Rockefeller Center and RCA Building from 515 Madison Avenue, New York. City

Ilargi: The following is part of an on-going conversation between Aaron Krowne (who runs The Mortgage Implode-O-Meter) and Stoneleigh on the subject of deflation. It began 3 days ago when Aaron sent me an email reacting to Stoneleigh's recent article The unbearable mightiness of deflation. Civilized and well-argued discussions are a welcome delight.

PS: 77 years ago today, July 8, 1932, the Dow reached its lowest point ever at 41.22.

Aaron: [You make] many good points. The way I understand it is that deflation is only happening in the financial economy, not the real economy.

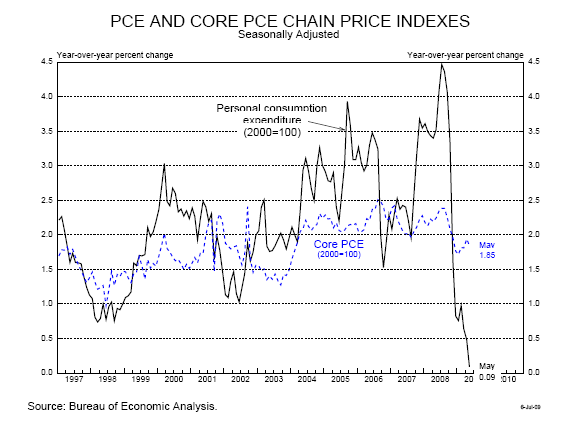

Stoneleigh: Deflation is a monetary phenomenon - the contraction of money and credit relative to available goods and services. It is either happening or it is not. Price falls in nominal terms are a lagging indicator of deflation as a price driver, but there are other price drivers as well, such as wage arbitrage, scarcity, substitutability (or lack thereof) etc. Price movements have no explanatory or predictive value in their own right as they are the net result of many factors that vary for different goods and services.

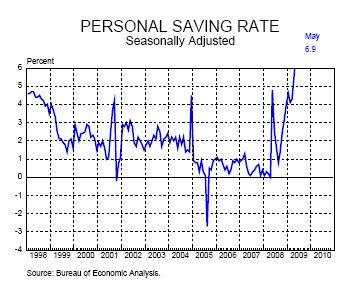

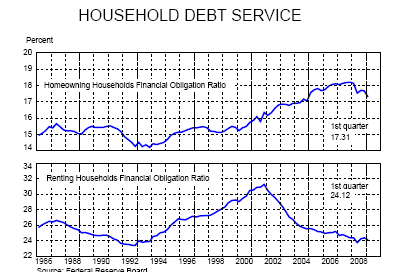

Deflation will eventually cause prices to fall almost across the board in nominal terms, while leaving them less affordable than they were before due to the collapse of purchasing power. Purchasing power will collapse as access to credit disappears and the ability to earn an income decreases drastically with skyrocketing unemployment. Lack of purchasing power will come from most people having no money. Those (very) few who have preserved their purchasing power in liquid form will find everything is very cheap indeed once we are further into a deflationary spiral.

Aaron: Many assets (i.e. cars, foreclosed houses) are transitioning from one economic sphere to the other. In the real economy (where they are bought outright, not financed), these goods have lower prices. But that doesn't mean "prices are falling" in the same sense as it would for a cup of coffee or your monthly power bill or health insurance -- and in fact all these prices are going up.

Stoneleigh: Prices will fall, but as prices lag a deflationary contraction, many prices have not fallen yet. We have not yet seen the impact of credit tightening on price support for many things, but it is coming. Already we are seeing credit limits cut, cards withdrawn, borrowing against property cut etc. All that will have an effect, especially as it has very much further to go. The market is temporarily rallying at the moment, as we said it would in March, but once the sucker rally is over, the decline will begin again and the impacts will be increasingly obvious.

Aaron: Nobody's savings or wages are actually going up in buying power, which makes the current "deflation" very different from the one in the 1930s, regardless of what one chooses to call it.

Stoneleigh: Savings will go up in buying power, at least those which are not lost to a systemic banking crisis, which is moving inexorably closer. Wages will go up in buying power, for those who still have wages that is, and that part of the population will be shrinking very substantially.

We are going to see circumstances similar to the 1930s. We are seeing the initial stages at the moment. By way of analogy, the sea has pulled back and the tourists are gawping at the newly exposed shells on the ocean floor, blissfully unaware that a tsunami is coming. The quantitative easing that the government is doing will be completely dwarfed by the forces arrayed against them as the power of the collective rushes for the exits over the next year or so.

Unfortunately, timely warnings are rarely credible at the time they are given, as they conflict with the received wisdom of the herd. In this case, the vast majority is expecting inflation, and messages to the contrary can seem laughable, but then so did warnings in 2005 about the housing bubble coming to an end.

Aaron: Come on. How are we seeing a "monetary phenomenon" ("the same as in the 1930s"), when what is going on clearly has more to do with a collapse in credit (not money), and we don't even have sound money as we did in the 1930s? Are those differences supposedly immaterial?

I say, they are VERY material. Credit collapse in an environment of fiat money produces debt deflation, not monetary deflation. This means that price collapses are isolated to financialized assets, by and large.

Stoneleigh: Inflation is an increase in the supply of money AND CREDIT relative to available goods and services, and deflation is the opposite. The contraction of credit, as credit loses 'moneyness', is a contraction of the effective money supply relative to available goods and services, which is deflation. Inflation and deflation are always and everywhere monetary phenomena. There is no difference between debt deflation and monetary deflation.

Price collapses will in no way be limited to financialized assets, although these should suffer greater losses than material goods. Illiquid securities could go to zero for instance, while oil certainly will not, but the price of oil nevertheless has further to go to the downside than we have seen so far as a result of the coming demand destruction. One would not expect price movements to be equal for different goods, services or financialized assets, but one would expect deflation to decrease price support across the board. Other price drivers, in one direction or the other, in combination with the effects of deflation, will determine the net effect on prices for each item.

Aaron: Note, for example, that the oil price has already rebounded strongly after becoming definancialized (yes the general market has rallied but oil has much more). As inventories are relatively high, this shows oil is likely acting as a substitute sound money against the fiat currency, which cannot constitute any sort of durable safe haven.

Stoneleigh: When oil was over $140/barrel we predicted the price would plummet, and it did. In March when the market began its sucker rally, which we warned our readers was about to happen, we said that the price of oil would rebound with the general return of liquidity, before falling further once the rally was over. We stand by this prediction today, as the combination of the destruction of economic activity, the lack of purchasing power and the need for oil-producing nations to pump flat out in order to bring in as much revenue as possible will further undermine oil prices. However, as we have pointed out in our energy primer (Energy, Finance and Hegemonic Power ), demand destruction will sow the seeds of supply destruction.

We expect oil, and gold, to bottom early in this depression, and to increase enormously thereafter. A price increasing in nominal terms against a backdrop of credit collapse means that prices will be going through the roof in real terms. Ordinary people will find themselves entirely priced out of the market. Fiat currency, and cash equivalents such as short term bonds, are not a enduring safe haven, but are a safe haven for the time being. During the deflationary deleveraging, the preservation of purchasing power in liquid form is the key. Following deflation, it will be necessary to move into hard goods, which will be available at prices that will look very cheap to those few who retain access to cash.

Aaron: Those waiting for their basic expenses to go down and their fiat money to become worth more will be waiting until they are blue in the face. And perhaps it is better they starve themselves of oxygen before meeting the monetary inflationary reality of the near future.

Stoneleigh: Most will see their basic expenses go through the roof in real terms (even as they fall in nominal terms), as they will have almost no access to goods and services, as a result of having no money or credit, and therefore no purchasing power. The very few who hold liquidity, and have been able to avoid losing it in a bank run, will find that their expenses will fall, but they will be a tiny minority. Monetary inflation is likely to be the scourge of the longer-term (ie many years hence), but it is not the scourge of the present or of the near future.

