Washington, D.C. Ingenious Prohibition-era fashion accessory, the cane-flask.

Ilargi: Foreclosures. I’ve never been foreclosed on. I can only imagine what it must feel like, be like. Having to tell your little children that they will never see their home again. That they will now live with grandma, or in a smaller place, or a tent.

"More than 1.5 million properties received a default or auction notice or were seized by banks in the six months through June, the Irvine, California-based seller of default data said today in a statement. That’s a 15 percent increase from the year earlier. One in 84 received a filing."

Annualized, that's 3 million homes, or one in 42 U.S. households, which directly affects some 10 million people, and indirectly perhaps as much as a third of the population, with neighbors, suppliers, family etc etc. tossed in.

We’re threatening to become blind and immune to numbers. "Trillion" is a household term, where it never was until 2 years ago, like almost no-one would have known what a tsunami was until one happened, and now everybody thinks they do. The effect of billion and trillion becoming so normal in our daily language, what does it mean to those of us not directly impacted that 10 million of our fellow citizens are under threat of losing their homes?

It has become such a seemingly insignificant number, 10 million. Still, it’s more than New York City’s entire population, and it's more than the biggest 7-8 states in the country.

The main factor these days in foreclosure numbers is unemployment. Initial job claims fell, and the hallelujah chanters are out in droves. Praise the deity, only 522.000 people (unrevised) applied for claims in the past week. All we need to feel better is for a number to be smaller than another number, or bigger where that applies. There are lots of voices out there who would argue that Goldman's multi-billion salary and bonus package is great news. The government is among those voices. So is Congress.

The idea is that the economy has been saved because a combination of first, childish and borderline constitutional loosened accounting regulations, and second, "Federal” Treasury Reserve pump and dump practices financed with taxpayer funds, have left the biggest banks standing. To date. And if Wall Street is alright, so are we all, or so goes the train of "reasoning", which is surprisingly hardly ever questioned.

The notion that the trillions in taxpayer money might alternatively have been used to aid the rightful owner of that money, the taxpayer, seems to have been completely lost in the smoke screens so expertly drawn up (or is that down?) by Washington, Lower Manhattan and the media they have a mutually parasitic relationship with.

Goldman Sachs has received a lot more public money than it has given back, so much is clear, but that won't prevent it from paying out grossly $500.000 per employee (an amount that may vary depending on how many toilet attendants you’d add in) in a year that has already seen 2.5 million jobs lost in the nation, and we're only halfway through.

It's simply not somewhat normal, or a little bit so, or defensible, or anything like that. It's perverted, it's morally repulsive, it's where Washington meets Mugabe and Kim-Jong-Il.

It would be one thing if Goldman and JPMorgan would have escaped the crisis, and applied real smart -legal- techniques to make a killing in the face of adversity. They haven't. They can stand up straight the way they do today, they can pay their hefty salaries (hefty in the real world), simply and only because the tax revenues collected from the people who are now thrown out on the street, both at their jobsites and at their homes, have been used to prop up Goldman but not the very people who've paid those taxes.

There is something so inherently wrong about this that there is no chance at all that it will turn out good. We're not talking some kind of honest mistake here.

There may be people, more like lost souls, in Washington, who actually believe that banks need to be saved ahead of people, that the sky would fall if Goldman would be no more. But the vast majority of them know very well that that is not true. They use the money that belongs to the millions, who have typically voted for them, to secure their own power positions.

This is a very fundamental issue. And there's no chance of changing it until you change the entire system. Which looks very, and increasingly, unlikely. It's much easier to "believe" that whoever you voted for will change it for you. Which they won't do, because it would endanger the power they have given up -the rest of- their lives and all of their innocent childhood dreams for.

As far as I can see, the growing indifference, the desensitization, about the numbers of unemployed and foreclosed upon fellow Americans is right up there with the refusal to see what government and Congress are really up to. Our perception of reality is not some constant factor. The only thing constant about it is that it changes constantly. You don't have an opinion, it is being custom-made for you day by day. Political campaign managers and main stream media leaders know this, be it consciously or unconsciously.

And if they convey the message in the approprite fashion, they know you will accept it, and even make it your own. Yes, even if that hurts every single one of your own personal interests. You're made that way, you want to belong.

Don't feel bad in your miserable poverty. Think of the greater good. You're saving the system that made you poor. Surely, that's a small price to pay.

Foreclosure Filings in U.S. Reach Record 1.5 Million

U.S. foreclosure filings hit a record in the first half, a sign that job losses and falling property prices deepened the housing recession, according to RealtyTrac Inc. More than 1.5 million properties received a default or auction notice or were seized by banks in the six months through June, the Irvine, California-based seller of default data said today in a statement. That’s a 15 percent increase from the year earlier. One in 84 U.S. households received a filing.

"People are losing their jobs, seeing their income go down and are underwater on their mortgage," Richard Green, director of the Lusk Center for Real Estate at the University of Southern California in Los Angeles, said in an interview. "It’s a toxic combination." Home prices in 20 major U.S. metropolitan areas dropped 18.1 percent in April from a year earlier, according to the S&P/Case-Shiller index. The unemployment rate rose to 9.5 percent in June, the highest since 1983, bringing the total number of lost jobs to about 6.5 million since the recession started in December 2007, the Labor Department said.

Defaults by subprime borrowers with poor credit histories spurred the housing recession and spread to prime borrowers as home prices and sales declined. The Mortgage Bankers Association said May 28 that prime fixed-rate home loans to the most creditworthy borrowers accounted for 29 percent of new foreclosures in the first quarter, the biggest share of any type of loan. One in eight Americans is now late on a payment or already in foreclosure, the Washington-based mortgage group said.

Twenty of the 50 U.S. counties with the highest foreclosure rates were in California and 12 were in Florida, RealtyTrac said. Clark County, Nevada, home to Las Vegas, had the highest rate in the nation with one in 13 households receiving a filing, according to RealtyTrac. Lee County, Florida, home to Fort Myers and Cape Coral, ranked second at one in 14. Three counties tied for third place at one in 15 households: Merced, California; Osceola, Florida; and Lyon, Nevada. Riverside, California ranked sixth; Nye, Nevada was seventh; and San Joaquin, San Bernardino and Stanislaus, all in California, ranked eighth through 10th, RealtyTrac said.

"I don’t see any turning of the tide," said Donald Haurin, an economics professor at Ohio State University in Columbus. "The effect of more foreclosures will be continued downward pressure on house prices, and lead to difficulty making mortgage payments that are continuing to reset." Payment-option adjustable rate mortgages will contribute to higher defaults, said Rick Sharga, executive vice president of RealtyTrac. Option ARMs allow borrowers to pay less than the interest they owe each month, tacking on the difference to their total debt and creating the potential for bigger bills in the future.

About three quarters of those loans will adjust to require higher payments next year and in 2011, with the peak coming in August 2011 when about 54,000 loans recast, according to data from First American CoreLogic of Santa Ana, California. Government and lender-supported plans to help troubled homeowners -- including President Barack Obama’s $275 billion pledge to jumpstart sales and encourage banks to modify sour loans -- have had little effect, Haurin said.

As many as 3.2 million U.S. households will get a foreclosure filing by the end of the year, Sharga said. "Stemming the tide of foreclosures is a critical component to stabilizing the housing market, so it is imperative that the lending industry and the government work in tandem to find new approaches to address this issue," James Saccacio, RealtyTrac’s chief executive officer, said in the statement. More than 8.3 million U.S. mortgage holders owed more than their homes were worth and an additional 2.2 million borrowers will be "underwater" on their loans if prices decline another 5 percent, First American said March 4.

Foreclosure filings in the second quarter totaled a record 889,829, up 11 percent from the first quarter and up 20 percent from a year earlier, RealtyTrac said. June filings were 336,173, the third highest monthly total in records going back to January 2005. Nevada had the highest foreclosure rate in the first half, with one in every 16 households receiving a filing, RealtyTrac said. A total of 68,708 properties were affected, 61 percent more than in the first half of 2008. Arizona had the second highest rate, one in 30 households; Florida was third at one in 33; and California ranked fourth at one in 34.

