Somewhere in California. "Motherless migrant children. They work in the cotton."

Ilargi: Shanghai stocks are taking a whoopin’. China's exports are down 23% from a year ago. Direct foreign investment in the country decreased by 35.7% over that same timeframe. Much of the downside has been papered over so far in 2009 by massive amounts of government stimulus and government-ordered lending by the banking system. But those sorts of policies are extremely costly and it looks like they may have already seen their peak. To wit: bank lending in China was down 77% from June to July.

And sure, it is -even- easier for Beijing to nationalize banks then it is for the Oval Office. However, those banks have a longstanding reputation for carrying far too many bad loans on their books, and very few people outside of the Forbidden City would believe that the giant lending wave of the first half of this year was based on substantially sounder principles. In fact, it's far more likely that the 77% decline is due to the highest leaders ordering a halt to -much- more of the same.

The question is justified, therefore, where China can go from here. It needs an estimated 8% growth rate in its GDP just to prevent unemployment from rising. Beijing keeps proudly announcing just such a number, which seems implausible in the face of plummeting exports But even if it is just a little bit true, it can only be for the same reason the US has managed to keep its GDP from tumbling double-digit wise.

That is, by assuming debt. By pumping money, one way or another, into companies that would otherwise fail. By creating and maintaining jobs that provide no realistic contributions to the economy. China has done it for half a year. Now the lending frenzy has been stopped short. So once more, the question is: where can China go from here?

In the end and down the line, Beijing's and Washington's policies are based on the same underlying assumptions, the same hopes and the same faith. The return of growth and the resumption of trade. And both face the same dire consequences if growth and trade don't make a come-back, soon. Like all the other countries, just about every single one, that refuse to prepare for the possibility that trade and growth won't be back, at least for a long time.

And that is not just some remote possibility. no matter how desperate the denials are. These days, all of a sudden, people all over are waking up to the option of deflation. Many don't yet seem to understand what it is, or what it will mean once it grabs a hold of an economy, as evidenced by a Bloomberg pundit, among others, singing the praises of deflation.

For them, it means prices will come down, and that seems a good thing. What they don't see is that what deflation really means is they won't have a penny left in their pockets to buy any of the cheaper goods. Over the past 20 months or so we've had a first glance at the effects of contracting credit, and the job losses and foreclosures it has caused. Deflation will be just like that, only many times faster and stronger, a credit crunch on crack.

Though they're generally not recognized as such, and denied where they are, the first steps of deflation are very much already here, the signs are everywhere. And there's no reason to presume that it will be gentler on China than it will be on the US or any other country.

Deflation or Inflation?

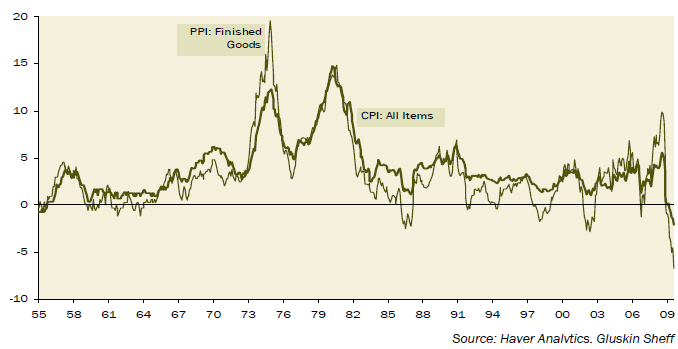

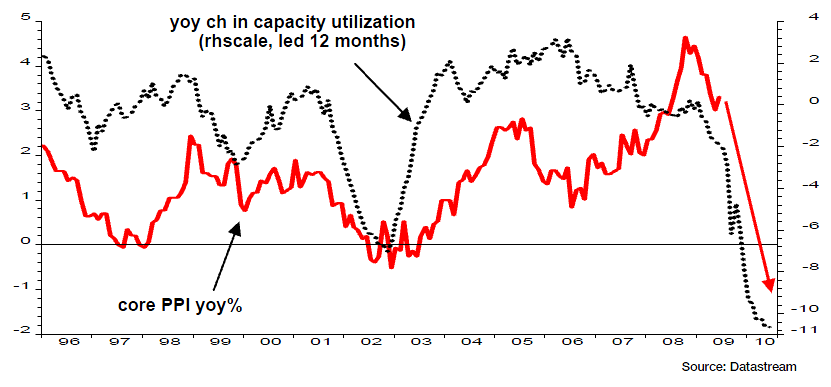

The one question I seem to get more than any is on (Hyper) Inflation versus Deflation. As previously noted, we clearly are in a Deflationary party of the cycle now.While inflation may occur ion the future, and the possibility exists for Hyper-Inflation, these are merely potential issues down the road. As these two charts show, we now have Deflation, are likely to see it continue for some time into the future:

>

Near Record Deflation Rates At All Levels

>

US capacity utilization leads core inflation by about a year

Chart source: Albert Edwards, Society General

More Evidence of Deflation

The Bureau of Labour Statistics released data Tuesday morning that confirms my previous premise that deflation is indeed active in the economy and accelerating. From the BLS:From July 2008 to July 2009, prices for finished goods fell 6.8 percent, the index for intermediate goods decreased 15.1 percent, and crude goods prices dropped 44.8 percent, all of which are record 12 month declines.

- The consumer price index is down 2.1% year over year.

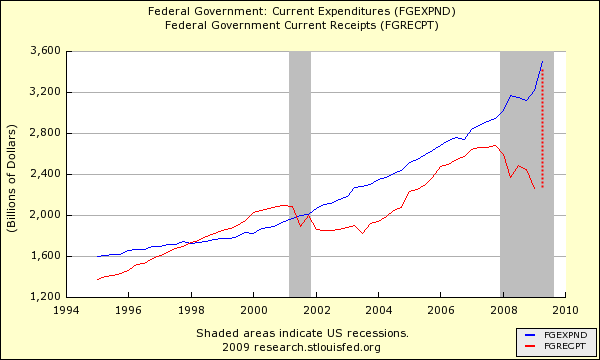

- The Federal Government current receipts are down negative 10+%; the rate of fall has not been this great in almost 60 years.

- Federal tax receipts on corporate income is down 40+% year over year; not since 1930 has the collapse been this great.

- State and local government sales tax receipts are negative for the first time since the beginning of World War II.

- Corporate profits after tax have experienced the most severe collapse in history.

- Net corporate dividends again have an historic collapse.

- Compensation of employees wages and salaries accruals - go back to 1949 to find the same level!

- Personal income is negative 2.5%, as is disposable personal income year over year.

- Personal consumption expenditures continue to dive off the cliff, as does personal consumption for durable goods.

- Total personal consumption expenditures is negative for the first time in modern history!

- Final sales to domestic purchasers, negative for the first time in modern history!

- Final sales of domestic products is, you guessed it, negative for the first time in modern history.

- Personal savings rate continues to skyrocket, now approaching $600 billion, as the general populace continues to deleverage at a feverish pace.

Now, speaking just for myself, I DO NOT see any indication of inflation being present in the above statistics and facts. What I do see is the start of a wage/price deflation spiral.

Hello, Deflation

Yes, inflation will eventually be a problem, when the economy or stagflation ignites and Bernanke waits too long to peel off the stimulus for fear of triggering a 1937-like relapse.But now the problem is the opposite: Deflation.

Check out the Producer Price Index, courtesy of Asha Bangalore at Northern Trust:

On a year-to-year basis, the PPI was down 6.8% in July, the largest drop on record. The price index for intermediate goods decreased 15.1% and the crude goods prices dropped 44.8%, both of which are also record 12-month declines.

The core PPI of finished goods, which excludes food and energy, edged down 0.1%, putting the year-to-year gain at 2.6%. The highlights of price declines of core items includes lower prices for cars and light trucks. The intermediate and crude goods prices fell 0.2% and 4.5%, respectively, in July. The core intermediate and crude goods prices moved up in July. The main take away from this report is that the threat of deflation at the wholesale level is valid.

Is Deflation Winning the Economic War?

This remains one of the hottest topics among the pundits. We saw another little bull move in the markets yesterday as the DOW rallied closing up 83 points. Futures are down after HP's earnings which met expectations. Despite yesterday's little rally, I still believe that sentiment is slowly changing back to doom and gloom. Investors are tired of hearing about earnings beats that were basically achieved as a result of companies slashing costs. Investors now want real growth!

