Betsy Ross house, Philadelphia, "birthplace of Old Glory"

Ilargi: When it comes to finance, and the economy in general, there are two prevailing questions these days, or so it seems. First, how long can the stock market rally last? And second, how many bank failures still lie ahead of us? Actually, as a sort of cross-over third question, you might ask: what will banks stocks do?

As for bank failures, in the US I’ve long had the impression -and I'm by no means the only one- that the FDIC (Federal Deposit Insurance Corporation) is simply not doing what it's supposed to do: liquidate failing banks. That may be to a large extent due to the lack of both qualified personnel on the one hand and sufficient funds on the other; a lack of political will could also play a part. Whatever the reasons are, a very odd and possibly borderline illegal situation is being created and maintained.

If a bank does not comply with the standards set by law (and by FDIC regulations), it should be closed down. If that doesn't happen, both depositors and shareholders risk putting their money where they wouldn't have put it had they known the true extent of a given bank's financial troubles, and risk losing (part of) that money.

If you have a banking regulator, it surely should serve to warn the public about dangers in the system, in order to facilitate the best informed decisions possible with their funds. And there's precious little evidence out there that says that is what the FDIC is presently trying to do.

If you look for instance at what's happened with Colonial Bank, which was closed on Friday in the biggest US bank failure in 11 months, it's hard not to wonder how long it had been in serious trouble before it was seized. A bank that size automatically poses huge headaches for the FDIC, so much is clear. Still, if they knew months ago Colonial was beyond rescue, what are the ethical and legal implications of letting it continue until a solution is found, and without informing the public ahead of time?

And, by now more importantly, how many banks are there that are in more or less equally deep trouble but continue to function as though there were nothing wrong, selling shares, accepting deposits and opening their doors every morning with a sunny face??

The FDIC added dozens of banks to its "endangered" list in one big move a while back, making it very obvious that many of the "newly endangered" should have been added earlier. So when will we see the next update to the list? How many banks out there are already marked down as dead by the FDIC? I don't want to go all the way back to the administration's promises of transparency, but aren't investors and depositors simply entitled to the most accurate and the most current information available?

If the FDIC would in reality need to close down 100 banks tomorrow morning, then it should do that. But that's not the impression that you get from looking at what goes on. Maybe it's time for bank shares to plunge in the near future, so Sheila Bair's hands are forced. And for a true realization across the board about the deep doodoo commercial real estate is in, a little nuisance that all by itself is capable of finishing of hundreds of small and intermediate banks.

You think perhaps it's time to get serious about the FDIC and its tasks? To close a bank when the laws and regulations say it should be, and not when the FDIC just so happens to have some time in its schedule? I don't mean to imply that the FDIC is the main culprit here, don’t get me wrong. It's the government, and in particular the Treasury, that should act here.

There are over 300 banks on the FDIC endangered list. 150 banks, according to Bloomberg, are known to have over 5% nonperforming loans (I'd volunteer to make that 1500, and easily).

Every single day now I see people asking which banks are still safe to put their money in. You’re building a giant confidence crisis here. That's what you get from a lack of transparency. And yes, I do know it would change the whole picture we have of the economy if everyone came clean, we'd go into painting with a much darker palette of colors. But if that's all there truly is in reality, wouldn't it be better to be brave and stand tall in front of it, instead of running away like so many cowards?

What happened to all that courage America was supposedly built upon? Can't even face yourselves anymore? When businesses fail, you close the doors, it happens all the time, what's the big deal all of a sudden? You’re broke, as a nation, as individuals, very broke, awfully terribly broke. Deal with it like real men do. Real men pay their debts and move on. They don't play Mr. Big off their children's piggy banks. It's a matter of honor. Quit lying to yourself, quit whining, get over it and get to work. I'd say, the sooner the better. You're in for troubled times no matter what, that much is cast in stone.

Might as well do it with your heads held up high.

Bears prowl Wall Street as insiders dump stock

A massive rally in U.S. stocks since March has reawakened bullish spirits, but insiders are jumping out of the market in a sign the run up is getting stretched. Company executives are selling stock at a rate not seen in two years after a near 50 percent rise in the S&P 500 from a March 9 low. That suggests directors and managers may think stock prices are nearing the top end of their range in the current economic climate.

There has been a decline in short interest -- borrowed shares sold but not yet repurchased -- which some analysts see as a warning. Some investors sell short to profit from price declines, and some say the recent rally has been supported by the reversing of short positions. For brokerage Jefferies & Co., a significant increase in insider selling transactions as well as a decrease in short interest across most sectors of the S&P 500 demonstrates the weathering of the bear market rally.

Short interest fell in mid-July and firms with insider selling activity outnumber those with buying activity two to one, according to research firm InsiderScore.com. "Both of those (factors) lends to our general thesis" that the equity market rally is running on borrowed time, said Patrick Neal, head of U.S. equity strategy at Jefferies & Co. Since early March investors have piled back into the stock market in the hope of an economic recovery, bank sector stabilization and expectations many more will follow them.

But there are doubts the run-up is warranted amid signs of a difficult economic recovery. Increased insider selling has in the past been an indicator of an inflection point for equity markets, said Ben Silverman, director of research at InsiderScore.com. Sales of stock by company insiders suggests managers have a dim view of the market's prospects. According to InsiderScore, buying peaked this year around the market low in early March. For the week ended March 3, six days before the market sank to a 12-year low, insider bullishness as reflected in buying activity recorded its fourth-highest reading ever.

"Insiders historically have a strong correlation on a macro level to buying and selling, said Silverman, who is based in Princeton, New Jersey. "There's a lot of negative signs right now coming from insiders." Jefferies said the selling has taken place in the consumer staples, information technology, materials and energy, and utilities sectors, with Neal pointing to a "huge" acceleration in some economically sensitive areas such as energy.

In the second half of July, short positions held by investors fell 10.3 percent on the New York Stock Exchange and 5.1 percent on the Nasdaq, according to the exchanges. Investors who sell securities short seek to profit from bets the shares will fall. Short-sellers borrow the shares and then sell them in the hope of buying back the shares at a lower price, pocketing the difference. The decline in short interest arguably removes a component of what has built the run-up in stocks. Fewer short positions means less potential short covering.

"A decrease in short interest takes away one element of support for the market," said Neal, who expects the market to pull back after the first week of September. However, analysts have questioned how much a role short covering has had in the current rally. "It's a reasonable point if you're seeing a 25 to 30 percent drop (in short positions)," said Eric Newman, a portfolio manager at TFS Capital in West Chester, Pennsylvania. "Then, you don't have that kind of fuel later on to push the market up, but I don't think this is a significant enough move to warrant that."

Newman said much of that 10 percent fall in short positions on the New York Stock Exchange was due to a huge drop in bets on Citigroup, which saw a 72 percent decline in short positions on its stock in the second half of July. Without Citigroup, short positions would have dipped less than 5 percent. Short interest on the NYSE is still higher now than it was at the beginning of the year, suggesting that a rally that runs on the back of bearish players forced to cover positions is still possible.

A rally with troubling aspects

US stocks have risen almost 50 per cent from their lows in March, a turbo-charged performance that ranks as the best post-war market rebound. Five months and counting since the lows in March has the S&P up 49 per cent, eclipsing the 43 per cent rally reached 105 trading days after the lows of August 1982. Investors in other established equity markets have also enjoyed big rallies from their March lows.

Japan’s Nikkei 225 index has bounced 50 per cent, London’s FTSE 100 climbing 36 per cent and the FTSE Eurofirst 300 as much as 45 per cent. Emerging market equities have recorded bigger rises with investors banking on stronger growth outside the US and particularly in Asia. Hong Kong is up 85 per cent from its March low while Brazil has rallied 57 per cent.

The nature of the US economic recovery and the behaviour of the consumer hold the key as to whether the 2009 rally continues. By June 1983, 10 months after the market bottomed, the S&P was sitting on a gain of 67 per cent and it would keep climbing until the great bull run of that era peaked in August 1987. Based on data compiled by Mizuho Securities, the S&P’s current rise is more than double the average 22 per cent gain seen during the first 105 days of a post-war bull run.

