Drought refugees from Oklahoma camping by the roadside in Blythe, California. "They hope to work in the cotton fields. There are seven in family. The official at the border inspection service said that on this day, 23 carloads and truckloads of migrant families out of the drought counties of Oklahoma and Arkansas had passed through from Arizona entering California."

Ilargi: Howard Davidowitz, who, if he’s not already, ought to be your favorite financial analyst, and grandfather, says hundreds of thousands of stores across the US have yet to close. Howard should know if anyone does, since retail is his field and has been for decades.

He also predicts that hundreds of banks will fail before the year is over. As I was listening to him, I was thinking that perhaps that's a bit steep, if only simply because the FDIC doesn't have the apparatus in place to deal with numbers like that, and certainly not with the numbers that will emerge from their books.

But then I heard big-time private equity master John Kanas claim that 1000 banks will fail over the next two years, and that does seem to fit Davidowitz’ assertion. Still, it was when I read yesterday's FDIC report, and comments on it, that I started thinking Howard was talking about change that I, so to speak, could believe in. Not only did the FDIC state that their troubled banks list went to 416 ‘clients', that list has little meaning unless they act on it. More significant is, as Huffington Post noted, that over 25% of all 8500 US banks, for a total of more than 2100 of them, are unprofitable today.

They are unprofitable at a time when stock markets are at insanely elevated heights compared to what happens in the real world out there, and must and will come down. At a time, also, when commercial real estate is certain to have a huge plunge ahead of it, and drag many smaller banks down with it. And obviously at a time when nobody doubts any longer that foreclosures in domestic real estate must increase dramatically this year and through at least 2015. The FDIC can't refuse to close banks that legally need to fail indefinitely. That in itself would be, or indeed is, a huge threat to the system. Then again, so is closing them.

Davidowitz sums it up by saying the US doesn't need more than 5000 banks. In other words, 3500 failures. There is no doubt that the Fed's refusal to report which banks have received taxpayer funded bailouts doesn't fit in a democratic system, but there is also no doubt that it would be a risky move. The banking system is a patient on what can perhaps best be labeled extreme life-support. Inviting the press into the ER would be pretty sure to finish off the ailment riddled body.

Not that I think that revealing reality is not inevitable. I have long said that the game is over, that both the banking system and in its wake the political system are dead and being propped up in a chair to fool people into thinking they are alive. The accumulated aggregate debt is simply too high to pay off. It's all just a matter of time. Spending $23.7 trillion, to follow Neil Barofsky's number, in order to do the propping up, is a very high price to pay for a few months more of a society already so deeply indebted across all levels of its organization, and indeed its entire political structure. Moreover, it does nothing to pay off the debt. On the contrary, it makes it that much worse. And, as Davidowitz says: "The banks are still in the crapper."

That said, it should be no surprise that I fully agree with Howard Davidowitz' assessment of the US:

"We are in the tank forever. As a country we are out of control, we're in a death spiral."The demise of the financial system, as should be obvious, is also the end of politics as we’ve come to know it. It makes no difference whether you would applaud that because of the deeply seated corruption that eats away at the system like a tumor, or regret it because there is no telling what comes after. No matter how we feel about it, we will have to transition into something new. The chances that we will do so quietly are negligible, as history tells us. There's too much power in the hands of those who have too much to lose, and not nearly enough in the hands of those who have nothing left to lose.

And that is the breaking point. People will accept just about anything as long as they feel they will lose out if there are major changes. They won't if they feel they've lost all that has intrinsic value. In a consumer based society, you need to keep the customer satisfied. And the customers won't be satisfied if they can't consume. Closing hundreds of thousands of stores and hundreds of banks, on top of all that has come down already in the past two years, will lead to a situation from which a return to "normalcy" is no longer an option. The camel's back can take only so many straws.

A good example of where we are going is the 38% plunge in income for American farmers. Just try and imagine that for yourself, a 38% pay-cut from one year to the next. What would that mean for your family? Where do you go from there, and how do you do it? Go out and look for work in the cotton fields?

Howard Davidowitz: US "In The Tank Forever", "In a Death Spiral"

Retail maven Howard Davidowitz paid another visit to Tech Ticker this week. And despite signs of improvement in consumer confidence and retail stocks rising, Davidowitz is steadfast in his belief the consumer is dead. Rather than summarize, let me just highlight some of his best one-liners:

- On retail:

- "The retail business is terrible... It's almost all negative."

- "We're going to close hundreds of thousands of stores."

- On the consumer:

- "They’re still over leveraged, they're losing jobs, their credit has been cut back."

- On America:

- "We are in the tank forever. As a country we are out of control, we're in a death spiral."

- On the stock market:

- "We're in terrible shape. That's what the fundamentals tell me. I can't explain the stock market."

But it's not all gloom and doom, believe it or not. Davidowitz, who runs a retail consulting firm Davidowitz and Associates, thinks certain discount retailers, grocers, drug store chains and a select few department stores can survive and prosper in the future. Most notably he likes the "extreme discounters" like Family Dollar, Dollar Tree (which was up almost 5% Tuesday after the company raised its outlook) and 99 Cents Only Stores. And, in the department store sector, he says, Kohl's will "be the only winner" because of their cost controls. (Davidowitz has no positions in stocks mentioned.)

Obama's Spending Spree, Budget Numbers "Have All Gone Mad," Says Davidowitz

When retail expert and all-around economy watcher Howard Davidowitz appeared on Tech Ticker in February declaring the worst was yet to come for the U.S. economy and that Americans' standard of living has changed permanently, our comment boards lit up. But surely with the latest rally off the March lows, bearish Davidowitz is more bullish, right? Not a chance. Look at your financial history books.

Two of the biggest rallies of more than 40 percent occurred during the Great Depression, says Davidowitz of Davidowitz & Associates,a retail consulting and investment banking firm. "People were sucked in and ultimately were destroyed," he says. It's a warning to today's investors, who are hoping to extend the rally. Don't get Davidowitz started on the economy or fundamentals. "Barack Obama's numbers have all gone mad," Davidowitz says. The Obama administration recently announced the U.S. budget deficit will be $9 trillion during the next decade; $2 trillion higher than the original forecast.

And, the proposed price tag for health-care reform? "Minimum $3 trillion," Davidowitz says. "One trillion? Are you kidding?" Stimulus binges? Roller coaster equity performance over years? Stubborn consumers holding out for sales as deflationary pressures loom over the recovery? Sounds like the U.S. economy is turning Japanese, Davidowitz says.

"Banks Still in the Crapper", We're going to close 100's of banks THIS YEAR!, Davidowitz Says

Since the government gave banks relief on mark-to-market accounting and the "stress tests" helped engineer a big round of capital-raising last spring, the financial sector has been on a tear. Now a major debate is occurring over whether the sector remains attractively valued or is living on borrowed time. On the optimistic side of the ledger, famed hedge fund manager John Paulson is upping his stake in Citigroup, The NY Post reports. Last month, an SEC filing revealed Paulson's fund taking big stakes in Bank of America, Goldman Sachs, JPMorgan, Capital One Financial and other financials.

On the other hand, regulators loosened restrictions on private equity firms' ability to buy failed banks, a nod to the drain on the FDIC's insurance fund given the failures of the past year - and more expected to come. (On Thursday, the FDIC said the number of banks on its problem watchlist rose to 416 in the second quarter from 305 in Q1, while its insurance fund fell 20% to $10.4 billion. "The decrease in the fund was chiefly caused by an $11.6 billion increase in the money the FDIC set aside for anticipated bank failures," Reuters reports.)

Count Howard Davidowitz of Davidowitz & Associates among the skeptics, which shouldn't surprise anyone who's seen his often grim (albeit entertaining) appearances on Tech Ticker. "I think the banks have major problems to come," Davidowitz says. "The banks still have tons of toxic assets. [Plus] the shape of the consumer comes right back to the banks with all this credit card debt, student loans, auto loans [going bad] - all of this goes to the banks." In addition to what he sees as a dire outlook for consumers, commercial real estate "is a catastrophe" and will add to the banks' woes, Davidowitz says.