Less bad is no longer cutting it anymore because the markets have moved up 50% from the lows. In order for the markets to continue and rally, earnings and top line revenue growth must start growing. If they don't, stocks are going to start to look highly overvalued because they got way ahead of themselves after a 50% relief rally based on nothing. Let's get real here: We all know there is ZERO chance for sustainable growth because the consumer remains suffocated in debt. There is no reason to believe that an economic recovery is coming anytime soon.

Signs of economic destruction are everywhere. Commercial real estate, job losses, housing foreclosures, underfunded pensions, massive state deficits, massive USA deficits... Need I go on? Whats been startling to me lately is the price destruction that's starting to pop up everywhere around me. I see it in restaurants, housing, and consumer products(I still can't believe I paid $360 for a computer the other day). What I am starting to wonder is this: Is the government starting to lose its battle versus deflation? The chart below says yes:

My Take: As you can see above, we are seeing the largest bout of deflation in our economy since WWII. Seeing inflation below zero is a rare occurrence in the history of this nation folks. What we need to be concerned about given the most recent data is a Japanese style deflationary collapse. I have discussed this subject many times before. The powerful deflationary forces that we are currently witnessing have to make you wonder if the Fed might be starting to lose the war with deflation.

My biggest fear here is how the Fed reacts to the obvious signs that deflation is beginning to overwhelm the economy. Do they react by doing something reckless like devalue the dollar in a desperate attempt to inflate their way out of this? Let's hope they aren't that stupid. As you can see in the chart above, the last deflationary death spiral seen in the US was The Great Depression. It was a long and painful 10 years before WWII came along and pulled us out of it. If the war hadn't created millions of new jobs who knows how long this could have lasted. Japan STILL hasn't recovered from their deflationary death spiral and that began about 30 years ago! Their stock market peaked at around 38,000. It now sits at 10,000 today.

The Bottom Line: The Fed is praying for inflation but so far its not happening folks. If these trends continue, your investment strategy should be refocused on shorts and hoarding as many US dollars as you can. I still plan on holding my metals because I am worried that the Fed might be stupid enough to destroy our currency in an attempt to stave off deflation.

The jury is still out, but a deflationary depression could very well be in the cards.

Canada Annual Consumer Prices Fall Most Since 1953

Canada’s consumer prices last month fell the most since 1953 on an annual basis, giving the Bank of Canada scope to honor its commitment to keep the benchmark lending rate unchanged at a record low. The consumer price index fell 0.9 percent in July from a year earlier, its second consecutive decline on lower gasoline prices, and was down 0.3 percent from the previous month, Statistics Canada said today. Economists surveyed by Bloomberg expected a 0.8 percent decline from a year ago and a 0.2 percent drop from June, based on the median of 23 estimates.

The Bank of Canada cut its rate to 0.25 percent in April and said it would leave it there through June 2010 because of spare capacity in the economy and a weak inflation outlook. Falling prices may now give policy makers ammunition to hold off on rate increases even after the conditional commitment expires in June, said Derek Holt, an economist at Scotia Capital in Toronto. "The risk is that the Bank of Canada is on hold longer than the market is expecting," Holt said. "It shows enough broader-base weakness in pricing power to put the hawks at bay." The bank runs monetary policy with the goal of keeping inflation at 2 percent annually.

The Canadian currency, nicknamed the loonie, weakened 0.7 percent to C$1.1092 per U.S. dollar at 9:22 a.m. in Toronto, from C$1.1011 yesterday. One Canadian dollar buys 90.16 U.S. cents. The yield on the bankers’ acceptance contract due in June 2010 fell 9 basis points to 0.95 percent today on the Montreal Exchange, indicating investors are paring bets that interest rates will rise. There are 100 basis points in a percentage point. Most economists surveyed by Bloomberg expect the Bank of Canada to start to raise its lending rate in the third quarter of next year. The bank’s next announcement date is on Sept. 10.

The bank projected in July that the consumer price index will fall at an annual pace of 0.7 percent during the third quarter of this year, and that inflation will not return to the bank’s 2 percent target before the second quarter of 2011. The annual inflation rate excluding gasoline and seven other volatile items -- the so-called core rate that the central bank watches closely -- decelerated to 1.8 percent from 1.9 percent in June. The median forecast by economists was that the rate would stay at 1.9 percent. Core prices were unchanged on a monthly basis, compared with economists’ forecast of a 0.1 percent rise.

July’s annual decline in the overall index was led by lower transportation costs, mainly a 28 percent drop in gasoline prices and lower prices for cars, Statistics Canada said. Falling prices for fuel oil and natural gas, along with a drop in homeowner’s replacement costs, led to a 2 percent annual decline in shelter costs, which account for 27 percent of the consumer basket. The 0.9 percent decline was the largest drop since the index fell 1.4 percent in July 1953, the Ottawa-based statistics agency said. Food prices were up 5 percent in July from a year earlier, the statistics agency said.

German Producer Prices Drop at Steepest Rate Since 1949

Germany's producer prices fell 1.5% in July from the previous month, and 7.8% in annual terms, the sharpest yearly decline since 1949, German statistics agency Destatis said Wednesday. Both declines were steeper than anticipated by the market. According to a survey by Dow Jones Newswires, analysts had expected prices to ease just 0.2% in July from June, and to drop 6.6% from a year earlier. Excluding energy, producer prices declined 0.2% from the previous month and 3.6% on a yearly basis, the statistics office said.

"Even excluding some oddities in energy prices, the trend in non-energy prices is weak," said Dominic Bryant, economist at BNP Paribas in London, adding that the 3.6% fall is the fastest year-to-year pace of decline going back to at least the early 1960s. Economists expect the downward pressure on prices to remain, although it will ease. "Overall, the figures are a reminder that, while activity data is looking a little more upbeat, the German economy is operating with a large excess of capacity, which will put downward pressure on prices for a prolonged period," said Mr. Bryant.

UniCredit economist Andreas Rees said that, given very low inventories, companies are virtually "forced" to work off the incoming orders flow rapidly. "Accordingly, the price pressure will ease regardless of which direction the oil price will go," he said. "We think that both in terms of producer and consumer prices, the yearly rates hit their trough in July 2009," he added.

Germany braces for second wave of credit crunch

Germany's economics ministry is drawing up a raft of special measures with the Bundesbank to head off a fresh financial crisis, fearing that a loan squeeze by struggling banks will set off a serious credit crunch early next year. "The most difficult phase for financing is going to be in the first and second quarter of 2010," said Hartmut Schauerte, the economic state secretary. "We are working as a government to create instruments that can offset a feared credit crunch or any credit squeeze in sectors of the economy," he said. Mr Schauerte said firms with weak balance sheets may struggle to roll over loans as they come due in coming months. Negotiations with banks could prove "very difficult".

State support is likely to be concentrated on boosting the capital base of German firms and providing credit insurance for exporters, perhaps to the tune of €250bn to €300bn (£256bn). "If this service fails, we are going to see dozens of credit collapses," he said. Axel Weber, Bundesbank chief and a key figure at the European Central Bank, said over the weekend that the economy remained fragile fundamental problems in the credit system had not been resolved. "I must warn that it is too early to talk about the end of the financial crisis. Unemployment is going to rise as 'Kurzarbeit' expires, and that could hurt consumption," he said, referring to the state scheme that subsidises firms to keep idle workers on their books.

German politicians have tended to blame the credit crisis on excesses in the US, which exported toxic debt to incompetent Landesbanken through collateralised debt obligations (CDOs) and other exotica of the sub-prime era. But Mr Weber said German has a home-grown problem of its own that has yet to manifest itself. "The first round of disruption in the bank balance sheets from structured credit products is behind us. Now we are threatened by stress from our domestic credit industry through the rise in the insolvency of firms and households," he told the Suddeutsche Zeitung "All the banks, even the biggest, must strengthen their defences. They need higher capital buffers, greater liquidity cushions, and better risk management."

While Mr Weber said Germany was resilient enough to withstand another shock, his comments are a surprise. The Bundesbank has in the past played down suggestions of an incipient credit crunch, despite warnings from the German banking association and the Mittelstand core of engineering and exporting companies. The revelation that key government agencies are drawing up relief plans overshadowed news that the ZEW index of financial confidence has soared to the highest level in three years. The headline index jumped from +39.5 to +56.1, although it is unclear whether this gauge tells us anything that cannot be gleaned from the ups and downs of the DAX index of Frankfurt stocks. The ZEW jumped the gun by signalling recovery much too early during the dotcom bust in 2002.

