Street haberdashery, New York City

Ilargi: There's a bad moon rising somewhere today. Not for the increasing numbers of people living in tent cities, they've been there and done it. All the happy talk passes them by. To get a home they need to find a job. But everyone agrees job losses will continue, even if the economy would really recover. If you don’t have a job, you ain't getting no home. And if you don’t have a home, you ain't getting a job. For many of the tent city dwellers, and the large numbers set to join them in the aftermath of mortgage resets, foreclosures and more job losses, that is their foreland.

There's a great piece of logic today in the Wall Street Journal that goes something like this: because so many people lost their jobs in the past 12-18 months, many more will find jobs. Or something. I kid you not. It's absolutely brilliant:

Pace of Job Losses Sets Stage for Quick Labor-Market Rebound

"But the biggest reason jobs might bounce back quicker from this downturn than the past two recessions, said Comerica Bank economist Dana Johnson, is that the economy looks likely to see a much bigger bounce as it recovers. Gross domestic product -- the value of all goods and services produced by the economy -- has fallen by 3.9% since economic output peaked last year, marking the steepest decline since the end of World War II. In contrast, the 2001 and 1990-91 recessions were among the shallowest on record.

History says that given the depth of the downturn, GDP should grow at a 6% to 8% rate over the next year..

Yes, history says so. That's one for the history books. Making up stuff like that must be highly satisfactory. It takes a lot of extra effort, of course, but you may well arrive at entirely new heights. And there'll always be people who believe you. I can't even say I'm sure I understand it. But it sure sounds pretty.

Still, I'm sticking with that bad moon. If we must have it, let's face it with honest minds. I don't take any pleasure in what's going to come under that moon, but neither do I long for any more empty promises and predictions.

Yes, stock markets have been going up. So what? That just means there's still money out there that's seeking a place to be. Or, more correctly, there was money out there when the rally started and now it's found a way to change hands. And when everybody and their pet parrot feels they need to get themselves a piece of the profits, that's when the lever for the false bottom is pulled. Tragic for many, but not exactly a unique event.

Consumers are still up to their necks in debt, the Obama administration requests permission to drag the nation deeper in, and companies across the industrial spectrum are hoarding cash as a buffer against what they fear will befall them once the bad moon starts rising. Namely, that they won't be able to pay back their debt. It's the same anguish that options trades are already acting on: a deep seated fear of September and October, a fear that is much less abstract and much more real than the childish green shoots mantra that has lifted markets in the first part of 2009.

We are at the tail end of a six month period of change we can believe in that hasn't changed much of anything, a period that will be remembered as one characterized primarily as an orgy of free money, free money for banks, for carbuyers and for homebuyers. We are soon to find out how free that money exactly has been. It may take another month, or two, it may take us into November even, if debt ceilings are raised and more stimulus plans full of free money are spread among the faithful flock.

But when the days shorten, when temperatures start dropping and that bad moon rises above a pale horizon, the time will loom for individuals, companies and governments to face their debts and make good on them. As governments from small to federal sink ever deeper into debt, while tax revenues sink into dark deep black holes, it'll be time for an increasing number among them to find themselves incapable of selling any more debt unless and until they pay off their old ones.

Which will lead to massive new job losses (Jefferson County last week laid off 2/3 of its workers), which will lead to more foreclosures, which will lead to more job losses. It will also lead to more bank failures, while the banks that are left standing will have no choice but to limit lending to a minimum, just in order to survive. Ironically, banks most often need that same lending business in order to survive. In order to make up for that lost business, many will put their money in what today seem to be solid investments, only to incur additional losses.

The appetite for risky investments that has greatly increased lately, driven largely by desperation over financial realities, will be the final straw for scores of individuals, governments and businesses. Double or nothing as the only way out will never work as a general principle. That is a reality that can only temporarily be hidden from view by what looks at first glance like free money. And then the bad moon will come to collect, and it won't appear so free anymore. Looks like we're in for nasty weather. One eye is taken for an eye.

I see the bad moon arising.

I see trouble on the way.

I see earthquakes and lightnin'.

I see bad times today.

Don't go around tonight,

Well, it's bound to take your life,

There's a bad moon on the rise.

I hear hurricanes a-blowing.

I know the end is coming soon.

I fear rivers overflowing.

I hear the voice of rage and ruin.

Hope you got your things together.

Hope you are quite prepared to die.

Looks like we're in for nasty weather.

One eye is taken for an eye.

Debt Burden to Weigh on Stocks

Economists are boosting growth forecasts. Employment numbers are improving. Manufacturing activity is bottoming. Housing demand is strengthening. Business leaders are starting to say the worst may be over.

Markets are celebrating, hoping the good news will keep on coming. But there is a smudge on the picture. A surprisingly large number of money managers and economists are warning that, despite the hopeful signs, the economy is still deep in the woods, not strong enough to support a long-running stock and bond recovery.

The Dow Jones Industrial Average now has jumped 43% from the 12-year low hit March 9. It finished Friday at 9370.07, its highest close since Nov. 4. Risky credit investments, such as junk bonds and even mortgage-backed securities, also have been recovering. "The question now is, 'Where do we go from here?' " John Osterweis, chief investment officer of Osterweis Capital Management, told clients in a recent report. "The simple answer is probably, 'Nowhere fast.' "According to this view, the market surge of the past five months has been a celebration of the government's success in staving off financial doom. Stocks deserved to rise from panic lows. To keep rising in the future, the market needs a sign of real economic recovery, and that requires a surge in consumer spending, business investment and home buying. That is what is in doubt, and one word explains why: debt. Despite an uptick in consumer saving, debt levels have only barely begun to come down. Even after the recession ends, economists expect the gradual reduction of the nation's massive consumer debt to take years. In the meantime, they are warning that the economic-growth surge expected for the second half of this year could be followed by slower growth and a softer stock market in 2010.

A survey of six leading Wall Street stock strategists, ordinarily a bullish bunch, shows them on average forecasting the Standard & Poor's 500-stock index at about 1033 by year's end. Their forecasts range from 930 to 1100. The S&P 500 finished Friday at 1010.48, already nearly at the average forecast. On Wednesday, in the wake of encouraging manufacturing and auto-sales data, economists at Goldman Sachs Group tripled their forecast for inflation-adjusted economic growth to a 3% annual rate for the second half of this year. And after that? They see the growth rate steadily declining to 2% in the first half of 2010 and 1.5% in the second half.

The debt data are striking. According to the Federal Reserve, total household indebtedness peaked at the end of 2007 at 132% of disposable income. That was by far the highest level since at least the end of World War II, nearly quadruple the 36% of 1952. By the end of March, with families boosting savings, repaying debt and defaulting, the ratio had fallen to 124%, a tad lower but still miles from the level of, say, 69% in the middle of 1985.

Consumer spending today accounts for two-thirds or more of economic output. But as they boost savings and cut borrowing, consumers can't be the drivers of economic growth that they were at the end of other recent recessions.

Consumer borrowing fell in June for the fifth consecutive month. The savings rate, which had fallen below zero in 2005 as a profligate nation spent more than it earned, was back to 6.9% of disposable income in May. It pulled back to 4.6% in June, but as people struggle to repay debt, many economists expect the savings rate gradually to return to the 7% to 10% range of the post-war years.

"Consumers are under significant financial pressure," Goldman notes in its report. "The weakness in household income -- partly resulting from the sharp slowdown in hourly wage growth -- will make it harder to raise saving without significant constraints on consumption." As for home building and capital spending, two other possible growth motors, "we do not expect a 'traditional' rebound in these sectors, largely because the overhang of unused capacity in both the housing and business sectors remains enormous," Goldman said.

Morgan Stanley, Goldman's big rival, is on pretty much the same page. "We believe that the painful adjustments to household and corporate balance sheets that are likely, given the excesses of the past, are enough to make the economic recovery a slow and tenuous one over the medium term," wrote Morgan Stanley economist Manoj Pradhan in a recent analysis. Nonsense! says Michael Darda, chief economist at brokerage firm MKM Partners in Greenwich, Conn., who bullishly and accurately predicted this year's huge rally in risky assets such as stocks and junk bonds."We continue to believe the consensus view of only 2% real [gross domestic product] growth for 2010 is far too tepid," Mr. Darda said in a recent report. He added, in another report, "The conventional wisdom has coalesced around the idea -- which goes virtually unchallenged -- that higher average savings on the part of households will ipso facto reduce the average rate of GDP growth during the impending recovery cycle." He says the pessimists once again are ignoring clear economic and financial signals, such as the continuing recovery in the corporate-bond market, which typically precede a recovery in stocks and in the economy. He thinks doubters soon will have still more egg on their faces. And he has been right so far.

