"Powder monkey by gun of U.S.S. New Hampshire, Federal depot ship off Charleston, South Carolina"

Stoneleigh and Ilargi: Dear TAE readers,

The DVD version of Stoneleigh’s acclaimed lecture "A Century of Challenges" is now available by clicking the top button in our right hand side column. Production, handling and shipping is handled by CG Publishing in Burlington, Ontario, Canada. The sales of the DVD will go a long way towards funding The Automatic Earth in 2011.

We have had incredibly generous amounts of donations over the past year, and we truly are deeply and humbly grateful to all of our donors and supporters, but if we are to go where we want to be, we’ll need both more revenue and a more steady and reliable source of it.

Or look at it this way: in 2010 we're not doing a Christmas Fund Drive as such, but we offer you the DVD instead as a bonus for your donations.

So put lots of those DVD's under all of your families’ and friends’ Christmas trees, and give every single one of your dearest not some trinket or gadget, but something of real value!!

Kindly and humbly yours,

Stoneleigh and Ilargi

Ilargi: Dan Weintraub's back with the Nominal Man's most dire message so far, one we mostly leave unattended at TAE since it feels far enough away from finance and nobody really wants to discuss it unless it's in foreign lands and even then, but also one which is there in the background of our lives all the time: war. We are human. We do war much better and much more often than we do not war.

Dan Weintraub:

Nominal Man Part III:

War Is The Health Of The State

"…Love is the answer and you know that for sure, Love is the flower you got to let it, you got to let it grow..."

John Lennon

"…War is the health of the State. It automatically sets in motion throughout society those irresistible forces for uniformity, for passionate cooperation with the Government in coercing into obedience the minority groups and individuals which lack the larger herd sense...

To most Americans of the classes which consider themselves significant the war [World War I] brought a sense of the sanctity of the State which, if they had had time to think about it, would have seemed a sudden and surprising alteration in their habits of thought.

In times of peace, we usually ignore the State in favor of partisan political controversies, or personal struggles for office, or the pursuit of party policies…With the shock of war, however, the State comes into its own again…

For the benefit of proud and haughty citizens, it is fortified with a list of the intolerable insults which have been hurled toward us by the other nations; for the benefit of the liberal and beneficent, it has a convincing set of moral purposes which our going to war will achieve; for the ambitious and aggressive classes, it can gently whisper of a bigger role in the destiny of the world…"

Randolph Bourne

In one of the many tragic ironies that define our fickle species, only war, deviously waged, has the ability to grant us a reprieve from our boundless greed, from our lawlessness and spiritual emptiness, from our gluttony and darkly comical self-delusion.

War is the sole industry that can effectively defy the self-aggrandizing forces of corporate off-shoring and the resultant impact of global wage arbitrage. War is the one enterprise that can, through the adroit fermentation of that loveliest of intoxicants (we call) "nationalism", dampen the destabilizing and tectonic forces of class struggle. War is the only industry capable of "employing" (distracting?) tens of millions of poor and disenfranchised and terminally indebted young American men and women away from the hopelessness that colors their futures. War, implies Mr. Scrooge, graciously decreases the surplus population.

War is indeed, as Randolph Bourne stated close to a century ago, the health of the state.

Conservative commentators in the United States are quick to chastise men like Paul Krugman for their unabashed and shameless support for additional trillions in government stimulus. These critics accuse the Krugmans of the world either of being wholly ignorant as to the implications of unbridled increases in the fiat money supply, or worse, of being in cahoots with the billionaire banking class and with its proxies on Capitol Hill.

In my opinion, these fury-fueled criticisms miss the mark. What Krugman fears most is austerity. He is concerned that moves toward austerity do not simply (and disproportionately) hurt society’s most vulnerable, but that such policies provide a fertile environment in which extremism and ultra-violence thrive. Krugman is thus willing to support "extend and pretend" fiscal policies in the present because he is afraid of the alternative.

In fact, I would characterize the Krugman position as a delaying tactic: kicking the fiscal can down the road for a while longer so as not to allow civil strife - the discontent that always accompanies increases in austerity along with its attendant human suffering (both real and perceived) - a foothold in the United States. Another, perhaps more cynical view, could be this: Better to watch the other nations of the world implode under the pressures of austerity than to let it happen here first.

And what of our oft-vilified Federal Reserve chairman? When confronted with the opinion that many people, both in the general public and in the field of economics, believe "QE2" to be a bad idea, Federal Reserve Chairman Ben Bernanke states, "...I know some people think that, but what they are doing is they’re looking at some of the risks and uncertainties with doing this policy action, but what I think they’re not doing is looking at the risk of not acting…".

It has been written time and time again - even by many conservative policy critics - that without the bailouts of 2008, the United States may very well have experienced a more immediate and steep systemic contraction than occurred that autumn. (It is true that these same critics argue that we must take our medicine sooner rather than later, and that the debt must be cleared before economic recovery can commence. I am simply pointing out that there are individuals on either side of the ideological spectrum who acknowledge that a removal of stimulus and a tightening of monetary policy will, at least in the short term, make things worse.)

Again, allow me to take a contrarian position to those who would argue that the Bernanke imperative illustrates the ignorance of those promoting loose monetary policies. I think that Chairman Bernanke understands all too well that his accommodating monetary policies will fail to fix the underlying and most fundamental and socially destructive of all economic ills-those of an ever-widening gap between rich and poor, and the absolute disaster caused by an ever-shrinking, formerly self-sustaining American middle class.

But here’s the deal: Like Paul Krugman, Ben Bernanke also believes - and this is why his voice cracks and his lips quiver when he speaks "confidently" of the Fed’s policies - that hedging against what would be pretty much instantaneous chaos here in America (if all support was withdrawn from the system, no matter how problematic such support is over the long term) through the infusion of trillions of fiat dollars into the economy is the only possible path to follow. (As for the growing austerity-driven crisis in Europe, we’ll just have to wait and see. I mean if war breaks out, it won’t be fought in our streets, right Mr. Chairman?)

I must be a member of the ruling elite to adopt such a seemingly apologetic tone toward men like Bernanke and Krugman.

But I am not. I am a nominal man living in a real world. In the real world, austerity and poverty hasten the arrival of civil strife. In the real world, real hunger and real suffering leads inevitably to the rise of radical and violent political and social movements.

And while it is certainly true that the American middle class is being summarily destroyed by the fraud perpetrated by the Wall Street moguls and by the complicity of the Constitution Avenue oligarchy, and while it is also true that financial hopelessness is on the rapid ascent throughout the land, our descent into the realm of Banana Republicanism (as opposed to Constitutional Republicanism) is neither precipitous nor volcanic. It is, at present, a slow burn.

And while I wholly and entirely agree with those who argue that three-plus decades of fraud and profligacy and lawlessness in the financial sector and in Washington have brought us to the edge of the abyss, I also believe that, at least for the past two years, we have the Federal Reserve and the Congress to "thank" for keeping us from falling off of a cliff.

Do not misunderstand me. While it may appear as if I am making a grotesque gesture of apparent gratitude to the very men whose policies and avarice have ruined the future for so many, please hear me out as I clarify my complete argument.

A question: Why would intelligent men and women, regardless of moral considerations, promote fiscal policies that many now agree can only buy them, at best, a few years of financial respite? Is it because they just want to grab as much of the metaphorical pie as is possible before the next leg down?

Is it because they truly believe that the "Pax Americana", arguably in force since 1918, can be sustained via the creation of trillions of new irredeemable dollars? Is it because they simply don’t understand how credit and debt function when all trust in the system evaporates? The answer, you see, lies within Randolph Bourne’s prescient words of a century past.