That has left the S&P 500 valued at 18.6 times the profit of its companies – the highest valuation since 2004. The index is now up 11.7 per cent so far this year but remains 35 per cent below its record high in October 2007. There have been signs of consolidation this week with sentiment taking a hit from poor retail sales data and weak consumer sentiment. Some warn the rally may have run its course for the time being as it is already pricing in a lot of good news.

"An analysis of past US recessions and recoveries suggests the rally could run out of steam soon," says John Higgins, senior market economist at Capital Economics. "Most of the re-rating of the stock market that we would usually see prior to – and in the early stages of – an economic recovery has already taken place." One troubling aspect of the rally is that, from a historical perspective, equity volatility remains elevated, with the CBOE’s Vix volatility index showing a reading of about 25. Before the credit squeeze in the summer of 2007, the Vix rarely rose to more than 20.

There is also concern that the strong run has largely reflected short sellers reversing bearish bets on stocks. According to Bespoke Investment Group, the average stock in the S&P 500 had 4.97 per cent of its float sold short as of the end of July, the lowest level since January 30. "It’s not just a short squeeze, when the market goes to 1,000 from 660," says Bill Strazzullo, chief market strategist at Bell Curve Trading. "There has been some sign of improvement in the economic data and overall sentiment while investors have also started chasing the rally."

Low summer trading volumes are a cause for concern. Daily share volume on NYSE Euronext has not been above 2bn since June 25 and, in recent weeks, is behind April and May. "I would like to see better volumes – it’s hard to put faith in this rally when volumes are low," says Jim Paulsen, chief investment strategist at Wells Capital Management. "It’s the missing ingredient – and I think buyers are waiting for a bigger correction before they enter the market." Others reply that retail investors have not yet joined the rally.

Carmine Grigoli, chief investment strategist at Mizuho Securities, says equity inflows since the market bottomed in March total $47.3bn, less than the $60bn liquidated during the three weeks before the stock market turnround: "We have yet to see the widespread optimism and the high levels of public participation that usually occur in the early stages of new bull markets." For that to occur, bulls are waiting for economic expansion to flow directly into company earnings. Mr Grigoli says: "The profit turnaround may be at hand."

Based on the bank’s calculations, quarter-to-quarter earnings and revenue growth turned positive during the second quarter. As the second-quarter earnings season fades, cost-cutting helped many companies exceed lowered estimates. Almost three-quarters of S&P companies beat estimates but many recorded revenue shortfalls. That disturbed some analysts but the market appears to be betting that lean and mean companies will prosper when the economy rebounds. Economists forecast expansion in the third quarter, the economy having fallen in the previous four quarters and enduring its longest decline since 1947 when records began.

The rebound is based on restocking of inventories but, once that is complete, there are concerns about sustainability of growth in 2010 as the consumer remains burdened by high debt, rising job losses and sharply lower housing prices. This week, the Federal Reserve highlighted the expectation of "sluggish income growth" in its latest policy statement. For the time being, the equity market bets on the strength of the recovery – but Mr Strazzullo says technical factors are driving stocks. "The money trade right now is the March rally, it’s a momentum play and not based on a fundamental change ... Between 1,100 and 1,150 [on the S&P] is where we think this rally will top itself out."

Coming Soon: Banking Crisis of Historic Proportions

With everyone (well, almost everyone - I am one of the lonely skeptics) convinced that we have stepped back from the "edge of the abyss", the title of this article may be viewed as laughable. When you connect the dots, as I will in this article, you will at least stop laughing, and, maybe, realize that we still have a big problem.We have a confluence of five factors that have the potential to create damage to banking not seen in 80 years, and that includes the Great Depression. We'll hit these factors one at a time.

First Factor: Banks Are Not Doing Enough Business

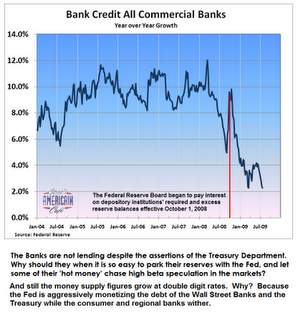

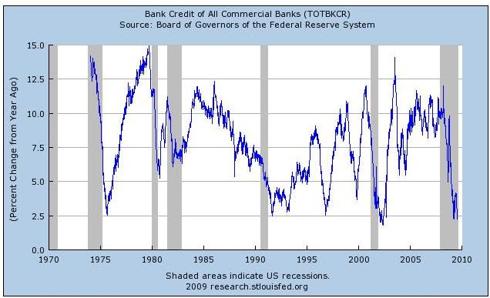

Commercial bank credit growth has dropped to 2%, according to Jesse's Cafe Americain (here). The recent history of credit growth is shown in the following graph.

Now, it is a good thing that banks are conserving capital, since they need to increase capital to offset bad loans.

But, if asset valuations deteriorate (and that is quite possible), the banks need to increase earnings to "earn their way" out of their problem. Interest paid by the Fed for reserves on deposit there (by the commercial banks) are not producing nearly the same level of income as new credit issued commercially under our fractional reserve banking system with much higher interest .

If credit issuance does not increase year over year, banks can not improve their financial condition unless the quality of their existing loan portfolio improves.

As discussed in the third factor, below, just the opposite is anticipated for loan portfolios.

So the first factor in this perfect storm is that the banks are not doing enough business.

Second Factor: Banks Are Failing at a Rate Not Anticipated Two Months Ago

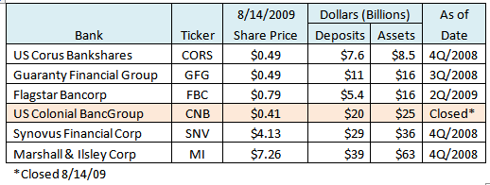

In his article, Jesse mentions reports by Bloomberg that 150 banks are in trouble. Some of these will be larger than many of the 77 (mostly community) banks that have gone under FDIC receivership so far in 2009.

Banks mentioned being in trouble by Bloomberg (here) include Wisconsin’s Marshall & Ilsley Corp. (MI), Georgia’s Synovus Financial Corp. (SNV), Michigan’s Flagstar Bancorp (FBC), Chicago-based Corus Bankshares Inc. (CORS), Austin-based Guaranty Financial Group Inc (GFG), and Colonial BancGroup Inc. (CNB) in Montgomery, Alabama.

These six banks became five at the close of business Friday, Aug. 14, as Colonial BancGroup was taken over by the State of Alabama and the FDIC. This was the largest bank failure since IndyMac Bank went under in the summer of 2008.

The following table shows some data regarding the six banks singled out by name in the Bloomberg article.

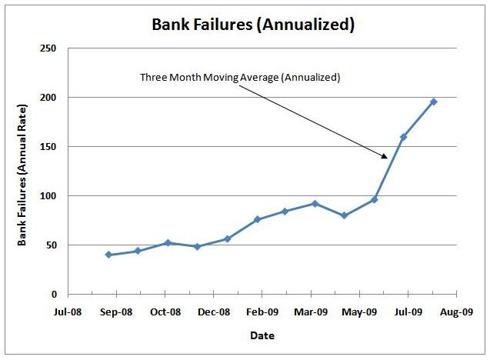

On July 5, Bill Cassill wrote (here) that he projected 125 bank failures for 2009 and 230 in 2010.

However, as of that date, Bill projected 82 closings by 9/30 and we have already reached 77 on 8/14. We still have half the quarter to go. With the 150 additional banks estimated by the Bloomberg article, and the 77 already closed thus far this year, we could be closer to 230 closings in 2009 than the 125 estimated just six weeks ago. Bill is not alone. I recall hearing other estimates of bank failures for 2009 of the order of 100 for the entire year.

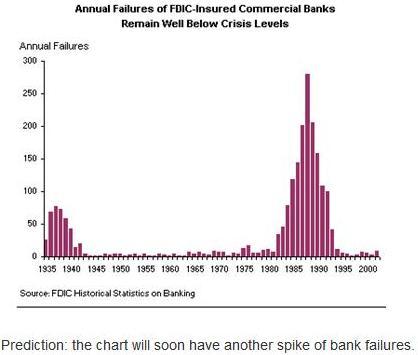

The following graph (and the prediction below it) was provided on July 12 (here) by Colin Peterson.

How is Colin's prediction doing? The following graph shows how bank failure rates have been trending.

