Miss Florence Skadding and H.J. McMullan. Opening of pool at Columbia Country Club, Chevy Chase, Maryland

Ilargi: I'm sure you saw that the Shanghai Composite Index dropped a major league 6.7% last night, right? Well, it did, sort of, as in yes and no. You see, Shanghai nights -and days- have their limits. berg says:

At least 150 stocks on the 898-member index dropped by the daily 10 percent limit

The Shanghai Index dropped 23% from August 4. Hmmm. Looks like it might have dropped that much just in one day if it were not tied to its chair. Depends on who the biggest funds are, and if any of them are among the 150. If I were a betting man, I’d go for positive. Who needs bans on shorts in that scheme?

I see all sorts of charts comparing Shanghai to Manhattan, but I don’t think that one really holds. Then again, a bubble's a bubble's a bubble, ain't they? On Wall Street, there's a different limit. They halt trading altogether if it gets too bad. And individual stocks can be taken out, true, but not -solely- because of a 10% drop.

By now, since everything's going according to plan, there are tons of folks out there in the full growth green mood, who just cannot wait for a good non-farm payroll reading by their oracle of choice in a few days, to find confirmation of their hopes and blessings and delve into that market like never before and like there’s no tomorrow. Their reasoning, if I read it well, is that the recent 5-month rise in the markets happened against a background of gruesome numbers, so once we only lose 200,000 jobs a month, them stocks a-must be a-bound for heaven and beyond.

Me, though, I think not. I like the theory that in very light summer trading, covering shorts has been the driving force with the leaden foot on the pedal. In essence, speculators are becoming afraid of betting against the government and the Federal Reserve. But who today's going to buy the government supported entities Fannie, Freddie, Citi et al that were leading the rally?

According to today's numbers, next to no-one. They were today's main Manhattan losers, with traffic in Citi outmuscling all the rest by a mile. Barron's told its readers to sell Citi, that may have been a factor. Is that their prerogative, though, I was wondering? The main winners were the skeleton holdings firms of Lehman's and Wamu, much to my amusement. You think there's anyone thinking those firms'll rise up gloriously, or that maybe there's something else going on?

Nah, Shanghai is not very likely to keep on falling today (or is it tomorrow?). That's not a likely scenario. And Manhattan isn't going to slip slide into the Hudson on September 1 either. Them things don’t drop in straight lines. But drop they do.

And for all you green shooters on September 1, I have but one or two questions. How many among you called the March bottom, and are now so gloriously rich as a result they have no need to follow the markets any longer? That 50% rise looks good now, and it makes you feel great, but ask yourselves, who made the real money from that surge? Was it you, or are you next? AIG rose 264% almost overnight. Did you? I don't think so. But you still feel that good July/August employment numbers are the sign to invest? It’s always right around the corner, isn't it?

My take is that those who got their profits in that 50% surge are not going to bet on more of the same. And neither are the shorts who lost their shirts (AIG 264% equals shorts buying), though they are prime candidates for double-or-nothings. I have a few other "takes" as well. Along with the back-to-business rising Manhattan trading volumes we’ll see rising foreclosures (a dead-sure given) and job losses (who fires anyone in August, after all?), a rising US dollar (no other safety available), a second stimulus package (though it won’t go by that name) and a world of pain for far more people than I am even remotely comfortable considering. A pain that others will be betting on to get richer.

There is nothing that points upwards but government spending, we're looking at an economy kept barely alive by transferring money from its left to its right pocket, making itself believe the right pocket is the only one that contains real value.

Dolphins don't have pockets to worry about.

I I will be king

And you You will be queen

Though nothing will Drive them away

We can beat them Just for one day

We can be Heroes Just for one day

And you You can be mean And I I'll drink all the time

'Cause we're lovers And that is a fact

Yes we're lovers And that is that

Though nothing Will keep us together

We could steal time Just for one day

We can be Heroes For ever and ever

What d'you say

I I wish you could swim

Like the dolphins Like dolphins can swim

Though nothing Will keep us together

We can beat them For ever and ever

Oh we can be Heroes Just for one day

I I will be king

And you You will be queen

Though nothing Will drive them away

We can be Heroes Just for one day

We can be us Just for one day

I I can remember

Standing By the wall

And the guns Shot above our heads

And we kissed As though nothing could fall

And the shame Was on the other side

Oh we can beat them For ever and ever

Then we can be Heroes Just for one day

We can be Heroes Just for one day

We can be Heroes

We're nothing And nothing will help us

Maybe we're lying Then you better not stay

But we could be safer Just for one day

Commercial Real Estate Lurks as Next Potential Mortgage Crisis

Federal Reserve and Treasury officials are scrambling to prevent the commercial-real-estate sector from delivering a roundhouse punch to the U.S. economy just as it struggles to get up off the mat. Their efforts could be undermined by a surge in foreclosures of commercial property carrying mortgages that were packaged and sold by Wall Street as bonds. Similar mortgage-backed securities created out of home loans played a big role in undoing that sector and triggering the global economic recession. Now the $700 billion of commercial-mortgage-backed securities outstanding are being tested for the first time by a massive downturn, and the outcome so far hasn't been pretty.

The CMBS sector is suffering two kinds of pain, which, according to credit rater Realpoint LLC, sent its delinquency rate to 3.14% in July, more than six times the level a year earlier. One is simply the result of bad underwriting. In the era of looser credit, Wall Street's CMBS machine lent owners money on the assumption that occupancy and rents of their office buildings, hotels, stores or other commercial property would keep rising. In fact, the opposite has happened. The result is that a growing number of properties aren't generating enough cash to make principal and interest payments.

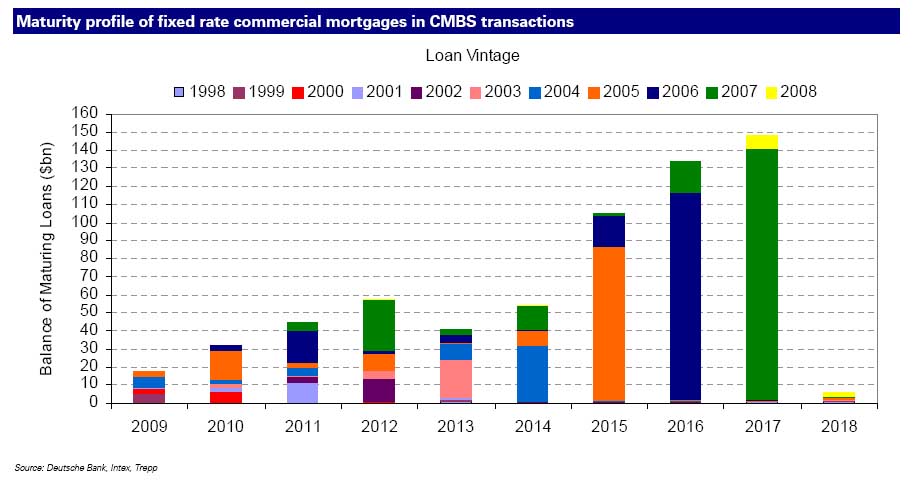

The other kind of hurt is coming from the inability of property owners to refinance loans bundled into CMBS when these loans mature. By the end of 2012, some $153 billion in loans that make up CMBS are coming due, and close to $100 billion of that will face difficulty getting refinanced, according to Deutsche Bank. Even though the cash flows of these properties are enough to pay interest and principal on the debt, their values have fallen so far that borrowers won't be able to extend existing mortgages or replace them with new debt. That means losses not only to the property owners but also to those who bought CMBS -- including hedge funds, pension funds, mutual funds and other financial institutions -- thus exacerbating the economic downturn.

A typical CMBS is stuffed with mortgages on a diverse group of properties, often fewer than 100, with loans ranging from a couple of million dollars to more than $100 million. A CMBS servicer, usually a big financial institution like Wachovia and Wells Fargo, collects monthly payments from the borrowers and passes the money on to the institutional investors that buy the securities. CMBS, of course, aren't the only kind of commercial-real-estate debt suffering higher defaults. Banks hold $1.7 trillion of commercial mortgages and construction loans, and delinquencies on this debt already have played a role in the increase in bank failures this year.

But banks' losses from commercial mortgages have the potential to mount sharply, and the high foreclosure rate in the CMBS market could play a role in this. Until now, banks have been able to keep a lid on commercial-real-estate losses by extending debt when it has matured as long as the underlying properties are generating enough cash to pay debt service. Banks have had a strong incentive to refinance because relaxed accounting standards have enabled them to avoid marking the value of the loans down.

