Children of Oklahoma drought refugees on highway near Bakersfield, California.

Family of six; no shelter, no food, no money and almost no gasoline.

The child has bone tuberculosis

Ilargi: 47 economists in a Wall Street Journal survey, and 53 in a Bloomberg one, say the recovery is here and the recession is over. That would add up to a nice even 100, but I'm afraid many might be the same. When reading through the two articles about the surveys, I find it -literally- hard to see what the optimism is based on. There is talk of confidence indices, the Obama stimulus gets mentioned, as does a Fed $1.45 trillion mortgage debt purchase. The consensus expectation is for unemployment to stay below 10%, but there's no reason(ing) provided for that.

The closest thing to a concrete fact I can find in either piece is the "better-than-expected employment report for July, where employers cut 247,000 jobs and the jobless rate fell for the first time in 15 months". And yes, that does sound nice, but those numbers cover just one month, and so many if's, but's and maybe's have been pointed out since they were published that they can only be a very slim foundation to base so much optimism on.

So I have to say, I don't know why the 47+53 club expects economic growth, recovery, any of that. There may well be better formulated grounds, but in the absence of such grounds, I feel left quite cold and alone with faith-based "economics". Of course, what I've left out thus far is what may well be the main reason for the hosanna feeling: the surge in stock markets. Still, I'm sure at least some of the economists would recognize that rising share prices are, all on their own, a questionable indicator for an economy that's been mired in recession/depression for, depending on your calendar, 10 or 20 months.

Now, I vividly remember many separate occasions on which many separate economists have alluded to two distinct sectors of the economy as the most important, make or break, ones. Those two are housing and employment, obviously. So if both those surveyed and the reporters writing about the survey fail to come up with concrete examples, I'd humbly suggest looking there.

Sure, officially "only" 247,000 people lost their jobs in one month, and the continuing jobless rate fell a bit. But first of all, anyone who can read by now understands that these BLS slash goverment numbers are not the undisputed final word on the topic. And moreover, let's see: one third of all America's jobless are long term unemployed, as in longer than 26 weeks. That's 4.4 million people. By December, 1.5 million will be out of a job for longer than any extended benefit timeframe will cover, i.e. on average a year or more. The number who fall off the back end of these stats make the data that claim the continuing jobless rate went down look suspicious.

It's not going to stop with those 1.5 million more or less perpetually hopeless. In fact they're merely the vanguard of an abundant legion that is being raised in the nation of people who are not just jobless, but simply and outright hopeless. What happens to the official U3 unemployment rate remains to be seen, but, again, one month does not a summer make, even if the numbers would be taken at face value. It would be much more useful for every reporting party to switch to the U6 data, since they encompass such large groups of people that we would all intuitively see as unemployed, but I digress for now.

Still, the unemployment stats hardly seem to point straight at recovery and growth. Everyone agrees the numbers will keep going up, the only real discussion is by how much.

The second pivotal indicator, besides jobs, is housing. For that, we can turn to today's news. Home sales in the 2nd quarter rose 3.8% from the first. That looks like good news, but not so fast. Home prices, for existing homes, fell by a record 15.6% over last year, the most in 30 years of record keeping. Yet another record was set by the number of foreclosure filings. 360,000 homes received such a filing in July, in one single month! And that's with state and federal anti-foreclosure programs in place.

So, excuse me, but no, I don't see a reason for optimism in housing either. I think the 47+53 economists have just proven once more that their field is very far away from being a science, that they are selling religious messages. And of course you can say: hey, it works for Christianity, so why not give it a go. But not even priests pretend to be scientists.

Luckily for all of us there are still analysts around, albeit not that many, who don't feel satisfied with just stories and belief systems.

Harry Markopolos predicts a major implosion in the CDS market. We don’t know what he bases that on, and we don't want to slip into faith as well, but such an event is on the way, be it sooner or later. Nassim Taleb sums it up like this (as assembled by Clusterstock):

- We're all in denial

- We're replacing private debt with public debt.

- We're not dealing with the cancer in our banking system.

- We're not making the structural changes we need to make.

- We're not being aggressive enough about restructuring debt (debt for equity swaps).

- Bernanke is a wimpy Greenspan sycophant

- Obama's rewarding the fools who got us here (Summers, Bernanke, Geithner)

- The banksters are taking over again

While Elizabeth Warren (surprisingly dark for a government employee) adds these pointers:

- The banks are still insolvent.

- That little tweak to mark-to-market accounting a couple of months ago has allowed us all to plunge into deep denial.

- Now that the banks are allowed to lie about what their toxic assets are worth, they'll never sell them (because if they did they would have to write them down).

- The smaller banks are undercapitalized and will have to raise another $12-$14 billion.

And Robert Prechter finishes off the position of the not-so-rosy:

Yes, the late 2007-early 2009 market debacle was just a warm-up to what Prechter believes will be the bear market's main attraction. In this regard, he says the current cycle will echo past post-bubble periods such as America in the 1930s and England in the 1720s, after the bursting of the South Sea bubble.

The 2000 market peak market a "major trend change" for the market from a very long-term cycle perspective, and the downside is going to continue to be painful well into the next decade, Prechter says. "The extreme overvaluation, the manic buying and bubbles in the late 1990s [and] mid-2000s are for the history books - they're very large," he says. "The bear market is going to have to balance that out with some sort of significant retrenchment."

How significant does Prechter think that retrenchment will be?

"This is the kind of top, the kind of degree, that we haven't seen for a couple of hundred years."

Yup. We're in for nasty weather. The markets are up 45%, while all serious indicators in the economy have worsened substantially, since their lows 5 months ago. Now, if you were a practical person, if you wanted proof instead of stories that "the worst may be over", where would you think those markets are likely to be headed?

It's still all about the toxic debt, nation. That is where the answers lie. Useless mortgage backed securities mixed with lost wagers on everything under the sun. Markopolos may or may not have the correct call on CDS revelations. But what's certain is that if home prices drop at record levels, so do the securities written on them. That means the toxic debt continues to become even more toxic, not less.

But, yes, I know, faith is a tempting proposition for the fickle human mind.

One more thing: I said when the crash started that you don't need the banks that were then starting to be bailed-out, that what you need is access to your money, plain and simple, which the government could guarantee through post office or supermarket. Today, Elizabeth Warren says this:

"The question of whether or not you think the world as we know it has ended, depends on what you think the world IS as we know it. If you think the world as we know it are a handful of huge financial institutions, the dinosaurs that roam the earth, then you're right; they’re not going to exist without HUGE infusions of government money.

On the other hand, if what you really believe is our economy and our world is [..] 115 million American households that are out there, that need jobs, you start to see it very differently, you think: the dinosaurs are gone, and [there’s still a lot of stuff to be done.]"

U.S. Home-Price Drops Accelerate as Foreclosures Climb

The year-over-year drop in the median sales price of single family homes showed its worst decline ever.

Home price declines in the U.S. accelerated in the second quarter, dropping by a record 15.6 percent from a year earlier, as foreclosures weighed on values. The median price of an existing single-family home dropped to $174,100, the most in records dating to 1979, the National Association of Realtors said today. Total sales rose 3.8 percent to a seasonally adjusted annual rate of 4.76 million from the first quarter and fell 2.9 percent from 2008’s second quarter.

Prices fell in 129 out of 155 metropolitan areas from a year ago and 39 states experienced sales increases from the first quarter, the Chicago-based realtors group said. Sales in U.S. housing market at the heart of the global recession are beginning to stabilize, said Patrick Newport, an economist for Lexington, Massachusetts-based IHS Global Insight. "I don’t think we’re at a bottom yet in home prices," said Scott Anderson, a senior economist at Wells Fargo & Co. in Minneapolis. "There’s also a pretty big shadow supply of houses. People are kind of waiting for the bottom but there’s a pent-up supply out there." Home prices are falling even as a survey of economists indicates that the U.S. economy is recovering from the worst recession since the 1930s. The economy will expand 2 percent or more in four straight quarters through June, the first such streak in more than four years, according to the median of 53 forecasts in the monthly Bloomberg News survey.

