluses during the good times. Going into the downturn, Germany was better prepared than the US, and has therefore proved more resilient. Whatever the explanation, realisation that there may be a structural problem of unemployment in the US on top of the cyclical one has come as a rude awakening for a country raised on the merits of hard work and enterprise.

US Treasury forecasts, both for growth and the public finances, continue to be based on delusionally optimistic use of "the Zarnowitz rule", which posits that deep recessions are followed by steep recoveries. Regrettably, it's not happening this time around. These harsh economic realities have combined with the relentlessness of the US political cycle to produce a tsunami of demands for job creative policy. It's not just experience of the Great Depression which instructs American terror of unemployment. Very limited jobless entitlements make the pain of mass and prolonged unemployment very real indeed, another key difference with Europe.

Serious losses for the Democrats in the mid-terms are already pre-cooked. If there aren't solutions over the next year, the Administration may in desperation turn to more populist measures. Retaliatory action against China and other "currency manipulators" is unlikely to help US employment much, but that's not going to deter a president who sees his chances of a second term going down the pan. It would on the other hand create chaos in China by depriving millions of their jobs.

The Chinese economy is only a fifth of the size of the US, and its consumption less than an eighth. Even assuming other Asian exporters are punished equally, currency devaluation and import tariffs are not going to solve the problem of US joblessness. So what's left? The Fed can act, by pouring more money into the economy (QE2), but the Hill is paralysed. A second fiscal stimulus of any size is blocked by political division. More monetary stimulus is all very well, but it's a blunt instrument which struggles to get through to the job creative bit of the economy - small and medium sized enterprises - and threatens new bubbles in emerging markets as abundent liquidity chases yield.

There's no political appetite or will in the US for the long term entitlement reform and tax increases necessary to bring the deficit under control. Nobody believes US Treasury forecasts that public debt will be stabilised by 2014. Much more believable are IMF estimates which see gross US debt rising to well in excess of 110pc of GDP by 2015. The US has no strategy for the jobless and no strategy for rolling back debt. Little wonder that a renewed sense of gloom has settled on international policy makers.

U.S. Economy Is 11.5 Million Jobs Short"

by William Alden - Huffington Post

Even though the unemployment rate remained flat at 9.6 percent in September, the labor market would now need to add a total of about 11.5 million jobs to restore the pre-recession rate, according to analysis from Heidi Shierholz, an economist with the Economic Policy Institute.The economy lost about 95,000 jobs last month, including temporary Census workers. Not including Census positions, roughly 18,000 jobs were lost, as the private sector addition of 64,000 jobs couldn't offset the 83,000 jobs cut by state and local governments, whose unusually severe deficits have lead analyst Meredith Whitney to predict that the next major financial crisis will come from municipal debt defaults. The state and local cuts included 58,000 teaching jobs.

The true numbers could be even worse. As HuffPost's Shahien Nasiripour notes, the reported numbers of jobs lost in July and August were revised up after the initial reports.

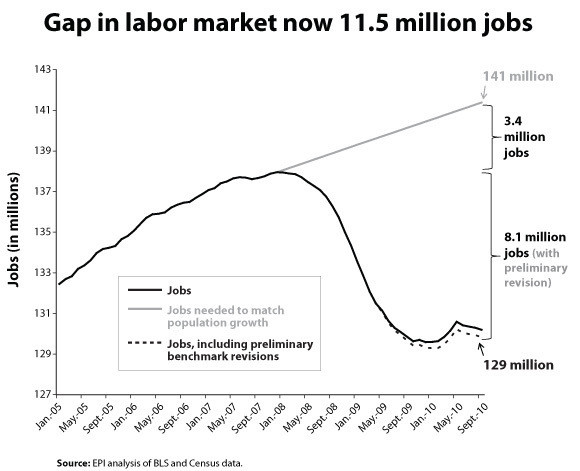

According to Shierholz's analysis, the economy is down about 8.1 million jobs from where it was when the recession began, in December 2007. Considering population growth, the economy should have added 3.4 million jobs during the recession, Shierholz notes. To fully recover, the country would need to add 11.5 million jobs. Check out the EPI's chart:

That's a huge number, and population growth continues to make it bigger. To fully recover in five years, Shierholz says, the country would need to add 300,000 jobs "every month for that entire period."

UK government spending cuts will see a million people lose their jobs

by Richard Tyler - Telegraph

Almost half a million people in the private sector will lose their jobs as a result of public spending cuts, new research suggests. The number is the same as the Government expects to cull from the public sector by 2015. For parts of the UK, it will mean one in 20 people lose their job over the next four years as a result of the £83bn public spending cuts to be announced by the Chancellor next week. Private sector output could be slashed by £46bn, or 2pc of the total, consultants PricewaterhouseCoopers (PwC) said. This would not be enough to push the economy back into recession, it said.

However, it is forecasting, that the private sector will only generate around 1m new jobs over the next four years in areas such as outsourced business services and social care. This is far fewer than the 1.6m new jobs predicted by the independent Office for Budget Responsibility in June. Of the industry sectors most exposed to the spending cuts, PwC said business services will shed 180,000 jobs and construction 100,000.

Job losses across the public and private sector are likely to hit 5pc of the total workforce in Northern Ireland, and 4pc in Wales, Scotland and the North East, although overall more jobs will be lost in London and the South East because their economies are larger. UK-based manufacturers of leather goods and footwear, electronic components, weapons and ammunition and office machinery and computers will all be hit hard by the cuts, PwC predicted. Nick Jones, PwC director, said: “Businesses have been scenario planning and making contingencies but now it is going to become very real.”

John Hawkesworth, PwC’s chief economist, said addressing the budget deficit would help keep interest rates low for longer, benefiting businesses. But rising taxes and a weaker international trading environment would “dampen down growth significantly”. Dave Prentis, general secretary of Unison, said: “This report bears out all we have been warning over the past few months. Public spending cuts will damage the economy and will drag the country into a downward spiral.”