The latest surge reflects the general mood of optimism in the markets and the rebound in industrial production. The problem for Germany is that car scrappage schemes and pent-up orders for German goods built up during the freeze in global trade finance over the Winter may have disguised the underlying weakness of the economy. Unemployment is expected to rise by another million to 4.5m by late next year.

Hans Redeker, currency chief at BNP Paribas, said the credit contraction was eclipsing recovery in Europe's bond market. "At the end of the day, there is not going to be any durable recovery until we see a revival in credit," he said.

Euro-zone trade surplus increased in June

The 16 countries that use the euro posted their biggest trade surplus in two years in June, but levels of trade remained low compared with last year. The euro zone's nonseasonally adjusted trade surplus widened to €4.6 billion ($6.5 billion) in June from a surplus of €2.1 billion in May, according to data released Monday by Eurostat, the European Union's statistics agency. That is the largest surplus since the €6.7 billion trade gap in June 2007. Economists were expecting a €3.5 billion surplus, according to a survey last week. May's surplus was revised up from the €1.9 billion reported last month.

Ben May of Capital Economics said the data suggested trade may have added a full percentage point to second-quarter gross domestic product. "While the latest trade figures do suggest that the worst of the downturn is over, there is little evidence that exports are set for a robust pickup," he said in a note. "With a significant near-term improvement in domestic demand unlikely, it is too soon to conclude that the region is about to embark on a sustained recovery."The data showed that trade remains substantially weaker than last year after the credit crisis plunged the economies in the euro zone and many of its trading partners into their deepest recessions since World War II. Euro-zone exports were €106.1 billion in June, down 22% from June 2008, while imports came to €101.5 billion, a 26% drop. Trade did, however, pick up from May, when the euro zone had €98.6 billion in exports and €96.5 billion in imports. Trade among the 16 euro-zone member states grew to €111.3 billion in June from €101.2 billion in May, but remained 20% lower than a year earlier.

Seasonally adjusted figures showed euro-zone exports totaled €101.5 billion in June, their lowest level since July 2005, while imports were unchanged from May at €100.5 billion, the weakest level since June 2005. For the first half, the euro zone posted a trade deficit of €1.6 billion, compared with a deficit of €13.3 billion over the first six months of 2008. Exports were 23% weaker than last year, while imports fell 24%. The euro zone's trade surplus with the U.K., its biggest export market, was narrower in the first five months of the year than for the year-earlier period, as exports fell 27% and imports dropped 29%. The surplus with the U.S. shrank by more than half, as exports in January to May were 21% weaker than the 2008 period, while imports fell only 9%.

The Highest P/E Ever!

Chart Of The Day observes that we've broken another record...

Why shouldn't we panic? Because the reason the PE is so high is that earnings are near a cyclical low. This chart actually illustrates why it's silly to use P/E ratios based on a single year of earnings--because they can be wildly misleading.

On normalized earnings, stocks are about 10%-15% overvalued (see Robert Shiller's chart below). That's a far cry from the record overvaluation shown in the chart above.

Of course, just because we're not at a record normalized PE doesn't mean the market won't crash.

China Stocks Slump, Briefly Enter Bear Market on Loan Concern

China’s stocks tumbled, briefly driving the benchmark index into a so-called bear market, on concern economic growth will falter as banks rein in lending. The Shanghai Composite Index lost 4.3 percent to 2,785.58, as Citic Securities Co., the nation’s biggest brokerage, slumped 7.8 percent and China Vanke Co., the largest developer by market value, fell 5.6 percent. The gauge has slumped 19.8 percent since Aug. 4, after more than doubling from November, as China rolled out a 4 trillion yuan ($585 billion) stimulus package. A plunge in new bank loans in July, disappointing earnings and concern the government will seek to damp property speculation has sapped confidence, driving losses close to the 20 percent threshold for a bear market.

"It’s irrational selling that has shattered market confidence," said Larry Wan, Shanghai-based deputy chief investment officer at KBC-Goldstate Fund Management Co., which oversees about $583 million in assets. "Some mutual funds have been reducing their stock holdings as they are pessimistic about the economic outlook." China Everbright Securities Co., which had the smallest first-day gain of any new stock in Shanghai this year, slumped by the 10 percent daily limit today. About 10 stocks fell for each that rose on the benchmark index.

"It’s scary," Xu Xuehong, a 64-year-old retired worker in Shanghai who had about 300,000 yuan invested in shares, said in an interview at a branch of Shenyin & Wanguo Securities Co. "The decline is too rapid; I am not going to make new investments." The market slump follows the lifting in June of a nine- month moratorium on initial shares sales that triggered about $1 billion worth of IPOs by eight companies including China Everbright, China State Construction Engineering Corp. and Sichuan Expressway Co.

The Shanghai index, the world’s best-performing major market from Jan. 1 to Aug. 4, remains 59 percent below its record level on Oct. 16, 2007. Of the so-called BRIC group of emerging economies that includes India and Brazil, only Russia is in a bear market. Chinese stocks are "extremely frothy" and investors should have an "underweight" position in the country’s shares, said Devan Kaloo, who oversees $11.5 billion as head of global emerging markets at Aberdeen Asset Management Ltd. "I’m worried about a correction in a market that has been driven by cheap money," said Kaloo, whose Aberdeen Emerging Markets Fund has beaten 98 percent of peers this year.

A slump in China’s July lending to less than a quarter of June’s level and disappointing earnings from companies including Yunnan Copper Industry Co. have weighed on shares. "The current correction is reflecting the tightening in lending," said Andy Xie, a former Asian chief economist at Morgan Stanley, who correctly predicted in April 2007 that China’s equities would tumble. "We’ve seen the peak of this market cycle."

An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months of this year, China Business News reported on June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council, China’s Cabinet. The market may fall a further 10 percent, Xie said Aug. 17. The Shanghai index is trading at 30.3 times reported earnings, against 17.5 times for shares on the MSCI Emerging Markets Index, and remains 53 percent higher than at the start of this year.

The economy expanded 7.9 percent in the second quarter from a year earlier, rebounding from the weakest growth in almost a decade. Still, exports last month fell 23 percent from a year earlier, while urban fixed-asset investment and industrial output both expanded less than economist estimates. China Construction Bank Corp. President Zhang Jianguo said that the nation’s second-largest bank will cut new lending by about 70 percent in the second half to avert a surge in bad debt. "We noticed that some loans didn’t go into the real economy," Zhang, 54, said in an Aug. 6 interview. "I feel that some industries are expanding too rapidly. For example, housing prices are rising too fast."

Real estate developers led today’s decline, with the China Se Shang’s Property Index falling 7.5 percent. China Vanke fell 5.6 percent to 11 yuan. Poly Real Estate Group Co., the second- biggest, dropped 5.6 percent to 23.76 yuan. "The Chinese market is very trend-oriented because there are many individual investors," said Philippe Zhang, chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $220 million. "It can rally very quickly and go down strongly as well." Maanshan Iron & Steel Co. fell 7.5 percent, the most in nine months, after posting a first-half net loss. Jiangxi Copper Co., China’s biggest producer of the metal, lost 8.4 percent as the metal slumped to its lowest in more than two weeks.

Everbright Securities tumbled by the maximum after yesterday advancing 30 percent on its debut. The first-day gain for the Shanghai-based brokerage trailed the average 109 percent of the seven other companies to list shares in China since the moratorium on IPOs ended. "The rally is over," Wu Ruiling, a 70-year-old retired teacher in Shanghai, said at the Shenyin & Wanguo branch. "All we heard is funds are exiting the market as the government tightens bank loans. If I sell, I will have big losses." The Hang Seng China Enterprises Index, which measures Hong Kong-listed shares of Chinese companies, dropped 1.6 percent today to 11,260.83.

The China Bubble’s Coming — But Not the One You Think

Financial commentators are obsessively debating whether the recent rise in the Chinese stock market means there’s a bubble — and if so, when it’s going to burst. My take? Who cares! What happens to the broader Chinese economy is what we should really be watching. It will have a far-reaching impact on the rest of the world — much more far-reaching than a decline in stocks.

Despite everything, the Chinese economy has shown incredible resilience recently. Although its biggest customers — the United States and Europe — are struggling (to say the least) and its exports are down more than 20 percent, China is still spitting out economic growth numbers as if there weren’t a worry in the world. The most recent estimate put annual growth at nearly 8 percent. Is the Chinese economy operating in a different economic reality? Will it continue to grow, no matter what the global economy is doing?