Although REITs like Vornado and Simon Property Group have been able to get financing, many property owners are unable to renegotiate terms with their lenders to account for the new economic realities. As a result, many are under water and Davidowitz expects more commercial real estate owners to just walk away from properties, just as residential homeowners have done.

"Jingle mail" is already happening in the commercial real estate sector, with developers like New York's Harry Macklowe and California's Hines and Sterling already having returned properties to their lenders. Davidowitz expect more of this, which means more losses for the banks, who've already been the beneficiaries of unprecedented government bailouts. "Did [regulators] do something for the banks? No question about it," Davidowitz says. "My question: when you spend $13 trillion, what did we get? Banks are still in the crapper. I have a problem with that."

1,000 Banks Could Fail In Next Two Years

Up to 1,000 banks could fail in the next two years, private equity chief John Kanas told CNBC in a recent appearance. Kanas' high-powered private equity conglomerate -- which included the buyout titans like the Carlye Group, the Blackstone Group and W.L. Ross -- bought Florida's failed BankUnited in May.According to Kanas, the second wave of failed institutions will include hundreds of smaller banks. "Many of these [failed] institutions no body has ever heard of," Kanas said. "It augurs poorly for smaller business mangers," he added. "Very small banks tend to lend money to small businesses -- this exacerbates the problem for small companies." More from Kanas:"Government money has propped up the very large institutions as a result of the stimulus package," he said. "There's really very little lifeline available for the small institutions that are suffering."

Bank Numbers Reveal Troubling Trend On Main Street

More than one in four U.S. banks are unprofitable, a number fueled by rising numbers of bad loans, the FDIC announced Thursday.

The percent of banks losing money has quadrupled since 2005. The U.S. added 111 banks to its "Problem List" for a total of 416, a 15-year high (the FDIC doesn't publicly identify those banks). And the rate of loans that are at least 90 days late or are so late they're no longer accruing interest is the highest recorded in U.S. history.

A look inside the FDIC's numbers also sheds light on how U.S. consumers are managing the recession. The health of banks is not just a Wall Street problem, or one for federal bank regulators in Washington, D.C.

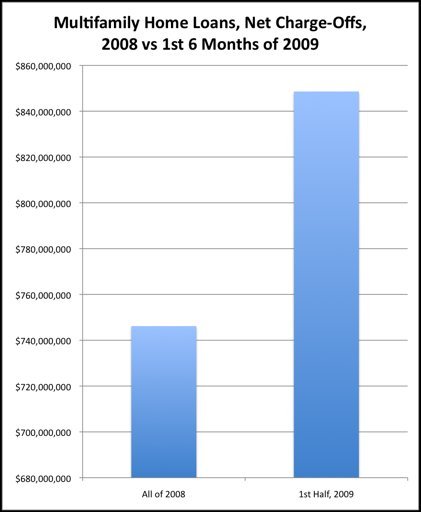

It's not a pretty picture. The amount of loans banks are charging off is rising (when banks charge off a loan it means they don't expect the borrower to repay). There have been more charge-offs on multifamily home loans (apartment buildings) so far this year than all of 2008. [See Figure 1 below] Looking at the past two quarters, overall charge-offs have increased 28 percent; on home loans they've increased 25 percent; and credit card charge-offs are up 21 percent.

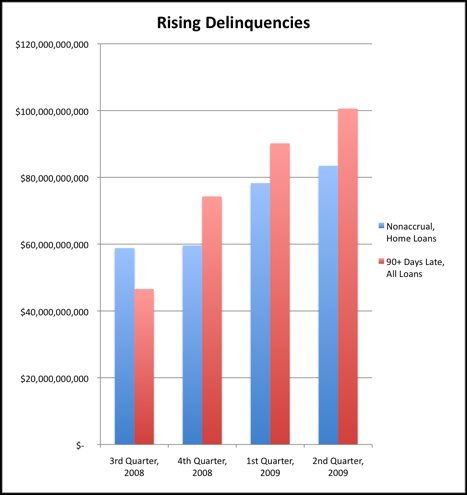

The financial armageddon many feared last fall never materialized, but these numbers show that the expected losses continue to rack up, especially among homeowners. [See Figure 2 below]

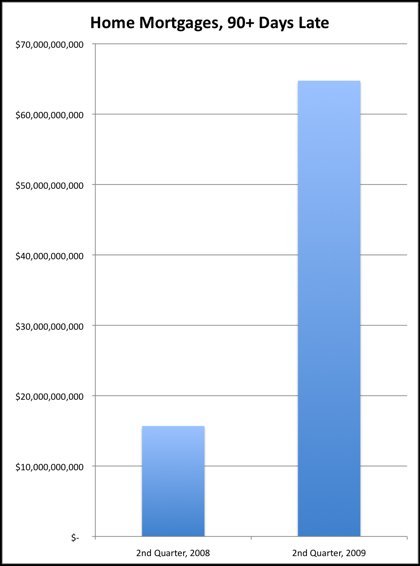

As the Huffington Post reported earlier this year in our series, Dispatches from the Displaced, homeowners are struggling. Home mortgages at least 90 days delinquent have quadrupled to about $65 billion since the same period last year. [See Figure 3 below]

But it's not just homeowners. All borrowers are hurting. Loans late at least 90 days have doubled since September 2008. [See Figure 2 below]

As for the type of banks taking these losses, it's the big banks that are suffering the most. Nearly half of banks with more than $10 billion in assets are unprofitable through the first six months of the year (41%); for smaller banks, it's just 26 percent (banks with less than $100 million in assets). Then again, the biggest banks have received the biggest government bailouts.

Figure 1

Figure 2

Figure 3

Preparing for a major bank shakeout

The problem bank list is just about the only part of the industry that's growing right now. The sector's financial problems, outlined by regulators in excruciating detail on Thursday, could speed a shakeout that already has slashed banks' ranks by almost half over two decades. "We could end up with a couple thousand fewer banks within a few years," said Terry Moore, managing director of consulting firm Accenture's North American banking practice. "You could say we're overbanked right now."

The Federal Deposit Insurance Corp. said Thursday that U.S. banks lost $3.7 billion in the second quarter. Bad loans are growing faster than institutions are setting aside in reserves for future losses, while total lending has declined for four straight quarters. The list of troubled institutions -- those deemed to pose at least a "distinct possibility" of failure -- rose by more than a third during the second quarter, to 416. The FDIC doesn't reveal the names of banks on the problem list.Anticipating rising costs of dealing with troubled banks, the FDIC on Wednesday formalized new rules for private equity firms and other investors buying failed banks. There has been a heavy trade in failed banks lately, given that 81 institutions have been closed in 2009 and dozens more are expected to be shut over the next year. The quick pace of failures has already rewarded some prescient bankers. "We were preparing for this moment for maybe two and a half years," said Norman C. Skalicky, CEO of Stearns Bank, a closely held St. Cloud, Minn., institution that has acquired four banks from the FDIC this year. "The biggest mistake we made was not getting ready a year earlier."

Bank failures aren't the only driver of consolidation. While bank mergers fell to 89 in the first half of 2009 from their recent peak of 153 in the first half of 2007, growth-minded banks such as First Niagara in Lockport, N.Y., are looking for opportunities to expand. "We are always working with our eyes wide open," said John Koelmel, CEO of First Niagara, which last month announced the acquisition of Harleysville National of Philadelphia. "Our shopping cart isn't full." The shopping spree ahead -- Moore says the U.S. could lose 2,000 banks by the end of 2012 -- is likely to claim some well known regional banks.Colonial BancGroup of Alabama and Guaranty Financial Group of Texas have failed over the past month. Chicago condominium lender Corus Bankshares has been on death watch for some time. Judging by stock prices, investors are still questioning the prospects of KeyCorp of Cleveland, Marshall & Ilsley of Milwaukee and Regions Financial of Alabama. But the bulk of consolidation is likely to come at the expense of smaller banks, whose numbers have been dwindling for decades in the face of deregulation and technological advances that disproportionately aided bigger competitors.