Aaron: I guess my main point of contention is the assertion that "there is no difference between monetary deflation and debt deflation". The reason is because only a minority of assets (and most of them having to do with investing with a long-term horizon) are financialized (financed). That seems factual to me... and the divergent path of the various prices seems to confirm it.

Certainly, while we are getting some spillover areas of prices going down, but some of the same prices are also going up from month to month, and structural costs evidently constitute a long-term rising tide.

Stoneleigh: Those rising prices are temporary, reflecting the previous credit expansion as a lagging indicator. I agree that 'financialization' opened the door to speculative excess and its aftermath, which drove prices up sharply and set them up for a huge fall. Not everything was subject to this kind of 'pump and dump', and therefore not all prices have been as volatile. Price movements are inconsistent as many price drivers operate simultaneously.

However, deflation at its most virulent is an extremely powerful price driver. We have yet to see its effects, and may have to wait until next year to do so, depending on the time lag between monetary contraction and the effects appearing in the broader economy.

I am expecting a late summer top for this current sucker rally, and for the downward trend to resume this autumn. If that downward trend becomes a market cascade, as I expect it to, then the effect on prices may not take too long to kick in. That is not to say that the time lag for everything would be the same. The rollover point for a new price trend could vary substantially. I would certainly expect the price of non-essential consumer goods to fall faster than essentials or regulated utilities, where there is more state influence over prices.

I do expect virtually all prices to fall in nominal terms at some point though, but not in real terms as we have discussed previously. Lower prices do not equate to greater affordability in a deflation, except for the lucky few who still have any money.

Aaron: The general assumption seems to be that we can only be "in" deflation or inflation, but I think it is evident we are in both, depending on whether you look primarily at real costs or financial assets. Again, this is a source of confusion, but when I say "inflation", by default, I mean the real economy sense -- as previously there was no popular acceptance of "inflation" referring to asset prices (and if you prefer money supply, the credit that financed these assets).

Stoneleigh: The use of the term 'inflation' to describe price movements rather than monetary expansion is a relatively modern convention. It represents the a popularization of the term, but a bastardization of its meaning in that such a usage obscures a very important concept. Inflation is a monetary phenomenon. We cannot, by definition, be in inflation and deflation at the same time, although price movements can certainly unfold in different directions simultaneously, depending on a number of factors.

Aaron: Cui bono -- who would it be convenient for to ignore inflation in asset prices while looking at "deflation" in goods as the bubble expands, then look at deflation in asset prices but ignore inflation in goods as the bubble pops?

Stoneleigh: I wouldn't suggest ignoring the effect on either assets or consumer goods as they are both part of the picture. However, explaining that picture requires a consistent analytical underpinning.

Aaron: I also do not buy the assertion that collapsing employment or "purchasing power" will cause price deflation. This is essentially the NAIRU philosophy and I would have thought it had been thoroughly debunked by the 1970s stagflationary experience and its inverse, the 1990s "great moderation" (low unemployment, low inflation). Withdrawn credit is a new twist to this, but when you think about it this is really no different than considering employment, as you are simply taking stock of the "demand" side. When you consider that most people were already stuck in a position of being able to afford little more than the basics, then you can see that beyond big screen TVs, demand for goods and basic services is relatively inelastic. So overall, I don't think this demand-side argument is compatible with the assertion that inflation is a monetary phenomenon.

Stoneleigh: We have yet to see a significant drop in aggregate demand, but it is coming. Demand is not what one wants, but one is ready, willing and able to pay for, and it is not inelastic when purchasing power is withdrawn. Without access to credit and without an income stream from employment, more and more people will fall by the wayside. Eventually they will be in the majority. We may find it inconceivable that a majority of people will have insufficient purchasing power to afford even basic essentials, but that has been very common pattern in human history - a large proletariat ruled by a small elite, with an enormous wealth disparity.

The 1990s were not a time of low inflation, it was a time of enormous credit expansion. Consumer prices were held in check by global wage arbitrage and international price competition, so the excess found its way into assets.

Aaron: And I agree that inflation is primarily a monetary phenomenon. I just do not believe that "money substitutes" act exactly like money. By and large when we talk about credit and derivatives and such, we are talking about a realm of fiction that is detached from the real economy. So I am surprised so many sharp analysts now seems to assign this realm some kind of central importance. If I write a you a $1M IOU, and we toss it back and forth 1000 times, we have not just done $1B of business, or added $1B to the global economy, or anyone's income or asset base. If we suddenly realize this, that does not constitute $1B of "deflation" either, though it might be disruptive for cloistered bankers or billionaires.

Stoneleigh: The period of time where money was chasing its own tail was adding to wealth expectations, and much of that wealth effect was propping up prices. Those who are of the opinion that they have a claim to a certain percentage of the real wealth pie will not readily concede that they do not. While currency inflation divides a wealth pie into ever smaller pieces, credit expansion creates multiple and mutually exclusive claims to the same pieces of pie. Everyone feels wealthier, but it is an illusion. Little or no wealth has actually been created, but the proliferation of claims has led to a very dangerous situation. Deflation is the process of extinguishing those excess claims once their existence has been generally recognized.

As there are probably at least a hundred claims to each slice of pie, thanks to leverage, the vast majority of claims will face extinction. This will not be an orderly process following legal niceties. On the contrary, those higher up the financial food chain will reach down and grab whatever they can in the way of real wealth in the biggest margin call in history. In other words, say good-bye to anything owned on margin.

Aaron: Back to money, as far as I can tell, so much money has already been printed that we are vulnerable to severe inflation if not hyperinflation if confidence in the dollar suddenly drops out. I reckon that massive interventions and propping have already taken place to prevent this from happening -- who can say? -- but it remains a great risk, and puts the US and the dollar in the same category as Argentina or Zimbabwe.

Stoneleigh: Forecasts of a collapse in the dollar are premature. Deflation will prop up the value of the dollar on a flight to safety, which will also drop bond yields to historic lows for a time. There is more dollar-denominated debt in the world than any other kind, hence its deflation will increase demand for dollars more than any other currency (except perhaps the yen as its carry trade unwinds). Eventually the value of the dollar will collapse, as all fiat currencies do, but that time is not now.

The amount of 'money printing' that as happened so far is completely dwarfed by the scale of credit contraction. We are not vulnerable to inflation as a result of this. On the contrary, most of it has disappeared into the black hole of credit destruction, never to be seen again. Much of the rest is being hoarded. It is doing nothing substantial to increase the velocity of money, although rallies are accompanied by a temporary return of liquidity along with the temporary return of confidence. In a very real sense, confidence IS liquidity. Once the rally is over, both will disappear again and the velocity of money will plummet.

Aaron: I think we are in agreement that long term, the risk is inflation -- but I additionally don't think we are "safe" right now. Specifically, the monetary authorities have no call to dramatically expand any sort of money or credit -- they are seriously playing with fire when they do so, as the vulnerable position of the dollar and the printing that has been done already form an underbrush of dry tinder.

Stoneleigh: I can see inflation in the very long term (ie years away at least), but to say that it represents the real risk is not a position I agree with. Deflation on the scale we are facing is simply devastating. It is a force that essentially sweeps all before it. Those who emerge shell-shocked from a deflationary depression will then have to face hyperinflation, once the power of the bond market has been broken thanks to the collapse of the international debt financing model, but that is a very long way off.

Aaron: Here is an additional argument you might want to consider on the question of whether or not consumer credit being withdrawn implies deflation. There are two main cases to consider -- people who are maxed (or "near maxed"), and those who do not use much credit and have lots of spare borrowing power.

In the latter case, the analysis is easy: credit being withdrawn has little effect on them, their behavior, or the economy (net demand for goods and services). On the other hand, if you are close to being maxed out, you have a problem. You've basically been living off your credit cards, and your lines are being cut (or equivalently your APRs are going up). It would seem you might have to scale back demand.