In an effort to make sense of the increasingly intense disagreement, Bridgewater Associates, an often-contrarian money-management firm that oversees about $72 billion in nearby Westport, Conn., has recently sent clients a series of reports. Although the reports are complicated and detailed, their essence can be summarized simply. The optimists see signs that the recession is ending, and they forecast the normal next step: a stronger stock market. The pessimists believe the most important development isn't the end of the recession, it is the long process of debt reduction by families and businesses. Bridgewater lines up with the pessimists. It has been trying to avoid stocks tied to the U.S. economy in favor of those linked to the emerging economies of the developing world, notably China.

The bulls believe the economic and stock-market recoveries will continue to look like a V. The pessimists fear they will be more like a W -- or even a succession of W's. "And remember that the up-leg of a V and the first up of a W look the same when you are in them," says David Kotok, president of money-management firm Cumberland Advisors in Vineland, N.J. He is betting that the stock market will keep doing well for a while, and then will suffer as the economy sputters. "The U.S. is not out of the woods by a long shot," he says.

VIX Signals S&P 500 Swoon as September Approaches

Options traders are increasing bets that the steepest rally in the Standard & Poor’s 500 Index since the 1930s won’t survive September, historically the worst month for U.S. equities. Traders were betting the VIX, a gauge of expected stock swings, would increase 13 percent in the next five weeks, according to futures prices at the end of last week compiled by Bloomberg. That’s the biggest spread since August 2008, before the S&P 500 suffered the steepest two-month plunge in 21 years. The indexes have moved in the opposite direction 81 percent of the time over the past five years, Bloomberg data show.

VIX futures above the level of the index show investors expect fluctuations to widen and stocks to retreat. The S&P 500 has rallied 49 percent in five months, pushing valuations to the highest levels since December 2004. The S&P 500 gained 2.3 percent last week as reports showed home sales rose and the unemployment rate fell. "It’s a danger sign," said Ronald Egalka, a 36-year options trader who oversees $8 billion as chief executive officer of Rampart Investment Management in Boston. "People expect volatility to pick up in the future, and that implies that there’s going to be a downward movement in the market."

History shows that U.S. investors lose the most in September. The benchmark index for American equities fell 1.3 percent on average since 1928 that month, data compiled by Bloomberg show. The S&P 500 lost 0.3 percent to 1,007.10 at 4 p.m. in New York. Mark Mobius said global stocks will drop as much as 30 percent following their recovery from last year’s rout as companies take advantage of the rebound to sell more shares.

"When you have these rapid increases almost without correction, you will definitely have a correction," Mobius, who oversees about $25 billion as executive chairman of Templeton Asset Management Ltd., said in an interview in Kuala Lumpur today. "We can expect a lot of volatility." The S&P 500 plunged 9.1 percent last September after New York-based Lehman Brothers Holdings Inc. collapsed. The biggest drop occurred in September 1931 during the Great Depression, when the S&P 500 tumbled 30 percent. February is the only other month when stocks fell on average since 1928, losing 0.3 percent, Bloomberg data show.

The VIX, as the Chicago Board Options Exchange Volatility Index is known, usually moves in the opposite direction of the S&P 500 because demand for insurance rises as stocks fall. VIX futures expiring in September were 3.29 points higher than the index on Aug. 7, and last month were as much as 5.91 points higher, a record gap for so-called second-month contracts. Last week’s spread was comparable to the one in August 2008. The VIX added 0.9 percent to 24.99 today, while the September futures contract was unchanged at 28.05.

The index has averaged 20.22 over its 19-year history and surpassed 50 for the first time in October after Lehman filed for the biggest U.S. bankruptcy. Frozen credit markets and bank losses approaching $1 trillion tied to subprime loans pushed the measure to a record 89.53 on Oct. 24. Losses at the world’s biggest financial companies now exceed $1.5 trillion, according to Bloomberg data. Last week’s reading indicated a 68 percent likelihood the S&P 500 would fluctuate as much as 7.2 percent in the next 30 days, according to data compiled by Bloomberg.

"VIX futures are telling you that investors are willing to pay a premium for protection," said David Palmer, who helps oversee $300 million as volatility portfolio manager at Hudson Bay Capital Management LLC, a New York-based hedge fund that returned 11 percent last year, according to Absolute Return magazine. "People expect some sort of a break in the market."

Hedge funds lost an average 18.3 percent in 2008, according to Chicago-based Hedge Fund Research Inc. The S&P 500 declined 38 percent, the worst performance since 1937. Options strategists saw the same upward-sloping curve last August, before the S&P 500 tumbled 9.1 percent in September and 17 percent in October. VIX futures two months from expiration were 4.11 points higher than the VIX on Aug. 22, when the index slumped to an 11-week low of 18.81.

Volatility may be increasing for reasons unrelated to stock prices, according to Macro Risk Advisors LLC, a New York-based options brokerage. Traders who sold bullish options when the rally began on expectations the gain would fizzle may be buying them back now, Dean Curnutt, the firm’s president, wrote in a note. That demand could be artificially boosting the VIX.

U.S. companies are also beating analysts’ earnings estimates at an almost record rate, making investors more bullish, according to Rob Morgan, who helps oversee $6 billion as market strategist at Clermont Wealth Strategies in Lancaster, Pennsylvania. For the second quarter, 72.2 percent of S&P 500 companies surpassed consensus estimates for profit, just below the 72.3 percent ratio five years ago that was the highest since at least 1993, data compiled by Bloomberg show.

Investors still hold more than $3.6 trillion of their assets in money-market funds, equal to about 30 percent of the total market capitalization of U.S. companies, according to data compiled by the Washington-based Investment Company Institute and Bloomberg. That’s double the percentage when the S&P 500 reached its all-time high in October 2007, the data show.

The number of contracts to buy previously owned homes in the U.S. rose 3.6 percent in June, the fifth straight monthly increase and more than economists estimated, as lower prices and mortgage rates lured buyers, the National Association of Realtors said Aug. 4. The unemployment rate fell for the first time in more than a year, dipping to 9.4 percent from a 26-year high of 9.5 percent, the Labor Department said Aug. 7.

"There’s a good underpinning to the market here, and the VIX is just one tool in the toolbox," Morgan said. "Stocks follow earnings and revisions are going up and you also have a boatload of cash still sitting on the sidelines as the economy is turning." The S&P 500 will keep rallying this year as exports to expanding Asian economies help U.S. companies boost profits, David Bianco, the chief U.S. equity strategist at Bank of America Corp., wrote in a report today. Bianco said S&P 500 companies will earn $59 a share this year, tying him with Credit Suisse Group AG’s Andrew Garthwaite for the highest estimate among 11 strategists that Bloomberg tracks who have 2009 profit projections. Bianco is based in New York, while Garthwaite is in London.

Paul Tudor Jones, the hedge fund manager whose $8.9 billion Tudor BVI fund gained 10 percent this year through July, said he expects that global stocks may "pause in September" on slower Chinese economic growth. The advance since March is a "bear- market rally," Jones wrote in a report to clients last week. "We are not inclined to aggressively chase the market here." The S&P 500 traded for 18.6 times its companies’ average earnings this year at the end of last week, the highest since December 2004, according to data compiled by Bloomberg.

The first global recession since World War II may worsen as more Americans get thrown out of work and the benefits of government spending wear off, according to Martin Feldstein of Harvard University. "There is a real danger this is going to be a double dip and that after six months or so we’ll have some more bad news," Feldstein, the former head of the National Bureau of Economic Research, said on Bloomberg Television last month. "We could slide down again in the fourth quarter."

The U.S. economy contracted at a 1 percent annual pace in the second quarter, less than economists forecast, as government spending increased the most since 2003. The outlays, part of President Barack Obama’s $787 billion stimulus package approved in February, masked a 1.2 percent drop in consumer spending, which accounts for more than two-thirds of the economy.

Almost half of U.S. homeowners with a mortgage are likely to owe more than their properties are worth before the housing recession ends, Karen Weaver and Ying Shen, New York-based analysts at Deutsche Bank AG, wrote in a report dated Aug. 5. The percentage of "underwater" loans may rise to 48 percent, or 25 million homes, as prices drop through the first quarter of 2011, according to Frankfurt-based Deutsche Bank. As of March 31, the share of homes mortgaged for more than their value was 26 percent, or about 14 million properties.

