"Coke delivery wagon and workers, Detroit City Gas Company"

Stoneleigh: Humans are not good at the taking the long term view. Our ability to do so does vary significantly with circumstances though, depending on our perception of stability. When we collectively feel that tomorrow will be similar to today, and that we have our basic needs covered, then we are free to think about longer term concerns and the bigger picture.

In contrast, when we exist under circumstances of little forward visibility, and where we are not confident about our access to basic necessities, then the luxury of the long term disappears, and we are pitched into a state of short term crisis management.

Economics describes this parameter as a change in our discount rate. When the discount rate rises, it means that the future is discounted increasingly steeply in comparison to the present, so that today has far more value than next week, and almost infinitely more value than the far future. This has been the natural state for humanity throughout much of its existence.

The fortunate in the developed world have lived through an unprecedented period of wealth and relative peace, hence longer term concerns have made it on to the political agenda. Concern for the environment and for other species always peaks in times of plenty, as the discount rate falls and people take on broader and longer term concerns. Unfortunately, this state is unlikely to last, meaning that the environment is not likely to retain its current level of protection, and that level is already insufficient to prevent continued degradation of our natural capital.

It is not just hard times that lead to a rise in the discount rate, it is times of uncertainty. In recent years, the world has been changing at such a rapid pace, that economic visibility has already contracted substantially. Even though the trajectory has been positive for much of the time (assuming you regard increasing material wealth for the few as positive), the rate of change has been uncomfortable for many, and has required people to be more and more fleet-footed in order to keep up.

Consequently, the number of people able to participate in the advance has been falling and the scope of that advance has been narrowing. More people, and companies, and sectors of the economy, and even countries, are falling off the back of the accelerating treadmill all the time.

As uncertainty has increased, there has been more and more emphasis on gaming the system in order to wring a quick profit out of it and less and less emphasis on productive investment, as productive investments have too long a time horizon to deliver gains in a world proceeding at a frenetic pace. This has been going on for years, and has led to our current milieu of casino capitalism, or ponzi finance.

This system of money chasing its own tail in ever tighter circles is clearly unstable, and I would argue is about to self-destruct under the increasing pressure of its own internal contradictions and the catabolic (self-consuming) process taken past real limits. As it does so, the pace of change will becomes even more rapid for a period of time, and coupled to that will be increasing hardship for a critical mass of people.

Up to now, where those who have lost out have not been a critical mass, their plight has been essentially invisible to a news system written by the winners, but that will change as the numbers affected increase dramatically.

The implication for discount rates is that they are about to shoot up from a level that is already too high, and that therefore people will collectively cease to value the future. This state is not conducive to rational or intelligent decision-making or the weighing up of alternative courses of action. It is a psychological environment favouring crisis management and simplistic knee-jerk reactions. Sadly, people in this collective state of mind are more subject to simplistic answers proposed by populist manipulators, and are all too prone to vote against their own best interests.

What we need to do is to take actions now to reduce our exposure, and the exposure of as many people as possible, to the risks inherent in the system as it has developed over at least several decades, if not longer. This is of course much easier said than done. Following in the advice in The Automatic Earth lifeboat primer - on reducing debt, holding cash, gaining some control over the essentials of one's own existence and, above all, building community - is the best way of taking enough mental pressure off in the future to enable people to hang on to an appreciation for the longer term.

The greater the number of people who do not have to worry where their next meal is coming from, the greater the number who will be able to keep their heads and retain the luxury of the (relatively) long term. This is important not just for them, but for others as well. The human over-reaction to adverse events typically has a greater impact than the adverse events themselves. We need to do whatever we can to blunt that over-reaction for the sake of holding our societies together in a highly uncertain future.

Chris Whalen: The Fed is now there to support the speculators, and lets the real economy go to hell

Fed Documents Reveal Scope Of Aid To Stabilize Economy

by Sewell Chan and Jo Craven McGinty - New York Times

As financial markets shuddered and then nearly imploded in 2008, the Federal Reserve opened its vault to the world on a scope much wider and deeper than previously disclosed.

Citigroup, struggling to stay afloat, sought help from the Fed at least 174 times during one remarkable 13-month period. Barclays, the British bank, at one point owed nearly $48 billion to the Fed. Even better-off banks like Goldman Sachs took advantage of Fed loans offered at rock-bottom rates.

The Fed’s efforts to stave off a financial crisis reached far beyond Wall Street, touching manufacturers like General Electric, the Detroit automakers and Harley-Davidson, central banks from Britain to Japan and insurers and pension funds in Sweden and South Korea. Under orders from Congress, the Fed on Wednesday released details of more than 21,000 transactions under the array of emergency lending programs and other arrangements it conjured up in response to the crisis.

The disclosures, which the Fed had resisted, offer the most detailed portrait of a panicky period in which the Fed lent money to banks, brokers, businesses and investors to keep the financial system functioning. The documents show that some of the biggest names in American business were either coming to the Fed in need of a bailout, or trying to make money at a time when the Fed was trying to entice investors back into the markets. Among the latter were prominent investors and entrepreneurs like John A. Paulson and Michael S. Dell, and the pension funds of the Philadelphia Teamsters and Omaha’s teachers, who were betting they could profit if the rescue worked.

At its peak at the end of 2008, the Fed had about $1.5 trillion in outstanding credit on its books. The central bank, in essence, pumped liquidity, the lifeblood of credit markets, into the circulatory system of an economy that was experiencing a potentially fatal heart attack. “I think our actions prevented an even more disastrous outcome,” said Donald L. Kohn, who was the Fed’s vice chairman during the crisis. Without the Fed’s help, he said, “liquidity would have dried up even more than it did, asset prices would have fallen even more than they did, and economic activity and employment would have fallen further and faster then they did.”

But Senator Bernard Sanders, independent of Vermont, who wrote a provision in the law requiring the disclosures by Dec. 1, reached a different conclusion. “After years of stonewalling by the Fed, the American people are finally learning the incredible and jaw-dropping details of the Fed’s multitrillion-dollar bailout of Wall Street and corporate America,” he said. “Perhaps most surprising is the huge sum that went to bail out foreign private banks and corporations.”

Mr. Sanders said the Fed should have forced banks to restrict executive pay and reduce the financial burdens on mortgage borrowers as a condition of its aid. The Fed, already reeling from attacks from both the right and the left over its latest effort to spur the economy, a plan to buy $600 billion in Treasury securities, braced itself for another moment in the spotlight.

In a statement accompanying the disclosure, the Fed said it had fully protected taxpayers. “The Federal Reserve followed sound risk-management practices in administering all of these programs, incurred no credit losses on programs that have been wound down, and expects to incur no credit losses on the few remaining programs,” it said. The 21,000 transactions span the period from December 2007 to last July. Even as investors began poring over the disclosures, details emerged from the trove of new data.

From December 2007 to October 2008, the Fed opened swap lines with foreign central banks, allowing them to temporarily trade their currencies for dollars to relieve pressures in their financial markets. The European Central Bank drew the most heavily on these currency arrangements, the records show, but nine other central banks also made use of them: Australia, Denmark, England, Japan, Mexico, Norway, South Korea, Sweden and Switzerland.

At home, from March 2008 to May 2009, the Fed extended a cumulative total of nearly $9 trillion in short-term loans to 18 financial institutions under a credit program. Previously, the Fed had only revealed that four financial firms had tapped the special lending program, and did not reveal their identities or the loan amounts. The data appeared to confirm that Citigroup, Merrill Lynch and Morgan Stanley were under severe strain after the collapse of Lehman Brothers in September 2008. All three tapped the program on more than 100 occasions.

The American subsidiaries of several foreign banks also benefited substantially from the program. Those institutions included UBS of Switzerland; Mizuho Securities of Japan; and BNP Paribas of France. The impaired credit markets quickly stretched well beyond Wall Street, engulfing money-market mutual funds and commercial paper — short-term borrowings that companies rely on for day-to-day operations like meeting payroll and paying vendors.