The number of banks with less than $100 million in assets has dropped by more than 5,000 since 1992, according to a study released this year by banking consultancy Celent. Even more pronounced has been the small banks' loss of deposits. Small banks' share of the U.S. deposit market plunged to 2% last year from almost 13% in 1992, according to Celent data. "The world is only getting more complex," Celent analyst Bart Narter wrote, noting ever-increasing regulatory paperwork and new businesses such as Internet banking. "Small banks are overwhelmed."

That said, small banks aren't going away. Policymakers such as FDIC chief Sheila Bair have emphasized their importance in lending to small businesses, and studies have found they tend to pay better deposit rates than bigger rivals. The FDIC on Wednesday extended a program that some community bankers credit with helping them to compete with the biggest banks. And the smallest banks have generally performed better during the financial crisis than their bigger rivals. Banks with less than $100 million in assets make up more than a third of the FDIC's problem bank list, but have accounted for just 11 of 81 bank failures so far this year.

Like their bigger rivals, community banks are now enjoying stronger profit margins in the second quarter, as the spread between the rates banks pay depositors and those they charge to lend to borrowers widened. "This is good news for community banks, since three-fourths of their revenues come from net interest income," Bair said Thursday.

Banks 'Too Big to Fail' Have Grown Even Bigger

When the credit crisis struck last year, federal regulators pumped tens of billions of dollars into the nation's leading financial institutions because the banks were so big that officials feared their failure would ruin the entire financial system. Today, the biggest of those banks are even bigger. The crisis may be turning out very well for many of the behemoths that dominate U.S. finance. A series of federally arranged mergers safely landed troubled banks on the decks of more stable firms. And it allowed the survivors to emerge from the turmoil with strengthened market positions, giving them even greater control over consumer lending and more potential to profit.

J.P. Morgan Chase, an amalgam of some of Wall Street's most storied institutions, now holds more than $1 of every $10 on deposit in this country. So does Bank of America, scarred by its acquisition of Merrill Lynch and partly government-owned as a result of the crisis, as does Wells Fargo, the biggest West Coast bank. Those three banks, plus government-rescued and -owned Citigroup, now issue one of every two mortgages and about two of every three credit cards, federal data show.

A year after the near-collapse of the financial system last September, the federal response has redefined how Americans get mortgages, student loans and other kinds of credit and has made a national spectacle of executive pay. But no consequence of the crisis alarms top regulators more than having banks that were already too big to fail grow even larger and more interconnected. "It is at the top of the list of things that need to be fixed," said Sheila C. Bair, chairman of the Federal Deposit Insurance Corp. "It fed the crisis, and it has gotten worse because of the crisis."

Regulators' concerns are twofold: that consumers will wind up with fewer choices for services and that big banks will assume they always have the government's backing if things go wrong. That presumed guarantee means large companies could return to the risky behavior that led to the crisis if they figure federal officials will clean up their mess. This problem, known as "moral hazard," is partly why government officials are keeping a tight rein on bailed-out banks -- monitoring executive pay, reviewing sales of major divisions -- and it is driving the Obama administration's efforts to create a new regulatory system to prevent another crisis.

That plan would impose higher capital standards on large institutions and empower the government to take over a wide range of troubled financial firms to wind down their businesses in an orderly way. "The dominant public policy imperative motivating reform is to address the moral hazard risk created by what we did, what we had to do in the crisis to save the economy," Treasury Secretary Timothy F. Geithner said in an interview.

The worry for consumers is that the bailouts skewed the financial industry in favor of the big and powerful. Fresh data from the FDIC show that big banks have the ability to borrow more cheaply than their peers because creditors assume these large companies are not at risk of failing. That imbalance could eventually squeeze out smaller competitors. Already, consumers are seeing fewer choices and higher prices for financial services, some senior government officials warn.

Those mergers were largely the government's making. Regulators pushed failing mortgage lenders and Wall Street firms into the arms of even bigger banks and handed out billions of dollars to ensure that the deals would go through. They say they reluctantly arranged the marriages. Their aim was to dull the shock caused by collapses and prevent confidence in the U.S. financial system from crumbling.

Officials waived long-standing regulations to make the deals work. J.P. Morgan Chase, Bank of America and Wells Fargo were each allowed to hold more than 10 percent of the nation's deposits despite a rule barring such a practice.

In several metropolitan regions, these banks were permitted to take market share beyond what the Department of Justice's antitrust guidelines typically allow, Federal Reserve documents show. "There's been a significant consolidation among the big banks, and it's kind of hollowing out the banking system," said Mark Zandi, chief economist of Moody's Economy.com. "You'll be left with very large institutions and small ones that fill in the cracks. But it'll be difficult for the mid-tier institutions to thrive." "The oligopoly has tightened," he added.

Federal officials and advocacy groups are just beginning to study the impact of the crisis on consumers, but there is some evidence that the mergers are creating new challenges for ordinary Americans. In the last quarter, the top four banks raised fees related to deposits by an average of 8 percent, according to research from the Federal Reserve Bank of Dallas. Striving to stay competitive, smaller banks lowered their fees by an average of 12 percent.

"None of us are saying dismember these institutions. But you do want to create a system that allows for others to grow, where no one has an oligopolistic power at the expense of others who might be able to provide financial services to consumers," said Richard Fisher, president of the Federal Reserve Bank of Dallas. Normally, when faced with price increases, consumers simply switch. But industry officials said that is not so easy when it comes to financial services.

In Santa Cruz, Calif., Wells Fargo, Bank of America and J.P. Morgan Chase hold three-quarters of the deposit market. Each firm was given tens of billions of dollars in bailout funds to help it swallow other banks.

The rest of the market, which consists of a handful of tiny community banks, cannot match the marketing power of the bigger banks. Instead, presidents of the smaller companies said, they must offer more personalized service and adapt to technological changes more quickly to entice customers. Some acknowledged it can be a tough fight.

Wells Fargo is "really, really good at the way they cross-sell and get their tentacles around you," said Richard Hofstetter, president of Lighthouse Bank, whose only branch is in Santa Cruz. "Their customers have multiple areas of their financial life involved with Wells Fargo. If you have a checking account and an ATM and a credit card and a home-equity line and automatic bill payments . . . to change that is a major undertaking."

Last October, when the Fed was arranging the merger between Wells Fargo and Wachovia, it identified six other metropolitan regions in which the combined company would either exceed the Justice Department's antitrust guidelines or hold more than a third of an area's deposits. But the central bank thought local competition in each of those places was sufficient to allow the merger to go through, documents show.

Camden Fine, president of the Independent Community Bankers of America, said those comments reveal the government's preferential treatment of big banks. He doubted whether the Fed would approve the merger of community banks if the combined company ended up controlling more a third of the market. "To favor one class of financial institutions over another class skews the market. You don't have a free market; you have a government-favored market," he said. "We will never have free markets again if you have the government picking winners and losers."

Before the crisis, many creditors thought that the big institutions were a relatively safe investment because they were diversified and thus unlikely to fail. If one line of business struggled, each bank had other ventures to keep the franchise afloat. And even if the entire house caught fire, wouldn't the government step in to cover the losses? With executives comforted by that thinking, risk came unhinged from investment decisions. Wall Street borrowed to make money without having enough in reserves to cover potential losses. The pursuit of profit was put ahead of the regard for safety and soundness. The federal bailouts only reinforced the thought that government would save big banks, no matter how horrible their decisions.

Today, even with the memory of the crisis fresh in their minds, creditors are granting big institutions more favorable treatment because they know the government is backing them, FDIC officials said. Large banks with more than $100 billion in assets are borrowing at interest rates 0.34 percentage points lower than the rest of the industry. Back in 2007, that advantage was only 0.08 percentage points, according to the FDIC. Such differences can cause huge variance in borrowing costs given the massive amount of money that flows through banks.

Many of the largest banks reported a surge in profit during the most recent quarter, including J.P. Morgan Chase and Goldman Sachs. They are prospering while many regional and community banks are struggling. Nearly three dozen of the smaller institutions have failed since July 1, including Community Bank of Nevada and Alabama-based Colonial Bank just last week. If the government continues to back big firms over small, regulators worry that reckless behavior could return to Wall Street.