Profit for companies in the S&P 500 will fall 22 percent this quarter before an earnings rebound by financial institutions spurs a 61 percent increase in the last three months of the year, according to analysts’ estimates. Excluding banks, brokerages and insurance companies, profits are projected to drop 8.6 percent in the fourth quarter. U.S. stock trading has also slowed by the most in at least two decades. An average of 1.34 billion shares changed hands daily on the New York Stock Exchange between May 1 and Aug. 7, about 16 percent less than the average from Jan. 1 to April 30.

That’s the biggest drop since at least 1989, according to data compiled by Harrison, New York-based research firm Bespoke Investment Group LLC. "There’s always a real risk that a rally is going to be tested," said Stephen Wood, New York-based chief market strategist for North America at Russell Investments, which had $151.8 billion in assets under management as of June 30. "Investors are thinking that giving up some upside to hedge the downside is a very reasonable investment profile."

Treasurers’ Fear of Next Credit Freeze Shown in Cash Hoarding

Two years after credit markets seized up and caused the worst financial crisis since the Great Depression, companies are hoarding the most cash in at least a decade. "Every action we take or contemplate taking is measured by its impact on our balance sheet and liquidity," Mark Jacobs, the chief executive officer of Houston-based RRI Energy Inc., told analysts and investors on Aug. 3. The company sold its Texas retail electricity business and the Reliant brand name in May, helping triple cash and equivalents from a year earlier to 18 percent of assets, according to data compiled by Bloomberg.

Even as government reports show that the first global recession since World War II may be easing, corporate treasurers are raising cash as fast as they can, wary of losing access to capital. Corporate defaults reached 10.7 percent worldwide in July, the highest since 1991, according to Moody’s Investors Service. Credit markets that started to freeze in August 2007, have now triggered more than $1.5 trillion in writedowns and losses at the world’s biggest financial institutions. Cash and short-term investments accounted for about $1.98 trillion, or 8.2 percent, of assets at the end of the second quarter for companies in the Standard & Poor’s 500 index, up from about $1.6 trillion, or 6.4 percent, a year earlier, Bloomberg data show. Cash reached a record $2 trillion in the first quarter, 8.3 percent of assets.

"Cash is king," said Paul Kasriel, the chief economist at Northern Trust Corp. in Chicago. "Businesses are in survival mode right now." While companies sold a record $837.9 billion of bonds this year and raised $109.8 billion in stock offerings, the increase in cash shows they are following the lead of consumers, who pushed the U.S. savings rate to a 14-year high of 6.2 percent in May. "There’s going to be a generational psychology shift as to how you and I and the rest of the world think about finance," said Jonathan Fine, a managing director on the investment-grade syndicate desk at Goldman Sachs Group Inc. in New York. "People will keep cash on hand so long as what happened in the last two years remains so visible in the rearview mirror."

General Electric Co., the world’s biggest maker of power- plant turbines, increased cash and short-term investments at the fastest pace in 14 years in the second quarter, to $97.5 billion, or 12.5 percent of assets, from $64.9 billion, or 7.7 percent, a year earlier, Bloomberg data show. The Fairfield, Connecticut-based company raised about $49 billion this year with unsecured and government-guaranteed debt through its GE Capital Corp. finance arm as CEO Jeffrey Immelt began boosting cash after the collapse of Lehman Brothers Holdings Inc. in September.

"We’ve done a lot of stress testing in terms of making sure we’ve got sufficient liquidity, sufficient cash," Kathryn Cassidy, GE’s treasurer, said in an interview. That wasn’t the thinking until defaults on subprime mortgages made to consumers with poor credit began accelerating in 2007, causing losses on securities backed by the loans. Concern that the contagion would spread led investors to rein in credit. The asset-backed commercial paper market contracted about 20 percent in five weeks from its peak in August 2007. Paris- based BNP Paribas SA said it halted withdrawals from three investment funds on Aug. 9 because France’s largest bank couldn’t "fairly" value their holdings. High-yield, high-risk companies such as Plainview, New York-based Aeroflex Inc., a maker of testing gear for the aerospace and defense industries, were forced to delay or cancel bond sales.

That month, the Federal Reserve, in a surprise move, cut the interest rate it charged banks. It would ultimately lower its target rate for overnight loans between banks to between zero and 0.25 percent from 5.25 percent.

As the financial crisis spread, New York-based Lehman Brothers, which was founded in 1850, filed for the biggest bankruptcy in U.S. history. The government bailed out American International Group Inc. and Citigroup Inc., while Bear Stearns Cos. and Merrill Lynch & Co. were acquired. The government assumed control of Fannie Mae and Freddie Mac, the nation’s two biggest mortgage-finance companies.

The collapse of so many financial giants worsened the credit freeze. Rates banks charged each other for three-month loans soared about fourfold to a record 4.63 percentage points more than Treasury bills of the same maturity on Oct. 10 from 1.17 percentage point a month earlier. Speculative-grade companies, those with ratings below Baa3 by Moody’s and BBB- at S&P, got shut out of the bond market as the extra yield investors demanded to own their debt soared to more than 20 percentage points above Treasuries, according to Merrill indexes. Before the markets collapsed, the spread was less than 3 percentage points.

"It’s been a road to hell," said Pat Freeman, treasurer of Calgary-based Agrium Inc., North America’s third-largest fertilizer producer. The company saw its shares tumble to as low as $23.31 from a high of $112.45 in June 2008. They closed at $49.12 last week. "You never know when the market might shut down on you." Unprecedented steps by the U.S. government and the Federal Reserve halted the slide as they spent, lent or committed $12.8 trillion to revive the economy, Bloomberg data show. Access to credit still remains limited for companies that need it the most. Defaults may rise to 12.2 percent worldwide in the fourth quarter, according to Moody’s. Commercial and industrial loans fell to $1.48 trillion at the end of July, down 11 percent from a peak of $1.65 trillion in October, Fed data show.

Yield spreads on junk bonds ended last week at 8.57 percentage points on average, Merrill data show. For investment- grade companies, the difference is 2.54 percentage points. While down a record 6.56 percentage points in December, it’s above the average 1.42 points this decade before the credit seizure. Even with the relatively high rates, U.S. corporate bond issuance in the first half rose 11 percent from the previous record pace in 2007, as businesses repaid short-term loans, Bloomberg data show. Stock sales were about double the same period of 2007.

"The days of excessive leverage are over," said Scott Minerd, who helps supervise more than $100 billion as chief investment officer of Guggenheim Partners LLC in Santa Monica, California. "Having term financing in place and not having yourself be vulnerable to a refinancing event is an important feature in every balance sheet." Signs the recession is easing may encourage companies to spend more cash, said Howard Silverblatt, a senior index analyst at S&P in New York. "Once they believe the economy is getting better and not just less worse, they’ll start spending," Silverblatt said.

The economy is showing signals of improving. Payrolls fell by 247,000 in July, after a 443,000 loss in June, the Labor Department said Aug. 7 in Washington. The jobless rate unexpectedly dropped to 9.4 percent from 9.5 percent. The recession may have ended in July, said Jeffrey Frankel, a member of the committee at the National Bureau of Economic Research that dates business cycles. The median estimate of 60 economists surveyed by Bloomberg is for growth of 2.10 percent in 2010, after a contraction of 2.50 percent this year.

"Confidence is improving but there are still a lot of people who are nervous," Ronald Millos, chief financial officer of Vancouver-based Teck Resources Ltd., Canada’s largest base- metals producer, said in an interview.

Teck eliminated its annual dividend last year, fired employees and reduced capital spending "to the bone" to bolster the confidence of lenders and investors, Millos said. The company sold $4.23 billion of notes in U.S. dollars in May at interest rates as high as 10.75 percent to retire short- term borrowing that funded last year’s purchase of Fording Canadian Coal Trust. When Teck issued $700 million of debt in 2005, it paid a coupon of 6.125 percent.

Pitney Bowes Inc., the world’s largest maker of postal meters, replaced commercial paper -- debt due in nine months or less -- with bonds after Lehman’s collapse reduced the availability of short-term financing. The company sold $300 million of 10-year, 6.25 percent bonds on March 2 at a spread of 3.38 percentage points. The average rate on 30-day commercial paper sold by non-financial companies ended last week at 0.15 percent, according to the Fed. "Our approach in general changed in the sense of giving ourselves a lot more event-risk protection," said Helen Shan, vice president and treasurer at Stamford, Connecticut-based Pitney Bowes.