The answer to both questions is no. China’s fortunes over the past decade are reminiscent of Lucent Technologies in the 1990s. Lucent sold computer equipment to dot-coms. At first, its growth was natural, the result of selling goods to traditional, cash-generating companies. After opportunities with cash-generating customers dried out, it moved to start-ups — and its growth became slightly artificial. These dot-coms were able to buy Lucent’s equipment only by raising money through private equity and equity markets, since their business models didn’t factor in the necessity of cash-flow generation.

Funds to buy Lucent’s equipment quickly dried up, and its growth should have decelerated or declined. Instead, Lucent offered its own financing to dot-coms by borrowing and lending money on the cheap to finance the purchase of its own equipment. This worked well enough, until it came time to pay back the loans. The United States, of course, isn’t a dot-com. But a great portion of its growth came from borrowing Chinese money to buy Chinese goods, which means that Chinese growth was dependent on that very same borrowing.

Now the United States and the rest of the world is retrenching, corporations are slashing their spending, and consumers are closing their pocket books. This means that the consumption of Chinese goods is on the decline. And this is where the dot-com analogy breaks down. Unlike Lucent, China has nuclear weapons. It can print money at will and can simply order its banks to lend. It is a communist command economy, after all. Lucent is now a $2 stock. China won’t go down that easily.

The Chinese central bank has a significant advantage over the U.S. Federal Reserve. Chairman Ben Bernanke and his cohort may print a lot of money (and they did), but there’s almost nothing they can do to speed the velocity of money. They simply cannot force banks to lend without nationalizing them (and only the government-sponsored enterprises have been nationalized). They also cannot force corporations and consumers to spend. Since China isn’t a democracy, it doesn’t suffer these problems.

China’s communist government owns a large part of the money-creation and money-spending apparatus. Money supply therefore shot up 28.5 percent in June. Since it controls the banks, it can force them to lend, which it has also done.

Finally, China can force government-owned corporate entities to borrow and spend, and spend quickly itself. This isn’t some slow-moving, touchy-feely democracy. If the Chinese government decides to build a highway, it simply draws a straight line on the map. Any obstacle — like a hospital, a school, or a Politburo member’s house — can become a casualty of the greater good. (Okay — maybe not the Politburo member’s house).

Although China can’t control consumer spending, the consumer is a comparatively small part of its economy. Plus, currency control diminishes the consumer’s buying power. All of this makes the United States’ TARP plans look like child’s play. If China wants to stimulate the economy, it does so — and fast. That’s why the country is producing such robust economic numbers.

Why is China doing this? It doesn’t have the kind of social safety net one sees in the developed world, so it needs to keep its economy going at any cost. Millions of people have migrated to its cities, and now they’re hungry and unemployed. People without food or work tend to riot. To keep that from happening, the government is more than willing to artificially stimulate the economy, in the hopes of buying time until the global system stabilizes. It’s literally forcing banks to lend — which will create a huge pile of horrible loans on top of the ones they’ve originated over the last decade.

But don’t confuse fast growth with sustainable growth. Much of China’s growth over the past decade has come from lending to the United States. The country suffers from real overcapacity. And now growth comes from borrowing — and hundreds of billion-dollar decisions made on the fly don’t inspire a lot of confidence. For example, a nearly completed, 13-story building in Shanghai collapsed in June due to the poor quality of its construction.

This growth will result in a huge pile of bad debt — as forced lending is bad lending. The list of negative consequences is very long, but the bottom line is simple: There is no miracle in the Chinese miracle growth, and China will pay a price. The only question is when and how much. Another casualty of what’s taking place in China is the U.S. interest rate. China sold goods to the United States and received dollars in exchange.

If China were to follow the natural order of things, it would have converted those dollars to renminbi (that is, sell dollars and buy renminbi). The dollar would have declined and renminbi would have risen. But this would have made Chinese goods more expensive in dollars — making Chinese products less price-competitive. China would have exported less, and its economy would have grown at a much slower rate.

But China chose a different route. Instead of exchanging dollars back into renminbi and thus driving the dollar down and the renminbi up — the natural order of things — China parked its money in the dollar by buying Treasuries. It artificially propped up the dollar. And now, China is sitting on 2.2 trillion of them. Now, China needs to stimulate its economy. It’s facing a very delicate situation indeed: It needs the money internally to finance its continued growth.

However, if it were to sell dollar-denominated treasuries, several bad things would happen. Its currency would skyrocket — meaning the loss of its competitive low-cost-producer edge. Or, U.S. interest rates would go up dramatically — not good for its biggest customer, and therefore not good for China. This is why China is desperately trying to figure out how to withdraw its funds from the dollar without driving it down — not an easy feat.

And the U.S. government isn’t helping: It’s printing money and issuing Treasuries at a fast clip, and needs somebody to keep buying them. If China reduces or halts its buying, the United States may be looking at high interest rates, with or without inflation. (The latter scenario is most worrying.) All in all, this spells trouble — a big, big Chinese bubble. Identifying such bubbles is a lot easier than timing their collapse. But as we’ve recently learned, you can defy the laws of financial gravity for only so long. Put simply, mean reversion is a bitch. And the longer excesses persist, the harder the financial gravity will bring China’s economy back to Earth.

Have the Chinese Become the World's Greatest Capitalists?

by Ellen Brown

"I don't care if it's a white cat or a black cat. It's a good cat so long as it catches mice."

-- Deng Xiaoping, who opened China to foreign investment after 1978

China is being called a "miracle economy." It seems to have decoupled from the rest of the world, preserving an 8% growth rate while the rest of the world sinks into the worst recession since the 1930s. How is that phenomenal growth rate possible, when other countries relying heavily on exports have suffered major downturns and remain in the doldrums? Economist Richard Wolff skeptically observes:We now have a situation in the world where we have a global capitalist crisis. Everywhere, consumption is down. Everywhere, people are buying fewer goods, including goods from China. How is it possible that in that society, so dependent on the world economy, they could now have an explosive growth? Their stock market is now 100 percent higher than at its low -- nothing remotely like that hardly anywhere in the world, certainly not in the United States or Europe. How is that possible? In order to believe what the Chinese are saying, you would have to agree that in a matter of months, at most a year, no more, they have been able to transform their economy from an export-based powerhouse to a domestically focused industrial engine. Nowhere in the world has that ever taken less than decades.

Perhaps, and the United States has certainly failed to pull that result off with its own stimulus plan; but there is a notable difference between its stimulus plan and China's. What Wolff calls a "global capitalist crisis" is actually a credit crisis; and in China, unlike in the U.S., credit has been flowing freely again to businesses and industry. State-owned banks have massively increased lending, with local governments and state enterprises borrowing on a huge scale. The People's Bank of China estimates that total loans for the first half of 2009 were $1.08 trillion, 50% more than the amount of loans Chinese banks issued in all of 2008. The U.S. Federal Reserve has also engaged in record levels of lending, but its loans have gone chiefly to bail out the financial sector itself, leaving Main Street high and dry.

The Secret of China's Success

Samah El-Shahat is a presenter for Al Jazeera English who has a doctorate in developmental economics from the University of London. In an August 10 article titled "China Puts People Before Banks," she writes:China is the one leading economy where the divide -- the disconnect between its financial sector and the world normal Chinese people and their businesses inhabit -- doesn't exist. Both worlds are booming again and this is due to the way the government handled its banks. China hasn't allowed its banking sector to become so powerful, so influential, and so big that it can call the shots or highjack the bailout. In simple terms, the government preferred to answer to its people and put their interests first before that of any vested interest or group. And that is why Chinese banks are lending to the people and their businesses in record numbers.

In the U.S. and the U.K., by contrast:[T]he financial sector is booming, while the world of normal people seems to be going from bad to worse, unemployment is high, businesses are folding and house foreclosures are still taking place. Wall Street and Main Street might as well be existing on different planets. And this is in large part because banks are still not lending money to the people. In the UK and US, banks have captured all the money from the taxpayers and the cheap money from quantitative easing from central banks. They are using it to shore up, and clean up their balance sheets rather than lend it to the people. The money has been hijacked by the banks, and our governments are doing absolutely nothing about that. In fact, they have been complicit in allowing this to happen.

Cracks in the Dike?

The Chinese economy is not perfect. Chinese workers are now complaining of too much capitalism, since they are having to pay for housing, health care and higher education formerly picked up by the State. The push to make profits, particularly from foreign investment capital, has encouraged speculative ventures, with a great deal of money going into high-rise apartments and other real estate developments that most people cannot afford. And state-owned businesses and large corporations are still getting most of the loans, because the banks have been told to tighten their lending standards, and these larger entities are safer credit risks. But efforts are being made to make more loans available to medium-sized and small businesses, and China's stimulus plan seems to be working well overall.