But here's the the thing: you were probably maxed out on the credit cards because you had no choice. Specifically, whether or not you have the credit lines available, you have to pay your bills, feed yourself (and your kids if you have any), etc. The vast majority of those maxed out are not actually doing so on "discretionary" spending.

This means that when those lines are cut, the spending cannot really go away. Instead, the pressure falls back on state or national government to support these people. Sure enough, we find massive amounts of stimulus money going to extend unemployment benefits, provide matching for "TANF" and other welfare programs, etc. This is essentially fresh money printing to substitute for the withdrawn credit. The paradox of consumer credit is that those with the most of it "need" it the least. But those who need it the most will find other forms of support when they lose it. So, at the end of the day, I don't think the cutting-back of consumer credit will have a very big effect on aggregate demand and hence CPI inflation.

Stoneleigh: Bailouts are never for the little guy, no matter what spin is put on them in order to sell them to the public. They are for the few insiders at the expense of everyone else. The population at large are the designated empty bag holders as the ponzi scheme hits its limit (From the Top of the Great Pyramid).

Saying that those who lose credit, and income from employment, will necessarily find other means of support, and that their demand will not therefore fall, seems completely preposterous to me. No government can afford to supply its populace to the extent that their demand would be unaffected. In fact, no government will be able to supply even the most basic essentials to all, let alone prop up demand at anything like current levels. A government pursuing that kind of strategy would be severely punished by the bond market very quickly.

Eventually this will happen anyway as a result of quantitative easing, but when it does, it will amount to hitting the 'emergency stop' button on the economy. Interest rates will shoot up into the double digits in nominal terms, and much higher in real terms. It will unleash a tsunami of debt default throughout the economy, as debts will no longer be remotely affordable. This will be hugely deflationary.

Governments facing very high interest rates (and there will be many) will have to slash spending to the bone. Just when people are most in need of support, they will be cast adrift in a pay-as-you-go world with no purchasing power. The effects of this will be gargantuan in terms of political unrest and upheaval. There is nothing governments, or anyone else, can do to avoid the consequences of the largest credit bubble in history bursting. We have had the party to end all parties, and now we have to deal with a hangover that will last for decades.

In California, Even the IOU’s Are Owed

The only thing worse than being issued an i.o.u. rather than a check from the State of California may be not getting the i.o.u. at all — at least in time to meet the deadline of your bank. But across California on Tuesday, many vendors who had been told they would receive the i.o.u.’s instead of actual money said they had not yet received them. And if they do not arrive soon, they may be hard to turn into cash.

Last week, the state began issuing the warrants for the second time since the Great Depression. It ran out of cash to pay its bills as the Legislature and the governor failed to resolve the state’s $26 billion budget deficit. Millions of dollars in i.o.u.’s, known as registered warrants, began rolling off the controller’s presses in lieu of checks to pay taxpayers, vendors and local governments. The warrants offer a 3.75 percent interest rate when they mature in October.

In most cases, banks around the state have agreed to honor the warrants only until Friday, in hopes that the deadline will prompt lawmakers to reach an agreement. As of Tuesday, 71,810 warrants to the tune of $108 million had been printed, but many had not yet been received. "We are out of cash now," said Carlos Flores, the executive director of the San Diego Regional Center, which provides services to Californians with developmental disabilities. The center is awaiting a $12 million warrant. "I can pay my staff next paycheck, and that’s it," Mr. Flores said.

Other state contractors who provide services to the disabled had similar stories. Mark Berger, the chief executive of Partnerships With Industry, which offers job placement and training for the same type of clients, said he, too, had yet to get a warrant. "I haven’t heard of anybody who has received one," Mr. Berger said. Jonathan Brown, president of the Association of Independent California Colleges and Universities, said he had yet to learn of a college that received the warrant in lieu of the state education grants.

"My expectation is that they will get them next week," Mr. Brown said. "That is a real problem because colleges and universities have cash flow needs at this time of year and usually use a line of credit to cover their expenses, and then fill that credit line up with tuition revenues." The majority of banks have been clear that they will not take the warrants after July 10. Banks "do not wish to facilitate the lack of resolution of the budget deficit by basically providing this accommodation for an extended period of time," said Rod Brown, chief executive of the California Bankers Association. "California must become more fiscally responsible."

Garin Casaleggio, a spokesman for the state controller, said that warrants were issued as bills became due, and that not every vendor would be issued paper immediately. People expecting money from the state who do not get a warrant by Friday have three choices. They can try to find an alternative bank or credit union willing to deal with someone who is not a customer, they can hold the warrant until it matures and collect the interest, or they can try their luck in secondary markets, where some people are already seeking to buy i.o.u.’s at a discount.

Because of a proliferation of potential customers on Craigslist and other Web sites, like BuyMyIOU.com, the California treasurer, Bill Lockyer, said Monday that his office would not redeem i.o.u.’s held by third parties unless they were accompanied by a notarized bill of sale.

Of course, it is not clear how attractive a piece of California’s debt would be to investors. On Monday, Fitch Ratings downgraded California’s long-term bond rating to BBB from A-, only two notches from junk-bond status, citing the state’s continuing budget drama. Matt Fabian, managing director of Municipal Market Advisors, said that general obligation bonds had the full faith and credit of the state behind them, but that i.o.u.’s had a lesser guarantee.

California IOU’s traded on secondary markets

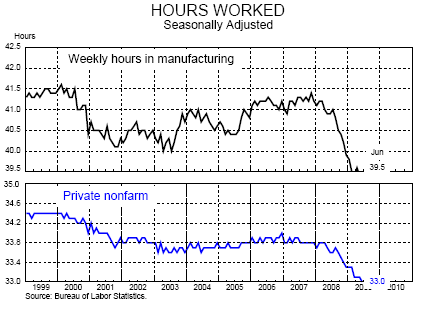

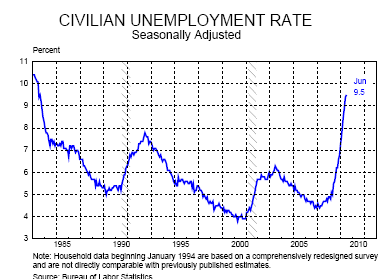

We've Wiped Out All The New Jobs Of The 21st Century

What's the best way to express just how bad the job market is? You could look at the soaring unemployment rate, or perhaps the ever-shortening work week. How about this: Total nonfarm payrolls, notes economist James Hamilton, are now back to where they were in mid 2000, and in a few months they'll certainly be back to pre-2000 levels. 21st century job creation: gone.

U.S. Food-Stamp Recipients Reached Record 33.8 Million in April

A record 33.8 million people received food stamps in April, up 20 percent from a year earlier, as unemployment surged toward a 26-year high, government figures show. Spending also jumped, as the average benefit rose. It was the fifth straight month of record participation in the Supplemental Nutrition Assistance Program, according to the U.S. Department of Agriculture, and up 1.8 percent from the prior month. Total spending was $4.5 billion, up 19 percent from the previous all-time high reached in March, the USDA said.

The government is boosting food aid in response to a jobless rate that rose to 9.5 percent in June from 9.4 percent in May. An additional $20 billion over five years was authorized for nutrition assistance in the $787 billion stimulus bill Congress passed in February. Utah had the biggest increase in the number of recipients from a year earlier, 46 percent, while South Dakota had the steepest jump from March, 6.4 percent.

Texas was the only state where the number of participants declined from the previous month. It still had the most recipients, 2.92 million, followed by California with 2.7 million and New York with 2.34 million. The average monthly benefit for an individual rose 17 percent from March to $133.28. An average of about 35 million people are expected to be receiving food stamps each month in the year that begins Oct. 1, according to the budget President Barack Obama sent to Congress in May.

Distressed Commercial Property in U.S. Doubles to $108 Billion

Commercial properties in the U.S. valued at more than $108 billion are now in default, foreclosure or bankruptcy, almost double than at the start of the year, Real Capital Analytics Inc. said. There were 5,315 buildings in financial distress at the end of June, the New York-based real estate research firm said in a report issued today. That’s more than twice the number of troubled properties at the end of 2008. Hotels and retail properties are among the most "problematic" assets following bankruptcy filings by mall owner General Growth Properties Inc. and Extended Stay America Inc., according to the report.