"There is no incentive for banks to realize losses" on their commercial-real-estate loans, says Jack Foster, head of real estate at Franklin Templeton Real Estate Advisors. CMBS are held by scores of investors, and the servicers of CMBS loans have limited flexibility to extend or restructure troubled loans like banks do. Earlier this month, it was no coincidence that CMBS mortgages accounted for the debt on six of the seven Southern California office buildings that Maguire Properties Inc. said it was giving up. "During most of the evolution [of CMBS] no one ever thought all these loans would go into default," says Nelson Rising, Maguire's chief executive.

Indeed, many property developers and investors complain there is no way to identify the investors that hold their debt and that it is difficult to negotiate with CMBS servicers. In light of the complaints, the Treasury is considering guidance that would allow servicers to start talking about ways to avoid defaults and foreclosures sooner, according to people familiar with the matter. But investors in CMBS bonds argue that the servicers are ultimately bound contractually to the bondholders.

So Maguire will soon have a lot of company. In a study for The Wall Street Journal, Realpoint found that 281 CMBS loans valued at $6.3 billion weren't able to refinance when they matured in the past three month, even though 173 such loans worth $5.1 billion were throwing off more than enough cash to service their debt. Mounting foreclosures in the CMBS sector would likely depress values even further as property is dumped on the market. And this would put pressure on banks to write down loans. "What's going on in the CMBS world is a precursor for what might be seen in banks' books," predicts Frank Innaurato, managing director at Realpoint.

The commercial-real-estate market could yet be salvaged by an improving economy and bailout programs coming out of Washington. In addition, capital markets are starting to ease for publicly traded real-estate investment trusts. Since March, more than two dozen REITs have managed to raise more than $13 billion by selling shares. Still, most of the $6.7 trillion in commercial real estate is privately owned. Also, it is unlikely commercial real estate will benefit much from an early stage of an economic recovery. What landlords need is occupancy and rents to rise, and that means employers have to start hiring and consumers need to shop more. So far, there are few signs this is happening.

China’s Stocks Slump Most Since June 2008, Cap Monthly Loss

China’s stocks plunged, with the Shanghai Composite Index falling the most since June 2008 and entering a bear market, on concern a slowdown in lending growth may derail a recovery in the world’s third-largest economy. The benchmark index tumbled 6.7 percent to 2,667.75, capping its biggest monthly loss since October. The gauge has slumped 23 percent from its 15-month high on Aug. 4 and is the worst performer this month among 89 benchmark indexes tracked by Bloomberg globally.

"The local market bears are convinced that tightening is already underway," said Howard Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion. Only "a very strong set of macro numbers in August" or "stronger statements from central authorities" would change this trend, Wang said. At least 150 stocks on the 898-member index dropped by the daily 10 percent limit. Industrial Bank Co. and Aluminum Corp. of China Ltd. tumbled by the permitted cap after Caijing magazine reported new loan growth this month may be almost half that of July. Lower profits dragged Baoshan Iron & Steel Co., the nation’s biggest steelmaker, and China Southern Airlines Co. down at least 7 percent.

China Petroleum & Chemical Corp., Asia’s largest refiner, slid 10 percent on concern the government will keep fuel prices unchanged to support the economy as crude climbs, squeezing refining margins. The Shanghai gauge slumped 22 percent this month as banks reined in lending to avert asset bubbles and policy makers advised industries such as steel and cement to curb overcapacity. The decline stopped a rally that had sent the measure up 103 percent from a November low on prospects the government’s 4 trillion yuan ($586 billion) stimulus program and a record amount of new loans will ensure the economy grows at least 8 percent this year.

The benchmark index lost 192.94 to 2,667.75, a three-month low. Today’s slump was the most since June 10, 2008, when the index tumbled 7.7 percent after the central bank ordered lenders to set aside record reserves to curb credit growth and inflation. The CSI 300 Index dropped 7.1 percent to 2,830.27. "The plunge reflects investor pessimism over short-term liquidity rather than any changes in the fundamentals of the economy," said Leo Gao, who helps oversee about $600 million at APS Asset Management Ltd. in Shanghai. "It’s panic selling."

China may have 200 billion yuan of new loans in August, the Beijing-based Caijing magazine reported today on its Web site. That compares with 7.4 trillion yuan for the first half of 2009 and 355.9 billion yuan in July alone. The government plans to tighten capital requirements for financial institutions, three people familiar with the matter said this month. Industrial Bank, which reported a first-half profit decline this month, fell to 27.88 yuan, the lowest since May 26. Aluminum Corp. of China, the nation’s No. 1 maker of the metal, slid to 12.74 yuan. Jiangxi Copper Co., the biggest copper producer, tumbled to 33.27 yuan after more than tripling this year. All declined by the 10 percent limit.

Ba Shusong, deputy director of the State Council’s Development Research Center said Aug. 28 the nation’s economic growth may start to slow in the second quarter of next year as the impact of government stimulus policies diminishes. Brokerages retreated on concern stock market declines and lower loan growth will curb equity trading. Citic Securities Co., the nation’s biggest by market value, dropped 6 percent to 24.88 yuan. Northeast Securities Co. tumbled 10 percent to 31.50 yuan.

An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months of this year, China Business News reported June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council. Baoshan Iron fell 7 percent to 6.42 yuan, capping a 33 percent loss this month. First-half profit plunged 93 percent to 669 million yuan as the economic slowdown curbed demand from automakers and shipbuilders. The company said the "global economy hasn’t recovered substantially and the foundations for a domestic recovery aren’t solid."

China Southern, the nation’s biggest carrier, fell 7.9 percent to 5.26 yuan. First-half net income at the Guangzhou- based carrier tumbled 97 percent to 25 million yuan, as it failed to repeat year-earlier foreign-exchange gains. The Shanghai Composite’s gain since its 2008 low on Nov. 4 made it the best performer among world equity benchmarks and more than tripled its valuation to 39 times reported earnings, according to Bloomberg data. It now trades for 29 times profit, while the MSCI Emerging Markets Index, a 22-country benchmark, valued at 19 times earnings.

"The market was priced for perfection," said Lee King Fuei, a Singapore-based portfolio manager at Schroders Plc, which oversees about $186.5 billion globally as of June. "At these levels, you need much stronger earnings to get investors excited." China Petroleum, or Sinopec, slumped 10 percent to 11.13 yuan, the most since June 2007. PetroChina, the world’s most valuable company, retreated 6.7 percent to 12.80 yuan.

The government will reduce the number of times it adjusts fuel prices at this "critical juncture" for the economy, the state-run Shanghai Securities News reported Aug. 29. The National Development and Reform Commission, the country’s top economic planner, said the report was untrue. Crude oil has gained about 35 percent since the government introduced a new mechanism for adjusting fuel prices that promises a "normal" profit for refiners.

Bond Market, Eyeing 10% Jobless Rate, Rejects Recovery

The bond market isn’t buying all the optimism over the end of the global recession. While the International Monetary Fund said last week the economic recovery will be faster than it forecast in July, investors pushed yields on government debt to the lowest level since April, according to the Merrill Lynch & Co. Global Sovereign Broad Market Plus Index. The gauge, which tracks $15.4 trillion of bonds worldwide, gained 0.73 percent this month, the most since 1.02 percent in March.

Debt investors can’t see a recovery strong enough to spur central bank interest rates anytime soon, especially with the Obama administration forecasting that unemployment in the U.S. - - the world’s largest economy -- will rise above 10 percent in the first quarter. After stripping out the effects of the U.S. government’s "cash for clunkers" program to buy new cars, consumer spending was unchanged in July, according to Commerce Department data released on Aug. 28. "The bond market does not believe we will see rapid robust rates of growth," said Jeffrey Caughron, an associate partner in Oklahoma City at The Baker Group Ltd., which advises community banks investing $20 billion. "The deleveraging of the consumer will act as a drag on growth, which will keep inflation to a minimum and interest rates relatively low."

Bond yields are lower now than when Federal Reserve Chairman Ben S. Bernanke said in an Aug. 21 speech at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming, that "prospects for a return to growth in the near term appear good." European Central Bank President Jean-Claude Trichet said that while the economy is no longer in "freefall," it faces "a very bumpy road ahead." Two-year Treasury note yields fell 7 basis points, or 0.07 percentage point, last week to 1.02 percent, and are down from this month’s high of 1.36 percent on Aug. 7, according to BGCantor Market Data. The 1 percent security maturing on August 2011, sold by the government Aug. 25, ended the week at 99 31/32.

The picture is the same in Europe. U.K. two-year gilt yields dropped to a record low of 0.828 percent on Aug. 25 before ending the week at 0.84 percent. German bund yields of similar maturity declined 12 basis points to 1.25 percent last week and fell from 1.61 percent on Aug. 10 even as government reports showed the economy exited the recession in the three months ended June 30. Yields on government bonds of all maturities average 2.27 percent, compared with this year’s peak of 2.62 percent on June 8, according to the Merrill Lynch index. The drop helped return fixed-income investors to profit, earning 2.14 percent since the start of June after losing 1.54 percent in the first five months of the year.

