Firestone Rubber, Akron, Ohio. Conversion of beverage containers to aviation oxygen cylinders. After shatterproof oxygen cylinders for high altitude flying have passed all tests in the metal division of a large Eastern rubber factory, hot air is blown through the cylinders to remove all trace of moisture. The cylinders are then sealed and stacked for painting

Ilargi: I’ll leave the financial commentary for a day, and gladly make way for an article I asked Stoneleigh to write on her view of the future of the electrical grid in connection with alternative energy forms. They are, after all, her meal ticket.

Stoneleigh: Since it is the major world conundrum with the shortest timescale, I usually focus on finance here, but alternative energy sources and power systems are my day job. Ilargi suggested that, in response to a question about the potential for renewable energy and electric vehicles (EVs), I write an article on the future of power systems.

With people hanging so many of their hopes on an electric future, it seems timely to inject a dose of reality. This is meant as a cursory overview of some of the difficulties we are facing with regard to electrical power in the future. The extraordinary technical and organizational complexity of power systems is difficult to convey, and there is far more to it than I am attempting to address here.

First off: As we are entering a depression, within a few years hardly anyone will have the money to buy an EV. Second: the grid could not come close to handling the current transportation load even if EVs could become common. An economy based on EV transportation would have to be fueled by base-load nuclear that doesn't currently exist and would take decades to build, and no one builds anything in a depression.

What they do is mount a losing battle to maintain existing infrastructure and hope they don't lose too much before better times return. This depression will last long enough that the infrastructure degradation will be enormous, even without the impact of above ground events resulting from serious societal unrest. Attempts at recovery after deleveraging are going to hit a hard energy ceiling. Power systems are critical to the functioning of a modern economy, but are almost completely taken for granted. That will not be the case in a few short years.

Here in Ontario, Canada (pop.13 million), the provincial government has just passed the Green Energy Act, and renewable energy proponents are queuing up to sign 20-year feed-in tariff contracts for power generation at a premium rate per kWh (varying by technology and reaching a maximum of 80 cents/kWh for small-scale roof-top solar).

The general assumption is that we are well on our way to building a future of renewable energy powered smart grids that will be able to accommodate not only our current demand, but much of our transportation load as well, thanks to EVs.

Unfortunately, much of this techno-positivist vision is nothing but pie-in-the-sky, thanks to the limitations of the electrical grid, as well as the low EROEI of renewable energy, the effect of receding horizons on the prospects for scaling up renewable energy development and the impending deflationary collapse of the money supply.

Investment in grid infrastructure, as with public infrastructure of most other kinds, has been sadly neglected for a long time. Much of the existing grid equipment is at or near the end of its design life, as are many of the power plants we depend on. (For instance, in Ontario we haven't got around to paying for the last set of nuclear power plants we built, that are now approaching the end of design life and have had to be very expensively re-tubed in recent years.

The outstanding debt is some $40 billion, and the debt retirement charge we pay doesn't even cover the interest.) Liberalization in the electricity sector has led to a relentless whittling away of safety margins in many places. Where we once had a system with a great deal of resilience through redundancy, that is generally no longer the case. In North America we now have an aging system with a very limited capacity for accommodating either new generation or new load, and we have great difficulty building any new lines.

As the power system was designed under a central station model to carry power in one direction only, with high voltage transmission and low voltage distribution, the modifications that would be required to enable two-way traffic, especially at the distribution level, are very substantial. Comprehensive monitoring and two-way communication would be required down to the distribution level, with central control (dispatchability, or at least the power to disconnect) of large numbers of very small generators.

The level of complexity would be vastly higher than the existing system, where there are relatively few generators to control in order to balance supply and demand in real time, and maintain system parameters such a frequency and voltage within acceptable limits.

The image above conveys by analogy the essence of power system frequency control - the easiest parameter to visualize. Frequency must be maintained at a set level by balancing supply and demand over the entire AC system. There are 4 such systems in North America - the east, the west, Texas and Quebec - and each functions as a single giant machine. The trucks in the image are generators and the boulder they tow up the uneven hill represents variable load. The trucks must pull the boulder at an even speed despite the bumps.

For a more accurate representation, one would actually need additional trucks, some moving at the same speed waiting to pick up a line if one should be dropped (spinning reserve) and others parked by the side of the hill (standing reserve). Some of the trucks would have to be able to start the boulder moving again from a standing start if it should stop for any reason (black-start).

We are looking at a world where there would be many more trucks, but each would be much smaller, and some of them would only pull if the wind was blowing or the sun was shining. The difficulty of the task will increase exponentially, and frequency management is only one parameter that must be controlled.

The mismatch between renewable resource potential, load and grid capacity is considerable. Resource potential is often found in areas far from load, where the grid capacity is extremely limited. Developing this potential and attempting to transmit the resulting power with existing infrastructure to where it can be used would involve very high losses. Many rural areas are served by low voltage single phase lines, and the maximum generation size that can be connected under those circumstances is approximately 100kW.

Even where three-phase lines exist, so that larger generators can be connected, carrying the power at low voltage is particularly inefficient, as low voltage means high current, and losses are proportional to the square of the current. Building high-voltage transmission lines to serve relatively small amounts of renewable energy would be an exceptionally expensive and difficult proposition, especially in a capital constrained future.

Renewable energy generation far from load could amount to little more than a money generating scheme, as a premium rate will be paid from the public purse for the time being, but little of the power might reach anywhere it could actually be used.

Difficulties occur when generation proposed would amount to more than 50% of the minimum load on the feeder. At this threshold, special anti-islanding measures are required that add considerable cost to the grid connection. In North America, we have large geographical areas served by a network of long stringy feeders with very low load. Adding much of anything to this system will be very challenging.

In much of Europe, where renewable energy penetration is relatively high, the population density is high enough to be served by a three-phase grid composed of relatively short feeders with high loads. Many of the limitations faced by North America simply do not apply in places like Germany, Denmark or the Netherlands. The North American grid has more in common with rural Portugal or the Greek Islands.

In this province alone, the amount of grid construction required in order to connect our renewable potential with load would cost tens, if not hundreds, of billions of dollars, and it would take decades to build. The cost of building, installing and connecting the necessary power generation equipment would also be enormous, and we would have to maintain at least some of the large plants needed for power system control and ancillary services (rapid load-following adjustments for frequency management, spinning reserve, rapid-response standing reserve, black-start capability, provision of reactive power etc).

This will be difficult as many large plants are due for replacement, large power plants take many years to complete, conventional fuels are depleting and capital will be very limited. While demand destruction will build in a temporary supply cushion, the lack of maintenance and new construction, which will inevitably follow a lack of funds, will take a huge toll in relatively few years.

Far from a future of greater high-tech connectedness under a smart-grid model, where EVs would charge at night and cover both transportation needs and power storage, we are looking at a much more fragmented picture. We are very unlikely to see massive AC grids covering anything like the area they do now, and much less likely to see power carried over large distances.

Far from a future of greater high-tech connectedness under a smart-grid model, where EVs would charge at night and cover both transportation needs and power storage, we are looking at a much more fragmented picture. We are very unlikely to see massive AC grids covering anything like the area they do now, and much less likely to see power carried over large distances. Rural areas may well be cut off and will have to provide any power they need themselves (yet another example of the core preserving itself at the expense of the periphery). This will mean a drastic cut in demand to a third world level in many rural areas, and may lead to other areas with no power production, and no money to build any, being abandoned completely or reverting to a pioneer lifestyle.

In urban areas, where dispossessed rural people migrate in very hard times, electricity provision in places down on their luck could look more like this picture of a favela in Rio de Janeiro. It's a far cry from a neat and tidy high-tech vision of efficiency.

Ilargi: Barry Ritholtz ran this graph today. It's not so much an update as it is a prediction, I would say. I suggest you look closely at where the known ends and the prediction begins. Prices fell 33% so far, the graph predicts about 10% more. Then there is a point where the line stops falling (in 2010-2011). What will cause prices to stop dropping?