The scarcity of credit is causing property defaults in all regions and among every investor type, Real Capital said. "Perhaps more alarming than the rapid growth in the distress totals is the very modest rate at which troubled situations are being resolved," the report said. About $4.1 billion of commercial properties have emerged from distress, according to Real Capital. "In far more situations, modifications and short-term extensions are being granted, but these can hardly be considered resolved, only delayed," the study said. The June figures issued today are preliminary.

Our banks are beyond the control of mere mortals

At Oxford university, I often hear people say there is nothing wrong with the system: the problem is the vice-chancellor/master/bursar/ university officials. And, in a sense, they are right. If the vice-chancellor had the wisdom of Socrates, the political skills of Machiavelli and the leadership qualities of Winston Churchill, not to mention the patience of Job, he or she would be very likely to be able to fulfil the conflicting demands of the post. But such paragons are few and far between. In the meantime we must try to find structures that can be operated by ordinary mortals.

In the same way, the claim that the fault with the banking system lies not with the structure of banks but with the boards and executives that claimed to run them is both correct and absurd. In one sense, the claim is correct: boards and executives did not successfully perform the tasks assigned to them – tasks that not only did they claim to be discharging, but for which they frequently paid themselves very large sums of money.

But, in another sense, the claim is absurd: if the failures are both as widespread and as persistent as it appears, the problem is in the job specification rather than with the incumbent. If you employ an alchemist who fails to turn base metal into gold, the alchemist is certainly a fool and a fraud but the greater fool is the patron. The bank executives pilloried by the UK’s Treasury select committee of MPs were all exceptional people.

The vilified Sir Fred Goodwin was an effective manager who had slashed through the National Westminster bureaucracy and revived a failing institution – a task that had defeated many able men before him. His chairman, Sir Tom McKillop, offered experience and ability that met every possible specification for such a role in a big international corporation. As chairman of HBOS, Lord Stevenson was Britain’s supreme networker. This skill is a particularly valuable attribute in an environment where the essence of banking is to extract very large sums of taxpayers’ money while giving as little as possible in return.

His chief executive, Andy Hornby, was criticised for being a retailer. But Halifax, half of HBOS, needed retail expertise. The only thing it needed to know about complex securitised products was that there was no good reason to buy them. Like Sir Fred, Sir Tom, Lord Stevenson and Mr Hornby, most of the people who sat on the boards of failed banks were individuals whose services other companies would have been delighted to attract. If there was a problem of board composition, it is not an issue just for financial services companies but for the UK corporate sector as a whole. Perhaps there is such a problem, but the restructuring of financial services will not wait for its identification and solution.

The hapless four were criticised for their lack of banking expertise but it is, in fact, not clear what modern banking expertise is. The world of modern banking requires all the skills of these gentlemen, plus some others, and no one can expect to have all these attributes. It has been said of Jamie Dimon (who does not have a banking qualification) that his dominance exists because at every meeting all the participants know that he could do each of their jobs better than they could. But the business world cannot operate at all if it can operate only with individuals of the calibre of Mr Dimon. Better, as so often, to follow an aphorism of Warren Buffett’s: invest only in businesses that an idiot can run, because sooner or later an idiot will.

Our banks were not run by idiots. They were run by able men who were out of their depth. If their aspirations were beyond their capacity it is because they were probably beyond anyone’s capacity. We could continue the search for Superman or Superwoman. But we would be wiser to look for a simpler world, more resilient to human error and the inevitable misjudgments. Great and enduringly successful organisations are not stages on which geniuses can strut. They are structures that make the most of the ordinary talents of ordinary people.

Treasuries Rise as Refuge Demand Bolsters 10-Year Note Auction

Treasuries surged as investors seeking refuge from an economy whose recovery may take longer than expected submitted the most bids on record at today’s $19 billion auction of 10-year notes. Yields on 10-year securities fell the most since March 18, when the Federal Reserve said it would buy U.S. debt in an effort to cap borrowing costs. The bid-to-cover ratio, which gauges demand by comparing total bids with the amount of securities offered, was 3.28. The note sale is the third of four this week totaling $73 billion. Traders speculated that company earnings reports scheduled to start today will show profits fell in the second quarter.

"The recession is still here, so the demand was strong," said Andrew Richman, who oversees $10 billion in fixed-income assets as a strategist in West Palm Beach, Florida, for SunTrust Bank’s personal-asset management division. The yield on the benchmark 10-year note fell 16 basis points, or 0.16 percentage point, to 3.30 percent at 4:41 p.m. in New York, according to BGCantor Market Data. The yield dropped as much as 18 basis points, the most since March 18, when it fell as much as 54 basis points. The 3.125 percent security due in May 2019 rose 1 9/32, or $12.81 per $1,000 face amount, to 98 1/2. It touched 3.278 percent, the lowest since May 21.

The 30-year bond yield fell as much as 15 basis points, the most in over five weeks, before tomorrow’s auction of $11 billion of the securities. The 10-year notes sold today drew a yield of 3.365 percent, below the 3.398 percent average estimate of six bond-trading firms surveyed by Bloomberg News. Investors bid for 2.62 times the amount of debt available at the June sale, versus an average of 2.40 at the previous 10 scheduled auctions.

Indirect bidders, a class of investors that includes foreign central banks, purchased 43.9 percent of the notes. At the June sale, they bought 34.2 percent, higher than the average for the past 10 sales of 27.9 percent. "There’s a real flight to quality going on here," said Andrew Brenner, co-head of structured products and emerging markets in New York at MF Global Inc., a broker of exchange- traded futures. "Everything points to a hiccup in the economy. There is tremendous demand for U.S. Treasuries."

The offering is the second reopening of the record $22 billion 10-year note sale on May 6, and the securities mature in May 2019. The June sale totaling $19 billion drew a yield of 3.99 percent, which was the highest since August 2008. Most U.S. stocks fell, with the Standard & Poor’s 500 index losing 0.2 percent. "We are seeing money coming out of equities mainly into the belly of the curve," said Paul Horrmann, a strategist in Jersey City, New Jersey, at ICAP Plc, the world’s largest inter-dealer broker. "We are caching a bid here when equities get lower on a small flight to quality trade."

Demand has been rising at the U.S. auctions, especially from indirect bidders such as foreign central banks. That investor class bought 54 percent of the three-year notes sold yesterday, up from 43.8 percent in June.

The levels of indirect bidders at recent sales of U.S. debt may have been affected by a rule change last month that eliminated a provision allowing some customer awards to be classified as dealer bids. After more than doubling note and bond offerings to $963 billion in the first half, President Barack Obama may sell another $1.1 trillion by year-end, according to Barclays Plc, another primary dealer. The second-half sales would be more than the total amount of debt sold in all of 2008.

Yields on 10-year notes touched 4 percent on June 11 on concern the government’s borrowing would deluge demand as the economy showed evidence of emerging from its deepest recession in 50 years. Since then, yields have fallen over 70 basis points as reports suggest the recession has further to run. The Labor Department said last week that the unemployment rate rose to 9.5 percent, the highest since 1983. Analysts estimate profits for companies in the Standard & Poor’s 500 index fell an average 34 percent in the second quarter and will decrease 21 percent from July through September, according to Bloomberg data.

Alcoa Inc., the first company in the Dow Jones Industrial Average to post results, reported a second-quarter loss that narrower than analysts’ estimates. Production cuts and workforce reductions helped the largest U.S. aluminum producer save money. The Fed announced on March 18 it would buy as much as $300 billion in Treasuries over six months to hold down borrowing costs. Falling Treasury yields have helped the central bank’s mission. The average rate on a typical 30-year fixed mortgage fell to 5.32 percent yesterday, from a 2009 high of 5.74 percent on June 10, according to North Palm Beach, Florida-based Bankrate.com.