In short order, the Fed set up programs to prop up both markets and get credit flowing again. The new data shows that some of the biggest names in the mutual fund industry sold assets to Fed-financed buyers during the credit crisis, including funds sponsored by Fidelity, BlackRock, Merrill, T. Rowe Price and Oppenheimer. In the first week of the Commercial Paper Funding Facility, the Fed bought more than $225 billion in debt. Companies ranging from Ohio’s Fifth Third Bank to the best-known bank franchises of Europe and Asia, like Royal Bank of Scotland and Sumitomo, were the primary occupants of the new lifeboat, along with the finance arms of the nation’s hard-pressed automakers.

But joining them were issuers of commercial paper with ties to Caterpillar, McDonald’s and Verizon. The data also show that the commercial paper market was impaired well into the latter half of 2009.

Another Fed program, the Term Asset-Backed Securities Loan Facility, brought the Fed into the unprecedented position of supporting small business, auto, student, and credit card loans. Plentiful helpings of low-cost debt encouraged institutions to ramp up lending and lured back private investors.

Among prominent investors in that program were the businessmen H. Wayne Huizenga and Julian Robertson; Kendrick R. Wilson III, a former Goldman executive who had been a top aide to Henry M. Paulson Jr., the Treasury secretary during the crisis; and Christy K. Mack, the wife of John J. Mack, the former chief executive of Morgan Stanley. Other surprises emerged from the data. Both the American International Group, the insurer bailed out by the government, and Lehman owned big stakes in funds that bought TALF securities. So did Jonathan S. Sobel, who ran the mortgage department at Goldman Sachs.

Big institutional investors, like Pimco, T. Rowe Price and BlackRock, borrowed from the TALF program. So did the California Public Employees Retirement System, the nation’s largest public pension fund, and several insurers and university endowments.

Money For Nothing: Wall Street Borrowed From Fed At 0.0078 Percent

by Shahien Nasiripour - Huffington Post

For the lucky few on Wall Street, the Federal Reserve sure was sweet. Nine firms -- five of them foreign -- were able to borrow between $5.2 billion and $6.2 billion in U.S. government securities, which effectively act like cash on Wall Street, for four-week intervals while paying one-time fees that amounted to the minuscule rate of 0.0078 percent.

That is not a typo.

On 33 separate transactions, the lucky nine were able to borrow billions as part of a crisis-era Fed program that lent the securities, known as Treasuries, for 28-day chunks to the now-18 firms known as primary dealers that are empowered to trade with the Federal Reserve Bank of New York. The program, called the Term Securities Lending Facility, ensured that the firms had cash on hand to lend, invest and trade.

The market was freezing up. Effectively free money, courtesy of Uncle Sam, helped it thaw. The European firms -- Credit Suisse (Switzerland), Deutsche Bank (Germany), Royal Bank of Scotland (U.K.), Barclays (U.K.), and BNP Paribas (France) -- borrowed $5.2-6.2 billion in Treasuries 20 different times. The one-time fees they paid on each transaction ranged from $403,277.78 to $481,110. Deutsche led the way with seven such deals. On each transaction, the fee paid for the 28-day loan is equal to a rate of just 0.0078 percent.

The first of these sweetheart deals began April 17, 2008. They ended nearly a year later on March 5. On that day, Goldman Sachs borrowed about $5.8 billion and paid just $450,000 for the privilege.

Goldman was one of four American firms that also paid that rock-bottom rate. Citigroup, defunct investment bank Lehman Brothers, and Merrill Lynch, which was gobbled up by Bank of America in a government-pushed transaction, benefited from the save-Wall-Street-at-all-costs approach. Goldman and Citi got the 0.0078 percent rate on five separate occasions, tops among U.S. banks.

The transactions highlight the extraordinary steps taken by the Fed -- and encouraged by both the Bush and Obama administrations -- to save Wall Street from its own mistakes. Households and small businesses have not been as lucky. The Fed's crisis-era programs "provided liquidity to particular institutions whose disorderly failure could have severely stressed an already fragile financial system," the Fed said in a statement Wednesday posted on its website. A spokesman did not respond to an e-mailed request for comment.

This year, Wall Street is poised to break yet another record for employee compensation and bonuses. Thanks to near-zero percent interest rates -- also set by the Fed -- firms are able to continue making easy money with minimal risk.

Are The Banks Insolvent? Fair Question, Given This....

by Karl Denninger - Market Ticker

I've been going through The Fed's "data dump" that the WSJ has linked and made "easier" for us.And I've got lots of questions.

Let's, for example, look at "Bank of Amer NA", otherwise known as BAC.

They used the TAF a lot. Here's a snapshot:

Pay particular attention to that pink column I highlighted.

Why?

Well, BAC borrowed $15 billion an awful lot. Maybe the same $15 billion.

Look at the face value of what they posted as collateral.

$127 billion - or in one case $185 billion - to borrow $15 billion?

What was being posted there - that's a more than 90% haircut!

That's a fairly clear declaration by The Fed that these "Assets" were worth no more than $15 billion, right? After all, that's all they got credit for when posting their collateral.

Ok, two immediate questions:

- What was that, and at what value was that carried on their balance sheet at the time?

- Where is it now and what value is it being carried at TODAY on their balance sheet?

Ah, Kemosabe, now we get to a problem, don't we? See, if BAC had to borrow $15 billion, why would they post collateral at that sort of haircut? Further, that's a God-Awful loss embedded in those instruments that's being assumed by the NY Fed and BOG and we damn well ought to know through their quarterly reports where that presumed loss of value went and where it was.

There's a problem of course - BAC never reported that sort of loss any time during this "crisis." That leaves me with the question as to where these so-called "assets" are now, what they're marked at, and whether we're still dealing with massive and outrageously bogus "marks" - that is, claims of value - in these securities!

By the way, they're not alone. Barclays has a bunch of these transactions with big haircuts too. So does Goldman, with several TSLF transactions that show $2 billion borrowed and $25 billion+ of notional value of alleged "collateral" deposited.

Then there's Wells, which has a nice single-page output that looks like this:

Have a look and take a gander. And don't keep your investigation to the above - try to find just ONE large institution that had all of its collateral postings valued at, say, 80 cents on the dollar or better.

Best of luck.

Remember, the claim was that all of these "facilities" were liquidity operations.

The Fed told us explicitly - many times - that it was taking "good collateral" to back up these loans and that it was quite confident it would not lose any money.

That, it turns out, was true.

What we were not told is that the "collateral" they took was so bad that it was in some cases valued at TEN CENTS on the dollar or less, and in each of these cases it leaves open the question as to where is that collateral now, having been returned to the bank, what is it actually worth, and how is it being carried on the books - because what we do know from the bank's financial reporting is that it most-certainly was NOT written off.

There's more than enough here in these tables to call for a massive forensic investigation into the accounting practices of each and every one of these institutions as the fact that FRBNY valued this "collateral" at such a tiny fraction of it's claimed value by the submitting institution leads to an immediate question as to how one squares that valuation with the values reported by the banks in their quarterly and annual reports, and whether they were at the time, or are today, in point of fact, at anything approaching actual valuations, insolvent.

We the people deserve both answers AND HONEST ACCOUNTING.

Pimco Led Among Borrowing by Funds

by Aparajita Saha-Bubna and Amy Or - Wall Street Journal

Money managers, including hedge funds, mutual and pension funds borrowed $71.1 billion under the Federal Reserve's Term Asset-Backed Securities Loan Facility, according to a filing Wednesday on the central bank's website.

Through the program, known as TALF, the central bank offered for a year low-cost loans to investors, enticing them to buy top-quality bonds backed by consumer finance loans, such as auto loans and credit-card debt. TALF was aimed at reviving consumer lending in the broad economy during the financial crisis.

Pacific Investment Management Co., a unit of Allianz SE, was the largest borrower of this cheap funding, the data show. The California-based giant fixed-income asset-management company borrowed $7.13 billion from the program known as TALF.

Other major borrowers were Philadelphia-based Emerald TALF Fund LP, which borrowed $4.18 billion; Ladder Capital Finance LLC, specializing in commercial real estate, which used $3.38 billion of TALF funds; investment manager Arrowpoint Partners, which participated in TALF via two funds, borrowing $3.18 billion; and One William Street Capital, which used $3.22 billion of TALF money via its fund OWS ABS LLC.