Updated: Case-Shiller 100-Year Chart

Yesterday, we discussed why the Case Shiller Index, which fell 18%, was not yet cause for celebration. Regular TBP reader Steve Barry created this chart last year which projected forward the ongoing losses for Case Shiller; We first ran this back in December, and it ran all over the internet (mostly without attribution). Well, its time to update this. Here is Steve’s most recent version:

Ilargi: Calculated Risk ran this great graph, in reaction to the New York Times piece right below. The two blue lines come from a January report (PDF) by White House economist Elizabeth Romer and Jared Feldstein. The red line depicts reality.

Note: the White House, including Romer, have acknowledged the line will break 10% this summer. It is presently at 9.4%, with June numbers expected to take it to 9.6%-9.7%. Was it really all that hard to foresee 6 months ago? Or is Romer perhaps the wrong party at the wrong table? The problem with this sort of prediction, which is off by a mile and a half, is that it leads to the wrong focus, the wrong sort of spending and overall faulty policies.

Unemployment Forecast With Too Much "Hope"

Ilargi: Looks like I may have been on to something this weekend: more New York Times criticism of the Obama administration.

A Forecast With Hope Built In

In the weeks just before President Obama took office, his economic advisers made a mistake. They got a little carried away with hope. To make the case for a big stimulus package, they released their economic forecast for the next few years. Without the stimulus, they saw the unemployment rate — then 7.2 percent — rising above 8 percent in 2009 and peaking at 9 percent next year. With the stimulus, the advisers said, unemployment would probably peak at 8 percent late this year.

We now know that this forecast was terribly optimistic. The jobless rate has already reached 9.4 percent. On Thursday, the Labor Department will announce the latest number, for June, and forecasters are expecting it to rise further. In concrete terms, the difference between the situation that the Obama advisers predicted and the one that has come to pass is about 2.5 million jobs. It’s as if every worker in the city of Los Angeles received an unexpected layoff notice.

There are two possible explanations that the administration was so wrong. And sorting through them matters a great deal, because they point in opposite policy directions. The first explanation is that the economy has deteriorated because the stimulus package failed. Some critics say that stimulus just doesn’t work, while others argue that this particular package was too small or too badly constructed to make a difference.

The second answer is that the economy has deteriorated in spite of the stimulus. In other words, the patient is not as sick as he would have been without the medicine he received. But he is a lot sicker than doctors realized when they prescribed it. To me, the evidence is fairly compelling that the second answer is the right one. The stimulus package does seem to have helped. But its impact has been minor — so far — compared with the harshness of the Great Recession.

Unfortunately, the administration’s rose-colored forecast has muddied this picture. So if at some point this year or next the White House decides that the economy needs more stimulus, skeptics will surely brandish that old forecast. Worst of all, the economy really may need more help.

•

There is no ironclad way to judge the stimulus, because we can’t rerun the last six months in an alternate universe. But you can get a pretty good sense by looking at the size of the gap between where the economy is today and where the administration thought it would be: those 2.5 million jobs that would still exist if the forecast had been right. This gap is just far too large to be explained by the stimulus.

The plan that Mr. Obama signed definitely has its flaws. It spends money more slowly than is ideal and spends some of it on projects of little long-term value. But no stimulus package could have come close to preventing 2.5 million job losses over six months. For starters, a stimulus package doesn’t affect the job market immediately because most employers don’t hire or fire workers as soon as they sense their business shifting. That’s why economists refer to employment as a lagging indicator.

When private economists began analyzing various stimulus proposals in January, they said that none would have a major effect on the jobless rate until the end of the year. By June, the effect would be only a few tenths of a percentage point, which translates into several hundred thousand jobs. The stimulus that passed may in fact be having an impact of roughly this scale. Consumer spending, after plummeting late last year, is up slightly this year, despite a continuing rise in the savings rate. This combination suggests that spending would still be falling if not for the tax cuts in the stimulus.

"Early results," says Mark Zandi, chief economist of Moody’s Economy.com, "suggest the stimulus is performing close to expectations." Obviously, though, the economy is not performing close to expectations. It’s not fair to expect Mr. Obama’s economists to be clairvoyant. But they did make one avoidable mistake that led directly to their overoptimism. They relied on the same forecasting models that had completely failed to see the crisis coming.

These models, which are also used by Wall Street and various research firms, do a decent job most of the time. But they are notoriously bad at forecasting turning points because they are based on an assumption that the recent past will more or less repeat itself. Clearly, recent economic history is not going to repeat itself. It included two huge asset bubbles, first in stocks and then in real estate. The models came to treat those bubbles — and the additional consumer spending they caused — as the new normal. When asset prices began falling, the models couldn’t keep up, with either the pace of declines or the economic damage they were causing.

"All sorts of relationships got completely out of whack, and models couldn’t cope with that," says Joshua Shapiro, an economist at MFR, a research firm. MFR did not take the models too literally and was one of the few firms to have been appropriately pessimistic. The Obama administration believed the models. And what do these models say today? They are forecasting that the recession will end in the next few months. Administration officials aren’t quite so specific, but they are in a similar place.

Christina Romer, a senior Obama economist, argues that businesses that have spent the last few months drawing down their warehouse inventories will eventually need to rebuild them. Lawrence Summers, the top economics adviser, says that many consumers who have been delaying the purchase of a new car will eventually take the plunge. The government, meanwhile, will be pumping out close to $30 billion in stimulus money every month for months to come. A big headline across the front page of Monday’s Financial Times summed up the position: "Romer upbeat on economy."

It’s an entirely reasonable prediction. Yet it’s hard not to look back on the last six months and worry that the administration is still underestimating the severity of the situation.

Many consumers may not rush back to their old buying habits. Mr. Shapiro points out that household debt, relative to assets, remains far higher than historically normal. "It’s going to be a very long slog," he predicts. That would certainly be consistent with the aftermath of other financial crises.

The larger point is that, even if the optimists are right this time, the economy isn’t going to feel remotely healthy anytime soon. Since jobs (and incomes) are a lagging indicator, the unemployment rate will probably surpass 10 percent this year and remain above 9 percent well into next year. Long after the experts say the economy has turned, it is going to feel pretty bad. Another stimulus package may soften the blow, but it can’t prevent most of the pain. The problems are too big. So it would make sense for everyone — the administration and the rest of us — to have a sober view of what might lie ahead.

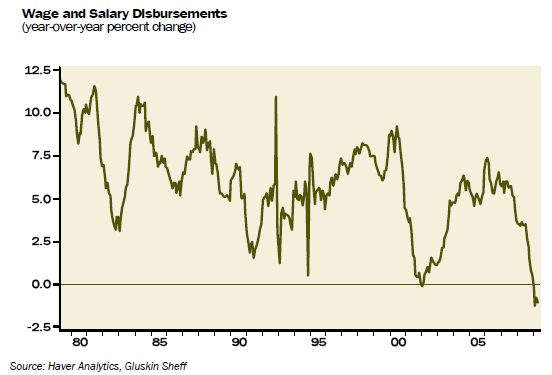

Wage Deflation in Our Midst

by David Rosenberg

A survey conducted by YouGov for the Economist magazine found that 5% of respondents had taken a furlough this year and 15% had accepted a pay cut (see The Recession and Pay: The Quiet Americans on page 33 of this week’s edition).As wages deflate, workers are looking for ways to supplement their shrinking income base, for example, by moonlighting. Indeed, a poll undertaken by CareerBuilder.com and cited in the USA Today found that one in every ten Americans took on an extra job over the last year; another one in five said they intend to do so in the coming year. These numbers are double for the 45 to 54 year olds who now see early retirement, once around the corner, as an elusive concept.

Most pundits who crow about green shoots and about an inventory restocking in the third quarter giving way towards some sustainable economic expansion live in the old paradigm. They don’t realize, for whatever reason, that the deflationary aftershocks that follow a post-bubble credit collapse typically last for 5 to 10 years. Businesses understand better than the typical Wall Street or Bay Street economist and strategist that everything from order books, to output, to staffing have to now be restructured to adequately reflect a permanently lower level of leverage in the economy.