Wolff thinks China's "miracle" is a bubble that is about to burst, with catastrophic consequences. But historically, when bubbles have collapsed suddenly, it has generally been because they were punctured by speculators. When the Japanese stock market bubble burst in 1990, and when other Asian countries followed in 1998, it was because foreign speculators were able to attack their currencies with exotic derivatives. The victims tried to defend by buying up their own national currencies with their foreign currency reserves, but the reserves were soon exhausted. Today, China has accumulated so much in the way of dollar reserves that it would be very difficult for speculators to do the same thing to the Chinese stock market. A gradual stock market decline due to natural market forces is something an economy can take in stride.

Economic Role Reversal

To the extent that China's stimulus plan is working better than in the U.S. and the U.K., this seems to be because the government is using the banks for public ends, rather than allowing the banks to use the government for private ends. The Chinese government can operate the banks' credit mechanisms in a way that serves public enterprise and trade because it actually owns the banking sector, or most of it. Ironically, that feature of China's economy may have allowed it to get closer to the original American capitalist ideal than the United States itself.

Politically, China is often referred to as communist, although it has never really been communist as defined in the textbooks and is far less so now than formerly. As Deng Xiaoping famously pointed out, the name isn't as important as whether the job gets done; and China's economy today provides a framework that effectively encourages entrepreneurs. Jim Rogers is an expatriate American investor and financial commentator based in Singapore. He wrote in a 2004 article titled "The Rise of Red Capitalism":Some of the best capitalists in the world live and work in Communist China....No matter how long China's leaders persist in calling themselves Communists, they seem quite intent on creating the world's dominant capitalist economy.

Five years later, the Chinese have evidently succeeded in this endeavor; and they have done it by keeping a brake on irresponsible bank speculation and profiteering by keeping a leash on their banking sector. While the Chinese have been busy perfecting their own brand of capitalism, the U.S. has sunk into what Rogers calls "socialism for the rich." When ordinary businesses go bankrupt, they are left to deal with the asphalt jungle on their own. But when banks considered "too big to fail" go bankrupt, we the taxpayers pay the losses while the banks' owners keep the profits and are allowed to continue speculating with them.

The bailout of Wall Street with taxpayer money represents a radical departure from capitalist principles, one that has changed the face of the American economy. The capitalism we were taught in school involved Mom and Pop stores, single-family farms, and small entrepreneurs competing on a level playing field. The government's role was to set the rules and make sure everyone played fair. But that is not the sort of capitalism we have today. The Mom and Pop stores have been squeezed out by giant chain stores and mega-industries; the small private farms have been bought up by multinational agribusinesses; and Wall Street banks have gotten so powerful that Congressmen are complaining that the banks now own Congress. Giant banks and corporations have rewritten the rules for their own ends. Healthy competition has been replaced by a form of predator capitalism in which small fish are systematically swallowed up by sharks. The result has been an ever-widening gap between rich and poor that represents the greatest transfer of wealth in history.

The Best of Both Worlds

The Chinese solution to a failed banking system would be to nationalize the banks themselves, not just their bad debts. If the U.S. were to follow that example, we the people could get something of value for our investment -- a stable and accountable banking system that belongs to the people. If the word "nationalize" sounds un-American, think "publicly-owned and operated for the benefit of the public," like public libraries, public parks, and public courts.

We need to get our dollars out of Wall Street and back on Main Street, and we can do that only by taking the punch bowl away from our out-of-control private banking monopoly. We need to reclaim "the full faith and credit of the United States" as a monopoly of the people of the United States. If the Chinese can have the best of both worlds, so can we.

States Shed Reinsurance and 'Run Naked' Through Storm Risks

Several states prone to natural disasters are measuring the odds on a mega-bet. Concerned observers say those calculations are based on "Lady Luck" and "rolling the dice." Public insurance programs in some coastal states are flirting with the notion of saving millions of dollars every year by shrinking or canceling the coverage they buy from private reinsurers -- the deep-pocketed companies that insure insurers whose exposure to loss exceeds the budgets of some nations.

States are the insurers in this case. And they are either tired of paying piles of cash for reinsurance policies that are rarely needed, or too broke financially to maintain coverage that has saved state residents from paying billions in hurricane damage claims. In the parlance of the insurance business, without coverage or a hedge against their expensive risks, they are "running naked." Here's the bet: Save hundreds of millions with no disaster, or pay perhaps billions with one.

"It's actively discussed every year," John Golembeski, president of Massachusetts' public insurance program, said of discontinuing the state's reinsurance policy. The price this year was $80 million. In return, the reinsurer promises to pay $900 million in claims if a storm sweeps ashore. Golembeski makes sure those decisions, made by money-counting legislators, are accompanied by a weather warning: "We don't know when it's going to hit."

Other states are more muscular in their movement away from reinsurance. Texas let its policy die at the end of May, less than a year after reinsurers paid $1.5 billion in claims related to Hurricane Ike. That's not a bad return on the state's investment. Texans paid $180 million for the policy. Texas will buck this hurricane season with no reinsurance. California is also looking to reduce its coverage. The state's public earthquake insurance program has paid $2.3 billion total for reinsurance since 1997 -- almost half of all its revenue. In return, it has collected $250,000 in claims. California wants to save its money and pay the claims on its own.

"Forty percent of all that California policyholders have paid in for their [earthquake] coverage, we've paid out the door by way of reinsurance premium," explained Glenn Pomeroy, president of the California Earthquake Authority. "It's time to reduce our heavy reliance on reinsurance." It's a challenging time for state insurance programs. They are designed to be a safety valve, providing last-gasp coverage to residents who can't find -- or afford -- private catastrophe insurance. But the punishing hurricane seasons in 2004 and 2005 helped redefine these programs.

Private insurers gasped at the rising number of storms and destruction inflicted on the United States beginning in the mid-1990s. Scientists, meanwhile, began warning of stronger hurricanes spurred by rising temperatures related to greenhouse gases. Insurers reduced their exposure by vanishing from risky coastlines and raising rates. Policyholders crowded into the public programs, elevating the states' financial risk. In turn, reinsurers responded to the rising risk of loss by charging states more. At the end of this June, premiums were up 15 percent from a year ago, according to the brokerage firm Guy Carpenter & Co. LLC.

That is vexing state insurance programs. And some of them hope the federal government will replace private reinsurers. Four states -- California, Florida, Louisiana and Texas -- are pushing Congress to pass a bill that would make the federal government a co-signer for states that borrow money to pay damage claims after natural catastrophes. That would mean the states could replace reinsurance with debt. The savings might be big. Millions normally paid for reinsurance could be stashed away into reserve accounts, used later to pay claims and service loans.

It could also backfire. One major storm could strap a state with debt for decades. Policyholders would have to pay it back through fees on all sorts of insurance policies, from auto coverage to inland property insurance. "It's typical of governments today to not be willing to make the hard decisions that are necessary to face up to the true risks and the true costs of the policies that they've undertaken," said Robert Hartwig, president of the Insurance Information Institute, an industry group.

"Most of the people who will be paying that [debt] aren't homeowners, probably aren't Florida residents right now, and some aren't even born," he added, noting that those states would be "rolling the dice." Critics warn that Texas, and perhaps other states, is following in the path of Florida. Residents there are paying fees, also called assessments, on every type of insurance policy except workers' compensation and medical malpractice from past hurricanes.

Florida hasn't had private reinsurance for years. Instead, it has a public program to reinsure its public insurance program. The Florida Hurricane Catastrophe Fund, the public reinsurance program, has failed to issue enough bonds needed to cover its exposure. Washington's signature guaranteeing those loans would make it easier. It would also provide a more attractive interest rate. Florida's insurance commissioner, Kevin McCarty, has been pushing the legislation, introduced by Sen. Bill Nelson (D-Fla.), among members of Congress and other states.

"It's going to be a difficult lift," McCarty acknowledged. "We're competing with national health care, systemic risk and a number of other things that President Obama has on his agenda." If the federal legislation passes, it could prompt more states to create their own reinsurance funds to save up-front money on the cost of private reinsurance. "That would make it politically much easier for us to step up and do something like this at the state level," said Massachusetts state Sen. Robert O'Leary (D), a longtime supporter of a state fund.