British middle classes hit again with tax raid on pensions

by Robert Winnett and Myra Butterworth - Telegraph

Middle-class professionals and savers are facing a tax raid on their pensions under measures to be unveiled by the Coalition. The amount that people can pay into their pension pot every year and still receive tax breaks is to be capped at less than a fifth of its current level. The maximum size of a pension pot that workers can accrue before high rates of tax apply is also likely to be significantly reduced by the Treasury.

Accountants predict that the changes will hit more than 500,000 people, including middle-class professionals, savers who choose to pay lump sums into pensions to benefit from tax relief and self-employed businessmen. Some will face demands to pay tens of thousands of pounds in tax as a result. Other allowances, including a scheme that allows people to pay more into their pension during the final year of their working life, may also be scrapped. The changes are likely to take effect next April.

It is the latest move by George Osborne, the Chancellor, designed to target higher earners. It follows the controversial decision to strip child benefit from higher-rate taxpayers and allow a rise in university tuition fees. The threshold at which higher-rate tax is payable is also being reduced. The Treasury is expected to announce today that the annual limit on payments that people can make into their pension and still receive tax relief will be cut to between £30,000 and £50,000. People can currently save £255,000 a year in their scheme and still receive relief on their contributions at the rate at which they pay income tax.

Ministers are also likely to reduce the total amount that people can save in a pension during their lifetime. It is currently capped at £1.8 million but will be reduced to £1.5 million. Retiring workers will lose 55 per cent of any sum above the limit in a one-off tax. Experts say the changes could save the Treasury more than £8 billion over the next three years. Mr Osborne will stress that the measures are aimed at only the richest Britons. The changes will effect many better-paid professionals and ordinary savers who pay into pensions because of tax relief. Anyone who sells a house or a business as they approach retirement and chooses to pay the money into a pension could also be hit.

Although most Britons save much less than the proposed annual limit into their pension, technical changes to the rules could result in even those on modest salaries in final salary schemes being landed with an unexpected tax charge. Complicated Treasury rules mean workers on salaries of between £40,000 and £50,000 who receive relatively small pay rises could be pushed above the new tax-free limits and left with tax demands running to several thousand pounds.

The changes come at a particularly bad time for many retiring workers who have to build up bigger pension pots than in the past to compensate for lower annuity rates, which determine how much pensioners earn each year from their savings. They are linked to interest rates and are at historically low levels. PricewaterhouseCoopers, one of the country's biggest firms of accountants, estimated that the changes would affect more than 500,000 people. "This will affect far more people than anyone imagined," said Marc Hommel, one of its pensions partners.

Tom McPhail, a pensions expert at Hargreaves Lans?down, a wealth manager, said: "Given the tone of the Treasury's thinking, the prospects look even darker for pensioners than initially thought. "We will certainly see severe restrictions to tax breaks available to pension investors. Particular losers will be middle senior managers in final salary schemes and those people looking to catch up on missed years in pension funding."

Ros Altmann, the director general of the Saga Group, said: “It could hit people on £40,000 a year and they are already being hit by things like child benefit changes. We have to stop targeting that group, the people who just hit the higher tax rate. “The Government is talking about fairness, but is creating a dangerous cliff edge at this income level. At a higher level, you won’t notice as much, and while £40,000 is higher than average, it is not the very well off.”

Critics say the pension changes will erode the “crumbling foundations” of final salary pension schemes. The new annual allowance — after which an extra tax charge would be applied — could be exceeded by someone whose pension entitlement in a final salary scheme had risen by just over £2,000 a year. Calculating the increased value of an individual’s pension pot if they are a member of a defined contribution scheme is relatively straightforward because they are given an annual statement of the value of their pension investments.

But assessing the total value of final-salary schemes is more complicated. It involves a calculation where the rise in someone’s annual pension entitlement is multiplied by 10. For example, an extra £2,000 in annual pension is valued at £20,000. It means a pay rise — of say, £50,000 to £57,000 — that resulted in increasing someone’s annual pension entitlement by £4,000 would fall within a £40,000 limit.

But the Treasury wants to increase the multiple to 15 or even 20, which would limit the annual pension increase that can take place tax-free. In this case, the increase of £4,000 in a year would be worth up to £80,000 and lead to a tax rise for the worker of up to £16,000.

David Cameron's secret plan to cut UK's £149bn debt by selling off property

by Alistair Osborne and Helia Ebrahimi - Telegraph

The Government is working on a secret plan to tackle Britain's £149bn deficit by hiving off state-owned property assets worth tens of billions of pounds and selling them to the private sector. Prime Minister David Cameron is understood to have written to all ministers demanding they produce an inventory of the property in their spending departments, including lengths of leases and occupants.

The Office for National Statistics estimates that government property is worth about £370bn. However, there is no comprehensive register of the entire portfolio and some City experts believe the estate could be worth £500bn. The Shareholder Executive, the body responsible for realising value from state-owned assets, has been tasked with co-ordinating the government-wide attempt to maximise returns from its property portfolio. Its work is being led by John McCready, the Ernst & Young senior partner hired last December to head a new property unit at the Executive.

The Government's property plan, which is at a relatively early stage, coincides with a crackdown on Whitehall waste being spearheaded by Bhs-owner Sir Philip Green. The retail entrepreneur will on Monday publish his report into how civil servants have wasted hundreds of millions of pounds through such things as renting empty offices and allowing each police force to source its own uniforms.

The previous government commissioned Labour peer Lord Carter of Coles to report on the value locked up in state-owned property. He found it could expect to make about £20bn from disposals over the next 10 years and a further £5bn in annual savings by the end of the period. However, Mr Cameron has brought fresh urgency to the project and expanded it beyond assets already managed by the Executive – including Royal Mail, the Met Office and the British Waterways Authority – to include all government property.