Mortgage applications in the U.S. rose last week as refinancing jumped by the most since March and purchases climbed to the highest level in three months. The Mortgage Bankers Association’s index of applications to purchase a home or refinance a loan increased 11 percent to 493.1 in the week ended July 3, from 444.8 in the prior week. The group’s refinancing gauge surged 15 percent, while the index of purchases gained 6.7 percent. The Fed is scheduled to buy Treasuries due from July 2010 to April 2011 tomorrow, followed by four more purchases over the following two weeks, according to the central bank’s Web site.

How Long Before the Fed's Days Are Numbered?

by Michael Panzner

It's no stretch to say the Federal Reserve is garnering a lot of attention these days. On Wall Street, there's a big debate over whether the Fed's next big move will come too soon or too late. In Washington, the Administration is promoting a plan to give the central bank new powers to oversee systemic risks. Over in the House of Representatives, maverick Republican Ron Paul has gathered more than 245 co-sponsors for a bill requiring an audit of the Fed. In the media, there are questions about whether President Obama will allow Fed Chairman Ben Bernanke to keep his job when his term ends in January.

And finally, some commentators are wondering whether this allegedly autonomous institution will retain its independence in a post-crisis world. But few seem to be asking what I believe is the key question: how long before the Fed's days are numbered? Before you dismiss my words as a rant, hear me out. Why, for example, is the power to commit substantial resources on taxpayers' behalf, to influence many of the most important commitments and relationships of businesses, individuals, and governments, and to initiate economic and regulatory policies with far-reaching consequences, in the hands of unelected officials with unexceptional abilities and no real accountability?

And even assuming the current arrangement has been the default choice up until now, does that mean things are destined to stay that way? The financial crisis has forced many people to rethink all sorts of assumptions, structures, and approaches. Against this backdrop, there are many reasons to believe that the broader question of why we have a Federal Reserve at all will gain traction in the period ahead.

For one thing, we have a group of individuals, entrusted with the job of reading the economic tea leaves and enacting policies in response, which not only failed to anticipate the worst financial crisis this century, but has yet to make a usefully accurate forecast since the disaster started. Remember, Chairman Bernanke is the man who maintained that the subprime meltdown would remain "contained." He also said in March that he could see the now elusive "green shoots" sprouting throughout the economy.

And once the crisis began to unfold in earnest, what was the response of those charged with looking after our nation's economic and financial interests? Cynics might describe it as Keystone Cops-like chaos. On the one hand, we've had a reactive whirlwind of aggressive monetary measures that, while creating the semblance of stability, have resolved little and stymied desperately-needed restructuring. Worse still, a broad swath of corporate America is now dependent on government support for its continued existence.

Add that to the alphabet soup of Fed-devised bailouts and rescue plans, nearly all of which seem to have been designed to reward failure, subsidize mostly insolvent but politically powerful businesses, and obscure the reality of how bad things are, and you have a system that could be characterized as even more dysfunctional than it was before the bubble burst. While it might seem like tranquility, it is more likely the calm before the (next) storm.

Then there is all the damage the Federal Reserve caused before now. Most of those who've analyzed the facts and thought about how we got this point -- I don't mean the clowns on Wall Street or the commentators spouting nonsense from both sides of the aisle -- lay a great deal of the blame on the bubble-blowing policies initiated during the Greenspan era. And if you want to go back even further, ask yourself how is it that an institution charged with maintaining stability has overseen so many crises through the years and allowed our nation's currency to lose more than 95 percent of its purchasing power since the Fed's creation in 1913?

America's central bank hasn't just failed in its economic mission. It's track record as a regulator also leaves a lot to be desired. Among the many questions people should -- and will -- be asking is: how come the Fed was ignorant of and did little to rein in the leverage and lending misadventures of America's banks, many of which have long had Federal Reserve examiners ensconced in their offices? Moreover, how is it that an institution that should have known about the intricacies of derivatives was so oblivious to the threats posed by these "weapons of financial mass destruction"?

The truth is, aside from those periods when conditions and markets have set out a relatively easy path for central bankers to follow, the Federal Reserve has not lived up to its mission or its promise. Pretty soon, a growing number of people are going to be wondering why we need this institution at all.

Obama's Support Collapses In Rust-Belt Ohio

The weak economy -- or, more importantly, the failure to create jobs quickly -- is flensing Barack Obama's support on Ohio, a crucial electoral state.Here's the announcement from Quinnipiac, which conducted the poll:

President Barack Obama gets a lackluster 49 - 44 percent approval rating in Ohio, considered by many to be the most important swing state in a presidential election, according to a Quinnipiac University poll released today. This is President Obama's lowest approval rating in any national or statewide Quinnipiac University poll since he was inaugurated and is down from 62 - 31 percent in a May 6 survey.

By a small 48 - 46 percent margin, voters disapprove of the way Obama is handling the economy, the independent Quinnipiac (KWIN-uh-pe-ack) University poll finds. This is down from a 57 - 36 percent approval May 6. A total of 66 percent of Ohio voters are "somewhat dissatisfied" or "very dissatisfied" with the way things are going in the state, while 33 percent are "very satisfied" or "somewhat satisfied," numbers that haven't changed since Obama was elected.It's numbers like these, even more than bad economic data, that will really get Democrats to rally around a second stimulus, one that's especially focused on creating blue-collar jobs ASAP. Ed Rendell, who's home state of Pennsylvania shares characteristics with Ohio, was on CNBC this morning saying exactly that: This time, let's do that infrastructure stuff.

Nate Silver is a little skeptical, but even he concedes voters are judging Obama on the bad economy:

Ohio, of course, has suffered more than most states from the recession. It's employment rate, at 10.8 percent in May, is the eighth-highest in the nation, and has increased by 3.5 points (and counting) since Election Day:

States with Largest Increases in Unemployment Rate since November

What Ohio hasn't done, though, is suffer uniquely from the recession. It doesn't have it nearly as bad as its neighbor, my native state of Michigan, where unemployment is now at 14.1 percent. And what are Obama's approval ratings like in Michigan?

Not so bad. A Rasmussen poll in mid-June put Obama's approval there at 59-39, including 39 percent strongly approving (and remember, Rasmussen has tended to have very bearish numbers on Obama overall). An EPIC-MRA poll of Michigan in late May, meanwhile, had 61 percent rating his job performance as "excellent" or "pretty good".

The point is not that Obama's approval ratings aren't suffering because of the economy, nor that they might not be suffering more in states where the economy is worse. (Whoa, too many double-negatives there). I just doubt that there any problems Obama has that are so unique to Ohio that you wouldn't also see them manifested in Michigan or Pennsylvania (where Obama's approval numbers have also generally been fine). As such, I think the headlines this poll has generated have been a little overwritten.Given Obama's support for the auto industry, the Michigan numbers may be inflated a bit. We'd be really curious about Indiana, a traditionally red state that went blue.

Power of Stimulus Slow to Take Hold

Five months after Congress approved a massive package of spending and tax cuts aimed at reviving an ailing economy, the jobless rate is still climbing and the White House is scrambling to reassure an anxious public that President Obama's prescription for economic recovery is on the right track. Yesterday, Obama took time out of his first presidential trip to Moscow to defend the $787 billion stimulus package, arguing that the measure was the right medicine at the right time. "There's nothing that we would have done differently," he told ABC News.

Back in Washington, senior Democrats on Capitol Hill were nervously contemplating whether additional government stimulus spending may be needed to pull the nation out of the worst recession since the 1930s. Senior administration officials acknowledged that the effects of the stimulus package have been overshadowed by an unexpectedly sharp drop-off in employment since the measure passed in February. But they reported that only about $100 billion has so far been spent and that as increasingly large sums flow out of Washington, the program is on pace to save or create 600,000 jobs over the next 100 days.

"It is clear from the data that there needs to be more fiscal stimulus in the second half of the year than there was in the first half of the year," White House economic adviser Lawrence H. Summers said. "Fortunately, the stimulus program designed by the president and passed by Congress provides exactly that."