Other states in the top 10 included Utah, Georgia, Michigan, Illinois, Idaho and Colorado. California led in total filings with 391,611, an increase of 15 percent from a year earlier; followed by Florida at 268,064 for a 42 percent increase, RealtyTrac said. Arizona was third with 89,799 filings, up 55 percent, and Illinois was fourth with 68,932, up 29 percent. Other states in the top 10 for their sheer number of foreclosures and defaults were Nevada, Michigan, Ohio, Georgia, Texas and Virginia, said RealtyTrac, which collects data from more than 2,200 counties representing 90 percent of the U.S. population.

Rising unemployment accelerates foreclosure crisis

Relentlessly rising unemployment is triggering more home foreclosures, threatening the Obama administration's efforts to end the housing crisis and diminishing hopes the economy will rebound with vigor. In past recessions, the housing industry helped get the economy back on track. Home builders ramped up production, expecting buyers to take advantage of lower prices and jump into the market. But not this time. These days, homeowners who got fixed-rate prime mortgages because they had good credit can't make their payments because they're out of work. That means even more foreclosures and further declines in home values.

The initial surge in foreclosures in 2007 and 2008 was tied to subprime mortgages issued during the housing boom to people with shaky credit. That crisis has ebbed, but it has been replaced by more traditional foreclosures tied to the recession. Unemployment stood at 9.5 percent in June and is expected to rise past 10 percent and well into next year. The last time the U.S. economy was mired in a recession with such high unemployment was 1981 and 1982. But the home foreclosure rate then was less than one-fourth what it is today. Housing wasn't a drag on the economy, and when the recession ended, the boom was explosive.

No one is expecting a repeat. The real estate market is still saturated with unsold homes and homes that sell below market value because they are in or close to foreclosure. "It just doesn't have the makings of a recovery like we saw in the early 1980s," says Wells Fargo Securities senior economist Mark Vitner, who predicts mortgage delinquencies and foreclosures won't return to normal levels for three more years. Almost 4 percent of homeowners with a mortgage are in foreclosure, and 8 percent on top of that are at least a month behind on payments — the highest levels since the Great Depression.

Because home values have declined so dramatically, many people can't refinance. They owe far more to the bank than their properties are worth. To combat the foreclosure crisis and help stabilize home prices, President Barack Obama launched an effort in March to help 9 million people avoid foreclosure by helping them refinance or modifying their loans to lower their payments. But that's of no help to people who can't even afford the lower payments because they're making much less money or have lost their jobs altogether.

As of early July, about 160,000 borrowers were enrolled in three-month trials of loan modifications under the plan, according to preliminary figures from the Treasury Department. Meanwhile, more than 1.5 million American households were threatened with losing their homes in the first six months of this year, foreclosure listing service RealtyTrac Inc. said Thursday. Last week, Treasury Secretary Timothy Geithner and Housing Secretary Shaun Donovan outlined their frustrations in a letter to 27 mortgage companies, saying the industry needs to "devote substantially more resources to this program for it to fully succeed."

While high-level pressure on the mortgage industry could help, "There's nothing there that's going to help people who don't have jobs," said Jay Brinkmann, chief economist with the Mortgage Bankers Association. Just ask anyone in Rockford, Ill. Over the last generation, the blue-collar city of about 157,000 northwest of Chicago has struggled to attract jobs as auto suppliers, aerospace companies and machine shops closed. Today, unemployment runs at more than 13 percent.

Robin and Thomas Lewis, who live there, once earned a combined $100,000. But he lost his job in shipping and receiving at a robotics company, and she had to close her at-home day care business. They are staring at an October deadline for foreclosure. Their water service was cut off in February because they couldn't afford to pay the bill. Since then, they and their two teenage sons have been showering at the homes of friends and family and filling up gallon jugs of water to drink at home.

Robin Lewis, 41, found a job as a cashier at Wal-Mart and is taking night classes in hopes of becoming an accountant. Her 43-year-old husband got a job through a temp agency working as a machine operator. "At least now we have some income coming in," Robin Lewis said. She hopes it's enough to persuade the mortgage company to modify their 30-year fixed-rate loan. They are meeting with a housing counselor next week to work on their application for a loan modification.

Around the country, the relationship between rising unemployment and foreclosures is growing. An Associated Press analysis of more than 3,100 U.S. counties found a much stronger link between foreclosure rates and unemployment this year than in 2007. According to April figures, some of the highest unemployment rates in the country are in California cities like Merced, Modesto and Fresno that have been struck hardest by the foreclosure crisis. In those areas, home prices have been cut in half. Even in areas where unemployment is lower, borrowers are struggling.

Claudia Escobar, a 44-year-old single mother in Clifton, Va., lives in a cozy three-story brick town house on a tree-lined suburban street about 25 miles west of the nation's capital. A combination of family health problems and the loss of her $50,000-a-year job at an accounting firm have made it impossible to make her $900 mortgage payment. She has staved off foreclosure so far and hopes to land a job while her lender evaluates her application for a loan modification. Her 14-year-old son, Tommy, broke down in tears when he found out that his mother lost her job. "That has to be the most devastating point since we lived here," she said, sobbing. "He keeps asking me every now and then if we're going to lose the house."

U.S. Jobless Claims Slump on Timing of Auto Shutdowns

The number of Americans filing claims for unemployment benefits fell last week to the lowest level since January, depressed by shifts in the timing of auto plant shutdowns. Initial jobless claims dropped by 47,000 to 522,000, lower than forecast, in the week ended July 11, from a revised 569,000 the prior week, the Labor Department said today in Washington. The number of people collecting unemployment insurance plunged by a record 642,000, also reflecting seasonal issues surrounding the closures at carmakers.

A Labor analyst said the distortions may play havoc with claims data for another couple of weeks. General Motors Co. and Chrysler Group LLC accelerated shutdowns this year heading into bankruptcy, months before the traditional July closings. Through the gyrations, job losses may subside amid signs the housing and manufacturing slumps are easing. "The automotive industry shutdowns have occurred and they aren’t occurring when the seasonals expected them to," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York. "We ought to see in the next couple of weeks claims come back to something resembling an underlying trend" in the 600,000 range, he said.

Stocks were little changed in early trading in New York and 10-year Treasury notes gained, pushing their yield down to 3.54 percent at 9:50 a.m. in New York from 3.61 percent late yesterday. Jobless claims were forecast to decline to 553,000 from an originally reported 565,000 the prior week, according to the median projection of 41 economists in a Bloomberg News survey. Estimates ranged from 480,000 to 605,000. Stock-index futures were lower and Treasury securities rose. Contracts on the Standard & Poor’s 500 Index fell 0.1 percent to 926 as of 8:45 a.m. in New York. Benchmark 10-year notes yielded 3.58 percent, down 3 basis points from yesterday.

Job cuts may be slowing after employers eliminated about 6.5 million positions since the recession began in December 2007, the most of any downturn since the Great Depression. Even so, hiring is limited and economists surveyed by Bloomberg project the jobless rate will exceed 10 percent by early 2010, restraining the consumer spending that accounts for two thirds of the economy. The four-week moving average of initial claims, a less volatile measure, dropped to 584,500 last week from 607,000.

Continuing claims dropped to 6.27 million in the week ended July 4 from 6.92 million the prior week. The unemployment rate among people eligible for benefits, which tends to track the jobless rate, plunged to 4.7 percent in the week ended July 4, from 5.2 percent the prior week. Twenty-six states and territories reported an increase in new claims for the week ended July 4, while 27 reported a decrease. These data are reported with a one-week lag. Initial jobless claims reflect weekly firings and tend to rise as job growth -- measured by the monthly non-farm payrolls report -- slows.

Federal Reserve officials expect the U.S. economy to contract less this year than they had anticipated in April, even as unemployment climbs to as high as 10 percent, according to their latest forecasts released yesterday.

"Most participants saw the economy as still quite weak and vulnerable to further adverse shocks," the central bank said in minutes of the Federal Open Market Committee’s June 23-24 meeting. Weekly jobless claims tend to be volatile at this time of the year, when automakers idle workers while they re-equip factories to build new models. Payrolls in June fell more than economists forecast and the unemployment rate reached 9.5 percent, the highest level since 1983, Labor said July 2.