Private investment firm Belstar Group used $2.98 billion of TALF money and launched funds in March 2009 to participate in both the asset-backed and commercial-mortgage-backed portions of TALF. Similarly, Cornerstone Investment Management LLC borrowed $1.48 billion through TALF, setting up a fund specializing in TALF-eligible securities.

Several state pension funds also tapped the program, including the following: California Public Employees' Retirement System; California State Teachers' Retirement System; and pension and retirement funds of Connecticut's cities of Bridgeport, Bristol and Milford. Money managers T. Rowe Price Inc. borrowed $981 million, and OppenheimerFunds Inc. borrowed $1.11 billion.

As of Sep. 30, more than 60% of TALF loans were repaid in full, with interest, ahead of their maturity dates, which range from March 2012 to March 2015, the Fed said on its website. Loans of $29.7 billion remain outstanding and are current in their payments. Since its introduction in March 2009, TALF aided the sale of more than $100 billion in bonds backed by auto, student and equipment loans and credit-card debt—the bulk of all the asset-backed deals sold in U.S.

During the credit crisis, when capital markets froze up, it made "complete sense that hedge funds and money managers were taking advantage of this program," said Dan Nigro, chief executive of Warfield Consultants, a Montclair, N.J., firm focused on asset-backed and residential-mortgage-backed securities. "The program was very successful. Returns under the TALF program will be tremendous." The Fed wrapped up the consumer loan-backed portion of TALF in March.

10 Reasons the Deficit Commission Proposal Is Still Unconscionable and Unacceptable

by Richard Eskow - Huffington Post

The co-chairs of the presidential Deficit Commission released the final draft of their report today, and it's now scheduled for a Friday vote by members of the Commission. We're being told that it's a fairer and more reasonable document than its predecessor. It's nothing of the kind.

In many ways this document is worse than the draft that preceded it, and those much-lauded "compromises" evaporate in the cold light of reality. This new draft is lipstick on a piggy-bank robber, a package of cosmetic changes meant to disguise its true purpose: To raid the future financial security of most Americans in order to benefit a few.

This proposal would still cripple government's vital role in society by imposing arbitrary limits on spending. It would still place great financial burdens on lower- and middle-class Americans while easing those of the wealthy. All in all, it's the most profoundly right-wing policy prescription the nation has seen in decades. Democrats who lack the political courage to oppose it will be remembered for it for a long time to come.

There are more balanced and effective ways to balance the budget. Instead, this plan is so ideologically driven that it actually increases the deficit at times, while the reductions it does achieve are needlessly unfair and destructive. Here are ten reasons why this proposal remains unacceptable and must be opposed -- not just by progressive or Democrats, but by anyone of good conscience who wants to reduce the deficit in a responsible way:

1. It's still a massive tax giveaway for the rich.

Imagine the outcry if a deficit-cutting commission recommended spending more money on government programs. Then imagine it recommended spending that money on programs that weren't needed, and which only benefited the wealthy. When it comes to tax revenues, that's exactly what this proposal does.

Remember, spending's only one-half of the deficit problem, and tax revenue's the other. A responsible plan would increase revenue wherever it's fair and possible to do so. Yet, in the name of "deficit reduction," this plan actually proposes cutting taxes -- for the wealthiest Americans. Its defenders point out that the proposal also ends all sorts of itemized deductions -- but those deductions primarily help the middle class.

Defenders will also say that it no longer eliminates vital middle-class tax breaks (like mortgage interest deductions) completely, which is true. But it would force "Congress and the president" to decide which of these deductions is retained and at what levels. And it would force Congress and the president to offset them with increased tax rates elsewhere, which the authors know is politically almost possible.

It's true that the plan proposes to tax capital gains and dividends as ordinary income. [1] But Wall Street law firms are no doubt already developing workarounds -- and, in any case, the net effect is still a tax break for the wealthiest Americans.

The wealthy even get a break on the payroll tax used to fund Social Security. The plan's defenders boast that it would raise the payroll tax cap to cover 90 percent of all income. But that was the percentage the tax covered back in the 1980s, before the explosion in very high-end wealth distorted the entire economy. This plan doesn't return to that 90 percent level until 2050! That's a 40-year wait before we fund Social Security with as much high-end income as we did twenty years ago.

In a little-noticed observation, the actuaries who reviewed this proposal observed that "lower marginal tax rates are expected to have a large effect on (this tax)... reducing revenue... by roughly 20 percent." The net effect will be to "increase the long-range... actuarial deficit... " Got that? This Commission's co-chairs insisted on attacking Social Security because they claimed to be so concerned about its long-term actuarial deficit (which is easily fixed by asking the wealthy to pay their fair share). Yet, having seized control of Social Security's under that pretense, they then propose tax breaks for the wealthy that make Social Security's long-term deficit worse.

Since this is supposed to be a deficit-reducing Commission, not a party-time-for-the-rich Commission, how are they going to pay for such big giveaways?

2. It still increases the tax burden for everyone else.

That's where you come in. (Unless you're a billionaire, of course.) Unless Congress and the president come up with something else, this proposal would set arbitrary caps on home-mortgage deductions and other tax deductions that are primarily used by the middle class. As we've seen, even that rise in payroll taxes is expected to hit the middle class more than the wealthy.

And, while this needs further study, it looks as if their new tax brackets place more of a burden on you, too. The 10 percent and 15 percent tax brackets seem to be compressed into a 12 percent bracket, which doesn't seem like a dramatic change. The 28 percent bracket goes to 25 percent, which is a little more than 10 percent and is more than offset in most cases by the loss of itemized deductions. But the highest bracket takes a deep plunge, from the current planned level of 39.6 percent down to 28 percent. That's more than 28 percent. Sweet -- if you're rich. But somebody's gotta pay for it.

That would be you.

3. It will result in millions of lost jobs.

As the Economic Policy Institute has demonstrated, this proposal will cost the nation four million lost jobs and damage our economic growth. This new draft demands even deeper discretionary spending cuts, enacted even sooner, so the loss of jobs is likely to be even greater.

That's why Mary Kay Henry, President of the SEIU, said, "This proposal is a jobs killer at a time when our number one priority must be putting America back to work." It's why AFL-CIO President Richard Trumka said that "this whole discussion reeks of hypocrisy. The faux deficit hawks on the commission -- and Senators who claim unemployment insurance must be paid for -- have no problem clamoring for more unpaid Bush tax cuts for millionaires. We need to focus now on the jobs deficit."

The report's defenders will dismiss Henry and Trumka as "special interests" (while criticizing any mention of co-chair Erskine Bowles' position on Morgan Stanley's Board of Directors or the financial interests of other commissioners as an "ad hominem" attack). But these two leaders are aware of proposals like the EPI's and the Citizens' Commission on Jobs, Deficits, and America's Economic Future. These reports demonstrate that these radical changes aren't needed to balance the budget -- and that, in fact, they interfere with that goal.

4. The elderly will face harsh benefit cuts.

The average Social Security retirement benefit today is $1,100, and even less for women ($920). Under this proposal a median earner, someone earning $43,000 in today's dollars, would face a 20 percent (19.1 percent) benefit cut.

It looks, therefore, as if the average benefit would eventually drop to $889 overall, with women receiving an average of $744. These cuts are offset somewhat for lower-income workers, but, as we'll see, those offsets aren't what they seem to be.

5. Most of us will still work longer for less.

You won't just receive less in benefits. You'll work longer to get it, since they're raising the retirement age.

We're told that there will be exceptions for people who would face hardship if forced to work longer. That's a nice thought, given all the benefit-slashing going on. But that decision is kicked down the road and assigned to Social Security administration staff. The cuts are fixed, but the exemptions are left vague and deferred to people who aren't trained in that kind of analysis.

Their definition of "hardship" is narrow, too, and it excludes hardships like discrimination. The net effect of this proposal is to ensure a longer work life for most people while making jobs harder to get. The only small mitigating factor they promise is delayed to a future date and left vague.

6. It punishes the long-term jobless.

This proposal doesn't just ignore the nation's "jobs deficit." It makes it worse, at a time when the number of long-term unemployed Americans is at historical levels. This program doesn't just leave them in the lurch, or ignore their urgent need for unemployment assistance. After having made their situation worse, it then punishes them in their old age too.