I am a nominal man with a pretty good understanding of how things work in the real world. In the real world, war comes, one way or the other. War always comes. And in the real world, governments pursue war not because it is the righteous or just thing to do, but because more often than not they view it as the only viable thing left to do.

Of course governments will always attempt to create and nurture an ethos of righteousness and justice surrounding the wars they wage, and it is far easier to convince the citizens of the nation that "civilizing" wars and wars of foreign liberation (Take up the White Man’s Burden?) are the most righteous causes of all. (Far easier to convince the people of that than to convince them to fire upon their own, in the streets) And so with nowhere seemingly left to turn, governments pursue wars of aggression, of impetus, and of pre-emption, rather than waiting for the collapse of their own state into civil war.

I am a nominal man living this real American tragedy. I live moment to moment, paycheck to paycheck. I have sold my car and many of my possessions so that I can feed myself and my children. I have purchased with the last of my dollars a small piece of land in rural America. There I will erect a humble 250 square foot cabin. I will grow vegetables to barter at the local marketplace. I will recede from that which I simply can no longer afford nor sustain.

And while I must admit to often feeling a great rage and despair at what has become of my world, and while I want to blame the masters of greed - the Bernankes and the Blankfeins and the Buffets - for the destruction of this world, I am also compelled to consider that Krugman and Bernanke are pursuing policies whose aim is to keep civil strife from destroying, in the near term, the very fabric of American society.

War will come. Perhaps men like Bernanke and Krugman are simply trying to let it arrive first in a foreign land.

I cannot offer any ethical defense for the actions of my country. I more often than not find such actions overwhelmingly reprehensible and amoral. But I must wonder: Why do conservative thinkers attack men like Ben Bernanke and Paul Krugman for promoting monetary policies aimed at keeping America free of civil unrest (and by logical extension delaying an American crisis while Europe begins to burn in the fires of austerity), when these same ideologues more often than not support military solutions abroad to many of our policy dilemmas?

It strikes me that the solutions offered by the Federal Reserve-policies of quantitative easing and of corporate bailouts and "printed" monies for food stamps and unemployment insurance and Medicaid, etc.-that these policies are poorly disguised attempts to let the rest of the world devolve into global austerity-driven conflict, while America uses the extra time bought by such policies to eventually pursue "righteous and just" wars; wars fought on foreign soil, to clean up the mess and to once again come to the rescue and to make the world a better and safer place for humanity.

Perhaps pursuing policies aimed at "extending and pretending" is in fact better than the alternative. Perhaps continuing on the clearly unsustainable, and I would argue eventually disastrous, path of debt monetization in order to extend unemployment benefits to those without jobs and in order to provide food stamp subsidies to those without any other way to feed their children and in order to fund health care benefits for our nation’s elderly and infirmed; perhaps that is the better choice-at least for the near term, and at least, in the eyes and hearts of our political leaders, as a way to prepare the nation for the inevitability of the great wars to come.

For individuals who view themselves as citizens of the world first, and of nations second, these policies are repugnant. But governments never view themselves as such, save only to profit through the mendacious efforts of such institutions as the World Bank and IMF.

War is the health of the state, but only if the war is fought somewhere else, correct? The policies currently pursued by our Congress, by our President, and by extension by the U.S. Federal Reserve, are policies aimed at keeping the peace at home just long enough so as to let other lands face the fury of a citizenry betrayed.

I am a nominal man living in the real world, and in this real world in which I toil and about which I mourn, love may be the answer for me and for my wife and children, but war remains the health of the state.

Tax Appeals Swamp U.S. Cities, Towns as Property Prices Plunge

by Jeff Green and Tim Jones - Bloomberg

A fiscal flood that threatens to swamp local government budgets across the U.S. overflows from file cabinets in the office of Patty Halm, chair of the Michigan Tax Tribunal. The backlog of cases from taxpayers seeking to lower property-tax bills of more than $100,000 shot up to 14,236 this year from an annual average of about 6,000 during the past decade. The backlog of smaller claims was at 28,558 at the end of September, eight times higher than a decade ago, according to records at the tribunal, a Lansing-based administrative court.

From Los Angeles to Atlantic City, the New Jersey gambling resort whose credit rating Moody’s Investors Service cut by three levels last month, property owners are demanding lower taxes after real-estate values plunged. The disputes over billions in dollars come as municipalities are already slashing services such as police and fire protection and may depress revenue further as communities try to recover from the longest recession since the 1930s. In Michigan, Governor-elect Rick Snyder has warned that hundreds of towns face financial crises. "We’re just getting swamped," said Halm, 54, who was appointed in 2003. "We’re constantly buying new file cabinets to hold all the cases. We even have six surplus file cabinets in the courtroom."

U.S. home prices are 30 percent below their peak of April 2006, according to the seasonally adjusted S&P/Case-Shiller index of property values in 20 cities. They may drop 10 percent more, Greg Lippmann, a founder of New York-based LibreMax Capital LLC, said Dec. 2 at the Hedge Funds New York Conference hosted by Bloomberg Link.

Appeals Upon Appeals

Meanwhile, the Moody’s/REAL Commercial Property Price Index of U.S. commercial property is 43 percent below its October 2007 peak. "If we look into the future, assessments will have to reflect the market value, and two years out, property-tax receipts will have to be coming down," Michael Pagano, dean of the College of Urban Planning and Public Affairs at the University of Illinois at Chicago, said in a telephone interview. "If the appeals are largely successful, they will generate a lot more appeals."

In Michigan, seven judges and 15 hearing officers are clearing the backlog. Five additional staff members are crammed into cubicles in hallways and a library space, said Halm, who is also one of the judges. More than a dozen mismatched file cabinets line the hallway outside the tribunal, among about 50 that have been added for the overflow.

This week a chief clerk sat surrounded by them on the floor, sorting files to get ready for hearings. Bins held even more folders. Oakland County, the Detroit suburb with Michigan’s second- highest median income, didn’t previously pay much attention to Tax Tribunal cases because any losses were covered by new construction gains, said Robert Daddow, deputy county executive. Now, about $3.9 billion in taxable value, or 5 percent of the county’s tax base, is under review, he said.

Cities and towns across Michigan had property-tax collections plunge as much as 20 percent in the past year, the steepest drop since a 1994 rewrite of state levies, forcing scores to decide whether to borrow to pay bills or risk default on bonds. Municipal budgets "tend to lag economic conditions" by 18 months to several years, according to a National League of Cities report in October that Pagano co-wrote. "The full weight of the decline in housing values has yet to hit the budgets of many cities and property tax revenues will likely decline further in 2011 and 2012," the report said.

Already Struggling

Douglas Roberts, Michigan’s former treasurer, said in a telephone interview from East Lansing that the impact of property-tax appeals "could be significant" because cities are already struggling with rising pension and health-care costs and declining revenue. Settlements are likely to increase across the state through 2013 as the backlog is worked through, compounding other revenue shortfalls, Daddow said. "In some of these instances, probably most of them, local governmental units have not been setting money aside for this," Daddow said. "That will be huge. That will be another big headache coming down the pike."

In many states, property-tax appeals are handled primarily at the local level. Clark County, Nevada, which includes Las Vegas, had 8,300 appeals last year, an increase from 6,000 the year before and 1,900 in 2008, according to Rocky Steele, assistant director of assessment services. "It was a big year, the biggest we’ve ever had," Steele said in a telephone interview. Clark County’s taxable real-estate value fell to $184 billion for the 2010-11 fiscal year from $263 billion the prior year and the record $320 billion in 2008-09, according to Steele. The one-year reduction will cost the county a projected $514 million in lost taxes. Almost all the hotel casinos and major property owners received reductions, Steele said.