GM, which emerged from bankruptcy this month as a majority government-owned carmaker, plans to end the year with 64,000 fewer workers in the U.S., a 30 percent decrease from Dec. 31, the Detroit-based company said this week. Other industries continue to trim workers. Lockheed Martin Corp., the world’s largest defense company, will cut 600 more jobs in New York following the cancellation last month of its contract to develop and build the next U.S. presidential helicopter.

The cuts will contribute to a 25 percent reduction in the total number of workers at the Owego facility to about 3,000 by the end of this year from 4,000 in January, spokesman Troy Scully said in an interview on July 14

Advanta Corp., the credit-card company that stopped lending as defaults soared, plans to cut its workforce by about half after shutting off accounts for small-business customers. Advanta will have fewer than 200 employees after the reduction, the Spring House, Pennsylvania-based company said July 10 in a regulatory filing.

Part-Time Workers Mask Unemployment Woes

In California and a handful of other states, one out of every five people who would like to be working full time is not now doing so. It is a startling sign of the pain that the Great Recession is inflicting, and it is largely missed by the official, oft-repeated statistics on unemployment. The national unemployment rate has risen to 9.5 percent, the highest level in more than a quarter-century. Yet it still excludes all those who have given up looking for a job and those part-time workers who want to be working full time.

Include them — as the Labor Department does when calculating its broadest measure of the job market — and the rate reached 23.5 percent in Oregon this spring, according to a New York Times analysis of state-by-state data. It was 21.5 percent in both Michigan and Rhode Island and 20.3 percent in California. In Tennessee, Nevada and several other states that have relied heavily on manufacturing or housing, the rate was just under 20 percent this spring and may have since surpassed it.

Almost nobody believes that unemployment has finished rising, either. On Tuesday, President Obama said he expected it to "tick up for several months." It’s fair to say, then, that the downturn is moving into a new stage. It has already been through three: the prologue, when credit markets began to quiver in 2007; the big shock, when the collapse of Lehman Brothers, in September 2008, led into almost six months of terrible economic news; and the stabilization, when the news became more mixed.

Now comes Stage 4: the slog. "It’s not going to be an overnight turnaround," as Bernard Smith, an unemployed engineer in Greenville, S.C. (a state where the broader jobless rate was 20.5 percent this spring), who has been looking for work since May, told me. "It’s going to take time." Various indicators suggest the nation’s economic output could start growing again this summer, which would mean the end of the recession. But the economy will still be weighed down by troubled credit markets and huge household debts. So it may be awhile before growth is fast enough to persuade companies to hire large numbers of workers.

This would make for an odd contrast, in which the economy was getting better but feeling worse. These broad measures of unemployment and underemployment could approach a hard-to-fathom 25 percent in California, up from 12 percent a year ago. In several other states, including Florida, North Carolina and Washington, the rate could yet reach 20 percent — and, unfortunately, the stimulus bill does not do a good enough job of targeting the hardest-hit states. After a decade in which household income barely outpaced inflation, a slow recovery could leave many people hard-pressed and frustrated. In just the last week, the Labor Department reported that the number of people filing new claims for jobless benefits dropped — but so did consumer confidence and Mr. Obama’s approval rating. Welcome to the slog.

•

A jobless rate of 20 percent is clearly a bit shocking. It sounds like something out of the Great Depression, and as bad as this recession is, it’s no Great Depression. So what’s going on? For starters, this rate does include part-time workers who want to be full time. Such people are not quite unemployed or fully employed. On average, they are working three days a week, and many are struggling to get by. Richard Smith (not related to Bernard) and his wife, Lynn, for example, moved from Michigan to Charlotte, N.C., last summer, after he had been laid off from white-collar jobs by both Ford and General Motors in the last five years. But after talking with 35 headhunters and sending out hundreds of applications, Mr. Smith, who’s 58, still hasn’t found full-time work.

Instead, he works a few days a week at a golf shop, repairing clubs and making $9.50 an hour. The money has helped the Smiths buy a bargain-basement foreclosed house. "You get depressed, obviously," he said. "But that never changes my attitude about my capability." Part-time workers like Mr. Smith make up about one-third of those counted in the broader rates, which leaves roughly 13 percent of the work force in states like Oregon and Michigan who are completely out of work.

And even that is probably an understatement, because it includes only people who have looked for work at some point in the last year. (To be counted in the official jobless rate, someone must have looked in the last four weeks.) Anyone who has spent time in old industrial areas knows that plenty of former factory workers would like a decent-paying job but haven’t looked for one in more than a year. When I saw these statistics last week, my first reaction was to wonder why there weren’t more tangible signs of joblessness. Many communities are pockmarked with foreclosure signs and postponed construction projects. But unless you go looking for the unemployed, they are mostly invisible.

As Susan Rose — a lawyer at a nonprofit group in South Carolina who represented the unemployed until she herself was recently laid off — said, "It’s almost as if unemployed people are a forgotten, silent crowd." The stimulus bill is helping somewhat. It has extended jobless benefits and prevented layoffs by state and local governments. A lot more stimulus is on the way, too. So far, about $90 billion has gone out the door, according to Moody’s Economy.com. From now until the end of 2010, an additional $25 billion or so will be spent every month.

But the stimulus isn’t helping as much as it could, because too much of the money is going to states that need it the least. In most of the Great Plains and Mountain West, the broad jobless rate was still below 12 percent this spring. In North Dakota, it was 7.8 percent. Yet these are some of the places receiving a disproportionate share of stimulus, as recent articles by The Associated Press and The Times have shown. It’s a classic case of politics trumping economics.

Barring an unexpected bit of bad news — something that turns the slog into a relapse — Congress and the White House are not likely to pursue another stimulus bill until September. By then, more of the money from the last stimulus will have been spent, and the economy’s condition will be clearer. If lawmakers do decide more is needed, they would do well to remember that this is not an equal opportunity recession. By September, one out of every four Californians — and Oregonians and South Carolinians and Michiganders — who would like to have a full-time job might not have one. Who ever thought we would be saying such a thing?

World Bank warns of deflation spiral

The World Bank has given warning that global economy will fall into a "deflationary spiral" unless urgent action is taken to reduce high levels of excess capacity in industry. Justin Lin, the bank’s chief economist, said factories running idle around world threaten to trap economies in a vicious cycle, risking further spasms of financial stress, requiring yet more rescue packages. "Significant excess capacity has been built up and unless this issue is addressed, we will face a deflationary spiral and the crisis will become protracted," he told an audience in Cape Town.

Mr Lin said capacity use had fallen to 72pc in Germany, 69pc in the US, 65pc in Japan, and as low as 50pc in some developing countries, mostly touching lows not seen in modern times. The traditional cure for countries caught in slumps is to claw their way back to health through devaluation, but this cannot be done today because the crisis is global. "No country can count on currency depreciation and exports as a way out of recession. Unless we deal with excess capacity, it will wreak havoc on all countries. There is urgent need for global, co-ordinated fiscal stimulus," he said.

Investments should be focused on infrastructure in poor countries that are bearing the brunt of the crisis. The downturn is already likely to trap over 50m more people in extreme poverty this year. Mr Lin said some $30 trillion has been wiped off global stock markets and a further $4 trillion off US house prices, creating powerful deflationary headwinds. While emergency measures have eased the financial crisis, they have not stopped it turning into a deeper "real economy" crisis entailing mass lay-offs.

The comments came as the Bank of Japan agreed to extend its quantitative easing (QE) policies – mostly the purchase of corporate debt – and warned that business investment is "declining sharply". Headline inflation has dropped to minus 1.1pc. Michael Taylor at Lombard Street Research said Japan has been too timid, repeating the error of its Lost Decade when it failed to carry out QE on a sufficient scale. "Japan is already back in deflation, and it is here to stay. This year the economy will shrink by around 7pc, dramatically increasing the output gap and intensifying deflationary pressures. Cash earnings are down 3pc in the last year,"

The Bank of Japan downgraded its growth forecast, predicting that the economy will contract 3.4pc in the fiscal year to next March. This follows a catastrophic fall in output at a 14.2pc an annual rate in the first quarter, the worst ever recorded. While industrial output has bounced over the summer, there are concerns that it may have been flattered by an "inventory rebound" as companies rebuild stocks. Eurostat confirmed on Wednesday that the eurozone has slipped into deflation. Prices fell 0.1pc in June.