Give Colin the handicapper award here. Not only have bank failure rates spiked, the current annualized rate would be in a virtual three-way tie for second highest in history if maintained for another nine months.

And a lot of the banks going under are a lot larger than the average savings and loan in the previous crisis.

According to About.com (here): Between 1986-1995, over 1,000 banks with total assets of over $500 billion failed. Even if the current crisis falls far short of the 1,000 bank total, the total assets involved will still be vastly larger. Just in the failures of Wachovia Bank and Washington Mutual, the total assets were $619 billion. Add to that the IndyMac failure and the six banks in the troubled list above and there is another $164 billion.

And I am not even mentioning the shadow banks (Merrill, Bear Stearns, Lehman and AIG are examples), which add hundreds of billions more.

There should be no false comfort taken in the prospect that we may have far fewer bank failures this time compared to the S&L crisis. The dollar amounts are likely to be many times larger.

Third Factor: Defaults Are Going to Increase for Several More Quarters

With home mortgage foreclosure rates remaining very high (and possibly increasing) and with the bulk of the commercial real estate defaults yet to come, the failure rate of banks is likely to increase further in the next nine to twelve months, not decline. The situation will be compounded if commercial and industrial (C&I) loans also default at higher rates because of a weak or non-existent recovery.

Reading some of the latest quarterly reports for a number of banks, C&I loan portfolios have generally been performing better than many other categories, but will that continue?

A reference for this subject is a Jeffrey Bernstein article published in late May entitled "C&I Loans Are Starting to Unravel" (here), which discussed the status of a wide variety of loan portfolio categories. C&I defaults may, at this time, be like an iceberg, with 90%+ still not visible above water.

Default rates in all credit areas have started to rise, although some have yet to reach levels of other recent recessions (see Bernstein article here). Residential mortgage defaults have been the elephant in the room. We have to continue to worry that problem may increase further, but we better also worry about all the baby elephants.

We may have "saved the financial system", but it seems likely that we will lose banks at levels far exceeding anything seen in our history. Even if we fall short in mumber of the approximately 1,000 S&Ls, the assets involved will be much larger.

We need one hell of a recovery here to prevent disaster. Muddle through will not do it. A return to 3% GDP growth may not do it. We need a couple of years at 4% (or higher) GDP growth to have any chance that some of these banks can earn their way out of the quagmire.

I don't think that type of economic growth can be realized. It certainly is not going to happen if commercial bank credit growth doesn't expand drastically and quickly.

Fourth Factor: The FDIC Is in Trouble

Rolfe Winkler (here) points out that the accelerating rate of bank failures may exhaust the Deposit Insurance Fund (DIF) at the FDIC, requiring that agency to draw on its credit line with the Fed. Rolfe calculates that the FDIC is currently on the hook for $8.3 trillion in insured deposits, had only $41.5 billion in reserves as of March 31 and has drawn that lower since.

Since only a small portion of deposits actually are paid out of DIF (failed banks have assets that cover most deposits), FDIC needs only a small fraction of covered deposits in reserve.

However, less than 0.05% is most likely several fold too small in a distressed banking system. The section title says the FDIC is in trouble. That is a polite way of saying they are bankrupt.

Fifth Factor: We May Be Going to Historic Lows in Bank Credit

Because we are approaching the one year anniversary of a growth spike in bank credit in September, 2008 (see the first graph in this article), there is likely to be continued pressure on the year-over-year growth rate. The year over year growth of credit may be driven much lower than the current 2% within the next couple months due to the negative effect on comparison due to the spike a year earlier.

As shown below, this would be an historic low.

There is one possible piece of good news here. Looking at a longer history from the Fed FRED data base (here), the current situation is similar to those seen after the end of the recessions of 1973-75, 1990-91, and 2001. A similar minimum was also reached in 1997.

It should be noted that several minima in commercial bank credit have occurred that were not associated with the end of a recession. This indicates there are non-recessionary factors related to dips in commercial credit.

All recessions have dips in commercial bank credit, but all dips in commerical bank credit are not associated with recessions.

This time, the minimum may not have been reached yet because of the spike in credit volume in September, 2008 (mentioned above). If September 2009 does see a minimum in commercial bank credit, this would be another sign that the recession probably ended earlier in the year.

However, the banks need far more than an end to the recession; they need a recovery of unlikely proportions.

One cautionary note: Although the minimum was much higher in the 1981-82 recession, the lowest point occurred about a year before the recession actually ended. That could always happen again.

Is There Any Hope?

Well, since so many people are predicting a weak recovery, that has a good chance of not happening, based on the observation that, in economic matters, agreement by a majority is often wrong. So, if the majority is wrong, which way do you think things will go? Back into recession? The robust recovery predicted by only a few?

I'll leave a definitive answer to the reader - after all I can't do all the work. I'll just share my bias, based on all the factors I can collect: An advance in real GDP of 4-5% in 2010 and 2011 (2-2.5% per year) seems to me to be the very best that might be obtained, but less is more likely.

Without a strong recovery, there is little hope of a good outcome for the non-oligarchy banks. With a return to recession, in 2010 (and possibly 2011 and 2012) there could be carnage in regional and local banks not seen since the early 1900s, and maybe even worse than what occurred then.

I hope we don't have to compare what happens in 2010 to 1873.

The banking crisis of 1873 started what has been called "The Long Depression". This consisted of a period of rolling recessions that continued for almost 40 years and included additional banking crises in 1893 and 1907. This long period of economic and financial turmoil was a major motivator in the formation of the Federal Reserve Bank. The Fed was the first true central national bank for the U.S. since the dissolution of the Second Bank of the United States in 1837 by Andrew Jackson.

Fifth Third Leads Banks Lower After Six-Month Surge

Fifth Third Bancorp led the nation’s largest lenders lower in New York trading on concern earnings prospects don’t justify average gains of about 74 percent in the past six months.

Fifth Third, based in Cincinnati, declined 2.9 percent, while Pittsburgh-based PNC Financial Services Group Inc. dropped 1.6 percent. Seventeen of the 24 companies on the KBW Bank Index fell today, after the index climbed 146 percent since March 6.

"The easy money has been made," said Bill Fitzpatrick, an analyst at Optique Capital Management, which manages $900 million, including Bank of America shares, in Racine, Wisconsin. "We are not convinced that the risk appetite is going to be as strong as it has been over the last month or so." Bank stocks have gained since March after first- and second-quarter earnings at companies including Goldman Sachs Group Inc. beat analysts’ estimates, and economic indicators including employment and gross domestic product reports showed that the worst U.S. recession in at least 50 years is coming to an end. Ten of the biggest recipients of government bailout funds repaid a total of $68 billion in May.

Billionaire hedge fund investor John Paulson is betting there’s room for more gains. Paulson, who manages about $29 billion, started the Paulson Recovery Fund last year to invest in financial firms hurt by mortgage writedowns. He bought 168 million shares of Bank of America Corp. in the second quarter, a regulatory filing showed this week, becoming the lender’s fourth-largest shareholder. Bank of America’s expected price-earnings ratio for next year is 18, based on 24 analysts’ earnings estimates compiled by Bloomberg. The company, the biggest U.S. bank by assets, had an average PE ratio over the past five years of 13.9.

Fifth Third shares have surged fivefold in the past six months, the most in the KBW index, and Bank of America has tripled. Regions Financial has gained 54 percent. Bank of America jumped 94 percent in the second quarter as concern the government would take an ownership stake eased amid signs of an improving economy. Citigroup Inc. was raised to "buy" from "underperform" today by analysts at Bank of America, who cited "stabilizing" credit markets. New York-based Citigroup, which has more than quadrupled since March, fell 2 cents to $4.04.

"In the short run, these stocks have gotten ahead of themselves because in the third quarter they’re likely to lose a lot of money," Rochdale Securities analyst Dick Bove said in an interview. "These stocks have made huge moves and none of the fundamentals have improved. Every earnings indicator that you would look at would suggest that this is not going to be a very attractive quarter for banks."

Paulson in the second quarter bought 35 million shares of Regions Financial, becoming the second-largest shareholder, according to the filing. Regions declined 5.2 percent during the quarter. The stock rose 44 cents today to $5.64. BB&T Corp. was the biggest gainer, with a 9.4 percent advance, after reports that the company would buy Colonial BancGroup Inc. in a deal backed by the Federal Deposit Insurance Corp.