The administration's regulatory reform plan takes aim at this problem by penalizing banks for being big. It would require large institutions to hold more capital and pay higher regulatory fees, as well as allow the government to liquidate them in an orderly way if they begin to fail. The plan also seeks to bolster nontraditional channels of finance to create competition for large banks. If Congress approves the proposal, Geithner said, it would be clear at launch which financial companies would face these measures. Economists and officials debate whether these steps would address the too-big-to-fail problem. Some say, for instance, that determining the precise amount of capital big financial companies should hold in their reserves will be difficult.

Geithner acknowledged that difficulty but said the administration would probably lean toward being more strict. Taken together, the combination of reforms would be a powerful counterbalance to big banks, he said. "Our system is not going to be significantly more concentrated than it is today," Geithner said. "And it's important to remember that even now, our system remains much less concentrated and will continue to provide more choice for consumers and businesses than any other major economy in the world."

Recession Finally Hits Down on the Farm: Incomes Plunge 38%

The American farm, which has weathered the global recession better than most U.S. industries, is starting to succumb to the downturn. The Agriculture Department forecast Thursday that U.S. farm profits will fall 38% this year, indicating that the slump is taking hold in rural America. Much of the sector had escaped the harsher aspects of the crisis, such as the big drop in property values plaguing city dwellers and suburbanites. "It is safe to say that the global recession has finally shown up on the doorstep of the agriculture economy," said Michael Swanson, an agricultural economist at banking giant Wells Fargo & Co.

The Agriculture Department said it expects net farm income -- a widely followed measure of profitability -- to drop to $54 billion in 2009, down $33.2 billion from last year's estimated net farm income of $87.2 billion, which was nearly a record high. The drop in farm prices is likely to lead to a slower increase in food costs for American consumers, economists say. The slump isn't affecting all farmers equally: Many are still reaping big profits while others are having a hard year. Farmers are accustomed to seeing their incomes swing widely, due to the vagaries of such things as Mother Nature and the oil market's impact on the price of corn-derived ethanol fuel.For instance, sugar farmers are seeing the highest global prices in 28 years, in part because of harvest problems in India. But many dairy and hog farmers are barely holding on because of low prices and shrinking foreign demand.

The sector's expected profit decline is unusually steep, coming after two boom years. According to USDA calculations, its 2009 forecast is $9 billion below the 10-year average for farm profits. Jay Roebuck, a 52-year-old dairy farmer in Turner, Maine, said he is falling behind on bill payments even though he has laid off two workers and reduced the rations of his cows. "This is by far the worst it's ever been," said Mr. Roebuck, who estimates he is losing $9,000 monthly.

For most Americans, the chill in the farm belt is related to one of the few positives they see in this economy: slowing inflation. Prices farmers are receiving for corn, wheat and hogs are down sharply from last year. Partly as a result, economists expect the Consumer Price Index for food to rise 3% this year, compared with 5.5% in 2008, which was the fastest annual rise in 18 years.

Less than 1% of Americans are engaged directly in agriculture. Yet farmers have a big impact on the economy. They are big spenders, produce commodities that are ubiquitous in the economy, and use about half of the nation's land. According to past calculations by the USDA, agriculture and food account for about 13% of U.S. gross domestic product. The profit drop signals that the decades-long contraction in the number of farmers who produce commodities such as hogs and milk is likely to accelerate this year.

Growers will probably cut back even more on their spending plans, making it harder for companies that sell such things as tractors, seeds and fertilizer to raise prices to farmers. "There is likely to be more pressure on pricing," said Ann Duignan, an analyst at J.P. Morgan who follows farm-implement makers. She said Thursday that manufacturers will probably have the hardest time passing along higher costs to livestock operators, who are having the most financial difficulty.

The profit drop is a wrenching change for farmers, many of whom enjoyed the most profitable years of their careers in 2007 and 2008, when crop prices hit stratospheric levels. Fueled by rising federal mandates, the ethanol industry's appetite for corn exploded. At the same time, the growing middle class in emerging nations such as China was increasing its spending on U.S. farm goods like soybeans and pork. Many farmers were able to reduce debts and increase savings, helping to insulate them from the recession in 2008.

Part of what had held the recession at bay in farm country earlier this year was that the prices of corn and soybeans, while down from last year's levels, were still roughly twice as high as what had been normal early this decade and in the 1990s. But prices of these commodities have steadily retreated in recent weeks amid forecasts for bumper harvests this fall. U.S. corn farmers are projected to harvest about 12.8 billion bushels this fall, which would be the second-highest crop ever. Soybean farmers are expected to harvest a record 3.2 billion bushes. The price of corn and wheat is 41% lower than last year, while prices of hogs and nonfat dry milk are down one-third from 12 months ago.

Gene Gourley, who raises 60,000 hogs every year on his farm in Webster City, Iowa, is losing as much as $30 on each hog he sells. He said Thursday that he is rethinking plans to buy a trailer for hauling feed to his livestock. "With hogs losing so much money, you're basically burning up anything you could have saved," said Mr. Gourley. "You just don't have the equity to go buy new upgrades." Before the recession, hog farmers enjoyed several years of good business in part because exports were booming to countries such as China. When the recession took hold, restaurants cut orders for pork and foreign demand cooled. Pork exports in June were 36% lower than June 2008, according to USDA figures. The decline in commodity prices also has begun to depress the value of U.S. farmland for the first time in two decades.

The Federal Reserve Bank of Chicago said in a report it issued Thursday that the price of good quality farmland in Iowa and Michigan was 5% lower on July 1 than it was on the same 2008 date. Falling land prices are making it harder for farmers to borrow because land is their biggest source of collateral. "No question that specific industries are burning through working capital very quickly," said Bill York, chief executive of AgriBank FCB, St. Paul, Minn. "Pork and dairy are of particular concern."

Farmers, many of whom already receive federal subsidies, are seeking more help. Last month, the Obama administration said it will put an additional $243 million into the pockets of dairy farmers by temporarily raising the price the government pays for products such as cheese under its long-running dairy-price support program. Midwest governors are asking Washington to buy more pork for government nutrition programs in hopes that would raise hog prices. The requests are likely to agitate critics of agricultural aid, who argue, among other things, that the average farmer is much wealthier than the typical U.S. household, and that U.S. subsidies put farmers in poor nations at a competitive disadvantage.

Consumer spending up 0.2% on ‘clunkers', incomes unchanged, savings rate down

U.S. personal incomes were unchanged in July as the impact of federal stimulus payments waned and wages rose for the first time in a year, the Commerce Department reported Friday.

Consumer spending increased 0.2% last month, led by higher outlays for autos. Spending rose for the third month in a row. On the surface, the July report was slightly weaker than expected, but with upward revisions to figures for May and June, income and spending levels were higher than forecast. Morgan Stanley economists raised their third-quarter forecast for gross domestic product growth to 4.8% from 4.3%.

Economists had been looking for July incomes to rise by 0.2% in July, with spending pegged to increase 0.3% in a MarketWatch survey. Inflation was tame during the month. Consumer prices were flat.

Excluding food and energy, consumer prices rose 0.1% on the month. In the past year, consumer prices are down 0.8%, while core prices are up 1.4%, the lowest inflation rate of this business cycle. With spending rising faster than incomes, the personal savings rate fell to 4.2%, down from 4.5% in June.

The savings rate has now retraced back to January's rate after surging in April and May. "The 'stimulus' payments to households were largely saved and had minimal impact on consumer spending," said Stephen Stanley, chief economist for RBS Securities. The government's report paints a picture of consumers slowly climbing out of the worst recession in generations. Real disposable incomes are up 0.7% since bottoming in March, but are down 3.5% from the peak in May 2008, when taxes were cut. Real consumer spending has risen 0.3% from the bottom in April, but is down 1.6% since the recession began in December 2007.

Incomes and spending were revised higher in May and June. Incomes dropped 1.1% in June, not the 1.3% originally reported. Real spending rose 0.1% in June, rather than falling 0.1% as initially reported. Incomes from private-sector wages and salaries increased 0.1% in July, the first such rise since August 2008. Private-sector wage and salary incomes are down 7% in the past 12 months -- the worst year-over-year decline on record, dating back to 1948. Incomes from small businesses rose 0.6% in July. Income from financial assets fell 1%. Income from transfer payments fell 0.2%.