Gary Shilling: Stock Market Will Crash As US Consumers Retrench

- The economy won't start to recover until 2010 (versus the current consensus of now). It will recover because the government will be forced into a second stimulus.

- The US consumer rules the world...and the US consumer is cutting back fast

- Consumer spending will drop from 70% of GDP to 60% as consumers pay down debt and go on a saving spree.

- Most recessions have a positive quarter or two of GDP, so if we get one, it won't mean anything.

- The S&P will plunge 35% to 600 by the end of the year.

- Buy Treasuries, Dollars

But isn't inflation going to turn dollars and Treasuries into toilet paper? That's what everyone's saying. They're wrong, says Gary. It's deflation we have to worry about. For the next 10 years, we're going to have chronic deflation, and the economy is going to grow at a paltry 2% per year.

The Doctrine of Preemptive Bailouts and the Biggest Bailout you haven’t Heard About: The U.S. Treasury Plan C and the $3.5 Trillion You will be Paying

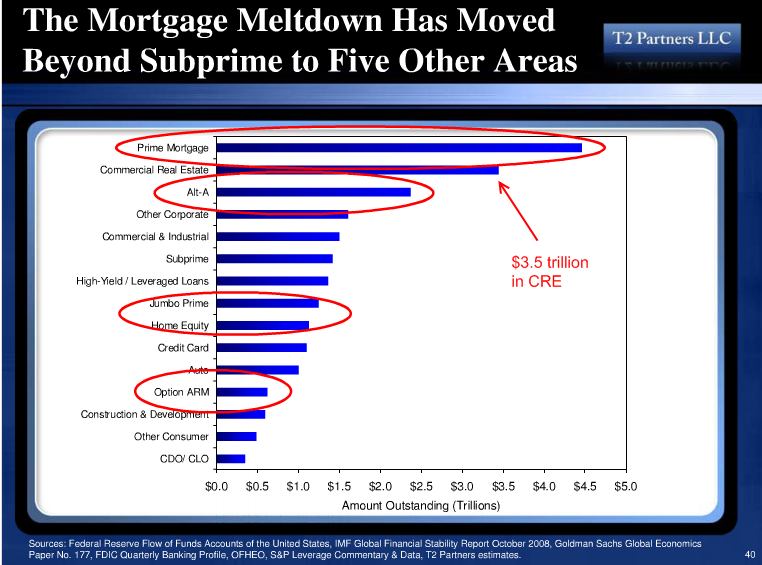

Last week a story which gained very little traction hit the financial newswires. The U.S. Treasury is working on an internal project informally called “Plan C” which seeks to deal with further problems in the economy before they occur. The anonymous report came out stating the administration is reluctant to commit any additional money especially to the level mentioned in the report. However this is a disturbing new development in our bailout nation since this is one of the first times that the U.S. Treasury will try to preemptively deal with a financial problem.The issues with this Plan C is that it is setup to be a buffer on further deterioration in various loan categories but the big one is commercial real estate. The commercial real estate market is gigantic and many of those loans are still active:

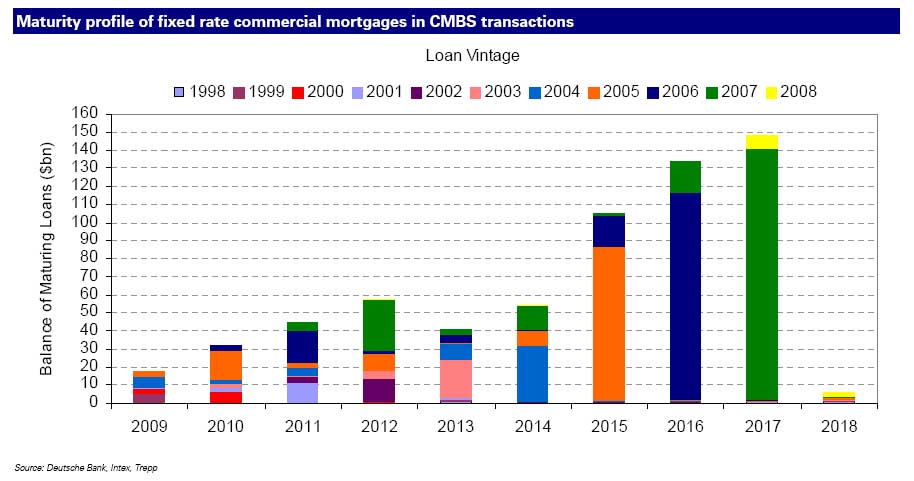

Some $3.5 trillion in commercial real estate loans are out in the market. The problem is complicated because commercial real estate holders simply rollover their debt into new loans. That of course has changed since the economy and credit markets have shutdown and many of these properties are now severely underwater. Take a look at how many loans will be turning over:

*Source: ZeroHedge

The amount of maturing loans in commercial real estate will double in 2010 and will continue upward into 2010. The chart is very clear and this is only for debt in CMBS and not held by regional banks which is over $2 trillion. This is the next multi-trillion dollar bailout you have yet to hear about. In fact, while many are discussing a second half recovery higher up officials are already planning a bailout for the commercial real estate industry. The challenge with this bailout is you are asking a public with 26,000,000 unemployed and underemployed Americans to shoulder the debt of largely speculative plays. To many it is palatable to bailout the residential real estate market because the public can understand that (even if it may be wrong) or bailing out the 2 large U.S. automakers. Yet bailing out the commercial real estate market is going to be a political nightmare.

Of course the U.S. Treasury would like you to believe this is merely a precaution but most of the last precautions we have heard about have turned out to be trillions and trillions in full on commitments shouldered by the American public:

“(WaPo) We are continually examining different scenarios going forward; that’s just prudent planning,” Treasury spokesman Andrew Williams said.

The officials in charge of Plan C — named to allude to a last line of defense — face a particular challenge in addressing the breakdown of commercial real estate lending.

Banks and other firms that provided such loans in the past have sharply curtailed lending.

That has left many developers and construction companies out in the cold. Over the next few years, these groups face a tidal wave of commercial real estate debt — some estimates peg the total at more than $3 trillion — that they will need to refinance. These loans were issued during this decade’s construction boom with the mistaken expectation that they would be refinanced on the same generous terms after a few years.

The credit crisis changed all of that. Now few developers can find anyone to refinance their debt, endangering healthy and distressed properties.”

The end of the road has been reached for commercial real estate. Many regional banks jumped into the commercial real estate market since they had little chance of competing with big subprime and Alt-A mortgage factories like WaMu or Countrywide. Many regional banks saw this as a way to stay competitive in local regions across the country. This is a much more diverse problem and the tentacles of the commercial real estate bust will be felt in every state.

These loans were made on strip malls, doctor’s offices, and drive-through restaurants for communities that are hurting from the recession. This is an enormous amount of debt that is out there that will surely default since there is no way to refinance this debt since many of these projects are literally underwater. Take a look at the composition of over 8,000 banks and thrifts across the country:

Factoring in construction and commercial loans you arrive at a stunning 26 percent of all loans in FDIC banks and thrifts. This is a staggering figure and the U.S. Treasury is well aware of this. The question isn’t whether there will be major defaults here but who will shoulder the cost? So far, each consecutive bailout has largely been taken up by the U.S. taxpayer. The problem of course is the cost of all these bailouts will eventually catch up through a tanking dollar and possibly the long-term viability of our economy. Plan C is a preemptive bailout on an entire industry. The reason the government is devising a plan is that these loans will start going bad in large amounts and they are gearing up on a process of dumping this large mess on the American people. Yet it is going to be a politically hard sell for many to bailout a strip-mall from some large developer.

And make no mistake, the market for commercial loans is all but closed:

You are reading the above graph correctly. In the 1st quarter commercial loans fell by a stunning 50 percent on a quarterly basis. And the amount of bad loans is only growing:

If you haven’t heard of Plan C you soon will. The commercial real estate bailout is the next ploy from Wall Street and the U.S. Treasury.