The median existing home price fell 9.7 percent in the Northeast from the same period a year earlier to $246,000, the group said. Sales jumped 15 percent from the first quarter and are down 8.4 percent from a year ago. In the Midwest, prices fell 8.6 percent to a median of $146,800 from a year earlier. In the South, prices slid 10.3 percent to $158,600. In the West, they declined 26.6 percent to $212,600. The largest decline was in the Cape Coral-Fort Myers metropolitan region, where the median price fell 53 percent to $84,000 from a year earlier. The second-largest decline was in the Las Vegas, Nevada, region, where prices fell 39.7 percent, followed by the Riverside-San Bernardino-Ontario metro area in California, where prices fell 39.1 percent.

The biggest increase in prices was in the Davenport-Moline- Rock Island area of Illinois and Iowa, where prices surged 30.6 percent to $113,200 from a year earlier. The second biggest jump was in the Cumberland metro area of Maryland and West Virginia, where prices rose 21.7 percent. The Elmira, New York, area had the third-biggest increase, where prices rose 11.3 percent. Home prices are tumbling even as mortgage rates remain near all-time lows. The average U.S. rate for a 30-year fixed home loan was to 5.22 percent last week, down from 5.25 percent the prior week, according to mortgage buyer Freddie Mac of McLean, Virginia. The rate dipped to 4.78 percent in April, the lowest ever recorded.

U.S. foreclosure filings -- notices of default, auction or bank seizure -- rose to a record in 2009’s first half, according to RealtyTrac Inc., an Irvine, California-based seller of real estate data. More than 1.5 million properties, one in every 84 U.S. households, received a foreclosure filing, RealtyTrac said in a July 16 report. Homes in or near default typically sell for about 20 percent less than non-distressed property, according to the Realtors group. Those sales reduce the value of each surrounding home by an average $8,667 because the lower price is used by appraisers to set values for other properties in the area, according to the Center for Responsible Lending in Durham, North Carolina.

The world’s largest economy will contract 1.3 percent this year, according to a July 10 forecast by Fannie Mae. The U.S. unemployment rate may climb to 9.9 percent in 2010, from 9.3 percent this year, according to the mortgage buyer controlled by the U.S. government.

U.S. home foreclosures set another record in July

U.S. home loans failed at a record pace in July despite ongoing federal and state programs to avoid foreclosures, which have severely strained housing and the economy. Foreclosure activity jumped 7 percent in July from June and 32 percent from a year earlier as one in every 355 households with a loan got a foreclosure filing, RealtyTrac said on Thursday. Filings -- including notices of default, auction and bank repossession -- have escalated with unemployment.

"July marks the third time in the last five months where we've seen a new record set for foreclosure activity," James J. Saccacio, RealtyTrac's chief executive, said in a statement. "Despite continued efforts by the federal government and state governments to patch together a safety net for distressed homeowners, we're seeing significant growth in both the initial notices of default and in the bank repossessions."

More than 360,000 households with loans drew a foreclosure filing in July, a record dating back to January 2005, when RealtyTrac started tracking monthly activity. Notices of default, auction or repossession have reached nearly 2.3 million in the first seven months of the year -- with more than half a million bank repossessions, the Irvine, California-based company said. Making timely payments keeps getting more harder for borrowers who have lost their jobs or seen their wages cut. The unemployment rate is 9.4 percent and President Barack Obama has said he expects it will hit 10 percent.

Obama's housing rescue is gaining traction in altering terms of loans for struggling borrowers, but slowly. Earlier this month the U.S. Treasury Department detailed the progress of the top servicers in modifying loans and prodded them to step up efforts to stem foreclosures. States where sales and prices surged most in the five-year housing boom early this decade remain hardest hit. California, Florida, Arizona, Nevada accounted for almost 57 percent of total U.S. foreclosure activity in July. Illinois had the fifth-highest total filings, spiking nearly 35 percent from June, in an example of how moratoriums often delay rather than cure an inevitable loan failure.

Default notices spiked by 86 percent in July, from artificially low levels the prior two months. A state law enacted on April 5 gave delinquent borrowers up to 90 extra days before foreclosure started, RealtyTrac said. Michigan's foreclosure activity fell 39 percent in July from June, mostly due to a 66 percent drop in scheduled auctions. A state law that took effect July 6 freezes foreclosure proceedings an extra 90 days for homeowners who commit to work on a loan modification plan. Other states with the highest foreclosure filing totals last month included Texas, Georgia, Ohio and New Jersey.

Nevada had the highest state foreclosure rate for the 31st straight month, with one in every 56 properties getting a filing, or more than six times the national average. Initial notices of default fell 18 percent in the month, with a new Nevada law taking effect on July 1 requiring lenders to offer mediation to homeowners facing foreclosure. Scheduled auctions and bank repossessions each jumped more than 20 percent, however, boosting overall foreclosure activity in the state by 4 percent from June. California, Arizona, Florida, Utah, Idaho, Georgia, Illinois, Colorado and Oregon were the other states with the highest foreclosure rates.

Ilargi: • Warren: On top of everything we have so far, we’ll see a 50-60% default rate on commercial mortgages, a problem that will be concentrated in intermediate and smaller banks.

• (When asked if Hank Paulson made the right call bailing out Wall Street): "The question of whether or not you think the world as we know it has ended, depends on what you think the world IS as we know it. If you think the world as we know it are a handful of huge financial institutions, the dinosaurs that roam the earth, then you're right; they’re not going to exist without HUGE infusions of government money. On the other hand, if what you really believe is our economy and our world is [..]115 million American households that are out there, that need jobs, you start to see it very differently, you think: the dinosaurs are gone, and [there’s still a lot of stuff to be done.]

Elizabeth Warren: "We Have A Real Problem Coming..."

- The banks are still insolvent.

- That little tweak to mark-to-market accounting a couple of months ago has allowed us all to plunge into deep denial.

- Now that the banks are allowed to lie about what their toxic assets are worth, they'll never sell them (because if they did they would have to write them down).

- The smaller banks are undercapitalized and will have to raise another $12-$14 billion.

And so on...Visit msnbc.com for Breaking News, World News, and News about the Economy

Ilargi: Prechter: "This is the kind of top, the kind of degree, that we haven't seen for a couple of hundred years."

Bob Prechter "Quite Sure" Next Wave Down Will Be Bigger and March Lows Will Break

In late February, Robert Prechter of Elliott Wave International said "cover your shorts," and predicted a sharp rally that would take the S&P into the 1000 to 1100 range. With that prediction having come to pass, Prechter is now saying investors should "step aside" from long positions, and speculators should "start looking at the short side." "The big question is whether the rally is over," Prechter says, suggesting "countertrend moves can be tricky" to predict. But the veteran market watcher is "quite sure the next wave down is going to be larger than what we've already experienced," and take major averages well below their March 2009 lows.

Yes, the late 2007-early 2009 market debacle was just a warm-up to what Prechter believes will be the bear market's main attraction. In this regard, he says the current cycle will echo past post-bubble periods such as America in the 1930s and England in the 1720s, after the bursting of the South Sea bubble. The 2000 market peak market a "major trend change" for the market from a very long-term cycle perspective, and the downside is going to continue to be painful well into the next decade, Prechter says. "The extreme overvaluation, the manic buying and bubbles in the late 1990s [and] mid-2000s are for the history books - they're very large," he says. "The bear market is going to have to balance that out with some sort of significant retrenchment."

Taleb: You Fools Don't Understand That We're Doomed

The Black Swan graced CNBC with His presence this morning. In sum:

- We're all in denial

- We're replacing private debt with public debt.

- We're not dealing with the cancer in our banking system.

- We're not making the structural changes we need to make.

- We're not being aggressive enough about restructuring debt (debt for equity swaps).

- Bernanke is a wimpy Greenspan sycophant

- Obama's rewarding the fools who got us here (Summers, Bernanke, Geithner)

- The banksters are taking over again

He's pretty much right, by the way.