Real spending on durable goods rose 1.8% in July, with autos accounting for all the increase. Real spending on nondurable goods fell 0.3% and spending on services rose 0.1%. The federal government's cash-for-clunkers program, which gave buyers up to $4,500 toward a new car, boosted spending on durable goods, and pushed consumer prices lower. The government didn't quantify the impact of the clunkers program on the July data. The program was running in the last week of July and was extended through most of August.

New Foreclosures Dwarf New Home Sales

New home sales are ticking up again, bringing some much-needed relief to the beleagured homebuilders. But watch out. Mark Hanson produced this chart, showing foreclosure starts against new home sales. As you can see, the new foreclosure starts jumped even more in july than new home sales, meaning trouble down the road for homebuilders -- especially once that $8,000 first-time homebuilder tax credit runs out.

Bankers watch as Sweden goes negative

For a world first, the announcement came with remarkably little fanfare. But last month, the Swedish Riksbank entered uncharted territory when it became the world’s first central bank to introduce negative interest rates on bank deposits. Even at the deepest point of Japan’s financial crisis, the country’s central bank shied away from such a measure, which is designed to encourage commercial banks to boost lending. But, as they contemplate their exit strategies after the extraordinary measures of the past two years, central bankers will be monitoring the Swedish experiment closely

.

Mervyn King, the Bank of England governor, has hinted he may follow the Swedish example as the danger of a so-called liquidity trap, where cash remains stuck in the banking system and does not filter out to the wider economy, is an increasing concern for the UK. Hoarding is exactly what happened in Japan earlier this decade when the Bank of Japan implemented quantitative easing between 2001 and 2006. Japanese banks refused to lend, in spite of central bank stimulus, because of fears over the dire state of the economy.

If this continues to happen in other economies, central bankers may be left with little choice but to follow the Swedish example. John Wraith, head of sterling rates product development at RBC Capital Markets, says: “The success of the UK’s quantitative easing experiment hinges a lot on whether the banks will use the extra money they are getting for lending to individuals and businesses. “If there is no sign of this over the next few months, then the Bank of England might consider a negative interest rate. In essence, it is a fine on banks that refuse to lend.”

In the UK, for example, nearly £140bn has been injected into the economy through central bank purchases of government bonds and corporate assets, mainly from the commercial banks. However, since the QE project was launched on March 5, a lot of this money, which in theory should be used by the commercial banks for lending to businesses and individuals, has ended up at the Bank of England in reserves. Commercial bank deposits have risen from £31bn in early March to £152bn at the end of July – the latest figure. This in itself is not a problem as the banks could be using this big increase in their reserves to step up their lending to the private sector. The more the banks have in reserves, the more they are allowed to lend.

However, there is no sign yet that they are using their much bigger reserves to lend on. The latest money supply figures for lending are still fairly anaemic. It is why Mr King did not rule the possibility of negative interest rates when asked about the Riksbank model this month following the unveiling of the quarterly inflation report. “It’s an idea we will certainly be looking at, whether the effectiveness of our asset purchases could be increased by reducing the rate at which we remunerate reserves,” he said. His comments are one reason why yields on short-dated UK government bonds have fallen to record lows and why sterling has been under pressure in the currency markets.

Initially, Mr King gave QE six months before it would start taking effect. That time limit is up next week. If there are no signs in the money supply numbers, particularly in the key M4 lending excluding financial institutions, then the policy may start to look a distinct possibility. In Europe, the European Central Bank is considered less likely to introduce negative interest rates. This is because it has maintained higher official rates than other banks and used money market operations to act as a stimulant instead. For example, it offered commercial banks unlimited funds for one year at the end of June. But it does have the same problem as the Bank of England in assessing the success of its policy. Like the UK, commercial bank deposits at the ECB have shot up in the past few months.

At this stage, the US also seems unlikely to introduce the policy as there has been little debate on the matter and no hints from policymakers about it being an option. At the Riksbank, which now has a deposit rate of minus 0.25 per cent, the most vocal advocate of the policy is deputy governor Lars Svensson, a world-renowned expert on monetary policy theory and a close associate of Ben Bernanke, chairman of the US Federal Reserve, since they worked together at Princeton University. According to the minutes of the Riksbank’s July meeting, Mr Svensson dismissed the “zero interest rate mystique” that had “exaggerated the problems” associated with zero or sub-zero rates. “There is nothing strange about negative interest rates,” he said.

Henrik Mitelman, chief fixed income strategist at SEB, the Swedish bank, said that the negative deposit rate, combined with a cut in the repo rate to an historic low of 0.25 per cent, sent a powerful signal to the market that the Riksbank intended to keep rates close to zero until economic recovery was well under way. “What the Riksbank did was very brave. They decided to see if markets could cope with it and the markets have.” Carl Milton, fixed income analyst at Danske Bank in Stockholm, cautions that the Riksbank decision was not as pioneering as some have portrayed. The Bank routinely keeps its deposit rate 50 basis points lower than the repo rate to regulate liquidity in the market, he says. When the repo rate was cut to 0.25 per cent, the deposit rate was automatically forced into negative territory. “It was not something put in place to punish banks or to force them to lend,” he says.

Moreover, Swedish banks make relatively little use of the central bank deposit facility, limiting the impact of negative rates. But by breaking the taboo surrounding sub-zero rates, the Riksbank may have set an important precedent that others could use to greater effect. Don Smith, economist at Icap, says: “Sweden’s policy is certainly very interesting. We will have to wait and see what happens there. This is certainly a very unusual policy, but these are very unusual times.”

Banks pay price for policySweden’s decision to introduce negative interest rates on deposits at the Riksbank means that commercial banks have to pay for the privilege of saving their money at the central bank.. The new rate of minus 0.25 per cent forces banks to pay 0.25 per cent to the Riksbank. Normally, banks would be paid interest on these deposits. It is thought to be the first time that negative rates have been introduced. Central banks usually shy away from such a drastic policy because it is in effect a tax or fine on the commercial banks and could hurt their balance sheets.

However, the Riksbank hopes that by charging banks for saving their money, rather than paying them, it will encourage them to increase their lending to individuals and businesses, boosting the economy. It also hopes that it might encourage them to divert the money into other assets, such as government bonds or even highly rated corporate bonds. This would bring down bond yields and act as an stimulant. In the UK, there have been signs that banks are switching cash into short- dated government bonds following hints from Mervyn King, Bank of England governor, that the policy could be introduced there.

Japan Deflation Deepens: Record CPI Drop and Jobless Rate

Japanese core consumer prices fell a record 2.2 percent in July from a year earlier, with weak demand playing a growing role in pushing the world's No. 2 economy deeper into deflation. And Japan's jobless rate rose to a record high 5.7 percent in July While last year's spike in energy costs continued to weigh on on-year comparisons in prices, an index stripping out both energy and food prices showed deflationary pressure was broadening.

The core-core inflation index, similar to the core index used in other developed countries, fell 0.9 percent in July from the same month a year ago after declining 0.7 percent in June. The drop in the core consumer price index, which excludes volatile fresh fruit, vegetable and seafood prices but includes those of oil products, matched a market forecast and was bigger than a 1.7 percent drop in June.

It was the third straight month of record falls in the index, and the biggest drop under calculation methods dating back to 1970. July also marked the fifth straight month of annual falls, the Ministry of Internal Affairs and Communications data showed on Friday. Core consumer prices in Tokyo, available a month before the nationwide data, fell a record 1.9 percent in August from a year earlier, more than a market forecast of a 1.8 percent decline.

Japan's economy returned to growth in the second quarter, pulling out of its longest recession since World War Two, but analysts warn of a rocky road ahead as the nascent recovery was based on short-term stimulus efforts around the world. Job availability in Japan sank to a record low, reinforcing views that it will take time for the job market to recover despite a pick-up in corporate activity. The seasonally adjusted unemployment rate rose to 5.7 percent from 5.4 percent in June and was above a median market forecast of 5.5 percent.

The jobs-to-applicants ratio slid to 0.42 from 0.43 the month before, meaning only about four jobs were available for every 10 applicants. It was the lowest reading since the data began in 1963 and fell short of a median market forecast of 0.43. The number of new job offers fell 23.4 percent in July from the same month last year but was flat from June, when new job offers rose on month for the first time in six months.