Commercial Mortgage Bond Market Stays Shut as U.S. Loan Program Falls Flat

The U.S. government’s program to jumpstart commercial real-estate lending will probably fail to produce any debt sales for a second straight month, thwarting efforts to revive the market for bonds backed by hotels, shopping malls and offices. While there will likely be no new issuance for July, deals should materialize by October, Alan Todd, an analyst at JPMorgan Chase & Co., said in a telephone interview. The Federal Reserve’s effort to breathe life into the $700 billion commercial mortgage-backed bond market is being hampered as lenders balk at originating new loans with no way to guard against price swings on the debt.

Building a pipeline of commercial mortgages to bundle and sell as securities takes several months, and banks are unwilling to risk holding them on their books without a means to protect themselves from price declines, said Christopher Hoeffel, a managing director at Investcorp International Inc. in New York. "The problem needs to be solved to restart the market," Hoeffel said in a phone interview. "The government efforts are commendable, but they don’t get us all the way there."

Investors were able to get loans from Fed’s Term Asset- Backed Securities Loan Facility starting in June to purchase newly issued commercial mortgage-backed bonds. There were no sales under the program last month.

The Fed will announce later today how much it received in loan requests to purchase the debt for July, the first month investors could get loans to purchase older securities backed by commercial mortgage-backed bonds. Standard & Poor’s has started to cut the ratings on top- ranked commercial mortgage bonds, disqualifying the securities for the part of the program that finances so-called legacy assets, or bonds sold before Jan. 1. S&P said it my lower the ratings on $235.2 billion of the bonds.

Reluctant lenders aren’t the only ones holding up new issuance, according to Dan Gorczycki, a managing director of Savills, a real-estate investment banking firm based in New York. Loan servicers are increasingly giving extensions to borrowers in hopes conditions will improve, bringing activity to a standstill and damping the demand for new loans, Gorczycki said. "Everybody has got their head in the sand," Gorczycki said in an interview. Two-thirds of loans bundled and sold as securities, or about $410 billion, may have trouble refinancing maturing debt, and may have to put more cash into the property as values plummet and underwriting standards tighten, according to Richard Parkus, a Deutsche Bank AG analyst.

Generating new loans and averting a wave of foreclosures as borrowers fail to refinance maturing commercial mortgages is a cornerstone of the Fed’s effort to cleanse bank balance sheets and enable lending. Sales of commercial mortgage-backed bonds plummeted as the cost to sell the bonds became too high to originate new loans, choking off financing to borrowers. A record $237 billion in commercial mortgage-backed debt was sold in 2007, compared with $12.2 billion last year, according to JPMorgan. There have been no sales so far in 2009.

U.S. to Recover, May Need More Stimulus, Roubini Says

The U.S. economy may pull out of a recession by the end of the year and a second stimulus package would help broaden the recovery, said Nouriel Roubini, the New York University professor who predicted the financial crisis. "The free fall of the economy has stopped," Roubini said at a Chilean investors’ conference in New York. "The economy is still contracting but slowly." To help shore up growth, a second spending package may be needed by late 2009 or early 2010 totaling between $200 billion and $250 billion, Roubini said.

"We should continue with fiscal stimulus and we might need a second one," Roubini said. While the worst of the crisis is over, there’s still a "meaningful amount of weakness" in labor markets, industrial production and housing, he said. China, India and Brazil are among economies that may recover faster once the global economy picks up, Roubini said. He also mentioned Chile, Uruguay, Colombia and Peru as countries better-positioned to grow, in an interview at the conference. Countries in emerging Europe such as Hungary, Bulgaria and Ukraine face the biggest challenges, he said.

Moody’s says More Stimulus, Foreclosure Aid Likely Needed

Moody’s has issued the first in a series of Special Comments looking at whether and how fast (or rather, how slowly) various sectors of the economy are recovering. Focusing on corporates, it contains an overview of the economy and coverage of the following global industries: autos, base metals, chemical, consumer durables, homebuilders, media and entertainment, oil and gas, packaging, retail, steel, and transportation.

Moody’s answers some of the following questions for each of these industries:

- How is the credit picture different than it was a few months ago?

- Have conditions stabilized? Are they beginning to improve?

- Is improvement in credit conditions well-established or precarious?

- Why haven’t credit conditions gotten better?

- What has to happen to improve credit conditions further?

Moodys.com Chief Economist Mark Zandi writes that "Another round of fiscal stimulus may also be warranted. The current stimulus, which includes aid to state governments and unemployed workers, tax cuts and increased infrastructure spending, has not yet had time to work and it may very well succeed. It is no accident that the recession will wind down in the next few months as the stimulus payout ramps up. The impact on jobs and unemployment should show up more clearly later this year and early in 2010."However, given how surprisingly severe this economic downturn has been, it is only prudent to consider the need for even more temporary tax cuts and spending increases for next year. -Mark Zandi, Chief Economist, Moody’s.com

"The Obama administration will almost certainly have to significantly adjust its response to the foreclosure crisis, Zandi adds. " Foreclosures continue to surge, weighing heavily on already crashing house prices. As long as house prices are falling and undermining household wealth and the financial system’s capital base, a self-sustaining economic recovery will not take hold. For foreclosures to abate and house prices to stabilize anytime soon, policy efforts to mitigate foreclosures through loan modifications must soon begin to work more effectively. To date, the Obama administration’s foreclosure mitigation plan has not had a meaningful impact."

International Demand for Long-Term U.S. Assets Falls

International demand for long-term U.S. financial assets weakened in May as investors sold the most Treasury notes and bonds in six months. Total net sales of long-term equities, notes and bonds were $19.8 billion in May, compared with net purchases of $11.5 billion a month earlier, the Treasury said today in Washington. Net selling of government notes and bonds totaled $22.6 billion, the most since sales of $25.8 billion in November, after net buying of $42 billion in April.

As investors abroad dumped long-term Treasuries, purchases of U.S. stocks in May were the strongest pace since January 2008. The Obama administration is selling a record amount of government debt to finance a budget deficit that’s projected to approach $2 trillion this year, raising concern about American fiscal policy and spurring purchases of shorter-term U.S. debt. "There is great worry regarding overseas holdings of U.S. Treasuries," said Dan Greenhaus, an analyst at Miller Tabak & Co. in New York, in a report to investors after the report was released. Total monthly foreign investment flows dropped $66.6 billion in May, compared with a decline of $38 billion in April.

The report showed $21.8 billion in net sales by foreign governments of Treasury notes and bonds in May, while the same group of official investors purchased Treasury bills totaling a net $55.6 billion. Bills have maturities of a year or less. China, the biggest foreign holder of U.S. Treasuries, increased its holdings of government notes and bonds by $38 billion to $801.5 billion. Holdings in Hong Kong also increased. Japan, the second-biggest international investor, reduced its total by $8.7 billion to $677.2 billion. Russia’s holdings fell $12.5 billion to $124.5 billion. Holdings at Caribbean banking centers also fell, declining by $9.9 billion to $194.8 billion. Analysts had anticipated international net purchases of long-term U.S. assets of $16.5 billion, according to the median of five estimates in a Bloomberg News survey.

Net purchases of American equities rose $16.7 billion in May after rising $4.6 billion the prior month. The Standard & Poor’s 500 Index jumped 5.3 percent in May, the third straight month of increases. The Treasury’s reporting on long-term securities captures international purchases of government notes and bonds, stocks, corporate debt and securities issued by U.S. agencies such as Fannie Mae and Freddie Mac, which buy home mortgages. Foreign investments in U.S. agency debt increased by $12.8 billion in May, after net selling in six of the prior seven months. Holdings of corporate bonds increased a net $935 million, today’s report showed.

The U.S. budget deficit topped $1 trillion for the first nine months of the fiscal year and broke a monthly record for June as the recession subtracted from revenue and the government spent to rejuvenate the economy. The shortfall for the fiscal year that began Oct. 1 totaled $1.1 trillion, the first time that the gap for the period surpassed $1 trillion, Treasury figures showed July 13 in Washington. The excess of spending over revenue for June was $94.3 billion, the first deficit for that month since 1991, according to data compiled by Bloomberg. For the fiscal year that ends Sept. 30, the Office of Management and Budget forecasts the deficit to reach a record $1.841 trillion, more than four times the previous fiscal year’s $459 billion shortfall.