RRI’s decision to sell its Texas energy provider freed up almost $3 billion of capital, Jacobs said. It also presented an opportunity for NRG Energy Inc., which snapped up the business for $288 million, said Robert Flexon, chief financial officer at the Princeton, New Jersey-based power producer. The purchase boosted NRG’s earnings by $233 million, according to a July 30 regulatory filing. "When you look back on the market over the last year, if you’re going to make a mistake, it’s to have too much liquidity," Flexon said in an interview. "In an environment like this, where liquidity is tight, the opportunities for investment are probably at their peak."

NRG had about 8.4 percent cash as a percentage of assets on its balance sheet in the second quarter, up from 4.9 percent the previous period and 4.7 percent a year earlier, Bloomberg data show. The company sold $700 million of 10-year, 8.5 percent notes on June 2 priced to yield 5.06 percentage points more than similar-maturity Treasuries. The last two years "really showed the importance of maintaining adequate cash and liquid investments so you’re not relying solely on banks," Flexon said. "We carry cash balances today of over $1 billion. We invest that primarily in U.S. government-backed overnight securities, so it’s an extremely liquid investment.

Corporate Earnings Are No Sign of Recovery

Despite grim predictions, most major U.S. companies have reported positive earnings for the second quarter of 2009. Given how wrong past predictions have been, the fact that earnings have blown away expectations shouldn’t be so surprising. Still, the numbers are genuinely impressive: More than 73% of the companies that have reported so far have beaten earnings estimates—and stocks have rightly rallied.

Yes, profits are down sharply from a year ago, but this is in the context of an overall global economy that is shrinking. If a company made $30 million on $100 million in revenue a year ago, and made "only" $20 million this quarter, it’s accurate to have a headline that says its profits fell 33%. But making $20 million, or a 20% margin, in an economy that contracted is nonetheless startling, or should be. The same Wall Street culture that failed to anticipate the tipping point in the financial system is just as prone to a herd mentality of negativity. Having overlooked the gaping fissures in the system last year, most analysts went to the other extreme in their analysis of what would happen this year. A similar process occurred in 2002 and 2003, as views whipsawed from unrealistic optimism to irrational pessimism.

This time, the slew of better earnings has also led to the conviction that the worst of the economic travails are behind us. As the stock market has soared, many have declared the recession either over or ending. These voices range from public officials at the Federal Reserve to notable pessimists such as New York University economist Nouriel Roubini. This rosy view assumes a connection between how listed companies are fairing and how the national economy will fair. That assumption is wrong.

The delinkage of the fate of corporate profits from that of the overall economy is not new. Beginning earlier in this decade, profits began to accelerate far in excess of either global or U.S. economic growth. In 2004, for instance, earnings for the S&P 500 grew 22%; in 2005 and 2006 they grew just under 20%. Those same years global growth barely exceeded 3%. As we now know, some of those elevated earnings were due to the leverage-fueled profits of the financial-service industry. And there’s little doubt that mortgage-laced derivatives artificially elevated growth. But even discounting those factors, the growth of corporate profits would have substantially exceeded the expansion of national economies.

Then, in the second half of last year and the first months of this year, profits plunged along with U.S. and global economic activity. That gave succor to the belief that companies can only grow as much as the economies in which they function grow. For years, most analysts argued that if there was too wide a variance between the two, something had to give. Either profits had to descend or national economic growth had to accelerate. As profits shrank over the past nine months, those who argued that a reversion to the mean was inevitable seemed to be vindicated. But that belief is wrong. Companies are increasingly less constrained by any national economy, and their success is no harbinger of national economic growth or sustained economic health for the United States.

First, companies have been profiting because they can cut costs aggressively. It’s not as if demand in the U.S. or Europe has picked up. Take Starbucks, which reported a surprising surge in profits. Little of that was due to American consumers suddenly becoming comfortable with $5 grande mocha lattes. Instead, it was because Starbucks—faced with weak demand and sluggish sales—closed stores and laid off workers. That has been a trend across industries.

Second, many larger companies have been profiting because they can focus on where the growth is around the globe. Companies such as Intel, Caterpillar, Microsoft and IBM now derive a majority of their revenues from outside the U.S., with the dynamic economies of the Asian rim and above all China assuming an ever-larger role. Companies are thriving in spite of economic activity in the U.S., not because of it.

That suggests the connection between corporate profits and robust economic recovery in the U.S. is tenuous at best. In fact, the financial crisis hastened the trend toward efficiencies, toward leaner inventories, and towards integrating both technology and global supply chains that has been taking place over the past decade. That has led to severe pressure on the American working class and eroding employment. As these companies profit from global expansion and greater efficiency, they have little or no reason to rehire fired workers, or to expand their work force in a U.S. that is barely growing. If you are a global company, you want to hire and expand where the most dynamic growth is. Unfortunately for Americans, that’s not the U.S.

So we are facing a conundrum: Companies can grow by leaps and bounds—by double-digits—and yet unemployment can skyrocket and remain high. There is nothing on the horizon that would lead one to expect a turnaround in the employment picture. Job losses slowed slightly last month as the unemployment rate fell to 9.4% in July from 9.5% in June, but that’s a far cry from any sign of job creation. The weight of more than 20 million marginally employed or unemployed, combined with the increasing pace of economic activity outside the U.S., presents the prospect of permanent change in the American economic landscape: high unemployment, moderate to weak growth, and soaring corporate profits.

The ability of companies—large ones especially, but even more modest ventures that assemble and source globally—to become more efficient and go where the growth is has never been greater. This is undoubtedly good for stocks and positive for investors, but it is also a challenge for American society that we have not even begun to confront.

History suggests bears will hold sway after rally

In the past five months, the world’s stock markets have gained more than 50 per cent. Anyone who timed the rally right should now be feeling much happier. Others may at least have recouped a chunk of last year’s losses. The big question now is: where next? This rally is not unprecedented but history offers few comparisons. Those that exist are all imperfect and contradict each other. But rallies in the last century stand out:

1930. In the wake of the Great Crash, the S&P 500 staged a rally a lot like this one. From its low on November 12 1929, it rallied 47.2 percent in five months. This fooled many. Anyone who bought at the top of the rally, on April 10 1930, would have lost 83 percent over the next two years. If there is a rally for the bears to cite in their cause, this is it.

1932. Marking the very bottom of the 1930s’ bear market and arguably the most impressive rally in stock market history, the S&P did twice as well as in this current rally, in half the time. It rose by 111 per cent in the 10 weeks from July 8. This time, the lows were never revisited. But the outlook was not good. After that violent upswing, just before the election of Franklin D Roosevelt, the bear market dragged on for decades, with gains only for opportunists. The S&P fell 25 percent once more by the end of 1932 and it would fall below its level of September 1932 in 1934 and again in 1938. This was not a great time to buy and hold.

1975. After the savage 1973-74 bear market, stocks enjoyed a 53.8 percent rally from October 12 1974 to July 15 1975. In one five-month span, it gained 47.1 percent. In hindsight, it looks like a cousin of the 1932 rally, as the rally gave way to a bear market that ground on for the rest of the decade. Stocks were no higher three years later. Profits were only for opportunists.

1982. With Paul Volcker at the Federal Reserve still attacking inflation, and Margaret Thatcher and Ronald Reagan applying unpopular economic medicine, the 15-year bear market suddenly ended. In the five months after August 12 1982, the S&P gained 43 percent, starting a secular bull market that lasted until the tech bubble burst 18 years later. August 1982 was possibly the best time ever to buy stocks; early 1983 was still a good time. This is the rally that bulls call to their aid. Those alarmed by the potential for fresh crises in emerging markets can even point out that this rally survived the first great Mexican devaluation crisis, which hit in the early weeks of the equity rally.

What did these rallies have in common? Pessimism had grown overwhelmingly, with fear far outbalancing greed when they started. Except for 1930, they came near the end of severe recessions. They have both points in common with the current rally. But there are differences. The rallies of 1932, 1975 and 1982 came when stocks were unambiguously cheap, and were still cheap after the initial 50 percent rally. The cyclically adjusted price/earnings ratio, a multiple of average earnings over 10 years, was at extreme lows. But in 1930, stocks never dropped to long-term fair value before rallying and were blatantly expensive by the time the rally ended. This time, prices fell a bit below their long-term average for a few months but the rally has already brought them back to look expensive.