Indeed, by our estimates, there is up to another $5 trillion of household debt that has to be eliminated in coming years and that process is going to require that consumers go on a semi-permanent spending diet. Companies see this, which is why they are not just downsizing their payroll, but have also cut the workweek to a record low of 33.1 hours. Fewer people are working and those that are still working have seen their hours dramatically cut this cycle.

Companies are finding other ways to save on the aggregate labour cost bill as well, which may be a factor reinforcing the uptrend in the personal savings rate (see more below). For example, a rapidly growing number of employers are now suspending contributions to worker 401(k) plans. According to a joint survey by CFO Research Services and Charles Schwab, nearly 25% of U.S. companies have either suspended their plans or are planning to do so (this is up from 2% at the turn of the year). Again, how we end up squeezing inflation out of the system when the labour market is clearly deflating wages and benefits for the 70% of the economy called the consumer is going to be interesting to watch.

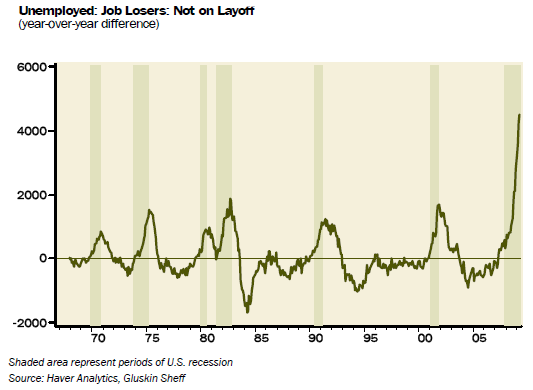

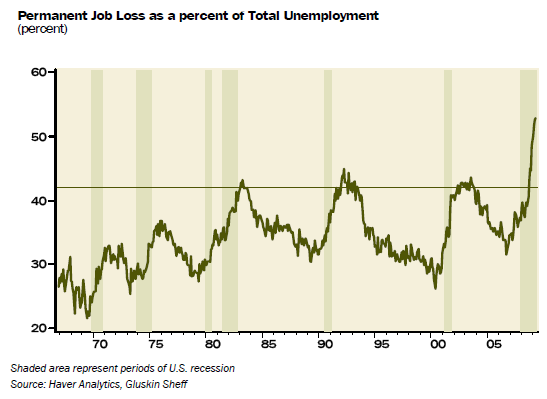

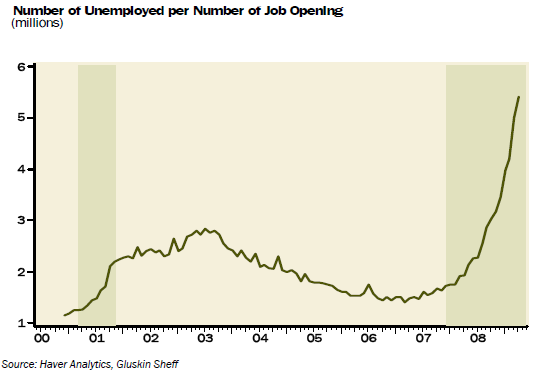

The op-ed column by Bob Herbert in the Saturday New York Times really hit the nail on the head on this whole ‘green shoot’ issue — how can there be ‘green shoots’ when the labour market is deteriorating at such a rapid clip fully nine months after the Lehman collapse. The full brunt of the credit collapse may be behind us, but please, the other two shocks, namely deflating labour markets and deflating home prices, are very much still front and centre. For every job opening in the USA, there are more than five unemployed actively seeking work vying for those jobs. That is unprecedented and nearly double what we saw at the depths of the 2001 recession. The official ranks of the unemployed have doubled during this recession to 14 million and if you take into account all forms of labour market slack, the unofficial number is bordering on 30 million, another record. For those who still believe that we somehow managed to avoid an economic depression this cycle because of a 13% fiscal deficit/GDP and a pregnant Fed balance sheet, the Center for Labour Market Studies at Northeastern University estimates that the real unemployment now stands at 18.2%, which is actually higher than the posted rate at the end of the 1930s.

WAGE DEFLATION IS A REALITY … FAR MORE IMPORTANT THAN THE CRB

AGAIN, HOW WE SQUEEZE INFLATION OUT OF THIS LEMON OF A LABOUR MARKET IS A VALID QUESTION.

When the recovery does come, the record number of people that have been pushed into part-time work are going to see their hours go back up, which will be good for them, but not so good for the 100,000 - 150,000 folks that will be entering the labour force looking for work with futility. The unemployment rate is probably going to rise through 2010, which is going to pose a challenge for incumbents seeking re-election in the mid-term voting season. It may also prove to be a challenge for Ben Bernanke’s re-appointment chances this coming February.

As we said above, companies have permanently reduced the size of their operations with the knowledge of how much credit is going to be available to them in the future to survive because the financial sector is going to be operating under more supervision and regulation and leverage ratios, which means the funds available to support a given level of GDP is going to be measurably smaller than what we had become accustomed to during the secular credit expansion, which really began in the mid-1980s, only to turn parabolic during the ‘ownership society’ era of 2002 to 2007.

What makes this cycle "different" is that three-quarters of the workers that were fired over the last year were let go on a permanent, not a temporary basis. A record 53% of the unemployed today are workers who were displaced permanently — not just temporarily because of the vagaries of the traditional business cycle. This means that these jobs are not going to be coming back that quickly, if at all, when the economy does in fact begin to make the transition to the next expansion phase. In turn, this implies that any expansion phase is going to be extremely fragile and susceptible to periodic setbacks. There may well be job growth in the future in health care, infrastructure, energy technology and the like, but we can say with a reasonable amount of certainty that there are a whole lot of jobs in a whole lot sectors where jobs lost this recession are not going to come back. For example, the 580k jobs lost in financial services; the 320k jobs lost in residential construction; the 1.7 million jobs lost in durable goods manufacturing; the 1.1 million jobs lost in the wholesale/retail sector; and the 380k jobs that were lost in the leisure/hospitality industry. That is over four million jobs that were shed this cycle that are not likely to stage a comeback even after the recession is over. To show you how big a number four million is, we didn’t create that many jobs in the prior expansion until it reached its fourth birthday towards the tail end of 2005.

PERMANENT JOB LOSERS SURGE TO RECORD OF NEARLY 8 MILLION

PERMANENT JOB LOSERS SURGE BY 4.5 MILLION IN THE PAST YEAR

OVER HALF OF THE UNEMPLOYED NOW LONG-TERM

THE TRUEST PICTURE OF EXCESS LABOUR SUPPLY

>

As Bob Herbert points out in his article in the Saturday NYT, the unemployment rate for males has already soared to 10.5% whereas the rate for females is at 8.0% in the largest gender gap in favor of women since World War II. Has anyone worked through the sociological repercussions from this divergence on divorce rates, birth rates, even crime rates?

Moreover, since employers are favouring experience over youth, and because the savings-constrained folks over the age of 55 are getting whatever jobs there are out there, a massive pool of joblessness has been created this cycle among the younger-age cohorts where the unemployment rate for 20-24 year olds has surged to 15.0% (and 23.0% for 16-19 year olds). This, too, will have social implications going forward. As Lawrence Mishel, president of the Economic Policy Institute was quoted as saying in the Bob Herbert column, "I believe this is going to leave a permanent scar on a generation of kids". Work habits and experience are honed when people are in their 20’s and this is the generation that is being most affected by the shrinking demand for labour — and this is going to lead down the road to a slower trend in structural productivity growth.

Quite frankly, we cannot imagine a more difficult environment for the stock market — the impact on both corporate earnings and fair-value estimates for the P/E multiple — than a backdrop that includes a permanently lower level of potential GDP growth alongside a record output gap. What that means is much lower volume growth and much lower pricing power over the next five to 10 years. This means that bear market rallies will come, as we have already seen repeatedly in the last two years with an obvious exclamation mark on the one posted from March 9 to May 4 … and they will go.

It is amazing how many pundits and media types believe we are in a new bull phase and yet the equity market has completely sputtered now for nearly three months above the 900 level on the S&P 500 and 8,400 on the Dow — not to mention the fact that instead of seriously breaking out above the 200-day moving average, the broad market has been struggling at this resistance level for the last few weeks, which is a sign that buying fatigue has likely set in (together with meager trading volumes).