Chinese Premier Wen Jiabao expressed concerned earlier this year that his country’s Treasury holdings may fall in value as the U.S. sells record amounts of debt to fund the budget gap. President Barack Obama is counting on nations such as China to fund his $787 billion economic stimulus and separate programs to aid financial firms and homeowners amid the worst downturn since World War II, which has cost about 6.5 million jobs. Treasury Secretary Timothy Geithner has sought to reassure investors such as China that their investments in Treasuries are safe, while also seeking to reassure U.S. voters that the government has a plan to get its debt under control.

Geithner, at the end of a trip this week to the Middle East and Europe, said the Obama administration favors a strong dollar and expressed confidence it will stay the world’s main reserve currency. "We support a strong dollar," Geithner said in an Internet chat with Les Echos newspaper in Paris. "The dollar will remain the principal reserve currency. The dollar’s role in the international financial system places special responsibilities on the United States, to sustain confidence in our financial system, to bring our fiscal deficits down when recovery is in place, and to preserve the Fed’s strong record of price stability."

Meanwhile, a People’s Bank of China economist wrote in the China Securities Journal yesterday that China should "moderately" increase its holdings of U.S. Treasuries and purchases this year should not be lower than the total for 2008. The holdings can be trimmed and purchases of other types of U.S. assets stepped up once the American economy recovers, Wang Yong, a professor at the central bank’s Zhengzhou-based training school, wrote in an article in the Xinhua News Agency-affiliated newspaper.

China and other nations with large dollar reserves should hold negotiations with the U.S. government on how those funds can be injected into the world’s largest economy, and those talks should include the possibility of shifting bond holdings into other assets such as stocks and gold, Wang wrote. Russian President Dmitry Medvedev who first questioned the dollar’s future last month, saying it isn’t "in a spectacular position, let’s be frank, and its prospects cause various questions," handed out coins at the July 10 G-8 meeting in Italy bearing the words "united future world currency."

Toxic Assets and Thanksgiving Gravy

Via Consumerist.com (which, trust me, in these economic times is a site you need to have bookmarked) comes this lovely video from American Public Media's Marketplace, in which senior editor Paddy Hirsch explained exactly what's been going on with those toxic assets that we've heard so much about.

Hirsch does a really lovely job explaining the matter, with an analogy to Thanksgiving gravy. See, about a year ago, the securities market looked like delicious gravy. But guess what happened? Precipitation or flocculation or whatever the term is for when the layer of fat settles out of solution at the top of the gravy. The fat is the "rubbish" that no one wants to buy. The upshot: reports of rosy bank balance sheets don't take into account the glistening, thick slab of nast that's making its way to the bottom of the gravy tureen as the good stuff is poured out.

Anyway, Hirsch goes on to discuss the actions that banks can possibly take to dispose of their toxic assets and the dangers that the toxic assets still pose, but I won't spoil the ending by disclosing what happens to Dumbledore or whatever. The salient point is that this is delightful, and hopefully Hirsch will do another one comparing credit-default swaps to haggis.Where's the toxic waste? from Marketplace on Vimeo.

A tipping point for world credit markets

by Gillian Tett

How Markit turned from a camera into an engine

When Lance Uggla, an entrepreneurial bond trader, created Markit back in 2001, he could have had little inkling that it would one day enter the US political spotlight. Back then, the business had barely a dozen staff working out of a barn in St Albans, or the bottom of Mr Uggla’s garden. Its area of interest seemed dull to most outsiders: Markit collates data from banks on trade flows and prices in the over-the-counter credit world, and sells it back to the market, mostly for valuation purposes.

But the days of innocent obscurity are over. The Department of Justice this week confirmed that it had started an investigation into pricing practices in the credit derivatives markets. It has demanded extensive data from Markit and the dozen-odd banks that own it, a request with which Markit is complying – out of swanky offices in London and New York. What triggered the DoJ probe is – like the credit markets – a touch murky. Some bankers think the DoJ is flexing its muscles in the new political landscape by demonstrating a tough interpretation of the so-called "Sherman" anti-competitive doctrine. Others fear that the exchanges and some hedge funds are leaning on the DoJ as part of a campaign to move credit default swap activity on to exchanges.

There may be a simpler explanation. In recent months the DoJ has had reason to look at the credit derivatives world because of a flurry of corporate activity. Most notably, efforts are under way to create clearing platforms and Markit is creating a joint venture. As the DoJ peers into this once-geeky world, it is not surprising if it thinks some of those practices look a touch odd – at least given the mood of the times. The essential problem is that growth in these markets has been so frenetic in recent years that activity has outgrown the infrastructure, in a logistical, political and social sense.

Take the case of pricing. When Markit sprang to life in its barn eight years ago, the credit derivatives market was so young it operated like the banking equivalent of a hunter-gatherer tribe. A few investors and bankers roamed about, cutting credit derivatives deals between themselves, in an ad hoc, decentralised manner. Markit’s appearance triggered an evolutionary leap, creating a more structured tribe. As it started gathering trade data from different banks and calculating average prices, it enabled the creation of communal benchmarks, which turned into indices, such as iTraxx, CDX or ABX.

Markit was not the only data-gathering group but it quickly came to dominate the field. And as it enjoyed this stunning success its role subtly changed. Most notably, the company stopped being a "camera" that merely reflected the market, and became an "engine" of growth (to use the metaphor coined by Donald MacKenzie, the academic). When Markit launched the ABX index of mortgage derivatives in early 2006, the sheer fact of having a way to track prices enabled the market to explode.

It is perhaps not surprising that some American observers started to snipe about the ABX – and Markit – when the turmoil erupted in 2007. Nor that the DoJ is questioning the wisdom of having Markit – and the dealers that own it – in such a powerful position in relation to data flows. For their part, the banks and Markit vehemently deny any wrongdoing. As far as I can tell, Markit seems a highly professional and well-run group. But the key problem is the evolutionary – or structural – one.

Eight years ago, the fact that any group was producing communal data on credit derivatives marked real progress for the markets, even if distribution of that data was controlled. Now, however, investors and politicians are no longer happy with just having a well-organised tribe. They want the financial equivalent of democracy: data that is available to all, or produced through open, competitive means, not just sold to a few paying banks and investors. It is a fair bet that the banks will keep fighting this trend. After all, if the tribal elites – aka the dealers – lose control of trade flows and price data, their profits will suffer. Hence it is entirely possible the banks will win this fight, given their political muscle.

But it is also easy to imagine a scenario where the DoJ probe turns out to be a real tipping point that could finally break the dealers’ control over the markets. After all, at the start of this decade, few would have guessed that a start-up in St Albans would end up shaping the markets so much. What will happen in the next eight years – or eight months – seems even more unpredictable, given the battle under way, with or without that DoJ probe.

Economy in China Regains Robust Pace of Growth

Fueled by a massive economic stimulus package and aggressive bank lending, China’s economy grew by 7.9 percent in the second quarter of this year, the government said Thursday, a surprisingly strong showing during the global economic downturn. The gross domestic product figures, released Thursday by the National Statistics Bureau in Beijing, suggest the country’s stimulus policies are working and that the government will meet the 8 percent growth target it set early in the year, analysts say.

While most other major economies are in recession or struggling with anemic growth, China appears to have turned a corner following a sharp slowdown at the end of last year and the beginning of this year, when the pace of growth in the country was cut in half. "This is a stunning recovery," said Andy Rothman, an economist at the brokerage firm CLSA in Shanghai. "And it’s also not just the government money fueling the recovery. The private sector is also recovering, and that’s the key."

After growing at a torrid pace of nearly 13 percent late in 2007, China’s growth dipped to 6.1 percent in the first quarter of this year, the slowest pace in a decade. Some analysts suspect growth during that period was even slower. But in recent weeks, analysts say they have begun to see signs of robust growth in the Chinese economy, including strong car and property sales, soaring commodity prices, long lines at ports and huge infrastructure projects.

"Demand for steel has rallied strongly in the last six months," said Jim Lennon, a London-based steel analyst at Macquarie Securities. "Many Chinese steel producers are now operating at full capacity. The Chinese are the only growth market for steel." While many countries may be relying on government-funded stimulus projects, China has turned to its state-owned banks, which have already made more than $1 trillion in loans this year.