Reluctant Shoppers Hold Back Recovery

Major retailers reported that American consumers are continuing to hunker down, casting a cloud over the durability of the U.S. recovery and underscoring the importance of overseas demand in restoring the world economy to health. Retailers across the spectrum provided foreboding reports. Discounter Target Corp. reported that sales at stores open at least a year were down 6.2% from a year earlier in the quarter ended Aug. 1, while luxury purveyor Saks Inc. reported a 15.5% drop in same-store sales over the past quarter as shoppers stuck to buying basics. Building-supply chain Home Depot Inc. saw total sales drop 9.1% in the quarter ending Aug. 2, and it reaffirmed expectations of a 9% sales drop this year.Retail executives said they don't expect conditions to improve until next spring. Some stores are girding for slow back-to-school and Christmas seasons by cutting inventories. Home Depot Chief Executive Frank Blake told investors Tuesday that he didn't expect a year-over-year increase in same-store sales until the second half of 2010. "We remain concerned by the high level of foreclosure activity, which we believe continues to put pressure on the housing markets," he said.

The cuts in inventories, as well as reined-in expenses, are helping some retailers bolster profit margins. Hoping to avoid the massive markdowns of last year, retailer Neiman Marcus said it has cut its purchases 25%. Such steps played well with investors Tuesday: Target shares jumped 7.6% and Saks rose 6.9% after each reported a smaller profit decline than expected. Target shares are up 28% this year and Saks is up 30.6%.

American consumers appear so shaken by the worst recession since the Great Depression -- and so pinched by unemployment, stagnant wages and stingier lenders -- that they are reining in spending on all but basics. Economists also see an upturn in U.S. household saving as the beginning of a prolonged period of thrift. The retailers' reports serve as a reminder that it will be consumers, foremost, who will fuel a sustained U.S. recovery. Consumer spending accounts for about 70% of all demand in the U.S. economy.

Most economists expect growth to resume in the second half of this year at a modest pace, as U.S. businesses rebuild depleted inventories and the housing market stabilizes. Economists who see a second-half rebound point to a global-manufacturing revival and recent reports that the economies of France, Germany and Japan managed to expand in the second quarter. The Commerce Department said earlier this month that U.S. exports in June rose 1.9% from May after rising 1.6% the month before.

But U.S. consumers could be the counterweight. In a survey of economists this month, The Wall Street Journal asked if a substantial increase in consumer spending was needed for sustained growth. Of the 43 economists who responded, 60% said yes. "Not only has employment fallen, but a lot people are facing salary freezes or other cutbacks," said Lou Crandall, chief economist of financial-research firm Wrightson ICAP. "That is going to have a significant drag on consumer spending going forward."

One of the few bright spots is the revival of auto sales, helped by the government's "cash for clunkers" program. General Motors Co. said Tuesday that it plans to add 60,000 vehicles to third- and fourth-quarter production plans, following announced increases at Ford Motor Co. last week. Meanwhile, TJX Cos., which operates the T.J. Maxx chain, said sales rose 4% over the quarter. Tuesday's results come on the heels of Wal-Mart Stores Inc.'s disappointing report last week that same-store sales in the U.S. slid 1.2%. Also last week, the Commerce Department said July sales, encompassing a wide swath of retailers, fell after two months of gains.

In Dallas, Ellen Berent, 56 years old, plans to go shopping this week to take advantage of Texas tax-free shopping days, a back-to-school tradition in many states. But Ms. Berent, who was laid off from a computer-parts company in May, says she will be more restrained than in the past. "I won't buy anything that I don't have the money for in hand," she said. In Los Angeles, Lucy Inedzhyan, 22, said her spending habits changed after receipts at her family's dry-cleaning business fell 30%. "When I spend, it takes away from the family," she said. Instead of heading to Nordstrom or Bloomingdale's two or three times a month, she says she shops for less-expensive clothes -- on the Web site of chain Forever 21, or using coupons to Victoria's Secret. "I don't splurge anymore."

But slimmer inventories and less-aggressive discounting can backfire if customers are disappointed by a lack of choice or have been conditioned to wait for discounts before buying. Target's chief executive, Gregg Steinhafel, told investors Tuesday that consumers have become "more promotionally sensitive" -- responding to advertised discounts and using coupons -- a dynamic he says is working against the company. Tighter consumer credit has also hurt. Target, which says about one-third of its overall sales come from credit cards, believes that tightening credit standards on its proprietary cards may have contributed as much as half a percentage point to its same-store sales declines.

Earlier this week, the Federal Reserve said a July survey of banks found continued tightening of lending standards as well as a diminished appetite for borrowing among consumers. About a third of banks said they tightened lending standards on credit cards and other consumer loans since April. No banks reported relaxing them. U.S. households are also reckoning with a large drop in wealth during the past two years. Between the second quarter of 2007 and the first quarter of 2009, the most recent for which Fed data are available, household net worth contracted by 22% amid drops in home prices and the stock market.

That gives Americans a greater incentive to save to make up for their paper losses. Economists expect business spending to bolster the economy's recovery in the coming month, in light of extreme inventory-paring. "That wild plunge for production [and] inventories can reverse, because it went well beyond the kind of declines that would be necessary in reaction to weakening consumer spending," said Robert Barbera, the Investment Technology Group's chief economist. "The second half will be the beneficiary of a handsome pop in simply inventory restocking."

Corporate Bonds Top $1 Trillion Mark

Global corporate bond volumes, excluding banks and other financial institutions, surpassed the $1 trillion mark for the first time as tight bank lending has forced companies to seek funding elsewhere. Bond volumes passed $1 trillion July 15 as French energy group Éléctricité de France SA sold bonds worth €3.3 billion ($4.6 billion), data compiled by data provider Dealogic showed Tuesday. The volumes have since risen to $1.10 trillion, up 22% from the previous record high of $898.3 billion set in 2007, with more than four months left in the year.

The utility and energy sector has made the largest contribution to the rise, according to Dealogic, with $188.4 billion issued so far this year. In Europe, where companies have traditionally preferred loans from banks over bonds, the volume of non-financial bond issuance totaled $426.5 billion in the year to date, up 47% from the $290.4 billion raised in 2008, Dealogic said. Meanwhile, loans have fallen dramatically. The volume of high-value, syndicated loans issued to European borrowers has declined to €235 billion so far this year from €651 billion in 2008, figures from Dealogic showed. On a global basis, loan volumes have dropped to $1.1 billion year to date in 2009, compared with $3 billion in 2008.

A shift to bond financing from loans was already underway in 2006 and 2007 as corporations sought to diversify and looked for longer-term funding, said Jean-Marc Mercier, head of syndicate Europe at HSBC Holdings PLC. Typically, bonds have a longer maturity than loans. "Even when bank-market conditions ease, corporates may continue to tap the capital markets for new cash," said Mark Lewellen, head of European corporate debt capital markets at Barclays Capital. J.P. Morgan Chase & Co. is the lead bookrunner globally of all corporate bonds, excluding those sold by financial institutions, this year with a share of 8%. Citigroup Inc. is ranked second with a 7.3% share, according to Dealogic.

Morgan Stanley issues alert on corporate bonds after explosive rally

Corporate bonds have seen the most explosive rally in nearly a hundred years since the markets touched bottom last winter, but, according to a report by Morgan Stanley, they look increasing vulnerable as they pull far ahead of equities. Andrew Sheets, the bank's European credit strategist, has advised clients to beware signs of creeping angst in the credit options markets, where volatility has been flashing an early warning signal for some weeks. "The pace of the recent rally has, for the first time, begun to show signs of over-extension," he said.

The September option contracts have seen a "sustained rise in implied volatility" yet the interest spreads on corporate bonds have continued to drop sharply. Bond investors ignore this sort of divergence at their peril. Morgan Stanley said none of the previous bond recoveries going back to 1925 had been as dramatic as this. "Credit rallies are historically fast and fierce, but this one has become unusually rapid. Levels are almost back to where they were in the first quarter of 2008, but equities are still a long way off that," said Mr Sheets.

Analysts say the current dividend yield on the German utility RWE is 7.7pc while the interest return on a five-year bond issued by RWE is 3.2pc, and the credit default swaps have dropped to just 50 basis points. These markets are clearly out of alignment. They appear to be reflecting an assumption of a prolonged 'bond-friendly' form of gentle deflation, which is at odds with assumptions in the rest of the market. The credit euphoria undoubtedly reflects the emergency measures by governments around the world to stabilize the financial system, but the wash of liquidity should be an equally good tonic for stock markets.