It may well be true that the University of Michigan Consumer Sentiment index improved in June to 70.8 from 68.7 in May, but not every confidence measure showed ebullience last month. The Rasmussen index averaged 73.1, down from 74.1 in May, and the ABC News/Washington Post consumer comfort poll is sitting at -53 compared with -49 at the end of May and is a mere two points shy of hitting a new all-time low. Interestingly, the ‘personal finances’ subindex at -22 did hit a new record low and is worse now than it was back in mid-March when the equity market was cratering (was -4 at that time).

Debt Deflation in America

by Michael Hudson

Happy-face media reporting of economic news is providing the usual upbeat spin on Friday’s debt-deflation statistics. The Commerce Department’s National Income and Product Accounts (NIPA) for May show that U.S. "savings" are now absorbing 6.9 percent of income. I put the word "savings" in quotation marks because this 6.9% is not what most people think of as savings.

It is not money in the bank to draw out on the "rainy day" when one is laid off as unemployment rates rise. The statistic means that 6.9% of national income is being earmarked to pay down debt – the highest saving rate in 15 years, up from actually negative rates (living on borrowed credit) just a few years ago. The only way in which these savings are "money in the bank" is that they are being paid by consumers to their banks and credit card companies.

Income paid to reduce debt is not available for spending on goods and services. It therefore shrinks the economy, aggravating the depression. So why is the jump in "saving" good news? It certainly is a good idea for consumers to get out of debt. But the media are treating this diversion of income as if it were a sign of confidence that the recession may be ending and Mr. Obama’s "stimulus" plan working.

The Wall Street Journal reported that Social Security recipients of one-time government payments "seem unwilling to spend right away," 1 while The New York Times wrote that "many people were putting that money away instead of spending it."2 It is as if people can afford to save more. The reality is that most consumers have little real choice but to pay. Unable to borrow more as banks cut back credit lines, their "choice" is either to pay their mortgage and credit card bill each month, or lose their homes and see their credit ratings slashed, pushing up penalty interest rates near 20%!

To avoid this fate, families are shifting to cheaper (and less nutritious) foods, eating out less (or at fast food restaurants), and cutting back vacation spending. It therefore seems contradictory to applaud these "saving" (that is, debt-repayment) statistics as an indication that the economy may emerge from depression in the next few months. While unemployment approaches the 10% rate and new layoffs are being announced every week, isn’t the Obama administration taking a big risk in telling voters that its stimulus plan is working? What will people think this winter when markets continue to shrink? How thick is Mr. Obama’s Teflon?

As recently as two years ago consumers were buying so many goods on credit that the domestic savings rate was zero. (Financing the U.S. Government’s budget deficit with foreign central bank recycling of the dollar’s balance-of-payments deficit actually produced a negative 2% savings rate.) During these Bubble Years savings by the wealthiest 10% of the population found their counterpart in the debt that the bottom 90% were running up. In effect, the wealthy were lending their surplus revenue to an increasingly indebted economy at large.

Today, homeowners no longer can re-finance their mortgages and compensate for their wage squeeze by borrowing against rising prices for their homes. Payback time has arrived – paying back bank loans, whose volume has been augmented to include accrued interest charges and penalties. New bank lending has hit a wall as banks are limiting their activity to raking in amortization and interest on existing mortgages, credit cards and personal loans.

Many families are able to remain financially afloat by running down their savings and cutting back their spending to try and avoid bankruptcy. This diversion of income to pay creditors explains why retail sales figures, auto sales and other commercial statistics are plunging vertically downward in almost a straight line, while unemployment rates soar toward the 10% level. The ability of most people to spend at past rates has hit a wall.

The same income cannot be used for two purposes. It cannot be used to pay down debt and also for spending on goods and services. Something must give. So more stores and shopping malls are becoming vacant each month. And unlike homeowners, absentee property investors have little compunction about walking away from negative equity situations – owing creditors more than the property is worth.

Over two-thirds of the U.S. population are homeowners, and real estate economists estimate that about a quarter of U.S. homes are now in a state of negative equity as market prices plunges below the mortgages attached to them. This is the condition in which Citigroup and AIG found themselves last year, along with many other Wall Street institutions.

But whereas the government absorbed their losses "to get the economy moving again" (or at least to help Congress’s major campaign contributors to recover), personal debtors are in no such favored position. Their designated role is to help make the banks whole by paying off the debts they have been running up in an attempt to maintain living standards that their take-home pay no longer is supporting.

Banks for their part are slashing credit-card debt limits and jacking up interest and penalty charges. (I see little chance that Congress will approve the Consumer Financial Products Agency that Mr. Obama promoted as a flashy balloon for his recent bank giveaway program. The agency is to be dreamed about, not enacted.) The problem is that default rates are rising rapidly.

This has prompted many banks to strike deals with their most overstretched customers to settle outstanding balances for as little as half the face amount (much of which is accrued interest and penalties, to be sure). Banks are now competing not to gain customers but to shed them. The plan is to offer steep enough payment discounts to prompt bad risks to settle by sticking rival banks with ultimate default when they finally give up their struggle to maintain solvency. (The idea is that strapped debtors will max out on one bank’s card to pay off another bank at half-price.)

The trillions of dollars that the Bush and Obama administration have given away to Wall Street would have been enough to buy a great bulk of the mortgages now in default – mortgages beyond the ability of many debtors to pay in the first place. The government could have enacted a Clean Slate for these debtors – financed by re-introducing progressive taxation, restoring the full capital gains tax to the same rate as that levied on earned income (wages and profits), and closing the tax loopholes that effectively free finance, insurance and real estate (FIRE) sector from income taxation.

Instead, the government has made Wall Street virtually tax exempt, and swapped Treasury bonds for trillions of dollars of junk mortgages and bad debts. The "real" economy’s growth prospects are being sacrificed in an attempt to carry its financial overhead. Banks and credit-card companies are girding for economic shrinkage. It was in anticipation of this state of affairs, after all, that they pushed so hard from 1998 onward to make what finally became the 2005 bankruptcy laws so pro-creditor, so cruel to debtors by making personal bankruptcy an economic and legal hell.

It is to avoid this hell that families are cutting their spending so as to keep current on their debts, against all odds that they can avoid default in today’s shrinking economy. Working off debt = "saving," but not in liquid form. People are putting more money away, but not into savings accounts. They are indeed putting it into banks, but in the form of paying down debt. To accountants looking at balance sheets, savings represent the increase in net worth. In times past this was indeed the result mainly of a buildup of liquid funds. But today’s money being saved is not available for spending.

It merely reduces the debt burden being carried by individuals. Unlike Citibank, AIG and other Wall Street institutions, they are not having their debts conveniently wiped off the books. The government is not nice enough to buy back their investments that had lost up to half their value in the past year. Such bailouts are for creditors and money managers, not their debtors. The story that the media should be telling is how today’s post-bubble economy has turned the concept of saving on its head. The accounting concept underlying balance sheets is that a negation of a negation is positive. Paying down debt liabilities is counted as "saving" because one owes less.

This is not what people expected a half-century ago. Economists wrote about how technology would raise productivity levels, people would be living in near utopian conditions by the time the year 2000 arrived. They expected a life of leisure and prosperity. Needless to say, this is far from materializing. The textbooks need to be rewritten – and in fact, are being rewritten.

Most individuals and companies emerged from World War II in 1945 nearly debt-free, and with progressive income taxes. Economists anticipated – indeed, even feared – that rising incomes would lead to higher saving rates. The most influential view was that of John Maynard Keynes. Addressing the problems of the Great Depression in 1936, his General Theory of Employment, Interest, and Money warned that people would save relatively more as their incomes rose. Spending on consumer goods would tail off, slowing the growth of markets, and hence new investment and employment.

This view of the saving function – the propensity to save out of wages and profits –viewed saving as breaking the circular flow of payments between producers and consumers. The main cloud on the horizon, Keynesians worried, was that people would be so prosperous that they would not spend their money. The indicated policy to deter under-consumption was for economies to indulge in more leisure and more equitable income distribution.