Leading economists agree that the most powerful effects of the stimulus package have yet to be felt. But even if the measure lives up to Obama's expectations, it would barely offset the 433,000 jobs the nation lost last month alone, and the resulting employment would represent a drop in the bucket compared with the 6.5 million jobs lost since the recession began in December 2007. "Just 130 days out on the adoption of a very, very major effort to get the economy moving, certainly I don't think we can make a determination as to whether or not that's been successful," House Majority Leader Steny H. Hoyer (D-Md.) said yesterday. But, he said, "I think we need to be open to whether or not we need additional action."Republicans, meanwhile, pounced on news that the unemployment rate increased to 9.5 percent in June and accused the Democrats of sinking the nation deeper into debt to finance an economic recovery package that has failed to save American jobs. Noting that the Obama administration predicted earlier this year that stimulus spending would keep the unemployment rate under 8 percent, Rep. Eric Cantor (R-Va.), the No. 2 Republican in the House, said, "I think any objective measure would indicate there's a failure when you have a commitment of nearly $800 billion in taxpayer funds and you have the type of job loss we're experiencing."

With many economists forecasting that the jobless rate will continue to climb -- and is likely to stay above 10 percent through much of next year -- Republicans vowed to make the 2010 midterm election a referendum on Obama's stewardship of the economy. "I think they're going to have some significant problems," said Sen. John Cornyn (R-Tex.), who leads the GOP campaign operation in the Senate, "and I view those as opportunities for us."

Despite the deepening pain of the recession, many Democrats in the White House and on Capitol Hill yesterday counseled patience. They said it would be extraordinarily difficult to win approval for more spending on the economy when Obama is pursuing a host of other expensive initiatives, including a $1 trillion expansion of the nation's health-care system. And they argued that the current stimulus package should be given a chance to work.

The stimulus was designed to deliver a gradually stronger push to the economy through the end of next year. It contains about $499 billion in new spending and about $288 billion in tax cuts for working families, businesses, college students and first-time home buyers. When the measure passed, the nonpartisan Congressional Budget Office predicted that about a quarter of the money would be spent by year's end, and that about 75 percent would flow by the end of 2010. So far, economists said, spending appears to be on track.

According to administration estimates, about $158 billion in new spending had been committed to specific projects by the end of June, but just a fraction of that money -- about $56 billion -- had been delivered to struggling state governments, unemployed workers and other recipients. An additional $43 billion had been left in the pockets of individuals and businesses through uncollected taxes, much of it the result of Obama's signature Making Work Pay tax credit for working families.

Those figures track closely with estimates by Mark Zandi, chief economist for Moody's Economy.com, who calculates that the government made $242 billion in stimulus funds available for various purposes through the end of June and paid out about $110 billion. In a recent analysis, Zandi predicted that "the maximum contribution from the stimulus should occur in the second and third quarters of this year," when it will add more than three percentage points to overall economic growth. "It's pretty much according to plan in terms of the payout and in terms of its economic impact. This is in the script," Zandi said. The problem, he said, is that "the economy has been measurably worse than anyone expected," with a surprisingly sharp "collapse in employment and surge in unemployment" that caught most economists off guard.

"That's why the administration's forecasts have been so wrong," he said. The White House continues to predict that the stimulus package will save or create 3.5 million jobs by the end of next year. Zandi predicts it will fall short of that, producing about 2.5 million jobs -- still a significant impact. Whatever the number, Democrats are hoping it will be enough to convince voters that Obama is leading them out of the economic wilderness.

"I think the president was very clear that things were going to take a long time to turn around," said Rep. Chris Van Hollen (D-Md.), who leads the Democratic Congressional Campaign Committee in charge of electing Democrats to the House. Republicans "are making the argument to the American people that doing nothing would have been the best policy. And I don't think people will buy that. . . . "The measures we have taken have certainly prevented things from getting much worse."

Stimulus: Where's the $787 Billion?

Administration officials insist that it takes time to dole out money properly, which explains why so little has been spent so far. Call it the $787 billion question: Where is all that government stimulus money, and why hasn't it stemmed the heart-stopping slide in U.S. employment? The stimulus plan was all about jobs, after all. Key Obama Administration officials pledged to save or create between 3 million and 4 million jobs with the measure. But the federal government's employment figures on July 2 clocked in worse that expected, with job losses lurching to 467,000 in June and the unemployment rate reaching its worst showing since 1983, at 9.5%; many expect it to rise further still.

Public confidence in the stimulus plan is slipping and over the weekend, Vice-President Joe Biden suggested another stimulus plan is possible, something of a shift from Obama's position just two weeks ago that more spending isn't yet called for. Yet analysts and federal contracting experts say that, in many ways, stimulus spending is going about as quickly as expected. Dispensing billions of dollars, it turns out, simply takes time, particularly given government contracting rules and the fact that much of federal spending is funneled through the states.

Moreover, some spending was intentionally spread out over several years, and other projects are fundamentally more long-term in nature. "There are real constraints—physical, legal, and then just the process of how fast you can commit funds," says George Guess, co-director of the Center for Public Finance Research at American University's School of Public Affairs. "It's the way it works in a decentralized democracy, and that's what we're stuck with." Certainly, based on key numbers, it looks as if the five-month-old spending legislation has been slow to unfold.

Onvia (ONVI), a Seattle company that tracks federal spending, estimates that some $65 billion of the $420 billion that was in the stimulus package for contract and infrastructure spending has gone out the door. Federal officials offer similar numbers, saying $60 billion of the $499 billion in total stimulus spending has been disbursed. (The remaining $288 billion consisted of tax cuts.) But those numbers mask a lot of activity, analysts and government officials say. Onvia has identified some 18,500 specific projects covered under the legislation, and while just under 1,800 of them have had contracts awarded, another 5,000 or so have been put out to bid. For the remainder, funds have been allocated but not spent, says Michael Balsam, the company's chief solutions officer.

Ed DeSeve, senior adviser to the President for recovery and reinvestment, tells BusinessWeek that $157.7 billion has been "obligated" for projects of various kinds, roughly a third of total stimulus spending, and $43.3 billion has been distributed in tax breaks. "We think we're right on target," DeSeve says. He also argues that it makes more sense to count funds allocated to specific projects than dollars actually spent. "When do you buy something—when you use your American Express, or when you pay your bill?" DeSeve says. "You buy it when you use your American Express." Critics of the stimulus rollout argue that what matters most is when the dollars reach the economy—the equivalent of when American Express pays the merchant.

The U.S. Transportation Dept. recently stressed that it routinely reimburses states for payments to contractors on federal infrastructure jobs, meaning work can be under way for some time before states pay contractors and seek reimbursement from the feds. Doing otherwise risks wasting federal funds by overpaying up front, the agency said on an Administration blog. Still, some basic facts of federal contracting slow the process, analysts say. Funneling federal funds through state agencies can prove slower than awarding contracts directly. Seeking competitive bids—a process that's designed to ensure the government doesn't overpay or favor select contractors—also takes time. "It's really not going all that slowly when you take into consideration just the process to spend federal money," says Clint Currie, a transportation analyst for Concept Capital's Washington Research Group.

Similarly, funds allocated to help states with Medicaid and school costs began flowing pretty quickly, says Nick Johnson, director of the Center on Budget and Policy Priorities' state fiscal project. But there, some of the spending was explicitly earmarked for 2010 and even 2011. The Administration has said it hopes to meet Congressional Budget Office estimates that 70% of stimulus funds will be spent by fall 2010. "Everyone knew the recession wasn't going to end in a blink," Johnson says.

Other projects will take time by their very nature—as is the case with funds intended to foster what the Administration calls long-term, sustainable growth in industries supporting public transit or renewable energy. Transit funds that go toward replacing light-rail or subway cars could take years to spend, and building a new light-rail system could take a decade or more, as did Charlotte's 18-month-old light-rail system, says Guess, the American University researcher. Plus, state and local agencies must determine which projects actually qualify for federal funds under rules set by Congress.