In Atlantic City, where 11 casinos account for 74 percent of the property-tax base, the city has exhausted a reserve for tax appeals that in 2006 held $26 million, according to a Nov. 4 Moody’s report on the rating cut. The company reduced the credit to Baa1, three levels above speculative grade, from A1. All Atlantic City casinos have pending property-tax appeals, Moody’s said. Since their valuation is based on gambling revenue, which has declined more than 11 percent this year, appeals may continue, the rating company said.

Resort Under Pressure

"The city’s negative fund balance position, outstanding tax casino credits and the significant number of remaining unsettled casino tax appeals will continue to pressure the city’s financial position," Moody’s said in the report. New Jersey homeowners filed 18,147 property-tax appeals in Tax Court during the fiscal year ending June 30, up from 10,067 in fiscal 2007, according to a report by the state judiciary.

Moody’s today cited continuing tax appeals when it lowered the rating on about $3.7 million in outstanding debt for the Borough of Roseland, New Jersey, to fourth-highest Aa3 from Aa2. A reserve fund for tax appeals in the town about 20 miles (32 kilometers) east of New York City may fall to $600,000 this year from $3.5 million in 2007, and the borough may issue bonds to handle future appeals, Moody’s said in the report.

'Overloaded' in L.A.

Across the country, the situation is similar. "We’re just overloaded," said Khanh Nguyen, chief of assessment appeals in Los Angeles County, whose more than 10 million residents make it the nation’s largest. The county expects "a few thousand" more than the 42,000 applications last year, Nguyen said. That’s quadruple the 9,353 in 2007, she said. The appeals are rising as the overall tax rolls declined by $18.5 billion, or 1.67 percent, to $1.089 trillion in 2010.

The phenomenon is not universal. In Miami-Dade County, which is Florida’s largest municipal borrower, 2010 tax appeals, due in September, dropped 27 percent from 2009, to about 105,000, said Robert Alfaro, Value Adjustment Board manager. In Illinois, pleas for relief arrive every week on the desk of Louis Apostol, executive director of the state Property Tax Appeal Board. "These letters are heart-wrenching. I’ve got drawers and drawers of them," Apostol said in a telephone interview from his office in Des Plaines.

Illinois may have 19,350 property appeals this year, 10 percent more than in 2009, he said. The backlog is about 35,000, to be processed by a staff of 21. Fifty-four people handled roughly half the workload in 2003, he said. More than 80 percent come from homeowners and the board approves an average of 30 percent of them, he said. Determining the impact could take two years, he said. In the meantime, Apostol will continue receiving letters of complaint forwarded by Governor Pat Quinn. "I respond directly," Apostol said. "I also include my phone number and tell them how they can appeal their taxes."

European Central Bank Plays Cat and Mouse Over the Euro

by Graham Bowley and Jack EwIng - New York Times

It is the battle that could well determine the fate of the euro.

On one side is the European Central Bank, which is spending billions to prop up Europe’s weak-kneed bond markets and safeguard the common currency. On the other side are hedge funds and big financial institutions that are betting against those same bonds and, by extension, against the central bank, that mighty symbol of Europe’s monetary union.

The war keeps escalating as traders position themselves for what some believe is inevitable: a default by Greece, Ireland or perhaps even Portugal. The strains grew Tuesday, when European finance ministers made no pledge to increase the emergency fund that the European Union has put in place to help protect the euro. The head of the International Monetary Fund, meantime, urged Europe to take broader action to fend off speculators. "The game now is one of cat and mouse," said Mohamed A. El-Erian, chief executive of the bond giant Pimco.

Since May, when the Greek debt crisis exploded, the European Central Bank has bought an estimated $69 billion of Greek and other government bonds. It has also indirectly injected hundreds of billions dollars into weak banking systems in Greece and Ireland.

But the speculators keep coming back. After the bond purchases fell to zero in October, the central bank waded back into the market aggressively last week, buying about $2 billion of debt securities, mostly Irish and Portuguese securities, traders said. The bank, based in Frankfurt, has yet to disclose the size and scope of the purchases late last week, when its intervention was the most intense.

While the bank appears to have backed off this week, traders are waiting for the official accounting of its latest purchases. The data are due Monday — and will provide some idea of just how aggressive the central bank has been. Already, the central bank owns about 17 percent of the combined debt of Greece, Ireland and Portugal, Goldman Sachs estimates. Yet in the bank’s mano a mano with the bond market, psychology could be more important than money. No single hedge fund, after all, can hope to outgun the central bank.

The bank also has the element of surprise. By emphasizing that the central bank is "permanently alert," Jean-Claude Trichet, its president, has raised the risk for speculators who might try to profit by selling short Greek, Portuguese or Irish bonds.

But the amount of intervention so far is far smaller than many investors and economists think is necessary to calm markets. These people assert that the central bank, its assurances aide, is concerned about taking on so many bonds of peripheral European countries — and being forced into what would be a de facto bailout of overextended government borrowers and the banks that bought their bonds.

And the markets continue to probe that discomfort. Pimco, for example, sold the vast majority of its holdings of Greek, Irish, Portuguese and Spanish government bonds late last year and early this year, although it continues to hold German bonds, considered Europe’s safest.

Pavan Wadhwa, head of European rates strategy at JPMorgan Chase, one of the main dealers in European government debt, said many clients had been eager to sell bonds of peripheral European nations to the central bank and would do more if the bank continued to buy, reflecting a belief that one or more countries were headed for insolvency. "If the E.C.B. wants to buy, I would still be recommending to sell into the demand," he said.

Mr. Wadhwa said in its latest operations the central bank had hoped investors would hold onto their bonds, encouraged by its presence in the markets. Instead, many had taken the opportunity to sell.

The chief investment officer of a large New York-based hedge fund, who spoke on the condition of anonymity because he was not authorized to comment publicly, said his fund and others had shorted Portuguese and Irish government bonds during the summer. They had done so by selling bonds in the cash market directly but mainly by buying protection against default in the market for credit-default swaps, a type of derivative.

"That trade was profitable," this money manager said. But he said the fund had closed its position because the trade had no further to run — the market was now discounting a strong likelihood that Ireland would be forced to restructure its debt in four or five years.

Even after the central bank’s intervention last week, speculators have been maintaining large positions in credit-default swaps on Spanish bonds and on the debt of Spanish banks. According to JPMorgan’s calculations, the credit-default swaps market implies around a 15 percent probability in any year of a Spanish default for the next five years.

Still, traders and analysts say the central bank is a sophisticated market actor. It conducts many trades via the Bundesbank and other national central banks, which in turn act through a circle of commercial dealer banks.

Mr. Trichet is known to keep a data terminal on his desk and speak frequently with the bank’s 20 in-house bond traders. He also occasionally visits them on a lower floor of the bank’s headquarters. For the central bank, the timing of the latest flare-up was, in a way, convenient. Bond trading typically tapers off at the end of the year as fund managers close out their positions. So trading was thin and the bank was able to move the market with relatively small sums, traders said.

"It may be that the E.C.B. could have moved spreads a long way without buying that many bonds," said Steven J. Major, global head of fixed income research at HSBC in London.

By placing a lot of orders with numerous banks, the central bank also created buzz in the market, which helped exaggerate the effect of its bond buying. But according to many traders, the bank has so far not intervened in the markets for Spanish or Italian debt, which would be harder to influence because of their relatively large size.

New EU Bank Stress Tests Planned for February

by Riva Froymovich

The new pan-European Union banking regulator will begin a new round of bank stress tests in February, the EU's economics commissioner said Tuesday. The fresh tests will be part of a broader drive for stricter monitoring of European financial institutions by the recently created European Banking Authority.

These details followed a meeting of EU finance ministers in Brussels Tuesday, when leaders officially approved a bailout package for Ireland. "Liquidity assessment needs to be included in future stress tests on the banking sector," said Olli Rehn, commissioner for economic and monetary affairs.