The modern dynamics of saving – and the increasingly top-heavy indebtedness in which savings are invested – are quite different from (and worse than) what Keynes explained. Most financial savings are lent out, not plowed into tangible capital formation and industry. Most new investment in tangible capital goods and buildings comes from retained business earnings, not from savings that pass through financial intermediaries. Under these conditions, higher personal saving rates are reflected in higher indebtedness. That is why the saving rate has fallen to a zero or "wash" level. A rising proportion of savings find their counterpart more in other peoples’ debts rather than being used to finance new direct investment.

Each business recovery since World War II has started with a higher debt ratio. Saving is indeed interfering with consumption, but it is not the result of rising incomes and prosperity. A rising savings rate merely reflects the degree to which the economy is working off its debt overhead. It is "saving" in the form of debt repayment in a shrinking economy. The result is financial dystopia, not the technological utopia that seemed so attainable back in 1945, just sixty-five years ago. Instead of a consumer-friendly leisure economy, we have debt peonage.

To get an idea of how oppressive the debt burden really is, I should note that the 6.9% savings rate does not even reflect the 16% of the economy that the NIPA report for interest payments to carry this debt, or the penalty fees that now yield as much as interest yields to credit-card companies – or the trillions of dollars of government bailouts to try and keep this unsustainable system afloat. How an economy can hope to compete in global markets as an industrial producer with so high a financial overhead factored into the cost of living and doing business must remain for a future article to address.

Bill Gross: Greed will come again, but fear to rule for at least a generation

Bill Gross, the influential investor who runs top bond fund Pimco, said on Wednesday that greed will eventually become the norm again for consumers and investors, but fear continues to rule for now -- a mindset that will result in subdued U.S. economic growth for some time. "Greed will come again. But for now, the trend is the other way and it promises to persist for a generation at a minimum," said Gross, the co-chief investment officer of Pacific Investment Management Co.

The evaporation of at least $15 trillion in wealth suffered by American consumers since early 2007 and a U.S. unemployment rate now approaching 10 percent will have an impact on consumption patterns, Gross said in his monthly newsletter to clients, posted on www.pimco.com. "When potential spenders feel less rich by that much, the only model one can use to forecast the future is a commonsensical one" that assumes higher savings and lower consumption.

Under this scenario, Gross, who manages the Pimco Total Return Fund, which has $159 billion in assets, sees a "new normal" for U.S. economic growth rate closer to 2 percent as opposed to the recent average of 3.5 percent. "There's no magic in that number, and no model to back it up, just a lot of common sense that says this is how people and economic societies behave when stressed and stretched to a near breaking point," he said.

But Gross, whose letters to investors are as famous for their quirky asides and analogies as for their economic and market analysis, said greed isn't just good for the economy but also essential. He divined upon John Maynard Keynes' famous observation during the Depression -- that much of individual economic behavior is due to "animal spirits" rather than long-term rational calculations so beloved by economic theorists.

Keynes defined animal spirits as "a spontaneous urge to action rather than inaction" and a "spontaneous optimism" and argued that long-term rational calculation could not account for such economic decisions as opening a small business or innovating new software. In an email response to Reuters expanding on his thoughts on "animal spirits," Gross said: "But when irrationally exuberant, they can be destructive as opposed to constructive."

In his July newsletter, Gross addressed the destructive events that led to the global financial crisis. "The supersizing of financial leverage and consumer spending in concert with the politicizing of deregulation describes in 15 words our most recent brush with irrational behavior and inefficient markets," he said. Against the current climate of caution ruling consumers, Gross said the Federal Reserve's short-term policy rates will be kept low for longer than cyclical norms. He said he sees the outlook for stocks, high-yield "junk" bonds, and commercial and residential real estate as still involving risk.

Investors should favor secure income offered by bonds and stable dividend-paying equities, said Gross, who has said he sees tremendous value in high-quality municipal bonds. Wednesday, in fact, Pimco launched the Pimco MuniGO Fund, the firm's first mutual fund to offer a portfolio of intermediate maturity general obligation bonds from top-rated municipal issuers, as well as pre-refunded municipal bonds backed by U.S. Treasury and Agency securities. Pimco oversees roughly $800 billion.

Ilargi: The Wall Street recipients of $14 trillion in public largesse are doing just fine, thank you. The public itself? Not so much.

Corporate Bonds Show Lehman Doesn’t Matter With 9.2% Return

Nowhere is the recovery in financial markets more evident than in corporate bonds, where Lehman Brothers Holdings Inc.’s bankruptcy is becoming a distant memory. U.S. investment-grade company debt returned 9.2 percent in the first half of the year, outperforming Treasuries by 13.7 percentage points, the most on record, according to Merrill Lynch & Co. index data. Corporate bonds also did better than the Standard & Poor’s 500 Index of stocks, marking the first time since 2002 that the fixed-income securities outshined both Treasuries and equities.

The gains may be the clearest indication that the more than $12.8 trillion pledged by the government and Federal Reserve to thaw frozen credit markets is starting to pull the economy out of the worst recession since the 1930s. Frankfurt-based Deutsche Bank AG boosted its forecast yesterday for global economic growth next year to 2.5 percent from 2 percent. “The only way to justify the kind of valuations six months ago is if we were in the process of creating the next Great Depression,” said Joseph Balestrino, a money manager at Pittsburgh-based Federated Investors Inc., which oversees $409 billion of assets.

Yields on investment-grade company securities fell to within 3.31 percentage points of Treasuries yesterday, the least since Sept. 10, according to Merrill’s U.S. Corporate Master Index. Spreads widened to a record 6.56 percentage points on Dec. 5, and the securities lost 6.8 percent in 2008, the worst year on record, as the shock to financial markets from Lehman’s collapse Sept. 15 froze credit markets and sparked a run on Treasuries that caused bill rates to fall below zero.

The rally shows fears that Lehman’s failure would create a domino effect that brought down the financial system were “overblown,” said Arthur Tetyevsky, chief fixed-income strategist at CF Global Trading LLC, a New York-based firm that trades securities for institutional investors, primarily U.S. and European hedge funds. “Spreads on corporate debt were so out of whack coming into the year, implying default rates that indicated more than 20 percent of all speculative-grade companies would go bankrupt,” said Kevin Sherlock, co-head of loan and high-yield capital markets at Deutsche Bank in New York. “The risk appetite is far more aggressive now than it was three months ago. It’s about where we were last summer at pre-Lehman levels.”

The biggest returns came in the riskiest securities. High- yield, high-risk bonds gained 29 percent, or 34 percentage points more than Treasuries, Merrill Lynch indexes show. The performance is the best since a market for the securities was created in the 1980s by Michael Milken, according to Merrill Lynch’s U.S. High-Yield Master II index. Junk bonds are rated below BBB- at S&P and less than Baa3 by Moody’s Investors Service. Bond bulls are encouraged by signs the economy may be recovering. Consumer spending rose in May as benefits from the Obama administration’s stimulus plan spurred a jump in American incomes.

The 0.3 percent increase in purchases was the first gain in three months, the Commerce Department said June 26. Incomes climbed 1.4 percent, the most in a year, driving the savings rate to a 15-year high. Another report showed consumer sentiment rose in June to the highest level since February 2008. “The pace of economic contraction is slowing” and “conditions in financial markets have generally improved,” the Fed’s Open Market Committee said in a June 24 statement after a two-day meeting in Washington, where it kept the target interest rate for loans between banks between zero and 0.25 percent.

With little need for the safety of government debt, Treasuries lost 4.5 percent in the first half as some of the biggest yields on corporate bonds in at least a dozen years lured investors. The S&P 500 Index gained 3.2 percent, including dividends. While credit spreads are narrowing, defaults continue to rise. The U.S. speculative-grade default rate jumped to 8.1 percent in May, the highest since October 2002, and may reach 14.3 percent by the first quarter of 2010, according to S&P.

“The easy money has been made,” said Richard Lee, a managing director in the fixed-income trading department of closely held broker-dealer Wall Street Access in New York. “You could have bought any corporate credit in January and February and made out like a bandit.”