The Real Misery Index: State Of The Economy Remains Gloomy

Consumer confidence is on the rise and home prices have rebounded slightly, but things are still pretty miserable for millions of Americans, according to the latest update of Huffington Post's Real Misery Index.

The index for July 2009 was 29.2, a slight decrease from June's 29.9, the highest number in the 25 years analyzed by the Huffington Post. Compared to June, the rate of inflation declined slightly, with smaller year-over-year increases in prices for food and medical care. But that good news was offset by other factors such as a rise in food stamp recipients and continuing home equity delinquencies.

To formulate our index, which provides a better snapshot of the economy than the often-criticized misery index (inflation added to unemployment), we used a more accurate unemployment statistic (the U6 formulation), with the inflation rate for three essentials (food and beverages, gas, medical costs), and year-over-year percent changes in credit card delinquencies, housing prices, food stamp participation, and home equity loan deficiencies. We gave equal weight to the broad unemployment numbers and the combination of the other seven metrics (with housing prices having an inverse relationship to the index). Thus, we added the broad unemployment U6 statistic (note: the current U6 was first introduced in 1994 so we used a similar number - the U7 - for the years 1985-1993) to the average of the seven other statistics.

For the current update, we've included the index for every year going back to 1985, the last year for which all the statistics were available, in a chart and graph. At this stage in the recession, almost everyone is wondering if the economy has really hit bottom and whether the recovery has truly begun. Last week in a speech to other central bankers, Fed chair Ben Bernanke said "The economic recovery is likely to be relatively slow at first, with unemployment declining only gradually from high levels." And indeed, most indicators paint a bleak picture: Highest percent of foreclosures in three decades, slower-than-anticipated growth in GDP and the looming double-digit unemployment numbers.

One point of confusion is the recent rise in the Dow, despite the lingering economic malaise. Part of that is due to economic indicators meaning different things on Wall Street and Main Street. For example, rising unemployment may mean layoffs at companies that improve their bottom line. "Our markets can be ahead of the pace of the recovery," says Art Hogan, director of Global Equity Product at Jefferies & Co. investment bank. "You get a lot of head-scratching from commentators that the market keeps going up but news doesn't correspond to it. It's an order of magnitude. People are looking across the valley and seeing that things could get better." But for most Americans, the outlook remains gloomy and a vicious cycle continues - as more lose their jobs, more fail to keep up with mortgage payments and some fall into poverty, forced to take public assistance.

AIG stock up 264% in August

AIG's stock closed at $47.84 on Thursday. At the start of the month, shares were trading at a mere $13.14. What's going on here?

AIG's stock has nearly quadrupled in August, but the company is no closer to paying back the $80 billion it owes taxpayers. Investors got all wound up after the company announced in the past few weeks that it had appointed a new CEO and returned to profitability. Shares gained another 27% Thursday after The Wall Street Journal reported that new Chief Executive Robert Benmosche's $10.5 million pay package has been fast-tracked for approval by Obama administration "pay czar" Kenneth Feinberg.

AIG pressed for a quick decision on Benmosche's compensation, over concerns he might leave the company if it wasn't immediately approved, according to the report. The news actually came as little surprise, since AIG had previously announced that Feinberg gave the pay package a preliminary nod of approval. A spokeswoman for AIG said the company would not comment on the status of Benmosche's pay package or on the stock price.

Investors' excitement about AIG began to build on Aug. 3, when the company announced it would replace retiring Chief Executive Ed Liddy with Benmosche, the former MetLife CEO. Shares gained a modest 3.5%. The stock skyrocketed on Aug. 5, with shares soaring 63% on hints that the company would post its first quarterly profit since October 2007. On Aug. 7, when AIG announced it earned $1.8 billion in the second quarter, shares gained another 20.5%.

On Aug. 20, Benmosche said that he was optimistic the company would be able to pay back the more than $80 billion it owes the U.S. taxpayers and return to the company's former glory. Shares rocketed 21% higher that day. "People really like this guy Robert Benmosche, because he's really a salt-of-the-earth New York financial guy," said Damon Vickers, managing director of Nine Points Management & Research fund, which has bought up AIG's stock in recent days. "He looks like he's got the spirit to take on this situation and make the best of it."

Since the beginning of the month, shares of AIG (AIG, Fortune 500) are up 264%. The company held a 20-1 reverse stock split on June 30, when shares closed at $1.16. Vickers said AIG's stock has a chance to hit $60 in the near term and $100 in the coming months. He noted that after the stock split, AIG's all-time high stands at $1,400, so the stock has plenty of room to grow.

Since the government holds its 79.9% interest in AIG in preferred shares, taxpayers don't stand to gain from a steep rise in the company's common stock price. Instead, the preferred shares pay a dividend. But the dividends on the TARP part of the bailout -- $41.6 billion, or about half of its overall loan -- are "noncumulative." That means that the company can skip dividend payments without the obligation to make up the difference later.

And that's just what AIG did on Aug. 3, failing to declare its dividend payment to Treasury. Should AIG miss three more dividends, the government will have the right to nominate two more directors to the insurer's board. Despite Benmosche and investors' enthusiasm, AIG is still a very troubled company with a sizeable debt to repay to the government. The insurer has said it did not make enough profit to repay the taxpayers, and AIG said it won't likely be able to sustain a string of profitable quarters anyway, as it will take hefty restructuring charges for its looming core asset sales.

AIG plans on paying back the government by selling off pieces of the company. But those asset sales have been slow-going and sold at depressed values thus far, as credit remains tight. AIG has made just over $9 billion on those deals to date. As a result, AIG has agreed to spin off three huge chunks of its business, selling stakes in two of them to the Federal Reserve to reduce its loan by $25 billion. Before his retirement on Aug. 10, Liddy reiterated that the company would likely be able to repay the government in full in three to five years, which Benmosche echoed last week.

The company also has to deal with the ongoing distraction of hundreds of millions of dollars in bonuses that have still yet to be paid to employees of its troubled Financial Products unit. The company became the subject of a public uproar after the revelation in March that AIG paid $165 million in bonuses to employees of the division that nearly brought the company to its collapse. Still, traders like Vickers are undeterred. "As risky as AIG seems, it has the full backing of the U.S. government," he said. "Apparently you can take that to the bank. I'm comparing AIG to a U.S. Treasury, and I know it's insane, but it's nonetheless true."

Treasury Document Called AIG Investment 'Highly Speculative'

The U.S. Treasury said in a draft of a presentation that its $40 billion investment in the American International Group Inc. bailout was “highly speculative.” A slide with the phrase was included in documents obtained in a Freedom of Information Act request by Judicial Watch, a group that advocates government transparency. The sentence was omitted from another version of the slide in a presentation describing the November revision to AIG’s rescue in which the insurer got $40 billion from the Treasury. “The prospects of recovery of capital and a return on the equity investment to the taxpayer are highly speculative,” according to the first of the two Treasury slides.

Treasury Secretary Timothy Geithner told Congress in March that New York-based AIG, once the world’s largest insurer, was saved last year to prevent “catastrophic damage” to economic markets. The company still owes the Federal Reserve about $39 billion on a credit line after announcing more than $9 billion in asset sales. “Why do you take out the fact that we are taking on risks for the taxpayers that are both huge and highly uncertain?” said William Black, associate professor of economics and law at the University of Missouri-Kansas City and a former U.S. bank regulator. “The last thing you want to spread is a culture in which people aren’t being absolutely blunt.”

Andrew Williams, a spokesman for Treasury, said the document with the “highly speculative” phrase was a draft created by the previous administration. It isn’t clear who at Treasury created the slides, entitled “Investment Considerations,” and who the intended audience was. “We are confident that Treasury’s investment in AIG has helped strengthen the institution for the greater stability of the American economy and appreciate Chief Executive Officer Robert Benmosche’s commitment to the objective of repaying us in full,” Williams said, declining to comment further.