Last summer's stress tests on European banks have been questioned for not examining liquidity risks and lacking rigor. Mr. Rehn said specific methodology on the stress tests will be announced shortly and the EU aims "for the fullest possible transparency." He added that more rigorous economic governance legislation should enter into force next summer.

Part of the closer look at budget rules by finance ministers Tuesday included a debate on whether reforms to privatize pension benefits—which are said to hurt government finances in the short run—should mean countries are allowed more time to contain their deficits, as argued in the past by Poland and Hungary.

Officials said governments will revisit this issue at the Dec. 16-17 European leaders' summit, and are close to an agreement. Mr. Rehn added that officials are trying to strike the right balance between respecting EU treaties "and taking into account the need to have strong incentives for systemic pension reforms."

Finance ministers also agreed Tuesday to exchange income and capital data, regardless of bank secrecy codes, to prevent tax fraud. The EU's tax commissioner Algirdas Semeta said that ensuring governments can prevent tax fraud is particularly important given "the current climate when budgets are under pressure."

Say What? 30 Ben Bernanke Quotes That Are So Stupid That You Won’t Know Whether To Laugh Or Cry

by Micheal Snyder - Ecnomic Collapse

Did you see Federal Reserve Chairman Ben Bernanke on 60 Minutes the other night? Bernanke portrayed the Federal Reserve as the great protector of the U.S. economy, he claimed that unemployment would be 15 percent higher if the Federal Reserve had sat back and done nothing during the financial crisis and he even started laying the groundwork for a third round of quantitative easing. Unfortunately, 60 Minutes did not ask Bernanke any hard questions and did not challenge him on his past record.

It was almost as if they considered Bernanke to be above criticism. But someone in the mainstream media should be taking a closer look at this guy and his record. The truth is that the incompetence that Bernanke has displayed over the past few years makes the Cincinnati Bengals look like a model of excellence.

Bernanke kept insisting that the housing market was stable even while it was falling apart, he had absolutely no idea the financial crisis was coming, he declared that Fannie Mae and Freddie Mac were in no danger of failing just before they failed, his policies have created asset bubble after asset bubble and the world financial system is now inherently unstable.

But even with such horrific job performance, Barack Obama and leaders of both political parties continue to publicly praise Bernanke at every opportunity. What in the world is going on here?Not that Bernanke is solely responsible. His predecessor, Alan Greenspan, was responsible for many of the policies that have brought us to this point. In addition, most of the other presidents of the individual Federal Reserve banks across the United States seem just as clueless as Bernanke.

But you would think at some point someone in authority would be calling for Bernanke to resign. Accountability has to begin somewhere.

The Bernanke quotes that you will read below reveal a pattern of incompetence and mismanagement that is absolutely mind blowing. Looking back now, we can see that Bernanke was wrong about almost everything.

But the mainstream media and our top politicians keep insisting that Bernanke is the man to lead our economy into a bright future.

It is almost as if we have been transported into some bizarre episode of "The Twilight Zone" where the more incompetence someone exhibits the more they are to be praised.

The following are 30 Ben Bernanke quotes that are so stupid that you won't know whether to laugh or cry....

#1 (October 20, 2005) "House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals."

#2 (On 60 Minutes in response to a question about what would have happened if the Federal Reserve had not "bailed out" the U.S. economy) "Unemployment would be much, much higher. It might be something like it was in the Depression. Twenty-five percent."

#3 (February 15, 2006) "Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise."

#4 (January 10, 2008) "The Federal Reserve is not currently forecasting a recession."

#5 (When asked directly during a congressional hearing if the Federal Reserve would monetize U.S. government debt) "The Federal Reserve will not monetize the debt."

#6 "One myth that’s out there is that what we’re doing is printing money. We’re not printing money."

#7 "The money supply is not changing in any significant way. What we’re doing is lowering interest rates by buying Treasury securities."

#8 (November 21, 2002) "The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost."

#9 (March 28, 2007) "At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency."

#10 (July, 2005) "We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though."

#11 "Although low inflation is generally good, inflation that is too low can pose risks to the economy - especially when the economy is struggling."

#12 (February 15, 2007) "Despite the ongoing adjustments in the housing sector, overall economic prospects for households remain good. Household finances appear generally solid, and delinquency rates on most types of consumer loans and residential mortgages remain low."

#13 (October 31, 2007) "It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions."

#14 (On the possibility that the Fed might launch QE3) "Oh, it's certainly possible. And again, it depends on the efficacy of the program. It depends on inflation. And finally it depends on how the economy looks."

#15 (November 15, 2005) "With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly."

#16 (January 18, 2008) "[The U.S. economy] has a strong labor force, excellent productivity and technology, and a deep and liquid financial market that is in the process of repairing itself."

#17 "I wish I'd been omniscient and seen the crisis coming."

#18 (May 17, 2007) "All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable."

#19 "The GSEs are adequately capitalized. They are in no danger of failing."

#20 (Two months before Fannie Mae and Freddie Mac collapsed and were nationalized) "They will make it through the storm."

#21 (September 23rd, 2008) "My interest is solely for the strength and recovery of the U.S. economy."

#22 "Economics has many substantive areas of knowledge where there is agreement but also contains areas of controversy. That's inescapable."

#23 "I don't think that Chinese ownership of U.S. assets is so large as to put our country at risk economically."

#24 "We’ve been very, very clear that we will not allow inflation to rise above 2 percent."

#25 "...inflation is running at rates that are too low relative to the levels that the Committee judges to be most consistent with the Federal Reserve's dual mandate in the longer run."

#26 (June 10, 2008) "The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so."

#27 "Not all information is beneficial."

#28 "The financial crisis appears to be mostly behind us, and the economy seems to have stabilized and is expanding again."

#29 "Similarly, the mandate-consistent inflation rate--the inflation rate that best promotes our dual objectives in the long run--is not necessarily zero; indeed, Committee participants have generally judged that a modestly positive inflation rate over the longer run is most consistent with the dual mandate."

#30 (October 4, 2006) "If current trends continue, the typical U.S. worker will be considerably more productive several decades from now. Thus, one might argue that letting future generations bear the burden of population aging is appropriate, as they will likely be richer than we are even taking that burden into account."

Dead Cat Bounce - Bernanke Is Dumber Than Gold - Mike Maloney

The Economic Incompetence Of The Political Class

by Charles W. Kadlec - Forbes

If politicians don't get serious about fiscal profligacy, markets will

The sovereign debt crisis now threatening Europe, as well as major American states and cities, discloses the sheer incompetence of a political class that has over-promised, under-delivered and squandered vast amounts of their citizens' wealth. Greece, Ireland, Spain, Portugal, California, Illinois, Los Angeles and Chicago are simply the poster children for what happens when elected officials engage in reckless and irresponsible management of their economies, their banking system or their respective government's public finances.

Greece's debt stands at 144% of its gross domestic product, the highest in Europe. Ireland's deficit is 98% of GDP, due in large measure to the liabilities it assumed when it bailed out the Irish banking system. The just-announced European loan of 50 billion euros to Ireland is equal to nearly 50% of its GDP. Within the next year, Italy will have to borrow 20% of its GDP just to refinance its maturing debt.

California's budget deficit has soared to $25 billion, or more than 25% of total spending. And, according to a recent study, the City of Chicago's unfunded pension liabilities total $45 billion, or more than $40,000 per household.

Politicians may not be solely responsible for this fiscal mess. But they are responsible for using borrowed money to pay for current expenses until they had borrowed more than they now seem able to pay back. Furthermore, they agreed to generous pension plans without properly funding those future obligations. As a result, massive tax increases--or a renegotiation of those commitments--now seem unavoidable. Neither alternative is going to be very pleasant economically or politically.