Other measures of credit also show improvement. The difference between what banks and the U.S. government pay to borrow for three months, the TED spread, has shrunk to 41 basis points, the lowest since July 2007 and down from 464 basis points in October. A basis point is 0.01 percentage point. The Libor-OIS spread, an indicator for banks’ willingness to lend, ended yesterday at 0.38 percentage point. That’s approaching the 0.25 percentage point that former Fed Chairman Alan Greenspan has said would indicate that markets were back to “normal.”

The increased demand has helped companies raise a record amount of money selling debt. Sales of corporate bonds surged 24 percent to $734.6 billion in the first half, compared with the same period of 2008, according to data compiled by Bloomberg. New York-based Pfizer Inc., the world’s largest drugmaker, raised $13.5 billion on March 17 in the biggest bond sale by a U.S. company as part of its fundraising to buy rival Wyeth, Bloomberg data show. Redmond, Washington-based software maker Microsoft Corp. sold $3.75 billion of debt on May 11 in its debut offering.

The commercial paper market has slumped the most ever as borrowers let the short-term debt mature or replace it with bonds. Unsecured commercial paper outstanding plunged 31 percent to $1.15 trillion, the lowest level since September 1998, according to Fed data. “I have been buying credit the whole year,” said Gregory Nassour, who helps oversee $36 billion as head of investment- grade portfolio management at Vanguard Group in Valley Forge, Pennsylvania. “The excess returns are gigantic.”

Britain has sunk itself deep into a fiscal black hole

This year, Britain is likely to incur a fiscal deficit of more than 12 per cent of national income. This figure is completely outside the normal experience of developed countries in peacetime. How did it happen and what are its implications? The normal rule of prudent public finance is to allow for substantial cyclical variation. Recessions cut tax receipts and lead to additional expenditure, especially on benefits. Moderate surpluses in good times turn into moderate deficits in bad times, so things balance out overall. The British government, ostensibly committed to this principle, has obfuscated to abuse it so that Britain entered the recession with a large underlying deficit.

The downturn turned a substantial gap in public finances into a chasm. This situation was aggravated by the speed and scale of the recession and the realisation that many of the earnings from financial services, which had previously boosted tax receipts, had been illusory. The contribution of financial services to public finances has been not only removed but reversed. Even if there were a rapid economic recovery, there would still be a large deficit. At least half of the current deficit will need to be eliminated by cuts in public expenditure and increases in tax rates. These will have to be very substantial.

After all, 1 per cent of gross domestic product equates to 3 per cent of public expenditure, two points on the basic rate of income tax and three points on the standard rate of value added tax. At least six such "units" of deficit budgeting will be required over the next few years. And the background is not benign. There are always upward pressures on public spending, but there are several additional ones ahead. The costs of servicing public debt will rise, as amounts and rates increase. The government will, like the banks themselves, defer accounting for the costs of the bank bail-outs as long as possible. But the reality remains that every penny that subsidises the financial system is a penny diverted from schools and hospitals.

The costs of off-balance-sheet financing have also come home to roost, as they always do. The spending of local authorities and National Health Service trusts will be squeezed by commitments they have incurred under the private finance initiative. The impact on health and benefit costs of an ageing population will begin to make itself felt over the next decade. In practice, the only successful method of reducing public spending as a share of GDP has been to impose tight curbs while the economy is growing rapidly. We shall be lucky if such an opportunity appears. The reality is that the usual victims of pressure on discretionary expenditure – nurseries and universities, culture and sport – should brace themselves for hard times, and Britain’s crumbling public infrastructure will crumble further.

Inflation reduces the value of public and private debts and makes many adjustments easier. It is much easier to fail to keep wages and salaries in line with inflation than to reduce them outright. It would be a pity to throw away the gains from a successful struggle over two decades to squeeze inflation from western economies. But the governments of Britain and the US may separately and privately conclude that such a choice is less bad than the other options they face. Even so, both countries are going to have to reconcile themselves to substantially higher tax rates.

A tax package to raise £70bn ($115bn, €82bn), probably the minimum required to stabilise Britain’s public finances, might put four points on the rate of income tax, take VAT to 20 per cent, freeze personal allowances and tax thresholds, add five points to corporation tax and collect a bit of extra revenue from the usual suspects such as alcohol, petrol and cigarettes. I wouldn’t want to be the political front person for that package. Perhaps the Conservatives should give the finance portfolio back to Kenneth Clarke. In 1997 he lost the election no chancellor would want to lose. Whoever succeeds in 2010 will have won the election no chancellor would want to win.

UK recession on par with very worst year of Great Depression

The recession is now on a par with the very worst year of the Great Depression. The dire state the UK is in emerged on Tuesday as revised figures uncovered the full extent of the country's economic contraction. The economy shrank by 4.9pc in the year to the first quarter of 2009, the Office for National Statistics said. The fall in gross domestic product was significantly greater than had previously been calculated, as Government statisticians became aware of the full scale of the fall in company activity. "Clearly this is now the worst peacetime recession since the 1930s," said Michael Saunders, chief UK economist at Citigroup. "The worst contraction then was a year of around -5pc; this year will not be hugely different."

The contraction in GDP during the first quarter alone was 2.4pc, compared with previous estimates of 1.9pc, according to the ONS. This was the biggest one-quarter fall in 35 years. Moreover, the 4.9pc annual fall was the biggest since Government records began. According to statistics compiled by economic historian Angus Maddison, the contraction was the worst since 1931 – worse than any year during the Second World War and the demobilisation that followed. The revision was partly the result of a steeper fall in construction and services output than first thought. Economists had predicted a downward revision but not on that scale. The ONS also revealed that the recession started in the second quarter of 2008, a quarter earlier than previously thought.

Simon Hayes of Barclays Capital said that although the figures were historical, they had a direct bearing on future growth. He said: "It reinforces the message that the recent signs of 'green shoots' reflect a rebound from an extraordinarily sharp fall in activity earlier in the year. We continue to be cautious about seeing them as material news about the medium-term growth outlook, which is likely to be hamstrung by tight credit conditions and the need for fiscal consolidation." Liam Byrne, chief secretary to the Treasury, said it would not be revising its growth forecasts. "There have been some tentative signs that the fall in output is moderating and I remain confident but cautious about the prospects for the economy," he said.

George Osborne, the shadow Chancellor, said: "We hope the recovery comes as soon as possible but sadly we now know this recession has been longer and deeper than we had thought. This also means that in the future unemployment will be higher and Labour's debt crisis will be even worse." There was better news yesterday from Nationwide, which said that UK house prices rose for the third month out of the last four in June, by 0.9pc to an average of £156,442. House prices were 9.3pc lower than a year ago, marking the slowest rate of annual decline since July last year. In a further blow for the UK, newly released figures from the International Monetary Fund showed that international investors' enthusiasm for Britain has dimmed further, with a third consecutive decline in the proportion of sterling held by central banks and other institutions.

Just six families helped by UK Mortgage Rescue Scheme

Britain is facing a reposession timebomb, Vince Cable warned yesterday, as it emerged just six families have been helped by the Government's Mortgage Rescue Scheme. The scheme, which cost more than 280 million to put in place, was launched at the beginning of this year, with the Government saying it would reach its 6,000 target within two years. But increasing numbers of households are struggling to meet their monthly mortgage payments and face losing their homes amid the recession. Politicians described the figures as "absolutely pitiful", saying it didn't begin to address the true extent of the problem facing Britain's home owners.

Liberal Democrat Treasury spokesman Vince Cable said: "Repossession is a ticking time bomb. "The numbers of repossessions are likely to soar in the next two years because of rising unemployment. Temporary Government schemes are deferring the problem, not solving it." And he warned: "If interest rates start to rise next year, the problem will become even more severe." Almost 1,000 home owners are being evicted every week, according to the Council of Mortgage Lenders. Repossession numbers reached 12,800 in the first three months of this year, a rise of more than 50 per cent from 8,500 this time last year. Housing Minister John Healey said: "We have put in place help for home owners struggling with their mortgage at every step of the way."