One bright spot: Bids for many projects are coming in under expectations, sometimes by as much as 20% to 30% in the case of some transportation contracts, analysts and government officials say. Depressed demand for materials has lowered prices, while contractors are willing to work more cheaply than when construction was booming, notes Currie, the transportation analyst. There are other, less obvious impediments as well. In a few cases, lawmakers have sought to reject federal funds, as in South Carolina Governor Mark Sanford's failed effort.

Other programs that would have qualified for federal matching dollars under the stimulus plan have been cut as states face their own budget woes. As the unemployment rate rises across the country, some states are forgoing stimulus dollars specifically designated to help the unemployed. As of July 2, little more than half of the money had been claimed, and four states rejected it altogether, according to ProPublica, a nonprofit news organization. In some cases, states worried that accepting the money would require them to sweeten the benefits they offered laid-off workers at a prohibitive cost to the state.

If simply tracking stimulus spending has proven complex, determining how many jobs have actually been created or saved is even more daunting. Most Administration estimates come down to a fairly straightforward but indirect calculation: Each $1 million of government spending creates 10.9 jobs, or about $92,000 a year for each job, including benefits, administrative costs, and other overhead. Using that ratio, for example, a $1.6 billion contract to demolish and remediate a Washington state nuclear facility could generate 17,740 jobs, but whether it ultimately does, only time will tell.

Starting Oct. 10, stimulus-fund recipients must begin reporting more concrete details on jobs and spending at www.federalreporting.gov, and federal budget officials have made it clear that they plan to refine reporting requirements as time goes on, says Craig Jennings, a senior policy analyst with OMB Watch, a nonprofit group that focuses on budget issues. "It's not hopeless," Jennings says. The federal Office of Management and Budget "has been very clear on the fact that their approach is iterative. They're not going to get it right the first time." But even then, it won't be easy to square whatever job gains are claimed with rising unemployment. Few economists expect the jobs picture to improve this year, and many predict the national unemployment rate will rise to 10% or beyond. Ultimately, stimulus supporters argue that, without it, job losses would be even worse.

Treasury Taps Nine Managers for $40 Billion Toxic-Debt Program

The U.S. Treasury named BlackRock Inc., Invesco Ltd. and seven other managers for the Public- Private Investment Program, in an effort to remove as much as $40 billion in troubled assets from financial institutions. The Treasury will invest as much as $30 billion in the program, and the nine companies may raise a combined $10 billion, the department today said in a statement. The others are: AllianceBernstein LP, Marathon Asset Management LP, Oaktree Capital Management LP, RLJ Western Asset Management LP, the TCW Group Inc., Wellington Management Co., and a team of Angelo Gordon & Co. and GE Capital Real Estate.

The fund managers each must contribute a minimum of $20 million of their own capital and also raise at least $500 million from private investors within 12 weeks. The first closing on an established PPIP fund is expected in August, the Treasury said. "While utilization of legacy securities will depend on how actual economic and financial market conditions evolve, the programs are capable of being quickly expanded if these conditions deteriorate," Treasury Secretary Timothy Geithner, Federal Reserve Chairman Ben S. Bernanke and Federal Deposit Insurance Corp. Chairman Sheila Bair said in a joint statement.

Pacific Investment Management Co. isn’t among the selected firms. The Newport Beach, California-based unit of the Munich- based insurer Allianz SE said today in a statement it withdrew its application to serve as a manager "as a result of uncertainties regarding the design and implementation of the program." Pimco manages $756 billion, including the world’s largest bond fund. PPIP funds will initially target commercial mortgage-backed securities and non-agency mortgage backed securities issued before 2009, with an initial rating of AAA or its equivalent, the department said. If the program goes above $40 billion, it could utilize the Fed’s Term Asset-Backed Securities Lending Facility.

Today’s announcement reflects the scaled-down start of a program that was announced as having the potential to reach $1 trillion in distressed loans, mortgage-backed securities and other assets. The program was laid out to use $75 billion to $100 billion from the $700 billion Troubled Asset Relief Program alongside private-sector leverage. The asset managers named today will work on the Legacy Securities Program, one half of the original initiative. A second component dealing with whole loans, to be run by the FDIC, was delayed last month.

Geithner, Bair and Bernanke said the FDIC is committed to making the Legacy Loan Program available as needed. The FDIC is planning to test its PPIP mechanisms in July when selling the assets from a failed bank, the regulators said. The FDIC previously has named Georgia’s failed Silverton Bank as its potential test case. For the securities program, TARP-related executive compensation limits will not apply to asset managers or private investors, provided the funds are set up so that the asset managers and their employees aren’t controlling investors, the Treasury said in a fact sheet accompanying its statement. Private investors in the funds will be subject to a maximum investment of 9.9 percent in the PPIP funds, the Treasury said. There is no other limit on foreign investor participation.

The PPIP funds will be allowed to buy securities from sellers eligible under the TARP law. In general, sellers must be established and regulated in the U.S. and not owned by a foreign government, except under certain circumstances related to failed institutions, the Treasury said. The Treasury also released conflict-of-interest rules, developed in consultation with the Fed’s compliance staff, fund managers, and the Special Inspector General for the TARP, the Treasury said. The nine asset managers also have established relationships with 10 small, woman-owned and minority-owned financial services businesses, the Treasury said.

Boston Fed: Obama Loan Mod Program Unlikely To Work

A study released by the Federal Reserve Bank of Boston this week indicates that the $75 billion that the Obama administration is directing to the lending industry to encourage loan modifications probably won’t work. The four-month-old anti-foreclosure program has — at least so far — shown weak results. According to the Obama administration’s own estimate, "over 50,000" loans were modified to make payments more affordable for borrowers at risk of default, The New York Times reported. That’s a small number considering that millions of new foreclosures are expected in the next couple years.

Paul S. Willen, senior economist at the Boston Fed, told The Boston Globe that it would probably make more sense to give the money directly to struggling homeowners to cover their payments because lenders aren’t eager to do loan workouts because they aren’t profitable. The Obama plan would give bonuses and other incentives to loan servicers to modify loans ($1,000 for each loan they modify and $1,000 each year that a borrower says current on their modified loan payments). According to The Globe:

"Willen said the success bonus could have the unintended effect of steering loan servicers away from those who need help the most, and toward only those borrowers most likely to recover on their own anyway. He said that if modifications increase, it won’t be by much. "My guess is they are going to help people who are OK, and they are not going to help people who are deep trouble,’’ he said."

US stimulus helps create 14,200 summer jobs

President Barack Obama's $787 billion economic stimulus package will help put 14,200 teens and young adults to work this summer in Ohio, and most of the stimulus-funded highway projects in the state are reaching economically distressed areas, according to a federal report released Wednesday. All but one of the state's highway projects are scheduled to be completed within three years. The exception is the replacement of the 50-year-old Interstate 90 bridge in Cleveland, a major project expected to take four years, the U.S. Government Accountability Office said in a report to Congress.

The GAO's audit covers 16 states and the District of Columbia that together are getting about two-thirds of the stimulus money. The agency is issuing reports every two months to examine how stimulus funds are being used. Ohio, where the unemployment rate has jumped to 10.8 percent, the highest in more than a quarter century, expects to get $8.2 billion in stimulus money over the next three years. The summer jobs program will put young workers in parks, community colleges, hospitals and public schools.

The Obama administration intended for the stimulus to jump-start the economy, build new schools and usher in an era of education reform. But government auditors said many states are setting aside grand plans to stay afloat. That included Ohio, where stimulus funds make up about 5 percent of Ohio's general revenues for the $54 billion 2010-2011 budget. Ohio still faces a deficit, and Democratic Gov. Ted Strickland and Republican lawmakers remain deadlocked over how to balance the budget.