Much has been made about the proposal's "generous" suggestion that benefit cuts be made offset for lower-income workers who are at the brink of poverty in old age. But many (if not most) of the workers struggling today would be excluded from this change. As the actuarial analysis of the proposal notes, "workers... (at) the level of the low and very low scaled earners, but with less than 25 years of (qualifying) work... would be subject to the full reduction in benefit for longevity... "

There's more, but you get the gist. These much-vaunted "safety nets" are filled with holes.

7. Women will pay an unfair price.

Women get the short end of the stick here, too. Women already receive less in retirement benefits than men, on average -- right now they receive an average of about $920 per month. They live longer, too. Women have traditionally moved in and out of the workforce more than men, because of traditional gender roles. They'll be punished even more for this difference under this proposal, thanks to rules and loopholes like the one described above. For a "family values" culture, that's not a very family-oriented policy.

Here's the future Simpson and Bowles plan for the mothers of America: First, cut their income by reducing the adjustments to their benefits. That means they'll get less than $920 in tomorrow's dollars. Then offer them a poverty exemption -- but dangle it out of reach for millions of women who chose to stay home with their children for a few years (and all of them who couldn't find work when they looked).

Thanks for raising us, Mom, now eat your Friskies and pipe down.

8. That "living longer" benefit bump is a pittance.

We're also hearing about the "benefit bump" America's beleaguered seniors have been promised once they reach extreme old age. But here's what the proposal actually says: "Provide benefit enhancement equal to 5% of the average benefits (spread out over 5 years) for individuals who have been eligible for benefits for 20 years."

Since they're proposing to raise the retirement age to 68 and then 69, that means offering this bounty when a retiree becomes 88 or 89. With the estimates we've made above, that amounts to a "bonus" of $45 per month ($37 for women).

9. The plan still discriminates -- by income and by race.

Even that minimal adjustment is likely to benefit wealthier -- and whiter -- Americans. As Paul Krugman and others have pointed out, average life expectancy has risen by six years for the top 50 percent of earners, but only by 1.3 years for the bottom half.

White Americans still live five years longer on average than African-Americans, too. So who is this really helping?

10. It doesn't solve the health-care problem. It just shifts the cost.

This proposal is filled with irreversible triggers, like the Doomsday Machine in Dr. Strangelove, that are set to go off if targets aren't met. But they're all designed to trigger spending cuts or regressive tax changes. When it comes to the single greatest driver of future deficits -- health-care costs -- there's no trigger for the public option that would significantly lower costs.

Here's a proposal that is in the plan: Repeal the CLASS Act. That's the Community Living Assistance Services and Supports Act, which provides funds that allow people to receive medical care in the home rather than the hospital. Why does this proposal single out the CLASS Act? It's only projected to cost $11 billion in 2015. But then, that's typical of this proposal. It ignores the big issues and then goes out of its way to step on programs that serve the public good.

Their health proposals tinker at the margin of cost and ignore the big picture. Reducing administrative cost support for Medicaid merely shifts costs from the federal government to the states, while freezing provider payments will reduce access to care with minimal reduction in costs. They also plan to cut health benefits severely for federal employees.

They want to force Medicare recipients to pay more out-of-pocket for their care. That's a double whammy for seniors who have already had their Social Security benefits cut.

The authors claim that because "(Medicare) cost-sharing for most medical services is low, the benefit structure encourages over-utilization of health care." That's unproven theory, especially when discussing seniors. Studies have shown that increasing out-of-pocket costs discourages utilization -- it keeps people from getting medical care -- but studies among younger populations that seemed to back this idea have recently come under question, while other studies among seniors suggest they're likely to skip needed care and suffer as a result.

These Medicare changes will impose unnecessary hardship without addressing the real causes of health-care cost. Why? Because private health insurance is one of this Commission's "sacred cows," and any program that would provide public competition for these insurers is deferred (while "all-payer" coverage is buried elsewhere as one of many possible alternatives once other avenues have failed.)

What do they propose for the under-65 crowd instead? One of the main features of their proposals is an increase in the health "excise tax," which would undermine employee benefit health plans and shift more health-care costs on the under-65 set, too. (For greater discussion of this very bad idea, see here.)

"No class act." Somehow that seems to say it all. Commission member Dick Durbin is a good Senator who has provided valuable service. But it's painful to hear him say, as he did today, that he's inclined to vote for this plan because the times call for "shared sacrifice." That's a highly regrettable statement. In this plan, the sacrifice is only shared among those who can least afford it, while the wealthiest enjoy a free ride.

This proposal must not be passed.

Simpson-Bowles: $4 Trillion of Beltway Mumbo Jumbo

by David Stockman - Minyanville

Based on the wailing in Washington DC you might think the deficit commission co-chairmen, Erskine Bowles and Alan Simpson, have gored some sacred cows. In fact, they have produced 59 pages of nearly incomprehensible beltway mumbo jumbo and gimmicks -- an alleged deficit-slashing plan that actually takes a powder on every one of the core fiscal issues.

And that starts with the gushing river of budgetary red ink itself. In order to “get real” as former Republican Senator Simpson is wont to say, you must account for incremental deficits of about $350 billion per year from the inevitable lame-duck deal to extend the Bush tax cuts, the AMT patch, the various expiring tax credits, the doc fix, the estate tax fix, extended unemployment benefits, Build America Bonds, and all the other hide-the-ball phony program expiration tricks now embedded in the budget. Then, add a couple hundred billion per year more in red ink because the commission’s economic assumptions -- such as 5% unemployment and 5% per year nominal GDP growth by 2015 -- are way too optimistic. Lay all that over the so-called “current law” budget baseline and you have a minimum federal deficit of $1.2 trillion per year through 2015; that is, $6 trillion of new bonds and bills that need to find a home over the next five years.

And what does Simpson-Bowles do about this tidal wave of US Treasury paper? Well, it urges a fat zero in fiscal year 2011 and then a pinprick savings of $56 billion, or 5% of the built-in deficit, in 2012. After that, the reductions get bigger, but still total only $875 billion over the full five-year period, or less than 15% of the deficit baseline. Stated differently, after all of the alleged “tough choices” and policy heroics recommended by the co-chairmen, we would only need to finance $5 trillion of new Treasury debt, not $6 trillion, through 2015.

The surface reason for this timidity is the assumption that the US economy is too “fragile” to absorb any material tax increase (or spending cuts) over the next several years. Therefore we must borrow another $5 trillion from our children and grandchildren -- so that not a single middle- or upper-class taxpayer will be denied the spending power to buy a few more Coach bags, iPads, barbecue grills, and Caribbean cruises.

Besides the rather ignoble intergenerational heist implied in this proposition, the main problem is that it assumes the required massive deficit financing sources -- the international monetary system and global bond markets -- are not equally as fragile as the US economy is alleged to be. And that wholly unexamined assumption is by no means obvious.

At the moment, the Fed is monetizing 100% of the deficit. This means that it's crediting the deposit accounts of government bond dealers with money made out of thin air to the tune of about $100 billion per month in exchange for existing bonds and notes. In turn, dealers and traders use these deposit account proceeds to take down an equivalent $100 billion monthly of newly issued Treasury paper, thereby keeping Uncle Sam’s checks from bouncing.

But only $600 billion of QE2 monetization has been so far announced by the Fed -- meaning that at the current $100 billion monthly rate, the bucket will be drained by next spring. In theory, of course, the Fed could resort to QE3, QE4, and so forth -- printing its way through the entire $5 trillion of new federal financing that would be required after the Simpson-Bowles “savings” have been fully implemented. Yet by 2015 that means the Fed’s balance sheet would reach an elephantine $7.5 trillion -- a figure nine times greater than the central bank’s footings on the eve of the Lehman heart attack in September 2008.

Assuming that not even Helicopter Ben would go for a money drop that big, the true “fragility” issue then presents itself. When the Fed’s big fat POMO bid disappears from the Treasury market, or the post-meeting press release merely hints that it's coming, or especially when the Fed’s PR mole embedded at CNBC leaks the news, won't the smart money, the fast money, and the wise guys go sellers -- if they haven’t done so already?