One source familiar with the project said: "The idea is that responsibility should be centralised in one place but there is still a huge amount of work to do. It's being taken very seriously but it's not easy." It is thought that the initial aim is to bring together similar sorts of properties spanning all departments that could be packaged up and eventually sold. That includes potentially floating portfolios on the stock market as real estate investment trusts (REITs) – a way of investing in property that cuts or eliminates corporate taxes.

One senior City source said flotations would allow the Government to sell assets at a lower headline price because the UK taxpayer would be a potential beneficiary. However, he added: "The downside of a flotation is that you may have the moral high ground to sell cheap but you then end up with 30m shareholders and an unworkable register." Insiders say the Government's biggest challenge is creating what would be the first realistic inventory of what it owns. "The real issue is that the Government do not know what they have," said a source. "In the Department of Health alone there are 77,000 buildings – but this inventory was completed only recently and no one know what the numbers are elsewhere."

America should open its vaults and sell gold

by Edwin Truman - Financial Times

Gold is back in the news. Its price is soaring in what some analysts say is a reflection of a weak economy and a lack of confidence in government policies. Naturally, investors are looking at a new sure thing in the expectation that prices will continue upward. My advice to the US government, however, is that this may be the best time – to sell. Doing so would help President Barack Obama and Congress reduce indebtedness, at little cost.

It is an article of faith in bullion markets that the US will be the last country to dispose of its gold stock. For 30 years it has had a no-net-sales policy for reasons ranging from resistance by US gold-producing interests to concerns about the international monetary system. That assumption may remain plausible. Yet the administration has an obligation to re-examine its policy.

The market price of gold has risen for more than a decade propelled by low interest rates, the hype of the bullion dealers (holding large inventories) and no doubt the normal amount of fraud and misinformation accompanying asset price bubbles. The Financial Times has reported that the precious metals industry expects the price to increase by a further 11 per cent over the next year.

Meanwhile, the US Treasury holds 261.5m fine troy ounces of gold. The government has been sitting on it since the Great Depression, receiving no return. At the current market price of $1,300 per ounce, the US gold stock is worth $340bn. The Treasury secretary, with the approval of the president, has the power to sell (and buy) gold on terms that the secretary considers most beneficial to the public interest. Revenues from sales must be used to reduce the national debt.

If the US were to sell its entire gold stock at the current market price, it would reduce the gross government debt by 2? per cent of gross domestic product. (US net government debt would decline by essentially the same amount because the US gold stock, listed as an asset on the balance sheet, is valued at only $42.22 an ounce.) Based on the average interest cost from 2005 to 2008, this reduction in debt would trim the budget deficit by $15bn annually. Thus, the Obama administration would be doing something about the US fiscal debt and deficit without reducing near-term support for the ailing economy.

This proposal has other benefits too. First, the US would be obeying the maxim to buy low and sell high. Second, it would be performing a socially useful function. Demand for gold exceeds normal production, driving up the price. To the extent that the gold craze is being fed by concern (rational or irrational) about government policies, public welfare would be enhanced by giving citizens something tangible to hang around their necks or place in safe deposit boxes. Third, if the price is a bubble, as seems likely, the sooner it is burst the better for the average investor.

Some people point to possible costs.

Aside from political pressures from those who want to protect the value of their holdings, above or below ground, two principal arguments are made against US gold sales. The first is that they would disrupt the market. But the US can be cautious in its sales, avoiding disruption of the sales programmes of other countries, as it has in the past. There is little risk. In recent years, sales under the Central Bank Gold Agreement have dwindled, and some other central banks are buying gold. (The US is not a party to the agreement.) Also the International Monetary Fund has completed more than three-quarters of its own planned sales of 403.3 metric tons.

Another counter argument is that the US should hold on to its stock in anticipation of a return – by itself alone or with other nations – to a monetary system based on gold. But returning to the gold standard would reinstate a system associated with unstable prices, wages, output and employment. It has not existed for a century; and will not make a comeback. Official discussions of the reform of the international monetary system do not include any advocates of a return to gold, and the IMF articles of agreement prohibit it.

The sooner thoughts of such a return are laid to rest, the better. A related argument is to keep the US gold stock as a “rainy day” precaution. But after the recent economic and financial crisis and with the prospect of misery for several more years, how much more rain must pour before the US acts?

The writer is a senior fellow at the Peterson Institute for International Economics in Washington

Ilargi: Don’t miss this video. Trust me.

The new poor: Baby boomers in the jobless crisis

by PBS

NOTE: Try here if the video is not available in your area.

U.S. urges lenders to vet foreclosures but keep process moving

by Zachary A. Goldfarb and Ariana Eunjung Cha - Washington post

Federal regulators on Wednesday urged the nation's lenders to verify that paperwork filed as part of the foreclosure process was properly reviewed and to file new documents if problems are found. But regulators also said that lenders should continue as quickly as possible with foreclosures when no problems are found. Their comments, fashioned in close consultation with the Obama administration, demonstrate how federal officials and the White House are at odds with Democratic leaders in Congress, who favor a national freeze on foreclosures.

The framework outlined by the Federal Housing Finance Agency, is the most elaborate federal response so far to the foreclosure debacle buffetting the housing and financial markets. But it's not clear whether it will play a positive role in cleaning up the foreclosure mess. The regulatory framework largely repeated what regulators have already said or what banks were already doing.

In essence, it tells banks to make sure that documents used as part of the foreclosure were properly reviewed and signed. If they weren't, banks must work with local lawyers on a fix. This might include filing new paperwork that has been properly reviewed, the framework says. Federal regulators are acting through the federally controlled mortgage finance companies, Fannie Mae and Freddie Mac, which own or guarantee well over half of the nation's home loans.