On this morning's singularity event--Nassim Taleb and Nouriel Roubini together on Squawk Box--we found ourselves waiting for the two gloomsters to duke it out. It never really got nasty. But at one point Taleb did chide Roubini for being too friendly to the Fed chairman. "I always agree with Nouriel except on small point. But he has a weakness," Taleb said. "He likes Ben Bernanke too much."

A Summary of My Bearishness

byDoug Kass

Let me summarize my market thoughts, as expressed on RealMoney Silver over the past two weeks. As I see it, the bull market argument is that the U.S. is exiting the recession just like the many that preceded the current one. Consequently, corporate profits will exceed consensus forecasts in tandem with:

- the resumption of revenue growth;

- the record fiscal and monetary stimulation;

- an export-led Asian recovery; and

- the operating leverage associated with productivity gains achieved through draconian cost cuts and influenced by the benefits of wage deflation.

The bulls further argue in favor of Say's Law of Production (i.e., business drives consumer incomes and spending) and that the high-tax health and energy bills introduced by the President have been recently set back (as the Blue Dog Democrats and the liberal leadership are already battling).

The bear market argument that I have now embraced is that we are seeing nothing more than a second derivative recovery and that, owing to a temporary replenishment of inventories, the economy is only getting less worse (or getting better from a depressed level). The ingredients for a durable and self-sustaining recovery are missing as an economic double-dip grows more likely in a climate of corporate cost cuts, elevated jobless rates, wage deflation and continued pressure on personal consumption expenditures. Bears, such as myself, reject Say's Law of Production and view weakening consumer incomes and spending as a poor foundation and as inadequate drivers to improving business activity into 2010.

The economic downturn of 2007-2009 has already been different this time in scope and duration. For example, unlike the other post-depressions/recessions of the last century, we have already witnessed two consecutive quarterly drops in nominal GDP. As well, the 20-month-old recession has resulted in a near 4% drop in real GDP vs. drops of between 2.5% and 3.0% in the mid 1970s and early 1980s recessions. The U.S. economy came out quickly from those prior downturns, with recoveries to new peaks in economic activity taking only three or four quarters. My view is that it will continue to be different this time as the typical self-sustaining economic recovery of the past will not be repeated for 10 important reasons.

- Cost cuts are a corporate lifeline and so is fiscal stimulus, but both have a defined and limited life.

- Cost cuts (exacerbated by wage deflation) pose an enduring threat to the consumer, which is still the most significant contributor to domestic growth.

- The consumer entered the current downcycle exposed and levered to the hilt, and net worths have been damaged and will need to be repaired through higher savings and lower consumption.

- The credit aftershock will continue to haunt the economy.

- The effect of the Fed's monetarist experiment and its impact on investing and spending still remain uncertain.

- While the housing market has stabilized, its recovery will be muted, and there are few growth drivers to replace the important role taken by the real estate markets in the prior upturn.

- Commercial real estate has only begun to enter a cyclical downturn.

- While the public works component of public policy is a stimulant, the impact might be more muted than is generally recognized. There may be less than meets the eye as most of the current fiscal policy initiatives represent transfer payments that have a negative multiplier and create work disincentives.

- Municipalities have historically provided economic stability -- no more.

- Federal, state and local taxes will be rising as the deficit must eventually be funded, and high-tax health and energy bills also loom.

"The balance of financial terror ... is a situation where we [in the U.S.] rely on the cost to others of not financing our current account deficit as assurance that financing will continue."

-- Lawrence Summers

Among the non-traditional headwinds listed above, a burgeoning fiscal deficit and the financial instability of our state and local municipalities are among two of the most significant challenges that face consumers, corporations and investors. Though the bulls generally agree with the presence of these intermediate-term challenges (especially the spiraling deficit and a nervous U.S. dollar stalemate), they generally dismiss them both over the short term, favoring the belief that the current upside surprises in earnings will dominate the market landscape in influence. I would argue that the aforementioned challenges are ever more predictable in consequence and will serve as a governor to further gains in market valuations.

An avalanche of spending by the public sector is now following an avalanche of spending by the private sector. In essence, we are (perhaps necessarily) fighting the slowdown with the same sort of incendiary kerosene that put us into the mess.

Profligate spending comes at a cost, a cost that we will experience sooner than later. It is only a matter of time before policy makers address the financing of this accumulated debt and the great reflation experiment of 2009 by raising taxes significantly. We have already witnessed the start of what is likely to become an avalanche of changing tax policy. New York City imposed its first sales tax increase in 35 years (rising from 8.375% to 8.875%), and, on the same day, the state of New Jersey imposed an additional tax hike on wholesale liquor distributors' sales of liquor and wine, which is sure to be passed on to the consumer. In Oakland, Calif., even the "high life" is being taxed as the city has recently passed a tax on marijuana sales and the state of California appears to be close in following Oakland's example.

This is just the start of a nascent and broad trend toward much higher taxes, a growth-impeding and P/E-diminishing secular development. The market optimism that we are now experiencing in the expectation of a clean handoff of the baton of stimulation from the consumer (2000-2006) to the government (2008-????) might be more short-lived than many believe, as the price of stimulation, regardless of whether it's source is the private or public sector, holds the promise of being more of a growth-retardant. With the debt super-cycle continuing apace (but in a public sector context), the fragility and inherently unstable "balance of financial terror" argues for a not-so-benign and extremely volatile stock market future.

Unquestionably, the animal spirits have been in full force as shorts are scrambling to cover and many more are joining the ever more vocal and growing bullish chorus. But to me, the margin of safety is becoming ever more thin as the enemy of the rational buyer -- namely, optimism -- reaches new heights. In summary, since a self-sustaining economic recovery appears doubtful, I do not believe that we have started a new bull market. Rather, it is more than likely that economic growth will disappoint in late 2009/early 2010 as the domestic economy confronts many of the emerging secular challenges discussed above.

Ilargi: CDS is only a $60 trillion market, but the mistake is the reporter's.

Markopolos: CDS Scandal Bigger Than Bernie Madoff

Harry Markopolos -- the whistleblower on Bernie Madoff who proved to be much smarter than the SEC -- says there are evildoers out there who will make the Ponzi scum "look like small-time." Markopolos gave a speech to 400 of the faithful at the Greek Orthodox Church in Southampton and predicted major scandals will soon be revealed about the unregulated, $600 trillion, credit-default swap market.

"To put it in simple terms, it is like buying fire insurance policies from five different insurance companies on your neighbor's house and then burning down the house," he said. After his lecture, Hampton Sheet publisher Joan Jedell reports Markopolos was feted at a dinner at Nello Summertimes hosted by John Catsimatidis and his wife, Margo, who were joined by Al D'Amato and Greek shipping magnates Nicholas Zoullas and Spiros Milonas.

U.S. Enters Recovery as Stimulus Refutes Skeptics

Recovery from the worst recession since the 1930s has begun as President Barack Obama’s fiscal stimulus -- derided as insufficient and budget-busting months ago -- takes effect, a survey of economists indicated. The economy will expand 2 percent or more in four straight quarters through June, the first such streak in more than four years, according to the median of 53 forecasts in the monthly Bloomberg News survey. Analysts lifted their estimate for the third quarter by 1.2 percentage points compared with July, the biggest such boost in surveys dating from May 2003. "We’ve averted the worst, and there are clear signs the stimulus is working," said Kenneth Goldstein, an economist at the Conference Board in New York.

The new projections, following better-than-anticipated reports on manufacturing, employment and home construction, echo gains in investor confidence that have propelled the Standard & Poor’s 500 Stock Index to its high for the year. A rebound may help cushion declines in Obama’s approval ratings, political analysts said. "The fact that people for the first time in over a year are starting to look at some glimmers of hope plays to the prospect of some strength in the stimulus," said Susan Molinari, a Republican strategist in Washington who advised Rudy Giuliani during his presidential nomination campaign in 2008.

Confidence in the world economy surged to a 22-month high in August on signs the worst global recession since World War II is coming to an end, a Bloomberg survey of users on six continents showed. The Bloomberg Professional Global Confidence Index jumped to 58.12 this month from 39.13 in July. A measure of U.S. participants’ confidence in the world’s largest economy rose to 47.3 from 29.5, the survey showed.