But the problem is now so severe that the Government is establishing a new team to fast-track the cases of those most at risk of repossession. Under the Mortgage Rescue Scheme, eligible families can either get an equity loan to reduce their mortgage, or sell their home and remain as tenants. It is one of several Government measures to help struggling home owners, which include the Homeowners Mortgage Support Scheme, which allows home owners facing a loss of income to reduce their monthly mortgage payments for up to two years. By the end of May, 200 households had repossessions proceedings stopped while they were being assessed for the Mortgage Rescue Scheme.

U.S. Mortgage Applications Fall 19%, Defying Obama

U.S. mortgage applications fell last week by the most since February, defying efforts by President Barack Obama’s administration to revive the housing market. The Mortgage Bankers Association’s index of applications to purchase a home or refinance a loan dropped 19 percent to 444.8 in the week ended June 26 from 548.2 the prior week. The group’s refinancing gauge declined 30 percent to the lowest in seven months, while the index of purchases fell 4.5 percent.

Unemployment, which touched a 26-year high in May, and rising borrowing costs discouraged homeowners from refinancing, while a growing number of foreclosures sidelined potential buyers waiting for house prices to stop tumbling. Pending home sales showing contracts signed in May rose 0.1 percent, compared with a gain of 6.7 percent in April, the National Realtors Association said today.

"The run-up in mortgage rates is exacting a toll in terms of depressing mortgage applications," Brian Bethune, chief U.S. financial economist at IHS Global Insight in Lexington, Massachusetts, said in an interview. "The economy is in a phase of attempting to find a bottom. Anything that comes in the way of that, like higher rates, is going to mean it takes longer." Home loan rates climbed above 5 percent the week of May 29 for the first time in three months, according to mortgage bankers’ data, and have remained elevated relative to 10-year Treasuries.

The percentage of people who said they plan to buy a home in the next six months fell to 2.7 percent in June from 2.8 percent in May, the Conference Board in New York said yesterday. The mortgage bankers’ refinancing gauge decreased to 1,482.2, the lowest reading since November, from 2,116.3 the previous week, today’s report showed. The purchase index fell to 267.7 last week from a two-month high of 280.3. The share of applicants seeking to refinance loans plunged to 46.4 percent of total applications last week from 54 percent.

The average rate on a 30-year fixed-rate loan fell to 5.34 percent from 5.44 percent the prior week. The rate reached 4.61 percent at the end of March, the lowest level since the group’s records began in 1990. At the current 30-year rate, monthly borrowing costs for each $100,000 of a loan would be $558, or about $62 less than the same week a year earlier, when the rate was 6.33 percent.

The average rate on a 15-year fixed mortgage dropped to 4.81 percent from 4.93 percent the prior week. The rate on a one-year adjustable mortgage decreased to 6.52 percent last week from 6.54 percent, according to the mortgage bankers. Home loan rates tracked by McLean, Virginia-based mortgage buyer Freddie Mac climbed along with Treasury yields through late May and early June on investor concern that a greater supply of government debt being sold to fund federal spending would fuel inflation.

This year the Federal Reserve purchases of mortgage bonds guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae brought down the yields on those securities, allowing lenders to reduce rates on new loans and still sell them at a profit. Still, rising foreclosures that sell at discounted prices are flooding the market and depressing home values, according to Lawrence Yun, chief economist of the Chicago-based Realtors’ group.

This year the number of foreclosures may rise to 2.5 million, the highest on record, Yun said. Existing U.S. home sales in May rose 2.4 percent to an annual rate of 4.77 million, lower than forecast, and the median price was down 16.8 percent from the same month in 2008, according to the Realtors. It would take about 9.6 months to sell the nation’s 3.8 million unsold homes at the current sales pace, according to the Realtors.

"The worst is behind us but we’re a long ways off from a recovery in housing," said Mark Vitner, a senior economist at Wachovia Corp. in Charlotte, North Carolina. "Inventories are still elevated. We’re not expecting any strength in housing until the second half of 2010." About 20.4 million of the 93 million houses, condos and co- ops in the U.S. were worth less than their loans as of March 31, according to Seattle-based real estate data service Zillow.com.

Builders including Los Angeles-based KB Home are slashing prices and reducing the size of houses to compete with foreclosures. KB Home’s revenue fell 40 percent last quarter to $384.5 million and net orders dropped 31 percent to 2,910 homes, the company said June 26. The Washington-based Mortgage Bankers Association’s loan survey, compiled every week, covers about half of all U.S. retail residential mortgage originations.

ADP Estimates U.S. Companies Cut Payrolls by 473,000

Companies in the U.S. cut more jobs than forecast in June, according to a private report today, showing the labor market will be slow to improve even as other parts of the economy indicate the recession is abating. The 473,000 drop in the ADP Employer Services gauge followed a revised reduction of 485,000 workers in May that was smaller than previously estimated.

Job losses may mount as the bankruptcies of General Motors Corp. and Chrysler LLC ripple through manufacturing. Increased firings threaten to further restrain consumer spending at a time when the world’s largest economy is showing signs of stabilizing. "This is a weak number," Joel Prakken, chairman of Macroeconomic Advisers LLC, said on a conference call with reporters. "It’s a pretty clear indication that, while we’re not shedding jobs as rapidly as the first part of the year, the labor market is still in a state of decline."

Economists forecast the ADP report would show a decline of 395,000 jobs, according to the median of 29 estimates in a Bloomberg News survey. Projections ranged from decreases of 280,000 to 532,000. A Labor Department report tomorrow may show employers cut 363,000 workers from payrolls in June and unemployment rose to a 26-year high of 9.6 percent. The increase from May’s 9.4 percent jobless rate would be the smallest since November 2008.

The ADP report ran counter to other figures today that showed job cut announcements in June fell 9 percent to 74,393, the fewest in more than a year, from 81,755 in June 2008, according to Chicago-based placement firm Challenger, Gray & Christmas Inc.. It was the first year-over-year decrease since February 2008. The ADP report showed a loss of 250,000 workers in goods- producing industries including manufacturers and construction companies. Employment in manufacturing dropped by 146,000. Service providers cut 223,000 workers. Companies employing more than 499 people reduced their workforces by 91,000 jobs. Medium-sized businesses, with 50 to 499 workers, cut 205,000 jobs and small companies decreased payrolls by 177.000.

"We are still months away from a trough in employment and the resumption of net employment gains is going to have to wait until early 2010," said Prakken. "Given that economic gains will be modest in coming quarters, I would see employment declining several more months." The ADP report is based on data from 400,000 businesses. ADP began keeping records in January 2001 and started publishing its numbers in 2006.

Pending Sales of Existing Homes in U.S. Increased 0.1% in May

The number of Americans signing contracts to buy previously owned homes rose for a fourth consecutive month in May, a sign the four-year slump in housing sales may be bottoming out. The 0.1 percent gain in the index of signed purchase agreements, or pending home resales, followed a 7.1 percent rise the prior month that was bigger than previously estimated, the National Association of Realtors said today in Washington. The May reading was up 4.6 percent from the same month a year earlier.

Collapsing home prices, historically low mortgage rates and tax incentives are making housing more affordable for Americans, helping to stabilize sales that have fallen since September 2005. Still, with unemployment forecast to reach 10 percent this year, home purchases may languish at low levels for months before a recovery emerges. "We’re starting to see sales stabilizing," Michael Gregory, a senior economist at BMO Capital Markets in Toronto, said before the report. "We’ve probably reached bottom or are close to that."

Economists forecast the index would remain unchanged in May after a previously reported 6.7 percent gain the prior month, according to the median of 36 projections in a Bloomberg News survey. Estimates ranged from a 3 percent drop to an increase of 7 percent. Pending resales are considered a leading indicator because they track contract signings. The National Association of Realtors’ existing-home sales report tallies closings, which typically occur a month or two later. The group, whose pending data goes back to January 2001, started publishing the index in March 2005.

Two of four regions saw an increase in pending sales, today’s report showed, led by a 3.1 percent month-on-month rise in the Northeast and a 2.2 percent gain in the West. Pending resales fell 1.7 percent in the South and 1.3 percent in the Midwest. The agents’ association reported last week that home resales increased 2.4 percent in May, a second consecutive gain that reinforced the case that the slump in home sales may level out this year. The median price dropped 17 percent from a year earlier, the third-biggest decline on record.