In the critical sense of valuation, then, this rally looks nothing like 1932, 1975 or 1982. It looks a little more like 1930. The environment of inflation and interest rates differed widely. In 1930, western economies were lapsing into deflation; in 1932, the world was mired in deflation; in 1975, it was stuck in inflation; and in 1982, inflation was high but coming under control. The current picture does not fit with any of these - consumer price inflation in the west has been tame for decades. Last year’s crisis created the risk of severe deflation but the prompt decision by governments to throw money at the problem is a huge point of difference from 1930. Those who believe the deflationary scenario can logically forecast a repeat of the 1930 collapse in share prices. But this is a pessimistic point of view.

Parallels with 1982 do not work any better. The 1980s’ huge gains from steadily lowering rates and innovation in the financial sector are not available this time around. The very opposite is more likely. The 1932 rally came in truly extreme conditions. But the 1975 rally may be a decent match; it came during a restocking boom after companies had slashed inventories (very much what the market is betting on now), at a point when oil prices were volatile and exerting a big influence on the economy. The world now is still different in many important respects from 1975 but this may just be the best comparison. That would suggest the most likely outcome now is a protracted dose of directionless trading. For those more optimistic or pessimistic, you have your examples to hang on to.

Deleveraging the U.S. Economy

We are in the process of deleveraging the most leveraged economy in history. Many investors look at this deleveraging as a positive for the United States. We, on the other hand, look at this deleveraging as a major negative that will weigh on the economy for years to come and we could wind up with a lost couple of decades just as Japan experienced over the past 20 years. It is true that Japan didn't act as quickly as we did but our debt ratio presently is much worse than Japan's debt ratios throughout their deleveraging process.Presently, the stock market is exploding to the upside, which you could say argues against the case we are attempting to make in this special report. However, if you step back and look at the larger picture, you can see that the stock market is still down over 35% from the highs reached in 2007 and also down over 33% from the highs reached in early 2000. In fact, the market now is acting in the same manner as it did in early 2000 at the peak of the dot com bubble and again in 2006 & 2007 at the combined housing and stock market bubble.

This seems to us to be a "mini bubble" of stocks reacting to an abundance of "money printing" by governments all over the world since stocks are rising worldwide. Of course, if the U.S. doesn't recover there will be no worldwide recovery since the rest of the world is still dependent upon the U.S. consumers' appetite for their goods and services (despite the so called growth of domestic consumption in China and India). We, however, don't believe that the U.S. massive stimulus programs and money printing can solve a problem of excess debt generation that resulted from greed and living way beyond our means. If this were the answer Argentina would be one of the most prosperous countries in the world. This excess debt actually resulted from the same money printing and easy money that we are now using to alleviate the pain.

Most investors believe the bailouts, stimulus plans, and quantitative easing will lead to inflation. In fact, almost all of the bearish prognosticators are negative because of the fear that interest rates will rise once the inflation starts to work its way into the economy. They point to the doubling of the monetary base which they believe will soon lead to rising prices as more dollars are created chasing the same amount of goods. We, on the other hand, are not as concerned about the doubling of the monetary base because we believe the excess money will need the money multiplier and increases in velocity in order to increase aggregate demand and eventually inflation. As long as velocity (turnover of money) is stagnant we expect the increases in the monetary base and all the quantitative easing will lead to a stagnant economy and deflation until the consumer goes into the same borrowing and spending patterns that was characteristic of the 1990s through 2007.

Remember, over the past decade (when we believe the secular bear market started) the total debt in the U.S. doubled from $26 trillion in 2000 to just over $52 trillion presently (peaking a few months ago at $54 trillion). This consists of $14 trillion of gross Federal, State and Local Government debt and $38 trillion of private debt. We expect the private debt to continue declining in the future as the deleveraging of America unfolds, while the government debt will very likely explode to the upside as the government tries to slow down the private deleveraging by helping out the entities and individuals in the most trouble with debt (such as over-extended homeowners).

We wrote a special report in January of this year titled "Substituting Debt for Savings and Productive Investment" in which we explained why the U.S. economy historically prospered because of hard working Americans saving a substantial amount of their income which was used for productive investment. Unfortunately, all of this changed over the past few decades and got worse over the past decade. In fact, we stated in the report that it took $1.50 of debt to generate $1 of GDP in the 1960s, $1.70 to generate $1 of GDP in the '70s, $2.90 in the '80s, $3.20 in the '90s, and an unbelievable $5.40 of debt to generate $1 of GDP in the latest decade. Over the past two decades, while most investors thought this trend could continue indefinitely, we have been warning them of the catastrophic problems associated with this ballooning debt.

The attached chart of total debt relative to GDP shows exactly how much debt grew in this country relative to GDP (it is now 375% of GDP). The total debt grew to over $52 trillion relative to our current GDP of approximately $14 trillion. This is worse than the debt to GDP relationship in the great depression (even when the GDP imploded) and greater than the debt to GDP that existed in Japan in 1989. Even if you took the debt to GDP when the U.S. entered the secular bear market in early 2000 and compared that to 1929 and Japan in late 1989, our debt to GDP still exceeded both (by a substantial margin relative to 1929). The approximate numbers at that time were about 275% in the U.S. in early 2000, 190% in 1929, and about 270% in Japan in 1989.

In fact, the similarities between Japan's deleveraging and the U.S. presently are eerie. Japan's total debt to GDP increased from 270% when their secular bear market started to just about 350% 7 years later (1998) before declining to 110% presently. The U.S. increased their total debt to GDP from 275% of GDP when our secular bear market started (in our opinion) to 375% presently (10 years later), and we suspect the total debt to decline similar to Japan's even though the Japanese govenment debt tripled during their deleveraging. The government debt relative to GDP was about 50% in both the U.S. and Japan when the secular bear market started. We also suspect that our government debt will grow substantially just like it did in Japan as the private debt collapses. Also, the Japanese stock market doubled during the three years preceding their secular bear market in 1987, 1988, and 1989 while the U.S. market also doubled during the three years preceding the beginning of our secular bear market in 1997, 1998, and 1999.

There also a few significant differences between the U.S. and Japan. The private debt in Japan was almost the reverse of the U.S. where most of our excess debt was in the household sector and most of the excess debt in Japan was in the corporate sector. The debt to GDP figures in Japan were not easy to come by from the typical sources until the mid 1990s and had to be estimated, but should be pretty close to the numbers used above. Our sources on the above Japanese debt figures came from Ned Davis Research and the Federal Reserve Bank of San Francisco. NDR's report, "Japan's Lost Decade-- Is the U.S. Next?" have great statistics and information and the Fed's report "U.S. Household Deleveraging and Future Consumption Growth" is well worth reading.

The Fed study charted the peak of the debt related bubble of the stock and real estate assets in Japan in 1991 (1989 for stocks and 1991 for real estate) and overlaid it with the peak of U.S. debt associated with the same assets in 2008. They concluded that if we are able to liquidate our debt at the same rate as Japan we would have to increase our savings rate from the present 6% (artificially high due to the recent stimulus paid to households) today to around 10% in 2018. If U.S. households were to undertake a similar deleveraging, the collective debt-to-income ratio which peaked in 2008 at 133% (H/H debt vs. Disposable Personal Income) would need to drop to around 100% by 2018, returning to the level that prevailed in 2002.

If the savings rate in the U.S. were to rise to the 10% level by 2018 (following the Japanese experience), the SF Fed economists calculate that it would subtract ¾ of 1% from annual consumption growth each year. We did a weekly comment about this very subject on June 25 of this year and came to a similar conclusion. In that same report we showed that from 1955 to 1985 that consumption accounted for around 62% of GDP. Because of the debt driven consumption over the past few years at the end of March 2009 consumption accounted for over 70% of GDP. If the percentage dropped to the normal low 60% area of GDP it would subtract about $1 trillion off of consumption (or from $10 trillion to $9 trillion). We also showed in that same report that H/H debt averaged 55% of GDP over the past 55 years and was 64% as late as 1995. It has since soared to over 100% of GDP giving a big boost to spending that will be reversed as the deleveraging takes place over the next few years.