There was just a one-in-five chance of a "double-dip" recession at some point in the next 12 months, where the economy shrinks again after starting to grow, according to the median of 33 economists answering a special survey question. The anticipated expansion in the coming year won’t be enough to prevent the unemployment rate from reaching 10 percent for the first time since 1983, the survey also showed. That will force the Federal Reserve to forego raising its benchmark interest rate until the third quarter of 2010, according to the median projection.

The Fed’s policy-setting Open Market Committee today kept the target rate near zero and retained plans to buy as much as $1.45 trillion of housing debt by year-end to help secure a recovery. Central bankers said they will slow the pace of the program to buy Treasury securities and anticipated the full $300 billion commitment will be purchased by the end of October. Obama’s $787 billion economic recovery effort, spanning tax cuts, infrastructure spending and a goal to create or save 3.5 million jobs, was enacted about six months ago. Republican lawmakers, nearly all of whom voted against the package, have pilloried the plan as a waste of money.

"Trillions more in Washington spending will not end a recession, it only puts future generations under a mountain of unsustainable debt," House Minority Leader John Boehner, an Ohio Republican, said last week. The nonpartisan Congressional Budget Office estimated last week that the stimulus has pumped $125 billion into the economy so far. A federal program to replace older vehicles with more fuel- efficient ones helped boost sales of cars and light trucks last month to the highest level since September, according to industry figures. Automakers, operating with lean inventories, will resume output to meet the jump in demand. "Cash-for-clunkers was the icing on the cake," said David Greenlaw, chief fixed-income economist at Morgan Stanley in New York. "It’s well-timed stimulus syncing with cyclical forces leading to a ramping up of production."

Company heads seeing an improvement include David Weidman, chief executive officer of Dallas-based chemical maker Celanese Corp. "We exited the quarter with increasing optimism," and there are "clear signs of economic recovery," Weidman said in an interview in July. "The stimulus was really a long-term political and economic play by the administration, and now they’re starting to see the results they wanted," said Bill Buck, a Democratic strategist who worked on the presidential campaigns of former Vice President Al Gore and retired General Wesley Clark. "The administration would be wise to use this to build their credibility with the public" on other issues like health care, he said.

The president’s approval rating is falling on concern over rising joblessness and the growing budget deficit, a Quinnipiac University poll showed last week. Half of the registered voters surveyed from July 27 to Aug. 3 by Quinnipiac said they approve of the job Obama is doing, compared with 42 percent who disapprove. That’s down from 57 percent approval and 33 percent disapproval in a late June poll. Americans are hurting as employers continue to cut jobs, albeit at a slower pace. The unemployment rate will average 9.8 percent in 2010, according to the Bloomberg survey taken from Aug. 5 to Aug. 11. "The labor market is going to be the key," said Michael Feroli, an economist at JPMorgan Chase & Co. in New York. "The risk isn’t that it gets much worse, but that it doesn’t improve quickly enough. It’d be nice if the consumer found his legs."

Consumer spending, which accounts for about 70 percent of the economy, will rise an average 1.5 percent from July to December, up from prior estimates, the survey showed. "What’s happening now is a leveling off, not a strong increase in growth, and that owes a little to the stimulus package," said Robert Solow, a Nobel laureate and professor emeritus at the Massachusetts Institute of Technology in Cambridge, Massachusetts. "Seeing the rest of it filter through to the economy in the second half of the year will be extremely helpful."

Roubini: I'm A Bull Now!

Dr. Doom finally capitulates: Global recovery by the end of the year. (Okay, yes, a double-dip is still a possibility--for lots of good reasons. And before you bash Nouriel for missing the turn, at least admit that he got the recession a heck of a lot more right than most people. And he did turn less negative several months ago.) And note that he still thinks house prices will drop a total of 40%.

Economic Forecasting Survey Shows Recession Over

Economists are nearly unanimous that Ben Bernanke should be reappointed to another term as Federal Reserve chairman, and they said there is a 71% chance that President Barack Obama will ask him to stay on, according to a survey. Meanwhile, the majority of the economists The Wall Street Journal surveyed during the past few days said the recession that began in December 2007 is now over. Battling the downturn defined most of Mr. Bernanke's term, which began in early 2006 and expires in January, and economists say his handling of the crisis has earned him four more years as Fed chief.

"He deserves a lot of credit for stabilizing the financial markets," said Joseph Carson of AllianceBernstein. "Confidence in recovery would be damaged if he was not reappointed." The Journal surveyed 52 economists; 47 responded. After months of uncertainty, economists are finally seeing a break in the clouds. Forecasts were revised upward for every period, with 27 economists saying the recession had ended and 11 seeing a trough this month or next. Gross domestic product in the third quarter is now expected to show 2.4% growth at a seasonally adjusted annual rate amid signs of life in the manufacturing sector, partly spurred by inventory adjustments and strong demand for the "cash for clunkers" car-rebate program.

A better-than-expected employment report for July, where employers cut 247,000 jobs and the jobless rate fell for the first time in 15 months, suggests the worst is over. The unemployment rate is still expected to rise to 9.9% by December, but economists forecast that the economy will shed far fewer jobs over the next 12 months than they had forecast last month. Many of the economists said there is little to be gained by changing the Fed chairman, especially considering the massive task at hand for the central bank as the economy emerges from the recession.

"Continuity is critical as we emerge from this crisis. Otherwise we could slip back in again," said Diane Swonk of Mesirow Financial. "Bernanke is the best suited to undo what has been done when the time comes." The Fed has taken unprecedented steps in an effort to avoid another Great Depression, and its exit strategy remains a key question. Some hints may emerge as the central bank's August policy meeting comes to an end Wednesday. The Fed's key policy-making tool, the federal-funds rate, isn't likely to change at this meeting or any time soon.

Only six economists expect the Fed to raise the federal-funds rate, now between 0% and 0.25%, this year. Most expect an increase at some point in 2010, but more than a quarter of respondents don't see the rate moving until 2011 or later. "The exit strategy will be very, very slow and cautious," said John Silvia of Wells Fargo. "The Fed will unwind the balance sheet before they raise the fed funds rates." The Fed's balance sheet -- the total value of all its loans and securities holdings -- had more than doubled during the course of the crisis to more than $2 trillion, as lending facilities expanded in an effort to unfreeze credit markets.

But as markets get back to normal, demand already has begun to wane, and the balance sheet has started to shrink. Now the composition of the balance sheet has begun to shift to Treasurys, mortgage-backed securities and agency debt as the Fed moves through a $1.75 trillion program announced in March to bring down long-term interest rates. The Fed is deciding at this week's meeting whether to let that program run its course and how best to communicate its intentions to markets.

Whatever the Fed decides, the economists expressed some confidence that the central bank will be dealing with how to manage a recovery, not another recession. They expect GDP growth to remain above 2% at an annualized rate through the first half of next year, and they put the chances at just 20% of a "double-dip" second downturn before 2010. But some said a recovery could make Mr. Bernanke's road to reappointment more rocky. "Once it is perceived that the economy is on its way to recovery, it gives Obama the opportunity to put in his own person," Mr. Silvia said. "It could be like Great Britain at the end of World War II. 'Thank you for all the hard work, Mr. Churchill, but we're going to bring someone else in to handle the next phase.'"

Former president George W. Bush appointed Mr. Bernanke to succeed the departing Alan Greenspan. Presidents appoint Fed chiefs to four-year terms, and there are no term limits. Mr. Bernanke's term expires Jan. 31. Though the economists were overwhelmingly supportive of Mr. Bernanke, they don't think his tenure was without mistakes. A slow initial response to the credit squeeze and the decision to let Lehman Brothers fail were cited as the biggest errors.

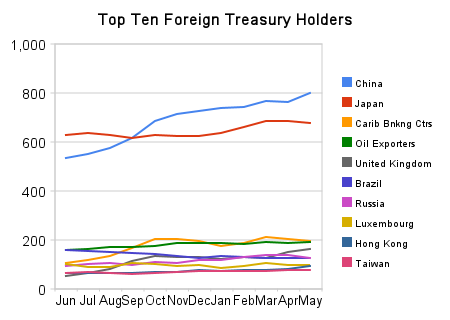

Japan still a major factor in US Treasury market

as reported in the US Treasury's TIC report. It's interesting that China did not surpass Japan until September of 2008; and that those two countries dwarf all the other holders. How long can Japan avoid having to redeem some of these assets to fund domestic social programs?