"This recovery is much more reliant on bank lending," said Wang Tao, the chief China economist at UBS Securities. "In the last few months, the bank lending has been massive — beyond anyone’s imagination." Analysts say the dynamics of the economy have begun to shift slightly this year, away from the once-booming coastal provinces and toward less developed regions in central and western China. But some analysts remain skeptical about China’s statistics, questioning whether the government is releasing overly rosy figures and masking serious troubles in the economy.

After dropping sharply in the early part of this year, exports have stabilized. But they are still struggling, analysts say. Analysts also point to weak electricity consumption figures and meager foreign investment as indications that growth may not be as strong as reported in official data. But many analysts say there are more signs of strength than of weakness, and that record bank lending is filtering through the economy and helping drive growth. "This is probably the only major economy in the world where manufacturing employment is rising," said Mr. Rothman of CLSA.

Most analysts are now forecasting strong growth for the second half of this year, at close to 9 percent from a year earlier. But there are risks emerging too. The government has already warned about wasteful government-spending projects, the possibility that overly aggressive lending could lead to a sharp increase in nonperforming loans and the threat of asset bubbles and inflation. Property prices are skyrocketing again in some parts of the country. And Shanghai’s stock market is up nearly 70 percent this year, after a huge drop last year.

Some experts say the stock market has been propped up partly by state-owned companies that are once again speculating on stocks rather than investing in their businesses. The government and many analysts are also worried about asset price inflation and the possibility that aggressive lending from state-owned banks will result in a raft of nonperforming loans in the coming years. "There are the two biggest worries for the government," said Ms. Wang of UBS Securities. "It’s impossible to make so many loans in such a short period and not have problems. Two or three years down the road, nonperforming loans could be a serious problem."

Chinese GDP a case of 'fake it ‘til you make it'

China’s GDP figures might show that the world’s third-largest economy is coming out of its funk. But few economists will take Thursday’s report at face value. While their caution is wise, the Middle Kingdom probably is recovering – tentatively. The country’s leadership has set a target of 8pc growth for 2009. Most economists believe the magic number will be hit, as do 88pc of investors in China, according to an ING survey. Reported growth in the first quarter was 6.1pc, and a 7.1pc "print" is expected for the second quarter, followed by above-trend growth in the second half.

But the GDP growth rate in China is too important a number politically to be reliable. From the bottom to the top of the data chain, everyone has a reason to report numbers that look politically correct. As economist Charles Goodhart pointed out, when leaders turn a measurement into a target, it stops being a good measurement. Still, simpler indicators also point to recovery. Car sales rose 37pc in June. Electricity consumption rose 3.7pc, reversing May’s decline. Production of steel, diesel, speciality chemicals and even fridges are all back at pre-downturn levels.

Exports are still falling, but a slower fall in imports suggests China's domestic consumption is recovering faster than that of its trade partners. None of these indicators is perfect. Sales can rise because prices are cut to unsustainably low levels. Industrial production counts what's made, not what's sold. And rising imports could be a sign of firms buying materials to make products that as yet have no buyers.

Either way, financial aid has certainly helped make this recovery, if there is one, look healthier. The central bank has pumped three times more money into the economy so far this year than in the same period last year. A record rise in the country’s foreign exchange holdings in June suggests speculative foreign money is now adding to the wall of liquidity. Whatever the GDP figures show, China remains an unbalanced economy. Real private consumption is immature. Only time can change that. The export engine remains dormant. Only a recovery in the US and Europe can get it moving. Over those things, Beijing has next to no control.

Fed's Lack of 'Conviction' on Outlook Signals Policy Stalemate

A split among Federal Reserve officials widened last month: Depending on who is doing the forecasting, economic growth will either remain stalled next year or will accelerate to the fastest rate since 1999. Minutes from the Fed’s June meeting show central bankers are less certain than they were in April over how the economy will emerge from the worst recession in a half century. Policy makers have differing assessments of how quickly credit markets will heal, and how effective a $787 billion fiscal stimulus and $1 trillion expansion of the Fed’s balance sheet will be, according to the Federal Open Market Committee’s minutes released yesterday.

"The committee as a whole lacks conviction about where the economy is going," said Lou Crandall, chief economist at Wrightson ICAP LLC in Jersey City, New Jersey. "Uncertainty has to make them slower to start warning about a turning point in policy." Central bankers left the benchmark lending rate in a range of zero to 0.25 percent last month and said the policy rate was likely to remain "exceptionally low" for an "extended period."

The range of unemployment forecasts for 2010 widened in June to 8.5 percent to 10.6 percent, a 2.1 percentage point gap, from 8 percent to 9.6 percent in April.

The range of projections for 2010 growth showed a gap of 3.2 percentage points, up from a 2.5 percentage-point divide in April. The lowest forecast suggests the economy will grow just 0.8 percent from this year’s fourth quarter to the final quarter of 2010; the highest projects 4 percent growth. "Uncertainty just lends itself to standing pat," said Vincent Reinhart, former director of the Fed Board’s Monetary Affairs Division and a resident scholar at the American Enterprise Institute in Washington. "You have a committee in which a significant fraction have unreconciled views among themselves."

Policy makers were concerned that consumer spending will resume its decline once temporary benefits to household income from the fiscal stimulus subside, the minutes showed. Some officials also saw a danger of a renewed decline in the housing market, in part as mortgage rates increase. "Labor market conditions were of particular concern to meeting participants," the minutes said. "With the recovery projected to be rather sluggish, most participants anticipated that the employment situation was likely to be downbeat for some time."

At the same time, the FOMC concluded that it was best to keep its programs for purchasing Treasuries and mortgage debt unchanged. "The effects of further asset purchases, especially purchases of Treasury securities, on the economy and on inflation expectations were uncertain," the minutes said. Forecasts also show members divided over whether economic growth will exceed their estimates of its long-run potential of around 2.5 percent to 2.7 percent. The difference of opinion is important because growth above potential would push down the unemployment rate faster. Unemployment stood at 9.5 percent in June, the highest since August 1983, as employers eliminated 467,000 jobs.

Growth estimates from 10 FOMC members for next year clustered in ranges above 2.7 percent, while seven were in ranges of 2.5 percent or below. The split over whether the expansion will be fast enough to restore job growth, or too slow, will complicate policy leadership for Fed Chairman Ben S. Bernanke, analysts said. "The wide array of estimates for everything from inflation to growth and unemployment suggests that we really don’t know how this economy is going to unfold in coming months, let alone two years from now," said Richard Yamarone, director of economic research for Argus Research Corp. in New York. "Until some of these clouds dissipate, I can’t imagine the Fed is going to take these programs off the table or change its target rate."

Ilargi: Never thought I’d one day post Karl Rove, other than to make -totally undeserved- fun of certain classes of little droolings rodents that leave little drooling droppings. But here we are. Rove points out where Obama fails, and how both that failure and the opaque denials that followed are feeding the Roves and Palins in the country. This is getting serious.

The President Moves the Economic Goalposts

by Karl Rove

So what's a president to do when the promises he made about his economic stimulus program fail to materialize? If you're Barack Obama, you redefine your goals and act as if America won't remember what you said originally. That's a neat trick if you can get away with it, but Mr. Obama won't. His words are a matter of public record and he will be held to them. When it came to the stimulus package, the president and his administration promised, in the words of National Economic Director Larry Summers, "You'll see the effects begin almost immediately." Now it's clear that those promised jobs and growth haven't materialized.

So Mr. Obama is attempting to lower expectations retroactively, saying in an op-ed in Sunday's Washington Post that his stimulus "was, from the start, a two-year program." That is misleading. Mr. Obama never said if his stimulus were passed things might still get significantly worse in the following year. In February, Mr. Obama said this about the goals of his stimulus package: "I think my initial measure of success is creating or saving four million jobs." He later explained the stimulus's $787 billion would "go directly to . . . generating three to four million new jobs." And his Council of Economic Advisors issued an official analysis showing that the unemployment rate would top out in the third quarter of this year at just over 8%.