Regulators were adamant that, in the absence of problems, foreclosures must move forward. Delays increase costs for communities, investors and taxpayers, regulators said. The Obama administration has expressed a similar view. That position runs counter to the stance taken by House Speaker Nancy Pelosi (D-Calif.) and Senate Majority Leader Harry M. Reid (D-Nev.), who have pressed for a nationwide halt to foreclosures.

"The country's housing finance system remains fragile and I intend to maintain our focus on addressing this issue in a manner that is fair to delinquent households, but also fair to servicers, mortgage investors, neighborhoods and most of all, is in the best interest of taxpayers and housing markets," said FHFA acting director Edward DeMarco in a statement. The move comes as attorneys general from all 50 states announced they are combining on an investigation of mortgage servicers who are accused of submitting false affidavits.

How Wall Street Shafted Main Street: Spitzer, Parker and Josh Rosner discuss mortgage fraud

The Mortgage Fraud Scandal Is The Biggest In Human History

by L, Randall Wray - Benzinga

We have long known that lender fraud was rampant during the real estate boom. The FBI began warning of an “epidemic” of mortgage fraud as early as 2004. We know that mortgage originators invented “low doc” and “no doc” loans, encouraged borrowers to take out “liar loans”, and promoted “NINJA loans” (no income, no job, no assets, no problem!). All of these schemes were fraudulent from the get-go.

Property appraisers were involved, paid to overvalue real estate. That is fraud. The securitizers packaged trash into bundles that ratings agencies blessed with the triple A seal of approval. By their own admission, raters worked with securitizers to provide the rating desired, never looking at the loan tapes to see what they were rating. Fraud.

Venerable investment banks like Goldman Sachs packaged the trashiest securities into collateralized debt obligations at the behest of hedge fund managers--who were allowed to choose the most toxic of the toxic waste—then sold the CDOs on to their own customers and allowed the hedge funds to bet against them. More fraud.Indeed, the largest financial institutions were run by their management as what my colleague Bill Black calls “control frauds”. That is, the banks used accounting fraud to manufacture fake profits so that they could pay huge bonuses to top management. The latest data out on Wall Street bonuses show that these institutions are still run as control frauds, with another record year of bonuses paid by cooking the books. The fraud continues unabated.

This is the biggest scandal in human history. Indeed, all previous scandals from around the globe combined cannot even touch this one in terms of scale and scope and stench. This is the mother of all frauds and it will be etched into the history books for all time.

Many have called for a national moratorium on foreclosures. Even some of the banks that have been run as control frauds have voluntarily stopped foreclosing. And yet President Obama, ever the centrist, has taken sides with the Securities Industry and Financial Markets Association, which warns that “it would be catastrophic to impose a system-wide moratorium on all foreclosures and such actions could do damage to the housing market and the economy”.

No, it would expose the securities industry, itself, as the chief architect of the biggest scandal in human history.

Now we know that it was not just the mortgage brokers, and the appraisers, and the ratings agencies, and the accountants, and the investment banks that were behind the fraud. It was the securitization process itself that was fraudulent. Indeed, the securities themselves are fraudulent. Many, perhaps most, maybe all of them.

Some are trying to argue that this is just a matter of some missing paperwork. A moratorium would allow the banks to get all their ducks in a row so that they can supply all the documents needed to foreclose.

However, as reported by Ellen Brown (at Web of Debt) and by Yves Smith (at Naked Capitalism), the paperwork does not exist. Worse, as Yves has discovered, the banks are furiously working to manufacture documents, aided and abetted by companies like DocX that specialize in “document recovery solutions”—for a fee they will create fraudulent documents that banks can use in court.

The banks would like us to believe that in the speculative frenzy of the real estate boom they “forgot” to do some of the required paperwork. That is not likely. The absence of the documents was required to run the scam.

Recall that the banks invented “no doc” mortgages. This was not at the behest of no-account borrowers, high school dropouts with bad credit histories who were duping investment bankers into making mortgage loans they could not repay. No, these mortgages were created and endorsed by originators and securitizers and credit raters to create a patina of “plausible deniability” to be used later in court when they were sued for fraud by investors who bought the securities and by the borrowers who could not possibly service the mortgages. Because if the originators had ever requested the documentation from borrowers it would have demonstrated that the mortgages and the securities were frauds.

Similarly, the paperwork required for the securities was never done because the securities were fraudulent. Yves helps to explains why. The trust that purportedly underlies a mortgage backed security must hold the “note”—the borrower's IOU (in 45 US states the mortgage that is a lien on the property is an “accessory” to the note, and is not sufficient to do a foreclosure). If the note is not conveyed to the trustee (usually before closing but sometimes up to 90 days after signing) the securities are no good.

This is not just some pesky little rule imposed by a pin-headed regulator. This is IRS code. As reported by Brown, MBSs are typically pooled through a Real Estate Mortgage Investment Conduit (REMIC) that must according to the Internal Revenue Code hold all the paperwork demonstrating a complete chain of title. Done properly, taxes are avoided. Since a number of intermediaries are usually involved from the mortgage originator through to the trustee of the REMIC, there must be endorsements all along the line. However, it now appears that most of the original notes are still held in the loan originator warehouses. There are no endorsements. The trustees do not have the notes. Can anyone say “tax fraud”?

So why weren't the notes conveyed to the REMICs? There seem to be two possibilities—probably both of them correct. Karl Denninger at MarketTicker believes it was because the REMIC trustees feared an audit by investors in the securities. If the documentation existed, it would show that the mortgage loans were fraudulent. Far better to “lose” the docs, then later manufacture new ones for the foreclosure.