Fixed-income strategists at London-based HSBC Holdings Plc said the drop in yields reflects a growing perception that central banks are unlikely to raise borrowing costs as soon as forecast just a month ago. "Interest rates are likely to remain at record lows for quite a while," said Andre de Silva, the deputy global head of fixed-income strategy at HSBC, Europe’s largest bank. Traders are pricing in less than a 50 percent chance of a U.S. rate increase before March, federal funds futures show. As recently as June, they saw 70 percent odds of a boost in the Fed’s target rate for overnight loans between banks to at least 0.5 percent in November from the current target range of zero to 0.25 percent.

In Europe, traders are paring bets the ECB will raise its main refinancing rate from 1 percent this year. The implied rate on the Euribor futures contract expiring in December was 0.85 percent on Aug. 28, down from 1.22 percent at the start of June. Bond investors are more pessimistic than stock investors, who have pushed the MSCI’s World Stock Index to the highest level since October. The index rallied 4.7 percent this month after the Washington-based IMF, which rescued countries from Iceland to Pakistan during the global crisis, said in July the world economy will expand 2.5 percent in 2010 following a 1.4 percent contraction this year. Since then, Japan, France and Germany returned to growth.

"We do believe the recovery is in sight and is going to be perhaps a little better than we had at one time thought, but we expect a rather muted recovery," Caroline Atkinson, the IMF’s external relations director, said to reporters in Washington on Aug. 27. Reports last week in the U.S. and Europe showed home sales, durable goods orders and business sentiment rose more than forecast. The median estimate of 55 economists surveyed by Bloomberg is for growth in the U.S. of 2.3 percent next year.

"It’s too pessimistic a view to look at all these factors and still think we won’t have a reasonable recovery," said Michiel de Bruin, who helps manage $27 billion as head of European government debt in Amsterdam at F&C Asset Management Plc’s Dutch unit. "Our view is that if unemployment rises at a slower pace than expected, that’s already good news. Against this backdrop, government bonds will find it very hard to sustain a rally going forward."

Two-year Treasury yields are forecast to end the year at 1.32 percent, while 10-year yields may rise to 3.87 percent from 3.45 percent last week, according to the median estimate of more than 45 economists and strategists surveyed by Bloomberg. An increase to those levels would still leave 10-year yields below their average of 5.63 percent during the past 20 years. Treasuries gained last week even as reports showed the housing market may have bottomed. Although the National Association of Realtors in Washington said Aug. 21 that sales of existing U.S. home jumped 7.2 percent in July to the highest level in two years, prices fell 15 percent from a year earlier.

"Evidence has been accumulating that housing has begun to put in a bottom," said Jay Mueller, a senior money manager who oversees about $3 billion of bonds at Wells Fargo Capital Management in Milwaukee. "Still, the news isn’t that earth shaking. Going forward we are going to need to see a lot more fundamental justification on the economy getter better, and not just less bad information, if the move to riskier assets is to be sustainable."

Mutual funds, pensions and endowments sold $1.79 billion more shares of companies that rely on consumer spending this month than they’ve bought, the fastest pace in at least 14 years, based on data compiled by Boston-based State Street Corp., the custodian of $16.4 billion of assets. The world’s biggest financial institutions, which have taken $1.6 trillion in writedowns and losses since the start of 2007, are scooping up bonds at an accelerating pace.

Bank holdings of government securities and debt of mortgage companies Fannie Mae in Washington and McLean, Virginia-based Freddie Mac increased to a record $1.37 trillion in the week ended Aug. 12, from $1.31 trillion on July 29, Fed data show. The 4.8 percent jump was the biggest for any two-week period since the start of the year. The surge comes as the U.S. savings rate reached 6.9 percent in May, the highest level since 1993. It was as low as zero as recently as April 2008. The bond market is signaling that the measures by policy makers may not be enough because unemployment is forecast to climb, capping consumer demand, which accounts for about 70 percent of U.S. economic activity.

"It’s not at all clear that the economy is out of the woods yet," said Mihir Worah, who invests the $14 billion Real Return Fund for Newport Beach, California Pacific Investment Management Co. "We still have to see convincing signs that the consumer can survive once the government stimulus is taken away, and we are not convinced of that." The last time the U.S. unemployment rate was above 10 percent was in 1983, following the recession of 1981 and 1982. Cuts in the Fed’s target rate from 20 percent at the start of that contraction to 8.5 percent, combined with deficit spending by the Reagan administration helped push the jobless rate down to 7 percent by the end of 1985.

At the start of this recession in December 2007, the Fed’s target rate for overnight loans between banks was 5.25 percent, driving policy makers to alternative measures such as purchases of bonds after it cut borrowing costs to almost zero in December. Wages and salaries fell 4.7 percent in the 12 months through June, the biggest drop since records began in 1960, Commerce Department figures show. Purchases will probably climb at an average 1.6 percent quarterly rate through June 2010, compared with 2.8 percent during the six-year expansion that ended in December 2007, according to a Bloomberg survey of economists this month.

Threadneedle Asset Management Ltd. in London, was bearish on Treasuries until May. "There’s much optimism about the state of the economy in general," said Dave Chappell, a money manager at the company, which oversees $90 billion. "But when the stimulus programs, such as a credit tax break for first-time home buyers, run off, can the momentum continue? It probably can’t. Treasuries, particularly long-dated ones, are unlikely to buckle with this improving view on the economy."

Why China Can't Save The World

While the Chinese economy is growing rapidly and becoming enormous, here's a reminder that China still can't lead the global economy into growth.As seen below, China's expenditures remain too small relative to those of the US, Europe, and to a lesser extent Japan.

(Charts via Societe General, "Global Market Outlook" Presentation, 21 August 2009)

China Stocks 'In Deep Bubble,' May Drop Another 25%

China’s economy isn’t "sustainable" and the benchmark Shanghai Composite Index may fall another 25 percent, former Morgan Stanley Asian economist Andy Xie said in an interview. "The market is in deep bubble territory," Xie, who correctly predicted in April 2007 that China’s equities would tumble, told Bloomberg Television. The Shanghai index plunged 6.7 percent to 2,667.75 today, the most since June 2008 and entering a bear market, on concern a slowdown in lending growth may derail a recovery in the world’s third-largest economy. Xie said the index "should be 2000 or less."

The Shanghai gauge slumped 22 percent this month, the worst performer among 89 benchmark indexes tracked by Bloomberg, as banks reined in lending to avert asset bubbles and policy makers advised industries such as steel and cement to curb overcapacity. The decline stopped a rally that had sent the measure up 103 percent from a November low on prospects the government’s 4 trillion yuan ($586 billion) stimulus program and a record amount of new credit would ensure the economy grows at least 8 percent this year.

"The local market bears are convinced that tightening is already underway," said Howard Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion. Only "a very strong set of macro numbers in August" or "stronger statements from central authorities" would change this trend, Wang said. The tumble in China stocks send the MSCI World Index of 23 developed nations down 1 percent at 10:17 a.m. New York time. The Bank of New York Mellon China ADR Index, tracking American depositary receipts, lost 2.6 percent, led by commodity producers.

At least 150 stocks on the 898-member Shanghai index dropped by the daily 10 percent limit. Industrial Bank Co. and Aluminum Corp. of China Ltd. tumbled by the permitted cap after Caijing magazine reported new loan growth this month may be almost half that of July. Lower profits dragged Baoshan Iron & Steel Co., the nation’s biggest steelmaker, and China Southern Airlines Co. down at least 7 percent. Chinese stocks are trading at the steepest discount in the world compared with analysts’ price targets after this month’s slump in the benchmark index.

Equities in China remain "a bright spot" among global stocks because of the nation’s strong growth potential, Goldman Sachs Group Inc. said today. "We think the market concerns about a near-term ‘exit strategy’ appear premature as the government remains pro- growth," Thomas Deng and Kinger Lau, analysts at Goldman Sachs, wrote in a research note. China may have 200 billion yuan of new loans in August, the Beijing-based Caijing reported today on its Web site.

That compares with 7.4 trillion yuan for the first half of 2009 and 355.9 billion yuan in July alone. The government plans to tighten capital requirements for financial institutions, three people familiar with the matter said this month. An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months of this year, China Business News reported June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council.