Credit rallies usually anticipate stocks by about 3 months, but we are well past that stage of the cycle. The two should be converging by now. Either stock markets will have to rise sharply to close the gap - an outcome in doubt after poor confidence date in the US and jitters in the Shanghai markets as the Chinese authorities restrain lending - or credit spreads must start to widen again to reflect the risk.

Spreads on non-financial grade BBB-rate bonds in Europe have dropped backed to the long-term average of around 200 basis points above benchmark government bonds, a fall from over 548 earlier this year. This may prove "rich" given the spate of defaults expected by the rating agencies over the next two years. It has taken just eight months for spreads to recover fully in this rally. It typically takes almost three years, and sometimes much longer. The credit markets seem to be telling us that the Great Recession of 2008-2009 was much ado about nothing.

Scholes, Merton Says Banks Should Value Assets Better

Myron Scholes and Robert Merton shared the 1997 Nobel price for economics, and they are now united in calling for banks to give more accurate valuations on their illiquid assets. Financial institutions should use mark-to-market accounting or list the hard-to-value securities on public exchanges whenever possible, Scholes said in a Bloomberg Radio interview yesterday. Scholes, winner of the Nobel with Merton for helping invent a model for pricing options, said investors need better data on prices to accurately value the debt and equity securities of banks.

"I’d like to see us encourage many more securities held on the books of the banks be migrated to exchanges if possible," he said. Doing so would "allow for market discovery and market pricing as much as possible," Scholes added. Banks that oppose new accounting standards on asset values want to conceal depressed prices, Merton wrote in the Financial Times yesterday. He composed the column with Robert Kaplan, a professor at the Harvard Business School along with Merton, and Scott Richard, a professor at the University of Pennsylvania’s Wharton School. "This is not the way forward," they wrote. "While regulators and legislators are keen to find simple solutions to complex problems, allowing financial institutions to ignore market transactions is a bad idea."

The Financial Accounting Standards Board said Aug. 13 that it will consider expanding fair-value rules to loans, a step that might accelerate banks’ recognition of losses and trigger lower earnings and book values. Accounting rules now let companies recognize most loan losses only when management judges them probable. Applying fair value to loans would require earlier recognition of losses.

Banks would benefit if some of their debt automatically converted to equity during a crisis, reducing the need to unload assets in frozen markets, Scholes said yesterday.

"That would mean the price to the banks and other financial institutions would increase accordingly, and the necessity of bailouts would be reduced and the necessity to sell assets at times of shock would also be reduced," he said. "We have to think about market mechanisms that actually reduce the costs associated with adjusting capital structures." Regulators need to "blow up or burn" the private over- the-counter derivative markets to help solve the financial crisis, Scholes said on March 6. Because markets had frozen, investors weren’t getting timely prices to inform their decisions, he said then, speaking at New York University’s Stern School of Business.

Scholes and Merton, together with the late Fischer Black, developed the Black-Scholes model of pricing options, or contracts that give the buyer the right to purchase a security or commodity at a later date for a specified price. Black died in 1995. Platinum Grove Asset Management LP, the Rye Brook, New York-based hedge fund where Scholes is chairman, was forced to freeze investor withdrawals in November after a surge in redemptions. He was a partner in Long-Term Capital Management LP, whose $4 billion loss in 1998 set off a near panic in financial markets and prompted the Federal Reserve to orchestrate a bailout by 14 lenders.

Why we need to regulate the banks sooner, not later

by Kenneth Rogoff

When in doubt, bail it out," is the policy mantra 11 months after the September 2008 collapse of Lehman Brothers. With the global economy tentatively emerging from recession, and investors salivating over the remaining banks’ apparent return to profitability, some are beginning to ask: "Did we really need to suffer so much?"

Too many policymakers, investors and economists have concluded that US authorities could have engineered a smooth exit from the bubble economy if only Lehman had been bailed out. Too many now believe that any move towards greater financial regulation should be sharply circumscribed since it was the government that dropped the ball. Stifling financial innovation will only slow growth, with little benefit in terms of stemming future crises; it is the job of central banks to prevent bank runs by reacting forcefully in a potential systemic crisis; policymakers should not be obsessed with moral hazard and should forget trying to micromanage the innovative financial sector.

This relatively sanguine diagnosis is tempting, but dangerous. There are three basic problems with the view that the costs of greater bank regulation outweigh the benefits, and that the whole problem was the botched Lehman bail-out.

First, the US economy was not exactly cruising along at warp speed in the run-up to September 2008. The National Bureau of Economic Research has the US recession beginning at the end of 2007. Financial markets had begun to exhibit distress from the subprime problem by the summer of 2007. The epic housing bubble had begun to burst six months earlier. Given that the US consumer had been propelling the global economy for a quarter of a century, was it reasonable to think that the inevitable collapse of the US housing market would be a non-event? As Carmen Reinhart and I argue in our forthcoming book This Time is Different: Eight centuries of financial folly, by most quantitative measures, the US economy was heading towards a deep post-war financial crisis for several years before the subprime crisis. Indeed, in related papers, we argued the case long before Lehman hit.

Second, the view that reining in the financial sector jeopardises future growth needs to be nuanced. Certainly enhanced financial development is integral to achieving greater growth and stability. But economists have less empirical evidence than we might care to admit on which financial sector activities are the most helpful. In general, the links between growth and financial development are complex. Mortgage "innovation" in the US was supposed to be helpful by lowering interest rates to homebuyers. Yet, as the crisis revealed, innovation was also a mechanism for levering implicit taxpayer subsidies. More generally, financial innovation was supposed to bring diversification and stability. But in a system-wide breakdown, it also fuelled contagion.

Third, it is dangerous to point to the nascent restoration of profits in the financial sector as clear evidence of a corresponding benefit to the economy. There is an element of arbitrage, as banks borrow at low rates against the implicit guarantee of a government bail-out in the event of a crisis. Do people really believe, as some argue, that moral hazard is a non-issue? Why should large systemically critical financial institutions be allowed to heavily leverage themselves with short-term borrowing? What would be lost if regulators placed stricter capital requirements to discourage arbitrage activities that excessively expose too-big-to-fail banks to systemic risk?

Certainly economists have models of why it can be efficient for lenders to keep borrowers on a short leash. Yet these models do not explain why the leash has to be wrapped around borrowers’ necks three dozen times, as in the case of a highly leveraged bank. The fact is that banks, especially large systemically important ones, are currently able to obtain cash at a near zero interest rate and engage in risky arbitrage activities, knowing that the invisible wallet of the taxpayer stands behind them. In essence, while authorities are saying that they intend to raise capital requirements on banks later, in the short run they are looking the other way while banks gamble under the umbrella of taxpayer guarantees.

If the optimists are wrong, does this mean that the pre-Lehman financial system was one big Sodom and Gomorrah, inevitably condemned to doom? We will never know. Again appealing to my work with Ms Reinhart, theory and history both tell us that any economy that is excessively leveraged with short-term borrowing – be it government, banking, corporate or consumer – is highly vulnerable to crises of confidence. Accidents that are waiting to happen usually do, but when?

Neither statistical analysis of history, nor economic theory offer tight limits on the timing of collapses, even to within a year or two. Certainly the US and global economy were already severely stressed at the time of Lehman’s fall, but better tactical operations by the Federal Reserve and Treasury, especially in backstopping Lehman’s derivatives book, might have stemmed the panic. Indeed, with hindsight it is easy to say the authorities should have acted months earlier to force banks to raise more equity capital.

The March 2008 collapse of the fifth-largest investment bank, Bear Stearns, should have been an indication that urgent action was needed. Fed and Treasury officials argue that before Lehman, stronger measures were politically impossible. There had to be blood on the streets to convince Congress. In any event, given the system’s manifest vulnerabilities, and the impending tsunami of the housing price collapse, it is hard to know if deferring the crisis would have made things better or worse, particularly given the obvious paralysis of the political system.

Economists will conduct post-mortems of the crisis for decades. In the meantime, common sense dictates the need for stricter controls on short-term borrowing by systemically important institutions, as well as regularly monitored limits on oversized risk positions, taking into account that markets can be highly correlated in a downturn. Better macroprudential action is needed, particularly in reining in sustained, large current account deficits. While such deficits can sometimes be justified, prolonged imbalances fuel leverage and can give the illusion that high growth and asset prices are sustainable. There should also be more international co-ordination of financial supervision, to prevent countries using soft regulation to bid for business and to insulate regulators from political pressures.