Prior to the euro, the political class in Europe could cover up its incompetence through a devaluation of the country currency in question. The ensuing inflation reduced the real value of the debt, providing elected officials and their economic advisors a face-saving way to force lenders to take a "haircut" on the value of their government bonds.

But with the euro devaluation is off the table, and capital markets are beginning to bring the political class--and the supporters of big government--to account. In fact, capital markets were further empowered to check government excess by an agreement among European leaders that after 2013, bondholders will face a loss of principle in the event of a financial rescue of a European state. Lenders, as well as taxpayers, will be at risk from wasteful government spending.

In the meantime, however, the European strategy of enabling more borrowing while imposing austerity plans, including higher tax rates, on overly leveraged countries may prove counterproductive. Increasing tax rates slows growth, reducing GDP, employment and the tax base necessary to service the debt. A shrinking economy and rising unemployment also increase the demand for higher government spending to support failing businesses and the unemployed. Moreover, lenders are already demanding higher interest rates, increasing the cost of refinancing past debts, which are now coming due.

At some point, there is a risk that one or more European countries may be unable to avoid a de facto, if not de jure default on their debt, requiring a complete restructuring. And that creates the risk that the European Central Bank will be forced to bail out the political class by buying that country's sovereign debt and devaluing the euro--hence the current weakness of the European currency.

In the U.S. at least, the looming debt crisis among states and municipalities also reflects a lack of diligence on the part of the citizenry. This can be attributed in part to a naïve assumption by the electorate that those in government, freed from the profit motive, could be trusted to do what was "right" for the community as a whole.

Instead, what we now can see is that elected officials, following a power motive, can be as greedy and irresponsible as anyone in the private sector. In many cases, officials from both parties have been captured by powerful interests, including public sector unions and recipients of transfer payments. As a consequence, they have willfully committed current and future taxpayer money to benefit those with political power at the expense of the community as a whole.

One lesson is that to live in liberty requires an elevated level of diligence, oversight and skepticism of our elected officials. Taxpayers and financial market regulators need to insist on more honest accounting and disclosure of the true costs of the government programs in general, and government employee pensions and benefits in particular.

The sovereign debt crisis now encircling Europe may well prove to be a preview of what lies ahead for the political class in the U.S. Like their European counterparts, they may be participants in an end-game in which capital markets force a reassessment of debt-financed government spending, especially on transfer payments, government pensions and wealth-destroying investments in bridges to nowhere, green energy and other government boondoggles with negative rates of return.

The Obama tax deal with Republicans is insane

by Tony Wikrent - Real Economics

e central premise of U.S. economic policy since the election of Ronald Reagan in 1980 has been that the people in the private sector who know how to invest – the rich – do a much better job allocating society’s financial resources than the federal government. In fact, Reagan told us in his first inaugural address, “government is the problem."

In order to get as much of society’s financial resources into the hands of the rich - the people in the private sector who supposedly would do a better job investing it - Reagan, the Republican Party, and American conservatives in general developed a simple-minded faith in tax cuts, especially in reducing taxes on the highest incomes.

What are the results of this thirty year experiment low taxes? The Reagan / Republican / conservative theory DOES NOT WORK. For the first time in American history, we now have a generation that has less education and worse economic prospects than their parents did thirty years ago.

In all the hub-bub and brou-hah-hah of the tax debate the past few days, weeks, and months, hardly anyone has put forward the clear and unambiguous information that

TAX

CUTS

DO

NOT

WORK.

In fact, there have been three grand multi-year national experiments with Republican / Conservative tax cutting over the past century. And all three experiments resulted in the average American becoming poorer, the real (industraal) economy in tatters, and spectacular financial crashes.

Tax Cut Experiment Number 1

In 1921, President Warren G. Harding proposed ending the wartime excess profits tax which had been imposed during World War I. Calvin Coolidge followed Harding into the White House in 1923. Coolidge was launched to national prominence when as Governor of Massachusetts, he mobilized the state’s National Guard in September 1919, to crush a strike of three quarters of the policemen of the Boston Police Department, who were trying to force official acceptance of their membership in, and representation by, the American Federation of Labor.

Coolidge, you may recall, was “rehabilitated” during Ronald Reagan’s (who broke the air traffic controllers' union) term as President. Coolidge’s brutal suppression of the Boston strikers, and his sharply worded rebuke to AFL president Samuel Gompers, led Harding to select him as vice president. So, when Harding died during a speaking tour in California in August 1923, Coolidge became President, and it was Silent Cal who actually signed into law the Revenue Act of 1924, which lowered personal income tax rates on the highest incomes from 73 percent to 46 percent.

Two years later, the Revenue Act of 1926 law further reduced inheritance and personal income taxes; eliminated many excise imposts (luxury or nuisance taxes); and ended public access to federal income tax returns. The tax rate on the highest incomes was reduced to 25 percent.

What resulted was the building up of a speculative frenzy in the stock markets, especially with the application of structured leverage in what were called at that time "investment trusts." In September 1929, this edifice of false prosperity began to wobble, and ended in October 1929 with the stock market crash.

Republican President Herbert Hoover (Coolidge did not seek re-nomination in 1928) responded with more tax cuts! Personal income tax on income under $4,000 was cut by two thirds; personal income tax on income over $4,000 was cut in half. The tax rate on corporations was cut by a full percentage point.

How did the economy respond to these tax cuts? It sunk further into the First Great Depression.

Tax Cut Experiment Number 2

In 1981, Reagan significantly reduced the top marginal tax rate, which affects the very wealthy, a from 70% to 50%; in 1986 he further reduced the rate to 28%. Contrary to the Reagan / Republican / conservative argument that the tax cuts would pay for themselves by boosting economic activity the budget deficit and federal debt exploded. Federal government debt grew from 33.3% of GDP in 1980 to 51.9% at the end of 1988.

Meanwhile, the average American family began working more hours just to keep place. The phenomena of latch-key kids took hold as mothers sought jobs to help keep their family afloat. Wikipedia notes that the number of Americans below the poverty level increased from 29.272 million in 1980 to 31.745 million in 1988, which means that, as a percentage of the total population, it remained almost stationary, from 12.95% in 1980 to 13% in 1988. The poverty level for people under the age of 18 increased from 11.543 million in 1980 (18.3% of all child population) to 12.455 (19.5%) in 1988.

Reagan's tax cuts failed to revive American industry, which was also being hammered by the Reagan / Republican / conservative blind faith in free trade.A number of American industries actually disappeared.

By the end of Reagan’s presidency, the American textile, apparel, and footwear making industries had been reduced to less than one tenth the size and sales they had been just two decades before. During Reagan’s tenure, the U.S. lost its trade surplus in consumer electronics, and began to also lose its advantage in industrial electronics. The most important industry of all, the machine tool industry - which is needed to make all other production equipment - slipped into a death spiral from which it has never recovered. Steel, auto, printing equipment, construction equipment, farm equipment, power generating equipment – in industry after industry, under Reagan, the U.S. began to lose its world lead.

Only the aerospace industry, the key component of the American empire’s military-industrial complex, managed to maintain its world lead. Oh, and the banking and financial sector. But in October 1987, the worst stock market crash since the First Great Depression shook Wall Street.

Tax Cut Experiment Number 3

Republicans and conservatives of course contend that the two Bush tax cuts created the economic boom of 2002-2006. But Wikipedia notes the following, rarely discussed, facts:A significant driver of economic growth during the Bush administration was home equity extraction, in essence borrowing against the value of the home to finance personal consumption. Free cash used by consumers from equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion dollars over the period. Using the home as a source of funds also reduced the net savings rate significantly. By comparison, GDP grew by approximately $2.3 trillion during the same 2001-2005 period in current dollars, from $10.1 to $12.4 trillion.