The fact is, the $9 trillion US Treasury market will reach $14 trillion, or 100% of current GDP -- even after all the Simpson-Bowles savings have been harvested. Yet the marginal buyers of US Treasury issuance in the recent past -- China, the other East Asian mercantilists, Brazil, and OPEC -- can no longer afford to renew a heavy bid without importing virulent inflationary pressures into their own over-heated economies (by printing even more of their own currency to buy dollars). So when the Fed’s bid ends and the fast traders go sellers, the global bond market is likely to provide a thundering demonstration of what “fragility” in the economic sense really means. Needless to say, it will be a lot more unpleasant than the 10% sales drop at Target, Ford, Home Depot, or Carnival Cruise Lines that might result from requiring American citizens to pay at least some portion of their government’s bills.

To be sure, the esteemed co-chairmen aren't known to be card-carrying Keynesians of the orthodox creed -- so they probably don't believe in the spending and tax “multipliers”, and for good reason. After a 30-year borrowing and money-printing binge, the US economy is freighted down with $52 trillion in public and private debt, which represents an excess burden of $30 trillion compared to the pre-1980 leverage ratio on national income. Under these conditions, an incremental dollar of debt-financed consumer spending catalyzes nothing. Like Cash for Clunkers and credits for new homebuyers, it pulls purchases forward on a one-time basis and then disappears without a ripple.

The explanation for Simpson-Bowles’ giant whiff on the one true here-and-now-deficit reducer -- letting all the Bush tax cuts including the AMT patch expire at an immediate gain of $300 billion -- is thus straight-forward: The Wall Street propaganda machine has vaccinated nearly the entire beltway population -- include its few brave denizens like the co-chairmen -- with a politically convenient strain of ersatz Keynesianism. Unlike the real thing, the latter holds that consumption spending on anything -- even by people who already have everything -- is to be embraced without question. On that meretricious point, of course, the questions should start, not end.

In fact, the question of serious revenue raising is never really addressed by the Simpson-Bowles plan -- not even in the by-and-by a decade from now when the current macro-economic “fragility” has presumably passed. Thus, compared to current policy, the co-chairman’s plan would raise the grand sum of $100 billion by 2015 or just over one-half of 1% of GDP. Yet any honest plan to close the nation’s massive structural deficit needs five times that much new revenue -- $500 billion per year or upwards of 3% of GDP.

Worse still, the co-chairmen’s plan gets to its paltry $100 billion revenue gain through the most convoluted route imaginable. It launches a frontal assault on $1 trillion worth of annual tax expenditures that are literally anchored to the K Street sidewalks in order to drop 80% of the revenue gain into tax rate reduction, not deficit reduction. Stated differently, the plan calls for the expenditure of nearly unfathomable amounts of political capital to shrink tax preferences for mortgage deductions, employer health plans, municipal bonds, and corporate loopholes of every shape and size. Yet it ends up with so little net revenue gain that taxes as a share of GDP would be only 19.3 % in 2015 -- a target lower than projected for the original Reagan tax cut way back in 1981!

This whole bizarre scheme was undoubtedly designed to win Republicans over to the task of revenue raising by hiding the broccoli in the garden salad. But that’s too clever by half because it also means that the 39.5% tax rate on the richest Americans that would become effective in 2011 would be reduced instead by one-third -- to 28% -- under Simpson-Bowles. There’s no way on earth so-called progressives are going to sit still for that.

And they shouldn’t because the world has long ago passed beyond the time and circumstances in which the Republican theology of low income tax rates was relevant. Back in the 1980s, when the nation had a comparatively clean balance sheet, an eager baby-boom population, and hadn't yet outsourced large parts of the middle class production and business service economy to Asia and the emerging markets, there was a compelling case for income tax rates geared to entrepreneurial advance.

But 30 years later our objective circumstances are a far cry from morning again in America. It's more like sundown, if the truth be told, owing to the massive debt deflation now underway and the imminent retirement of 80 million baby boomers who have saved comparatively nothing and will therefore consume massive fiscal transfers on their way off the stage. Under these conditions, the days of rising living standards and robust economic growth are long gone. What's relevant now is maintaining national solvency -- and that requires equitable burden sharing of the massive taxes due bill, which is relentlessly coming our way in the decades ahead.

The co-chairmen’s plan is equally hostage to the vestigial ideology of the Left. Spending for the retirement entitlements -- Medicare and Social Security -- will total nearly $1.5 trillion by 2015 but the plan includes less than $30 billion of net savings -- that is, just 2% of the preponderant core of the welfare state budget. To be sure, the plan includes considerable arm waving about raising the retirement age 40 years from now and the need for new health cost containment mechanisms. But what the plan doesn’t do is utter the two words that could actually make a material difference in the fiscal equation: “means test.”

The fact is, probably two-thirds of the $1.5 trillion in retirement entitlement spending goes to elderly who have virtually no private assets, pensions, or other income, and literally could not survive without the full measure of current law income and medical-care benefits. But the remaining $500 billion goes to the top quarter of the retired population, which does have private means -- and in the case of the very top ranks, very considerable private wealth. A properly structured means test that treated Medicare and Social Security as a combined cash equivalence, could efficiently, fairly, and reliably extract $100 billion, or 20%, of the spending that would otherwise go to the top quartile of the elderly. Such measures would make a difference in the here-and-now fiscal equation when the true fragility of the global bond market and monetary system is certain to be tested.

Just like in the case of the missing revenue-raising plan owing to Republican tax theology, however, the missing entitlement means test is attributable to the “social insurance” mythology held by the Democrats. But contrary to the latter, almost no beneficiary “earned” the benefits they are entitled to under current law. And the trust fund is a pure accounting artifact with $3 trillion in paper “reserves” that represent payroll taxes collected long ago and have been fully spent on general fund programs or squandered on farm subsidies, middle-class student loans, and bribes to Afghan tribal leaders, as the case may be.

Thus the social insurance myths are basically a cover for a pure fiscal operation that's essentially an intergeneration transfer scheme. Unfortunately, the benefits promises made to the baby-boom generation can't be kept without turning the generation still in the work force into virtual tax serfs. Undoubtedly, the co-chairmen choose to take a powder on the means-test issue in part to spare themselves of inane Republican lectures about “privatizing” this Ponzi scheme for those under 40. But at the end of the day, the Democrats are so fiercely dug in against means testing that they didn’t even try to raise the issue.

Finally, the co-chairmen also took a powder on the last big chunk of the budget -- the $1.4 trillion that goes to “discretionary” spending. To be sure, they propose to save about 12%, or $175 billion, by 2015 by means of various “caps” and “freezes.” But it doesn't take a commission and a whole regiment of beltway staffers to imagine a cap at an altitude of 10,000 feet above the budget nitty-gritty, where real programs live and fierce bureaucratic and interest group defenders are dug in behind nearly every dollar.

The fact is, $800 billion, or two-thirds of the discretionary spending, is for national security, including homeland security. A mere “cap” is an earnest wish and little more. The only thing that can come even close to the savings projected by the commission is a sweeping demobilization of the nation’s vast and far-flung military establishment. That means elimination of numerous army and marine divisions and air force air-wings; mothballing of dozens of navy warships and several carrier-battle groups; elimination of hundreds of bases and overseas facilities; and cancellation of a fair share of new weapons procurement programs currently in the pipeline.

The reality is that the days of policing the world and foreign policy adventurism of the type embodied in George Bush’s two unnecessary wars are over -- not just because such policies are wrong-headed but also because they're profoundly unaffordable. It would have been helpful, therefore, if the co-chairmen had said something to that effect. But in 59 pages of beltway mumbo jumbo, the reader won't find a single policy declaration that supports the magnitude of Pentagon shrinkage that will be necessary to restore fiscal solvency.

So forget the $4 trillion headline -- that’s just reflective of the old Washington game of projecting a decade’s worth of guesstimates into the foggy future. The truth is, in the here and now, where it counts and where the coming conflagration in the global bond and currency markets might have been forestalled, the co-chairmen’s plan amounts to an earnest pinprick and little more. But it’s not their fault. Instead, it reflects the degree to which the nation’s fiscal governance has fallen hostage to partisan ideologies that are utterly detached from the real-world conditions we face. It’s a certainty that the plan -- however it's finessed on Friday -- will be DOA in the new Congress. The stalemate now runs so deep that only a thunderous crack-up of the global financial system is likely to make any difference, and when that day of reckoning actually comes it will be too late for Washington to do anything about it.