According to Brown (quoting Steve Liesman and Neil Garfield), the other possibility is that the tranching process actually prohibited assignment of the notes to the REMICs. Bundles of mortgages of varying quality would be tranched into a variety of securities, say from AAA to BBB. But no individual mortgage is actually assigned to a particular tranche—until it defaults. When one defaults, it is assigned to a lower tranche security and then the foreclosure process begins. This means that from inception of that BBB security, there was no way to assign a note to the trustee because the trustee did not know in advance which mortgage would default. The REMIC trustees tried to get around that by using a dummy conduit called MERS (Mortgage Electronic Registration System) that would “hold” the mortgages and assign them to the proper tranches later. But they do not have the paperwork either, and some courts have rejected their claims as owners.

This is a complete mess. What President Obama must understand is that fraud is endemic at every level of the home finance food chain. We were long told that securitized mortgages cannot be modified because of the complexity involved—modification of most mortgages would require consent of the holders of the securities that each have a piece of the mortgage. But actually it is impossible to tell how many—if any—of these securities holders have a legitimate claim on any of the mortgages. Simply imposing a moratorium will not be enough—it will just give the banks time to manufacture false documents, encouraging even more fraud. Meanwhile, half of all homeowners with mortgages are already underwater or are within spitting distance of being underwater. Many of these are drowning because the epidemic of fraud perpetrated by financial institutions destroyed our economy and caused housing prices to collapse.

The President needs to try a different approach, consisting of the following series of steps:

1. Declare a national bank holiday that would close the biggest financial institutions—say, the top dozen or so. Send in the supervisors to examine their books to uncover fraud. Determine which ones are insolvent and resolve them. While resolving them, net their claims on one another (including derivatives). Do not allow any insolvent institutions to reopen, and do not use the resolution process to merge institutions (we don't need even bigger “too big to fail” banks). Prosecute the crooks and jail the guilty.

2. Stop all foreclosures. Investigate and prosecute all institutions that have been selling or buying fake documents to be used in foreclosures. Prosecute the crooks and jail the guilty.

3. Announce that all homeowners who occupied their homes on October 1, 2010 will be allowed to remain in their homes indefinitely. Create a national mediation board to adjust all mortgage payments to “owner's equivalent rent”—the fair value of rent for the home. Establish a fund to provide rental assistance to keep low income homeowners in their homes.

4. Give purported mortgage holders 30 days to produce the original notes; if they cannot find them, hand the homes over to the owner-occupants—free and clear of debt.

5. Create a process to allow securities holders to sue for recovery of value. This must be national—state courts will not be able to handle the case load.

6. Direct the GSEs to refinance mortgages at a low fixed rate. Mortgages would be provided against real estate appraised at fair market value to any borrower for a primary residence. The GSEs would pay holders of existing mortgages only current fair market value. Those holding these mortgages can seek redress through the process outlined in step 5. Only in the case of borrower fraud would the homeowner be held responsible for losses attributed to the refinancing.

7. There will be fall-out from losses. It is better to deal with the collateral damage directly than to prop up the control fraud banks. For example, pension funds hold toxic waste securities as well as equities in the control fraud banks, and by all reasonable accounting the Pension Benefit Guarantee Corporation is already insolvent. But it is better to directly bail-out pensions than to maintain the charade that fraudulently created securities have value.

Bill Black likes to joke that economists are afraid to use the “F” word (fraud). The President must come to realize that there is no other word that can be applied to the US home finance system. Until we deal with the fraud we will never resolve this financial crisis.

(Go to www.nakedcapitalism.com for Yves Smith, “4ClosureFraud posts lender processing services mortgage document fabrication sheet”, October 3, 2010; and to www.webofdebt.com for Ellen Brown, “Foreclosuregate and Obama's ‘pocket veto'”, October 7, 2010.)

L. Randall Wray is a Professor of Economics, University of Missouri—Kansas City.

Geithner: Foreclosure Freeze Would Be 'Very Damaging'

by William Alden - Huffington Post

As doubts about the legality of foreclosure proceedings continue to grow, Treasury secretary Timothy Geithner said a nationwide foreclosure freeze would do more harm than good, Bloomberg reports. Speaking to PBS's Charlie Rose, Geithner, who called the foreclosure crisis "a national tragedy," said a moratorium could further depress housing prices and said it would be "very damaging to exactly the kind of people we're trying to protect," according to the transcript of his remarks (hat tip to Politico). A nationwide freeze could prevent foreclosed properties from being sold, and, as Geithner noted, unoccupied houses tend to hurt the value of their neighbors.

President Obama's top adviserr David Axelrod has also said he was "not sure" about a national moratorium. Both Axelrod and Geithner warn that such a move could cause collateral damage to valid foreclosure processes. Geithner told Rose "we're not going to make the problem worse." In an editorial last week, the Wall Street Journal expressed a similar opinion. Errors may exist in the paperwork, but, the WSJ says, there's been no proof of "substantive error" in the execution of a foreclosure.

"Out of tens of thousands of potentially affected borrowers, we're still waiting for the first victim claiming that he was current on his mortgage when the bank seized the home," the editorial reads. "Even if such victims exist, the proper policy is to make them whole, not to let 100,000 other people keep homes for which they haven't paid." The WSJ reported Tuesday that the government has not found any evidence of wrongful foreclosure eviction.

But some commentators beg to differ. Barry Ritholtz, CEO of Fusion IQ, who spoke Monday on CNBC about the severity of the foreclosure crisis, blogged Monday in response to the WSJ editorial that the newspaper's editors are either "clueless" or "liars." Ritholtz points to the case of the Florida man whose home did not have a mortgage and yet was foreclosed upon anyway by Bank of America, which has since frozen its foreclosures nationally.

Reuters' Felix Salmon, for his part, is also skeptical of the argument against a foreclosure moratorium. Responding to a release by a Wall Street trade group that warned about the damage a nationwide freeze would inflict on the economy, Salmon said, "it's far from clear that a foreclosure moratorium would hurt house prices." He added that such a move might help mortgage servicers sort out their legal issues.