Economist Paul Krugman wrote in 2009: "The prosperity of a few years ago, such as it was — profits were terrific, wages not so much — depended on a huge bubble in housing, which replaced an earlier huge bubble in stocks. And since the housing bubble isn’t coming back, the spending that sustained the economy in the pre-crisis years isn’t coming back either." Niall Ferguson stated that excluding the effect of home equity extraction, the U.S. economy grew at a 1% rate during the Bush years.

The amount of money Americans took out of their bubbling home equity was more than double the increase in GDP under Bush. Meanwhile, U.S. industries continued to weaken and falter. Even the semiconductor and computer industries - once the crown jewels of the American industrial economy - basically collapsed under Bush, fleeing offshore. As Andy Grove, one of the founders and former chairman of semiconductor pioneer Intel wrote back in early July (How to Make an American Job Before It's Too Late):Today, manufacturing employment in the U.S. computer industry is about 166,000 -- lower than it was before the first personal computer, the MITS Altair 2800, was assembled in 1975. Meanwhile, a very effective computer-manufacturing industry has emerged in Asia, employing about 1.5 million workers -- factory employees, engineers and managers.

The largest of these companies is Hon Hai Precision Industry Co., also known as Foxconn. The company has grown at an astounding rate, first in Taiwan and later in China. Its revenue last year was $62 billion, larger than Apple Inc., Microsoft Corp., Dell Inc. or Intel. Foxconn employs more than 800,000 people, more than the combined worldwide head count of Apple, Dell, Microsoft, Hewlett-Packard Co., Intel and Sony Corp.

Most important to note, wages and earnings for all but the richest Americans continued to stagnate, and actually declined for the bottom quintile of wage earners. And, in late 2006, the sub-prime mortgage crisis began to unravel the very fabric of the world financial system, leading to the crashes of April and September 2008.

The failure of our national debate on tax cuts

Most discouraging about this entire national debate on taxes, has been the complete failure of President Obama and the Democratic leadership to point to these clear facts, and ask - and answer - the obvious question:

Why do tax cuts lead, counter-intuitively, to industrial decline, stagnant wages, and finally financial collapse?

The fact is that high marginal tax rates strongly correlate with economic growth. As Mike Kimel wrote yesterday on Angry Bear:But perhaps it is unfair to compare Reagan to big-government types like Lyndon Johnson or Roosevelt, as they served during very different eras. Focusing instead on more recent periods, real GDP also grew faster under Bill Clinton, who raised taxes, than it did under Ronald Reagan. In fact, from 1981 to the present, the period in which Reagan’s philosophies have reigned triumphant, the correlation between the top marginal tax rate and the annual growth in real GDP has been positive. That is to say, higher top marginal tax rates have been associated with faster, not slower real economic growth. Conversely, lower top marginal tax rates have coincided with less economic growth.

The positive relationship between the top [higher] marginal tax rate and the growth in real GDP is very nearly bullet-proof. For instance, it extends all the way back to 1929, the first year for which the government computed GDP data. Additionally, higher marginal tax rates are not only correlated with faster increases in real GDP from one year to the next, but also with increases in real GDP over the subsequent two, three, or four years. This is as true going back to 1929 as it is for the period since Reagan became president. In fact, since the Reagan Revolution took hold, similar relationships have existed between the top marginal rate and several other important variables, like real median income, real private investment, consumer sentiment, the value of the dollar relative to other major currencies, and the S&P 500. Lower tax rates in any given year are associated with slower growth rates for each of these variables, whether those growth rates are measured over periods of one, two, three or four years.

If you look under the hood of the industrial economy, you easily see why there is this counter-intuitive relationship between tax rates and economic growth . With high taxes, the only way to retain the bulk of the wealth created by a business is by reinvesting it in the business -- in plants, equipment, staff, research and development, new products and all the rest. But if tax rates are low, then there is more incentive to pull the wealth out, by declaring it as profits that are taxed at what turns out to be too low a rate. In other words, low taxes create an incentive for profit taking.

This in turn creates an incentive for short-term horizons in business planning. If you’re going to be taking all the profits out of a company, and take home a few million a year, why bother to reinvest anything in the business? You’re going to be rich, and never have to work again, even if the business goes bust. Or gets packed on a boat and shipped to China. Or goes “virtual” and lets all the hard work, like, you know, actually making something, be done by the lowest bidder. Employees? Don’t need them.

But employees are also customers. If enough businesses “take profits”, after some length of time, the former employees also become former customers. Meaning, they stop buying. The economy's aggregate demand generation is crippled. From the three Republican tax cut experiments this past century, it appears the length of time for this to happen is five to seven years.

If tax rates are high enough to discourage profit taking - forcing wealth created by a business to be recycled back into the business – then businesses are pushed toward longer-term planning, as they invest in new plant and equipment that will be used for many years. And you do not get the absurd situation you have now, where companies are posting record breaking profits, but are not buying new equipment, nor hiring new employees.

Low tax rates encourage taking wealth out of industrial companies; the wealth taken out must then be “put to work.” That means more money chasing “investment” opportunities, leading to price increases in financial capital or real estate or some other asset. In other words, an asset bubble. The rise in prices of an asset bubble has nothing to do with the creation of real wealth. It all looks like prosperity – until the asset bubble bursts. That’s where we are now.

Tax cuts only work to build bubbles that enrich mostly the financial sector. Tax cuts do nothing to help the real, industrial economy. The rich of America have proven that they are not very good at investing: they prefer credit default swaps over investing in sustainable energy start-ups. The major economic challenge of the past three decades has been to create a new economy that is not dependent on burning fossil fuels. The Reagan / Republican / conservative theory that the rich are best at allocating our society's financial resources has been a disastrous failure. We have wasted thirty years testing their theory. It's time to force elites to admit that it does not work.

The virtuous economic cycle that was destroyed by Reagan

Another reason tax cuts do not create economic growth has to do with the distribution of income in the economy. The Republican / conservative religious belief that “tax cuts create jobs” has become so shallow and so insipid, that they don’t even understand the actual process of job creation contained in their own lousy theory. Tax cuts do NOT create jobs. It is the response of business to growth of aggregate demand in the economy that creates jobs.

So, will the tax cuts of this new Obama / Republican / conservative deal boost aggregate demand?

A bit, maybe , but not as much as direct spending on infrastructure would. Dave Johnson explained the essential problem of the flawed economic assumptions of the thinking behind the Obama / Republican / conservative deal back in August:Tax Cuts Are Theft

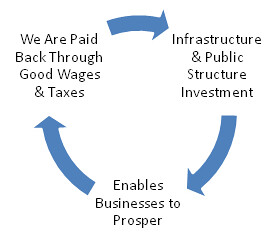

The American Social Contract is supposed to work like this:

A beneficial cycle: We invest in infrastructure and public structures that create the conditions for enterprise to form and prosper. We prepare the ground for business to thrive. When enterprise prospers we share the bounty, with good wages and benefits for the people who work in the businesses and taxes that provide for the general welfare and for reinvestment in the infrastructure and public structures that keep the system going.

We fought hard to develop this system and it worked for us. We, the People fought and built our government to empower and protect us providing social services for the general welfare. We, through our government built up infrastructure and public structures like courts, laws, schools, roads, bridges. That investment creates the conditions that enable commerce to prosper – the bounty of democracy. In return we ask those who benefit most from the enterprise we enabled to share the return on our investment with all of us – through good wages, benefits and taxes.