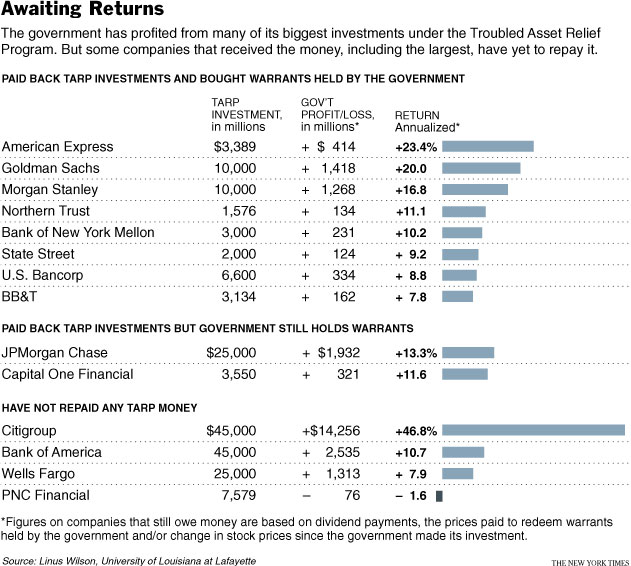

Bailout Profits? Don’t Make Me Laugh!

The government has taken profits of about $1.4 billion on its investment in Goldman Sachs, $1.3 billion on Morgan Stanley and $414 million on American Express. The five other banks that repaid the government — Northern Trust, Bank of New York Mellon, State Street, U.S. Bancorp and BB&T — each brought in $100 million to $334 million in profit.”

-New York Times>

My definition of an investment profit is simple: You take the money you have invested, and if adds up to more that what you began with, well, then, you have a profit.

Let’s say on the other hand, you own 20+30 positions; 5 of them are higher than where you purchased them, and all the rest deeply in the red. Net net, your portfolio is down immensely. Most rational investors would hardly call that investment a “profit.”

Looking just at early TARP repayments means that we are ignoring a) the rest of the TARP; and b) the majority of other expenses, guarantees, loans capital injections, and outright spending that has taken place.

Perhaps the rookies are manning the terminals, with the senior people away on vacation. That would explain the inexplicably clueless headline over at the NYT this morning: As Big Banks Repay Bailout Money, U.S. Sees a Profit.

Excerpt:

“Nearly a year after the federal rescue of the nation’s biggest banks, taxpayers have begun seeing profits from the hundreds of billions of dollars in aid that many critics thought might never be seen again.

The profits, collected from eight of the biggest banks that have fully repaid their obligations to the government, come to about $4 billion, or the equivalent of about 15 percent annually, according to calculations compiled for The New York Times.”

Now, by any traditional measure of profits, you include all of the costs incurred against the total revenue, to determine if there is a net gain (or loss). This simple mathematical analysis of what a profit is — Are we up or down? — seems to have eluded the headline writers.

At least the author makes mention of how tenuous the usage of that word is the article’s body:

“These early returns are by no means a full accounting of the huge financial rescue undertaken by the federal government last year to stabilize teetering banks and other companies.

The government still faces potentially huge long-term losses from its bailouts of the insurance giant American International Group, the mortgage finance companies Fannie Mae and Freddie Mac, and the automakers General Motors and Chrysler. The Treasury Department could also take a hit from its guarantees on billions of dollars of toxic mortgages.”

What this is more appropriately described as is a return of capital; to call this a profit is to ignore trillions of dollars in taxpayer monies that have been spent, lent, guaranteed, drawn against and otherwise consumed in what will likely be the greatest transfer of wealth in the planet’s history.

Raft of Deals for Failed Banks Puts U.S. on Hook for Billions

The biggest spur to deal-making among banks isn't private-equity cash or foreign investors. It is the federal government. To encourage banks to pick through the wreckage of their collapsed competitors, the Federal Deposit Insurance Corp. has agreed to assume most of the risk on $80 billion in loans and other assets. The agency expects it will eventually have to cover $14 billion in future losses on deals cut so far. The initiative amounts to a subsidy for dozens of hand-picked banks.

Through more than 50 deals known as "loss shares," the FDIC has agreed to absorb losses on the detritus of the financial crisis -- from loans on two log cabins in the woods of northwestern Illinois to hundreds of millions of dollars in busted condominium loans in Florida. The agency's total exposure is about six times the amount remaining in its fund that guarantees consumers' deposits, exposing taxpayers to a big, new risk. As financial markets heal and the economy appears to be pulling out of recession, the federal government is shifting from crisis to cleanup mode. But as the loss-share deals show, its potential financial burden isn't receding. So far, the FDIC has paid out $300 million to a handful of banks under the loss-share agreements.

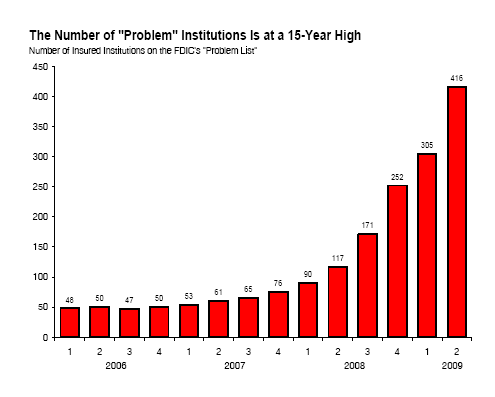

The practice is largely a response to the number of bank failures of the past 18 months, which has stretched the FDIC's financial and logistical resources. The FDIC had just $10.4 billion in its deposit-insurance fund at the end of June, down from more than $50 billion last year. The agency said Thursday it had 416 banks on its "problem" list at the end of the second quarter, which means the list of banks at a higher risk of insolvency has been growing.

Many of the government programs aimed at attacking the financial crisis have carried high price tags, including the Treasury Department's $700 billion Troubled Asset Relief Program, which includes major government investments in American International Group Inc., Citigroup Inc., Bank of America Corp., and the U.S. auto industry. But federal money isn't just going one way. Some of the emergency programs put in place last year, including TARP, have brought in billions of dollars for the government.

On a range of rescue programs run by the Federal Reserve, such as loans to investment banks and purchases of mortgage-backed securities, the Fed earned $16.4 billion through the first six months of 2009. The FDIC said earlier this year that it earned more than $7 billion on the fees it charged through a program that guaranteed debt issued by banks.

On Aug. 14, Alabama's Colonial Bank collapsed, felled by bad commercial-real-estate lending. The FDIC, assuming its traditional role, brokered a sale of the bank's deposits to BB&T Corp., ensuring that customers wouldn't see any interruption. It also agreed to help BB&T buy a $15 billion portfolio of Colonial's loans and other assets by agreeing to absorb more than 80% of future losses. Under the deal, the most BB&T can lose is $500 million, the bank says, and that is only in the unlikely event that the entire portfolio becomes worthless. The FDIC is on the hook to cover the rest.

In June, Wilshire State Bank, a division of Wilshire Bancorp Inc. in Los Angeles, agreed to buy $362 million in deposits and $449 million of assets from failed Mirae Bank, also of Los Angeles. The FDIC agreed to assume most future losses on roughly $341 million of those assets, largely commercial real estate and construction loans in Southern California. "After we understood how [the loss-share] works, we were literally overjoyed," says Joanne Kim, chief executive of Wilshire State Bank.

Loss-share agreements made a brief appearance in the early 1990s during the savings-and-loan crisis, but haven't been used this extensively before. The FDIC sees the deals as a way to keep bank loans and other assets in the private sector. More importantly, it believes such deals mitigate the cost of cleaning up the industry. The FDIC contends it would cost the agency considerably more to simply liquidate the assets of failed banks, especially with the current crop of troubled institutions and their portfolios of loans on misbegotten real estate.

The FDIC's premise is that banks that take on the troubled assets will work to improve their value over time. The agency estimates the loss-share deals cut will cost it $11 billion less than if the agency seized the assets and sold them at fair-market value. "This is an issue the FDIC is grappling with because the loss rates they are estimating on these failed banks are pretty amazing," says Frederick Cannon, chief equity strategist at Keefe, Bruyette & Woods Inc. By potentially mitigating losses -- or at least stretching them out over time -- the deals provide some protection for the agency's insurance fund. "It's a great opportunity for banks," says James Wigand, deputy director of the FDIC's division of resolutions and receiverships. "It's a great opportunity for us."

The federal government is on the hook for billions of dollars in bank losses if the economy doesn't recover. It will carry that burden for a long time. Many of the loss-share deals will be in place for up to 10 years. Some industry officials worry that bankers might tire of the partnerships with the FDIC and put little effort into reworking the soured loans because the bulk of losses will fall to the government. FDIC officials maintain that because banks still have a "material" exposure, they will be reluctant to do this.

"There is certainly an incentive for the banks to play fair and do right, but there is never a limit on the ability of the private sector to shift cost to the government," says John Douglas, a former FDIC general counsel who now advises banks as a partner at the law firm Davis, Polk & Wardell LLP. The FDIC's inspector general has said he is examining the controls designed to ensure that banks play by the rules. Since Jan. 1, 2008, 109 banks in 29 states have failed, ranging from one of the smallest banks in the country, Dwelling House Savings and Loan in Pittsburgh, a one-branch bank with $13.4 million of assets, to Washington Mutual, which had $307 billion of assets and was the largest bank failure in U.S. history.