Banks Hired Hair Stylists, Teens, Walmart Workers as Foreclosure 'Robo-Signers'

by Michelle Conlin - AP

In an effort to rush through thousands of home foreclosures since 2007, financial institutions and their mortgage servicing departments hired hair stylists, Walmart floor workers and people who had worked on assembly lines and installed them in "foreclosure expert" jobs with no formal training, a Florida lawyer says.

In depositions released Tuesday, many of those workers testified that they barely knew what a mortgage was. Some couldn't define the word "affidavit." Others didn't know what a complaint was, or even what was meant by personal property. Most troubling, several said they knew they were lying when they signed the foreclosure affidavits and that they agreed with the defense lawyers' accusations about document fraud.

"The mortgage servicers hired people who would never question authority," said Peter Ticktin, a Deerfield Beach, Fla., lawyer who is defending 3,000 homeowners in foreclosure cases. As part of his work, Ticktin gathered 150 depositions from bank employees who say they signed foreclosure affidavits without reviewing the documents or ever laying eyes on them -- earning them the name "robo-signers." The deposed employees worked for the mortgage service divisions of banks such as Bank of America and JP Morgan Chase, as well as for mortgage servicers like Litton Loan Servicing, a division of Goldman Sachs.

Ticktin said he would make the testimony available to state and federal agencies that are investigating financial institutions for allegations of possible mortgage fraud. This comes on the eve of an expected announcement Wednesday from 40 state attorneys general that they will launch a collective probe into the mortgage industry. "This was an industrywide scheme designed to defraud homeowners," Ticktin said.

The depositions paint a surreal picture of foreclosure experts who didn't understand even the most elementary aspects of the mortgage or foreclosure process -- even though they were entrusted as the records custodians of homeowners' loans. In one deposition taken in Houston, a foreclosure supervisor with Litton Loan couldn't define basic terms like promissory note, mortgagee, lien, receiver, jurisdiction, circuit court, plaintiff's assignor or defendant. She testified that she didn't know why a spouse might claim interest in a property, what the required conditions were for a bank to foreclose or who the holder of the mortgage note was. "I don't know the ins and outs of the loan, I just sign documents," she said at one point.

Until now, only a handful of depositions from robo-signers have come to light. But the sheer volume of the new depositions will make it more difficult for financial institutions to argue that robo-signing was an aberrant practice in a handful of rogue back offices. Judges are unlikely to look favorably on a bank that claims paperwork flaws don't matter because the borrower was in default on the loan, said Kendall Coffey, a former Miami U.S. attorney and author of the book "Foreclosures." "There has to be a cornerstone of integrity to the process," Coffey said.

Bank of America responded to Tiktin's depositions by re-affirming that an internal review has shown that its foreclosures have been accurate. "This review will ensure we have a full understanding of any potential issues and quickly address them," Bank of America spokesman Dan Frahm said. Frahm added that, on average, the bank's foreclosure customers have not made a payment in more than 18 months. JP Morgan Chase spokesman Thomas Kelly said the bank has requested that courts not enter into any judgments until the bank had reviewed its procedures. But Kelly added that the bank believes that all the underlying facts of the cases involved in the document fraud allegations are true.

Even before the foreclosure scandal broke, the housing market was in the midst of an ugly detoxification. Now the escalating crisis is likely to prolong the housing depression for at least another few years. The allegations are opening the entire chain of foreclosure proceedings to legal challenge. Some foreclosures could be overturned. Others could be deemed illegal. For a housing recovery to occur, all the foreclosed properties -- which could account for 40 percent of all residential sales by 2012 -- need to be re-scrutinized by the banks and resold on the market. Now, with so much inventory under a legal threat, the process will become severely delayed.

"This just adds more uncertainty to the whole mortgage process, so buyers are asking themselves: do I want to buy a home in this environment?" says Cris deRitis, director of credit analytics at Moody's Analytics. "We need to fix these issues before the economy can recover."

Though some have chalked up the foreclosure debacle to an overblown case of paperwork bungling, the underlying legal issues are far more serious. Yes, swearing that you've reviewed documents you've never seen is a legal offense. But at the center of the foreclosure scandal looms something much larger: the question of who actually owns the loans and who has the right to foreclose upon them. The paperwork issues being raised by lawyers and attorneys generals have the potential to blight not just the titles of foreclosed properties but also those belonging to homeowners who have never missed a mortgage payment.

So far, JP Morgan Chase, PNC Financial and Litton Loan Servicing have stopped some foreclosure proceedings in 23 states. Bank of America and GMAC, recently renamed Ally, have extended their moratoriums to all 50 states. Wells Fargo and Citigroup have said they are continuing with foreclosures, adding that they are confident in their documents and processes. But Citigroup has now backpedaled some on that assertion. The bank sent out a press release Tuesday that it was no longer using the law firm of "foreclosure king" David Stern, now under investigation by the Florida attorney general's office. "Pending the outcome of the AG's investigation, Citi is not referring new matters to this firm," the bank said in an e-mailed statement.

Late last week, in an interview with the Florida attorney general, a former senior paralegal in Stern's firm described a boiler-room atmosphere in which employees were pressured to forge signatures, backdate documents, swap Social Security numbers, inflate billings and pass around notary stamps as if they were salt.

Meanwhile, the public outrage continues to mount. In what is perhaps a sign of things to come, a Simi Valley, Calif., couple and their nine children broke into their foreclosed home over the weekend and moved back in, according to television station KABC of Simi Valley. The couple, Jim and Danielle Earl, say they were working with the bank to catch up on payments until they discovered a $25,000 difference between what they owed and what the bank said they owed. The family was evicted from their Spanish-style two-story in July. The home has been sold, and the new owner was due to move in soon. The Earls and their attorney now allege that they were victims of fraudulent paperwork.