Fed wants to strip a key protection for homeowners

by Tony Pugh - McClatchy Newspapers

As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys. They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

In a letter to the Fed's Board of Governors, dozens of groups that oppose the measure, including the National Consumer Law Center, the NAACP and the Service Employees International Union, say the proposal is bad medicine at the wrong time. "At the depths of the worst foreclosure crisis since the Great Depression, we are surprised that the Fed has proposed rules that would eviscerate the primary protection homeowners currently have to escape abusive loans and avoid foreclosure: the extended right of rescission." Because the public comment period on the Fed's proposal is still open until Dec. 23, a spokesman declined comment on the matter.

But in a September passage in the Federal Register, the Fed said the proposal was designed to "ensure a clearer and more equitable process for resolving rescission claims raised in court proceedings" and reflects what most courts already require. Since 1968, the Truth in Lending Act has given homeowners the right to cancel, or rescind illegal loans for up to three years after the transaction was completed if the buyer wasn't provided with proper disclosures at the time of closing.

Attorneys at AARP have used the rescission clause for decades to protect older homeowners stuck in predatory loans with costly terms. The provision is also helping struggling homeowners to fight a wave of foreclosure cases in which faulty and sometimes-fraudulent disclosures were used. The violations must be of a material nature to invalidate a loan under the extended-rescission clause. To do so, homeowners — usually those facing financial problems or foreclosure — hire an attorney to scour their mortgage documents for possible violations regarding the actual cost of the loan or payment terms.

If problems are found, a notice of rescission is sent to the creditor, which can either admit to the alleged violation or contest it in court. Creditors that end up rescinding a loan are then required to cancel their "security interest," or lien, on the property. Once that occurs, the homeowner must then pay the outstanding loan balance back to the lender — minus the finance charges, fees and payments already made.

Dropping the lien provides homeowners with a defense against foreclosure and allows them to refinance to pay the outstanding loan amount. Critics say the proposed change by the Fed would render the rescission clause useless. The Fed proposal would require homeowners who seek a loan rescission through the courts, to pay off the entire loan balance before the lender cancels the lien.

"This, of course, would be almost impossible for most consumers to do because they can't come up with the money until they get out of the loan. And they can't get out of the loan until the lien is released," said Barry Zigas, director of housing and credit policy at the Consumer Federation of America. "None of us are quite sure what purpose is being served by this proposal or what prompted it."

The Fed's proposal is part of an ongoing effort begun in 2005 to review and update rules and guidelines for disclosure in the rescission process, said Kathleen Keest, the senior policy counsel for the Center for Responsible Lending. That effort, which includes a review and update of the forms used for rescission, pre-dates the housing-market meltdown and the recession, she said.

The Fed "believes this adjustment would facilitate compliance with the Truth in Lending Act," adding that the "majority of courts that have considered this issue" condition the release of a lien on a homeowner's ability to repay the balance. The Mortgage Bankers Association, the main trade group for the real estate finance industry, hasn't taken a position on the issue or submitted public comment to the Fed. But "we are inclined to support the direction the Fed is headed," said John Mechem, the MBA's vice president for public affairs.

Requiring homeowners to pay what remains of the original loan before a rescission can proceed is tantamount to a "verdict first, trial later" philosophy, Keest said. "It basically puts the cart before the horse," she said, adding that securing the "right to rescind determines how much you have to (pay)."

David Certner, the legislative policy director at AARP, which also has criticized the proposal, said rescission is an effective tool to make sure creditors follow the rules and are transparent about the true cost of loans. "It can help put off a foreclosure and give one the leverage in negotiating some other type of appropriate payment or settlement. It's a very powerful tool to help people stay in their homes," Certner said. He called the proposal "egregious."

What Ever Happened To That Dollar Crash?

by Cullen Roche - Pragcap

Back in October the economic buzzwords had become “money printing” and “debt monetization”. Of course, at the time, the Fed was initiating their policy of QE2 and you’d have been hard pressed to find someone in this country (and around the world for that matter) who wasn’t entirely convinced that the USA was about to send the dollar into some sort of death spiral. QE2 was about to set off a round of inflation that would make Zimbabwe look like a cakewalk. And then something odd happened – the dollar rallied as QE2 set sail and hasn’t looked back since.Just days before the dollar rally started I said the market was excessively confident in the Fed’s ability to create inflation and misinterpreting the impacts of QE2:

“If my theories prove correct it is likely that the dollar is well oversold and equities have become overextended on false hopes of a Fed driven economic recovery. This means the market is excessively concerned about inflation and we are likely to move closer towards our economic reality of disinflation with a higher risk of deflation than high inflation. If this is correct it means there is a fairly sizable air pocket beneath risk assets currently. Warren Buffett once said it is better to be greedy when others are fearful and fearful when others are greedy. I am currently fearful.”

Since then we’ve seen a 7%+ move in the trade weighted dollar and the smallest 12 month increase in the history of the CPI report. In other words, inflation remains non-existent. For the minority who understood how QE was actually going to impact the economy this was an obvious inefficiency at work (yes Eugene Fama, you are still wrong and this was real-time evidence of it). QE2 wasn’t inflationary and it never was going to be inflationary because it merely alters the term structure of outstanding government debt and nothing more. It is not money printing.This was just one more opportunity for the fear mongering hyperinflationists to latch onto something. Even as Ben Bernanke himself explained that he was not printing money we continued to see aspiring Presidential candidates, talking heads and even bunny rabbits explain to millions how the Fed was destroying the value of the dollars in our pockets. This was not only irresponsible, but entirely wrong. QE2 is not inflationary in the least bit. It does not help the US government spend in the future. It will not cause a dollar crash. It’s just an asset swap. It’s an unusual form of the standard monetary operations that the Federal Reserve always performs. But monetary policy during a balance sheet recession becomes a blunt instrument. QE2 is perhaps the most misunderstood and irrelevant policy the Fed has ever embarked upon. Or as I prefer to call it – the greatest monetary non-event.

Here's Why I'm Not Worried About Hyperinflation In The U.S.

by Rondy Smith - Business Insider

We are constantly being bombarded by fear mongers about the likelihood of hyperinflation in the US economy because of what is considered to be the irresponsible use of monetary policy, chiefly in the form of Quantitative Easing (QE) that might or might not be working. Monetary policy is not producing the desired linear modulation of economic output, and I've demonstrated why this is true. But, I'm not the tiniest bit worried about hyperinflation. It's a fairy tale composed by those who don't understand the psychological and philosophical basis of money. Hyperinflation is not really inflation at all. Rather, it's the sudden and exponential loss of Monetary Obedience to the currency.

There won't be any hyperinflation unless we lose Monetary Obedience and there's not much chance of that happening any time soon. Monetary Obedience is the term I have coined to explain that delicate equilibrium established among market participants at which their need for conducting the ordinary monetary exchanges of life counteracts the otherwise human need to nullify an irrational concept. Because, indeed, fiat money is exactly that, an irrational concept. Still, we're nowhere near the point of equilibrium that the Weimar Republic experienced.

If hyperinflation were possible in the US, we'd have already experienced it, because the dollar has long been worthless.

Pull out a USD bill of any denomination and place it before you. Look at it and ponder its worth. It has no conventional value whatsoever. The only reason it has value is because you are commanded to accept it, and given the opportunity to demand that it also be accepted as legal tender for debts incurred in the US. Monetary Obedience derives from the power of the US to command that acceptance.

The hyperinflation fear mongers often point to the Weimar Republic's collapse after WWI, when wheelbarrow-full loads of old marks were needed to exchange the massively deflated currency for just one new mark. But that wasn't because of the acceleration of prices of goods and services in terms of the equivalent labor of exchange for obtaining these goods and services, but rather because the German government no longer had the power to enforce monetary obedience to the mark.

The fiat money used in modern societies is not money at all, but rather a force, a facilitating force controlled by the central bank. Urban, labor-specialized modern culture could not function economically otherwise.

Let me illustrate in this manner. Assume that a giant and wonderful event that produced all the elements of a bazaar will be held in a sort of open-air stadium with row after row of seats and stalls extending into infinity, such that no person attending the event could avoid exchanging goods or services with other attendees. However, persons not attending would have no opportunity to exchange their goods or services at all.