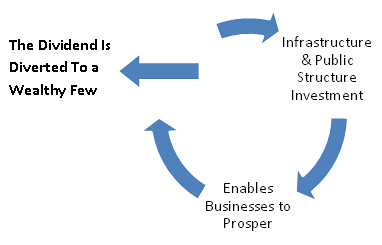

But the "Reagan Revolution" broke the contract. Since Reagan the system is working like this:

Since the Reagan Revolution with its tax cuts for the rich, its anti-government policies, and itsderegulation of the big corporations our democracy is increasingly defunded (and that was the plan), infrastructure is crumbling, our schools are falling behind, factories and supply chains are being dismantled, those still at work are working longer hours for fewer benefits and falling wages, our pensions are gone, wealth and income are increasing concentrating at the very top, our country is declining.

This is the Reagan Revolution home to roost: the social contract is broken. Instead of providing good wages and benefits and paying taxes to provide for the general welfare and reinvestment in infrastructure and public structures, the bounty of our democracy is being diverted to a wealthy few.

So, the idea that these tax cuts will help get boost the economic recovery just when President Obama is campaigning for re-election, is absurd. In fact, Ian Welsh, who has been eerily prescient about economic and political developments in the U.S. the past few years, guarantees that this deal will NOT help the economyThe past 30 years, and the past 10 years in particular, have been a huge experiment in tax-cutting, and for ordinary people, the result has been stagnation and now an absolute decline. Because ordinary people do not have pricing power, either as workers for their labor (since there are plenty of people who need jobs) or as consumers (because the oligopolies who sell food, energy, telecom and so on know you must have their services) every single red cent of tax cuts which go to the middle and lower class will be taken away by corporations and the rich. Those corporations and rich will then use that money to either play leveraged financial games or to offshore jobs to low cost, low regulation domiciles. Not only do tax cuts not do any good, they accelerate the loss of US jobs. No, this isn’t what you’ve been told, indeed propagandized, for the last thirty years. But how has trickle down economics worked out for you? Are you going to believe your lying eyes, or the talking heads who tell you that tax cuts create jobs?

The sane alternative: tax the financial system

Proof that both parties are controlled by a single financial oligarchy – or, as OnePissedOffLibeal proposes, there’s no use blaming President Obama - is that the single best solution is missing from the national discussion. A tax of just one fifth of one percent on all financial market transactions – stocks, bonds, futures, currency forex, options, swaps, and other derivatives - would raise nearly one trillion dollars in the first year , because of the sheer volume of trading. But such a tax would rapidly shrink the volume of trading, so the few economists, like Dean Baker, who have worked the numbers stick with a figure of around $200 billion a year.

In the 1960s, all the trading in all the financial markets amounted to about one and one half times the U.S. annual gross domestic product. Today, the trading of all the stocks, bonds, futures, foreign exchange, and other financial instruments amounts to over fifty times U.S. GDP, or around three trillion dollars a day in the U.S.

Above from the Wikipedia article on Financialization

How much does it cost our economy to move around this much financial paper each and every day? Let us assume that the fees, commissions, and so on paid to the financial system for all this frenetic activity amount to one percent. (An October 2003 study conducted by John P. Hussman, President of Hussman Investment Trust, found that the costs to the funds he manages actually amounted to approximately 1.87%; scroll down to the bottom.)

So, one percent of three trillion a day is $30 billion in commissions / fees / bonuses, etc., paid to the financial system for all that paper being shoved around. $30 billion a day going to the financial system in fees and commissions? Couldn’t that be used instead to pay 600,000 (six hundred thousand) jobs paying $50,000 a year?

Taken ten days of trading away from the financial markets, and we can pay for six million jobs. Six. Million. Jobs.

This is how the financial system sucks the life blood out of the economy. This is where we so desperately need the change Obama promised - a promise it now appears, was merely a campaign slogan. But, as Stirling Newberry noted in March 2009:The more conservative thinkers are appalled at the idea that the monetary order that emerged post-collapse of Bretton Woods might be attacked, because living off of dipping a small cup in the Niagra Falls of finance is the only world they have ever known. . .

The need to increase the volume of financial trading was the basic driver of securitization of home mortgages, and the development and proliferation of financial derivatives. This level of financial trading, and the toll it exacts on the rest of the economy, is nothing less than a plague of usury of Biblical proportions. Until the financial system is cut down to size, there can NOT be any economic recovery for the rest of us. It is basic economics that when you have too much of socially destructive activity, you should tax it - heavily.

Why is it that no one – NO ONE – among our elites, including even Paul Krugman, ever push for a tax on financial market transactions?

Cui bono?

Why has the entire national debate been so devoid of these facts? Why are certain things, such as the insane level of trading in the financial markets, never discussed?

To answer those questions, simply ask:

Who benefits?

July 2010: Brian Lenihan calls end to "mad bonuses". Dec 2010: AIB bankers get €40m bonus

by Journal.ie

AIB bankers will be paid €40m in salary bonuses this year – exactly six months after Brian Lenihan said: “We can’t go back to those mad bonuses.”Even yesterday, speaking on Pat Kenny’s RTE Radio1 show, Finance Minister Lenihan said:

There have been no bonuses paid to senior bankers for 2009 or 2010. And there’ll be no bonuses paid to bankers until these banks start making profits and start returning money to us again.

The news that AIB is to hand out the massive Christmas bonus – averaging around €16,700 to each of 2,400 ‘key’ staff – has been greeted with derision in the week that €6bn of cuts and taxes were announced in Budget 2011. The bonuses are deferred payouts which were awarded for the year 2008.

- Six months ago, Finance Minister Brian Lenihan gave an interview to the Sunday Independent claiming that banker fat cats would no longer be taking home huge bonuses while the Irish public paid off their debts. Minister Lenihan said in early July 2010:

Well, under the guarantee arrangement, as you know, the banks were forced to abolish the bonuses in recognition of the commitment made by the taxpayer and they couldn’t have these bonuses. And rememberm some of these generous bonuses incentivised much of the reckless lending that has led us here. We can’t go back to those mad bonuses.

- And exactly a year ago, on December 8, 2009, a Department of Finance spokesperson told the Examiner that Minister Lenihan would “bring in legislation, if necessary” to stop bankers receiving bonuses after it emerged that former Irish Nationwide chief executive Michael Fingleton had received a €1m bonus. The Government said it was already adopting the recommendations of the recent Covered Institutions Remuneration Oversight Committee (Ciroc) report, that no bonuses would be paid in the immediate future.

- However, on the Pat Kenny Show on RTE Radio yesterday, Mr Lenihan said that the €500,000 cap on banking salaries would not be reduced because otherwise banks would not be able to continue to attract people of the right “calibre” to such posts. They would not be subject to the €250,000 public service pay maximum – even though the AIB is due to be 95 per cent owned by the State under one of the bailouts.

Now it has emerged that AIB executives will be paid €40m in bonuses which date back to 2008, according to the Guardian newspaper – the year that marked the height of the banking crisis.The bonuses were initially deferred to staff but after legal action was taken by a number of AIB employees, led by a trader called John Foy, it was argued that they must be paid because they had been stitched into the employees’ contracts.

The Foy case was concluded last month and AIB says it now has to legally award the 2008 bonuses to staff “as per the contractual entitlements arising from the business’s performance in 2008″.

The amount of bonus is in stark contrast to the value the stock exchange places on AIB. The entire bank is valued at €540m.

AIB has already been given €3.5bn in bailouts by the taxpayer – and it will need to raise €5.3bn more by the end of February to comply with targets set by the Central Bank. Its share price has tumbled from €23.95 to just over 50c over the past two years.