Other problems we have in the U.S. that will exacerbate the deleveraging are excess capacity, unemployment rates skyrocketing (putting a damper on wages), credit availability contracting, and dramatic declines in net worth. The attached chart of capacity utilization is self evident that excess capacity in the U.S. has just dropped to record lows with the manufacturing capacity dropping to under 65% and total capacity utilization is just a touch better at 68%. It is very hard to imagine corporations adding fixed investment at this time. With unemployment rates close to 10% and rising, it is unlikely that wages will grow anytime soon. The charts on credit availability and net worth reductions are self explanatory and will also put a damper on consumer spending rising anytime soon.

We expect that the U.S. deleveraging will follow along the path of Japan for years as real estate continues to decline and the deleveraging extracts a significant toll from any growth the economy might experience. We also expect that, just like Japan, the stock market will also be sluggish to down during the next few years as the most leveraged economy in history unwinds the debt.

Total Credit Market Debt as a % of GDP

H/H Debt relative to Disposable Income

Savings Rate

Personal Consumption vs. GDP

H/H Debt vs. GDP

Credit Conditions

Capacity Utilization

Net Worth

Cities Tolerate Homeless Camps

Last summer, police responding to complaints about campfires under a highway overpass found dozens of homeless people living on public land along the Cumberland River. Eviction notices went up -- and then were suspended by Nashville Mayor Karl Dean, a Democrat, who said housing for the homeless should be found first. A year later, little has been found -- and Nashville, with help from local nonprofits, is now servicing a tent city, arranging for portable toilets, trash pickup, a mobile medical van and visits from social workers. Volunteers bring in firewood for the camp's 60 or so dwellers.

Nashville is one of several U.S. cities that these days are accommodating the homeless and their encampments, instead of dispersing them. With local shelters at capacity, "there is no place to put them," said Clifton Harris, director of Nashville's Metropolitan Homeless Commission, says of tent-city dwellers. In Florida, Hillsborough County plans to consider a proposal Tuesday by Catholic Charities to run an emergency tent city in Tampa for more than 200 people. Dave Rogoff, the county health and services director, said he preferred to see a "hard roof over people's heads." But that takes real money, he said: "We're trying to cut $110 million out of next year's budget."

Ontario, a city of 175,000 residents about 40 miles east of Los Angeles, provides guards and basic city services for a tent city on public land. A church in Lacey, Wash., near the state capital of Olympia, recently started a homeless camp in its parking lot after the city changed local ordinances to permit it. The City Council in Ventura, Calif., last month revised its laws to permit sleeping in cars overnight in some areas. City Manager Rick Cole said most of the car campers are temporarily unemployed, "and in this economy, temporary can go on a long time."

After years of enforcing a tough anticamping law to break up homeless clusters, Sacramento recently formed a task force to look into designating homeless tracts because shelters are overflowing. One refuge in the California capital, St. John's Shelter for Women and Children, is turning away about 350 people a night, compared with 25 two years ago, said executive director Michele Steeb. Some communities may be "less inclined to crack down quite as hard on people" because of the recession, said Barry Lee, a professor of sociology and demography at Pennsylvania State University.

Municipal leniency isn't universal. New York City officials last month shut down a tent city on a vacant lot in East Harlem. It was erected partly as shelter and partly to campaign for more-affordable housing. Seattle authorities have repeatedly booted off public land a tent city that popped up last year. Anticipating Tuesday's vote on the homeless proposal in Tampa, hundreds of neighbors in a nearby 325-house subdivision have formed the "Stop Tent City" coalition. They are gathering petitions, passing out lawn signs and threatening lawsuits. Hal Hart, a paralegal and a neighbor who is part of the coalition, testified at the county meeting that a tent city would "devalue my home" and "devalue my community." He lives 300 feet from the proposed park.

Some homeless are battling mental illness or addictions, or both. Municipal officials in the U.S. acknowledge the tent cities can breed crime and unsanitary conditions, but with public shelter scarce, they say they have to weigh whether to spend police time to break up encampments that are likely to resurface elsewhere. Pastors in Champaign, Ill., last week asked the City Council to allow people to live in organized tent communities of as many as 50 people. Legalizing the camps is more compassionate and cost-effective than forcing "poor people who are camping because they have a lack of better choices to constantly have to fear being rousted and cited by police," says Joan Burke, advocacy director for Sacramento Loaves & Fishes, a homeless-assistance agency.

In Nashville, Mr. Harris, director of the city's homeless commission, said tent cities have existed for years, but he has seen the numbers surge. He now knows of 30 encampments. While some people are chronically homeless, he said, foreclosures have forced others into the streets, as has Tennessee's 10.8% unemployment rate, the highest in 25 years. Nashville estimates that on any given day, the city has 4,000 homeless people and 765 shelter beds. About 25% of the homeless have jobs, Mr. Harris said, but can't afford housing. A nonprofit coalition of 160 churches called Room in the Inn said it received 816 requests for financial assistance to ward off evictions or electricity shutoffs in July, up from 499 in July 2008.

More housing could be available soon. Tennessee will receive $53 million in federal stimulus money to help pay for the development of affordable rental housing across the state, the federal government announced last month. While no one is suggesting that the tent city that popped up on police radar last summer is a permanent solution, local churches and synagogues are trying to give residents there a sense of order. The Otter Creek Church of Christ built residents a shower, with a fiberglass stall, plywood door and garden hose, and on Friday, associate minister Doug Sanders went to the tent city in what is the start of a church project to help residents institute some type of formal rules -- for everything from cleaning the shower to determining the progress residents should have to show toward finding housing.

The city and local nonprofits have found permanent housing for about 25 people from the tent city. Many haven't been so lucky. David Olson, 47 years old, said last week he and his wife wound up under the Nashville overpass after he lost a job making cement pipes in Iowa four months ago. The couple came to Nashville for a remodeling job that turned out to be a scam. "I've got five years' experience in carpentry and 10 years' roofing and I can't find a job," he said.

Mr. Olson, his arms and shirt caked with dirt, said life is hard in the swampy woods. The couple woke up to mud after a night of rain. His wife said she is frightened by the dogs that roam around the encampment. As mosquitoes buzzed, they tried to set up camp on higher ground. They struggled to secure a tarpaulin over their tent to keep out the rain. Mr. Olson's wife, holding onto a pole to prop up the tarp, cried. "I'm not used to living like this."

Freddie Mac Says Its Loss From Taylor Bean May Be 'Significant'

Freddie Mac, the mortgage-finance company under government control being supported by taxpayers, said the collapse of lender Taylor, Bean & Whitaker Mortgage Corp. may cause it "significant" losses. Taylor Bean, the 12th-largest U.S. mortgage originator, shuttered its lending business last week after being suspended by U.S. agencies and Freddie Mac. The Federal Housing Administration cited possible financial-statement fraud.

The Ocala, Florida-based lender accounted for about 5.2 percent of Freddie Mac’s single-family mortgage purchases last year, according to a Securities and Exchange Commission filing by the McLean, Virginia-based company on Aug. 7. Freddie Mac can force lenders to repurchase defaulted loans that weren’t of the credit quality they represented, a use of its contracts already made harder by the collapses of IndyMac Bancorp., Washington Mutual Inc. and Lehman Brothers Holdings Inc., the company said.

"We are in the process of determining our total exposure to TBW in the event it cannot perform its contractual obligations to us," Freddie Mac said in the filing. "The amount of our losses in such event could be significant."

Lenders bought back $1.7 billion of home loans from Freddie Mac during the first six months of this year, up from $737 million during the same period of 2008, according to the filing. Lenders also can promise to cover Freddie Mac’s losses on bad mortgages without repurchasing the debt, the company said.

Also on Aug. 7, Freddie Mac, which has taken $50.7 billion of capital under a U.S. lifeline since being seized by regulators in September, reported its first profit in two years and said that it wouldn’t seek more U.S. Treasury aid.

Brad German, a Freddie Mac spokesman, declined to comment today. Brian Faith, a spokesman for Fannie Mae, Freddie Mac’s Washington-based rival, said last week his company hasn’t done business with Taylor Bean "for some time."

The Next Fannie Mae

Ginnie Mae and FHA are becoming $1 trillion subprime guarantors.

Much to their dismay, Americans learned last year that they "owned" Fannie Mae and Freddie Mac. Well, meet their cousin, Ginnie Mae or the Government National Mortgage Association, which will soon join them as a trillion-dollar packager of subprime mortgages. Taxpayers own Ginnie too. Only last week, Ginnie announced that it issued a monthly record of $43 billion in mortgage-backed securities in June. Ginnie Mae President Joseph Murin sounded almost giddy as he cheered this "phenomenal growth." Ginnie Mae’s mortgage exposure is expected to top $1 trillion by the end of next year—or far more than double the dollar amount of 2007. Earlier this summer, Reuters quoted Anthony Medici of the Housing Department’s Inspector General’s office as saying, "Who would have predicted that Ginnie Mae and Fannie Mae would have swapped positions" in loan volume?