For investors with a longer time horizon, 12 to 18 months, bank stocks are the place to be, Gerard Cassidy, an analyst at RBC Capital Markets in Portland, Maine, said in an interview. Many of the 19 banks that underwent government stress tests earlier this year are trading below book value, and Cassidy said they will probably move back toward book value as the economy recovers. Bank stocks will "be one of the most profitable sectors to be in," Cassidy said. "The biggest positive impact coming to earnings will be the reduction in credit costs over the next 12 to 18 months. Investors will be surprised how dramatic that’s going to be as the economy recovers." Cassidy expects that some bank stocks could climb a further 100 percent to 120 percent.

The Paulson group "was very smart on the downside and I think they are going to be as smart on the upside," Cassidy said. "We’re not out of the woods yet," said Josh Siegel, co- founder of New York-based StoneCastle Partners LLC, which manages about $3.1 billion, including shares of Bank of America. "What we’ve seen so far is a little bit of fool’s gold. There’s very little actual evidence other than companies beating earnings expectations," which he said had been pushed too low. Siegel said third-quarter earnings will probably show stability, not growth, and most investors won’t be willing to pay large earnings multiples for what may be a "slow crawl" that could last for years.

How many more Colonials are out there?

The expected failure-turned-rescue of Colonial BancGroup Inc. by BB&T Corp. underscores the lingering danger in the banking industry: small- to medium-sized institutions unable to meet obligations as deposits dwindle. In this case, Montgomery, Ala.-based Colonial is being rewarded for the size of its recent expansion, not for the shrewdness of it. Strategically minded BB&T is eager to tack on what is the fourth-biggest market share in Alabama, according to reports.

There are more than 300 banks on the Federal Deposit Insurance Corp.'s list of troubled institutions. And a Congressional Oversight Panel concluded this week that "an overwhelming portion of the troubled assets from last October remain on bank balance sheets today." It's also the small banks most at risk because most government bailout programs have been designed to aid big banks shed problem assets, the panel found.

For the smaller banks such as Colonial, a BB&T takeover may be a difficult end, but it is far preferable to an FDIC seizure. The question is: how many banks will take the risky path BB&T is taking? After all, Wells Fargo Corp. has struggled to absorb Wachovia Corp., while Bank of America Corp. has been criticized not only for its acquisition of Merrill Lynch & Co. but for snapping up Countrywide Financial Corp. as well.

Bank CEOs are an egotistical lot. Acquiring smaller rivals to build their empires is a favorite pastime. But in today's climate, buying a broken competitor is a big risk -- as Bank of America CEO Ken Lewis can certainly attest. By the same token, the FDIC may not be able to handle all of the bank failures if healthier players don't step up. BB&T's Kelly King reportedly is making the move now. Should things get worse, are there enough CEOs to follow in his footsteps?

There's no quick fix to the global economy's excess capacity

There is one overwhelming fact about the world economy that cannot be wished away. Excess capacity in industry is hovering at levels not seen since the Great Depression. Too many steel mills have been built, too many plants making cars, computer chips or solar panels, too many ships, too many houses. They have outstripped the spending power of those supposed to buy the products. This is more or less what happened in the 1920s when electrification and Ford’s assembly line methods lifted output faster than wages. It is a key reason why the Slump proved so intractable, though debt then was far lower than today.

Thankfully, leaders in the US and Europe have this time prevented an implosion of the money supply and domino bank failures. But they have not resolved the elemental causes of our (misnamed) Credit Crisis; nor can they. Excess plant will hang over us like an oppressive fog until cleared by liquidation, or incomes slowly catch up, or both. Until this occurs, we risk lurching from one false dawn to another, endlessly disappointed.

Justin Lin, the World Bank’s chief economist, warned last month that half-empty factories risk setting off a "deflationary spiral". We are moving into a phase where the "real economy crisis" bites deeper – meaning mass lay-offs and drastic falls in investment as firms retrench. "Unless we deal with excess capacity, it will wreak havoc on all countries," he said. Mr Lin said capacity use had fallen to 72pc in Germany, 69pc in the US, 65pc in Japan, and near 50pc in some poorer countries. These are post-War lows. Fresh data from the Federal Reserve is actually worse. Capacity use in US manufacturing fell to 65.4pc in July.

My discovery as a journalist is that deflation is a taboo subject. Those who came of age in the 1970s mostly refuse to accept that such an outcome is remotely possible, and that includes a few regional Fed governors and the German-led core of the European Central Bank. As a matter of strict fact, two- thirds of the global economy is already in "deflation-lite". US prices fell 2.1pc in July year-on-year, the steepest drop since 1950. Import prices are down 7.3pc, even after stripping out energy. At almost every stage over the last year, in almost every country (except Britain), deflationary forces have proved stronger than expected.

Elsewhere, the CPI figures are: Ireland (-5.9), Thailand (-4.4), Taiwan (-2.3), Japan (-1.8), China (-1.8), Belgium (-1.7), Spain (-1.4), Malaysia (-1.4), Switzerland (-1.2), France (-0.7), Germany (-0.6), Canada (-0.3). Even countries such as France and Germany eking out slight recoveries are seeing a contraction in "nominal" GDP. This is new outside Japan, and matters for debt dynamics. Ireland’s nominal GDP is shrinking 13pc annually: debt stays still. Global prices will rebound later this year as commodity costs feed through – though that may not last once China pricks its credit bubble after the 60th anniversary of the revolution in October. My fear – hopefully wrong – is that we are being boiled slowly like frogs, complacent until it is too late to jump out of the deflation pot.

The sugar rush of fiscal stimulus in the West will subside within a few months. Those "cash-for-clunkers" schemes that have lifted France and Germany out of recession – just – change nothing. They draw forward spending, leading to a cliff-edge fall later. (This is not a criticism. Governments did the right thing given the emergency). The thaw in trade finance has led to a V-shaped rebound in East Asia as pent up exports are shipped. But again, nothing fundamental has changed. Deficit countries in the Anglo-Sphere, Club Med, and East Europe are all on diets. People talk too much about "liquidity" – a slippery term – and not enough about concrete demand.

Professor James Livingston at Rutgers University says we have been blinded by Milton Friedman, who convinced our economic elites and above all Fed chair Ben Bernanke that the Depression was a "credit event" that could have been avoided by a monetary blast (helicopters/QE). Under that schema, we should be safely clear of trouble before long this time.

Mr Livingston’s "Left-Keynesian" view is that a widening gap between rich and poor in the 1920s incubated the Slump. The profit share of GDP grew: the wage share fell – just as now, in today’s case because globalisation lets business exploit "labour arbitrage" by playing off Western workers against the Asian wages. The rich do not spend (much), they accumulate capital. Hence the investment bubble of the 1920s, even as consumption stagnated.\ I reserve judgment on this thesis, which amounts to an indictment of our economic model. But whether we like it or not, Left or Right, we may have to pay more attention to such thinking if Bernanke’s credit fix fails to do the job. Back to socialism anybody?

A Nation Of Part-Time Workers

Here's another vivid reason why the unemployment rate and the "10% question" is meaningless. The percentage of workers not working full time for "economic reasons" is nothing like it has been in the past. Today's chart, put together by the Atlanta Fed, show how many of these forced part-time workers exist compared to the start of the recession. As you can see, we've almost doubled this number, which represents vastly higher numbers than in past recessions.

The Countrywide Senators

How do you define 'substantial credible evidence'?

As the old Irish toast goes, may your sins be judged by the Senate ethics committee. Actually that's not an Irish toast but it must be the fervent hope of every politician who received a "Friend of Angelo" loan from former Countrywide Financial CEO Angelo Mozilo. Late last week the six Senators on the ethics panel dismissed complaints against Senators Kent Conrad and Chris Dodd with a mere admonishment about the appearance of impropriety.

The three Republican and three Democratic Senators say they conducted an exhaustive probe and inspected 18,000 pages of documents. They say they found "no substantial credible evidence as required by Committee rules" that the Senators received mortgage rates or services that weren't commonly available to the public, and thus did not violate the Senate gift ban. We'll have to take their word that the evidence wasn't "substantial," because they didn't release those documents, nor did they encourage Mr. Dodd to release any of his records. Readers will recall that in February Mr. Dodd staged a peek-a-boo release with selected reporters but did not allow anyone to have copies of the documents. If the evidence was so clear-cut, why the months of stonewalling?