AIG stock surged this month after the insurer on Aug. 7 posted its first quarterly profit since 2007 and Benmosche, who replaced Edward Liddy as CEO, said Aug. 20 he expects to repay the U.S. The shares closed yesterday at $47.84 on the New York Stock Exchange, more than three times the July 31 price. “We believe we will be able to pay back the government and we hope we will be able to do something for our shareholders as well,” Benmosche said in a Bloomberg Television interview on Aug. 20. AIG will rebuild assets and won’t be pressured by regulators to sell businesses at unfavorable prices, he said in the interview.

The Treasury documents were turned over last month in response to a March FOIA request from Judicial Watch, according to Chris Farrell, director of investigations at the Washington- based organization. Christina Pretto, an AIG spokeswoman, declined to comment. “They incorporated the ‘highly speculative’ line onto that slide for a reason, and someone elected to have it removed,” said Farrell. “Both of those pieces of information let the reader draw conclusions about what went on at Treasury.” In the latest revision to AIG’s rescue in March, Treasury’s commitment swelled to as much as $70 billion, bringing the bailout package to $182.5 billion. That includes a $60 billion Federal Reserve credit line and $52.5 billion to buy mortgage- linked assets owned or backed by AIG.

AIG posted a $1.82 billion second-quarter profit on Aug. 7 on narrowing investment losses and a rebound in the value of some derivatives. The company also benefited from gains in hedge-fund holdings. The insurer has used proceeds from some asset sales to shore up its property-casualty operations rather than repay the U.S. The company retained $2.4 billion from the sale of auto insurer 21st Century to Zurich Financial Services AG and from the public offering of reinsurer Transatlantic Holdings Inc. to improve the “quality of capital” at its Chartis Inc. division.

AIG won access in November to the $40 billion Treasury investment. Geithner committed as much a $30 billion more in March when the company announced a record fourth-quarter loss. AIG said this month that it tapped $1.2 billion from the second facility to shore up its U.S. life insurance and retirement services operations. The funds helped the units maintain “solid” risk-based capital ratios, a measure of an insurer’s strength, AIG said. The insurer agreed in September to turn over a stake of almost 80 percent in exchange for the bailout. AIG said in November, when it announced the $40 billion investment, that Treasury would get preferred shares with a 10 percent coupon. The company said in March that Treasury’s investment would be modified to “more closely resemble common equity and improve AIG’s financial leverage.” AIG also won a lower interest rate on its credit line.

Goldman "Trading Huddles" Expose Fiction of Level Playing Field

Massachusetts Secretary of the Commonwealth William Galvin has subpoenaed Goldman Sachs for more information about its "trading huddles"--the internal meetings in which analysts produce near-term trading ideas that are given to the firm's proprietary traders and a select group of clients but not disseminated broadly. Galvin's concern? This is selective dissemination that benefits Goldman and its biggest clients and screws everyone else.

Our guest Susanne Craig broke the Goldman story for the Wall Street Journal that led to Galvin's investigation. She thinks Goldman's "huddle" practice raises several important questions, such as whether the select group of clients are being "tipped" about future ratings changes. If that is in fact what is happening--explicitly or implicitly--the practice should be investigated. But as a former Wall Street analyst, I think there is a much more important lesson here:

- It will never be a level playing field.

- The best clients of firms like Goldman Sachs will always get better information from the firm's traders and analysts than small investors. Big investors will always get better access to companies than small investors. Big investors will always be able to afford better research, better analysis, and better trading systems than small investors. (Just one example: The facial expression of a CEO when asked a tough question is often more revealing than a hundred-page SEC filing).

- By implying that the playing field should or can be level, regulators encourage small investors to think that it usually is. This is crazy. The sooner small investors learn that the better.

Barney Frank says Ron Paul Fed audit bill will pass

House Financial Services Chairman Rep. Barney Frank, Massachusetts Democrat, said he expects former GOP presidential candidate Ron Paul's legislation to audit the Fed to pass out of his committee in October as part of a larger regulatory package. Rep. Paul's, Texas Republican, bill if added to Mr. Frank's other proposed reforms could give a boost to a financial regulation package the Obama Administration wanted to pass last spring. The Fed bill has 282 co-sponsors, including every Republican member of the House and a considerable number of Democrats. The Senate's lead sponsor of the bill is Sen. Bernard Sanders, a Vermont independent and self-described socialist.

Today, the Government Accountability Office has no power to audit the Federal Reserve. Mr. Paul's bill would empower the government watchdog to do so and make their findings available to the public. Mr. Frank was asked at a town hall meeting when he would put the bill up for a vote in committee and after giving a lengthy explanation of current problems with the Federal Reserve Mr. Frank said he was working with Mr. Paul and that, "This will probably pass in October." Below is a complete transcript of Mr. Frank's remarks concerning the bill:"I have been pushing for more openness from the Fed. I want to restrict the powers of the Federal Reserve. First of all, the Fed will be the major losers of power if we are successful, as I believe we will be, setting up a financial product protection commission. The Federal Reserve is now charged with protecting consumers. They were supposed to do subprime mortgage restrictions.

Congress in 1994 gave the Fed powers to ban subprime mortgages. Alan Greenspan refused to do it. They had the power to ban credit card abuses. Under Greenspan they did nothing. Under Bernanke they started but only after Congress acted.That's one of the reasons why in the new consumer protection agency, we will take away from the Federal reserve the power to go consumer protection.

Secondly, they have has since 1932 a right under Herbert Hoover to intervene in the economy whenever they could. Last September, the Federal Reserve they were going to advance $82 billion to AIG. I was kind of surprised and said, 'Mr Bernanke do you have $82 billion?' Mr. Bernanke replied, 'I have $800 billion and under section 13.3 of the Federal Reserve Act they can lend anything they want.'

We are going to curtail that lending power. We are going to put some restrictions on it. Finally we will subject them to a complete audit. I have been working with Ron Paul, who is the main sponsor of that bill. He agrees that we don't want to have the audit appear as if influences monetary policy as that would be inflationary.

One of the things the audit will show you is what the Federal Reserve buys itself. And that will be made public, but not instantly because if it was made instantly people would be trading off it, so the data would be released after a time period of several months, enough time so it will not be market sensitive. This will probably pass in October."

Do campaign contributions help win pension fund deals?

More than two dozen firms that have surfaced in a broad corruption investigation of public pension funds gave at least $1.97 million in campaign contributions to officials with potential influence over the funds' investments, a USA TODAY analysis shows. The givers included private-equity giants such as the Blackstone Group, the Carlyle Group and the Quadrangle Group, the firm founded by Steven Rattner, who in July resigned as the White House point man for the auto industry rescue. The contributions are legal, and the firms haven't been accused of wrongdoing related to the giving.

The analysis of donations since 1998 showed the money flowed in 30 states to incumbents and candidates for governor, treasurer and other posts that influence billions of dollars in pension fund awards. Several of the firms won pension investment work after they, their executives or hired intermediaries gave contributions. The awards generate lucrative fees and lend prestige that could help lure new clients. Several states are investigating the awards after charges last spring in New York that a former pension fund official, a political adviser and others got millions of dollars for influencing investments by the state's pension fund. The Securities and Exchange Commission has filed parallel civil charges.

The probes come as pension funds have increasingly invested more of their $2.2 trillion in assets with private-equity firms and hedge funds as they seek returns that outpace the stock market. The interest has been reciprocated, as the private firms vie for the fees involved. The financial stakes have sometimes bred corruption. Kent Nelson, owner of a California investment business, pleaded guilty to devising a fraud scheme in a 2005 court case that accused him of paying a New Mexico official for state investment deals.

And in 2003, Charles Spadoni, the former vice president of a Boston investment firm, was convicted of racketeering, obstruction of justice and other charges in a case that accused him of agreeing to provide consulting deals to friends of Connecticut's treasurer in exchange for $200 million in pension fund awards. An appeals court overturned all but the obstruction conviction last year and ordered a new trial.

Conflicts of interest

Even in cases with no charges of illegality, watchdogs argue that the campaign contributions — known as pay-to-play — create conflicts of interest. "The selection of investment advisers to those plans shouldn't be based on campaign contributions. They should be based on the merits," said Mary Schapiro, chairwoman of the Securities and Exchange Commission, which she said is probing potential pay-to-play cases "in multiple states." The SEC in July proposed a rule that would disqualify firms from being awarded pension fund investments for two years after making campaign contributions over $250. Schapiro said the rule is crucial because pay-to-play practices harm pension fund beneficiaries by fostering "subpar advisory services at inflated prices."