September home foreclosures top 100,000 for first time

by Corbett B. Daly - Reuters

The number of homes taken over by banks topped 100,000 for the first time in September, though foreclosures are expected to slow in coming months as lenders work through questionable paperwork, real estate data company RealtyTrac said on Thursday.

Banks foreclosed on 102,134 properties in September, the first single month above the century mark, RealtyTrac said. There were 347,420 total foreclosure filings in September, 3 percent higher than August and 1 percent higher than a year earlier. "We expect to see a dip in those bank repossessions -- and possibly earlier stages of the foreclosure process -- in the fourth quarter as several major lenders have halted foreclosure sales in some states while they review irregularities in foreclosure-processing documentation that has been called into question in recent weeks," said James J. Saccacio, chief executive officer of RealtyTrac.

On Wednesday, all 50 states launched a joint investigation of the mortgage industry after widespread reports of mortgage industry officials signing foreclosure documents without knowing their contents. For the quarter, there were 930,437 foreclosure filings, an increase of 4 percent over the prior three months and 1 percent lower than a year ago. One in every 139 homes received a foreclosure filing in the third quarter.

The firm said foreclosures could spike after a brief lull if lenders are able to quickly resolve the paperwork questions. "However, if the documentation issue cannot be quickly resolved and expands to more lenders we could see a chilling effect on the overall housing market as sales of pre-foreclosure and foreclosed properties, which account for nearly one-third of all sales, dry up and the shadow inventory of distressed properties grows - causing more uncertainty about home prices," Saccacio said.

Nevada posted the highest foreclosure rate for the 45th straight month, followed by Arizona, Florida, California and Idaho. In 2005, before the housing bust, banks took over just about 100,000 houses, according to the Irvine, California-based company.

Foreclosure Fraud: It's Worse Than You Think

by Diana Olick - CNBC

There has been plenty of pontificating over the ramifications of foreclosure freezes on troubled borrowers, foreclosure buyers and the larger housing market, not to mention lawsuits, investor losses and bank write downs. There has been precious little talk of what the real legal issues are behind the robosigning scandal. Yes, you can't/shouldn't sign documents you never read, but that's just the tip of the iceberg. The real issue is ownership of these loans and who has the right to foreclose. By the way, despite various comments from the Obama administration, foreclosures are governed by state law. There is no real federal jurisdiction.

A source of mine pointed me to a recent conference call Citigroup had with investors/clients. It featured Adam Levitin, a Georgetown University Law professor who specializes in, among many other financial regulatory issues, mortgage finance. Levitin says the documentation problems involved in the mortgage mess have the potential "to cloud title on not just foreclosed mortgages but on performing mortgages."

The issues are securitization, modernization and a whole lot of cut corners. Real estate law requires real paper transfer of documents and titles, and a lot of the system went electronic without much regard to that persnickety rule. Mortgages and property titles are transferred several times in the process of a home purchase from originators to securitization sponsors to depositors to trusts. Trustees hold the note (which is the IOU on the mortgage), the mortgage (the security that says the house is collateral) and the assignment of the note and security instrument.

The issue is in that final stage getting to the trust. The law demands that when the papers get moved around they are "wet ink," that is, real signatures on real paper. But Prof. Levin tells me that's not the worst of it. Affidavits assigned to the notes and security instruments are supposed to be endorsed over to the trust at the time of sale, but in many foreclosure scenarios the affidavits have been backdated illegally. So with the chain of documentation now in question, and trustee ownership in question, here is one legal scenario, according to Prof. Levitin:The mortgage is still owed, but there's going to be a problem figuring out who actually holds the mortgage, and they would be the ones bringing the foreclosure. You have a trust that has been getting payments from borrowers for years that it has no right to receive. So you might see borrowers suing the trusts saying give me my money back, you're stealing my money.

You're going to then have trusts that don't have any assets that have been issuing securities that say they're backed by a whole bunch of assets, and you're going to have investors suing the trustees for failing to inspect the collateral files, which the trustees say they're going to do, and you're going to have trustees suing the securitization sponsors for violating their representations and warrantees about what they were transferring.

Josh Rosner, of Graham-Fisher, put the following out in a note today, claiming violations of pooling and servicing agreements on mortgages could dwarf the Lehman weekend:Nearly all Pooling and Servicing Agreements require that “On the Closing Date, the Purchaser will assign to the Trustee pursuant to the Pooling and Servicing Agreement all of its right, title and interest in and to the Mortgage Loans and its rights under this Agreement (to the extent set forth in Section 15), and the Trustee shall succeed to such right, title and interest in and to the Mortgage Loans and the Purchaser's rights under this Agreement (to the extent set forth in Section 15)”.

Also, an Assignment of Mortgage must accompany each note and this almost never happens. We believe nearly every single loan transferred was transferred to the Trust in “blank” name. That is to say the actual loans were apparently not, as of either the cut-off or closing dates, assigned to the Trust as required by the PSA. Rather than continue to fight for the “put-back” of individual loans the investors may be able to sue for and argue that the “true sale” was never achieved.

Quite the can of worms. Anyone who says that the banks will fix all this in a few months is seriously delusional.

Josh Rosner: “Could Violations of PSA’s Dwarf Lehman Weekend?”

by Yves Smith - Naked Capitalism

Josh Rosner, a well respected bank analyst (he describes himself as “a recovering GSE analyst”) is circulating a client note and it takes the foreclosure crisis very seriously.

The critical part is his discussion of the conveyance chain. As we indicated before, the minimum chain for a recent mortgage securitization is is A (originator) => B (sponsor) => C (custodian) => D (trust). Older deals might only have three parties, but recent vintage typically had at least four, and some as many as seven or eight.