The Associated Press may have the answer. AP recently noted that among the peek-a-boo papers were two documents titled, "Loan Policy Analysis." Reports AP, "The documents had separate columns: one showing points 'actl chrgd' Dodd — zero; and a second column showing 'policy' was to charge .250 points on one loan and .375 points on the other. Another heading on the documents said 'reasons for override.' A notation under that heading identified a Countrywide section that approved the policy change for Dodd."

How does Mr. Dodd explain that one? He may not have had to. The Senate ethicists don't seem to have required either Mr. Dodd or Mr. Conrad to provide sworn testimony. In its letters to Messrs. Conrad and Dodd, the committee referred to the "depositions" it collected from Countrywide employees, but it described only "responses" and "explanations" from the Senators. Mr. Dodd never spoke to committee members or staff, and never communicated directly with them.

When committee Senators wrote to Mr. Dodd to get answers to their questions about his VIP loans, they received a response signed by his attorney Marc Elias of Perkins Coie. We remember former Senator Robert Torricelli providing a sworn deposition before he was admonished by the committee in 2002. Perhaps he should have tried the Dodd strategy. As for Mr. Conrad, his staff won't say if the Senator answered questions directly or let his lawyers handle it. Either way, he has to be thrilled that his colleagues found no violation of Senate rules, even after he acknowledged last summer that he had received a benefit and promptly donated $10,500 to charity.

We'd also like to know what committee members thought of Robert Feinberg, the former Countrywide loan officer who told us last year that Mr. Dodd received, and knew he was receiving, preferential treatment. The Washington Post reported last month that Mr. Feinberg told the same thing, under oath, to Senate investigators and said that Mr. Conrad also knew he was receiving special treatment. Mr. Feinberg said the same to the minority staff of the House Oversight and Government Reform Committee.

Does the committee think he's lying, or that his testimony simply wasn't "substantial" enough? Again, we don't know because the letters released by the ethics committee don't mention Mr. Feinberg. Mr. Dodd is running for his sixth term next year and will no doubt claim this as vindication. Voters will have to decide if a Banking Committee Chairman who allowed himself even to be considered a VIP by the nation's foremost subprime lender deserves it.

Dealers yet to see most Cash for Clunkers payments

Auto dealers say they still haven't been repaid for the majority of Cash for Clunkers deals they have made, creating cash crunches for many as they wait for the government to reimburse them under the popular $3 billion vehicle trade-in program. Some dealers report they have hundreds of thousands of dollars worth of rebates they have submitted to the federal government for repayment that are still outstanding, including deals that were made in the first days of the program nearly three weeks ago.

Duane Paddock, who owns a Chevrolet dealership near Buffalo, N.Y., said dealers may stop selling clunkers under the program because of the funding lags. "I've got dealers who are reporting to me that they've got over $3 million that they've fronted and they haven't been paid anything. It's just killing dealer cash flow right now," said Paddock, who serves as co-chair of GM's northeast region dealer council. The National Highway Traffic Safety Administration, the federal agency overseeing the program also known as NHTSA, said Friday that dealers have submitted requests for rebates that total $1.5 billion — half of the money allocated to the program — through the online system set up to process and pay the claims. But NHTSA did not provide a dollar figure for the total amount that has actually been paid since the program began July 27.

There are indications that not much of that money has actually flowed to dealers. A survey of about one-fifth of Virginia's 519 dealerships done this week by the Virginia Automobile Dealers Association found that only 2.8 percent of the roughly 4,000 Cash for Clunkers deals submitted to the government have been paid. The program has also been plagued by heavy demand that has overwhelmed the computer system and review process NHTSA set up. The agency has since hired more staff to process claims and has increased the capacity of the computer network. NHTSA has also held regular information sessions with dealers to help them file claims that will meet the legal requirements for reimbursement.

"The Department of Transportation is committing enormous resources and working overtime to process the overwhelming volume of applications both quickly and responsibly while getting rebates paid for complete and valid deals," said Sasha Johnson, a department spokeswoman. Under Cash for Clunkers, car buyers are eligible for discounts of $3,500 or $4,500 depending on the fuel economy of the vehicles they trade in and buy. Dealers take the amount of the rebate off the sale price, then submit paperwork to the government proving the sale and that the trade-in will be scrapped. Data released Friday shows the Toyota Corolla is the best-selling vehicle under the program, while the most popular trade-in is the Ford Explorer. The majority of consumers are purchasing passenger vehicles while trading in trucks and SUVs.

NHTSA has told dealers they can expect to wait 10 days to be repaid if their paperwork is in order and the deal is approved. But if there is a problem, dealers must resubmit their claim, leading to another potential wait period. That can create problems for dealers, who usually borrow money to put new cars on their lots and must repay lenders within a few days of a sale. Government officials a big hitch has been that dealers are not following proper procedures by filing incomplete or inaccurate materials. For example, one of the main reasons Cash for Clunkers deals were rejected early on was because dealers failed to write "Junk Automobile, Cars.gov" in black magic marker on the title of the older cars that buyers were trading in.

A major reason for the close scrutiny of paperwork is fraud prevention. Citing the heavy volume of deals, Sen. Chuck Grassley, R-Iowa, asked the Transportation Department's inspector general Thursday to review the program for potential wrongdoing. Many dealers still expect long waits. David McGreevy, sales manager for AutoServ, a New Hampshire dealer chain, said it may take up to a month to get repaid for $250,000 worth of rebates. "That is quite some time," he said.

Ilargi: Doug Short with yet another angle on the crisis. Always interesting.

Six Lobbyists Per Lawmaker Work to Influence Obama's Health-Care Overhaul

If there is any doubt that President Barack Obama’s plan to overhaul U.S. health care is the hottest topic in Congress, just ask the 3,300 lobbyists who have lined up to work on the issue. That’s six lobbyists for each of the 535 members of the House and Senate, according to Senate records, and three times the number of people registered to lobby on defense. More than 1,500 organizations have health-care lobbyists, and about three more are signing up each day. Every one of the 10 biggest lobbying firms by revenue is involved in an effort that could affect 17 percent of the U.S. economy.

These groups spent $263.4 million on lobbying during the first six months of 2009, according to the Center for Responsive Politics, a Washington-based research group, more than any other industry. They spent $241.4 million during the same period of 2008. Drugmakers alone spent $134.5 million, 64 percent more than the next biggest spenders, oil and gas companies. "Whenever you have a big piece of legislation like this, it’s like ringing the dinner bell for K Street," said Bill Allison, a senior fellow at the Sunlight Foundation, a Washington-based watchdog group, referring to the street in the capital where many lobbying firms have offices.

Health-insurer and managed-care stocks have gained this year, led by WellCare Health Plans Inc., based in Tampa, Florida; Cigna Corp., based in Philadelphia; and Coventry Health Care Inc., a Bethesda, Maryland, company. The three paced a 13 percent increase in the Standard & Poor’s Supercomposite Managed Health Care Index since Jan. 1. Drugmaker shares have stagnated. Health-care lobbyists said their efforts are the biggest since the successful 1986 effort to overhaul the tax code. The result is a debate involving thousands of disparate voices, forcing Congress to pick winners and losers. "There’s a lot of money at stake and there are a lot of special interests who don’t want their ox gored," Allison said.

The lobbyists are on all sides of the issue. Pharmaceutical Research and Manufacturers of America, the Washington-based trade group for drug companies such as Thousand Oaks, California-based Amgen Inc. and New York-based Pfizer Inc., has embraced a health-care overhaul. Lobbying by Amgen, the world’s largest biotechnology company, is intended to "effectively shape health-care policy," said Kelley Davenport, a spokeswoman. Pfizer, the world’s largest drugmaker, is "dedicated to insuring that our voice is heard," said spokesman Ray Kerins.

The Washington-based U.S. Chamber of Commerce, the nation’s largest business lobby, is opposing efforts to offer government- run health insurance to compete with private companies. The chamber spent $26 million in the first six months of 2009 to lobby, more than any other group. For lobbyists, the goal is to ensure that whatever measure eventually becomes law doesn’t cripple the industry they represent. "They assume health-care reform is going to happen and they want to be protected," said John Jonas, a partner with the lobbying firm of Patton Boggs LLP in Washington.