It is good that the economy appears to be stabilising, albeit on the back of a vast array of non-transparent taxpayer subsidies to financial institutions. But this strategy must not be relied on indefinitely because it risks compromising the fiscal credibility of rich-country governments. The view that everything would be fine if Hank Paulson, then US Treasury secretary, had simply underwritten a $50bn bail-out of Lehman is dangerously misguided. The financial system still needs fundamental reform, and not just starting in five years.

Fitch Ratings Steps Up Probe into Commercial Mortgage Exposure

Fitch Ratings expanded its analysis of commercial real estate (CRE) as the performance metrics "deteriorate at an unprecedented pace." As part of the broader analysis, Fitch issued surveys to more than 75 US bank and thrift institutions it rates, requesting more details on the firms’ exposure to CRE. Details sought include collateral type, geography, internal risk rating and performance, according to a Fitch Ratings statement Tuesday.

CRE loans, excluding construction and development portfolios — which Fitch says tends to present more problems — represent more than 125% of total equity for the 20 largest banks Fitch rates. That risk is higher for banks with less than $20bn of assets, where average CRE exposure represents more than 200% of total equity.

This substantial exposure to CRE loans is only more risky considering the degree of deterioration among CRE loans, Fitch says. The rating agency released analysis last week detailing the 3.04% delinquency rate among commercial mortgage-backed securities (CMBS), which is on track to rise above 5% delinquency by year-end. The exposure to this CRE debt and its deteriorating performance lends "major concern" to the current outlooks on large institutions. Fitch currently keeps negative outlooks on nearly half of the 20 largest US banks and thrift institutions it rates.

"While the relative size of the CRE portfolio is smaller for some of the very large banks Fitch rates, the recent performance trends, expectations for continued economic weakness and the uncertain availability of the CMBS market increases the concern regarding CRE exposure and makes it a likely rating driver as we look out over the next few quarters," says James Moss, managing director and co-head of Fitch’s North America financial institutions group. The Federal Reserve and US Treasury Department on Monday responded to this uncertain availability of CMBS, extending the deadlines of major liquidity programs through the Term Asset-Backed Loan Facility (TALF) aimed at stimulating CMBS issuance.

Credit card companies make changes midstream

Harry Lopez of Stockton knew he had a clean borrowing record: making payments on time, never exceeding his credit limit - he'd even taken out a consolidation loan in 2008 and paid off all his credit cards. Then he got a Chase Bank credit card that promised a zero percent interest rate for six months. Imagine his shock when Chase suddenly broke that promise and imposed interest on his outstanding balance and any cash advances, then later announced it was closing the account and would accept no further charges.

Lopez acknowledged he unknowingly hurt his credit by closing all his old charge accounts and that his credit report - which he checked only after Chase shut off his new card - contained erroneous negative information. Still, he feels he was treated unfairly. "Do you really want, as an unknowing public, to walk into a bank like this and do business with them thinking they're going to give you zero interest, then two months later jack you up to 18 percent and 23 percent. ... And then find some excuse later on and just close your account on you before you even know what's happened?" A Chase spokeswoman, responding in an e-mail, said bank is constantly monitoring its credit account, as a regular part of doing business.

"When necessary, we make changes to pricing, terms or credit lines based on borrower risk, market conditions and the costs to us of making loans. These are factors we have always monitored and processes we have consistently followed," she said in an e-mail. But Bill Hardekopf, chief executive of the credit card comparison Web site www.LowCards.com, said Chase and other lenders have greatly increased restrictions on credit card accounts in the midst of the credit market meltdown and recession. "Issuers in general are trying to cut their risks," he said.

Banks had been generous in granting credit, both in issuing cards and in providing high credit limits, Hardekopf said. "Then a year or so ago, the economy goes into the tank and ... life for the issuers suddenly changed," he said. "They started to show all these losses, and they realized, 'Oh, my gosh. We need to make some changes.'" As a result, a significant number of credit card customers have had their credit limits slashed, and issuers are also closing many accounts that are seen as risky or have been largely inactive, Hardekopf said.

It's a dramatic shift, according to banking analyst Meredith Whitney. She predicted in March that lenders would cut about $2 trillion in available credit card lines by year's end and $2.7 trillion by the end of 2010. That's half of the roughly $5 trillion in credit card lines that were available to consumers in the spring. That will affect many credit customers, said Joseph Ridout, consumer services manager with Consumer Action. "It's an enormous ratcheting down of credit availability for individual card holders," he said from his San Francisco offices.

Consumers may want to take steps to preserve and protect their credit lines should a card issuer decide to lower their credit limits, Ridout said. That's because the so-called "utilization ratio" - the total amount of a borrower's debt divided by total available credit - accounts for roughly 30 percent of an individual credit score, he said. So while Harry Lopez did fine in paying off his credit card debt, Ridout said, "Where he went wrong was in actually closing the accounts." It also lowered the average age of his accounts, a factor that contributes about 10 percent to individual credit scores.

"It behooves you to think twice about closing existing credit card accounts," Ridout said. ... "The trend is lower credit lines and fewer credit cards to borrowers. There's no guarantee you'll get that back." Consumers with more than one credit card might also seek higher credit limits on their other accounts, but they should be careful not to trigger a credit check or "inquiry" by the lender. Too many such inquiries in a short amount of time can be another negative mark, Ridout said.

"Another thing people can do to minimize their exposure to these kinds of unfair credit line changes ... is to make sure your credit report is accurate and dispute any incorrect information," he said. Consumers may request a free credit report once a year from each of the three national credit bureaus, Equifax, Experian and TransUnion. Requests may be made online at www.annualcreditreport.com; by downloading a form from that Web site and mailing it in; or by calling (877) 322-8228.

People may simply order all three forms once a year or, if they want to check more frequently, order a report from one credit bureau, in rotation, every four months. "Credit card banks are closing many accounts. Even accounts of customers who have never paid late and been model customers," Ridout said. "The reality is there will be fewer cards and lower limits available in the near term than they have been in the past."

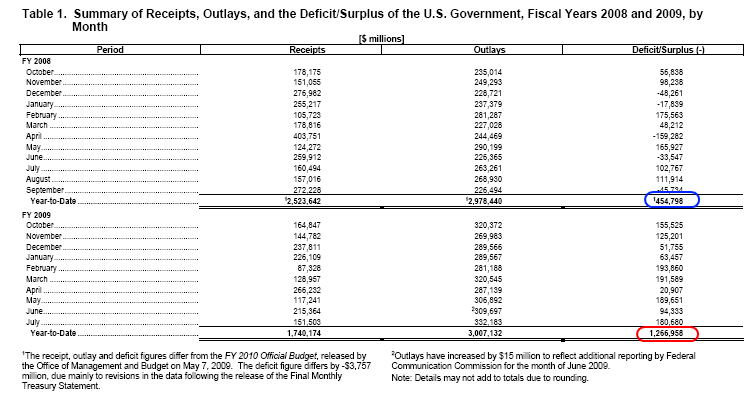

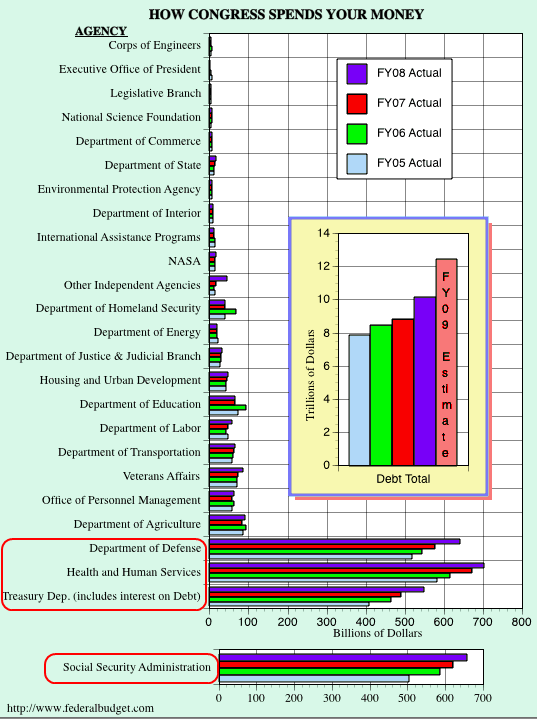

Why Budget Deficits Matter: Government at a $1.26 Trillion Budget Deficit for the 2009 Fiscal Year. Three Times as Large as Last Year and we still have Two More Months of Data