Commercial real estate woes weigh on Fed

The collapse in commercial real estate is preventing Federal Reserve chairman Ben S. Bernanke from declaring the economy and financial markets are healed. Property values have fallen 35 percent since October 2007, according to Moody’s Investors Service. That’s making it tough for owners to refinance almost $165 billion of mortgages for skyscrapers, shopping malls, and hotels this year, pressuring companies such as Maguire Properties Inc., the largest office landlord in downtown Los Angeles, to put buildings up for sale.

The industry is likely to be high on the agenda when Bernanke and his colleagues sit down in Washington today at the Federal Open Market Committee meeting on monetary policy. Lawmakers including Barney Frank and Carolyn Maloney are pushing the central bank to extend an aid program designed to restore the flow of credit. If nonresidential real estate remains in the doldrums, the Fed may be forced to leave emergency-lending programs in place and keep its benchmark interest rate close to zero for longer than some investors expect, given positive signs elsewhere in the economy.

Commercial property is "certainly going to be a significant drag’’ on growth, said Dean Maki, a former Fed researcher who is now chief US economist in New York at Barclays Capital Inc., the investment banking division of London-based Barclays PLC. "The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.’’ The Fed is "paying very close attention,’’ Bernanke, 55, told the Senate Banking Committee on July 22, the second of two days of semiannual monetary-policy testimony before the House and Senate. "As the recession’s gotten worse in the last six months or so, we’re seeing increased vacancy, declining rents, falling prices, and so, more pressure on commercial real estate.’’

The pressure may be easing in other areas of the economy. Gross domestic product shrank at a better-than-forecast 1 percent annual pace in the second quarter after a 6.4 percent drop the prior three months, and residential housing starts rose unexpectedly by 3.6 percent in June as construction of single-family dwellings jumped by the most since 2004, according to data from the Commerce Department.

Employers cut fewer workers than anticipated last month as the jobless rate fell to 9.4 percent from 9.5 percent in June - the first decline since April 2008, based on Labor Department figures. Amid such glimmers of improvement, commercial real estate is a "particular danger zone,’’ said Janet Yellen, president of the Federal Reserve Bank of San Francisco, in a July 28 speech in Coeur d’Alene, Idaho.

Credit tightening threatens China's 'giant Ponzi scheme'

China's loan growth plunged in July while exports fell 23pc from a year ago after grinding lower for nine months as consumers in the West tighten their belts further. The data raise fresh doubts about the strength of global trade and whether the world can rely on China's growth miracle to power recovery. Separately, the Baltic Dry Index – measuring freight rates for bulk goods – has tipped over, dropping 25pc since late July. The shipping figures buttress reports that China has stopped building up stocks of metals and other commodities after a spate of frantic buying over the early summer.

China's central bank said loan growth fell to $52bn (£31bn) from $248bn a month earlier, although it is too early to tell whether Beijing has begun to rein in credit after the explosion of bank loans in the first half of the year. The loan figures are being watched closely by analysts and traders in the City. Excess liquidity in China has been a key driver of global markets since the rally began in March. Beijing is walking a tightrope by trying to offset the collapse in exports – almost 40pc of GDP – with an investment blitz in roads, railways, and industry through state-owned companies.

The real economy cannot absorb the money, so it is leaking into asset speculation. The central bank estimates that 20pc of fresh credit has ended up in equity markets. The Shanghai index is up 80pc this year, though profits have fallen by almost a third. The pattern echoes the final phase of Japan's Nikkei bubble in 1989. "China is a big fat tail risk for world markets," said Hans Redeker, currency chief at BNP Paribas. "Shanghai equities have reached the same extreme as in late 2007. The country will have to cut credit growth, and when this happens, Shanghai equities and commodities will suffer. That is what could bring this global rally to a halt."

China Construction Bank, the number two lender, is cutting loans by 70pc over the second half of the year. "We noticed that some loans didn't go into the real economy. Housing prices are rising too fast," said the bank's president, Zhang Jianguo. Andy Xie, a leading consultant, said China's boom was a "giant Ponzi scheme" that was likely to "bring very bad consequences" for the country. "The stock market is in a final frenzy again. The most ignorant retail investors are being sucked in by rising momentum," he said. Equities are overvalued by 50pc to 100pc.

Mr Xie, who wrote his doctoral thesis on Japan's bubble in the 1980s, said China's ratio of property prices to incomes is seven times higher than in the US. It costs three months' salary per square meter of space – arguably the highest in the world – though tower blocks are sitting empty. Prices are being propped up by state enterprises, abetted by local Communist bosses. Mr Xie said Chinese booms and busts follow a political rythmn. There is a deeply-rooted belief that the authorities can keep the game going – the "Panda put", China's answer to the "Greenspan Put" – and that the Communist Party will not let the rally fizzle before the 60th anniversary of the revolution on October 1. This belief is self-fulfilling, for a while.

Mr Xie expects China's rally to falter around October, followed by fresh shots of liquidity before the economy falls into a deeper slump by 2012. "Property prices could drop like Japan's in the last two decades, which would destroy the banking system," he said. Mr Xie said China's asset boom is the flip-side of the weak US dollar. US monetary stimulus is in effect leaking across the Pacific. Bust will follow when the dollar rallies, draining liquidity again. If the Fed tightens abruptly as it did under Paul Volcker in the early 1980s, the denouement could be painful for China.

Beijing deserves praise for trying to switch reliance from exports towards the domestic economy. It has had some success. Retail sales have risen 15pc over the last year. But Professor Michael Pettis from Beijing University said it is proving very hard to induce the Chinese to alter their spending habits. The cultural barriers will take years to overcome. Instead, the stimulus is feeding more industrial investment, leading to more excess capacity worldwide. While Chinese GDP continues to grow near 8pc, this is based on output. In the West, GDP growth is based on spending. These two definitions are chalk and cheese. The underlying story has not changed. The East-West imbalances that lay behind the Great Recession of 2008-2009 are getting worse, not better.

Yuan Forwards Decline Most in a Month on Exports Data, Dollar

Yuan forwards declined the most in a month after a ninth monthly slump in China’s exports prompted traders to reduce bets on how far the currency will strengthen. Twelve-month non-deliverable contracts dropped after the customs bureau yesterday reported overseas sales slid 23 percent in July from a year earlier. The ICE’s Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, was near this month’s high as Asian stock losses spurred demand for the perceived safety of the dollar.

"The dollar’s strength led to the plunge in yuan 12-month NDFs," said Liu Xin, an analyst at the Hong Kong branch of Bank of Communications Ltd., China’s fifth-biggest lender. "The disappointing export data also contributed to the drop." Twelve-month non-deliverable forwards contracts dropped 0.35 percent to 6.8155 yuan per dollar as of 5:30 p.m. in Shanghai, according to data compiled by Bloomberg. In the spot market, the currency was little changed at 6.8351, compared with 6.8350 yesterday, according to the China Foreign Exchange Trade System.

China has capped yuan appreciation since July 2008 as a global recession curbed demand for Chinese goods. Local demand is unlikely "to provide a full remedy for the sharp contraction in external demand," the commerce ministry said today. China’s money-market rate dropped for a second day after the biggest slide in consumer prices since 1999 spurred speculation the central bank will delay any monetary tightening.

A government report yesterday showed an index of prices in the economy declined 1.8 percent in July from a year earlier. New loans plunged to 355.9 billion yuan ($52 billion), less than a quarter of lending in June, the central bank said yesterday. "The data prompted speculation China will stick to its loose monetary policy for quite some time," said Liu Junyu, a fixed-income analyst at China Merchants Bank Co., the country’s sixth-largest lender. "The money-market rate also dropped because of a temporary pause in big-stock IPO."