Patton Boggs, the top lobbying firm in terms of revenue, has three dozen clients in the health-care debate, including New York-based Bristol-Myers Squibb Co., and Bentonville, Arkansas- based Wal-Mart Stores Inc., more than any other lobbying firm. Brian Henry, a spokesman for Bristol-Myers, maker of the world’s No. 2 best-selling drug Plavix, said the company wants to ensure any legislation preserves incentives for innovation. "We believe the health-care system needs to be reformed and we’ve specifically supported an employer mandate and cost- containment measures," said Greg Rossiter, a spokesman for Walmart, the largest U.S. employer.

The lobbyists fill the appointment books of lawmakers, and line up at House and Senate office buildings. The staff of Senate Finance Committee Chairman Max Baucus, a Montana Democrat, rotates weekly meetings among the various groups in the health-care debate, providers one week, purchasers a second, consumers a third. "We hear from lobbyists all the time," said Representative Frank Pallone, a New Jersey Democrat who heads the House Energy and Commerce health subcommittee.

The blitz by lobbyists carries a risk for the public, said Larry McNeely, a health-care advocate with the Boston-based U.S. Public Interest Research Group. "The sheer quantity of money that’s sloshed around Washington is drowning out the voices of citizens and the groups that speak up for them," said McNeely, whose group backs a public health plan, which Obama and many Democrats consider a centerpiece of any proposal and most Republicans oppose. The lobbying push also risks delaying legislation, said Rogan Kersh, associate dean at New York University’s Wagner School of Public Service. "That amount of activity is inevitably going to slow down the process," Kersh said.

The quest for influence isn’t limited to lobbying. Health- care advocates have spent $53 million on commercials, according to Arlington, Virginia-based TNS Media Intelligence/Campaign Media Analysis, which tracks advertising spending. The health-care industry also contributed $20.5 million to federal candidates and the political parties during the first six months of the year, according to the Center for Responsive Politics. Senate Majority Leader Harry Reid, a Nevada Democrat who is up for re-election next year, received $382,400, more than any other lawmaker.

"There is a cacophony going on with so much money and so many individuals hoping to shape the legislation," said Sheila Krumholz, executive director of the Center for Responsive Politics, a Washington-based research group. The number of lobbyists could grow once Congress returns next month and resumes efforts to enact legislation by the end of the year. "They have just decided this is serious enough and more fully understand the impact it’s going to have," Jonas said.

Treasury Bailout's Limits on Lobbyists Still Haven't Taken Effect

A plan by Treasury Secretary Timothy Geithner to limit lobbyists' influence over the $700 billion bailout program has yet to get off the ground -- even as the program nears an end. Just a few hours after being sworn in last January, Mr. Geithner promised to craft rules preventing external influence over bailout decisions. More than six months later -- and 100 days before the financial-industry bailout program is scheduled to stop taking applications for aid -- those rules have yet to be finalized.

Mr. Geithner's Treasury has disbursed $10.2 billion to various institutions since January, part of the more than $200 billion the government has funneled into the banking system. Several firms already have repaid more than a combined $70 billion, entering and exiting from the program before the adoption of rules aimed at curbing external influences. Mr. Geithner told a government watchdog that "other issues had consumed Treasury's time and taken precedence over completing the guidance," according to a report released Aug. 6 by a special inspector general overseeing the government's bailout.

The Treasury, which didn't respond to requests for comment Friday, has largely been consumed with trying to respond to the financial crisis, operating at the outset with just Mr. Geithner and a skeleton crew of advisers. The watchdog report said the Treasury was completing its draft policy limiting lobbyist communication with Treasury officials. It said the Treasury was waiting for the White House to finalize lobbying restrictions related to the $787 billion economic-stimulus program before issuing its bank-rescue guidelines.

The report noted that while available information gave "little indication" that special interests have influenced the government's bailout decisions, it said inconsistent record-keeping made it "impossible to examine the impact of all potential external inquiries" on the process. When the Treasury announced its plans to curb bailout lobbying earlier this year, a spokeswoman said the department intended to publish weekly communication logs showing contact between public officials and external entities -- such as lobbyists -- discussing rescue plans for specific institutions. No such logs have been made available.

Did Treasury Lie About Its AIG "Investment"?

That AIG is a giant sink-hole for taxpayer dollars is no secret now. But that's not what Washington communicated last year, maintaining that the bailout of AIG was an investment that would be paid back.New documents show, however, that Washington never really believed what it was saying, and that the "this is an investment" rhetoric was just to make the gigantic bailout more palatable. Conservative watchdog group Judicial Watch just dug up some juicy Treasury documents on Washington's bailout of AIG.

The documents, obtained through a FOIA request, include internal Treasury emails, presentation slides and articles outlining the details of the government's "investment" in AIG, which at the time totaled as much $152 billion.

"Clearly Treasury Department officials felt strongly that the $152 billion 'investment' in AIG would not be recovered by the taxpayers. And it appears someone at Treasury did not want the risky nature of the deal to be relayed to the American people," said Judicial Watch President Tom Fitton in a statement. "These documents show that some government officials recognize their responsibility to measure the effectiveness of their TARP investments. Yet the American people are misinformed and remain in the dark about how their money is being spent."

Some highlights:

1. A series of presentation slides detailing bailout terms. Included is a slide titled "Investment Considerations." On the slide the words, "The prospects of recovery of capital and a return on the equity investment to the taxpayer are highly speculative" are crossed out by hand:

2. An outline that describes the strict controls "imposed" on AIG as a condition of the cash infusion, including those related to private executive compensation and corporate expenses. On the bottom of the third page, it notes that the government's corporate expense policy "…shall remain in effect at least until such time as any of the shares of the Senior Preferred are owned by the UST (United States Treasury). Any material amendments to such policy shall require the prior written consent of the UST until such time as the UST no longer owns any shares of Senior Preferred."

3. A December 15, 2008 Treasury internal email from Jonathan Fletcher, Chief Interim Risk Officer for TARP, revealing the existence of an internal government program to track the effectiveness of the AIG bailout. Fletcher writes: "As you know, we are obligated by EESA (Emergency Economic Stabilization Act) to determine the effectiveness of TARP investments…We would propose to follow up on the TARP investment by preparing a risk assessment note that spells out the objectives…and then create both a benchmark for AIG today and then establish metrics to track AIG's progress (or lack thereof) in coming months." As Judicial Watch notes, no documents related to this government tracking program have been released to the public.

'Tarantula' blew the whistle on Swiss secrecy

Two years ago almost to the day, the phone in the FT’s Zurich office rang as I reached the door. "My name is Tarantula," said the mystery caller. "That is not my real name. But the information I will provide will put my life in danger and be the end of Swiss bank secrecy." Loonies on the line are not unfamiliar in journalism. But in the months of contact that followed, it emerged that my informant, though driven, was entirely compos mentis.

"Tarantula" turned out to be Bradley Birkenfeld, the American private banker whose disclosures have played a crucial part in the massive crackdown by US authorities on Switzerland’s hallowed bank secrecy. This week, the US and UBS, Switzerland’s biggest bank and target of the campaign, reached an out-of-court settlement on efforts by the Internal Revenue Service – the US tax authority – to gain the names of up to 52,000 Americans with secret accounts. Reflecting the importance of the case for one of the Swiss economy’s biggest money-spinners, Bern was party to the deal.

Details should be released next week. Lawyers reckon the settlement will require the disclosure of at least 5,000 names and a possible fine on a bank already reeling from more than $50bn (£30bn, €35bn) in writedowns from the credit crisis. Bank secrecy looks in tatters. None of this may have come to pass without Mr Birkenfeld and the information he provided on how, over the years, UBS solicited business from rich American clients and helped create structures that enabled them to avoid tax. A tall, well-built man of 43, his manner is anything but cloak-and-dagger. The son of a Boston brain surgeon, he grew up in the city’s privileged southern suburbs. He began his banking career at State Street, the local lender, before moving into international wealth management at Credit Suisse, Barclays and UBS.