Ginnie’s mission is to bundle, guarantee and then sell mortgages insured by the Federal Housing Administration, which is Uncle Sam’s home mortgage shop. Ginnie’s growth is a by-product of the FHA’s spectacular growth. The FHA now insures $560 billion of mortgages—quadruple the amount in 2006. Among the FHA, Ginnie, Fannie and Freddie, nearly nine of every 10 new mortgages in America now carry a federal taxpayer guarantee. Herein lies the problem. The FHA’s standard insurance program today is notoriously lax. It backs low downpayment loans, to buyers who often have below-average to poor credit ratings, and with almost no oversight to protect against fraud. Sound familiar? This is called subprime lending—the same financial roulette that busted Fannie, Freddie and large mortgage houses like Countrywide Financial.

On June 18, HUD’s Inspector General issued a scathing report on the FHA’s lax insurance practices. It found that the FHA’s default rate has grown to 7%, which is about double the level considered safe and sound for lenders, and that 13% of these loans are delinquent by more than 30 days. The FHA’s reserve fund was found to have fallen in half, to 3% from 6.4% in 2007—meaning it now has a 33 to 1 leverage ratio, which is into Bear Stearns territory. The IG says the FHA may need a "Congressional appropriation intervention to make up the shortfall."

The IG also fears that the recent "surge in FHA loans is likely to overtax the oversight resources of the FHA, making careful and comprehensive lender monitoring difficult." And it warned that the growth in FHA mortgage volume could make the program "vulnerable to exploitation by fraud schemes . . . that undercut the integrity of the program." The 19-page IG report includes a horror show of recent fraud cases. If housing values continue to slide and 10% of FHA loans end up in default, taxpayers will be on the hook for another $50 to $60 billion of mortgage losses.

Only last week, Taylor Bean, the FHA’s third largest mortgage originator in June with $17 billion in loans this year, announced it is terminating operations after the FHA barred the mortgage lender from participating in its insurance program. The feds alleged that Taylor Bean had "misrepresented" its relationship with an auditor and had "irregular transactions that raised concerns of fraud."

Is anyone on Capitol Hill or the White House paying attention? Evidently not, because on both sides of Pennsylvania Avenue policy makers are busy giving the FHA even more business while easing its already loosy-goosy underwriting standards. A few weeks ago a House committee approved legislation to keep the FHA’s loan limit in high-income states like California at $729,750. We wonder how many first-time home buyers purchase a $725,000 home. The Members must have missed the IG’s warning that higher loan limits may mean "much greater losses by FHA" and will make fraudsters "much more attracted to the product."

In the wake of the mortgage meltdown, most private lenders have reverted to the traditional down payment rule of 10% or 20%. Housing experts agree that a high down payment is the best protection against default and foreclosure because it means the owner has something to lose by walking away. Meanwhile, at the FHA, the down payment requirement remains a mere 3.5%. Other policies—such as allowing the buyer to finance closing costs and use the homebuyer tax credit to cover costs—can drive the down payment to below 2%.

Then there is the booming refinancing program that Congress has approved to move into the FHA hundreds of thousands of borrowers who can’t pay their mortgage, including many with subprime and other exotic loans. HUD just announced that starting this week the FHA will refinance troubled mortgages by reducing up to 30% of the principal under the Home Affordable Modification Program. This program is intended to reduce foreclosures, but someone has to pick up the multibillion-dollar cost of the 30% loan forgiveness. That will be taxpayers.

In some cases, these owners are so overdue in their payments, and housing prices have fallen so dramatically, that the borrowers have a negative 25% equity in the home and they are still eligible for an FHA refi. We also know from other government and private loan modification programs that a borrower who has defaulted on the mortgage once is at very high risk (25%-50%) of defaulting again.

All of which means that the FHA and Ginnie Mae could well be the next Fannie and Freddie. While Fan and Fred carried "implicit" federal guarantees, the FHA and Ginnie carry the explicit full faith and credit of the U.S. government.

We’ve long argued that Congress has a fiduciary duty to secure the safety and soundness of FHA through common sense reforms. Eliminate the 100% guarantee on FHA loans, so lenders have a greater financial incentive to insure the soundness of the loan; adopt the private sector convention of a 10% down payment, which would reduce foreclosures; and stop putting subprime loans that should have never been made in the first place on the federal balance sheet. The housing lobby, which gets rich off FHA insurance, has long blocked these due-diligence reforms, saying there’s no threat to taxpayers. That’s what they also said about Fan and Fred—$400 billion ago.

Lawmakers Urged to Raise Nation's Debt Limit

U.S. lawmakers, already under pressure to move controversial health-care legislation and a revamp of the financial system, were saddled Friday with the unpopular task of quickly increasing the maximum amount of money the federal government can borrow. Treasury Secretary Timothy Geithner, in a letter to sent to top U.S. lawmakers on Friday, asked Congress to move "as soon as possible" to increase the nation's statutory debt limit. The Treasury estimates that the $12.1 trillion current limit could be reached as soon as mid-October, Mr. Geithner wrote.

"It is critically important that Congress act before the limit is reached so that citizens and investors here and around the world can remain confident that the United States will always meet its obligations," Mr. Geithner said in the letter. A spokesman for Senate Majority Leader Harry Reid (D., Nev.) said Senate Democratic leaders would work with the Treasury Department on debt limit legislation, but that they have yet to decide on a final form for the measure.

One issue that will need to be decided is how much of an increase is needed. Mr. Geithner didn't offer a specific figure in his letter to lawmakers. A Treasury official said Monday that the debt increase is due to the deterioration in the economy and not necessarily attributable to spending on stimulus programs or the bailout of the financial system. "The president has made it clear that as soon as recovery is firmly established we will bring our fiscal deficit down to a level that is sustainable in the long term," the official said.

The request highlights the difficulty facing the Obama administration and Congress as they take on an ambitious legislative agenda while also seeking to improve the nation's fiscal position amidst a still-troubled economy. The non-partisan Congressional Budget Office said last week that the federal government's budget deficit is on track to reach a record high of $1.8 trillion for fiscal 2009, after reaching $1.3 trillion through the first ten months of the fiscal year.

If Congress agrees to the Treasury's request it would mark the second increase in the debt ceiling this year. The economic stimulus package passed by Congress earlier this year increased the debt ceiling by $789 billion to $12.1 trillion. As of Aug. 7, the federal debt outstanding totaled roughly $11.7 trillion. Congressional Republicans appear ready to use a vote on whether to raise the debt ceiling to contrast their approach on economic issues with Democrats and argue that the Obama administration's agenda on health care and climate change would further exacerbate the country's fiscal challenges.

"It's a clear that we've got a sign that we've got a federal government that is out of control from the fiscal standpoint," said Rep. Tom Price (R., Ga.), who leads the conservative Republican Study Committee in the House. "I don't see how anyone can vote in favor of an increase in the debt ceiling and say they're doing it is a responsible way." Robert Bixby, executive director of budget watchdog the Concord Coalition, said the debt ceiling has little practical application in curtailing government spending. "You can't not raise it, because if you do, the Treasury in effect would be defaulting on the debt, which would be crazy," Mr. Bixby said. "It doesn't really provide a whole lot of restraint."

Other deficit reduction advocates say that that the proposed increase in the debt ceiling provides an opportunity for Congress and the president to address the country's long-term fiscal challenges. Maya MacGuineas, president of the Committee for a Responsible Federal Budget, in an interview said "the time is now" for lawmakers to tackle [the] issue. "If we were doing this right, it would be tied to a requirement that Congress and the president work together to put some kind of budget deal out there," Ms. MacGuineas said.