In order to attend the event, attendees must bring value for the purpose of exchange, either 1) - as mechanical or intellectual labor, or 2) - as commodities, finished or unfinished goods. These items of intellectual or tangible value they will bring in whatever quantity and quality they are capable of producing.

However, one additional requirement must be met before attendees are allowed through the entrance gate to the bazaar. They must have a small black marble both to enter and also that must be shown in any exchange made, regardless of the type of exchange. It doesn't have to be exchanged itself, but must in all cases be shown by both (or all) parties conducting any exchanges of value.

The black marble has nothing to do with the exchanges of value. These are ultimately conducted in the core basis of all money, and that core basis is labor, intellectual or mechanical. From that labor all items of value are produced, all goods and services of every sort. In this sense the black marble is inert. However, it must be shown at every exchange, and in that sense it is a facilitating force.

Fiat currency is that black marble. Likewise, it is merely a facilitating force and is entirely inert in regards to the exchanging of all values which are instead conducted in terms of the pricing of labor, whether intellectual or mechanical. Possessing the black marble only permits the exchanges and has nothing to do with their values. Monetary obedience occurs at the bazaar because the attendees obey the requirement to show and present the black marble.

Because of this obedience, all values of exchanges are eventually conducted, like in human language, in a parent tongue of familiarity, that being in terms of the black marble, even though market participants subconsciously understand all values derive from the pricing of labor.

If ever an event or chain of events causes the loss of monetary obedience to the black marble, then it is as though the language of an entire society could be forgotten in an instant, destroying the familiar mechanism in which the ultimate values of exchanges are priced, in terms of what is the core basis of all money, intellectual or mechanical labor. When no mechanism exists to facilitate that pricing, the bazaar is reduced to pandemonium as participants frightfully search for some new facilitating force to replace it.

The United States is probably at the peak of its power and influence (debating the point is not my purpose here). It has the power to enforce monetary obedience of the black marble, and it isn't at risk of losing it any time soon. Fiat currency is simply an inert facilitating element of economic exchange and has nothing to do with its pricing.

Small Investors Pouring Into Stocks

by by Cullen Roche - Pragcap

Small investors aren’t just feeling bullish – they’re acting bullish. According to the AAII‘s November allocation poll small investor equity allocation reached an 11 month high. Charles Rotblut at AAII elaborated on the details:“Individual investors’ allocations toward stocks and stock funds reached an 11-month high of 62.3% last month, according to the November AAII Asset Allocation Survey. The 2.1 percentage point rise represented the fourth consecutive increase in the amount of portfolio dollars allocated to equities. The historical average is 60%.Bond and bond fund allocations were essentially unchanged at 21.8%. This was the 10th time in 11 months that fixed income allocations have exceeded 20%. The historical average is 15%.

Cash allocations fell 1.8 percentage points to 15.9%. This is the lowest amount of portfolio dollars held in cash since March 2000, when stock allocations reached 77%. The historical average is 25%.”

Naturally, small investors are chasing the rally. They were very bearish at the bottom and now remain only mildly bullish after the rally. At 62.3% the equity allocation is just above its historical average of 60%. At 21.8% bond allocations are substantially above the average of 15%.

Source: AAII

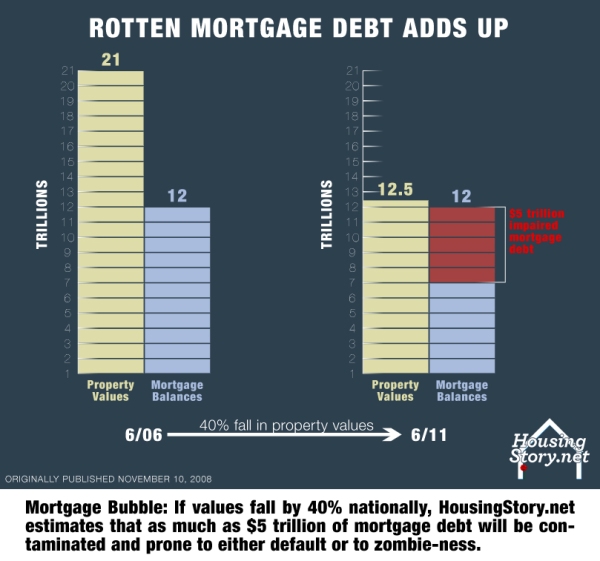

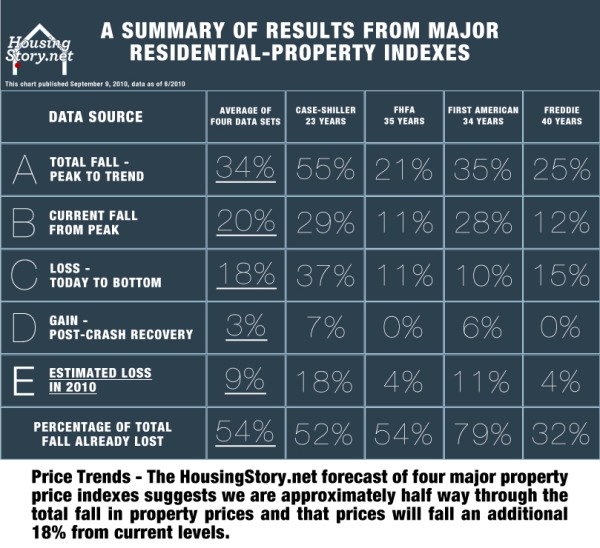

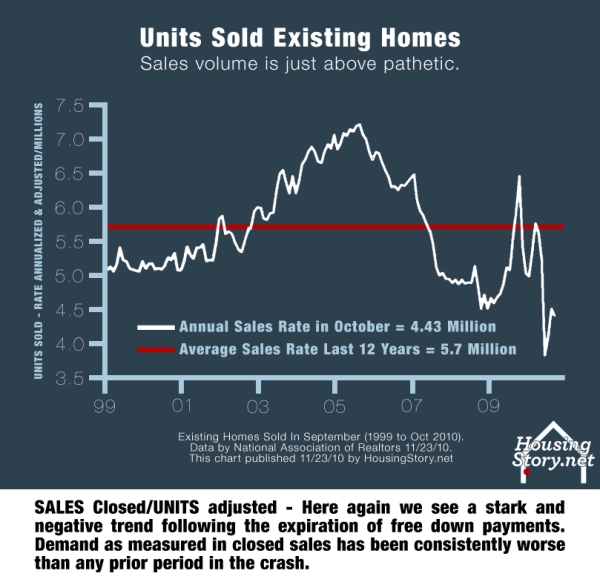

New housing crash trend and obvious severe risks in 15 key charts

by Micheal David White - Housingstory.net

Holidays About Survial As Jobless Benefits End

by Tom Breen - AP

Shawn Slonsky's children know by now not to give him Christmas lists filled with the latest gizmos. The 44-year-old union electrician is one of nearly 2 million Americans whose extended unemployment benefits will run out this month, making the holiday season less about celebration than survival. "We'll put up decorations, but we just don't have the money for a Christmas tree," Slonsky said.

Benefits that had been extended up to 99 weeks started running out Wednesday. Unless Congress approves a longer extension, the Labor Department estimates about 2 million people will be cut off by Christmas. Support groups for the so-called 99ers have sprung up online, offering chances to vent along with tips on resumes and job interviews. Advocacy groups such as the National Employment Law Project have turned their plight into a rallying cry for Congress to extend jobless benefits.

Things used to be different for Slonsky, who lives in Massillon, Ohio. Before work dried up, he earned about $100,000 a year. He and his wife lived in a three-bedroom house where deer meandered through the backyard. Then they lost their jobs. Their house went into foreclosure and they had to move in with his 73-year-old father. Now, Slonsky is dreading the holidays as his 99 weeks run out. "It's hard to be in a jovial mood all the time when you've got this storm cloud hanging over your head," he said.

The average weekly unemployment benefit in the U.S. is $302.90, though it varies widely depending on how states calculate the payment. Because of supplemental state programs and other factors, it's hard to know for sure who will lose their benefits at any given time. Congressional opponents of extending the benefits beyond this month say fiscal responsibility should come first. Republicans in the House and Senate, along with a handful of conservative Democrats, say they're open to extending benefits, but not if it means adding to the $13.8 trillion national debt.