Mr Birkenfeld spent much of the past 15 years in Switzerland, where he burnished his upper middle-class US credentials with the charm and savvy of a pukka Swiss private banker. He worked in Geneva as one of about 60 UBS private bankers in three Swiss cities, providing services for clients that ranged from advice on buying jewellery and art to tricks such as squeezing diamonds into toothpaste tubes so as to move them without detection.

The material trappings came in tow. Over the years, Mr Birkenfeld accumulated a flat in Geneva and a dream chalet in Zermatt with an unblocked view of the Matterhorn. So established was he in Switzerland that he gained a coveted "C" residency status – the category allowing permanent residence only available to those who have put down roots and show an unblemished record. With so much going for him, it seems extraordinary that Mr Birkenfeld blew the whistle. He says he felt obliged as his bosses, driven by demands from above and incentivised by big bonuses, put pressure on client advisers such as himself to break internal guidelines and US laws on what Swiss-based bankers could do in America.

In 2006, Mr Birkenfeld formally pointed out the irregularities, copying in Marcel Rohner, then UBS’s head of private banking and later chief executive, and Peter Kurer, then UBS’s top lawyer and later chairman. An internal investigation prompted some improvements in policies. But the regular trips across the Atlantic with encrypted computers and training in counter-surveillance continued. So did the participation at events such as Art Basel Miami or yacht racing in Newport, Rhode Island, where UBS bankers would meet clients and try to make new contacts.

Others say Mr Birkenfeld’s motives were venal. His whistleblower letter came only at the end of the six-month "gardening leave" taken after quitting UBS in 2005. Revenge may have played a part: Mr Birkenfeld successfully sued the bank over his final bonus. Others still suggest he might have been "turned" by the US authorities, having come to their attention in earlier inquiries. US law offers registered whistleblowers up to 30 per cent of any unpaid tax their information reveals. The reward has no ceiling, and applies to everyone, including convicted felons. With estimates that UBS’s clients had assets of $20bn, the temptation would have been mesmerising.

That other Swiss bankers have never come forward reflects Mr Birkenfeld’s status as a maverick. Earning handsomely from managing rich people’s money, no sensible banker asks too many questions about clients’ tax compliance. A reputation as a troublemaker would ruin one’s prospects. Client confidentiality in Switzerland is strictly enforced by law. In spite of his acclimatisation, Mr Birkenfeld was always an outsider. Colleagues recall his "Tequila Tuesdays", when he cracked open a bottle to enliven quiet afternoons at the sober Geneva office. A big man with bright blue eyes and a barely noticeable goatee beard, he has the look of a former athlete gone slightly to seed. "He’s one of the funniest people you’d want to be around," says a former colleague.

Ultimately, Mr Birkenfeld may end up punished by all. In Switzerland, his name is anathema. The chalet in Zermatt is history. Among bankers in the now dissolved UBS team, incomprehension is the most charitable reaction. Higher echelons prefer not to comment: while not directly responsible, the fact that Mr Rohner and Mr Kurer were recipients of Mr Birkenfeld’s whistleblower letter almost certainly contributed to their departure from UBS. Even in the US, things have not gone right. On his return to Boston in May 2008, Mr Birkenfeld was arrested in spite of hopes to secure immunity. He has been charged with conspiracy to defraud the US government by helping tax evasion: sentencing, progressively postponed, is due next week.

Mr Birkenfeld still hopes to benefit from the whistleblower reward scheme. The US authorities have acknowledged his role, if grudgingly. But the fact he has ended up under arrest has fed suspicions among former colleagues that his position may have been compromised from the start. That Mr Birkenfeld has spent the past year with an electronic "bracelet" around his ankle, restricted to his home state and with a 10pm curfew, will count in his favour. Even so, the tarantula that sank its fangs into UBS could well end up in jail.

UK councils 'not prepared for next wave of the recession'

• Addiction and domestic violence set to increase • Low-income households 'hardest hit and ignored'

Councils are not doing enough to prepare their communities for the fallout from the recession and face a surge in social problems such as addiction, alcoholism and domestic violence, the leading public sector watchdog warned yesterday. The Audit Commission said that local authorities in England were now facing the "second wave" of the downturn, as the effects of rising business failures, bankruptcies and unemployment bite.

"Many councils should be doing more to prepare for the expected social, financial and economic development challenges ahead," it said. "This includes councils that have escaped the worst effects to date, some of which are complacent." It coincided with a separate report that found that despite predictions that the recession would lead to an exodus of non-UK nationals, one in 12 employers in the UK plan to recruit migrant workers in the next few months. The study, by the Chartered Institute of Personnel and Development and the consultants KPMG, found that the number of migrant workers rose between the first quarters of 2008 and 2009 while employment of UK nationals fell.

Gerwyn Davies, public policy adviser at the CIPD, said many employers found it hard to fill vacancies with UK workers. "The idea that migrant workers comprise a marginal segment of the UK workforce that is dispensed with when times are tough is clearly wide of the mark. Most are recruited and retained by employers because they provide skills or attitudes to work in short supply amongst the home-grown workforce." Official figures due to be published this morning will be closely scrutinised for evidence that the economy is bottoming out. The broad measure of joblessness, which covers those looking for work rather than simply those eligible for state benefits, has been rising at a record rate.

A third report found that low earners are being disproportionately hit by the recession. Amid growing political concern about the alienation of UK-born workers, the Resolution Foundation, a charity, said people with household incomes of between £11,600 and £27,150 were facing severe financial pain, were being overlooked by the government, and missed out on help from employers. The chief executive of the Resolution Foundation, Sue Regan, said despite signs of economic recovery it was likely that job losses among low earners would continue to rise. "If you look at the sectors where they are most likely to work, they are areas which are likely to [have been] depressed for a long time," she said.

In its report, Squeezed: The Low Earners Audit, the Resolution Foundation said low earners in work were more vulnerable to the softening labour market "than benefit-dependent households – who are less likely to be reliant on earned income – or higher earner households – who are more likely to have savings and insurance". The charity reported a 45% jump in benefit claimants in the distribution, hotels and restaurants sector since April 2008, from 49,000 to 71,000.

The charity estimates that 400,000 low earners were receiving jobseeker's allowance in April 2008 and at least 180,000 more have joined them since the recession began. "In truth, the figure is likely to be higher because of the higher levels of vulnerability and job insecurity faced by low earners," it said. The charity said these workers were likely to have difficulty "bouncing back" from unemployment because "employers don't tend to invest as much in training them … but the government tends to focus on people with no skills. We would like to see the skills strategy extended specifically to help low earners."

Venezuela, Russian Group Plan $30 Billion Oil Venture in Orinoco Region

Petroleos de Venezuela SA and a group of Russian oil companies plan to spend $30 billion on a joint venture in Venezuela’s Orinoco region. The 40-year venture will seek to produce crude in the Junin 6 area and may expand to other Orinoco blocks, Russian Deputy Prime Minister Igor Sechin told reporters in St. Petersburg today after meeting with Venezuelan Vice President Ramon Carrizalez. Russian investors will include OAO Gazprom, OAO Rosneft, OAO Lukoil, TNK-BP and OAO Surgutneftegaz. The venture will be signed "in the coming months," Sechin said.

Presidents Dmitry Medvedev and Hugo Chavez are expected to sign an agreement to create a bank to fund projects during Chavez’s visit to Russia in September, Carrizalez told reporters. Russian and Venezuelan officials signed accords today covering energy, education, tourism, environment and drug enforcement cooperation. PDVSA-Servicios, the state oil company’s oilfield services subsidiary, and Gazprom’s Latin American division agreed last month to form a venture to operate drilling rigs and gas compression equipment. Venezuela has reached out to Russia in an attempt to obtain financing and reduce dependency on the U.S., the country’s main trading partner.

Gazprom will use its Gazprombank unit to lend $4 billion to Venezuela starting at the end of August, Boris Ivanov, chief executive officer of Gazprom EP International BV, told Chavez on state television on July 28. The loan will be collateralized by Venezuelan exports, he said. Five Russian oil companies last year formed a company known as Consorcio Ruso to pursue joint ventures in the South American country.

91 comments:

Fifth Third Bank - We use that bank in Ohio. It is based in Cincinnati. We have no issues with 5th3rd, but, fyi, a few years ago, it started buying up banks in other states.