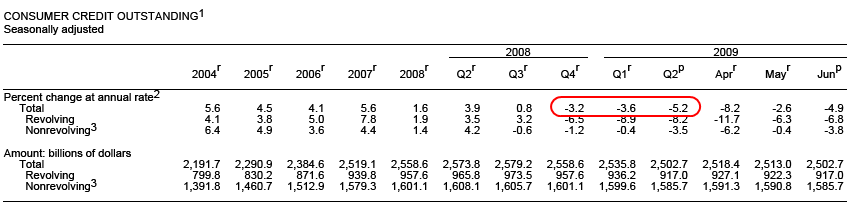

The End of the Peak Credit Era: 3 Quarters of Contracting Consumer Debt. Credit Card debt Contracts on a Year over Year Basis for First Time Ever

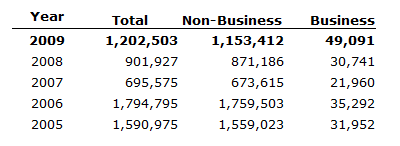

There is a small silver lining in the unemployment report released on Friday. The positive side was the amount of people being fired slowed down in July (if you can call an annual rate of 3 million layoffs positive). However, there is still a major reluctance for firms to hire. We still have 26,000,000 unemployed and underemployed Americans in the country. Many have been relying on the plastic support of credit cards to ease the pain of the deep recession. Yet many are finding out that they are unable to have access to the once abundant lines of credit. It may be the case that we have witnessed peak consumer debt.Even though some 8 million credit cards were yanked earlier in the year, many consumers are simply embracing a more frugal lifestyle. The contraction is occurring from both sides in that consumers are being more watchful on what they spend while lenders are actually vetting more carefully who they give credit to. The latest consumer credit report from the Federal Reserve shows that the trend in less consumption is still going strong:

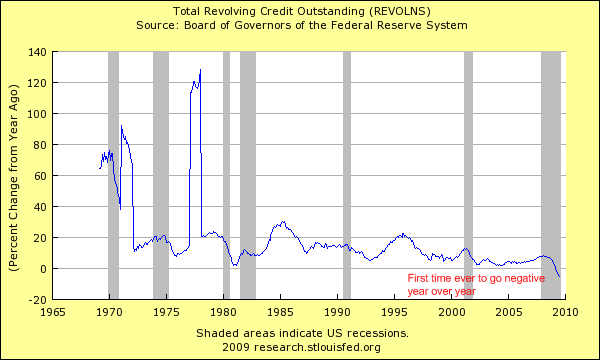

This is now the third consecutive quarter of credit contracting. Keep in mind this is debt that is already used up. These were purchases of flat screen televisions, food, vacations, and many items that have already been used up. The lines of credit are being pulled back at the same time. Credit card companies are hiking up minimum payments and charging higher rates to make up for the rising amount of defaults occurring in the country and they are also squeezing their prime credit borrowers. The last option may be counterproductive in the long-term. Now you might look at this contraction and think that it is no big deal. It is an enormous deal. This is the first time on record that consumer debt has contracted on a year over year basis:

Some 40 years of data and not once has consumer debt pulled back on an annual basis. It is a rather fascinating phenomenon when you pause to contemplate the massive unrelenting growth in debt over the past four decades. Americans are now having to deal with less access to cheap debt. And that is probably an important caveat to note. The days of 0 percent credit cards and no money down loans for homes are probably long gone. We see that Fannie Mae has posted a loss of over $10 billion for the second quarter and these are the more “safer” loans in the market. With unemployment this high, many people were using their credit card as a bridge loan to get through this tough patch of time.

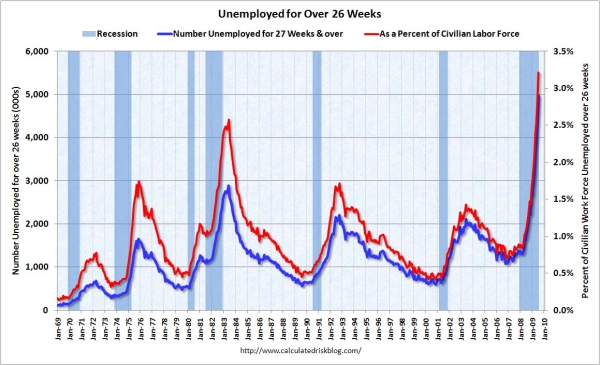

Much of the drain that is occurring is also because we have never seen so many people unemployed for such a long time:

*Source: Calculated Risk

This is a troubling sign and has also increased the amount of bankruptcies that we are seeing. Peak debt was bound to happen at some point in time. The massive 30 year housing bubble was simply unsustainable. Spending more than you earn will eventually catch up with you. The U.S. Treasury and Federal Reserve are focused on saving the banks and Wall Street and the rest of Americans will need to fend for themselves. You would think with all this new found liquidity that banks would somehow pass it on to the average consumer. Unfortunately that is the line they sold to the public to get the bailouts passed. Remember all that talk about credit being the lifeblood of the economy? Apparently not since companies are chopping back credit for regular consumers. What was pushed through was essentially last minute expensive measures to ensure the banking syndicate remained in place. The bailouts were to fix their balance sheets. Now with taxpayer money in hand, they are squeezing the vice around the actual taxpayer that has saved them from failing. It is really a perverse system when you think about.

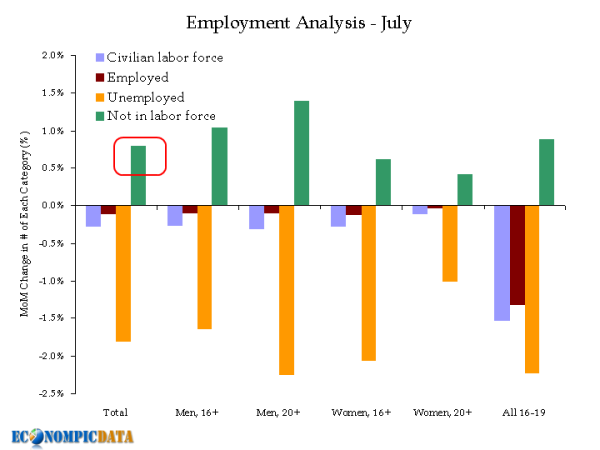

The average credit card rate has all shot up during this time when liquidity was being made abundant to 14.43 percent. With rising unemployment, this is still a major problem. You might be asking why did the unemployment rate drop to 9.4% when 247,000 people lost their job last month. Simply put, people left the labor force:

*Source: Econompicdata

And with this combined, it shouldn’t come as a surprise that even with tougher bankruptcy regulations, more people are filing for bankruptcy:

Although it is better news that the layoff number wasn’t so grim, the fact that many left the labor force and companies are not hiring should cause you to pause as to what really constitutes a recovery. The peak credit era is over and we will need to remake our economy into a completely different machine.

Where did that bank bailout go? Watchdogs aren't sure

Although hundreds of well-trained eyes are watching over the $700 billion that Congress last year decided to spend bailing out the nation's financial sector, it's still difficult to answer some of the most basic questions about where the money went.

Despite a new oversight panel, a new special inspector general, the existing Government Accountability Office and eight other inspectors general, those charged with minding the store say they don't have all the weapons they need. Ten months into the Troubled Asset Relief Program, some members of Congress say that some oversight of bailout dollars has been so lacking that it's essentially worthless."TARP has become a program in which taxpayers are not being told what most of the TARP recipients are doing with their money, have still not been told how much their substantial investments are worth, and will not be told the full details of how their money is being invested," a special inspector general over the program reported last month. The "very credibility" of the program is at stake, it said.

Access and openness have improved in recent months, watchdogs say, but the program still has a way to go before it's truly transparent.

For its part, the Treasury Department said it's fully committed to transparency, and that it's taken unprecedented steps to report the status of TARP to the public. It regularly posts information on which banks have received money, as well as details about each of those transactions. Further, Treasury said, it doesn't agree with all of its watchdogs' recommendations, which it said could hamper the program's effectiveness.

TARP was passed in the midst of last fall's financial meltdown as a way to keep American banks from falling deeper into the abyss.

The program was controversial from the start. Its supporters say it's helped spark bank lending in the country, but critics say it's unfairly rewarded the big banks and Wall Street firms that pushed the economy to the brink.

The program also has undergone a major transformation. When the Bush administration first went to Congress for the money, TARP's main purpose was to buy up hundreds of billions of dollars in bad mortgages and so-called mortgage-backed securities that were bought and sold on Wall Street.

Today, TARP consists of 12 programs that sent those hundreds of billions of dollars to big banks, but it's also bailed out auto companies, auto suppliers, individuals delinquent on their mortgages, small businesses and American International Group, the big insurance company.

The watchdogs now must oversee the maze that TARP has become.

Just because a lot of people are watching, however, doesn't mean they get everything they want to see.