The benchmark seven-day repurchase rate, which measures funding availability in the interbank market, dropped four basis points to 1.51 percent. A basis point is 0.01 percentage point. China’s government bonds rose after yesterday’s data suggested an economic recovery will be delayed. Urban fixed-asset investment for the seven months to July 31 climbed 32.9 percent, the statistics bureau said. That was less than a 33.6 percent gain through June and the 34 percent median estimate in a Bloomberg News survey of 22 economists. The 1.8 percent decline in July consumer prices compared with forecast drop of 1.6 percent.

"The economic data, especially investment, fell short of our expectations," said Yang Yongguang, a fixed-income analyst with Guohai Securities Co. in Shenzhen. "The slower recovery may help boost bonds in the near term." The yield on the 2.22 percent note due July 2012 slid three basis points to 2.43 percent, and the price gained 0.07 per 100 yuan face amount to 99.43, according to quotes from the China Interbank Funding Center.

China Stocks Slump; Shanghai Composite Index Enters Correction

China’s stocks tumbled, with the Shanghai Composite Index entering a so-called correction, on concern a slump in exports and new loans will undermine the country’s economic recovery. The benchmark index fell 4.7 percent to a four-week low as the commerce ministry said China’s $4 trillion yuan ($585 billion) stimulus package can’t completely offset falling export demand. The gauge has lost 10 percent since reaching a 15-month high on Aug. 4 as banks reined in lending to avert asset bubbles.

"Investors have realized the recovery of the economy isn’t as solid as they had expected," said Wang Zheng, a fund manager at Jingxi Investment Management Co. in Shanghai. "Inflows into equities will slow down for the rest of the year as new lending growth eases." Jiangxi Copper Co., the nation’s biggest producer of the metal, plunged 7.4 percent after quadrupling this year, while PetroChina Co., the world’s most valuable company, slid 5 percent. China Cosco Holdings Co., the world’s largest operator of dry-bulk ships, slipped 6.5 percent, a fifth day of declines.

The Shanghai Composite sank 152.01 to 3,112.72, its lowest close since July 13. The gauge has gained 71 percent this year as regulators loosened lending restrictions and the government implemented a stimulus package to revive the economy. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, retreated 4.5 percent to 3,397.4. Domestic demand is unlikely "to provide a full remedy for the sharp contraction in external demand," the commerce ministry said in a statement today. Exports fell 23 percent from a year earlier, the government said yesterday, while urban fixed-asset investment rose a less-than-estimated 32.9 percent in the first seven months from a year earlier.

Jiangxi Copper, the 10th best performing stock on the Shanghai index this year, slumped 7.4 percent to 39.36 yuan. Aluminum Corp. of China Ltd., the country’s biggest producer of the metal, sank 7 percent to 16.27 yuan, capping a 17 percent plunge this month. PetroChina retreated 5 percent to 14.14 yuan. An index of materials producers sank 5.9 percent on the CSI 300, while energy stocks tumbled 5.4 percent. A gauge of six metals on the London Metal Exchange fell 2 percent yesterday and crude oil dropped 1.6 percent in New York to close below $70 for the first time this month. Zhuzhou Smelter Group Co., China’s biggest producer of refined zinc, lost 6 percent to 13.44 yuan after saying first- half profit dropped.

China’s new loans plunged to 355.9 billion yuan in July, less than a quarter of advances in June, official data yesterday showed. China Construction Bank Corp. President Zhang Jianguo said last week the world’s second-most valuable bank will cut new loans by 70 percent to avert a rise in bad debt. "The slowdown in new lending is an excuse for investors to exit a market that’s risen too fast and gotten too expensive," said Philippe Zhang, chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $220 million. Investors should sell China’s stocks as the market is in "bubble territory" and share prices already reflect expectations for a rebound in the economy and earnings, Shenyin & Wanguo Securities Co. said in a report yesterday.

China Cosco slid 6.5 percent to 16.06 yuan. China Shipping Development Co., a unit of the nation’s second-biggest sea-cargo group, lost 6.6 percent to 15.09 yuan. The Baltic Dry Index sank 2.5 percent, according to the Baltic Exchange, on speculation Chinese demand for iron ore may be weakening. Individual investors have rushed into equities as regulators lifted a nine-month moratorium on initial public offerings and the economy rebounded. Investors opened more than 660,000 accounts to trade stocks last week, data from the nation’s clearing house showed today, the second-highest amount since January 2008. Household savings fell in July for the first time since October 2007 probably because people withdrew money from banks to buy into IPOs, the Shanghai Securities News said today, citing Li Hongrong, an analyst at Ping An Securities Co.

China’s Falling Exports, Loans Signal Stimulus Needed

China’s exports and new loans tumbled in July and industrial output rose less than estimates, underscoring government concern that the world’s third-biggest economy is yet to establish a solid recovery.

Exports fell 23 percent from a year earlier, the customs bureau said. Industrial production gained 10.8 percent, the statistics bureau reported. New loans plunged to 355.9 billion yuan ($52 billion), less than a quarter of June’s level, the central bank said.

China will maintain a "moderately loose" monetary policy and "proactive" fiscal stance to bolster domestic spending in the face of slumping exports, Premier Wen Jiabao said Aug. 9. New loans fell as the government and banks moved to avert bad debt and bubbles in stocks and property after a record $1.1 trillion of lending in the first half helped drive a 7.9 percent economic expansion in the second quarter. "There’s an element of fragility in the recovery," said Glenn Maguire, chief Asia-Pacific economist at Societe Generale in Hong Kong. "The government needs an appropriately loose monetary policy."

The yen rose against the euro and the dollar as investors sought safety because of the weaker-than-estimated output number and the export decline. The Shanghai Composite Index closed 0.5 percent higher, taking this year’s increase to 79 percent. Appliance manufacturer Qingdao Haier Co. and spirits maker Kweichow Moutai Co. climbed as the statistics bureau said retail sales rose 15.2 percent, more than estimates. China’s economy will grow 9.4 percent this year, topping the government’s 8 percent target, Goldman Sachs Group Inc. said yesterday. The credit boom and a 4 trillion yuan stimulus package helped General Motors Co. to report a 78 percent increase in vehicle sales in China in July.

Urban fixed-asset investment for the seven months to July 31 climbed 32.9 percent, the statistics bureau said. That was less than a 33.6 percent gain through June and the 34 percent median estimate in a survey of 22 economists. "The fixed-asset investment number is worrying because government-sponsored investment is a pillar of the recovery," said Tao Dong, chief Asia-Pacific economist at Credit Suisse AG in Hong Kong. "This set of data should postpone any thought of more aggressive tightening; the economy is slowing down a little bit."

Policy makers cautioned this month that a recovery is not yet on solid foundations and central bank Governor Zhou Xiaochuan said July 28 that the nation will take its cue from the U.S. on when to end economic rescue efforts. The Bank of Japan left its key lending rate unchanged today, citing "downside risks to economic activity" and South Korea held its benchmark at a record low, with Governor Lee Seong Tae saying a recovery faces "some uncertainties." The gain in industrial production in China compared with a 10.7 percent advance in June and economists’ median forecast for an 11.5 percent increase.

The export decline matched economists’ estimates and was the third biggest since China’s shipments began to shrink in November last year. China Shipping Container Lines Co., the country’s second-largest carrier of sea-cargo boxes, forecast last month a first-half loss on weaker global demand. Imports fell 14.9 percent, leaving a trade surplus of $10.63 billion. The industrial production figure suggested the economy "started the third quarter on a slightly softer tone," Ben Simpfendorfer, a Hong Kong-based economist for Royal Bank of Scotland Plc, said in a Bloomberg Television interview. "It’s a modest disappointment."

July’s new loans were the least since the government dropped quotas limiting lending in November last year and pressed banks to support a 4 trillion yuan stimulus package. None of 11 economists surveyed forecast such a low number. M2, the broadest measure of money supply, rose 28.4 percent. Loans growth was in keeping with the moderately-loose monetary policy, the state-run Xinhua News Agency quoted an unidentified central bank official as saying in a report on a government Web site. New loans are usually higher in the first half of the year and in March, June and September, the official said.