Those collapses have cost the FDIC $40 billion, putting a huge dent in its reserves. The FDIC was created during the Depression to maintain consumer confidence in banks by guaranteeing deposits. If its deposit-insurance fund runs out, the FDIC would likely have to borrow money from the Treasury Department or slap higher fees on the banks whose contributions keep the fund afloat. During the savings-and-loan crisis in the 1980s and early 1990s, more than 1,000 banks failed. The government set up the Resolution Trust Corp. to take over assets from failed banks and sell them. Such a structure doesn't exist now, which means that the FDIC has to take on those assets or somehow persuade healthy banks to do so.

Last year, the agency struck only a handful of loss-share deals with healthy banks. That left the government with lots of troubled loans from failed banks to sell. "The hardest part today in the acquisition game is valuing assets or determining real equity, and with a loss share you can do that," says Len Williams, chief executive of Home Federal Bank in Idaho, which picked up $197 million in assets from the failed Community First Bank in Oregon on Aug. 7, most of it covered by a loss-share agreement.

Over the past 12 months, no bank has been a buyer of more failed banks than Stearns Bank of St. Cloud, Minn., which began as an agricultural bank. It bought the deposits and most of the assets of Horizon Bank in Pine City, Minn., on June 26; of Community National Bank of Sarasota County and First State Bank, both of Sarasota, Fla., on Aug. 7; and of ebank in Atlanta on Aug. 21. It brokered loss-share arrangements on all the deals, covering $619 million in assets. The acquisitions expanded the bank's assets by 60%, with limited risk of future losses.

By comparison, when Stearns agreed to buy the deposits of failed Alpha Bank & Trust in Alpharetta, Ga., last year, loss-share deals hadn't yet become common. Stearns purchased just $39 million of Alpha's $354 million in assets, leaving the rest for the FDIC to sort out. Stearns has entered into more loss-share deals than any other bank. "We have had to bid on [each of the banks], so everybody has had the same opportunity," says Chief Executive Norman Skalicky. In most cases, the FDIC agrees to cover 80% of future losses on a big portion of the assets, and 95% on the rest. The FDIC says it doesn't anticipate facing the 95% loss-coverage scenario on any deal.

Typical assets include loans on commercial real-estate developments, condominiums and single-family homes. Banks are required to report at least every quarter on estimated loan losses, and to have a team in place working full time to maximize the value of the assets. Banks must get permission from the FDIC to sell any loans. Big banks also have used the deals to grow with minimal risk. On Aug. 21, BBVA Compass, a unit of the giant Spanish company Banco Bilbao Vizcaya Argentaria, bought $12 billion in loans and other assets from the failed Guaranty Bank in Austin, Texas. As part of the deal, the FDIC said it would cover most losses on a $9.7 billion portion of that pool.

The Office of Thrift Supervision said last week that more than half of Guaranty's loans were "higher risk," including commercial, construction and land loans. BBVA Compass said the deal would have the FDIC "bear 80% of the first $2.3 billion of losses and 95% of the losses above that threshold." Its chairman, José Maria Garcia Meyer-Dohner, described it as a "low-risk transaction." The arrangement made BBVA Compass the 15th largest bank in the U.S. Veteran banker Joseph Evans saw the loss-share deals as a major opportunity.

He approached State Bank and Trust Co., a tiny bank in Pinehurst, Ga. with just $35 million in assets, with a proposition: He would take charge of the bank, find investors to pump $300 million of capital into it, then buy up the assets of failing banks in Georgia. Mr. Evans, who has spent years selling distressed assets, recruited investors, and on July 24 he put his plan in motion. The FDIC shut down six affiliated Georgia banks and agreed to sell $2.4 billion of deposits and $2.4 billion of assets to Mr. Evans's team. The FDIC agreed to absorb most losses on $1.7 billion of those assets. Overnight, the small bank became one of the largest in the state.

"From a turnaround guy's perspective, I've never had this kind of downside protection," Mr. Evans says. "I don't believe we would have either been interested or found interested investors to enter the banking industry at this moment in time, absent the FDIC assistance." He says there's a good chance his team will make a strong profit. He estimates it will take roughly four years to work through the bad assets in the portfolio. The FDIC wouldn't have to resort to such deals if it could easily sell the assets of failed banks. But last year, most healthy banks refused to bite.

In 20 of 2008's 25 failures, banks acquired less than 30% of the assets of the failed banks. When ANB Financial failed in Bentonville, Ark. on May 9, 2008, for example, Pulaski Bank and Trust Co. of Little Rock agreed to buy only $236 million of the $2.1 billion of the failed bank's assets. Last month, Galena State Bank in Galena, Ill., bought most of the assets of failed Elizabeth State Bank in Elizabeth, Ill., under a loss-share agreement.

As a result, Galena's portfolio now includes delinquent loans on two log cabins in the area. Andrew Townsend, Galena's chief executive, say his people have yet to visit the properties, which were often rented out to tourists. "There's a lot of work to getting your arms around everything and working through credit issues and conversion issues and valuation," he says. "Relatively speaking, that shouldn't take forever, and at the end of the day, we should have a nice pool of earning assets and clientele."

St. Louis Fed Charts – Banks Not Looking that Healthy at ALLL…

by Nathan Martin

When a banks’ loans begin to non-perform, they begin to eat into their capital reserves. Each banks’ Board of Directors is responsible to assess their reserves and make certain that they comply with legal and accounting requirements and, of course, they are certainly free to maintain standards that are higher than minimums.

The Fed tracks the banks’ Allowance for Loan and Lease Losses (ALLL) and produces charts showing ALLL versus NONPERFORMING loans. A ratio of 100 would mean that all the banks in that size have ALLLs that exceed their nonperforming loans – a condition of health. The lower the ratio number, the less healthy the banks are for that size stratum. The banks are complaining about arbitrary rules regarding ALLL, to learn more here is an article from July of this year; Banks' loan loss reserves are lagging behind delinquent loans… (site will only let you view article once w/o login).

The Fed groups banks into those with ASSETS less than $300 million, those with assets $300M to $1B, those $1B to $20B, and those $20B and Higher. Of course, you and I don’t know how those “assets” are valued or by who. That’s where Enron accounting mark-to-model accounting standards come in – thus the charts below are likely indicating a false sense of health, if you can call them healthy at all. Also keep in mind that there are now millions of home owners underwater on their loans, and many commercial real estate loans are facing the same fate. As asset deflation drives prices lower, any hiccup in income drives those loans into the nonperforming category. Let’s examine the small to medium size ($300M to $1B) and the large banks above $20B…

BANKS $300M to $1B:

Nonperforming loans:

ALLL Ratio:

BANKS over $20B:

Nonperforming loans:

ALLL Ratio:

Here’s the chart of TOTAL nonperforming loans:

So, the big banks would appear to have fewer nonperforming loans, but their ALLL ratio is running around 12 while the smaller banks are up around 30. Again, I’m betting that the REAL ALLL is much, much lower due to mark-to-model, but what you’re seeing here regardless is NOT a picture of health, that’s for sure.

For more on bank capital requirements, you may want to start your research with a visit to Wikipedia - Capital Requirements.

Note that the total loans and leases at all commercial banks are now negative:

And that net commercial loan charge offs are continuing to skyrocket:

And I think the chart of the week is the chart showing net capital inflows. Is that what a loss of confidence looks like?

[..] I still think these charts have deflation written all over them.

Ilargi: TRIN is NYSE Short Term Trading Index

Why is TRIN (Arms Index) So Low?

by Brett Steenbarger

A few readers have asked this question, noting recent low TRIN values. (TRIN is also known as the ARMS Index). Of course, what this means is that a high proportion of daily trading volume has been concentrated in rising stocks. But is TRIN low?

To address this, I looked at the median 20-day TRIN values going back to 2000. I used the median because the TRIN ratio is constructed in such a way that you can get much larger readings above 1.0 than below. With the median, I wanted to capture whether the average day was showing greater concentration of volume to the winning or losing stocks.

Guess what? The current 20-day median TRIN is the lowest value we've seen since 2000 at around .75. I'm not exactly sure what to make of that. What I can tell you with certainty is that two of the past historical occasions in which we've had 20-day price highs and ultra low median 20-day TRIN readings have been March, 2000 and late May/early June, 2007. Both corresponded more or less to bull market peaks.

The ultra low TRIN seemed to capture frothiness in those markets: lots of volume going into a few speculative, rising issues. Might we be seeing the same thing with the recent pops in such low priced stocks as AIG, C, FNM, FRE, CIT, and BAC? I note that about 2 billion of NYSE volume was concentrated in C, FNM, and FRE alone. Seems like lots of money chasing low-priced volatile financial stocks. Just like lots of money chasing volatile tech stocks or emerging market stocks. Not something you'd see at market bottoms. A bit of a sentiment caveat for this market shrink.