Commentator Fintan O’Toole pointed out on his Twitter account this morning that the €40m being paid in bonuses to the AIB workers is equivalent to the amount saved in the Budget by cutting school capitation grants and student grants:

Fury over UK bid to cut pension payments by 25%

by James Kirkup and Myra Butterworth - Telegraph

Pension changes that could lead to millions of private sector workers losing up to a quarter of their retirement income have been strongly criticised. Ministers have been studying plans to allow funds to water down their own rules promising members minimum annual increases in pension payments.

About six in 10 private-sector pension schemes have clear rules dictating that members' pension payments should increase every year in line with the retail prices index (RPI) measure of inflation. Steve Webb, the pensions minister, will publish today a consultation on changes that could allow schemes to override their rules and increase payments according to the consumer price index (CPI) instead, which is generally significantly lower.

Inflation by the CPI is now 3.2 per cent, but the RPI, which includes mortgage payments, stands at 4.5 per cent. Treasury forecasters expect RPI to average 1.2 percentage points above CPI over the next five years.

Ministers signalled earlier this year that they wanted to make it easier for companies to move their pension payments to the less generous measure. But experts warned that any change would trigger a major revolt and expose ministers to expensive and damaging legal challenges from pension scheme trustees.

At an industry conference yesterday, Mr Webb was confronted by one trustee who warned of the damage the switch could do to members. Mike Post, of the British Airways pensions scheme, said members would face a 20 per cent loss in what they received over their retirement if the scheme were forced to adopt CPI. Legal experts also warned that ministers would be taking a considerable risk.

Lynda Whitney of Aon Hewitt, a consultancy, said: "Lawyers will have a great deal of work to do to actually work this out. Potentially we could see court cases." Jane Samsworth, a partner at Hogan Lovells, a law firm that advises pension trustees, said: "There is a strong argument that if your rules state that pensions in payment will increase by reference to RPI, current pensioners have a subsisting right to RPI increases, which cannot be taken away."

The Coalition has already confirmed a similar switch for increases in public-sector pensions, welfare payments and private schemes which do not explicitly guarantee RPI increases. Ministers say the change is needed to help schemes remain financially viable as life expectancy rises and liabilities grow. Pension campaigners complain that the price will be paid by individual members.

Hargreaves Lansdown, a financial advice firm, has calculated that for someone who retires at 60 and lives to 80, a switch to CPI in determining annual increases would eventually mean pension payments 25 per cent lower. The average occupational pension pays £1,600 a year. Twenty years of increases at the RPI's current 4.5 per cent would take that to £3,692. But the same sum increased by the CPI's 3.2 per cent a year would be £2,910.

Roger Turner of the Occupational Pensioners' Alliance, a campaign group, said: "Over 15 or 20 years, switching to CPI will make a substantial difference to pensioners' incomes. "Ministers say CPI is better for pensioners, but how can that be when CPI is consistently lower than RPI? It's better for companies and better for the Treasury, but it's worse for individual pensioners."

Mr Webb told the National Association of Pension Funds conference yesterday that RPI was "volatile" and did not accurately reflect the cost of living for pensioners, only 7 per cent of whom have mortgages. There are around 5million people now drawing a pension from private sector schemes and another 6.6million members who have left jobs with pension rights but not yet retired.

Figures from the NAPF today show that 61 per cent of private-sector schemes have rules promising their members increases in line with RPI. Tom McPhail of Hargreaves Lansdown said that any switch would be controversial. "This is probably going to upset quite a few people, given the historical trend for CPI to undershoot RPI," he said. "With life expectancy at retirement now exceeding 20 years, such a relatively innocuous change could have a significant impact to the financial security of pensioners in later life."

Nick Griggs of Barnett Waddingham, a firm of actuaries, said the change would benefit companies struggling to fund pension schemes. Changes to public service pension schemes introduced in 2007-08 will cost teachers, civil servants and NHS staff a total of £67billion over the next 50 years, according to a report. The National Audit Office said the changes were "on course to deliver significant savings and stabilise pension costs around their current levels as a proportion of GDP".

66 comments:

Dan Weintraub said ...

“... in the real world, governments pursue war not because it is the righteous or just thing to do, but because more often than not they view it as the only viable thing left to do.

... governments pursue wars of aggression, of impetus, and of pre-emption, rather than waiting for the collapse of their own state into civil war.”

---

The wars of tomorrow are already happening.

Cyborwar.

Destroy the lines of communications. Destroy the supply lines by destroying the transfer of money.

The Wikileak salvo was the first of the future wars.

Guns and boots are antiques.

==

On municipal taxes.

Those bond payment obligations don’t change – the tax rates have to increase, and this means that in most cases, people’s property taxes are increasing at the same time the values of their property are decreasing.

And local governments aren’t anywhere near ready to come to grips with this scenario. Most of the individuals sitting on boards don’t have a clue about this type of issue – their eyes glaze over almost immediately.

===

On REAL CAUSES OF THE COLLAPSE OF THE FINANCIAL SERVICES

http://www.c-spanvideo.org/program/FannieMaean

She has been a very vocal person.

http://www.tavakolistructuredfinance.com/

Tavakoli Structured Finance, Inc.® Janet Tavakoli, President 360 E. Randolph St. Suite 3007 Chicago, Illinois 60601 USA

From last post comments:

"Cloud cookoo land" is (C) Stoneleigh 2010, in one of her talks. Used without permission :p

Regards,

Paul

Dan W - A thoughtful piece and well worthy of contemplation.

I call these QE1 and QE2... QExx's a way of plugging holes in the dike.

Sure, these people know what they are doing, and there have to be manifold reasons why they do it anyway in the face of what it means for future debt levels--as in preposterous! And absolutely guaranteeing our financial, likely political, and possibly social demise. They know it's coming! Well 95% of them anyway.

We are on Bageant's Bus riding headlong into the Grand Canyon. It's out of our hands to repair. The only thing left to do is... as a musician says... play it by ear.

We can offer and share advice, point out possibilities and each of us work on our own "lifeboat." But in the none of us know what is coming in any detail.

Good luck with your project. Keep some skedaddle options open!

Bluebird - Agree, I have my own ideas about good nutrition, but when/if push comes to starve, we'll eat what we can get our hands on. Still, I appreciated the discussion.

jal- Agree. Warmaking is evolving still. Up to the 20th century soldiers lined up and marched toward each other, shooting each other down! Seems absurd now.

Then in the 20th century warmaking "progressed" to dropping bombs, from planes, and then missiles.

Now in the cyborworld no doubt has sprung another tangential way to infiltrate and destroy. I wish that digital war was the worst we had to look forward to but no doubt that will not be the case.

@ jal

"...The wars of tomorrow are already happening.Cyborwar. Destroy the lines of communications. Destroy the supply lines by destroying the transfer of money. The Wikileak salvo was the first of the future wars. Guns and boots are antiques..."

I with respect disagree. Censorship is certainly high on the agenda of any ruling body's attempt to control the population, but censorship does not aggrandize citizens toward support for the State. War does. Even when the citizens of a nation KNOW that their leaders are lying to them, a patriotic call to arms, masterfully spoken into the T.V. cameras of the major networks, works every time.

We knew GWB was lying about WMD. Didn't matter. Refusing the patriotic call simply does not happen when the propagandists do their best work.

MY thesis is that our leaders KNOW that, if things really begin to fall apart, they hold the trump card of War, deviously waged.

"Cloud cookoo land" is (C) Stoneleigh 2010, in one of her talks. Used without permission

Thanks Paul, I liked it so well, I referred to that phrase too :)

http://tinyurl.com/25dn8ow

War on WikiLeaks and Assange: 6 Ways the Whistleblower Is Being Attacked and Suppressed

WikiLeaks has faced non-stop attacks by government officials. Both internet and financial companies are cutting off services. Here's a round-up of efforts to suppress the site.

Sorry to be off-topic on this post but I *really* think some people might find this interesting.