Republicans maintain they are willing to instead use unspent money from Obama stimulus programs to foot the bill: a $12.5 billion tab for three months. Democrats argue that the extended benefits should be paid for with deficit spending because it injects money into the economy. The GOP didn't pay any political price for stalling efforts earlier this year to extend jobless benefits that provide critical help to the unemployed – including a seven-week stretch over the summer when jobless benefits were a piece of a failed Democratic tax and jobs bill. But bad publicity because the benefits end over the holidays has long been forecast.

Democrats hope that a final deal on extending Bush-era income tax cuts to the wealthy and middle class will include an agreement from Republicans to another extension of deficit-financed emergency unemployment benefits. U.S. Rep. Mike Pence, R-Ind., the No. 3 Republican in the House, said extended benefits must be paid for now, rather than later, if they're going to win support from fiscal conservatives. "The fact that we have to keep extending unemployment benefits shows that the economic policies of this administration have failed," said Pence spokeswoman Courtney Kolb.

Labor Secretary Hilda Solis told The Associated Press on Wednesday that declining to extend the benefits would be a mistake for Congress. "This is a bad way to start off the new, incoming season of new politicians that said that they wanted to make government work for people in a better way," she said.

Even if Congress does lengthen benefits, cash assistance is at best a stopgap measure, said Carol Hardison, executive director of Crisis Assistance Ministry in Charlotte, N.C., which has seen 20,000 new clients since the Great Recession started in December 2007. "We're going to have to have a new conversation with the people who are still suffering, about the potentially drastic changes they're going to have to make to stay out of the homeless shelter," she said.

Forget Christmas presents. What the 99ers want most of all is what remains elusive in the worst economy in generations: a job. "I am not searching for a job, I am begging for one," said Felicia Robbins, 30, as she prepared to move out of a homeless shelter in Pensacola, Fla., where she and her five children have been living. She is using the last of her cash, about $500, to move into a small, unfurnished rental home. Robbins lost her job as a juvenile justice worker in 2009 and her last $235 unemployment check will arrive Dec. 13. Her 10-year-old car isn't running, and she walks each day to the local unemployment office to look for work.

Jeanne Reinman, 61, of Greenville, S.C., still has her house, but even that comes with a downside. After losing her computer design job a year and a half ago, Reinman scraped by with her savings and a weekly $351 unemployment check. When her nest egg vanished in July, she started using her unemployment to pay off her mortgage and stopped paying her credit card bills. She recently informed a creditor she couldn't make payments on a loan because her benefits were ending. "I'm more concerned about trying to hang onto my house than paying you," she told the creditor.

Ninety-nine weeks may seem like a long time to find a job. But even as the economy grows, jobs that vanished in the Great Recession have not returned. The private sector added about 159,000 jobs in October – half as many as needed to reduce the unemployment rate of 9.6 percent, which the Federal Reserve expects will hover around 9 percent for all of next year.

For people like JoAnn Sampson, decisions made by Congress can seem very distant. The former cart driver at U.S. Airways in Charlotte and her husband are both facing the end of unemployment benefits, and she can't get so much as an entry-level job. "When you try to apply for retail or fast food, they say 'You're overqualified,' they say 'We don't pay that much money,' they say, 'You don't want this job,'" she said. Sampson counts her blessings: At least her two children, a teenager and a college student, are too old to expect much from Christmas this year.

Wayne Pittman has been telling his family not expect much for Christmas either. The 46-year-old carpenter, along with his wife and 9-year-old son, have stopped going to movies and restaurants and buying new clothes. With his $297 weekly checks gone, holiday gifts are definitely out. "It's not in our budget," Pittman said. "I have a little boy, and that's kind of hard to explain to him. To try to let him know, certain things he's not going to be getting."

Bailouts Are For Banks: Unemployed People Get Zilch

by Peter S. Goodman - Huffington Post

In Washington, the agenda has long since moved on from bailing out megabanks to figuring out how to stop paying for things that regular people need -- luxuries like health care, retirement benefits and unemployment insurance. In the suburbs of Denver, Anthony Roebuck and his family find themselves confronting an action list that seems cruelly divorced from the proceedings in the nation's capital: They have to figure out how to keep the heat on through the Colorado winter now that his unemployment check has run out.

The latest extension of emergency unemployment benefits expired on Tuesday, as a dysfunctional Congress let the deadline go without striking a deal to keep the money flowing. That put Roebuck -- who drew his last check on Monday -- among the two million or so unemployed Americans facing the imminent loss of their benefits between now and the end of the year.

A sheet metal worker by trade, Roebuck, 44, is accustomed to earning his own way through the force of his hands. Since May, he and his family have subsisted on his wife's paycheck from her job as a university administrator, plus a nearly $500 weekly unemployment check. They slashed away at their grocery bill, cutting out non-essentials such as the fried snacks favored by his 15-year-old son. They traded in their late-model Jeep Cherokee for an elderly Dodge sedan. They quit going to church on Sunday to save the gas money required to get there.

Now, the math is set to get uglier still, as they contemplate how to run the household minus his unemployment check -- a situation that seems not only impossible but also unfair. How could there have been so many billions for Wall Street, so much room to lower taxes for people with golf memberships and country houses, yet a $500-a-week check to help him pay the rent while he looks for another job suddenly threatens to bankrupt the nation? "It's like a gut shot," he says. "I get really upset when I think about it. I have to watch my words or I'm liable to get profane."

Perhaps even more disturbing than the callousness governing the political process is how so many powerful people in Washington are now competing to take credit for depriving the economy of meaningful relief. In the political calculus of the moment, exacerbating the troubles of the most vulnerable has become a pragmatic way to curry favor.

Republicans in Congress have held up the extension of unemployment benefits and are also demanding an extension of the tax cuts President George W. Bush handed out to the wealthiest Americans. They are selling this as a stand against fiscally reckless spending and oversized government -- a form of pandering that poses dire consequences to the economy.

Unlike wealthy people handed tax cuts, laid-off workers receiving unemployment checks tend to inject nearly all of that money directly into the economy, leaving their dollars at the local supermarket, the hardware store, and the auto repair shop, supporting jobs for people who work at those places. Cutting off those checks deprives the economy of cash just as the market is showing tentative signs of improvement.

Meanwhile, the Obama administration has become so captive to the budget-cutting-as-progress mantra ruling Washington that it is taking a victory lap for diminishing the costs of the federal bailouts -- even as the savings come at the direct expense of the only piece of its rescue package that was designed to aid regular people: its anti-foreclosure program.

Earlier this week, the non-partisan Congressional Budget Office released an analysis showing that the administration would spend only about $12 billion of the $50 billion that had been dedicated under the primary bailout funds for its signature anti-foreclosure program. This, even as the foreclosure crisis shows no sign of abating.

When President Obama announced the program amid great fanfare early last year, he declared that help was on the way for somewhere between three to four million American homeowners who would now be given a chance to lower their monthly payments. But through October, fewer than 500,000 distressed homeowners were making lower payments under the program.

The reasons for this abysmal record are many: From its inception, the program has been a fiasco. The giant banks that send out monthly mortgage bills and collect the money for the investors who generally own the notes have repeatedly lost documents sent in by applicants seeking relief. They have forced troubled homeowners to endure interminable stints on hold, waiting to be handed the latest conflicting instruction from another bank representative.

They have been told that the good people at Bank of America or J.P. Morgan Chase -- to pick on two giants -- would love to give them a break, but the greedy investors who own their mortgages will not go along, even though the opposite is often true: The clueless investors, who would be better served by loan alterations that cut their losses, are kept in the dark while the big banks drag out the foreclosure process, capturing fees by funneling orders for fresh appraisals and title searches that they funnel through their own subsidiaries.

And even the supposed success stories-- the homeowners who have navigated through the rat's nest of ineptitude and deceit to come out with loan modifications -- do not represent a fix to the fundamental problem. Lower payments have come through lowering interest rates and extending the life of the loans, not by writing down the size of the outstanding balances. With millions of people now owing more to the bank than their homes are worth, many have given up and stopped mailing checks to their lender.