Recent Concentration of Volume in Financial Stocks: Coordinated Capital Infusion?

by Brett Steenbarger

I just wanted to add some color to my recent post regarding why the NYSE TRIN indicator might be broken

Reader Brian adds a very interesting perspective, indicating that he’s watched TRIN and C side by side and has seen a very strong correlation. When C flips from up to down (or vice versa), there is a corresponding huge move in TRIN. This could only be the case if a stock like C comprised a large share of total NYSE volume, which indeed seems to be the case, as noted by The Big Picture blog.

Above I took C, FNM, and FRE and expressed their *composite* volumes (e.g., the volumes transacted across all exchanges) as a fraction of NYSE volume. What we see is that, early in 2007, those three stocks accounted for only 1-3% of NYSE volume. During the financial crisis of late 2008 and again as the market was bottoming in early 2009, that ratio skyrocked to well over 50%.

Recently, however, the volume in these three stocks has hit astronomical levels relative to total NYSE trading, as all three have made phenomenal percentage gains during August. Indeed, the composite volume of these three stocks alone has recently doubled total NYSE volume. If we look at just the NYSE trading of these firms, they are accounting for about 40% of NYSE volume. It is not surprising that Brian would notice TRIN flipping up and down as these stocks change direction.

Again, the question is what all this means. There is no way that mom and pop trader and investor are involved in any meaningful way in generating these kind of daily trading volumes. Nor are proprietary trading shops capable of generating volumes that exceed those of the entire New York Stock Exchange. While I have no doubt that the algorithmic trade close to the market is participating in this movement, the directionality of the involvement suggests that large financial institutions are systematically buying the beaten-up shares of the poster children for TARP: C, FNM, FRE, AIG, and the like.

It is worth noting in this regard that other major (healthy) financial firms, such as GS and JPM, have seen no such surge in their volume or their trading prices.

My best guess? We’re seeing a massive infusion of capital into very troubled financial institutions, no doubt aided by short covering and the participation of program traders and proprietary daytrading firms. Where is the capital coming from? Why has it poured in so suddenly (the really large infusions began in early August)? Why is it coming in at such a pace that it is dominating NYSE volume? Zero Hedge rightly wonders why this hasn’t triggered alarms at the exchange. And why is it happening with only the weakest financial institutions?

If you were the government and you saw that these institutions were on the verge of a major fail, with billions of taxpayer dollars at risk, I’m not sure you’d announce that to the world. Nor, at this point politically, could you ask for yet another bailout package. But you would only pour money into those stocks at a frantic pace (capable of detection) if you perceived a dire need for the capital.

I’m not inclined toward conspiracy theories, but it’s difficult to imagine a scenario in which this is not a (frighteningly necessary) coordinated capital infusion, with taxpayer dollars ultimately at work in financial markets.

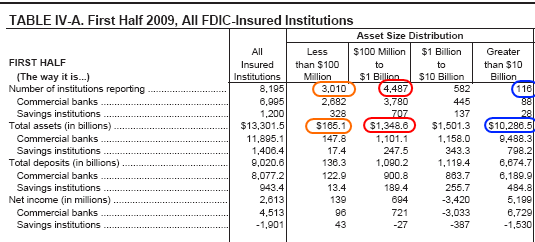

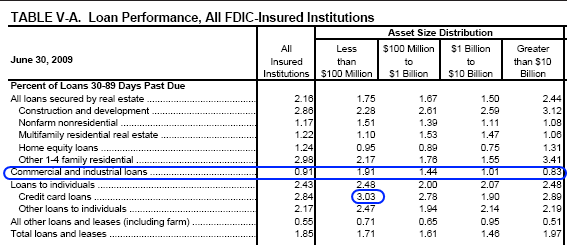

FDIC Insured Institutions have $13.3 Trillion in Assets

The banking system has taken the country to the financial edge of the greatest recession since the depression. The enormous number of bad loans floating out in the economy only complicates the unemployment situation. When we look into the latest banking data, we realize that over 1,000 of current banks will fail or merge with a too big too fail bank. In fact, the total number will be over 1,000 simply because the “not too big” to fail banks heavily bet on commercial real estate loans that amount to $3 trillion.Recent data shows that approximately 25% of all the banks insured by the FDIC are unprofitable. That number tells us that some 2,000 banks cannot turn a profit. Let us first look at the current data:

This is probably one of the more telling charts. We have 8,195 institutions. 3,010 of those have less than $100 million in assets. 4,487 have between $100 million to $1 billion. 582 fall between $1 billion and $10 billion. Those over $10 billion? 116. This is incredibly disturbing and shows the monopoly that a few big banks have. 116 banks make up 77 percent of all total banking assets in the United States! So you can have the lower 8,079 banks fail and you wouldn’t even lose 25 percent of the total assets of the banking system.

To show you the heavy weight of commercial real estate loans in the lower rung of banks, take a look at this data:

For commercial and industrial loans the banks with the lowest assets seem to have the highest non performing loans. This is bad news since there are $3 trillion in commercial loans floating out in the market and the U.S. Treasury has already mentioned plans to bail these loans out. Bad news of course for the taxpayer but more money thrown to the bigger banks. It would seem that politically we are letting smaller banks fail to placate the public with bread and circuses while the big banks get the real money. You’ll also notice that the banks with smaller assets are also facing higher credit card non-current loans. Given that many of these banks are small enough to fail by our government standards, you can expect that many will fail in the upcoming months. The government seems to be following one path right now. That path includes protecting those 116 banks.

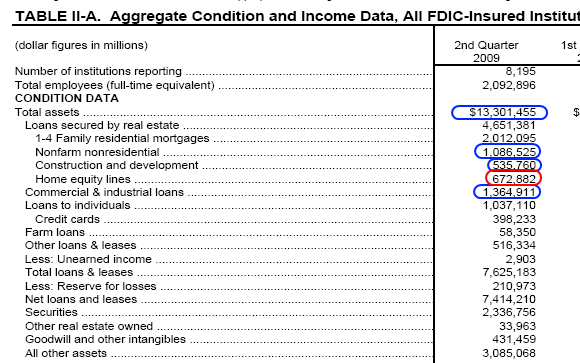

$13 trillion is a large number of total assets. It equates to approximately one year of our national GDP. The number is even more daunting when you realize much of the assets are secured by real estate. In addition, the 8,195 institutions employ over 2 million people. More bank failures mean more layoffs that will add to the already 26 million unemployed and underemployed Americans. But let us look at that balance sheet:

$1 trillion in non-farm residential loans

$535 billion in construction and development loans

$672 billion in home equity lines

$1.3 trillion in commercial and industrial loans

$398 billion in credit cards

Do you think these loans will do well in the current recession? But a more curious data point, in 2004 there were 8,976 FDIC insured institutions. Now it is down to 8,195. What has happened? The big banks keep swallowing up the smaller banks. Since 2004 we have 781 fewer FDIC insured banks. Not all these are failures. What is happening is that the banking sector is consolidating with the too big to fail. Did we not learn any lessons with the gigantic trusts in the early part of the 1900s? Monopolies are not good but it would appear that is our current philosophy. Let the small fail or be eaten up while the big banks are protected at all taxpayer costs. Recently, the FDIC started charging big and smaller banks, even those that were prudent higher fees because they need more money. More money to help the bigger banks not fail while closing the door on smaller banks. This is selective crony capitalism here. Lehman Brothers collapses yet Goldman Sachs remains. Now tell me, who has more political connections?

The number of problem institutions is steadily growing:

The FDIC has 416 institutions listed as “problem” banks. Keep in mind some of the biggest failures like IndyMac did not appear on this list. It is becoming clear that we may have over 1,000 bank failures since it has little consequence in the total asset size of the banking system of the country and our government seems set on protecting the big banks only.

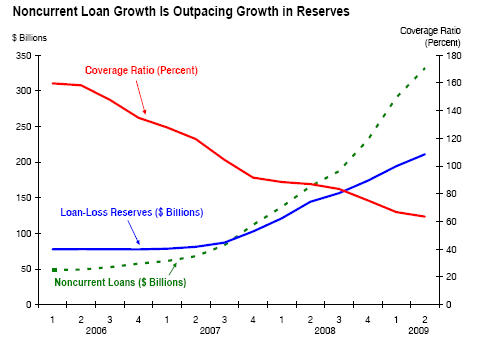

So far, the non-current loans are growing at a steady pace. This chart does not look like a green shoot:

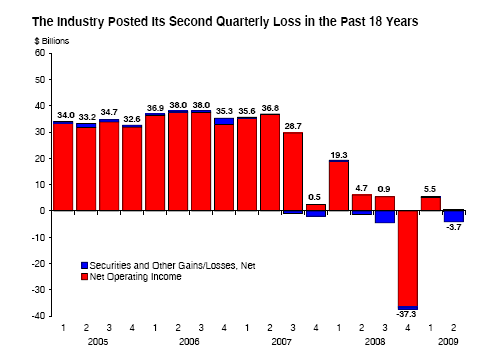

Over $300 billion in loans are currently non-current. The trend is still heading higher. So the obvious conclusion is more money is going to be launched at banks. Until we start seeing stability in this area we can expect more and more banks to fail. The banking sector posted its second quarterly loss in the last 18 years:

I find the Q1 data incredible. The only way banks turned a profit here was because of the trillions in taxpayer bailouts. This is where your mega banks started stating they turned profits even though they had taxpayer handouts and suspended mark to market accounting.