China Construction Bank Corp., the nation’s second-largest bank, will cut new lending by about 70 percent in the second half to avert a surge in bad debt, President Zhang Jianguo said last week. "We noticed that some loans didn’t go into the real economy," Zhang, 54, said in an Aug. 6 interview at the bank’s headquarters in Beijing. "I feel that some industries are expanding too rapidly. For example, housing prices are rising too fast, and housing sales are growing too fast."

UBS AG said in a July 31 note that the scale of China’s new lending in the first half was "neither sustainable nor necessary." New loans of 300 billion yuan to 400 billion yuan a month in the second half would be "more than enough" to support the nation’s recovery, the report said. Consumer prices fell 1.8 percent last month from a year earlier, the biggest decline since 1999, the statistics bureau said today. They were unchanged from the previous month. Producer prices dropped a record 8.2 percent.

Food Firms Warn of Sugar Shortage

Some of America's biggest food companies say the U.S. could "virtually run out of sugar" if the Obama administration doesn't ease import restrictions amid soaring prices for the key commodity. In a letter to Agriculture Secretary Thomas Vilsack, the big brands -- including Kraft Foods Inc., General Mills Inc., Hershey Co. and Mars Inc. -- bluntly raised the prospect of a severe shortage of sugar used in chocolate bars, breakfast cereal, cookies, chewing gum and thousands of other products.

The companies threatened to jack up consumer prices and lay off workers if the Agriculture Department doesn't allow them to import more tariff-free sugar. Current import quotas limit the amount of tariff-free sugar the food companies can import in a given year, except from Mexico, suppressing supplies from major producers such as Brazil. While agricultural economists scoff at the notion of an America bereft of sugar, the food companies warn in their letter to Mr. Vilsack that, without freer access to cheaper imported sugar, "consumers will pay higher prices, food manufacturing jobs will be at risk and trading patterns will be distorted."

Officials of many food companies -- several of which are enjoying rising profits this year despite the recession -- declined to comment on how much they might raise prices if they don't get their way in Washington. The letter is the latest salvo fired in a long-simmering dispute between U.S. food companies and the sugar industry over federal policy that artificially inflates the domestic price of U.S.-produced sugar in order to support the incomes of politically savvy sugar-beet farmers on the Northern Plains and cane-sugar farmers in the South. Most years, the price food companies pay for U.S. sugar is twice the world level.Ron Lucchesi, head of procurement for Gonnella Frozen Products in Chicago, which signed the letter, said current U.S. sugar policy distorts pricing. Though sugar accounts for only 0.5% of total costs at Gonnella, soaring sugar prices are "part of the equation" that already has led the company to raise prices for kaiser rolls, hamburgers and hot dogs, all of which include sugar. The issue is coming to a boil again because sugar prices, both in the U.S. and globally, have soared to unusually high levels for more than a year and show little sign of easing any time soon. Prices of sugar futures contracts have risen 95% so far this year, hitting a 28-year high in recent days. On Wednesday, raw-sugar futures jumped 4.8% to 22.97 cents a pound at the Intercontinental Exchange.

Prices are up because the world is consuming more sugar than farmers are producing. One big factor: The world's largest sugar producer, Brazil, is diverting huge amounts of its cane crop to making ethanol fuel. Likewise, the food industry has complained bitterly in recent years about the U.S. ethanol industry's ravenous appetite for corn, which helped push up prices for that key ingredient too. More than half of Brazil's sugar-cane crop is processed into ethanol while about one-third of the U.S. corn crop is made into the alternative fuel. An erratic monsoon season in India also has led sugar analysts to reduce their production forecasts for the world's second-largest sugar producer.

At the same time, U.S. sugar supplies are tight. In its monthly report on global farm markets released Wednesday, the Agriculture Department said it expects U.S. sugar supplies by September 2010 to drop 43% from this fall.

According to USDA estimates, the food industry will import about 1.4 million tons of sugar under the tariff-rate quota system during the crop year that ends in late September. An economist for the Sweetener Users Association, a food-industry trade group, said Wednesday that food executives want to be able to import an additional 450,000 tons of tariff-free sugar by Sept. 30.

As a percent of input costs, sugar varies for food companies. It is about 1%, 8% and 6%, respectively, of the costs for ConAgra Foods Inc., Hershey and Kraft, according to a recent report by Barclays Capital analyst Andrew Lazar. It's far from clear whether the Obama administration will move to increase the flow of foreign sugar into the U.S. anytime soon. The Agriculture Department released a statement saying it will "continue to review market conditions to ensure...an appropriate safety net for growers" as well as "a stable supply environment."

Earlier this month, Agriculture Undersecretary Jim Miller told a sugar-industry gathering in Utah that he wouldn't rule out a quota increase in the future. However, such a move would probably be politically unpopular among sugar farmers, who have a big voice in Washington through Rep. Collin Peterson, the Minnesota Democrat who is chairman of the House Agriculture Committee. Mr. Peterson, whose district is home to many sugar-beet growers, couldn't immediately be reached for comment Wednesday.

Phillip Hayes, a spokesman for the American Sugar Alliance, a trade group of cane and sugar-beet farmers, said farmers are "absolutely opposed" to expanding the sugar-import quota in part because it would cause the prices received by U.S. growers to sink. Jack Roney, the alliance's chief economist, said food companies probably wouldn't pass along any savings to consumers from a widened import quota. But each one-cent drop in the price of sugar costs U.S. farmers about $160 million, he said. "We take offense at any notion of reducing producer prices for sugar having any benefit for consumers, because historically we've never seen any pass-through of lower commodity prices of ingredients," he said. "It really is a profit-increasing opportunity for user companies."

Some big brands aren't jumping into the sugar fight. The big U.S. beverage companies, for example, didn't sign the letter to Mr. Vilsack. Although Coca-Cola Co. and PepsiCo Inc. use sugar in their international beverage business, both companies generally rely on high-fructose corn syrup to sweeten drinks in the U.S., their biggest market. Coke, of Atlanta, said it hasn't yet felt the impact of the sugar price rise because of continuing hedges on commodities. PepsiCo, the Purchase, N.Y., food and beverage giant, declined to comment.

Electricity Prices Plummet

Slack demand for electricity across the U.S. is leading to some of the sharpest reductions in power prices in recent years, offering a break for consumers and businesses who just a year ago were getting crunched by massive electricity bills. On Friday, the nation's largest wholesale power market serving parts of 13 states east of the Rockies is expected to report that electricity demand fell 4.4% in the first half of the year. That helped to push down spot market prices by 40% during the first half of this year.

Wholesale electricity -- power furnished to utilities and other big energy users -- cost an average of $40 a megawatt hour in the region, down from $66.40 a year earlier. The price declines in this market, which extends from Delaware to Michigan, come on top of a 2.7% drop in energy use in 2008 over 2007. The falloff in demand represents a reversal of what has been one of the steadiest trends in business. For decades, the utility sector could rely on a gradual increase in electricity demand. In 45 of the past 58 years, year-over-year growth exceeded 2%. In fact, there only have been five years since 1950 in which electricity demand has dropped in absolute terms.

But this year is shaping up to have the sharpest falloff in more than half a century, and coming on top of declines in 2008, could be the first period of consecutive annual declines since at least 1950. Dramatic price reductions don't immediately mean lower power bills for all consumers. That's because many customers pay prices based on long-term contracts. But lower prices will have a softening effect over time. In California and Texas, a combination of cheap natural gas and lower industrial demand is putting pressure on prices.In the Houston pricing zone, which has many power-gobbling refineries and chemical plants, the spot market price was $61.82 in June, versus $129.48 a megawatt hour a year earlier. Power demand in Texas is down 3.2% so far this year due to business contraction and reductions in employment which are causing many households to economize. Just a year ago, many businesses and residential customers were reeling from electricity prices on the spot market that had spiked to historic highs, driven by high fuel prices and hot summer weather. Some businesses curtailed their operations because electricity and natural gas were too pricey.