New York Attorney General Andrew Cuomo, whose office began a now-two-year corruption investigation that has recently been expanded by other states, issued a code of conduct with similar restrictions earlier this year. The probes focus in part on charges that some firms met kickback demands by public officials or others in exchange for pension fund awards. Cuomo's investigation so far has produced two guilty pleas and criminal charges against four defendants.

The suspects include Hank Morris, a nationally known campaign strategist who was the top political adviser to former New York state comptroller Alan Hevesi, and David Loglisci, a former Hevesi aide at the nation's third-largest public pension fund. Both have pleaded not guilty. The probe also is examining private investment firms' hiring of placement agents, intermediaries who at times use political connections to help win pension fund business. Several funds have recently banned the practice. Cuomo said the alleged illegality and separate ethics issues uncovered in New York are part of "a nationwide problem."

Prominent givers

USA TODAY's analysis focused on private firms mentioned but not charged with wrongdoing in the pay-to-play cases filed by Cuomo and the SEC. The analysis, based on campaign financial disclosure data collected by the National Institute on Money in State Politics, found many contributions to pension officials in New York and elsewhere. Prominent givers included David Rubenstein, co-founder of the Carlyle Group. He contributed $48,000 since 2002 to Hevesi's election bids, records show.

Carlyle manages nearly $1.5 billion for the New York state pension fund and received about $38.6 million in management fees since the state's 2004 fiscal year, said Robert Whalen, a spokesman for Thomas DiNapoli, New York's current comptroller. Carlyle executives or employees also gave at least $114,375 to 18 pension fund officials or office seekers in 10 states since 1998, the campaign records show. Those donations included at least $28,750 in California, where records of the state's main pension fund, the nation's largest, show it has committed more than $4.1 billion to investments in 28 Carlyle funds since 1996.

Carlyle surfaced in the New York investigation via its energy-related joint venture with Riverstone Holdings, a smaller private-equity firm. In 2003, a Riverstone executive learned the venture could get a New York pension fund management deal by retaining Morris "as a finder," according to the SEC's court complaint. Carlyle agreed to the hiring even though it already "had its own in-house marketing operation and was spearheading the marketing efforts" for the joint venture, the SEC alleged. Although the Carlyle-Riverstone team had previously managed only one small energy fund, the joint venture got a $500 million pension fund investment after hiring Morris. He was paid $4.75 million in fees on the deal, according to the SEC complaint.

In a June agreement with Cuomo's office, Riverstone agreed to pay a $30 million settlement and end its use of placement agents in seeking pension fund work. In May, Carlyle agreed to pay $20 million and enact reforms to resolve its role in the New York case. The reforms included adoption of the Cuomo code of conduct, which bars investment firms from doing business with a pension fund for two years after making a campaign contribution to an official able to influence the fund's investment decisions.

Carlyle backed Cuomo's bid "to implement reforms that usher in a new era of transparency and accountability into the pension fund investment process." The firm said in a news release that it would file a lawsuit seeking $15 million in damages from Morris and the brokerage where he worked "for the harm" they caused Carlyle. Company spokesman Christopher Ullman declined to say whether the lawsuit has been filed. Commenting on the campaign donations, Ullman said, "These contributions were given by Carlyle employees on their own behalf and were properly disclosed to the public." The firm now has a $300 limit on contributions to state or local officials, said Ullman, who added that the giving must be pre-approved by Carlyle's compliance officer.

Blackstone contributions

Officials of the Blackstone Group have similarly contributed to pension fund incumbents and candidates. The firm's chairman is co-founder Stephen Schwarzman, a former Lehman Bros. executive. Co-founder Peter Peterson retired as Blackstone's senior chairman in 2008. Campaign finance records show Schwarzman; his wife, Christine; and Peterson gave a combined $30,000 to three candidates who ran in 2002 to succeed H. Carl McCall as state comptroller. Hevesi, the winner, got the most, $21,000. Separately, McCall received $25,000 from Christine Schwarzman for his unsuccessful bid for governor.

Blackstone has received about $1.74 billion in private equity- and real estate-related investments from the New York pension fund since 1993 and has been paid about $20 million in fees, said Whalen, the state comptroller's spokesman. The firm has not been accused in the New York investigation. Stephen Schwarzman gave $11,000 to Pennsylvania Gov. Edward Rendell's races in 2002 and 2006, campaign finance records show. Pennsylvania's governors by law appoint six of the state pension board's 11 members. Blackstone's relationship with the Pennsylvania pension fund dates to at least 1994 and includes more than $2.8 billion in private-equity, real estate, stock and other investments, a state summary shows. The deals have paid about $129 million in fees.

Blackstone declined to comment directly on the Pennsylvania contributions. Spokeswoman Christine Anderson said the firm adopted a policy more than three years ago that required Blackstone's general counsel to approve campaign giving. The policy "banned outright contributions to candidates for office with direct, day-to-day oversight" of public pension funds, Anderson said. As the New York investigation expanded this year, Anderson said Blackstone "proactively" tightened the policy to include governors and others in pension funds' command chains.

Tightening regulation

The Quadrangle Group is a global private investment firm founded by Rattner, a chief architect of the federal bailout of Chrysler and General Motors. In 2005, the firm sought an investment from the New Mexico State Investment Council, which manages the $12 billion state endowment created by oil, gas and natural resource extraction fees. The nine-member council, chaired by Gov. Bill Richardson, approved a $20 million Quadrangle investment in November 2005, state records show. The award has generated about $1 million in fees for Quadrangle so far, said council spokesman Charles Wollmann.

Rattner gave $5,000 to Richardson's election committee in 2002, campaign finance records show. Long known as a major Democratic fundraiser and contributor, Rattner gave an additional $15,000 to Richardson in 2006, the records show. The gifts didn't pose a conflict because Richardson didn't vote on the Quadrangle investment, Wollmann said. However, the panel in May approved a policy restricting campaign gifts by executives and others connected to firms that receive investments. It bans campaign gifts to elected and appointed officials serving or seeking posts "that may have influence over" the investment council and other state investment boards. The ban applies during the term of investment deals and for two years after. Had it been in effect then, it could have barred Rattner's 2006 contribution to Richardson. Quadrangle declined to comment.

The SEC pay-to-play proposal, unveiled July 22, would impose a two-year ban on pension fund awards to advisers that have given more than $250 in campaign contributions to any public official able to influence the fund's investments. The rule would cover donations to incumbents and challengers and would apply to investment executives, their firms and some employees. The proposal is similar to a never-enacted 1999 SEC plan. It would bar investment advisers from directing political action committees or intermediaries to make such contributions. It would also bar investment advisers from paying intermediaries to solicit pension fund investments and would prohibit indirect contributions.

The SEC is scheduled to set a final vote on the crackdown after a 60-day public comment period. "It's certainly an issue that we think, based on our enforcement experience, really deserves our attention," said Schapiro.

Do We Really Need Uncle Henry's Fantasy Finance Eggs?

by Les Leopold

- (Neighbor 1) "My Uncle Henry thinks he's a chicken."

- (Neighbor 2) "So why don't you have him institutionalized?

- (Neighbor 1) "We need the eggs."

Uncle Henry is still clucking away on Wall Street even though we know his imaginary financial eggs crashed the world financial system -- fantasy finance eggs that turned into trillions of dollars of financial toxic waste. To prevent the Great Depression II, we could not afford to institutionalize all the Uncle Henrys. In fact, we had to bail out their institutions with trillions of dollars of tax payer money.

Uncle Henry is still laying his imaginary eggs. Goldman Sachs, for example, recently announced it was selling synthetic CDOs again even though these are the most prone-to-disaster financial instruments ever created by Wall Street's financial engineers in the run up to the crash of 2008. (Of course, they are still unregulated.) Even more importantly, Uncle Henry wants to be paid in full for those eggs, just like he was paid before the crash, a time when everyone thought the eggs were golden.