Rising foreclosures have pulled down median home prices by nearly a third from their peak in mid-2006, boosting demand. Foreclosure filings, including default and auction notices as well as property seizures, climbed 18 percent in May from a year earlier, according to Irvine, California-based RealtyTrac Inc. Distressed sales accounted for about 33 percent of existing homes sold in May, according to the agents’ association on June 23.

Federal Reserve purchases of Treasuries and mortgage securities also brought mortgage rates down to 4.78 percent in early April, the lowest since records began in 1971. They have since risen to 5.42 percent in the week ended June 25, still low levels by historic standards, according to Freddie Mac, the biggest buyer of mortgage securities. In addition, the Obama administration’s economic stimulus plan provided an $8,000 tax credit for first-time home buyers for purchases completed before Dec. 1.

Still, tight credit and job losses exceeding 6 million since the recession began in December 2007 have turned most Americans cautious about making big-ticket purchases. Homebuilders see little relief in sight. Sales of new homes will remain little changed in coming months because of low consumer confidence and the difficulty would-be buyers have getting loans, Pulte Homes Inc. Chief Executive Officer Richard Dugas said at an investor conference June 23.

"Buyers are unwilling and unable to take on new mortgages," Dugas said at conference in Boston. "Despite the record fall in prices and the tremendous deal that consumers get relative to the 30-year mortgage rates where they are today, we’re still having difficulty convincing people to get into the market."

Amid plummeting sales, auto bankruptcy debate rages on

Automakers rolled out their June sales reports Wednesday, adding some serious heat to the debate over whether bankrupting two of the nation's biggest carmakers was the right or wrong thing to do. Of Detroit's former Big Three, Ford Motor Co. was first out with its numbers. It sold nearly 11% fewer cars and pickups than it did a year ago. According to Ford, that's great news. Given the economy, it could have been much worse. And auto industry analysts certainly expected worse, predicting a sales decline closer to 15%.

At the same time, Ford can rightfully claim to have grabbed market share away from General Motors and Chrysler, both of whom were forced to walk the plank by President Barack Obama. Obama had no confidence they could ever get back on their feet financially without a good dunking in bankruptcy court. GM's June sales fell 33% from a year ago, while Chrysler's fell 42% -- both slightly worse than analysts expected.

These numbers bolster the conviction of anyone arguing that the public will not buy a new car from a company in bankruptcy. It also stands to reason that a wary public would gravitate toward Ford, which they did -- sort of -- if we look past the fact that their sales were still well below where they stood a year ago. But that doesn't silence those who argued that extensive government meddling in the industry is bound to give GM and Chrysler an unfair advantage over Ford as they emerge from Chapter 11.

We won't know whether Ford's decision to spurn federal bailout money was the right long-term strategy until GM and Chrysler can point to a full month of sales without the stigma of bankruptcy. For Chrysler, that will be July. For GM, it's likely to be before the end of summer. By then, they will also have shed billions of dollars worth of costs that landed them in this mess in the first place.

When that day arrives, will Ford still be holding a competitive edge? Hard to say. At that point, however, the game reverts to basics. All the publicity points Ford scored for its go-it-alone attitude will evaporate under the harsh realities of price and quality. In other words, the product will trump public sentiment.

The NYC Real Estate Collapse Keeps Accelerating

We noted earlier that real-estate in the northeast--and in New York City especially--hasn't fared nearly as badly as many other places in the country. Specifically, NYC real estate is now down 21% from the peak, according to the April Case Shiller index. That compares to 54% in Phoenix. Ah, but there's a catch. Phoenix real estate has fallen so far so fast that the rate of collapse is finally beginning to decelerate. Not so, NYC. In April, the NYC price decline accelerated to 13% year over year, a new record for this cycle. And it will probably continue to accelerate, en route to at least a 40% total decline.

Cracked Houses: What the Boom Built

Robert and Kay Lynn lay in bed shortly after closing on their new home in the Blue Oaks subdivision in Rancho Murieta, Calif., abutting an 18-hole golf course. They were listening to the "pop, pop, pop" of what they thought were acorns falling onto the roof. The Lynns soon realized those were not acorns dropping on the roof. "Little did we know it was the house cracking," says Mrs. Lynn, 67 years old. Mr. Lynn, 68, says they bought the property in 2002 for $357,000 as a weekend home and an investment. The stucco house was moving and shifting, with part of it subtly pitching toward the golf course, resulting in cracks and fissures in the walls, ceiling and floors, the couple says.

Many of their neighbors say they had similar problems. In the Sacramento Valley subdivision of about 250 houses, more than half the residents have reported some type of flaw. The Lynns and dozens of their neighbors last year filed construction-defect lawsuits against the builders, and the lead case is expected to go to trial next week. They are seeking enough money to permanently repair the houses, a figure expected to total millions of dollars. A spokeswoman for the builders, Reynen & Bardis Development LLC, said they would have no comment pending litigation, but a response the company’s attorneys filed with California Superior Court said time limits for some of the plaintiffs’ claims had run out.

Whatever the outcome of the case, hundreds of thousands of people from California to Georgia say their almost-new homes need costly repairs because of construction defects. The furious pace of home building from the late 1990s through the first half of the 2000s contributed to a surge in defects, experts say. It caused shortages of both skilled construction workers and quality materials. Many municipalities also fell behind inspecting and certifying new homes.

At the height of the boom in 2005, more than two million houses were built in the U.S., according to the National Association of Home Builders, a trade group. Criterium Engineers, a national building-inspection firm, estimates that 17% of newly constructed houses built in 2006 had at least two significant defects, up from 15% in 2003. Residential construction-defect claims filed with insurance companies in the current housing slump have been receding, "but the ones that are being filed are pretty severe in terms of the total damage alleged," says Paul Amirata, vice president of claims for Axa Insurance Co. in New York, a unit of AXA SA.

James Wadhams, a Nevada lobbyist who represents builders and insurers, says homeowners are filing lawsuits mainly because home inspectors and attorneys are "prospecting" in new subdivisions. Like California, Texas and Florida, Nevada experienced a surge in construction-defect claims in recent years. Because of tumbling real-estate values, those stuck with faulty houses say repairs often cost more than the homes are now worth. Many say they can’t refinance their mortgages or sell, and they have no equity to leverage for repairs.

Defects are also a concern for those shopping for a home. Owners generally are required to disclose housing defects to potential buyers. Buyers of new homes should scrutinize purchase and warranty contracts with a real-estate attorney, with special attention to arbitration clauses and liability releases. One of the best defenses against buying a defective house is a thorough inspection by a state-licensed building-inspection engineer, experts say.

Charlene Croal, 34, a consultant, says it would cost $228,000 to fix her nearly nine-year-old house in North Branch, Minn., though the house would be valued at only $190,000 today if it were in good condition. Its interior is riddled with mold because of water seepage, partly caused by a faulty roof and poorly installed windows, she says. She and her husband relocated their family of seven because of health problems linked to the mold, says Ms. Croal, who did not name the builder.

Owners of defective properties say they’re finding it even harder to get repairs now because of rising builder bankruptcies. Some builders, especially smaller ones, also carried inadequate liability insurance, construction experts say. Other homeowners say they are hamstrung by mandatory binding arbitration clauses in purchase contracts and new-home warranties, as well as "right to cure" laws, which require homeowners to notify builders and give them a chance to remedy a defect before the homeowners can file a lawsuit. More than 30 states have some type of right-to-cure legislation, according to the home-builders group. The NAHB says it "strongly supports" the option of using "alternative dispute resolution including mandatory, binding arbitration in consumer contracts," saying litigation is an inefficient means to resolve construction-defect disputes.

In Rancho Murieta, residents say they just want to save their homes. It turned out that much of Blue Oaks Estates was built on clay soil that expands in the rainy season and contracts in the scorching summers, the builder, Reynen & Bardis, acknowledges. This is damaging the homes’ foundations and subtly twisting the frames, causing homes to slowly pull apart—as evidenced by cracking floors, walls and ceilings, separating gutters, and jammed windows and doors.