That quarter began on July 1, and unemployment is now 9.5%, up from 7.6% when Mr. Obama took office. There are 2.6 million fewer Americans working than there were on the day Mr. Obama was sworn in. The president says now that unemployment will exceed 10% this year, and his advisers say it will remain high through much of next year. Earlier this year, Mr. Obama assured us that most of the stimulus money "will go out the door immediately." But it hasn't. Only about 7.7% of the stimulus has been spent in the six months since its passage, and more of it will be spent in the program's last eight years than in its first year. So now the president claims he said something different. "We also knew that it would take some time for the money to get out the door," Mr. Obama said in his weekly radio address on Saturday.

One problem with Mr. Obama's stimulus bill that is rarely talked about is that it will force a huge, and likely permanent, increase in discretionary, domestic spending. That portion of federal spending was $393 billion in President George W. Bush's last budget. Democrats immediately raised it to $408 billion for this fiscal year and now face the question of whether to make the stimulus a one-time expenditure or a permanent spending increase. Federal education spending is a good example. As part of the stimulus, Mr. Obama nearly doubled education spending to $80 billion from $41 billion. If Congress adds that and other stimulus spending into the baseline for future budgets, discretionary domestic spending could mushroom to $550 billion or $600 billion next year. If that happens, Mr. Obama will have broken his pledge that the stimulus would be temporary spending.

As is Mr. Obama's habit, he has answered his critics by creating straw-man arguments. In last weekend's radio address, he attacked detractors as those who "felt that doing nothing was somehow an answer." But many of Mr. Obama's critics didn't feel that way. They offered -- and Mr. Obama almost completely ignored -- constructive ideas to jump-start the economy. For example, House Republicans offered an alternative recovery package of immediate tax cuts and safety-net measures that cost half as much as Mr. Obama's stimulus program. Republicans have also calculated that their plans would have created 50% more jobs than the stimulus. They reached that estimate by using the same job-growth econometric model that the president's Council of Economic Advisors used for the stimulus.

While in Moscow recently, Mr. Obama answered questions on whether his administration had misread the economy by saying "there's nothing that we would have done differently." Let me suggest two things: He could have proposed pro-growth policies rather than ones that retard economic recovery with a massive increase in deficit spending. And he could fulfill his promise to speak to us honestly rather than selling his proposals with promises and goals he rapidly discards.

In his 1946 essay "Politics and the English Language," George Orwell wrote about words used in a "consciously dishonest way." "That is," Orwell wrote, "the person who uses them has his own private definition, but allows his hearer to think he means something quite different." Americans are right to wonder if their president is using his own private definitions for the words he uses to sell his policies.

Government To CIT: DROP DEAD

So the CIT Group, the commercial lender, isn't getting a government rescue. CIT had sought permission to borrow with government backing, but was turned down. More recent negotiations were over a plan to permit CIT to transfer assets from its holding company to its bank in Utah. The Federal Reserve would open the discount window to CIT, allowing the bank to borrow money by pledging some of those assets at collateral.

Government officials reportedly worried that these moves may not be enough to stave off CIT’s demise. As early as yesterday, there was word that CIT might be pretty much unrescuable. The company already has $2.3 billion in TARP funds, but has still found itself on the brink of bankruptcy. CIT has $1 billion in bonds due in August and another $10 billion by the end of 2010. By that point, the government plans to have cancelled theTemporary Liquidity Guarantee Program, the FDIC guarantee on the bonds of financial firms.

"Even if CIT receives another round of support, we believe bondholders are not out of the woods," David Hendler, an analyst at CreditSights in New York, wrote prior to the news of the bailout tonight. "We believe CIT's funding model is broken and have our doubts over whether an additional capital injection would cure the problem." Many people (including us) argued that the lender should be allowed to fail, as a sign that the government would not continue to prop up failed companies. Others worried that a CIT bankruptcy would hurt the businesses that depend on CIT for financing.

Reportedly, a struggle had broken out between Treasury Secretary Tim Geithner and FDIC chair Sheila Bair. Geithner favored the rescue, citing dangers to small businesses. Bair opposed extending FDIC credit to the weak firm that many believe could fail without causing major systemic upheavals. While CIT and U.S. regulators worked through the night discussing details of a potential recue, a bank run was underway. Customers reportedly drained hundreds of millions of dollars from the lender in the past few days, drawing down on credit lines they had with CIT. The run seems to have been prompted by news over the weekend that CIT had hired lawyers to prepare for a bankruptcy filing.

Treasury Bets U.S. Financial System Can Weather CIT Collapse

The U.S. spurning of CIT Group Inc.’s aid request suggests officials are betting they’ve fixed the financial system enough to withstand the bankruptcy of a mid-sized lender. "I hate to say this, but it was probably expendable," said Dennis Santiago, chief executive officer of Institutional Risk Analytics, a Torrance, California, research firm that studies systemic risk. "It may have just missed the boat" on federal rescues, Santiago said.

Yesterday’s decision to forego a lifeline for CIT came 10 months after Lehman Brothers Holdings Inc. filed for bankruptcy. Lehman’s collapse ushered in the depths of the credit crisis to date, and resulted in the establishment of a $700 billion bailout fund; officials yesterday indicated programs created with that money would help fill any lending gap left by CIT. Treasury Secretary Timothy Geithner, en route to Paris as CIT acknowledged policy makers had turned it down, is also wagering the administration will weather any political fallout. Unlike Bear Stearns Cos. or American International Group Inc., which got extraordinary aid last year, New York-based CIT specializes in loans to smaller firms, counting 1 million enterprises, including 300,000 retailers, among its customers.

A Treasury official said the department anticipates losing the $2.3 billion of taxpayer funds that it had already injected into the company from the Troubled Asset Relief Program should it file for bankruptcy. There will be "a lot of disruption and anger among voters, particularly among people who rely on firms such as CIT for funding," said Sean Egan, head of Egan-Jones Ratings Co. in Haverford, Pennsylvania, which rates CIT below investment grade. "A major provider of capital in the middle market is likely to be out of business in the near future," and investors will be concerned, at least in the "short run" about CIT, Egan said.

CIT, whose stock trading was halted by the New York Stock Exchange before the close, said late yesterday it was told "there is no appreciable likelihood of additional government support being provided over the near term." CIT added that it was "evaluating alternatives" with its advisers. The Treasury then highlighted in a statement that the government has enacted "powerful" mechanisms to revive credit markets. "Even during periods of financial stress, we believe that there is a very high threshold for exceptional government assistance to individual companies," the department said.

An Obama administration official separately said CIT didn’t receive more government assistance because it hadn’t gone to private capital sources to rebuild its balance sheet, something that several of the biggest Wall Street and regional lenders did earlier this year. The official, who requested anonymity to discuss the deliberations, said the government also determined that CIT didn’t pose systemic risk to the economy if it failed to receive more aid.

Yesterday’s collapse in talks between regulators and CIT followed reluctance by the Federal Deposit Insurance Corp., the bank’s main regulator, to give it permission to participate in the agency’s debt-guarantee program.

The Federal Reserve had separately considered whether to let CIT put some of its parent assets into a banking unit, a move that could have increased its potential borrowing from the central bank. No such aid was forthcoming. The Fed has doubled its balance sheet to more than $2 trillion as it engaged in Wall Street rescues and emergency loans to banks across the nation.

"If the government would have rescued them they would have been in there for a very long time, and they would have taken very big losses," said Eric Hovde, who manages $1 billion at Hovde Capital Advisors LLC in Washington, which concentrates on financial and real-estate related companies. Part of the Fed and Treasury efforts to shore up the financial markets have been directed at restarting lending to small businesses. The two agencies in March jointly started the Term Asset-Backed Securities Loan Facility, or TALF. Under the program, the Fed lets investors borrow to purchase securities backed by auto, credit-card and other loans, with the idea that should spur lenders to extend more credit.

TALF loans from the Fed totaled $24.9 billion as of last week, compared with the program’s planned capacity of $1 trillion, backed by $100 billion of funds from the $700 billion Troubled Asset Relief Program. Fed officials credit the existence of the TALF with spurring the market for new asset-backed securities and reducing the difference, or spread, between yields and benchmark rates. "So far, the evidence indicates that the program is working as designed," New York Fed President William Dudley said in a speech last month. Yield premiums on consumer asset- backed securities have dropped "sharply," he said.