But the flagging economy has resulted in a slump in demand that has jolted some energy markets. American Electric Power Co. and Southern Co., for example, both reported double-digit drops in industrial electricity use for the past quarter. Meanwhile, natural gas, which strongly influences electricity prices, has fallen below $4 per million BTUs, or British thermal units. That's down from $12 at last year's peak. For many businesses, the cost of electricity represents one of the few bright spots in a dismal economy. Andy Morgan, president of Pickard China Inc. in Antioch, Ill., which makes fine china, figures his electricity cost is down 30% to 40%.

Last year, when everything was spiking, he looked at different options -- including negotiating a fixed-price contract for energy with a supplier. He says he held off and now he's happy he did. "We've definitely reaped savings," says Mr. Morgan, adding that "especially in a down economy, you'll take whatever you can get. That's one of the few blessings during this storm." Slowdowns at major industrial companies such as Alcoa Inc. help account for the decline in electricity usage this year. The recession and drop in consumer demand for products that contain aluminum has caused the company to idle 20% of its smelting capacity world-wide this year.

In the U.S. the company has cut production at smelters, which are traditionally big energy users, in New York, Tennessee and Texas. Kevin Lowery, a company spokesman, said he did not believe that Alcoa has saved much money thus far because the company primarily purchases electricity through 25- to 35-year contracts. Steel Dynamics Inc. is benefiting from lower pricing. The company operates five steel mills, with four purchasing electricity at spot market prices in Indiana, Virginia and West Virginia. The benefit, though, is smaller than it might be because the steelmaker is producing less steel this year.

"We're producing fewer tons, but every ton we produce we seek to minimize the costs and electricity is one of those," said Fred Warner, a company spokesman. Its mills are running at 50% capacity this year, down from 85% capacity last year. Some wonder whether the deregulated markets of the Eastern U.S., Midwest, Texas and California will be especially hard hit if demand comes roaring back. That's because utilities in these markets no longer are required to build new resources. It's left up to the power generators to determine when the market conditions are ripe.

"There's more supply than demand and prices are really low so it doesn't make sense to build anything," says John Shelk, president of the Electric Power Supply Association in Washington, D.C., a group that represents power generators. Many electricity markets throughout the country have implemented demand reduction programs that give consumers a further incentive to reduce power use. The 13-state PJM Interconnection market has been one of the most aggressive -- and has seen one of the steepest price drops.

A new report from the region's official market monitor found a strong correlation between falling prices and an increase in demand-reduction programs. In the PJM market, energy users can collect money through an auction process for pledging to cut energy use in future periods. In May, PJM conducted an auction to ensure it will have the resources it believes it will need in 2012-13. About 6% of the winning bids came from those who pledged to cut energy use by a total of 8,000 megawatts in that future period.

UK young jobless count climbs to 'crisis' point of 1 million

Nearly one million young people are out of work as British unemployment hits a 14-year high, new figures showed today. Official data revealed that youth unemployment has soared, with more than 700,000 18 to 24-year-olds and 206,000 16 to 17-year-olds jobless.

In the three months to June, the number of 16 to 17-year-olds in work dropped to only 28.6 per cent, from 34 per cent a year earlier. The employment rate for people aged 18 to 24 dropped to 59.8 per cent, from 64.1 per cent.

The figures formed part of what economists described as a "ghastly" set of employment data, which showed that the jobless total had hit a 14-year high of 2.44 million and that the jobless rate had reached a 13-year-high of 7.8 per cent. Analysts and unions are particularly concerned about the outlook for hundreds of thousands of young people, warning that it was set to get worse as the latest crop of students left education only to find themselves unable to find work.

Brendan Barber, General Secretary of the TUC, said that the figures showed the desperate need for more help for young people. He said: "With over one in six young people out of work unemployment is at crisis level.

"The Government must do more to get people back into work, otherwise we risk losing another generation of young people to mass unemployment." The Prince's Trust has calculated that a young person lost a job almost every minute between March and May and alone. In the three months to June, the total number of jobless people surged by 220,000 to its highest level since 1995. The overall jobless rate, at 7.8 per cent, was the highest since December 1996. The figure was worse than analysts' forecast of 7.7 per cent. The number employed fell by a record 271,000.

The only glimmer of hope was in the number of people claiming benefit. That rose by 24,900 in the period, compared with an expected 28,000 rise. The number of jobless 16 to 17-year-olds rose by 7,000 in the quarter. The number of jobless 18 to 24-year-olds leapt by 46,000. The dire figures undermine a spate of more recent optimistic data that had suggested that Britain was firmly on track to exit the recession. Last month a survey found renewed expansion in the critical services sector for a second consecutive month, and mortgage data from bodies such as the Council for Mortgage Lenders has given hope of a pick-up in the battered property market.

Howard Archer, chief UK and European economist for IHS Insight, said that today's figures were "ghastly." He said: "Unemployment is a lagging indicator and the sharp economic contraction suffered between the second quarter of 2008 and the second quarter of 2009 will continue to weigh down on the labour market for an extended period. "Even if the economy does return to growth in the third quarter, we suspect unemployment will rise for the rest of this year and much, if not all, of 2010." In a recent doomsday scenario, the Centre for Economics and Business Research, the think-tank, said that unemployment could rise to nearly 4 million by the end of the recession.

Earlier today Lord Mandelson, the Business Secretary, conceded that unemployment levels are "unacceptable". However. he sought to defend Labour's record, saying that the steps that the Government had taken to help employers, combined with the Bank of England's quantitative easing programme and interest rate cuts, had considerably eased the situation, saving at least 500,000 jobs. Lord Mandelson claimed that the jobless toll would have been much higher if the Conservatives had been in power . The Business Secretary, currently in charge of the country while Gordon Brown takes a holiday, said: "One thing I and the Government know is that any such level of unemployment is unacceptable."

In an interview on BBC Radio 4's Today, Lord Mandelson said: "The question is, what is the Government doing about it and what would be the level of unemployment if the Government had not intervened in the economy in the way in which we have?" He said that £5 billion was being spent getting the jobless back into work. However, a report today by the Audit Commission, the public sector watchdog, warns that councils are not doing enough to help communities with the fallout of the recession. It says that Britain faces a surge in drug addiction, alcoholism and domestic violence as the second wave of the slump takes hold.

Sterling tumbles on gloomy inflation outlook

The pound continued to fall against the dollar today after the Bank of England said inflation could temporarily fall below 1 per cent amid a recession that has grown deeper than its Monetary Policy Committee (MPC) expected. Mervyn King, the Governor of the Bank of England, said that it "is more likely than not that later this year I will need to write a letter to the Chancellor to explain why inflation has fallen more than one percentage point below the target [of 2 per cent]".

Last month, the Bank said that inflation fell to an annual rate of 1.8 per cent in June, from 2.2 per cent in May, reaching its lowest level since September 2007. Inflation could stay below 2 per cent until at least the end of 2012, Mr King said today as he unveiled the Bank's Inflation Report. Mr King’s comments sent the sterling down from $1.6478 to $1.64, taking its decline to more than 2 per cent against the dollar since last Thursday, when the Bank announced plans to pump another £50 billion of newly created money into the system through its "quantitative easing" programme.

The Governor also said that Britain remained firmly in the grip of a long-lasting downturn. Mr King said: "The recession appears to be deeper than the MPC thought likely at the time of the May report ...nominal indicators remain weak and the adjustment of balance sheets has a long way to run." However, Mr King tempered the gloom with some more upbeat comments on the economic outlook. He said: "There are more encouraging signs looking ahead. Confidence has recovered somewhat from its collapse last autumn and strains in the financial system have eased."

He added: "It is likely that output stabilised in the middle of this year, and business surveys and other short-run indicators suggest that growth is more likely than not to resume over the next few quarters." The growing likelihood that any increase in the interest rate from its current record low of 0.5 per cent would be postponed to at least the second quarter of 2010, sent the FTSE 100 index of leading shares up by 7.76 points, or 0.62 per cent, to 1,264.99.

Mr King said he was "surprised that people were surprised" by last Thursday’s decision to increase the quantitative easing programme to £175 billion, given the outlook for inflation. Officials took the decision "in order to avoid a period of perhaps quite protracted below-target inflation," Mr King said.