The stalemate is preventing some Ohio school districts from launching long-term education reforms because stimulus money for schools is tied to the state budget, GAO auditor Cynthia Fagnoni said. And as tax revenues across the state continue to drop, many school officials are just looking to retain programs and teachers they have and avoid large layoffs, Fagnoni said. Cleveland, however, is trying something different. School officials plan to offer 200 teachers who are at or near retirement the chance to stay and serve as teacher coaches or tutors for students. These teachers must agree to retire or resign after two years, when the stimulus act ends.

In the 16 states, about half the money set aside for road and bridge repairs is being used to repave highways rather than to build new infrastructure, the GAO said. And officials aren't steering the money toward counties that need jobs the most, auditors found. The Ohio Department of Transportation, which is getting $774 million in stimulus money, fared better.

Ohio has selected 210 transportation projects to get stimulus money, and 194 of them are located in economically distressed counties, the GAO said. Transportation officials told the GAO that since 79 of Ohio's 88 counties are considered economically distressed under federal guidelines, targeting projects in struggling areas wasn't difficult. The GAO didn't provide an estimate of jobs created under the stimulus plan but noted that as of June 25, Ohio had awarded 52 highway contracts valued at $92.1 million and construction on some projects had begun.

An unknown country

by Paul Krugman

A correspondent writes in, denouncing my latest column, and says that if things go my way we’ll end up with the government providing health care to everyone, which will “destroy the American way of life.”Hmm. There’s a country this correspondent — and many others who denounce “socialized medicine” — should look at. It’s a country where there is, indeed, a substantial private health insurance industry, which pays 35 percent of medical bills. But the government pays a larger share — 46 percent. (Most of the rest is out-of-pocket spending.)

The country is called the United States of America.

The inevitable socialisation of health care financing

by Willem Buiter

Private insurance only works if there is risk. If the risk is eliminated, profitable insurance is impossible. This holds for health insurance as it holds for credit default swaps. When risk vanishes, insurance turns into redistribution. That’s a task for the state, whether through the tax payer or by mandated pooling in quasi-private insurance schemes of individuals with known heterogeneous health profiles.

The rise of genomics - the branch of genetics that studies organisms in terms of their full DNA sequences or genomes - will in the not too distant future kill off most private health insurance. That’s probably a good thing, for two reasons. First, because of asymmetric information, when there is risk and uncertainty about a person’s future health, health insurance markets are badly affected by adverse selection and moral hazard. Second, because the private health insurance industry is a monument to inefficiency everywhere and, especially in the US, a rent-seeking Leviathan whose ruthless lobbying efforts corrupt all it touches.

When it becomes possible early in life to map out a person’s future infirmities, illnesses, disabilities and eventual cause(s) of death (other than those due to accidents or violence), it becomes impossible to have health insurance based on market principles and the profit motive. With profitable health insurance impossible because you cannot insure a sure thing, there are but two options left. Either you leave those with poor health prospects to their own devices (the ‘tough luck’ approach) or you turn health insurance into interpersonal redistribution of income, that is, you socialise health care funding. This redistribution is from those with above-average health prospects to those with below-average health prospects.

Such a redistribution policy can either use general tax revenues (the way the British National Health Service is financed) or can involve subsidised health ‘insurance’ in a world with mandatory health insurance where those with below-average health prospects are pooled with the rest of the population and where individual health insurance premia do not reflect an individual’s health prospects - like the assigned-risk pool for car insurance in the US. Under either system there would be a minimum guaranteed quality of health care that everyone is entitled to, regardless of ability to pay, and that would be paid for either out of general tax revenues or out of the premia contributed by those with above-average health prospects.

I start from the proposition that health care, up to a collectively decided minimum standard, should be available to everyone. That is, it should be universal and mandatory. Obama’s plan does not include the provision that everyone has to have health insurance up to a minimum standard. If health care is to be universal, it should be de-coupled from employment completely. The availability of health care should be a function of the condition of being alive, not of the condition of being employed. Here too, Obama’s health care plans, which retain tax advantages for employer-provided health insurance, fall down badly.

With socialised healthcare financing, health care will be rationed for most people. If you include price rationing among the rationing mechanisms, health care will be rationed for everyone. Jones can get dialysis; Smith cannot. There is a liver for Blogs but not for Blags. Drug X (which costs thousands of dollars for a year’s supply) will be made available to persons with early stage breast cancer but not to those with late stage breast cancer. No hip replacements for those over 95, unless you are a member of the royal family etc. etc. With heroic, high-tech health care capable of absorbing most of GDP unless rationed by quantity or price, health care rationing - involving involuntary euthanasia by committee or market for those rationed out of access - will be part of all our futures.

The details of the health care rationing mechanism will be a matter of life and death - literally. It has always been thus when ability to pay was used to select those who would gain access to scarce and costly treatments in the market for health services. Rationing of life-saving and comfort-enhancing costly treatments in the British National Health Service has been achieved through various forms of administrative discretion, sometimes involving the (professional or unprofessional) judgments of physicians. Education, influence and connections - the trademarks of the ‘aristocracy of pull’ everywhere - have been key drivers of who gets what quality health care in the NHS since its inception.

It is essential that the health care rationing mechanism be transparent; it should also be contestable - in real time - by those excluded from a treatment they desire. New forms of discrimination will become politically important and old forms of discrimination (e.g. age-based, as in "why give a new kidney to 95-year old?" or "do we assign this incubator to the premature baby most likely to benefit from it or the one most in need of it?") will take on greater political significance. At work, people and committees will be playing God on an ever-growing scale. I wonder how they behave when they come home.

Note that nothing I have said sheds any light on the best way to provide medical care - on whether health services should be supplied privately, cooperatively, by the state, with or without regulation etc. It only concerns who pays, and there the answer is clear: you and I as tax payers or you and I as mandated providers of subsidies in large assigned-risk pools.

Shipping flashes early warning signals again

Port statistics are revealing. They were a leading indicator before the production collapse in the Japan, Europe, and the US over the winter, and they may be telling us something again. Amrita Sen at Barclays Capital says the number of Baltic Dry ships waiting to berth — mostly in China and Australia — has begun to fall after peaking at 154 in mid-June. The Capesize Iron Ore Port Congestion Index (a new one for me, I must confess) is replicating the pattern seen a year ago just before the commodity boom tipped over.

"The anecdotal evidence we are hearing is that vessel queues have been falling. There are reports of cancelled tonnage from China pointing to a slowdown in Chinese buying of coal and iron ore. "We are definitely expecting a correction. People have been building stocks of iron ore too quickly in anticipation of the stimulus package in China," she said. The Baltic Dry Index measuring freight rates jumped 450pc in the first half of the year on the China rebound, but has begun to fall back over the last two weeks. (Sen doubts freight rates will recover much since 1000 new ships are hitting the market this year and again next year, compared to 300 in normal years. There is obviously a horrendous shipping glut).

Over at Naked Capitalism they are reporting that international port traffic for containers (ie finished goods) is as dire as ever. The rates for 40-foot container from Asia and America’s West have actually fallen this year from $1,400 to $920. "There has never been a decline like this before," said Neil Drecker from the Drewry Report. "The container industry is looking at a $20-billion black hole of losses. We can expect a lot of casualties."

As readers can guess, I remain extremely sceptical of this commodity rally (although it was to be expected as part of the inventory restocking effect). It is not underpinned by real global demand. It is a anti-inflation play by funds betting that quantitative easing by the world’s central banks will lead to systemic currency debasement. That may ultimately happen, but the more immediate threat is the abrupt slowdown/contraction of the broad money supply (M3, adjusted M4) and the collapse in the velocity of money, as well a post-War low in capacity use (68pc in the US), and a massive global "output gap".

All the deeper signs suggest to me that action by the Fed, Bank of Japan, Bank of England, and the European Central Bank is still not enough to offset the deflation shock. Though I recognize that this is a deeply unpopular view these days in the blogosphere. Deutsche Bank has told clients to tread carefully. It says the global output gap is minus 6pc, and it is this gap — not the level of economic growth as such — that drives oil prices over the long run.