The charts above tell us that we are going to see a large number of bank failures. Many of those commercial real estate loans come up for refinancing in the next few years:

Source: Zero Hedge

Now you tell me who is going to refinance an empty strip mall in Arizona? Some of these are going to have massive losses. Many banks are carrying these toxic mortgages at close to face value. As the months go along, we are going to become very accustomed to bank failure Fridays. Get used to it

Citi investors should take profits: Barron's

Investors that bought Citigroup Inc shares should take profits after the U.S. bank's shares climbed almost 100 percent in the last month, Barron's said in its August 31 edition. Further gains in Citi's shares are likely to be limited, the newspaper -- which was bullish on the bank a month ago -- said, adding that other U.S. bank stocks look more attractive. Citi shares closed on Friday at $5.23.

Shares in Citigroup fell as low as $1 earlier this year after it received $45 billion in bank bailout money from the U.S. Treasury's Troubled Asset Relief Program and the government now owns a 34 percent stake in the company. The second-largest U.S. bank, JPMorgan Chase & Co, and former investment bank Morgan Stanley are both in better shape than beleaguered Citi, the newspaper said, noting that both have returned U.S. government bank bailout funds.

Commercial Real Estate Lurks as Next Potential Mortgage Crisis

Federal Reserve and Treasury officials are scrambling to prevent the commercial-real-estate sector from delivering a roundhouse punch to the U.S. economy just as it struggles to get up off the mat. Their efforts could be undermined by a surge in foreclosures of commercial property carrying mortgages that were packaged and sold by Wall Street as bonds. Similar mortgage-backed securities created out of home loans played a big role in undoing that sector and triggering the global economic recession. Now the $700 billion of commercial-mortgage-backed securities outstanding are being tested for the first time by a massive downturn, and the outcome so far hasn't been pretty.

The CMBS sector is suffering two kinds of pain, which, according to credit rater Realpoint LLC, sent its delinquency rate to 3.14% in July, more than six times the level a year earlier. One is simply the result of bad underwriting. In the era of looser credit, Wall Street's CMBS machine lent owners money on the assumption that occupancy and rents of their office buildings, hotels, stores or other commercial property would keep rising. In fact, the opposite has happened. The result is that a growing number of properties aren't generating enough cash to make principal and interest payments.

The other kind of hurt is coming from the inability of property owners to refinance loans bundled into CMBS when these loans mature. By the end of 2012, some $153 billion in loans that make up CMBS are coming due, and close to $100 billion of that will face difficulty getting refinanced, according to Deutsche Bank. Even though the cash flows of these properties are enough to pay interest and principal on the debt, their values have fallen so far that borrowers won't be able to extend existing mortgages or replace them with new debt. That means losses not only to the property owners but also to those who bought CMBS -- including hedge funds, pension funds, mutual funds and other financial institutions -- thus exacerbating the economic downturn.

A typical CMBS is stuffed with mortgages on a diverse group of properties, often fewer than 100, with loans ranging from a couple of million dollars to more than $100 million. A CMBS servicer, usually a big financial institution like Wachovia and Wells Fargo, collects monthly payments from the borrowers and passes the money on to the institutional investors that buy the securities. CMBS, of course, aren't the only kind of commercial-real-estate debt suffering higher defaults. Banks hold $1.7 trillion of commercial mortgages and construction loans, and delinquencies on this debt already have played a role in the increase in bank failures this year.

But banks' losses from commercial mortgages have the potential to mount sharply, and the high foreclosure rate in the CMBS market could play a role in this. Until now, banks have been able to keep a lid on commercial-real-estate losses by extending debt when it has matured as long as the underlying properties are generating enough cash to pay debt service. Banks have had a strong incentive to refinance because relaxed accounting standards have enabled them to avoid marking the value of the loans down.

"There is no incentive for banks to realize losses" on their commercial-real-estate loans, says Jack Foster, head of real estate at Franklin Templeton Real Estate Advisors. CMBS are held by scores of investors, and the servicers of CMBS loans have limited flexibility to extend or restructure troubled loans like banks do. Earlier this month, it was no coincidence that CMBS mortgages accounted for the debt on six of the seven Southern California office buildings that Maguire Properties Inc. said it was giving up. "During most of the evolution [of CMBS] no one ever thought all these loans would go into default," says Nelson Rising, Maguire's chief executive.

Indeed, many property developers and investors complain there is no way to identify the investors that hold their debt and that it is difficult to negotiate with CMBS servicers. In light of the complaints, the Treasury is considering guidance that would allow servicers to start talking about ways to avoid defaults and foreclosures sooner, according to people familiar with the matter. But investors in CMBS bonds argue that the servicers are ultimately bound contractually to the bondholders.

So Maguire will soon have a lot of company. In a study for The Wall Street Journal, Realpoint found that 281 CMBS loans valued at $6.3 billion weren't able to refinance when they matured in the past three month, even though 173 such loans worth $5.1 billion were throwing off more than enough cash to service their debt. Mounting foreclosures in the CMBS sector would likely depress values even further as property is dumped on the market. And this would put pressure on banks to write down loans. "What's going on in the CMBS world is a precursor for what might be seen in banks' books," predicts Frank Innaurato, managing director at Realpoint.

The commercial-real-estate market could yet be salvaged by an improving economy and bailout programs coming out of Washington. In addition, capital markets are starting to ease for publicly traded real-estate investment trusts. Since March, more than two dozen REITs have managed to raise more than $13 billion by selling shares. Still, most of the $6.7 trillion in commercial real estate is privately owned. Also, it is unlikely commercial real estate will benefit much from an early stage of an economic recovery. What landlords need is occupancy and rents to rise, and that means employers have to start hiring and consumers need to shop more. So far, there are few signs this is happening.

Sen. Corker Wants $15,000 Credit for Home Buyers

The housing market looks for hope today and it may mean a new tax break for you. There's already a tax credit for first-time home buyers. Now, Tennessee Senator Bob Corker says he will fight for an existing home-owner's credit on a new house. Corker says housing will lead the country out of the recession, even as Chattanooga real estate agents are seeing foreclosures. "We have quite a few foreclosures and we're expecting to get more according to what Washington tells us," says Chattanooga Association of Realtors President Nickie Schwartzkopf.

But a bit of good news came from Corker Tuesday, who delievered welcome news to the Realtors. "Things feel like they're beginning to turn around as it relates to real estate no question," says Corker. Everyone agrees that is in large part to the $8,000 first-time tax credit. It has allowed new home buyers to move in and existing homeowners to move up. But time is quickly running out on the opportunity. "Because it has to be bought and closed on by November 30th, so it takes a little over thirty days to get a loan through so we're getting down to the wire," Schwartzkopf says.

Corker hopes the tax credit will be extended. In fact he wants a $15,000 dollar tax credit for any home buyer. All though he's not a huge fan of the 'cash for clunkers' program, he says it proved it you give buyers a break, they will buy. "Even though the 'cash for clunkers' program was one that didn't work particularly well from a logistics standpoint, I think it showed that incentives do drive people."

And a purchased home means paid property taxes and money spent at stores for everything from furniture to paint. "If you can buy, now would be a great time to do that and to own a home," says Schwartzkopf. Corker also talked briefly about the health care debate, saying he agrees some sort of reform is needed -- but he doesn't agree it should be rushed through Congress.

Lehman faces up to $100 billion in claims

Lehman Brothers’ European businesses plan to lodge claims for as much as $100bn against their former holding company in the coming weeks, as the winding up of the collapsed US bank gathers pace.

The filing of the demands, which are being prepared by PwC, represents the opening of another front in the battle to recoup billions of dollars from Lehman Brothers, following its bankruptcy almost a year ago. Tony Lomas, a partner with PwC – which is acting as administrator of the defunct investment bank’s main European operations – described the range of claims as "exceptionally complex". Many relate to past guarantees that the former parent company issued to its global subsidiaries, Mr Lomas said.