The reason for doing this is bankruptcy remoteness. You as the buyer of a mortgage backed security want certainty in what you purchased. If an originator goes bust (as ironically many did), you don’t want the creditors to say, “They were already toast by the time they set up that MBS, so the sale of the loans was a fraudulent conveyance, we are gonna take the loans back.”

The way to prevent that was to introduce intermediary parties between the originator and the trust. Each party had to be independent (which meant fit the legal definition of independence; the intermediary parties and even many originators were dependent on financing called warehouse lines from the investment bank packager/distributors). The note (the borrower IOU) had to be endorsed (like a check) to the next party in the chain, who then endorsed it over to the party after that, with the last party being the trust.

Rosner’s remarks are consistent with our prior posts, and he adds a couple of important additional observations: We have a larger and more significant concern, which, if proved out, could call into question the validity of nearly all securitizations and raise material questions about whether “true sale” was achieved.Nearly all Pooling and Servicing Agreements require that “On the Closing Date, the Purchaser will assign to the Trustee pursuant to the Pooling and Servicing Agreement all of its right, title and interest in and to the Mortgage Loans and its rights under this Agreement (to the extent set forth in Section 15), and the Trustee shall succeed to such right, title and interest in and to the Mortgage Loans and the Purchaser’s rights under this Agreement (to the extent set forth in Section 15)”. Also, an Assignment of Mortgage must accompany each note and this almost never happen.

We believe nearly every single loan transferred was transferred to the Trust in “blank” name. That is to say the actual loans were apparently not, as of either the cut-off or closing dates, assigned to the Trust as required by the PSA. Rather than continue to fight for the “put-back” of individual loans the investors may be able to sue for and argue that the “true sale” was never achieved. To think of it simply, if you go to sell your car and you endorse your title but neither you nor the party you are selling it to sign their name who owns the car? It appears you likely still do.

While there may be a view that the government can intervene it appears that the private contract spelling out the terms was violated at the transfer point. The Trustee, who has responsibility to make sure all loans were properly assigned to the trust, may have liability. So too might the lawyers who issued the legal opinions.

Yves here. Let’s deal with this in reverse order. The attorneys are probably not liable; lawyers who have looked at typical opinions have advised us that the legal opinions provided on these deals were highly qualified (they took the form “if you took the steps you said you are going to, you have a true sale”). However, the significant part of Rosner’s comment is his belief (and Rosner typically has very good contacts) that the notes were endorsed in blank. That means they were presumably endorsed only by the originator. This means, effectively, that none of the intermediary transfers took place. This is independent of verification of what we’ve been told. Per a post from late September:One of my colleagues had a long conversation with the CEO of a major subprime lender that was later acquired by a larger bank that was a major residential mortgage player. This buddy went through his explanation of why he thought mortgage trusts were in trouble if more people wised up to how they had messed up with making sure they got the note. The former CEO was initially resistant, arguing that they had gotten opinions from top law firms.

My contact was very familiar with those opinions, and told him how qualified they were, and did not cover the little problem of not complying with the terms of the pooling and servicing agreement. He also rebutted other objections of the CEO. The guy then laughed nervously and said, “Well, if you’re right, we’re fucked. We never transferred the paper. No one in the industry transferred the paper.”

This creates a lot of problems. If the originator is bankrupt (New Century, IndyMac), the bankruptcy trustee is supposed to approve any assets leaving the BK’d estate. I’m told bankruptcy judges who have been asked were not happy to hear this sort of thing might be taking place, which strongly suggests this activity is going on without the requisite approvals. And who from the BK’d entity can endorse it over? It doesn’t have any more officers or employees. Similarly, a lot of the intermediary entities (the B and C in the A-B-C-D chain earlier) are long dead. How do you obtain their endorsements?

Now you understand why everyone is resorting to fabricated documents and bogus affidavits. There is no simple way to fix this mess. The cure for the mortgage documents puts the loan out of eligibility for the trust. In order to cure, on a current basis, they have to argue that the loan goes retroactively back into the trust. This is the cure that the banks have been unwilling to do, because it is a big problem for the MBS.

Yves here. The next question is “what does this mean for MBS investors?” If you are a Fannie and Freddie investor, there will probably be no obvious consequences, even thought there ought to be. The government is not going to want to raise doubts about the integrity of such an important market. Servicers will continue to pay advances on delinquent accounts.

The bigger implications will be for the servicers and trusts of securitizations for so-called non-conforming mortgages, aka private label or non GSE paper. If Rosner is correct and no one endorsed the notes correctly, at best this is now effectively unsecured paper. I’ve had securitization lawyers argue that even though the trusts may have impaired rights to foreclose, a lower standard of rights applies to ongoing payment, so the trust may be OK as far as non -defaulted borrowers is concerned. But the New York trust experts (and all the trusts are governed by New York law, this was the standard choice for these deals) say if no notes got to the trust by closing, it was unfunded and does not exist.

Regardless, this mess looks likely to be an attorney full employment act. Stay tuned.

States to Probe Mortgage Mess

by Robbie Whelan and Ruth Simon - Wall Street Journal

Attorneys General Hope Lenders Will Re-Write Loans With Troubled Documents

A coalition of as many as 40 state attorneys general is expected Wednesday to announce an investigation into the mortgage-servicing industry, an effort some of them hope will pressure financial institutions to rewrite large numbers of troubled loans. The move comes amid recent allegations that mortgage-servicers, which include units of major banks such as Bank of America Corp., submitted fraudulent documents in thousands of foreclosure proceedings nationwide.

The banks say the document problems are technical—largely the result of papers approved by so-called robo-signers with little review—and don't reflect substantive problems with foreclosures. Still, they have drawn criticism from consumer advocates and state and federal lawmakers. "I think the mortgage-servicing firms need to understand that they face real exposure now, and they would be well advised to take this very seriously, to clean this up by doing loan workouts to keep people in their homes, which up till now they've just paid lip-service to," said Ohio Attorney General Richard Cordray.