Scandia

The temperature in the mountains doesn't vary that much with the seasons. It rains a lot more in their summer, our winter. Truth is I have been there only in Sep & Oct as I would flee STJ during the height of hurricane season.

Why is Bill Gates selling?

http://online.wsj.com/article/SB125029373754433433.html

* AUGUST 14, 2009, 10:06 P.M. ET

Gates Foundation Sells Off Most Health-Care, Pharmaceutical Holdings

http://blog.seattlepi.com/microsoft/archives/175955.asp

Bill Gates continues selling off Microsoft stock

Microsoft chairman and extremely rich dude Bill Gates has sold off another 1 million shares of Microsoft stock, according to a Securities and Exchange Commission filing on Monday, bringing up his August stock sell-off to 8 million.

But no worries for the Gates family: According to the SEC filing, William H. Gates III still owns more than 725 million shares - 8 percent of outstanding Microsoft stock. At Monday's market-closing price of $23.42 per share (down 0.59 percent on the day, by the way), that took Gates' stake in Microsoft down to, um, just $16.98 billion.

In an SEC filing Aug. 3, Gates reported selling 2 million shares at $24.17 a pop. The next day, he reported selling 1 million more ($23.78). Another day, another 2 million shares ($23.74). Last Thursday, he dumped yet another 1 million shares at $23.64 each. Friday was 1 million at $24.01 and today saw Gates sell 1 million more at $23.70.

Umm,

http://www.calculatedriskblog.com/

From the Boston Globe: President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

Bill Fleckenstein article dated for tomorrow. Warns about the inevitable Social Security crunch coming sooner (possibly next year) rather than later.

http://articles.moneycentral.msn.com/Investing/ContrarianChronicles/social-security-crunch-coming-fast.aspx

El G,

Yeah, Texas needs about 3 feet of rain. Preferably not all in one storm, but that's the way things work out sometimes here in what will soon become part of the Chihuahuan Desert.

I'll post the bank-evaluation link again, and linkify it this time: http://banktracker.investigativereportingworkshop.org/

For what it's worth ... I don't think the not-good-at-fractions bank had the best statistics -- well according to banktracker they accepted TARP money. You can put in the name of a bank, and the site will list statistics, based on public information, about how much troubled debt the bank has.

The toxic assets on almost all bank books, big, medium and small, should immediately sink more than just a few hundred of them, try a few thousand.

Crooked deceitful, peep-a-boo accounting is the only thing holding back the dam at this point. That and no regulation, or should I say no regulation on the politically connected.

What are they waiting for, a convenient time to let go of the puppet show and let it all explode in one big show stopper?

The Sheeple are completely confident in the promise of the FDIC. I argued with someone recently and they said it CAN'T fail, the government won't let it. It's hard to reason with an all trusting attitude like that.

When this all inevitability implodes, I can't wait for the twisted, surreal rationalizations of why it did.

The general public is infantilized.

So who's their Daddy now?

re.:

Coming Soon: Banking Crisis of Historic Proportions

Now, it is a good thing that banks are conserving capital, since they need to increase capital to offset bad loans.

-------

I would add …

Companies are also trying to conserve capital to cover their loans and to try to operate within their revenue streams.

Companies are not borrowing except to renew their present loans and line of credit.

Consumers are maxed out and banks are the restricting the credit to try to limit defaults.

====

@anon

… as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

Like I said before, Fannie and Freddie will not have to write off those loans because the will be rental units. Some will have with option to buy.

jal

I am reposting this here as it came up just after the new post announcement and it may have a germ of value for some of the readers beyond El G. Thank You.

August 16, 2009 1:34 PM

Anonymous RC said...

El G, I was going to comment that the DDS must be a Cepeda, but you corrected that. The pharmacists on the Plaza of all the little towns of Latin America know everything you ever need to know about the town and its persons and most either speak English to some degree or can call in a friend or family member who can.

Many of these pharmacists do more doctoring than the doctors and I think all do more prescribing. They often provide services like B12 shots, right there standing in front of the counter. They know and have all the common and cheap remedies for the insects that bite and they know how to avoid those insects. They know all the important things. El G, I knew you were ahead of the crowd in the gray matter department, but I can see you will plainly be fine in your Latin travels if you continue to confer with the farmacia savants. Dreda is the savant here in my little town. She knows all, sees all.

Now, a small suggestion, G. Once you arrive {or even while you are in Florida} speak Spanish all the time no matter how wrong it is. Read the local Spanish paper to add two nouns a day and two verbs a week. Bit by bit, over a year or two the thing will right itself and you'll be much more fluent. People will laugh at your hilarious usages and unintended double entendres. But we laugh at the way children speak also, but we aren't laughing at them, it's just that what they say is very funny by accident.

In my 30 years of observing the very sad general Gringo incapacity to grasp the idioma, it comes down to that. The ego doesn't like the laughing. There is also a more serious degree of ignorance {and perhaps mental illness} that sets in here. The non speaker begins to feel {and this may happen the first week they are here} that the native speakers are "talking about me and laughing". Usually this occurs in a restaurant where the folks at an adjoining table may be glancing our way in a friendly manner, and since I know the lingo, I have to say in 30 years I've never seen an actual case of the imagined ridicule.

The gringo that adopts this view is the gringo that even I do my best to avoid.

I am not at all saying that G is in this category or the bad grammar category, but I will say this, and in fact do say it to the other North American English speakers here all the time.

Living in a country and not speaking the language is like swimming without getting wet. Why would you want to ever do that?

Buen Viaje G and enjoy being laughed at. Been there, done that,

laughed along with my fellows. What occurs is that the laughers become your mentors and they adopt you as a project. I learned Spanish by speaking it, I have no schooling. In order to expand my abilities beyond buying food and building homes I read {present and past tense} the most erudite newspaper I could find. I might add that although my IQ is considered off the scale, in school I never did any actual studying and as a result was one of the world's worst language students learning very little of several languages other than English which I seemed to absorb by, you guessed, reading the New York papers at the age of three. So, even though I, typical Gringo Flojo in the language department, never learned a damn thing in school, I learned French by being laughed at by my French wife and Spanish by being laughed at by everyone in town, and thus, I recommend the technique. BTW, for anyone amongst the readers who doubts the viewpoint of G about the Island Life, I must state that he is very accurate. He is also very accurate about his sociological navigations in Peru. I would accept the advice as Bible. BUT, be sure Dr. Cepeda isn't on a little vacacion before you go. Call that Farmacia to find out. Ask them anything. In Spanish.

August 16, 2009 2:09 PM

This spring the congress gave the FDIC a $500billion "line of credit". The stated reason was to fund PPIP, the toxic loan program that is moving at a glacial pace. If that can be drawn on to fund depostit insurance, according to the legislation I don't know. I do know that when it comes to the Treasury, of which the FDIC is part, the law doesn't apply.

Hardly anyone, even mighty bears,worry much about bank deposits disappearing. Everyone thinking that one way or another the Fed will print that. That's probably about right.

The nightmare scenarios that might come from that are too numerous to mention. For now pretending is much easier.

While personally of the mind,its all going to go "bye bye" this fall,I don't feel it will happen in a uniform manner...

We will probably see how a complex system "dies",or the way I look at it,reverts to a lower energy form..in stages.

First the extremities,

then core functions

Then a complete system reboot.

By this time,no one will "recognize"their home town,much less their home.

One year ago,I was at the top of my game at my company...good money...you could see a few clouds,IF,you looked ...but all the overtime you wanted...life was good.

1 year later...

5 months of less than 20 hours a week..2 months of <5...finding myself in a new "position" that is "tenuous" to say the least[at this point 40 hrs a week is a blessing]

I don't recognize my company...The economy has changed it beyond words...I dont want to think about this fall...What little we have will drop off a cliff..then ,My guess, I join the ranks of the un-employed...again..

Except this time it may last a long long time...

It will be Bees,and fruit trees,and garden.I have some ideas to spark some small business...Like gasifiers...that could power a home "stand alone"using whatever is available..but those have to wait until I have time to work on them.

I think our gentle hosts are on the money when they say folks wont recognize their towns...mine is changing so fast it is difficult to track it...so I have given up.I will look at Portland more carefully when I have the luxury of time ...

Time to be productive...

snuffy