More than 100 former Lehman companies across Europe are demanding repayment for work completed as part of the filing, according to Mr Lomas, and claims must be filed by September 22 to comply with a deadline set by the US bankruptcy court. "We’re dealing with a large number of entities and therefore the claims could be as much as $100bn?.?.?.?we anticipate a large amount of further work in dealing with these claims." Since Lehman Brothers’ bankruptcy last September, administrators have been working to quantify the bank’s position and verify claims of creditors, including clients. The sheer range of activities carried out by Lehman and the fact that its businesses are being handled by different administrators have complicated the process.

Information on claims and assets is being shared by rival companies, in a bid to speed up proceedings and avoid law suits. Lehman Brothers declared bankruptcy with debts of more than $613bn. Lehman Brothers International (Europe) held more than $30bn of client assets at the time of its collapse. Clients of Lehman Brothers’ European operations will face delays in recovering up to $9bn of assets after a judge in England decided this month that he could not approve a scheme that would have helped customers with assets trapped in the defunct bank receive compensation more quickly.

PwC had proposed a scheme that would have divided more than 1,000 clients into three classes and allowed the administrators to deal with claims by class rather than individually. Mr Justice Blackburne decided that the English courts did not have the jurisdiction to modify Lehman Brothers International (Europe) clients’ claims.

Euro Zone August Inflation Negative

Euro zone consumer prices fell for the third month running year-on-year in August and the data, coupled with falling inflation expectations, looks set to keep ECB rates steady despite a nascent economic recovery. Prices in the 16-country area fell 0.2 percent this month, European Union statistics office Eurostat estimated on Monday, after a 0.7 percent drop in July and a 0.1 percent easing in June.

Forecasts from economists polled by Reuters had centred on a 0.3 percent fall in August, but some had forecast a 0.2 percent dip after stronger-than-expected German inflation data last week. "Despite the emerging strong growth in the second half of 2009, the ECB will not hike rates in the current year," said Christoph Weil, economist at Commerzbank. With survey and hard data pointing to the euro zone emerging from recession in the third quarter, markets are speculating about when the European Central Bank might start tightening policy again after cutting borrowing costs to 1 percent earlier this year.

"With the inflation rate set to remain dampened for the foreseeable future and the credit downturn in full swing, we see a strong case for a steady refi rate throughout 2010," said Tullia Bucco, economist at Unicredit. The ECB wants inflation to be just below 2 percent but Commerzbank's Weil expects the rate of consumer price growth could rebound to 1 percent at the end of the year. The bank meets on interest rates on Thursday, when the market expects no change to its main refinancing rate. A detailed breakdown of the estimate and month-on-month data will be available on September 16. The fall in prices is likely to be mainly due to cheaper oil, the cost of which has roughly halved since August 2008.

A monthly consumer survey by the European Commission showed that inflation expectations among households set a new record low in negative territory in August for the fifth month in a row. "With the current outlook and the stabilising economy, the euro zone will not slip into a Japan-like, full-fledged, deflation," said Carsten Brzeski, economists at ING bank. "At the same time, huge excess capacities, a further widening output gap in 2010, very weak credit growth and private sector inflation expectations at record lows send a clear signal that monetary policy tightening will not be on the ECB's agenda any time soon," he said.

Swiss "Black" Accounts – A Trillion Dollar Problem

by Bruce Krasting

The case against UBS is over. The Justice Department appears to have won this one. A total of 4,450 out of a total of 52,000 names will be divulged to either DOJ or IRS. Based on what has been presented it would appear that the other 48,000 names that were not disclosed either had the money sent back to a bank in the Sates (equivalent of full disclosure) or they had hired a lawyer and confessed their sins to the IRS.

According to the DOJ the 52,000 names had a total of $15 billion in their black accounts. A sizable amount of money. The question that has been hanging in the air is how much money is still in Swiss black accounts that has not been flushed out at this point? How many other Americans have accounts that were not with UBS? How many accounts are there from non-US names? What is an estimate as to the size of this problem?

The August edition of Swiss Review provides some insight. While Swiss Review is not the end all source of information on this topic their writing is not independent of the Swiss Government who provides a portion of the operating budget. With that in mind I was shocked to find the following in the August edition of SR:

“Switzerland has become a paradise for foreign capital on which tax is not paid. The uproar from foreign governments is understandable.” These are not the words of a critic of the banks, but of private banker Konrad Hummler. He says that around 30%, or CHF 1,000 billion, of the CHF 2,800 billion or so of foreign assets in Swiss banks is untaxed “black money”.

Mr. Hummler probably knows as much about the topic of black accounts in Switzerland as anyone. His Bio:

Konrad Hummler is managing partner of Wegelin & Co., private bankers, and has acted for many years as personal advisor to the chairman of the board of directors of the Union Bank of Switzerland (UBS). He serves as a colonel in the general staff of the Swiss Army.

Mr. Hummler has put a number of nearly 1 Trillion dollars on the problem. This is much higher than any estimate that I have seen before. I thought it could be as high as $500b. It appears that I was understating things by a factor of 2. Some perspective based on the comments by Mr. Hummler:

-The $15 billion owned by the 52,000 American names represents 1.5% of the total.

-The average US account balance at UBS was $300,000. ($15b/52k). Extrapolating from that number one gets an estimate on the total number of black accounts at 3.3 million. Based on this calculation a range of estimates on the total number would be between 2 and 4 million.

Mr. Hummler’s comments are unlikely to go unnoticed by the global taxing authorities. The idea that there is this much money waiting to be claimed by the host countries makes it certain that the attacks against Swiss banks will continue far into the future. Everyone will want their share of $1 Trillion.

I believe that the trees are shaking and the leaves falling on this issue as I write. I recently reviewed a letter from a large Swiss private bank (not Wegelin & Co) that was sent to a US client it reads, in part, as follows:

“To ensure transparency toward the IRS, we would ask you to sign the enclosed form W-9 and return it to us by 30 September 2009. We will then forward form W-9 to our US depository, which will in turn disclose your holdings to the IRS.”

While this letter may not represent the thinking and action of other Swiss banks it is likely that they will be forced to follow suit in the not too distant future. Mr. Rolf Ribi the author of the story in Swiss Review states in his lead in, Banking confidentiality is facing, “the beginning of the end”. I would disagree with Mr. Ribi. We are far from the beginning of this process. The end will come much sooner than is expected. Black accounts in Switzerland are a thing of the past.

A Hat Tip to Mr. Hummler for providing this insight.

Ilargi: Two articles on the same survey, wildly different in focus.

Inflation Will Accelerate This Decade, Business Economists Say

The Federal Reserve will be unable to prevent the trillions of dollars in government stimulus pumped into the U.S. economy from stoking inflation later this decade, a survey of business economists showed.

The price gauge tracked by the central bank will rise 3 percent a year on average from 2014 through 2018, according to the median estimate in a poll taken by the National Association for Business Economics. The rate exceeds the 2 percent pace that the respondents said was the Fed’s unofficial target.

The report is in line with surveys of consumers and indicates the central bank may have to work harder to damp inflation expectations after pouring more than $1 trillion into credit markets in a strategy known as quantitative easing. Economists in the survey also said the Obama administration’s $787 billion stimulus program would push consumer prices higher. "An excessively stimulative fiscal policy and a complicated exit from its quantitative easing policies over the medium term will result in the Fed tolerating a higher level of inflation than it desires," according to a statement issued by the Washington-based group today.

The price measure that tracks consumer spending and excludes food and fuel costs, the Fed’s favorite, rose 1.4 percent in July from the same month last year, the smallest gain since 2003, a Commerce Department report showed last week. The last time it exceeded 3 percent was in 1992. The main reasons cited for concern over the inflation outlook included "lagged effects of policies now in effect," "monetization of the debt" and an "ineffective exit strategy" by the central bank, the report said. Only a "small percentage" thought a loss of Fed independence will cause prices to accelerate.

American consumers projected this month that inflation will rise 2.8 percent per year over the next five years, according to the Reuters/University of Michigan sentiment survey issued last week. Fifty-six percent of the economists in the NABE survey said the Fed will keep the benchmark interest rate target near zero for at least the next six months, while 44 percent projected it would rise. Half of those surveyed thought the government’s fiscal measures were excessive, up from 33 percent in the group’s March survey. Almost eight out of every 10 economists surveyed said a second stimulus bill wasn’t needed.

Three-quarters said they would like to see the government cut spending over the next two years, while only 28 percent projected the reductions would actually take place. The economists also favored increased regulation of financial markets, including greater oversight of derivatives, requirements on financial institutions to put more of their own funds at stake when securitizing mortgages and reform of the credit-rating companies. This was the most surprising finding for Chris Varvares, the president of NABE and of Macroeconomic Advisers LLC in St. Louis. "This tends to be a fairly conservative group, and you can see it except when it comes to regulation," Varvares said in an interview. "They definitely are into more regulation in financial services."

No need for second U.S. fiscal stimulus package: survey